Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- • Credit card strategy

- • Credit card comparisons

Bankrate expert Garrett Yarbrough strives to make navigating credit cards and credit building smooth sailing for his readers. After regularly featuring his credit card, credit monitoring and identity theft analysis on NextAdvisor.com, he joined the CreditCards.com and Bankrate teams as a staff writer to develop product reviews and comprehensive credit card guides focused on cash back, credit scores and card offers.

- • Rewards credit cards

- • Travel credit cards

Nouri Zarrugh is a writer and editor for CreditCards.com and Bankrate, focusing on product news, guides and reviews. His areas of expertise include credit card strategy, rewards programs, point valuation and credit scores, and his stories on building credit have been cited by Mic.com, LifeHacker, People.com and more. Through his thorough card reviews and product comparisons, Nouri strives to demystify personal finance topics and credit card terms and conditions to help readers save money and protect their credit score.

- • Rewards strategy

- • Small business marketing

Cathleen’s stories on design, travel and business have appeared in dozens of publications including the Washington Post, Town & Country, Wall Street Journal, Marie Claire, Fodor’s Travel, Departures and The Writer.

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Bottom line

The Journey Student Rewards from Capital One (No longer available) may be a decent option for students building credit who want a straightforward rewards program, but it falls short of several competing student cash back cards because of its high APR and low rewards rate.

Journey Student Rewards from Capital One

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Intro offer

Intro offer is not available for this Capital One credit card.

Rewards Rate

Earn 1% cash back on all your purchases. Pay on time to boost your cash back to a total of 1.25% for that month

Regular APR

On This Page

What are the pros and cons?

- Current offer details

- Key cardholder perks

- Understanding the fees

- Journey Student Rewards from Capital One vs. other student cards

- Is the card worth getting?

- Frequently asked questions

Journey Student Rewards from Capital One overview

A straightforward student card like the Journey Student Rewards Card from Capital One is a fantastic way to build credit history and learn the ropes of earning rewards. The Journey Student Rewards card weighs in as a solid starter card since it’s low-maintenance, earns cash back on all purchases, rewards good credit habits and poses no extraneous fees. Plus, its security benefits and lack of foreign transaction fees make it a great study abroad companion.

However, several other student cards may have more to offer once you’re comfortable with credit, and Capital One’s new student cards deliver a ton more value for equally fresh credit builders.

You can increase your cash back rate to 1.25 percent on purchases for the month after making an on-time payment.

The card charges no annual fee or foreign transaction fees.

You’re automatically considered for a higher credit line after only six months, which is one of the quickest review periods on the market.

This card has a high ongoing APR, even for a student credit card.

The card is missing zero-interest offers and common student perks like cellphone insurance, which other Capital One student cards offer.

You only receive your boosted rewards rate after making on-time payments each month.

A deeper look into the current card offer

Quick highlights.

- Rewards rate: Unlimited 1 percent cash back on all purchases — boosted to 1.25 percent for the month when the card is paid on time, 5 percent cash back on hotels and rental cars booked through Capital One Travel (terms apply)

- Welcome offer: N/A

- Annual fee: $0

- Purchase intro APR: N/A

- Balance transfer intro APR: N/A

- Regular APR: 29.99 percent (variable)

Rewards rate

The Journey Student Rewards card earns flat-rate cash back , meaning it earns the same rewards rate on all purchases. This rewards structure can be especially helpful for student expenses like textbooks, technology and student fees that typically aren’t bonus reward categories don’t typically cover. A flat-rate card is great for students new to credit because there are no bonus categories to track and there aren’t tiered categories, making earning rewards a simple process.

However, simplicity is not always best or the most rewarding. At its best, the Journey Student Rewards card is only a fraction better as a rewards card than some of the most basic secured cards and cards for fair credit users.

How you earn

You’ll earn 1 percent flat-rate cash back on all purchases, but that bumps up to 1.25 percent back for the month if you pay your credit card bill on time. This structure works by adding an extra 0.25 percent cash back on that billing cycle’s purchases to your rewards balance if Capital One sees that your account isn’t past due by the end of the billing period.

This rewards rate isn’t bad for a student, especially if you want simplicity, but it’s far from the best. You can get higher cash back rates if you’re willing to deal with bonus categories .

How you redeem

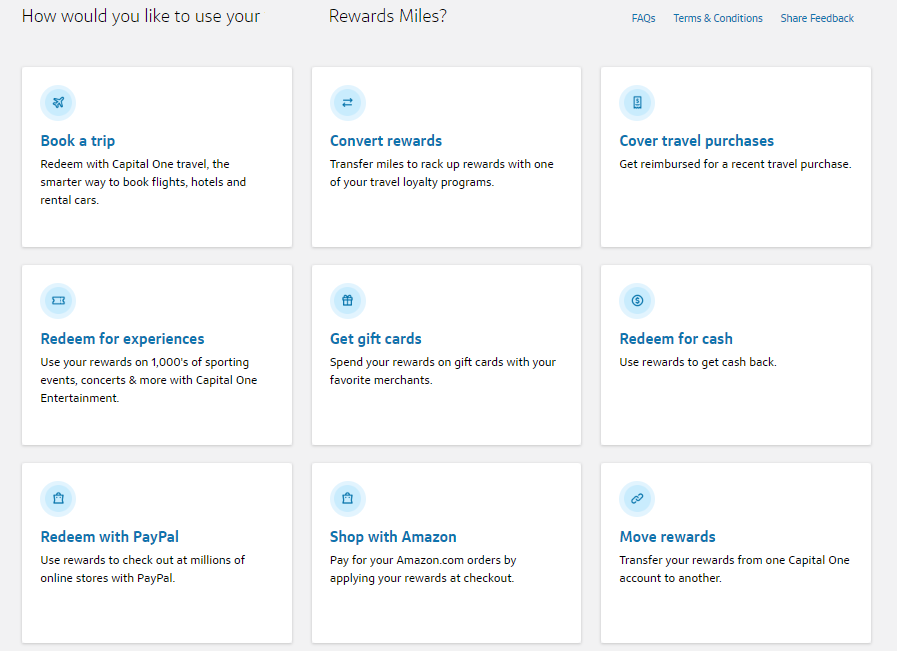

Like other cash back credit cards , redeeming your rewards with the Journey card can be as simple as requesting your cash back in the form of a statement credit or a mailed check. Or, if you want to explore more redemption options, Capital One gives cardholders the chance to redeem cash back as credits for previous purchases, gift cards and checkout payments through PayPal and Amazon.com’s “Shop with Points” feature.

How much are the rewards worth?

The Journey card earns cash back, so your rewards are worth an equivalent of 1 cent or 1.25 cents per dollar, depending on the rate you qualify for – which is determined by whether you pay your bill on time or not.

Capital One’s terms on other redemption options, such as Amazon’s “Shop with Points,” state that your reward value may vary. However, basic cash back is the most versatile choice and will always keep its full value. If you want consistent, predictable rewards value, you should choose cash back.

Other cardholder perks

The Journey Student Rewards card carries extra features that are standard for other Capital One credit cards , but its student perks put it a notch above several other competitors if you’re looking for some peace of mind while shopping or traveling.

Automatic credit line reviews

If you use your credit responsibly, you may qualify for an upgrade to a higher credit line in only six months. An increased credit limit could help you improve your credit score even faster if you keep a low credit utilization ratio .

Credit card security

Besides basic account alerts and card lock, students worried about identity theft can feel a bit safer with these features:

- CreditWise from Capital One: Cardholders can enroll for free in order to receive Experian and TransUnion credit report change alerts, as well as dark web scanning and Social Security number tracking. This level of credit monitoring means Capital One will let you know if it finds your Social Security number and other sensitive data possibly compromised on the internet.

- Virtual credit card numbers : Capital One is one of the few issuers that still offer virtual credit card numbers. Through the Capital One Eno browser extension, you can use randomly generated tokens instead of your credit card for online purchases for an added layer of security. Eno will even keep track of nicknames you give your virtual card numbers for each merchant.

- Fraud Coverage: You’re covered by $0 Fraud Liability if your card is ever lost or stolen and used to make unauthorized purchases.

- Emergency Card Services: If your credit card is lost or stolen, you can get an emergency card replacement and a cash advance, subject to available credit.

Rates and fees

If you prefer a low-maintenance credit card to start with, the Journey Student Reward card doesn’t charge an annual fee or foreign transaction fees. However, there are no introductory APR offers in case you need to make big purchases for school or moving. Unfortunately, student credit cards usually carry high interest rates and late fees, and the Journey Student card is no different. Carrying a balance means that you could be hit with the 29.99 percent ongoing variable APR and a late payment fee up to $40.

This APR is still very high compared to other top student cards , depending on your credit score. On the bright side, the Journey card’s APR won’t change with a missed payment, since there is no penalty APR .

How the Journey Student Rewards from Capital One compares to other student cards

Overall, the Journey card provides slightly better benefits than some other cards, including Capital One’s credit line increase review at six months, but the cash back rate and practical everyday perks leave much to be desired compared to a few competing cards — even Capital One’s other student cards.

The Journey card also doesn’t waive your first late fee or offer intro zero-interest periods — key benefits other issuers may extend for students. If you’re a first-time cardholder who wants a safety net while building credit, you might want to look at alternative cards like the ones presented here:

Recommended Credit Score

Discover it® Student Cash Back

Intro Offer: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases - automatically.

Bank of America® Customized Cash Rewards for Students credit card

Online $200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings 2% cash back at grocery stores and wholesale clubs 1% cash back on all other purchases

Journey Student Rewards vs. Discover it® Student Cash Back

Rewards-wise, Discover student credit cards offer much more than the Journey Student Rewards card. The Discover it® Student Cash Back , earns higher rates of cash back on rotating bonus categories each quarter you enroll, up to a set spending cap before it drops to 1 percent. Discover also matches all the cash back you earn at the end of your first year with the card, maximizing its first-year value.

The Discover it® Student Cash Back is also one of your best options for a low-cost student card. The Journey Student Rewards card poses a higher-than-average variable APR, but the Discover it® Student Cash Back a much more reasonable variable APR, especially for a student card. Plus, the Discover it® Student’s intro APR offer already puts it ahead of the Journey Rewards Student card. Discover’s policy to charge no annual fee, foreign transaction fee, penalty APR or a late fee on your first late payment (up to $41 after) creates an excellent safeguard for students new to credit cards. The Journey Student Rewards card does win out if you would prefer a simpler rewards structure, even if it’s not as lucrative as what you could get out of a card with rotating bonus categories. As long as your focus is locked in on building credit and paying your balances in full every month, the Journey Student Rewards’ high APR could be a nonfactor.

Journey Student Rewards vs. Bank of America Customized Cash Rewards credit card for Students

Although the Bank of America Customized Cash Rewards Card for Students’ benefits are light compared to Capital One cards, it can be a much more rewarding alternative to the Journey card in the right hands. It also comes with better interest rates and introductory APRs that can make early student life a breeze by comparison.

This Bank of America Customized Cash Rewards Card for Students earns impressive rates of cash back on purchases in one of six choice categories that you can swap each month based on your expected expenses. These categories include online shopping, gas, dining, travel drugstores and home improvement/furnishings. You’ll also get a competitive earning rate for purchases at grocery stores and wholesale clubs and 1 percent on all other purchases. The catch here is that your highest earning categories share a quarterly $2,500 spending limit for combined purchases before reverting to 1 percent. If you’d rather have higher cash back rates with some minor spending restrictions and fewer convenience features, like CreditWise and virtual account numbers, the Bank of America Customized Cash Rewards Card for Students may be the better fit for you. Still, strategizing and keeping a close eye on your monthly spending habits could be a time-consuming task for a busy student schedule. The Journey Student Rewards card keeps things simple by earning the same rate on all purchases, and you’d still have the opportunity to earn elevated rates on hotels and rental cars booked through the Capital One Travel portal. Your final decision between these two cards could come down to time, energy, and earning value.

Best cards to pair with the Journey Student Rewards Card from Capital One

Since the Journey Student Rewards card is a flat-rate card with a low 1 percent to 1.25 percent cash back when you make an on-time payment that month, other cash back cards with higher rewards rates in your top spending categories can help maximize your rewards earnings.

If you tend to spend money on everyday purchases, like shopping or going out with friends, the Capital One SavorOne Student Cash Rewards credit card is an excellent choice to pair with the Journey Student Rewards. Its unlimited 3 percent cash back on dining, entertainment, popular streaming services and grocery store purchases (excluding superstores like Walmart and Target) will be a great fit. Plus, the SavorOne Student gives you unlimited 8 percent back on entertainment purchases when you book through the Capital One Entertainment portal.

Bankrate’s Take — Is the Journey Student Rewards Card from Capital One worth it?

The Journey Student Rewards Card from Capital One is an understandable option for first-time cardholders who want an easy-to-handle cash back card for every occasion. The card’s 1 percent flat cash back rate on all purchases can seem like a generous offer, especially if you’ve never earned rewards before. Plus, the card’s perks can give you peace of mind when you’re shopping or traveling.

However, the card’s high ongoing APR and relatively low rewards rate might make other student cards more valuable and accessible. Other cards — including other Capital One student cards — also offer higher rewards rates and better perks like cellphone insurance.

*All information about the Bank of America® Customized Cash Rewards credit card for Students has been collected independently by Bankrate and has not been reviewed or approved by the issuer.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Frequently Asked Questions

Do you have to be a student to get the journey student rewards from capital one, is the journey student rewards card a visa or mastercard, what is the journey student rewards card’s credit limit, does the journey student rewards card have foreign transaction fees, what credit score do you need for the journey student rewards card.

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

Capital One SavorOne Cash Rewards Credit Card Review

Chase Freedom Unlimited® Review

Citi Custom Cash® Card Review

Discover it® Cash Back Review

Bank of America® Customized Cash Rewards credit card Review

Citi Double Cash® Card Review

Upgrade Cash Rewards Elite Visa® Review

Discover it® Chrome Review

Bank of America® Unlimited Cash Rewards credit card Review

Capital One Quicksilver Cash Rewards Credit Card Review

Find your odds with no impact to your credit score

Apply for a credit card with confidence.

Apply for a credit card with confidence. When you find your odds, you get:

A personalized list of cards ranked by likelihood of approval

Special card offers from top issuers in our network

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score

Tell us your name to get started

This lets us verify your credit profile

Your personal information and data are protected with 256-bit encryption.

Your personal information is secure

We use your info to run a soft credit pull which won’t impact your credit score

Here’s how we protect your safety and privacy. That means:

We only use your info to run a soft credit pull, which won’t impact your credit score

We’ll never send mail to your home

All of your personal information is protected with 256-bit encryption

What’s your mailing address?

This helps us verify your credit profile.

Why we're asking

Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile.

Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible.

What’s your employment status?

What's your estimated annual income?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan. Increase non-taxbile income or benefits included by 25%.

Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio (DTI) which is your monthly debt payments divided by your pre-tax monthly income.

Why does DTI matter? Your DTI gives us a clearer picture of your credit profile, which allows us to evaluate which cards you’re likely to get approved for more accurately.

Monthly rent or mortgage payment

Put $0 if you currently don’t have a rent or mortgage payment.

Almost done!

We need the last four digits of your social security number to run a soft credit pull.

We need the last four digits of your Social Security number to run a soft credit pull. This helps us locate your profile and identify cards that you may qualify for. Your information is protected by 256-bit encryption.

A soft credit pull will not affect your credit score.

Enter the last 4 digits of your Social Security number

Last step! Once you enter your email and agree to terms:

Your approval odds will be calculated

A personalized list of cards ranked by order of approval will appear

Your odds will display on each card tile

Enter your email address

Enter your email address to activate your approval odds and get updates about future card offers.

By clicking “Agree and See Results” you acknowledge receipt of our Privacy Notice , Privacy Policy and agree to our Terms of Use . By agreeing, you are giving your written instruction to Bankrate and our lending partners (together, “Us”) to obtain a soft pull of your credit report to determine whether you may be eligible ...show more for certain targeted offers, including pre-qualified and pre-approved offers (your "CardMatch offers"), as well as display what we estimate your approval odds to be for participating offers (“Approval Odds”). You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results.

You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer. To apply for a product you will need to submit an application directly with that provider. Seeing your results won't hurt your credit score. Applying for a product may impact your score. See partner for complete product terms. Show less

We’re sending you to the issuer’s site to complete your application.

Just a second... We’re matching you with personalized offers

Hold tight, we’re loading your personalized results page, sorry, we couldn't access your approval odds..

This often happens when the information that's provided is incorrect. Please try entering your full information again to view your approval odds.

Check your approval odds before you apply

Answer a few questions and see if you’re likely to be approved in less than a minute—with no impact to your credit score.

Check your approval odds on similar cards before you apply

Before you apply...

See which cards you’re likely to be approved for

In less than 60 seconds, answer some questions and we’ll estimate your odds of approval on eligible cards. You get:

A personalized list of cards ranked by likelihood of approval.

Access to special card offers from top issuers in our network.

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score.

But don’t worry! You can check out other cards that are a better fit.

Journey Student Rewards from Capital One review

Written by: Robin Ratcliff

In a Nutshell:

The Journey Student Rewards from Capital One is no longer available.

The Journey Student Rewards from Capital One has some great features to teach good credit management, but it’s weighed down by a high interest rate.

Other Notable Features: Bonus rewards for paying on time, credit tracking tools, credit line increase, no foreign transaction fee

With the Journey Student Rewards card, Capital One has designed a program for students geared to reinforce good credit habits, offering tools and incentives unmatched by any other student card. It is one of the best student cards for establishing good credit practices, although it falls short in other areas.

Motivates you to pay on time

Capital One provides some serious incentives for meeting your payment deadline. One of these is the CreditWise, which allows you to follow the progress of your credit score as you make or fail to make payments. After six months of timely payments, you’ll automatically be considered for a credit line increase. And then there’s a 25 percent increase to your cash back rewards every time you make the deadline. Capital One also allows you to set email and text alerts, to ensure that you don’t forget your deadline.

Cash back rewards are OK

On top of this, Capital One offers a cash-back program with a decent, if not stunning, rewards rate. You get 5 percent back on hotel and rental card bookings made through Capital One Travel as well as 1 percent back on all other purchases, a flat base rate you can boost to 1.25 percent if you make your payments on time. Rewards are also very flexible – you can redeem any dollar amount at any time. The overall value of the program is a drawback, however. Capital One falls short of other cash-back cards for students. Several cards offer large sign-up bonuses and a much higher rewards rate, thanks to rotating bonus categories.

The APR is high

The interest rate on this card is its biggest detractor. At 29.99% variable, it’s one of the highest among the student cards we reviewed. While we laud them for offering good credit management tools, we are less enthused about the high interest rate, since first-time cardholders are prone to missing payments and carrying balances. Also, there’s no introductory APR, which means cardholders are beholden to a high rate from the get-go.

This leaves us with mixed feelings about this card. We like that the card provides a strong set of incentives for good credit management, but we think the value of the card could be better. Aside from the high APR, the rewards program leaves something to be desired. We would recommend this card to first-time cardholders who are seeking to learn good credit habits with a card that contains a lot of user-friendly payment features – the value of the cash back program should be a second thought.

Is the Journey Student Rewards card worth it?

Why get the Journey Student Rewards card?

- You’re a frequent traveler who will benefit from the travel perks, including the lack of a foreign transaction fee.

- You want a card with a long list of features and perks.

- You want a card that rewards you for having good spending practices.

- You want a simple, straightforward card that will help you build a strong credit history with responsible use.

How to use the Journey Student Rewards card:

- You can transfer a balance with no fee, but we wouldn’t recommend it due to the high APR ($0 balance transfer fee at the Transfer APR).

- Make your payments on time to earn extra rewards points and increase your credit limit.

- Use the text and email alerts to stay on top of your due dates.

All information about the Journey Student Rewards from Capital One has been collected independently by CreditCards.com and has not been reviewed by the issuer.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Our reviews and best card recommendations are based on an objective rating process and are not driven by advertising dollars. However, we do receive compensation when you click on links to products from our partners. Learn more about our advertising policy

All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Responses to comments in the discussion section below are not provided, reviewed, approved, endorsed or commissioned by our financial partners. It is not our partner’s responsibility to ensure all posts or questions are answered.

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Know your odds before you apply

- Enter your information

- We’ll run a soft credit pull, which won’t impact your credit score

- You’ll see your estimated approval odds near cards to help you narrow down your options

Your personal information and data are protected with 256-bit encryption.

Tell us your name to get started

We’ll use this information to to verify your credit profile.

What’s your mailing address?

What's your employment status?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considered as a basis for repaying a loan. Increase non-taxable income or benefits included by 25%.

Put $0 if you currently don't have a rent or mortgage payment.

Last four digits of your Social Security number

We’ll use the last four digits of your Social Security number to get your approval odds. This won’t impact your credit score.

What’s your email address?

Your email address unlocks your approval odds. Don’t worry, we won’t spam your inbox.

By clicking "See my odds" you agree to our Terms of Use (including our Prequalification Terms ) and Privacy Policy . These terms allow CreditCards.com to use your consumer report information, including credit score, for internal business purposes, such as improving the website experience and to market other products and services to you. I understand that this is not an application for credit and that, if I wish to apply for a credit card with any participating credit card issuer, I will need to click through to complete and submit an application directly with that issuer.

Calculating your approval odds

Oops something went wrong..

We’re sorry, but something went wrong and we couldn’t find your approval odds. Instead, you'll see recommended credit ranges from the issuers listed next to cards on our site.

Other credit cards to consider in place of the Journey Student Rewards from Capital One

Building credit with the capital one journey student rewards card, alternative cards, our methodology.

Why You Can Trust CNET Money

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

Journey Student Rewards from Capital One: Students Can Build Credit at Home or Abroad

College students can use this credit card to build credit and earn cash back.

Jaclyn DeJohn

Jaclyn is a CNET Money editor who relishes the sweet spot between numbers and words. With responsibility for overseeing CNET's credit card coverage, she writes and edits news, reviews and advice. She has experience covering business, personal finance and economics, and previously managed contracts and investments as a real estate agent. Her tech interests include Tesla, SpaceX, The Boring Company and Neuralink.

The Journey Student Rewards from Capital One has been discontinued. Here are some similar credit card options for students.

Discover it® Student Cash Back

Capital One SavorOne Student Cash Rewards Credit Card

Petal® 2 “Cash Back, No Fees” Visa® Credit Card

The Journey Student Rewards from Capital One* is designed for students looking to build credit with responsible use while earning cash back on purchases.

Though it doesn’t offer the best rewards of any student credit card , the Journey Student card has a few compelling benefits. With no foreign transaction fees , it’s a good choice for students studying abroad. It also makes a good first credit card , with extra cash back incentives for making on time payments. That noted, this card has a particularly high APR at 29.99% variable, so you’ll want to make sure you pay off the balance in full every month.

Otherwise, there’s not much else that’s noteworthy about this card: no introductory APR , no welcome bonus , no travel perks. But it’s a decent stepping stone for improving credit and setting the stage for a credit card with better rewards and perks.

The model is simple and straightforward: Earn 1% on all purchases with the Capital One Journey Student Rewards Card -- with no limit. There are no bonus categories, unlike with most rewards credit cards, which means less to manage and track.

There is, however, a secondary reward: When you make your monthly payment on time, you’ll earn an additional 0.25%, for a total of up to 1.25% cash back. Though other student cards offer higher cash back rates, we appreciate the incentive for students getting started with building credit. Ontime payments are a major component of a credit score.

This card is designed to help students build credit. As such, there are some best practices for cardholders to bear in mind. As with any credit card, using 30% or less of your credit limit will have the best impact on your credit score. Known as a “credit utilization ratio,” this ratio makes up a major part of your credit score.

That noted, if you find that your monthly spending is regularly exceeding the 30% guideline, you could proactively reach out to Capital One to discuss a credit limit increase.

Otherwise, after six months, Capital One will automatically review your account. If you have been making your payments on time and keeping your balance in check, you may automatically earn a higher credit limit.

By making your payments on time and keeping your balance relatively low, you should be able to increase your credit score over time.

Though we appreciate the simplicity of the Journey Student Rewards card, you can earn more cash back with student credit cards that offer more complicated rewards programs.

The Discover it® Student Cash Back* is the best way to earn the most cash back for most students. You earn the standard 1% on all purchases, and 5% on everyday purchases at select rotating locations each quarter when you activate, on up to $1,500 of spending each quarter, then 1%. Select locations have included grocery stores, gas stations, restaurants, Target, Walmart, Amazon and more. Just as significant is the Unlimited Cashback Match™ welcome bonus, which essentially doubles your cash back earned at the end of your first year.

To learn more about the rotating category and other perks, see our full review of the Discover it Student Cash Back card.

The Capital One SavorOne Student Cash Rewards Credit Card* offers the same 1% on all of your purchases, but with a handful of important bonus categories.

You’ll earn 3% cash back on dining at restaurants, grocery stores (excluding superstores like Target and Walmart) and for entertainment. Entertainment includes movie theaters, sports promoters, theatrical promoters, amusement parks, tourist attractions, aquariums, zoos, dance halls, record stores, pool halls and bowling alleys. There’s also no annual fee .

What’s more is you’ll get a pretty solid welcome bonus as far as student credit cards go. If you spend $100 in the first three months of opening your account, you’ll earn a $50 cash bonus.

Capital One Journey Student Card lists their acceptable credit history as “fair” -- which would be a credit score between 580 and 669. However, it is not unusual for a student to get approved for a student credit card despite not having previous credit accounts.

Once you graduate, you are eligible to upgrade to a non-student credit card. These cards often offer better rewards and perks. You’ll likely need to provide your income and housing payment information to your credit card issuer first.

Capital One considers anyone currently enrolled at an accredited university, community college or other higher education institution to be a student. You may also be admitted and planning to enroll in the next 3 months.

CNET reviews credit cards by exhaustively comparing them across set criteria developed for each major category, including cash back, welcome bonus, travel rewards and balance transfer. We take into consideration the typical spending behavior of a range of consumer profiles -- with the understanding that everyone’s financial situation is different -- and the designated function of a card.

* All information about the Discover it Student Cash Back, Journey Student Rewards from Capital One and Capital One SavorOne Student Cash Rewards Credit Card have been collected independently by CNET and has not been reviewed by the issuer.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

We'll Be Right Back!

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

Should college students have credit cards?

January 9, 2024 | 6 min read

Tuition. Rent. Food. Books. Gas. There’s a lot to handle in college as you build your future. No wonder you’re thinking about getting your first credit card. But just because responsible use of a card can help you budget and build credit doesn’t necessarily mean it’s right for you.

There’s no right or wrong answer to whether college students should have credit cards. It’s a highly individual choice and depends on your specific situation. Before you make that decision, here are some points to think through.

Key takeaways

- With responsible use, credit cards can help college students build credit history, be prepared in an emergency and learn how to manage their finances.

- To use credit responsibly, it helps for students to understand things like card terms and conditions, interest rates and potential fees.

- Credit card options for students include a student credit card, a secured credit card or becoming an authorized user on someone else’s credit card.

Student rewards credit cards

With responsible use, students can earn cash back rewards today while building credit for tomorrow.

Why should college students have credit cards?

You’re probably already picturing how having a credit card could help you in college . A card can help if you’re shopping online, buying groceries, paying bills, studying abroad or studying in the U.S. as an international student . Here are some other ways a credit card could be helpful, if you use it responsibly .

Build credit history

How you use and repay debt affects your credit history and credit scores , according to the Consumer Financial Protection Bureau (CFPB). And companies can use the information in your credit reports to decide whether to offer you a car loan, an apartment, a mortgage and sometimes even a job. Building a credit history in school means you won’t be starting from scratch when you graduate.

Prepare for emergency situations

What if your car breaks down or you need to upgrade your laptop or cell phone? If you don’t have an emergency fund , a credit card could help you deal with an unexpected cost. Just make sure that you don’t overuse this resource and have a plan in place for how you’ll pay it off. The CFPB notes you should be clear with yourself about what represents an emergency.

Learn to manage your finances

Having a credit card can help you build financial literacy through doing things like budgeting and making on-time payments. The CFPB says that young people learn financial skills more and benefit when they have opportunities to make their own financial decisions.

Earn cash-back rewards for essentials

Cash-back credit cards can help you get the most out of your spending . And when you’re a student, every little bit helps. It may be worth checking out other kinds of rewards credit cards too, if you’re interested in different perks.

Help protect yourself from fraud

If your cash is stolen, there might not be much you can do about it. But if you lose money through credit card fraud, you might not be held responsible. And if you’re a Capital One customer, your credit card has a number of security features that may help you detect fraud.

What are the disadvantages of credit cards for college students?

There are lots of good reasons to have a credit card in college. But everyone’s situation is different, and understanding how credit cards work and using them responsibly is important.

Consider your situation

Do you have a regular source of income? If you’re unable to make your credit card payments , it could result in derogatory marks on your credit reports. This will lower your credit scores.

Paying your statement on time every month is only one key to building credit. If you’re able to pay more than the minimum each month, it can help you limit or avoid interest charges on new purchases.

Understand the basics

Do you understand the basics, like how the interest rate works , credit card terms and conditions and common credit card fees ? Different transactions might have different rates or fees. For example, a cash advance might not be treated the same as a standard purchase.

Know the consequences

You could be tempted to overspend. Making late payments can result in late fees. You’ll be legally responsible for repaying your debt. And negative information could damage your credit scores, which could hurt your long-term goals, like owning a home or buying a car.

Credit card options for college students

If you’ve weighed the pros and cons and decided to go for it, you can start thinking about the best credit card for you. If you use them responsibly , the following options could be a good entry point into the world of credit:

Student credit card. Having a student credit card isn’t that different from having a regular credit card. Student cards can be more accessible to those with no credit history . They may have features like credit-tracking tools that can help you build a healthy relationship with credit, and they might offer more fraud protection than a debit card. Capital One credit cards for students let you earn rewards while you build credit with responsible use. But make sure you understand how student credit cards work. They may come with a lower credit limit and a higher interest rate than some credit cards for people with a more established credit history.

Find a student card that fits your needs

Pre-approval makes it quick and easy to browse card offers without impacting your credit score.

- Secured credit card. With a secured credit card, you deposit an amount of money that the issuer holds as collateral, sometimes known as a security deposit. For example, the Capital One Platinum Secured card has refundable security deposits of $49, $99 or $200, depending on your creditworthiness , for an initial credit line of $200. Deposit more, and you could raise your credit line as high as $1,000. You can then use the card to make purchases just like you would with other credit cards.

- Authorized user on someone else’s credit card. Becoming an authorized user means you get a card linked to an existing account that you’re authorized to use. The account could belong to a friend or family member who is willing to add you to their credit card account. You’ll get your own card linked to the account’s line of credit. The primary cardholder is ultimately the one who is responsible for the account. But the CFPB says negative actions, such as late payments, could affect both of your credit scores if they’re reported to credit bureaus.

Should you get a credit card in college, in a nutshell

Getting a credit card in college is an exciting milestone. And if it’s used responsibly, it can be a great way to jumpstart your financial future. Before you get a credit card as a college student, you should consider your financial situation and whether you will be able to use it responsibly.

If you’ve decided you’re ready for it, you could see whether you’re pre-approved for some Capital One credit card offers, like the Capital One Platinum Secured card or a Capital One Student credit card . The pre-approval process is quick, only requires some basic info and won’t hurt your credit scores.

Related Content

A guide to finding the best student credit cards for you.

article | April 16, 2024 | 11 min read

Credit card tips for college students

article | February 11, 2021 | 5 min read

How to build credit as a college student

article | February 8, 2024 | 6 min read

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

Capital One Quicksilver benefits guide 2024

Lee Huffman

Ashley Barnett

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Published 5:47 a.m. UTC April 22, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Vectorian, Getty Images

If you’re looking for a straightforward cash-back program without an annual fee, the Capital One Quicksilver Cash Rewards Credit Card * The information for the Capital One Quicksilver Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. delivers. But the card is more than just a vehicle for budget-conscious consumers to earn rewards, as it comes with other perks, too.

Capital One Quicksilver overview

The Capital One Quicksilver is a cash-back credit card that offers numerous benefits without charging an annual fee , including unlimited cash-back rewards, a welcome bonus, an intro APR offer and no foreign transaction fees. Here’s everything you need to know about the Capital One Quicksilver’s benefits and rewards.

Major Capital One Quicksilver benefits

As a cardholder, you gain access to Capital One Quicksilver benefits that can enhance the value of your rewards credit card. Some benefits are available for a limited time only, so use them right away to maximize their value.

An easy-to-attain welcome bonus

With the Capital One Quicksilver, you can earn a $200 cash bonus after spending $500 on purchases within the first three months of account opening. The minimum spending requirement to earn this bonus is significantly lower than many other cash-back cards that require spending of upwards of $1,500 or more to earn a bonus.

An intro APR offer on purchases and balance transfers

When you open a Capital One Quicksilver card, one of the benefits is an intro APR offer on purchases and balance transfers. You’ll get a 0% intro APR on purchases and balance transfers for 15 months, then a 19.99% to 29.99% variable APR. There is a 3% fee on each balance transfer in the first 15 months but no fee for amounts transferred at the purchase APR after the first 15 months.

Keep in mind that the standard APR applies to any remaining balance when the intro APR promotion is over.

Unlimited cash-back rewards

One Quicksilver card benefit that is available year after year is the ability to earn an unlimited 1.5% cash back on purchases and 5% cash back on hotels and rental cars booked through Capital One Travel. This gives you a decent cash-back earnings rate on most of your spending without having to keep track of bonus categories.

Additionally, when you book hotels or rental cars through Capital One Travel, you’ll receive an elevated cash-back rate. Capital One’s travel portal offers free price drop protection on qualifying flights, competitive hotel rates and price matching within 24 hours of booking.

Rewards never expire as long as your account is open and in good standing. You can redeem rewards manually or set up an automatic redemption on either specific calendar days or whenever your rewards balance exceeds a set dollar amount.

No foreign transaction fees

None of Capital One’s credit cards charge foreign transaction fees. These hidden fees increase the cost of your international purchases by up to 3%. Using a card without foreign transaction fees can save you money when traveling or making purchases from an overseas vendor. Capital One will automatically convert the charges to U.S. dollars without tacking on any fees.

Additional benefits worth noting

Other Capital One Quicksilver benefits also provide value, even if they aren’t used frequently. For some cardholders, these benefits can be worth as much as, if not more than, the rewards earned on the card.

Complimentary Uber One membership

When you activate this benefit, you’ll receive up to six months of complimentary Uber One membership statement credits. This benefit is available through November 14, 2024, but note that activation is required. An Uber One membership normally costs $9.99 per month and includes $0 delivery fees on eligible Uber Eats orders, member pricing, no cancellation fees or penalties, as well as other benefits.

Extended warranty

The manufacturer’s warranty is extended for up to an additional year, on eligible purchases made with the card. This benefit applies to eligible warranties of three years or less and doubles the warranty period up to one additional year. For example, if the manufacturer’s warranty is three months, you’ll receive an additional three months of coverage, for a combined total of six months of coverage.

Virtual card numbers

Purchases made online and over the phone are often targeted by criminals to steal your credit card information. Capital One cardholders can use free virtual card numbers from Eno to protect their information and reduce the potential for unauthorized transactions.

Potential drawbacks

While many Capital One Quicksilver benefits are included with the card, no card is perfect. Here are some of the drawbacks to consider.

- Limited redemption options. You have limited redemption options and the card does not have any airline or hotel transfer partners. There are no redemption options to receive outsized value for your rewards, just cash back.

- No bonus categories. Bonus categories provide additional rewards on purchases made at eligible merchants. Getting a card with bonuses that match your biggest spending categories allows you to maximize your rewards.

- Requires excellent credit. People with blemishes on their credit may not qualify for the Quicksilver Card. If your credit needs repair, the Capital One Quicksilver Secured Cash Rewards Credit Card * The information for the Capital One Quicksilver Secured Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. earns cash-back rewards while building credit.

If the drawbacks are too much for you, you can always opt to cancel your Capital One credit card .

Should you get the Capital One Quicksilver?

The Capital One Quicksilver cash rewards credit card is an excellent choice for people who want a straightforward cash-back credit card . It earns unlimited and straightforward cash-back rewards on every purchase without having to remember bonus categories or activating limited-time offers.

As a new cardholder, you can earn a welcome bonus and enjoy 15 months of interest-free financing on purchases and balance transfers. Take advantage of the Capital One Quicksilver benefits to maximize the value of your card.

However, if your spending is concentrated in a few categories, you might be better off finding a card with matching bonus categories so you can maximize the rewards on your purchases.

Additionally, if you like to travel, consider instead one of best travel rewards credit cards that offers transfer partners or comprehensive travel protections. These features can enhance the value of your rewards and save money in case you face problems with your travel plans.

Frequently asked questions (FAQs)

You’ll earn a $200 cash bonus after spending $500 on purchases within the first three months of account opening. These rewards won’t expire as long as your account is open and in good standing. You can redeem rewards for cash back, statement credits or gift cards.

No, you won’t receive rental car insurance when paying with your Capital One Quicksilver Card. For rental car insurance against theft or damage, consider a card like the Capital One Venture X Rewards Credit Card * The information for the Capital One Venture X Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , which offers primary auto rental coverage.

Travelers receive automatic travel accident insurance for covered losses on reservations made with the Capital One Quicksilver card. However, the Capital One Quicksilver’s travel benefits are limited; it does not offer trip delay, cancellation or interruption insurance, rental car protection or baggage insurance. To receive these protections, consider a card like the Chase Sapphire Preferred® Card or the Capital One Venture X .

The Capital One Quicksilver includes numerous benefits, but reimbursement for TSA PreCheck is not one of them. For a low-annual-fee Capital One card that reimburses Global Entry or TSA PreCheck application fees, consider the Capital One Venture Rewards Credit Card * The information for the Capital One Venture Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , which has a $95 annual fee and will reimburse you up to $100 (via statement credit) every four years for the application fee for one of those Trusted Traveler programs.

The Capital One Quicksilver and Capital One QuicksilverOne cards both earn an unlimited 1.5% cash back on purchases and 5% cash back on hotels and rental cars booked through Capital One Travel, but there are distinct differences.

People with excellent credit are more likely to qualify for the Quicksilver card, which has no annual fee, a lower interest rate, and new cardholders can earn a welcome bonus and take advantage of an intro APR promotion. However, the QuicksilverOne card charges a $39 annual fee and targets people with fair credit.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

*The information for the Capital One Quicksilver Cash Rewards Credit Card, Capital One Quicksilver Secured Cash Rewards Credit Card, Capital One QuicksilverOne Cash Rewards Credit Card, Capital One Venture Rewards Credit Card and Capital One Venture X Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Lee Huffman spent 18 years in banking and investments and now uses that insider knowledge to write about credit cards, travel, and other personal finance topics. Lee enjoys showing people how to travel more, spend less, and live better through the power of travel rewards. You can connect with him at BaldThoughts.com.

Ashley Barnett has been writing and editing personal finance articles for the internet since 2008. Before editing for USA TODAY Blueprint, she was the Content Director for an international media company leading the content on their suite of personal finance sites. She lives in Phoenix, AZ where you can find her rereading Harry Potter for the 100th time.

Check it out: This is what the average household spends on grocery costs per month

Credit Cards Stella Shon

United Airlines credit cards have a secret perk that makes it easier to book awards

Credit Cards Jason Steele

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

Credit Cards Lee Huffman

How to do a balance transfer with Discover

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Wells Fargo Autograph Journey vs. Capital One Venture: Both Have Bragging Rights

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Capital One Venture Rewards Credit Card has long been a mainstay for travelers seeking low-effort rewards for a relatively modest annual fee. It touts a generous sign-up bonus, the same rewards rate for most purchases, flexible rewards redemption options and additional travel benefits that boost its value.

The Wells Fargo Autograph Journey entered the credit card marketplace in March 2024, but it’s quickly catching up with the Capital One Venture Rewards Credit Card . You can earn a sign-up bonus and elevated rewards in certain spending categories. Redeeming your rewards is easy with this card, too. Plus, it provides impressive travel protections.

Which card is right for you comes down to which perks you value the most. Here’s how to decide.

» MORE: NerdWallet’s best travel credit cards

Why you might prefer the Capital One Venture Rewards Credit Card

Compared with other travel credit cards that have convoluted rewards programs, the $95 -annual-fee Capital One Venture Rewards Credit Card has always kept earning and redeeming miles super simple.

Flat rewards rate

The Capital One Venture Rewards Credit Card earns:

2 miles per dollar spent on purchases.

5 miles per dollar on hotels and car rentals booked through Capital One's travel portal.

For the most part, there are no spending categories to memorize — just a decent rewards rate no matter where you use the card. If you want travel rewards that keep it simple, this is hard to beat.

» MORE: Capital One Miles: How to earn and use them

Sign-up bonus

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. That’s a lot of value in the first year you carry this card.

Flexible redemptions

There are multiple ways to use your miles:

Cover the cost of travel purchases made within the past 90 days. Eligible travel purchases include airlines, hotels, trains, buses, rental cars, cruises, taxis and limousine services, travel agents and timeshares.

Redeem miles on Capital One's travel portal for flights, car rentals and hotel bookings.

Transfer rewards to other eligible Capital One cards.

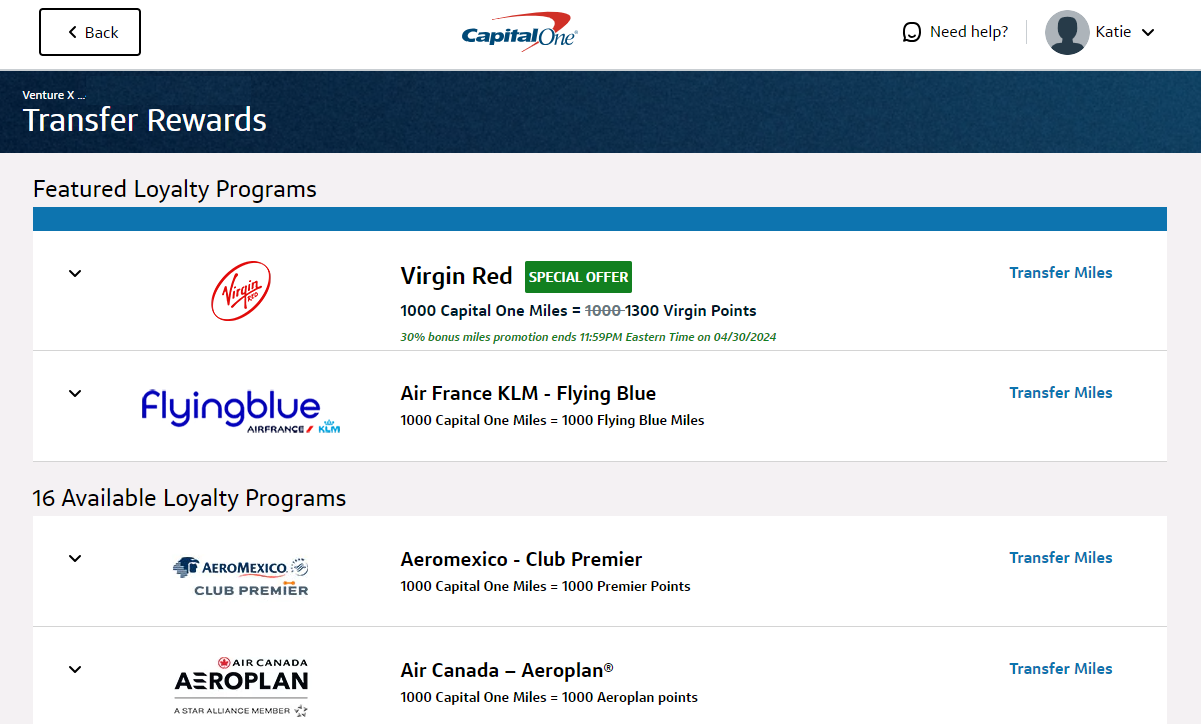

Transfer rewards to Capital One’s airline and hotel transfer partners.

Aeromexico (1:1 ratio).

Air Canada (1:1 ratio).

Air France-KLM (1:1 ratio).

Avianca (1:1 ratio).

British Airways (1:1 ratio).

Cathay Pacific (1:1 ratio).

Emirates (1:1 ratio).

Etihad (1:1 ratio).

EVA (2:1.5 ratio).

Finnair (1:1 ratio).

Qantas (1:1 ratio).

Singapore Airlines (1:1 ratio).

TAP Air Portugal (1:1 ratio).

Turkish Airlines (1:1 ratio).

Accor (2:1 ratio).

Choice Privileges Hotels (1:1 ratio).

Wyndham Rewards (1:1 ratio).

You can also redeem miles for cash back or gift cards, but redemption values vary, so this isn’t an ideal way to use your rewards.

Travel and entertainment extras

The Capital One Venture Rewards Credit Card offers a statement credit of up to $100 to cover the cost of TSA PreCheck or Global Entry every four years. You’ll also get Hertz Five Star status, which offers a wider selection of rental cars, upgrades when available and more.

Get access to VIP event experiences and ticket presales through Capital One Entertainment . You can also book tables at in-demand restaurants and attend special events through Capital One Dining.

Why you might choose the Wells Fargo Autograph Journey instead

Like the Capital One Venture Rewards Credit Card , the Wells Fargo Autograph Journey has a $95 annual fee and travel-focused rewards. While it lacks a statement credit for TSA PreCheck or Global Entry, the card offers other benefits, including robust travel protections.

Higher rewards in specific categories

The Wells Fargo Autograph Journey earns:

5 points per $1 on hotels.

4 points per $1 on airlines.

3 points per $1 on other travel and dining.

1 point per $1 on other purchases.

That’s a bit more complicated than the flat rate on most purchases with the Capital One Venture Rewards Credit Card , but it’s potentially more rewarding if you spend more on travel and dining specifically.

» MORE: Wells Fargo Rewards: How to earn and use them

Welcome offer

Earn 60,000 bonus rewards points after spending $4,000 in the first 3 months. That’s not as generous as the sign-up bonus on the Capital One Venture Rewards Credit Card , but it’s still a nice bonus if this is the card you choose.

Redeem rewards for not just travel, but also statement credits to offset eligible purchases, gift cards, charitable donations and merchandise. You can also pay with points at select merchants.

Another option is to transfer points to Wells Fargo’s airline and hotel partners. It’s a relatively short list for now, but according to Wells Fargo, there are plans to expand it.

Aer Lingus (1:1 ratio).

Iberia (1:1 ratio).

Choice Privileges Hotels (1:2 ratio).

The Wells Fargo Autograph Journey lacks a TSA PreCheck/Global Entry credit, but it does offer a $50 annual statement credit for airfare purchases. The Capital One Venture Rewards Credit Card offers no such credit toward airfare.

Plus, with the Wells Fargo Autograph Journey, you’ll have robust travel protections, including a reimbursement of up to $15,000 if your trip is canceled for a covered reason.

You can also take advantage of Autograph Card Exclusives, which is a series of concerts in small venues.

Cell phone protection

If you pay your cell phone bill with your Wells Fargo Autograph Journey, you’re covered if your phone is stolen or damaged. You can claim up to $1,000, with a maximum of two claims per year.

» MORE: NerdWallet's best credit cards for cell phone insurance

Which card should you get?

When you compare these two cards, it comes down to rewards earnings and perks. Opt for the Capital One Venture Rewards Credit Card if you prefer simple rewards and want to save on TSA PreCheck or Global Entry.

The Wells Fargo Autograph Journey may be a better match if you want to earn more rewards on certain spending and you’d like enhanced travel and cell phone protections.

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

1%-10% Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases. Earn 8% cash back on Capital One Entertainment purchases. Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024. Terms apply.

$200 Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening.