Age Pension tips and traps for overseas travellers

by James Coyle | Dec 8, 2021 | Centrelink Age Pension | 53 comments

Tell Centrelink about your travel plans

Some things you can’t ‘untell’ Centrelink – Tips and traps for overseas travellers

With international borders finally reopening many older Australians are keen to head overseas. But leaving Australia – particularly where you go and for how long – can have a major impact upon your Age Pension entitlements.

It’s critical that you know what your obligations are, including:

- which information you need to share, and

- the timelines of when you need to reveal this information.

If you are in any doubt, you can book an appointment with our customer service team to double check the detail you need to reveal, as you cannot ‘untell’ incorrect or inaccurate information. When you get it wrong, there is often a long process, sometimes including a rejection of your current or expected entitlements.

Mary got caught out when she went on a holiday. She did not need to inform Centrelink, but thought she did.

She told Centrelink she was moving overseas for the foreseeable future. Unfortunately due to circumstances beyond Mary’s control she was forced to return to Australia 8 months later.

Whilst Mary did not do anything wrong, committing to a permanent move overseas from the outset meant that Mary immediately lost her pension and energy supplements as well as a portion of her pension due to Mary not being an Australian resident for 35 years prior to her departure date.

Had Mary initially treated the move as a holiday and then updated Centrelink on her intent to live there permanently later on, she could have kept her supplements longer (they would eventually have been removed though) and her pension would have stayed as it was for longer before being reduced.

Travelling outside Australia does not necessarily mean losing your Age Pension entitlements, even when you take up residence in another country. But the amount you get is connected with the time you are away – and the country in which you resettle.

If you are undertaking holiday travel, you do not need to advise Centrelink.

If, however, you:

- are going to live in another country

- will be away for longer than 6 weeks

- will receive a welfare payment from another country

- returned to live in Australia within the past two years and received an Age Pension in this time

- then you need to advise Centrelink through your online or myGov account.

There are three main categories of Centrelink interest when you travel:

- If you leave for between 6 and 26 weeks

- if you leave for more than 26 weeks

- if you leave to live in another country

If you leave Australia for between 6 and 26 weeks

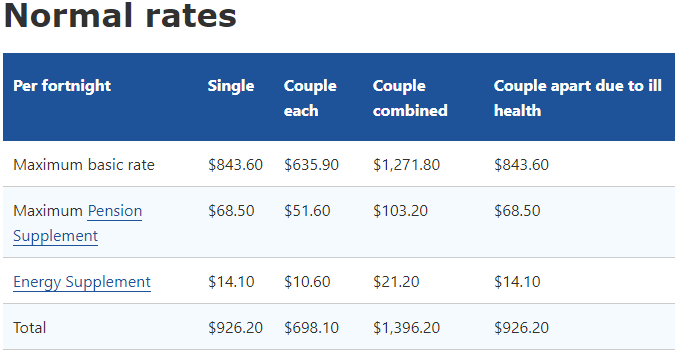

Your pension supplement drops to the basic rate and your energy supplement stops.

If you leave for more than 26 weeks

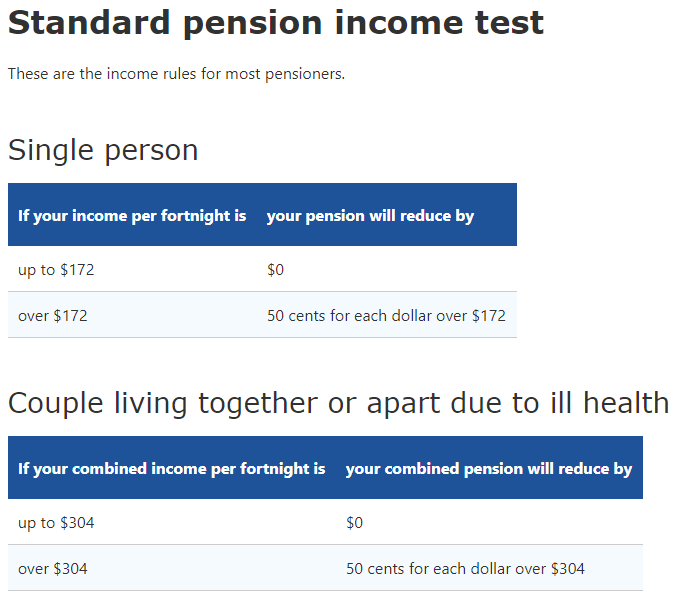

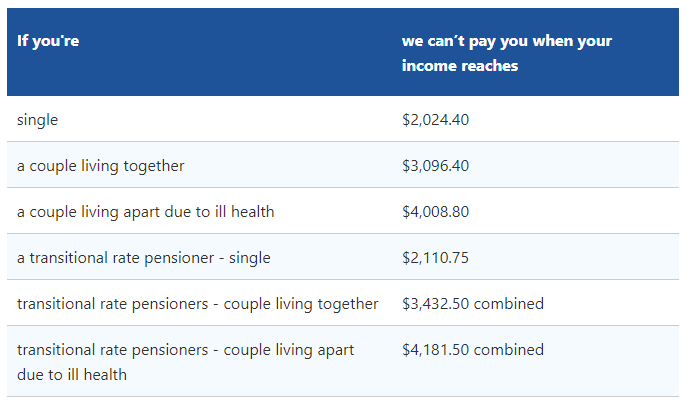

There is a sliding scale of the rate by which your pension is affected, depending upon the length of your Australian residency. Those who are residents for 35 years or longer will see no change, but under 35 years the pension is paid at a pro-rata amount, according to your length of residency.

If you leave to live in another country

You will be paid what is termed an ‘outside Australia rate’. Your pension supplement will be reduced to the basic rate and your energy supplement will be removed.

If your travel plans change due to circumstances outside your control, including Covid-19, you may need to contact Centrelink to explain your situation.

Tips and traps

- Timing when you reveal your plans has a direct impact upon your pension payments as happened with Mary.

- Choosing to relocate to another country is a big decision. You will need to do your research on availability of medical care, aged care and whether Australia has a social services agreement with that country. It’s not just about entitlements – it’s worth checking out the country’s human rights record and whether Australia has a strong consular presence there. Cost of living will also be of vital interest.

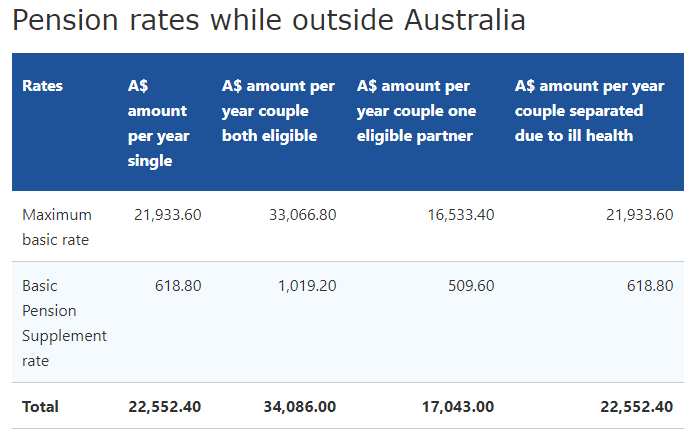

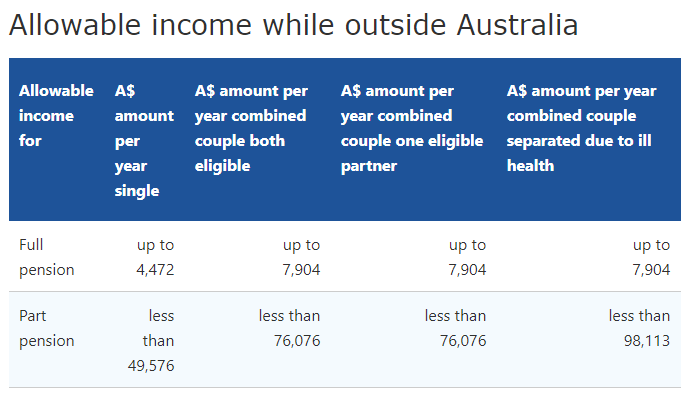

- Payments for overseas pensions are approximately $2,000 per annum lower than payments to Australian residents

- Pension are paid every four weeks, not every fortnight – you need to plan for the gap in income if you change from an Australian to an international payment

[Services Australia – these figures are a guide only and are effective from 20 September 2021.]

In summary, short-term travel has little effect on your pension income. Heading overseas for a longer time will need to be more carefully considered. So make sure you thoroughly understand the rules well before you leave.

And if in doubt, or need further information, our expert team are happy to explain all the rules. Book a consultation .

Have you headed away for a long period? If so, did you find it easy to manage your pension payments and concession card access? We’d love to hear your story.

53 Comments

Does Australia have agreement with thePhilIppines ?

Hi Keith, thanks for reaching out for further clarity regarding residency eligibility. Australia does not currently have a Social Security Agreement with The Philippines.

If you or anyone else reading would like to talk about the residency eligibility criteria in more detail we do offer 30min consultations at a cost of $75. We can clarify how Centrelink will assess you specifically and help guide you on any related matters that might impact your Age Pension. If you wish to proceed please CLICK HERE to book the best suitable time available.

My wife and I would like to travel overseas for 25 weeks. Iam presently getting the age pension and my wife is getting jobseeker. My wife will get the pension before we leave, so we will receive the pension as a couple combined. Question is can we leave as a couple ever if my wife has just started receiving pension. Is it best to let them know that we will be staying longer that 6 weeks closer to the 6 weeks time while we are overseas, or prior to departure. We had previously left the country for three months a few months after I received the pension, my wife was on jobseeker. My pension supplement was reduced after 7 weeks and they stopped the other supplement after 6 weeks. My wife’s jobseeker was stopped when we left. Could you please let me know the best way to handle this situation. Thanking You David

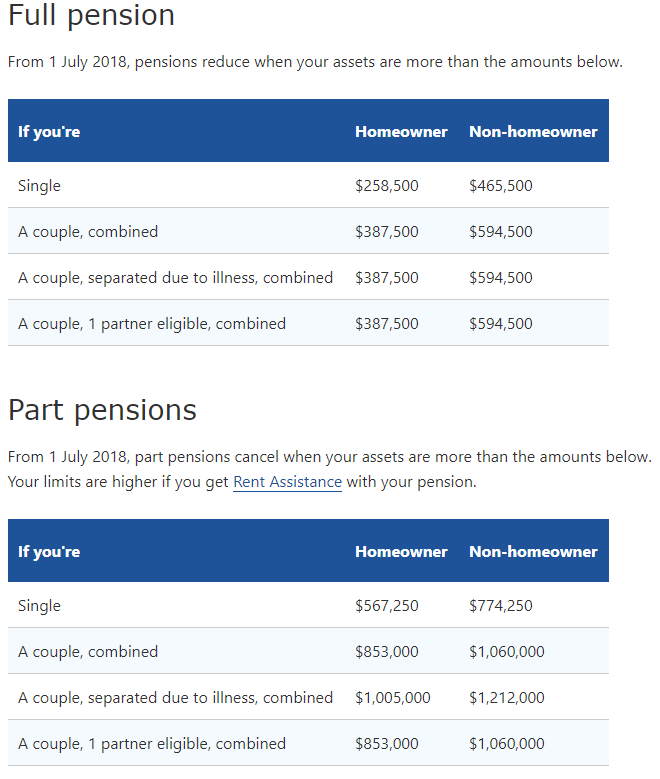

I do not believe I qualify for any pension due to assets unless I am considered a non home owner. I share a home with my family and I legally own 40% of the property. Am I considered a home owner or is there a proportion applied due to my reduced ownership.

Hi Chris, if your name is on the title then you will be assessed as a home owner (even if the ownership is split with others and not 100%). Regarding your overall eligibility we do offer 30min consultations at a cost of $75. We can clarify how Centrelink will assess you specifically and help guide you on any related matters like if the Commonwealth Seniors Health Card is an option for you. If you wish to proceed please CLICK HERE to book the best suitable time available.

I want to know why we’re paying a pension for people to live overseas, dual citizen or not It’s not fair on our tax payers

Julie: Rather unkind comment. Some people when they get old want to return to their country of birth. Why should they not be allowed to receive their pensions to which they are entitled? As well, plenty of people receive an overseas pension although they have not lived or worked in their home countries since way back when. Should they refuse these so they can get a full Oz pension?

I lived in Australia 34 years. I spent 3 years in My Home Country when I wasn’t a Pensioner due to the instability of Housing and work. I recently advised Centrelink of moving for 6 to 8 months and see if I lived with more resources in My Country of Birth since in the last 8 I moved 18 times with no grounds and unlawful renting on behalf of Landlords. I get the basic Pension but I have a more stable Home and life with family and Friends. I miss My children and grand children but loneliness and struggling was too much to handle. Centrelink said I can only stay 6 months and if I don’t go back to Australia they Will reduce the Pension in half due to my traveling while I was an Australia citizen? Does that mean You can’t have holidays? because I haven’t been anywhere since I’m a Pensioner. I don’t get it and don’t understand why all these since there is a Housing Crisis in Australia and Nice people homeless in they street because they can’t rent anything under 350 a week. So how long do they require we stay in Australia before we depart again where we can live with the Pension we get.

Hi Anabel, thank you for sharing your situation with us! There are 2 rules that come into play when looking at the impact of having lived/living overseas. The first is referred to as the ‘Returning Resident’ rule and based on your comments it does not apply to you specifically but I am posting it HERE for the benefit of other readers in similar situations whom it may impact. The second, which is what you are referring to in your comment, is the rules around how your pension is impacted by overseas travel even if you have not recently returned to Australia to live and you can read about the timeframes and impacts HERE .

I guess Julie, its because most of these people have been paying taxes all their working lives in Australia. When they retire they should be able to receive and spend their pension anywhere they like. I would much prefer people getting a pension that have earned it (in Australia) rather than pay pensions to immigrants the minute they lob on our shores. No offense to the immigrants its not their fault.

I agree wholeheartedly! I cant even get $1, I worked f o r 54 years in Oz…paid taxes raised 3 kids…and I kn oiw people who haver NEVER worked in Oz get an overseas pension AS WELL as an Oz pension! Its BS!

You mean they get less of an Australian pension as the income from the overseas pension kicks in. So its better that way as it saves the Oz taxpayer more money and they are less of a burden on Medicare right?

Its not fair to pay politicians and all the infrastructure around them. All they do is sign papers. Absolutely useless just like councils. Unfair is negative gearing and other taxpayer funded incentives that drive up house prices ti even more unaffordable levels. Unfair to the taxpayer is the billions subsidizing the industries of the politicians friends in big industry. At least those who have worked all their lives are entitled to live anywhere they like because they cannot afford to live in Australia as everything here is ridiculously expensive and why is that? They are less of a burden on the resources of Australia especially Medicare. So it makes more economic sense and humane to allow them to live out the rest of their lives elsewhere. They earned it unlike the politicians you vote for.

I guess that because I worked for nearly 60 years , paid taxes . Obeyed the law and tried to be a good citizen raised 7 children , putting 4 of them through University, I am more than annoyed that at 75 yo my old age pension will be affected if I do go overseas for a time.

Think economics Julie, it’s cheaper for Aust to pay pension than to pay their aged care in nursing homes or pay their medical needs while aging.

It cost approximately $136 a day (in early 2000) for a level 4 resident in the nursing home, aside from paying them full pension. Lower level of needs can be $90 a day. That’s something to learn Julie, aside being nicer to others. We are all migrants not unless you are an Aboriginal.

Thank you for the article. In the chart it states “maximum basic rate” and “basic pension supplement rate”. Can you clarify what these mean please? Give an example if possible?

So if you having been living overseas for a few years and return for a holiday for example six weeks does your pension increase? Do you need to inform Centrelink of your return and then your departure back overseas?

The point is where is the fairness to long term Australians , my Grandfather was a Pioneer in Australia Farming, my father was born in Australia and also a Pioneer in the Farming Industry , i was born here and also a Farmer . I applied and was approved for Pension here ,but then had it immediatly cancelled because i went overseas .. It is cheaper for the Govt if eligible penshioners live overseas and not claiming medical etc ..

Why was it cancelled? You should be eligible for a full pension reduced only for rent, power etc assistance. Depending on where you move to and their agreements with Australia.

As a New Zealand citizen living in Australia I’m on a SCV which is issued at the border. I’ve worked and lived half my life in NZ and half in Australia, I’m entitled to the age pension paid half by Australia and half by NZ. But unlike everyone else on age pension mine will stop if I chose to live out my retirement outside Australia. This is because of legislation which says the SCV ends the moment you leave Australia and begins again the moment we enter so in effect while overseas we have no visa. What this does is removes my opportunities to experience retirement overseas something I’d planned for years. This has been taken away from us. It’s discriminatory and wrong in an all inclusive society as other than how the visa works there is absolutely no reason why we shouldn’t be able to spend our age pension the same as everyone else

Hi Brenton, thank you for articulating your struggle so well! It sounds like you have done some homework but I must say that the scenario you have explained is not how we believe the Australian Age Pension to work when you wish to live overseas. You may wish to call Centrelink’s International Services Team on 131 673 (Monday to Friday 8am to 5pm AEDT) because if you CLICK HERE and scroll down to the heading “If you leave Australia for more than 26 weeks” you will see that your pension may be reduced depending on how many years you have been an Australian Citizen prior to leaving but it does not instantly cancel.

I don’t understand the 2-year residency rule. If I have been residing overseas for several years, should I return to Australia 2 years prior to my eligibility for the aged pension? For example, if I reach pension age at 67 years of age should I return when I reach the age of 65 years or do I return when I reach the age of 67?

Hi Graeme. As a rule of thumb you need to be living in Australia when you apply for the Age Pension; be a permanent resident,; have lived in Australia for at least 10 years; five of which were continuous. The two year residency rule impacts you if you are currently living overseas, return to Australia, and then apply, you will have to remain in the country for two years else your Age Pension will be cancelled

I would like some clear and accurate clarification on this rule that you must be living in Australia when applying for the pension, and then must remain in Australia for another 2yrs after first receiving the pension or risk having it Cancelled. I believe there are exceptions to the rule.

My understanding is that if the Australian Govt has an agreement with a country to share social responsibilities for social security coverage, ( for example Japan) then I believe you are able to apply for and receive your aged pension accordingly.

After reading the information available on the Australian Govt Services Agreement with Other Countries documents it clearly states that if you live in one of the countries listed you are able to receive Centrelink Payments and does not say you must be in Australia and living in Australia when applying and in fact says you can apply online or at the Japanese Social Insurance Agency.

I could be wrong, as Govt information is hardly ever clear and is always full of gobbledygook however this is an important issue for many retiring Aussies that needs clarifying.

Some Services Australia links are here for ref.

https://www.servicesaustralia.gov.au/international-social-security-agreements-between-australia-and-countries-asia?context=22476

extension://bfdogplmndidlpjfhoijckpakkdjkkil/pdf/viewer.html?file=https%3A%2F%2Fwww.servicesaustralia.gov.au%2Fsites%2Fdefault%2Ffiles%2F2022-07%2Fint033-2205en.pdf

Hi Edward, it can be tricky knowing what rules apply and when! How Centrelink will assess each person specifically can vary so it is difficult for us to give the level of specificity you are seeking in a forum such as this. You would need to book a consultation with us ( HERE ) so that we can discuss your individual scenario and clarify how Centrelink will assess you.

I have been overseas this year four times with no trip being longer than three weeks. Does the 6 week rule apply to the total of several shorter holidays overseas or just when a trip consists of more than 6 weeks of consecutive days.

have lived and worked in Australia for 34 years ,moved overseas at age 63 can i get age pension when i am 67 if i come back to apply for it ,then go back overseas or will i have to stay here 2 years first. not living in an agreement country

Hi Kevin, thanks for your query! If you have been living overseas within the last 2 years before lodging your claim, Centrelink will ask you to remain in Australia for 2 years from the day you first moved back (not when you applied/got approved for Age Pension). Therefore you could move back here at age 67, lodge the claim and then remain here until you are 69 or you could move here at age 65, live here until 67, then apply/get approved and move back overseas.

I understand that I can travel overseas for 24 weeks and stay in Australia fir 28 weeks in a year my pension is not affected . My confusion is how is the year calculated- calendar year or financial year ?

Hi Ranjana, thanks for your comment! You are right that if the total amount of time you have spent outside of Australia in the past 12 months is only 24 weeks then you will not be considered to be living in another country however, any holiday abroad that goes for more than 6 weeks will result in your pension being reduced as the pension and energy supplements are removed at this time. Therefore it is incorrect to believe that you could go on a 24 week holiday and not have any impact to your pension, you would have to go on six holidays, for 4 weeks each, to avoid any impact.

In regards to the timing, it is based on whenever your first trip overseas starts. If you leave for your trip in February then the 12 month period taken into account is from the February you first leave up to the following February next year.

On this point do these rules apply to both partners if only one is of pension age?

Hi Eddie, thanks for asking a great question! If your partner is under Age Pension age then their travels overseas will not impact your Age Pension.

How would my pension be affected if I returned to the UK. I am 93 years of age and have been on a UK pension frozen since I was 65 because I have lived in Australia since 1994.. I have been receiving a part Australian pension from Australia for more than ten years. A response email would be appreciated.

Hi Colin, glad to hear you loved Australia so much you couldn’t leave! Regarding the potential impacts that moving to another country can have, there are a couple of factors to be considered. To understand the potential impact to you specifically we would need to have a confidential discussion to then provide you with your options and the pros/cons of each. Please CLICK HERE to book a day/time that suits you.

I’m an Australian citizen 58 years old. Married to a British Citizen husband who has permanent residency in Australia, and is currently receiving an Australian aged part pension We are planning on moving to the UK to live permanently within the next 12 months or so and are aware that we need to return to Australia at a later date , for two years if I decide to apply and begin claiming the aged pension. We are then returning back to the UK after the 2 years has expired. What I would like to know is – Would I qualify for the pension even though I I would have been living in the UK for approximately 9 years prior with the intention to return back to the UK to live indefinitely or would Centrelink require me to return to Australia to reside and show proof of this before they grant me the pension?

Hi Michelle, thank you for sharing your situation with us! It sounds like you’ve already done your homework as not many people are aware of the need to reside here for 2 years so well done! Thankfully the residency requirement is simply that you have spent at least 10 years living in Australia ad a citizen/permanent resident (with 5 of them having been consecutive). It does NOT have to be the last 10 years prior to applying. Therefore you have likely already ticked this box and are free to do as you plan to, so long as you spend the 2 years living here when the time comes for you to apply for the Age Pension yourself. Lastly Michelle, if you haven’t already, READ HERE about how you and your husbands Age Pension amounts may reduce when you do move overseas.

I have been living in AU for over 35 yrs however my age pension has been reduced to the basic rate on the grounds that I’m now living overseas for over 26 weeks and that I have been australian resident for only 22 years according to centrelink’s weird calculations. When I spoke to customer service representative I was informed that the counting of numbers of years in Australia stopped in 2009 (I arrived in AU in 1987). I could not find any information on centrelink website or anywhere else about this calculation method, no legislation, no documents proving it.+ So the information provided on centrelink website that you need to be a resident for minimum 35 years to get full rate of pension when living overseas is misleading.

Hi Andrew, thank you for sharing your experience with us! There are reasons why some years spent living in Australia may not be counted in the 35 year rule. For example any years you spend living here after you hit Age Pension age are not counted. If you turned 65 in 2009 (as that was the Age Pension age back then) this would mean that consequent years spent living here were not taken into account. CLICK HERE to learn more.

Thank you for all the information! I have a separate query. As an age pensioner, what if I leave Australia for around 26 weeks but then visit New Zealand for 2 weeks. But what happens to my pension payments if I again take a trip outside of Australia for less than 6 weeks. How will may payments be effected? This is all within 12 months after my less-than-26 week initial trip. A bit confusing for me!

Thank you again, Warren

Hi Warren, don’t feel bad, this is a subject that many people are unsure about! Thankfully Centrelink do have a good web page that explains what happens to your payments when you travel HERE .

I have claimed for my age pension, I lived for more than ten years in Australia. My family decided to return to Italy in 1980. My application for age pension, through the Italian INPS, was submited in february and received in march 2023.My question is: how long will it take before payments are competed? Your information will be appreciated…..

Hi Giuseppe, thank you for reaching out! If your claim was approved in March then you definitely should have started receiving payments by now, You should contact Centrelink to query what is happening.

I am 63 years old and have a Thai wife who has a property in Thailand. I would like to know if I can permanently move there once I can claim the pension at 67

Hi Dirk, thank you for seeking our assistance! Yes you can move overseas and still receive the Age Pension however as per the content in this article the amount of Age Pension you receive will be reduced.

Hi, i own my home in NSW and i want to buy a holiday home in Italy but i want to keep both homes so in a few years will lose my age pension cause of the second home in Italy

I’m 60 and was born in Australia, living here all my life apart from some 3 month holidays overseas. I’m ill health retired with a defined benefit pension. In the next couple of years I would like to relocate overseas (to a non-social services partner country). Do I have to then return to Australia for 2 years to be eligible for the pension after spending my entire working life here? Does the 2 year rule mean I cannot even leave temporarily during that time? Thanks for a great article – so hard to find quality information about this online.

Hi Vincent, thank you for the compliment and glad to hear you found the article helpful! In order to avoid complications you would need to return to Australia at age 65 and live here for 2 years prior to applying for the Age Pension. If you do this then once the pension is approved you can then leave again and live overseas with no need to return again.

What about if he spends 24 weeks overseas during that 2-year period?

Hi Ray, thanks for getting into the nitty gritty! In that scenario the 24 weeks would likely be classed as an overseas holiday but still living in Australia during that time and so it would not impact the 2 years rule.

Hello! My dream is to retire to Scotland after turning 67 in 4 years time. I have lived most of my life in Australia and will qualify with a AWLR of 50 plus years. I understand that I will need to be a full time resident for 2 years before applying for the pension but my query is do I need to serve the 2 years after claiming the pension before I can move permanently overseas? All the info I have seen online seems to apply to people that have returned to Australia to claim the pension. Fingers crossed!

Hi Paul, thank you for sharing your scenario with us and well done on your research! The good news is you are right, the 2 year residency rule only applies to people who recently returned to live in Australia and apply for the pension. If you have been living here for +2 years prior to applying then there is no need to remain here once approved.

Thanks Steve and the crew at RE for your generous answers. I found clarity around that 2 year stay in Oz rule. It don’t apply to me as i’ve been a resident for way over 35 years. I did take an 18 month holiday in 1990-1991 though.

Hi Bri, thank you for the recognition, we don’t always know if our efforts are hitting the mark or not so much appreciated.

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

News Topics

Centrelink Age Pension

Commonwealth Seniors Health Card

Planning for Retirement

Retirement Advice

Retirement Income

Retirement Spending

Superannuation

Our Services

Age Pension Eligibility Calculator

Age Pension Application Service

Commonwealth Seniors Health Card Application Service

Retirement Advice Consultation

- Ortho Month at Mt Lawley

- Things to do in self-isolation or quarantine

- Riverside Theatres’ newsletter sign up and double pass giveaway competition

- So Much Myself: Piano Portraits

- Neighbourhood connection improves mental health

- Pickleball fun for all

- New regional swimming courses available for active adults

- The ultimate end-of-lease cleaning checklist

- Music, words and more at the 19th Woodend Winter Arts Festival

- Highway of Lost Hearts

Travelling overseas on the age pension: what you need to know

You’re revelling in having earned your retirement. You’ve found a great financial adviser that has structured your income and assets so that you can maximise age pension benefits. Travelling overseas regularly is on your wish list. Perhaps you’ve dreamed of renting an idyllic cottage in the South of France or Tuscany or an apartment in New York? At long last, you can realise that dream. Or can you?

Depending on how long you leave our sunny shores, your government funded payments and concession and health cards may be affected. The outcome depends on how long you intend to travel outside of Australia for, and how long you’ve been an Australian resident.

If you are not paid under an international social security agreement , keep reading.

Here is what you need to know about your age pension benefits and travelling overseas to enjoy an extended holiday.

What you need to know about travelling overseas on an age pension if:

You’re travelling overseas for less than six weeks.

If you’ve been an Australian resident for more than two years and you plan to be back in less than six weeks, simply enjoy planning your holiday.

You don’t even need to let Centrelink know and you’ll continue to be paid your Age Pension.

You’re travelling overseas for more than six weeks

You’ll need to let Centrelink know. Your Age Pension rate will reduce after six weeks. The Pension Supplement will be paid at the basic rate and your Energy Supplement will stop being paid to you. You can find details of the reduced pension rates while you’re away from Australia via the link below.

Department of Human Services website > Customer > Enablers > Pension rates payable outside of Australia .

You’re travelling overseas for more than 26 weeks

If you’re aspiring to rent somewhere in a village somewhere outside of Australia to pen that first novel, this one is for you.

Rates of payment are a little more complicated when you’re outside of Australia more than 26 weeks.

The pivot point is based on the number of years you have lived in Australia as an Australian resident from back when you were sweet 16 to qualifying for an age pension. If your calculation is 35 years or more, you may still be entitled to a full means tested rate of Age Pension after 26 weeks outside of Australia. Otherwise the rate reduces and is calculated proportionally.

You’ve returned to live in Australia in the last two years and want to travel overseas

If you’re being paid an Age Pension and have recently returned to live in Australia, you’ll need to talk to Centrelink. You may not be entitled to payments while you’re travelling overseas. Centrelink may rule that you have to wait out two years of receiving the Age Pension while you’re living in Australia, first.

You’re an Australian Concession Card or Commonwealth Seniors Health Card Holder

If you’re off to live elsewhere, your cards will be cancelled when you leave Australia. When your plan is to holiday overseas for less than six weeks, your Concession Card stays intact. If you’re overseas for more than six weeks, your Concession Card will be valid for up to six weeks and then reactivated once you’re back in Australia.

After 19 weeks outside of Australia, your Commonwealth Seniors Health Card will be cancelled. You can reactivate your card once you return to Australia.

Enjoy your adventure

If you haven’t already, make sure you sign up to my.gov.au before you go travelling overseas so you can access all your Age Pension information online.

And if all this has dampened those novel writing dreams, then perhaps a cottage in Hobart would do the trick?

Other helpful resources about travelling overseas on an age pension

Australian Department of Human Services > Customer > Australians Overseas

Smart Traveller > Senior Travellers

STAMP OF APPROVAL FOR 2016 MACAU GRAND PRIX

How to care for your ageing pet dog

Related posts, travel the natural world and journey through seven continents, debunking retirement living myths: freedom, fun and a full life, hunter valley, australia’s first valley of wine, 11 comments.

Thank you for this article Julie. Most informative indeed!

“Rates of payment are a little more complicated when you’re outside of Australia more than 26 weeks.”

Are you aware if the 26 week period is for one continuous period? Or is it the accumulation over trips made over a 12 month ?

I would like to travel an number of times between Australia and Thailand each year … perhaps spending 3 months there and 1 month back home in AUS each time. I am finding it difficult to get a ruling on this situation.

I understand there may also be ramifications with Medicare as well??

Are you able to add any further?

Thanks again

Hello John. Thank you for your feedback and for following Go55s.com.au! As a writer, I have researched the information from various sources – mostly from the Department of Human Services. The safest way to ensure you’re getting the right information when you have specific travel plans, without risking your Age Pension payments would be to call the Age Pension number on 132 300 directly with your questions in hand. That way you can ensure you have a time and date that you called, in case any payment issues arose further down the track. Sounds like you have wonderful plans ahead. Enjoy.

Hi Julie, I will reach pension age in February 2022 and hoping to spend as much time as possible with family in the Philippines afterwards, by then I will have lived in Australia for approximately 25 pension qualifying years so my pension would be reduced by two sevenths after six weeks, I am trying to work out if it would be economically viable to return to Australia after every six week period or just stay there permanently but cannot find anywhere how you are considered to still be a permanent resident i.e. would I need to keep a permanent address here in Australia during my absence, obviously paying rent while overseas would make this prohibitive, any advice you could give would be gratefully received.

Hello David. Thank you for reading the article and reaching out. As I writer, I know a little about all the topics I get to indulge writing about, but cannot claim to be an expert and am not qualified to offer you sound advice on your particular situation. You really need the advice here of an accountant or financial adviser that is experienced in the ins and outs of the Aged Pension. I recommend some expert counsel. Good luck. It sounds like you have wonderful plans ahead! Enjoy.

Hi Julie. Thanks for the very concise and uncomplicated review. In it you state “When your plan is to holiday overseas for less than six weeks, your Concession Card stays intact. If you’re overseas for more than six weeks, your Concession Card will be valid for up to six weeks and then reactivated once you’re back in Australia”. I will be overseas for more than 6 weeks and have notified Centrelink of my travel plans. Do I actually have to take any action to reactivate my Concession Card or will this happen automatically? Thanks in anticipation of your reply.

Hello Peter. Thank you for taking the time to provide feedback, and reach out with a questions. My understanding from what information is available online is that if you’ve advised Centrelink of the date you’re planning to return, your concession card will be automatically reactivated. Enjoy your travel!

Hi, Im confused with the time allowed overseas we are a couple on age pension my wife only is going overseas fo 5 weeks does this mean we are only allowed 1 more of overseas travel or is it 6 weeks per person allowed also is it per calendar year or finacial ? Thanks AL.

I have a simple question. Does Centrelink monitors overseas travel by pensioners?

hello thanks for the useful information and posts 🙂

I arrived as a migrant in Australia 1975 i travelled to Germany in 1981 and returned to live in Australia in 1983 I took a 6 months holiday overseas

will I stil lget myage pension I travel again for six months after my return from my curren tholiday?

See this article was written in 2016, mindful that rules change frequently, wondering if this is still the case.

You’re travelling overseas for less than six weeks If you’ve been an Australian resident for more than two years and you plan to be back in less than six weeks, simply enjoy planning your holiday.

Write A Comment

Save my name, email, and website in this browser for the next time I comment.

Type above and press Enter to search. Press Esc to cancel.

Age Pension and Travel Overseas

Now that Covid is no longer such a thread, international borders have opened, all airlines are just waiting for you to jump on the plane and cruises boats are awaiting new passengers, many retirees start thinking, how long can I actually be overseas and still continue receiving my Age Pension.

As anything to do with the Centrelink office, there are strict rules how travelling overseas may affect your payment, of Age Pension or Service Pension received from the DVA office (Department of Veteran’s Affairs), so it only makes sense to understand those rules before you jump on the plane or the cruise liner to enjoy your long-overdue overseas holiday.

So today, we are NOT talking about leaving Australia for good in order to live overseas, You can read about living overseas: “ Retirement and Living Overseas ” and “ Retirement overseas and Age Pension “

Today, we are talking about the situation when you are leaving Australia to go overseas maybe for trip of a lifetime, travel from one country to another, from one continent to another, to fly, to sail, to hike, to bike, whatever takes your fancy, this would be my dream overseas holiday travel.

But maybe you have a family overseas, for example your kids left Australia to pursue an incredible professional career in another country, of maybe you were born overseas, and you’ve always wanted to re-visit the country of your heritage, get to know its people and the culture.

Whatever the reason for your long overseas travel is, it pays to understand the rules if you are a recipient of any government retirement income, whether it is Age Pension or Service Pension or any other government benefit.

“You don’t choose the day you enter the world and you don’t choose the day you leave. It’s what you do in between that makes all the difference.” Anita Septimus

I love this quote and you can apply it to anything you do in your life.

So now, let’s jump into our today’s topic: “How long can I travel overseas before it affects my Age Pension?”

1. Travel overseas for less than 6 weeks

If your plan is to be away from Australia for less than 6 weeks at the time, your Age Pension will not be changed and you will enjoy the full payment you are eligible for, as if you were in Australia all the time.

2. Travel overseas for more than 6 weeks but less than 12 months

If you stay outside of Australia longer than 6 weeks, the government will remove your payment of Pension Supplement and you will be receiving the basic rate. Also, the Energy Supplement will stop. Both of those payments will be reinstated on your return to Australia.

So as you can see, unlike the common believe, you can be overseas for quite some time and still enjoy your government pension payments going to your bank account every fortnight.

Things change however, if you are outside of Australia for a period longer than 12 months

3. Travel overseas for longer than 12 months (26 fortnights)

If you wish to stay overseas for longer than 26 fortnights, your eligibility to continue your Age Pension payments will depend on how long you were an Australian resident between the age of 16 and Age Pension age. If you are unsure what Age Pension age means, read “ Age Pension explained “ where you will understand all the basic requirement of Age Pension eligibility.

So let’s discuss the Australian residency rules.

As mentioned above, your residency is based on your length of your “Australian Working Life Residency” and it is set at 35 years. Despite its name, it is not a requirement for you to be working all those 35 years.

If your Australian Working Life Residency is 35 years or longer, you can spend overseas longer than 26 weeks and your basic Age Pension rate will continue with no disruption. The only change could be that your payments might be made to the bank account every 4 weeks, rather than a fortnight, and you might be receiving payments in the local currency or US dollar, depending on the country you are in and the agreement between Australia and that country.

If you’ve lived in Australia for less than 35 years, then your Age Pension payment rate will be proportional, based on number of years of your residency in Australia.

So to make it clear, let’s look at some examples of pensioners receiving full Age Pension payments:

- John is a single pensioner and has been living in Australia for 50 years. He is now 72 years old and wants to visit his daughter who moved to UK, married there and has the family and a successful career. Because John’s Australian Working Life Residency is longer than 35 years, after 26 weeks of stay in UK, his Age Pension will continue at the full basic Age Pension rate of $22,937pa.

- Stefano is also single and in a similar situation having all his children in Italy, but he’s only been an Australia resident for 20 years. Therefore after 26 weeks in Italy, Stefano’s Age Pension will be reduced proportionally, down to $13,107pa.

Those calculations are correct based on the full basic Age Pension payment of $22,937 in April 2022

4. What happens to my Pensioner Concession card while I am overseas?

If you leave Australia to live overseas, then your Pensioner concession card will be cancelled immediately upon your departure from Australia.

If however you leave Australia for a prolonged holiday, your Pensioner Concession Card will stay valid up to 6 weeks, after which time will be cancelled. However, it will be reissued to you once back in Australia.

If you don’t know the benefits of that card, see: “ Pensioner Concession Card “

5. Commonwealth Seniors Health Card

This card will also be cancelled if you are outside of Australia for longer than 19 weeks. When you return, just contact Centrelink, advise of your income level and as long as you continue to be within the income limit, your card will be reinstated. If you don’t know income limits and benefits of Commonwealth Seniors Health Card, check: “ Centrelink concession Cards for your Retirement “

6. What to do before you leave Australia?

It is recommended that you either:

- register for a Centrelink online account via myGov or

- provide a nomination to a third party to act on your behalf, this could be a member of your family or your financial planner. Keep in mind that not all financial planning offices provide such support, my practice does, but due to many changes that our government introduced to financial planning, and some of them are dreadfully unfair and virtually killing this profession, many older and very experienced financial planners left the industry, leaving many retirees with no support and advice, as younger generation is not equipped with knowledge or experience to deal with issues retirees face.

- Also, don’t forget to update Centrelink of your income and assets before you leave to ensure that your payment is not delayed.

7. What to do on your return to Australia?

Generally you don’t need to contact Centrelink on your return to Australia, unless:

- your payment was stopped while you were overseas and it hasn’t restored automatically

- you were required to provide reason for the travel and you have not provided those details

Travel overseas can be a great fun, but my sincere recommendation is:

- make sure that you have provided all details Centrelink requested of you to ensure you Age Pension payments will not stop.

- ensure that you have sufficient cash backup in your bank account.

- never, ever travel overseas without the Travel Insurance. In most cases people think about covering your luggage, or your camera and other personal items,. As important and dear to your heart those items could be, it is the medical cover and assistance that should be the most important, as well as cover of your cards and all your travel documents.

“Retirement is a Journey, not a Destination, so be well prepared for the Ride”

By: Katherine Isbrandt CFP® Money Strategist & Retirement Planner Principal of About Retirement

Select a topic

- Aged Care Simplified

- Beautiful Retirement

- Creating Financial Success

- Estate Planning

- Ethical & Environmental Investing

- Pre Retirement & Super

- The World of Investing

- Woman and Money

More Resources

- Forms & Calculators

Say Hi on Social

Get the latest news.

A tiny request: if you liked this article, please share it

Most people don’t share articles, thinking that one share will not make a difference, but believe when I say, each article takes hours of putting it together, and I create them as I really want to make a difference in people’s lives.

So thank you so much for your support. Not only you will seriously help this blog to grow, but more importantly you will help people who might need this information and advice.

Some great suggestions how you can share it:

- Share it on Facebook

- Email to your friends and colleagues

Just pick your favourite button from the left side of this post, write your note and it’s done. THANK YOU

Related Posts

Steps to prepare for retirement

Feb 21, 2024 | Beautiful Retirement

You are ready to retire, and now what? Steps to prepare for retirement.I’m sure that in every country you have to put...

What’s Planned for 2024

Jan 10, 2024 | Beautiful Retirement

What’s Planned for 2024 HAPPY NEW YEAR I do hope you had an amazing Christmas with your loved ones, and that you...

Is gifting money for Christmas a good present

Dec 13, 2023 | Beautiful Retirement

Is gifting money for Christmas a good present I don’t know about you, but I have noticed that the older I get, the...

Pin It on Pinterest

- Skip to navigation

- Skip to main content

About the Department

Portability requirements (taking your payment overseas)

Covid-19 information and support.

Portability periods may be extended for those who are overseas and unable to return to Australia. Visit the Services Australia website for more information.

- Introduction to portability

Current portability rules by payment type

Portability and residence, portability of payments for former residence, introduction of general portability in the 1970s, changes to portability in the 1980s, changes to portability in the 1990s, indefinite portability in certain circumstances, 26 week portability for temporary absences (short-term), extension of the portability period, saved cases, proportionalisation of pension payments, certain dsp recipients granted indefinite portability, other short-term portable payments and specific requirements.

- July 2011 – Residency requirement for DSP recipients travelling overseas

- July 2012 – Indefinite portability for some DSP recipients

- January 2013 – Reduction of portability from 13 weeks to six weeks

- July 2014 - Australian Working Life Residence (AWLR) requirements increase from 25 years to 35 years

- January 2015 - Change to DSP portability rules (four weeks in a 12-month period)

January 2015 - Portability of student payments reduced to limited circumstances

July 2016 - family tax benefit (ftb) part a portability reduced from 56 weeks to six weeks, introduction to portability.

The term 'portability' refers to the continuation of Australian income support payments during a recipient's overseas absence. Portability policy acknowledges that travel is an integral part of modern living. This is particularly true in ethnically diverse societies such as Australia, where more than a quarter of the population is overseas born.

There is a fundamental difference between most overseas insurance-based contributory systems and the Australian social security system. Australia's income support system is not based on contributions or taxes paid in Australia. Australia’s social security system is based on the concepts of residence and need. Payments are made from general revenue paid by the current taxpayers.

To be eligible for income support, customers must normally be Australian residents and in Australia at the time of the claim. For many payments, such as Age Pension and Disability Support Pension (DSP), claimants must also satisfy payment-specific qualifying periods of Australian residence.

Portability of Australian social security payments is regulated by the Social Security Act 1991 (the Act), setting out which payments that are portable, for how long, at what rate and under what conditions. Portability of Family Tax Benefit is regulated by the A New Tax System (Family Assistance) Act 1999 .

Chapter 7 of the Social Security Guide provides more detailed information on Australia’s portability rules.

Apart from the portability rules under domestic law, Australia currently has 31 international social security agreements that regulate reciprocal portability of benefits between Australia and an agreement country. The provisions in the agreements override the portability rules under domestic law. The portability rules under the international social security agreements are country specific and can be found in the Social Security (International Agreements) Act 1999 .

Chapter 10 of the Social Security Guide provides more detailed information on Australia’s international social security agreements.

The Department’s Social Security Guide sets out the general portability rules and current portability provisions for individual social security payments and benefits. This information is reviewed and updated regularly to reflect portability policy changes. The Portability Table can be found in the Social Security Guide at Topic 7.1.2.20 .

The availability of short-term portability (excluding DSP, Widow B and Wife pensions) depends on whether the customer continues to satisfy the residence requirements. In deciding whether a person travelling overseas for a short time continues to reside in Australia, regard is given to the nature of the person's accommodation in Australia, family relationships, employment, business, financial ties, assets and the frequency of or duration of travel outside Australia. Recipients who return to Australia just to renew their portability period would not satisfy the 'residing in Australia' criterion and would not qualify for continued payment.

Further information on the residence requirements can be found in the Social Security Guide at Chapter 3.1.1.10 Residence Requirements.

The fundamental tenets of the Australian social security system are residence and need. Because residence is a fundamental qualification criterion for Australian social security payments, former residents who return to Australia and subsequently claim Australian social security payments with indefinite portability, are required to stay in Australia for at least two years before their payment becomes portable. The policy rationale for this requirement is that indefinite portability is only available to Australian residents. The former resident rule prevents people who lose their connections with Australia to return to Australia just to obtain a pension and return overseas.

Further information on the former residence requirements is in the Social Security Guide at Chapter 7.1.4 Requirements for former residents of Australia receiving a portable pension.

Evolution of portability policy

In 1973, general indefinite portability was introduced for many Australian pensions. Portability enables certain payments to continue to be paid when a person travels overseas. Indefinite portability was extended to most pension categories and did not impose additional residence conditions for payments to be made overseas. Generally, if a pension was payable in Australia, it was payable overseas. This approach was supported by the special need provisions. Former residents with a substantial connection to Australia, in special need of financial assistance, could access entitlements if they had left Australia without a portable pension before indefinite portability was introduced on 8 May 1973.

Australia’s portability policy in the 1980s continued to depend on a person’s residence and need. Policy initiatives curtailed the payment of pensions overseas where the person had very little residence in Australia.

Key policy changes made to Australia’s portability arrangements in the 1980s included the following:

In 1986, as part of the negotiation of international social security agreements with several overseas countries, policies were introduced to pay a proportion of a person’s pension if they moved overseas. This policy emphasised the principle of shared responsibility and provided a mechanism to rationalise the extent of Australia's responsibility to provide income support to non-residents.

Proportional portability also provided for some compatibility to the minimal contributory period applied by the social security systems of other countries. In order for the customer to be paid, a minimal contributory period was required. In the Australian social security system, once a person satisfies the qualifying residence rules, the pension is paid overseas, but the rate of pension may be adjusted to reflect the person’s period of working life residence in Australia (ie: between 16 years of age and pension age).

On 8 May 1985, in line with its intention to create a portability system compatible with the contributory systems of other countries and the network of international social security agreements, the Government modified general portability conditions with the introduction of proportional portability based on working life residence for pensions granted after 1 July 1986, with savings provisions.

From 1 October 1987, indefinite portability of Carer Pension was stopped.

From 1 July 1988, the portability of Sole Parent Pension was limited to the first twelve months of an absence except for special widows.

From 1 February 1989, departure certificates were introduced.

In 1991, the portability of Wife and Widow B Pensions was limited to the first twelve months of an absence unless recipients were entitled persons.

From 12 November 1991, a twelve-month limitation on the portability of certain DSP payments was introduced.

In 1992, short-term portability of Carer Pension was re-introduced for carers travelling overseas together with the person being cared for and for carers in a respite period.

From 1 January 1993, additional family payments ceased to be portable. This is the date from which additional payments for children of pensioners were integrated into the family payments system. Portability of those payments was barred, unless pensioners were already overseas or able to export the payments under the provisions of an international social security agreement.

From 1 January 1995, the penalty clauses in the departure certificate provisions were moderated.

September 2000 - simplification of the portability rules

In the 1999-2000 Budget, the Government proposed simplification of all portability rules contained in social security law. The simplified portability rules were introduced by the Social Security and Veterans' Entitlements Legislation Amendment (Miscellaneous Matters) Act 2000 with the date of effect 20 September 2000. The rules addressed the problems of complexity and provided a comprehensive and consistent approach to portability across all payment types.

As part of the changes, portability was not considered a qualification criterion for Australian social security payments. It became a payability issue. From 20 September 2000, all social security payments could be paid while a customer was overseas subject to continuing qualification.

The simplified approach to portability was guided by the principles of fairness, equity and the need for administrative simplicity. Instead of nine different portability periods, the simplified rules generally prescribed only two portability periods for social security payments:

indefinite portability for permanent absences; and

short-term, 26 week portability for temporary absences.

Where a pension was needed for a major contingency of life, such as age or severe disability, the recipient was offered the right to choose their permanent place of residence and could continue to be paid overseas indefinitely. However, portability of these pensions also reflected international practice in that the overseas pension rate for this group depended on the length of contributions/residence in the paying country.

For payments that required a customer to be an Australian resident to maintain qualification for the payment, portability was allowed for temporary absences of up to 26 weeks. This change complied with the residence principles of the Australian social security system and, at the same time made the standardised portability system possible.

The introduction of a standard 26 week portability period was the most important aspect of the September 2000 changes. Selection of the length of the standard short-term portability period was based on research of the travelling patterns of social security customers. More than 85 per cent of all social security recipients who travelled overseas went for less than 26 weeks. Within the group that travelled, around 90 per cent travelled for up to 13 weeks. After the 13-week period the numbers of travellers rapidly declined. In addition, a survey commissioned by FaCS in 1999, showed that more than 80 per cent of respondents from a representative sample of the Australian population identified periods shorter than 26 weeks as the intended period of travel. A majority of respondents selected a portability period of up to 13 weeks.

Where the customer could not return to Australia before the end of the portability period, the new portability rules also introduced the possibility of an extension of the portability period under strictly defined conditions. This discretionary power could only be applied if the event preventing the return occurred while the person was overseas and was not foreseeable before departure. The typical events are described in social security legislation and the Secretary's discretionary power was delegated to Centrelink.

Customers already overseas at the time of introduction of new portability rules were protected against any possible detrimental effects of the changes. Customers in receipt of pensions, such as Age, DSP, Wife and Widow B, were subject to old rules until they returned to Australia for longer than 26 weeks. Other customers overseas were subject to old rules until they returned to Australia.

After the 20 September 2000 changes, the Australian overseas rate of Age Pension and DSP became proportional after 26 weeks of absence from Australia. After that period the Australian overseas rate reflected the years of residence that a recipient has accumulated in Australia during their working life. Recipients moving overseas for more than 26 weeks could only be paid their full rate of Age Pension if they had 25 years (increased to 35 years from 1 July 2014) or more of Australian Working Life Residence (the period between the age of 16 and Age Pension age). Recipients with less than 25 years were paid a proportional rate based on the duration of their working life residence in Australia. For example, if a person had 16 years of working life residence, after 26 weeks of absence they would have received 16/25ths of their rate paid in Australia.

Proportionality does not apply to severely disabled DSP recipients if the disabling event occurs in Australia when the person was an Australian resident.

In the 2015-16 Budget, a measure was proposed to reduce the period that Age Pension, and a small number of other payments with indefinite portability, could be paid outside Australia at the normal (means-tested) rate from 26 weeks to six weeks. This measure is no longer Government policy and was reversed in the 2017-18 Budget.

July 2004 - Reduction in portability period from 26 weeks to 13 weeks

As part of the 2003-2004 Budget, the Government reduced the allowable period of temporary overseas absence for portable pensions and allowances from 26 to 13 weeks. These rules were introduced by the Family and Community Services and Veterans' Affairs Legislation Amendment (2003 Budget and Other Measures) Act 2003 and were effective from 1 July 2004. The measure encouraged people of workforce age and on income support payments to remain in Australia and be available to contribute through employment or social participation.

This change did not apply to Age pensioners and 'entitled' Widow B and Wife pensioners. 'Entitled' Widow B and Wife pensioners included women who had been Australian residents for more than 10 years or whose legally married partner died.

People paid Age Pension or DSP under an international social security agreement were not affected as long as they remained in the agreement country. They were able to travel outside that country for 13 weeks without being affected, the same allowable period that applied to someone who was temporarily absent from Australia. Customers who were overseas at 1 July 2004 were not affected unless they returned to Australia.

This change applied to DSP recipients who were severely disabled or blind (who at the time of the changes had unlimited portability). These people, from 1 July 2004, had their allowable overseas absence limited to 13 weeks. Carer Payment and Carer Allowance customers were also affected by these changes.

As defined in the legislation, in special circumstances recipients of DSP could be granted payment indefinitely if they were terminally ill and planning to return to their country of origin to be with family for care and support.

DSP recipients who were residing overseas and were currently paid portable pensions could continue to receive payment if they came to Australia to visit family and returned overseas without becoming Australian residents again.

While all short-term portable payments were made portable for up to 13 weeks, qualification for some payments also required that a person satisfied criteria such as looking after a dependent child, providing care to a person with a disability, studying or actively seeking employment. It may not have been possible to satisfy these criteria while customers were overseas. For this reason, in order for payments to be portable, recipients had to be exempted from these qualifying requirements for the period of overseas absence. This exemption was usually for a defined period of time and often under specific conditions. For example, recipients of Newstart Allowance may be exempted from the activity test if they are going overseas to seek medical treatment of a kind not available in Australia, to attend to an acute family crisis, for a humanitarian purpose, or Army Reserve training camp. The exemption from the activity test and, therefore, portability of the payment is only for the period needed to undergo the treatment or attend to other responsibilities.

The standard short-term portability period of 13 weeks meant that, if a customer qualified for the payment, it could be paid for up to 13 weeks while the customer was overseas. After that period, the payment stopped due to the portability limits. However, if a recipient of a payment was required to satisfy specific qualification criteria that could only be satisfied in Australia and had been exempted from these for a specified period, the person could go overseas for the duration of the exemption period provided it was no longer than 13 weeks. However, if the person remained overseas longer than the period of exemption the payment stopped even though the portability period of 13 weeks may not have expired. This was because the recipient ceased to be qualified for the payment.

For some payments such as Youth Allowance and Austudy, the activity test could be satisfied while overseas, for example, recipients going overseas as a part of an approved Australian educational course. In these circumstances portability was allowed for the duration of the overseas course. Also, recipients of payments such as Newstart Allowance, Youth Allowance, Austudy, Parenting Payment and Mature Age Allowance who were overseas for the purpose of undertaking Reserve Service could be paid for the duration of the Reserve Service activities overseas.

July 2011 - Residence requirement for DSP recipients travelling overseas

The changes introduced on 1 January 2011 required a person receiving DSP to be a permanent resident in Australia to continue to receive their payment. This measure brought DSP in line with all other workforce age payments which have an ongoing residence requirement. The residence status of DSP recipients is reviewed to ensure that only customers living permanently in Australia will continue to be eligible for DSP.

To determine whether or not a person is residing in Australia, regard is given to the following factors:

- the nature of the accommodation used by the person in Australia;

- the nature and extent of the family relationships the person has in Australia;

- the nature and extent of the person's employment, business or financial ties with Australia;

- the nature and extent of the person's assets located in Australia;

- the frequency and duration of the person's travel outside Australia; and

- any other matter relevant to determining whether the person intends to remain permanently in Australia.

The change did not affect DSP recipients who needed to leave Australia temporarily. The 13 week temporary absence remained to allow DSP recipients to legitimately travel overseas for short periods.

The change did not affect any DSP recipients who had portability under an international social security agreement, was grandfathered from changes introduced in 2001 or 2004, or was entitled to extended portability because they were severely disabled and terminally ill and overseas to be cared for by a family member.

July 2012 - Indefinite portability for some DSP recipients

Since 1 July 2012 DSP recipients with a severe and permanent disability and no future work capacity, who travel overseas permanently or for periods longer than 13 weeks, are able to apply for indefinite portability of their pension. This rule recognises that highly vulnerable people with a severe and permanent disability and no future work capacity may need to travel to be with their family for care and support.

The majority of DSP recipients who may have some capacity to work were not affected by this measure. They continued to be subject to the then 13 week portability rule.

DSP recipients who wish to claim indefinite portability are required to be assessed against the new criteria prior to their departure with regard to the severity and permanency of their disability. Additionally, they are assessed for their capacity for work through the Job Capacity Assessment process.

January 2013 - Reduction of portability from 13 weeks to six weeks

On 1 January 2013 the time that most income support recipients could receive a payment while outside Australia reduced from 13 weeks to six weeks.

July 2014 - AWLR requirements increase to 35 years

Since 1 July 2014 the period of Australian Working Life Residence (AWLR) required to receive a full means-tested pension outside Australia after 26 weeks increased from 25 years to 35 years. A person’s working life residence is the period of time they have lived in Australia between the age of 16 and Age Pension age.

To continue receiving the full rate of Australian pension, recipients will generally need to have spent 35 years of their working life in Australia. People do not need to have worked or paid tax during this period.

If a person has less than 35 years AWLR their rate of payment will be adjusted according to their working life residence. For example, if they have 27 years AWLR, they will receive 27/35ths (77 percent) of the maximum means-tested rate of payment.

Recipients on the following payments may be affected by the AWLR change:

- Age Pension

- DSP (in limited circumstances)

- Wife Pension

- Widow B Pension

People who were outside Australia immediately before 1 July 2014 can continue to receive their payment under the rules which applied when they left, unless they return and stay in Australia for 26 weeks or more.

Payment arrangements under some international agreements may differ.

More information about rates of payment outside Australia can be found at the Department of Human Services website.

January 2015 - Change to DSP portability rules (four weeks in a 12‑month period)

Since 1 January 2015, the period a person can normally be paid and continue to qualify for the DSP outside Australia reduced to four weeks in a rolling 12-month period.

DSP recipients, who remain outside Australia, on a temporary absence for more than four weeks in a rolling 12 month period, will have their payment stopped.

For example, if a DSP recipient departs Australia on a temporary overseas trip on 1 May 2015 the 12-month portability entitlement period commences from that date and ends on 30 April 2016. If the person does not depart overseas again until 20 December 2018, then the 12-month period will commence from that date. Approved temporary absences do not count towards this 12-month rolling period.

DSP recipients with a severe and permanent disability and no future work capacity will continue to be able to apply for unlimited portability of their pension.

More information is provided at Changes to Disability Support Pension portability.

Since 1 January 2015, general portability for Youth Allowance (student), Austudy and Abstudy has been removed. Students will only remain eligible for payment overseas:

- where the recipient is undertaking approved full-time overseas study as part of their Australian course or an Australian apprenticeship, or

- for approved medical treatment (not available in Australia), or

- to attend an acute family crisis.

Recipients overseas immediately before 1 January 2015 are subject to the rules under which they departed until they return to Australia for more than six weeks.

Since 1 July 2016, the period a person can normally be paid and continue to receive Family Tax Benefit (FTB) Part A outside Australia was limited from 56 weeks to six weeks. FTB recipients will still be able to take multiple overseas trips and retain FTB but each trip must be less than six weeks duration.

This change aligns the portability rules for FTB Part A with those of FTB Part B and most income support payments.

More information is provided at Family Tax Benefit Part A – Reduced portability.

Last updated: 19 May 2022 - 1:27pm

- Never miss a deal again – sign up now for your free WYZA eNewsletter!

- Entertainment

- Food and Wine

- In Praise of

- Relationships

- Small Business

last index=2 Array ( [0] => [1] => articles [2] => travel [3] => travelling-and-your-pension-know-the-risks ) WP_Term Object ( [term_id] => 11 [name] => Travel [slug] => travel [term_group] => 0 [term_taxonomy_id] => 11 [taxonomy] => category [description] => [parent] => 0 [count] => 1016 [filter] => raw [cat_ID] => 11 [category_count] => 1016 [category_description] => [cat_name] => Travel [category_nicename] => travel [category_parent] => 0 ) check====travel Travel

Travelling and your pension: know the risks.

We take a look at how travelling overseas can affect your pension entitlements

Older Australians love to travel — and retirement is the perfect opportunity to visit loved ones, and see more of the world. If you receive the age pension, however, overseas travel could affect your payments, so it’s worth understanding the rules before you step onto a plane or cruise ship.

Domestic travel is straightforward: grey nomads can dizzy themselves with laps of Australia and their age pension will not be affected. But travel overseas — especially for a decent chunk of time — and your age pension may be reduced.

“Age pensioners can generally receive their payment for the whole time they’re outside Australia, even if they go to live in another country,” says Hank Jongen, General Manager of the Department of Human Services.

“However, the payment rate may change depending on how long a pensioner is away, whether their income and assets change, or if they receive their Australian age pension through a social security agreement with another country.”

The all-important six week mark Travel for less than six weeks — 42 days and under — and your pension rate won’t change.

“After six weeks travelling outside Australia, the pension supplement will reduce to the basic rate and the energy supplement will stop,” Jongen says.

However, if an age pensioner is moving overseas to live, the pension supplement will automatically reduce to the basic rate and the energy supplement will stop as soon as they leave Australia, he says.

“Migrant pensioners” and longer trips After 26 weeks outside the country, a person’s age pension payment rate will depend on how long they have lived in Australia.

If an age pensioner has been an Australian resident for 35 years or more between the age of 16 and age pension age, their payment rate normally won’t change beyond what it already has at the six week mark.

Where an age pensioner has been an Australian resident for less than 35 years, they’ll receive a lower, proportional payment rate.

“Some other additional payments such as rent assistance will stop after 26 weeks outside Australia,” Jongen says.

Share your travel plans Age pensioners need to tell the Department of Human Services if they are going to live in another country or will be overseas for longer than six weeks.

“The easiest way for age pensioners to tell the Department about their travel plans is by using their Centrelink online account through myGov,” he says.

A word of warning If you have informed Centrelink about your sojourn, it’s worth keeping an eye on your payments to make sure you are receiving what you expect.

A WYZA member from Tasmania was recently left furious after informing Centrelink of her plans to travel overseas.

Not long after Julia Bestwick told Centrelink of her New Zealand travel dates via the myGov website, she received a call from a Centrelink representative saying her age pension would cease after 28 days away.

“I was astonished. He told me that my pension would cease to be paid two days before I returned to Australia because it was only payable for a total time overseas of 28 days in a 13-week period,” she said.

Not to be beaten, Ms Bestwick wrote a letter expressing her astonishment to prime minister Malcolm Turnbull and copied in several other members of parliament. She also sent her letter to WYZA.

Three weeks later, she received a call from a Centrelink representative who explained that the information she had received was incorrect.

“I was advised that my informant was completely wrong and there was no basis for him to contact me at all, and offered an apology,” said the 71-year-old.

“It was very distressing, as you can tell from my letter. Perhaps he was new and testing his wings.”

Fortunately, the misunderstanding was resolved but it’s a reminder to Centrelink customers that government departments do make mistakes. If you have a feeling that you’ve been given incorrect information, it’s worth double-checking.

And if you’re still not happy — you can always write a letter to “all and sundry” as Ms Bestwick did.

Disability pension If you’re on a disability support pension, the rules surrounding overseas travel are different.

If you take an overseas trip, you can only be paid the disability support pension for up to four weeks in a 12-month period. It doesn’t matter if you make a single trip, or multiple trips — if you exceed 28 days overseas in total, you will not receive the disability support pension.

Prior to January 2015, travellers on the disability support pension could stay overseas for six weeks before their payments were cut.

There are exceptions to this rule, however. For example, if you are travelling abroad to receive medical treatment that you can’t get in Australia, you will still receive your payments.

The Department of Human Services website, humanservices.gov.au , has more information about pensioners travelling outside Australia.

Have you travelled overseas while receiving the age pension? Share your experiences in the comments below.

- 25 stunning 'bucket list' beaches

- Cruise trends for 2018

- Top 5 sailing spots in Australia

Make a Claim

Help for foreign pensions.

- Make a claim help index

Foreign Pension

Authority or agency, country of payment, type of payment, reference number, gross income, date of commencement, provide these details later.

Foreign Pensions are pensions, benefits or allowances paid by a country other than Australia.

The government authority or agency that pays the Foreign Pension.

The country that pays the Foreign Pension.

The type of the Foreign Pension.

Foreign Pension reference number (or description if required). This may be a social security number.

The currency in which the Foreign Pension is paid.

The amount of Foreign Pension in the foreign currency before any tax or other deductions are made. Where there are components to the pension, they have been added to get this total figure.

The date from which the Foreign Pension was first granted.

This will be either yourself or your partner. If both you and your partner receive the same Foreign Pension, then two entries are necessary, one for each of you.

This option lets you defer providing details about this category. If selected, any information provided so far will be saved and you can continue with your claim online.

You can provide the remaining income and asset details for your claim in the following ways:

Up to the point that you submit this online claim you can return to a category that you have chosen to defer, un-check the "I am unable to supply complete and accurate details" checkbox, and add further details about that category.