- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Best COVID travel insurance of 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 4:00 a.m. UTC April 1, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

The best COVID travel insurance is Seven Corners’ Trip Protection Basic, according to our analysis of travel insurance plan rates and coverage options.

Editor’s note: This article contains updated information from a previously published story .

Seven Corners

Travel insured, usi affinity.

Why trust our travel insurance experts

Our team of experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 851 coverage details evaluated.

- 161 rates reviewed.

- 5 levels of fact-checking.

Top-rated travel insurance for COVID-19

Top-scoring plan

Medical limit per person, emergency evacuation limit per person, what you should know.

Seven Corners’ Trip Protection Basic plan is the most affordable of all COVID travel insurance plans we analyzed. This 5-star plan comes with basic coverage levels for emergency medical and medical evacuation.

If you’d like higher coverage limits, consider Seven Corners’ Trip Protection Choice plan which gets 4 stars in our rating. It’s more expensive but comes with $500,000 per person in primary medical coverage and $1 million per person in medical evacuation coverage.

Pros and cons

- A low cost option for COVID travel insurance.

- “Cancel for any reason” and “interruption for any reason” upgrades available.

- Average cost of a CFAR upgrade is lower than many competitors.

- Basic plan has secondary emergency medical coverage, not primary.

- No coverage for non-medical evacuation with Basic plan ($20,000 with Choice plan).

Top-scoring plans

Medical evacuation limit per person.

WorldTrips has two COVID travel insurance plans that tie with 4.5 stars: Atlas Journey Preferred and Atlas Journey Premier.

The Preferred plan is more affordable and provides $100,000 per person in emergency medical benefits as secondary coverage, with an optional upgrade to primary coverage. Atlas Journey Preferred is also the best travel insurance for cruises .

The more expensive Premier plan comes with $150,000 in travel medical insurance that’s primary coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan includes travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

- “Interruption for any reason” upgrade is only available with the Premier plan and only offers up to 50% reimbursement if you want to end your trip early.

Travel Insured’s Worldwide Trip Protector plan provides strong benefits overall for the price. It falls short of our emergency medical coverage benchmark but offers superior evacuation benefits at a competitive price.

- Emergency medical evacuation coverage is a superior $1 million.

- Excellent 75% “cancel for any reason” upgrade available.

- Very good 75% “interruption for any reason” upgrade available.

- Lost baggage and personal items coverage of $1,000 per person could be better.

- Relatively low emergency medical coverage of $100,000.

- Optional “Interruption for any reason” coverage doesn’t start until 72 hours into your trip.

Travel Guard Preferred from AIG allows you to customize your policy with a host of optional upgrades. These include “ cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings. There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million.

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Emergency medical limit per person

USI’s Ruby plan meets our standards for emergency medical evacuation and healthcare coverage. Plan costs increase by an average of 50% when you add “cancel for any reason” coverage.

- Good emergency medical primary coverage of $250,000 per person.

- Great 75% “cancel for any reason” upgrade available at a competitive price.

- $300 per person baggage delay and $1,000 baggage loss coverage are just okay.

- No “interruption for any reason” upgrade available.

- One of the higher-priced options among our top-rated plans.

Tin Leg’s Gold plan provides plenty of medical and evacuation coverage to help you get health care if you catch COVID or have another medical problem during your trip. Plan costs increase by an average of 50% when you add “cancel for any reason” coverage.

- Best-in-class emergency medical primary coverage of $500,000.

- Optional 75% “cancel or any reason” upgrade available.

- “Interruption for any reason” coverage isn’t available.

- Subpar baggage delay ($200 per person) and baggage loss ($500 per person) coverage.

- One of the more expensive options among our top-rated plans.

Compare the best COVID travel insurance plans

Methodology

Our insurance experts reviewed 851 coverage details and 161 rates to find the best COVID travel insurance plans. For this rating, we only scored travel insurance plans that cover COVID.

The benefits we scored out of a possible 100 points include:

Cost: 70 points. We scored the average cost for each COVID travel insurance policy with “cancel for any reason” (CFAR) coverage for a variety of international trips and traveler profiles.

Emergency medical expense: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with travel medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

“Interruption for any reason” upgrade: 10 points. We gave travel insurance plans with the option of “interruption for any reason” coverage 10 points. This coverage allows you to end your trip early for any reason, including reasons not listed in your policy, and get reimbursed for a certain percentage of your prepaid expenses.

How to buy COVID-19 travel insurance

“Look for travel insurance that covers trip cancellation , trip interruption, emergency medical and emergency medical transportation ,” said Daniel Durazo, director of external communications at Allianz Partners USA. A policy that provides epidemic-related coverage may reimburse you for costs associated with a canceled trip, travel delays, mandatory quarantines and being denied boarding due to suspected illness.

Plans that offer emergency medical coverage usually provide medical coverage for treating COVID-19, but you’ll want to read the policy to be sure.

Most travelers are surprised to learn about the 15-day review period that comes with many travel insurance policies, Durazo said. “Consumers should take the time to read their policy and call their provider with questions. If they don’t feel that their policy meets their needs, they can exchange it for a new product or cancel it for a full refund.”

Average cost of COVID travel insurance

The average cost of our top-scoring COVID travel insurance plans is $415 . By adding optional “cancel for any reason” (CFAR) coverage, the average cost of COVID travel insurance rises to $615, an increase of 48%.

CFAR coverage gives you the flexibility to cancel your travel plans for any reason, as long as you do so at least two days before your scheduled departure. When you cancel, you will typically be reimbursed up to 75% of your prepaid, nonrefundable trip expenses. If you’re interested in adding CFAR coverage to your travel insurance plan, you usually need to do so within two to three weeks of making your first trip deposit.

How much you pay for travel insurance will depend on factors such as how many travelers you’re insuring and their ages, your trip destination, trip length and total trip cost. On average, travel insurance costs 5% to 6% of your prepaid, nonrefundable trip expenses, and adding CFAR coverage to your plan could increase the cost of travel insurance by about 50%.

What travel restrictions are still in place?

Many travel restrictions that existed in the past three years due to COVID-19 are no longer in place. However, if a new, more dangerous variant emerges or if another infectious disease becomes a serious concern, national governments might reinstate previous restrictions such as requiring a negative virological test or proof of vaccination to enter the country. States and territories may have requirements that differ from national requirements.

Things are always changing, so it’s best to consult the official government website of the country you’re visiting and Travel.State.gov for the latest entry requirements and travel recommendations before booking your trip. Then, continue to check these websites as your trip date approaches to see if you’ll still be able to enter and leave your destination and re-enter the United States.

Quarantine reimbursement from travel insurance

Getting reimbursed by your travel insurance provider requires submitting documents that support your claim. Your policy should spell out what documents you’ll need.

“Failure to get proper documentation for a claim will almost always delay processing of the claim,” said Daniel Durazo, director of external communications at Allianz Partners USA. “Never assume that your insurance company will accept less than what they ask for. Call your insurance provider if you have questions about what documentation they’ll need to process your claim.”

In the case of a quarantine claim, you’ll typically need proof of getting infected with or being exposed to COVID-19, proof that you were required to quarantine, and invoices and receipts from any medical treatment and additional lodging costs.

For coverage purposes, “a COVID diagnosis has to be from a licensed physician who determines that you can’t travel,” said Stan Sandberg, co-founder and CEO of TravelInsurance.com. “An at-home, self-administered COVID test won’t be enough to pursue a claim under a travel insurance policy.”

What does COVID-19 travel insurance cover?

“Most travel insurance providers today consider COVID like any other unexpected sickness for purposes of coverage,” said Sandberg.

If your plan does not exclude costs related to COVID-19, specific types of coverage under your plan can reimburse some or all of your expenses. These might include additional hotel nights, transportation, meals, medical care, flight changes and more. Here’s how different parts of a travel insurance policy would apply as it pertains to COVID.

- Extension of coverage. Applies if you have to stay at your destination longer than planned because you get sick and have to quarantine or new travel restrictions emerge.

- Travel delay. Applies if you or someone traveling with you gets sick or injured en route to, at or returning from your destination or if, say, an airline refuses to let you board because of suspicion of illness.

- Trip cancellation . Applies if you get sick before you leave for your trip and have to cancel the whole thing. Be sure to get a diagnosis from a licensed physician.

- “ Cancel for any reason ” upgrade. Applies if you decide you don’t want to travel because of a spike in COVID cases or national entry and exit requirements change. Not all plans offer this upgrade, and it can add quite a bit to the cost of your insurance.

- Trip interruption. Applies if you have to interrupt your trip after reaching your destination — for example, if you have to fly home early because you or someone traveling with you gets sick.

- “Interruption for any reason” upgrade. Applies if you miss part of your trip for a reason your policy doesn’t otherwise cover — for example, because you have to quarantine, but you don’t actually have COVID. Not all plans offer this upgrade.

- Emergency medical treatment. Applies if you unexpectedly get COVID during your trip and need health care. Pre-existing conditions are usually excluded. Plan to pay out of pocket and wait for reimbursement.

- Medical evacuation and repatriation . Applies if you need to be transported to the nearest adequate medical facility for treatment. If, God forbid, you should die of COVID during your trip, this coverage would reimburse you for costs associated with transporting your body back home.

What does COVID-19 travel insurance not cover?

“Most travel insurance providers that offer comprehensive policies have done a great job at accommodating COVID-related disruptions, providing reimbursement for events like quarantines and hospital stays,” said James Clark. Clark is a spokesperson for the travel-insurance comparison site Squaremouth, which is also the company behind Tin Leg and Cat 70 travel insurance.

“However, there have been a handful of events that travel insurance simply does not cover,” Clark said. “During the height of the pandemic, when countries would close their borders for travel due to the coronavirus outbreak, many customers were unhappy that border closures were not covered by their standard trip cancellation policy.”

“Policyholders that no longer wanted to travel due to negative test and face mask requirements were also unable to receive reimbursement through standard policies,” he said. “In order to receive reimbursement in these scenarios, a customer would have needed the ‘cancel for any reason’ upgrade.”

That upgrade also covers “fear of travel,” which almost all travel insurance policies usually exclude, according to Clark. Canceling your trip out of fear of COVID infection or fear that the virus will disrupt your trip somehow is only covered by the CFAR upgrade, he explained.

Best COVID travel insurance FAQs

If you’re traveling within the United States or the U.S. territories, check with your health insurance company to see what coverage you get outside your state of residence. You may have coverage for emergency care and telehealth visits, but not for routine care. It’s also possible that your in-state plan may have arrangements with providers in other states that give you reduced rates.

With the end of the U.S. national emergency and public health emergency declarations related to the COVID-19 pandemic ending in May 2023, group health plans and individual health insurance plans will no longer be required to cover COVID tests and testing-related services without cost-sharing or prior authorization. This, too, could mean an extra expense for you.

Medicare usually does not pay for health care you receive abroad (unless you’re in a U.S. territory, or, in rare cases, near the border of Canada or Mexico ).

Other U.S. health insurance may not cover international health care, either, or the health insurance deductible may be high.

For these reasons, it’s important to choose a travel insurance policy with good emergency medical coverage — which usually has no deductible — when you’re traveling abroad.

Yes, as long as the policy covers COVID-19 and travel to the country or countries you visit. All of the travel insurance plans in our Best COVID travel insurance cover COVID.

Your travel insurance policy’s trip cancellation benefits will apply if you have to cancel your trip before you leave because you test positive for COVID-19. But you need to get diagnosed by a licensed physician if you hope to file a successful claim for your prepaid, nonrefundable trip costs like airfare and lodging.

Cruise travel insurance is just travel insurance that doesn’t exclude cruise-related issues or has additional cruise-specific benefits. If you’re going on a cruise and want COVID-19 coverage, make sure your travel insurance policy covers COVID-19 and has high coverage limits for emergency medical and emergency medical evacuation .

You should expect to spend your own money if you need proof of a negative COVID-19 test for travel because travel insurance does not cover predictable expenses. In some cases, such as when you’re recovering from a COVID infection, your health insurance or travel insurance may cover a doctor-ordered test.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Amy Fontinelle has more than 15 years of experience helping people make informed decisions about their money, whether they’re refinancing a mortgage, buying insurance or choosing a credit card. As a freelance writer trained in journalism and specializing in personal finance, Amy digs into the details to explain the products and strategies that can help (or hurt) people seeking greater financial security and wealth. Her work has been published by Forbes Advisor, Capital One, MassMutual, Investopedia and many other outlets.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

Travel Insurance Jennifer Simonson

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travel Insurance Mandy Sleight

Travelex travel insurance review 2024

Best travel insurance companies of April 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

Survey: Nearly 85% of Americans avoid family over the holidays

Travel Insurance Kara McGinley

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Payroll Services

- Best HR Software

- Best HR Outsourcing Services

- Best HRIS Software

- Best Performance Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Home Equity Loan Rates

- Best Home Equity Loans

- What Is a HELOC?

- HELOC vs. Home Equity Loan

- Best Free Checking Accounts

- Best High-Yield Savings Accounts

- Bank Account Bonuses

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Best CD Rates

- Citibank CD Rates

- Synchrony Bank CD Rates

- Chase CD Rates

- Capital One CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Best COVID-19 Travel Insurance Companies (2024)

We round up the best travel insurance options that offer pandemic and medical protections.

Sarah Horvath is one of the home service industry’s most accomplished writers. Her specialties include writing about home warranties, insurance, home improvement and household finances. You can find her writing published through distributors like HouseMethod, Architectural Digest, Good Housekeeping and more. When not writing, she enjoys spending time in her home in Orlando with her fiance and parrot.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

As the world continues to navigate the COVID-19 pandemic, hotels, airlines and other hospitality-related businesses have seen a surge in travelers . However, the concern of a new variant is consistent — experts have identified new strains of COVID-19 as recently as Dec. 2023, which could cause some travelers to consider purchasing travel insurance.

While some travel insurance policies now classify COVID-19 as a standard inclusion under medical expense and evacuation coverage, others include varying terms. According to our research, the best travel insurance companies offering COVID-19 coverage are Faye and Travelex.

Compare Top Travel Insurance Companies with COVID-19 Coverage

Use the table below to compare COVID-19 coverage inclusions and details of top travel insurance companies:

10 Best COVID-19 Travel Insurance Companies

- Faye: Our top pick

- Travelex: Our pick for budget travelers

- Seven Corners: Our pick for international travelers

- Tin Leg: Our pick for customizable coverage

- Allianz Travel Insurance: Our pick for concierge services

- TravelSafe: Our pick for equipment coverage

- Generali: Our pick for emergency assistance

- John Hancock Travel Insurance: Our pick for delay coverage

- Trawick: Our pick for well-rounded coverage

- HTH Travel Insurance: Our pick for group travel

We pulled price quotes for four vacations outlined in our methodology at the bottom of this page. The costs in this article reflect the premium for each of those four trips for each provider averaged together.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Pros and Cons

Why we picked it.

Faye is our top choice for COVID-19 travel insurance because it includes a robust set of protection to support policyholders both before and after diagnosis. The company classifies COVID-19 as a standard illness under its medical insurance policies, which means you can use any medical and evacuation coverages deemed necessary by local health professionals.

Since Faye classifies its travel medical insurance as primary coverage, it goes into effect before your domestic health coverage. This is especially beneficial for COVID-19, which could lead to hospitalization in some cases and include higher diagnosis, evacuation and treatment costs.

Coverage and Cost

Add-On Options

Faye currently offers the following add-ons for international excursions:

- Cancel for any reason (CFAR) coverage

- Adventure and extreme sports protections

- Rental car coverage

- Vacation rental damage protection

- Pet care protection

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Faye’s average trip cost is $298.

Travelex is one of the most generous travel insurance providers we reviewed in terms of COVID-related situations and when you’re covered. Travelex travel insurance policies include specific language that ensures COVID-related hospitalizations and diagnoses are eligible for trip interruption coverage. Travelex’s policies also specify that if a loved one back home is hospitalized or determined in critical condition due to COVID-19, the policyholder is covered for an early return. These features, combined with lower overall premiums, makes Travelex a top choice for COVID-concious travelers.

Below are customizable add-ons to consider for your Travelex policy:

- Accidental death and dismemberment (air travel only)

- Additional medical coverage

- Adventure sports coverage

- Cancel for any reason coverage

- Car rental collision coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Travelex’s average trip cost is $242.

Another top option for COVID-related travel concerns, Seven Corners offers a wide range of medical policies, all of which include coverage for coronavirus as a standard illness. Seven Corners policies indicate that both trip interruption and cancellation coverage extends to COVID-19-related reasons, including quarantines. Missed connection coverage may even extend to your travel plans if COVID causes you to miss a portion of your trip, specifically while on a cruise . Overall, Seven Corners offers COVID-friendly policies and includes generous cancellation and interruption benefits to give you peace of mind while traveling.

Below are add-on options you may be able to include in your Seven Corners policy:

- Trip interruption for any reason coverage

- Rental car damage coverage

- Sports and gold equipment coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Seven Corners’s average trip cost is $206.25.

Tin Leg’s Silver and Gold policies include COVID-19 hospitalization and diagnosis as a standard inclusion under trip cancellation and interruption benefits. Like competitors, Tin Leg’s policies include stipulations that allow you to use travel delay benefits for ordered quarantine periods, offering between $500 and $2,000 depending on your chosen coverage level. However, you will need to receive a documented diagnosis from a licensed medical professional to use your trip benefits — a home rapid test is not sufficient proof.

Below are add-on options for Tin Leg travel insurance:

- Rental car damage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Tin Leg’s average trip cost is $166.50.

Both of TravelSafe’s insurance policies for international travel include comprehensive coverages and protections for COVID-19 , with identical medical coverage and evacuation limits no matter the condition. Trip delay benefits — available up to $2,000 on the TravelSafe Classic policy — include coverage for mandatory quarantines if required by a licensed medical professional. Policyholders can also apply mandatory quarantine benefits to missed connections coverage, which adds another layer of protection if you have multi-leg trips planned.

Below are add-on options you may include to your TravelSafe policy:

- Accidental death and dismemberment (air only)

- Extended personal property coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, TravelSafe’s average trip cost is $241.

Allianz Global Assistance

Allianz Global Assistance offers a policy endorsement to cover concerns related to COVID-19. Referred to as the “ Epidemic Coverage Endorsement ,” this benefit extends medical expense, emergency evacuation and trip delay coverage to include COVID-related situations. Like most other competitors, you will need a documented diagnosis of COVID-19 and a written order from a local government figure or medical authority requiring you to quarantine before you can use benefits.

When we requested a quote, all three available policies included the Epidemic Coverage Endorsement free-of-charge with standard pricing. However, it’s important to note that coverage for COVID-19 is not specifically written into the terms of Allianz’s policies in the same way as other illnesses, which is the standard verbiage in the industry. Be sure your policy includes this endorsement to maintain COVID-related coverage.

Below are add-ons to consider for your Allianz Travel Insurance policy:

- Rental car protection

- Required to work coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Allianz’s average trip cost is $265

In addition to including COVID as a standard coverage under medical, cancellation and interruption benefits, Generali Global Assistance includes the added peace of mind that comes with around-the-clock assistance. All policies include 24/7 emergency travel assistance with a multi-lingual support team, which can help policyholders communicate with medical staff. This is especially useful if you’re visiting an area where you do not speak the primary language.

However, as of Jan. 2020, newly issued policies include an exclusion that prevents you from using trip delay benefits to cover a quarantine period unless officially diagnosed with COVID-19. This exclusion does not apply if you are sick and quarantined with the virus, in which you can access your benefits to cover the cost of related expenses. This exclusion remains in effect even if a local government mandates your quarantine due to exposure — so we recommend researching the quarantine procedures for the country you’re visiting beforehand if you choose Generali.

Below are coverages you may be able to add to your Generali policy:

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Generali’s average trip cost is $255.

Under most travel insurance verbiage, COVID-19 is now considered a known threat, and the announcement of a new variant is considered a risk you accept when booking. This means that travel insurance may not allow reimbursement for trip cancellation due to concerns about the emergence of a new variant.

Cancel for any reason (CFAR) coverage extends your cancellation benefits to include fear of traveling due to COVID-19 or a new variant. In addition to classifying COVID-19 as a standard medical condition, John Hancock allows you to add CFAR coverage to a wider selection of policy choices, including its lower-cost Bronze package. Comparatively, most travel insurance providers limit your ability to add CFAR coverage to the most expensive plan.

Add-on options for John Hancock travel insurance:

- Rental car collision coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, John Hancock’s average trip cost is $225.

Trawick International offers one policy with coverage for COVID-19: Safe Travels International . This plan includes up to $1 million in medical coverage, up to $2,000 in trip delay benefits for potential quarantines and up to $2 million in medical evacuation coverage. This general range of coverage combined with CFAR add-on availability can make Trawick a customizable choice for travelers looking to add protections that cover COVID-19 without reviewing multiple plans.

Below are Trawick International add-on options:

- 24-hour accidental death and dismemberment

- Additional accident and sickness medical coverage

- Interruption for any reason coverage

- Upgradable trip delay coverage

Based on quotes we obtained using the seven trip profiles outlined in our methodology, Trawick’s average trip cost is $212.

While HTH’s policy details do not outline special benefits specifically for COVID-19 , its plans include standard medical interruption language allowing the use of benefits if you’re hospitalized. HTH’s policies include generous medical coverage and evacuation limits of $500,000 and $1 million respectively. The company also offers higher-than-average trip interruption benefits with a maximum benefit of 200% in reimbursements.

Below are additional options that may be available through HTH Travel Insurance:

Based on quotes we obtained using the seven trip profiles outlined in our methodology, HTH’s average trip cost is $221.

HTH also offers discounted pricing for group travel insurance policies.

What To Look for in Pandemic Travel Insurance

Once you understand how travel insurance can benefit you in the event of a COVID-19 diagnosis or emergency, you can get into the details of each coverage option. We’ve compiled a few essential features to consider when shopping for travel insurance with a focus on COVID-19 coverage.

Medical Expense Coverage

If you’re traveling to an area where you think you might be at risk of catching COVID-19, consider choosing a travel insurance policy with higher medical coverage limits. Travel medical insurance can help cover the cost of medical treatments you receive outside the U.S. if you become sick or injured. Most travel insurance policy providers now classify COVID-19 as a standard illness, meaning you can qualify for reimbursement if hospitalized with coronavirus abroad.

Trip Delay Coverage

If you contract COVID abroad, depending on the country’s requirements, you may have to undergo a mandatory quarantine period before you can leave or enter another country. In these circumstances, your trip delay benefits could help cover the cost of expenses like meals, additional hotel stays and any toiletries you might need. To qualify to use trip delay benefits, most policies state a licensed medical professional must order a quarantine for 24 hours a day, seven days a week, until expiration.

Trip Interruption Coverage

If you’re leaving dependents or older loved ones at home and concerned about the effect COVID-19 could have on their care, consider a policy with higher trip interruption coverages. Trip interruption insurance compensates you for things like the cost of an early return flight home and unused trip expenses if you must leave your trip ahead of schedule due to a covered reason. Some travel insurance providers like Seven Corners and Travelex include the illness of a family member and hospitalization with COVID-19 as a valid reason to use interruption benefits. Other providers only consider the health status of the insured traveler.

CFAR Coverage

CFAR coverage is an optional add-on that allows you to receive a partial trip reimbursement if you cancel your trip for a reason not covered by insurance. For all providers on our list, this includes fear of a new variant of COVID-19 emerging at home or your destination. If this is a concern for you, consider a provider like John Hancock, which offers more options for policyholders to buy CFAR-level benefits.

Does Travel Insurance Cover COVID-19 Directly?

Most travel insurance policies now classify COVID-19 as a standard inclusion under medical expense and evacuation coverage. This means coronavirus is usually treated the same way as any other illness or injury you might sustain abroad or before your trip. While this offers protection for your travel plans if you’re hospitalized due to COVID-19, fear of new variants and minor illnesses will usually not qualify you for a reimbursement .

Let’s take a look at sample situations when you might need to use COVID-19 coverage as a part of your travel insurance. First, say you fall sick before traveling and are diagnosed with a serious case of COVID-19. Your physician determines you require hospitalization a day before you’re supposed to travel. If you purchased travel insurance, you could file a claim to reimburse nonrefundable trip costs, such as airfare and lodging, because you’re medically unable to travel.

Now, let’s imagine you have a trip planned to Germany. A few days before your travel, information on a new Covid variant becomes available and officials advise the public to avoid travel if possible. While you may be hesitant to travel due to the new strain, you would not be entitled to reimbursement with travel insurance unless specifically outlined in your policy. However, if you opted for CFAR coverage during enrollment, you could cancel your trip and get a refund for nonrefundable expenses regardless.

Does Travel Insurance Cover Quarantine?

Your travel insurance policy might cover the COVID-19 quarantines if ordered by a medical professional, which includes expenses related to additional lodging. If you’re diagnosed with a new variant of the virus before your trip and forced to quarantine at home, you will usually qualify for trip cancellation benefits under your policy’s illness cancellation clause. However, travel insurance will not compensate you for additional domestic quarantine-related expenses like food and rent.

If you’re advised to quarantine abroad after being diagnosed with COVID-19, you could also qualify for coverage under your insurance’s travel delay benefits. While travel delay benefits are designed to help cover hotel rooms and alternate airfare if you’re forced to miss a connection, you can also use coverage for mandatory quarantine orders. To qualify, you will usually need to provide documentation of both your illness and a quarantine recommendation from a local medical professional.

If you’re concerned about the cost and possibility of an international quarantine, it’s important to look at the travel delay benefits included with your insurance coverage. Policies with higher total travel delay benefits will cover more quarantine-related expenses, which can make these policies more valuable. Be sure to note both overall and daily limits on trip delay benefits, which can also influence policy value.

How Much Does COVID-19 Travel Insurance Cost?

In our comprehensive review of travel insurance policies, we found the average cost of a plan with COVID-19 coverage is about $220 per trip. However, the price of your premium will vary depending on the level of benefits included with your policy. Browse the table below to compare how some of our top travel insurance providers compare in terms of average price and included benefits.

Factors That Impact Cost

Factors that affect the cost of your travel insurance include your age, where you’re traveling to, the cost of your trip and the length of your trip. Adding various custom riders, like protection for a rental car or cancellation for any reason coverage, will also increase the cost.

Is Pandemic Travel Insurance Worth It?

While almost all COVID-19 restrictions are lifted in the U.S., the virus is still a global health threat. Even if travel insurance isn’t required for a trip, purchasing insurance that includes COVID-19 protections can help you avoid a financial burden if you contract the virus before or during the trip.

You might not need the pandemic travel coverage if you’re taking a low-cost trip and not crossing international borders. Your health insurance may cover medical costs within the country, and the money you lose from canceling an affordable trip could be too low to justify shopping for and buying coverage. It’s different if you pay a lot of money up front for a long, expensive vacation.

Another option is looking at the travel protections that your credit card company provides. Some cards offer trip protection for emergencies that could include coverage if you call off a trip or end a trip early after contracting COVID-19. But travel costs usually have to be paid for with the card for them to qualify.

Frequently Asked Questions About Travel Insurance

What are the cheapest ways to get travel insurance for a pandemic.

The best way to find cheap travel insurance with pandemic coverage is by shopping around with different providers. Many offer free quotes online, and it takes minutes to check rates.

What are the advantages of purchasing pandemic travel insurance?

The advantage of pandemic travel insurance is that it reimburses prepaid travel costs if you cancel or cut short a trip because of getting COVID-19 before or during the trip. And if a family member contracts COVID-19 while you’re away, pandemic travel insurance may reimburse you for expenses related to returning home early to care for a loved one.

Can you cancel your flight if you have COVID?

Many travel insurance policies now include coverage for trip cancellations due to COVID-19. However, coverage is usually included under standard medical inclusions, which means you must be medically unable to travel at the time of your scheduled departure to claim a reimbursement. Review your specific travel insurance coverage to learn more about flight cancellation benefits.

What does travel insurance not cover?

Travel insurance usually does not cover cancellations due to fear of travel, government restrictions or pre-existing medical conditions. You generally cannot cancel your trip and claim any reimbursements unless it’s for a covered reason such as the illness or death of a family member or natural disasters. Carefully read your policy to understand the exclusions and limitations unique to your coverage.

Methodology: Our System for Rating the Best Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Guides

- Best cruise insurance plans

- Best travel insurance companies

- Cheapest travel insurance

- Best group travel insurance companies

- Health insurance for visitors to USA

- Best senior travel insurance

- Best travel insurance for families

- Best student travel insurance plans

- Travel insurance for parents visiting USA

- Best travel medical insurance plans

- How much does travel insurance cost?

More Travel Insurance Resources

Search When autocomplete results are available use up and down arrows to review and enter to select.

Choose the plan that meets your needs and spend more time enjoying your international experience not worrying about your insurance coverage.

- Customer Stories

- Resume Quote / Application

What type of coverage do you need?

Vacation / holiday, visitor / immigrant, student / scholar, employer / business traveler, expat / global citizen, mission / social good, marine captain / crew.

- Flights / Airfare

- Cruises / Excursions

Travel Medical Insurance

Temporary coverage for accidents, sicknesses, & emergency evacuations when visiting or traveling outside of your home country.

Popular Plans

International health insurance.

Annually renewable international private medical insurance coverage for expats and global citizens living or working internationally.

Travel Insurance

Coverage designed to protect you from financial losses should your trip be delayed, interrupted, or cancelled.

Enterprise Services

Meet your duty of care obligations with confidence, knowing your travelers are safe, healthy, and connected wherever they may be in the world.

What type of organization do you represent?

- Corporations

- Insurance Companies

- Educational Institutions

- Mission Organizations

- Maritime Industries

- Government Agencies

- Non-Profit Organizations

Medical & Travel Assistance

Your travelers can access 24/7 global support should they need medical attention, travel assistance, or medical transport services.

Global Workers' Compensation Case Management

Rest assured knowing you have an experienced team who is committed to reducing your costs, moving your files forward, and serving as an international resource for all your work injury claims.

Security Assistance Services

Keep your travelers safe, no matter where they are, with real-time alerts and intelligence on safety, health, political, and other global risks.

Insurance Administrative Services

You’ll have experts to guide you through all things related to your health care plan needs, from enrollment to claim reimbursement.

COVID-19 & The Need for Travel Insurance

Travel Insurance to Protect Your Trip & Your Health

Travel insurance has always been there to protect you and your trip expenses from the unexpected, but the onset of the COVID-19 pandemic in 2020 truly shed a light on how quickly travel plans can change and how important it is to have the proper coverage in place.

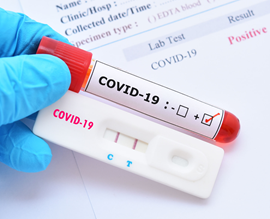

While COVID-19 restrictions, limitations, and requirements differ across the world and can change frequently, having travel insurance that offers protection and treats COVID-19 diagnosis the same as any other illness is essential. What if you test positive for COVID-19 right before your trip? During your trip? What if you have to extend your trip due to quarantine?

If you are looking for a travel protection plan that will cover you in the event a COVID-19 diagnosis disrupts your travel plans, check out IMG's iTravelInsured Travel Series or get a quote today.

Travel Insurance to Meet COVID-19 Concerns

There are several ways a positive COVID-19 test can negatively impact your travel plans both before and during your travels, which makes having a travel protection plan in place critical. IMG's iTravelInsured travel protection plans can provide benefits for trip cancellation, trip interruption, and travel delay specifically caused by a COVID-19 diagnosis and/or a quarantine requirement. Below are some examples that could result in a payable claim due to COVID-19. *

Flight Insurance Benefits

Getting Sick Before You Leave

Your bags are all packed, you’re ready to go, and even if it isn’t required for your destination, you take a COVID-19 test before leaving for the vacation you’ve been looking forward to for months. When the test comes back positive, you contact your physician and realize you have to cancel your trip. With an iTravelInsured travel insurance plan, you can be reimbursed your prepaid, non-refundable insured trip expenses, up to the maximum benefit amount, as long as a physician determines at the time of cancellation that you are not able to travel due to a COVID-19 diagnosis.

Your Traveling Companion Gets Sick

What if you are traveling for vacation, to visit loved ones, or for other reasons and the person you are traveling with is the one to test positive for COVID-19? With a travel protection plan, you may have trip cancellation or trip interruption benefits that reimburse you as long as a physician has determined at the time of cancellation/interruption that your traveling companion is not able to travel or continue traveling due to a COVID-19 diagnosis.

Getting Sick While You’re Traveling

You are a couple of days into a journey across Europe when you wake up one morning with a fever and a dry cough. Because these are both symptoms of COVID-19, you take a COVID-19 test which comes back positive. Thankfully, you purchased a plan with trip interruption benefits prior to leaving for your trip, which means you can be reimbursed for your unused, prepaid payments or deposits for the travel arrangements made for your trip, plus the additional transportation cost paid, if a physician determines at the time of interruption that you are not able to continue traveling due to a COVID-19 diagnosis.

You Have to Quarantine While Traveling

If you test positive for COVID-19 while traveling, it’s bad enough that your trip plans have been ruined, but you may be required to quarantine past the day you expected to return home, thus being forced to extend your trip. If you have an iTravelInsured plan, you can be reimbursed for additional hotel and meal expenses you incur due to a travel delay because of a quarantine as long as a physician or government authority has ordered you to quarantine under strict medical isolation, confined 24/7 throughout its duration.

Popular Plans Ideal for Vacationers & Business Travelers

iTravelInsured Travel SE

- Family-friendly plan for domestic and international destinations

- Trip cancellation maximum benefit up to 100% of trip cost

- Trip interruption maximum benefit up to 150% of trip cost

- Up to $125 per day per person to a maximum benefit of $2,000 for trip delay

- $500,000 maximum benefit for medical evacuation and repatriation of remains

Plan Benefits

The iTravelInsured Travel SE program is our most popular plan for domestic and international destinations. Travel Insurance benefits are available whether traveling on a cruise, tour or vacation abroad.

iTravelInsured Travel LX

Robust plan with optional cancel and interruption for any reason benefits

- Up to $250 per day per person, $2,500 maximum benefit for trip delay

- $1,000,000 maximum benefit for medical evacuation and repatriation of remains

- Optional Cancel for Any Reason (CFAR) / Interruption for Any Reason (IFAR) add-on benefit available (Additional cost and terms apply)

The iTravelInsured Travel LX plan provides the highest levels of benefits of all iTravelInsured® plans for the most discerning travelers. Cancel and Interruptions for Any Reason (CFAR) can be purchased as an optional upgrade. This plan provides a variety of benefits and can be ideal for travelers going to remote and exotic locations worldwide.

Additional Travel Insurance Plans

iTravelInsured Essential

Limited travel protection with cost effective coverage

iTravelInsured Travel Sport

Trip cancellation and interruption coverage for sport or adventure travel

iTravelInsured Travel Lite

budget-level plan for price-conscious travelers.

This advertisement contains highlights of the plans, which include travel insurance coverages underwritten by United States Fire Insurance Company under form series T7000 et. Al., T210 et. al. and TP-401 et. al. The Crum & Forster group of companies is rated A (Excellent) by AM Best 2022. C&F and Crum & Forster are registered trademarks of United States Fire Insurance Company. The plans also contain non-insurance Travel Assistance Services provided by iTravelInsured. Coverages may vary and not all coverage is available in all jurisdictions. coverages are subject to the terms, limitations and exclusions in the plan, including an exclusion for pre-existing conditions. Benefits and limits may vary by state of residence and not all plans are available in all states. In most states, your travel retailer is not a licensed insurance producer/agent, and is not qualified or authorized to answer technical questions about the terms, benefits, exclusions, and conditions of the insurance offered or to evaluate the adequacy of your existing insurance coverage. CA DOI toll free number: 800-927-4357. The cost of your plan is for the entire plan, which consists of both insurance and non-insurance components. Individuals looking to obtain additional information regarding the features and pricing of each travel plan component, please contact International Medical Group 9200 Keystone Crossing Suite 800 Indianapolis, IN 46240 USA. [email protected]. +1 (317) 655-9796. iTravelInsured Insurance Services CA Non-Resident Producer License No. 0F17093.

Select why you are away from home.

Get plan recommendations and helpful resources., government services.

- "Although one hopes never to use travel insurance, IMG was a godsend throughout our ordeal. We couldn’t have done it without your continued assistance." Joan D. United States

" I took comfort in the fact that IMG had my back. "

While skiing in Chile, Mark, an IMG member, found himself on the brink of paralysis.

Select your Language

Headquarters, send a message.

If you need to send personal information such as medical records, payment information, etc., please use our Secure Message Center .

Thank you for your message! We'll be in touch shortly.

How do you choose travel insurance that covers COVID-19?

Oct 26, 2021 • 5 min read

COVID-19 has made it more important to check the health coverage on your travel insurance © Maskot/Getty Images

After 18 months of pandemic-related travel restrictions, you may be itching to act on your pent-up wanderlust—but the situation and the rules are still continuously evolving. So before you go anywhere, it’s best to have a travel insurance plan that protects the investment you’ve made in a long-awaited trip.

A robust travel insurance plan will reimburse pre-paid trip costs and non-refundable deposits if you have to cancel or interrupt your trip, encounter trip delays, experience baggage loss or require medical expense and medical evacuation. Your policy will also reimburse “covered reasons” in your plan, such as death, illness or injury, serious family emergencies, unplanned jury duty, military deployment, acts of terrorism, or your travel supplier going out of business.

But COVID-19 has added an additional checklist to your usual insurance needs—it’s now important to check to ensure your travel insurance plan includes coverage for COVID-19 medical expenses, and losses related to illness. Your policy should also cover quarantine costs if you need to self-isolate after testing positive for the virus.

What do I look for in COVID-19 insurance coverage?

When you’re shopping for a travel insurance plan that covers COVID-19, you need to do your research and read the fine print of your plan.

Look for a travel insurance product that will protect your non-refundable, prepaid expenses if you have to cancel your trip due to illness caused by COVID-19. Your policy should also cover emergency medical treatment and emergency medical transportation. With regard to COVID-19 coverage, be sure your policy covers medical care, medicine, hospitalization and quarantine expenses.

“The type of coverage you should look for depends on you, your needs, travel dates, and the type of trip you’re taking,” says Sasha Gainullin, CEO of battleface , a travel insurance carrier. He says some travel insurance companies have now excluded COVID-19 coverage because it has been labeled a “known/foreseeable event”, while others may exclude pandemics altogether.

“It’s important to search for plans that include medical and quarantine expenses as well—this will be critical in the event you become ill and need to receive treatment while traveling,” continues Gainullin.

One additional tip is to confirm there are no exclusions based on the destinations you’re traveling to—this can happen with countries under government-issued travel warnings, Gainullin says.

“If a traveler feels uncertain, I recommend speaking with the travel insurance company directly. They can review the policy details with you, answer all of your questions, and confirm all of your required coverage options are included,” he adds.

Is getting coverage dependent on vaccination?

While it’s a good idea to be fully vaccinated before traveling, vaccination is not required to purchase a travel insurance policy, says Daniel Durazo, spokesperson with Allianz Partners USA.

What are the medical costs that are covered by travel insurance?

Travel insurance can cover the cost of both medical treatment and emergency medical transportation. A US health insurance plan, as well as Medicare, generally will not cover overseas medical expenses, so it’s best to check with your personal health insurance provider if any global coverage is available.

“While losing the cost of a trip due to an unexpected cancellation would be painful, paying for expensive emergency medical treatment or emergency medical transportation can be financially devastating,” Durazo says.

Under a travel insurance plan, medical costs could range doctor visits, pharmacy expenses, imaging costs and covering a hospital stay if required. Other expenses that can be covered are transportation to medical care and medicine.

Read more: Will my health insurance cover getting COVID-19 while traveling in the US—or abroad?

What about covering an unexpected quarantine due to COVID-19?

Many international destinations are now requiring that visitors purchase travel insurance coverage for an unexpected quarantine. Allianz Travel Insurance has added coverage to many of its products that includes reimbursement for quarantine-related accommodations if you or a traveling companion is individually-ordered to quarantine while on their trip, says Durazo.

This coverage typically covers the cost of additional food, lodging and transportation while quarantined. In addition, trip interruption and travel delay benefits on certain Allianz plans also provide coverage if you or your travel companion is denied boarding by your travel carrier due to suspicion of illness.

The benefits for quarantine coverage vary from carrier to carrier. For example, on select Trawick International plans, they offer $2,000 in quarantine benefits and for an additional charge, and you can increase it up to $7,000.

What about pre-flight COVID-19 testing?

Your plan may provide coverage for flights if you are turned away at a border for not passing a health inspection. Foster says Trawick’s travel insurance plans that cover COVID-19 would cover the expenses if you could not pass your pre-health inspection. Also, the plan would cover the costs of the failure of your PCR test to return to the United States, such as having to quarantine abroad.

It’s important to note that the actual cost of the PCR test is not covered by your policy, just the loss associated with the negative test.

Read more: PCR tests for travel: everything you need to know

Some destinations require COVID-specific insurance coverage—how do I comply with those restrictions?

Before any international travel, you should check the country where you are headed to make sure you comply with insurance coverage requirements. Countries like Spain, Turks and Caicos and Thailand are among the nations that mandate COVID-19 insurance coverage.

“You first must check the countries’ specific COVID regulations for entry into the country. Some countries require travelers to provide proof of travel insurance that covers COVID-19 related expenses purchased from a third party,” explains Foster. Providing proof coverage is key; so travelers need to ensure they receive documentation from their insurance provider that their policy covers COVID-19 related expenses to show customs officials, she says.

Should you arrive in a country that requires proof of insurance to cover COVID-19 medical expenses and quarantine costs, and you don’t hold a policy, you will not be granted entry.

For more information on COVID-19 and travel, check out Lonely Planet's Health Hub .

You may also like: What happens if I'm denied entry to a country on arrival? What is a vaccine passport and do I need one to travel? What is the IATA Travel Pass and do I need it to travel?

Explore related stories

Destination Practicalities

Mar 28, 2023 • 3 min read

Here’s all you need to know about getting a traveler visa to visit China now that “zero COVID” has come and gone.

Sep 12, 2022 • 4 min read

Apr 4, 2024 • 14 min read

Apr 4, 2024 • 4 min read

Apr 4, 2024 • 12 min read

Apr 4, 2024 • 7 min read

Apr 4, 2024 • 5 min read

Apr 4, 2024 • 6 min read

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Safer travel starts with travel protection

If you are a travel agent or were referred by one, enter the ACCAM number below.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

At Allianz, we continue to show our commitment to sports through our sponsorship with the International Olympic Committee and the International Paralympic Committee. Read More >>

Entry Requirements & COVID-19 Travel Resources

Confused about entry requirements for your destination? Our interactive map shows current travel rules and restrictions for each destination, including info on COVID-19 testing, necessary travel documents and quarantine periods.

Find out how our Epidemic Coverage Endorsement can protect your next trip from certain losses related to COVID-19.

Why do I need travel insurance?

Because sometimes..., you have to cancel a trip last-minute..

Travel insurance can reimburse you for your prepaid, non-refundable trip costs — including vacation rentals, car rentals, hotels and flights — if you have to cancel for a covered reason.

Travel delays leave you stranded.

Travel insurance can reimburse you for eligible meals, accommodation and transportation expenses during a covered delay.

You get sick or hurt when you're far from home.

Travel insurance can reimburse you for care following a covered medical emergency while traveling. We can even arrange and pay for a medical evacuation if needed.

Fender-benders are unavoidable.

Renting a car means taking on a big financial risk; even a tiny scrape can cost you hundreds. Low-priced rental car insurance lets you drive worry-free.

You need help in a hurry.

Whether you're planning a week-long road trip or a weekend getaway, you never know what might happen. Travel insurance gives you access to our 24-Hour Assistance hotline for expert, personalized support in a crisis.

Why go with Allianz Travel Insurance?

As a world leader in travel protection, we help more than 70 million people answer the call of adventure with confidence every year.

We're Protecting You

From protection for trip cancellation to medical bills abroad, our benefits are designed to help you explore reassured.

We're There For You

We've got your back with award-winning 24/7 assistance and a worldwide network of prescreened hospitals to help you get the right care.

We're Built For You

From our TravelSmart app to proactive SmartBenefits, we innovate for the way you travel today - and tomorrow.

TRAVEL RESOURCES

How Travel Insurance Works

How the Cancel Anytime Upgrade Works

What Does Rental Car Insurance Cover?

Is It Too Late to Buy Travel Insurance?

The Comprehensive Guide to Annual Travel Insurance

5 Ways the TravelSmart App Can Help During Winter Travels

Travel Insurance with Emergency Medical Benefits

Destination Guide: Croatia

Travel Insurance & COVID-19: The Epidemic Coverage Endorsement Explained

More Travel Resources »

LATEST COVERAGE ALERTS

The events listed below are considered "known and foreseeable" for travel insurance purposes on the date listed next to the event. Please consult your policy for more information.

More Coverage Alerts »

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Advertisement

Supported by

What You Need to Know Now About Travel Insurance

A spate of new travel insurance policies have begun covering Covid-19, just as many international destinations begin to require it. Here’s what to look for.

- Share full article

By Elaine Glusac

When the pandemic struck, many travel insurance policies failed to cover Covid-19-related trip interruptions and cancellations, often because they excluded pandemics. But in the intervening months, the travel insurance industry has introduced a spate of new policies covering the disease just as many foreign destinations begin to require them.

“We’ve seen progress in that many plans will now treat Covid like any other unexpected sickness or illness,” said Stan Sandberg, a co-founder of the comparison website Travelinsurance.com . “If you have a trip and travel insurance and came down with Covid-19, which made it impossible to travel, that would fall under cancellation coverage as an unexpected illness that prevents you from traveling.”

Likewise, policies now including Covid-19 would cover holders in the event that a doctor diagnosed them with the virus while traveling under the trip interruption benefit.

Not all travel insurance excluded pandemics when the coronavirus began to spread early this year; Berkshire Hathaway Travel Protection was one exception. But the broader change partially arises from consumer demand, a better understanding of the virus — including mortality rates and hospital costs — and the industry’s eagerness for travel to resume.

“People who are traveling are more conscious of their risks and thinking about protecting themselves and their investment,” said Jeremy Murchland, the president of the travel insurer Seven Corners. The company launched policies that included Covid-19 coverage in June; they now account for more than 80 percent of sales.