News on cruises, cruise ship reviews and cruising tips

How to buy COVID travel insurance for a cruise

CRUISE TIPS: Here’s how to buy COVID travel insurance for a cruise. InsureMyTrip and Yonder Travel Insurance are seeing an increase in travel insurance policies purchased for cruises and here is their advice.

Please note that this information can change suddenly so check with the cruise line and insurance company about their requirements closer to your cruise date. This information is intended as a general guide only.

On July 29, 2021 InsureMyTrip cited that Royal Caribbean 1 , Carnival 2 and now Disney 3 cruise lines require unvaccinated passengers 12 and older, to show proof of a travel insurance policy ranging from $10,000 – $25,000 per person in medical expansive coverage and $20,000 – $50,000 in medical evacuation coverage.

InsureMyTrip offers cruise travel insurance plans that meet and exceed these requirements. Travelers can purchase cruise-specific travel insurance from InsureMyTrip , a trusted third-party travel insurance comparison site that also offers personalized insurance quotes and options for insuring redeemed vouchers.

MORE: Travel Insurance for Cruisers

Note: Travel insurance plans with an optional “cancel for any reason” coverage offers the most protection for cruisers who may want coverage for COVID-19 related fears. Traditional trip cancellation coverage does not cover COVID-19 related cancellations.

InsureMyTrip , the nation’s first-and-largest unbiased travel insurance comparison site, said the number of policies sold for future cruises hit their highest levels since February 2020 — up 60 percent from four weeks ago. This comes as the first trial cruise set sail from the United States in over a year.

“Travel insurance has always been top-of-mind for cruisers. We expect the cruise industry to really pick up speed following the pandemic-related slump — and we are doing everything we can to ensure cruisers have the right travel insurance,” says Cheryl Golden, vice president of ecommerce for InsureMyTrip.

Here’s how to buy Covid travel insurance for a cruise. Travel insurance agents urge travelers to buy cruise-specific travel insurance from InsureMyTrip, an unbiased and trusted third-party travel insurance comparison site that also offers the most options for insuring redeemed vouchers.

1 https://www.royalcaribbean.com/faq/questions/will-i-require-travel-insurance-for-my-cruise 2 https://www.carnival.com/Legal/covid-19-legal-notices/covid-19-guest-protocols 3 https://disneycruise.disney.go.com/why-cruise-disney/experience-updates/before-you-leave-home-us/

Source: InsureMyTrip

Yonder Travel Insurance

Yonder Travel Insurance reported on June 29, 2021 that after two unvaccinated travelers recently tested positive for COVID-19 on a Royal Caribbean cruise the line made changes to its requirements a few days later.

The line had announced it required unvaccinated guests over the age of 12 to provide proof of travel insurance for all Florida cruise departures between August 1, 2021 – December 31, 2021.

Even if cruisers are vaccinated, having a travel insurance policy provides extreme peace of mind when planning your long-awaited cruise.

The experts at Yonder Travel Insurance (insureyonder.com) provide advice as to what to look for in a cruise travel insurance policy. Here’s how to buy Covid travel insurance for a cruise:

Insurable Trip Expenses

Most travel insurance policies offered by cruise lines only protect the non-refundable cost of your cruise. Other non-refundable trip expenses such as your airfare, excursions or additional accommodation expenses are not insurable under a cruise line travel insurance policy. By purchasing a comprehensive policy through a travel insurance comparison site like Yonder , you may insure all non-refundable trip expenses under one travel insurance policy.

Trip Cancellation List of Covered Events

Here’s how to buy Covid travel insurance for a cruise. When looking at a travel insurance certificate, the first benefit highlighted is often a list of covered trip cancellation events. In a previous study of airline and cruise line insurance policies , it became very apparent that cruise line policies have a substantially smaller list of covered events for trip cancellation.

“We’ve seen cruise line policies with as little as 5 reasons to cancel,” says Beckah Morris, Operations Manager at Yonder Travel Insurance. “A comprehensive policy bought elsewhere includes 20-30 covered trip cancellation events on average.”

In addition, Cancel for Any Reason has seen a dramatic increase in popularity this past year due to pandemic exclusions. Yet, with cruise line policies, Cancel for Any Reason will likely result in a future cruise credit instead of a cash refund.

Medical Expense Limits

Medical treatment or an emergency medical evacuation from a cruise ship can quickly add up. Royal Caribbean is requiring unvaccinated travelers to provide proof of insurance with a medical limit of $25,000 and a medical evacuation limit of $50,000, common minimum limits on a standard comprehensive travel insurance policy.

The experts at Yonder Travel Insurance have poured over hundreds of policies from the best travel insurance providers in the U.S. to provide the best travel insurance recommendation for how you travel.

Run a quick quote and compare travel insurance policies for your next trip using the instant quote tool . Yonder donates meals to vulnerable children in need with each policy sold so you can travel well, and do well, when you go Yonder.

Source: Yonder Travel Insurance

Sources: InsureMyTrip and Yonder Travel Insurance

Share this:

Related News

How to choose the best packing cubes

How to avoid seasickness on a cruise and what to do if you feel sick

How to get a job on a cruise ship

Discover more from cruiseguru.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- Nationwide Travel Insurance

- AXA Assistance USA

- Seven Corners Travel Insurance

- HTH Worldwide Travel Insurance

- World Nomads Travel Insurance

Cruise Travel Insurance Tips

- Why You Should Trust Us

Best Cruise Insurance Companies of April 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

A cruise vacation can take much of the stress out of planning a vacation. With a pre-set itinerary on the high seas, you don't have to worry about how you're getting to your destination and what you're going to do there. However, an unexpected emergency can take the wind out of your sails and money out of your travel budget. So you'll want to ensure you have the best travel insurance coverage that won't leave you high and dry in an emergency.

Best Cruise Insurance Companies

- Nationwide Travel Insurance : Best Overall

- AXA Assistance USA : Best for Affordability

- Seven Corners Travel Insurance : Best for Seniors

- HTH Worldwide Travel Insurance : Best for Expensive Trips

- World Nomads Travel Insurance : Best for Exotic Locations

Compare the Top Cruise Insurance Offers

- Trip cancellation coverage of up to 100% of trip costs (for cruises) or up to $30,000 (for single-trip plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Three cruise-specific plans to choose from

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual travel insurance plans available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong trip cancellation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancel for any reason coverage available

- con icon Two crossed lines that form an 'X'. CFAR insurance not available with every single plan

- con icon Two crossed lines that form an 'X'. Medical coverage is lower than what some competitors offer

Nationwide Travel Insurance offers many of the standard benefits you might see with a travel insurance policy. This can include things like trip cancellation coverage, so you can recover pre-paid costs or trip interruption in the event your vacation is interrupted by an unexpected event. There's also baggage delay coverage and medical coverage.

- Cancel for any reason coverage available

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse coverage options such as CFAR, optional sports equipment coverage, etc.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Available in all 50 states

- con icon Two crossed lines that form an 'X'. Prices are higher than many competitors

- con icon Two crossed lines that form an 'X'. Reviews around claims processing are mixed

- Trip cancellation insurance of up to 100% of the trip cost

- Trip interruption insurance of up to 150% of the trip cost

- Cancel for any reason (CFAR) insurance available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Three plans to choose from

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Reasonable premiums

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR coverage available with some plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical emergency and evacuation coverage

- con icon Two crossed lines that form an 'X'. Special coverages for pets, sports equipment, etc not available

- con icon Two crossed lines that form an 'X'. Limited reviews with complaints about claims not being paid

- Trip cancellation of up to $5,000 with the Economy plan and up to $50,000 with the Preferred plan

- Cancel for any reason insurance and missed connection insurance available with the Preferred plan

- Baggage delay insurance starting after 24 or 12 hours depending on the plan

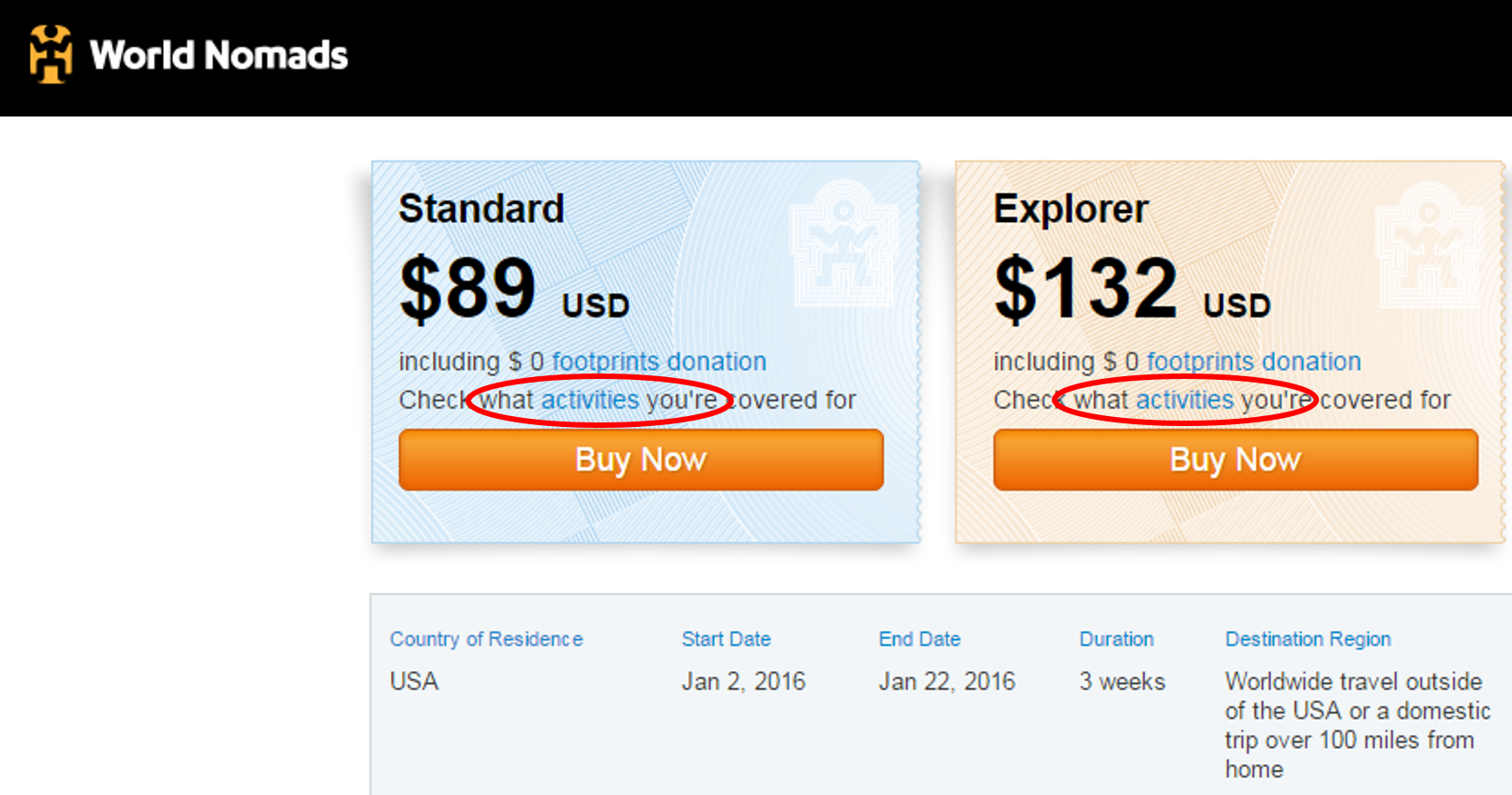

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

Cruise Insurance Reviews

Best cruise insurance overall: nationwide travel insurance.

Nationwide Travel Insurance is a long-standing and reputable brand within the insurance marketplace that offers cruise insurance plans with solid coverage and reasonable rates.

It has three cruise insurance options: Universal, Choice, and Luxury. The Nationwide Choice plan, for example, offers $100,000 in emergency medical coverage and $500,000 in emergency medical evacuation coverage.

The right plan for you depends on your budget and coverage needs. But each plan offers cruise-specific coverages like ship-based mechanical breakdowns, coverage for missed prepaid excursions if your cruise itinerary changes, and covered service disruptions aboard the cruise ship.

Read our Nationwide Travel Insurance review here.

Best Cruise Insurance for Affordability: AXA Travel Insurance

AXA Assistance USA offers three comprehensive coverage plans: Gold, Silver, and Platinum. Each of these plans offers coverage for issues like missed flights, medical emergencies, lost luggage, and more.

The highest-tier Platinum plan provides $250,000 in medical emergency coverage and $1 million in medical evacuation coverage. The baggage loss coverage is $3,000 per person, and their missed connection coverage is $1,500 per person for cruises and tours.

In addition, travelers can take advantage of AXA's concierge service, which provides an extensive network of international service providers. They'll be able to assist you with things like restaurant reservations and referrals, golf course information, and more. This service could come in handy if you're stopping at a variety of unfamiliar destinations during your cruise.

The coverage limits on AXA's policies are on the higher end compared to other providers. And you can buy coverage for a little as 4% of your trip cost depending on your age, travel destination, and state of residence.

Read our AXA Travel Insurance review here.

Best Cruise Insurance for Seniors: Seven Corners Travel Insurance

Seven Corners Travel Insurance lets cruisers enjoy traveling in their golden years with the knowledge they're covered in the event of an accident or emergency. While other providers do offer coverage to those 80+ years old, Seven Corners is known for its affordable premiums while offering above-average medical expenses and medical evacuation coverage limits — two areas of travel insurance coverage that are even more important as we get older.

Seven Corners also offers the option of a preexisting conditions waiver and CFAR insurance at an additional cost, plus "Trip Interruption for Any Reason" coverage, which you won't find on many policies.

You can choose between the Trip Protection Basic or Trip Protection Choice plans, with the higher-tier Choice plan costing more but providing more coverage.

Read our Seven Corners Travel Insurance review here.

Best Cruise Insurance for Expensive Trips: HTH Worldwide Travel Insurance

HTH Worldwide Travel Insurance offers three levels of trip protection: TripProtector Economy, Classic, and Preferred. The higher the tier, the more coverage you'll get for things like baggage delays, trip delays & cancellations, and medical expenses. But their premiums remain reasonable even at the highest tier of coverage.

Not only does the HTH Worldwide Trip Protector Preferred plan offer higher-than-average medical emergency and evacuation coverage limits ($500,000 and $1 million, respectively), but you'll also get a baggage loss coverage limit of $2,000 per person and coverage for trip interruption of up to 200% of the trip cost. You also have the option to add CFAR coverage for an additional cost.

Read our HTH Worldwide Travel Insurance review here.

Best Cruise Insurance for Exotic Locations: World Nomads Travel Insurance

World Nomads Travel Insurance has been a top choice for comprehensive travel insurance for many years now. And it's a great option when it comes to cruise coverage, too.

Even the most basic Standard Plan comes with $100,000 in medical emergency coverage and $300,000 in emergency evacuation coverage. And you'll get higher coverage limits with their Premium Plan. Plus, unlike many other providers, World Nomads trip cancellation and emergency medical coverage include COVID-19-related issues.

What sets World Nomads apart from many other insurance companies is that its policies cover 200+ adventure sports. This can be important for adventurous cruisers who plan to take part in activities like jet skiing, scuba diving, or parasailing during their cruise.

Read our World Nomads Travel Insurance review here.

Introduction to Cruise Insurance

Cruise insurance may offer unique coverage like missed port of call and medical evacuation coverage. You might not need the flight protections of a regular travel insurance plan if you're catching a cruise at a port near you, but medical and cancel for any reason coverage could be critical.

Understanding the Basics of Cruise Insurance

At its core, cruise insurance is your financial lifeboat, designed to protect you from unforeseen events that could disrupt your sea voyage. Whether it's a sudden illness, adverse weather, or other unexpected occurrences, having the right insurance can make a world of difference.

Why Cruise Insurance is Important

Picture this: You're all set for your dream cruise, but a sudden family emergency means you can't set sail. Or worse, you fall ill in the middle of the ocean. Without cruise insurance, you're not just missing out on an adventure, but also facing potentially huge financial losses. That's why securing cruise insurance isn't just recommended; it's a crucial part of your cruise planning.

Types of Cruise Insurance Coverage

Cruise insurance isn't a one-size-fits-all life jacket. There are various types of coverage, each tailored to protect different aspects of your cruise experience.

Trip Cancellation and Interruption Coverage

This coverage is like your safety net, catching you financially if you need to cancel your trip last minute or cut it short due to emergencies, be it due to personal, health-related, or even certain work conflicts.

Medical Coverage

Being on a cruise shouldn't mean being adrift from medical care. Medical coverage ensures that if you fall ill or get injured, your medical expenses won't sink your finances.

Emergency Evacuation Coverage

In the rare case that you need to be evacuated from the ship due to a medical emergency or severe weather, this coverage ensures you're not left adrift in a sea of expenses.

Baggage and Personal Effects Coverage

Imagine reaching your dream destination only to find your luggage lost at sea. This coverage ensures that lost, stolen, or damaged baggage doesn't dampen your cruise experience.

Buying Cruise Insurance

Securing the best cruise insurance isn't just about finding the best price; it's about ensuring it covers all your potential needs.

When to Purchase Cruise Insurance

Timing is everything. Purchasing your insurance soon after booking your cruise can often provide additional benefits and ensure you're covered for any early surprises. As you get closer to your trip your coverage options may get more expensive, and certain providers may not be able to offer you coverage.

How to Find the Best Deals on Cruise Insurance

Keep a lookout for deals, but remember, the cheapest option isn't always the best. Balance cost with coverage, and ensure you're getting the protection you need at a price that doesn't rock your financial boat. A travel insurance comparison site like SquareMouth is a good place to compare multiple quotes from all of the major carriers at once.

How to Pick The Best Cruise Insurance for You

When buying travel insurance for a cruise, consider the additional risks that are specific to cruising. These include hurricanes and other weather-related concerns, strict cancellation terms, high pre-paid costs of a cruise, and the distance to emergency medical assistance.

To find the policy that's right for you, it's best to compare several different cruise insurance policies based on the pricing and coverage they provide. Remember too that all reputable insurance providers will offer a "free-look period." This allows you to return the policy you've purchased for any reason, within a specific time period, for a full refund.

The most important coverages to look for in cruise insurance are:

- Medical coverage — This coverage will pay for medical bills outside the US. But because treatment can be more expensive while onboard, make sure your policy offers sufficient coverage ($100,000+).

- Medical evacuation coverage — This coverage will transport you to the nearest hospital or even back home if you become sick or injured during your journey. But an evacuation from sea will be more expensive than one from land. So you'll want to make sure your coverage has sufficiently high limits ($250,000+).

- Missed connection (missed port of call) coverage — This type of coverage will help you catch up to your itinerary if you miss your port of call for a covered reason, like a delayed flight on the way to the airport.

- Coverage for hurricane warnings — With this type of coverage, you don't actually need to be affected by the hurricane. You can cancel and be reimbursed for your trip if the NOAA issues a hurricane warning. If you're cruising anywhere during (or on the tail ends) of hurricane season, this can come in handy. Just note: You can't buy travel insurance to cover a weather event once a storm or hurricane has been named.

- Cancel for any reason (CFAR) — This is the most comprehensive coverage you can get, as it allows cancellations and reimbursement for pre-paid expenses for any reason. This can be a wise add-on for cruise coverage given the often higher prepaid expenses associated with cruising. See our guide to the best CFAR travel insurance options to learn more.

- Preexisting conditions — This coverage ensures that no known health conditions are excluded from coverage. Obtaining a preexisting condition waiver usually requires purchasing your travel insurance soon after booking your trip.

- Personal possessions insurance — Because of the events and fancy dinners cruise ships hold, you might take more valuable clothing or jewelry with you on a cruise. This type of coverage will insure your belongings against loss or theft while cruising.

- Baggage loss and delay — This coverage will reimburse you up to a specified amount for essentials if your bags are delayed or if your bags get lost en route.

As a rule of thumb, you can expect to pay between 5% and 10% of your prepaid, nonrefundable trip expenses for cruise insurance coverage. The price will vary depending on factors like your age, your travel destination, and whether you require additional coverage.

If you're booking a cruise, we recommend purchasing travel insurance when you make your first trip payment. That could be for the cruise itself or an expense like airfare to get you to your cruising destination. This way, if you have to cancel your trip, you'll have the most extended coverage period possible.

You can buy your own cruise insurance that isn't offered directly through the cruise line operator. In fact, this could be a better option if you want coverage for your travel to the cruise's departure point, not just for the cruise itself.

The difference between traditional travel insurance and cruise insurance is that cruise insurance offers more specialized coverage, for situations such as missing a departure port and more coverage for medical evacuations, since it's more expensive to evacuate someone at sea than on land.

Most cruise insurance includes coverage for missing a departure port, so you should be able to claim for a missed port. Just make sure you check the details of your policy before you file a claim, and before you travel so you know what compensation you're entitled to.

Why You Should Trust Us: How We Chose the Best Cruise Travel Insurance

When comparing cruise travel insurance providers, we evaluated them based on the following criteria to come up with our list of top picks:

Customer Satisfaction

We look at ratings from JD Power and other industry giants to see where a company ranks in customer satisfaction. We also look at customer review sites like Trustpilot and SquareMouth.

Policy Types

We look at policy types and offerings, from standard travel protections to adventure sports coverage. We look at the amount of insurance offered

Average Premiums

We compare average premiums per trip. Some companies also offer annual plans, and we compare policies accordingly.

Claims Paid

How frequently do companies pay claims easily and quickly? We check customer reviews and other resources to see which companies honor policies most effectively.

We look at the company's overall behavior. Is it operating ethically? Companies can earn additional points for such behaviors.

You can read more about how Business Insider rates insurance here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Best of Wellness Awards 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Here are the 5 best cruise insurance plans

Cruise insurance can cover many situations, but you need to shop around to find the best coverage..

A cruise is an ideal vacation for anyone who likes the all-inclusive concept , where you pay one price and have just about everything taken care of, from accommodations to meals and activities. But they also aren't always cheap and a lot of things can go wrong. You could have a flight delay that causes you to miss your departure or be unable to sail because of a sickness. In these situations, cruise insurance can reimburse you for prepaid and non-refundable expenses.

CNBC Select analyzed 19 cruise insurance companies and selected the best plans for various situations. (See our methodology for more information on how we chose the best cruise insurance plans.)

Best cruise insurance

- Best overall: Nationwide Travel Insurance

- Best for affordable coverage : AXA Travel Insurance

- Best for adventure excursions: World Nomads

- Best for pre-existing conditions: Seven Corners Travel Insurance

- Best for cancel-for-any-reason coverage: Travel Guard Travel Insurance

Best overall

Nationwide travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

Nationwide's wide coverage for travel insurance allows many different types of travelers to find coverage that fits their needs. Three levels of cruise insurance coverage gives extra options to cruise passengers.

24/7 assistance available

- 10-day review period on cruise insurance policies to make sure the plan meets your needs (not available in NY or WA)

- Most basic cruise plan doesn't offer CFAR coverage

Who’s this for? Nationwide is a top choice for many travelers due to its variety of cruise-specific coverage. The insurer offers three three tiers of cruise insurance, but its standard Universal Cruise Plan should meet many needs.

Standout benefit: Nationwide's cruise-specific plans can cover things like emergency accidents, sicknesses, itinerary changes, mechanical breakdowns and other trip interruptions or on-ship disruptions. The company also offers a 10-day review period on its cruise policies (not available in NY or WA), giving you extra time to look over the policy and ensure it’s a good fit.

[ Jump to more details ]

Best for affordable coverage

Axa assistance usa travel insurance.

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

- Three tiers of plans available

- Highly rated for financial strength

- Cancel for any reason only available on highest-tier coverage

Who’s this for? Budget-conscious cruisers should consider AXA . In our research, AXA's Silver Plan stood out as the top budget plan for its mix of affordable premiums and essential coverage. CNBC Select also named AXA one of the best overall travel insurance providers .

Standout benefit: AXA's Silver Plan includes the standard coverage you need to protect yourself from delays and cancellations, as well as employment layoff coverage. This benefit reimburses you for prepaid and nonrefundable travel costs if you cancel because of involuntary layoff or you are terminated from your job. You only need to have been at your current employer for one continuous year to qualify, which is generous compared to other plans that require at least three continuous years of employment for this coverage — if it's even included at all.

Best for adventure excursions

World nomads travel insurance.

World Nomads offers travel insurance for all sorts of travelers, from families to solo adventure travelers. Policies are underwritten by Nationwide and offer strong coverage of emergency accident and illness situations, as well as emergency evacuation scenarios.

- Affordable coverage for many travelers

- Coverage for adventure activities like scuba diving, bungee jumping and more

- Lower trip cancellation limits than other travel insurance we reviewed

Who’s this for? World Nomads offers insurance underwritten by Nationwide , geared specifically toward thrill-seekers. The World Nomads Explorer Plan covers over 200 adventure activities and sports. With this plan, you can take part in just about any excursion without fear of negating your coverage .

Standout benefit: The World Nomads Explorer Plan covers baggage and personal items for loss, theft or damage for up to $3,000 and $1,500 per item. Sporting equipment is included in this coverage, so you can bring your golf clubs along on your cruise without worry.

Best for pre-existing conditions

Seven corners travel insurance.

Policies provide missed and delayed tour/cruise connection coverage. Cancel for any reason coverage and pre-existing conditions waiver are also available if you buy your plan within the specified time. ***CFAR and IFAR are subject to certain eligibility criteria and are not available in all states

- High coverage limits available

- Offers group insurance (10+ people)

- Covers Covid-19 illness

- Pre-existing conditions waiver not available for the Economy plan

- Cancel for any reason not available for the Economy plan

Who’s this for? Seven Corners offers a standard Trip Protection Economy plan and a more premium Trip Protection Elite plan. The Seven Corners Trip Protection Elite plan stands out for offering generous coverage limits and an add-on option for cancel for any reason (CFAR) coverage, which both pair well with its pre-existing conditions waiver.

Standout benefit: This plan's pre-existing conditions waiver for medical coverage applies to plans purchased within 20 days of booking and paying your initial trip deposit. That's a generous window compared to some plans which can require you to purchase insurance within seven to 14 days. If you don't purchase your coverage within the waiver window, this plan only considers conditions existing within the previous 60 days, whereas other plans may look back up to 120 days.

Best for cancel for any reason coverage

Travel guard® travel insurance.

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

Who’s this for? AIG's Travel Guard Preferred plan comes with a wide range of coverages and a variety of useful add-ons for an extra fee such as pet coverage , wedding coverage and cancel for any reason coverage (CFAR).

Standout benefit: The optional CFAR insurance for this plan begins at 12:01 a.m. on the day after you pay for coverage and ends two days before departure (or when the travel is canceled). This benefit reimburses up to 50% of the trip cost (up to $25,000 maximum), which includes reimbursement for:

- 50% of change fees

- 50% of cancellation penalties for unused travel

- 50% of award travel redeposit fees

More on our top cruise insurance plans

Nationwide universal cruise plan.

Nationwide's standard Universal Cruise Plan will be more than sufficient for many cruisers. It offers strong coverage for many different scenarios, but if you're seeking higher levels of coverage or are taking a long cruise, you can opt for the Choice Cruise Plan, or the Luxury Cruise Plan, which offers the highest level of benefits.

Trip cancellation and interruption

The full trip cost (100%) is covered for both cancellations and interruptions. This includes canceling because of a Covid-19 illness .

Covered delays of six hours or more (or at least three hours for missed connections) are eligible for reimbursement of:

- Up to $500 per day

- $500 maximum

Medical coverage and evacuation and repatriation

- $75,000 in emergency accident and sickness coverage

- $250,000 in evacuation and repatriation coverage

- $750 in emergency dental treatment coverage

Pre-existing conditions

No coverage for pre-existing conditions that fall within 60 days of your policy's start date.

Notable perks

All of Nationwide's cruise plans, including the Universal Cruise Plan, include cancel for work reason coverage, meaning you may be covered if you need to cancel because of work-related issues, as well as coverage for extension of the school operating session. The Universal Cruise Plan also provides coverage for delayed and lost baggage, which begins to kick in after delays of eight hours or more, as well as coverage for trip delays of three hours or more for missed connections or other trip delays of six hours or more. You can also get reimbursed if your trip is canceled or interrupted because of terrorism (foreign or domestic) or financial default of the travel provider (14-day waiting period applies). Itinerary changes that cause you to miss a pre-paid excursion are covered by up to $250.

[ Return to summary ]

AXA Silver Plan

AXA offers three insurance plans, with the Silver Plan being the most affordable. The Gold Plan has most of the same types of coverage with higher reimbursement limits. Meanwhile, the Platinum Plan is for anyone who prefers premium benefits, such as cancel-for-any-reason coverage.

The full trip cost (100%) is covered for both cancellations and interruptions. This includes canceling because of a Covid-19 illness.

After a 12-hour delay or more, you're eligible for:

- Up to $100 per day

- Primary medical coverage of $25,000 per (covers Covid-19)

- Evacuation and repatriation coverage of $100,000 per person

No coverage for pre-existing conditions that fall within this policy's 60-day look-back period.

AXA's Silver Plan comes with coverage for delayed and lost baggage, including $200 per person for covered delays of 24 hours or more and $750 per person ($150 per item) for lost baggage and items. You can also get reimbursed if your trip is canceled or interrupted because of terrorism (foreign only) or financial default of the travel provider (10-day waiting period applies). If a hurricane or bad weather causes your travel provider to cease services for at least 48 hours, you can be reimbursed for up to the full trip cancellation/interruption coverage. Notably, you must purchase the coverage before a storm is named.

World Nomads Explorer Plan

The Explorer Plan is World Nomads' premium travel insurance plan and covers a longer list of activities than the Standard Plan. You can review the list of covered activities here and decide if the more affordable Standard Plan works for you.

Covered up to the trip cost with a $10,000 maximum.

Covered delays of six hours or more are eligible for reimbursement of:

- Up to $250 per day

- $3,000 maximum

- $100,000 in emergency accident and sickness coverage

- $500,000 in evacuation and repatriation coverage

No coverage for pre-existing conditions that fall within 90 days of your policy's start date.

This plan includes $35,000 in rental car damage coverage (where it's valid) due to collision, theft or a natural disaster. And an accidental death and dismemberment benefit of $10,000. When your baggage is delayed for more than 12 hours, you can be reimbursed up to $150 a day ($750 maximum) for any necessary personal items you purchase.

Seven Corners Trip Protection Elite

The Seven Corners Trip Protection Elite plan has generous coverage limits for evacuation and repatriation and accident and sickness. Seven Corners Travel Insurance plans also cover Covid-related illnesses.

Trip cancellations are covered for 100% of the trip cost and interruptions are covered for 150% of the trip cost.

Trip delays of six hours or more can qualify for reimbursement of:

- Up to $300 per day

- $1,500 maximum

- $250,000 in emergency accident and sickness coverage

- $1,000,000 in evacuation and repatriation coverage

- $750 in emergency dental coverage

Pre-existing conditions are covered if you purchase coverage within 20 days of making your initial trip deposit. If you don't qualify for the pre-existing conditions waiver, there is no emergency medical coverage for conditions existing within 60 days of your policy's start date.

This plan covers baggage delays of more than 12 hours for up to $600 and covers lost, damaged or stolen bags or personal items for up to $300 per item ($2,500 maximum). It also has missed cruise connection coverage of $150 per day for accommodations and meals ($1,500 maximum).

AIG Travel Guard Preferred

The CFAR coverage is available as an upgrade on Travel Guard's Preferred and Deluxe plans. If you don't need this optional upgrade, you could save money on your premium with Travel Guard's Essential plan.

Trip cancellations are covered for 100% of the trip cost (up to a max of $150,000) and trip interruptions are covered for 150% of the trip cost (up to a max of $225,000).

Trip delays of five hours or more can qualify for reimbursement of:

- Up to $200 per day

- $800 maximum

- $50,000 in emergency medical coverage

- $500 in emergency dental coverage

A pre-existing conditions waiver applies when you purchase coverage within 15 days of the initial trip deposit.

With this plan, you'll have coverage for lost, stolen or damaged baggage or travel documents for up to $1,000. You also receive baggage delay reimbursement for delays of more than 12 hours with a coverage limit of up to $250 per day ($300 maximum). If you miss a connection, you can be reimbursed up to $1,000 for unused prepaid or nonrefundable travel you missed and transportation expenses to rejoin your trip.

When should I buy insurance for a cruise?

It's usually best to purchase cruise insurance shortly after booking. This lets you take advantage of the protections sooner and qualify for certain benefits such as pre-existing condition waivers.

Is there a difference between travel insurance and cruise insurance?

Travel insurance typically covers cruises and other types of travel, whereas cruise insurance is designed to specifically protect you while cruising or getting to your cruise.

Does cruise insurance cover missed ports?

Cruise insurance may cover missed connections, but it's important to read your policy before you purchase it. Each policy has different limits on how much you'll be reimbursed and what exactly you'll be reimbursed for.

Bottom line

Cruise insurance plans protect you in all sorts of situations when something goes wrong while you're cruising. You can be covered for emergency medical expenses, trip delays, trip cancellations or interruptions and more. Shop around and compare providers to find the best cruise insurance policy for you.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every cruise insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of travel insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best cruise insurance plans.

Our methodology

To determine the best cruise insurance plans, CNBC Select analyzed the offerings of 19 insurance companies and compared them based on various factors. These included the maximum coverage limits, optional coverages, types of coverage, premiums and what the policies cover. We also considered financial strength ratings from AM Best and Better Business Bureau ratings for customer satisfaction.

We based premium costs on a sample cruise with the following details (when applicable):

- 40-year-old male

- Living in New York, New York

- Sailing for seven days in April

- Total trip cost: $2,800

- Destination: Mexico

- Flying to the port of departure

Sample quotes assumed that payments were made on the date of quoting.

Note that the premiums and policy structures advertised for cruise insurance companies are subject to fluctuate in accordance with the company's policies.

Catch up on CNBC Select’s in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- 5 hidden insurance fees to avoid Liz Knueven

- Can I pay my mortgage with a credit card? Kelsey Neubauer

- How can I get homeowners insurance after nonrenewal? Liz Knueven

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Smooth Sailing Ahead: Your Guide to Cruise Travel Insurance [2023]

Jessica Merritt

Editor & Content Contributor

82 Published Articles 462 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

89 Published Articles 62 Edited Articles

Countries Visited: 54 U.S. States Visited: 36

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3091 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

![cruise guru travel insurance Smooth Sailing Ahead: Your Guide to Cruise Travel Insurance [2023]](https://upgradedpoints.com/wp-content/uploads/2020/04/MSC-Cruise-Ship.jpeg?auto=webp&disable=upscale&width=1200)

Best Cruise Travel Insurance for Seniors: Seven Corners

Best cruise travel insurance with covid-19 coverage: battleface, best cruise travel insurance for young travelers: aegis, best cruise travel insurance for adventure tours: img, best cruise travel insurance, cancel for any reason coverage: john hancock insurance agency, what is cruise insurance, is cruise insurance worth it, cruise insurance costs, types of cruise insurance, what to look for in a cruise travel insurance policy, how to get cruise insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Taking a cruise is one of the easiest ways to travel, but cruising isn’t immune to unexpected hiccups. Sudden illness, travel delays, or other unforeseen events could cancel or interrupt your cruising plans — you might even need medical coverage.

With cruise insurance, you’re covered for unexpected issues that can interfere with your travel plans . Read on to learn what cruise insurance is, how to get it, and how to find the best cruise insurance policies, whether you’re buying directly from the cruise line or a third-party insurance company.

The 5 Best Cruise Travel Insurance Policies

The right cruise insurance policy offers the coverage you need at a good price, but policies aren’t one-size-fits-all. We’ve run quotes for various coverage scenarios — from seniors to adventure tours — to find the best cruise insurance policies .

Consider these travel insurance policies for your next cruise:

Seniors cruising the world can get comprehensive coverage from Seven Corners Travel Insurance . We were quoted $89 for a 70-year-old cruising Mexico . The Seven Corners Trip Protection Basic policy offers trip cancellation and interruption, medical coverage, and medical evacuation, along with COVID-19 cancellation and medical coverage.

Comprehensive travel insurance, regardless of your age, is widely available and relatively affordable. Check out our complete guide to travel insurance for seniors .

If you’re concerned about COVID-19 derailing your cruise travel plans, getting cruise travel insurance with COVID-19 coverage is essential. The battleface Discovery Plan covers COVID-19 cancellation and medical expenses, along with regular trip cancellation, medical evacuation, and medical emergency coverage. We were quoted $36.54 for a 35-year-old cruising Italy on this plan.

Young travelers often have the lowest-priced travel insurance policies. We got a quote for just $30.27 from Aegis for a 22-year-old cruising the Bahamas . The Aegis Go Ready Choice policy covers COVID-19 medical and cancellation, trip cancellation and interruption, medical evacuation, and medical expenses.

Are you planning adventurous excursions on your cruise? IMG’s iTravelInsured Travel Lite , with options for winter, adventure, and extreme sports, can give you the coverage you need. We were quoted $58.87 for a 40-year-old traveler cruising to Costa Rica with plans to zipline . It covers trip cancellation and interruption, medical expenses, medical evacuation, and adventure sports with some exclusions, such as diving and adventure races.

Your travel insurance might not cover everything you want to do — particularly if you plan on adventure activities. Here’s our complete guide to adventure and extreme sports travel insurance .

If you’re especially concerned you may need to cancel your cruise, Cancel for Any Reason coverage allows you to cancel your trip and receive partial reimbursement for nonrefundable trip expenses, even if you cancel for reasons not normally covered by trip cancellation coverage. We were quoted $100.50 for a 55-year-old cruising Alaska for John Hancock Insurance Agency’s Silver plan , which reimburses up to 75% of your trip cost under Cancel for Any Reason coverage. It also offers coverage for COVID-19 medical and cancellation, trip cancellation and interruption, and medical expenses and evacuation with primary coverage.

Cruise insurance is travel insurance that covers cruises . It can help you manage all the what-ifs on your cruise. What if you need to cancel your booking? What if your flight is late? What if you get sick or hurt? Travel insurance for cruises can cover you for all of these things.

Many travel insurance policies cover cruises, but cruise insurance may be tailored to the risks of cruises, covering transportation, accommodations, and activities. Getting travel insurance for cruises can offer peace of mind if you’re concerned about losing nonrefundable trip payments, travel delays, or covering emergency medical care.

Cruise bookings can be unforgiving, and cruise insurance can help you minimize your risk of losing the money you’ve paid for your trip. Travel insurance coverage is often a good idea if you’re concerned about losing nonrefundable prepaid travel expenses or covering emergency medical expenses .

Because cruises are often less flexible than other types of travel, it’s generally a good idea to get cruise travel insurance. For example, you might be able to rebook a flight or hotel room, but if you cancel your cruise, you could lose your deposit or more. Often, cruise lines won’t offer any refunds if you cancel within a certain period before your cruise, such as 14 or 30 days .

Additionally, you shouldn’t expect your U.S.-based health insurance plan to cover you on your cruise, especially if you’re on an international cruise. And it’s exceptionally expensive if you need to be evacuated for a medical condition.

While everyone hopes for smooth sailing, the reality is a lot of unexpected issues could pop up on your cruise. Your flight to the cruise port could be delayed, you might get sick or injured on your cruise, or you might have to cancel the whole thing if illness or obligations prevent you from going on your cruise. A hurricane could interfere with cruising in storm hotspots such as the Caribbean and Gulf of Mexico.

Cruise insurance can offer financial support for many unexpected problems you might experience with a cruise. And with a 24-hour travel assistance hotline , you can get knowledgeable help whether you need to find a local pharmacy or coordinate the replacement of lost travel documents such as your passport.

That said, you might have travel insurance coverage available with a credit card . Some credit cards offer travel insurance benefits such as trip cancellation and interruption, emergency medical treatment and evacuation, and travel delay coverage. Still, you should check the details of your credit card’s coverage to ensure it’s enough for your needs.

Looking for a credit card with travel protections? Read our guide to the best credit cards for travel insurance coverage and protection.

Generally, expect cruise insurance to cost between 5% to 10% of the total cost of your cruise . For a $3,000 cruise, you’ll typically pay between $150 to $300 for comprehensive travel insurance coverage. But keep in mind several factors influence the cost of cruise insurance, including:

- Add-ons, such as CFAR

- Coverage options

- Cruise cost

- Deductibles and limits

- Destination

- Group policies

- Traveler age

- Trip duration

Learn more about travel insurance costs in our guide to the average cost of travel insurance .

What Cruise Insurance Covers

Each travel insurance policy is unique, but travel insurance for cruise coverage typically includes:

- 24/7 Assistance: You can get 24/7 support for itinerary changes, rebooking, medical emergencies, and more.

- Baggage Protection: Your luggage is covered for loss, theft, or damage on your flight or during your cruise.

- Cabin Confinement: You may get reimbursement if you have to stay in your cabin during your cruise, such as a required quarantine due to COVID-19.

- Cancel for Any Reason: Usually available as an add-on, CFAR travel insurance allows you to cancel your cruise for any reason and receive a partial reimbursement of your nonrefundable travel expenses.

- Itinerary Changes: You can get covered for changes in your cruise’s itinerary, missed port calls, or extended delays beyond your control.

- Missed Connections: If you miss your cruise departure due to a flight delay or other covered reason, you can get reimbursed for your nonrefundable travel expenses.

- Medical Emergencies: Cruise insurance can cover medical treatment on the cruise and may offer coverage for medical evacuation.

- Trip Cancellation or Interruption: You can get reimbursed for your nonrefundable travel expenses if you cancel your cruise or end your trip early due to covered reasons such as illness or injury. You’re typically covered if the cruise line cancels due to mechanical issues, weather, or other unforeseen events.

Cruise-specific travel insurance may also offer reimbursement if your cruise ship is disabled. And if you want to cover shore excursions, be sure to include the cost of excursions in your total travel cost when you get quotes for cruise insurance.

While these coverage types are common among cruise insurance policies, checking the terms and conditions to confirm all coverage areas is a good idea.

There are many options for travel insurance, and you can generally choose as little or as much coverage as you’d like. You can opt for a comprehensive travel insurance policy, which may offer Cancel for Any Reason (CFAR) coverage, or you might prefer to limit your costs and choose just the coverage you need. For example, you might choose standalone trip cancellation insurance or a travel medical insurance policy but decide you don’t need coverage for missed connections or baggage.

Consider these factors as you compare the best cruise travel insurance policies:

- Cancellation Window: Understand how many days before your cruise departure you must cancel to qualify for reimbursement.

- Coverage Availability: Travel insurance policies typically offer cruise coverage, but it’s best to confirm that a policy specifically covers cruises before you purchase it. Also, consider availability for coverages that may be important to you, such as CFAR or adventure sports.

- Customer Reviews and Reputation: You can get insight into the insurance provider and how claims and customer service work by reading customer reviews and ratings.

- Eligibility Criteria: Cruise insurance policies may have eligibility criteria such as limits on age or trip duration and preexisting conditions. For example, some travel insurance policies max out at 90 days.

- Exclusions and Limitations: Read the policy to understand what’s excluded or limited specifically to cruise-related coverage, such as reimbursements for port closures, itinerary changes, or medical incidents on the cruise.

- Policy Cost: Get multiple quotes and compare each cost and coverage value to ensure you get a good value for your cruise insurance policy.

- Purchase Timeline: You’ll usually need to purchase your cruise insurance within a certain period of booking your trip, so be sure you’re buying your policy within that timeframe.

- Reimbursement Structure: Review the cruise insurance policy to confirm how much you can be reimbursed for under qualifying circumstances, such as if you need to cancel or interrupt your trip.

You can buy cruise insurance from the cruise line when you book, or a travel agent may offer cruise insurance plans. You also have the option to purchase cruise trip insurance independently. It’s a good idea to get multiple quotes to compare your costs and coverage and get the best deal on cruise insurance.

You should buy cruise insurance when you make your first deposit so you’re immediately covered for trip cancellation. Here are some of the options and coverages if you purchase cruise insurance directly from the cruise line:

Before you purchase cruise insurance from a cruise line, compare your third-party options. You can get quotes from multiple travel insurance companies at once using a travel insurance aggregator such as Squaremouth .

Even a meticulously planned cruise can run into unforeseen disruptions — and cruise insurance can come in handy for the unexpected.

Cruise insurance covers you for sudden illnesses, travel delays, and more, offering financial protection so you’re safeguarded against uncertainties. Whether you get cruise insurance from the cruise line or third–party insurance providers, understand your coverage and how it protects your investment in cruise travel.

Frequently Asked Questions

Does my health insurance cover me on a cruise.

Some health insurance policies offer limited coverage on cruises, but coverage often depends on where you’re cruising and your planned activities. Check with your insurance provider about coverage before you depart on your cruise. Find out if supplemental cruise insurance is available if you want to use your existing health insurance coverage.

Are cruises covered under travel insurance?

Cruises are typically covered under travel insurance , so you don’t necessarily have to buy specialized cruise insurance, such as coverage from the cruise line. Travel insurance can cover trip cancellations and interruptions, medical emergencies, lost luggage, and more on your cruise trip.

Can you buy cruise insurance after booking?

You can buy cruise insurance after booking. It’s generally best to purchase cruise insurance as soon as possible after making your initial trip deposit — when you have money on the line. The sooner you purchase cruise insurance, the sooner you’re covered for trip cancellations.

Can you buy medical insurance for a cruise?

You can buy medical travel insurance to cover your medical expenses on a cruise, offering coverage such as medical emergencies, illnesses, and injuries.

How do I add travel insurance to my cruise?

You can add travel insurance to your cruise when you book with the cruise line or a travel agent. Alternatively, you can purchase travel insurance directly from travel insurance agencies.

Was this page helpful?

About Jessica Merritt

A long-time points and miles student, Jessica is the former Personal Finance Managing Editor at U.S. News and World Report and is passionate about helping consumers fund their travels for as little cash as possible.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Cruise Insurance: Why You Need It + 4 Best Options for 2024

Seven Corners »

Travelex Insurance Services »

AXA Assistance USA »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Cruise Insurance Plans.

Table of Contents

- Seven Corners

- Travelex Insurance Services

Cruise vacations come with the same considerations as any other trip, including the potential for trip cancellations, trip interruptions, unforeseen medical expenses and even a need for emergency medical evacuation. Add in the potential for unruly weather during hurricane season , and it's easy to see why cruise insurance plans are so popular and recommended.

Read on to find out which cruise travel insurance plans U.S. News recommends and how they can protect the investment you made in a cruise when something goes wrong.

Frequently Asked Questions:

All cruise insurance plans are unique, and some have different coverages than others. However, most travel insurance plans for cruises cover the following:

- Trip delays, interruptions and cancellations: This kind of coverage is essential any time of the year, but especially during hurricane season when storms can impact your travel plans.

- Protection for medical emergencies: This type of coverage can help pay for unexpected medical bills if you're injured on board the ship or hurt during a shore excursion. You can also choose a cruise insurance plan that covers emergency medical evacuation from the ship or to the nearest hospital.

- Coverage for lost or delayed baggage: Coverage for baggage is important for cruises just like any other trip. This type of insurance can pay for essential items you need to buy if your bags are lost or stolen and don't make it on the ship.

With each of these protections, a coverage limit is listed with your plan. This means you may get reimbursed for your losses or prepaid travel expenses up to this limit, but only when a covered reason applies to your claim.

One of the main reasons to buy cruise insurance is for medical emergencies. Note that, once you're on a cruise ship or visiting a destination outside the United States, your own U.S. health insurance plan will not apply. The same truth applies if you have government health coverage like Medicare.

You can purchase cruise insurance through your cruise line, but these plans are often very basic with low limits for medical expenses and other coverages. For example, cruise line travel insurance policies often come with just $25,000 in coverage for emergency medical expenses and up to $50,000 in coverage for emergency medical evacuation, which may not be enough.

Fortunately, you can buy cruise insurance from any travel insurance provider when planning this type of trip. By buying coverage from an independent travel insurance provider instead of your cruise line, you get to select the exact coverages and limits you need for the best protection possible.

- Seven Corners: Best Overall

- Travelex Insurance Services: Best for Families

- AXA Assistance USA: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best Cost

Plan is cruise-specific

Get coverage for missed cruise connections and tours

Medical expense coverage is secondary if you opt for lower-tier Basic plan

- Up to 150% in reimbursement for trip interruption

- Up to $250 per person, per day in trip delay coverage ($2,000 maximum)

- Up to $250 per day in missed tour or cruise connection coverage ($1,500 maximum)

- Primary emergency medical expense coverage worth up to $500,000

- Medical evacuation and repatriation of remains coverage worth up to $1 million

- Political and security evacuation coverage worth up to $20,000

- Up to $2,500 in protection for baggage and personal effects (limit per item of $250)

- Up to $100 per day ($500 maximum) in coverage for baggage delays of six hours or more

Travel Select plan offers coverage with pricing for kids included

Customize your plan with additional medical coverage, adventure sports coverage and more

Only $1,000 in coverage for baggage and personal effects

$200 maximum coverage for baggage delays

- Trip cancellation coverage worth up to 100% of total trip cost (maximum $50,000)

- Trip interruption coverage worth up to 150% of trip cost (maximum $75,000)

- $2,000 in trip delay coverage for a delay of at least five hours ($250 per day)

- $750 in coverage for missed connections (delay of at least three hours required)

- Emergency medical expense coverage worth up to $50,000 (dental emergency sublimit of $500 included)

- Emergency medical evacuation coverage worth up to $500,000

- $1,000 in protection for baggage and personal effects

- Up to $200 in coverage for baggage delays (at least 12-hour delay required)

- Travel assistance services

Provides comprehensive coverage for all aspects of cruising

High policy limits for medical expenses and emergency evacuation

Does not offer cruise-specific travel insurance

- Trip cancellation coverage up to 100%

- Trip interruption protection up to 150%

- $1,250 in travel delay coverage ($300 per day)

- $1,500 in protection for missed connections

- Emergency accident and sickness coverage up to $250,000

- Emergency medical evacuation coverage up to $1 million

- Nonmedical emergency evacuation coverage up to $100,000

- $50,000 in accidental death and dismemberment coverage

- Baggage and personal item coverage up to $3,000

- Baggage delay coverage worth up to $600

Comes with enhanced medical and luggage benefits, protections for cruise ship disablement, and more

Cruise delay coverage kicks in after five hours

Baggage delay coverage is only for $200 and doesn't kick in for 24 hours

No option to purchase CFAR coverage

- Up to $75,000 in protection for emergency medical care

- Emergency evacuation and repatriation of remains coverage worth up to $750,000

- Cruise cancellation coverage for 100% of trip cost up to $25,000 per person

- Cruise interruption coverage for 150% of trip cost up to $37,500 per person

- Cruise delay coverage worth up to $1,000 ($200 per day for delays of five hours or more)

- Missed connection coverage worth up to $500 (for delay of three hours or more)

- Cruise ship disablement coverage worth up to $500

- Up to $1,500 in coverage for baggage and personal effects

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel, travel insurance and cruises for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries, some of which have included cruises all over the world. Johnson lives in Indiana with her two children and her husband, Greg – a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

How Much Does a Cruise Cost?

Gwen Pratesi

The average cost of a cruise varies by ship, destination, trip length and more. Use this guide to learn more about cruise costs.

Cruise Packing List: 56 Essentials Chosen by Experts

Gwen Pratesi and Amanda Norcross

This cruise packing list includes all of the essentials – plus items you didn't know you needed.

The 12 Best All-Inclusive Cruises for 2024

When most of the extra costs are paid before you sail, you can truly enjoy your cruise.

Cruise travel insurance: What it covers and why you need it

What does cruise travel insurance cover? And does it pay to buy cruise travel insurance?

The answer is not always clear-cut, as we'll discuss in this guide. But consider this: It's not always smooth seas when it comes to cruising. Even the best-laid plans for a cruise vacation can sometimes be thrown off course by an unexpected event.

You might need to cancel a cruise in advance due to the sudden onset of an illness, such as COVID-19 or the flu. Or, maybe you fall ill during the cruise and need emergency medical attention. Maybe your flight to your ship gets canceled, and you miss the vessel's departure. Or your ship is late arriving in port at the end of a voyage, and you miss your flight home.

In all of these situations, you might benefit from having cruise travel insurance — keyword "might."

Cruise insurance policies vary widely, and not every policy covers every type of mishap. That's why it always pays to read the fine print in a travel insurance policy before you purchase it to know what you're getting in advance.

It's also why you should read this introduction to everything you need to know about cruise insurance. It has many details, but the next time something unexpected happens on your cruise vacation, you'll be glad to be educated and covered by a comprehensive travel insurance policy.

What does travel insurance cover when you cruise?

The typical cruise insurance policy covers a wide range of circumstances that can go wrong in conjunction with a vacation at sea — both before and during the sailing.

For starters, policies often will reimburse you for the cost of canceling a cruise due to a last-minute crisis. They will also often cover costs related to an interruption of a cruise (maybe your ship breaks down, requiring you to fly home mid-voyage ). These two elements are known as trip-cancellation and trip-interruption insurance, and they are bundled into a typical travel insurance policy.

Some policies will also cover out-of-pocket costs related to a flight delay or cancellation that results in you missing your cruise departure (for instance, the cost of catching up to the ship at its next port). Expenses related to baggage delays and loss are often covered as well.

But perhaps most importantly, many travel insurance policies will cover medical expenses you incur while on a cruise. Some will even cover the cost of evacuating from a foreign destination if you are in the midst of a medical crisis.

Travel insurance giant Allianz Global Assistance reports that 53% of all cruise-related "billing reasons" for claims are because of illness for the insured person, while 14% are for an injury. Another 8% are for the illness of a family member, 4% for the death of a family member and 4% for the illness of a traveling companion, among other reasons.

Those percentages include illness and accidents that happen to cruisers just before a trip, making travel impossible. But, in many cases, such claims result from illness and injuries that occur during voyages.

"People often take risks during vacation that they might not take back home, whether riding a jet ski, zipping around on a motorized scooter in a city they don't know well or hiking unfamiliar terrain," James Page, senior vice president and chief administration officer of AIG Travel, told TPG .

Some policies also cover the financial default of a travel provider. In such cases, if your cruise line goes out of business before you sail, you could get all — or at least some — of your money back.

Cruise travel insurance policies don't cover everything. For instance, standard travel insurers generally will not reimburse you for the cost of a cruise you cancel due to worries about an outbreak of an illness. That's true even if a U.S. government agency such as the U.S. Centers for Disease Control and Prevention issues a recommendation that you don't cruise due to an illness outbreak, as it did during the COVID-19 pandemic .

If you want the ultimate flexibility to cancel for such a reason or any other, you'll want to look into a more expensive cancel for any reason travel insurance upgrade.

Related: Avoiding outbreaks isn't covered by most travel insurance policies

Where to find a cruise travel insurance policy

You can buy a travel insurance policy directly from your cruise line when booking your trip or through your travel agent (if you're using one, which often is a good idea when booking a cruise). You also can go directly to a third-party travel insurance provider or a travel-insurance aggregator site, such as InsureMyTrip or TravelInsurance . Your credit card might even give you some travel protections.

Here's what you need to know about each type of cruise travel insurance.

Third-party insurance companies

Third-party insurance companies that specialize in writing travel insurance include AIG Travel, Allianz Travel Insurance, Travelex Insurance and American Express Travel Insurance.

One reason to use a travel agent or a travel aggregator: They can help you find a policy that offers added coverage specific to cruising.

Related: The Points Guy's guide to the best travel insurance companies

"Many plans now offer benefits that will specifically appeal to cruise travelers, such as missed connection, missed port-of-call and cruise disablement coverage," Stan Sandberg, cofounder of TravelInsurance.com, said.

Missed connection coverage reimburses cruisers for a set dollar amount if they need to rebook travel to catch up with their cruise at the next port. Missed port-of-call coverage pays a benefit if the cruise ship misses a scheduled port of call due to weather, a natural disaster or a mechanical breakdown.

Cruise disablement coverage pays a benefit if the traveler is confined on a ship for more than five hours without power, food, water or restrooms.

As noted, policies vary widely. It's a good idea to compare plans and make sure the one you buy has the elements that are most important to you. One size doesn't fit all.

Credit cards with travel benefits