- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Does Travel Insurance Work?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

While every traveler hopes for the best when going on a trip, it's possible for unexpected outcomes to ruin some or all of your vacation. Travel insurance helps in those unfortunate situations by covering the necessary expenses to get you back on the right track.

But how does travel insurance work, how do you buy coverage, and is it a good idea for your next trip? Let’s find out.

What is travel insurance?

Travel insurance protects against financial losses and other risks from unexpected events that occur when traveling. Policies cover the expenses and inconveniences incurred from delayed flights, canceled reservations, lost or delayed luggage, injuries and illness.

You can buy policies that cover one reservation, an entire trip or a specific period of time. Policies can provide protection for a single person or a whole family. Prices vary based on your age, protected items, coverage limits and duration of coverage.

You don’t always have to buy a policy out-of-pocket, though. Some travel cards include built-in travel insurance as a perk. Keep in mind, however, that these policies and their coverage limits vary widely, so it pays to be mindful of what’s covered by any given travel card.

» Learn more: How to find the best travel insurance

Types of travel insurance coverage

Now that we know what it is, how does trip insurance work? There are many types of policies and coverage levels available, depending on your budget and what risks you want to cover.

So what is travel insurance for? Typically it will cover some or all of the following situations:

Trip delay. If your flight or other transportation has delays, you’ll receive compensation to cover food, lodging and other related expenses.

Trip interruption/cancellation. When your trip is interrupted or canceled for a covered reason, it provides financial assistance to make other arrangements to continue your trip or go home early.

Baggage delay. Covers the cost of reasonable clothing, toiletries, medication and other necessary items until your bag arrives.

Lost or damaged baggage. Pays to replace lost or damaged items, including both the luggage itself and personal effects that were in the luggage.

Rental car damage. Commonly called an auto collision damage waiver, this covers the cost to repair or replace a damaged or stolen rental car. Some policies also cover the lost income of the rental to the car agency while it’s being repaired.

Injury or sickness. If you get injured or sick during your trip, this benefit pays for necessary medical care. Depending on the coverage you choose, this benefit may be primary or secondary to your existing medical insurance.

Emergency assistance and transportation. Pays to transport you to the nearest facility that offers adequate medical care to treat your illness or injury. In some cases, this may mean transporting you back to your home country.

Keep in mind that many travel insurance policies do not provide protection for COVID-related situations or pre-existing medical conditions.

» Learn more: Trip cancellation insurance explained

How to use your travel insurance

Travel insurance works like most insurance policies. You purchase coverage for a period of time to protect against certain risks. When a covered event occurs, you file a claim with the insurance company to request payment or reimbursement for financial losses.

In most cases, travel insurance covers only prepaid or non-cancelable reservations. If you are able to cancel your reservations for a full refund, you should cancel them directly with that company as soon as possible. Additionally, most travel insurance policies do not cover reservations booked with airline miles or hotel points .

When you submit a claim, you’ll need to provide documentation for your loss. For example, you should document the cause of the issue (e.g., flight delay or cancellation) and provide copies of your receipts to substantiate your claims. Since there are many different types of losses that could occur, your claims process may vary by company and type of loss.

» Learn more: How do travel insurance claims work?

How to get travel insurance coverage

For travelers interested in getting a travel insurance policy, there are three primary ways to obtain coverage — purchase a standalone policy, use travel card benefits, or add on coverage when booking a trip.

Purchase a travel insurance policy

Many companies sell travel insurance as standalone policies that vary in length from a single trip to a full year. Your policy can cover a single person or an entire family. Policies range from those that offer basic coverage to others that are very robust and cover almost every possibility. Coverage options start from around $20 per trip.

For frequent travelers, it may make sense to purchase a full year of coverage instead of buying a policy for each individual trip.

» Learn more: When you don’t need to buy travel insurance

Access via travel card benefits

Many travel cards include protections that cover issues with your flight, bags and other aspects of your trip. These protections are included at no extra charge, and their coverage levels vary from card to card. You may have travel protections from some of the travel cards that are already in your wallet.

Here's a sample of the coverage available from some popular cards:

Terms apply.

» Learn more: The best credit cards for travel insurance benefits

Get add-on protection for your trip

Some companies offer travelers the option of purchasing insurance when booking a trip. However, they are generally limited in nature and usually cover only that specific reservation.

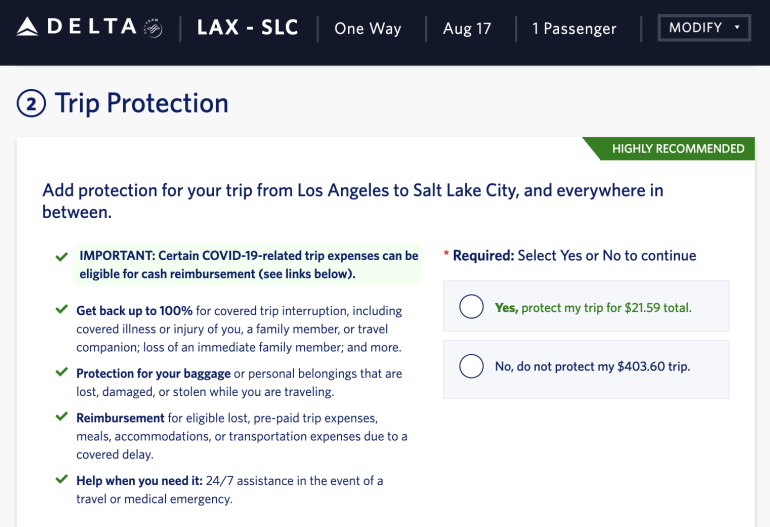

Below is an example of an add-on policy proposed by Delta Air Lines for a flight from Los Angeles to Salt Lake City for a refundable, first-class fare.

In most situations, these add-on policies only make sense for a large financial commitment, such as a cruise or a premium cabin flight. Even then, you should compare how the add-on insurance works versus buying a general policy that could cover your entire trip.

» Learn more: Airline travel insurance vs. independent travel insurance

If you’re interested in buying travel insurance

Now that we've answered "how does travel insurance work," you can see how it can be a smart way to protect your trip in case an unexpected problem occurs. Coverage limits and benefits vary by company and budget, so shop around for the best deal. Review your travel card benefits to ensure that you’re not paying for coverage that you’re already getting for free. And, if you have a claim, document everything and compile your receipts to request reimbursement right away.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

The Connected Traveler’s Guide to International Travel Insurance

You've got your passport, packed your bags, and booked your hotels — you're ready to hit the tarmac and head out on your next international adventure. But hold up: have you purchased your international travel insurance yet?

If traveling internationally, you should approach purchasing travel insurance like booking a hotel — necessary for your safety and peace of mind.

In this article, we're digging into everything related to international travel insurance so you can buy a policy you know will give you the protection you need while overseas. So, please buckle up your seatbelt, put your tray table and seat in the upright position, and let's get into it!

In this article:

- What is international travel insurance?

- How does travel insurance work?

- Why it's important to get insurance before you travel internationally

- What does international travel insurance cover?

- Things to consider before purchasing international travel insurance

- Stay connected wherever you travel

- International travel insurance FAQs

What Is International Travel Insurance?

International travel insurance is a plan you purchase that protects you from various financial risks that can occur while traveling. Depending on your coverage, this could include a lost suitcase, a medical emergency, or a last-minute trip cancellation.

Most international travel insurance plans also include some form of 24/7 assistance that allows you to access advice, arrange for medical treatment, and even get a translator to serve as an interpreter.

How Does Travel Insurance Work?

While every insurance provider and plan is different, most travel insurance plans will reimburse you for any covered expenses after you file a claim and the claim is approved. You do need to pay for expenses upfront, so keep that in mind when planning.

To file a claim, you must submit proof of the expenses incurred during your travel. Most insurance providers allow you to submit your claims online, but be sure to look into the requirements for your specific plan.

Let's look at a real-world example of how international travel insurance works. You've purchased a plan that includes medical and trip cancellation insurance for your three-week trip to Italy from the United States. While you're at your first stop in Rome, you fall off your bicycle while making your way to visit the Trevi Fountain. You take an ambulance to the ER, are given a variety of tests and X-rays, and are ultimately treated for a broken wrist.

Without travel insurance, you would be responsible for covering all the costs you incurred due to the accident. Thankfully, with medical travel insurance, the insurance company would cover the trip to the ER and the cost of treatment for your broken wrist.

Once you're feeling better, you get all your receipts and bills in order and file a claim to receive your reimbursement.

Why It's Important to Get Insurance Before You Travel Internationally

If you're traveling internationally, purchasing travel insurance for the duration of your trip is extremely important. While some experts will debate the need for travel insurance when traveling in your own country, traveling internationally is always seen as a reason to insure your trip.

There are three main reasons to protect yourself with insurance that can give you peace of mind while overseas.

- Financial protection : By its very nature, international travel is expensive. Travel insurance can protect almost everything you prebook — flights, accommodations, tours, and more. Make sure you read the fine print and look for a plan that offers "trip cancellation coverage." That way, if you need to cancel your trip last minute, you won't lose all your nonrefundable deposits.

- Travel issues : While traveling overseas is exciting, there are times when it can be more of a nightmare than a dream come true. Comprehensive travel insurance can help you get through those difficult times with your sanity and wallet intact. Whether your luggage has been lost or delayed or you need assistance with an emergency translation, travel insurance can help you work through some of the most frustrating travel issues.

- Medical coverage : Maybe the most essential piece of travel insurance when it comes to peace of mind, medical coverage makes sure you're protected overseas in case of an accident or illness. When you purchase international travel insurance, you know no matter what might happen, you have emergency healthcare coverage wherever you are.

What Does International Travel Insurance Cover?

Every international travel insurance plan will cover different things — it's important to dot your is and cross your ts to make sure you get a plan that gives you everything you need.

Wondering what could be covered? Here are six common things that international insurance policies can cover.

Medical Insurance

Medical emergencies are stressful when you're on home soil. When they happen internationally, the mental and financial stress of the unforeseen emergency can start to pile up. You face additional barriers like different cultures, languages, customs, and climates. Plus, it's hard to ignore the financial implications of needing medical care.

But, if you opt for travel insurance, the medical insurance coverage would cover the cost of hospitalization and other medical bills if you get sick or have an accident. Some plans even offer a daily hospital cash allowance to help you take care of extra expenses while hospitalized overseas.

Emergency Dental Insurance

Emergency dental insurance covers any emergency dental work that's needed while you're traveling (note the word 'emergency!'). If you broke a tooth while enjoying a Brazil nut in Rio de Janeiro and needed immediate medical attention, your travel insurance would cover the dental bills.

Trip Cancellation Coverage

No one wants to have to cancel their vacation — it's the last thing anyone plans on doing. But it happens. And when it does, you don't want to be left with thousands of dollars in nonrefundable bookings for a trip you can't even take.

Consider this: you've been planning a trip to your favorite overseas destination for months. You've booked your flights, accommodations set, and even a few tours for when you arrive at your destination. You're three days away from leaving on a trip when you have no choice but to cancel — maybe you become ill, there's a death in the family, or the destination is expecting a weather crisis like a hurricane or volcanic eruption.

With a good travel insurance plan, the insurance company will reimburse you for all your nonrefundable, prepaid travel expenses.

Trip Interruption Coverage

Another scenario that people don't think about as much as trip cancellation is trip interruption coverage. If an emergency means you need to cut your trip short, trip interruption coverage will reimburse you for hotel reservations and other prepaid expenses. It will also cover a return flight that may need to be booked at the last minute — and we all know how pricey those last-minute flights can be.

Baggage Insurance

You get a sinking feeling when you arrive at your destination, only to learn that your luggage hasn't arrived with you. If it's delayed, you can be without your baggage for 12 hours up to a week. And if it's lost, you won't ever get it back, not to mention have nothing to wear for your trip. In both these situations, you'll need to buy new clothes, toiletries, and other essentials while you wait to find out the fate of your luggage.

This can put a strain on your travel budget. But with travel insurance, when your baggage is lost or misplaced by the airline carrier, the insurance company covers the financial loss you experience.

Evacuation Insurance

If you're traveling to a remote location, medical evacuation insurance is something you should consider. This insurance is usually offered as an add-on to a standard policy as it is something only some people need. But if you're traveling to a remote or hard-to-get-to location, add this to your plan. Suppose you have a medical emergency while hiking the Tour du Mont Blanc in France . In that case, emergency evacuation insurance will cover the cost of a helicopter evacuation if you get sick or injure yourself.

Things to Consider Before Purchasing International Travel Insurance

Now that you know what kind of insurance you should be looking for, there are some things to think about when you start looking for the best travel insurance policy. Above all else, make sure you find a policy that fits your needs and take the time to read through the whole policy — have we mentioned the fine print yet?

Here are a few important things to think about while researching travel insurance options.

Are There Potential Exclusions?

Check what the policy you're booking covers and what it doesn't. Don't assume that all medical expenses will be covered simply because the plan includes emergency medical coverage. Get curious and dig into that fine print. For example, some plans will cover lost luggage but won't cover expensive items like jewelry and electronics . You'll need to pack accordingly or buy additional coverage to make sure you're fully protected.

Is There a Deductible?

Like many insurance policies, some international travel insurance policies come with a deductible. A deductible is the amount you pay before the insurance plan starts to pay. While you may be comfortable with a deductible, it's important to know if there is one and how much it is.

If the deductible is US$2,000, that might be more than you can pay, in which case you'd need to look for a travel insurance plan with a lower deductible.

Does the Plan Cover Your Destination(s)?

There are some destinations that a travel insurance plan may not cover. Insurance companies typically won't cover areas with political or civil unrest or acts of war and rioting. Some plans won't cover areas when travel advisories are in place, and other insurance companies may have some destinations they choose not to cover at all times.

Is the Claims Process Straightforward?

If you have to claim your travel insurance policy, you want to know that it'll be a simple, straightforward process. Take some time before you decide which insurance provider you use to look at reviews, check out their social media, and get an idea of what the real-life claims experience has been for customers.

Stay Connected Wherever You Travel

No one wants to find themselves in an emergency, especially when they're supposed to be on holiday overseas. But it happens. International travel insurance is a great way to protect yourself in an unexpected emergency.

To stay protected in any situation, you need to be connected while traveling. With an eSIM from Airalo , you're connected anywhere in the world the second you can turn off airplane mode. No more huge roaming bills, dropped connectivity, or searching for a SIM vendor internationally. Just easy connections and quick access, all from your phone, thanks to Airalo.

Stay connected wherever you travel with an eSIM from Airalo .

International Travel Insurance FAQs

Is travel insurance necessary for international travel.

Most countries don't require travel insurance, but getting travel insurance when you travel overseas is in your best interest. Traveling internationally won't be covered by any health insurance or coverage from your country of origin in case of a medical emergency. Additionally, international travel is often expensive, and travel insurance protects you from trip cancellation and interruption.

Some countries require some or all travelers to have travel insurance to enter the country:

- Saudi Arabia

- Schengen Countries

- Ukraine

When is the Best Time to Buy Travel Insurance?

The best time to buy travel insurance is right after you've booked your trip. There is something called a "pre-existing condition waiver" that you want to have in place. However, insurance companies require you to purchase insurance within a set timeframe to access it. For some companies, you have 14 days from when you start booking your trip. For others, it's as little as 24 hours. So booking your insurance the same day you book flights, for example, is the best time to buy travel insurance.

How Much Does Travel Insurance Cost?

Travel insurance costs vary depending on the policy, length of your trip, and inclusion you choose. But on average, you can expect to pay 4-12% of your total trip cost. For a trip that costs US$10,000, the average travel insurance cost is about US$456.

An SEO specialist who loves copy? It’s the perfect match. After 15+ years as a freelance writer, Marianne knows a thing or two about writing copy that actually gets seen. Marianne lived as a digital nomad across Europe, North America, and Australia for five of those years, and knows a thing or two about the importance of staying connected overseas. Next on her travel bucket list? A tour through South East Asia.

Ready to try eSIMs and change the way you stay connected?

Download the Airalo app to purchase, manage, and top up your eSIMs anytime, anywhere!

Use Your Free Credit.

You can earn US$3 Airmoney credits by sharing your referral code with friends.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Is travel insurance worth it?

The right policy can protect your belongings, your bank account and your peace of mind..

Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more.

On April 24, 2024, the White House established new rules for airlines , mandating automatic and timely refunds for passengers whose flights had been changed, delayed or canceled. That's a big relief to travelers, but there are still many unexpected situations where travel insurance can be a lifesaver before or during your trip.

"Travel insurance is often an overlooked investment until the unforeseen happens," says Beth Godlin, president of Aon Affinity Travel Practice . "It's designed to give travelers peace of mind and financial protection against travel risks."

A policy doesn't have to be expensive, according to Godlin, to add a layer of protection and security.

Getting travel insurance

How do i get travel insurance, what does travel insurance cover.

- New airline regulations in 2024

How much does travel insurance cost?

- Bottom line

There are many options in the travel insurance marketplace: Aggregator site Squaremouth lets you get price quotes from different carriers and, because it receives a commission from the insurance companies on its site, users aren't charged any additional fees.

Allianz has both single-trip and annual plans, with a Cancel For Any Reason (CFAR) policy that reimburses up to 80% of prepaid, non-refundable expenses. That's more than most similar plans on the market.

In addition to trip cancellation, Allianz's popular OneTrip Prime plan includes travel interruption, emergency medical care and emergency transportation. Children 17 and under are covered for free when traveling with a parent or grandparent.

AIG's Travel Guard® plans are great if you need to customize your coverage: The mid-range Travel Guard Preferred plan pays out 100% for trip cancellation and 150% for trip interruption, with up to $50,000 in coverage for medical expenses and up to $500,000 for emergency evacuation. There's even a payout of up to $1,000 if you miss your connection.

Travel Guard® Travel Insurance

The best way to estimate your costs is to request a quote

Policy highlights

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

24/7 assistance available

If you're booking a trip with an aggregator site like Expedia , review the details of any travel policy that's offered. Plans are usually based on the elements of the trip (hotel, flight, rental car, etc.) and can differ every time you book.

A travel insurance policy typically costs between 4 and 10% of the overall price of your trip. The cost can vary:

- Plans with higher limits and more optional coverage cost more.

- A plan with a CFAR benefit can cost up to 40% more.

- Older travelers typically pay more because there's more of a likelihood of a claim being filed.

Whichever plan you choose, read the fine print so you understand what you're paying for.

Travel insurance generally covers your expenses, your belongings and your well-being. When shopping for a policy, look for these benefits:

Trip cancellation

If your trip is canceled for a covered reason, a policy will often reimburse airline tickets, hotel rooms, rental cars, tours, cruises and other prepaid, non-refundable expenses. Covered situations can include illness or injury, the death of a family member or traveling companion, job loss, military deployment and even unplanned jury duty, according to Allianz's Daniel Durazo.

Cancellations can also be covered if a natural disaster, severe weather or airline strike prevents your carrier from getting you to your destination for at least 24 hours.

CFAR plans provide a lot more flexibility and typically reimburse 50% to 75% of your expenses. But they can bump up the cost by about 40%, said Durazo. Policyholders are also still usually required to cancel no later than 48 hours before their scheduled departure.

Trip delay

Should you experience a hiccup in your plans, your policy can provide some relief: Food, lodging and local transportation are usually covered if a delay is due to severe weather, airline maintenance or civil unrest.

"For a traveler to be eligible, they must be delayed for the minimum amount of time listed on their policy," Squaremouth spokesperson Megan Moncrief said. "Some policies are very lenient and provide benefits for any length delay, while others list a length requirement — usually somewhere between three to 12 hours."

Daily payout limits range from $150 to $250 per traveler, Moncrief said, while the total policy limit can be anywhere from $500 to $2,000. Save any receipts to submit with your reimbursement claim.

Don't miss: The best credit cards with trip delay insurance

Trip interruption

Should you need to cut your trip short due to illness or injury, or if there's a family emergency back home, your policy may reimburse non-refundable expenses you forfeited.

It may also cover the cost of a one-way economy airline ticket home.

Baggage loss

Airlines are required to compensate passengers luggage lost in transit, but a travel insurance policy may have a higher benefit limit, and cover you if your bags, passport or other possessions are lost, damaged or stolen once you've gotten to your destination., The Platinum plan from AXA Assistance USA has a $3,000 benefit limit for lost luggage, well beyond the $1,700 that airlines are required to cover on international flights. AXA has offices in more than 50 countries, with multilingual operators available 24 hours a day to help reschedule flights, book hotels and make other arrangements.

AXA Assistance USA Travel Insurance

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

Travel insurance doesn't cover every loss: Cash is not reimbursable and many policies won't reimburse for expensive jewelry or heirloom items. Read your policy carefully to see what is included.

Medical expenses and emergency evacuation

If you travel within the U.S., your health insurance should cover any illness or injury you sustain. If you're traveling abroad, though, your plan may provide little or no coverage. The right travel insurance should cover doctors' fees and hospital bills, Durazo said.

The provider can also help coordinate care and ensure you're at a medical facility that's up to U.S. standards.

An emergency medical evacuation can cost anywhere from $15,000 to over $200,000, Durazo added.

New airline regulations in April 2024

The Biden administration announced on April 24, 2024 , that it had finalized new rules requiring airlines to issue cash refunds to passengers if their flights were canceled or significantly changed, their checked luggage was significantly delayed or if purchased services, like Wi-Fi, were not provided.

Refunds must be automatic and made via the same form of payment as the original purchase. Travelers must be reimbursed within seven business days if the refund is going to a credit card. (Other forms of payment can take 20 calendar days to be reimbursed.) The new Department of Transportation regulations also require airlines and ticket agents to disclose upfront any fees for changing or canceling your reservation, seat selection, checked bags or carry-ons. The Biden administration has targeted junk fees across numerous industries, including credit card companies. It said the rule will help consumers avoid unneeded or surprise charges that can quickly add up and obscure the real cost of an seemingly inexpensive ticket.

While regulations on airlines are becoming increasingly stringent about reimbursing travelers for delayed or canceled flights, that doesn't do you any good if it wasn't the airline that put a kink in your plans. Travel insurance covers numerous scenarios, from medical emergencies to tropical storms. It could be particularly useful if:

- You've spent a lot on prepaid, non-refundable expenses

- You're traveling internationally where your health insurance won't apply

- You're traveling to a remote area

- Your flight involves multiple connections or destinations

"When deciding if travel insurance is right for you, ask yourself how much you could stand to lose if you had to cancel at the last minute," said Godlin.

If you're not as concerned about risk, your credit card may offer built-in travel protection if you book with that card: Chase Sapphire Preferred® , Southwest Rapid Rewards® Plus Card and the *American Express® Gold Card all come with trip cancellation and interruption coverage, among other benefits.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

Chase Sapphire Reserve®

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Regular APR

22.49% - 29.49% variable

Balance transfer fee

5%, minimum $5

Foreign transaction fee

Credit needed.

Terms apply.

Read our Chase Sapphire Reserve® review.

Southwest Rapid Rewards® Plus Credit Card

Earn 2X points on Southwest® purchases, 2X points on local transit and commuting, including rideshare; 2X points on internet, cable and phone services; select streaming. 1X points on all other purchases

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

21.49% - 28.49% variable

Foreign transaction fees

Excellent/Good

American Express® Gold Card

4X Membership Rewards® points at Restaurants (plus takeout and delivery in the U.S.) and at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X), 3X points on flights booked directly with airlines or on amextravel.com, 1X points on all other purchases

Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

Not applicable

See Pay Over Time APR

See rates and fees , terms apply.

Read our American Express® Gold Card review .

Research your card's travel benefits before making any purchases related to your trip.

Policies vary, but most comprehensive plans cover travel cancellation and interruption, baggage loss, medical care and emergency transportation.

While the price for coverage varies, most policies cost between 4% and 10% of the trip's prepaid, non-refundable expenses.

When should I get travel insurance?

It's best to take out a policy within days of making your reservations.

Does travel insurance cover COVID-19?

If you contract COVID-19 before or on your trip, it may be covered by your policy's trip cancellation/interruption benefit . You'll likely have to confirm your test results with a diagnosis from a healthcare provider.

Bottom line

Travel can be a wonderful experience, but it involves a lot of time, planning and money. Missing a single connection can have a cascade effect that impacts your flight, hotel room, dinner reservations and more. A good travel insurance policy can provide peace of mind so you can focus on your vacation.

Compare and find the best life insurance

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Meet our experts

At CNBC Select, we work with experts with specialized knowledge and authority. For this story, we interviewed Beth Godlin, president of Aon, which provides custom travel insurance for tour operators, cruise lines, travel websites and others. We also spoke with former Squaremouth Megan Moncrief and Allianz communications director Daniel Durazo.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every insurance article is based on rigorous reporting by our team of expert writers and editors . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

For rates and fees for the American Express® Gold Card , click here .

- This 5-month term CD offers 9.5% APY, but with a catch — here's how to get your hands on it Andreina Rodriguez

- How Quicken Simplifi can help you get a grip on your spending Elizabeth Gravier

- IRA vs CD — what's the difference and which one should you pick? Andreina Rodriguez

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Safer travel starts with travel protection

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

Type the country where you will be spending the most amount of time.

Age of Traveler

Ages: {{quote.travelers_ages}}

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

International Travel Insurance

International travel is exciting whether it's a quick visit to Paris, an African safari or a week in the Caribbean. Wherever your adventure takes you, international travel insurance can help you travel with peace of mind. If you become sick or injured while traveling; or if circumstances cause you to cancel or interrupt your trip, international travel insurance is there to help you. And, with our OneTrip Prime plan , kids 17 and under are covered for free when traveling with a parent or grandparent (not available on policies issued to Pennyslvania residents). If something goes wrong when you're far from home, we're here to help. Just call our 24-hour assistance hotline.

View international travel insurance products .

International Travel Articles

The rewards of international travel are incredible — but before your adventure begins, you have to get through customs. We'll help you plan your next overseas trip, figure out what to pack, and protect yourself while you're traveling.

Featured Articles

Share this page.

- {{errorMsgSendSocialEmail}}

Travel Insurance with Benefits for International Travel

Travel overseas is one of the most wonderful experiences, but if something goes... More »

What's the Best International Travel Insurance?

Heading overseas soon? Luck you! Just make sure that you have travel insurance... More »

Maximize Your Travel Budget with Currency Exchange Habits

With all the trip planning that goes into making getaways equal parts fun... More »

{{articlePreview.snippet}} Read More

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Search Search Please fill out this field.

What Is Travel Insurance?

Understanding travel insurance, how travel insurance works, comprehensive travel insurance.

- Trip Cancellation or Interruption

Damage and Baggage Losses Coverage

Rental insurance, travel health insurance.

- AD&D Coverage

Other Travel Insurance Coverage

How to get travel insurance, the bottom line.

- Personal Finance

What Is Travel Insurance, and What Does It Cover?

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Jackyenjoyphotography / Getty Images

Travel insurance is a type of insurance covering financial losses associated with traveling, and it can be useful protection for domestic or international travel. Whether you missed your flight to Florida, lost your bags in Berlin, or broke your ankle in Ankara, the best travel insurance companies can help remedy all kinds of travel mishap costs.

Key Takeaways

- Travel insurance can be purchased online, from your tour operator, or from other sources.

- The main categories of travel insurance include trip cancellation or interruption coverage, baggage and personal effects coverage, rental property and rental car coverage, medical coverage, and accidental death coverage.

- Coverage often includes 24/7 emergency services, such as replacing lost passports, cash wire assistance, and rebooking canceled flights.

- It's important to understand what's covered and what's not, and any limitations on coverage amounts and coverage requirements.

Travel insurance helps cover financial losses associated with surprise circumstances that could ruin a trip, including illness, injury, accidents, flight or other transportation delays, and other issues. This insurance costs 4% to 10% of a trip's price. So, for a $10,000 trip, trip insurance could cost between $400 and $1,000.

Premiums—or the price you pay for coverage—are based on the coverage type, your age, destination, trip cost, and more. Specialized policy riders focus on the needs of business travelers, athletes, and expatriates .

You may already have travel insurance coverage from your homeowners or renters insurance or your credit cards. Call your insurance agent to find out about your current travel coverage, and your credit card company to find out about any benefits you get when you purchase air or train tickets, rent a car, or book a hotel using the card. Many travel rewards cards come with built-in travel insurance and other travel benefits.

Travel insurance may be sold online by travel agents, travel suppliers (airlines, cruise lines), private insurance companies, or insurance brokers when booking your flight, accommodations, or car. Travel insurance companies include AIG Travel, Berkshire Hathaway Travel Protection, Generali Global Assistance, GeoBlue, Nationwide, and more.

Typically, you'll purchase coverage shortly after initial bookings for lodging, flights, or other transportation, activities, and rental cars. Some policies may require you to do so to retain full coverage. Here are some terms to know for travel insurance.

Primary and Secondary Coverage

If you buy travel insurance, you may have concurrent insurance coverage , meaning you're covered under more than one policy. When the travel coverage is primary, the travel insurance reimburses you first without needing to make a claim through another company—and sparing you potentially increased policy rates.

If the travel insurance coverage is secondary, you'll first need to attempt to file a claim with other coverage, such as an airline (lost baggage) or your own auto insurance (damaged car).

Coverage Requirements

There are usually stipulations spelled out on how you qualify for coverage. Your claim must fall under the types of coverage offered. For example, lost baggage insurance might include coverage for personal items, prescriptions, credit cards, and your passport or visa. You may also need to take extra steps to qualify for coverage, such as reporting the loss or theft to the police.

Policy Coverage Limits

This is the maximum amount you can receive for the claim. For example, you might only receive $500 per bag. You may not even receive more for expensive items such as jewelry or electronic devices. You might need to provide receipts for items over a certain amount. Without receipts, the insurer may only pay for repairs.

Some coverage might require you to pay a deductible, or flat amount, before covering the remainder of your claim up to the limit.

These are the conditions under which your coverage will not cover the loss. Each policy differs. For example, your baggage damage coverage may not cover losses caused by animals. It may exclude coverage of bicycles, hearing aids or other medical devices, keys, and tickets, or seizure by a government or customs official.

Pre-existing conditions may not be covered by travel medical insurance, or may only be covered if you buy a travel insurance plan within one to two weeks of booking your trip.

Comprehensive travel insurance includes many types of coverage listed below, bundled into one plan. Most commonly, comprehensive travel insurance bundles a 24-hour assistance line to help find doctors or get assistance in an emergency, reimburse you for trip cancellation , interruption and delay, baggage loss or delay, and medical expense and medical evacuation coverage.

Alternatively, you can purchase each coverage type separately. This may be wise if you already have coverage through other insurance or can cover your losses in many cases.

Trip Cancellation or Interruption Coverage

This insurance reimburses a traveler for some or all prepaid, nonrefundable travel expenses, and comes in the following forms:

- Trip cancellation : Reimburses you for paid travel expenses if you can't travel for a preapproved reason.

- Travel delay : Reimburses you for expenses if you can't travel because of a delay.

- Trip interruption : Reimburses you for travel costs if your trip is cut short.

- Cancel for any reason (CFAR) : Reimburses you for a portion of costs if you cancel the trip for any reason; typically more expensive than the other types listed above.

With most of the above, acceptable cancellation and interruption causes and reimbursement amounts vary by provider. Acceptable reasons for a claim might include the following:

- Your illness

- Illness or death in your immediate family

- Sudden business conflicts

- Weather-related issues

- Legal obligations such as jury duty

You may need to pay more or meet more requirements to file a claim for a cancellation due to financial default, terrorism in your destination city, or work reasons.

When traveling, register your travel plans with the State Department through its free travel registration website , the Smart Traveler Enrollment Program (STEP). The nearest embassy or consulate can contact you if there is a family, state, or national emergency.

Baggage and personal belongings being lost, stolen, or damaged is a frequent travel problem—and can quickly ruin a trip as you must shop for replacements. Baggage and personal effects coverage protects lost, stolen, or damaged belongings during travel to, in, and from a destination.

However, many travel insurance policies pay for belongings only after you exhaust all other available claims. Baggage coverage may have many restrictions and exclusions, such as only covering up to $500 per item and $250 for each additional item. You may be able to increase or decrease amounts, shop around for coverage, or increase limits by paying more.

For example, the insurance may not pay for lost and damaged luggage due to airline fault. Most carriers, such as airlines, reimburse travelers if baggage is lost or destroyed due to the airline's error. However, there may be limitations on reimbursement amounts, so baggage and personal effects coverage provide an additional layer of protection.

Vacation rental insurance covers costs from accidental damage to a vacation rental property. Some plans also offer trip cancellation and interruption to help reimburse costs when you can't use your vacation rental. Some of these reasons could include the following:

- Lost or stolen keys

- Unsanitary or unsafe vacation property

- Vacation rental wasn't as advertised

- The company oversold your vacation rental

Rental car insurance covers a rental car's damage or loss while on a trip, taking the place of the rental agency's collision damage waiver (CDW) or your regular car insurance policy. Policies vary and may cover collisions, theft, vandalism, and other incidents. Rental car insurance may be a secondary policy to your own car insurance. However, it doesn't cover your liability or legal responsibility for damage or injury you cause to others.

Medical coverage can help with unexpected international medical and dental expenses, and help with locating doctors and healthcare facilities abroad. As with other policies, coverage will vary by price and provider.

- Foreign travel medical coverage : These policies range from five days to one year or longer, and cover costs arising from illness and injuries while traveling.

- Medical evacuation: May cover airlift travel to a medical facility and medical evacuation to receive care.

Consult with your current medical insurers before purchasing a policy to determine whether a policy extends its coverage outside the country. Most health insurance companies pay “customary and reasonable” hospital costs if you become sick or injured while traveling, but few will pay for a medical evacuation.

The U.S. government doesn't insure citizens or pay for medical expenses abroad. Before purchasing a policy, read the provisions to see what exclusions, such as preexisting medical conditions, apply. Don't assume that the new coverage mirrors that of your existing plan. Routine medical care is typically excluded unless you buy a long-term medical plan intended for expatriates, missionaries, maritime crew members, or others abroad for extended periods.

Medicare or Medicaid generally don't cover medical costs overseas unless you have specific Medicare Advantage or Medigap plans covering emergency overseas care.

Accidental Death and Dismembership (AD&D) Coverage

If an accident results in death or serious injury, an AD&D policy pays a lump sum to surviving beneficiaries or you for an injury. The insurance usually offers three parts, providing coverage for accidents and fatalities:

- Flight accident insurance: Occurring during flights on a licensed commercial airliner.

- Common carrier: Resulting from public transportation such as train, ferry, or bus travel.

- General travel: Occurring at any point during a trip.

Exclusions that may apply include death caused by drug overdose or sickness. In addition, only some injuries may be covered, specifically hand, foot, limb, or eyesight. There are stated amount limits per injury.

Accidental death coverage may not be necessary if you already have a life insurance policy. However, benefits paid by your travel insurance coverage may be in addition to those paid by your life insurance policy, leaving more money to your beneficiaries.

Depending on your plan or package selected, you may be able to add the following travel insurance types:

- Identity theft resolution services

- School activity coverage

- Destination wedding coverage

- Adventure sports coverage

- Pet health as a reason for cancellation or delay

- Hunting or fishing activities as a reason for cancellation or delay

- Missed flight connections

Travel insurance varies in cost, exclusions, and coverage. Coverage is available for single, multiple, and yearly trips. To get travel insurance, you fill out an insurance company's application about your trip, including the following:

- Travelers going

- Destination

- Travel dates

- Date of first payment toward your trip

The insurance company reviews the information using underwriting guidelines to guide issuing a policy and the rate. If it accepts your application, the company will issue a policy covering your trip. If the company rejects your application, you can apply with another insurer.

When you receive your policy, you'll typically get a 10- to 15-day review period to review the contract's fine details. If you don't like the policy, you can return it for a refund. Read through the document and ensure the plan you purchased doesn't apply too many loopholes, and that it covers:

- Emergency medical care and transport back to the U.S.

- High enough limits to cover your costs or damages

- Regions you're traveling to

- Your trip duration or number of trips

- All activities you plan to enjoy

- Preexisting conditions and people of your age

Also, read through for any exclusions. For example, types of property covered, and whether property lost or damaged by the airline is covered, and how.

Do I Need Travel Insurance?

You might consider travel insurance if you can't afford to cancel and then rebook an expensive or long trip. You might also consider travel health insurance if your health insurance doesn't cover international costs. An alternative is to book an easily cancellable vacation—look for a pay-later hotel room and car rental options, flexible cancellation terms, and the ability to rebook without a fee.

What Is Not Covered by Travel Insurance?

Review the travel insurance policy to discover exclusions. According to NAIC, common travel policy exclusions are:

- A traveler's pre-existing health conditions

- Civil and political unrest at the traveler's destination

- Pregnancy and childbirth

- Coverage for those engaging in adventure or dangerous activities.

Pandemics may also be excluded from coverage.

How Can I Get Cheap Travel Insurance?

Your homeowners or renters insurance may provide some protection for personal belongings, and airlines and cruise lines are responsible for loss and damage to your baggage during transport. Also, credit cards may provide automatic protection for things like delays and luggage or rental car accidents if used for deposits or other trip-related expenses.

The main types of travel insurance include trip cancellation or interruption coverage, baggage and personal effects coverage, medical expense coverage, and accidental death or flight accident coverage. Before buying a policy, check to see if you already have coverage through your own health or car insurance or a credit card.

Mass.gov. " Travel Insurance. "

Minnesota Department of Commerce. " Travel Insurance ."

U.S. Travel Insurance Association. " Frequently Asked Questions ."

Texas Department of Insurance. " Should You Get Travel Insurance? "

National Association of Insurance Commissioners. “ Taking a Trip? Information about Travel Insurance You Should Know Before You Hit the Road .”

U.S. Department of State. “ Your Health Abroad. ”

Medicare.gov. " Medicare Coverage Outside the United States ." Page 4.

Medicare.gov. " Medigap & Travel. "

NAIC. " Travel Insurance ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1298119759-22e222fecf2b40e796b160171147c13f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best International Travel Insurance Companies for 2024

Allianz Travel Insurance »

AIG Travel Guard »

Generali Global Assistance »

World Nomads Travel Insurance »

GeoBlue »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best International Travel Insurance Companies.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

With demand for international travel still on the rise, buying travel insurance makes more sense now than ever before. Having an international travel policy in place will ensure you won't lose the money you spent if your trip is canceled or interrupted for reasons beyond your control – or if your bags are delayed or lost entirely by your airline or cruise line .

Other protective benefits come from the best international travel insurance policies as well, including travel medical coverage for unexpected medical expenses and emergency medical evacuation. You may even find that the destination you plan to visit requires travel insurance, although most countries have dropped travel insurance requirements they initially put in place due to the pandemic.

U.S. News editors compared more than 20 of the top providers to find the best travel insurance companies for trips around the world. If you're hoping to secure the best international travel policy for your needs this year, the policies outlined below provide a solid foundation for you to start your research.

Frequently Asked Questions

While many countries began mandating travel insurance for visitors during the COVID-19 pandemic, most have loosened entry requirements and dropped this condition by now. Countries that still require international visitors to have travel insurance include the following:

- Antarctica: Travel medical insurance is generally required by cruise lines and tour operators for trips to Antarctica , with a standard minimum of $100,000 in emergency medical and evacuation coverage.

- Ecuador: You do not need travel insurance to visit the country of Ecuador, but you do need insurance with medical coverage to visit the Galápagos Islands .

- Qatar: Travelers visiting Qatar for more than 30 days are required to have a travel insurance policy that is approved by the country's Ministry of Public Health.

- Saudi Arabia: Visitors to Saudi Arabia from eligible countries must pay for an eVisa, and the cost includes compulsory travel insurance coverage.

International travel insurance works the same as travel insurance for domestic trips. These plans include various coverage options and coverage limits, and a deductible may or may not apply. Travelers can choose to purchase international travel insurance for a single trip or multiple trips; long-term plans for expats and missionaries are available from some providers.

While travel insurance policies can include a broad range of coverages, the main protections you'll want for international trips include the following:

- Trip cancellation and interruption coverage: This type of protection can reimburse you for prepaid travel expenses when a trip is canceled or interrupted for a covered reason beyond your control.

- Baggage delay insurance: This coverage can pay for incidental expenses that occur when your bags are delayed for a specific period of time (usually six hours or longer).

- Lost luggage coverage: This protection can replace your luggage and your belongings or reimburse you for costs if your bags are lost by a common carrier.

- Rental car insurance: This type of insurance may provide primary coverage when you rent an eligible rental car.

- Emergency medical and dental coverage: This type of insurance will pay for emergency medical treatment or dental expenses that may arise during your trip.

- Emergency evacuation coverage: This protection can pay for emergency transportation costs when you're sick or injured during your trip.

Also note that many travelers booking an international trip choose to purchase travel insurance that offers cancel for any reason protection, so they can cancel a trip for any reason at all, even if they just decide they don't want to go. That said, adding CFAR coverage to your policy will make your travel insurance plan more expensive. Most plans also have limits on how much of your prepaid travel expenses can be refunded, which are usually capped between 60% to 80% of your trip costs.

While coverages offered through international travel insurance plans tend to be broad, keep in mind that this type of insurance won't cover every situation that could arise. Some common issues that are not covered by international travel insurance plans include:

- Acts of war

- Claims due to air or water pollution

- Claims due to natural disasters

- Epidemics not specifically included in coverage

- Extreme, high-risk sports

- Government regulations or proclamations

- Nuclear radiation and contamination

- Terrorist events

- Travel bulletins or alerts

Many travel credit cards offer international travel insurance benefits, but you should know that these coverages have some limitations. For example, travel insurance plans from credit cards never provide meaningful amounts of coverage for medical emergencies or dental emergencies. You also have to pay for each trip with your travel credit card for coverage to apply.

The best international health insurance plan depends on factors like the length of your trip, where you're traveling and how much coverage you need. While you can take the time to get quotes from several different companies, websites like TravelInsurance.com and Squaremouth make it easy to compare coverage details, limits and pricing among several providers all in one place.

The cost of international travel insurance varies and can depend on your age, the length of your trip, your total trip cost and other factors. Consider getting multiple travel insurance quotes through TravelInsurance.com to get an idea of the cost of coverage for your upcoming travel plans.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for the Cost

- Generali Global Assistance: Best for Medical

- World Nomads Travel Insurance: Best for Active Travelers

- GeoBlue: Best for Expats

Buy coverage for single trips or multiple trips at once

Annual plans available

Lower coverage amounts for emergency medical expenses than some other plans

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage up to $50,000

- Emergency medical transportation coverage up to $500,000

- Trip change protector coverage worth up to $500

- Baggage loss and damage coverage up to $1,000

- Baggage delay coverage up to $300 (12-hour delay required)

- Travel delay coverage up to $800 ($200 per day)

Add-on coverage available for lodging expenses, preexisting medical conditions and rental cars

Optional CFAR coverage available with some plans

Coverage limits for its lowest-tier Essential plan may be insufficient for some trips

Add-on coverage for preexisting conditions must be purchased within 15 days of the initial trip payment

- Trip cancellation coverage worth up to 100% of the trip cost

- Trip interruption coverage worth up to 100% of the trip cost

- Baggage coverage worth up to $750

- Up to $200 in coverage for baggage delays

- Travel medical expense coverage worth up to $15,000

- Up to $150,000 in coverage for emergency medical evacuation

Choose medical coverage limits based on your needs

Generous limits for emergency medical expenses and medical evacuation across all plans

CFAR coverage must be purchased within 24 hours of initial trip deposit and is only available with Premium plan

Rental car coverage only included in top-tier Premium plan

- Trip cancellation coverage up to 100% of the trip cost

- Trip interruption coverage up to 175% of the trip cost

- Travel delay coverage up to $1,000 per traveler ($300 daily limit)

- Up to $2,000 per person in baggage protection

- Up to $2,000 in coverage for sporting equipment

- Up to $500 per person for baggage delays

- Up to $500 per person for sporting equipment delays

- Up to $1,000 per person in protection for missed connections

- Up to $250,000 per person in coverage for emergency medical and dental procedures

- Up to $1 million in coverage for emergency assistance and transportation

- Up to $25,000 per person in rental car coverage

- Up to $100,000 per plan in accidental death and dismemberment coverage

24-hour travel assistance services included

More than 200 sports and activities covered in every plan

Coverage limits within standard plans may be insufficient

No coverage for most preexisting conditions

- Up to $10,000 in coverage for trip cancellation

- Up to $100,000 in coverage for emergency medical expenses

- Up to $500,000 in protection for emergency medical evacuation

- Up to $3,000 in protection for damage or theft to your bags or gear

Purchase international travel medical insurance for individual trips, multiple trips or long-term travel

Coverage is mostly for emergency medical expenses abroad

Some plans require a primary U.S. health insurance plan

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has covered travel and travel insurance for more than a decade. Johnson has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and she has experience navigating the claims and reimbursement process. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson also works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – in their family media business.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings.

Travel Insurance for Europe: 4 Best Options for 2024

Learn about a range of coverage options for traveling abroad.

The Best Travel Insurance for Mexico in 2024

Find coverage options for medical emergencies, travel delays, lost baggage and more.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

How does Travel Insurance Work?

How does travel insurance work.

Picture this: You and your siblings organize a cruise for the whole family to celebrate your parents’ 50 th anniversary. Everyone else has uneventful travel to the destination, but a delay in your outbound flight results in a missed connection. You finally arrive a day late and hours after the ship has departed without you.

Now what? In the worst-case scenario, you’re still stuck at the airport hours later. You feel powerless to do anything more than stare glumly at the vacation photos on your family’s social media feeds.

But if your trip is insured, your AXA-Assist representative already knows about that missed connection and started working on a solution even before you landed. Instead of having to figure it all out on your own, you have a team with the experience and contacts necessary to get you to the next port of call. Our priority is to get you aboard the ship as soon as possible so you can make everyone a little weepy with that toast you’ve been perfecting for weeks.

That’s how travel insurance works. It lets you offload the troubleshooting to the experts and frees you to just enjoy your trip.

What does travel insurance cover?

What exclusions should i be aware of, can i add options to a plan after i buy it but before my trip begins, can i extend my plan after my trip begins, do policies cover travelers individually, or are plans available for couples or families, how much time do i have to file a claim, what documentation do i need to present to support a claim, for trip interruption or trip delay, for medical or dental claims.

- For baggage delay, loss or theft claims

At the baseline, travel insurance covers:

Trip cancellation

Trip interruption

Lost, Misdirected or Damaged Luggage

Medical Emergencies (including Emergency Medical Evacuation).

You can also choose plans that cover medical or dental treatment, car rentals, or optional add-ons such as lost ski days or lost golf rounds.

But those “baseline” bullet points cover more than you might expect at first glance.

For example, if your medical emergency requires hospitalization, our network of doctors and nurses are on call to review your medical records, monitor the care you’re receiving and ensure you’re getting appropriate treatment.

If your condition doesn’t require hospitalization but you need to see a doctor, we can secure an appointment for you at a reputable facility. And we’ll follow up with you by phone after you’re treated to review the care you received and provide further assistance if needed.

Or let’s say you and a group of school friends book a one-week tour together. Prices are based on double occupancy, so everyone pairs up with a roommate, but your roommate gets sick at the last minute and has to cancel. Your travel insurance protects you from getting stuck paying the single supplement.

We’re a global brand, but we’re also people with the same interests and concerns as you. So we get it: even something that others might regard as a little thing can throw your trip off. That’s why we immerse ourselves in details that you might not even think about, like what happens to your pet if your flight home is delayed overnight. The answer? Your Travel Insurance covers reimbursement for that unexpected extra day of boarding your best friend.

We define a pre-existing medical condition as an illness, disease or other condition that you had during the 60-day period immediately prior to the effective date of your travel insurance coverage. That restriction extends to your traveling companions, business partners or family members who are booked to travel with you.

The condition is excluded from coverage unless it is treated or controlled solely by taking prescription drugs or medicine and remains controlled during the 60-day look-back period.

There are options for waiving the pre-existing conditions exclusion if you purchase an AXA-Assist Gold or Platinum plan within 14 days of paying your initial trip deposit.

For additional information, be sure to read your policy’s Terms and Conditions or call one of our representatives to discuss your specific concerns.

We allow you to make changes to your travel protection plan as long as your trip has not already started and you have not filed a claim. Refer to our contact page to get in touch with an AXA-Assist representative about any changes you wish to make to your plan.

Your AXA-Assist policy can cover up to 10 people per plan. They can be, but don’t have to be, family members. The only restriction is that each member of the group covered by your travel insurance plan must live in the same state. (That’s because travel insurance coverage is regulated by state.) If everyone in your travel group lives in the same state, but there are more than 10 people total, you’d have to buy multiple plans to extend coverage to everyone.

The time limit for filing a claim can vary depending on the specific policy you have purchased. It's crucial to carefully review the terms and conditions of your insurance policy document provided by AXA Partners US.

For any type of claim, you must provide your completed claim form, policy verification and booking confirmation. Additional documentation will depend on the reason for your claim and could include, but not be limited to:

claims, a cancellation statement from the travel supplier, documentation of the circumstances (such as injury or illness) that caused the interruption and documentation of expenses you need to have reimbursed.

receipts for costs you paid, a report detailing your diagnosis and the treatment you received and an explanation of the benefits statement from your primary insurance provider, if applicable. Note that if you have a Medicare supplement policy, you must submit charges to your Medicare supplement carrier before you submit your claim to AXA-Assist.

For baggage delay, loss or theft claims

your Property Irregularity Report from your airline, cruise line, or tour company and a copy of the carrier’s written response to the report you filed. In the event of theft, we will need to see a police report. You will also have to provide receipts for essential items you purchased or had repaired and for which you need reimbursement.

Refer to the File a Claim page on our website for additional details and phone contact information for team members who can answer any questions you have.

We wish you safe, happy travels, and we’re here 24/7 to help you resolve your concerns and get back to enjoying your best vacation experiences!

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too