An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- A–Z Index

- Operating Status

Pay Administration

Questions and answers, what is compensatory time off for travel.

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

An official website of the United States government

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Office of Human Resources Management

Department of Commerce

- Our mission

- Organizational chart

- Servicing HR offices

- Policy program directory

- Staff directory

- Internships

- Federal programs

- DC Summer Youth Employment Program

- Senior professionals

- Hiring initiatives

- Frequently asked questions

- Health insurance

- Dental and vision insurance

- Flexible spending accounts

- Life insurance

- Long term care insurance

- Eligible Employees

- Legal Definitions

- Establishing Bi-Weekly Deduction

- Affordable Care Act information

- Federal employee retirement system

- Civil service retirement system

- Thrift Savings Plan

- Transit benefits

- Student loan repayment

- Domestic Partners - Eligible Benefits Programs

- Domestic Partners - Programs that Exclude Eligibility

- Employment & income verifications

- Employee personal page

- Pay periods and dates

- Overtime pay

- Carrying Over

- Charging Sick Leave to Annual Leave

- Earning Leave Chart

- Exceptions to Full Bi-Weekly Pay Period Requirement

- Loss of Leave Accruals - Nonpay Status

- Repaying Advanced Leave

- Restoring Lost Leave

- Use or Lose

- Using Advanced Leave

- Alternating Between Full and Part Time

- Liquidating Advances

- Part-Time Leave Accrual Chart

- Requesting and Using Donated Leave

- Serious Health Condition

- Unusual Work Schedules

- Alternative Position

- Equivalent Position

- FMLA - Serious Health Condition

- Impact on Probationary Status

- Irregular Schedules

- Delayed Arrival/Unscheduled Leave

- Early Dismissal

- Emergency Employees

- Heating and Cooling Failures

- Organ Donations

- Transition Leave

- Travel and Exams

- Unnecessary Excused Absences

- Premium Pay

- Working Outside of U.S.

- Calculating Leave to Restore

- Care for a Family Member

- Documents You Must Keep

- Leave Accrual While on Donated Leave

- OPM Form 630

- Other Agencies

- Rules on Donating Leave

- Types of Medical Emergencies

- Workers' Comp and Donated Leave

- Restoring Leave to Donors

- Points of Contact

- Alternative work schedules

- Dependent and elder care

- Employee Assistance Program

- Grievances and complaints

- Health and safety

- Commerce Training Options

- Commerce Learning Center

- Chief Learning Officers Council

- Individual Development Plans

- Administrative Professional Certificate Program

- Executive Leadership Development Program

- SES Candidate Development Program

- Performance planning process

- Your performance plan

- Evaluating your performance

- Writing up your accomplishments

- Cash awards

- Non-monetary awards

- Annual Honor Awards

- Performance Management System Fact sheet

- Policies for SES employees

- Pay and leave

- Executive Performance Management System

- Data on pay and performance

- Agendas and minutes

- Drug-free workplace

- Reasonable accommodation

- Pay administration

- Federal Register Notices

- Position descriptions

- Temporary promotions

- Health Savings Account

- Death Gratuity Policy

- General pay

- Premium pay

- Leave policies

- Honor Awards Program

- Contractors

- Guidelines for SES Special Act Award Nominations

- Performance Management System Definitions

- 5-Level Performance Management System

- Briefing Video

- Performance plan library

- EPMS Implementation Resources

- SES Pay and Performance Profile Data

- RPL Registration Form

- CLC Registration Instructions

- Career Transition Assistance Program

- Voluntary Early Retirement Authority

- Voluntary Separation Incentive Payment

- Adverse Actions

- Grievance Processes

- Equal Employment Opportunity

- Mediation Services/ADR Programs

- Professional Liability Insurance

- Chief Human Capital Officer

- HCMA Council

- Diversity and Inclusion

- Commerce Annual Employee Survey

- Commerce New Employee Survey

- Office of Human Resources Accountability

- Brief History

- Electronic Official Personnel Folder (eOPF) Information

- Employee surveys

- Recognition

- Labor-Management Relations

- RIF, Transfer of Function, and Furlough

- Commerce.gov

- Students and recent grads

- People with disabilities

- Compensation

- Work-life balance

- Training and Development

- Performance and awards

- Senior Executive Service

- Labor Management Forum

- Position management

- Recruitment

- Benefits policies

- Compensation policies

- Performance management

- SES policies

- Workforce reduction

- Employee relations

- Human Capital Management

- Labor-management relations

- Practitioners

Was this page helpful?

Special compensatory time off for travel.

This program allows employees to accrue compensatory time off for time spent by an employee in a travel status away from the employee’s official duty station when such time is not otherwise compensable. The travel must be officially authorized for work purposes and approved by an authorized official.

An employee as defined in Title 5 U.S.C. 5541(2), who is employed in an “Executive Agency,” as defined in 5 U.S.C. 105, ) is entitled to earn and use compensatory time off for travel regardless of whether the employee is exempt or non-exempt from the Fair Labor Standards Act (FLSA). Coverage includes employees in Senior Level (SL) and Scientific of Professional (ST) positions, Federal Wage System (or Wage Grade, WG), and commissioned (tenured) Foreign Service Officers (in pay plan FO) and Commissioned Foreign Service Officers (in pay plan FO).

Senior Executive Service members and intermittent employees (who do not have a scheduled tour of duty for leave purposes) are excluded from coverage.

Effective Dates of Coverage

Final regulations implementing compensatory time off for travel for most employees was effective May 17, 2007. Coverage for WG employees was effective April 27, 2008. Coverage for Foreign Service Officers (in pay plan FO) and Commissioned Foreign Service Officers (in pay plan FO) was effective June 8, 2006.

Creditable Travel Time

Time in a travel status includes the time the employee spends traveling between the official duty station and a temporary duty station (or the lodging in the temporary duty station) or between two temporary duty stations (or the lodging in the temporary duty station) and the “usual waiting time” that precedes or interrupts such travel.

“Usual waiting time” is the time required to arrive at the airport (or other transportation hub) for security checks-ins, etc., prior to a designated departure time.

Time spent at an intervening airport (or transportation hub) waiting for a connecting flight also is creditable time.

In the Department, “usual waiting time” is 2 hours for domestic travel and up to 4 hours for international travel.

Non-Creditable Travel Time

The following do not qualify as creditable time:

- Unusually long or extended waiting periods that occur prior to an employee’s initial departure time or between actual periods of travel if the employee is free to rest, sleep, or otherwise use the time for his/her own purposes;

- Long waiting periods that occur during an employee's regular scheduled working hours; these periods are compensable as part of the employee's regularly scheduled administrative workweek;

- Time spent traveling outside of an employee’s regular working hours to or from a transportation terminal that are within the limits of the employee’s official duty station;

- Time spent traveling in connection with the performance of union representational activities;

- Time spent traveling on a holiday or an “in-lieu-of” holiday; the employee is entitled to his or her rate of basic pay for the holiday hours; and

- Time spent at a temporary duty station between arrival and departure times; and

- Meal times.

Once an employee arrives at the temporary duty station (i.e., TDY work site, training site, or hotel at the temporary duty station), the employee is no longer considered to be in a travel status. Any time spent at a temporary duty station between arrival and departure is not creditable for earning compensatory time off for travel.

Offsetting Normal Commuting Time

When an employee travels directly between the home and a temporary duty station that is outside the limits of the employee's official duty station, the employee's normal “home-to-work/work-to-home” commuting time must be deducted from the creditable travel time.

Normal commuting time must also be deducted from the creditable travel time if the employee is required to travel outside of regular working hours between the home and a transportation hub outside the limits of the employee's official duty station.

Travel between Multiple Time Zones

When an employee’s travel involves two or more time zones, the time zone from the point of first departure must be used to determine travel status for accruing compensatory time off. For example, if an employee travels from his official duty station in Washington, DC, to a temporary duty station in Boulder, CO, the Washington, DC, time zone must be used to determine hours in a travel status. However, on the return trip to Washington, DC, the time zone from Boulder, CO, must be used to determine hours in a travel status

Timeframes for Use

An employee must use accrued compensatory time off by the end of the 26th pay period after the pay period during which it was earned and reported on the webTA.

All compensatory time off for travel must be used in the chronological order in which it was earned; that is, time earned first is used first.

Forfeiture of Unused Hours

Accumulated compensatory time that is unused by the end of the 26th pay period after the pay period in which it was earned is forfeited. Unused balances are also forfeited when an employee voluntarily transfers to another agency or separates from Federal service. Forfeited hours may not be paid or restored.

When an employee fails to use accumulated compensatory time balances within the required timeframe due to an exigency of the public service beyond the employee’s control, the time limit for using the hours may be extended for up to an additional 26 pay periods. Additional extensions are not authorized and forfeited hours may not be restored.

Exceptions to Forfeiture of Unused Hours

Unused compensatory time off for travel must be held in abeyance for an employee who separates, or is placed in a leave without pay (LWOP) status, and later returns:

- To perform service in the uniformed services (see 38 U.S.C. § 4303 and 5 CFR § 353.102) with restoration rights; and

- Due to an on-the-job injury with entitlement to injury compensation under 5 U.S.C. Chapter 81.

In these cases, the employee must use all of the compensatory time off for travel held in abeyance by the end of the 26th pay period following the pay period in which he/she returns to duty, or the compensatory time off will be forfeited.

Biweekly Salary Limitation and Aggregate Limitation on Pay

Compensatory time off for travel is not considered in applying the bi-weekly pay cap under 5 U.S.C. 5547 or the aggregate limitation on pay under 5 U.S.C.507.

Alternate Mode of Transportation

When an employee is allowed to use an alternate mode of transportation, or travels at a time/route other than what is initially approved by the authorizing official, creditable time for travel status must be estimated. The estimate is based on the amount of time the employee would have had if the mode of transportation or the time/route initially approved by the authorizing official was used. In determining the estimated amount of creditable time for travel that an employee would have had, the employee will be credited with the lesser of the:

- Estimated time in a travel status the employee would have had if the employee had traveled at the initially approved time, or

- Employee's actual time in a travel status at a time other than that initially approved.

Applying for Compensatory Time off for Travel

Employee must officially request the earning of compensatory time prior to the actual travel or within 10 calendar days of termination of the travel. The request may be submitted via the webTA Leave and Premium Pay Request functionality, Commerce Department Form CD-81, “Authorization for Paid Overtime and/or Holiday Work, and for Compensatory Overtime”, electronic mail, or memorandum. The request should estimate the number of hours the employee expects to earn. Upon the employee’s return from travel, the employee must provide a chronological record of travel information including:

- Duration of the normal home-to-work commute;

- Time and place of departure (i.e., the employee’s home or official duty station);

- Actual time spent traveling to and from the transportation terminal if the terminal is outside of the employee’s official duty station;

- Usual waiting time; and

- Time of arrival at and departure from the temporary duty station.

Earning Limitations

There is no limit on the amount of compensatory time for travel that may be earned.

Using Compensatory Time off for Travel

Compensatory time off for travel is credited and used in 15 minute increments with the compensatory time off for travel earned first being charged first. Additional leave will be charged in corresponding units. Employees must request permission from their supervisor or leave approving official to schedule the use of accrued compensatory time off via the webTA Leave and Premium Pay Request functionality, a SF-71, Application for Leave, or Form OPM-71, Request for Leave or Approved Absence.

Share this page

- HR + Payroll Software

Talent Acquisition

- Talent Management

Workforce Management

- Benefits Administration

Payroll Software

Hr software, expense management software, recruiting software, automated talent sourcing, onboarding software, talent development, career management software, paycor paths, learning management system, pulse surveys, compensation planning, time + attendance software, scheduling software, benefits advisor, aca reporting software, workers’ compensation, compliance overview, payroll / business tax credits, workforce benefits, regulatory compliance, data & security.

Transform Frontline Managers Into Effective Leaders

Simplify Compliance Management With Paycor

- By Industry

Professional Services

Manufacturing, restaurants, 1-49 employees, 50-1000 employees, 1000+ employees, transform frontline managers into effective leaders, apps & tech partners, retirement services, franchisor opportunities, private equity, guides + white papers, case studies, hr glossary.

Perspectives+

News + press, sponsorships, ai guiding principles.

DE&I AT PAYCOR

Plans + pricing, take a guided tour, watch a demo, solution finder, call us today:.

Exclusive Access to Select Products

What is compensatory time off, or comp time off.

Last Updated: February 17, 2022 | Read Time: 7 min

One Minute Takeaway

- Compensatory time is a legal term that refers to an arrangement by which employees take time off instead of receiving overtime pay.

- Under most conditions covered by the FLSA, it’s illegal to offer comp time in the private sector.

- Personal days and flex time are more important to employees than ever.

HR leaders are looking for ways to recruit, reward, and engage employees without breaking the bank. Offering employees comp time, additional time off or flexible schedules, are some ways to do that. However, changes to scheduling, compensation plans, or benefits must follow applicable laws to ensure employees are treated fairly. To help you understand comp time, we’ve pulled together a few quick facts and watchouts as well as other ways to reward workers with time off.

What is Compensatory Time (Comp Time) and Who is Eligible?

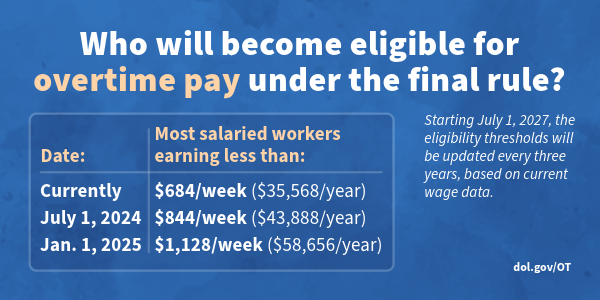

In some instances, employees who have worked more than 40 hours in a work week can earn compensatory time or comp time in place of overtime pay. Comp time is most often used in the public sector by state and federal agencies to reimburse covered nonexempt or hourly employees for overtime under the Fair Labor Standards Act (FLSA).

As a reminder, exempt employees are typically salaried employees exempt from the overtime provisions of the FLSA and include executives, professionals, or outside sales employees. Nonexempt employees are typically hourly employees and entitled to overtime pay when they work more than 40 hours in a workweek.

Under most conditions covered by the FLSA, it would be illegal to offer comp time in the private sector.

Nonexempt or hourly employees who work more than 40 hours a week must receive overtime pay at a rate not less than time and a half their regular rate. Even if the employee would prefer time off, you’re still obligated to pay them. So, under what conditions can you offer comp time? Let’s find out.

What are the Rules for Comp Time?

The main guidelines that employers need to follow to replace overtime with compensatory time include:

- Paying hourly rate times one and a half hours for every hour of overtime worked

- Following union agreements about compensatory time policies

- Developing terms of compensatory time and ensuring that they are followed before crediting payroll

- Ensuring compensatory time is taken in the same pay period as overtime hours

Nearly 30% of business owners are in legal jeopardy from providing comp time to nonexempt employees.

Don’t Call it Comp Time

It’s important to note that compensatory time is a legal term. It applies to the public sector and is defined as a nonexempt method of noncash payment for overtime under the FLSA. If you are rewarding employees with time off, you may want to use another name such as personal days or flexible time off.

Personal Days

The FSLA does not require payment for time not worked, such as personal leave, vacations, sick leave, or federal or other holidays. If a company offers personal days above and beyond the employment agreement, employers should avoid hour-for-hour time off.

Flexible Work Schedules

According to an American Time Use Surveyconducted pre-COVID by the Bureau of Labor Statistics, 57% of wage and regular salary workers were allowed to use a flexible work schedule that varies arrival and departure times or gives them the freedom to choose their work hours. Depending on the company’s compensatory time policy, employees work a prescribed number of hours per pay period and may need to be present during certain times of the day. For some roles and remote work situations, employees have the flexibility to create their own work arrangement even though they work the same number of hours as a traditional schedule.

A well-implemented flex time policy addresses concerns proactively, manages productivity and staffing, keeps expectations transparent, and creates accountability for employees and management. It also helps build goodwill when employees meet deadlines, achieve goals, and earn trust.

Benefits of Personal Days & Flex Time Programs

Personal days and flex time are highly desirable perks in a tight labor market. These policies can help employees find more work/life balance, but they also help with less aspirational, more everyday challenges, like finding time to (finally) go to the dentist, get to the BMV, navigate parenting/co-parenting needs, etc.

Schedule Management Programs & Compliance

Besides legal and regulatory compliance issues, 41% of CEOs say labor cost is the most important metric organizations should monitor and measure. The first step towards monitoring, measuring, and predicting labor cost trends is to automate and use time and attendance management software. Paycor Time allows HR leaders to collect and monitor employee hours and review overtime spend by department, manager, location and more.

Paycor offers a single source of truth for all employee data; you will never have to switch platforms, log in to multiple systems, re-key information, or open multiple spreadsheets. Paycor allows you to focus on talent acquisition, employee engagement, developing your people and being a more strategic leader.

Related Resources

Read Time: 9 min

Rethinking Employee Appreciation: 10 Ways to Celebrate Your Team

Workplace celebrations don’t just lower turnover – they can also boost revenue. Find out how HR can impact this with these 10 recommendations.

The Most Important Facts About Workers’ Compensation

Maximize the benefits of workers’ compensation insurance as an employer by knowing these key points.

Read Time: 11 min

What is Middle Management and Their Role?

Learn more about the crucial functions of middle managers from organizational knowledge to interpersonal communication skills.

An official website of the United States government.

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- American Rescue Plan

- Coronavirus Resources

- Disability Resources

- Disaster Recovery Assistance

- Equal Employment Opportunity

- Guidance Search

- Health Plans and Benefits

- Registered Apprenticeship

- International Labor Issues

- Labor Relations

- Leave Benefits

- Major Laws of DOL

- Other Benefits

- Retirement Plans, Benefits and Savings

- Spanish-Language Resources

- Termination

- Unemployment Insurance

- Veterans Employment

- Whistleblower Protection

- Workers' Compensation

- Workplace Safety and Health

- Youth & Young Worker Employment

- Breaks and Meal Periods

- Continuation of Health Coverage - COBRA

- FMLA (Family and Medical Leave)

- Full-Time Employment

- Mental Health

- Office of the Secretary (OSEC)

- Administrative Review Board (ARB)

- Benefits Review Board (BRB)

- Bureau of International Labor Affairs (ILAB)

- Bureau of Labor Statistics (BLS)

- Employee Benefits Security Administration (EBSA)

- Employees' Compensation Appeals Board (ECAB)

- Employment and Training Administration (ETA)

- Mine Safety and Health Administration (MSHA)

- Occupational Safety and Health Administration (OSHA)

- Office of Administrative Law Judges (OALJ)

- Office of Congressional & Intergovernmental Affairs (OCIA)

- Office of Disability Employment Policy (ODEP)

- Office of Federal Contract Compliance Programs (OFCCP)

- Office of Inspector General (OIG)

- Office of Labor-Management Standards (OLMS)

- Office of the Assistant Secretary for Administration and Management (OASAM)

- Office of the Assistant Secretary for Policy (OASP)

- Office of the Chief Financial Officer (OCFO)

- Office of the Solicitor (SOL)

- Office of Workers' Compensation Programs (OWCP)

- Ombudsman for the Energy Employees Occupational Illness Compensation Program (EEOMBD)

- Pension Benefit Guaranty Corporation (PBGC)

- Veterans' Employment and Training Service (VETS)

- Wage and Hour Division (WHD)

- Women's Bureau (WB)

- Agencies and Programs

- Meet the Secretary of Labor

- Leadership Team

- Budget, Performance and Planning

- Careers at DOL

- Privacy Program

- Recursos en Español

- News Releases

- Economic Data from the Department of Labor

- Email Newsletter

Travel Time

Time spent traveling during normal work hours is considered compensable work time. Time spent in home-to-work travel by an employee in an employer-provided vehicle, or in activities performed by an employee that are incidental to the use of the vehicle for commuting, generally is not "hours worked" and, therefore, does not have to be paid. This provision applies only if the travel is within the normal commuting area for the employer's business and the use of the vehicle is subject to an agreement between the employer and the employee or the employee's representative.

Webpages on this Topic

Handy Reference Guide to the Fair Labor Standards Act - Answers many questions about the FLSA and gives information about certain occupations that are exempt from the Act.

Coverage Under the Fair Labor Standards Act (FLSA) Fact Sheet - General information about who is covered by the FLSA.

Wage and Hour Division: District Office Locations - Addresses and phone numbers for Department of Labor district Wage and Hour Division offices.

State Labor Offices/State Laws - Links to state departments of labor contacts. Individual states' laws and regulations may vary greatly. Please consult your state department of labor for this information.

By continuing to use our website, you are consenting to Cookies being placed on your device. If you do not want Cookies placed on your device, we suggest you exit our website

How Travel Nurse Pay Works: A Comprehensive Guide

Table of Contents

Understanding travel nurse pay: your comprehensive guide.

Travel nursing is an exciting career option for registered nurses, offering the opportunity to explore new locations while helping patients in different healthcare facilities. As a travel nurse, understanding your pay is important to help you make informed decisions about your career and financial future. In this guide, we explore how travel nurse pay works, the factors that influence your earnings, and how to negotiate your contract to get the best pay package possible.

{{cta-light-with-image}}

How Does Travel Nurse Pay Work?

Travel nurse pay can be a complicated topic for many healthcare professionals. Unlike staff nurse positions, travel nursing contracts often come with multiple variables that can impact your take-home pay. This can include the bill rates at healthcare facilities, additional benefits like housing stipends, and vendor management fees that certain travel nursing companies apply to your pay. In this article, we will explore these various factors and dive deeper into how your pay works as a travel nurse.

Taxable Base Rates: What You Need to Know

First and foremost, it's essential to understand that your taxable base rate is the core component of your travel nursing pay package. As a travel nurse, this is the hourly wage that is taxed, similar to how a staff nurse is paid. This ensures you remain compliant with tax laws while working in your nursing position. Importantly, taxable base rates can vary between different travel nursing agencies, so it is essential to be aware of the rate you are receiving when comparing offers.

Tiered Bill Rates: How They Affect Your Earnings

Healthcare facilities typically pay travel nursing companies a bill rate for their services, which in turn covers your pay, benefits, and agency overhead costs. Some facilities use a tiered bill rate system, meaning the rates they pay to travel nursing companies can fluctuate based on specific factors. For example, a hospital may offer a higher bill rate for a nursing position in a hard-to-fill specialty or for an urgent need, which can sometimes result in increased pay for the travel nurse.

Being aware of tiered bill rates can be helpful when comparing travel nursing contracts and understanding the basis of your earnings. By exploring opportunities with higher bill rates, you could potentially maximize your earnings during your assignment.

Gross Profit Margin: Understanding Your Agency's Profit

Travel nursing companies make their profit by skimming some of the bill rates paid by healthcare facilities after covering the costs of your pay, benefits, and company overhead. This profit is referred to as the gross profit margin, and it's an important aspect to understand when examining the difference in pay between multiple agencies.

A transparent travel nursing agency should be able to provide a sample breakdown of how much from the bill rate is allocated towards your pay, benefits, payroll costs (e.g., taxes and Social Security), liability insurance, and company overhead. This understanding can empower you to ensure you're getting a fair deal and to potentially negotiate better pay and benefits if there's room for it within the bill rate.

Breaking Down the Travel Nursing Pay Package

Now that we have a grasp of taxable base rates, bill rates, and gross profit margin, let's dive into the other aspects of the travel nursing pay package, including travel stipends, housing reimbursements, and vendor management fees. These factors can have a profound effect on your final take-home pay, so it's essential to understand and compare them carefully when considering travel nursing contracts.

Travel Nursing Salary: Factors That Influence Your Earnings

Travel nursing agencies typically offer a benefits package on top of your taxable base rate, which can include housing stipends, travel reimbursements, and other tax-free reimbursements. It's important to understand how these factors work in addition to your base pay to get a full picture of your overall earnings on an assignment.

For instance, housing stipends might be offered based on the cost of living in your assignment area, while your travel stipend could cover any expenses related to commuting to and from your tax home. Some agencies may also offer shift differentials, overtime, certification reimbursement, or other bonuses that can influence your pay. Keep these factors in mind as you explore travel nursing contracts and compare offers.

Vendor Management Fees: What They Are and How They Affect Your Pay

Vendor management fees are another crucial aspect of the travel nursing pay package. Some healthcare facilities employ a Vendor Management System (VMS) to streamline the process of onboarding and managing temporary staff, including travel nurses. These VMS companies typically charge a small percentage of the bill rate as their fee, which is ultimately passed on to the travel nursing agency in the form of a reduced bill rate.

When a vendor management fee is taken into account, it can potentially influence the bottom line of your pay package. Agencies might have less flexibility in offering higher pay or better benefits given the reduced bill rates. Understanding this aspect of the system can help you set realistic expectations for pay when working with healthcare facilities that use a VMS.

Agencies Gross Profit: How It Affects Your Paycheck

Lastly, it's crucial to reiterate the connection between your travel nursing pay and the agency's gross profit. As mentioned earlier, travel nursing companies make their money by allocating a portion of the bill rate after covering your pay and benefits. Some agencies may have larger overhead costs or simply choose to retain more profit, resulting in lower pay and benefits for you. In contrast, other agencies that operate on a slimmer margin might be able to offer you better pay or additional benefits.

To ensure you get the best possible pay package and a fair deal from your agency, it's essential to ask questions and ensure transparency in their breakdown of the bill rate. Comparing your pay and benefits across multiple agencies can help you find the best fit for your needs and potentially increase your overall travel nurse earnings.

Understanding Your Total Pay Package as a Travel Nurse

When considering a travel nursing contract, it's essential to understand the various components that make up your total pay package. Unlike staff nurse positions, the travel nursing pay structure often comprises several components, including hourly wages, stipends, bonuses, and even liability insurance reimbursements. Travel nursing companies work with healthcare facilities to determine the bill rate for each nursing position - a figure that encompasses a travel nurse's wages, benefits, and vendor management fee paid to the agency.

To fully comprehend your travel nursing pay package, it's crucial to break down each element, such as the base pay, travel stipend, and housing stipend. Doing so will help you make informed decisions when comparing offers from different travel nursing agencies. Furthermore, understanding your pay package will help you negotiate more effectively with travel nursing companies, ensuring that you receive a fair deal for your services.

Travel Nursing Pay: Other Forms of Compensation to Consider

Beyond base pay, travel nursing agencies offer additional compensation to make their positions attractive and competitive. Recognizing these other forms of compensation is essential when comparing travel nursing pay packages:

1. Travel Stipend: Many travel nursing contracts include a travel stipend to cover the cost of transportation to and from your assignment. This amount varies depending on the distance of the assignment and the travel nursing agencies you choose.

2. Housing Stipend: A crucial aspect of a travel nursing pay package is the housing stipend. This stipend is intended to cover the cost of temporary housing during your assignment. It's essential to verify whether this housing stipend is sufficient to cover the entire cost of accommodation in your destination city.

3. Bonuses and Incentives: Travel nursing companies may also offer bonuses and incentives, such as completion bonuses or extension bonuses, to travel nurses who fulfill their contract obligations or extend their contracts beyond the initial term. These bonuses can enhance the travel nursing pay package and should be taken into consideration when evaluating offers.

4. Liability Insurance: Some travel nursing agencies provide liability insurance coverage for their nurses. This coverage is essential for travel nurses, as liability claims can be financially devastating. Ensure to inquire whether the travel nursing company includes this insurance in their pay package or if you need to secure it independently.

Travel Nurse Housing: Options and Costs

For many travel nurses, housing is one of the most critical considerations when accepting a traveling nursing position. Typically, travel nursing agencies offer two primary housing options - agency-provided housing or a housing stipend. Travel nurses can elect to use the stipend to arrange their accommodation, or they can choose to stay in housing organized and funded by the travel nursing company.

When evaluating housing options, travel nurses should account for factors such as location, convenience, safety, and cost-efficiency. If you decide to arrange your housing, research average rental rates in the assignment's city to ensure the housing stipend is sufficient to cover accommodation costs. Keep in mind that agency-provided housing is often move-in ready and may include furniture, utilities, and other conveniences that make transitions easier.

How to Negotiate Your Travel Nursing Contract

When negotiating your travel nursing pay package, it's essential to approach the process with a thorough understanding of the various components and industry norms. The following steps can help you negotiate effectively with travel nursing companies:

1. Research and compare: Gather information on travel nursing pay packages from multiple travel nursing agencies and identify the industry's standard rates for your specialty and experience. This knowledge will empower you when negotiating your desired pay package.

2. Determine your priorities: Before entering negotiations, identify which components of the pay package are most important to you, such as the housing stipend or travel reimbursement. This clarity will allow you to focus on those areas during the negotiation process.

3. Be assertive and confident: Don't be afraid to express your desires and concerns regarding the contract. Remember that travel nursing agencies' primary goal is to ensure your satisfaction so that you remain with the company. Your assertiveness may secure you a better pay package or assignment conditions.

4. Consult a mentor or colleague: If you have connections in the travel nursing industry, seek their advice on negotiating contracts and navigating conversations with recruiters. Gaining insight from experienced travel nurses can be invaluable during the negotiation process.

Sample Breakdown of a Travel Nursing Pay Package

Here's an example of a travel nursing pay package, with amounts allocated for various pay components:

- Base Pay (Hourly Wages): $25 per hour

- Overtime Pay: $37.50 per hour (1.5 times the base pay)

- Housing Stipend: $2000 per month

- Travel Stipend: $500 upon completion of the contract

- Completion Bonus: $1000 upon contract completion

- Extension Bonus: $500 for extending the contract past the initial date

- Liability Insurance: Included in the pay package

By understanding the various components and industry norms, a travel nurse can successfully evaluate and negotiate their travel nursing contract. Comparing offers, researching housing options, and effectively communicating your needs to travel nursing companies will ensure that you secure favorable travel nursing pay and assignment conditions.

GET STARTED IN

Land your dream job faster when you travel with us. Get started with top local and national travel nurse jobs in On Demand.

Similar Posts

Why pediatric nursing is a rewarding career, unveiling the secrets of long-term acute care travel nurse salary insights, what you need to know about the lucrative behavioral health travel nurse job market, view top jobs in.

Search, apply and be the first in line for your dream job today.

Apply to Top Jobs in

Get Started in

Take Control of Your Career with

Understanding Comp Time: Guidelines for Employers

November 15, 2023

Home » Blog » Understanding Comp Time: Guidelines for Employers

Compensatory time off, or “comp time,” is often misused by employers who don’t understand Fair Labor Standards Act (FLSA) laws. As a very specific type of compensation, financial and HR professionals need to understand how comp time works. This comprehensive comp time guideline helps you understand the rules for salaried, exempt, and hourly employees and the possible consequences of poor compliance.

What Is Comp Time?

Compensatory time allows employers to provide employees paid time off to account for hours worked beyond their regular schedule. Comp time is commonly used as part of a regulated compensatory policy for flexible work scheduling but can also be used case-by-case to manage unexpected scheduled changes.

What is a comp day?

A comp day refers to a day an employee takes off when they have accumulated enough hours of overtime.

What is travel comp time?

Travel comp time is compensatory time off for travel earned when an employee’s work requires work away from their daily workplace, and this work time is not compensated via other means.

Comp Time vs. Overtime – What’s the Difference?

Although both comp time and overtime compensate employees for extra hours worked, comp time is paid out in hours off, while overtime is paid in dollars. When an employee works over 40 hours in a week, they are entitled to either earn time and a half pay for every hour over 40 hours or time and a half in hours off.

Comp time for exempt employees

However, not all employees qualify for comp time. Only exempt workers qualify, which in most cases are government or salaried employees. In fact, government employees are the only employees who can legally be offered comp time in lieu of overtime unless state laws allow otherwise.

FLSA Comp Time

According to the Code of Federal Regulations, Compensatory time off is “paid time off the job which is earned and accrued by an employee instead of immediate cash payment for employment in excess of the statutory hours for which overtime compensation is required by section 7 of the FLSA.”

The rules governing time off require government employers to provide comp time at a rate not less than one and one-half hours for each hour of employment for which overtime compensation is required in accordance with section 7. Furthermore, comp time, in lieu of paid overtime, is limited to a public agency that is a state, a political subdivision of a state, or an interstate governmental agency. It is illegal for private sector employees to use time off in lieu of pay.

Employers must adhere to the guidelines based on maximum accrual limits, documentation of hours and use, and deadlines to use comp time within a specified timeframe. For example, limits on the total number of comp hours an employee can accrue is 240 for most salaried workers or 480 hours for workers such as firefighters and law enforcement officers. This adds further restrictions to comp hours as the 480-hour limit on accrued compensatory time can’t represent more than 320 hours of actual overtime worked, and the 240-hour limit represents not more than 160 hours.

Comp Time for Exempt vs. Non-Exempt Employees

Nonexempt employees are hourly workers entitled to receive overtime when they work over 40 hours in a week in accordance with the FLSA. In this case, it is illegal to offer private employees comp time. Exempt employees are salaried employees who are ineligible for overtime pay or comp time. This is because their salary is intended to cover extra work expected in typical salaried roles. However, although not required by law, as an employer, you have the right to offer time off to salaried workers as a reward for their hard work.

Use of Comp Time in the Public vs. Private Sector

The U.S. Department of Labor (DOL) does not allow comp time for nonexempt employees in private-sector employment. Comp time is limited to public agencies at both state and local levels. However, as mentioned, private-sector employers can offer time off as a reward for salaried employees. In this case, it is important to avoid using the term “compensatory time,” as this is a legal term used specifically in the public sector. Many companies adopt terms such as flex time or personal days to identify this form of compensation.

State Exemptions for Comp Time

Despite the above information, some states allow private sector comp time for salaried employees in lieu of overtime as long as the employee agrees. However, this can open employers up to possible lawsuits should an employee leave the company, be fired, or change their minds and expect to be compensated with extra pay. Because of this, it is imperative to understand state laws such as:

- Industries: Some states might allow comp time for specific industries, while states like California ban comp time completely.

- Accrual and usage limits: Different maximums might apply, such as New York’s 240/30-day maximum.

- Employee consent: Some states forbid comp time in the private sector, while others, like Minnesota, allow it if there is a transparent written and signed agreement.

- Conversions: How hours are converted is also often regulated by states. For example, in Washington, employers must convert unused hours to cash after two years.

- Collective bargaining agreements: Comp time rules might be governed by collective bargaining agreements in some states, outlining comp time usage and accrual.

Penalties for Comp Time Violations

Some possible consequences of comp time violations include:

- Fines of up to $10,000

- Mandatory payout based on twice the amount of back wages owed for unpaid overtime

- Legal fees for employees out of pocket due to lawsuits

- Jail time for repeat offenders

- Civil money penalties of up to $1,000 per infraction

When is Comp Time a Good Idea?

If your state allows comp time, it is essential to develop a policy and ensure you adhere to state laws. This might include the following:

- Creating terms and conditions for comp time

- Having new employees read and sign the policy indicating they accept time off in lieu of pay as part of your onboarding process

- Being clear at all levels how your policy works, when it applies, and how hours are incurred and used

- Using automated time tracking to ensure an accurate record is kept of all overtime to accrue hours and determine compensation time owed

- Tracking employee use of comp hours, especially in states where it is required to convert hours into pay after a certain period

- Remote time tracking for hybrid workplaces

- Leveraging a management approval system to avoid fraud and approve hours from anywhere to avoid disruption to operations

Applying comp time legally is easier when you have software to create a streamlined onboarding process to share company policies and track hours and overtime accurately. This ensures your comp time policies remain transparent and that hours are tracked to ensure employees receive the hours and compensation they are entitled to.

About the Author

Reduce your annual workload by 5 months

See how payroll automation reduces manual processing time

- Name This field is for validation purposes and should be left unchanged.

Related Articles

Paypro: enterprise performance management.

April 23, 2024

Paypro: Payroll Error Outline

What percent of gross revenue should go to payroll.

March 22, 2024

Would you like to view this website in another language?

What is Travel Time Pay and How Does it Work?

- Written by: Rinaily Bonifacio

- Last updated: 25 April 2024

This article will clear up any confusion about what constitutes travel time pay, who’s eligible, and the rules that need to be followed.

Table of contents

What is travel time pay?

Who is eligible for travel time pay, what is the criteria for compensable travel time, how to calculate travel time pay.

Travel time pay is the compensation employees receive for the time they spend traveling outside of their normal work hours as part of their job. This isn’t about the routine commute from home to work.

Instead, it’s about situations where an employee might need to travel to different job sites or attend meetings away from their usual workplace. It’s essential for employers to know when this time counts as payable work hours.

Travel time pay vs. Meal time pay

Travel time pay and meal time pay are distinct forms of employee compensation regulated under U.S. labor laws, specifically the Fair Labor Standards Act (FLSA). Here's a concise overview of each:

Travel time pay

Purpose : Compensates employees for work-related travel not part of their regular commute.

Compensability : Includes travel during regular working hours and overnight travel that intersects with normal work hours.

Exclusions : Does not cover the regular commute between home and work or personal travel outside work hours.

Meal time pay

Purpose : Addresses compensation during meal breaks within work hours.

Compensability : Generally unpaid unless the employee is required to perform duties during the meal period.

Exclusions : Meal breaks are non-compensable if the employee is completely relieved of duties for typically 30 minutes or more.

Legal basis for travel time compensation

In the United States, the Fair Labor Standards Act (FLSA) sets the ground rules for travel time pay. This law requires that non-exempt employees — those who qualify for overtime and minimum wage — must be paid for all hours worked.

According to the FLSA, time spent traveling during regular working hours as part of the employee's main job activities should be compensated. This doesn’t include commuting from home to work, but it does cover travel from one job site to another during the day or travel to a location for a special one-time task.

Eligibility for travel time pay under U.S. labor laws is mostly about whether an employee is exempt or non-exempt from the wage and hour laws stipulated by the FLSA.

Non-exempt employees are entitled to overtime pay and must be paid for travel time that occurs during their regular working hours. This includes hourly employees who often move between different job sites or are sent on special assignments outside of their regular working environment .

Exempt employees, those who typically receive a salary and are exempt from overtime pay due to their job nature, might not be eligible for additional pay for travel time, depending on the specifics of their roles and hours.

Travel time is compensable when it involves tasks that an employee must perform as part of their work, or during the employee’s regular work hours. This can include travel to and from different job sites within the same workday or unexpected travel required to complete work-related tasks.

The main criteria is that the travel directly pertains to and is necessary for the job, occurring during the employee's regular working hours.

Eligible travel scenarios for compensation

Understanding which travel scenarios are eligible for compensation under U.S. labor laws is crucial for employers to ensure they are compliant and fair. Here are eight detailed scenarios where travel time is typically compensable:

1. Travel between job sites:

When an employee travels between multiple job sites during their regular work hours, this travel time is compensable. For example, an electrician traveling between different homes or commercial buildings to perform installations or repairs during the day should be paid for this travel time.

2. One-time assignments in another city:

If an employee is sent to another city for a one-time assignment, the travel time spent getting to and from the destination is usually compensable. This includes the time spent driving or flying, minus the usual commute time.

3. Client visits during normal hours:

When employees need to travel to meet clients or attend meetings away from their primary workplace during their normal work hours, this time is compensable. For instance, a salesperson driving across town for client meetings during their scheduled workday should be paid for travel time.

4. Overnight travel:

Travel that requires an overnight stay away from the employee’s home community is generally compensable during the employee's normal working hours. This includes time spent traveling to and from the destination city. For example, if an employee usually works from 9 AM to 5 PM, travel time within those hours on an overnight trip should be paid.

5. Emergency calls out of regular hours:

If an employee must travel for emergency work outside of their regular hours, such as a technician called to fix a utility breakdown at night, the travel time is compensable.

6. Training events required by employer:

If attendance at a training event during regular hours requires travel, this time is typically compensable. For example, if an employer requires attendance at a training session that is not held at the usual place of work, the travel time to and from the training location during normal working hours is compensable.

7. Early morning or late night flights:

If travel involves early morning or late-night flights that fall outside of regular working hours but are necessary to reach a business-related destination, these may be compensable depending on the circumstances, like if travel during normal hours is not possible.

8. Travel to a different worksite for short duration:

If an employee is assigned temporarily to a worksite far from their regular location, the travel time more than their normal commute to the regular worksite is typically compensable. For example, if an employee who normally works in a downtown office is assigned for a week to a suburban office, the additional time spent traveling beyond their usual commute time should be paid.

Non-eligible travel scenarios for compensation

There are several travel scenarios where time spent is typically not compensable under U.S. labor laws. Understanding these can help employers avoid unnecessary payments and clarify company policies regarding travel. Here are five scenarios where travel time generally does not require compensation:

1. Regular commute from home to work:

The everyday travel time from an employee's home to their primary workplace is not compensable. This rule applies regardless of whether the employee works at a fixed location or at various locations. For example, a construction worker commuting to different job sites each day would not be paid for the time spent traveling from home to the first site or from the last site back home.

2. Travel from home to work on special one-time occasion:

If an employee is required to report to a job site that is not their regular workplace for a special one-time task and the travel distance is similar to their normal commute, this travel time is generally not compensable. For example, if an employee who normally works in an office downtown is asked to work one day from a client's office across town, the travel time does not need to be compensated if it is similar to their usual commute.

3. Travel as part of a residential move:

If an employee is relocating to another city for work and the company is paying for moving expenses, the time spent by the employee moving their residence is not compensable. This is viewed as personal travel, even though it's related to work.

4. Voluntary training not during regular hours:

When employees choose to attend training sessions or professional development workshops on their own time and such attendance is not required by the employer, the travel time to and from these events is typically not compensable. For instance, if an employee attends a weekend seminar related to their field but not specifically required by their employer, the travel time would not be paid.

Calculating travel time pay correctly is essential to ensure fair compensation for employees and compliance with labor laws. Here’s how you can accurately calculate the pay owed to employees for the time they spend traveling for work-related tasks.

Calculation of travel time pay

To calculate travel time pay, you should follow these steps:

Determine the employee's pay rate : This is the regular hourly wage the employee earns.

Identify compensable travel time : Record the amount of time the employee spends traveling during their normal work hours that does not include their regular commute from home to work.

Calculate total payable hours : Multiply the hours of compensable travel by the employee's hourly wage.

Formula : Travel Time Pay=(Number of Hours Spent on Compensable Travel)×(Hourly Wage)Travel Time Pay=(Number of Hours Spent on Compensable Travel)×(Hourly Wage)

For example, if an employee who makes $20 per hour spends 3 hours traveling to different job sites during their normal work hours, the calculation would be:

Travel Time Pay=3 hours×$20/hour=$60Travel Time Pay=3hours×$20/hour=$60

Discuss any mandatory minimums or rates stipulated by law

In the United States, several mandatory minimums and rates are defined under the Fair Labor Standards Act (FLSA) and must be adhered to when calculating travel time pay:

Minimum wage : The federal minimum wage is a baseline; however, some states have higher minimum wages. Employers must pay at least the federal minimum wage for all compensable travel time unless their state's minimum wage is higher.

Overtime : If travel time plus regular working hours exceed 40 hours in a week, employers must pay hourly employees overtime at one and a half times the regular rate for the hours over 40.

Special rates : Some contracts or state laws might specify higher rates for travel time, especially if traveling involves unusual hardship or is outside of normal working hours.

How to design a policy for travel time compensation?

Creating a clear and comprehensive travel time compensation policy is essential for any organization. This policy not only helps ensure compliance with labor laws but also sets clear expectations for employees regarding their compensation for travel .

Here are five detailed steps to guide you in designing an effective travel time compensation policy:

Step 1. Define compensable travel time:

Clearly outline what qualifies as compensable travel time within your organization. Specify the types of travel that are covered, such as travel between job sites, overnight travel required for work, and travel during an employee’s normal working hours.

Make sure to distinguish between travel that is part of the employee’s daily commute (which is generally not compensable) and travel that is an integral part of the employee’s duties.

Step 2. Establish travel time pay rates:

Determine the pay rates for travel time. Decide if the rate will be the same as the regular hourly rate or if there will be a different rate for travel time. Include details on how to handle overtime pay if the travel time contributes to an employee working more than their standard working hours.

Make sure these rates comply with the Fair Labor Standards Act (FLSA) and any relevant state laws.

Step 3. Outline procedures for recording travel time:

Develop and implement a system for employees to record their travel time. This could involve logging their hours in a timekeeping system or filling out a travel time sheet.

Provide clear instructions on how and when to submit these records, ensuring that employees know the importance of accurate and timely reporting to receive appropriate compensation.

Step 4. Communicate the policy to all employees:

Once the policy is developed, communicate it effectively to all employees. This can be done through staff meetings, email distributions, or by posting it on the company’s internal website.

Ensure that every employee understands the policy and knows who to contact if they have any questions or issues related to travel time pay.

Step 5. Review and update the policy regularly:

Laws and business needs change, so it’s important to review your travel time compensation policy regularly—at least annually. This will help ensure that your policy remains compliant with current laws and continues to meet the needs of your organization and its employees.

Be open to feedback from employees about how the policy is working in practice, which could provide valuable insights into any necessary adjustments.

.png?width=323&height=124&name=img-16%20(1).png)

Employee scheduling and Time-tracking software!

- Easy Employee scheduling

- Clear time-tracking

- Simple absence management

Travel time pay is a crucial aspect of employee compensation, particularly for non-exempt employees under the Fair Labor Standards Act (FLSA). Employers must carefully distinguish between compensable and non-compensable travel scenarios to comply with legal standards and maintain fair workplace practices.

By establishing a clear policy that outlines compensable travel, sets appropriate pay rates, and details procedures for recording travel time, organizations can ensure both compliance and clarity for all employees. Regular review and updates of this policy are essential to adapt to any changes in labor laws or organizational needs.

Written by:

Rinaily Bonifacio

Rinaily is a renowned expert in the field of human resources with years of industry experience. With a passion for writing high-quality HR content, Rinaily brings a unique perspective to the challenges and opportunities of the modern workplace. As an experienced HR professional and content writer, She has contributed to leading publications in the field of HR.

Please note that the information on our website is intended for general informational purposes and not as binding advice. The information on our website cannot be considered a substitute for legal and binding advice for any specific situation. While we strive to provide up-to-date and accurate information, we do not guarantee the accuracy, completeness and timeliness of the information on our website for any purpose. We are not liable for any damage or loss arising from the use of the information on our website.

Ready to try Shiftbase for free?

- Travel Time Pay

- Straight Time Pay

- Payroll Reports

- Prorated Pay

Does Workers Comp Coverage Follow Traveling Employees? //

(Hidden) Catalog-Item Reuse

Does workers comp coverage follow traveling employees.

Traveling employees can create workers compensation coverage nightmares—and many agents are unaware of these traveling landmines until after the injury.

The problems arise at the junction of two key concepts:

Extraterritoriality. How does the sending state’s workers comp policy respond when one or several workers leave the state to perform operations for or conduct duties on behalf of the employer? More simplistically, does the workers comp coverage follow the employee when they leave the state to work? And are there any limitations on the extraterritorial benefits?

Answering the first question is easy. Every state provides extraterritorial work comp benefits to employees who travel to another state for business purposes. However, some states limit the applicability of these traveling benefits in one of two ways:

- Extraterritorial benefits end after a specified number of days. Some states limit the number of days coverage follows the worker to another state.

- The worker must qualify for in-state benefits based on a multipart test. Many test-based states apply Larson’s four-part test to determine whether an employee working in another state qualifies for in-state protection and benefits. Larson’s four-part test extends in-state benefits to traveling employees if they meet one of the following four qualifications:

- Their employment is principally localized in the sending state.

- They are working under a contract of hire made in the sending state for employment not principally localized in any state.

- They are working under a contract of hire made in the sending state for employment principally localized in another state whose workers comp law is not applicable to the employer, such as a state that has a number threshold.

- They are working under a contract of hire made in the sending state for employment outside the U.S.

Test-based states that do not directly apply the Larson test generally use a similar variation. If the worker does not qualify under the state’s test, benefits do not follow the worker and there is no extraterritoriality.

Reciprocity. How does the receiving state—the state to which the worker travels to work—view the workers comp coverage from the sending state? This question involves two issues: Does the receiving state’s workers comp law have jurisdiction over the out-of-state workers traveling into the state? And does the workers comp policy from the sending state satisfy the receiving state’s workers comp statutes?

Reciprocity is more frustrating than extraterritoriality. While every state provides extraterritorial benefits to qualified employees for some period of time, extraterritorial laws don’t consider the receiving state. In practicality, extraterritorial benefits apply only when the receiving state recognizes the coverage. So the important question becomes, what are the receiving state’s reciprocity rules?

Some states simply don’t care about another state’s extraterritorial coverage. Employees working in non-reciprocating circumstances or non-reciprocal states must abide by and are subject to the workers comp law of the receiving state. These statutes vary widely and fall into one of three levels of reciprocity:

- No reciprocity: These states are not concerned with the laws of any other state. Employees who work in these states must abide by their workers comp laws.

- Full reciprocity: These states generally maintain a list of states with which they have a reciprocity agreement, fully recognizing the other jurisdiction’s laws without limitation.

- Limited reciprocity: These states reciprocate, but not in full. Four common reasons for non-reciprocity are:

- Business class: Construction is the most common business class excluded from reciprocity. States that otherwise reciprocate may refuse to recognize the sending state’s workers comp coverage when the insured is in a construction class.

- Employee count: Some states reciprocate when the out-of-state employer sends only a limited number of workers into the state. These are generally states that have a number threshold greater than one for even an in-state employer to have workers comp. Once the number of out-of-state workers eclipses a certain number, these states no longer reciprocate.

- Time in state: A few states recognize the sending state’s coverage for a limited amount of time. Once the time limit is eclipsed, reciprocity ends.

- Lack of mutual reciprocity: Quid pro quo—mutual reciprocity states recognize the sending state’s benefits only if the sending state recognizes the receiving state’s benefits when the roles are reversed.

Out of Sync?

Knowing the states to which employees might travel for work is essential when developing an insured’s workers comp plan. If you miss or ignore the extraterritorial and reciprocal exposures, you risk complete loss of protection. If the sending state’s workers comp does not respond, the insured is responsible for paying out of its own pocket all benefits required by law for a work-related injury.

No self-funding threat exists when the sending and receiving states’ extraterritorial and reciprocity provisions align. The sending state’s workers comp follows the worker, and the receiving state recognizes the coverage. Benefits are paid under the sending state’s laws and the receiving state asserts no authority over the situation.

But when extraterritorial and reciprocal laws do not dovetail, coverage for travelling employees requires specific action on your part. Depending on the situation, workers comp protection can be extended in one of two ways.

When the sending state’s benefits do not apply in the receiving state, list the receiving state as an additional “Primary” state, also known as a 3.A. state. Use this approach anytime there are known or suspected extraterritoriality or reciprocity issues. States that may require 3.A. status include:

- The employer’s home office and branch office states.

- The employer’s state of incorporation, if other than a home or branch office state.

- Any state where the employer hires temporary employees solely to perform operations in that state of hire.

- Any state where a subcontractor is hired to perform work on behalf of a general contractor if proof of workers comp is not provided.

- Any state that has significant contact with an employee.

- The state in which the contract of hire was executed, even if the employee moves.

- Any state that does not reciprocate with any listed state.

- States with limited reciprocity provisions.

- Monopolistic states, which require a separate policy.

These are merely recommendations and not rules. Keep in mind, underwriters may be unwilling to extend 3.A. status, even when you make a good case.

Uh-Oh Protection

You may also extend “Other State,” also known as secondary or 3.C., status to the receiving state, but this is intended only as a safety net. Use this approach only in situations where there is no indication that the receiving state can or will assert authority over the worker, or when an insured begins new temporary operations during the policy period.

Part Three – Other States Insurance dictates how the workers comp policy responds if an employee is injured in a non-3.A. state, but—due to unexpected extraterritorial or reciprocity problems—receives the option to choose the benefits mandated by the state of injury rather than a listed 3.A. state.

Benefits extended to workers in 3.C. states comply with the statutory benefits required by the state where the employee is injured. The workers comp policy responds and pays benefits in listed 3.C. states, just as if the state was scheduled under 3.A.

3.C. protection should be structured to include any state to which the underwriter is willing to extend coverage. Most errors & omissions carriers recommend garnering 3.C. status with the phrase, “All states, territories and possessions other than 3.A. states and monopolistic states.” However, some carriers refuse to allow this breadth of protection due either to license status or a desire for greater information regarding the location and activities of the employees.

If the underwriter is unwilling to apply the overt “All states…” wording, build the “other states” coverage as broad as possible by taking the following steps:

- Specifically schedule those states that qualify for 3.A. as per the previous recommendations but which the underwriter would not allow.

- If not included in 3.A., specifically list all bordering states.

- List all states to which employees regularly travel for training or meetings.

- Complete the schedule by adding the terminology, “All remaining states, territories and possession other than 3.A. states, listed states and monopolistic states.”

Note that an underwriter might argue, “We can’t list State as a 3.C. state because we are not licensed there.” This is a bogus claim. Paragraph A.3. under Part Three – Other States Insurance reads: “We will reimburse you for the benefits required by the workers’ compensation law of that state if we are not permitted to pay the benefits directly to persons entitled to them.”

Other than not being licensed in the state, why would the carrier not be allowed to pay the injured worker directly? Just because they don’t want to list a state doesn’t mean they can’t.

Chris Boggs is executive director of the Big “I” Virtual University and an IA contributor.

Trending Now

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Office of Human Resources Management

- Practitioners

- Leave Policies

Was this page helpful?

Special compensatory time off for travel.

This program allows employees to accrue compensatory time off for time spent by an employee in a travel status away from the employee’s official duty station when such time is not otherwise compensable. The travel must be officially authorized for work purposes and approved by an authorized official.

An employee as defined in Title 5 U.S.C. 5541(2), who is employed in an “Executive Agency,” as defined in 5 U.S.C. 105, ) is entitled to earn and use compensatory time off for travel regardless of whether the employee is exempt or non-exempt from the Fair Labor Standards Act (FLSA). Coverage includes employees in Senior Level (SL) and Scientific of Professional (ST) positions, Federal Wage System (or Wage Grade, WG), and commissioned (tenured) Foreign Service Officers (in pay plan FO) and Commissioned Foreign Service Officers (in pay plan FO).

Senior Executive Service members and intermittent employees (who do not have a scheduled tour of duty for leave purposes) are excluded from coverage.

Effective Dates of Coverage

Final regulations implementing compensatory time off for travel for most employees was effective May 17, 2007. Coverage for WG employees was effective April 27, 2008. Coverage for Foreign Service Officers (in pay plan FO) and Commissioned Foreign Service Officers (in pay plan FO) was effective June 8, 2006.

Creditable Travel Time

Time in a travel status includes the time the employee spends traveling between the official duty station and a temporary duty station (or the lodging in the temporary duty station) or between two temporary duty stations (or the lodging in the temporary duty station) and the “usual waiting time” that precedes or interrupts such travel.

“Usual waiting time” is the time required to arrive at the airport (or other transportation hub) for security checks-ins, etc., prior to a designated departure time.

Time spent at an intervening airport (or transportation hub) waiting for a connecting flight also is creditable time.

In the Department, “usual waiting time” is 2 hours for domestic travel and up to 4 hours for international travel.

Non-Creditable Travel Time

The following do not qualify as creditable time:

- Unusually long or extended waiting periods that occur prior to an employee’s initial departure time or between actual periods of travel if the employee is free to rest, sleep, or otherwise use the time for his/her own purposes;

- Long waiting periods that occur during an employee's regular scheduled working hours; these periods are compensable as part of the employee's regularly scheduled administrative workweek;

- Time spent traveling outside of an employee’s regular working hours to or from a transportation terminal that are within the limits of the employee’s official duty station;

- Time spent traveling in connection with the performance of union representational activities;

- Time spent traveling on a holiday or an “in-lieu-of” holiday; the employee is entitled to his or her rate of basic pay for the holiday hours; and

- Time spent at a temporary duty station between arrival and departure times; and

- Meal times.

Once an employee arrives at the temporary duty station (i.e., TDY work site, training site, or hotel at the temporary duty station), the employee is no longer considered to be in a travel status. Any time spent at a temporary duty station between arrival and departure is not creditable for earning compensatory time off for travel.

Offsetting Normal Commuting Time

When an employee travels directly between the home and a temporary duty station that is outside the limits of the employee's official duty station, the employee's normal “home-to-work/work-to-home” commuting time must be deducted from the creditable travel time.

Normal commuting time must also be deducted from the creditable travel time if the employee is required to travel outside of regular working hours between the home and a transportation hub outside the limits of the employee's official duty station.

Travel between Multiple Time Zones

When an employee’s travel involves two or more time zones, the time zone from the point of first departure must be used to determine travel status for accruing compensatory time off. For example, if an employee travels from his official duty station in Washington, DC, to a temporary duty station in Boulder, CO, the Washington, DC, time zone must be used to determine hours in a travel status. However, on the return trip to Washington, DC, the time zone from Boulder, CO, must be used to determine hours in a travel status

Timeframes for Use

An employee must use accrued compensatory time off by the end of the 26th pay period after the pay period during which it was earned and reported on the webTA.

All compensatory time off for travel must be used in the chronological order in which it was earned; that is, time earned first is used first.

Forfeiture of Unused Hours

Accumulated compensatory time that is unused by the end of the 26th pay period after the pay period in which it was earned is forfeited. Unused balances are also forfeited when an employee voluntarily transfers to another agency or separates from Federal service. Forfeited hours may not be paid or restored.