- Back to Menu

- Military Basics Overview

- New to the Military

- Advancing in the Military

- Logistics for Service Members

- Wounded, Ill or Injured & Their Caregivers

- Deployment Overview

- Preparing for Deployment

- During Deployment

- Returning Home From Deployment

- Transitioning & Retiring Overview

- Military Separation

- Transitioning to Civilian Life

- Joining the Guard & Reserves

- Casualty Assistance Overview

- Support After Loss

- Understanding Grief

- Survivor Finances & Legal

- Making the Final Move

- Moving & PCS Overview

- Preparing to Move

- Moving Your Personal Property

- Settling in After Moving

- OCONUS/Overseas Moves

- Housing & Living Overview

- On-Base Housing

- Off-Base Housing

- Making the Most of Your Installation

- Living Overseas

- Disaster Preparedness

- Recreation, Travel & Shopping Overview

- MWR, Recreation, Fitness & Libraries

- Travel & Lodging

- Commissary & Exchange

- Relationships Overview

- Friendships & Single Life

- Support Community

- Married Life & Domestic Partnerships

- Separation & Divorce

- Parenting Overview

- New Parents

- Adoption & Foster Care

- Children, Youth & Teens

- Child Care Programs

- Preventing Harmful Behaviors

- Military Family Life

- Special Needs Overview

- EFMP — Exceptional Family Member Program

- Support for Families With Special Needs

- Medical Needs

- Educational Needs

- Health & Wellness Overview

- Prevention & Care

- Mental Health

- Nutrition & Fitness

- Substance Abuse

- Safety From Violence & Abuse Overview

- Unhealthy Relationships

- Domestic Abuse

- Child Abuse

- Financial & Legal Overview

- Personal Finance

- Education & Employment Overview

- For Spouses

- For Service Members

- For Youth & Teens

- Service Member

- New Service Member

- Transitioning Service Member

- National Guard Member

- Wounded Warrior

- Retiree/Veteran

- Family With Special Needs

- Service Provider or Leader

- Extended Family or Friend

- View Benefits Finder

- Military OneSource Services

- Planning & Prevention

- Discounts & Perks

- Pay & Leave

- Education & Employment

- Family & Child Care

- Relationships

- Health Care & Emotional Well-being

- Assistance Programs

- Popular Benefits

- Space-A Travel

- DOD MWR Libraries

- View Resources Finder

- MilLife Guides

- Military OneSource Network Websites

- Government Websites

- External Websites

- Directories & Tools

- Online Learning

- Mobile Apps

- Popular Resources

- MilitaryINSTALLATIONS

- Plan My Move

- Moving Personal Property

- Other Resources

- Data, Research & Statistics

- View Products Finder

- Popular Product Types

- Book/Booklets

- Fact Sheets

- Educational Items

- Popular Products

- Steps to a Smart Move Infographic

- Preparing for Your Move Fact Sheet

- Military and Family Life Counseling Brochure

- Benefits of Commissaries Fact Sheet

- Spouse Ambassador Network Fact Sheet

- Start at the Table Book

- Non-medical Counseling

- Military OneSource Non‑medical Counseling

- Military and Family Life Counseling

- Specialty Consultations

- Building Healthy Relationships

- Health & Wellness Coaching

- New MilParent

- Peer-to-Peer

- Special Needs

- Spouse Relocation & Transition

- Transitioning Veterans

- Interactive Tools & Services

- Financial Counseling

- MilTax: Free Tax Services

- Language Services

- Caregiver Support Services

- Spouse Education and Career Opportunities

- Resilience Tools

- My Military OneSource App

- Chill Drills App

- Domestic Abuse Victim Advocate Locator

- Relationship Resource Tool

24/7/365 Access to Support

No matter where you serve or live, free and confidential help is available.

- 800-342-9647

- Call Us OCONUS

- Call Us TTY/TDD

- Veterans/Military Crisis Line

Dial 988 then press 1 or text 838255

Chat with a VA responder

Call from OCONUS

www.veteranscrisisline.net

- National Domestic Violence Hotline

Call 800-799-SAFE (7233)

Chat live now

Text “START” to 88788

- DOD Safe Helpline - Sexual Assault Support

Call 877-995-5247

www.safehelpline.org

- 988 Suicide & Crisis Lifeline

Chat with a crisis responder

Use your preferred relay service, or dial 711 then 988

- Domestic Abuse Victim Advocate Locator - Family Advocacy Program

Find an advocate.

In the United States, call 911 if you are in an emergency.

For those outside the United States, call your local emergency number.

- Casualty & Mortuary Affairs

- Child & Youth Advocacy

- Child & Youth Programs

- Commissary, Military Exchange & Lodging

- Family Advocacy Program

- Military Community Support Programs

- Military & Family Life Counseling

- Military Family Readiness Programs

- Military Funeral Honors

- Morale, Welfare & Recreation (MWR)

- Office of Special Needs

- Personnel Accountability & Evacuations Operations

- Spouse Education & Career Opportunities

Contact Military OneSource

Information and support for service members and their families. About the Call Center .

- Additional Ways to Contact Us

PCS: The Basics About Permanent Change of Station

Each year more than 400,000 service members make a permanent change of station. As a service or family member, you probably expect a permanent change of station to be part of your military life. In this article we break down what you need to know about PCS.

Received PCS orders?

Military OneSource moving experts can help you with moving tips, information about your new duty station and everything you need to master your PCS.

Overseas? OCONUS dialing options .

START LIVE CHAT

What your PCS orders include

Unlike temporary duty assignments, permanent change of station orders are a longer-term assignment, generally two to four years. Broadly speaking, your orders will tell you where you’ll be moving to – either CONUS or OCONUS.

- CONUS: Inside the continental United States

- OCONUS: Outside the continental U.S. Includes Alaska, Hawaii and U.S. territories.

Your orders include important information related to your authorizations and entitlements. You will need a copy of your orders to coordinate your military move.

Organizing your move

Moving can be a challenge, and in times of global uncertainty it is more important than ever to know the best ways to organize the logistics of your move and act fast once you get your orders. The Defense Department provides a variety of resources to help make your PCS as easy and safe as possible:

- Personal Property Customer Service Contacts

- Personal Property resources such as packing guides and tips, entitlement brochures, FAQs about shipping your household goods and more

- Defense Personal Property System , or DPS, log in link and information

- Plan My Move is an online tool that helps you create, organize and manage your PCS through customized checklists, so you can stay on top of important to-dos as you go through the moving process. Answer a couple of questions and you’re on your way to building your custom checklist.

- Military OneSource is available 24/7 anywhere in the world with expert moving consultants and online tools and resources to help you get organized and settled. Call anytime to speak with a consultant, or set up an online chat. Learn more about arranging a personal property shipment and find out how our experts can help you master your PCS.

Pinning Down PCS Success

Looking to pin down resources to get ahead of your move? From your local Relocation Assistance Program office to the Plan My Move, Defense Personal Property System and MilitaryINSTALLATIONS tools, you can get answers to questions and take control of your move.

Relocation assistance and resources

There are a variety of resources both online and through your installation to help you transition before, during and after your move:

- Your installation’s Relocation Assistance Program is a great source of information and support for moving and getting settled at your new duty station. Relocation experts offer pre-departure briefings, newcomer orientations, and information about job opportunities, child care, school liaisons and more. Connect early in your PCS planning to make the most of the resources provided by your local relocation assistance program.

- The MilitaryINSTALLATIONS website provides comprehensive information about military installations worldwide. Search for programs and services, access information on temporary housing, check-in procedures, schools, surrounding community, contact information and more. Learn how to explore your base and beyond with MilitaryINSTALLATIONS .

- Your military sponsor is someone from your unit who is assigned to assist you throughout your PCS. Typically, your unit will assign a service member of similar rank and family make-up to help you learn the ropes at your new duty station. Learn more about the benefits of sponsorship in the Sponsorship MilLife Guide.

- The Blog Brigade website offers insider moving tips and military life insights from other service members and spouses.

Personally procured moves for do-it-yourself movers

If you prefer to organize your move yourself, you may be able to choose a personally procured move , or PPM. You are eligible for a PPM when you have PCS orders, a temporary duty assignment, or face separation, retirement or assignment to, from or between government quarters.

During a PPM, you coordinate the move of your household goods yourself without using any military moving services. This means that you are responsible for all the planning and communications that a military-coordinated move usually handles. Doing it all yourself can mean added stress and possible problems.

But military moves don’t have to be exclusively one or the other. You can use some military moving services and manage other parts of the move yourself. For more information, contact your local transportation office or ask a Military OneSource moving expert.

Whether this is your first PCS or you’re a seasoned professional, let Military OneSource help you master your move so you can get on with your mission.

Related Articles

Was this article helpful, we are sorry you didn’t find this article helpful. please provide a little more information to help us improve..

Learn about military bases worldwide. Get installation overviews, check-in procedures, housing, neighborhood information, contacts for programs and services, photos and more.

Find an Installation

View All Installations

Click "Extend" below to stay logged in.

If you are part of the general public, navigate to the public site. This site is solely for testing and approving site pages before they are released to the general public.

Military Travel (PCS) Move Services And Allowances

Military Service Members Enjoy a Number of Benefits When Moving

- US Military Careers

- Technology Careers

- Sports Careers

- Project Management

- Professional Writer

- Music Careers

- Legal Careers

- Government Careers

- Finance Careers

- Fiction Writing Careers

- Entertainment Careers

- Criminology Careers

- Book Publishing

- Animal Careers

- Advertising

House Hunting Prior to a Move

- Temporary Lodging Expense (TLE)

- Temporary Lodging Allowance (TLA)

Dislocation Allowance

Per diem for pcs travel, travel by poc, dependent travel within conus, dependent travel outside conus, household goods transportation, limited hhg transportation overseas.

- Non-Temporary Storage

Additional Consumables Allowance

Mobile home transportation, transportation of povs, pov storage.

Rod Powers was a retired Air Force First Sergeant with 22 years of active duty service.

- Air Force NCO Academy

When a member of the U.S. military makes a permanent change-of-station (PCS) move from one duty station to another, they are entitled to a number of services and monetary allowances.

The list of all of those benefits are too numerous to list here, but below you'll find a quick guide to the major entitlements authorized in conjunction with moving from one duty assignment to another.

A few months before the move to your next duty station , military members are allowed a permissive TDY (temporary duty) for up to 10 days in conjunction with a PCS move within the 50 states and the District of Columbia. You must travel and stay in temporary lodging on your own dime (no transportation or per diem paid), but you will not be charged for up to 10 days leave.

You can select when you prefer to take these 10 extra days of leave. You can choose to travel months in advance of your PCS move and see the local options for living arrangements, or you can take the extra 10 days of house-hunting leave and take your normal leave as you make this transition. However, if you are still living in the barracks, dorms, or on ship, you cannot take house-hunting leave.

Temporary Lodging Expense (TLE)

TLE is an allowance given to partially offset lodging and meal expenses when a member and/or dependents need to occupy temporary lodging in CONUS (continental United States) in connection with a PCS. The member receives reimbursement for temporary lodging and meal expenses.

If the member is moving from one CONUS base to another, he or sshe is authorized up to 10 days TLE, either at the former duty station or at the new duty station (or any combination, up to 10 days total). Typically, the base has temporary quarters in the form of a Navy Lodge or Air Force Inn, but if not the local hotels will have to be used and the full amount of TLE can be authorized.

TLE is not the same as per diem. Per diem is actual pay and reimbursement for lodging made during the actual travel days from one duty station to another. TLE is pay and reimbursement for temporary lodging in CONUS at the old duty station, before departure, or at the new duty station once the service member arrives.

Temporary Lodging Allowance (TLA)

TLA is for OCONUS (outside the continental United States) or overseas PCS moves. Up to 60 days—which can be extended—may be paid for temporary lodging expenses and meal expenses after a military member and family arrive at a new overseas location while awaiting housing. Up to 10 days of TLA can be paid for temporary lodging expenses in the overseas location prior to departure.

Military members may be entitled to a dislocation allowance (DLA) when relocating their household due to a PCS. DLA is intended to partially reimburse relocation expenses not otherwise reimbursed. DLA amounts vary by rank and dependency status.

Military members receive a per diem allowance, which is designed to partially reimburse for lodging and meal expenses when traveling from one duty station to another.

When traveling by what is referred to as "privately owned conveyance" (POC), military members are paid a flat rate per day for each day of authorized travel used. When the member travels by commercial means, they are paid the established per diem rate for the new permanent duty station (PDS), or the rate for the delay point if the member stops overnight.

Per diem for dependents is 75% of the member's applicable rate for each dependent 12 years old or older and 50% of the member's rate for each dependent under 12 years.

When members elect to travel to their new duty station by POC (such as with their own automobile or motorcycle), they are entitled to receive a mileage allowance. The reimbursement rate depends on the number of authorized travelers in the vehicle.

Dependents who travel within CONUS may use commercial means, unless they elect to travel by POC. The military member can be reimbursed for this travel up to what it would have cost the military to purchase an airline ticket.

Dependents can travel to overseas assignment locations, either via military aircraft or by commercial means. However, if a service member purchases their own commercial airline tickets for travel to an overseas assignment location, the military may only reimburse if the aircraft is a U.S. flag air carrier. The only time one can be reimbursed for flying on a commercial foreign carrier is if Air Mobility Command does not service that overseas location.

Military members can ship up to 18,000 pounds of household goods (HHG) from their old duty station to their new duty station. In addition to allowing the military to arrange for movement of household goods, the member can elect to move it themselves , and receive reimbursement if the move is within CONUS.

If the military member's orders state that government furnishings are provided at the overseas location, the member's household good weight shipping allowance is limited to 2,500 pounds or 25 percent of HHG weight allowance, plus non-available items. Additional items (up to the weight allowance) can be placed in non-temporary storage.

Non-Temporary Storage

Military members can elect to have the military store all or part of their household goods on a permanent basis during the assignment, up to the maximum weight allowance.

This is a separate allowance for annual shipment of up to 1,250 pounds per year of consumable items. This weight is in addition to the household goods weight limit.

When moved by a commercial transporter, reimbursement includes carrier charges, road fares, tolls, permits, and charges for the pilot car. If towed by POC, reimbursement is for actual costs. Reimbursement is limited to what it would have cost the government to transport a member's maximum HHG weight allowance.

Military members can ship POVs in conjunction with many overseas assignments (and, of course, can ship them back to the CONUS, upon completion of the assignment). The military services can apply restrictions on this entitlement. For example, for assignments to Korea, military members must be "command sponsored" (allowed to be accompanied by family members), or must be in the grade of E-7 or above, in order to ship a vehicle.

Members may also be authorized shipment for a replacement POV during any four-year period while assigned overseas.

The military also authorizes mileage reimbursement when driving the vehicle to the authorized port for shipment, and when picking up the vehicle from the authorized receiving port.

There is only limited authority for POV shipment within CONUS. Shipment within the CONUS is authorized only when medically unable to drive, there is a homeport change, or the individual does not have enough time to drive.

A member is authorized storage of a POV either when ordered to an overseas assignment to which POV transportation isn't permitted or the member is sent TDY on a contingency operation for more than 30 days.

Six months prior to making your PCS move, look into all the different services and allowances you are entitled. Do your homework, as you will need to reference the Department of Defense webpages and your personnel support on your local base to set up the move to your new base.

Official websites use .mil

Secure .mil websites use HTTPS

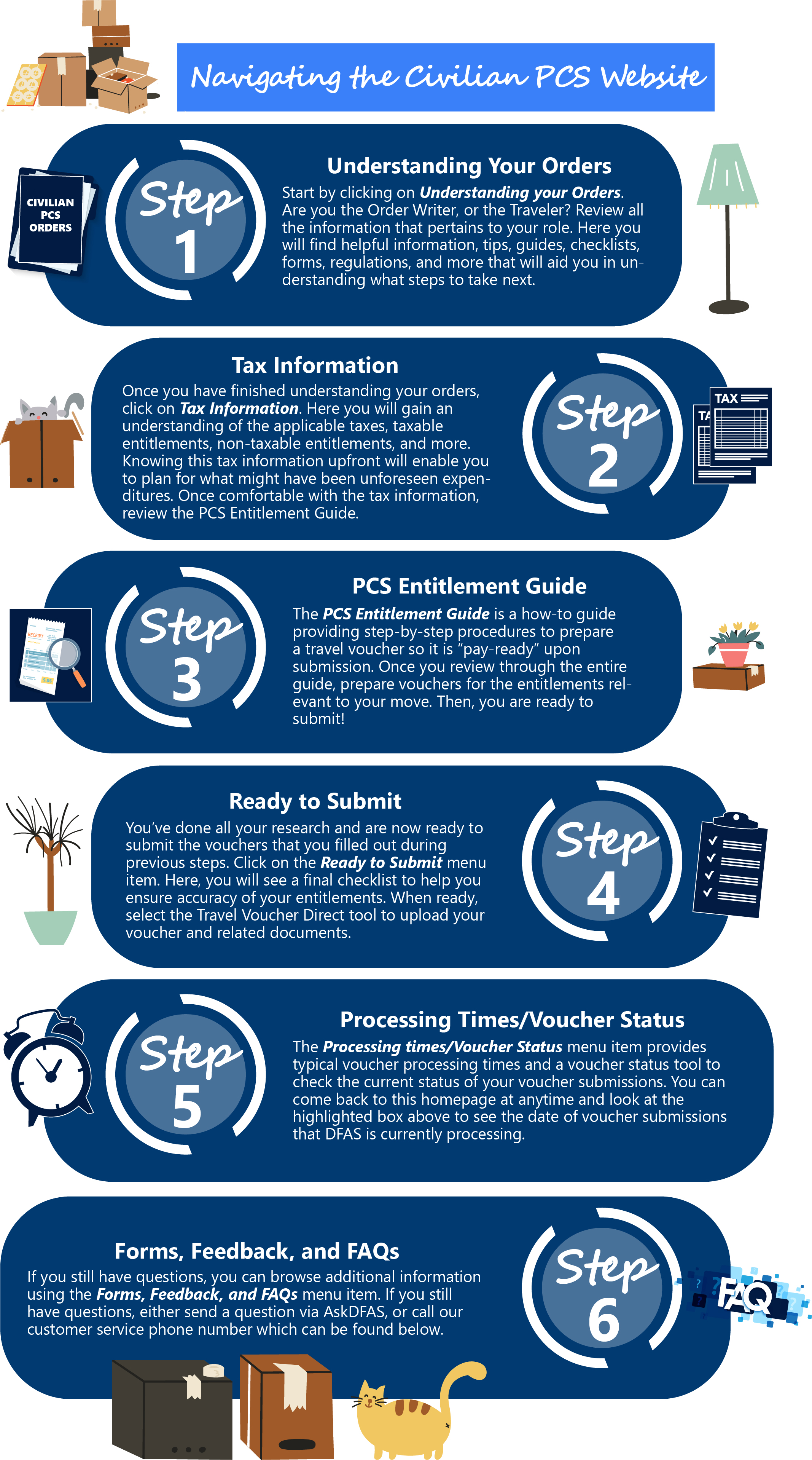

Customer Service

- Civilian PCS Home

- For the Order Writer

- For the Traveler

- Step 2 - Tax Information

- About the Civilian PCS Entitlement Guide

- Submitting your advance or settlement voucher

- Taxable Entitlements

- Withholding Tax Allowance

- Travel Advance Entitlement

- House Hunting Trip

- En Route Travel

- Temporary Quarters Subsistence Expenses (TQSE)

- Miscellaneous Expense Allowance (MEA)

- Movement and Storage of Household Goods (HHG)

- Privately Owned Vehicle (POV) Shipment

- Privately Owned Vehicle (POV) Drop off and/or pick up

- Real Estate

- Home Marketing Incentive Payments (HMIP)

- Unexpired Lease (UEL)

- Renewal Agreement Travel (RAT)

- Relocation Income Tax Allowance (RITA)

- Step 4 - Submit Travel Voucher

- Step 5 - Check Voucher Status

- Step 6 - FAQs, Feedback and Forms

Civilian Permanent Change of Station (PCS)

- By Category

- By Component

- By Life Event

- State/Territory Benefits

- Resource Locator

- Benefit Library

- Federal Benefits

Permanent Change of Station (PCS) CONUS

Benefit fact sheet.

There are numerous steps in the Permanent Change of Station (PCS) process. Through various agencies the Department of the Air Force provides guidance and counseling to assist Service members and their Families in making the best choices.

To further ease the process of Permanent Change of Station (PCS) moves , the Secretary of Defense has directed the Department to:

- Permanently increase standard TLE maximum coverage from 10 to 14 days for CONUS moves and allow up to 60 days of TLE if a Service member is in a specified Military Housing Area with a housing shortage, that went into effect in October 2022 .

- Increase the Dislocation Allowance (DLA) for E-1 to E-6 Service members, to further help offset personal expenses for PCS moves. DLA payments for all Service members will be paid automatically one month prior to their move date to pre-empt out-of-pocket expenses. This went into effect October 2022 .

For more information, please visit: https://www.defense.gov/News/Releases/Release/Article/3167769/dod-announces-immediate-and-long-term-actions-to-help-strengthen-the-economic-s/

Active duty Airmen and Guardians who make a PCS are entitled to receive PCS services and allowances to help manage the move.

A Permanent Change of Station (PCS) much like everything else in the military is a process. There are various agencies in place to help with any questions or concerns you may have during any stage of your move.

1) Notification of Move - Most PCS orders, DAF 899 , Request and Authorization for Permanent Change of Station – Military, are produced in the Virtual Out-Processing Application (vOP)

Normal Orders Processing - The Military Personnel Flight (MPF) can begin drafting PCS orders in vOP at any time after the assignment notification is received and acknowledged by the Airman. The MPF vOP Technician/Approving Official submits orders for authentication not later than 60 days prior to departure per Department of the Air Force Manual 36-2102 , Base-Level Relocation Procedures. The orders are then sent to Air Force Personnel Center’s (AFPC) Total Force Service Center (TFSC) Assignments Section via vOP for authentication. AFPC TFSC Assignments Section authenticate orders by the projected departure date, or PDD, in vOP. Orders will be authenticated no earlier than 120 days prior to the PDD unless an exception to policy is approved by AFPC Military Assignments Programs Branch.

Exceptions to Policy- Exception to policy reasons may include obtaining a diplomatic or official passports, requiring dependents to obtain a Visa, per Foreign Clearance Guide or short notice assignments, in accordance with DAFI 36-2110 . All exception to policy requests must be submitted by the Airman through myFSS ; select PCS Order Exception Waiver.

Expedited Orders Request- Expedited processing requests are submitted by the MPF for short notice assignments or cases where orders are submitted and the Airman's PDD is within 36 hours of the order submission date, or if extraordinary circumstances exist. Justification is required. The MPF relocation function sends expedited processing requests via email to the AFPC TFSC Assignments Section and may follow up on requests 24 hours after submission.

2) Documents required for orders – The following documents are required to receive your PCS orders. DD Form 1172-2 , DEERS verification form is required to receive your PCS orders and must be turned in if you have dependents. This form can be obtained from MPF Customer Service.

Retainability (If applicable): If you need retainability for the assignment, print off the Retainability Memorandum and provide to the MPF/Reenlistment and Extension Section. The retainability must be completed within 30 days of receiving your initial assignment notification. Failure to complete the retainability in the required timeline could result in cancellation of assignment.

Personnel Processing Codes (if applicable): They are 3 letter codes that require you to accomplish additional actions prior to orders being issued and/or out processing. If applicable, the PPC guide/description will be included in your initial assignment notification e-mail.

Advance Basic Pay - Advance Basic Pay is similar to an interest-free loan for a PCS with military salary as collateral. Repayment is normally made in 12 equal installments beginning the month after it is drawn. Request using DD Form 2560

Permissive TDY (PTDY) - Typically up to 10 days, where leave is not charged, and is granted by a unit for purposes of relocating.

Leave - Submit an DAF 988 , Leave Request/ Authorization if you wish to take leave in conjunction with a PCS.

3) Orders - To proceed with arranging your move you will receive an approved set of orders.

4) Moving Services and Transportation - Moving services can be arranged using M ilitaryOneSource and logging into the Defense Personal Property System (DPS) or in person at your local Traffic Management Office (TMO).

You cannot use DPS if…

This is your first personal property move

This is your last personal property move (you are separating or retiring)

You are storing or moving personal property AND you have contingency or deployment orders

You are storing or moving personal property AND moving your family to an overseas location

You are not the property owner AND you are using a Power of Attorney (POA)

You are moving personal property as “next of kin” or Summary Courts Officer.

Provide the following at time of counseling:

Complete set of orders/authorization, including amendments, for each type of shipment planned (e.g., Household Goods (HHG), Non-Temporary Storage (NTS), Unaccompanied Baggage (UB))

An idea of when you want to move and an estimated weight. Be as flexible as possible when selecting HHG pack and pickup dates. Your preferred dates may not be available during some periods such as summer or days near official holidays. Avoid scheduling lease termination or house sale closing on the same date your HHG are to be packed, picked up, or delivered. Leave some time in your schedule for the unforeseen. You or your designated representative must be available between the hours of 8:00 am and 5:00 pm local time on pack, pickup, and delivery dates.

The date you plan to arrive at your new duty station. Your arrival date assists your Transportation Service Provider (TSP) and/or local TMO with scheduling delivery of your shipment(s), which may reduce storage costs paid by the Government

What type of shipment you want to make (HHG, UB and/or NTS) and the estimated weight. Do not forget to declare Professional Books, Papers, and Equipment / Professional Gear (PBP&E/Pro-Gear)

Information on excess cost. The minimum excess cost is approximately $100.00 per hundred pounds over the maximum weight allowance.

A list of large or unusual items (e.g., large screen TV [i.e., plasma, LCD, DLP], piano, pool table, china cabinet, wall unit, satellite dish, hot tub, boat, motorcycle, recreational vehicle)

A letter of authorization signed by you or a POA; required if you are unable to visit the TMO. You may appoint your spouse or an agent to act on your behalf. Be sure the person you choose knows what you want and has the information to make the right arrangements. Remember, this person is acting for you, and you are responsible for that person’s decisions.

Personally Procured Move (PPM) , formerly called Do It Yourself (DITY)

The PPM program allows you to personally move HHG and either be reimbursed up to the Government’s cost or to collect an incentive payment from the Government.

The TMO must provide counseling and prior approval for a PPM move. Failing to comply with Service requirements of the program may limit payment or result in complete denial of your claim.

Weight estimator for a PPM

U.S. Transcom provides an “It’s Your Move” Guide to assist Service members in understanding allowances and responsibilities during the packing, shipping and storage of household goods.

Weight Allowance

Moving allowance is based on the Service members rank, dependency status, and if the move is Outside the Continental United States (OCONUS) or in the Continental United States (CONUS). Overages are the Service member’s financial responsibility. For up to date information regarding household goods weight allowance see the DoD Joint Travel Regulations

To estimate weight of your personal belongings use a weight estimator calculator .

Professional Books, Papers, and Equipment / Professional Gear (PBP&E) Allowance

PBP&E is limited to 2,000 pounds net weight and does not include personal computers and accompanying equipment, and/or awards presented for significant contributions while performing official duties.

PBP&E/Pro-Gear is defined as:

HHG in a member’s possession needed for the performance of official duties at the next or a later destination

If you have PBP&E/Pro-Gear to declare, you must do so in DPS

If your estimated and declared PBP&E/Pro-Gear weighs 1,000 pounds or less, there will be no additional approval or review of your declared Pro-Gear and it may be included and packed with the rest of your HHG

If your estimated and declared PBP&E/Pro-Gear weighs more than 1,000 pounds, your Service may review your declaration and items at their discretion outside of DPS

When PBP&E/Pro-Gear is properly declared in or DPS, the weight of PBP&E/Pro-Gear does not count against the total weight of your shipment(s). Before signing your inventory prepared by the TSP(s), be sure these items are declared as “PBP&E/Pro-Gear”. The proper designation of these items and the exclusion of the weight can be very important.

The following items are considered PBP&E/Pro-Gear:

Reference material not ordinarily available at the next Permanent Duty Station (PDS)

Instruments, tools, and equipment peculiar to technicians, mechanics, and members of the professions

Specialized clothing such as diving suits, astronaut’s suits, flying suits and helmets, band uniforms, chaplain’s vestments, and other specialized apparel not normal or usual uniform or clothing

Communications equipment used by a member in association with the Military Affiliated Radio System

Individually owned or specially issued field clothing and equipment

Government- or uniformed service-owned accountable organizational clothing and individual clothing property issued to the employee or member by the Service/DoD component for official use.

Excluded from PBP&E/Pro-Gear are:

Commercial products for sale/resale used in conducting business

Sports equipment

Office furniture

Household furniture

Shop fixtures

Furniture of any kind even though used in connection with PBP&E/Pro-Gear (e.g., bookcases, study/computer desks, file cabinets, and racks)

Personal computer equipment and peripheral devices

Memorabilia, including awards, plaques, or other objects presented for past performance (includes any type of going-away gifts, office decorations, pictures, etc.)

Table service, including flatware (including serving pieces), dishes (including serving pieces, salvers, and their heating units), other utensils, and glassware

Other items of a professional nature that are not necessary at the next/subsequent PDS, such as textbooks from previous schools unrelated to future duties; personal books, even if used as part of a past professional reading program or course of instruction; and reference material that ordinarily would be available at the next/subsequent PDS either in hard copy or available on the Internet.

What to expect from your Transportation Service Provider (TSP)

TSP’s Responsibilities (at Origin):

Conduct Pre-Move Survey (physical or telephonic) depending on the type of shipment and estimated weight. It should be conducted prior to the first day of packing.

Begin packing/pickup between 8:00 am and 5:00 pm

Protect appliances against damage while in transit. The TSP secures moving parts that, if allowed to move in transit, could damage the appliance.

Use new, clean packing materials for linen, clothing, and bedding

Use new or like-new packing materials for all other items. Excelsior or newspaper is not allowed. Items packed in boxes should be padded and insulated from carton walls.

Pack mirrors, pictures, and glass tabletops in specially designed cartons

Wrap and protect all finished surfaces from marring or scratching; use furniture pads

Properly roll and protect rug and rug pads at residence. Only small throw rugs may be folded.

Pack all designated PBP&E/Pro-Gear in separate boxes. These cartons must be marked “PBP&E/Pro- Gear”, weighed separately, and listed on the inventory form.

Put all nuts, bolts, and screws from a disassembled item in a bag and attach securely to the item

Mark each carton to show general contents

Prepare an accurate and legible inventory

Obtain approval from the TMO prior to loading on the tailgate of the moving van

Remove all excess packing material from your residence

TSP’s Responsibilities (at Destination):

Begin delivery between 8:00 am and 5:00 pm

Perform a one-time placement of rugs prior to placement of your HHG

Place each item or carton in the room you indicate. This one-time placement includes placing unpacked articles in cabinets, cupboards, or on kitchen shelves when convenient, safe, and it is your desired location. Have placement planned out before the TSP arrives. TSPs are required to place each item only once.

Assemble all furniture and equipment if disassembled at origin

Remove packing and blocking from appliances. The TSP is not required to connect appliances to electric, gas, or water outlets.

Provide a “Joint” written record of any loss and/or damage at delivery on DD Form 1842 or on the “Defense Personal Property Program Notification of Loss or Damage AT Delivery” Form. You and or your designated representative along with the delivery TSP sign this form. The TSP’s representative must provide a copy of this form.

TSPs are not required to go into an attic, crawl space, or similar storage area for the purpose of delivering and placing personal property

Once the shipment has been delivered, the TSP is not required to deliver property to a self-storage facility.

NOTE: It is not advisable to waive unpacking at any time during the delivery. However, if unpacking is waived, the TSP is not required to return later to unpack or remove debris

5) Housing - Installations are required to provide Housing Support and Referral Services to all DoD personnel and their dependents to help locate suitable, affordable, and nondiscriminatory housing in the local community or in privatized housing. In accordance with DoD policy, Service members shall obtain housing support services prior to agreeing to rent, lease, or purchase housing. Your orders should also state to contact the Housing Office prior to entering into a rental or lease agreement. This requirement is in your best interest to ensure you make fully informed decisions on housing for you and your family at your new assignment.

Housing Early Assistance Tool (HEAT) creates an easy on-line experience to connect you, the Service member, with your future destination and offers an on-line venue to obtain housing assistance prior to a PCS transfer. The Air Force has successfully implemented HEAT across the AF Enterprise so members can reach out to installations when preparing for transition. Installations are accessible through the HEAT tool across CONUS and most OCONUS installations. Members should use HEAT when preparing to transfer to their new assignment. The housing options that are available when relocating:

Government Owned / Controlled Housing: Property is owned, managed, and maintained by the Department of Defense. Basic Allowance for Housing (BAH) is forfeited to cover the cost of rent, maintenance and utilities. Use the Resource Locator for housing information at your destination.

Privatized Military Housing: Property is managed and maintained by a private entity. BAH is paid, typically by allotment, to cover the cost of rent, maintenance and some utilities. Use the Resource Locator for housing information at your destination.

Rental Property: The DoD provides HOMES.mil which is designed to connect Service members and their families with community housing rental listing located near U.S. military bases. Remember to ensure your lease contract incorporates the Servicemembers Civil Relief Act (SCRA) an additional protection to military members. Service Members are required to have their lease reviewed by the Housing Services Office before signing.

Purchase a Home: Service members may also choose to purchase a home. See the DoD Homeowners Assistance Program (HAP) and VA Home Loan Fact Sheets for purchase information.

Unaccompanied Personnel with Dependents - Unaccompanied personnel with dependents who voluntarily separate from their dependents are sometimes referred to as “geographic bachelors.” Unaccompanied personnel with dependents must submit an exception to policy through their chain of command to the housing office for processing to reside in UH. If approved, they are housed on a “space available” basis.

Your local housing office is available to provide more information. Be sure to check local BAH rates before deciding on which option is right for your family.

6) Claims - Unfortunately, you may suffer loss or damage to your personal property during movement. If your property is lost or damaged, you have the right to file a claim directly with the TSP.

First you must give written notice to the TSP that you intend to file a claim you can do this ether at delivery or afterwards.

At delivery- Review and sign the Notification for Loss and Damage at Delivery Form given to you by the delivery crew.

After delivery- Using the Defense Personal Property System (DPS) submit the Notification of Loss and Damage After Delivery. The form can be found under "Start My Loss & Damage Report".

Next, within nine months from the delivery date you must file a claim with DPS. Log on to DPS and click on "Start my Loss and Damage Report". Have as much information as possible regarding each item listed in your claim to include: manufacturer, inventory item number, cost at purchase and year of purchase. Also include a description of the damage and repair or replacement estimate. Once your claim is submitted the TSP must confirm receipt of your claim within 15 calendar days. The TSP is responsible for assessing the value of your property and may inspect the damaged property, repair items, or pick up any items damaged beyond repair.

If a claim is filed directly with the TSP within nine months of delivery, then the TSP’s maximum liability on each domestic HHG is:

$7,500 per shipment or

$6.00 times the net weight of the HHG shipment, or gross weight of the UB shipment, in pounds, not to exceed $75,000, whichever is greater.

For direct claims settlement between member and TSP:

Claims must be filed through DPS

Claims must be filed with the TSP first to maintain Full Replacement Value (FRV) eligibility.

A member has the option to transfer the claim to the military claims service after 30 days. In these instances, the military claims service pays the member a depreciated value and then pursues the FRV claim with the TSP. After settlement with the TSP, if the FRV settlement exceeds the amount paid by the military claims service to the member, the member receives the difference.

Accepting a Claim Offer The TSP will provide you with an itemized listing of their offer for each item. You can accept or make a counter offer for each item listed. You may be offered a cash payment or having an item replaced in lieu of cash. You will submit your final offer acceptances into DPS to complete the process.

Inconvenience Claims An Inconvenience Claim is paid by the TSP when they fail to meet the required pickup and delivery dates for your PCS. You must meet the following conditions you may be eligible for an Inconvenience claim.

The TSP fails to pick up a shipment upon the agreed date

The TSP fails to deliver on or before the required delivery date, provided you are in possession of residence and are available to receive the delivery

The TSP places your shipment into storage in transit, or SIT, without you being notified

You have requested your shipment be released from SIT and the carrier is unable to deliver the shipment within the following dates:

Seven government business days from the date you first make requested delivery

Within two government business days, when your requested delivery date is more than seven business days out.

TSP should notify you within a few days of the delivery date if there is an expected delay with your shipment. Download the DP3 Shipment Inconvenience Claim Form and contact your Transportation Office is you believe you are owed an Inconvenience claim.

For household good shipments picked up after May 15, 2020 instead of submitting receipts for the first seven days of meals you have the option to receive 100% reimbursement of the local per diem for meals and incidental expenses. If your expenses were more than per diem, you can choose to submit receipts and be reimbursed 100% of your out of pocket costs.

7) Monetary Allowances and Subsidies

Transferring your Professional License: The 2018 National Defense Authorization Act allows each service branch to reimburse the Service member up to $1,000 for Spouse's re-licensure and certification costs resulting from relocations or PCS moves that cross U.S. state lines. Learn more about licensing and certifications from the Installation Military & Family Readiness Center, the Department of Labor website at https://www.dol.gov/agencies/vets/veterans/military-spouses , and the DoD Spouse Education and Career Opportunities Program . Free Career Coach counseling is also available by calling 800-342-9647.

Travel Voucher

For a detailed guide on how to complete the DD 1351-2 click here .

SmartVoucher can be used to make filling in your DD Form 1351-2 easier. Sending in vouchers that are legible, correct and include all the necessary information and documents is the first step in getting your travel claim paid promptly. After you’ve sent your voucher, check your claim status online at: https://www.dfas.mil/militarymembers/travelpay/checkvoucherstatus/ .

Documents to include when claiming entitlements:

DD Form 1351-2 voucher

Complete set of orders and all amendments

Receipts showing the following

Company name

Date item/service was provided

Cost of item/service

Taxes shown as a separate item on receipt

Proof of payment (marked “paid” or amount due $0.00)

Dislocation Allowance (DLA) The purpose of DLA is to partially reimburse a member for the expenses incurred in relocating the household on a PCS, ordered for the Government's convenience, or incident to an evacuation. This may be paid in advance. For current rates see the Defense Travel Management Website .

Monetary Allowance in Lieu of Transportation (MALT) MALT is used as mileage reimbursement for Service members and their dependents during a PCS move. When a member and dependents relocate on a Service member’s PCS move, MALT reimbursement is authorized for two privately-owned conveyances (POCs), if used. MALT is paid on a per mile basis for the official distance of each portion of the travel. The MALT Rate per authorized POC is $0.22/mile for PCS travel beginning on or after 1 July 2022.

Per Diem is used to reimburse Service members for travel expenses. Rates are set each fiscal year and determined based on location. There are three components to this allotment: lodging, meals and incidentals.

For information on Per Diem rates at your location use the Per Diem Calculator .

Temporary Lodging Expense (TLE)

TLE is an allowance intended to partially pay members for lodging/meal expenses incurred by a member/dependent(s) while occupying temporary lodging at a CONUS location in association with a PCS move.

TLE is only authorized in the vicinity of the old/new PDS; it is not authorized for house hunting.

TLE Reimbursement is limited to 14 days for a CONUS to CONUS PCS

TLE Reimbursement is limited to five days to/from an OCONUS PDS

*Lodging at OCONUS locations may be reimbursed under Temporary Lodging Allowance (TLA). Contact Military Pay Office for additional information.

Determining TLE Entitlement:

Determine the TLE entitlement by multiplying the percentage in the following table by the applicable locality lodging and M&IE rates .

8) Resources at New Duty Location - These resources can be located by contacting your local Military and Family Readiness Center .

Loan Closet: Common household items are available to borrow for up to 30 days. Items available are specific to each installation but usually include: irons, ironing boards, kitchen appliances, dishes, flatware, and pots and pans.

Post-Move Newcomers Orientation: Provides information about your new installation, including housing, education, healthcare, briefings on the PCS In-Processing System, the online travel voucher filing system and more.

Individual Counseling: Your Relocation Assistance Program Manager can address specific issues with you one-on-one and give guidance and suggestions to help resolve any problems that may come along with your move.

Provide sponsorship: Sponsor assists in facilitating a smooth PCS transition. Sponsors serve as the link between the inbound member/Family and the unit, providing sufficient information and support so newly assigned Service members understand expectations, role(s), and reinforce the importance of our core tenants (e.g., warfighting excellence, esprit de corps, standards, thriving Airmen, Guardian and Families, etc.).

School Liaison : Can provide assistance to relocating families and act as an advocate for military connected students.

Childcare : Up to 20 hours of free childcare per child with a licensed day care provider. This is available to all ranks and needs to be used within 60 days of your PCS. Bring a copy of your PCS orders to the Military & Family Readiness Center in order to get your voucher for each child and a list of day care providers. This program is based on FCC provider availability.

Department of the Air Force Instructions 36-3003, Military Leave Program https://static.e-publishing.af.mil/production/1/af_a1/publication/dafi36-3003/dafi36-3003.pdf

Department of the Air Force Manual 36-2102, Base-Level Relocation Procedures https://static.e-publishing.af.mil/production/1/af_a1/publication/dafman36-2102/dafman36-2102.pdf

Air Force Personnel Center https://www.afpc.af.mil/Assignment/

Joint Travel Regulations (JTR) https://www.travel.dod.mil/Policy-Regulations/Joint-Travel-Regulations/

DFAS-Travel Pay https://www.dfas.mil/militarymembers/travelpay/checklists/

DFAS- Claim Status https://www.dfas.mil/militarymembers/travelpay/information/

Weight Allowance Calculator https://www.ustranscom.mil/dp3/weightestimator.cfm https://www.militaryonesource.mil/benefits/pcs-entitlements/

Monetary Allowance in Lieu of Transportation (MALT) https://www.dfas.mil/MilitaryMembers/travelpay/armypcs/malt/

“It’s Your Move” Armed Forces Members Guide https://www.ustranscom.mil/dtr/part-iv/dtr_part_iv_app_k_1.pdf

Military One Source https://www.militaryonesource.mil/moving-pcs/

Exceptional Family Member Program https://www.afpc.af.mil/Airman-and-Family/Exceptional-Family-Member-Program/EFMP-Assignment/

DoD Overseas Station and Housing Allowance Process Guide https://media.defense.gov/2022/Jul/13/2003034513/-1/-1/0/DOD_OVERSEAS_STATION_AND_HOUSING_ALLOWANCE_PROCESS_GUIDE.PDF

DoD 7000.14 R, Volume 7A, Chapter 26 https://comptroller.defense.gov/Portals/45/documents/fmr/archive/07aarch/07a_26a.pdf

Air Force Civil Engineer Center https://www.afcec.af.mil/What-We-Do/Housing/UnaccompaniedHousing/

Air Force Housing https://www.housing.af.mil/

HOMES.MIL (Off-Post Housing) https://www.homes.mil

Official websites use .mil

Secure .mil websites use HTTPS

- Login to DTS

- JTR Ch. 1 - 6 & Appendices

- JTR Changes

- JTR Supplements

Computation Examples

- Travel Regulations Archive

- Frequently Asked Questions

Select a topic to display related computation examples.

- Computing Per Diem with a 300% AEA at a Single TDY Location. AEA Authorized for Lodging and M&IE Paid on a Per Diem Basis (JTR, par. 020307.A)

- Computing Per Diem when 150% AEA for Lodging to One of Multiple TDY Locations. Per Diem or AEA authorized Differently at Different TDY Locations (020307.B3)

- Computing Per Diem when 150% AEA for Lodging, Meals, and Averaging Incidental Expenses Limiting to $5.00 a day (020307.F2)

- CPP - Constructed Transportation Cost

- Overseas COLA (OCONUS COLA) Computation

- Computing Per Diem when Meals are Available in a Government Dining Facility or Mess, or Provided by the Government when Included as Part of a Conference Fee or a Lodging Rate (e.g. Breakfast) (020304.B)

- Computing Per Diem and Reimbursable Expenses for Dual Lodging (020303, Table 2-16)

- Emergency Leave (Service Members Only) Reimbursement for personally procured transportation costs - Example 1 (040201.C)

- Emergency Leave (Service Members Only) Reimbursement for personally procured transportation costs - Example 2 (040201.C)

- Personal Emergencies for a Service Member on TDY or Away from Homeport (Service Members Only). Reimbursement for personally procured transportation costs (040201.C) Example 1 - Exceeds

- Personal Emergencies for a Service Member on TDY or Away from Homeport (Service Members Only). Reimbursement for personally procured transportation costs (040201.C) Example 2 - Less Than

- Traveler in Hotel When Flat-Rate Per Diem Transitions to Lodging Plus Per Diem (JTR, par. 020311)

- Traveler Shares Housing with Other Official Travelers and Flat-Rate Per Diem Transitions to Lodging Plus Per Diem (JTR, par. 020311)

- Traveler Rents an Apartment and Flat-Rate Per Diem Transitions to Lodging Plus Per Diem Mid-Month (JTR, par. 020311)

- Traveler Stays in Non-Traditional Lodging at ILPP Site After Flat-Rate Per Diem Transitions to Lodging Plus Per Diem (JTR, par. 020311)

- Traveler Moves to Hotel at Rate Higher than ILPP Rate After Flat-Rate Per Diem Transitions to Lodging Plus Per Diem (JTR, par. 020311)

- Funded Environmental Morale Leave (FEML) Traveling to an Alternate Destination. Transportation Costs Exceed Authorized Destination (040401.B1, 040501-B, 040503-B2))

- Funded Environmental Morale Leave (FEML) Traveling to an Alternate Destination. Transportation Costs Less Than Authorized Destination (040401.B1, 040501-B, 040503-B2)

- Computing Per Diem when Crossing the International Date Line (IDL) traveling in a Westward Direction with a Lost Day (020314)

- Computing Per Diem when Crossing the International Date Line (IDL) and traveling in a Westward Direction without a Lost Day (020314)

- Civilian Employee Returns to a PDS or Place of Abode on a Non-Workday

- 2 or Fewer Non-Workdays if Leave is Taken for all Workdays between the Non-Workdays

- Non-Workday When a Civilian Employee Takes Leave for a Whole Workday before and a Whole Workday Following a Non-Workday

- Traveler Departs the PDS Prior to the First Day of Scheduled Travel

- Commuting Distance Greater than Ordinary - POV (020603.B1c1(a))

- Commuting Distance Less than Ordinary - POV (020603.B1c1(a))

- Combined Use of POV and Public Transportation - Example 1 (020603.B1d)

- Combined Use of POV and Public Transportation - Example 2 (020603.B1d)

- Public Transportation Cost Less Than Ordinary Cost (020603.B1b)

- Distance Traveled Less than Ordinary Commuting Distance (020603.B1b)

- Computing Per Diem when Lodging Costs are Obtained on a Long-Term Basis and Taking Leave while on TDY (020303.G)

- Leave Taken While on a TDY with Long-Term Lodging (Not Flat-Rate Per Diem) (033302)

- Service Member with Dependents

- Service Member Married to another Service Member with Dependents

- Service Member with no Dependents

- Computing Per Diem when Deployment and Contingency Travel is to an Area of Responsibility (AOR) (032901.C2)

- Computing Per Diem when a POV Is Authorized to the Government's Advantage (020302.A)

- Computing Per Diem when POV Is not Authorized to the Government's Advantage and Excess Travel Time is Involved due to Leave, Permissive Travel, or an Administrative Absence (020302.A)

- Agreement Violations for Transfers to, from, and within CONUS

- Reimbursement when a Civilian Employee Chooses to Deliver or Pick-Up a Privately Owned Vehicle (POV) to or from the Port or Vehicle Processing Center (VPC) (FTR §302-9.104)

- Civilian Employee PCS Travel Per Diem Computation-8 travel days

- Civilian Employee PCS Travel Per Diem Computation-4 travel days

- Civilian Employee PCS Travel Per Diem Computation - Actual Costs Exceed the Government Cost

- Civilian Employee PCS Travel Per Diem Computation OCONUS to OCONUS

- Civilian Employee PCS or Separation Travel Per Diem Computation - Travel Completed in One Day

- Civilian Employee PCS or Separation Travel Per Diem Computation

- Eligibility Determination for Privately Owned Vehicle (POV) Transportation and Storage outside the Continental United States (OCONUS)

- Non-Temporary Storage (NTS) of Household Goods (HHG) in Connection with Moves to and between Areas Outside the Continental United States (OCONUS) (FTR §302-8.200-203)

- House-Hunting Trip (HHT) Subsistence Calculation

- Home Marketing Incentive Payments (HMIP)

- Non-Temporary Storage (NTS) of Household Goods (HHG) for Duty at an Isolated Permanent Duty Station (PDS) in the Continental United States (CONUS) (FTR § 302-8.108)

- Professional Books, Papers, and Equipment (PBP&E) - Administratively Restricted HHG Weight

- PCS Mixed Modes Travel Example

- Permanent Change of Station (PCS) Per Diem Computation - Civilian Employee's Spouse or Domestic Partner Traveling Separately from Civilian Employee

- PCS Travel Time Computation when Travel Is by Mixed Modes-1,500 mi

- PCS Travel Time Computation when Travel Is by Mixed Modes-1,000 mi

- PCS Travel Time Computation when Travel Is by Mixed Modes-385 mi

- PCS Travel Time Computation when Travel Is by Mixed Modes with Leave

- PCS Elapsed Time Is Less than Authorized Travel Time

- Civilian Employee En Route Travel by Automobile for Permanent Duty Travel (PDT)

- Renewal Agreement Travel (RAT) Leave - Per Diem

- Removing Household Goods (HHG) from Non-Temporary Storage (NTS)

- Renewal Agreement Travel (RAT) - Computing the Tour of Duty when Delayed RAT is Involved and an OCONUS Service Limitation does not Affect the Civilian Employee

- Sample Statement Computation of Liabilities and Credits for Violation of Renewal Agreement

- TQSE (LS) Computation

- Timing of Real Estate Transactions

- TQSE (AE) Computation with House Hunting Trip (HHT) Deduction (CBCA 3689-RELO, CBCA 4579-RELO)

- TQSE (AE) Lodging Portion Computation when an Apartment, House, Mobile Home or Recreational Vehicle Is Rented or Used for Lodging

- TQSE (AE) Option

- Civilian Employee Does not Stay at ILPP Preferred Location

- Lodging Plus Per Diem while Awaiting Transportation

- Service Member Permanent Duty Travel - Elapsed Travel Time is Less than Authorized (050205.A)

- Service Member PCS Travel Time Computation when Travel Is by Mixed Modes - POV Travel Distance Less than Official Distance (050205.B)

- Service Member PCS Travel Time Computation when Travel Is by Mixed Modes with Leave - Actual Distance Greater than Authorized (050205.B)

- Per Diem Rate when New Permanent Duty Station (PDS) is a Ship (0509)

- PCS Per Diem Computation for Service Member and Dependents through Ports of Embarkation and Debarkation (050303)

- Consecutive Overseas Tour (COT) Leave (050812)

- Monetary Allowance in Lieu of Transportation (MALT) for Permanent Duty Travel - Multiple Travelers Using the Same Privately Owned Vehicle (POV) (050203.B1)

- Household Goods (HHG) Transportation - Unused Balance to New Permanent Duty Station (PDS) (051301.D)

- Excess Charges - HHG Transportation in Excess of Authorized Weight Allowance (051306.B)

- Household Goods (HHG) Transportation Other than between Authorized Locations (051306.C)

- Household Goods (HHG) Transportation Methods - Unaccompanied Baggage and Professional Books, Papers and Equipment (PBP&E) (051401.A)

- Household Goods (HHG) Transportation Related to the Early Return of a Dependent (ERD) - Authority on the Next Permanent Change of Station (PCS) Order (052005)

- POV Transportation in the CONUS: Driving One POV and Shipping One POV (052901.B)

- Rental Vehicle Reimbursement in connection with the Shipment of a Privately Owned Vehicle (POV) Transported at Government Expense (053104.B)

- Household Goods (HHG) Transportation Authorized When a Mobile Home is Also Transported (052102.A)

- Mobile Home Transportation under Unusual or Emergency Circumstances (052701.A)

- Temporary Lodging Expense (TLE) in the Continental United States (CONUS) (050601-B)

- Dislocation Allowance (DLA) - Two Service Members Married to Each Other (050506-B)

- Calculating Excess Weight of HHG (PBP&E) (051304 and Table 5-39)

- Calculating Excess Weight of HHG (Medical Equipment) (PBP&E) (051304 and Table 5-39)

- How to compute awaiting transportation allowances during a PCS

- How to compute a PCS Order's Effective Date

- Evacuation from a PDS OCONUS to a Safe Haven in the CONUS (JTR, par. 060205.B, Table 6-17)

- Evacuation from a PDS OCONUS to a Safe Haven in a Foreign Area (JTR, par. 060205.B, Table 6-17)

- Evacuation from a PDS OCONUS to a Safe Haven in the CONUS while in the CONUS on Authorized Leave (JTR, par. 060205.B, Table 6-17)

- Evacuation from a Foreign Area PDS to a Designated Place in the CONUS (JTR, par. 060205.B, Table 6-17)

- Per Diem for an Evacuation from a PDS within the CONUS to a Safe Haven in the CONUS (JTR, par. 060401)

- Per Diem for an Evacuation from a PDS within the CONUS to a Safe Haven in a Non-Foreign Area OCONUS (JTR, par. 060401)

- Per Diem for an Evacuation from a PDS within the CONUS to a Safe Haven While on Authorized Leave (JTR, par. 060401)

- Evacuation from a PDS in the CONUS to a Designated Place in the CONUS (JTR, par. 060401)

- Per Diem for a Civilian Employee or Dependent While at Safe Haven due to an Evacuation from a PDS within the CONUS or Non-Foreign Location OCONUS (JTR, par. 060410.B2)

- Appropriate Per Diem Locality Rate with a Stopover Point and Multiple TDY Locations on the Same Day (020310.B)

- TLA for TDY or Deployment (POV Travel)

- TLA for TDY Status, Vessel at Homeport or Underway

- Temporary Lodging with Meal Preparation Facilities

- Service Member Married to Another Service Member in the Same Temporary Lodging without Meal Preparation Facilities (POV Travel)

- Two Service Members Married to Each Other with Dependents in Temporary Lodging with Meal Preparation Facilities for Each Service Member (POV Travel)

- Service Member Married to Another Service Member with Dependents with Two Rooms without Meal Preparation Facilities for Both Service Members (POV Travel)

- Service Member with Multiple Dependents and Two Rooms without Meal Preparation Facilities (POV Travel)

- PCS Reporting Date and Authorized TLA are on the Same Day (Commercial Transportation)

- Lodging with Currency Conversion Fees

- PCS Reporting Date and Authorized TLA are on the Same Day, Lodging with Friends and Relatives (Commercial Travel)

- TLA Special - Rate Increase National Convention

- TLA Special - Rate Increase International Sporting Event - Multiple Rooms Used

- TLA Special - Two Service Members Married to Each Other without a Dependent, Sharing Temporary Lodging Facilities

- TLA Special - Computation for a Service Member without a Dependent

- Authorizing or Approving Official (AO) Directs a Service Member to Use Usually-Traveled Route Instead of Government Transportation

- Cover Letters

- Jobs I've Applied To

- Saved Searches

- Subscriptions

- Marine Corps

- Coast Guard

- Space Force

- Military Podcasts

- Benefits Home

- Military Pay and Money

- Veteran Health Care

- VA eBenefits

- Veteran Job Search

- Military Skills Translator

- Upload Your Resume

- Veteran Employment Project

- Vet Friendly Employers

- Career Advice

- Military Life Home

- Military Trivia Game

- Veterans Day

- Spouse & Family

- Military History

- Discounts Home

- Featured Discounts

- Veterans Day Restaurant Discounts

- Electronics

- Join the Military Home

- Contact a Recruiter

- Military Fitness

How Far Can We Drive Each Day of our PCS?

Before permanent change of station (PCS) orders even hit your inbox you've likely already mapped out your route to your next duty station, and maybe even planned a detour to see friends or family along the way. But then you read the rules and feel confused: what is this talk about a 350 miles per-day limit?

The orders probably say something like, "Travel by privately owned vehicle is authorized....." followed by more details on reimbursement.

The orders may or may not have information on them about how many travel days you are allotted. But they will have the report date on them. A quick look at a map will show you how many hours of driving it will take to get there.

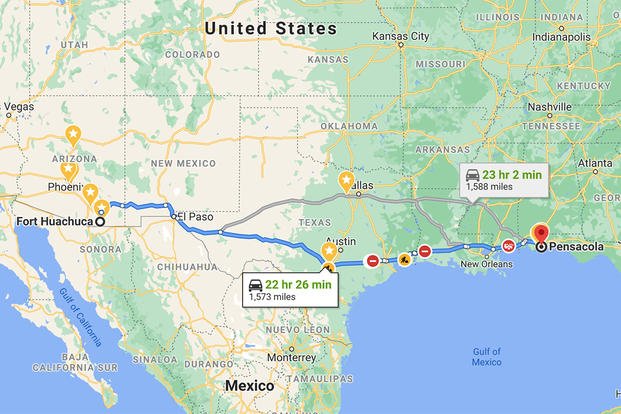

For example, if you're traveling Arizona to Naval Air Station Pensacola , Florida, you'll be driving 1,573 miles. As you might guess, the military does not want you making this almost 23-hour drive in one go. They also don't want you to take two months getting there.

That's why the military created travel rules, with guidelines for how many days -- and overnight stops -- it should take a service member to get from point A to point B.

Related: 8 Tips to Prepare for Your First PCS Move

According to the Defense Travel website's FAQs , "A traveler who is authorized PCS travel by POV is allowed one day of travel for the first 400 miles between authorized points. For any distance greater than 400 miles, the traveler is allowed another day of travel for every additional 350 miles. See the JTR, par. 050205."

That's the calculation the military uses for determining how many travel days they'll pay for. For the 1,573 mile trip, you are authorized to take 5 travel days. (If the remainder of the mileage divided by 350 is more than 51, add a day.)

But what's really important is that you arrive and sign-in on your report date. If you take three days to get there or seven days to get there, it doesn't really matter. You'll get paid per diem for the five days.

Seasoned military spouses and service members have figured out that there's not much benefit to pushing the limits on this. The reason 350 miles is the recommended amount of miles a day is because that is approximately 6six hours a day at 60 miles-per-hour. That's not a lot if you are driving on the interstate at a higher speed than that. But it can really add up to long days if you're driving two vehicles, one of them hauling a trailer and the other with three kids, a dog and a cat.

Six hours of driving a day for eight days is a lot. The military doesn't want you to push it to the point of exhaustion. They want to give you wiggle room to stop early if you're tired and to allow for flat tires or vehicle repairs.

But that doesn't mean you can't manipulate the timeframe a little to your advantage. For example, on that trip from Fort Huachuca to Pensacola, you may be able to plan some longer days, and then take a day in San Antonio and hit up Sea World.

Most importantly, drive carefully, plan your stops ahead of time and make the most of where this journey takes you.

Keep Up with the Ins and Outs of Military Life

For the latest military news and tips on military family benefits and more, subscribe to Military.com and have the information you need delivered directly to your inbox.

Rebecca Alwine

You May Also Like

A new report finds that the system, now used at all military treatment facilities except for most dental clinics, earns low...

Drinking tea has a much less positive image in American culture, and U.S. military veterans are out to change that.

While you might not feel at your peak during workouts, you might also notice that your performance isn't as low as you...

Kids are starting to bank at a younger age, according to statistics from USAA. Here's what could be fueling the trend, along...

Select Service

- National Guard

PCS & Relocation Resources

- PCS Podcast

- Basic Allowances for Housing

- Base Guides

- By Category

- By Component

- By Life Event

- State/Territory Benefits

- Resource Locator

- Benefit Library

- Federal Benefits

Permanent Change of Station (PCS) OCONUS

Benefit fact sheet.

There are numerous steps in an Overseas Permanent Change of Station (PCS) process. Through various agencies the Army provides guidance and counseling to assist Soldiers and their Families in making the best choices.

Retired Army National Guard Soldiers may be eligible for a government funded move. If the Service members last assignment was on AGR status.

Permissive Temporary Duty (PTDY) : If you are retiring you may be authorized up to 20 days of Permissive TDY (See AR 600-8-10 for clarification or for approval speak to your Command). The approving authority for PTDY of ten days is an LTC or above, if more than 10 days, COL or above. AR 600-8-10 paragraph 5-35G states: “Transition PTDY may be used in increments (not to exceed days as authorized in paragraphs e and f, above) or used in one period; however, once a soldier signs out and permanently departs the duty station, PTDY may not be taken in increments.”

PTDY taken in increments must be done prior to clearing the post. Any PTDY authorized once a Soldier has cleared post, will be limited to 20 consecutive days to include weekends.

Moving Services and Transportation - Moving services cannot be arranged using MilitaryOnesource , the Defense Personal Property System (DPS). They must be arranged in person at your local Transportation Office (TO).

Provide the following at time of counseling:

Complete set of orders/authorization including amendments/for each type of shipment planned (e.g., Household Goods (HHG), Non-Temporary Storage (NTS), Unaccompanied Baggage (UB))

An idea of when you want to move and an estimated weight. Be as flexible as possible when selecting HHG pack and pickup dates. Your preferred dates may not be available during some periods such as summer or days near official holidays. Avoid scheduling lease termination or house sale closing on the same date your HHG are to be packed, picked up, or delivered. Leave some time in your schedule for the unforeseen. You or your designated representative must be available between the hours of 8:00 a.m. and 5:00 p.m. on pack, pickup, and delivery dates.

The date you plan to arrive at your end of service location . Your arrival date assists your Transportation Service Provider (TSP) and/or local TO with scheduling delivery of your shipment(s), which may reduce storage costs paid by the Government.

What type of shipment you want to make (HHG, UB and or NTS) and the estimated weight. Do not forget to declare Professional Books, Papers, and Equipment / Professional Gear (PBP&E/Pro-Gear).

Information on excess cost. The minimum excess cost is approximately $100.00 per hundred pounds over the maximum weight allowance.

A list of large or unusual items (e.g., large screen TV [i.e., plasma, LCD, DLP], piano, pool table, china cabinet, wall unit, satellite dish, hot tub, boat, motorcycle, recreational vehicle).

A letter of authorization signed by you or a power of attorney; required if you are unable to visit the TO. You may appoint your spouse or an agent to act on your behalf. Be sure the person you choose knows what you want and has the information to make the right arrangements. Remember, this person is acting for you, and you are responsible for that person’s decisions.

Personally Procured Move (PPM) , formerly called Do It Yourself (DITY)

The PPM program allows you to personally move HHG and either be reimbursed up to the Government’s cost or to collect an incentive payment from the Government.

The TO must provide counseling and prior approval for a PPM move. Failing to comply with Service requirements of the program may limit payment or result in complete denial of your claim.

Weight estimator for a PPM

U.S. Transcom provides an “It’s Your Move” Guide to assist Service members in understanding allowances and responsibilities during the packing, shipping and storage of household goods.

Short Distance Moves

If you were living on base and your housing agreement requires you to move out of government quarters before you can determine your Home of Selection (HOS), you are authorized a short distance HHG move from the government quarters to a local temporary residence in the vicinity of the vacated quarters. The usual rank-based weight limits do not apply to this "local move" out of government quarters. This local move does not count as your retirement move, but you will need a memo from the garrison housing office providing the funding citation to be used for the move. If you have any questions, your local personal property office can help you figure out the right steps.

Weight Allowance

Moving allowance is based on the Service members rank and dependency status at the time of retirement. Overages are the Service members financial responsibility.

To estimate weight of your personal belonging use a weight estimator calculator .

Professional Books, Papers, and Equipment / Professional Gear (PBP&E / Pro-Gear) Allowance

PBP&E allowances limit PBP&E to 2,000 pounds net weight and no longer include personal computers and accompanying equipment, and/or awards presented for significant contributions while performing official duties.

PBP&E/Pro-Gear is defined as:

HHG in a member’s possession needed for the performance of official duties at the next or a later destination

If you have PBP&E/Pro-Gear to declare, you must do so in DPS

If your estimated and declared PBP&E/Pro-Gear weighs 1,000 pounds or less, there will be no additional approval or review of your declared Pro-Gear and it may be included and packed with the rest of your HHG

If your estimated and declared PBP&E/Pro-Gear weighs more than 1,000 pounds, your Service may review your declaration and items at their discretion outside of DPS

When PBP&E/Pro-Gear is properly declared in DPS, the weight of PBP&E/Pro-Gear does not count against the total weight of your shipment(s). Before signing your inventory prepared by the TSP(s), be sure these items are declared as “PBP&E/Pro-Gear”. The proper designation of these items and the exclusion of the weight can be very important.

The following items are considered PBP&E/Pro-Gear:

Reference material not ordinarily available at the next Permanent Duty Station (PDS)

Instruments, tools, and equipment peculiar to technicians, mechanics, and members of the professions

Specialized clothing such as diving suits, astronaut’s suits, flying suits and helmets, band uniforms, chaplain’s vestments, and other specialized apparel not normal or usual uniform or clothing

Communications equipment used by a member in association with the Military Affiliated Radio System

Individually owned or specially issued field clothing and equipment

Government- or uniformed service-owned accountable Organizational Clothing and Individual Clothing property issued to the employee or member by the Service/DoD component for official use.

Excluded from PBP&E/Pro-Gear are:

Commercial products for sale/resale used in conducting business

Sports equipment

Office furniture

Household furniture

Shop fixtures

Furniture of any kind even though used in connection with (ICW) the PBP&E (e.g., bookcases, study/computer desks, file cabinets, and racks)

Personal computer equipment and peripheral devices

Memorabilia, including awards, plaques, or other objects presented for past performance (includes any type of going-away gifts, office decorations, pictures, etc.)

Table service, including flatware (including serving pieces), dishes (including serving pieces, salvers, and their heating units), other utensils, and glassware

Other items of a professional nature that are not necessary at the next/subsequent PDS, such as textbooks from previous schools unrelated to future duties; personal books, even if used as part of a past professional reading program or course of instruction; and reference material that ordinarily would be available at the next/subsequent PDS either in hard copy or available on the Internet.

Unlike some PCS moves, you are only allowed ONE of the following options:

Short Term Storage - Storage-In-Transit (SIT) at your destination up to 90 days. This applies to separating and retiring service members. If your household goods are not delivered before the 90 days expires, you will be responsible for excess storage costs. You may also lose the ability to file any loss or damage claims with your branch of Service's Military Claims Office.

What to expect from your Transportation Service Provider (TSP)

TSP’s Responsibilities (at Origin):

Conduct Pre-Move Survey (physical or telephonic) depending on the type of shipment and estimated weight. It should be conducted prior to the first day of packing

Begin packing/pickup between 8:00 a.m. and 5:00 p.m.

Protect appliances against damage while in transit. The TSP secures moving parts that, if allowed to move in transit, could damage the appliance

Use new, clean packing materials for linen, clothing, and bedding

Use new or like-new packing materials for all other items. Excelsior or newspaper is not allowed. Items packed in boxes should be padded and insulated from carton walls.

Pack mirrors, pictures, and glass tabletops in specially designed cartons

Wrap and protect all finished surfaces from marring or scratching; use furniture pads

Properly roll and protect rug and rug pads at residence. Only small throw rugs may be folded.

Pack all designated PBP&E in separate boxes. These cartons must be marked “PBP&E/Pro Gear”, weighed separately, and listed on the inventory form.

Put all nuts, bolts, and screws from a disassembled item in a bag and attach securely to the item

Mark each carton to show general contents

Prepare an accurate and legible inventory

Obtain approval from the TO prior to loading on the tailgate of the moving van

Remove all excess packing material from your residence

TSP’s Responsibilities (at Destination):

Begin delivery between 8:00 a.m. and 5:00 p.m.

Perform a one-time placement of rugs prior to placement of your HHG

Unpack and unwrap all cartons, boxes, and crates

Place each item or carton in the room you indicate. This one-time placement includes placing unpacked articles in cabinets, cupboards, or on kitchen shelves when convenient, safe, and it is your desired location. Have placement planned out before the TSP arrives. TSPs are required to place each item only once.

Assemble all furniture and equipment if disassembled at origin

Remove packing and blocking from appliances. The TSP is not required to connect appliances to electric, gas, or water outlets.

Provide a “Joint” written record of any loss and or damage at delivery on DD Form 1840 or on the “Defense Personal Property Program Notification of Loss or Damage AT Delivery” Form. You and or your designated representative along with the delivery TSP sign this form. The TSP’s representative must provide a copy of this form.

TSPs are not required to go into an attic, crawl space, or similar storage area for the purpose of delivering and placing personal property

Once the shipment has been delivered, the TSP is not required to deliver property to a self-storage facility.

NOTE: It is not advisable to waive unpacking at any time during the delivery. However, if unpacking is waived, the TSP is not required to return later to unpack or remove debris

Claims - Unfortunately, you may suffer loss or damage to your personal property during movement. If your property is lost or damaged, you have the right to file a claim directly with the TSP.