Injured On The Way to or From Work in Queensland: Your Rights and Entitlements

Knowledge Base

Getting injured on your way to or from work can be extremely stressful. Fortunately, in Queensland, you might be entitled to make both a workers' compensation and motor vehicle insurance (CTP) claim, depending on how your injury occurred.

Does WorkCover Cover Travel to and From Work?

Yes; in many situations , WorkCover Queensland (or your employer's self-insurer) may cover injuries sustained while travelling to or from work.

WorkCover claims can be made regardless of fault, so you can be entitled to claim even if there was no other party at fault, so long as your injury is taken to arise out of or in the course of your employment.

These are called "journey claims." Here's what you need to know:

- Eligible journeys: Generally, a journey claim is approved if your injury occurred while you were directly travelling:

- between your home and workplace; or

- between your home and a work-related training location (which you are required under your employment to attend); or

- If you have an existing injury and WorkCover claim - a journey between your home and a place to undertake rehabilitation, medical advice, or receive payment of WorkCover compensation; or

- between one place of employment to another place of employment.

Your “home” means your usual place of residence.

- Deviations and delays: Minor breaks or deviations from your standard route may not always affect your claim. However, an injury will not be “in the course of your employment” (or approved) if the accident happens during or after:

- a “substantial delay” before you start your journey; or

- a “substantial interruption or deviation” from the normal route from your home to the workplace - unless the delay or deviation occurs because of circumstances connected with your employment or out of your control

Your claim will also not be approved if you were contravening road rules, regulations or the law if that contravention was a major significant factor (e.g. speeding). Engaging in unrelated activities could also void your rights to claim.

What Does WorkCover Queensland Cover?

WorkCover Queensland can provide the following benefits if your journey claim is accepted:

- Medical and rehabilitation expenses: This includes costs for doctor's appointments, medications, treatment, and rehabilitation services.

- Weekly income replacement: If you're unable to work due to your injury, you may receive payments to replace a significant portion of your lost wages.

- Lump-sum compensation: In cases of permanent impairment, you could be eligible for a lump-sum payment.

How to Start a WorkCover Claim

- Seek medical attention: Get immediate treatment for your injuries and obtain a Work Capacity Certificate from your doctor.

- Notify your employer: Inform your employer about your injury as soon as possible and provide them with your Work Capacity Certificate.

- Submit your claim: Contact WorkCover Queensland or your employer's self-insurer to lodge your claim

Can I Make a Compensation Claim?

If another party's negligence caused your injury while commuting, you could be entitled to additional compensation through a so-called ‘common law claim’ via a personal injury lawyer. For example:

- Motor vehicle accidents: If you were injured in a car, truck, or motorcycle accident caused by another driver, you might be able to claim through their Compulsory Third Party (CTP) insurance.

- Public transport accidents: Injuries on buses, trains, or due to infrastructure issues could lead to claims against the transport operator.

- Cycling or walking accidents: You might have a CTP claim if a pedestrian or cycling accident was the fault of a motor vehicle driver.

Important points:

- Time limits: There are strict time limits for common law claims in Queensland, so it's crucial to seek legal advice as soon as possible.

- Legal Representation: It's highly recommended to get an experienced personal injury lawyer's expertise for common law claims to help build a strong case.

Disclaimer: This information is designed for general information in relation to Queensland compensation law. It does not constitute legal advice. We strongly recommend you seek legal advice in regards to your specific situation. For help understanding your rights, please call 1800 960 482 or request a free case review to talk to one of our lawyers today.

Car accident lawyers Brisbane

Car accident lawyers gold coast, related articles, what is maximum medical improvement (mmi).

Whether it's at work, on the road, at the hospital or in a public place, if you have been injured in Queensland due to the fault of another party, you may be entitled to make a compensation claim

Does WorkCover cover me if I’m working from another location?

How long do workcover payments last, if it's time to talk, we're here to help. get free advice direct from our solicitors today..

1800 700 125

Home > Guides > Does Queensland WorkCover apply when injured travelling to or from work?

Does Queensland WorkCover apply when injured travelling to or from work?

You could claim workers’ compensation in Queensland when you are injured travelling for work purposes, including travel to or from your workplace and other work-related trips.

When claiming personal injury compensation for work-related travel, you make a “journey claim”.

You could also have a WorkCover claim if your employer influenced your accident. For example, they asked you to travel quickly to meet a deadline, or they asked you to work long hours and then made you drive somewhere while you were fatigued.

When you are harmed during work travel overseas or interstate, you could have a valid journey claim if your job contributed significantly to your injury.

NOTE – if you have recently resigned from your employment, you could still be eligible for a journey claim.

What is a WorkCover journey claim?

A journey claim is a work injury compensation claim when a work travel accident causes you an injury. For example, you might have a car accident driving to or from your job while using your own or a company vehicle for work purposes. Journey claims are “no-fault”, so you do not need to prove who was liable for causing you harm.

How do I have a successful WorkCover work-related travel claim?

To have a successful WorkCover journey claim for work-related travel, you must:

- Be defined as a worker by the Workers’ Compensation and Rehabilitation Act 2003 .

- You must have already started your work trip without deviation or lengthy delays.

So, you don’t have a journey claim if you are injured at home before starting your trip to work. However, you could have a public liability claim if you are harmed while at another property (e.g., a privately owned property or rental dwelling).

There are other eligibility criteria, such as:

- You must lodge within the required time frame

- There was no illegal activity that facilitated the accident (like breaking road rules)

What if I am already on workers’ compensation and have a car accident?

Suppose you suffer a further injury while travelling to or from your medical or rehabilitation provider, and you are already receiving WorkCover payments . In that case, you will be entitled to make a journey claim for your loss.

You might also be eligible to make a common law claim, depending on the circumstances of your road accident and who was at fault.

What is the journey compensation claim process?

- Seek urgent medical attention and begin your recovery

- Retain an expert journey claim compensation lawyer. They will help you take the correct steps to achieve your desired outcome.

- Ensure you meet the legal definition of a worker. Splatt Lawyers will let you know this for free.

- Collect evidence – All compensation claims rely on expert assessments and reports, and your lawyer will work with you to create a compelling case.

WorkCover might reject your journey claim if:

- You committed an illegal act, and this contributed to your accident.

- There was a substantial delay prior to starting your journey

- There was a significant deviation or disruption to your trip

What compensation do I get for a journey claim?

When you are injured and can’t work but need to pay your bills and fund medical rehabilitation, your WorkCover benefits help pay your debts. When you have a successful compensation claim for a work-related travel accident, you could receive the following:

√ Weekly payments for your lost wages

√ Medical treatment expenses cover

√ Rehabilitation expenses reimbursement

√ Travel costs related to your medical care

When your injuries are stable and close to the end of the workers’ compensation process, you will receive a whole-person impairment assessment. You might be offered a WorkCover lump-sum payout. At this time, you must seek legal advice. Accepting the lump-sum offer will preclude you from making a common law claim.

More about WPI claims →

How can Splatt workers’ compensation lawyers help me?

Our experienced WorkCover lawyers have supported Queenslanders with work-related injury claims for nearly three decades. People love our 100% No Win, No Fee funding policy, which means;

√ It’s free to start your case

√ You pay our fees and costs when you win

√ Pay nothing if you lose

√ We fund your medical assessments and reports

√ We support your rehabilitation costs

Once we win your case, we recover these fees, but if you lose, you owe nothing. This is the Splatt Lawyer’s No Win, No Fee, No Risk guarantee. Call now 1800 700125 .

Get Started Now- It's Free

Disclaimer – This is general information only and does not constitute legal advice. It is free to receive legal advice on your situation. Please get in touch with our experienced personal injury compensation lawyers for help understanding your legal rights and your free claim review. Call 1800 700 125 or email: [email protected]

More Legal Advices

how long will my workcover payments last, get back on track with splatt lawyers.

Our friendly experienced lawyers love to help. Contact our team with your questions or start your claim online now. It costs nothing to understand your options.

Enter Email

Subscribe to our newsletter

- 1800 860 777

- [email protected]

- 69 Amelia St, Fortitude Valley QLD 4006

Legal Services

- Road Accidents

- Work Accidents

- Public Liability

- Serious Accidents

- Mental Illness

- Insurance Claims

- Professional Negligence

Service Areas

- Sunshine Coast

Quick Links

- Our Pricing

- Legal Guides

At the end of your visit today, would you complete a short survey to help improve our services?

Thanks! When you're ready, just click "Start survey".

It looks like you’re about to finish your visit. Are you ready to start the short survey now?

What to do in the event of an injury

If one of your workers suffers a work-related injury, they may be entitled to claim for workers' compensation. Queensland's statutory workers' compensation scheme is a no fault scheme (e.g. an injured worker is entitled to statutory compensation regardless of whether it is the worker's or the employer's fault that the injury occurred). Workers' compensation may include weekly compensation (for lost wages), medical/rehabilitation expenses, and reasonable travel costs.

Issues of fault and negligence (including contributory negligence by a worker) may be dealt with in a common law action for damages. Access to common law is available to all workers in Queensland who can prove negligence against an employer and who have a work-related injury. Damages may include compensation for pain and suffering or economic loss. The employer is covered for the cost by WorkCover Queensland through their accident insurance policy.

The injured worker needs to lodge a claim with WorkCover Queensland if their employer is not self-insured.

Work-related injuries

A work-related injury may include:

- a cut or fracture

- industrial deafness

- an injury sustained while travelling to or from work

- an injury while on a recess either at work or away from work

- psychiatric or psychological disorders such as stress or depression

- aggravation of a pre-existing condition

- death from an injury, disease or aggravation of a disease.

Lodging a workers' compensation claim

If one of your workers is injured, the following steps should be taken:

- The worker notifies you immediately.

- You assess the situation to make sure they're safe. Call 000 if it's an emergency.

- Check if you need to report the incident to Workplace Health and Safety Queensland .

- The worker sees a doctor to get a workers' compensation medical certificate.

- The worker lodges a claim with WorkCover Queensland .

If the injury results in a death, you must lodge a fatal injury claim with WorkCover Queensland by phoning 1300 362 128.

You must pay the worker for the day of the injury. This is separate to compensation paid from your insurance and must not come out of the worker's sick leave, holiday leave, or any other entitlements.

You will also need to pay an excess to WorkCover Queensland. This represents the first payment of weekly compensation.

The sooner a claim is lodged, the less it will cost you, as WorkCover Queensland can make a decision and start paying the claim sooner. WorkCover Queensland will then help your worker get back to work as safely and as soon as possible.

Rehabilitation for return to work

Workers' compensation laws require employers to participate in rehabilitation and return-to-work programs for injured workers.

Rehabilitation is designed to ensure workers a safe and early return to work. If you have an injured worker, they need to advise WorkCover Queensland when they intend to return to work. They may need to take part in a rehabilitation program, which could include medical treatments and alternative duties until they fully recover from their injury.

WorkCover Queensland provides information on injuries at work and the return to work plan .

Directors, partners or sole traders

Workers' compensation legislation does not cover directors, partners or sole traders, so it is not mandatory to have cover. To insure yourself against work-related injury or illness, read more about Workplace personal injury insurance .

Also consider...

- Learn more about how you can keep your workplace safe .

- Read about work, health and safety in Queensland .

- Last reviewed: 16 Jul 2019

- Last updated: 8 May 2018

- Print topic

A Comprehensive Guide to WorkCover Queensland Psychological Injury Support

work workersCompensation

Written by Talked Team

If you currently work in Queensland and have incurred a work-related psychological or mental injury, you may be eligible to claim WorkCover benefits, compensation, or support. However, the process of accessing support for these services is often complex and challenging to navigate, particularly for those who are seeking support for the first time.

In this article, we will outline a comprehensive guide to WorkCover Queensland and provide details on how you can best manage your workplace psychological injury to help make your recovery a little bit easier. Follow the step-by-step process outlined in our guide to ensure that you do not overlook anything so that you can access the support you need.

Table of contents

What is workcover queensland, what are mental and psychological injuries, common triggers of psychological injuries under workcover queensland, am i eligible to make a workers’ compensation claim for a psychological injury, can i claim for a psychological injury, do i need to provide evidence to make a mental injury claim, who administers queensland's workers' compensation policy, are there time limits for mental injury claims.

How do I make a WorkCover Queensland claim for a psychological injury?

Claims assessment and determination

Can i access psychology support during the assessment period, what happens after my psychological injury claim is approved.

Where can I find a WorkCover Queensland Psychologist?

Access additional mental health support

WorkCover Queensland is a workers' compensation scheme established and funded by the Queensland Government. It serves as the workers' compensation insurer for a majority of workers in Queensland. WorkCover Queensland provides eligible workers support, including access to psychological services, to assist employees in their recovery from workplace or work-related injuries. Injuries sustained can occur while travelling to, from, and between work and while performing work-related duties outside of their usual work site.

If you currently work in Queensland, please note that all Queensland employers must have a workers' compensation policy unless they are self-insured. This policy is generally taken with WorkCover Queensland. If your employer is self-insured (or group-insured) the process set out below varies according to the workers' compensation policy established by your employer. Self-insurers generally at a minimum have 2,000 employees. You can find a list of self-insurers here .

Injuries sustained at work are not limited to purely physical injuries. Often some circumstances mean that employees or workers incur a psychological injury. In Queensland, workers have the legal right to a safe and healthy work environment. As such, where an employer’s negligence results in harm regardless of whether this harm is physical or psychological, employees have a right to support.

This means that if you are diagnosed with a psychological or mental injury, or psychiatric disorder because of your job, you may be eligible to claim workers’ compensation under WorkCover Queensland. A claim for psychological injury may also be classified by a medical professional as a mental health or work stress claim. In the eyes of WorkCover Queensland, these claims are the same with the only difference being the type of disorder.

“ Work-related stress alone is unlikely to be considered a psychological injury. ”

Please note that job stress alone would not qualify as a workers' compensation claim. Recently, court findings outlined that everyone experiences work-related stress occasionally, and as such, it alone cannot be considered a psychological injury.

Examples of psychological or mental health disorders include:

Adjustment disorder

Anxiety disorders

Bipolar affective disorder

Dissociative disorder

Schizophrenia

Working with an experienced WorkCover Queensland Psychologist can help with understanding the scope of the injury and aid in the provision of ongoing support.

Get started with a WorkCover Queensland Psychologist

There are several incidents or actions that have resulted in successful workers' compensation claims in Queensland for mental health injuries. These injuries include:

Harassment or bullying from management, colleagues or clients

Negligent or toxic managers

Long work hours

Incomplete or insufficient onboarding and training

Undefined job descriptions

Traumatic event(s) occurring at work

Breach of WHS standards

Imbalanced workplace policies or procedures

Read more about work-related issues from our collection.

A Queensland-approved General Practitioner together with a WorkCover Queensland Psychologist can help you understand your psychological injury. Symptoms of these injuries can include anger , blurred thinking, social withdrawal, and fatigue .

You will be eligible to make a Workers' Compensation Claim from your employer if you are:

Full-time employee

Part-time employee

Casual worker

A subcontractor

This claim process can only commence once you have been diagnosed with a mental or psychological injury, and your job is a significant contributing factor to the diagnosis. Please note that having an existing psychological condition does not prevent you from accessing support. You may still have a successful psychological injury claim if your diagnosis worsens due to your work.

“ …having an existing psychological condition does not preclude you from accessing support ”

Meet the eligibility criteria? Start your WorkCover Queensland psychology sessions today.

To be eligible for a workers’ compensation claim in Queensland, you must ensure they satisfy the criteria set out in the Workers Compensation and Rehabilitation Act 2003. WorkCover Queensland will consider the following questions when you make a claim:

Has the claim been lodged within the statutory timeframe?

Was the worker employed by the employer when they sustained the work-related injury?

Is the worker actually considered to be a worker (as defined in the legislation)?

Was the workers’ job a significant contributing factor to their injury?

Successful mental health injury claims in WorkCover Queensland come off the back of compelling medical evidence. With the support of your treating GP and a WorkCover Queensland Psychologist or mental health therapists who assist with diagnosing and treating your condition, a strong claim can be built. WorkCover Queensland tends to provide more weight to a psychological or psychiatric assessment than one from a general practitioner.

Collecting this supporting information is dependent on you as you are the one bringing the claim forward.

Regardless of which workers' compensation policy your employer has chosen (e.g. WorkCover Queensland or through self-insurance), once you have lodged your workers' compensation claim, you will generally be allocated a Case Manager or Customer Representative. The Case Manager will be the point of contact for all communication for yourself, your doctors, psychologists and any additional support. If you

The role of a Case Manager will be to assist in the rehabilitation and return to work of employees who sustain physical or mental injuries at work. At their core, a Case Manager aims to process and assess claims, collect information and ultimately determine whether support is to be provided. This determination is a continuous process meaning that an approved claim can ultimately be terminated if the Case Manager deems it necessary.

Are you a Case Manager? Refer employees to Talked today.

WorkCover Queensland has strict timeframes for the lodgement of mental health claims. This is generally within six (6) months and there are minimal circumstances that allow an extension to the timeframe. There are also rare circumstances where WorkCover Queensland will wait this timeframe for psychological injury claims.

How do I make a WorkCover Queensland claim for a Psychological Injury?

The WorkCover Queensland claiming process is relatively straightforward, provided that you follow the following steps. WorkCover Queensland requires injured workers seeking to make a psychological injury claim to fill in and submit a claim form.

To put yourself in the best position to submit a successful Workers’ Compensation Claim in Queensland, completing the below steps can assist.

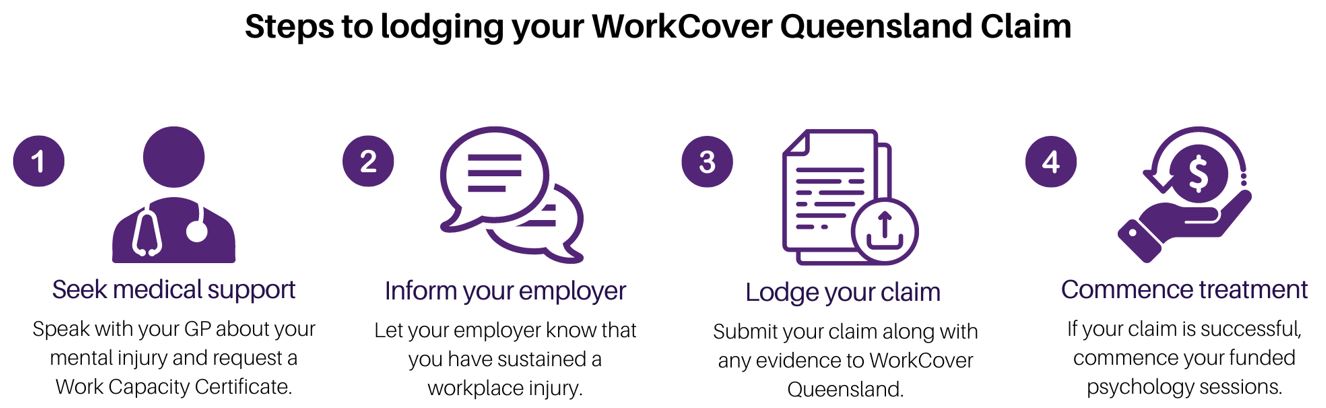

Step 1 – Seek medical support

Regardless of whether your injury is physical, psychological or both, it is important to seek treatment from a general practitioner (if possible, one who specialises in workers' compensation claims) about your work-related injuries. If you are looking for a GP who has this expertise, you can reach out to our WorkCover Queensland partner GP .

Your treating GP will generally issue you a Work Capacity Certificate (if not, we recommend that you request your GP prepare one). This Work Capacity Certificate will be important in the submission process as well as to assist with communication with your employer. A copy of an example Work Capacity Certificate can be found here .

“ During the WorkCover Queensland claiming process, some medical costs will be covered by the scheme. ”

The Work Capacity Certificate will include details about:

The injury that you have sustained

A proposed treatment plan

The capacity that you have for work

Your current functional ability

A proposed return to work plan, including any workplace modifications that may be necessary.

If you have experienced a psychological injury, and your doctor has made a consistent finding, your GP can make an initial recommendation of up to five (5) sessions with a qualified WorkCover Queensland psychologist . Note that you will only be able to access these initial sessions once your Case Manager has approved your claim.

In addition to these recommendation sessions, you can access one fully funded psychological support during the WorkCover Queensland assessment period, regardless of the outcome of your claim. You can read more on how to access this support below .

Step 2 – Inform your employer of the incident

This step may be made concurrently with Step 1 as there are time limits to making a workers’ compensation claim in Queensland (generally around 20 days).

All employers are required to have an injury register. By reporting your work-related psychological injury, your employer can maintain an up-to-date record. To assist your employer, they may request you complete an Incident Report. It is important to ensure that you maintain a copy of this report for your records. Note that it is important to be concise, accurate and honest when completing this Incident Report.

Step 3 – Lodge the claim with WorkCover Queensland

Once you have obtained your Work Capacity Certificate from your GP (as outlined in Step 1), you can submit your claim to WorkCover Queensland. This may be completed by:

Submitting the claim via the online WorkCover Queensland portal .

Calling WorkCover Queensland on 1300 362 128 and speaking with a member of the team.

Completing the claim form and either upload it using the WorkCover online service, fax it to 1300 651 387 or post the completed form to GPO Box 2459, Brisbane Qld 4001.

We recommend using the online WorkCover Queensland portal as the lodgment process is relatively straightforward so long as you ensure you have the following details on hand:

Your personal contact information, fullname and DOB. You will also be asked to provide your email address and mobile number.

Your employers' details including business name and location.

The Work Capacity Certificate (see Step 1 ) provided to you by your GP following your initial consultation.

Your bank account details. This information is necessary for any compensation payments that will be made by WorkCover Queensland.

A Tax File Number declaration . This is necessary for time loss claims.

Details about the injury or illness that you have sustained during the course of work, including any details about how and when the injury happened.

Once you have lodged your claim you will be provided with a claim number which you can use to keep track of the claims process through Worker Assist . Worker Assist is how you can communicate, lodge and provide updates with WorkCover Queensland.

Step 4 – Commence funded treatment

If your claim is successful, your psychology treatment along with any additional support recommended under your Work Capacity Certificate or as determined by your GP and Case Manager will commence.

Additionally, you may be compensated for the lost wages you have incurred because of your injury. Generally, your employer will pay for your first week's compensation afterwards WorkCover Queensland will manage payments afterwards.

Ready to commence psychology treatment? Book a session with a WorkCover Queensland Psychology session today.

Upon receipt of your workers' compensation claim, the Case Manager allocated to your claim by WorkCover Queensland will assess it to determine whether you are eligible to access paid support and compensation. It generally takes 20 business days for WorkCover Queensland to make this determination.

During the assessment process, the WorkCover Queensland team may contact your employer, doctor, current supports, and any witnesses to your injury.

If the Case Manager determines to approve your claim, you will be eligible to access compensation for your medical expenses, lost wages, and other related expenses. Additionally, you may also be able to access support to help you get back to work through methods such as rehabilitation and retraining. Case Managers can also refer to psychology practices who can offer support.

If the Case Manager determines to not approve your claim, you may be able to appeal the decision.

Yes, you can access support. WorkCover Queensland understands that where a person believes that they have suffered a psychological injury, accessing support immediately to commence the recovery process. However, note that this psychological support by a registered WorkCover Queensland psychologist will only be sufficient to fund one session.

“ Once you have submitted your claim and Work Capacity Certificate to WorkCover Queensland, WorkCover Queensland will fund one psychology session regardless of the claims outcome. ”

Access to this funded treatment can only occur once you have lodged your claim with WorkCover Queensland.

This funding can also be for:

GP appointments

Psychology or counselling sessions

Psychiatry appointments

Medication, such as antidepressants

If it is deemed necessary as part of your return to work, WorkCover Queensland can also support mediation services between a worker and their employer.

Please note that although WorkCover Queensland will endeavour to help support you as an injured worker in your recovery process, they will not cover the following:

In-patient hospital costs

Costs related to a hospital stay, such as nursing, or medications received in the hospital

If your claim is ultimately denied by WorkCover Queensland, any additional psychology sessions after the decision has been made will not be funded.

If following the assessment and determination process, your WorkCover Queensland Case Manager approves your psychological injury claim, WorkCover Queensland will commence funding your recovery and rehabilitation.

“ The recommended psychology sessions outlined in your Work Capacity Certificate will only be funded if they are completed within the timeframe set out by your Case Manager. ”

As flagged above in Step 1 , if your GP indicates in your Work Capacity Certificate that you have sustained a mental injury during the course of work and make a recommendation for psychology sessions, these sessions will now be funded. The maximum number of initial sessions a GP can recommend is five (5). Your Case Manager will set a time limit on when these funded psychology sessions must be used. This time limit is generally between three (3) to six (6) months. Any remaining sessions after the timeframe will no longer be accessible.

Once you have finished the initial recommended psychology sessions, your WorkCover Queensland psychologist will complete and submit a report to your Case Manager informing them of the next steps. This can include a recommendation for further psychology sessions or a recommendation that you are fit to return to work. If you have been recommended to receive further sessions, the Case Manager will assess the recommendation and make a determination.

Additionally, your Case Manager may request your WorkCover Queensland psychologist to prepare interim reports providing updates on your recovery status.

Start your WorkCover Queensland Psychology support today.

Where can I find a WorkCover Queensland psychologist?

You can access psychology support if you have submitted your claim along with your Work Capacity Certificate to WorkCover Queensland. To access this support you may need to request your GP to provide you with a referral letter to your chosen WorkCover Queensland psychologist. However, finding a psychologist available to help support you may be difficult as 1 in 3 psychologists in Australia do not currently accept new clients. Additionally, not all psychologists are registered with WorkCover Queensland and as such you will not be able to access funded support from them.

Luckily, Talked is a registered WorkCover Queensland psychology provider with several qualified WorkCover Queensland psychologists available in under 24 hours. If you wish to access support from one of our psychologists, we are happy to contact your WorkCover Queensland case manager to seek this approval and provide them with the GP referral.

Our psychologists can assist in your recovery, rehabilitation and ultimately, your return to work. These registered and clinical psychologists have extensive experience in providing services such as:

Cognitive behavioural therapy

Dialectical based therapy

Mindfulness based therapy

Each of these modalities, among others, has been shown to have efficacy in treating psychological conditions such as:

Talked psychologists understand that sustaining a psychological injury at work can make for a significant challenge. The role that a psychologist can play in the recovery process cannot be understated. During the recovery process coping strategies and skills that are developed in the sessions can help with:

Managing stress

Time management

Communication with colleagues and supervisors.

Get started today and reach out to Talked to start accessing psychology support for your mental health injury through your WorkCover Queensland claim.

If you are looking for additional resources to support your recovery, we have outlined several Queensland mental health injury support services that you can access.

Lifeline 13 11 14 Provides 24-hour crisis counselling, support groups and suicide prevention services.

Beyond Blue 1300 224 636 Aims to increase awareness of depression and anxiety and reduce stigma.

Workers’ Psychological Support Service 1800 370 732 A free, confidential and independent service available to Queensland residents who are struggling mentally due to a workplace injury.

Suicide Call Back Service 1300 659 467 A national 24/7 telehealth provider that offers free professional phone and online counselling for people living in Australia.

1300 MH CALL 1300 642 255 A confidential mental health telephone service for Queenslander residents that will connect you to public mental health services available near you.

QLife (LGBTIQ+) 1800 184 527

Kids Helpline 1800 55 1800. A free 24/7 online and phone counselling service for teens and young people aged up to 25.

For Aboriginal and Torres Strait Islander peoples

13 Yarn Crisis Support 13 92 76 24-hour crisis support for Aboriginal and Torres Strait Islanders.

Brother to Brother 24-hour crisis line 1800 435 799 Provides phone support for Aboriginal men who need someone to talk to about relationship issues, family violence, parenting, drug and alcohol issues or who are struggling to cope for other reasons.

WellMob Social, emotional and cultural wellbeing online resources for Aboriginal and Torres Strait Islander People.

Black Dog Institute offers a list of support services for Aboriginal and Torres Strait Islander peoples.

Domestic and family violence support

1800 RESPECT 1800 737 732. 24-hour national domestic, family and sexual violence counselling, information and support service.

Emergency service workers

National Emergency Worker Support Service Offers free and confidential mental health support for emergency service workers and volunteers (both active and retired).

Employee Assistance Programs

Many employers offer Employee Assistance Programs (EAPs) as a benefit to their employees. An EAP provides company-supported counselling. Reach out to your employer to explore whether they have an EAP. If not, you may want to recommend them Talked's best-in-class PAYG EAP offering.

Recommended Therapists Available Now

Social Worker

I'm a little unusual as a trauma specialist as I exist quite obviously outside the psychological arena and I don't make a point of pretending otherwise. As someone who ge... More

Psychologist

I'm a licensed psychologist both in Australia and Italy with more that 10 year experience providing mental health, psychosocial and clinical intervention in various commu... More

Hi, I'm an experienced Psychologist with a passion for helping people function at their best. I provide evidence-based psychological treatment to help people traverse and... More

Hi, I'm Robyn. I'm a Psychologist with 20 + years of experience in providing a variety of therapies and supports. I am warm and open in my approach, and I will work col... More

Book a FREE online therapy session with one of our top rated therapists

Manuela Sberna

Michael Hines

Essential reading, free mental health tests.

- Anxiety Test

- Depression Test

- Healthy Relationship Quiz

- Drinking Problem Test

- Self Esteem Test

Talked Services

- Best Rated Therapists

- Low Cost Therapists

- Psychologists Available Now

- Cognitive Behavioral Therapy

- Medicare Rebates Available

- Bupa Approved Therapists

- Telehealth Therapy Sessions

- In-Person Therapy Sessions

Find a Therapist

Get the help you need from a therapist near you .

Book a Therapy Session Today

Find a therapist and book your session online, helpful links, ready to take that first step.

If you are in a crisis, or experiencing suicidal or homicidal thoughts, contact 000 or your local emergency counselling service. Do not use this site to seek emergency help.

©2024 Talked Pty Ltd. ACN 640 295 272

Am I Responsible if My Employee Is Injured on the Way to Work?

By George Turnbull Legal Account Manager and Lawyer

Updated on January 31, 2024 Reading time: 5 minutes

This article meets our strict editorial principles. Our lawyers, experienced writers and legally trained editorial team put every effort into ensuring the information published on our website is accurate. We encourage you to seek independent legal advice. Learn more .

- What is Workers’ Compensation?

Differences Between the States and Territories

- Journeys for Work Purposes

- Key Takeaways

Frequently Asked Questions

Most employers are aware that employees who injure themselves at work may be a ble to claim compensation benefits. But what if an employee receives an injury on their way to work? Are you responsible for paying workers’ compensation? This article explains whether you are responsible if your employee receives an injury on their way to work.

As an employer, understand your essential employment obligations with this free LegalVision factsheet.

What is Workers’ Compensation?

If one of your employees has been injured in the workplace , you should immediately take action. Firstly, this involves helping them with any necessary first aid or medical treatment. You should also document the extent of the injury as well as what happened to cause it. Then, you should look into whether or not you will need to pay workers’ compensation. This is an amount you will have to pay to help your employee recover from their injury. This will usually involve reimbursing medical fees and a lump sum payment to compensate for loss of work. Ideally, this will help them get better and make a successful return to work.

No Compensation for Injured Employees

There are localised differences on whether or not you are responsible for an employee who receives an injury on their way to work. In South Australia , Tasmania , Western Australia and Victoria , employers will generally not be legally responsible. However, in Victoria , employees who receive an injury on their way to or from work can apply for compensation under a separate transport accident compensation scheme .

Possible Compensation for Injured Employees

However, the situation is slightly more complicated in New South Wales . Generally, you will not need to pay compensation for any injuries on a journey to or from work. This is unless there is a connection between their employment and the accident which caused the injury.

For example, this connection might be if your employee was:

- directed to pick up work mail on the way to work;

- directed to travel to a training course somewhere other than their typical workplace;

- travelling to meet a client; or

- involved in an accident that was caused by fatigue after completing a double shift.

Likely Compensation for Injured Employees

In the Northern Territory and the ACT , you will generally be legally responsible for your employees on their way to and from work.

Similarly, in Queensland , employers can be legally responsible for their employees while they travel to and from work. There are, however, several exemptions.

For example, in Queensland, an employee will not receive any workers compensation for injuries if they broke a road rule or criminal law while incurring the injury.

You will not be responsible for paying compensation if:

- the injury occurred too long before the employees’ work journey; or

- your employee had substantially deviated from their route to work.

Journeys for Work Purposes

Often, employees not only travel to and from work but also during the workday. Therefore, if your employee injures themself during the workday, you may be legally responsible. This means that you may need to pay worker’s compensation.

In most states and territories, what may constitute a work journey is relatively broad.

For example, it could include injuries incurred on journeys:

- during lunch breaks;

- on the way to a training conference;

- to receive a work certificate; or

- to client meetings.

Key Takeaways

In most of Australia, it is unlikely that you will be responsible for paying workers’ compensation if your employees receive an injury on their way to work. It is even more unlikely if your employee is injured as a result of their serious misconduct or by breaking the law. However, the laws surrounding needing to pay workers’ compensation differ between each state and territory. Either way, you must ensure that you have the appropriate level of cover and insurance so that you are adequately protected if any workers compensation claims arise.

If you have any questions about your employment requirements, our experienced employment lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 1300 544 755 or visit our membership page .

In NSW, you typically will not need to pay compensation for any injuries sustained on the way to work. However, you may be responsible if there is a connection between their employment and the accident which caused the injury. For example, if they are on their way to meet a client or have been directed to pick up a package on the way to work.

No, employers in Victoria will generally not be legally responsible if an employee is injured on their way to work.

We appreciate your feedback – your submission has been successfully received.

Register for our free webinars

Privacy law reform: how the proposed changes affect in-house counsel obligations, avoiding common legal and tax pitfalls for online businesses in australia, cyber attack how to prevent and manage a breach in your business, sealing the deal: in-house counsel’s guide to streamlining corporate transactions, contact us now.

Fill out the form and we will contact you within one business day

Related articles

Worker Injured on the Job? Here is What You Should Do.

Psychiatric Injury Claims and an Employer’s Liability

My worker has suffered a psychiatric injury – am I liable?

I Am an Employer. Can I Accept My Employee’s Heat of the Moment Resignation?

We’re an award-winning law firm

2023 Fast Firms - Australasian Lawyer

2022 Law Firm of the Year - Australasian Law Awards

2021 Law Firm of the Year - Australasian Law Awards

2020 Excellence in Technology & Innovation Finalist - Australasian Law Awards

2020 Employer of Choice Winner - Australasian Lawyer

Your guide to worker’s compensation claims in Queensland

Sunday March 17, 2024

Download as PDF

If you sustain a workplace injury in Queensland , in the midst of undertaking medical treatment and rehabilitation, there is the added stress of navigating the world of worker’s compensation claims. This blog is a guide for injured workers. We explore:

- who is covered for worker’s compensation in Queensland;

- lodging your worker’s compensation claim;

- what benefits are available;

- relevant timeframes for the worker to lodge a claim and the insurer to respond; and

- options to appeal a denied worker’s compensation claim.

CALL FOR FREE WORKERS COMPENSATION ADVICE: 1800 659 114

OR CLICK HERE TO EMAIL YOUR INQUIRY: [email protected]

Who is covered by the Queensland worker’s compensation scheme?

To determine your eligibility for worker’s compensation in Queensland, you are required to meet the following criteria:

- You are a worker in Queensland;

- You have sustained an injury;

- You were injured during the course of your employment; and

- Your employment was a significant contributing factor to your injury.

Please note that some workers who work in Queensland are covered under the Commonwealth worker’s compensation scheme, Comcare. You can read information about the Comcare scheme here .

Lodging your Queensland worker’s compensation claim

You should notify your employer of a workplace injury or illness as soon as possible after the accident or after any diagnosis of a work-related illness. You should complete an incident report and attend on your doctor or a hospital.

To lodge a worker’s compensation claim, you will need a “work capacity certificate”. This is a type of medical certificate specifically for worker’s compensation claims. It should be completed by your treating doctor.

Once you’ve notified your employer and obtained your work capacity certificate, you can lodge a worker’s compensation claim with WorkCover Queensland, either online here , or by calling them on 1300 362 128 . If your employer is self-insured, you can lodge your claim directly with them.

Tips before lodging your claim

- To claim worker’s compensation in Queensland, you need to be able to prove that an incident has occurred, causing injury (including psychological injuries and illnesses);

- Whether the injury you sustained is a compensable injury is defined under Workers’ Compensation and Rehabilitation Act 2003 (Qld) (“ the Act ”) as:

“… a personal injury arising out of, or in the course of, employment if the employment is a significant contributing factor .”

- A connection between the injury sustained and employment is paramount. If you get injured, your injury will generally be considered “work- related” if it occurred while you were working or because of your work. However, just because an injury occurs at your workplace, it does not mean it is because of your work. Similarly, if you are injured because of your work but outside of your workplace, your injury might be work-related.

- An injury includes an aggravation of a pre-existing injury (which need not be an injury resulting from your employment). Requirements for psychological injuries arising out of certain circumstances vary. You can read more about psychological injury claims in our blog, “I’ve suffered a psychological injury at work. What do I do?”

- The correct worker’s compensation medical certificate (a work capacity certificate) must have been completed by a medical practitioner;

- You should include any relevant evidence to support your application for worker’s compensation. For example, incident reports, medical reports and witness statements.

What worker’s compensation benefits are available in Queensland?

Injured workers in Queensland with an accepted worker’s compensation claim may be entitled to:

- weekly payments for loss of wages;

- reasonable medical expenses related to the workplace injury;

- lump sum compensation for permanent impairment; and

- travel expenses when travelling to/from medical appointments.

In addition to your statutory (no-fault scheme) entitlements, if your injury was caused by the negligence of another person or entity, you may also be entitled to common law damages.

Time limits for worker’s compensation claims in Queensland?

Under the Act, generally, an application for compensation should be lodged within 6 months after the entitlement to compensation for the injury arises. A WorkCover insurer, under certain special circumstances, may consider a late application.

If you’ve lodged a worker’s compensation claim outside the 6-month time limit and the claim has been denied, you should seek legal advice from a worker’s compensation lawyer.

GET ADVICE FROM A WORKERS COMPENSATION LAWYER: 1800 659 114

How long does the insurer have to make a decision on my worker’s compensation claim?

The WorkCover insurer has 20 business days to make a decision on your application, however, they may require more time to undertake further investigation or to obtain further information to assist in making a decision. The insurer has an obligation to communicate the outcome with you in writing.

Can I appeal an adverse decision on my worker’s compensation claim?

If your worker’s compensation claim is rejected, the WorkCover insurer must advise you of that decision (within 20 business days, as mentioned earlier, and they must also advise you of the reasons for denying your claim in writing.

If you disagree with the insurer, you are entitled to have the decision reviewed within 3 months of receiving the decision and reasons for the decision. You should seek legal advice from a lawyer experienced in Queensland worker’s compensation claims, if you wish to review an adverse decision.

Get help from a Queensland worker’s compensation lawyer

When considering lodging a worker’s compensation claim in Queensland, it is important to understand your eligibility to claim, provide all the necessary documentation and evidence (including your work capacity certificate) and be mindful of time limits. If you’re unsure of your rights and entitlements, or you’ve received an adverse decision from the WorkCover insurer at any time, you should seek legal advice.

Hall Payne’s worker’s compensation lawyers can assist you with any aspect of your claim, including any rights to pursue lump sum compensation for permanent impairment or a common law claim due to negligence.

Contacting Hall Payne Lawyers

You can contact us by phone or email to arrange your consultation; either face-to-face at one of our offices, by telephone or by videoconference consultation.

Phone: 1800 659 114 Email: [email protected]

This article relates to Australian law; either at a State or Federal level.

The information contained on this site is for general guidance only. No person should act or refrain from acting on the basis of such information. Appropriate professional advice should be sought based upon your particular circumstances. For further information, please do not hesitate to contact Hall Payne Lawyers .

Get in touch with today's blog writer: Fadzai Mudimu

Previous Blog Post Next Blog Post

This article relates to Queensland personal compensation. If you are seeking information about Queensland personal compensation law, click 'yes' to view the article.

We need to show you specific information for your location. please select your state:, if you would like to find out more about your rights and the process for making a personal injury claim, please answer ‘yes’ below., are you making a genuine enquiry about a personal injury, if you would like to find out more about your rights and the process for making a personal injury claim in queensland, please answer ‘yes’ below..

You're using an outdated browser. Please upgrade your browser to improve your experience.

Your browser has Javascript disabled. Some features may be limited.

- 1800 316 716

Road Accident Claims

For accidents that take place on the road, as a motorist, cyclist, or pedestrian.

Work Accident Claims

For accidents that happen at work or from work-related activities.

Silicosis Disease Claims

For silicosis and silica exposure-related illnesses.

Whiplash Claims

For whiplash injuries following a road accident or collision.

Asbestos Disease Claims

For asbestosis or illnesses related to asbestos exposure.

Public Place Injury Claims

For injuries following accidents that happen in public places.

Industrial Deafness Claims

For industrial deafness or occupational noise-induced hearing loss.

Institutional Abuse Claims

For compensation following abuse by institutions like schools or churches.

Super Insurance Claims

For assistance with Total and Permanent Disability (TPD) claims.

Medical Negligence Claims

For claims following negligence by medical professionals or hospitals.

Prefer to speak to someone directly?

- Claims Process

- No Win, No Fee

- Our Low Fees

- Meet Our Team

- What Our Clients Say

- Our Locations

- Book a free consultation

The latest industry insights into compensation law.

- Workers Compensation

- 6 December 2021

Common Questions About WorkCover Queensland Claims

We get asked a lot of questions from Claimants about WorkCover Queensland claims and their compensation entitlements.

The purpose of this article to answer some of the more commonly asked questions, which we hope might be useful to Claimants.

Can you claim WorkCover for a pre-existing injury?

If a worker sustains an injury during the course of their employment, they are entitled to lodge a WorkCover Queensland claim .

It is quite often the case that a worker might aggravate a pre-existing condition. For example, a Claimant may have had previous issues with their lower back in the past but at the time of a new work event, they were asymptomatic. If the worker then aggravates their lower back injury, say as a result of lifting something heavy, they are entitled to lodge a claim with WorkCover.

It will be important for the doctors to differentiate the extent of the pre-existing condition and the aggravation injury, together with the permanency of any aggravation injury.

It is often essential to have appropriate expert medico-legal evidence to properly address this.

We run a number of matters for Claimants who were asymptomatic at the time of the work event who then suffer from a permanent aggravation to a pre-existing condition. It is important to seek legal advice as early as possible with respect to any potential WorkCover claim.

It is also important to note that even pre-existing injuries that are symptomatic at the time of the work event can be compensable. If a work event has made the symptoms worse, this would still qualify as a compensable injury. Again, it is important to seek legal advice as soon as possible.

What Injuries can you Claim on Workers’ Compensation?

There are number of injuries that can be claimed under WorkCover Queensland. If a work-related injury or illness happens to you (if you are a worker) or to one of your workers (if you’re an employer), there are potential entitlements through WorkCover Queensland .

An example of some of the injuries that workers can claim under WorkCover are as follows:

- Psychological or psychiatric injury;

- Industrial deafness ;

- Work related respiratory diseases such as silicosis ;

- Critical injuries;

- Back injuries;

- Shoulder injuries; and

- Ankle injuries.

In certain circumstances, workers injured whilst travelling to or from work can also be compensated for an injury sustained. For example, if you were driving to work and were rear ended on the way to work, a Claimant would be entitled to lodge both a WorkCover Queensland claim and a CTP claim .

If a worker dies as a result of work, a family member who was dependent on the person who has died, such as their partner or children may be able to lodge a claim with WorkCover Queensland.

It is important to get immediate legal advice regarding compensation entitlements should a work-related injury be sustained.

How Long Does a WorkCover Claim Take to be Approved?

The timeframe for a WorkCover claim to be approved varies. The first step is to lodge a WorkCover Queensland Claim Form together with a Workers’ Compensation Medical Certificate completed by your treating doctor.

Generally speaking, WorkCover must then make a decision with respect to whether your claim is accepted or rejected within 20 business days of receiving your claim.

In certain circumstances, WorkCover may take longer to make a decision if there is outstanding information they require. WorkCover should be communicating this clearly with the Claimant. It may be the case that further information is required from the employer.

Can an Employer Dispute a WorkCover Claim?

An employer can dispute the acceptance of a WorkCover claim. If WorkCover accepts a claim, the employer is entitled to dispute that decision and they must lodge an appeal with the Workers’ Compensation Regulator (“the Regulator”) within 3 months of WorkCover making the decision to accept the claim.

WorkCover will notify you if your employer has taken such a step to lodge an appeal with the Regulator.

It is important to seek immediate legal advice regarding your entitlements should this occur. There are strict time limits involved in Regulator appeals and the Regulator will advise a Claimant of an appeal lodged by the employer and provide a right of reply. Again, this is where it is important to obtain legal advice so you are fully aware of your rights and entitlements.

How Long Do You Have to Lodge a Claim with WorkCover Queensland?

For an injury that occurs as a result of a single incident event, a claim with WorkCover Queensland must be lodged within 6 months of that event. This time limit is usually applied very strictly by WorkCover Queensland and it is important not to delay in lodging a claim if there is an entitlement.

Some injuries occur over a period of time, for example, heavy repetitive tasks at work being undertaken over a number of months resulting in a back injury. For an over period of time claim such as this, a claim with WorkCover must be lodged within 6 months of first attending on a medical practitioner. A medical practitioner can include doctors and nurses at a hospital and is not confined to your regular GP. It is therefore essential that a claim is lodged as soon as possible after the first consultation.

It is important that workers are aware there are also very strict limitation periods with respect to common law entitlements.

For a single event injury, a compliant Notice of Claim for Damages must be lodged within 3 years of the date of incident, failing which the claim may be statute barred.

For an over period of time claim the 3-year limitation date starts from the date the work was first subjected to the harm. There is the potential for this date to have occurred many years ago and outside of the 3 year limitation date. It is therefore essential to seek immediate legal advice regarding steps that may be taken to protect an expired or expiring limitation date.

- Posted 6th December 2021

- in Workers Compensation

Obligation free advice

Claiming compensation can be intimidating, but it doesn’t need to be. vbr Lawyers is the multi award winning firm that gets you real results. Lower costs, higher claims and unrelenting advocacy.

Digital Marketing by Excite Media

- Terms of Service

- Privacy Policy

State updated!

Start your free & no obligation claim check

Main murphy's law website form enquiry.

" * " indicates required fields

- No Win No Fee

- Switching to Murphy's Law

- Best Lawyers Awards

- Car and Road Compensation

- Cycling Compensation

- Work Compensation

- Public Place Compensation

- Medical Compensation

- Covid Vaccine Injury Compensation Claims

- Child Abuse Compensation

- TPD Claims Lawyers

How to Make a WorkCover Claim in Queensland

Table of contents.

The Queensland worker’s compensation scheme is designed so that injured workers can obtain support for their recovery, including through payment of medical expenses, cover for lost wages, and compensation for the impact a work related injury has had on their lives.

The scheme is also intended to achieve:

- improved worker safety

- prevention of injuries

- effective rehabilitation and return to work programs.

This is a straightforward guide to making a WorkCover claim for workers who have been injured and anyone supporting them.

Unsure of your rights after a work injury? If you’ve suffered an injury at work due and are unsure of your rights then you should seek legal advice. Our work injury compensation experts can provide free and no obligation initial advice on your rights and explain your options including whether a no win, no fee claim for a tax-free lump sum may be possible.

Unsure of your workers compensation rights. Get free expert advice now.

Who is entitled to make a workcover claim.

Workers are entitled to compensation where they have suffered a work-related injury or illness.

The law says that workers compensation can be claimed for an injury ,illness and/or death if it “arises out of, or in the course of, employment”. So, what does this mean?

Generally, an injury or illness will be considered to arise out of, or in the course of employment, if it happens while a worker is:

- at their place of employment

- somewhere else performing work duties, or because they are required to be there by their employer

- on a normal break during the workday

- travelling to or from their home to their workplace (such as a car accident on cycling injury )

- travelling to or from their home or workplace to a school or training course they are doing for work purposes

- on a journey between two workplaces

There is an additional requirement that the employment is a significant contributing factor to the injury if a claim is being made for an injury incurred at the place of employment or at another place performing work duties.

Step by step guide: making a claim to WorkCover Queensland

Obviously the first thing to be done after a workplace accident has nothing to do with claiming compensation – it is to make the workplace safe and to secure immediate medical treatment for the injured worker.

The injured worker:

- may be treated in hospital, if the injury is serious enough, or

- should consult a doctor for treatment.

If you have been injured, make sure all medical professionals are advised up front that the injuries or illness are work-related, and that a WorkCover claim may be made. This ensures that they keep suitable records for you to submit in the course of making your claim.

You should then take the following 8 steps to make your WorkCover claim.

- Advise your employer in writing about the accident and your injuries – if you are too unwell, someone can do this on your behalf.

Your employer may already know about the accident if it happened at work, but it’s still a good idea to confirm it in writing.

- Obtain a work capacity certificate from your treating medical professional, such as your GP or specialist. If you are treated in hospital, they can complete the work capacity certificate and forward it to WorkCover on your behalf (if you have told them it is a work-related injury).

The doctor will complete the certificate of capacity and can access guidance on how to do this effectively. For your information though, a work capacity certificate is a specific type of medical certificate that contains details about:

- the injured worker

- the injury and the circumstances in which it occurred

- what treatment plan is proposed by the doctor

- any limitations to physical functioning caused by the injury

- rehabilitation and return to work plans

- Submit the work capacity certificate to your employer and advise them that you will be making a WorkCover claim.

- Decide whether to make your claim to WorkCover, or to your employer . You would claim directly to your employer if they are self-insured.

How do I know if my employer is self-insured?

Most employers will be insured by WorkCover Queensland. Some, however, arrange their own workers compensation claims insurance and manage their own WorkCover claims. WorkSafe Queensland publishes a list so you can check if your employer is self-insured.

Some of the major employers on the list include:

- Brisbane City Council

- Wesfarmers - owners of Bunnings, Kmart, Officeworks and more

If your employer is not on that list, make your claim directly through WorkCover.

- Submit your claim

To submit your claim, you will need to complete an online claim , or submit a claim form

A claim must be submitted within 6 months of the accident, or the date you receive a medical opinion linking your injury or illness to your work. However, it’s best to get the claim submitted as soon as you can, because if it is approved you can start receiving payments to help with your medical expenses and to cover any lost wages.

It might assist with a smooth submission of your claim if you take a little time to gather the necessary information first. This information includes:

- Personal details, including bank account information to receive payments

- Employment details

- Details of the injury

- Your work capacity certificate

If for some reason you don’t have a work capacity certificate to attach to your claim form, you will need information about:

- When the certificate was completed

- Your treating doctor and their diagnosis

- Your capacity to work

- Future treatment required

In many cases your doctor will provide a clear statement linking your injury or illness to your employment. If this is not the case, you may need further evidence to establish your entitlement to claim. This might include:

- A statement by you about how the injury occurred, or the illness came about

- If there was an accident, statements from any witnesses about what happened

- A letter or report from a doctor, specialist or other medical professional linking the injury or illness to your workplace or the performance of your work duties.

Some types of claims, like psychological injury , industrial deafness, or workplace fatalities , will require more information than others. WorkSafe Queensland provides additional guidance for claims of these kinds.

- Provide further information to WorkCover Queensland or your self-insured employer if required.

During the claims assessment process, WorkCover (or a self-insured employer) may require additional information to determine your claim. It is best to provide the information as soon as possible.

You may also be required to have an independent medical examination.

If you are unsure about further information or assessment that has been requested, or unable to provide what is being asked of you, it may be worth seeking legal advice about your options.

- Consider the outcome of your claim.

WorkCover Queensland aims to provide a decision on claims within 20 business days, provided all the required information has been provided.

If your claim is accepted, you will receive certain support and payments – more information about these is available here .

- Consider all your options

A WorkCover claim is generally the most straightforward way in which to secure compensation for a workplace injury or illness. However, injured workers do have the option to make a compensation claim in the court, called a common law claim.

Some information is available from WorkSafe Queensland about the process and implications.

The seriousness of your injury will be medically assessed and the extent of any permanent impairment to your functioning will be determined. This is called a “DPI” or “degree of permanent impairment”, and is expressed as a percentage. Based on this, WorkCover will offer a lump sum payment.

If you thankfully have little permanent impairment, that is, a DPI less than 20%, you must choose whether to accept the lump sum payment or to make a common law claim. You cannot do both.

For those workers who are unfortunately more significantly impacted, with a DPI over 20%, you can accept the lump sum and still make a common law claim.

However, once you receive your Notice of Assessment and accompanying offer of lump sum compensation, it is vitally important that you seek legal advice immediately as to whether you should accept the assessment, reject the assessment or defer your decision. If you choose to accept the assessment and the accompanying lump sum offer, you will very likely lose your rights to pursue a common law claim for that injury.

You only have 20 business days in which to make a decision once the Notice of Assessment is issued. As such, you should seek legal advice immediately once you receive your Notice of Assessment.

You can always seek advice

The steps to make a WorkCover claim are relatively straightforward, and there is much helpful information published by the government and available on the internet at the links referred to above. However, many injured workers still appreciate the assistance and advice of a lawyer experienced in workers compensation claims.

This is especially the case if you reach the point of considering whether to accept a WorkCover lump sum payment or to pursue a common law claim.

How helpful was this article

Thank you for your feedback.

Step-by-Step Guide: How to Lodge a WorkCover Claim in QLD with Ease

Tina veivers.

- December 23, 2023

Home » Blog » Step-by-Step Guide: How to Lodge a WorkCover Claim in QLD with Ease

DIRECTOR / LAWYER QUEENSLAND LAW SOCIETY ACCREDITED SPECIALIST

Tina is the director of the firm and a lawyer who has 20 years of experience running and managing compensation claims for Plaintiffs. In contrast to the industry standard of larger compensation firms, Tina is a strong believer in ensuring that plaintiffs receive the vast majority of any settlement payout they do receive and will often reduce fees to ensure this occurs. In her spare time, Tina enjoys going to the beach and enjoying time with her family.

Have you ever been injured at work and wondered how to navigate the complicated maze that is the workers’ compensation system? You’re not alone.

Every year, countless workers in Queensland find themselves in this exact situation. But there’s good news: understanding and managing a WorkCover claim doesn’t have to be a daunting journey. Armed with the right information on how to lodge a WorkCover claim in Queensland, it’s a path that can be navigated with relative ease. Let’s unravel this complex process together, step by step.

Key Takeaways

- WorkCover Queensland provides coverage for employees injured at work, including various medical expenses and wage losses. Initiating a claim involves promptly seeking medical attention, notifying the employer in writing, and lodging a claim with WorkCover QLD.

- All employees in Queensland are covered by WorkCover for work-related accidents, including travel and work-related activities. However, volunteers may not be eligible.

- After a claim is lodged, WorkCover assesses it based on medical reports, wage verification, and other evidence. If approved, claimants receive weekly compensation payments calculated based on wages before the injury.

- Effective claim management includes verifying the accuracy of compensation payments and cooperating with WorkCover throughout the recovery process. A safe and gradual return to work is encouraged, with WorkCover supporting necessary medical treatments and workplace adjustments.

- If a claim is denied, understanding the reasons for denial, and seeking legal advice from experienced workers’ compensation lawyers , like South East Injury Lawyers, can be crucial.

Understanding WorkCover Queensland

WorkCover Queensland provides support and hope for employees who have suffered work-related injuries or illnesses. As a workers’ compensation insurance provider, it serves Queensland employees who have experienced a work-related incident by providing them with benefits. Every employer is mandated to possess WorkCover insurance, making it a ubiquitous part of the employment landscape.

When an injury at work occurs, it’s not just a race against time for recovery, but also to report the injury to WorkCover Queensland. As the workers compensation regulator, WorkCover allows notifications through various accessible means – online, via phone, or through the mail. But remember, the key aspect here is promptness. The sooner you notify, the sooner you can claim.

Who is Covered by WorkCover?

So, who exactly is covered by WorkCover Queensland? The answer is simple: all employees. WorkCover’s coverage is broad, offering protection for work-related accidents, including those happening during travel to or from work and while carrying out work-related activities. This coverage applies to both self-insured and non-self-insured employers, ensuring a broad safety net for all Queensland employees.

However, there is a catch. Volunteers, despite their invaluable contributions, unfortunately may not qualify for coverage under WorkCover Queensland. You can find out from WorkCover if the organisation you volunteer for is eligible.

So, if you’re a worker in Queensland, WorkCover has got you covered. But remember, it is always advisable to clarify your eligibility status with your employer or WorkCover Queensland directly.

What is Covered by WorkCover?

WorkCover’s protection extends beyond injuries to also cover the ensuing financial burdens, including medical expenses. Once a claim is approved, WorkCover intervenes to offer weekly payments and meet various medical costs. Lost wages, physiotherapy, rehabilitation, surgery, and any other necessary assessments or treatments are covered, ensuring that the road to recovery isn’t marred by financial hurdles.

However, while WorkCover’s coverage is comprehensive, it does have its limits. Certain services such as:

- massage therapists

- natural therapists

- pilates instructors

- personal trainers

- naturopaths

- acupuncturists

are not usually covered. Therefore, it’s important to be aware of what treatments are covered and plan your recovery accordingly.

Initiating a WorkCover Claim

Following a work injury, it’s important to start your WorkCover claim promptly. Seeking immediate medical attention is the first step. Taking this action can be essential to your health and wellbeing. also, isn’t just a crucial step for your health but also for your claim, as a medical certificate or report from your treating doctor is a necessary component of the claim form.

Once your health is taken care of, the next step for an injured worker is to notify your employer about the injury. This should be done in writing and include details of how and when the injury occurred.

Finally, lodge a WorkCover claim with WorkCover Queensland either online, by phone, or by mail. The claim should provide detailed information about your injury, employment, and medical status. Although this process may appear complicated, it’s a required route to securing your rightful compensation.

Seek Medical Attention

When a work-related injury occurs, your first priority should be your health. Seeking immediate medical attention is not only crucial for your recovery but also for your WorkCover claim. A timely visit to the doctor helps prevent your injury from worsening and ensures prompt treatment. More importantly, it allows for accurate documentation of your injury, which is key for your workers’ compensation claim.

A Work Capacity Certificate from your doctor is necessary to back up your claim. This certificate should confirm that the injury is work related. It’s essential to consult with a medical professional before notifying your employer about the injury. Remember, WorkCover can reimburse you for initial emergency medical treatment costs, so don’t hesitate to seek immediate medical attention if required.

Notify Your Employer

The sooner you notify your employer, the better. Delay can lead to complications in your claim process. If your employer fails to acknowledge your injury, you have the right to notify the Workplace Health and Safety Queensland (WHSQ) immediately. Your employer is legally obliged to support you through this process and ensure that your rights to access workers’ compensation are upheld.

Complete the Claim Form

Once your employer is notified, the next step is to lodge your WorkCover claim. You have multiple options to do this. You can either do it online, by phone or by mail. The claim form requires detailed information about your injury, your employment, and your employer. You must submit a medical certificate or report from your doctor as evidence. This must include details of treatment, diagnosis and test results from any tests performed.