What are Round-Trip Transactions?

Complete Explanation of Round Tripping including Purpose, Example, & Risks

Home › Finance › Corporate Finance › What are Round-Trip Transactions?

In the complex world of financial markets and corporate accounting, the term “round-trip transactions” often surfaces amidst discussions of financial ethics, regulatory compliance, and corporate governance.

These transactions, while not inherently illicit, tread a fine line between strategic financial management and the murky waters of manipulative practices.

This comprehensive guide aims to unravel the intricacies of round-trip transactions, shedding light on their purposes, risks, and the legal and ethical considerations they entail.

- Round-Trip Transactions Meaning

Key Takeaways

The purpose of round-trip transactions, how is round tripping used, round tripping example, the risks and implications of round-trip transactions, legal and regulatory framework, ethical considerations of round trip transactions, detecting and preventing round-trip transactions, what exactly defines a round-trip transaction in financial terms, why might a company engage in round-trip transactions, what are the potential risks of engaging in round-trip transactions, how can round-trip transactions be identified or prevented.

Round-trip transactions refer to a series of transactions in which a company sells an asset to another party with the agreement that the asset will be bought back at a later date, usually at a similar or predetermined price.

This cycle creates the appearance of genuine business activity without any substantive change in the company’s financial position or the asset’s ownership. While round-trip transactions span various industries, they are notably prevalent in the energy sector and financial markets, where companies might engage in these deals to inflate revenue figures or to create a facade of heightened market activity.

The distinction between legitimate and manipulative uses of round-trip transactions hinges on intent and disclosure. Legitimate uses are typically transparent and aim to achieve lawful financial or operational objectives, such as hedging against price fluctuations. Conversely, manipulative practices are designed to deceive stakeholders or regulatory bodies about a company’s true financial health or market activity.

Manipulative Impact on Financial Statements : Round-tripping is primarily used to artificially inflate a company’s revenue and trading volume, misleading stakeholders about the company’s true financial performance and market activity.

Legal and Ethical Risks : Engaging in round-trip transactions carries significant legal and ethical risks, including regulatory penalties and reputational damage, as these practices can be considered deceptive and manipulative.

Importance of Transparency and Regulation : The detection and prevention of round-trip transactions highlight the importance of transparent accounting practices and stringent regulatory oversight to ensure the integrity of financial markets and protect investor interests.

Round tripping is often used to artificially inflate a company’s revenue and trading volume, creating the appearance of a higher level of business activity than actually exists.

This practice can be employed to meet financial targets, influence stock prices, or enhance the attractiveness of the company to investors by manipulating financial statements. By artificially inflating revenue, a company can appear more financially robust and liquid than it truly is, potentially influencing stock prices and investor perception.

The allure of round-trip transactions lies in their ability to temporarily enhance a company’s financial standing without necessitating actual business growth or operational improvements. This can make a company more attractive to investors, lenders, and analysts in the short term, albeit at significant risk.

Companies might engage in round-trip transactions in several different ways. Here are the most common round-trip transactions:

Inflating Revenue : A company may engage in round-tripping by selling an asset to another entity and buying it back at a similar price. These transactions can be recorded as legitimate sales and purchases, artificially inflating the company’s revenue and sales volume without any real change in its economic situation, misleading stakeholders about the company’s financial performance.

Boosting Asset Turnover : By repeatedly selling and repurchasing assets in round-trip transactions, a company can give the impression of higher asset turnover than is actually the case. This can make the company appear more efficient in its use of assets, potentially misleading investors about its operational effectiveness.

Manipulating Market Activity: In the case of publicly traded companies, round-trip transactions can be used to create an illusion of heightened trading activity for the company’s shares. This can influence stock prices by suggesting a higher demand for the shares than actually exists, potentially attracting more investors based on misleading information.

An example of round-tripping involves a company, Company A, selling an asset to Company B for $1 million. Shortly thereafter, Company B sells the same asset back to Company A for approximately the same price, say $1.01 million.

This sequence of transactions makes it appear as though Company A has engaged in $1 million worth of sales, thereby inflating its revenue figures, even though there has been no real change in the economic position of either company.

This practice can be used to manipulate financial statements and give an inflated impression of the company’s financial health and trading volume, potentially misleading investors and regulators.

The primary risk associated with round-trip transactions is the potential for legal repercussions and loss of investor trust. Regulatory bodies in many jurisdictions scrutinize such practices closely, and companies found guilty of using round-trip transactions to manipulate financial outcomes can face hefty fines, legal sanctions, and reputational damage.

Notable incidents, such as the Enron scandal, highlight the catastrophic impact that deceptive financial practices can have on stock prices, market stability, and investor confidence.

Moreover, round-trip transactions can distort market perceptions, leading to inefficient capital allocation and undermining the integrity of financial markets. The artificial inflation of activity or liquidity can mislead stakeholders about market demand, price stability, and the true value of assets involved.

The legal status of round-trip transactions varies by jurisdiction, but there is a growing trend towards stricter regulation and oversight. Financial regulatory bodies worldwide have implemented guidelines and reporting requirements to curb the abuse of such transactions.

The role of auditors and financial regulators is pivotal in detecting manipulative practices, necessitating rigorous examination of financial records, transaction trails, and disclosure statements.

Beyond legal implications, round-trip transactions pose significant ethical dilemmas. The fine line between creative accounting and outright fraud is often blurred, challenging companies to maintain integrity and transparency in their financial reporting.

Ethical business practices and robust corporate governance structures are crucial in mitigating the temptation to engage in deceptive financial maneuvers.

Companies must foster a culture of honesty and accountability, ensuring that all stakeholders can rely on the veracity of financial statements and market activities.

For investors and regulators, identifying potential round-trip transactions involves scrutinizing sudden spikes in revenue or trading volume without corresponding changes in market conditions or company operations. Vigilance and due diligence are essential in assessing the authenticity of reported financial health and operational activity.

Companies, on their part, can prevent misuse by adopting transparent accounting practices, regularly auditing financial records, and ensuring that all transactions are conducted at arm’s length and properly disclosed. As the financial landscape evolves, so too must the strategies for maintaining fairness and integrity in corporate reporting and market transactions.

Round-trip transactions, while a legitimate tool in certain contexts, present a complex challenge in the realm of financial ethics and regulation. As companies navigate the pressures of financial performance and market competitiveness, the temptation to engage in such practices underscores the importance of robust regulatory frameworks, corporate governance, and ethical leadership.

The future of round-trip transactions will undoubtedly be shaped by ongoing efforts to balance financial innovation with transparency and integrity, ensuring the stability and trustworthiness of markets and corporate institutions. In this ever-changing environment, the collective responsibility of companies, regulators, and investors to foster transparency and integrity has never been more critical.

Frequently Asked Questions

A round-trip transaction refers to a set of transactions where an asset is sold and subsequently repurchased by the original seller, often at a similar price, to artificially inflate volume or revenue without any real change in asset ownership.

Companies may use round-trip transactions to meet financial targets or create the illusion of increased business activity, thereby enhancing their financial statements or market valuation temporarily.

Round-trip transactions can lead to legal penalties, reputational damage, and a loss of investor trust if used to manipulate financial statements or deceive stakeholders.

Identifying round-trip transactions involves scrutinizing financial records for transactions that inflate company activity without real economic substance, while prevention requires transparent accounting practices and rigorous financial oversight.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Search Search Please fill out this field.

- Guide to Mutual Funds

A Guide to Mutual Fund Trading Rules

:max_bytes(150000):strip_icc():format(webp)/biopic_2__claire_boytewhitebw-5bfc261bc9e77c00262f61d9.png)

Investing in mutual funds isn't difficult, but it isn't quite the same as investing in exchange traded funds (ETFs) or stocks. Because of their unique structure, there are certain aspects of trading mutual funds that may not be intuitive for the first-time investor. Notably, many mutual funds impose limits or fines on certain types of trading activity, due to past abuses.

Key Takeaways

- Mutual funds can be bought and sold directly from the company that manages them, from an online discount broker, or from a full-service broker.

- Information you need to choose a fund is online at the financial company websites, online broker sites, and financial news websites.

- Pay particular attention to the fees and expenses charged, which can drain your earnings.

A basic understanding of the ins and outs of mutual fund trading can help you navigate the process smoothly and get the most out of your investment in mutual funds.

How to Buy Mutual Fund Shares

Mutual funds are not traded freely on the open market as stocks and ETFs are. Nevertheless, they are easy to purchase directly from the financial company that manages the fund. They also can be purchased through any online discount brokerage or a full-service broker.

Many funds require a minimum contribution, often between $1,000 and $10,000. Some are higher, and not all funds set any minimum.

You also may notice that some mutual funds are closed to new investors. The more popular funds attract so much investor money that they get unwieldy, and the company that manages them makes the decision to stop enrolling new investors.

Doing Your Research

Before you make a decision, you'll want to do your research to find the fund or funds that you want to invest in. There are thousands of them, so there's plenty of choice out there.

These have a wide range to appeal to the many types of investors, from "conservative" funds that invest only in blue-chip stocks to "aggressive" and even speculative funds that take big risks in hopes of big gains. There are funds that specialize in particular industries and in certain regions of the world.

There also are many choices beyond stocks. Don't forget bond funds, which promise steady payments of interest and low risk.

Keep in mind that most funds don't put all their eggs in one basket. A percentage of the fund may be reserved for investments that balance the portfolio.

Read about Investopedia's 10 Rules of Investing by picking up a copy of our special issue print edition.

Best Sources of Information

Your first stop should be the website of the company that manages the fund. Companies like Vanguard and Fidelity provide a wealth of information on every fund they manage, including a description of the fund's goals and strategy, a chart showing its quarterly returns to date, a list of its top stock holdings, and a pie chart of its overall composition. All expenses and fees also will be listed.

A further search of financial news websites can get you insight into the fund and its competitors from analysts and commentators. If you use an online broker, you'll find additional information on its site, including risk ratings and analyst recommendations.

If it is an indexed fund, check its historical tracking error. That is, how often does it beat, match, or miss the benchmark that it aims to outperform?

As with any investment, you need to know what you're getting into.

When to Buy and Sell

You can only purchase mutual fund shares at the end of the trading day.

Unlike exchange-traded securities, mutual fund share prices do not fluctuate throughout the day. Instead, the fund calculates the total assets in its portfolio, called the net asset value (NAV), after the market closes at 4 p.m. Eastern Time each business day. Mutual funds typically post their latest NAVs by 6 p.m.

If you want to buy shares, your order will be fulfilled after the day's NAV has been calculated. If you want to invest $1,000, for example, you can place your order any time after the previous day's close, but you won't know how much you'll pay per share until the day's NAV is posted . If the day's NAV is $50, then your $1,000 investment will buy 20 shares.

Mutual funds typically allow investors to purchase fractional shares. If the NAV in the above example is $51, your $1,000 will buy 19.6 shares.

Mutual funds carry annual expense ratios equal to a percentage of your investment, and a number of other fees may be charged.

Some mutual funds charge load fees, which are essentially commission charges. These fees do not go to the fund; they compensate brokers who sell shares in the fund to investors.

Mutual funds are a long-term investment. Selling early or trading frequently triggers fees and penalties.

Not all mutual funds carry upfront load fees, however. Instead of a traditional load fee, some funds charge back-end load fees if you redeem your shares before a certain number of years have elapsed. This is sometimes called a contingent deferred sales charge (CDSC).

Mutual funds may also charge purchase fees (at the time of investment) or redemption fees (when you sell shares back to the fund), which go to defray costs incurred by the fund.

Most funds also charge 12b-1 fees, which go towards marketing and advertising the fund. Many funds offer different classes of shares, called A, B or C shares, which differ in their fee and expense structures.

Trade and Settlement Dates

The date when you place your order to purchase or sell shares is called the trade date. However, the transaction is not finalized, or settled, until a couple of days have elapsed.

The Securities and Exchange Commission (SEC) requires mutual fund transactions to settle within two business days of the trade date. If you place an order to buy shares on a Friday, for example, the fund is required to settle your order by Tuesday, since trades cannot be settled over the weekend.

Ex-Dividend and Report Dates

If you are investing in a mutual fund that pays dividends but you want to limit your tax liability, find out when shareholders are eligible for dividend payments. Any dividend distributions you receive increase your taxable income for the year, so if generating dividend income is not your primary goal, don't buy shares in a fund that is about to issue a dividend distribution.

The ex-dividend date is the last date when new shareholders can be eligible for an upcoming dividend. Because of the settlement period, the ex-dividend date is typically three days prior to the report date, which is the day that the fund reviews its list of shareholders who will receive the distribution.

If you want to receive an upcoming dividend payment, purchase shares prior to the ex-dividend date to ensure your name is listed as a shareholder on the date of record.

On the other hand, if you want to avoid the tax impact of dividend distribution, delay your purchase until after the date of record.

Selling Mutual Fund Shares

Just like your original purchase, you sell mutual fund shares directly through the fund company or through an authorized broker.

The amount that you receive will be equal to the number of shares redeemed multiplied by the current NAV, minus any fees or charges due.

Depending on how long you have held your investment, you may be subject to a CDSC sales charge. If you want to sell your shares very soon after purchasing them, you may get slapped with additional fees for early redemption.

Early Redemption Rules

Stocks and ETFs can be short-term investments, but mutual funds are designed to be long-term investments.

Constant trading of mutual fund shares would have serious implications for the fund's remaining shareholders. When you redeem your mutual fund shares, the fund often has to liquidate assets to cover the redemption, since mutual funds don't keep much cash on hand.

Any time a fund sells an asset at a profit, it triggers a capital gains distribution to all shareholders. That increases their taxable incomes for the year and reduces the value of the fund's portfolio.

This kind of frequent trading activity also causes a fund's administrative and operational costs to rise, increasing its expense ratio.

Not surprisingly, fund companies discourage frequent trading.

To discourage excessive trading and protect the interests of long-term investors, mutual funds keep a close eye on shareholders who sell shares within 30 days of purchase – called round-trip trading – or try to time the market to profit from short-term changes in a fund's NAV.

Mutual funds may charge early redemption fees, or they may bar shareholders who employ this tactic frequently from making trades for a certain number of days.

Securities and Exchange Commission. " Mutual Funds and ETFs: A Guide for Investors ," Page 4.

Securities and Exchange Commission. " Mutual Fund Fees and Expenses ," Pages 4-6.

Securities and Exchange Commission. " Mutual Fund Fees and Expenses ," Pages 6-7.

Securities and Exchange Commission. " Mutual Fund Classes ."

Securities and Exchange Commission. " Updated Investor Bulletin: New “T+2” Settlement Cycle – What Investors Need To Know ."

Securities and Exchange Commission. " Mutual Fund Fees and Expenses ," Page 6.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-157281270-5a6a625f02cf4db1bd671de03dd6d67b.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- it Italiano

- fr Français

- ru Русский

- es Español

- zh 中文

- hi हिन्दी

- ar العربية

- pt Português

- ms Bahasa Melayu

- ko 한국어

- tr Türkçe

- ja 日本語

- nl Nederlands

- is Íslenska

Round Trip Transaction Costs

What Are Round Trip Transaction Costs?

Round trip transaction costs allude to all the costs incurred in a securities or other financial transaction. Round trip transaction costs include commissions , exchange fees, bid/ask spreads, market impact costs, and occasionally taxes. Since such transaction costs can dissolve a substantial portion of trading profits, traders and investors endeavor to keep them as low as could really be expected. Round trip transaction costs are otherwise called round turn transaction costs.

How Round Trip Transaction Costs Work

The impact of round trip transaction costs relies upon the asset involved in the transaction. Transaction costs in real estate investment, for instance, can be fundamentally higher as a percentage of the asset compared to securities transactions. This is on the grounds that real estate transaction costs include registration fees, legal expenses, and transfer taxes, as well as listing fees and specialist's commission.

Round trip transaction costs have declined fundamentally throughout the course of recent a long time due to the nullification of fixed brokerage commissions and the multiplication of discount brokerages . Subsequently, transaction costs are at this point not the obstacle to active investing that they were in the past.

The concept of 'round trip transaction costs' is like that of the ' all-in cost ,' which is each cost involved in a financial transaction. The term 'all-in costs' is utilized to explain the total fees and interest included in a financial transaction, like a loan or CD purchase, or in a securities trade.

Round Trip Transaction Costs and Profitability

At the point when an investor trades a security, they might enroll a financial advisor or broker to assist them with doing so. That advisor or broker undoubtedly will charge a fee for their services. At times, an advisor will enroll a broker to execute the transaction, and that means the advisor, as well as the broker, will actually want to charge a fee for their services in the purchase. Investors should factor in the cumulative costs to determine whether an investment was profitable or caused a loss.

Round Trip Transaction Costs Example

Shares of Main Street Public House Corp. have a bid price of $20 and a ask price of $20.10. There is a $10 brokerage commission . In the event that you bought 100 shares, immediately sell all of them at the bid and ask prices above, what might the round-trip transaction costs be?

Purchase: ($20.10 per share x 100 shares) + $10 brokerage commission = $2,020

Deal: ($20 per share x 100 shares) - $10 brokerage commission = $1,990

The round-trip transaction cost is: $2,020 - $1,990 = $30

- The concept of 'round trip transaction costs' is like that of the 'all-in cost,' which is each cost involved in a financial transaction.

- Throughout recent many years, round trip transaction costs have declined fundamentally due to the termination of fixed brokerage commissions, yet at the same time remain a factor to think about in purchasing a security.

- Round trip transaction costs allude to all the costs incurred in a financial transaction, for example, commissions and exchange fees.

Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10 .

- Payment Plans

- Product List

- Partnerships

- Try Free Trial

- Study Packages

- Levels I, II & III Lifetime Package

- Video Lessons

- Study Notes

- Practice Questions

- Levels II & III Lifetime Package

- About the Exam

- About your Instructor

- Part I Study Packages

- Parts I & II Packages

- Part I & Part II Lifetime Package

- Part II Study Packages

- Exams P & FM Lifetime Package

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

- About your Instructors

- EA Practice Questions

- Data Sufficiency Questions

- Integrated Reasoning Questions

Cost of Owning an ETF

Some cost factors must be considered when trading in ETFs. They can either be implicit costs , e.g., tracking error, bid-ask spread, premium or discount to NAV, portfolio turnover, and secured lending; or explicit costs , e.g., management fees, commissions, and taxable profits or losses to traders.

From the investor’s perspective, these cost factors can either be positive or negative. Positive costs may include premiums and taxable profits, whereas the rest are negative costs.

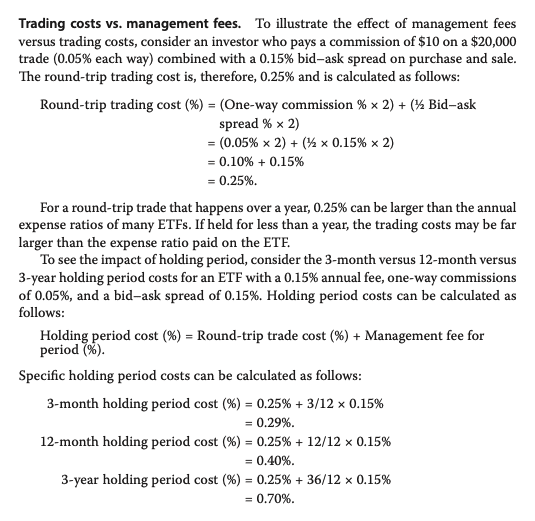

Trading Costs versus Management Fees

We will illustrate the effect of management and trading costs by calculating the round-trip and holding period costs.

1. Round-trip Cost

Suppose an investor pays a commission of $4 on a $10,000 trade. Additionally, he pays a 0.12% bid-ask spread. The investor’s round-trip trading cost is closest to :

$$ \begin{align*} \text{Round-trip trading cost } (\%) & = \left(\text{One-way commission } \%\times2\right) \\ & +\left(\frac{1}{2}\text{Bid}-\text{ask spread } \%\times2\right) \\ \text{One-way commission} & = \frac{$4}{$10,000}=0.04\% \\ & =\left(0.04\%\times2\right)+\left(\frac{1}{2}\times0.12\%\times2\right) \\ & =0.20\% \end{align*} $$

2. Holding Cost

Suppose an investor pays a commission of $4 on a $10,000 trade. Additionally, he pays a 0.12% bid-ask spread. The 4-month, 12-month, and 2-year holding period of the investor with an annual fee of 0.18% is closest to :

$$ \begin{align*} \text{Holding period cost } (\%) & = \text{Round-trip trade cost } (\%) \\ & + \text{Management fee for period } (\%). \end{align*} $$

The holding period costs for:

$$ \begin{align*} \text{4-month holding period cost }(\%) & = 0.20\%+\left(\frac{4}{12}\times0.12\%\right)=0.24\% \\ \text{12-month holding period cost } (\%) & = 0.20\%+\left(\frac{12}{12}\times0.12\%\right)=0.32\% \\ \text{2-year holding period cost }(\%) & = 0.20\%+\left(\frac{24}{12}\times0.12\%\right)=0.44\% \end{align*} $$

The trading costs and the management costs can be obtained, as shown in the following table.

$$ \begin{array}{c|c|c|c} \textbf{Holding Period} & \textbf{4-month} & \textbf{12-month} & \textbf{2-year} \\ \hline \text{Commission} & 0.08\% & 0.08\% & 0.08\% \\ \hline \text{Bid-Ask Spread} & 0.12\% & 0.12\% & 0.12\% \\ \hline \text{Management Fee} & 0.04\% & 0.12\% & 0.24\% \\ \hline \text{Total} & 0.24\% & 0.32\% & 0.44\% \end{array} $$

For the 4-month holding period :

$$ \begin{align*} \text{Trading cost } \% \text{ of the total} & = \frac{0.20\%}{0.24\%}=0.83\% \\ \text{Management fees } \% \text{ of the total} & = \frac{0.04\%}{0.24\%}=0.17\% \end{align*} $$

For the 12-month holding period :

$$ \begin{align*} \text{Trading cost } \% \text{ of the total} & = \frac{0.20\%}{0.32\%}=0.625\% \\ \text{Management fees } \% \text{ of the total} & = \frac{0.12\%}{0.32\%}=0.375\% \end{align*} $$

For the 2-year holding period :

$$ \begin{align*} \text{Trading cost } \% \text{ of the total} & = \frac{0.20\%}{0.44\%}=0.45\% \\ \text{Management fees } \% \text{ of the total} & = \frac{0.24\%}{0.44\%}=0.55\% \end{align*} $$

From the above calculations, note that for holding periods of 3 and 12 months, trading costs represent the largest proportion of annual holding costs (0.83% and 0.625%, respectively). Moreover, for a three-year holding period, management fees represent a much larger proportion of holding costs (0.55%), excluding the compounding effect.

Question Jayson Smith is an investor who pays a commission of $8 on a $22,000 trade. He also spends 0.14% on the bid-ask spread. Smith’s round-trip trading cost is closest to : 0.036%. 0.248%. 0.212%. Solution The correct answer is C. $$ \begin{align*} \text{Round-trip trading cost } (\%) & = \left(\text{One-way commission } \%\times2\right) \\ & +\left(\frac{1}{2}\text{Bid}-\text{ask spread } \%\times2\right) \\ \text{One-way commission} & = \frac{$8}{$22,000}=0.036\% \\ & =\left(0.036\%\times2\right)+\left(\frac{1}{2}\times0.14\%\times2\right) \\ & =0.212\% \end{align*} $$

Reading 39: Exchange Traded-Funds, Mechanics and Applications

LOS 39 (f) Describe the costs of owning an ETF.

Offered by AnalystPrep

ETFs Premiums and Discounts

Types of etf risks, exposure measures and their use.

Equity Exposure Measures Alpha: This is a financial risk ratio used in the... Read More

The Regulatory Tools

The regulatory and government policies should be predictable, contemplative, and effective in reaching... Read More

Assessing the Long-run Fair Values of ...

Parity conditions are useful in the assessment of the fair value of currencies.... Read More

Black Option Valuation Model

The Black options valuation model is a modified version of the BSM model... Read More

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

Round-trip transactions costs

Costs of completing a transaction , including commissions , market impact costs , and taxes.

- Earnings per share (EPS)

- Market capitalization

- Outstanding

- Market value

- Over-the-counter (OTC)

- Sexvigintillion

- National Association of Securities Dealers (NASD)

Copyright © 2018, Campbell R. Harvey. All Worldwide Rights Reserved. Do not reproduce without explicit permission.

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

Discover the deeper importance of low ETF expense ratios

Vanguard Perspective

June 16, 2023

While tallying the total cost of ownership (TCO) for an ETF may seem as simple as adding its expense ratio and trading cost (i.e., spread), there’s actually more to it than that. This shortcut ignores one critical component: time. The longer the holding period, the more a relatively low ETF expense ratio becomes a deciding variable.

Spread is still important, especially for shorter holding periods. But at what point does expense ratio become more important? Asked another way, when does the holding period go from short-term—where spread matters more—to long-term?

As you’ll see, it’s sooner than you may think.

That’s true whether your clients own an equity ETF such as Vanguard S&P 500 ETF (VOO) or a fixed income ETF such as Vanguard Intermediate-Term Corporate Bond ETF (VCIT).

Here, we’ll include both the entry spread and the exit spread—the costs of a “round trip trade.” That’s because if you’re trading in and out of ETFs, say to equitize cash for a discrete amount of time, you’ll be paying the trading spread both times. So again, we’ll include both trades in our TCO calculation.

Focus on smaller trades

We’ll also focus on relatively smaller trades that execute within the quoted spread rather than large ETF trades that can include additional market impact costs. Moreover, we won’t include premiums and discounts, which can vary a lot depending on volatility. Both are subjects for another day.

The table below makes clear that the importance of expense ratio gets flipped completely depending on holding period.

Real world examples

Voo vs. spy.

With all these considerations in mind, we’ll start by comparing the total costs of VOO and State Street Global Advisors' SPDR S&P 500 ETF (SPY), the most-traded equity ETF by volume in 2022. 1 Both ETFs aim to provide exposure to the stocks listed in the S&P 500 Index and seek to track the index’s performance.

SPY’s expense ratio is 0.0945% (9.45 basis points or bps), or more than three times as much as VOO’s expense ratio of 0.03% (3 basis points). This is the cost for owning the ETF for one year. If you own it less than one year, you only pay a pro-rated expense ratio for the holding period.

But the average of SPY’s round-trip trading spread of 0.39 basis points (bp) is a bit more than twice as narrow as VOO’s round-trip spread of 0.83. 2 This, again, is the round-trip cost, the sum of the spread when the ETF is bought and when it’s sold.

At first glance, we can observe two things: There’s a real difference in cost to initiate ownership of these two ETFs, and the magnitude of difference between spread and expense ratio is substantial. That said, integrating the trading costs and the expense ratio means that the break-even calculation—when the cost advantage of VOO’s lower expense ratio starts to kick in—comes in 26 days for a round trip trade, as the chart below shows.

The chart also clearly shows that VOO’s lower expense ratio shines more and more beyond the point of breaking even. That’s what the widening space between the two lines is all about. Beyond day 26 of holding VOO, those cost advantages build and compound over time. In other words, investors can take home increasing amounts holding VOO than they would holding SPY.

Total cost of ownership: VOO vs. SPY

Notes : There may be other material differences between products that must be considered prior to investing. Bid-ask spread totals may appear off due to rounding of displayed data. Bid-ask spreads appearing throughout this article are time-weighted averages for each trading day in 2022.

Source : Bloomberg, from January 1, 2022, to December 31, 2022.

VCIT vs. LQD

Shifting to the realm of fixed income, let’s compare Vanguard’s very liquid and low-cost investment-grade corporate bond ETF, VCIT, and the highest-volume investment-grade credit ETF 3, iShares iBoxx Investment Grade Corporate Bond ETF (LQD).

Unlike VOO and SPY, these ETFs are not designed to provide the same exposure. VCIT only includes intermediate-term bonds between 5-10 years of maturity, and LQD includes bonds all along the corporate bond yield curve with a tilt towards more liquid bonds. Despite these differences, they’re similar in terms of risk with both having intermediate durations.

The breakeven in this comparison is just 13 days for a round-trip trade. That’s because VCIT’s expense ratio is 4 bps, or more than three times less costly than LQD’s expense ratio of 14 bps. This difference offsets LQD’s relatively modest spread advantage—0.90 bp vs VCIT’s 1.24 bps.1

Again, it takes 13 trading days for VCIT’s lower expense ratio to make up for the spread difference in an in-and-out round trip analysis.

As in the VOO vs. SPY comparison, the longer the holding period of VCIT, the more the lower expense ratio will enable your clients to maximize returns by minimizing costs.

To put a finer point on the comparison, as the table below shows, an investor who holds $100,000 worth of VCIT for a year before selling would incur a total cost of ownership of $52.41, while it would cost an investor holding $100,000 of LQD for a year before selling $148.96.

Notes : There may be other material differences between products that must be considered prior to investing. Bid-ask spread totals may appear off due to rounding of displayed data. Bid-ask spreads appearing throughout this article are time-weighted averages for each trading day in 2022.

VGSH vs. SHY

Let’s look now at U.S. Treasury ETFs, comparing iShares 1-3 Year Treasury Bond ETF (SHY) to Vanguard Short Term Treasury ETF (VGSH) , which offers exposure to 1-3 year Treasury bonds. The round-trip breakeven here is 17 days. VGSH has an expense ratio of 4 bps while SHY costs 15 bps per year. The trading spread on VGSH is 1.70 bps a bit wider than SHY’s spread of 1.21 bps. 1

But as with the previous two comparisons, the lower expense ratio becomes more and more decisive once breakeven is reached, which is to say that the advantages of VGSH’s lower expense ratio pay off increasingly over time. And as the breakevens of each example show, it doesn’t take longer than just several days for the expense ratio advantage starts rewarding investors after just several days.

Total cost of ownership: VGSH vs. SHY

Notes : There may be other material differences between products that must be considered prior to investing. Bid-ask spread totals may appear off due to rounding of displayed data. Bid-ask spreads appearing throughout this article are time-weighted averages for each trading day in 2022.

Compounding returns

There have always been big differences between day traders and long-term investors and, as these examples show, a lower expense ratio benefits the long-term investor more than the day-trader.

But there are more practical applications of this analysis for investors and their advisors. Some of these ETFs are used by investors to quickly equitize cash or put cash to work with bonds as a temporary holding until they're ready to rebalance, make another investment, or meet a spending need.

In other words, they only plan to hold the ETF for a few days or a couple months. In this scenario, the ETF you choose really matters.

As an example, it could benefit an investor to closely examine the potential cost savings they could realize by holding VGSH for a liability coming due in 30 days as opposed to more costly Treasury ETFs. Likewise, an advisor aiming to quickly equitize a client’s portfolio contribution could potentially consider VOO to fulfill that function, given its low total cost of ownership advantage past the 26-day mark.

The widening delta of extra returns over time related to a lower expense ratio is something most investors will find extremely valuable. Investing success has a lot to do with staying the course over the long haul. Relatively small differences in expense ratio can make a big difference over time.

Check out our lineup of low-cost ETFs

View our ETFs representing almost every marketplace.

1 Source: Bloomberg, as measured by total trading volume over the 2022 calendar year.

2 Source: Bloomberg, The bid-ask spreads appearing throughout this article are time-weighted averages for each trading day in 2022. That spread reflects volatility of every market open and close, and reflects data from days when the Federal Reserves lifted interest rates , and news of Russia’s February 2022 invasion of Ukraine.

3 Source: Bloomberg, as measured by total ETF volume over calendar year 2022.

Legal notices

- For more information about Vanguard funds, visit advisors.vanguard.com or call 800-997-2798 to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

- Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling.

- All investing is subject to risk, including possible loss of principal. Diversification does not ensure a profit or protect against a loss.

- Bond funds are subject to interest rate risk, which is the chance bond prices overall will decline because of rising interest rates, and credit risk, which is the chance a bond issuer will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline.

- U.S. government backing of Treasury or agency securities applies only to the underlying securities and does not prevent share-price fluctuations. Unlike stocks and bonds, U.S. Treasury bills are guaranteed as to the timely payment of principal and interest.

This article is listed under

- ETF Investing

Save articles

Save articles to your profile using the bookmark icon.

Implied transaction costs by Leland option pricing model: A new approach and empirical evidence

- Original Article

- Published: 09 November 2012

- Volume 18 , pages 333–360, ( 2012 )

Cite this article

- Steven Li 1 &

- Mimi Hafizah Abdullah

7365 Accesses

2 Citations

Explore all metrics

Estimation of transaction costs in a stock market is an important issue for stock trading, asset pricing, stock market regulation and so on, and it is often done by combining the bid-ask spread estimate with commissions and other fees provided by market participants, which can be subjective. This study aims to offer an innovative alternative method to estimate the transaction costs in stock trading via the implied transaction costs by using the Leland option pricing model. The effectiveness of this new approach is tested by using the S&P/ASX 200 index call options data. On the basis of the actual transaction costs estimates on the Australian Securities Exchange (ASX) documented by previous studies and Roll's model, the empirical results reveal that this new approach can provide a reliable transaction costs estimate on stock trading on the ASX. Furthermore, the accuracy of the implied transaction costs across option moneyness and maturity and the variation of the implied transaction costs during the recent global financial crisis period are investigated.

Similar content being viewed by others

The Size Effect in Malaysia’s Stock Returns

Foreign Exchange Risk Hedging Policy: Evidence from France

The effect of ETFs on financial markets: a literature review

Avoid common mistakes on your manuscript.

INTRODUCTION

Bid-ask spreads, commissions or brokerage fees, execution costs, and other costs related to securities trading can be collectively referred to as transaction costs. Transaction costs are an important factor in trading options, stocks or any other asset. They affect the equilibrium asset prices and hence the mean asset returns.

Consequently, estimating transaction costs is an important topic for empirical analyses. Smith and Whaley (1994) pointed out the importance of understanding and accurately measuring transaction costs for the purpose of business and regulatory decisions regarding market operations.

Given the importance of transaction costs in securities trading, this study aims to offer a new approach to estimating the transaction costs used by the market for the selling and buying of an asset. This study differs from others in the literature and considers estimating transaction costs from an option pricing model together with empirical evidence.

The Black-Scholes-Merton (BSM) model for option pricing has made a great impact on securities trading in the real world. However, the BSM model suffers from the unrealistic assumption of no transaction costs. There are many studies that have explored ways to deal with option payoff replication and hedging errors owing to transaction costs.

Leland (1985) developed a hedging strategy in which the price of a call option should be given by the BSM model with an adjusted volatility. The adjusted volatility depends on the proportional transaction costs rate, the volatility of the underlying asset and the rebalancing interval of the replicating portfolio. He claimed that the hedging error can be arbitrarily small, if the length of the rebalancing frequency tends to zero and also if one uses the BSM delta-hedging with the adjusted volatility. Despite the critiques of Leland's strategy, a number of studies have empirically shown that the modified Leland strategy exceeded the accuracy of the BSM model, such as Primbs and Yamada (2006) and Zakamouline (2008) . Further, Leland (2007) provided two adjustments to the original Leland (1985) formula by incorporating the initial costs of trading with the assumptions that the initial portfolios are all cash and all stock positions. The adjustments were made because the original Leland (1985) model did not explicitly consider initial costs of trading. In addition, Leland's model does not depend on the investor's risk preferences and has a closed-form solution.

There are also other studies dealing with hedging errors but using a preference-dependent hedging strategy, which is called the utility-maximisation approach to option pricing with transaction costs. Although the models of the utility-based approach pioneered by Hodges and Neuberger (1989) are successful in terms of the optimality of the hedging strategies and good empirical performances, they have a few disadvantages that restrict their broad application in practice. Among the disadvantages are the fact that they are slow to compute as they usually result in three- or four-dimensional free boundary problems ( Whalley and Wilmott, 1999 ); they appear to be difficult to handle and impractical as they are time consuming to compute ( Atkinson and Alexandropoulos, 2006 ); the investor's risk must be specified, the market must be continuously monitored and there are computational problems in deriving the parameters of the bounded area ( Gregoriou et al, 2007 ); and they lack closed-form solutions and the calculations of the optimal hedging are time consuming ( Zakamouline, 2006 , 2008 ).

Taking into account the complexity and the few disadvantages of utility-dependent option pricing models, this study considers estimating the transaction costs per trade implied by an option price observed in the market using the Leland (1985) model. This study is further motivated by the development of the Leland option pricing model, which is a modified strategy of the widely used BSM model, and also the unresolved questions of whether Leland's method can be used effectively to price and hedge options with realistic transaction costs and rebalancing intervals.

In practice, traders incur several types of transaction costs every time they trade. These include commissions, bid-ask spread and other costs that are related to the price impact of trades. To the best of our knowledge, all studies in the literature estimate the transaction costs by combining the bid-ask spread estimate with commissions and other fees provided by market participants, which can be subjective. In contrast, the implied transaction costs proposed in this study provide a total transaction costs estimate in one go. This is based on the realised volatility and the market prices, which are all objective.

This study uses the S&P/ASX 200 index options data to demonstrate the effectiveness of the proposed approach. The S&P/ASX 200 index options are chosen for this study because they are the most popular and liquid index options on the Australian Securities Exchange (ASX). Furthermore, index options offer a wider choice of exercise prices compared to options on individual stocks, which typically trades with a limited number of exercise prices. The implied transaction costs are estimated from the Leland model with respect to option moneyness and time to maturity, respectively. We perform statistical tests on whether the estimated implied transaction costs differ between option moneyness and time to maturity groupings. Then the option moneyness and time to maturity groupings that best estimate the transaction costs can be identified.

The accuracy of the implied transaction costs is assessed based on a few benchmarks. First, we consider the bid-ask spread estimate by using the best-known Roll (1984) model, which should be a lower bound for our estimate as the bid-ask spread is only one part of the implied transaction costs obtained here. We also compare the bid-ask spread estimate obtained from Roll (1984) with that of the actual stock market bid-ask spread estimate reported in Cummings and Frino (2011) . Second, we compare the implied transaction costs estimate with the actual round-trip transaction costs estimates for large stocks on the ASX reported in previous studies, including Aitken and Frino (1996) and Comerton-Forde et al (2005) . These actual transaction costs are also recently documented in Chen et al (2010) . We contacted a few brokerage firms in order to obtain indicative round-trip costs, but we did not receive any response. Therefore, third, we consider comparing the implied transaction costs estimate with a study by Fong et al (2010) on the brokerage services in Australia. Fong et al (2010) conducted the study from 1995 to 2007. The nature of these studies is discussed in a later section of this article.

Compared to the previous studies, a few features of the implied transaction costs approach stand out. It is more objective as it does not need to estimate the commission and many other fees based on the information provided by market participants. It is relatively straightforward as it is based on the historical volatility and other market-observable variables. The empirical results also reveal that the new approach is reliable.

The US subprime mortgage crisis in mid-2007 led to a global financial crisis that lasted until about the end of 2008. Volatility of the underlying asset and transaction costs rose significantly during this crisis. Therefore, this study also investigates the implied transaction costs during this crisis period. Thus, we investigate the implied transaction costs using the S&P/ASX 200 index call options for the period from 2 April 2001 to 31 December 2010, which covers the recent global financial crisis. We divide the sample into three groups: pre-crisis, during crisis and post-crisis. We hypothesise that the implied transaction costs are higher during the crisis period. This is because there are high levels of uncertainty about market future movement and enormous transaction costs associated with the trading of the underlying asset. We find that during the crisis, the implied transaction costs increase more than double the rate before the crisis. However, the implied transaction costs decrease around 40 per cent after the crisis, but the costs are still higher than those before the crisis.

The remainder of this article is organised as follows. The next section briefly reviews the transaction costs structure in the capital markets. The description of the Leland model, the methodology to estimate the transaction costs and the description of the data are provided in the following three sections, respectively. The empirical results and conclusions are then presented.

TRANSACTION COSTS IN CAPITAL MARKETS

Generally speaking, transaction costs in capital markets consist of the following three main components: commissions or brokerage fees, bid-ask spreads and market impact costs. In addition, there are other components of transaction costs in capital markets, such as opportunity costs and desk-timing costs (see Freyre-Sanders et al, 2004 ; Kissell et al, 2004 ; Kissell, 2006 ).

Commissions or brokerage fees form a part of the total transaction cost in stock trading and they vary across brokers. The majority of brokers will tier their fees on the size of the trade or the trade value. For example, for a low-trade value transaction, an investor could pay a higher commission rate compared to that of a large-trade value transaction. In fact, Fong et al (2010) reported that the brokerage is not just dependent on trade size, but also on the ordering route method and other considerations. Furthermore, Johnsen (1994) argued that the execution costs of trading are often bundled with ‘soft dollars’ that pay for research, which may or may not be related to a specific trade.

Developing this theme further, in addition to the commission paid to the broker, an investor also incurs the bid-ask spread, which is the difference between the bid price and the ask price of the stock. These costs occur for investors who wish to buy at the best ask price or sell at the best bid price, incurring a liquidity cost. Liquidity refers to the ease with which a stock can be bought or sold without disturbing the price ( Zakamouline, 2008 ).

Market impact costs, on the other hand, represent the movement in the price of the stock caused by a particular trade or order. The costs occur for two reasons: first, the liquidity demands of the investor, and second, the information content of the order ( Kissell, 2006 ). Market impact costs occur when investors trade too aggressively or when they buy and sell large positions. These large transaction orders impact on the stock price. This usually occurs in stocks that are not very liquid and are considered less significant with liquid stocks. Market impact costs are further deemed to be the sum of two components: temporary and permanent price effects ( Zakamouline, 2008 ).

Given the structure of transaction costs in the capital markets, it is not easy to find a representation of realistic transaction costs. Therefore, as stated in Zakamouline (2008) , to simplify the treatment of transaction costs, most studies assume that transaction costs are proportional to the value of trading. This assumption is valid only for large investors who trade in liquid stocks. In this situation, the bid-ask spread is the main component of transaction costs and the market impact costs are considered negligible.

Therefore, this study assumes that the estimated transaction costs are proportional to the value of trading, as Leland (1985) proposed in his model. This assumption is valid for large investors who trade in liquid stocks. The estimated transaction costs obtained are considered to cover more than the commission charged by the broker. The estimated transaction costs will include the bid-ask spread and other related trading costs, which in practice are sometimes difficult to identify and estimate.

A few studies have analysed the transaction costs associated with stock trading on the ASX. Aitken and Frino (1996) examined the magnitude and determinants of execution costs associated with institutional trades on the ASX. Their results suggested that the factors explaining the magnitude of the execution costs are brokerage commissions, trade size, stock liquidity (proxied by the bid-ask spread), broker identification, the proportion of the trade executed using market orders and the duration of the trade. Comerton-Forde et al (2005) also examined the magnitude and determinants of execution costs on the ASX using institutional trade data. Their results revealed that trade complexity, stock liquidity, bid-ask spread and brokerage commission are the significant factors influencing the execution costs.

LELAND OPTION PRICING MODEL

The strategy of Leland (1985) is identical to the BSM strategy, except that it incorporates transaction costs through an adjustment to the volatility of the underlying asset. It is assumed that transaction costs are proportional, and that the portfolio is rebalanced at discrete time intervals that are δt apart. The adjusted volatility is as follows

where δt is the rebalancing interval, k is the round-trip proportional transaction costs rate (measured as a fraction of the value of transactions) and σ is the volatility of the underlying asset.

When there are transaction costs, the price of buying an asset is higher than the actual price of the asset and the proceeds from selling the assets are lower than the price of the asset. Essentially, when transaction costs are included in this situation, the effective prices are more volatile than without transaction costs. This was what Leland did by increasing the volatility as above. Therefore, Leland (1985) addressed the transaction costs shortcoming of the BSM strategy. Both the BSM and Leland models assume that the risk-free interest rate and the underlying asset volatility are constant over the life of the option.

One of the assumptions in Black and Scholes (1972) is that the stock pays no dividend. However, dividends on some stocks may be substantial, and can have a significant effect on the valuation of options whose stocks make such payments during the life of the options. Therefore, a dividend adjustment must be allowed for in the option pricing formula.

The d 1 * and d 2 * are obtained as in (4) and (5), respectively, by replacing σ with the adjusted volatility σ * , and after adjusting for dividend yield at rate q . The function N (.) is the cumulative probability distribution function for a standardised normal distribution.

We now consider the variables required by the Leland option pricing model.

Time to maturity

According to Hull (2009) , the life of an option should be measured in trading days rather than calendar days. The normal assumption in equity markets is that there are 252 trading days per year. Li and Yang (2009) used 252 trading days in their study on the Australian index options market. Thus, we employ 252 days as the number of trading days in a year for stocks.

In this study, the time to maturity, T , is measured by the number of trading days between the day of trade and the day immediately before expiry day divided by the number of trading days per year.

Realised volatility

Since the recognition that the BSM option price depends upon only one unobservable parameter, that is, the volatility of stock returns, considerable attention has been paid by researchers to measuring volatility. Return volatility is widely used in portfolio construction, options pricing and trading, volatility-related derivatives’ trading, and risk management. Many different methodologies and theories have been developed in the past decades.

As in Hull (2009) , the realised volatility approach is used to determine the return standard deviation (volatility). This measure is only a proxy of true but unknown realised volatility. The same realised volatility formula was used by Li and Yang (2009) .

Let n be the number of trading days before the expiration of an option. Daily return of the index is calculated as:

for i =2, 3, …, n . Let S i be the index level and R i be the log-return on the i th day during the remaining life of the option.

Therefore, the annualised realised volatility can be expressed as:

There are a few other alternative approaches to estimating volatility for the input to a model. Using low-frequency daily return data, Parkinson (1980) , Rogers et al (1994) , Yang and Zhang (2000) and other researchers developed the methodologies for realised volatility estimates. However, these approaches do not necessarily lead to optimal estimates.

Among other different measures of volatility are the generalised autoregressive conditional heteroscedasticity (GARCH) models and stochastic volatility models. The original GARCH model was developed by Bollerslev (1986) . Others such as Nelson (1991) and Bollerslev and Mikkelsen (1996) contributed significantly to the GARCH models. Heston and Nandi (2000) , Yung and Zhang (2003) and Barone-Adesi et al (2008) are among the few empirical studies that adopted GARCH models in the option pricing model. There is a large amount of literature on GARCH models that aims to measure volatility, but the models cannot be reviewed as a variant of the BSM model, given that it is a firmly discrete-time theory.

The stochastic volatility model is where the volatility is allowed to be random. This is because of the fact that the BSM model treats the volatility as a constant. Hull and White (1987) , Heston (1993) , Danielsson (1994) , Kim et al (1998) and many others have studied the stochastic volatility models. Among the few empirical studies that adopted stochastic models are Bakshi et al (1997) , Sarwar and Krehbiel (2000) , Kim and Kim (2004) and Sharp et al (2010) .

It is concluded that with all the different methodologies to measure volatility, the challenge remains to find the ‘best’ approach for estimating volatility to be used in an option pricing model. In addition, Brailsford and Faff (1996) undertook a comprehensive study to test a number of different models, Footnote 1 which include GARCH models, and assessed their predictive performance against different measures of prediction error. Footnote 2 No one model was found to be consistently the best, but the GARCH model did perform relatively well.

According to the Reserve Bank Bulletin (2003) Footnote 3 dividend yields on the ASX 200 have averaged 3.6 per cent since 1997 up to 2003, and from the Reserve Bank Australia statistics Footnote 4 , the dividend yields S&P/ASX 200 index reported for 2004–2010 are in the range of 3.38–7.44 per cent. In this study, the dividend yields are converted to continuous compounding dividend yields.

Risk-free interest rate

For the risk-free interest rate, the Australian 90-day Bank Accepted Bill (BAB) rate is used as a proxy. Daily BAB yields data are obtained from the Reserve Bank of Australia. Australia 90-day BAB is probably close to the rate faced by option traders and the maturity matches the S&P/ASX 200 option's maturity well ( Li and Yang, 2009 ). The BAB yields are in the range of 3.00–8.12 per cent. The risk-free interest rates are then converted to continuous compounding risk-free interest rates.

Rebalancing interval

This study aims at estimating the implied transaction costs for the buying and selling of an asset. This means that the costs for the buying and selling of an asset should be the same regardless of the rebalancing interval.

METHODOLOGY

This study offers a new way to estimate the transaction costs per trade by matching the market-observed prices of options with the model prices of the corresponding options. The implied transaction cost is in fact the proportional transaction costs rate for the buying and selling of the asset in rebalancing a portfolio replicating an option. This section describes the methodology used in estimating the round-trip transaction costs, k , and the benchmarks used.

Estimation of transaction costs per trade using Leland option pricing model

The estimation of the proportional round-trip transaction costs rate, k , of stock trading will be the same regardless of the rebalancing interval, whether the rebalancing is done on a quarterly or daily basis. Therefore, this study will only consider daily rebalancing.

The implied adjusted volatility, σ * , from the Leland model is estimated. The implied adjusted volatility is calculated using a Visual Basic for Application function in which an iterative algorithm using a procedure called the bisection search method is adopted from Kwok (1998) . Using Leland model, the theoretical model call price is computed and equalised with the market-observed option price of the S&P/ASX 200 index as follows:

where C market is the market-observed call price and C model is the computed call price, which is based on a set of variables: security price ( S ), strike price ( K ), option time to maturity ( T ), risk-free interest rate ( r ), adjusted volatility ( σ * ) and dividend yield ( q ).

The benchmarks

The benchmarks are (1) the bid-ask spread estimated from Roll's model; (2) the actual stock market bid-ask spread estimate reported in Cummings and Frino (2011) ; (3) the actual round-trip transaction costs estimates for large stocks on the ASX reported in Aitken and Frino (1996) and Comerton-Forde et al (2005) ; and (4) the Australian brokerage commission charges documented by Fong et al (2010) .

Roll's model

One of the methods that has been developed to measure the bid-ask spread is the use of serial covariance of asset price change, such as Roll (1984) and its extensions: Glosten (1987) , Choi et al (1988) , Stoll (1989) , George et al (1991) , Chu et al (1996) , Chen and Blenman (2003) and Holden (2009) .

The Roll (1984) model estimates the effective spread implied in a sequence of trades. The effective spread was calculated from the observed serial correlation of transaction prices. The two major assumptions of Roll's model are that the asset is traded in an informationally efficient market and the observed price changes are stationary. Under these assumptions, Roll showed that the trading costs induce negative serial dependence in successive observed market price changes. Further, he assumed that the underlying true value of the security lies at the centre of the spread. The possible paths of observed transaction price changes are assumed to be restricted, whereby the transaction prices can only bounce either at the ask price or at the bid price. Roll's bid-ask spread estimator is given by

where s is the spread, and Δ P t and Δ P t −1 are defined as the observed stock price changes at times t and t −1, respectively. Roll's model assumed that the next observed price is equally likely to go up by s or down by s , or remain the same. The negative covariance term was used because successive price changes are assumed to be negatively correlated to each other.

Similarly, in order to obtain a relative spread, the covariance of successive return is

However, the last term ( s 4 /16) is very small and is ignorable.

Using the serial covariance estimator, the bid-ask spreads of the data will have both positive and negative serial covariances. The disadvantage of using Roll's measure as well as its extensions is that if a bid-ask spread of the data has positive serial covariances, a problem of imaginary root exists. Therefore, the spread is undefined.

The extensions of Roll's model differ from Roll's model only in scale because, with appropriate parameter substitutions, the models do in fact reduce to Roll's model and therefore seem to be perfectly correlated ( Anand and Karagozoglu, 2006 ). Hasbrouck (2004 , 2009 ) improved Roll's estimator by using the Gibbs sampler and Bayesian estimation, but these measures require an iterative process and are computationally intensive.

Thus, this study employs the Roll (1984) model as representative of the serial covariance-based estimator to measure the bid-ask spread. Although Harris (1990) argued that Roll's model cannot provide estimates for more than half of the firms listed on the New York Stock Exchange (NYSE)/American Stock Exchange (AMEX), it is in fact regarded as one of the most appealing and easy to use spread measurement models. It is able to measure directly from a time series of market prices.

With respect to the bid-ask spread of the data that have positive serial covariances that lead to the spread being undefined, Goyenko et al (2009) , Hasbrouck (2009) and Holden (2009) solved this problem by substituting a default numerical value of zero. Therefore, we use a modified version of Roll's bid-ask spread as follows:

Bid-ask spread estimate by Cummings and Frino (2011)

Cummings and Frino (2011) examined the mispricing of Australian stock index futures. In one element of their study, they have measured the percentage bid-ask spread in the stock market. They measured the percentage bid-ask spread on each of the constituent stocks in the index. The study reported that the mean bid-ask spread of the stock market is 0.17 per cent. Cummings and Frino (2011) obtained the quote data for the index constituents using the daily list of Bloomberg from the period of 1 January 2002–15 December 2005.

It should be noted that the time period of their study coincides with ours and that their estimate of the bid-ask spread of stocks can be used for comparison to our estimate of the index spread using Roll's model. Therefore, we consider 0.17 per cent as the benchmark for the bid-ask spread for stock trading.

The actual round-trip transaction costs estimates by Aitken and Frino (1996) and Comerton-Forde et al (2005)

Aitken and Frino (1996) analysed the magnitude and determinants of execution costs associated with institutional trades on the ASX. In terms of the transaction costs estimate, they used data that extend the period from 1 April 1991 to 30 June 1993. Their sample includes the 70 top stocks by market capitalisation. There were 6996 institutional purchases and 8032 sales analysed in this study. They reported that the magnitude of execution costs was small and that the costs were 0.27 per cent as the value of round-trip transaction costs.

Comerton-Forde et al (2005) examined the institutional trading costs on the ASX and the impact of broker ability on the cost of institutional trading. The data used were provided by an active institutional investor that consists of 42 229 institutional trades (18 773 purchases and 23 526 sales) made by 41 different actively managed portfolios from 15 May 2001 to 15 May 2002 on the ASX. The results of their study revealed that the transaction costs for large stocks on the ASX are around 0.50 per cent.

We note that our study period does not coincide with that of Aitken and Frino (1996) but does coincide with that of Comerton-Forde et al (2005) . However, the transaction costs estimate can be taken as a reference. Therefore, we consider transaction costs for large stocks on the ASX between 0.27 and 0.50 per cent as another benchmark to the implied transaction costs estimate obtained in our study.

The brokerage commission charges in Australia documented by Fong et al (2010)

Fong et al (2010) studied the brokerage service and individual investor trade performance in Australia. In one element of their study, they studied the commissions charged by brokers. Using the Australian Stock Exchange data over a 13-year period from 1 January 1995 to 31 December 2007, they identified the types of brokers and also distinguished the classes of investors. They categorised brokers into (1) institutional brokers, (2) retail discount brokers and (3) full service retail brokers. They also distinguished the trades made by (1) individual investors at discount brokerage firms, (2) individual investors at full service brokerage firms and (3) institutional investors.

On the basis of their research of institutional investors, websites and telephone surveys, Fong et al (2010) found that the commission rates in Australia range between 0.1 and 0.5 per cent for institutional brokers, 0.11 and 0.66 per cent for retail discount brokers, and 1 and 2 per cent for full service retail brokers.

Our study assumes that the estimated transaction costs are proportional to the value of trading, as Leland (1985) proposed in his model. This assumption is valid for large investors who trade in liquid stocks. Thus, referring to the findings by Fong et al (2010) , we consider taking the commission charged by the broker to institutional investors trading in large stocks to be between 0.1 and 0.5 per cent. When doubled, the commission charges are 0.2 and 1 per cent. Thus, the minimum brokerage fee charged by brokers for large stocks trading on the ASX is 0.2 per cent. On the basis of this, we expect that the implied transaction costs rate for stock trading is greater than 0.2 per cent.

This section describes the data used in this study. The first subsection describes the S&P/ASX 200 index option data. The second and third subsections describe the data sampling procedure, as well as the sample statistics.

Data description

S&P/ASX 200 index options are chosen for this study because they are highly popular and liquid. S&P/ASX 200 index option prices are European in style and cash-settled with quarterly expirations. They are available over a wide variety of exercise prices and several maturities. The quarterly expiry cycles are March, June, September and December. The expiration day is the third Thursday of the expiry month or the following business day if an expiry Thursday happens to be a public holiday, unless otherwise specified by ASX. Trading of expiry contracts ceases at 12:00 noon on the expiry date. Trading continues after the settlement price has been determined. The options are quoted in index point and each index point is valued at AUD $10. Footnote 5

For S&P/ASX 200 index options, the period before 2 April 2001 was a period of excessive movements owing to the changes in the underlying asset of S&P/ASX 200 index options. On 15 November 1985, ASX first listed options on the All Ordinaries Index (XAO), which was the main benchmark for its listed stocks. The first trading of options was on 8 November 1999, and since then the trading of index options has grown tremendously. On 3 April 2000, the underlying index for ASX index options was changed from All Ordinaries Index to the S&P/ASX 200 index. During the period from 3 April 2000 to 31 March 2001, a continuation of the former All Ordinaries Index was calculated and disseminated by the ASX to allow for the maturity of futures contracts based on the superseded index. During this period the ASX re-listed index options on the All Ordinaries Index where they had been delisted twice largely owing to thin trading. From 31 March 2001, the S&P/ASX 200 index was formally used as the underlying asset of index options on the ASX. Footnote 6

Owing to the excessive movements and changes occurring in the underlying asset of S&P/ASX 200 index options before 2 April 2001, we begin our sample period from 2 April 2001. Our sample data cover the period from 2 April 2001 to 31 December 2010. This sample period covers the recent global financial crisis that began on 1 July 2007 and ended at the end of 2008. Footnote 7 For our analysis, we divide our sample into three periods. We consider the pre-crisis period as the starting date of our sample, 2 April 2001 until 30 June 2007, while the post-crisis period is from 1 January 2009 until the end of the sample period.

In this study, the closing price of the S&P/ASX 200 index on each day is used as the underlying price, while the closing price of the option is taken as the actual option price. In this study, daily index options data that consist of trading date, expiration date, closing price, strike price and trading volume for each trading option are collected from the Securities Industry Research Centre of Asia-Pacific. We refer to a few Australian empirical studies that used daily data in their analysis, such as Do (2002) , Do and Faff (2004) , Li and Yang (2009) and Sharp et al (2010) , as well as to other studiesconducted in markets other than Australia, such as Sarwar and Krehbiel (2000) and Li and Pearson (2007) .

The next subsection discusses the possible problem of non-synchronous data arising from using daily closing prices for both the options and the S&P/ASX 200 index, as well as the steps taken in order to reduce such problems. We acknowledge that using the potentially non-synchronous data may yield noisier results and weaken the conclusions of the analysis. On the other hand, the noise caused by non-synchronous data has not been shown to be systematic, and studies that eliminate the problem still show the presence of the pricing biases (see Rubinstein, 1985 ; Bakshi et al, 1997 ; Lam et al, 2002 ; Lehar et al, 2002 ; Kim and Kim, 2004 ).

Data sampling procedure

Using closing prices for both the options and the S&P/ASX 200 index may result in non-synchronous data. To reduce the non-synchronous data problem, we conduct the following sampling procedure and also employ some filter rules to remove any offending daily option prices.

First, in this study, the daily closing price of the option is taken as the actual option price. When this study was done, high-frequency data or transactions data were not obtainable. Owing to the unavailability of data, this study uses daily closing option prices. The daily closing option price represents the price of the last trade of an option contract during the trading session. The last option trade does not often correspond to the closing time of the market, and could occur anytime during the trading hours. This leads to potentially non-synchronous data because option prices and the closing index level may be non-synchronous as the closing times for the two markets differ. We will explain the procedure to reduce the non-synchronous problems later in the article.

This study does have bid-ask quotes data, but not every quote becomes a trade. We noted that there are studies that consider the midpoint of bid-ask quotes in order to reduce non-synchronous problems, such as Heston and Nandi (2000) , Yung and Zhang (2003) , Li and Pearson (2007) and Barone-Adesi et al (2008) . Midpoints are based on bid and ask quotes, which are more frequently refreshed than trade prices. However, as mentioned, not every quote becomes a trade. Brown and Pinder (2005) pointed out that the representation of an option's value with the midpoint of the bid-ask spread results in an overestimation of the option's value. Thus, based on this, in our study, we use daily closing option price as the actual option price.