How to use Scene+ points to reduce travel costs

by Anne Betts | Mar 21, 2024 | Travel Hacking | 32 comments

Updated March 21, 2024

What’s the best use of Scene+? Is Scene+ a useful program for travelling the world on miles and points? How does Scene+ work and what are the ways to use Scene+ points to reduce travel costs ? How does it measure up against the former Scotia Rewards program? How does it compare to other fixed-point reward programs? These questions and more hopefully will be answered in this guide to Scene+.

Table of Contents

Scene+ loyalty program

How to earn scene+ points, current scene+ credit card offers, other scene+ credit cards, what’s the best use scene+ points, 1. scene+ travel, how to redeem using ‘apply points to travel’, what qualifies as a travel purchase , refundable bookings, 1. several ways to earn scene+, 2. enhanced earning on travel purchases, 3. convenient system to cancel refundable bookings, 4. discounted annual fee, 5. no forex fee, 6. one-tier redemption value, 7. twelve months to redeem points, 8. excellent online redemption process, 9. access to rebates on credit card applications, 10. user-friendly scene+ app, 1. no way to extract greater value, 2. limited number of travel expenses, 3. points can’t be transferred to airline or hotel loyalty programs, 4. a rocky transition to the new program, 5. cineplex booking fee, final verdict.

Scene+ is the result of a merger between two former programs: Scotiabank’s Scotia Rewards and Cineplex’s SCENE with an effective date of December 13, 2021. In June 2022, grocery giant Empire joined as a third partner with a plan to replace Air Miles with Scene+ as its loyalty program.

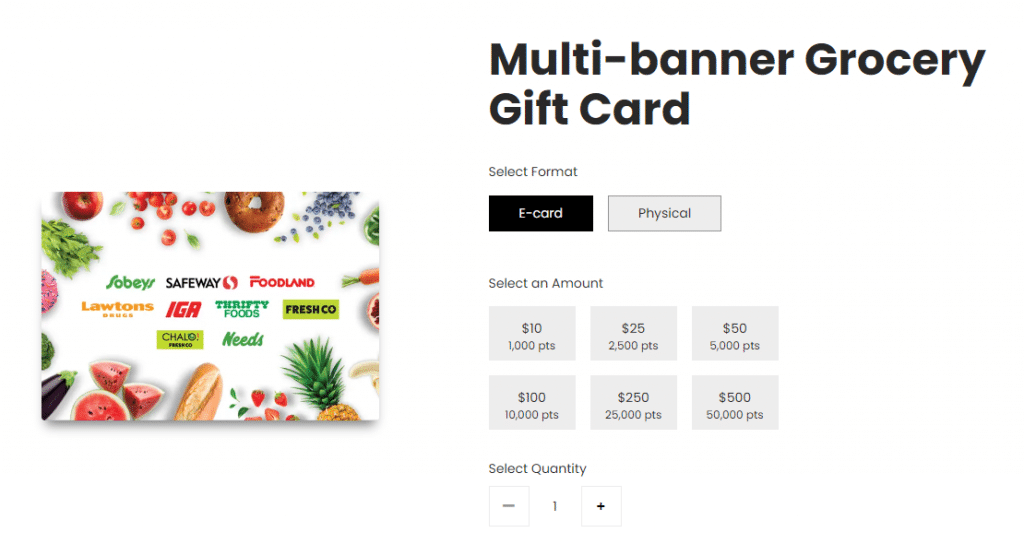

Scene+ is a third-party program operated by Scene Limited Partnership (owned by Scotia Loyalty Ltd., a subsidiary of The Bank of Nova Scotia), Galaxy Entertainment Inc. (a subsidiary of Cineplex Entertainment LP), and Empire Company Ltd., the parent company of stores that include Sobeys, Safeway, Foodland, IGA, FreshCo, Needs,Thrifty, and Lawtons Drugs.

As such, Scotiabank no longer has an in-house loyalty program. This means that Scene+ points earned on Scotiabank credit cards reside in a third-party account. If the credit card that earned Scene+ points is cancelled, the points remain in the member’s Scene+ account, pooled with points earned on other Scotia banking products or a Scene+ Membership Card.

However, there are rules regarding activity. A Scene+ account may be closed, and points forfeited, without any earning or redeeming activity during any 24-consecutive-month period. But a member with a Scene+ Scotiabank product (a credit card or debit card in good standing) is exempt from account closure.

The Scene+ program offers several earning opportunities. These include:

- sign-up bonuses associated with credit cards that earn Scene+ points

- everyday spending on a choice of seven credit cards earning Scene+ points

- purchases using a debit card associated with Scotiabank’s banking packages (Preferred Package, Ultimate Package, Private Banking, Student Banking Advanced Plan, Getting There Savings Program for Youth)

- purchases at partners such as *Empire stores (e.g., Sobeys and Safeway) and Home Hardware

- movie and entertainment purchases at Cineplex theatres or online at the Cineplex store

- cashback in points by shopping through the rebate portal, Rakuten

- dining at partners that include East Side Mario’s, Harvey’s, Kelsey’s, Montana’s, and Swiss Chalet

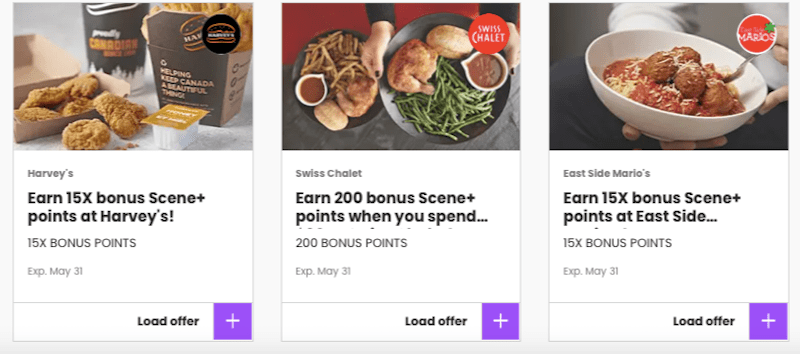

- booking hotel stays and car rentals through Scene+ Travel (powered by Expedia)

- purchases of games and eats at Playdium and The Rec Room

Another advantage of the merged program is that it’s possible to double-dip on earning at partner locations when using a Scene+ credit card and Scene+ Membership Card. Dining purchases at Swiss Chalet, for example, earn one point for every $3 spent and five points per dollar with the dining multiplier on the Scotiabank Gold American Express Card. Special offers increase the earning power.

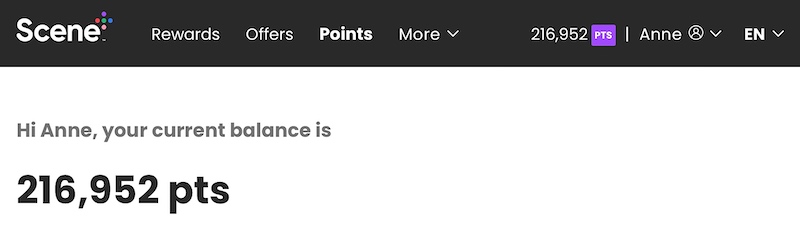

It pays to check your Scene+ account on a regular basis for current offers from Scene+ partners.

*Empire stores include Sobeys, Sobeys Liquor, IGA, Safeway, Safeway Liquor, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry, and Needs Convenience. In the Atlantic, Scene+ points can be earned at Lawtons Drugs that’s owned by Empire.

And of course, Scotiabank customers using select Scotiabank credit cards can ‘double dip’ by paying for purchases with a Scotiabank credit card that earns Scene+ points. At Empire grocery stores, the multipliers are higher.

- Scotiabank Gold American Express Card earns 6 points per dollar

- Scotiabank Passport Visa Infinite Card earns 3 points per dollar

- Scotiabank American Express Card earns 3 points per dollar

The latest promotion on the Scotiabank Passport Visa Infinite Card sees a return of an annual fee waiver in the first year (a saving of $150). The sign-up bonus is

- an attractive 30,000 Scene+ on spending $1,000 in the first three months

- an unattractive 10,000 Scene+ points on spending $40,000 each year

Besides having worldwide acceptance as a Visa card, attractive features of the Scotiabank Passport Visa Infinite include

- an accelerated earning rate of x3 at Empire stores

- accelerated earning rates of x2 on eligible grocery, transit, ride share, dining, and entertainment (applicable worldwide)

- no foreign transaction fees (2.5%)

- complimentary Visa Airport Companion membership and six lounge visits per year

The offer is available until July 1, 2024. Applying through the Great Canadian Rebates portal sweetens the deal with a $30 rebate.

The current promotion on the popular Scotiabank Gold American Express Card is in effect July 1, 2024. Unfortunately, it doesn’t have an annual fee waiver in the first year. The annual fee is $120, or $79 for seniors, that can be offset by applying through a rebate portal. The current rebate at Great Canadian Rebates is $125.

The Scotiabank Gold American Express Card earns:

- 20,000 Scene+ on a $1,000 spend in the first three months

- additional 20,000 Scene+ on a $7,500 spend in the first year

- 6 Scene+ per dollar spent at Empire grocery stores

- 5 Scene+ per dollar spent on groceries (at grocery stores other than Empire), dining, food delivery, and entertainment

- 3 Scene+ per dollar spent on gas, transit, and select streaming services

- 1 Scene+ per dollar spent on everything else

There’s no FOREX (foreign transaction) fee on purchases in a foreign currency.

Like most banks, Scotia offers a banking package where the annual fee on a credit card can be waived every year. For more information see the Ultimate Package bank account.

In addition to the Scotiabank Gold American Express Card, the other Scene+ credit cards are:

- Scotiabank Passport Visa Infinite Card

- Scotiabank Passport Visa Infinite Business Card

- Scotiabank Platinum American Express Card

- Scotiabank American Express Card

- ScotiaGold Passport Visa Card

- SCENE Visa Card

- SCENE Visa Card for Students

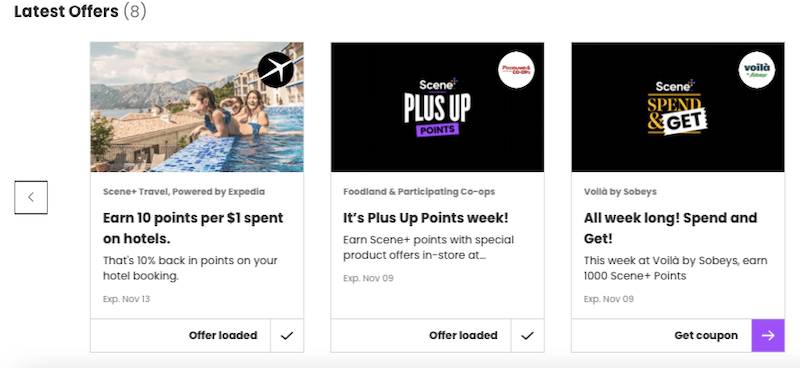

What’s the value of a Scene+ point?

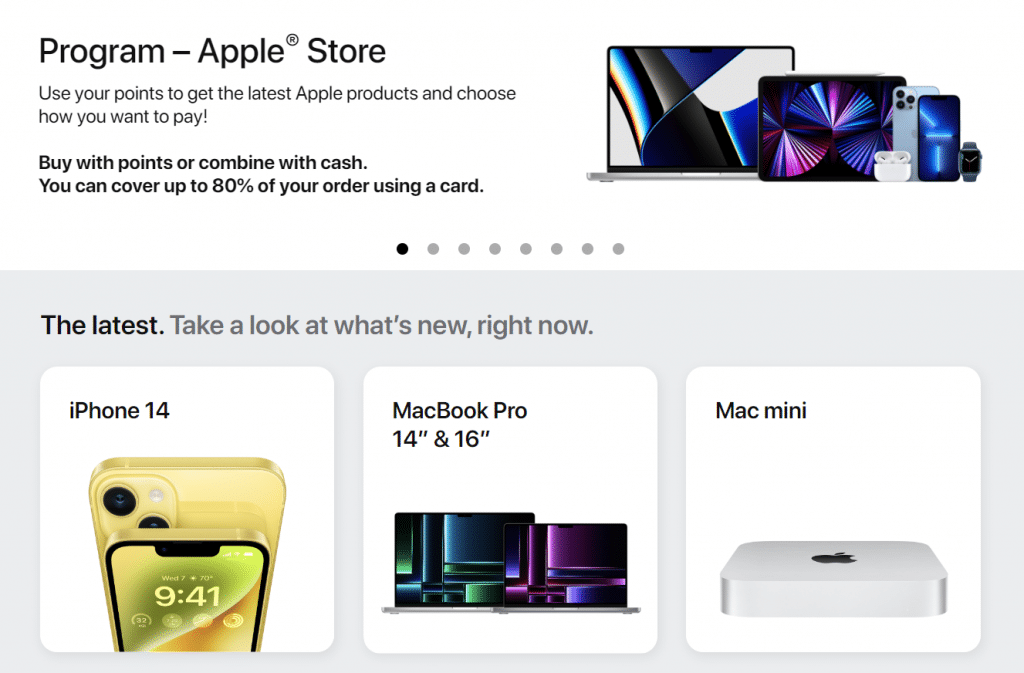

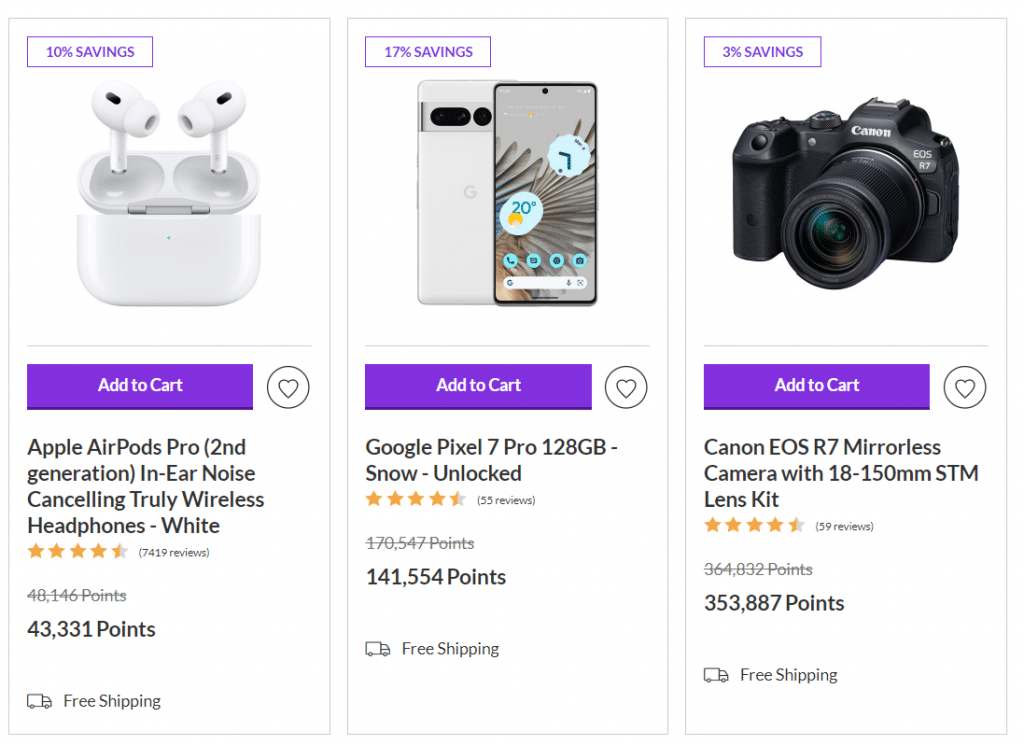

Scene+ can be redeemed for Apple and Best Buy merchandise and gift cards, dining, movie tickets, and Scotiabank credit card account credits. Unless there are special offers, these types of redemptions are at a lesser value than when redeemed for travel.

The exception is at participating grocery stores where 1,000 points can be redeemed for $10 off grocery purchases. This is a value of one cent per point.

Travel redemptions are consistently valued at one cent per point (i.e., 10,000 points = $100). This applies to Scene+ Travel bookings, and those booked independently through other providers.

Much like the former Scotia Rewards Program, there are two ways to redeem points for travel. An advantage over the former program is that the minimum threshold of 5,000 points ($50) no longer exists.

Scene+ Travel replaces the former in-house Scotia Rewards Travel Service. The new service under the auspices of Expedia operates in much the same way as ExpediaForTD, the portal for members of the TD Rewards program. Points can be redeemed against any travel booked via the portal.

Charge the full amount to your credit card, or against the points balance in your account. Or, use the part-points-part-charge option.

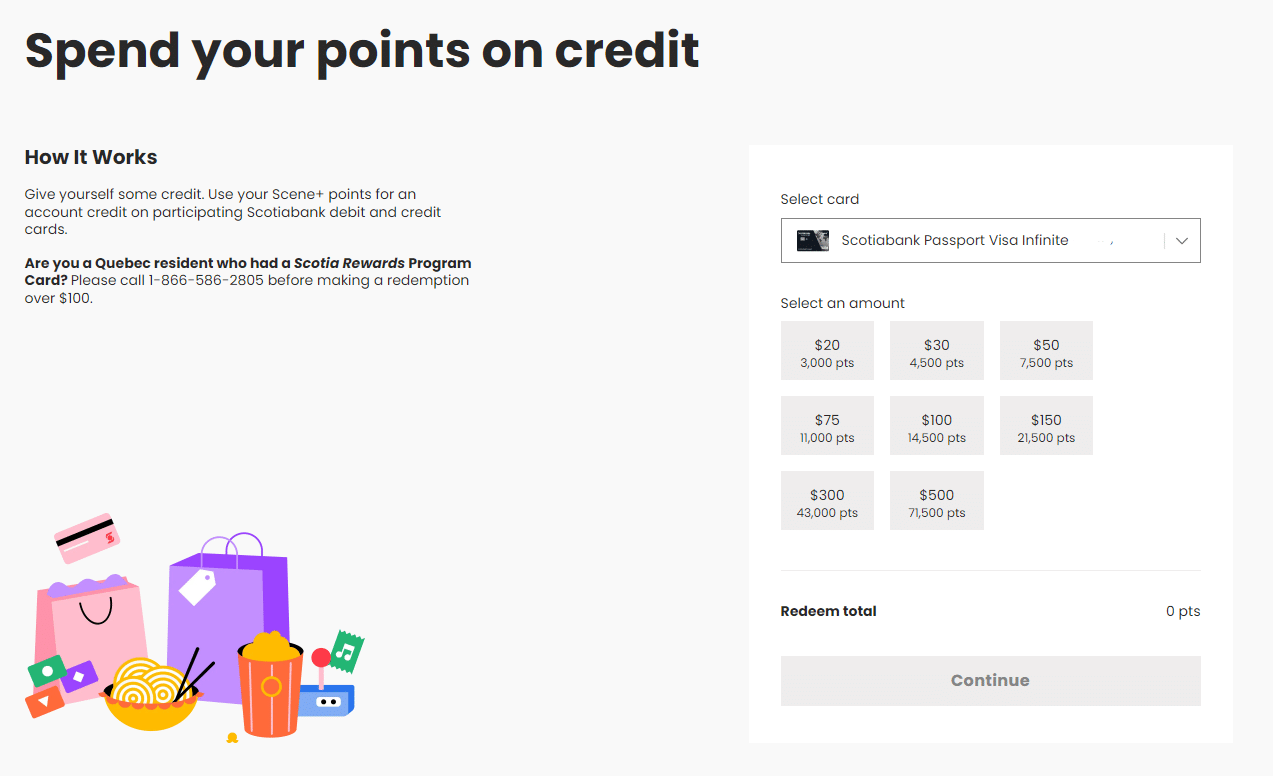

2. ‘Apply Points to Travel’

This operates much the same way as it did under the former Scotia Rewards Program. It’s for bookings with travel providers other than Scene+ Travel.

Charge a purchase to your credit card and wait for it to post to your account. Points can then be redeemed against the purchase. This includes taxes, booking fees, airport fees, and travel insurance premiums.

A cardholder has 12 months from the posting date of the purchase to apply the points.

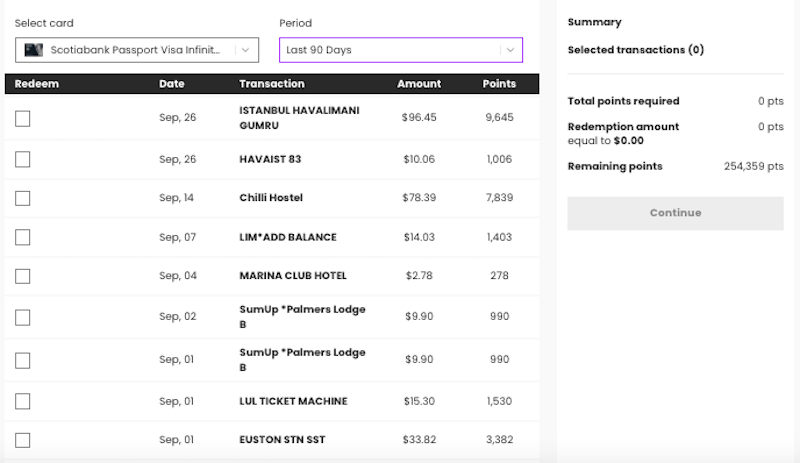

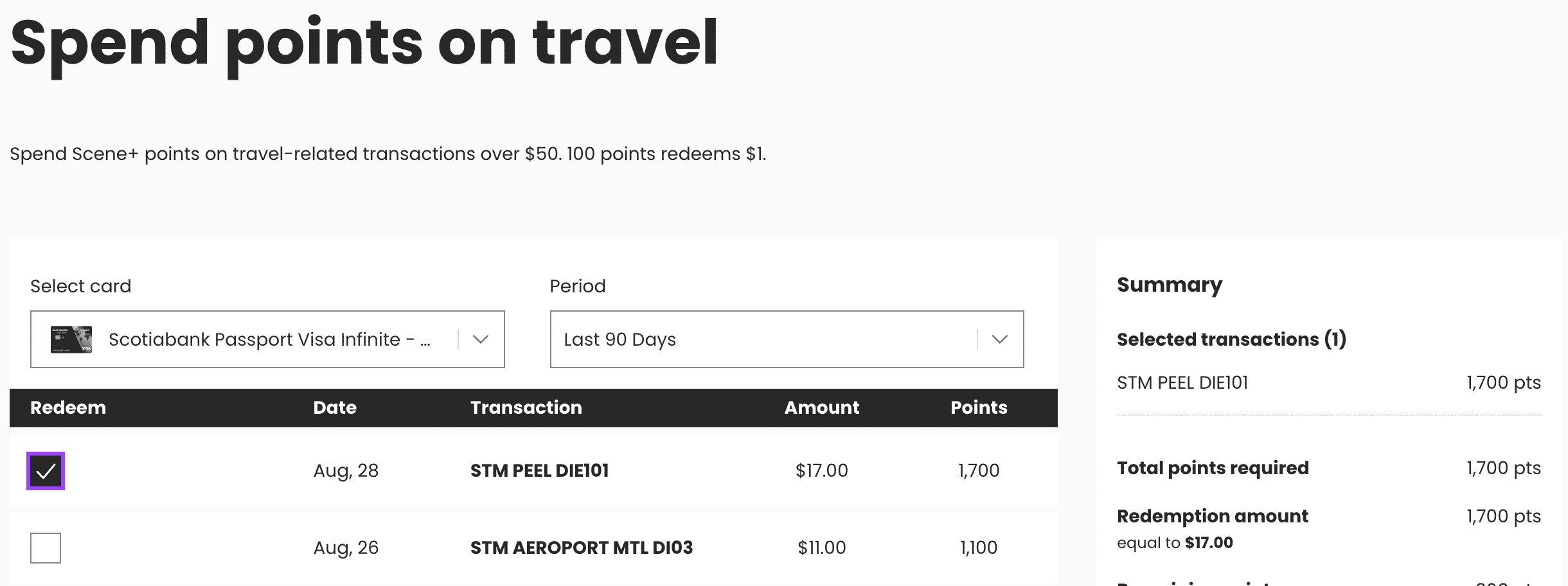

Log into your Scene+ account and navigate your way to > Rewards > Travel (under Spend your points) > Apply Points to Travel

A drop-down menu will list the credit cards attached to your Scene+ account. Clicking on each credit card will reveal any purchases coded as travel in the period you select.

For example, in my case, all travel purchases charged to my Scotiabank Passport Visa Infinite Card in the last 90 days appear as a list. They include a visa for Turkey, airport bus, hostel accommodation, transit card purchase and initial load, train ticket, scooter account top-up, and a drink at a hotel.

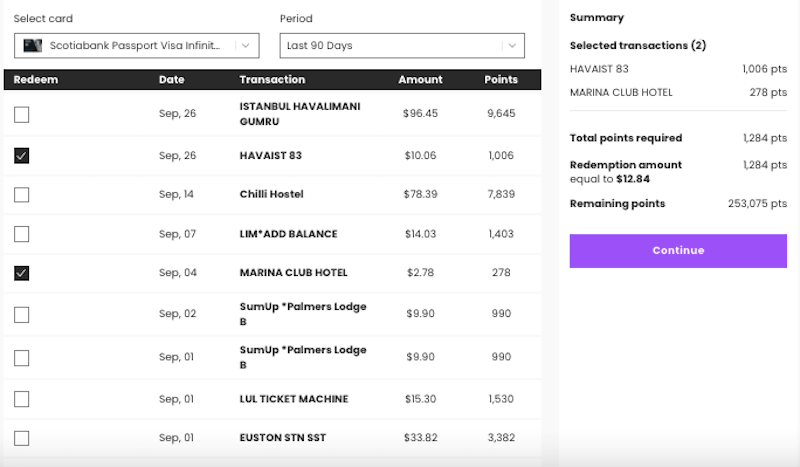

I can redeem Scene+ points for specific charges by selecting each one. The Summary box to the right shows me my selected charges, the total number of points I’ve chosen to redeem, the monetary value of those points, and the remaining points in my Scene+ account.

Clicking the Continue button takes me to a confirmation page, and the information that the monetary value of my redemption will be credited to my credit card account in two to three days. A confirmation email with the same information is received within seconds.

To be eligible for redemption, the charge needs to be recognized as a travel purchase with merchant codes or identifiers set by the Visa network as:

- airlines and air carriers, airports, flying fields, and airport terminals

- lodgings, hotels, motels, resorts, trailer parks, and campgrounds

- passenger railways, bus lines, steamship, and cruise lines

- travel agencies and tour operators

- automobile rental agencies, and motor home/recreational vehicle rentals

These were the same identifiers previously used by the Scotia Rewards Program.

Based on previous experience, I’ve found that charges for passenger railways, bus lines, and tour operators could be inconsistently included or excluded as candidates for redemption.

For example, Queensland Rail travel between Brisbane and Maryborough West in Australia was eligible as a travel redemption. A journey of a similar distance with Irish Rail between Dublin and Galway wasn’t.

Also, when a purchase is coded as entertainment, it’s excluded from the list of travel charges. This has an impact on tours. For example, tours of Dublin’s Kilmainham Gaol and Belfast Titanic were coded as entertainment. As a result, they didn’t appear on the list of eligible travel redemptions. Admission to Dublin’s Christ Church Cathedral for a self-guided tour wasn’t coded as entertainment, but it appeared on the list of possible travel redemptions.

Another observation concerned dining purchases if they were purchased at a hotel or while travelling by train. They appeared as travel purchases on my account and were therefore eligible as a travel redemption.

There are many reasons to make refundable bookings. One issue to consider is whether you prefer to be refunded in points or cash if you need to cancel.

If you book through Scene+ Travel and make a booking using points, your cancelled booking will be refunded in points rather than cash. If you prefer a cash refund, you should book through a platform other than Scene+ Travel (e.g., Expedia) using your Scotiabank credit card and prepay in full. Once the charge posts to your account as a travel purchase, use the ‘Apply Points to Travel’ feature and select the transaction for redemption. The points value of the charge will be deducted from your Scene+ points balance and the cash value of the charge will post to your account within a few business days.

Then, cancel the refundable booking. I find the online process at Expedia using the Virtual Assistant is user-friendly and efficient. The charge will be refunded to your credit card account within five business days.

Ten attractive features of the Scene+ program

When combined with Scotiabank’s best features, the Scene+ program offers several advantages.

In addition to opportunities to earn points with Scene+ partners, Scotiabank has seven credit cards in the Scene+ family. Several of them offer points multipliers for various types of category spending.

The best points multiplier is on spending using the popular Scotiabank Gold American Express Card. It earns 5 points per dollar on groceries, dining, and entertainment and 3 points on gas, daily transit, and select streaming services. (The multiplier increases to 6 points per dollar at Empire grocery stores.)

Only purchases in Canadian funds are eligible for the points multiplier, but there have been reports of cases where the multiplier has been applied while travelling abroad. In my view, t he best use of the Scotiabank Gold American Express Card is to use it exclusively for the x5 multiplier (x6 at Empire grocery stores). Even for gas, purchase gas gift cards at a grocery store for the x5 or x6 multiplier, and gift cards of other merchants you support.

For moviegoers, the Scene Visa Card (or the Scene Visa Card for Students) may be useful as a no-fee ‘forever card’ to build and anchor a person’s credit history. It earns x5 on purchases at Cineplex theatres or at cineplex.com, but its value to someone without a lengthy credit history is that it could help elevate a credit score and a person’s credit worthiness.

Scene+ credit cards earn 3 points per dollar (pre-taxes and fees) on hotel and car rental bookings at Scene+ Travel. The occasional offer such as x10 points on hotel bookings in the fall of 2022 boost earning efforts. This is in addition to the points earned on the respective credit card.

Refundable bookings at Scene+ Travel are conveniently and efficiently processed by Expedia’s Virtual Agent. Clicking on the Customer Support link at the bottom of the confirmation email takes you to your Scene+ account login and then to the Virtual Agent where you’ll be prompted to enter your itinerary number or the last four digits of the credit card used for the booking. Once the Virtual Agent locates the booking, one click cancels it and an email arrives within seconds confirming the cancellation.

Scotiabank offers discounted annual fees for seniors. The Scotiabank Gold American Express Card has a fee of $79 (as opposed to $120). The ScotiaGold Passport Visa Card’s fee is $65 (compared to $110).

Scotiabank is to be applauded for being the first of the big-five banks to offer a no-FOREX-fee credit card to its Scotiabank Passport Visa Infinite Card. I suspect that dropping the 2.5% fee cuts into a lucrative profit margin but clearly it’s been worth it. Otherwise, Scotia wouldn’t have added this feature to the popular Scotiabank Gold American Express Card. Needless to say, it came with an annual fee increase from $99 to $120 and the downgrading of several benefits.

To help you decide if a no-FOREX-fee credit card is the best credit card to have while travelling abroad, see Is a no-FOREX-fee credit card always the best choice for international travel?

Unlike other programs (e.g., TD Rewards), there’s no loss of value between using Scene+ Travel and other travel providers. The flexibility to book travel with any provider without any devaluation of points means cardholders can search for the best deal and use a vendor of their choice.

Dealing directly with a provider can be beneficial. In the case of flight delays and overbooked or cancelled flights, it’s my experience that service is better if the booking was made directly with the airline. For hotel bookings, it’s usually necessary to have booked directly with the hotel’s booking service to earn loyalty points and other loyalty program benefits.

(For AirBnB bookings, if you’re chasing Avios points, consider booking through the British Airways Executive Club portal to earn x3 Avios points on each pre-tax £1/€1/$1 spend on accommodation or experiences, plus what you earn on your credit card of choice.)

Having 12 months to use the ‘Apply Points to Travel’ route means you don’t need to have the points when you book. You can accumulate the necessary points using the welcome bonus and points multipliers with your Scene+ credit card, and then redeem them when it’s to your advantage.

The online system for post-purchase redemptions is user-friendly and efficient.

Scotiabank regularly uses affiliate partners that offer rebates on approved credit card applications. For example, the Great Canadian Rebates (GCR) rebate of $150 on the popular Scotiabank Gold American Express Card is very appealing.

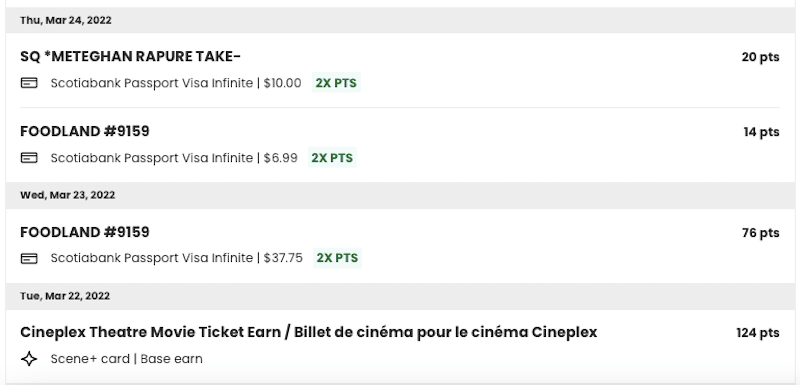

Offers are loaded on the app and the Scene+ membership card is within easy reach to take advantage of earning opportunities. Tapping on an account holder’s points total reveals points-earning activity by date and credit card, with multipliers. A quick glance reveals if points and multipliers have been correctly applied.

The Scene+ app mirrors essential account information available at the Scene+ site.

Five shortcomings of the Scene+ program

Unlike CIBC Aventura, RBC Avion Rewards, and American Express Membership Rewards, at the present time, Scene+ doesn’t have a flight reward chart where it’s possible to extract a value greater than one cent per point.

For more information on the CIBC Rewards (Aventura) program, see When travelling the world on miles and points, is the CIBC Aventura program worth it?

The system of merchant codes and travel identifiers is mostly restricted to flights, accommodation, transit, car rentals, cruises, and travel packages. Attractions, tours, and sundry travel purchases are mostly excluded. In this respect, TD Rewards can be redeemed for a broader range of travel expenses.

For more information on the TD Rewards program, see: When travelling the world on miles and points, is the TD Rewards program worth it?

There are no conversion partners where it might be possible to extract a greater value than one cent per point on travel redemptions.

Based on the comments in various miles-and-points forums, far too many people had negative experiences with the transition to the Scene+ program. Missing points, missing multipliers, and other anomalies have resulted in reports of people who, in frustration, stopped using Scene+ credit cards until such time as the glitches were resolved. While some issues have been addressed, not all problems have been resolved. Thankfully, Scene+ has a callback system based on a caller’s place in the callback queue.

Also, Scene+ is yet to expand its two-factor authentication to include email. Members with a physical SIM card and local number (or eSIM data-only package) while travelling abroad cannot receive a text or call to a Canadian number that temporarily doesn’t exist or is not in service. Unlike Aeroplan, I can receive an email to confirm my identity and log into my account to manage bookings. This isn’t possible with Scene+ and renders it less useful while travelling.

In June 2022, Cineplex undermined the convenience of online bookings by introducing a non-refundable booking fee $1.50 per movie ticket. The fee is discounted for Scene+ members (to $1.00 per ticket), and waived for CineClub members enrolled in Cineplex’s monthly subscription service. It doesn’t apply to movie tickets purchased at the theatre.

1. The x5 points multiplier on groceries, dining, and entertainment (x6 at Empire grocery stores) helps make the Scotiabank Gold American Express Card a useful keeper card for many cardholders, and a strong earner of Scene+ points.

2. The addition of Empire is exciting news for Scene+ members who find value in the Scene+ program and now earn points on grocery and drug store purchases at stores under the Empire umbrella. The points boost from x5 to x6 on purchases at Empire grocery stores on the Scotiabank Gold American Express Card is welcome news indeed.

3. The flexibility in redeeming Scene+ for purchases from any travel provider with no loss in value makes it a very attractive fixed value program. In this respect, it has the edge on the TD Rewards Program that has a two-tier redemption structure.

4. The ease of redeeming points online is a welcome user-friendly feature. Having 12 months to do so adds to the appeal.

5. Scene+ points are handy for a variety of travel expenses such as budget flights or those that aren’t part of a primary airline alliance/frequent flyer program. They’re useful for ground transportation, ferries, and miscellaneous accommodation that are outside existing airline and hotel loyalty programs. When used strategically, they can play a beneficial role in reducing out-of-pocket travel expenses.

6. The program has excellent potential as one of several secondary programs in a diversified miles-and-points portfolio. As such, it can be used to complement frequent flyer and hotel loyalty programs that are capable of generating a much greater value than one cent per point.

As far as I can see, the new Scene+ program is greater than the sum of its former parts. With no obvious signs of devaluation, it replaces Scotia Rewards as my favourite fixed-point program.

If you found this post helpful, please share it by selecting one or more social media buttons. Do you collect Scene+ points? If so, what’s your experience with the program? Please share your thoughts in the comments. Thank you.

Might you be interested in my other miles-and-points posts?

- When travelling the world on miles and points, is the CIBC Aventura program worth it?

- Is a no-FOREX-fee credit card always the best choice for international travel?

- Finding Aeroplan flights: a step-by-step guide

- Meeting Minimum Spend Requirements to travel the world on miles and points

- Lounge and flight review of United Airlines’ Polaris experience

- Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet?

- Travelling the world on miles and points. Is the TD Rewards program worth it?

- Why the Best Western loyalty program is good for travellers

- What is the best credit card for trip cancellation, trip interruption and flight delay insurance for trips on points?

Care to pin for later?

32 Comments

Hi Anne Great article on a card I do not have yet. One question. It says that the points credit may not show up for up to two statements. Does this mean interest is charged for those two months, then credited back or is the credit in the system but just not showing? I would hate to leave any balance on a card even when a credit will eventually come.

Hi John. The credit appeared on my account much faster, and there’s no interest involved. Here’s an example using the Spirit of Queensland train fare. I charged it to my credit card in January and the $371.38 charge appeared on my next statement. Each monthly balance is paid in full so by the time I took the train in March, it had already been paid. When I returned from Australia in April, I redeemed 37,138 points and the credit voucher for $371.38 appeared in my account within a matter of days. That put my credit card account in the black at the end of April, and each subsequent charge on my credit card was deducted from that credit. Had I chosen to close the account with a credit, I could have asked for a cheque, or had it transferred to my no-fee Scotia credit card. Does this help answer your question?

Anne, hi. I have the same question on how many days are taken from the date of post-purchase redemption request to a date of showing up in a credit card account. The UP-TO 2 statement periods is really scaring me. You said that it took only several days in your example. Based on your experience , is a week realistic?

Hi Seong. Thanks for dropping by. My experience involved just a few days. It’s my sense banks are over cautious with their “up-to” advertised long periods for points, refunds, buddy passes and the like to be posted. I should think a week is a reasonable expectation despite the stated two statement periods.

Hi Anne, as March 8 2023, the Apply Points to travel Button seems to be gone as an option to redeem existing points. The only way left is to purchase a new trip through their portal powered by Expedia!

Hi Anne, Although in theory the merger of ScenePlus and ScotiaRewards seems to be an excellent program, it is having some serious startup problems : missing points, missing multiplier points, as well as points double-posted including double-posted points for returns. Calculating an accurate points total is almost impossible. A month and a half after the merger the problems have not yet been resolved. Phoning in to rectify the points balance involves wait times of up to four hours plus. All of this for a points program that that involves annual fees. Disappointed? You bet.

Agreed, there have been lots of complaints, especially on multipliers. I’m fortunate in that my Scotia Rewards all converted to Scene+ but I’m taking a break from using Scene+ credit cards until there are reports that the glitches have been fixed. Some reports indicate a commitment to have it fixed sometime in February. Fingers crossed, as I quite like this as a secondary program.

Hello, Anne. Although the merger of ScenePlus and ScotiaRewards appears to be a great programme in theory, it has a number of major initial issues, including missing points, missing multiplier points, and double-posted points, including double-posted points for returns. It’s nearly impossible to calculate an exact point total. The issues have not been resolved a month and a half after the merger. Calling in to correct the points balance can take up to four hours or more. All of this for the sake of a points programme with annual payments. Disappointed? Yes, absolutely.

Hello, Anne. I have the same issue about how long it takes from the time a post-purchase redemption request is submitted to the time the funds appear in a credit card account. I’m terrified of the UP-TO 2 statement periods. In your example, you mentioned it just took a few days. Is a week realistic based on your experience?

A week was realistic with the former Scotia Rewards program. I’m yet to make a redemption from the new Scene+ program.

Hi Anne, thanks for the review. The lack of Forex fees is a big win for me and anybody who uses their VISA abroad. However I noticed that booking travel although is ‘powered by’ Expedia, doesn’t offer the same benefits as using Expedia directly. i.e. must book flights and hotels separately, no packages or package discounts are available. I even did a head-to-head comparison for an upcoming trip to Miami and found the Expedia website price cheaper than via Scene+ Travel, which is very frustrating.

Thank you for this breakdown Anne. I have the Scotia Gold Amex and waiting for the Scotia passport in the mail. Im have no experience in this program and my question is, do my points combine from both cards or do I end up with 2 separate Scene+ accounts?

Marlene, your points combine in the same Scene+ account. You’ll see your total points and a breakdown of the points from your feeder cards. Many people have experienced problems with points being posted correctly, including multipliers, so it’s a good practice to check your points during these early months of the new program.

Greetings, I have a Scotiabank Passport Infinite card I’ve been using in the United States but I don’t seem to be accumulating scene rewards points. Are US dollar spends eligible for points? Tried to connect with Scenes.ca but don’t have time to wait for the estimated 1 hour and 45 minutes.

Yes, the Passport Visa Infinite earns Scene+ on foreign purchases, both base points and the multiplier. It sounds like you’re one of several people experiencing glitches during the transition from Scotia Rewards to Scene+.

This was really helpful – thank you so much! I was struggling to find information on the new program and you’ve summarized it in a very user-friendly way.

Hello. Do you know if AirBnB bookings can be redeemed as part of the Points for Travel program? Is it considered an Eligible Travel Expense?

Hi Cathy. AirBnB is a recognized accommodation provider by the Visa network so it should appear on your list of eligible travel redemptions on your Scotiabank credit card account that earns Scene+ points.Good luck.

Unlike with Scotia Rewards, booking airfare through the new Scene+ system is a complete horror show. People assisting with bookings are incompetent and most do not have adequate English language skills.

I have had exactly the same experience. Very disappointing after receiving consistently excellent service through the previous program.

Where can I find the redeem Scene+ points for travel purchases already made button. I can see my points balance but can’t seem to find the button to redeem. Thanks

It should be in your Scotia account (not Scene+). Any purchases coded as travel should appear as eligible for redemption.

The apply points to travel is not operating at all like it used to with scotia rewards. I made several purchases in the last 6 months of airlines, hotels, taxis, etc. and none of them show up in the list for redemption. It’s really frustrating. Also I used to get double points with my card on any travel bookings before and now it’s just regular points. And living overseas it used to also allow me to get bonus points on restaurants/ entertainment that wasn’t exclusively in Canada. Now not..

Says you need to phone if you want to apply “partial” redemption, as it isn’t yet available in the app. But when you live overseas calling doesn’t work. Overall just a huge disappointment since switching.

Thanks a lot for your summary – so useful. I’ve had a Scotiabank visa infinite since earlier this year. My question is, I have about 60000 scene + points. I’ve incurred hundreds of dollars of travel expenses within the last 6 months. Is there any downside to simply using the “apply points to travel” option and cashing everything out? Am I missing out on any potential better use of the points? Doesn’t seem like it to me, but I’m new to this program, so just wanted to ask an expert. Thanks!

Hi Jonathan. Unless there are special offers, I’m assuming travel redemptions at a penny a point offer the best return. The only downside I can think of to NOT using the points now against recent travel expenses is the possibility of a devaluation. I like to think that’s not likely in the near future given the need to attract members and build confidence in the Scene+ program.

My mother just got her visa infinite scene card in the mail and she is ready to collect points. After reading this I’m a little concerned. We planned on paying our travel agency with the card to earn points, but I’m starting to see that won’t work. Will we earn points for booking tours and whatnot when not using the travel portal? Do you earn points with every purchase?

Thanks for the help

Yes, you earn points with every purchase. So is it the Scotiabank Passport Visa Infinite Card? If so, the earning rate is 1 point for every $ spent, except it increases to 2 points per $ on groceries, dining, entertainment, and daily transit. So if you pay your travel agent $500, 500 points will be earned on the purchase. Does this help?

I just got a new Scene+ card from my local Foodland store. When I went to register it I was not happy that I was expected to enter a credit card number as well to complete the process. I found that very suspicious and unless I can be convinced that it is necessary I won’t bother with the card.

Scene is terrible to deal with, please if you are reading this DO NOT GET ANY SCENE CARD! I ordered a 100 dollar gift card that never came. I have called and emailed for months and they will not return my points, so I’m out 100 dollars. All banks have points now, go to one that works, scene is garbage.

It is March 2023 and Scene+ still is in a mess. It is unclear whether they give 3x points for flights and hotels (as they advertise) or 1 point for every dollar spent. Just got back from Europe where all travel and hotels were paid for using Scotiabank Infinite Passport card and only 1 point/$spent appears on statement. The call centre staff are, for the most part, absolutely useless. Why is it called Powered by Expedia? Do you have to book through Expedia?

Thanks for this information. I’ve been trying to confirm with Scotia Passport Visa Infinite Card that even foreign purchases earn points (1 point per dollar). Is that your understanding? Purchases made around the world still earn points? Thank you!

Yes, the Scotia Passport Visa Infinite earns points on all foreign transactions. It also earns points on the multiplier categories. So if you use the card in any country on dining or groceries, it earns x2 points. If you link it to your Uber account, you’ll earn x2 on the ride-share category. All the best.

Trackbacks/Pingbacks

- 25 Tips on earning Aeroplan miles - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Why the Best Western loyalty program is good for travellers - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Lounge and flight review of United Airlines’ Polaris experience | Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Minimizing Aeroplan taxes, fees and surcharges - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Finding Aeroplan flights: a step-by-step guide - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- What is the best credit card with trip cancellation, trip interruption and flight delay insurance for trips on points - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Is the BMO Air Miles World Elite MasterCard a good deal? - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Travel the world on miles and points by meeting Minimum Spend Requirements - Packing Light Travel - […] What’s the best use of Scotia Rewards? Travel the world on miles and points […]

- When travelling the world on miles and points, is the TD Rewards program worth it? - Packing Light Travel - […] What’s the best use of Scotia Rewards if travelling the world on miles and points […]

- Is a no-FOREX-fee credit card always the best choice for international travel? - Packing Light Travel - […] What’s the best use of Scotia Rewards for travelling the world on miles and points […]

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search this site

Welcome to Packing Light Travel. I'm Anne, a dedicated carry-on traveller. For information on the site, please see the About page.

Book: The Ernie Diaries

Packing Light

Join the mailing list for updates, and access to the Resource Library.

You have Successfully Subscribed!

Connect on instagram, if you find this information useful, subscribe to the newsletter and free access to packing lists, checklists, and other tools in packing light travel's resource library..

Your email address will never be shared. Guaranteed.

Pin It on Pinterest

- Book Travel

- Credit Cards

Best ways to earn:

Best ways to redeem:.

Scene+ was launched towards the end of 2021 as a revitalized merger between the existing Scene points program and Scotia Rewards. Then, with the induction of grocery powerhouse the Empire Company as co-owner in 2022, Scene+ has rapidly evolved as one of the top rewards programs in Canada.

With several everyday spending opportunities, Scene+ is one of the easiest points currencies to collect in Canada these days. They’re easy and flexible to redeem too; you use them at a fixed value towards not only travel purchases but also groceries, dining, entertainment, and gift cards.

But let’s be clear – these aren’t necessarily the points that will fly you in business class or First Class. However, you’ll find how they’re quite useful when redeemed to offset other travel purchases and minimize your out-of-pocket expenses.

Earning Points via Signup Bonuses

While it’s possible to earn Scene+ points in a variety of ways outside of credit card spending, it’s noticeably easier to earn sizable amounts as credit card signup bonuses.

- The Scotiabank Platinum American Express Card is a flagship premium credit card, with the most perks and benefits. You can find the largest signup bonus on this card.

- The Scotiabank Gold American Express Card is a mid-range American Express card, with frequent First Year Free promotions and a strong, consistent signup bonus.

- The Scotiabank American Express Card is an entry-level no-fee American Express card, with a small welcome bonus, usually of between 5,000–10,000 Scene+ points.

- The Scotiabank Passport Visa Infinite Card is a mid-tier Visa card with no foreign transaction fees and complimentary lounge access

- The Scotiabank Passport Visa Infinite Business Card is the business version of the Passport Visa Infinite Card and offers similar bonuses and benefits

Earning Points via Daily Spending

In addition to welcome offers, you can earn Scene+ points through daily spending on the above credit cards. The earning rates are as follows:

- 2 Scene+ points per dollar spent on all purchases

- 6 Scene+ points per dollar spent at Empire-affiliated grocery stores (Safeway, Sobeys, IGA, Thrifty Foods, etc).

- 5 Scene+ points per dollar spent on groceries, dining, and entertainment

- 3 Scene+ points per dollar spent on gas, transit, and streaming services

- 1 Scene+ point per dollar spent on all other purchases

- 2 Scene+ points per dollar spent on dining, grocery, movie theatres, gas, transit and streaming services purchases

- 1 Scene+ point per dollar spent on all purchases

- 2 Scene+ points per dollar spent on transit, groceries, dining, and entertainment

- 1.5 Scene+ points per dollar spent on all purchases

From this list, we can see the Scotiabank Gold American Express Card has some of the highest earning rates around, with the Scotiabank Platinum American Express Card comes out strong with a relatively high base earning rate on all purchases.

Aside from credit card spending, as a multifaceted rewards program, you can also earn Scene+ points on the following by mostly using your membership card alone:

- 1 Scene+ point per $5 spent on all purchases using a Scotiabank debit card

- 1 Scene+ point per $3 spent on dine-in or takeout at Recipe Unlimited restaurants (Harvey’s, Swiss Chalet, East Side Mario’s, Montana’s BBQ & Bar, Bier Markt, and Kelsey’s Original Roadhouse)

- Personalized and weekly offers/bonuses found on the Scene+ app

Entertainment

- 5 Scene+ points per dollar spent on Cineplex movie tickets, and food and drink

- 5 Scene+ points per dollar spent on Cineplex Store rentals and purchases

- 1 Scene+ point per dollar spent at The Rec Room and Playdium

Groceries & Pharmacy

- 2 Scene+ points per dollar spent on entire amount of prescriptions at Empire Company pharmacies (Sobeys, Safeway, Lawton Drugs, etc.) – applicable to Nova Scotia, Manitoba, and Saskatchewan only

- 1 Scene+ point per $2 spent at Needs Convenience

- Personalized and weekly offers/bonuses found on flyers and apps of Empire Company grocery stores (Sobeys, Safeway, FreshCo, Foodland, IGA, etc.), grocery delivery services (Voila), and pharmacies (Lawton Drugs)

- 50 Scene+ points per $50 spent at Home Hardware

- Up to 20% more Scene+ points back with a cash back portal powered by Rakuten

- Exclusive higher Scene+ rebate offers for members

- 3 Scene+ points per dollar spent on hotels and car rentals when booked with Scene+ Travel powered by Expedia

Redeeming Scene+ Points

The revamped Scene+ rewards program offers countless redemption possibilities, with some being more valuable than others.

The highest redemption value for Scene+ points comes by redeeming them on travel purchases, either through the dedicated redemption portal powered by Expedia or by offsetting any travel purchase charged to your card. By redeeming points this way, you’ll get a fixed value of 1 cent per point (cpp).

Scene+ Travel powered by Expedia is essentially the same platform as the regular Expedia, except you log in through the Scene+ portal first to enable you to earn and redeem points.

But again, with the flexibility of Scene+ points, you’re not limited to booking directly with Scene+, and it’s almost always recommended to book any flights, hotels, or other travel directly then just offsetting your purchases with points.

This avoids common problems with online travel agencies such as higher rates, lack of loyalty program benefits, and poor customer service when it comes to irregular operations .

After making your travel purchase and waiting a few days for the transaction to post, and head to the “ Apply Points for Travel ” page. You have up until 12 months after you’ve travelled to do this, so it’s not time sensitive by any means.

Simply find the transaction and offset it with your points. It’s that easy!

Scene+ points are particularly useful for booking travel that is otherwise difficult to book using points. Common applications can include independent hotels, cruises, car rentals, or any other travel purchase you encounter along the way.

While it would take a large sum to book a free flight in business class, Scene+ points are useful to reduce the other expenses that tend to add up during a trip. When used in conjunction with other points currencies, they can be a great way to bring down the overall cost of a trip.

General Statement Credits

As an alterative to travel statement credits, you may opt to use your Scene+ points for a general credit towards your bill. But compared to the travel statement credits above, this option gives you less value for your Scene+ points.

Whether you redeem $20 or $500 in statement credits, you’re only getting approximately 0.7 cent per point , which again, is poor value versus using your points to offset travel purchases.

But since it could also be applied as a credit towards your linked Scotiabank debit card, you can, technically-speaking, convert your Scene+ points to cash that you can withdraw.

Grocery, Entertainment, and Dining

If you don’t currently have travel plans or would rather charge your travel expenses on other credit cards, Scene+ flexibly allows redemptions for grocery, entertainment, and dining as an instant credit to your bill.

At Empire Company grocery stores (Sobeys, Safeway, FreshCo, Foodland, IGA, etc.) nationwide, you can redeem blocks of 1,000 points to get $10 off your bill directly.

Then, at Cineplex entertainment venues, including The Rec Room and Playdium, you can redeem blocks of 500 points to get $5 off your bill directly.

Lastly, at Recipe Unlimited restaurants (Harvey’s, Swiss Chalet, East Side Mario’s, Montana’s BBQ & Bar, Bier Markt, and Kelsey’s Original Roadhouse), you can redeem blocks of 500 points to get $5 off your bill directly.

On all the redemptions above, you’re also getting a value of 1 cent per point, making these instant redemptions a great alternative to travel statement credits.

Note that you’d only need your Scene+ membership card or number when redeeming at outlets/stores, and you don’t necessarily have to charge the rest of your bill with your Scene+ co-branded credit card.

Home Hardware

The most recent addition to the roster of Scene+ partners is Home Hardware and its associated brands, namely Home Building Centre, Home Hardware Building Centre, and Home Furniture.

Through 1,100+ dealer-owned locations, as well as online at homehardware.ca, you can redeem your Scene+ points instantly at a rate of 1,000 points = $10. Like other Scene+ redemption opportunities, you’re getting a value of 1 cent per point .

Another flexible redemption for your Scene+ points is gift cards. You can redeem gift cards for a variety of categories, including groceries, gas, beauty, and electronics.

Most gift cards, including Shell and Home Hardware, yield the optimal redemption value of 1 cent per point, but others give you less. For instance, you can get a $10 Best Buy or Sephora gift card for 1,400 points, making the redemption value 0.7 cent per point.

You can order gift cards in electronic form delivered within 24 hours or as physical cards shipped within two weeks.

Merchandise

Scene+ offers a selection of merchandise for redemption through its own Apple storefront and its Best Buy catalogue.

As an authorized reseller, Scene+ offers the complete range of Apple products that you would find in an Apple Store. However, these redemptions aren’t necessarily a good use of your Scene+ points.

For example, an iPhone Pro Max 128GB costs 223,745 Scene+ points, which are worth $2,237.45 (CAD) at the ideal 1 cent per point redemption value. Currently, the same model sells for $1,549 (CAD) at the Apple Store, so even with taxes and recycling fees, you’re still losing substantial value by directly redeeming your Scene+ points for Apple products.

The Best Buy catalogue, on the other hand, offers a huge variety of merchandise that you’d otherwise find at the retailer’s brick-and-mortar and online stores. But again, you’re not getting good value in redeeming through it either.

Taking the Apple Airpods 3rd generation as an example, the Best Buy catalogue requires 30,332 Scene+ points, which are worth $303.32 (CAD) at 1 cent per point. You’ll end up losing value on your Scene+ points when the Best Buy online store itself sells them for $209.99 (CAD).

As you can see, in some cases, you can get maximum value out of Scene+ points by redeeming them for things aside from travel; however, you can also get much worse value.

Scene+ is a flexible rewards currency that you should definitely look into including in your points arsenal. While it may not necessarily fly you in business class or First Class, its flexibility and simplicity to be applied as a statement credit will lower your out-of-pocket costs on travel purchases otherwise not redeemable by miles or other point currencies.

But if you’re not looking to travel anytime soon, you’re also afforded the option to instantly redeem your points on groceries, dining, entertainment, and even gift cards – all at a great redemption value.

I should also note that there are occasional redemption bonuses for Empire stores, meaning the redemption value goes above 1 cpp in those cases

Am I correct in my understanding that you have to have a Scotiabank credit card to apply Scene+ points for travel credit? Put another way, can I apply Scene+ points to a Cobalt statement?

I have been using this card for the past 4 years and it’s covered a lot of our travel expenses during this time. However, I’m still unclear if the points are transferable to other programs to maximize the benefit that we get out of our daily spending.

Also, now that we’re well past the point of the sign-up bonuses, it may be time to move on or add another card to our strategy.

Scene+ points aren’t transferable to any other loyalty programs.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

We can't sign you in

Your browser is currently set to block JavaScript. You need to allow JavaScript to use this service.

To learn how to allow JavaScript or to find out whether your browser supports JavaScript, check the online help in your web browser.

Your browser is currently set to block cookies. You need to allow cookies to use this service.

Cookies are small text files stored on your computer that tell us when you're signed in. To learn how to allow cookies, check the online help in your web browser.

About this app

Data safety.

Ratings and reviews

- Flag inappropriate

- Show review history

What's new

App support.

Trending Search is available and can be access through arrow keys

- Bank Your Way

New to Scotia OnLine? Activate Now

Ordinary purchases, extraordinary rewards

Earn more points at participating partners with Scotiabank and Scene+.

Earn points faster with Scotiabank

Scotiabank offers the only credit and debit cards that allow you to earn Scene+ points on every transaction

Shop at one of our stellar partner stores for your everyday needs.

Pay with an eligible Scotiabank credit or debit card to earn points.

Show your Scene+ membership card to earn even more points.

Get rewarded faster

From grocery to travel, to shopping and dining, earn up to 6X the Scene+ points faster †† with one of our award-winning Scene+ debit and credit cards.

- Credit Cards

Ultimate Package

Earn Scene+ TM points

on everyday purchases and redeem them for travel, dining, entertainment, and more.

Earn up to $400 with a Scotiabank banking package and an investment plan. ‡

- Unlimited debit transactions 2 , Interac e-Transfer † transactions, and Scotia International Money Transfers. ±

- Up to $150 annual fee waiver each year on select credit cards. 9

Preferred Package

on everyday purchases and redeem them for travel, dining, entertainment, and more

- Unlimited debit transactions 2 and Interac e-Transfer † transactions

- Up to $150 annual fee waiver for the first year on select credit cards 8

Scotiabank ®* Scene+ ™ Visa * Card

2X the Scene+ points 4

for every $1 spent at Sobeys, Safeway, Foodland & Participating Co-ops, FreshCo and more.

for every $1 spent at Home Hardware.

for every $1 spent on purchases made at Cineplex.

1X the Scene+ points 4

for every $1 spent on all other eligible everyday purchases.

Scotiabank Passport ®* Visa Infinite * Card

3X the Scene+ points 3

for every $1 spent at Sobeys, Safeway, IGA, Foodland & Participating Co-ops and more.

2X the Scene+ points 3

for every $1 spent on groceries at other eligible grocery stores, dining, entertainment, and daily transit.

1X the Scene+ points 3

Scotiabank ®* Gold American ® Express Card

6X the Scene+ points 5

for every $1 CAD spent in Canada on at Sobeys, Safeway, FreshCo, Foodland and more.

5X the Scene+ points 5

for every $1 CAD spent in Canada on groceries at other eligible grocery stores, dining, and entertainment.

3X the Scene+ points 5

for every $1 CAD spent in Canada on gas, transit and select streaming.

1X the Scene+ points 5

Scotiabank ®* American Express ® Card

3X the Scene+ points 10

for every $1 spent at Sobeys, Safeway, FreshCo, Foodland and more.

2X the Scene+ points 10

for every $1 spent on groceries at other eligible grocery stores, dining, entertainment, gas, daily transit, and select streaming services purchases.

1X the Scene+ points 10

for every $1 spent on other eligible purchases.

Scotiabank ®* Platinum American Express ® Card

Student Banking Advantage ® Plan

Earn Scene+ points

on debit transactions 15

A worry-free account matched for student life

- No monthly account fee 13

- Unlimited debit transactions 12 and Interac e-Transfer † transactions 14

Getting There Savings Program for Youth

Earn Scene+ points

on debit transactions 15

- Unlimited debit and Interac e-Transfer † transactions 12,14

Scotiabank ® Scene+ ™ Visa * Card for Students

for every $1 you spend at Sobeys, Safeway, Foodland & Participating Co-ops, FreshCo and more.

New! Discover your credit card rewards

Enter your monthly spending details to compare Scotiabank's credit card benefits and calculate your rewards.

Join the millions of Canadians who love Scene+

What is scene+.

Scene+ offers members rewards their way – allowing them to earn and redeem Scene+ points for entertainment, movies, travel, shopping, dining, and banking.

Members can also accelerate their earning power with eight Scotiabank credit and debit cards .

To learn more about all the ways to earn and redeem with Scene+, please visit www.sceneplus.ca/en-ca/how-it-works .

What if I do not want this reward program?

We take pride in providing expert advice and excellent service to find solutions for our customers. If you don’t think this program fits your needs, we are available to discuss other banking options that may work for you. Please visit your local branch or call us at 1-800-472-6842 .

Where can I view my points?

You can view your points through the Scotiabank App or by logging in to Scotia OnLine.

You can also see your points by logging into sceneplus.ca

Please note that your total points shown include all of the Scene+ points that you have earned with your eligible Scotiabank payment cards and your Scene+ membership card.

Points are updated within 2-3 business days.

Will my Scene+ points expire under the new Scene+ program?

No, your Scene+ points will not expire as long as your Scotiabank product that is eligible for the Scene+ program remains open.

If you close your Scotiabank product you will remain an active Scene+ member and points will only expire after 24 months of inactivity.

For more information on Scene+ points please visit www.sceneplus.ca/en-ca/how-it-works .

I’m already a Scene+ member, how do I find my Scene+ membership number?

You can get your Scene+ membership number emailed to you by visiting www.sceneplus.ca/en-ca/send-my-card .

Scene+ Terms & Conditions and Your Privacy

It’s always a good idea to look over the Terms & Conditions and privacy policies.

For answers, check out our FAQs.

Scene+ Customer Service: 1-866-586-2805

Scotiabank Customer Service: 1-800-472-6842

Offer Description and Conditions: The 7,500 Bonus Scene+ Points Offer (the “Offer”) applies only to new Scotiabank Scene+ Visa credit card accounts (“Account”) opened by July 1, 2024 and is subject to the below terms and conditions. Offer may be changed, cancelled or extended without notice at any time and cannot be combined with any other offers.

7,500 Bonus Scene+ Point Offer Description and Conditions: To be eligible for 2,500 bonus Scene+ points (the “2,500 Point Bonus”), you must open a new Account by July 1, 2024 and have at least $250 in eligible purchases posted to your new Account in the first 3 months of the Account open date. To be eligible for an additional 5,000 bonus Scene+ points (the “Additional 5,000 Point Bonus”), you must have at least $1,000 in eligible purchases posted to your new Account in your first 3 months of Account open date. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

The 2,500 Point Bonus will be credited to the primary cardholder’s Scene+ account within approximately 2-3 business days after the qualifying $250 in eligible purchases being posted to your Account within the first 3 months of Account open date, provided the Account is open and in good standing. The Additional 5,000 Point Bonus will be credited to the primary cardholder’s Scene+ account within approximately 2-3 business days after the qualifying $1,000 in eligible purchases being posted to your Account within the first 3 months of Account open date, provided the Account is open and in good standing. The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account. All other terms and conditions of the Program Terms continue to apply during the Offer period.

Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank small business credit cardholders are also eligible for the Offer.

Rates and Fees: There is currently no annual fee for the primary card and no fee for each additional card (including those issued to co-borrowers and supplementary cardholders). The current preferred annual interest rates for the Account are: 20.99% on purchases and 22.99% on cash advances (including balance transfers and cash-like transactions). All rates, fees, features and benefits are outlined in the Application Disclosure Statement and are subject to change.

Customers earn 1 Scene+ point for every $1 spent using their Scene+ ScotiaCard debit card on purchases made at Cineplex Entertainment theatres and online at cineplex.com . Gift cards are excluded. Maximum Scene+ points that can be earned per transaction are 300. Maximum daily Scene+ points that can be earned are 600. Some conditions and limitations apply.

Visit www.sceneplus.ca for complete details.

You are awarded three (3) Scene+ Points for every eligible $1.00 purchase made at Sobeys, Safeway, IGA, Foodland, Foodland & Participating Co-ops, FreshCo, Chalo! FreshCo, Thrifty Foods, Rachelle Béry, Les Marchés, Voilà by Sobeys, Voilà by Safeway and Voilà par IGA locations charged and posted to the Scotiabank Passport Visa Infinite Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores .

You are awarded two (2) Scene+ Points for every eligible $1.00 purchase on all other grocery (not listed above), dining, entertainment, and daily transit purchases charged and posted to the Scotiabank Passport Visa Infinite Account (the earn rates for each of the above categories and merchants are referred to as the “Accelerated Earn Rates”). See below for the Spend Threshold that applies to this Accelerated Earn Rate.

You are awarded one (1) Scene+ Point for every $1.00 in all other purchases of goods and services charged to the Scotiabank Passport Visa Infinite Account (the “Regular Earn Rate”).

Spend Threshold for the Accelerated Earn Rate (Scotiabank Passport Visa Infinite Accounts only): You will earn the Accelerated Earn Rate on the first $50,000 in purchases made on your Scotiabank Passport Visa Infinite account (the “Account”) annually at the following: purchases made at merchants classified in the Visa credit card network as: Grocery Stores and Supermarkets; Eating Places and Restaurants, Drinking Places, Fast Food Restaurants; Entertainment including Motion Picture Theatres, Theatrical Producers, Ticket Agencies, Bands, Orchestras, Miscellaneous Entertainers; Railroads, Local and Suburban Commuter Passenger Transportation, including Ferries, Passenger Railways, Taxicabs and Limousines, Bus Lines, Transportation Services (Not Elsewhere Classified). Some merchants may sell other products/services or are separate merchants who are located on the premises of these merchants, but are classified by the credit card network in another manner, in which case this added benefit would not apply. The annual spend calculation for the $50,000 maximum threshold is calculated annually from January 1st to December 31st each year. You will earn 1 point per $1 on purchases made on the Account after the 2 points per $1 / $50,000 annual spend maximum is reached and on all other purchases made on the Account. Scene+ points are only awarded on purchases. Scene+ points are not awarded for cash advances, balance transfers, Scotia® Credit Card Cheques, payments, returns, refunds or other similar credits, fees or interest or other charges. All dollar amounts are in Canadian currency unless otherwise stated.

Regular Earn Rate: You are awarded one (1) Scene+ Point for every $1.00 in all purchases of goods and services charged to the Scotiabank Scene+ Visa Account (the “Account”).

Accelerated Earn Rates: You will earn accelerated earn rates on the following eligible purchases charged to the Account:

Grocery Stores

You are awarded two (2) Scene+ Points for every eligible $1.00 purchase made at Sobeys, Safeway, participating IGA, Foodland, Foodland & Participating Co-ops, FreshCo, Chalo! FreshCo, Thrifty Foods, Rachelle Béry, Les Marchés Tradition, Voilà by Sobeys, Voilà by Safeway and Voilà par IGA locations charged and posted to the Scotiabank Scene+ Visa Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores .

Home Hardware Stores

You are awarded two (2) Scene+ Points for every eligible $1.00 purchase made at eligible Home Hardware, Home Building Centre, Home Hardware Building Centre, Home Furniture locations in Canada and online at homehardware.ca charged and posted to the Scotiabank Scene+ Visa Account. The list of eligible locations may be changed from time to time without notice. See full list of eligible locations across Canada at scotiabank.com/participatingstores .

You are awarded two (2) Scene+ Points for every $1.00 purchase made at Cineplex theaters, the Cineplex App and online at cineplex.com charged and posted to the Account.

Eligibility: Only purchases earn Scene+ Points. Cash advances (including Balance Transfers, and Cash-Like Transactions), fees, interest or other charges, returns, refunds or other similar credits to your Account do not qualify for Scene+ Points. Scene+ Points will not be posted to an Account that is not in good standing when purchases are made or when a statement is issued, or if the Account is not open when a statement is issued. See your Scene+ Points terms at www.scotiabank.com/sceneplus for full program details.

All dollar amounts are in Canadian currency unless otherwise stated.

You are awarded six (6) Scene+ Points for every eligible $1.00 CAD purchase made at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry, and Co-Op locations charged and posted to the Scotiabank Gold American Express Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores .

You are awarded five (5) Scene+ Points for every eligible $1.00 CAD purchase on all other grocery (not listed above), dining, and entertainment charged and posted to the Scotiabank Gold American Express Account. You are awarded three (3) Scene+ Points for every eligible $1.00 CAD purchase in gas, public transit and select streaming services purchases charged and posted to the Scotiabank Gold American Express Account (the earn rates for each of the above categories and merchants are referred to as the “Accelerated Earn Rates”). You are awarded one (1) Scene+ Point for every $1.00 in all other purchases of goods and services charged to the Scotiabank Gold American Express Account (the “Regular Earn Rate”).

You will earn the accelerated Scene+ Points (6X, 5X or 3X as applicable) under the Scene+ program if you make purchases in Canadian currency only. For purchases that are made in foreign currency, you will only earn 1 Scene+ Point for every $1 charged to the Scotiabank American Express® credit card once that foreign currency has been converted into Canadian dollars.

Merchant classifications – American Express network Purchases must be made at merchants classified through the American Express network with a Merchant Category Code (“MCC”) that identifies them in the American Express network in the “grocery”, “dining”, “entertainment”, “gas”, “streaming service” or “transit” category. Purchases at merchants where these categories are not their primary business do not qualify. Some merchants may (i) provide other goods or services; or (ii) have separate merchants located on their premises that may not be classified with an MCC under the Accelerated Earn Rate categories and such purchases will not earn the Accelerated Earn Rate as applicable. The Accelerated Earn Rates for the Scotiabank Gold American Express Card applies to the first $50,000 in purchases charged to the Scotiabank Gold American Express Account annually at merchants qualifying for the Accelerated Earn Rate, calculated annually from January 1st to December 31st each year. Once you exceed the applicable annual spend threshold, you will continue earning points at the Regular Earn Rate of one (1) Scene+ Point per $1.00 in purchases charged and posted to the Scotiabank Gold American Express Account. Eligibility: Only purchases earn Scene+ Points. Cash advances (including Balance Transfers and Cash-Like Transactions), fees, interest or other charges, returns, refunds or other similar credits to your Account do not qualify for Scene+ Points. Scene+ Points will not be posted to an Account that is not in good standing when purchases are made or when a statement is issued, or if the Account is not open when a statement is issued. See your Scene+ Points terms at www.scotiabank.com/sceneplus for full program details. All dollar amounts are in Canadian currency unless otherwise stated.

Offer Description and Conditions: The 30,000 Bonus Scene+ Points Offer and First Year Annual Fee Waiver (the “Offer”) applies only to new Scotiabank Passport Visa Infinite credit card accounts (“Accounts”) that are opened by July 1, 2024 subject to the conditions below. We will waive the annual fee for the primary card issued before July 1, 2024 on the Account for the first year only. Offer may be changed, cancelled or extended at any time without notice and cannot be combined with any other offers.

Plus, as a Scotiabank Passport Visa Infinite credit cardholder you are always eligible to earn an annual 10,000 Scene+ point bonus when you spend at least $40,000 in everyday eligible purchases annually on your Scotiabank Passport Visa Infinite account. Conditions apply - see below for further details.

30,000 Bonus Scene+ Point Offer Description and Conditions: To qualify for the 30,000 bonus Scene+ points (the “Bonus Offer”), you must have at least $1,000 in eligible purchases posted to your new Account within the first 3 months of the Account open date. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges. The 30,000 Bonus Offer points will be credited to the primary cardholder’s Scene+ account within approximately 2-3 business days following the qualifying $1,000 in eligible purchases being posted to your Account within 3 months from the Account open date, provided the Account is open and in good standing. The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account. Bonus Offer applies to new Accounts only opened by July 1, 2024. All other terms and conditions of the Program Terms continue to apply during the Offer period.

10,000 Annual Bonus Scene+ Point Conditions: As a Scotiabank Passport Visa Infinite credit cardholder you can earn an annual Scene+ point bonus starting at 10,000 Scene+ points when you make at least $40,000 in eligible purchases annually on your Account each year (12-months). Annual period starts from the Account open date and resets every 12 months thereafter. You will earn 2,000 bonus Scene+ points for every additional $10,000 in eligible purchases thereafter in that same year, after the $40,000 annual spend has been reached. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

The Annual bonus Scene+ points will be credited within approximately 2-3 business days after you have met the $40,000 annual spend threshold on the Account and within approximately 2-3 business days after you have met each additional $10,000 annual spend threshold on the Account, provided your Account is open and in good standing (as defined above).

First Year Annual Fee Waiver Offer Description and Conditions: We will waive the annual fee for the primary card issued before July 1, 2024 on the Account for the first year only.

Offer Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank small business credit cardholders are also eligible for the Offer.

Rates and Fees: The current annual fee is $150 for the primary card, $0 for the first additional card and $50 for each additional card thereafter (including those issued to co-borrowers and supplementary cardholders).

The current preferred annual interest rates for this Account are: 20.99% on purchases and 22.99% on cash advances (including balance transfers and cash-like transactions). All rates, fees, features and benefits are outlined in the Application Disclosure Statement and are subject to change.

Offer Description and Conditions: The 40,000 Bonus Scene+ Points Offer (the “Offer”) applies only to new Scotiabank Gold American Express credit card accounts (“Accounts”) opened by October 31, 2023 and is subject to the conditions below. Offer may be changed, cancelled or extended without notice at any time and cannot be combined with any other offers.

40,000 Bonus Scene+ Point Offer Description and Conditions: To be eligible for 20,000 bonus Scene+ points (the “20,000 Point Bonus”), you must open a new Account by October 31, 2023 and have at least $1,000 in eligible purchases posted to your new Account in the first 3 months of the Account open date. To be eligible for an additional 20,000 bonus Scene+ points (the “Annual 20,000 Point Bonus”), you must have at least $7,500 in eligible purchases posted to your new Account in your first year (12 months) of Account open date. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

The 20,000 Point Bonus will be credited to the primary cardholder’s Scene+ account within approximately 2-3 business days after the qualifying $1,000 in eligible purchases being posted to your Account within the first 3 months of Account open date, provided the Account is open and in good standing. The Annual 20,000 Point Bonus will be credited to the primary cardholder’s Scene+ account within approximately 2-3 business days after you have met the $7,500 annual spend threshold on the Account, provided your Account is open and in good standing. The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account.

Rates and Fees: The current annual fee is $120 for the primary card and $29 for each additional card.

The current preferred annual interest rates for the Account are: 20.99% on purchases and 22.99% on cash advances (including balance transfers and cash-like transactions).

All rates, fees, features and benefits are outlined in the Application Disclosure Statement and are subject to change.

You are awarded three (3) Scene+ Points for every eligible $1.00 purchase made at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry, and Co-Op locations charged and posted to the Scotiabank American Express Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores .

Additionally, you are awarded two (2) Scene+ Points for every eligible $1.00 purchase all other grocery (not listed above), dining, entertainment, gas, daily transit and select streaming services charged and posted to the Scotiabank American Express Account (the “Account”) (the earn rates for each of the above categories and merchants are referred to as the “Accelerated Earn Rates”). You are awarded one (1) Scene+ Point for every $1.00 in all other purchases of goods and services charged to the Scotiabank American Express Account (the “Regular Earn Rate”).

Merchant classifications – American Express network Purchases must be made at merchants classified through the American Express network with a Merchant Category Code (“MCC”) that identifies them in the American Express network in the “grocery”, “dining”, “entertainment”, “gas”, “streaming service” or “transit” category. Purchases at merchants where these categories are not their primary business do not qualify. Some merchants may (i) provide other goods or services; or (ii) have separate merchants located on their premises that may not be classified with an MCC under the Accelerated Earn Rate categories and such purchases will not earn the Accelerated Earn Rate as applicable.

Scene+ Points are awarded for purchases charged to your Scotiabank Platinum American Express Credit Card Account (“the Account”). The regular earn rate is two (2) Points per $1.00 in purchases charged and posted to the Account.

Eligibility: Only purchases earn Scene+ Points. Cash advances (including Balance Transfers, Scotia® Credit Card Cheques and Cash-Like Transactions), fees, interest or other charges, returns, refunds or other similar credits to your Account do not qualify for Scene+ Points. Scene+ Points will not be posted to an Account that is not in good standing when purchases are made or when a statement is issued, or if the Account is not open when a statement is issued. See your Scene+ Points terms at www.scotiabank.com/sceneplus for full program details.

The Accelerated Earn Rates for the Scotiabank American Express Card applies to the first $50,000 in purchases charged to the Scotiabank American Express Account annually at merchants qualifying for the Accelerated Earn Rate, calculated annually from January 1st to December 31st each year. Once you exceed the applicable annual spend threshold, you will continue earning points at the Regular Earn Rate of one (1) Scene+ Point per $1.00 in purchases charged and posted to the Scotiabank American Express Account.

Eligibility: Only purchases earn Scene+ Points. Cash advances (including Balance Transfers, Scotia† Credit Card Cheques and Cash-Like Transactions), fees, interest or other charges, returns, refunds or other similar credits to your Account do not qualify for Scene+ Points. Scene+ Points will not be posted to an Account that is not in good standing when purchases are made or when a statement is issued, or if the Account is not open when a statement is issued. See your Scene+ Points terms at www.scotiabank.com/sceneplus for full program details

Savings and reward potential in first 12 months based on the following card usage and offers:

$400 in travel rewards (40,000 bonus Scene+ points) when you spend $1,000 within your first 3 months (to earn 20,000 points) and when you spend $7,500 within your first 12 months (to earn an additional 20,000 points);

$33 in foreign transaction fee savings based on average first year annual foreign spend per account (save the 2.5% foreign transaction fee typically charged by other card issuers);

$247 in travel rewards (24,709 Scene+ points) on everyday purchases based on average annual first year spend on the Account with an average spend of 21% in 5x accelerator and 7% in 3X accelerator categories.

Potential First Year Value = up to $680

Actual savings and rewards earned will depend on individual card usage and eligibility for applicable offers. Conditions apply.

The Scotiabank $400 Cash Bonus Bundle Offer (the “Offer”) is available between March 1, 2024 and July 31, 2024 (the “Offer Period”) to individuals who open new eligible accounts. Subject to the conditions below, eligible customers can earn $350 when they open a new Preferred Package or Ultimate Package and complete certain qualifying transactions and an additional $50 boost when they open a new eligible Registered Retirement Savings Plan, Tax-Free Savings Account or First Home Savings Account (each an “Eligible Registered Account”) with either The Bank of Nova Scotia or Scotia Securities Inc. (together, “Scotiabank”) and complete certain qualifying transactions.

For the purposes of this Offer, the following Scotia registered accounts are eligible for the Offer: Registered Retirement Savings Plans (RRSPs, excluding locked-in plans such as LIRAs and LRSPs) (each an “RRSP”), Scotia Tax-Free Savings Accounts (each a “TFSA”) and Scotia First Home Savings Accounts (each a “FHSA”). Scotia RRIFs (including locked-in income plans), RESPs, RDSPs, and non-registered Scotia Investment Accounts are not eligible for the Offer.

$350 Cash Bonus for Preferred or Ultimate Package Conditions: To qualify for the $350 cash bonus (the “Package Bonus”), you must:

1. Open a new Ultimate Package or new Preferred Package (the “Eligible Chequing Account”) during the Offer Period; and