An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

IRS issues standard mileage rates for 2023; business use increases 3 cents per mile

More in news.

- Topics in the News

- News Releases for Frequently Asked Questions

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IR-2022-234, December 29, 2022

WASHINGTON — The Internal Revenue Service today issued the 2023 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 65.5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022.

- 22 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces, consistent with the increased midyear rate set for the second half of 2022.

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2022.

These rates apply to electric and hybrid-electric automobiles, as well as gasoline and diesel-powered vehicles.

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station. For more details see Moving Expenses for Members of the Armed Forces .

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

Taxpayers can use the standard mileage rate but generally must opt to use it in the first year the car is available for business use. Then, in later years, they can choose either the standard mileage rate or actual expenses. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.

Notice 2023-03 PDF contains the optional 2023 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate (FAVR) plan. In addition, the notice provides the maximum fair market value of employer-provided automobiles first made available to employees for personal use in calendar year 2023 for which employers may use the fleet-average valuation rule in or the vehicle cents-per-mile valuation rule.

- Book a Speaker

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Reuse Permissions

Request permission to republish or redistribute SHRM content and materials.

Travel Expense Policy

It is the policy of [Company Name] to reimburse staff for reasonable and necessary expenses incurred during approved work-related travel.

Employees seeking reimbursement should incur the lowest reasonable travel expenses and exercise care to avoid impropriety or the appearance of impropriety. Reimbursement is allowed only when reimbursement has not been, and will not be, received from other sources. If a circumstance arises that is not specifically covered in this travel policy, then the most conservative course of action should be taken.

Business travel policies are aligned with company reimbursement rules. All business-related travel paid with [Company Name] funds must comply with company expenditure policies.

Authorization and responsibility

Staff travel must be authorized. Travelers should verify that planned travel is eligible for reimbursement before making travel arrangements. Within 30 days of completion of a trip, the traveler must submit a travel reimbursement form and supporting documentation to obtain reimbursement of expenses.

An individual may not approve his or her own travel or reimbursement. The travel reimbursement form must be signed by the executive director or the director of finance (for travel over $[amount]) or by the business manager (for travel under $[amount]).

Travel and reimbursement for members of the management team must be approved by the executive director or the director of finance and will be reviewed annually by the internal auditor.

Designated approval authorities are required to review expenditures and withhold reimbursement if there is reason to believe that the expenditures are inappropriate or extravagant.

Personal funds

Travelers should review reimbursement guidelines before spending personal funds for business travel to determine if such expenses are reimbursable. See Section II: Travel Expenses/Procedures for details. [Company Name] reserves the right to deny reimbursement of travel-related expenses for failure to comply with policies and procedures.

Travelers who use personal funds to facilitate travel arrangements will not be reimbursed until after the trip occurs and proper documentation is submitted.

Vacation in conjunction with business travel

In cases in which vacation time is added to a business trip, any cost variance in airfare, car rental or lodging must be clearly identified on the travel request form. [Company Name] will not prepay any personal expenses with the intention of being "repaid" at a later time, nor will any personal expenses be reimbursed.

Occasionally it may be necessary for travelers to request exceptions to this travel policy. Requests for exceptions to the policy must be made in writing and approved by the executive director or by the director of finance. Exceptions related to the director's or the director of finance's expenses must be submitted to the opposite person or to the treasurer of the board of trustees for approval. In most instances, the expected turnaround time for review and approval is five business days.

Travel Expenses/Procedures

General information Authorized business travel for staff that includes prepayments must be pre-approved.

Reimbursement of parking, mileage, gasoline in lieu of mileage and ferry or bus passes do not require requests if they are under $[amount]. Requests for reimbursement of expenses over $[amount] are to be submitted on a travel reimbursement form.

Permissible prepaid travel expenses Before the travel, [Company Name] may issue prepayments for airfare, rail transportation, rental vehicles, conference registration fees and cash advances. Applicable policies and methods of payments for these prepayments follow.

Airfare. Travelers are expected to obtain the lowest available airfare that reasonably meets business travel needs. Airfare may be prepaid by the business office.

Travelers are encouraged to book flights at least [amount of time] in advance to avoid premium airfare pricing.

Coach class or economy tickets must be purchased for domestic or international flights with flight time totaling less than five consecutive hours excluding layovers.

A less-than-first-class ticket (i.e., business class) may be purchased at [Company Name]'s discretion for domestic or international flights with flight time exceeding five consecutive hours excluding layovers.

Airfare may be purchased with a credit card or check through the business office with a request for payment form.

Rail transportation. [Company Name] will prepay rail transportation provided that the cost does not exceed the cost of the least expensive airfare.

Rental vehicles. [Company Name] will pay for approved use of a rental vehicle. See the section on reimbursements below in this section.

Conference registration fees. Conference registration fees can be prepaid with a credit card or check through the business office with a request for payment form. Business-related banquets or meals that are considered part of the conference can be paid with the registration fees; however, such meals must be deducted from the traveler's per diem allowance.

Travel advances. Cash advances are authorized for specific situations that might cause undue financial hardship for business travelers. These situations are limited to staff traveling on behalf of [Company Name]. A maximum of 80 percent of the total estimated cost can be advanced.

Expenses associated with the travel must be reconciled and substantiated within two weeks of the return date. The traveler must repay [Company Name] for any advances in excess of the approved reimbursable expenses. The department initiating the travel is responsible for notifying the business office to deposit any excess funds into the appropriate departmental account.

Travel advances are processed by submitting a completed request for payment form and travel request form to the business office. Reimbursement for any remaining expenses is processed on a travel reimbursement form approved by the designated approval authority.

Reimbursements Requests for reimbursements of travel-related expenses are submitted on a travel reimbursement form. This form must be accompanied by supporting documentation. If the requested reimbursement exceeds 20 percent of the total pre-trip estimate, the travel reimbursement form must be signed by the executive director or the director of finance.

These forms must be submitted to the business office within two weeks after the trip is completed. Travel reimbursement forms not submitted within this time frame require exception approval from the executive director or from the director of finance.

Reimbursement of travel expenses is based on documentation of reasonable and actual expenses supported by the original, itemized receipts where required. Reimbursements that may be paid by [Company Name] are shown below.

Airfare. If the airfare was not prepaid by the business office, an original itemized airline receipt, an e-ticket receipt/statement or an Internet receipt/statement is required. The receipt must show the method of payment and indicate that payment was made.

Rail transportation. If rail transportation was not prepaid by the business office, an original itemized receipt, original e-ticket receipt/statement or Internet receipt/statement is required. The receipt must show the method of payment and indicate that payment was made.

Automobile (personally owned—domestic travel). A valid driver's license issued within the United States and personal automobile insurance are required for expenses to be reimbursed. Drivers should be aware of the extent of coverage (if any) provided by his or her automobile insurance company for travel that is business or not personal in nature.

Reimbursement for use of a personal automobile is based on the [Company Name] mileage rate.

A staff travel reimbursement form is required for reimbursement of all vehicle-related expenses, including gasoline, wear and tear, and personal auto insurance. As of [date], the rate is [$] per mile. Travelers may opt to request reimbursement for actual gasoline expenses in lieu of the [Company Name] mileage rate. In these instances original, itemized receipts are required.

Automobile (rental—domestic travel). Reimbursement for a commercial rental vehicle as a primary mode of transportation is authorized only if the rental vehicle is more economical than any other type of public transportation, or if the destination is not otherwise accessible. Vehicle rental at a destination city is reimbursable. Original receipts are required.

[Company Name] authorizes reimbursement for the most economic vehicle available. In certain circumstances larger vehicles may be rented, with supervisory approval. The rental agreement must clearly show the date and the points of departure/arrival, as well as the total cost. Drivers must adhere to the rental requirements, and restrictions must be followed. Original receipts are required.

When vehicle rentals are necessary, [Company Name] encourages travelers to purchase collision damage waiver (CDW) and loss damage waiver (LDW) coverage. [Company Name] will reimburse the cost of CDW and LDW coverage; all other insurance reimbursements will be denied.

Drivers should be aware of the extent of coverage (if any) provided by his or her automobile insurance company for travel that is business or not personal in nature.

Parking fees, tolls and other incidental costs associated with the vehicle use are not covered by the rental agreement.

Travelers are strongly encouraged to fill the gas tank before returning the vehicle to the rental agency to avoid service fees and more expensive fuel rates.

Conference registration fees. If the conference fee was not prepaid, [Company Name] will reimburse these fees, including business-related banquets or meals that are part of the conference registration. Original receipts to support the payment are required. If the conference does not provide a receipt, then a cancelled check, credit card slip/statement or documentation that the amount was paid is required for reimbursement.

A prorated amount for the meals provided must be deducted from the traveler's per diem. See Meals (per diem) for more detail. Entertainment activities such as golf outings and sightseeing tours will not be reimbursed.

Registration fees paid directly by an individual will not be reimbursed until the conference is completed.

Lodging (commercial). The cost of overnight lodging (room rate and tax only) will be reimbursed to the traveler if the authorized travel is 45 miles or more from the traveler's home or primary worksite.

Exceptions to this restriction may be approved in writing by the executive director or by the director of finance.

[Company Name] will reimburse lodging expenses at reasonable, single occupancy or standard business room rates. When the hotel or motel is the conference or convention site, reimbursement will be limited to the conference rate.

Only single room rates are authorized for payment or reimbursement unless the second party is representing the agency in an authorized capacity. If the lodging receipt shows more than a single occupancy, the single room rate must be noted. If reimbursement for more than the single room rate is requested, the name of the second person must be included.

Meals (per diem). Per diem allowances are reimbursable for in-state overnight travel that is 45 miles or more from the traveler's home or primary worksite.

Per diem allowances are applicable for all out-of-state travel that is 45 miles or more from the traveler's home or primary worksite.

[Company Name] per diem rates are based on the U.S. General Services Administration Guidelines, which vary by city location. In addition to meals these rates include incidental expenses such as laundry, dry cleaning and service tips (e.g., housekeeping or porter tips). Incidental expenses, unless specifically cited in this policy, will not be reimbursed.

Per diem reimbursements are based on departure and return times over the entire 24-hour day and are prorated accordingly.

If a free meal is served on the plane, included in a conference registration fee, built in to the standard, single hotel room rate or replaced by a legitimate business meal, the per diem allowance for that meal may not be claimed.

Receipts are not required for per diem allowances. Per diem allowances are reimbursed after the trip is completed.

Business meals. Travelers are required to follow [Company Name] expenditure policies when requesting reimbursement for business meals. Original itemized receipts are required.

Business expenses. Business expenses, including faxes, photocopies, Internet charges, data ports and business telephone calls incurred while on travel status, can be reimbursed. Original itemized receipts are required.

Parking. Original receipts are required for parking fees (including airport parking) totaling $[amount] or more. The lodging bill can be used as a receipt when charges are included as part of the overnight stay.

Telephone calls. The costs of personal telephone calls are the responsibility of the individual.

Tolls. Original receipts are required for tolls totaling $[amount] or more.

Miscellaneous transportation. Original receipts are required for taxi, bus, subway, metro, ferry and other modes of transportation if costs are $[amount] or more for each occurrence.

Visa, passport fees and immunizations. If these items are required for international travel, their reimbursement is left to the discretion of your supervisor. If approved by the designated authority, original itemized receipts are required.

Nonreimbursable Travel Expenses The following items that may be associated with business travel will not be reimbursed by [Company Name]:

- Airline club memberships.

- Airline upgrades.

- Business class for domestic flights or first class for all flights.

- Child care, babysitting, house-sitting, or pet-sitting/kennel charges.

- Commuting between home and the primary work location.

- Costs incurred by traveler's failure to cancel travel or hotel reservations in a timely fashion.

- Evening or formal wear expenses.

- Haircuts and personal grooming.

- Laundry and dry cleaning.

- Passports, vaccinations and visas when not required as a specific and necessary condition of the travel assignment.

- Personal entertainment expenses, including in-flight movies, headsets, health club facilities, hotel pay-per-view movies, in-theater movies, social activities and related incidental costs.

- Travel accident insurance premiums or purchase of additional travel insurance.

- Other expenses not directly related to the business travel.

Travel for Non-Employees Additional costs for travel, lodging, meal or other travel expenses for spouses or other family members will not be reimbursed unless the individual has a bona fide company purpose for engaging in the travel or attending the event. Such travel is generally limited to senior management and should occur infrequently.

Related Content

Rising Demand for Workforce AI Skills Leads to Calls for Upskilling

As artificial intelligence technology continues to develop, the demand for workers with the ability to work alongside and manage AI systems will increase. This means that workers who are not able to adapt and learn these new skills will be left behind in the job market.

Employers Want New Grads with AI Experience, Knowledge

A vast majority of U.S. professionals say students entering the workforce should have experience using AI and be prepared to use it in the workplace, and they expect higher education to play a critical role in that preparation.

Advertisement

Artificial Intelligence in the Workplace

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

HR Daily Newsletter

New, trends and analysis, as well as breaking news alerts, to help HR professionals do their jobs better each business day.

Success title

Success caption

- Expense Management for Service Companies

- Expense Management for Construction

- Expense Management for Property Management

- Expense Management for Event Production

- Expense Management For Bookkeepers

- Expensify Alternative

- Dext Alternative

- Concur Alternative

- Airbase Alternative

- Travel Reimbursement Policy: A Comprehensive Guide

Starting a journey for a corporate excursion can be a whirlpool of commotion, but the genuine expedition frequently commences upon arrival, when confronted with a heap of receipts and the intimidating mission of maneuvering through your organization’s protocol for its travel reimbursement policy . This guide acts as your essential resource for understanding and mastering the intricacies of these policies, ensuring that you receive reimbursement for every eligible penny spent.

Understanding the Basics: What is a Travel Reimbursement Policy?

At its core, a travel reimbursement policy is a set of rules that governs how employees can claim expenses incurred on business trips. These guidelines are tailored to each company, detailing eligible expenses and the process for submitting claims. They’re the blueprint for fair compensation, covering transportation, lodging, meals, and other incidental costs.

Expense Categories

- Transportation: Flights, trains, taxis, and more.

- Accommodation: Hotels and rentals.

- Meals and Entertainment: Daily allowances based on location.

- Incidentals: Parking fees, internet charges, etc.

Spend Limits

These policies often set spending limits to prevent excessive claims, such as daily meal caps or maximum hotel rates.

Required Documentation

Receipts, invoices, and boarding passes are the keystones of a solid claim, providing the evidence needed to back up your expenses.

Approval Process

Understanding the chain of command for approvals is crucial to a smooth reimbursement experience.

Eligible Expenses: What Can You Claim?

Knowing what you can claim is half the battle. From efficient expense management solutions to transportation costs, here’s a breakdown of typical reimbursable expenses:

Transportation Costs

- Airfare, train tickets, rental cars, and taxi fares.

- Keep all travel documents as proof.

Accommodation Expenses

- Hotel stays and rentals are reimbursable.

- Save hotel bills or rental agreements.

Meals and Entertainment Allowances

- Companies usually provide a daily meal allowance.

- Document your meal expenses within the set limits.

Incidental Expenses

- Claim parking fees, internet charges, and tips.

Appropriate Documentation: How to Keep Track of Your Expenses

Organization is key when it comes to reimbursement. Here’s how to keep your expenses in check:

Save All Receipts

Collect and save every receipt related to your business expenses. Consider using a receipt management app for digital storage and easy access.

Record Details

For each expense, jot down the date, location, and purpose. This will streamline your claim process.

Use Digital Tools

Embrace digital tools and apps for expense tracking. They can automate the process, making it less of a chore.

Submission Procedures: Navigating the Reimbursement Process

With your documentation in order, it’s time to submit your claim. Here’s a step-by-step guide:

Create an Expense Report

Compile a detailed report of your expenses, complete with all supporting documents.

Submit Your Expense Report

Follow your company’s procedures, whether it’s through an online portal or via email, to submit your report.

Reimbursement Timelines: When Can You Expect to Get Paid?

Timelines for reimbursement vary, but most companies have set periods for processing claims. Stay informed about these timelines and follow up if necessary.

Tips and Strategies for Maximizing Your Reimbursement

Maximizing your reimbursement is an art. Here’s how to master it:

Review your company’s policy before your trip to understand the coverage and limits.

Keep Track of Expenses in Real-Time

Document expenses as they occur to ensure accuracy and ease the reimbursement process.

Submit Claims Promptly

Don’t delay in submitting your expense report. The quicker you submit, the faster you’ll be reimbursed.

Common Pitfalls to Avoid: Mistakes that Could Delay or Deny Your Reimbursement

Even with the best intentions, mistakes can happen. Here’s what to avoid:

Inadequate Documentation

Lack of proper receipts and invoices is a common reason for reimbursement hiccups.

Non-Compliance with Policy Guidelines

Stick to the rules set out in your company’s policy to avoid any reimbursement roadblocks.

Travel Reimbursement Policy Best Practices: Recommendations for Employers

For employers, crafting a clear and concise policy is paramount. Here are some best practices:

Clear Communication

Ensure all employees are well-versed in the policy’s details, from eligible expenses to submission guidelines.

Simplify Procedures

Streamline the process to avoid confusion and make it easier for employees to submit their claims. As we navigate the complexities of travel reimbursement, it’s clear that a solution like Clyr can transform this often cumbersome process into a seamless experience. With Clyr’s ability to integrate with major management platforms and provide real-time expense notifications, the days of manual tracking and lengthy reimbursement cycles can be a thing of the past.

Crafting a Travel Reimbursement Policy That Works for Everyone Leveraging Technology for Efficient Reimbursement

In the age of digital transformation, leveraging technology is not just a convenience—it’s a necessity for efficient expense management solutions. With the right tools, the reimbursement process can be significantly streamlined, reducing the time from submission to payment. Here’s how technology can make a difference:

- Automated Financial Reporting for Out-of-Office Teams : For teams that are constantly on the move, automated financial reporting can be a game-changer. It ensures that expenses are logged and categorized accurately, which is essential for timely reimbursement.

- Integration-Friendly Financial Tools for Property Management : Property management teams often juggle multiple tasks and expenses. Integration-friendly financial tools can synchronize financial data across platforms, making it easier to track and manage expenses.

- Real-Time Expense Tracking Software : Real-time tracking allows for immediate recording of expenses, which can prevent the loss of receipts and ensure that no expense goes unclaimed.

By adopting top financial reporting software for field teams, companies can benefit from a more cohesive and transparent expense management process. Clyr, for instance, offers seamless financial data synchronization for field services, ensuring that every dollar spent is accounted for and reimbursed accordingly.

The Role of Mobile Apps in Expense Management

Mobile apps have revolutionized the way we manage our expenses on the go. They offer the convenience of capturing receipts and tracking expenses in real-time, which is particularly beneficial for employees who are often out of the office. Here are some advantages of using mobile apps for expense management:

1. Instant Receipt Capture : Snap a photo of your receipt, and it’s securely stored and ready for your expense report.

2. On-the-Spot Expense Entry : Enter expenses as they happen, reducing the risk of forgetting or losing track of them.

3. Accessibility : Access your expense records anywhere, anytime, right from your smartphone.

For example, a receipt management app can simplify the process of collecting and organizing receipts, making it easier for employees to submit accurate expense reports. This not only saves time but also reduces the likelihood of errors that could delay reimbursement.

How to Handle International Travel Expenses

International travel adds another layer of complexity to expense management. Currency conversions, varying tax laws, and additional documentation requirements can complicate the reimbursement process. Here are some tips for handling international travel expenses:

- Understand Currency Exchange Rates : Keep track of the exchange rates at the time of each transaction to ensure accurate reimbursement.

- Know the Tax Implications : Different countries have different tax laws. Be aware of what can and cannot be claimed as a business expense.

- Use Efficient Expense Management Solutions : Choose a platform that can handle multiple currencies and automate the conversion process.

For businesses with international operations, it’s crucial to have efficient expense management solutions that can adapt to the complexities of global travel. This not only simplifies the reimbursement process but also ensures compliance with international financial regulations.

Addressing Common Questions About Travel Reimbursement

Travel reimbursement policies can be complex, and employees often have questions about what they can claim and how to go about it. Here are some common questions and their answers:

- What if I lose a receipt?- Check if your company accepts credit card statements or if they have a specific policy for lost receipts. Some companies may allow a signed statement explaining the expense.

- Can I claim expenses for leisure activities during a business trip? – Typically, only business-related expenses are reimbursable. However, some companies may allow for a reasonable amount of leisure expenses if they do not add additional cost to the trip.

- How do I claim mileage if I use my personal car?- Companies usually reimburse mileage at a standard rate. Keep a log of your business travel mileage to submit with your expense report.

- How can I address a delay in my reimbursement? – Take the initiative to follow up with your finance department. While delays can happen, it is crucial to verify that your claim is being processed.

By addressing these questions proactively, companies can alleviate concerns and make the reimbursement process smoother for everyone.

The Future of Travel Reimbursement: Trends and Predictions

The landscape of travel reimbursement is evolving with technology and changing work patterns. Here are some trends and predictions for the future:

- Increased Automation : With platforms like Clyr, we can expect more expense management automation , reducing manual entry and speeding up the reimbursement cycle.

- Mobile-First Solutions : As remote work becomes more common, mobile apps will play a larger role in expense management.

- Personalized Expense Policies : Companies may start to offer more personalized policies that cater to individual needs and work habits.

- Integration with Travel Booking : Seamless integration with travel booking systems will allow for pre-approval of expenses and automatic tracking.

These advancements will not only make the process more efficient but also more employee-friendly, leading to higher satisfaction and compliance.

Case Studies: Successful Reimbursement Stories

Let’s explore a few case studies where companies have successfully implemented efficient expense management solutions:

- A Tech Startup: By using expense report automation , a growing tech company reduced its reimbursement cycle from weeks to just a few days, improving employee satisfaction.

- A Consulting Firm: With the adoption of real-time expense tracking software, consultants could submit expenses on the go, leading to real-time budget updates and better financial planning.

- A Nonprofit Organization : By simplifying job costing with financial software, a nonprofit was able to allocate funds more accurately and report to donors more transparently.

These stories highlight the positive impact of adopting modern expense management practices.

Expert Insights: Interviews with Finance Professionals

In conversations with finance professionals, several key points are consistently highlighted:

- The Importance of Policy Clarity : Clear policies prevent confusion and ensure that employees know what’s expected of them.

- The Role of Technology: There’s a consensus that technology, especially expense reporting in QuickBooks and similar integrations, is crucial for efficiency.

- Employee Training: Educating employees on the use of expense management tools is essential for maximizing their benefits. These insights from experts underscore the need for companies to invest in both technology and employee training.

The Intersection of Travel Policies and Employee Satisfaction

Employee satisfaction is closely tied to how travel policies are structured and implemented. A fair and transparent policy can lead to:

- Boosted Morale: The sense of being valued among employees is heightened when they are assured that their expenses will be reimbursed effortlessly.

- Better Compliance: Clear guidelines and easy-to-use tools encourage employees to comply with the policy.

- Attracting Talent: Competitive reimbursement policies can be a factor in attracting and retaining top talent.

By considering employee satisfaction, companies can create policies that are beneficial for both the staff and the organization.

Crafting a Travel Reimbursement Policy That Works for Everyone

Creating a travel reimbursement policy that meets the needs of both the company and its employees involves several key steps:

- Gather Input: Include feedback from employees who travel frequently to understand their needs and challenges.

- Define Clear Guidelines: Establish what is and isn’t reimbursable, and under what circumstances.

- Leverage Technology: Implement tools like Clyr to streamline the process and reduce administrative burdens.

- Regularly Review and Update: As business needs and travel norms evolve, so should your policy.

By crafting a well-thought-out policy, companies can ensure a smooth reimbursement process that supports their financial goals and keeps employees content.

To start, please provide your work email so we can reach you. *

press Enter ↵

Thank you! Book a time for your demo below:

[cf7mls_step cf7mls_step-1 "OK" ""]

Got it. Can we have your full name? *

[cf7mls_step cf7mls_step-2 "Back" "OK" "Step 2"]

Please share your contact number? *

[cf7mls_step cf7mls_step-3 "Back" "OK" "Step 3"]

Thank you. What's the company's name?*

[cf7mls_step cf7mls_step-4 "Back" "OK" "Step 4"]

How many people are in your organization?*

1-5 6-10 10-30 30-50 50+

[cf7mls_step cf7mls_step-5 "Back" "OK" "Step 5"]

What's the biggest pain point when managing expenses today?*

[cf7mls_step cf7mls_step-6 "Back" "Step 6"]

Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Build a Transparent Travel Reimbursement Policy

As a business owner, you’re bound to reimburse employees for business expenses at some point, especially if they’re traveling for business purposes. If you reimburse employees for costs while traveling, you might consider creating a travel reimbursement policy.

Read on to learn more about travel reimbursement and what sections to include in your travel reimbursement policy.

What is a travel reimbursement policy?

Travel reimbursement is when you pay employees back for expenses they incur while traveling for business. The expenses you reimburse employees for depend on your business and reimbursement policies.

A travel reimbursement policy specifies your procedures and rules regarding travel expense reimbursement. Typically, policies cover things like:

- Which travel expenses you cover

- The travel expenses you won’t cover

- How employees report travel expenses

- How quickly you reimburse employees

Policies might also include information about overnight trips as well as traveling to meet clients during the workday.

What to include in your travel reimbursement policy

You must outline many details in your travel reimbursement policy, including types of expenses you’ll cover, which expenses are excluded, and your employees’ responsibilities.

Dive into what sections you should cover in your travel expense reimbursement policy below.

Travel expenses

Your travel reimbursement policy should specifically state which expenses your business is willing to reimburse employees for.

Some travel-related expenses you might cover include:

Under your travel expenses section, clarify which travel expenses you’re willing to cover. Include whether you have spending limits.

For example, you might indicate employees can only spend X dollars on meals. Your policy might state employees can spend up to $75 on meals per travel day. Setting limits prevents employees from splurging on expensive meals.

You can also give a breakdown of how much employees can spend per meal:

- Employees can spend no more than $15 each travel day for breakfast

- Lunches can be no more than $20

- Dinners have a maximum reimbursement of $25

Include what occurs if an employee goes over the limits for expenses (if applicable) in your business travel policy. Are employees responsible for covering the difference?

Level of the employee

For some businesses, employee status might impact which travel expenses are covered. Businesses that break travel reimbursements down by employee level should include this information in their policy.

Clearly state what you will cover for different employees (e.g., senior manager vs. junior sales rep).

Family members

Sometimes, businesses allow employees to bring their spouses or family members along on business trips.

If spouses or family members can go on a business trip with an employee, list whether or not non-employees can be reimbursed, and for which expenses (if applicable).

Along with stating which expenses you plan to cover, lay out what is not included in your policy. In most cases, businesses only reimburse travel expenses that are business-related and priorities.

Create a list of things you do not reimburse employees for. List them in a separate section of your policy.

Some things you might not reimburse employees for when traveling include:

- Alcoholic beverages with meals

- Upgrades (e.g., first class seats)

- Activities that aren’t considered business-related (e.g., going to a movie or show)

Employee responsibilities

In your policy, state the steps employees need to follow to receive their travel reimbursement.

Some businesses might require employees to turn in a travel reimbursement form along with their travel receipts. Other companies might require that employees submit a digital form online.

If your business opts to use forms, you can create your own template and distribute the forms to employees. While creating your template, include spaces for the employee’s name, title, travel dates, expenses, and signature.

Employees can either fill out the form while they’re traveling or when they get back from their trip.

Some steps you can list in your policy for employees include:

- Save all business-related receipts

- Fill out your travel reimbursement form

- Turn in your receipts and form to the HR department for reimbursement

State what department or individual (e.g., HR Manager) your employees need to turn their travel expense information into.

Time frame for reimbursement

List out how long it takes to reimburse employees for travel expenses. That way, employees know when to expect their reimbursement.

Most businesses strive to reimburse employees as soon as possible. However, it takes time to review receipts and paperwork.

Give employees an idea of the time frame for the reimbursement process. For example, your policy might state employees should expect their reimbursement one week after submitting their paperwork.

From accurate calculations to unlimited payroll runs, it’s time to see what Patriot’s award-winning payroll software can do for your business.

Per diem pay

Per diem is a daily allowance employees receive to cover business travel-related expenses. Per diem only covers meals, lodging, and incidental expenses (e.g., dry cleaning).

If you offer employees per diem pay, include per diem rates and information in your travel and reimbursement policy.

Updating your travel policy

Review your travel reimbursement policy from time to time. Look at your policy regularly and make adjustments if needed.

You will likely need to make a change to your policy if you add or change procedures (e.g., reimbursement forms). Or, you might need to adjust your policy if new reimbursement laws go into effect.

Need a quick way to reimburse your employees for travel expenses? Patriot’s payroll software lets you easily reimburse employees for expenses while running payroll. And, our free, expert support is only a phone call, email, or chat away. Get started with your free trial today!

This article has been updated from its original publication date of July 17, 2019.

This is not intended as legal advice; for more information, please click here.

Stay up to date on the latest payroll tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

Tax Resources for Accountants and Small Businesses (U.S.)

- Expense Reimbursements / IRS / Meals and Incidental Expenses / Mileage / Payroll / Per Diem Rates / Small business

- Complete Guide to Reimbursing Employees for Travel Expenses

Published September 2, 2020 · Updated April 21, 2021

When an employee travels away from the office and incurs expenses, the company should reimburse them. Whether travelling across the world or just driving their car to a client’s location, getting the reimbursement right isn’t hard.

Keep reading to learn how to make proper employee reimbursements.

Accountable Plans

You’ll first need to decide if you will implement an accountable or nonaccountable plan. This is just as it sounds; either you’ll have employees be accountable for business expense reimbursements or not.

All businesses should have an expense reimbursement plan in writing. This includes corporations, sole proprietors, the self-employed, and non-profits. Non-profits should be extremely careful when reimbursing disqualified persons because nonaccountable plan reimbursements not properly approved or recorded can cause significant tax exposure to the charitable organization.

An accountable plan must follow the IRS guidelines for expense reimbursement. To qualify, the following rules must be met:

- Expenses must be for business purposes.

- Expenses must be adequately reported to the company in reasonable time.

- Any excess reimbursement or allowance must be returned in a reasonable amount of time.

Any expense that doesn’t meet these three criteria is considered a reimbursement under a nonaccountable plan.

This distinction between these two types of plans is important because accountable plan reimbursements are not taxable to the employee, whereas nonaccountable plans are taxable.

Business Purpose

Expenses incurred as an employee while completing work for an employer have a business purpose. Examples include things like registration fees for a conference, taxi rides to the airport for a business trip, or meals while away on a business trip.

If however, an employer reimburses an employee for dinner when the employee works late, this does not qualify as a business purpose. This reimbursement would be taxable to the employee because it was made under a nonaccountable plan.

Reporting in a Reasonable Time

While what is considered a reasonable amount of time is subjective, the general rule is that all reimbursable expenses must be submitted within 60 days of when they were incurred.

Adequate reporting involves providing a record, like an expense report, of all expenses incurred and providing evidence, like receipts, to support the expenses.

Excess Reimbursement

If an employee receives a travel advance to cover travel expenses but spends less than the advance, the difference is an excess reimbursement and must be returned to the employer to not be taxable. If the excess isn’t returned in a reasonable amount of time, it’s taxable.

A reasonable period of time in this instance is generally deemed to be within 120 days of when the expense was incurred.

With a travel advance, employees should submit an expense report and receipts to substantiate all expenses.

Mileage and Business Use of Personal Vehicle

When an employee uses their personal vehicle for company business, you’ll need to reimburse them. You have three options.

- Standard mileage rate

- Actual costs

- Monthly allowance

Standard Mileage Rate

If you use the standard mileage rate, it is 57.5 cents per mile for 2020.

You can pay more, but the IRS’ safe-harbor threshold of 57.5 cents per mile will allow you a tax deduction without having to substantiate the rate.

Note that the IRS typically updates rates in December. So, you can expect to see the 2021 rate announced in December 2020. IRS 2021 Mileage Rates are here.

IRS Standard Mileage Rates 2020

Actual Costs

Instead of using the standard rate, you can reimburse employees for actual expenses.

The employee will sum up all the costs of owning the vehicle including everything from fuel, maintenance, tolls, registration, and insurance. And based upon the percentage of business miles driven, that portion of the total actual costs is reimbursed.

Monthly Allowance

Using the monthly allowance method is relatively easy. Each month you provide a set dollar amount to the employee.

If you require the employee to provide a mileage log at the end of the month, this will determine if any part of the allowance is taxable. If no mileage log is required, the entire allowance is taxable under an unaccountable plan.

If a mileage log is provided and the employee drove less than expected, they should return the excess allowance within 30 days. If they don’t, the excess becomes taxable to them.

An employee’s commute from their home to their normal place of business is not a reimbursable expense. Any business miles driven in excess of the commute miles is reimbursable.

For example, an employee’s normal round-trip commute is 20 miles. On Fridays, the employee works on-site at a client’s office that is 30 miles away from the employee’s home. So, the employee drives 60 miles round-trip on Fridays. Since this is longer than he would drive if he commuted to the office, you’ll want to reimburse the employee for 40 miles (60 miles – 20 miles).

Mileage Logs

Employees should keep mileage logs when using a personal vehicle for business use. The log should include:

- Employee’s name

- Description of vehicle

- Date of business use

- Purpose of business use

- Starting mileage on odometer

- Ending mileage on odometer

- Approval authorization

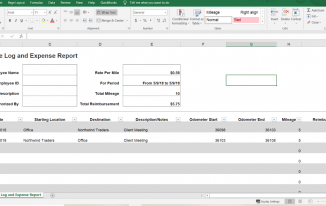

Here’s an example of a mileage log using Microsoft Excel.

Mileage log and expense report – employee reimbursement

Note that in this example, the employee drove from the office to a client and then back to the office. Therefore, there is no need to deduct commuting mileage.

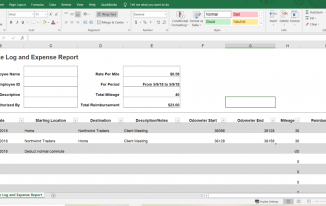

But suppose, like in our example from above, that on Fridays the employee drives from home to the client’s location and back home. His mileage log would look like this:

Mileage log and expense report example – employee reimbursement

But what if in this example, the drive to the client’s office from the employee’s home was shorter than his regular commute? In this case there is nothing to reimburse and the employee enjoys the benefit of less driving.

What would happen if this same employee didn’t normally work on Fridays or he always worked from home on Fridays? Then the entire drive to the client’s office would be reimbursable since the employee’s normal work schedule didn’t require him to commute on Fridays.

Many employees will forget to deduct their normal commute from mileage reimbursement requests. You’ll want to remind them.

Direct Expense Reimbursement of Travel Expenses

For employees who travel frequently, providing them with a company credit card is ideal. But for those times when an employee must use their own money for business expenses, you’ll want to reimburse employees quickly.

For easy recordkeeping, have employees complete expense reports when seeking reimbursements. Like the mileage log, it will detail who incurred the expense and when, what it was for, and the amount.

You can reimburse your employees with cash; however best practices would be to pay with check or some other trackable means, like ACH.

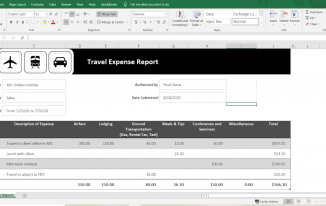

Here’s an example of an easy expense report in Excel.

Travel expense report example – employee reimbursement

For each expense, the employee should include receipts to support the amounts requested.

Receipts for purchases should contain the amount, date, place, and a brief description of the expense.

For example, hotel receipts should include:

- The name and location of the hotel.

- The dates stayed.

- Separate amounts for charges (i.e. lodging, meals, or food).

Restaurant and meal receipts should include:

- The name and location of the restaurant.

- The names of people in attendance.

- The date and amount of the meal.

You may choose to reimburse employees for meal tips. Be sure to have a clear policy of what will be reimbursed and what will not. For example, you’ll reimburse up to 20% for tips. Anything above that will not be reimbursed.

You’ll also need to consider your policy for lost receipts. You can still reimburse but have the employee fill out a missing receipt form to document the expense.

In lieu of direct expense reimbursement, consider using a per diem.

A per diem provides the employee with a specified dollar amount per day to use on meals, snacks, lodging, or other miscellaneous purchases. Larger expenses like airfare would be paid using the direct expense reimbursement method or paid for directly by the company.

Per diems should be prorated for partial days of travel. Acceptable methods include the ¾’s method or any other method you choose that is reasonable. The ¾’s method adds ¾ of a daily per diem rate on departure days and another ¾’s on return days.

The IRS sets per diem rates for cities and metropolitan areas. More expensive locales have higher daily rates than cheaper cities. For example, the daily rate for high cost cities like San Francisco, Vail, Colorado, and Nashville, Tennessee is $297. And many cities are designated high cost for only portions of the year. Miami and Park City, Utah are considered high cost only from December 1 – March 31.

And if you’re not in a high cost city, the daily rate is $200. These per diem rates are often updated each year. So you’ll always want to check for the current rates.

For example, Dave is travelling to Seattle for business. Seattle is a high cost locale. He’s leaving on Monday and returning on Thursday. Seattle’s maximum per diem rate is $297 per day. Dave will receive $222.75 ($297 x ¾) for Monday and Thursday and the full $297 for Tuesday and Wednesday.

Per diems are not taxable income to your employee if you use the IRS rates and your employee provides an expense report with receipts. However, using higher rates will create taxable income for the amount above the federal rate. And not submitting an expense report and receipts will make the entire per diem taxable because you’ll have an unaccountable plan and your company will not have the required receipts to support the tax deduction.

If your business operates in the transportation sector (i.e. shipping, trucking, or rail, etc…), it’s important to note that there are different per diem limits and rules you must follow.

Entertainment Expenses

With the 2017 Tax Cuts and Jobs Act, entertainment expenses are no longer tax deductible for companies.

As an employer, you may still reimburse your employees for entertainment expenses; however, these reimbursements will need to be segregated so that they are not included on your tax return. Examples of entertainment expenses include tickets to entertain clients at sporting events or country club fees for golf memberships.

What documentation you require for entertainment reimbursements is up to you but best practices suggest following the same requirements for travel or mileage reimbursements.

Commingling

If travel or meals involve both a business and personal aspect, only the portion of the expense that is business related is reimbursable. Expense reports and receipts should indicate whether there are any personal expenses.

For example, an employee makes a business trip to California from Georgia and elects to stay two days after business is finished for a mini-vacation. Best practices would have the employee check out of his hotel room and check back in using his personal credit card to pay the hotel bill for his extended stay. This way he has two different receipts; one for business and one for pleasure. However, if he doesn’t do that and the entire hotel stay is charged on the same receipt, you’ll need to back out the charges related to his personal stay.

None of this information should be taken as legal or financial advice, nor should it deter you from seeking the assistance of a licensed attorney, accountant, or financial services professional. But if you want to make sure your company’s policies for employee reimbursements are consistent with best practices, implementing these policies is a great place to start!

Tags: Business Use of Personal Vehicle Commingling Direct Expense Reimbursement employee Commuting reimbursement Employee Expense Reimbursement employee Monthly Allowance employees reimbursements entertainment expenses Excess Reimbursement Expense Reimbursement IRS Accountable Plans IRS Expense Reimbursement Mileage log and expense report Mileage Logs mileage on odometer Per Diem reimbursed expenses Reimbursing Employees Standard Mileage Rate travel expenses

- Next story 11 Facts about Employee Reimbursements Taxation

- Previous story Late Payment Calculator

- 2020 Mileage rates

- 2021 Mileage Rates

- Employee Reimbursements Taxation

- Gross from Net Calculator

- Reverse Sales Tax Calculator

- Taxation of Fringe Benefits

- IRS Mileage

Useful links

- Chamber of Commerce

Bistvo.com – Daily Inspiration

- 2020 Tax Calculator

- Accounting books

- Accounting education

- Accounting Jobs

- Accounting links

- Accounting software

- Accounting Software

- Accounting tutorials

- Additional Medicare Tax

- Annual Reports

- Calculators

- Chart of accounts

- Coronavirus

- Court decisions

- Depreciation

- EU Electronic Services

- European VAT on digital services

- Expense Reimbursements

- Federal income tax

- Federal Tax

- Financial statements

- FLSA – Fair Labor Standards Act

- Fringe Benefits

- Invoicing software

- Local Taxes

- Massachusetts

- Meals and Incidental Expenses

- Minimal Wage

- Minimum Wage

- Mississippi

- Net investment tax

- Nonprofits & Activism

- North Carolina

- OVDI Offshore Voluntary Disclosure Initiative

- Overtime pay

- Partnerships

- Payroll outsourcing

- Payroll software

- Penality and Interest

- Pennsylvania

- Per Diem Rates

- Principal business codes

- Professional tax software

- Retirement planning

- Self-Employed

- Small business

- Social Security and Medicare

- Sole Proprietorship

- State Licenses and Permits

- State Sales Tax

- Tax and Accounting Dictionary

- Tax calculators

- Tax court cases

- Tax Preparation Software

- Tax websites

- Title 26 – Internal Revenue Code

- U.S. Department of Labor (DOL)

- Underpayment Interest Rates

- Washinghton

- West Virginia

- West Viriginia

MileIQ Inc.

GET — On the App Store

Comprehensive Guide to Mileage Reimbursement Rules for Employees and Employers

Mileage reimbursement is a form of compensation businesses provide their employees for using personal vehicles at work. As the name suggests, reimbursements are based on distance traveled and can be completely tax-free if calculated using the standard mileage rate provided by the Internal Revenue Service. The rate is updated annually to reflect the ever-changing gas prices, insurance, depreciation, and other car maintenance costs.

In addition to mileage rates, the IRS specifies what is considered business-related travel and can be reimbursed without paying income tax. For example, daily commuting from home to the regular workplace is not counted as business-related travel.

While mileage reimbursements aren’t mandatory on a federal level, they’re considered a standard procedure, especially in professions that require frequent driving. They’re a crucial mechanism for employers to keep their staff happy and fairly compensated for their business travels.

Understanding Mileage Reimbursement Rules

Employee mileage reimbursement is the process of compensating employees for work-related driving using their personal vehicles. This type of reimbursement is not mandatory in most states, but in many industries, it’s considered a standard procedure that helps maintain employee satisfaction through fair compensation. The only states that require businesses to reimburse employees for using their vehicles for work are California, Illinois, and Massachusetts.

For reimbursements to be tax-free, companies need to use standard mileage rates provided by the IRS. In 2024, it means that companies can issue tax-free reimbursements at the maximum rate of 67 cents per mile.

Any vehicle reimbursement higher than that is considered taxable income. Still, companies sometimes may choose to offer higher reimbursement rates based on factors like:

- Local fuel and maintenance costs

- Difficult driving conditions

- Industry standards

Therefore, a well-crafted mileage reimbursement policy guarantees accurate travel payment for employees and significantly contributes to attracting and retaining staff.

It’s also worth mentioning that to keep employees happy, some companies choose to implement different compensation methods like a car allowance. In that case, employees have more freedom around using the benefit since it’s not dependent on mileage.

Download MileIQ to start tracking your drives

Automatic, accurate mileage reports.

What Are Employee Reimbursement Methods ?

Mileage-based reimbursements are quite common. They usually result in fair compensation, and they’re quite easy to implement, especially with the help of a mileage-tracking app like MileIQ.

However, other methods may be more suitable for companies and employees, depending on the specific situation.

For example, the actual expenses method is considered more accurate and can result in higher compensation, but it requires much more detailed recordkeeping and accounting for all vehicle-related expenses.

Then, there’s the fixed and variable rate (FAVR) method, which combines the mileage-based approach and the actual expense method.

A slightly less popular method is providing a car allowance. It’s a fixed benefit added to salary, which can be spent entirely according to the employee’s preferences. Remember, that some employers might have usage guidelines that need to be followed.

IRS Mileage Reimbursement Rates

Before we talk about the current rates, it’s necessary to point out that the standard rates set by the IRS only specify the maximum rate at which businesses can reimburse employees for mileage tax-free. In other words, reimbursement payments under or at the IRS limit do not count toward an employee's taxable income.

Because there’s no federal law enforcing mileage reimbursements, companies in most states can set their own rates that can be lower or higher than the standard. Any amount exceeding the standard rate has to be considered a taxable income.

For 2024, the standard mileage rate for business use is set at 67 cents per mile, which means it increased by 1.5 cents compared to the previous year. As always, the IRS determined the rate through an annual study of the fixed and variable costs of operating a vehicle, taking into account factors like:

- depreciation

- maintenance

- fuel prices

Mileage Allowance

Another method of mileage reimbursement is mileage allowance. This is a fixed amount given to employees each month to cover their driving expenses. It’s probably the easiest method of vehicle reimbursement for employers.

However, it is fully taxable, so it may not be the most optimal method from a fiscal standpoint. On top of that, it’s also the most inaccurate form of compensation. Depending on their vehicle use every month, employees usually will be reimbursed either too generously or not sufficiently enough.

Still, it’s often appreciated by employees as it gives them complete freedom in terms of how exactly they spend their allowance.

FAVR (Fixed and Variable Rate)

The Fixed and Variable Rate (FAVR) is a unique reimbursement method that combines a flat monthly allowance with a variable rate per mile driven. This method is sanctioned by the IRS, allowing companies to reimburse employees tax-free for business driving using their personal vehicles.

FAVR takes into account both the fixed costs (depreciation, insurance, license fees) and variable costs (fuel, maintenance, repairs) of operating a vehicle. One of the main reasons for its introduction was to allow companies to build their own reimbursement systems that reflect specific costs and conditions in different geographic areas.

Legal Requirements for Mileage Reimbursement

Only three states require companies to reimburse employees for their use of personal vehicles: Illinois, California, and Massachusetts. Everywhere else, mileage reimbursements are optional, so businesses can create their own policies as long as they align with the IRS regulations.

However, there are general rules for employee reimbursement in the Fair Labor Standards Act. For example, if an employee’s business expenses (such as gas) effectively reduce their income below the federal minimum wage, they must be reimbursed to match the difference.

You can find more reimbursement regulations in the Tax Cuts and Jobs Act. Since its introduction in 2017, employees can’t claim unreimbursed expenses as tax deductions.

Calculating Mileage Reimbursements

The formula for calculating mileage reimbursement is quite simple.

But before you go through the numbers, you should make sure that you track and categorize all your business miles properly throughout the year. There’s quite a wide range of tools that can help you track and prepare documentation for the IRS.

While it’s still possible to keep records in a notebook or a simple spreadsheet, it’s much more convenient to use a mobile tracking app that helps you with all the steps of the process, from mileage tracking to calculating and preparing documents for your tax return.

But if you prefer the traditional way, here’s the formula for calculating mileage reimbursement:

business miles driven * mileage rate = reimbursement

While calculating, remember that not all companies use the IRS standard mileage rates. It’s possible that your employer has a different rate, but if the reimbursements are still based on mileage, the formula remains the same.

Documenting Mileage for Reimbursement

In addition to mileage, the IRS requires a few other details to allow tax-free reimbursements. Records about each trip have to include:

- purpose of the trip

- starting and ending point

- odometer readings

Any missing information may lead to an IRS audit and costly penalties, so that’s another reason to keep your records accurate. Be sure to hold on to any relevant documentation for at least three years — which is typically how far back the IRS checks records during an audit.

Best Practices for Employers

The most important part for employers is choosing the right reimbursement method that will be easy to manage and fair for employees. The basic mileage-based method can work out just fine, but there are situations in which it may be insufficient. For example, if a profession requires not only driving but also renting vehicles, it may be better to use the FAVR method or car allowance.

Communication is another crucial aspect. The mileage reimbursement policy has to be perfectly clear to ensure that employees understand what to expect when it comes to mileage reimbursement.

It’s also important to leave room for discussion and potential optimization. Just like standard mileage rates are updated yearly, employees may ask for the policy update if the rate doesn’t reflect growing prices of gas and other vehicle-related expenses.

Automating Mileage Tracking

Mileage tracking software and apps, like MileIQ, make employee reimbursements much more manageable by automating the most tedious parts of the process..

Trips can be tracked with just a few clicks, and reports for the IRS can be easily generated at the end of the year. And on top of that, you don’t need to worry about misplacing any crucial documents.

Common Questions and Concerns

There’s always a risk of an IRS audit if there’s any missing documentation or miscalculation, so businesses need to pay close attention to all the records backing tax-free reimbursements. They may review the mileage log and sometimes even ask for supporting documentation proving the purpose of a trip.

That’s why, as an employee, you should make sure to record each business-related trip, including all the relevant information about purpose and date. That way, you’ll have the necessary proof for the IRS and your employer.

Still tracking miles by hand?

Check out more mileage guides.

- Accounts Payable Software

- Accounts Receivable Software

- Travel & Expense Management

- Payment Automation

- Cash Flow Management

- Account Payable

- Account Receivable

- Travel & Expense

- Finance News

- Press Release

- Get Started

What is Mileage Reimbursement? Process, Policy, and More

Managing a team of employees who frequently travel for work demands a strategic approach to ensure both fairness and cost-effectiveness. A well-structured mileage reimbursement policy is not just about compensating employees for their travel expenses; it’s about optimizing resources and aligning them with business objectives.

In this guide, we’ll delve into what mileage reimbursement is and the essentials of crafting a robust mileage reimbursement policy. Let’s explore how your company can leverage its travel reimbursement process to drive efficiency and accountability.

What is Mileage Reimbursement?

Mileage reimbursement refers to the compensation provided to employees for using their vehicles for work-related purposes. This includes expenses associated with operating a vehicle, such as

- Vehicle maintenance

- Depreciation

- Registration and licensing fees

- Tolls and parking fees

Employers commonly use mileage reimbursement to cover the expenses incurred by employees while driving for business errands. The reimbursement rate is typically calculated per mile traveled. However, these rates can vary depending on the country and state regulations. It is crucial to ensure that your mileage reimbursement program complies with relevant laws to avoid any potential legal issues.

For example, if an employee drives 100 miles for a business trip and the reimbursement rate is $0.50 per mile, the employee would be reimbursed $50 (100 X $0.50= $50) for their travel expenses. This reimbursement would cover the cost of fuel, wear and tear on the vehicle, and other associated expenses incurred during the trip.

How Does Mileage Reimbursement Work?

Mileage reimbursement works by compensating employees for the business miles they drive using their vehicles. To receive reimbursement, employees must track their business mileage and submit it to their employer using either paper or digital forms.

Employees can record their business miles by filling out a mileage reimbursement form provided by their employer. This form typically requires details such as the date, purpose of the trip, starting and ending locations, miles traveled, and total miles for each trip. Some companies may require employees to submit these forms monthly, while others may have different submission timelines.

Alternatively, employees can use digital tools such as apps or online spreadsheets to track their business miles. Digital forms offer the same information as paper forms but provide a more convenient and organized way to track mileage.

Companies need to have a clear mileage reimbursement policy in place, detailing how employees should track their mileage, submission deadlines, and any other relevant information. This policy should be included in the employee handbook to ensure consistency and compliance across the organization.

What is the Mileage Reimbursement Policy?

A mileage reimbursement policy is a set of guidelines and rules a company establishes to govern how employees are compensated for using their vehicles for work-related travel. This policy outlines the reimbursement rate per mile, which expenses are eligible for reimbursement, and the process for submitting mileage claims.

The policy typically includes details on how to calculate mileage, such as using odometer readings or GPS tracking, and may specify any limitations or restrictions on mileage reimbursement. It also addresses compliance with legal requirements, ensuring that the reimbursement rates and practices adhere to relevant laws and regulations.

A well-defined mileage reimbursement policy helps ensure that employees are fairly compensated for their use of personal vehicles while also providing clarity and consistency in the reimbursement process.

What Expenses are Covered Under Mileage Reimbursement Policy?

Expenses covered under the mileage reimbursement policy typically include:

Business-related travel: Reimbursement for miles driven for business meetings, client visits, or other work-related purposes.

Errands and deliveries: Compensation for driving to run work-related errands or make deliveries.

Customer visits: Reimbursement for travel to meet with clients or customers.

Training and conferences: Coverage for mileage to attend training sessions, seminars, or conferences related to work.

Site visits: Compensation for driving to inspect job sites, facilities, or projects.

Travel between offices: Reimbursement for travel between company locations for work purposes.

Other approved business travel: Any other mileage incurred while on official company business, as per the company’s expense report policy .

Benefits of Mileage Reimbursement Policy

A mileage reimbursement policy is a crucial component of any organization’s travel and expense management strategy , providing clear guidelines for both employers and employees on how business-related mileage expenses are handled. This policy not only ensures fair compensation for employees but also helps employers control costs and comply with legal requirements.

Benefits for Employers

- Cost Control: A clear policy helps employers control expenses by setting reimbursement rates and guidelines, ensuring that reimbursements are fair and within budget.

- Legal Compliance: The policy ensures compliance with tax laws and regulations governing mileage reimbursement, reducing the risk of audits or legal issues.

- Employee Satisfaction: Fair and consistent reimbursement practices can improve employee morale and motivation, leading to higher productivity and retention rates.

- Accurate Record-Keeping: A standardized policy helps employers maintain accurate records of mileage expenses, which is essential for tax purposes and audits .

Benefits for Employees

- Fair Compensation: A clear policy ensures that employees are fairly compensated for using their vehicles for work-related travel, which can help alleviate financial burdens.

- Transparency: Employees can easily understand how mileage reimbursement is calculated and what expenses are eligible, reducing confusion and disputes.

- Convenience: Digital forms or apps provided by the employer can make it easier for employees to track and submit mileage claims, saving time and effort.

What are the Methods of Mileage Reimbursement Calculation?

There are several methods for calculating and reimbursing mileage, each with its advantages and considerations. Here are some common methods:

1. Standard Mileage Rate: This method uses a standard rate per mile set by the IRS or a similar authority. Employees simply multiply the number of business miles driven by the standard rate to calculate their reimbursement amount. This method is simple and widely used.

2. Actual Expense Method: With this method, employees track and report all actual expenses related to their vehicle use, such as gas, maintenance, insurance, and depreciation. Reimbursement is based on the total actual expenses incurred. This method requires more record-keeping but can be more accurate for employees with higher expenses.

3. Fixed and Variable Rate (FAVR): FAVR programs reimburse employees based on fixed costs (like insurance and registration) and variable costs (like gas and maintenance) specific to their geographic area and driving habits. This method provides more accurate reimbursement tailored to individual circumstances but requires more administrative effort.

4. Hybrid Method: Some organizations use a combination of the standard mileage rate and the actual expense method. For example, they may use the standard rate for routine trips and the actual expense method for longer or more unusual trips.

The choice of method depends on factors such as the complexity of the reimbursement process, the level of accuracy required, and the administrative burden.

What are the Key Considerations for Framing a Mileage Reimbursement Policy?

When framing a mileage reimbursement policy, several key considerations can help ensure it is fair, reasonable, and compliant with applicable laws:

1. Type of Vehicle: Differentiate between personal and company-owned vehicles, setting reimbursement rates accordingly. Establish standards for the age, condition, and safety features of personal vehicles used for business purposes.

2. Distance: Encourage efficient routes to minimize mileage and costs. Set maximum travel distances, reducing the rate and requiring additional approvals for longer trips. Establish predetermined routes for certain types of trips, such as service calls, with set reimbursement rates based on distance and route.

3. Fluctuating Expenses: Periodically review and adjust reimbursement rates to reflect changes in fuel costs and other expenses related to mileage.

4. Risks: Consider liability issues, insurance requirements, and safety concerns. Ensure policies comply with regulations to protect the company and its employees.

5. Requisits: The company must have a written accountable plan in place outlining the terms and conditions of reimbursement, including the types of expenses eligible for reimbursement, the documentation required, and the process for submitting expenses.

What are the Challenges of the Manual Mileage Reimbursement Process?

Manual methods, such as paper forms or spreadsheets, pose several challenges for both employees and employers. These methods are often time-consuming and prone to errors, as employees must manually record their mileage and submit it for reimbursement.