- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Allianz Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Allianz Travel Insurance cover?

Allianz single trip plans, allianz annual/multi-trip plans, which allianz travel insurance plan is best for me, can you buy allianz travel insurance online, what isn't covered by allianz travel insurance, is allianz travel insurance worth it.

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards , Allianz Global Assistance offers plenty of options.

Allianz trip insurance plans fall into two categories: single trip and annual/multi-trip plans. We evaluated several single trip and annual/multi-trip plans to help you figure out which policy makes sense for you.

Depending on what type of coverage you’re looking for, Allianz offers several different travel insurance options. Allianz’s plan choices fall under single trip or annual/multi-trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

Annual/multi-trip plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Because the coverage period is longer, these plans are more expensive.

Some of these plans include medical coverage only while others also provide more comprehensive travel insurance perks. There’s coverage for business equipment as these plans are geared toward work travelers.

Allianz offers five travel insurance plans for single trips, including a plan that's mainly focused on emergency medical coverage.

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don't need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Allianz single-trip plan cost

Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs of 4%-8%, according to the U.S. Travel Insurance Association.

» Learn more: How to find the best travel insurance

Allianz offers four different annual/multi-trip plans.

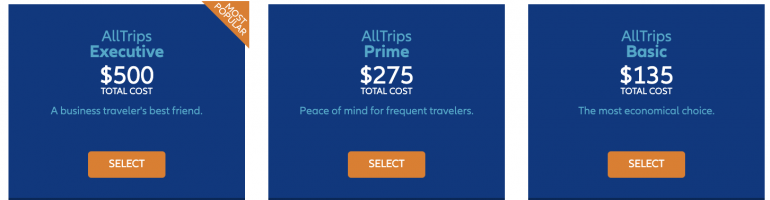

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

Allianz annual/multi-trip plans cost

Let's look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan's price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re abroad.

If you have a premium travel card (e.g., the Chase Sapphire Reserve® ): These cards often offer some trip cancellation and trip interruption coverage, so you may not need a plan that offers all the same coverage. In this case, getting the OneTrip Medical plan might be enough.

If you’re going on a trip and returning home: OneTrip Prime, Basic or Premier are good options to choose from while offering different levels of coverage.

If you’ll be going on multiple and longer trips: the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length. The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card: In these instances, it's best to choose a comprehensive plan depending on how much coverage you need and for how long. Consider one of the single trip or multi-trip plans.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

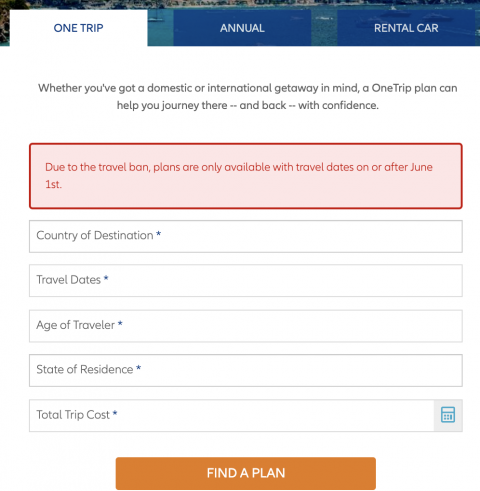

Yes, head over to AllianzTravelInsurance.com and choose "Find a Plan" from the menu on the top.

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the "Get a Quote" option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

» Learn more: Is travel insurance worth it?

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different needs.

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

No, Allianz doesn't offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel isn't.

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Allianz Global Assistance offers several good travel insurance plans to choose from. If you’re looking for a travel insurance plan for a vacation, a single-trip plan is your best bet.

If you’re a frequent traveler or take lots of business trips, a multi-trip plan could be the way to go. If you have a travel credit card, look at what travel insurance benefits you may already have so you don’t duplicate your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Our history

- Allianz Advantage

- Global footprint

- Social responsibility

Travel protection

- Tuition protection

- Event ticket protection

- Bankcard services

- Assistance services

- Technology solutions

- Allianz Fusion

- Allianz TravelSmart

- Stories & insights

- In the news

- Press releases

- Vacation confidence index

- Internships

When the world calls, help your customers answer with confidence.

Looking for a travel insurance plan, get a quote at allianztravelinsurance.com ..

Benefits to help travelers explore reassured.

Expert assistance means travelers are never alone.

Industry-leading technology for the future of travel.

Travel safe. Travel simple. Allianz TravelSmart.

Our free Allianz TravelSmart TM app puts your customers’ travel protection plan at their fingertips, making it easy to check their coverage benefits, connect to our 24/7 assistance, or file a claim on the go.

What makes Allianz TravelSmart even smarter? We’ve loaded it with safety features to help customers explore more securely, including timely alerts about events that may impact their travels, a locator for nearby emergency assistance, medical translations, and more.

“I cannot even begin to tell you how wonderful my experience was with Allianz!! I had a terrible ski accident in France and every single Allianz person was unbelievably helpful. I now recommend Allianz to everyone I know and I will NEVER travel overseas without it. I am so very grateful for all the support I received.”

- Lindsay T., MN, 2021

“So often when you buy warranty or insurance it’s hard to actually get it to do what it’s supposed to do, but Allianz worked as it should. The cost for travel insurance is so negligible that it’s a no brainer to add to your trip.”

- Kyle Y., GA, 2021

“When I filed my claim your company made the process very easy. And you did not try to avoid your contract responsibilities like many other insurance companies with whom I have had to work with. I have recommended you to all of my travel friends.”

– Scott H., IL, 2021

Have questions about our products or services?

contact us — we’re here to help. .

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Trip Cancellation Insurance: Covered Reasons Explained

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Allianz Travel Insurance Coverage Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3074 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Why Purchase Travel Insurance

Allianz epidemic coverage endorsement, onetrip plans — for affordability and select coverages, alltrips annual plans — cover all of your trips for a 12-month period, how to obtain a quote with allianz, onetrip emergency medical plan, onetrip cancellation plus plan, rental car damage protector, allianz vs. credit card travel insurance, allianz vs. other travel insurance companies, allianz vs. point-of-sale travel insurance and protection, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

There are a lot of choices when it comes to travel insurance companies , so narrowing your selection to those that have a solid financial rating, offer products that provide good value, and receive high customer ratings should be baseline criteria.

Allianz Global Assistance company ( Allianz Travel) checks all of those boxes. Its parent company, Allianz SE, receives an A+ rating from A.M. Best (a leading insurance financial rating firm), and the company offers competitive individual trip and annual travel insurance products. It also serves over 45 million customers in the U.S. each year with 84% of those customers giving the company a 5-star rating.

Allianz has also been around a long time. In fact, the company was there to insure the Wright Brothers’ first flight and the construction of the Golden Gate Bridge — so you know you’re working with an established organization. You’ll also find that Allianz does business in more than 35 countries.

Let’s take a look specifically at Allianz Travel’s insurance products, show you how to obtain a quote, and give you some tips on purchasing and comparing travel insurance policies.

And while our focus is on Allianz Travel coverage, much of our information can apply to purchasing travel insurance in general.

Travel insurance can protect your trip investment with coverage for disruption due to unforeseen events such as severe weather, should you become ill, for illness in your family, missed connections, medical emergencies, and more.

Deciding whether to purchase travel insurance for your trip is an option each time you make a travel booking. The coverage is commonly offered by airlines, cruise companies, tour operators and other travel providers at the point of sale. If you travel infrequently and the cost is relatively low, you may just opt for the coverage during the booking process.

However, if you’re going to be taking several trips, you may be able to save money and receive better coverage if you compare with other travel insurance policies in the marketplace. Additionally, you’ll want to determine if it makes sense to purchase single insurance coverage for each trip or an annual all-trips-included policy.

Situations where it makes sense to purchase travel insurance include the following:

- You’re booking an expensive trip that includes a lot of non-refundable upfront expenses

- Your trip includes several travel providers (i.e. airlines, hotels, and tour operators)

While travel insurance is meant to cover unforeseen events, purchasing Cancel for Any Reason coverage may allow you to cancel your trip for any reason.

Bottom Line: If you’re uncomfortable with the amount of money you have at risk when you travel, securing travel insurance can provide immediate peace of mind . You’ll have solace in knowing that if you needed to cancel your travel plans due to a covered event or if your travel is disrupted, you’ll be able to recoup most, or all, of your investment.

Travel Insurance and the COVID-19 Virus

Most travel insurance policies do not provide coverage for trip cancellation due to fear of the coronavirus pandemic . However, COVID-19 is an included illness on many travel insurance policies as it relates to certain coverages such as emergency medical care while traveling and canceling a trip if you become ill with the virus. You may also have coverage if a family member or travel companion contracts the virus and you must cancel your trip as a result.

The only way to cover trip cancellations due to fear of contracting COVID-19 is to purchase Cancel for Any Reason insurance. This coverage can be added to a comprehensive travel insurance policy (with limitations) and subsequently allows you to cancel your trip for any reason.

While Allianz does not offer Cancel for Any Reason insurance , it may cover COVID-19 related illness in the following circumstances:

- Emergency medical care while traveling

- Trip cancellation due to becoming ill with the virus

Allianz recently announced that it is adding a new endorsement to select policies that will offer limited coverage for COVID-19 . Circumstances such as becoming ill with COVID-19 and having to cancel your trip, hospitalization, and trip delays due to such illness while traveling will have coverage.

Emergency transportation coverage has also been expanded to include COVID-19-related illness. Terms and conditions apply and the endorsement is not available on all policies Allianz offers.

You can find policies that offer Cancel for Any Reason insurance at TravelInsurance.com and Aardy.com .

Bottom Line: Travel insurance policies normally do not cover canceling your trip because of fear you might get ill. However, Cancel for Any Reason insurance allows you to cancel a trip for any reason you determine is necessary.

Types of Travel Insurance Policies Available With Allianz

Allianz Travel offers 2 core types of travel insurance plans: single trip plans and multi-trip plans . Each plan allows you to select the level of coverage you want and subsequently, the level of premium you prefer to pay.

We’ve used criteria to obtain a quote for a traveler age 35, traveling for 1 week to Mexico on a trip costing $3,000 . All benefits are per person, per trip, unless otherwise noted.

The single trip option allows you to select from a Basic, Prime, or Premier plan. Premiums vary by plan and coverage levels. For the example we selected, the premiums ranged from $116 for the Basic to $192 for the Premier pla n .

OneTrip Basic Plan — the Most Affordable Plan

The OneTrip Basic plan offers basic trip protection at an affordable price.

OneTrip Prime Plan — the Most Popular Plan

Need more coverage but still want your travel insurance protection to be affordable? The OneTrip Prime plan offers higher coverage limits at a reasonable cost.

The following are the maximum coverage limits for OneTrip plans. These coverages can be found under the OneTrip Premier Plan:

- Trip Cancellation — up to $100,000 reimbursement for prepaid non-refundable expenses; pre-existing medical conditions included

- Trip Interruption — up to $150,000 reimburses for remaining non-recoverable expenses and increased cost of return transport due to trip interruption as the result of a covered event; pre-existing medical conditions included

- Emergency Medical — up to $25,000

- Emergency Medical Transportation — up to $500,000 for transportation to the nearest medical facility

- Baggage Loss/Damage — up to $1,000 for theft, loss, or damage

- Baggage Delay — up to $300 for delays 12 hours or more

- Trip Delay — up to $800 ($200/day for 4 days) for delays of 6 hours or more, for eligible expenses; an option to receive $100/day with no receipts required is also available

- Change Fee Coverage — $500

- Loyalty Program Re-deposit Fee Coverage — $500, covers re-deposit of points/miles due to covered trip cancellation

- 24 Hour Hotline Assistance

- Optional coverages include pre-existing medical coverage, rental car coverage, and required to work coverage — restrictions apply

Also worth noting is that kids age 17 and under are covered at no additional charge when traveling with a parent or grandparent.

Bottom Line: Allianz offers several levels of single-trip travel insurance plans that can fit every budget and level of coverage needed.

If you’re a frequent traveler and want to ensure all of your trips are covered without having to purchase individual travel insurance policies, one of the AllTrips plans might be an appropriate choice. All of the trips you book within the 12-month policy period are covered automatically.

Coverage limits are per person, per trip, but more than 1 person can be included in the policy. Children 17 and under are covered at no additional charge when traveling with a parent or grandparent.

The AllTrips Executive plan is the most comprehensive policy and includes the maximum coverage limits listed below . AllTrips Prime and AllTrips Basic have less coverage than the Executive plan but may still be appropriate for your situation.

For example, the AllTips Basic plan does not include trip cancellation/interruption insurance but has emergency medical, evacuation, trip delay, baggage insurance, and car rental insurance.

- Trip Cancellation — up to $10,000 reimbursement for prepaid non-refundable expenses

- Trip Interruption — up to $10,000 reimburses for remaining non-recoverable expenses and increased cost of return transport due to trip interruption as the result of a covered event

- Emergency Medical — up to$50,000

- Emergency Medical Transportation — up to $250,000 for transportation to the nearest medical facility

- Baggage Loss/Damage — up to $1,000 for theft, loss, or damage

- Baggage Delay — up to $1,000 for delays 12 hours or more

- Trip Delay — up to $200 per day for eligible expenses, up to $1,600 in coverage , for delays of 6 hours or more

- Rental Car Damage and Theft — up to $45,000

- Business Equipment Coverage — up to $1,000

- Change Fee Coverage — up to $500

- Loyalty Program Redeposit Fee — up to $500

- Travel Accident Insurance — up to $50,000

- Concierge Services

- Optional Pre-Existing Medical Coverage — restrictions apply

Bottom Line: Allianz’s AllTrips 12-month plans offer affordable options to cover every trip you have booked or have yet to book within a 12-month period.

Travel insurance is one of the easiest policies for which to obtain a quote and subsequently purchase a policy. Unlike auto or home insurance, you simply input some basic information about your trip, your age, where you reside, and your quote is instant.

You can then read through the coverages, select a policy that fits, and hit the purchase button. There is also no risk as you’ll have a free-look period where you can review the policy and decide whether to keep it or not.

If not, you can get a full refund. This period can be 10-14 days after purchase , depending on your plan and state regulations.

Additional Travel Insurance Offered by Allianz

In addition to the travel insurance packages offered by Allianz, you can purchase these additional plans and coverages available for single trips:

If trip interruption/cancellation is not important to you, you’ll find this plan with emergency medical, baggage insurance , emergency transport, travel accident coverage , and trip delay an affordable alternative.

If you need to cancel your trip for a covered reason or your trip is interrupted for a covered event, you’ll have coverage. Trip delay and 24-hour assistance are included.

For $9 per day, receive rental car damage/theft coverage, rental car trip interruption protection, and baggage loss coverage.

Hot Tip: If trip cancellation/interruption or trip delay coverage comes with your credit card is adequate for your trip but you want additional medical coverage, the Allianz’s OneTrip Emergency Medical plan may be a viable and affordable supplement.

How Allianz Compares

When it comes to comparing travel insurance policies, it’s difficult to match apples to apples. Coverages vary widely, as well as terms and conditions. The lowest-priced policy is not always the best value for your needs. The flip side is possible, too. You may find a policy with plenty of coverage at a price that is more than you want to spend.

The best solution is when you find a balance between coverage and cost.

Here’s how Allianz’s travel insurance offerings compare with other travel insurance options.

The coverage that comes with your credit card does not compare with a comprehensive travel insurance policy . In addition to the limited travel insurance coverage credit cards offer, if you do have a claim, you’ll have the potential hassle of dealing with a third-party claims administrator.

With that being said, the trip cancellation, trip interruption, trip delay insurance, and primary rental car insurance coverages found on several credit cards may be more than adequate for your trip.

Here are some of the best credit cards for travel insurance:

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

The Amex Platinum card comes with trip cancellation and trip interruption insurance with a benefit of $10,000 per trip, up to a maximum of $20,000 per account per 12-month period.

Pay for your trip with your eligible card and you, your immediate family, and eligible traveling companions are covered for non-refundable expenses paid to the travel provider. Trip interruption coverage will also reimburse for additional travel expenses incurred due to a covered loss during your trip.

Trip delay coverage is also included on the Amex Platinum card for delays more than 6 hours. Reimbursement for incidentals and eligible incurred expenses is limited to $500 per trip with 2 claims allowed per 12-month period.

The Amex Platinum card also comes with emergency medical evacuation coverage .

For more information, check out our detailed guide to the travel insurance benefits offered by the Amex Platinum card.

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Pay for your trip with your eligible card for up to $10,000 in coverage per person, $20,000 per trip, and up to $40,000 in a 12-month period. You and your qualifying immediate family are covered.

You’ll also find primary car rental insurance on the Chase Sapphire Preferred card and the Chase Sapphire Reserve ® card .

To learn more about the travel insurance benefits on the Chase Sapphire Preferred card , you’ll want to review this detailed article.

Chase Sapphire Reserve ® Card

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

In addition to the same trip cancellation/interruption/delay coverage as the Chase Sapphire Preferred card, the Chase Sapphire Reserve card offers up to $2,500 in emergency dental and medical coverage , emergency medical evacuation .

For more information check out this guide to all of the travel insurance benefits offered by the Sapphire Reserve.

Before purchasing any travel insurance policy, it’s wise to compare — fortunately that’s an easy task to execute. With comparison sites such as the ones listed here, you can compare as many as 100 travel insurance policies very quickly and find a policy that fits your situation and budget.

Keep in mind that insurance rates and coverages are highly regulated by the states . Insurance companies file a certain policy for a certain price with the state insurance commission, then the company is allowed to offer that policy, at that price, in that state.

For this reason, you won’t find the same policy offered at different prices. However, you could find a policy that is a better fit and possibly for less money by comparing several companies’ offerings.

Not all comparison sites include Allianz but when comparing similar policies, you’ll find that the company is competitively priced (a few companies lower and many companies higher). Individual results will vary based on your criteria.

Here are 4 websites that allow you to easily compare travel insurance policies.

- Insure My Trip — With over 60,000 customer reviews, 21 highly-rated travel insurance providers, and a best price guarantee, Insure My Trip makes it easy to find the right travel insurance policy.

- Travelinsurance.com — Compare major top-rated travel insurance company policies easily with this licensed online insurance search engine.

- SquareMouth — This popular travel insurance search engine offers easy comparisons of hundreds of policies offered by dozens of highly-rated insurance companies.

- Aardy — AardvarkCompare is a licensed travel insurance company with agents on staff to help you find the right travel insurance policy. Its website allows you to compare the policies of over 30 travel insurance providers.

There are also specialty companies such as World Nomads that do a great job providing travel insurance for active individuals. If you’re into outdoor sports, adventure activities, or even more risky activities such as skydiving, you can find coverage through World Nomads.

Bottom Line: If you’re looking to purchase a travel insurance policy, you’ll want to compare companies and policies . First, look at companies with a strong financial rating, select a policy with coverages that are a priority to you, then select a premium you’re comfortable paying.

Allianz is actually one of the companies that provides the travel insurance you’re offered when you book a flight. An example is displayed in the above image of their offerings when you purchase a Delta Air Lines ticket.

Point-of-sale travel insurance, however, can run from inexpensive options that offer little coverage to expensive options that provide greater coverage but still have limitations, similar to stand-along travel insurance policies.

If you fly once or twice a year, the coverage is adequate for your needs, and the cost is reasonable, you may easily choose to go this route and purchase coverage at the point of sale. However, you may fare better by securing a separate travel insurance quote to compare coverage/cost.

Always read the fine print before purchasing any coverage to ensure you’re getting the coverage you expect. For example, one might assume by looking at this example that canceling the trip would be covered, when in reality the covered reasons are limited.

Bottom Line: Even for point-of-sale travel insurance to cover a single travel purchase, it’s good to get a comparison quote. Securing a quote may save you money while offering broader coverage that could cover your entire trip versus just a portion of it.

Allianz is a solid, established, company offering a nice selection of packaged travel insurance products. Its website is easy to use with a quick quoting function and a simple purchase process. The site is also easy to understand as it is clearly written in plain language rather than legal verbiage.

One downside of Allianz is that the company does not sell Cancel for Any Reason Insurance . This is not an issue if you understand this up front and know that your policy does not allow you to cancel a trip for just any reason. After all, this is the case with most travel insurance — there are specific covered reasons for being able to cancel a trip and have coverage.

Cancel for Any Reason insurance can also result in a premium as much as 70% more than a standard policy, so many travelers may not consider it due to its cost.

If money is not a concern, you can purchase as much insurance as you’d like to have. However, in reality, purchasing travel insurance that works for you involves finding a balance between the coverage you want and the maximum premium you’re willing to pay.

Allianz is a respected company that offers a variety of policy choices with appropriate coverage for the majority of travelers at price points that fit most budgets.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is travel insurance worth it.

Yes, it can be worth it. If you are uncomfortable with the amount of money you would lose or be forced to pay in the event you had to cancel your trip or if you incurred disruption while traveling, you should purchase travel insurance.

An inexpensive trip or single flight may not warrant purchasing travel insurance, but insuring an expensive or complicated trip where you have a lot of non-refundable prepaid expenses at risk makes economic sense.

Travel insurance also provides the intangible benefit of peace of mind, knowing you are protected if you have to cancel due to a covered event or your trip is disrupted once in motion.

What is covered for trip cancellation?

There are limited covered reasons for receiving a benefit from trip cancellation insurance. The number 1 reason most travelers cancel their trips, according to InsureMyTrip.com , is the unforeseen illness of the traveler or of family members.

Fortunately, this is a covered reason for trip cancellation, although the level of coverage varies by company and policy.

Additional covered reasons can include death, hospitalization, or accident to you or covered family, legal obligations, your home becomes uninhabitable, the default of the travel provider, or natural disaster.

Deciding not to take a trip is not a covered reason for trip cancellation. Cancel for Any Reason insurance must be purchased in order to cover canceling a trip for a reason you personally deem necessary.

Does travel insurance cover flight cancellations?

Yes, travel insurance can cover flight cancellations in certain circumstances and depending on the policy purchased.

However, if an airline cancels your flight, whether prior to travel or during your travels, you would first contact the airline or the agency where you purchased your ticket for rebooking, a refund, or travel credit.

If you are not made whole, you could then look for coverage in your travel insurance policy.

If a flight is canceled due to weather during your travels, for example, and you are forced to incur unexpected expenses as a result, you could have coverage under a travel insurance policy if these expenses are not covered, or insufficiently covered, by the airline.

There could also be coverage under trip interruption/delay insurance if an airline cancels a flight and it causes you to miss ongoing travel which has been prepaid and is non-refundable.

Which is the best travel insurance company?

The best travel insurance company will have a high financial rating from a respected insurance industry rating company such as A.M. Best, offer a selection of coverages that matches your protection priorities, and does this at a price you’re willing to pay.

You should check reviews as well, keeping in mind that most consumers want to pay the least amount of money they can at the time of purchase and by doing so, coverage can be sacrificed. When there’s a claim, it’s natural to want the highest degree of coverage, although that may not have been the level purchased.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![allianz travel protection plan The Ultimate Guide to Buying the Best Travel Insurance [For You]](https://upgradedpoints.com/wp-content/uploads/2018/09/Travel-insurance-tag-on-luggage.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

Allianz Trip Insurance

Protect your travel experience

Read about Allianz Trip Insurance’s COVID-19 insurance coverage limitations and accommodations.

U.S. coverage alert Opens another site in a new window that may not meet accessibility guidelines.

Top reasons to buy trip insurance

- Financial reimbursement if you have to cancel or interrupt your trip due to a covered illness, injury, jury duty, and more

- Emergency medical benefits in and outside the U.S. – where many personal health insurance policies (like Medicare) won’t cover you

- 24-hour emergency assistance to help you solve medical and other travel-related problems on the go

Types of trip insurance plans

Allianz Trip Insurance comes in a variety of plans to fit your specific needs. Single-trip plans can protect one trip, annual plans can protect all your trips for an entire year, and rental car protection plans can keep your budget safe from accidental collision and damage to a rental vehicle.

All insurance is recommended / offered / sold by 3rd party, Allianz Global Assistance, not American Airlines. Underwriter: Jefferson Insurance Company or BCS Insurance Company. AGA Service Company is the licensed producer and administrator of these plans. AGA Service Company is a licensed producer in all 50 states plus the District of Columbia.

Get a quote Opens another site in a new window that may not meet accessibility guidelines.

Trip insurance benefits

Reimburses your prepaid, non-refundable travel expenses if you need to cancel your trip due to a covered illness, injury, and more.

Reimburses the unused, non-refundable portion of your trip and increased transportation costs it takes for you to return home early or to continue your trip due to a covered illness, injury, and more.

Reimburses expenses related to covered emergency medical or dental care incurred on your trip.

Provides benefits for medically necessary transportation to the nearest appropriate medical facility following a covered injury or illness.

Reimburses extra meals and accommodations you may need if your flight is delayed for 6 or more hours for a covered reason.

Reimburses you if your luggage is lost, damaged or stolen during your trip—keeping your travel plans on track.

Reimburses the purchase of essential items if your luggage is delayed for more than 24 hours.

Turn your trip into a VIP experience. Our travel experts can give you destination information, make restaurant reservations, find tickets to shows, and more.

Help is just a phone call away. Our team of multilingual problem solvers is available to help you with medical and other travel-related emergencies.

Provides primary coverage with no deductible.

Review period

If you’re not completely satisfied, you have 15 days (or more, depending on your state of residence) to request a refund, provided you haven’t started your trip or initiated a claim. Plans are non-refundable after this period.

Additional assistance

Coverage by country of residence.

- Frequently asked questions

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive,Richmond, VA 23233 or [email protected]

Email [email protected]

PLEASE BE ADVISED: This plan contains insurance benefits (which may include disability and/or health insurance benefits) that only apply during the covered trip. This optional coverage may duplicate coverage already provided by your personal auto, home, renter’s, health, life, personal liability, or other insurance policy or source of coverage but may be subject to different restrictions. You should review the terms of this policy with your existing coverage. If you have any questions about your current coverage, call your insurer/health plan or insurance agent/broker. This insurance is not required to purchase any other products/services. Unless licensed, travel retailers and their employees may provide general information about the insurance, including a description of coverage and price, but are not qualified/authorized to answer technical questions about terms, benefits, exclusions, and conditions of the insurance or evaluate the adequacy of existing coverage. Plans are intended for U.S. residents only and may not be available in all jurisdictions. Rental Car Protector is not available to KS and TX residents, except when purchased as a separate policy and is not available in all countries or for all cars. This coverage does not provide liability insurance or comply with any financial responsibility law, or any other law mandating motor vehicle coverage and does not cover you for any injury to another party. Additionally:

California Residents: We are doing business in California as Allianz Global Assistance Insurance Agency, License # 0B01400. California offers a toll-free consumer hotline at 1-800-927-4357.

New York Residents: The licensed producer represents the insurer for purposes of the sale. Compensation paid to the producer may depend on the policy selected, or the producer’s expenses, volume of business, or profitability. The purchaser may request and obtain information about the producer’s compensation, except as otherwise provided by law.

Maryland Residents: The purchase of travel insurance would make the travel insurance coverage primary to any other duplicate or similar coverage. The Commissioner may be contacted to file a complaint at: Maryland Insurance Administration, ATTN: Consumer Complaint Investigation Property/Casualty, 200 St. Paul Place, Suite 2700, Baltimore, MD 21202.

Texas Residents: Before deciding whether to purchase this insurance plan, you may wish to determine whether your own automobile insurance or credit card agreement provides you coverage for rental vehicle damage or loss and determine the amount of deductible under your own insurance coverage. The purchase of this insurance plan is not mandatory. This coverage is not all inclusive, which means it does not cover such things as personal injury, personal liability, or personal property. It does not cover you for damages to other vehicles or property. It does not cover you for any injury to any other party.

Plan charge includes the cost of insurance benefits and assistance services. See your Plan Details for more information, or call Allianz Global Assistance at 800-284-8300.

AGA Service Company dba Allianz Global Assistance (AGA) compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency.

*Terms, conditions, and exclusions apply, including for pre-existing conditions. Plans may not be available to residents of all states. Insurance benefits are underwritten by either BCS Insurance Company or Jefferson Insurance Company, depending on insured’s state of residence. AGA Service Company is the licensed producer and administrator of these plans.

- Travel Planning Center

- Ticket Changes & Refunds

- Airline Partners

- Check-in & Security

- Delta Sky Club®

- Airport Maps & Locations

- Flight Deals

- Flight Schedules

- Destinations

- Onboard Experience

- Delta Cruises

- Delta Vacations

- Delta Car Rentals

- Delta Stays

- In-Flight Wi-Fi

- Delta Trip Protection

- How to Earn Miles

- How to Use Miles

- Buy or Transfer Miles

- Travel with Miles

- SkyMiles Partners & Offers

- SkyMiles Award Deals

- SkyMiles Credit Cards

- SkyMiles Airline Partners

- SkyMiles Program Overview

- How to Get Medallion Status

- Benefits at Each Tier

- News & Updates

- Help Center

- Travel Planning FAQs

- Certificates & eCredits

- Accessible Travel Services

- Child & Infant Travel

- Special Circumstances

- SkyMiles Help

As an exception, travel certificates issued during the COVID-19 situation are valid for bookings made through December 31, 2023, for travel throughout 2024. For more information please click here .

Delta Vacations Travel Protection Plan & Travel Protection Plus

WHY TRAVEL PROTECTION? Your vacation is an investment of time and money. Delta Vacations, in conjunction with Allianz Global Assistance, the foremost provider of travel protection plans and travel insurance, help protect your investment from the unexpected.

Travel protection plans purchased prior to 2/20/20 are serviced by Trip Mate. For more information please review the details for Trip Mate policies please click here .

Travel Protection Plan

Part A: Pre-departure Benefits Provided by Delta Vacations

Refund of cancellation fees

Documentation required

Purchase period

Part B: Post-departure Benefits (Vacation Protector)

Provided by Allianz Global Assistance For complete details, go to:

Travel Protection Plan PLUS

Received in the original form of payment 1

May be purchased any time prior to final payment 1

Plan Details , opens in a new window

Received in the form of a Delta Vacations travel certificate 2

May be purchased any time prior to final payment 2

1 Cancel For Any Reason Waiver applies only if the Travel Protection Plan Plus is purchased within seven (7) days of your initial deposit for your trip. Payments made with miles and/or travel certificates will be refunded in the form of a travel certificate that will have an expiration date one year from the date of issuance of such travel certificate. All other payments refunded to original form of payment. 2 Cancel For Any Reason Waiver applies only if the Travel Protection Plan is purchased within seven (7) days of your initial deposit for your trip. The refund of cancellation fees will go to a Delta Vacations travel certificate that will have an expiration date one year from the date of issuance of such travel certificate. 3 Pre-existing conditions coverage only applies if Travel Protection Plan is purchased within fourteen (14) days of initial deposit for your trip (and for pre-existing conditions, the traveler must not be disabled from travel at the time the plan is purchased.)

Provided by Delta Vacations

- The Cancel for Any Reason Waiver protects the cost of your vacation and protects you from most cancellation penalties. Also, you can cancel for any reason and have comfort in knowing that your travel investment is protected. You must cancel before your scheduled departure.

- The Cancel for Any Reason Waiver is provided by Delta Vacations and is not an insurance benefit.

With this option, you receive all of the benefits with the Travel Protection Plan (listed in the chart above) PLUS you:

- Receive the refund of the cost of your vacation package AND cancellation fees in the form of your original payment should you need to cancel your vacation for any reason (less the cost of the protection plan).

- Receive the lowest price guarantee.

Please Note:

- If purchased, everyone on the booking must purchase the Travel Protection Plan.

- The cost of the Travel Protection Plan is only refunded for cancellations covered by the hurricane policy (or within the state required free look period).

- Refer to Delta Vacations Cancellation & Change Policy for penalty and refund details.

- Certain restrictions apply to groups booked with our Group Department.

- Certain items may not be refundable, such as show or event tickets, theme park passes, etc.

- Airfare cancellation fees are currently being waived by Delta Vacations for a limited time and other non-air fees may still apply and will be covered under this plan.

- When one or more travelers cancel off of a booking but the entire booking is not cancelled, the booking will be repriced to reflect the remaining number of travelers. This may reduce the refundable amount for the person(s) whose travel is being cancelled.

Additional Information

For additional information about the Part A: Pre-departure Benefits or pricing or to purchase separately, please contact Delta at 1-800-800-1504.

Provided by Allianz Global Assistance and Underwritten by Jefferson Insurance Company or BCS Insurance Company

Your post-departure benefits can help protect you from the unexpected during your vacations, such as:

- Medical and emergency assistance

- Can reimburse up to $50,000 for covered emergency medical expenses, emergency medical transportation and 24-hour emergency assistance service for covered sickness or injury during the trip.

- Trip Interruption Can reimburse non-refundable, unused, pre-paid trip costs when you must interrupt your trip or return home early for reasons such as covered sickness, injury, etc.

- Travel delay Can reimburse for meals and accommodations when you are delayed on your trip for 6 hours or more

- Baggage delay Can reimburse for clothing and personal items if your luggage is delayed more than 24 hours

- Loss or damage to baggage or personal effects Can reimburse for loss or damage to baggage or personal effects that occur during the trip.

For additional information on Part B: Post-Departure Benefits, see plan and pricing details , opens in a new window .

Part B: Post-departure Vacation Protector includes insurance benefits and assistance services. Insurance benefits are underwritten by either BCS Insurance Company or Jefferson Insurance Company depending on the insured's state of residence. AGA Service Company is the licensed producer and administrator of these plans, 9950 Mayland Dr., Richmond, VA 23233.

LOWEST PRICE GUARANTEE (PROVIDED BY DELTA VACATIONS)

If Delta Vacations advertises an identical vacation at a lower price, Delta Vacations will guarantee that price. The advertised vacation must be available and include the same air components (including air fare class), hotel and room category, and any other previously purchased components, including the Travel Protection Plan PLUS. Refunds for the difference in the package price will be issued in the original form of payment.

Below, you'll find information on how to request the Lowest Price Guarantee along with lowest price guarantee terms and conditions.

To request the Lowest Price Guarantee 10 days or more before departure:

- Create a new reservation with lower price and place on hold.

- Note: Some reservations may require confirmation with a credit card.

- Contact Delta Vacations at 1-800-800-1504, 6:00 am - 11:00 pm CST.

- If the new reservation qualifies, the travelers will receive confirmation of the new reservation at the adjusted price. Previous reservation will be refunded to the original form of payment.

To request the Lowest Price Guarantee within 10 days of departure:

- Create a new reservation and confirm with credit card.

- If the new reservation qualifies the travelers will receive confirmation of the new reservation at the adjusted price. Previous reservation will be refunded to the original form of payment.

Travel Protection PLUS and Lowest Price Guarantee Terms and Conditions

- The Travel Protection Plan PLUS cannot be applied to Miles to Go or upgraded bookings.

- Lowest Price Guarantee is on the total package price, not component to component.

- All components must be available at the time of the new reservation.

- Lowest price guarantee must be on the exact same vacation package including the same dates, air components, hotel and room category, and any other previously purchased components, including the Travel Protection Plan PLUS.

- Lowest price guarantee is allowed to be used only one time per booking and may be exercised up to the time of departure.

- Promotional codes applied to the original reservation must be valid at the time of the lowest price guarantee request to maintain promotional code discount. If the promotional code is no longer valid, a new promotional code can be applied, as long as all terms and conditions are met.

- Lowest price guarantee does not apply to group reservations.

- Lowest price guarantee cannot be purchased separately and is only available through the Travel Protection Plan PLUS program.

- Delta Vacations is the final authority on the interpretation of these rules and reserves the right to change these terms and conditions without prior notice.

Travel Protection Plan Travel Certificate Redemption Terms and Conditions

Redemption Instructions

- Contact Delta Vacations at 1-800-800-1504 or online at delta.com/vacations.

- Enter/provide the 12-digit travel certificate number printed on the front of the travel certificate document during the payment step.

- Provide additional form of payment, if necessary.

- Delta Vacations will issue and send your travel documents via the delivery method requested during the booking process.

Redemption Terms and Conditions

- Travel certificate is valid for the value indicated on the front of the travel certificate document, when redeemed toward the purchase of any Delta Vacations air and hotel package; air, hotel and car package; hotel only; or hotel and car or ground transportation package purchase.

- Travel certificate can be redeemed in its entirety or in increments up to the value or balance remaining on the certificate.

- If the price of the booking is more than the value of the travel certificate, an additional form of payment for the remaining balance will be necessary to complete the transaction.

- Travel documents for the redeemed travel certificate will be issued, and sent via the delivery method identified during the booking process.

- Purchases with this travel certificate will be deducted from the balance until the value reaches zero or until the expiration date is reached, whichever occurs first.

- No refunds or credits will be issued for any unused portion of the travel certificate.

- Travel certificate is not valid for use toward the purchase of Group bookings, ski bookings, gift cards or another travel certificate.

- The expiration date for this travel certificate is printed on the front of the travel certificate document; the travel certificate is valid for payments made prior to the expiration date.

- Extensions to the expiration date will not be permitted, and travel certificate is not rechargeable.

- Lost, stolen or destroyed travel certificates will not be replaced.

- Travel certificate is void if altered or sold, is nontransferable, nonrefundable, may not be redeemed for cash, has no resale value, and is valid for use only by the person(s) indicated on the front of the travel certificate document.

- Travel certificate is not retroactive, and cannot be applied as alternative payment to reservations already paid in full.

- If a booking using a travel certificate as payment is cancelled, any remaining value after applicable cancellation fees have been deducted will be refunded back to the original travel certificate, and all terms of the original travel certificate, including original expiration date, will apply.

- Travel certificate cannot be redeemed for an Delta Vacations reservation with the same origin and destination and the same departure and arrival dates as the original trip that the travel certificate was issued for.

- Must be redeemed through Delta Vacations, and is not valid for redemption through Delta Air Lines or its website, delta.com.

- Delta Vacations must issue all airline tickets and travel documents.

- Standard Terms and Conditions and cancellation policies apply, which are outlined during the booking process; other restrictions apply.

- Delta Vacations is the final authority on the interpretation of these rules, and reserves the right to change these Terms and Conditions without prior notice.

- Travel Agents: Travel certificate can be redeemed via our agent website or Reservations.

For balance and expiration date inquiries, refer to the contact information on the front of the travel certificate document.

Learn more about us.

Your elevated vacation experience starts here. Choose from flights, hotels, rides and activities all over the world, all in one place.

WE’RE HERE FOR YOU

As trusted experts, we’ll help with recommendations, booking and support — whenever and wherever you need it.

PREFERRED BY SKYMILES® MEMBERS

We make it easier to get more from your miles while also earning bonus miles and earning toward Medallion® Status.

TRAVEL WITH CONFIDENCE

Things come up, and we’ve got you covered, from flexible changes and cancellations to travel protection plans .

- Investor Relations

- Business Travel

- Travel Agents

- Comment/Complaint

- Browser Compatibility

- Accessibility

- Booking Information

- Customer Commitment

- Tarmac Delay Plan

- Sustainability

- Contract of Carriage

- Cookies, Privacy & Security

- Human Trafficking Statement (PDF)

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses