Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Introduction to American Express Travel Protection

Types of travel protection offered, american express travel protection: a guide to your benefits.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Hilton Honors American Express Aspire Card, Amex EveryDay® Preferred Credit Card, American Express® Green Card, The Plum Card® from American Express. The details for these products have not been reviewed or provided by the issuer.

- Some American Express cards offer trip cancellation and interruption benefits .

- You'll find these perks on cards like The Platinum Card® from American Express.

- If you're eager to sign up for a travel credit card with perks, compare each card's offerings.

Overview of Travel Protection Benefits

While credit card insurance and travel protection coverage are usually considered secondary to rewards programs and other cardholder perks, these benefits can be equally important if you travel.

When you pay for a trip with a credit card that offers trip cancellation and interruption insurance, for example, you can get reimbursed for some of your travel expenses in the event your vacation is halted for reasons beyond your control. Meanwhile, trip delay insurance lets you apply for some reimbursement when a delay of your trip results in surprise expenses, such as an unplanned hotel stay near the airport when your flight is on hold.

Importance of Travel Insurance

Chase credit cards like the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card have really stood out for years in terms of the protections they offer, and with some of the highest limits out there. Still, American Express is still coming around — it recently added trip cancellation and interruption insurance, along with trip delay coverage, to many of its top rewards credit cards.

If you're in the market for an American Express card and you're hoping to take advantage of important travel benefits, consider the cards below and their expanded travel protections.

Trip Cancellation and Interruption Insurance

New trip cancellation and interruption insurance from American Express credit cards will provide you with up to $10,000 in coverage (and up to $20,000 per account per year) you can use for reimbursement of prepaid travel expenses like airfare and hotels. This coverage can come in handy if your trip is canceled for a covered reason beyond your control, or you're stuck in your destination and require an extended stay and additional costs before you can return home.

Note that this coverage is good for round-trip travel booked with your credit card, meaning you have to pay for travel expenses with a common carrier with your American Express credit card in order to be eligible.

American Express cards that qualify for this coverage include:

- The Platinum Card® from American Express

- Delta SkyMiles® Reserve American Express Card

- Hilton Honors American Express Aspire Card

- Marriott Bonvoy Brilliant® American Express® Card

- The Business Platinum Card® from American Express

- Delta SkyMiles® Reserve Business American Express Card

Other versions of the Amex Platinum card — including the Goldman Sachs, Morgan Stanley, and corporate flavors — also offer this coverage, as do all versions of the Amex Centurion (black) card , which is invite-only.

Baggage Insurance Plan

Quite a few American Express credit cards also offer a baggage insurance plan, although this isn't a new or upgraded benefit from the card issuer. This coverage can come in handy if your luggage is lost or stolen during a covered trip. To be eligible for this coverage, you have to pay for travel with a common carrier (airfare, cruise fare, etc.) with your American Express credit card.

The amount of coverage you'll receive depends on the card you have. For example, baggage insurance from the The Platinum Card® from American Express offers up to $3,000 in coverage per person for carry-on luggage and up to $2,000 per person in coverage for some types of checked baggage.

With baggage insurance from the Amex EveryDay® Preferred Credit Card , on the other hand, you'll only qualify for up to $1,250 in coverage per person for carry-on luggage and up to $500 for covered checked baggage, although an extra benefit of $250 is offered for qualified "high risk items" like jewelry or sporting equipment.

American Express cards that come with baggage insurance include:

- The Platinum Card® from American Express (including various versions)

- American Express® Gold Card (including various versions)

- American Express® Green Card (including various versions)

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Platinum American Express Card

- Hilton Honors American Express Surpass® Card

- Amex EveryDay® Preferred Credit Card

- The Plum Card® from American Express

American Express business cards with baggage insurance include:

- American Express® Business Gold Card

- The Blue Business® Plus Credit Card from American Express

- Delta SkyMiles® Gold Business American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Marriott Bonvoy Business® American Express® Card

- The Hilton Honors American Express Business Card

- Lowe's Business Rewards Card from American Express

- Amazon Business Prime American Express Card

- Amazon Business American Express Card

Various versions of the Amex Centurion card and several Amex corporate cards also offer baggage insurance.

Travel Accident Insurance

Some American Express cards also offer secondary auto rental coverage, which means this coverage kicks in after other policies you have are exhausted, as opposed to primary car rental coverage.

While this benefit applies to many Amex cards, note that coverage limits can vary. With the Amex Gold card, for example, coverage is limited to $50,000 per rental agreement for damage or theft, yet the Amex Platinum card offers up to $75,000 in coverage. The insurance doesn't cover personal liability, either.

Also note that this coverage comes with a certain amount of Accidental Death or Dismemberment Coverage that varies by card. With , for example, you'll receive up to $200,000 in coverage per person and up to $300,000 in coverage per car accident for accidental death and dismemberment. Make sure to read your credit card's terms and conditions so you know exactly how much coverage you have.

American Express cards that come with secondary auto rental coverage include:

- The Platinum Card® from American Express (including various versions)

- Delta SkyMiles® Blue American Express Card

- Hilton Honors American Express Card

- Marriott Bonvoy American Express® Card (no longer available to new applicants)

- Blue Cash Everyday® Card from American Express

- Blue Cash Preferred® Card from American Express

- Amex Everyday® Credit Card from American Express

And business cards from Amex that offer secondary car rental insurance include:

While American Express did offer travel accident insurance on some of its cards, this coverage was effectively dropped as of January 1, 2020. The same is true for the American Express Roadside Assistance Hotline, which is no longer available.

Trip Delay Insurance

In January of 2020, American Express also rolled out an upgraded trip delay insurance benefit for many of its top rewards credit cards. While this perk may seem like an unusual one, there are so many scenarios where trip delay coverage could help you save money and avoid surprise expenses when travel is delayed beyond your control.

With trip delay coverage from Amex, you can be reimbursed for up to $500 per trip for hotel stays, meals, and other miscellaneous required expenses when your flight or other trip plans are delayed by more than six hours. If you're sitting at the airport and your flight is suddenly delayed until the next morning, for example, you could use this coverage to get reimbursed for a nearby airport hotel and your dinner, then for an Uber or Lyft ride back to the airport.

To qualify for American Express trip delay coverage, you need to pay for your round-trip travel expenses with a common carrier with your credit card.

Amex cards that come with trip delay coverage include:

- American Express® Gold Card

- American Express® Green Card

Again, the various versions of the Amex Platinum and Amex Centurion cards also offer trip delay insurance.

Most travel protections are automatically activated when you use your American Express card to book your travel. However, specific activation steps, if any, depend on the benefit.

Covered reasons for trip cancellation or interruption typically include illness, severe weather, and other unforeseen events, reimbursing you for non-refundable travel expenses.

Yes, baggage insurance plans come with coverage limits, which vary depending on the card and the type of loss (e.g., lost, damaged, or stolen baggage).

The Global Assist Hotline offers medical, legal, and other emergency coordination and assistance services, but financial costs for services rendered are typically the cardholder's responsibility.

Eligibility for specific travel protections varies by card. Premium cards often offer more comprehensive protections compared to basic cards.

For rates and fees of The Platinum Card® from American Express, please click here.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Trip Delay Insurance, Trip Cancellation and Interruption Insurance, and Cell Phone Protection Underwritten by New Hampshire Insurance Company, an AIG Company. Global Assist Hotline Card Members are responsible for the costs charged by third-party service providers. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers. Extended Warranty, Purchase Protection, and Baggage Insurance Plan Underwritten by AMEX Assurance Company. Car Rental Loss & Damage Insurance Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

- Main content

Who is covered by credit card travel insurance?

Editor's Note

No matter how carefully you plan your vacation, bad weather or mechanical delays can throw your trip off track without warning. That's why it's important to consider getting travel insurance to protect your trip.

Thankfully, many of the top travel rewards cards on the market include various travel protections automatically when you use your card to pay for your trip.

What is credit card travel insurance?

Credit card travel insurance protects you from unexpected circumstances that disrupt your travel plans. These can include illness, weather and other emergencies outside your control.

Here's a list of common travel protections included with many travel credit cards:

- Baggage delay coverage

- Car rental coverage/auto collision damage waiver

- Emergency medical and dental insurance

- Global Assist hotline

- Lost and damaged baggage coverage

- Travel accident insurance

- Trip cancellation and interruption coverage

- Trip delay coverage

Related: What's covered by credit card travel accident and emergency evacuation insurance?

The people covered by your credit card travel insurance policy can vary from issuer to issuer. Most issuers cover your spouse and immediate family members to give you added peace of mind.

Does credit card travel insurance cover my partner?

In most cases, travel insurance coverage will include a spouse or domestic partner. Take The Platinum Card® from American Express , for example. In regards to its trip cancellation and interruption Insurance, the following eligible travelers are covered:

Eligible Traveler means you and your Family Members and Traveling Companions who purchase a covered trip to your Eligible Card. Family Member means a spouse, domestic partner, or unmarried dependent child up to age 19 (or under age twenty-six (26) if a full-time student at an accredited college or university).

Traveling Companion means an individual who has made advanced arrangements with you or your family members to travel together for all or part of a Covered Trip.

Related: Should you get travel insurance if you have credit card protection?

Does credit card travel insurance cover my family?

Depending on the card, travel insurance will cover your immediate family. For example, Chase offers trip delay, cancellation and interruption insurance on several credit cards, including the Chase Sapphire Preferred® Card and Chase Sapphire Reserve® .

The exact terms of the different policies, including when they kick in and how much coverage they carry, vary by card, but the list of eligible parties does not.

Depending on which travel protection you're using, here's who your Chase cards cover:

- Trip delay reimbursement: Includes the cardholder and their spouse or domestic partner and dependent children under age 26.

- Trip cancellation/interruption insurance: Includes the cardholder and their immediate family members (even if the cardholder is not traveling).

Chase defines immediate family as "your Spouse or Domestic Partner and their children, including adopted children or step-children; legal guardians or wards; siblings or siblings-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephews."

The great thing about this, and one of the reasons why the Chase Sapphire Reserve is one of our favorite cards, is that these insurance benefits apply to family members even when they are not traveling with you.

Related: 7 times your credit card's travel insurance might not cover you

Which credit cards include travel insurance?

Many credit cards offer travel insurance. Here are some of our favorites:

- Amex Platinum

- American Express® Gold Card

- Capital One Venture X Rewards Credit Card

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Ink Business Preferred® Credit Card

For more information, check out our list of the best cards with travel insurance .

Related: 4 times your credit card's travel insurance can help with summer travel woes, and 7 times it won't

Bottom line

Travel insurance is included on many cards and can offer peace of mind in case of the unexpected. This insurance generally covers your spouse or partner and, in some cases, your immediate and extended family.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Gold Card

Full List of Travel Insurance Benefits for the Amex Gold Card [2023]

Christine Krzyszton

Senior Finance Contributor

308 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Jessica Merritt

Editor & Content Contributor

88 Published Articles 495 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Senior Editor & Content Contributor

96 Published Articles 683 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![amex travel insurance family Full List of Travel Insurance Benefits for the Amex Gold Card [2023]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Gold-Upgraded-Points-LLC-19-Large.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Amex gold card — snapshot, amex gold card — travel insurance benefits, travel benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The American Express ® Gold Card is known for being a go-to card for everyday purchases at restaurants and at U.S. supermarkets. The card also doubles as a travel rewards card offering elevated earnings on select flight purchases and a nice selection of flexible travel redemption options.

The card is far less known for its travel insurance benefits. Today, we’re turning the spotlight on some of the useful travel insurance benefits that come with the card and talking about how these benefits can add value to the cardholder.

First, let’s look at the overall earning and redemption features of the Amex Gold card, then jump right into the list of travel insurance benefits you can expect to find on the card.

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at Amex Travel

- $250 annual fee (see rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards ® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards ® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards ® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 90,000 points with the Amex Gold card. The current public offer is 60,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

Why We Like the Card Overall

We like that you can jumpstart your earnings with a generous welcome bonus after meeting minimum spending requirements in the first 6 months after card approval.

The Amex Gold card also strikes a nice balance between functioning as an everyday spending card and offering accelerated earnings on flights. It also offers flexible travel redemption options.

You’ll earn 4x Membership Rewards points at restaurants worldwide and at U.S. supermarkets (on up to $25,000 in purchases each year). Plus, you’ll receive 3x earnings on flights purchased directly with the airline and via AmexTravel.com .

With monthly statement credits for select purchases, it’s easy to find enough value to offset the annual fee.

When it’s time to use your rewards, you’ll have options such as redeeming points for flights via AmexTravel.com or transferring your points to the American Express transfer partners for even more potential value.

While the Amex Gold card doesn’t come with a long list of comprehensive travel benefits, you’ll find these core travel insurance benefits useful for saving money and for access to assistance should something go wrong during your journey.

Car Rental Loss and Damage Insurance

Having car rental insurance can save you money and provide a level of peace of mind when renting a vehicle . The Amex Gold card comes with secondary car rental insurance that would require you to first file a claim with any other applicable insurance before card coverage kicks in.

Secondary coverage can still be valuable coverage, but there is another car rental coverage option included on the card that is a much better choice.

Premium Protection

The option to purchase Premium Protection car rental insurance on the Amex Gold card is a game changer.

You’ll pay one low price of $12.25 to $24.95 for the entire period, up to 42 total days, for primary theft and damage coverage. The actual rate will depend on your state of residence and the level of coverage chosen. Note that this is not a per-day rate like the car rental agencies charge.

Just enroll in the coverage via your online card account, then whenever you charge your rental car to your card, you’ll have the coverage automatically. You are not charged prior to renting a car.

There is no deductible. Accidental death/dismemberment coverage is included. Liability coverage, uninsured/under-insured motorist coverage, or disability coverage is not included.

Cardholders and authorized listed drivers are covered.

Applicable coverages for both secondary and Premium Protection include rental car damage, theft, and loss of use.

Coverage is not available when renting vehicles in Australia, Ireland, Israel, Italy, Jamaica, and New Zealand.

There are several additional exclusions, including the theft of an unlocked vehicle, illegal activity, intoxication of the driver, and war. Access the Guide to Benefits for a complete list of exclusions, terms, and conditions.

Filing a Claim

You can file a claim online or call 800-338-1670. You must file the claim within 30 days of the event and submit the required claim form within an additional 15 days. You’ll then have 60 days to submit the required documentation.

Bottom Line: The Amex Gold card comes with secondary car rental insurance with the option to purchase primary Premium Protection for one low rate that covers the entire rental period.

Trip Delay Insurance

To be eligible for trip delay insurance, you must pay for your entire trip with your Amex Gold card, associated rewards, or a combination of the 2. Using airline vouchers, certificates, or discounts, such as those associated with your frequent flyer account, in combination with your card, are also acceptable. Eligible travelers include family members, travel companions, and a spouse or domestic partner.

Trip delay insurance reimburses an eligible traveler for incidental expenses incurred after a 12-hour or greater trip delay. Eligible expenses can include lodging, meals, toiletries, medication, and necessary personal items.

Eligible Losses and Coverage Limits

The following types of losses are eligible covered losses :

- Inclement weather preventing a traveler from beginning a trip or continuing on a trip

- Terrorism or hijacking

- A common carrier’s equipment failure (documented)

- Lost/stolen travel documents, such as passports

You could receive up to $300 per trip with a limit of 2 claims per card, per 12-month period. Coverage is secondary to any other applicable coverage including reimbursement by the airline.

Loss exclusions include prepaid expenses, losses that were known to the public or the traveler prior to the trip, and intentional acts by the covered traveler. Access the card’s Guide to Benefits for more details on loss exclusions under trip delay coverage.

You’ll have 60 days from the date of the loss to file a claim. You can do so by calling 844-933-0648 or the number on the back of your card to be directed to the claims department.

You’ll then have 180 days to submit the required documentation, which can include a statement from the common carrier validating the delay, receipts, your card statement showing the trip charge, and other requested supporting information.

Bottom Line: The Amex Gold card comes with trip delay insurance that provides up to $300 per trip for eligible expenses incurred after a 12-hour or greater delay due to a covered loss.

Baggage Insurance Plan

To be eligible for baggage insurance, pay for your common carrier ticket entirely with your Amex Gold card and/or associated rewards. Trips paid for, in full or in part, with non-American Express rewards such as airline loyalty programs are not eligible.

You, your spouse or domestic partner, children under 23, and certain dependent handicapped children are covered for baggage insurance as long as the trip is paid for in full with your card and/or associated rewards.

Lost, damaged, or stolen baggage is covered, except in the event of war, government confiscation, or acts arising out of customer actions, for the following coverage limits.

High-risk items such as jewelry, gold, silver, platinum, electronics, furs, and sporting equipment, are limited to $250 per item maximum, per trip.

Certain items are not covered under baggage insurance — here is a condensed list of those items:

- Credit cards, cash, securities, or money equivalents (such as money orders or gift cards)

- Travel documents, tickets, passports, or visas

- Plants, animals, or food

- Glasses, contact lenses, hearing aids, prosthetic devices, and prescription or non-prescription drugs

- Property shipped prior to departure

You’ll have 30 days from the date of the loss to file a claim. To file a claim, you can go online or call 800-228-6855 within the U.S. To call from outside of the U.S., call 303-273-6498 collect.

You’ll then have 60 days to submit supporting documentation including a list of items lost, receipts, a statement showing the trip was purchased with the card or associated rewards, and common carrier reports.

Please note that we have abbreviated coverage descriptions and all terms and conditions are not spelled out in their entirety. You’ll want to access the benefits guide for full information.

Bottom Line: You and certain family members are covered for baggage insurance of up to $1,250 per person when traveling with a common carrier. You’ll need to pay for your entire trip with your card or rewards associated with your card for coverage to be valid.

Travel Accident Insurance

Travel accident insurance that comes with the Amex Gold card pays a benefit in the unlikely event of accidental death or dismemberment of the primary card member, additional card member, spouse or domestic partner, or children under the age of 23.

The trip must be paid for with the Amex Gold card and/or associated Membership Rewards points (Pay With Points).

The coverage pays a benefit for death or severe injury suffered as a result of riding in, boarding, exiting from, or being struck by a common carrier.

The benefit paid is based on a table provided and can be up to $100,000.

While not travel insurance specifically, these additional benefits can provide assistance when planning a trip or if an unexpected event should disrupt your trip.

Emergency Travel Assistance

The Amex Global Assist Hotline provides important 24/7 assistance when traveling more than 100 miles from home. Receive help finding medical, legal, and translation referrals as well as assistance securing emergency transportation.

In addition, you could receive help securing a replacement passport or finding missing luggage.

You can reach the Global Assist Hotline at 800-333-2639. Outside the U.S., call 715-343-7977.

Actual services provided by third parties that incur costs are the responsibility of the cardholder.

Services are also not available in areas such as Cuba, Iran, Syria, North Korea, or the Crimea region.

No Foreign Transaction Fees

You’ll want to include the Amex Gold card during your next trip, as the card does not charge foreign transaction fees ( rates & fees ).

Additional Travel Benefits

Receive help planning your trip with Insider Fares via AmexTravel.com, upgrade your flights with points , American Express Travel Insurance , onsite benefits at The Hotel Collection , Amex Offers , and more.

While the Amex Gold card comes with several valuable travel insurance benefits, you would not select the card for this specific reason. The card shines when it comes to earning on select everyday purchases, for purchasing airline tickets, and its flexible travel redemption options. Those should be key reasons for selecting the card.

The fact that there are travel insurance benefits that come complimentary with the card is just one more reason to consider the card.

If having premium travel insurance benefits is a priority for you, you might consider the Chase Sapphire Preferred ® Card , The Platinum Card ® from American Express , the Chase Sapphire Reserve ® , or the Capital One Venture X Rewards Credit Card , all of which offer some of the best travel insurance benefits.

You can read about more credit cards with travel insurance in our article on this specific topic.

For the car rental collision damage coverage benefit of the American Express Gold Card, car rental loss and damage insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car rental loss or damage coverage is offered through American Express Travel Related Services Company, Inc. For the trip delay insurance benefit of the American Express Gold Card, up to $300 per covered trip that is delayed for more than 12 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company. For the baggage insurance plan benefit of the American Express Gold Card, baggage insurance plan coverage can be in effect for eligible persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier (e.g. plane, train, ship, or bus) when the entire fare for a common carrier vehicle ticket for the trip (one-way or round-trip) is charged to an eligible account. Coverage can be provided for up to $1,250 for carry-on baggage and up to $500 for checked baggage, in excess of coverage provided by the common carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. For the global assist hotline benefit of the American Express Gold Card, you can rely on the Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Card members may be responsible for the costs charged by third-party service providers.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the American Express ® Gold Card, click here . For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Does the amex gold card have travel insurance benefits.

While the list of travel insurance benefits on the Amex Gold card is not extensive, you will find coverage such as secondary car rental insurance, the option to purchase Premium Protection car rental insurance, trip delay, baggage insurance, a Global Assist Hotline, and travel accident insurance.

Does the Amex Gold card have trip interruption or trip cancellation insurance?

No. The Amex Gold card does not offer trip interruption or trip cancellation insurance. The card does come with trip delay insurance.

Does the Amex Gold card charge foreign transaction fees?

No. You will not be charged foreign transaction fees when using the Amex Gold card for foreign purchases ( rates & fees) .

Does the Amex Gold card cover lost luggage?

Yes, the Amex Gold card can cover lost, stolen, or damaged luggage. The coverage is secondary to any coverage or reimbursement received by the airline or other applicable insurance.

Does the Amex Gold card have good car rental insurance?

The Amex Gold card comes with secondary car rental insurance, which means that you must first file a claim with any other applicable insurance before card coverage kicks in. You will have the option, however, to purchase Premium Protection for one low rate that covers the entire rental period, up to 42 days.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex travel insurance family Amex Gold Card vs. Amex Rose Gold Card [Are They Different?]](https://upgradedpoints.com/wp-content/uploads/2022/08/Amex-Gold-vs-Amex-Rose-Gold-Upgraded-Points-LLC.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Best travel insurance plans for 2024: a unique and comprehensive list for travelers from international citizens insurance.

Including the Best Plans for Seniors, Global Nomads, Visitors to the USA, Pets, Adventure Sports Addicts and More

BOSTON, MA / ACCESSWIRE / May 2, 2024 / International Citizens Insurance, a leading international insurance broker, has announced the best travel insurance plans for 2024 summer travel. As the cost of airfare and hotels continues to rise along with the increase in flight delays and cruise cancellations, this list could not have come at a better time for travelers looking to protect their travel plans and their finances.

"This summer's travel season promises a high level of demand, increasing costs, and a strong potential for travel disruptions due to political unrest, weather, and other factors," said Joe Cronin, President of International Citizens Insurance. "Our clients want travel insurance they can trust to help them if they suffer a cancellation, a medical emergency, lost luggage, a natural disaster, or have to change plans due to unforeseen events. With this list, they will be able to find the best overall travel insurers as well as the right plans for their individual needs."

International Citizens Insurance judged each company and plan on six key criteria: the user-friendliness of their site, the ease of policy purchase, the number of countries plans are offered in, how extensive the benefits are, the ease of making a claim and the quality of the company's customer service. The most trusted insurers include WorldTrips , who made history as one of the first insurers to offer plans for purchase over the internet; GeoBlue Travel Insurance , which supports seniors with coverage for people up to 84 years old; and Trawick International, which offers coverage for over 500 adventure sports activities.

To help customers find the best insurance for their specific needs, International Citizens Insurance has also identified the best insurance for several use cases, including Cancel for Any Reason (CFAR) insurance, travel medical plans, and insurance with coverage for pets. International Citizens Insurance has also identified the best plans for clients with special needs, including seniors, missionaries and volunteers, U.S. citizens abroad, and digital nomads.

In today's unpredictable world, travel insurance has become the most essential accessory for any international traveler. Travelers want trip cancellation insurance to protect their trip and travel medical insurance plans to protect their health. But with so many companies out there, which ones can you trust?

Learn more about the best travel insurance companies at https://www.internationalinsurance.com/travel-insurance/best-companies.php .

About International Citizens Insurance

International Citizens Insurance is the insurance division of International Citizens Group. We provide educational content, reviews, and unique comparison engines that enable travelers and expatriates to research, quote, compare, and purchase global life, travel, and international health insurance from various carriers.

Contact Information

Joe Cronin President [email protected] 617-500-6738

Andrew Blomberg Vice President, Global Group Benefits [email protected] (339) 221-5190

SOURCE: International Citizens Insurance

View the original press release on newswire.com.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Faye Travel Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can be a worthwhile investment, especially if you’re worried about unexpected costs during your trip. There are a ton of different travel insurance companies out there, so finding one that suits your needs can be a struggle. That’s why we’ve done the work for you.

Let’s take a look at travel insurance provider Faye to see what type of plans the company offers, the coverage levels you can expect and whether Faye travel insurance is right for you.

About Faye travel insurance

Faye is the brand name for customizable travel protection plans offered by a company called Zenner Inc. Its website notes that it specializes in quick reimbursements, which can be a big draw for travelers. Policies issued by Faye are underwritten by the United States Fire Insurance Company.

» Learn more: How to pick between travel insurance providers

Faye insurance plans

Unlike many other travel insurance companies , Faye offers only one plan.

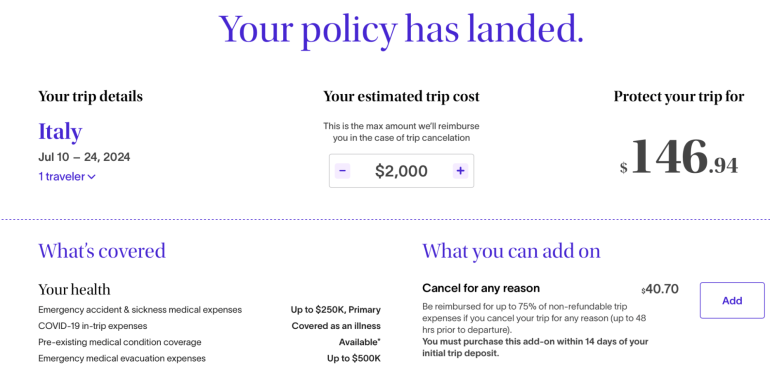

To find out what types of coverage Faye travel insurance plans include, we generated a quote for a 44-year-old woman from Arizona who was traveling to Italy for two weeks. Her total trip cost came in at $2,000.

Here’s what Faye provides:

This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis .

The plan is comprehensive and includes coverage you don’t typically see, such as reimbursement for lost credit cards and a payment for being inconvenienced.

Faye also offers a number of customizations; there are different add-ons from which to choose, all of which vary in price. More on your options in the next section.

» Learn more: How travel insurance for domestic vacations works

Plan add-ons

If you'd like to customize your Faye travel insurance plan to meet your needs more specifically, you can add on extra coverage for more money.

» Learn more: How does travel insurance work?

What isn’t covered by Faye

Even if you purchase a very comprehensive travel insurance policy, there are still situations where you’re not covered.

These include:

Bad weather, including hurricanes, if the policy was purchased after the storm was named.

Intentionally self-inflicted injuries or suicide.

Expenses incurred while under the influence of drugs or alcohol.

High-risk sports for which you are paid.

Psychological disorders, unless you’re hospitalized.

War and acts of war.

Illegal acts.

Piloting or learning to pilot or acting as crew of an aircraft.

To find the full list of exclusions for your specific policy, be sure to review your plan’s benefits schedule.

» Learn more: What to know before buying travel insurance

How to choose a Faye plan online

Purchasing a Faye travel insurance plan online is simple. You’ll first want to head to the company’s website to generate a quote.

You’ll need to input information like your age, where you live, where you’re going and how long you’re going to be away. Once you’ve got that all entered in, you’ll be taken to the results page.

Here, you’ll be able to see what plan options you have available, as well as what add-ons there are to pick.

After you’ve selected the coverage you’d like, you’ll need to go through the online checkout process.

» Learn more: Is travel insurance worth it?

Which Faye plan is best for me?

Although Faye has just one base plan available for purchase, it has plenty of different add-ons from which to choose. Faye sorts its bundles and add-ons according to the trip you’re taking, so you may see your bundled offer vary from time to time.

For tentative plans . Choosing to add on a Cancel For Any Reason (CFAR) policy can provide peace of mind if your travel plans aren’t solid. With the ability to get up to 75% of your money back, you’ll just want to make sure you’re canceling at least 48 hours in advance.

For pet owners . Not many travel insurance companies include coverage for your pets , especially not when it comes to vet bills. With a low overall cost, this add-on can make a huge difference if you end up delayed on your return.

For those wanting to customize everything . Faye’s base plan allows customers to create tons of different customizations according to their travel needs. Even though it’s costly, it makes up for it with wholly comprehensive coverage.

Faye’s travel insurance offerings may suit your needs, but before purchasing a plan, take a look in your wallet. Many different travel credit cards offer complimentary travel insurance , which can include benefits such as trip cancellation reimbursement, rental car insurance and more.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Personal Accounts

Business Accounts

Online Services

Help & Support

Personal Cards

Businesses Cards

Featured Personal and Business Cards

Discover More

Online Travel

Business Travel

Other Travel Services

Credit Card

Membership Rewards® Program

Other Reward Programs

Benefits and Offers

Refer a Friend

Corporations

Small Business

Global Network

You are now leaving this American Express website and will transfer to the Royal & Sun Alliance Insurance Company of Canada(RSA) website. RSA is responsible for handling your claim. All of the information you provide will be subject to the RSA Privacy Policy that can be found on their website. Claims are subject to terms, conditions, limitations and exclusions as outlined in the Certificate of Insurance. Please continue to the RSA website by clicking continue below. Continue Cancel

Amex ® travel insurance..

Coverage you need to feel confident when you travel.

You are now leaving this American Express website and will transfer to the Royal & Sun Alliance Insurance Company of Canada’s(RSA) website, the insurance underwriter for AMEX ® Travel Insurance. All of the information you provide will be subject to the RSA’s Privacy Policy that can be found on their website. Please ensure that you review the premium, coverage details and exclusions of all our Travel Insurance plans to select a product appropriate for your circumstances, including your financial and coverage needs Continue Cancel

Amex ® Travel Insurance is optional group travel insurance underwritten by Royal & Sun Alliance Insurance Company of Canada.

After assessing all of your current coverages, to help you find an appropriate Amex Travel Insurance product, please use our ‘Get a quote or purchase a plan’ feature or call 1 844 200-8959.

Don't have an American Express ® Card?

You may still apply for coverage

that suits your needs.

Cardmember?

See what coverage is included on

your Card and explore additional

travel insurance options.

Need to make a

We're here to help – 24 hours a day, 7 days a week.

You are now leaving this American Express website and will transfer to the Royal & Sun Alliance Insurance Company of Canada’s(RSA) website, the insurance underwriter for Amex ® Travel Insurance. All of the information you provide will be subject to the RSA’s Privacy Policy that can be found on their website. Please ensure that you review the premium, coverage details and exclusions of all our Travel Insurance plans to select a product appropriate for your circumstances, including your financial and coverage needs Continue Cancel

Get insurance coverage for your travel needs.

Whether you are looking to embark on a road trip across the country or a quick trip to a top Canadian destination, you can feel good knowing that Amex ® Travel Insurance 1† may cover the following:

- Trip cancellation, interruptions or delays

- Loss, theft or damage of baggage and personal items

- Expensive medical bills in the event of an emergency

Due to the global pandemic and travel restrictions, certain trip cancellation/interruption and other travel coverages available under an Amex Travel Insurance plan 1† may be restricted or unavailable. For more information, please visit www.rsagroup.ca/amexcovid19 .

Need your insurance today?

Don’t leave home without packing extra reassurance with Amex ® Travel Insurance 1† . Get a free, no obligation quote online in minutes and you could receive policy document immediately when you buy online.

Travel Insurance Plans

Per-Trip Plans (single trip)

Whether you’re heading on a weekend road trip or backpacking through Europe, our flexible trip insurance plans can provide travel insurance for your one-off travels.

Multi-Trip Annual Plans (unlimited trips of 10, 16, or 31 consecutive days)

Frequent traveller? Amex Travel Insurance provides Multi-Trip Annual Plans that are a convenient and cost-effective way to get travel insurance coverage when you travel more than once in a 365-day period.

Emergency Medical

Trip Cancellation Insurance

Trip Interruption Insurance

Baggage & Personal Effects

Flight & Travel Accident

Frequently Asked Questions

How does COVID-19 affect my coverage?

How do i purchase amex ® travel insurance.

Get a no obligation quote and make a purchase online in minutes by clicking the ‘Get a quote or purchase a plan’ feature on the Amex® Travel Insurance home page , or by calling +1-844-200-8959.

What is the maximum number of days I can buy travel insurance for?

You can purchase travel insurance for up to 365 days, which will cover you beyond the maximum number of days allowed outside your Canadian province or territory of residence. This is provided you receive written permission from the provincial government in your province of residence to maintain your provincial government health insurance coverage beyond the regular maximum in advance of your departure. In the event of a claim, you will be asked to provide such written permission.

When should I buy travel insurance?

If you are planning on travelling outside your home province or territory, it’s important to purchase travel insurance before you leave, to help protect yourself in the event of a medical emergency. If you plan on purchasing pre-paid travel arrangements, you may wish to consider purchasing trip cancellation/trip interruption coverage at the same time in order to protect your investment should you have to cancel your trip due to a covered reason.

How do I file a complaint in relation to the service or coverage I have received?

Why Amex ® Travel Insurance?

Coverage meets

Amex ® Travel Insurance provides flexible coverage to fit your travel plans and budget.

Service you can

You can travel with confidence knowing your trip is backed by the same quality service from American Express that you’ve come to know and trust.

Flexible to suit your needs

Amex ® Travel Insurance offers four pre-packaged plans that may be topped up or extended based on the coverage you’re looking for.

We keep it simple

With us, you can get a free, no-obligation quote online in minutes and you could receive policy documents immediately when you buy online.

Contact us: 1-844-200-8959

Mon - Fri: 8am-8pm (EST); Sat: 9am-5pm (EST)

† Amex ® Travel Insurance is optional group travel insurance underwritten by Royal & Sun Alliance Insurance Company of Canada. You may contact the insurer at 1-888-877-1710 in Canada and the U.S. or visit rsagroup.ca . In this outline, we have given a brief description of just some of the benefits available under Amex ® Travel Insurance. All insurance coverage is subject to the terms and conditions of the Group Policy issued to Amex Bank of Canada and the applicable limitations and exclusions described in the Certificate of Insurance issued upon enrollment. Please read the Certificate of Insurance carefully. Amex ® Travel Insurance is underwritten by Royal & Sun Alliance Insurance Company of Canada. Amex Bank of Canada identifies insurance providers and products that may be of interest to some of its customers. In this role we do not act as an agent or fiduciary for you, and we may act on behalf of the insurance provider, as permitted by law. We want you to be aware that we receive compensation from insurance providers and our compensation may vary by provider and product. We do not require you to purchase any insurance product, and you may choose to cover your insurance needs from other sources on terms they may make available to you.

® , TM: Used by Amex Bank of Canada under license from American Express.

© 2022 Royal & Sun Alliance Insurance Company of Canada. All rights reserved. ®RSA, RSA & Design and related words and logos are trademarks and the property of RSA Insurance Group Limited, licensed for use by Royal & Sun Alliance Insurance Company of Canada. RSA is a trade name of Royal & Sun Alliance Insurance Company of Canada.

COMMENTS

American Express Travel Insurance is offered through American Express Travel Related Services Company. Inc., California license number 0649234. Enrollment is limited to permanent residents of the 50 United States or D.C. American Express Travel Related Services Company, Inc., which is the licensed insurance agency offering you this coverage ...

Covered amount. The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is ...

Rewards. Coverage. The Platinum Card® from American Express. $695 (see rates & fees) 5x on flights booked directly or with Amex Travel (on up to $500,000 per calendar year), 5x on hotels booked through Amex Travel. Terms apply. Trip cancellation, interruption and delay Insurance.

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Eligibility and Benefit level ...

Up to $2,000 per person for checked bags and $3,000 per person for carry-ons, up to $3,000 per person. N/A. Premium Global Assist. The Business Platinum Card ® from American Express. $10,000 per covered trip, up to $20,000 in a 12-month period. Up to $500 per trip for delays above 6 hours. Secondary.

How to make an AmEx travel insurance claim. To file a claim, you'll need to contact your benefit administrator. The phone number and timeframe will vary according to the type of insurance you ...

Level 1: Higher-end cards. Some of American Express' top products offer baggage insurance coverage of up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage. This coverage is in excess of coverage provided by the common carrier.

The maximum benefit amount for Trip Cancellation Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. The maximum benefit amount for Trip Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is secondary to and in excess of any ...

Rental Car Coverage. The Amex Platinum Card provides a number of rewards and benefits for rental cars, including premium status with Avis, Hertz and National, as well as loss and damage insurance ...

American Express Travel Insurance offers 4 levels of travel insurance package policy plans — a Basic Plan, Silver Plan, Gold Plan, and Platinum Plan. Each has its own levels of coverage and associated premium cost. Let's take a look at the package policy offerings and pricing. We chose a week-long trip for a 40-year old that cost $3,000.

Trip Cancellation and Interruption Insurance. New trip cancellation and interruption insurance from American Express credit cards will provide you with up to $10,000 in coverage (and up to $20,000 ...

For the trip cancellation and interruption insurance coverage benefit of The Platinum Card® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card.

Trip Cancellation and Interruption Insurance is effective for round-trip purchases made entirely with your eligible Card and protects against Covered Losses (e.g. Sickness or Injury of the traveler or traveling companion). If your Card is not listed on this page or if you are an Additional Card Member, please call the number on the back of your ...

Overall, the average cost of a plan came out to $257.78, though one plan priced out far below the rest. Basic coverage cost. Recommended for. Allianz Travel. $453. Those with pre-existing ...

Car rental loss and damage insurance. When you rent a car, you can use your Amex Platinum Card travel insurance to cover damage or loss. You'll have to pay for the rental with your card and ...

Travel insurance is included on many cards and can offer peace of mind in case of the unexpected. This insurance generally covers your spouse or partner and, in some cases, your immediate and extended family. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product.

Terms apply. Generally speaking, trip cancellation insurance from AmEx will cover your trip's prepaid, nonrefundable costs under eligible circumstances. The coverage maximum for reimbursement is ...

The option to purchase Premium Protection car rental insurance on the Amex Gold card is a game changer. You'll pay one low price of $12.25 to $24.95 for the entire period, up to 42 total days, for primary theft and damage coverage. The actual rate will depend on your state of residence and the level of coverage chosen.

The Travel Inconvenience Insurance Plan provides benefits in the event of: Missed Departures and Missed Connections; delay, cancellation or overbooked flights; and Luggage Delay and Extended Luggage Delay when the Covered Trip is purchased and charged to your American Express International Dollar Card (IDC).. Up to US$250 per covered person for alternate travel, restaurant meals or refreshments

Key exclusions and limitations * Claims arising directly or indirectly from any pre-existing medical conditions other than those on the accepted conditions list which is available by visiting our Insurance Benefit Centre * Medical assistance and expenses benefits if aged 70 years or over at any time during the trip 1 * Medical treatment in the country of residence

Including the Best Plans for Seniors, Global Nomads, Visitors to the USA, Pets, Adventure Sports Addicts and More. BOSTON, MA / ACCESSWIRE / May 2, 2024 / International Citizens Insurance, a ...

Please note: There is important updated information regarding COVID-19 and insurance coverage you may have available to you. Coverage is available for COVID-19 medical emergencies, provided a travel advisory to avoid non-essential travel or avoid all travel due to COVID-19 is not in effect for your destination or cruise.

Shopping for travel insurance? Explore Faye's customizable plans and coverage details to see if they're the right fit for you and your upcoming travel needs.

† Amex ® Travel Insurance is optional group travel insurance underwritten by Royal & Sun Alliance Insurance Company of Canada. You may contact the insurer at 1-888-877-1710 in Canada and the U.S. or visit rsagroup.ca. In this outline, we have given a brief description of just some of the benefits available under Amex ® Travel Insurance. All ...