A Practical Guide to Buying Travel Insurance

Travel insurance could be the difference between a huge medical bill or a modest copay. use these tips to find the best policy for your trip..

- Copy Link copied

It’s far better to buy travel insurance and never use it than to not be covered in an emergency.

Courtesy of Shutterstock

For many, travel insurance can seem like an unnecessary, additional expense. But if you get stuck in a costly situation—a medical emergency, a canceled trip due to a pandemic , a stolen camera—it suddenly feels like a totally worthwhile investment that saves, not costs, you money.

This was the case for writer Chris Ciolli. After years of traveling without a safety net, she invested in travel insurance on a recent trip during which she was rushed to the hospital at 3 a.m. for a slew of just-in-case tests. She ended up with an underwhelming diagnosis of gastritis, but also a slow trickle of medical bills—a few hundred dollars here, a thousand there—that totaled nearly $6,000. Fortunately, her month-long $185 World Nomads policy covered everything after an initial $80 copay.

But even if you understand the benefits and you’re committed to buying travel insurance, choosing the right policy for your needs—and even knowing what those needs are—can be tricky. To help you choose the best travel insurance for your trip, we’ve consulted a number of travel agents, insurance industry professionals, and lifelong travelers for advice. In this guide, you’ll find everything you need to know, from travel insurance reviews and comparisons to common questions answered, to pick the best policy for your next trip.

What is travel insurance?

Travel insurance is a plan, similar to health or auto insurance, that protects you from expenses incurred during unforeseen mishaps while traveling, such as lost luggage, trip cancellations, or medical emergencies.

Although your current homeowner’s, renter’s, auto, or health insurance may cover you for certain things while traveling, it usually doesn’t cover everything—especially on international trips. A good travel insurance plan will cover the gaps.

Where do you get travel insurance?

Some very basic forms of travel insurance are included if you booked your trip with a credit card such as World MasterCard, Capital One Venture Rewards, and Chase Ink and Sapphire cards. With these plans, you may be covered for some delay, luggage, and travel accident expenses, but it’s usually pretty basic.

You can also purchase it as an add-on while booking flights, cruises, or hotels. These plans are also limited and will only cover you in the event of an unavoidable cancellation due to events such as a natural disaster or a death in your family. “While it may seem less expensive, it may not cover all of the components of your trip,” says Andrew David Harris, vice president and COO of Harris Travel Service .

While both of these are better than nothing, the most comprehensive and best travel insurance policies are sold by providers such as World Nomads, Allianz Global Assistance, Seven Corners, or TravelEx. You can purchase these plans through your travel agent, but it’s often less expensive to book directly with the travel insurance provider or through a comparison website, like Squaremouth .

What does travel insurance cover?

Every traveler and trip is different, which is reflected by the variety of travel insurance plans on the market. No matter what plan or provider you choose, below are some common things travel insurance covers. Experts agree that before you buy, you should absolutely look for specific exclusions in the fine print on potential policies. If you’re unsure about something, reach out. A good insurance company will be responsive and willing to clarify your questions.

Trip cancellation and interruption

Most travel insurance policies will include some form of trip cancellation and interruption coverage to reimburse you for nonrefundable expenses, like a prepaid hotel or plane ticket. Unless you add cancel for any reason (CFAR) insurance to your plan, there will be a limited set of acceptable reasons to claim this. Illness, death of an immediate family member, and weather are commonly accepted reasons.

Trip delays and missed connections

Also common is reimbursement for additional expenses incurred if a trip is delayed and meets criteria set out by the provider. With World Nomads, your flight must be delayed by at least six hours to qualify.

Baggage and personal effects

Most plans will cover the cost of lost or damaged luggage and personal belongings, as well as the cost of purchasing additional items if your luggage is delayed.

Emergency medical and dental care

This covers the cost of medical care when you get sick or have an accident in another country and usually includes medical evacuation. However, travel insurance isn’t a substitute for regular health insurance so nonemergency medical expenses (physicals, anything cosmetic, eye exams) aren’t covered. Childbirth isn’t covered either, even for pregnant travelers who go into labor prematurely.

Shannon O’Donnell, 2013 National Geographic Traveler of the Year and blogger at A Little Adrift , mentions another coverage gap travelers miss: “You’re only covered for what you’re licensed to do back home—if you don’t have a permit for a motorbike and you drive one in Southeast Asia, you might not be covered in an accident.”

Emergency medical evacuation

This covers the cost of an emergency transfer (in an ambulance or helicopter, for example) from an area with inadequate medical care to the nearest medical center with the services you need. It’s costlier but essential in isolated and politically unstable parts of the world.

Accidental death and dismemberment and repatriation

Phil Sylvester, head of PR and Media Communications for World Nomads, says that “truckloads of coverage for hospital costs and medical repatriation home” are the most important things to look for. “The rest is just window dressing.” A lot of basic plans won’t include this in their coverage, but you can easily add this on with an upgrade to a more premium tier.

Concierge and 24/7 service

Daniel Durazo, director of Marketing and Communications for Allianz Global Assistance , says that “a good policy includes a 24/7 contact line for both medical and travel emergencies.”

Common travel insurance add-ons to consider

A basic plan is usually enough for most travelers, but it may not cover everything you need if you’re older, have pre-existing medical conditions, participate in sports while traveling, book an expensive trip, or travel with expensive gear (such as a high-end camera). If you fall into any of these categories, consider an add-on or upgrade.

Upgrade lost luggage, trip delay, and cancellation amounts

“Standard travel insurance levels cover more modest belongings and lodging,” advises Annette Stellhorn, president and Group Luxury Travel designer at Accent on Travel . If you’re traveling with expensive gear or spending a lot on your trip, consider upgrading to a tier that covers your costs adequately.

Additional coverage for adventure and high-risk travel

Stellhorn also notes that adventure and high-risk travel “require higher benefit amounts for medical evacuation, which can run more than $250,000.” And Judy Perl at Judy Perl Worldwide Travel says that “most insurance companies will not insure high-risk travel at all, with the exception of big companies like First Allied and Travelex .” Even less risky activities and sports may only be covered to a limit—that is, climbing to certain heights and diving to certain depths.

Most sports are only covered up to a certain level of intensity—any higher and you may have to purchase a different tier of insurance. World Nomads, for example, will cover a slew of adventure travel activities and sports, but at an additional cost on top of its basic insurance.

Cancel for any reason (CFAR) insurance

It’s important to read the fine print of any insurance plan because, even if it includes trip cancellation coverage, this often only kicks in under certain circumstances. As many travelers found out recently, trips canceled due to the recent coronavirus pandemic were not covered unless they had a CFAR add-on .

Jennifer Wilson-Buttigieg, co-owner and copresident at Valerie Wilson Travel , explains that these plans “only cover 75 percent of trip expenses [and only] if travelers cancel their trips at least 48 hours in advance.”

Does travel insurance cover pandemics?

No. “Once actual events have unfolded, such as the current coronavirus outbreak, they are considered known or foreseeable events and are no longer covered by most travel insurance policies,” says Michelle Baran . The exception is if you chose to upgrade your plan to include a CFAR add-on. During the current coronavirus outbreak, getting the CFAR add-on is definitely a good idea.

What are the best travel insurance policies?

The best travel insurance policy will depend on you and your trip. You’ll want to make sure you have a plan that covers the cost of your entire trip and the activities you want to do and won’t leave you in the dark if you have pre-existing conditions. The following are some of the best travel insurance partners to consider:

Best for: Older travelers and those with pre-existing conditions.

While Allianz provides great travel insurance for any traveler, it’s especially appropriate for those with pre-existing conditions, since those are covered in every one of its plans. However, its basic coverage only covers up to $500 in lost or damaged baggage, so consider an upgrade if you’re traveling with more expensive equipment.

Get a quote: allianztravelinsurance.com

Seven Corners

Best for: Traveling during the COVID-19 outbreak

Although most travel insurance plans don’t cover travelers in the current coronavirus pandemic without a CFAR add-on, Seven Corners has designed a plan specifically for travelers planning a domestic road trip in the United States, Canada, or Mexico, called Armor . Its Liaison Travel Plus and Wander Frequent Traveler Plus plans also include medical coverage should you need medical attention due to COVID-19. Seven Corners has been providing high-quality travel insurance coverage since 1993 and, pandemic or no, is one of our top choices.

Get a quote: sevencorners.com

Best for: Medical coverage only

GeoBlue’s Voyager basic medical coverage is not a comprehensive travel insurance plan that covers a slew of scenarios, but rather just provides travelers with basic medical travel insurance. The deductible is a high $500 but at $19 to $35 per trip, it’s an inexpensive way to protect yourself in case something catastrophic happens. If you feel like you’re adequately covered for travel mishaps like lost luggage or stolen goods by other insurance (like your credit card or homeowner’s insurance), this might be the insurance for you.

Get a quote: geobluetravelinsurance.com

Best for: Traveling with kids

With TravelEx, travelers can choose between a basic or select travel insurance package with options to customize it according to their needs. Both plans cover standard things like trip cancellation and emergency medical services and are an all-around comprehensive option. However, its Travel Select plan also includes free coverage for any children under 17 traveling with you. For families, TravelEx Select is a great money-saving option.

Get a quote: travelexinsurance.com

How much does travel insurance cost?

Complete travel insurance packages can cost as little as $8 per day, but vary depending on the length of the trip, destination(s), and the tier of travel insurance you choose. Some, but not all, travel insurance may also cost more for travelers with pre-existing conditions or older adults.

As a comparison, here are some examples of travel insurance costs for a 45-year-old traveler on a $5,000, one-week trip to Mexico:

- $98 for an explorer plan with World Nomads

- $188 for a basic plan with Allianz

- $214 for a basic plan with AIG

- $226 for a basic plan with Travelex

While some of these plans may seem expensive, keep in mind that if they provide you the coverage you need, they can be a huge money saver. Insurer World Nomads says that its average claim amount for 2017 was $1,634, and its most expensive claim—a medical evacuation of a child from Sitka, Alaska, to Seattle—was nearly $200,000. Suddenly, that $8 per day makes travel insurance worth it . But, as Michael Holtz, founder and CEO of the travel agency Smart Flyer , says, “People don’t think they need it until they need it.”

How do I buy travel insurance?

You should always buy travel insurance from an official, reputable provider or website, such as purchasing directly through the insurance provider, a travel agent, or a comparison website; these “offer a way to search, compare, and purchase from a wide array of plans,” says Stan Sandberg, cofounder of TravelInsurance.com .

Comparison sites to buy travel insurance include:

- Travelinsurance.com

- Squaremouth

- Insuremytrip

Sandberg strongly recommends consumers speak with a licensed agent when they are unsure about benefits. The website elliot.org is another good resource and features a list of reputable travel insurance companies compiled by consumer advocate Christopher Elliott.

When to buy travel insurance

Generally, you should book your travel insurance as soon as you can after booking your flights and hotels. If you’re traveling to a destination affected by hurricanes , book sooner than later, because you can’t buy insurance to cover delays or cancellations related to a storm that already has a name.

People with pre-existing conditions need to take other factors into consideration. Most insurers will only cover expenses related to prior illnesses in very specific circumstances; travelers with pre-existing conditions must book coverage within a specific time frame—usually between 14 and 21 days—following their initial trip reservation, and they must be medically able to travel on the date they purchase the insurance.

Your travel insurance policy period should be for the duration of your trip from door to door (no gaps or shortcuts, please), and cover you for every place you plan to visit, whether it’s in-state, out of state, or international. Some destinations are higher risk than others so insurers don’t offer the same coverage for the same price everywhere.

What does your existing insurance cover while traveling?

While your existing health, auto, renter’s, or homeowner’s insurance may cover a few things while you’re traveling, it likely doesn’t cover everything.

- Health insurance: Many U.S. healthcare policies, including Medicare, don’t cover travelers on international trips. Some plans will cover you abroad, so check with your provider. If your health insurance only covers you domestically, both the Centers for Disease Control and the U.S. State Department recommend purchasing medical travel insurance.

- Travel insurance: Credit cards can provide limited coverage of some delay, luggage, and travel accident expenses, as well as part of your rental car insurance.

- Homeowner’s and renter’s insurance: Home contents or rental insurance may cover some lost, stolen, or damaged valuables or even offer a reasonably priced floater policy (an add-on to your regular policy that covers easily moveable property) if you travel with expensive equipment.

- Auto insurance: Within the United States, your primary auto insurance will almost always cover rental vehicles. There are a few exceptions for domestic rentals, like if your current auto insurance has low coverage limits. International car rentals are a different story. In Mexico, for example, rental car insurance is mandatory , even if you have insurance at home. Always be sure to check local rules before you reserve a rental car.

Tips for filing claims and getting reimbursed

Unlike most domestic health insurance policies, travel insurance doesn’t typically have a deductible. Some inexpensive policies will require you to pay a small, nonrefundable, initial policy excess amount before further costs up to the benefit limit are covered. Many policies work on a reimbursement plan: You pay upfront, save your receipts, and file a claim, then after processing, your insurance company pays you back for covered expenses.

Most policies require you pay nonemergency expenses out of pocket and submit your claim for reimbursement afterward. In a non-life-threatening emergency, call your insurer for instruction if you’re able—it will make the claims process easier, and the insurer may be able to direct you to a hospital or medical center where your care can be billed directly to it.

Hannah Logan, of the blog Eat Sleep Breathe Travel , says this step is especially important because the small print on many policies “reads that calling the contact number [may be] a requirement for coverage.”

No matter what, document everything. Whether it’s lost baggage, a medical expense, or damage to your rental car, gather and keep anything that can help your claims case: your original rental car agreement, receipts, photos, medical paperwork, a copy of your boarding pass.

Buying travel insurance is a little like packing a suitcase—it can seem overwhelming at first, but eventually it becomes a routine and necessary part of every trip. And once it does, you can travel worry-free, calm in the knowledge that you’ve saved yourself from a possible $6,000 mistake.

This article originally appeared online in 2018; it was updated on June 19, 2020, to include current information.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

>>Next: Everything You Need to Know About Getting a New U.S. Passport

The Best Travel Insurance Companies of 2021

Best overall travel insurance, best for solo travelers.

John Hancock

Best for Tailored Plans

Allianz Global Assistance

Best for Premier Travel Insurance Plans

AXA Travel Insurance

Best for Adventure Sports Coverage

World Nomads

Best Travel Insurance for Groups

APRIL International

Advertiser Disclosure

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

Reviews Report

- Reviews.com rates IMG as the best travel insurance company, earning a 4.75 out of 5.

- The best travel insurance companies have broad areas and limits of coverage and excellent service for the insured.

- Medical coverage and trip cancellation/interruption are must-haves when choosing the best travel insurance company.

Travel insurance is an often overlooked way to protect the investment in your vacation or trip abroad. It covers incidents such as canceling trips, medical evacuation, lost or delayed baggage, and more. However, picking the best travel insurance policy isn’t always easy — especially when COVID-19 has slowed travel and canceled trips outright.

In making our selections for the best travel insurance companies of 2021 we analyzed each company’s travel insurance offerings using a number of criteria like medical coverage limits, available add-on coverage options, and the number of plans to choose from.

The 6 Best Travel Insurance Companies of 2021

- IMG : Best Overall Travel Insurance

- John Hancock : Best Insurance for Travel Cost Reimbursement

- Allianz Global : Best Travel Insurance for Tailored Plans

- AXA : Best for Premier Travel Insurance Plans

- World Nomads Travel Insurance : Best Travel Insurance for Adventure Sports

- APRIL International : Best Travel Insurance for Group Travel

Compare the Best Travel Insurance Companies

Information accurate as of April 2021

Why we chose it

- 4.75 Reviews Score Score is based on company’s customer experience, financial stability, and coverage options.

- NR AM Best Rate AM Best rates insurance providers creditworthiness. Ratings are based on the provider’s ability to follow through with a payout when a consumer files a claim.

- $100K–$500K Medical Coverage Medical coverage is what the company will pay out to you if you were injured or ill on your trip and needed medical care abroad.

- 180 days Trip Length This is the maximum number of days the travel insurance company will cover your trip.

- Plans specifically for seniors available

- Additional add-on coverage available

- High medical coverage

- Number of plans is limited

- Lengthy wait to initiate claim for lost luggage

- Trip cancellation: $50K

- Trip interruption: 150% cost of trip

- Medical coverage: $500K

- Medical evacuation: $1M

- Sports/recreation: $500K

- Travel delay: $500 (Max $125/day)

- iTravelInsured Travel Lite

- iTravelInsured SE

- iTravelInsured LX

- Senior plan

- 4.2 Reviews Score Score is based on company’s customer experience, financial stability, and coverage options.

- A+ AM Best Rate AM Best rates insurance providers creditworthiness. Ratings are based on the provider’s ability to follow through with a payout when a consumer files a claim.

- $50K–$250K Medical Coverage Medical coverage is what the company will pay out to you if you were injured or ill on your trip and needed medical care abroad.

- 90 days Trip Length This is the maximum number of days the travel insurance company will cover your trip.

- Multiple plans

- 24/7 emergency travel assistance

- Up to $1K missed connection coverage

- Lower medical emergency coverage than competitors

- Few add-on coverage

- No free child traveler coverage

- Trip cancellation: Up to 100% of trip cost

- Trip interruption: Up to 150% of trip cost

- Emergency medical: Up to $250K

- Medical evacuation: Up to $1M

- Baggage delay: $500

- Lost baggage: $2,500

- Bronze: Basic plan with lower coverage limits than other two

- Silver: Intermediate plan with more value than Bronze

- Gold: Premier plan with best coverage

More John Hancock Insurance Reviews

- John Hancock Travel Insurance Review

- 3.4 Reviews Score Score is based on company’s customer experience, financial stability, and coverage options.

- $25K–$50K Medical Coverage Medical coverage is what the company will pay out to you if you were injured or ill on your trip and needed medical care abroad.

- Multiple plans to choose from

- Children 17 and under, free

- Annual plan for multiple trips

- Relatively low medical limits

- Often difficult to compare multiple plan offerings

- Some plans are relatively expensive

- Trip cancellation: Up to $100,000

- Trip interruption: Up to $150,000

- Medical coverage: $50,000

- Emergency medical: $25,000

- Lost baggage: $1,000

- Change fee: $500

- Annual Plans

- One Trip Cancellation Plus

- One Trip Basic, Prime, Premier

- One Trip Emergency Medical

More Allianz Global Insurance Reviews

Allianz Travel Insurance Review

- 4 Reviews Score Score is based on company’s customer experience, financial stability, and coverage options.

- $25K–$250K Medical Coverage Medical coverage is what the company will pay out to you if you were injured or ill on your trip and needed medical care abroad.

- 60 days Trip Length This is the maximum number of days the travel insurance company will cover your trip.

- Very comprehensive top tier coverage

- Broad adventure travel coverage

- No deductible

- Limited coverage for lower tier plans

- Extensive exclusions for lost/damaged personal property

- Trip delay: Up to $300/day; $1,250 max

- Medical coverage: Up to $250K

- Medical evacuation: Up to $1M

- Baggage delay: Up to $750 max

- Lost baggage: Up to $3K

- Silver Plan: Basic plan

- Gold Plan: Better value

- Platinum Plan: Premier coverage

- Adventure Product

- 2.75 Reviews Score Score is based on company’s customer experience, financial stability, and coverage options.

- Not Rated AM Best Rate AM Best rates insurance providers creditworthiness. Ratings are based on the provider’s ability to follow through with a payout when a consumer files a claim.

- Up to $100K Medical Coverage Medical coverage is what the company will pay out to you if you were injured or ill on your trip and needed medical care abroad.

- Adventure sports coverage

- Language apps for iPhones

- COVID-19 coverage

- No pre-existing med coverage

- Restricted civil unrest coverage

- Less extensive med coverage

- Emergency dental: $750

- Trip cancellation: $2,500 / $10K

- Trip interruption: $2,500 / $10K

- Medical evacuation: $300K / $500K

- Lost, damaged, stolen gear: $1K/$3K

- Standard Plan

- Explorer (Enhanced) Plan

- 4.25 Reviews Score Score is based on company’s customer experience, financial stability, and coverage options.

- 60-90 days Trip Length This is the maximum number of days the travel insurance company will cover your trip.

- High coverage for trip delay

- Group travel policies available

- Cancel for any reason available

- Low trip cost coverage

- Sports equipment coverage not automatic

Add-ons and Coverage

- Trip cancellation: 100% of cost

- Cancel for any reason: 75% of cost (only for Pandemic Plus plan)

- Trip interruption: 150%–175% of cost

- Medical evacuation: $500K (only for Pandemic Plus plan)

- Lost baggage: Up to $2,500

- APRIL Pandemic Plus

- APRIL Trip Cancellation

- APRIL Choice with Pre-Ex Waiver

- APRIL Cruise

Travel Insurance: What You Need to Know

Travel insurance is an optional protection that most travelers should consider. Travel insurance helps people recover losses if travel plans are disrupted. This can include full recovery of prepaid expenses if the trip is canceled entirely as well as coverage for expenses incurred on a trip if facing problems such as a medical emergency or lost items.

A number of credit card companies provide some automatic travel insurance but coverage is limited and often doesn’t cover crisis situations such as the need to evacuate for a civil disturbance or natural disaster. The best travel insurance policies will provide full coverage, can be tailored to specific needs, and reimburse customers for losses and costs that will arise if plans go astray.

Purchasing travel insurance works much like buying other common coverage, such as home or auto insurance. The first step is to understand and list all of anticipated travel costs and potential risks, then contact several companies to obtain quotes to compare.

What Travel Insurance Covers

Medical care and evacuation.

The best travel insurance policies provide coverage for emergency medical expenses should a traveler be injured or become ill. Most policies will also offer coverage for the cost of evacuation due to a medical emergency.

Typically, plans reimburse for the cost of emergency care up to a limit set in the policy. It is important to review these limits carefully in light of personal medical risks and health concerns specific to the travel destination. Medical coverage will continue to be a vital part of any trip planning during the COVID-19 pandemic and post-pandemic environments.

Trip cancellation and interruption

Trip cancellation coverage is important if you need to completely cancel a trip because of personal reasons, weather-related incidents, or other covered events. You should review the coverage to assure that protection also applies when a trip is cut short for one of these same reasons.

This interruption coverage is designed to reimburse travelers for the unreimbursed costs incurred for the unused part of the trip. When searching for appropriate travel insurance policies, make sure to carefully forecast your costs for a trip Interruption or cancellation and ensure coverage limits are sufficient.

Delayed or lost baggage

Delayed baggage coverage reimburses travelers for the cost of obtaining toiletries and other basic necessities when baggage is delayed during a trip. On the other hand, lost baggage covers personal items and bags that are completely list and cannot be recovered. In addition to reimbursement for items lost, many policies provide lost baggage tracking assistance. Be certain to read the fine print as usually each of these coverages come with some pretty stringent conditions. Also, compare this coverage with coverage offered by your credit card providers, as this is one area where these coverages may overlap.

Cancel for any reason

For an additional fee, many insurers will add a “Cancel for Any Reason” provision, which covers travelers in the event of a canceled trip, because of the risk of some disaster, such as a forecasted hurricane or civil unrest while traveling internationally .

The policy timeframe for canceling a trip will be critical so it is important to review the specific policy terms and understand just how close to departure you can cancel and be covered. Also, the extra cost of this coverage can be steep so be certain it is necessary.

How to Choose the Best Travel Insurance Company

Prior to buying travel insurance, it is important to determine the travel coverage you may already have from other sources such as your credit cards, existing health insurance, or homeowners insurance. Also, have your total prepaid and anticipated trip costs calculated and handy.

Here are some tips on selecting the best travel insurance company policy for your needs:

- Review any home insurance, umbrella insurance, health insurance, and credit card coverage that may already apply to traveling. For example, some home insurance policies cover lost items no matter where you are and health insurance could apply to situations outside of the United States.

- Understand the factors that will guide you in selecting the best policy for you — length of trip, destination, your age and health condition and anticipated involvement in high risk sports or other activities.

- Compare the detailed features and prices of several plans — try to find the cheapest travel insurance company plan that will also cover everything you need.

- Understand all of the deductible options that are available.

- Read the fine print and don’t be afraid to ask questions of the insurance company when plans are confusing or you would like a modification to the plan offered.

Finally, once you have purchased a policy and before departing on your trip, make sure you understand the process for filing a claim and seeking emergency assistance should the need arise. You do not want to face a crisis on the other side of the world and not be able to put your hands on the number to call for help.

Travel Insurance FAQ

Can you buy travel insurance after booking a flight or hotel.

Yes, you can purchase travel insurance after you book your trip. In fact, it can be desirable as you will better understand all costs at that point. Do not wait too long though and miss out on some features.

Can you be refused travel insurance?

Unfortunately, yes. Travel insurance companies often take specific medical conditions into account and can refuse coverage if they determine the risk is too high. This is another good reason to explore various coverage options with different companies.

Is travel insurance worth getting?

Spending 5%–7% of the total cost of your trip to assure that you are not forced to spend perhaps several hundred thousand dollars for a serious medical problem and related expenses is worth getting travel insurance.

Methodology

We evaluated travel insurance providers based on coverage, number of plans, optional coverage, medical coverage limits, and AM Best ratings to determine Reviews.com scores and create our best travel insurance provider reviews. To compare travel insurance providers with other brands across the board, we calculate each Reviews.com score based on the following:

- Essential Coverage: When comparing travel insurance providers, we considered essential coverage to be 24/7 assistance, trip cancellation/interruption, medical evacuation and more. Providers with more points of essential coverage scored higher.

- Number of Plans: Flexibility and having options is important which is why Reviews.com awarded travel insurance providers with higher scores if they presented more plans.

- Add-on Coverage: Travel insurance providers with more optional coverage add-ons scored higher in this metric — higher flexibility and customization in travel insurance is an indicator of the best travel insurance companies.

- Medical Coverage Limit: We compared the medical coverage limits of the best travel insurance companies and awarded providers with higher scores if they had higher medical coverage limits.

- AM Best: Reviews.com utilized AM Best ratings to assign a score based on each home insurance company’s financial stability.

About the Authors

Rick Hoel Contributing Writer

Rick Hoel is an international business attorney and legal and insurance writer for Reviews.com. Over the last several years, he has covered topics dealing with personal and commercial insurance and technology and the law.

Recently Added

HTH Travel Insurance Review

World Nomads Travel Insurance Review

Allianz Global Assistance Travel Insurance Review

Table Of Contents

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Is Travel Insurance Worth It in May 2024?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does travel insurance cover?

What does travel insurance not cover, when is travel insurance not necessary, when is trip insurance worth it, where to buy travel insurance, how much does travel insurance cost, should you rely on credit card travel insurance instead, so, is travel insurance worth it.

Travel can be expensive. Insurance protects your nonrefundable vacation investment if the unexpected occurs. But is travel insurance worth it?

The answer will depend on whether your trip is refundable, where you're going, whether you'll have health coverage at your destination and how much coverage you already get from your credit card. Here are some key topics to understand when deciding if travel insurance is right for you.

Travel insurance (or trip insurance) covers a number of travel-related risks, from flight cancellations to lost bags to medical emergencies.

Accidental death insurance .

Baggage delay and lost luggage insurance .

Cancel for Any Reason insurance .

Emergency evacuation insurance .

Medical insurance .

Rental car insurance .

Trip cancellation insurance .

Trip interruption insurance .

The dollar amount of your coverage depends on the policy you bought and where and when you bought it. Most travel insurance providers offer several different policies to choose from, with higher or lower levels of coverage and higher or lower prices to match.

» Learn more: What to know before buying travel insurance

You can buy policies that cover a single trip, multiple trips or a full year. You can buy an individual policy or one that covers your entire family. There are many companies that offer policies, with Allianz and Travel Guard among the best-known. Here is a chart showing the benefits and coverage levels available on some Allianz policies.

NerdWallet recently analyzed various travel insurance policies to help you choose the plan that best aligns with your travel goals. Check out our results here: Best Travel Insurance Companies Right Now .

» Learn more: Does travel insurance cover medical expenses?

Incidents not covered by your travel insurance vary by policy and provider.

Pre-existing medical conditions are often excluded from coverage, meaning your benefits don't apply to claims related to that condition. Some policies cover pre-existing medical conditions if you meet certain criteria, for example if you purchased the policy within 14 days of paying for your trip and if you were well enough to travel when you booked your trip.

» Learn more: The best travel credit cards might surprise you

Plan on mountain-climbing or engaging in other dangerous activities on your trip? Many policies won't cover you if something goes wrong unless you buy a policy that specifically includes adventure sports. World Nomads travel insurance , for example, offers the Explorer plan, which includes coverage for cave diving, cliff jumping, heli-skiing and many other activities that are considered risky.

Other incidents excluded from a trip insurance policy may involve war, acts of terrorism and the use of alcohol, which can cause your injuries to be designated as "self-inflicted," or the use of drugs, which may be illegal.

If you want full flexibility to cancel your trip you'll need to find a policy that allows you to purchase a Cancel For Any Reason (CFAR) add-on. This additional benefit does exactly what the name implies and allows you to cancel your trip for any reason. Typically, you'll get around 75% of your prepaid nonrefundable trip expenses back, although exact timing and percentages vary by policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

Travel insurance primarily covers two aspects of your trip — your nonrefundable reservations and your medical expenses while traveling.

If all of your reservations can be canceled without penalty, then trip cancellation or trip interruption coverage isn't necessary. But even if your trip isn't 100% refundable, insurance may not be necessary. For example, a cheap flight and hotel stay may not be worth covering, though you may still want to purchase travel insurance for medical situations.

Medical coverage typically is not necessary if you have a U.S.-based health insurance policy and you're traveling within the U.S. In those cases, you probably already have adequate coverage for illness or injury.

There are a few reasons that travel insurance can be worthwhile: to protect your nonrefundable trip costs, your luggage or your health.

When should you get trip cancellation and/or trip interruption insurance?

If you would lose the money you paid for your flights, accommodations, rental car, or activities if you had to cancel or go home early, travel insurance that specifically includes trip cancellation and trip interruption is probably a good idea. If your trip is canceled or interrupted for a covered reason, this protection will cover your reservations.

For example, if you're planning to travel to a destination that could have weather-related issues, like hurricanes in the Caribbean, travel insurance may protect your noncancelable reservations. Some policies also provide emergency evacuation to escape dangerous situations. However, if you try to purchase travel insurance after the storm poses a risk, the insurance probably will not protect you.

When should you get baggage delay and/or lost luggage coverage?

Imagine if you go on a one week trip and your checked baggage is lost or delayed. While you’re waiting to get your luggage, baggage delay insurance will reimburse you for any essentials (i.e. toiletries, medicine, socks, clothing, etc.) that you may need to purchase because you don’t have your own things.

But what if the worst case scenario happens and your bag is just lost or stolen? Lost luggage insurance will reimburse you for your misplaced bag, up to a specified dollar amount.

If you’re only traveling with a carry-on, you don’t need these two types of coverage.

When should you purchase travel medical insurance?

U.S.-based health insurance policies generally offer coverage anywhere within the U.S. But if you get sick or hurt when you travel internationally, some policies like Medicare may not cover you.

Even if your health insurance covers you outside the country, doctors at your destination may not accept it. Without travel insurance, you could be stuck paying for these bills out of pocket, then seeking reimbursement from your healthcare provider.

When should you purchase CFAR?

Most travel insurance policies won’t help you get your expenses if you cancel for a “non-covered” reason, like when your plans change or you simply don’t want to go anymore. That’s when it might be good to purchase CFAR.

If you’ve booked a trip but think that you may need to cancel for a reason that’s not covered by trip cancellation, the CFAR add-on will allow you to get up to 50-75% of your nonrefundable trip costs back as long as you cancel at least 2 - 3 days before the trip starts. The add-on must also be purchased within a specific time of the initial trip deposit (usually 14 - 21 days).

What can be an example of a cancellation that’s reimbursable under CFAR? Let’s say you book a trip with your significant other but you break up a week before the trip and don’t want to go alone. Or you book a trip really far in advance but when the date nears, you realize that you don’t want to go anymore. CFAR will be helpful for you in these instances.

When should you purchase travel insurance even though you already have a credit card that provides it?

If you already have some travel insurance protections (e.g., trip cancellation, trip interruption, baggage delay) from your credit card, but you feel that the limits are insufficient, consider purchasing a comprehensive travel insurance plan or a standalone travel medical insurance policy to protect you in case of medical emergencies on your trip.

» Learn more: The majority of Americans plan to travel this year, according to recent NerdWallet study

If you booked your trip through a travel agent, you can likely purchase coverage through them. That includes online travel booking engines like Expedia. If you're taking a cruise , you're usually offered the chance to purchase coverage during the booking process. Similarly, airlines may offer you certain types of coverage when you book a flight through their website. If you have an award booking , you have travel insurance options too.

Another option: Purchase travel insurance directly through the website of a travel insurance company, like Allianz , AXA or Travel Guard .

» Learn more: Airline travel insurance versus independent travel insurance: Which is right for you?

The cost of travel insurance is based on the specifics of your trip. The best way to get a price is to request a quote through the websites of travel insurance providers. Or you can compare multiple insurers in one place with a consolidator like InsureMyTrip.com or SquareMouth .

Many travel credit cards provide certain types of coverage in case your flight is delayed or canceled, your rental car is damaged, or your luggage is lost or delayed.

Here are a few credit cards offering travel protections that could serve as an alternative to travel insurance. But even with these cards, the benefits have a lot of fine print.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Travel accident: Up to $500,000.

• Rental car insurance: Up to $75,000.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Travel accident: Up to $1 million.

• Rental car insurance: Up to the actual cash value of the car.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

These are attractive benefits, but the coverage may not be as broad as you would get buying insurance. For example, AmEx cards only cover round-trip travel, so if you don’t have a return flight booked yet, you might want to consider additional coverage.

Secondly, only the Chase Sapphire Reserve® provides emergency medical and dental coverage. The other cards don’t.

Plus, these cards can come with steep annual fees that may be more than you would pay for a travel insurance policy. So don't sign up for a card just to cover one trip unless you've compared costs.

» Learn more: The best credit cards for travel insurance benefits

If you've paid a considerable sum for a nonrefundable vacation, travel insurance is likely a good idea. International travelers who need coverage in case they get sick or injured should also consider buying a policy. If troubles arise, you'll be glad that you're protected.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Ad-free. Influence-free. Powered by consumers.

The payment for your account couldn't be processed or you've canceled your account with us.

We don’t recognize that sign in. Your username maybe be your email address. Passwords are 6-20 characters with at least one number and letter.

We still don’t recognize that sign in. Retrieve your username. Reset your password.

Forgot your username or password ?

Don’t have an account?

- Account Settings

- My Benefits

- My Products

- Donate Donate

Save products you love, products you own and much more!

Other Membership Benefits:

Suggested Searches

- Become a Member

Car Ratings & Reviews

2024 Top Picks

Car Buying & Pricing

Which Car Brands Make the Best Vehicles?

Tires, Maintenance & Repair

Car Reliability Guide

Key Topics & News

Listen to the Talking Cars Podcast

Home & Garden

Bed & Bath

Top Picks From CR

Best Mattresses

Lawn & Garden

TOP PICKS FROM CR

Best Lawn Mowers and Tractors

Home Improvement

Home Improvement Essential

Best Wood Stains

Home Safety & Security

HOME SAFETY

Best DIY Home Security Systems

REPAIR OR REPLACE?

What to Do With a Broken Appliance

Small Appliances

Best Small Kitchen Appliances

Laundry & Cleaning

Best Washing Machines

Heating, Cooling & Air

Most Reliable Central Air-Conditioning Systems

Electronics

Home Entertainment

FIND YOUR NEW TV

Home Office

Cheapest Printers for Ink Costs

Smartphones & Wearables

BEST SMARTPHONES

Find the Right Phone for You

Digital Security & Privacy

MEMBER BENEFIT

CR Security Planner

Take Action

Should You Buy Travel Insurance for the Holidays?

Here's what to consider when buying a policy, sharing is nice.

We respect your privacy . All email addresses you provide will be used just for sending this story.

When booking a holiday getaway, you often have more to consider than the price of an airline ticket and hotel. You also have to decide whether to buy travel insurance, which could be useful if a trip is canceled or delayed because of natural disasters at your destination, such as the wildfires in California or a winter storm.

"Some travel insurance policies also allow you to cancel a trip if your home is damaged by a wildfire or hurricane ," says Julie Loffredi, a spokeswoman for InsureMyTrip.com, a leading travel insurance comparison website.

Terrorism is another reason travelers may want to opt out of a trip. In the wake of terror attacks earlier this year in England and New York, online searches for terrorism coverage are up 49 percent over a year ago, says Steven Benna, a spokesman for SquareMouth, another website that compares travel insurance options.

There are generally three types of policies offered by insurers: basic, midlevel, and premium, with coverage and prices increasing accordingly. Policies that allow you to cancel for any reason give you the most flexibility and the best option to back out over fears about terrorism anywhere in the world rather than just on your itinerary.

If you're thinking about purchasing travel insurance, here's what you should consider first:

Choices: If you buy from a travel agent, you'll probably be offered only one or two policies from one company. Some online travel sites also tend to limit your choices. You can get more options by going to travel insurance comparison websites like InsureMyTrip.com (800-487-4722), which sells hundreds of policies from 29 insurance companies, and SquareMouth (800-240-0369), which offers 110 policies from 25 insurers. Price: Travel insurance generally costs 5 percent to 10 percent of your prepaid nonrefundable costs. So if your up-front airline tickets, resort hotel, cruise , and/or family tour package add up to, say, $8,000, travel insurance can cost $800. Older travelers may pay more, along with those taking longer trips or opting for more comprehensive coverage or the cancel-for-any-reason protection. The best way to make sure you aren't overpaying is to shop around.

Go to Consumer Reports' 2017 Holiday Gift Guide for updates on deals, expert product reviews, insider tips on shopping, and much more. And be sure to check our Daily Gift Guide .

Whether the policy offers a waiver for a pre-existing medical condition: Unexpected injury and illnesses are usually covered. But if you consulted a doctor about a problem 60 to 180 days before your trip and that problem arises after you pay for your travel expenses, that would be considered an excludable pre-existing condition.

To be eligible for a pre-existing medical condition waiver, buy your travel insurance within 10 to 14 days of making your first payment for your travel, says Jim Grace, CEO of InsureMyTrip.com.

Whether the policy provides healthcare coverage: U.S. health insurance coverage for travel overseas varies by insurer and plan, so you must contact your carrier to get the details of your specific policy, says Cathryn Donaldson, a spokeswoman for America's Health Insurance Plans, a trade association. In general, Medicare does not cover you outside the U.S., but Medicare supplemental policies might.

So travel insurance could be useful for healthcare benefits. Although most trip cancellation/interruption coverage requires a small deductible or none at all, travel healthcare coverage gives you the option of a zero to $1,000 deductible. Of course, the lower the deductible, the higher the premium.

Likelihood you might need medical evacuation: The more adventurous and remote your travel plans are, the more it will cost to transport you to competent medical treatment. A commercial flight with a rescue nurse can cost $10,000 to $50,000, and an air ambulance can cost $20,000 to $250,000, depending on the departure point and destination as well as medical complexity, says William Siegart, M.D., chief medical officer of On Call International, one of the major services providing medical evacuations.

On Call arranges medical evacuation for ill and injured travelers 24/7/365 to a worldwide network of 4,000 medical centers via numerous air ambulance and commercial medical transport providers.

Whether the policy offers coverage you don't need: "Don't buy insurance that covers small, manageable losses or only a slice of risk," says Bob Hunter, director of insurance for the Consumer Federation of America. For example, losing some of your belongings won't break you financially, so keep a close eye on your valuables and be ready to accept losing less valuable stuff. If you're worried about dying in a plane crash, buy term life insurance , which covers you no matter how you die as long as your policy is in force, rather than flight insurance, which only pays benefits if you die in a plane crash and covers you only for the short time you're flying.

Jeff Blyskal

I learned how corporations operate as a reporter at Forbes and now use my business savvy to uncover the tricks and find better deals for consumers like you. My passion for investigative reporting about money earned two National Magazine Awards and a Loeb Award. I love sharing wine with my wife and pitching batting practice to my MLB-focused son. Follow me on Twitter (@JeffBlyskal).

Be the first to comment

TPG's comprehensive guide to independent travel insurance — including coronavirus coverage

Update: Some offers mentioned below are no longer available. View the current offers here .

As we head into the middle of summer and vaccination rates continue to expand, travel is surging back. More countries are opening back up to tourists , and many U.S. destinations are seeing a notable uptick in visitors. If you are planning to travel this year, it's a good idea to think about third-party travel insurance. No one wants to think about having to cancel a trip last minute or something going wrong while away from home. But having travel insurance can help give you peace of mind and potentially save you hundreds or even thousands in case things do go awry.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

We'll start off with everything you need to know about third-party travel insurance coverage during the COVID-19 pandemic before diving into the ins and outs of trip protection as a whole.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that will fit your travel needs.

Trip insurance during COVID-19: What you need to know

We'll give you the bad news first: Some travel insurance plans do not cover coronavirus disruptions . This holds true whether your plan is included with your credit card or was purchased from a third-party provider. The most important thing to do is carefully review the policy details — some plans specifically exclude COVID-19, while others exclude pandemics in general.

Related: Will future travel insurance plans offer coronavirus protection? Experts say yes

While it's true that trip insurance covers illness and emergency evacuations, the coronavirus pandemic does not fall under the qualifying criteria unless you personally have been diagnosed with the coronavirus, which falls under the typical clauses on illness.

Travel insurance doesn't cover cancellations from airlines, restricted country entrance guidelines based on coronavirus-related border closures or many of the pandemic-related reasons why you might not be able to complete a trip as planned.

Related: When should you purchase travel insurance, and when are your credit card trip protection benefits enough?

Plans typically cover unforeseen issues such as accidental bodily injury; loss of life or sickness; severe weather; terrorist incident; and jury duty or a court subpoena that cannot be postponed or waived. If you need to cancel your trip and are looking for full reimbursement under the policy, it must be due to a covered reason listed within the policy's wording.

Some airlines now offer free coronavirus coverage — but even if you qualify, your coverage and benefits are often quite limited.

How many insurance plans offer COVID-19 coverage?

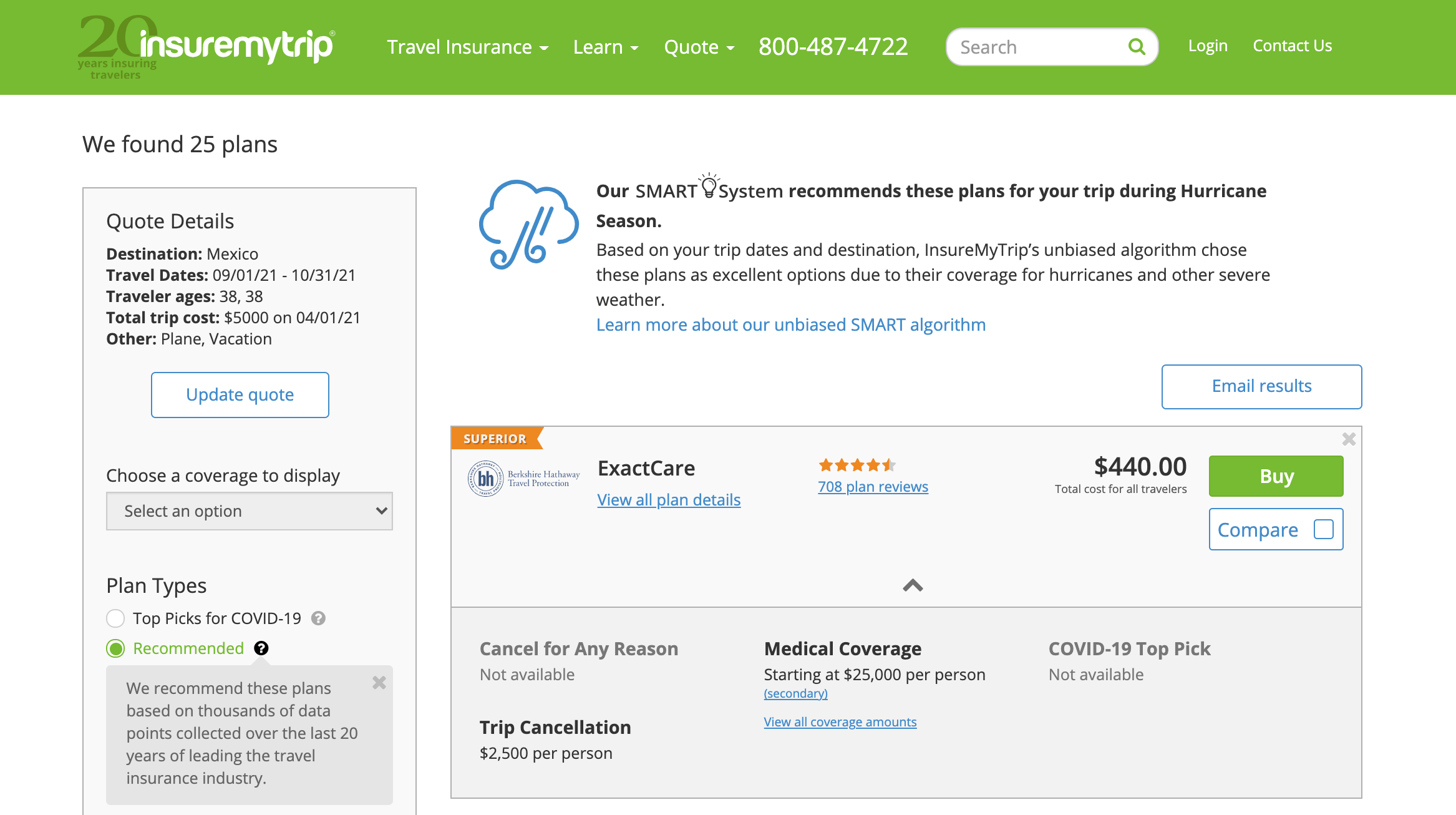

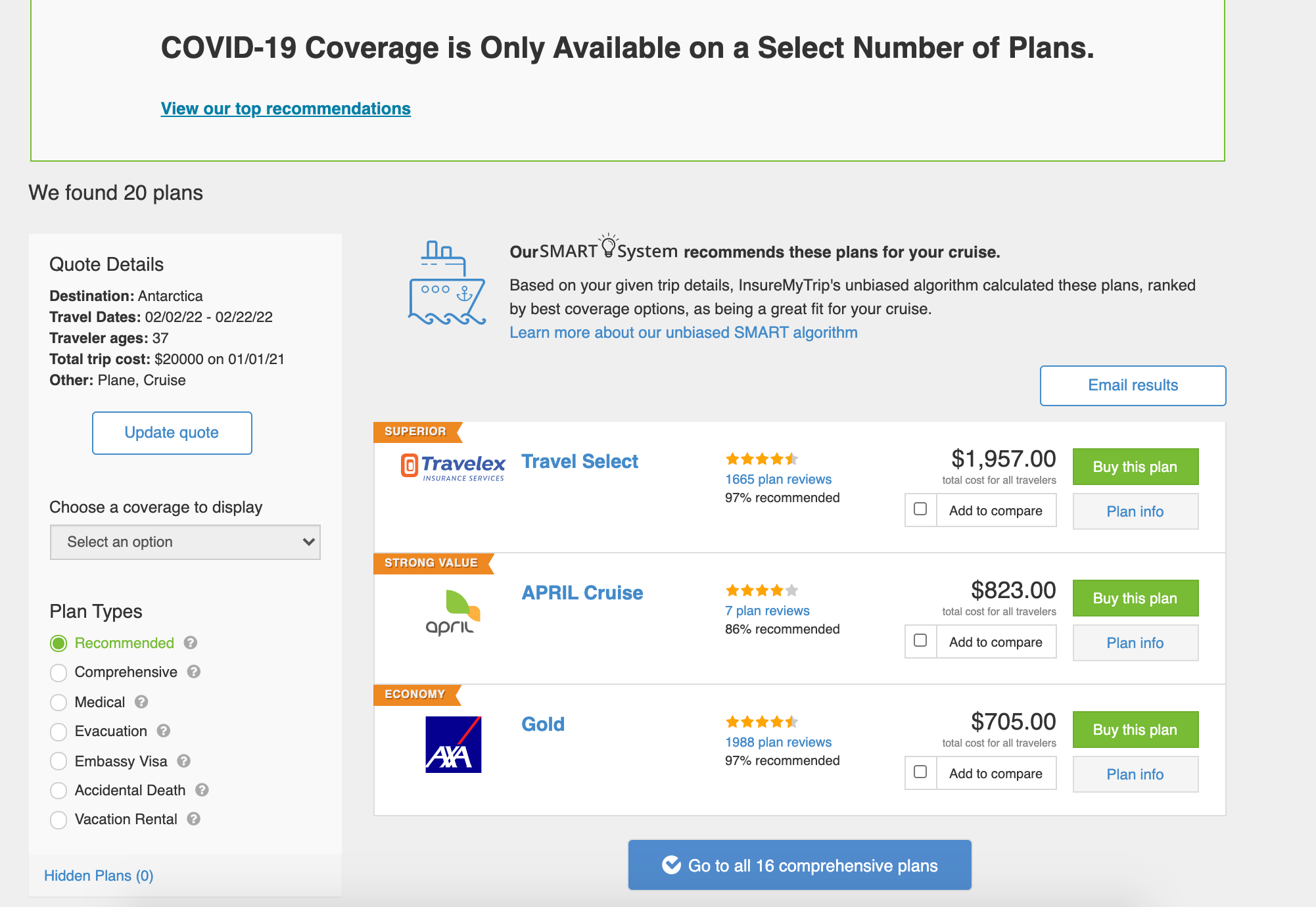

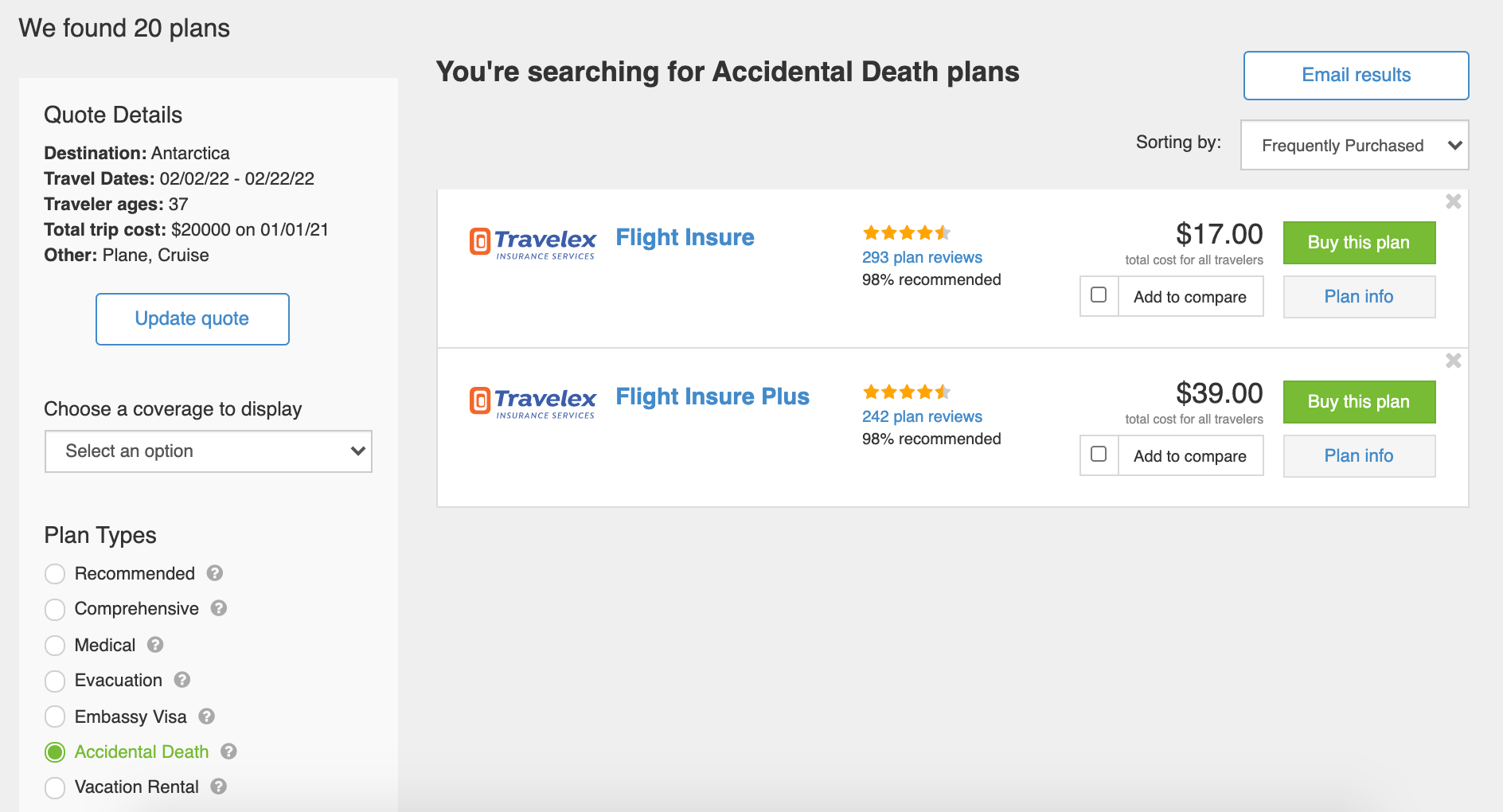

Your insurance options will vary depending on your destination, trip duration and many other factors. However, let's show you an example in action from the insurance marketplace website InsureMyTrip .

In the screenshot below, you'll see that a traveler from New York purchasing insurance for a hypothetical two-month stay in Mexico in the fall of 2021 has 25 plans to choose from.

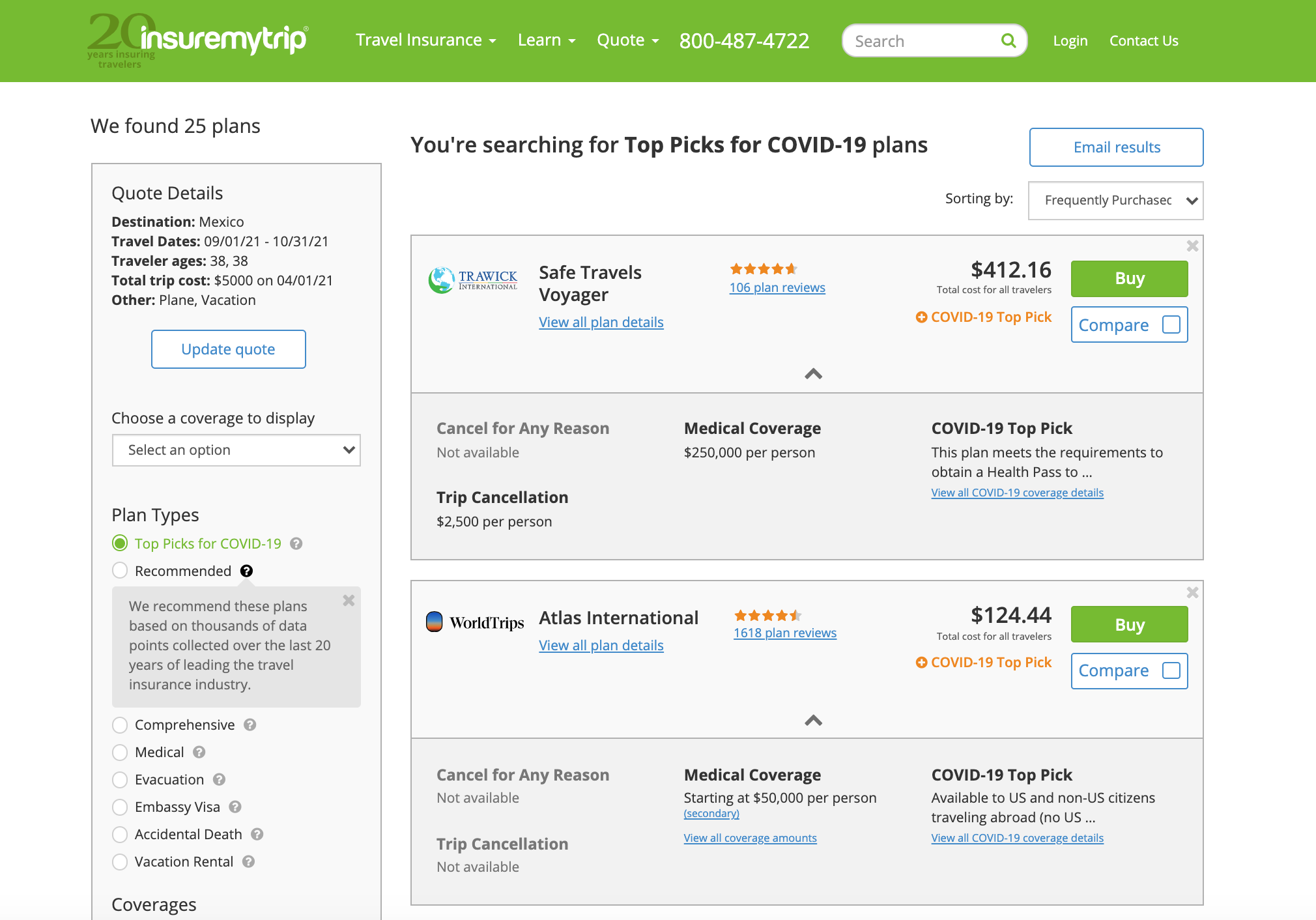

However, someone looking for COVID-specific coverage should select the "Top Picks for COVID-19" option at the left-hand side of the results page. This will then display the best options for your unique travel details.

Furthermore, costs and coverage vary significantly between the coronavirus-covered plans. A comprehensive plan in this example trip — issued by Trawick International in the above screen shot — starts at $412.16, while a basic medical plan with emergency coverage for serious COVID-19 issues only — issued by WordTrips — costs $124.44.

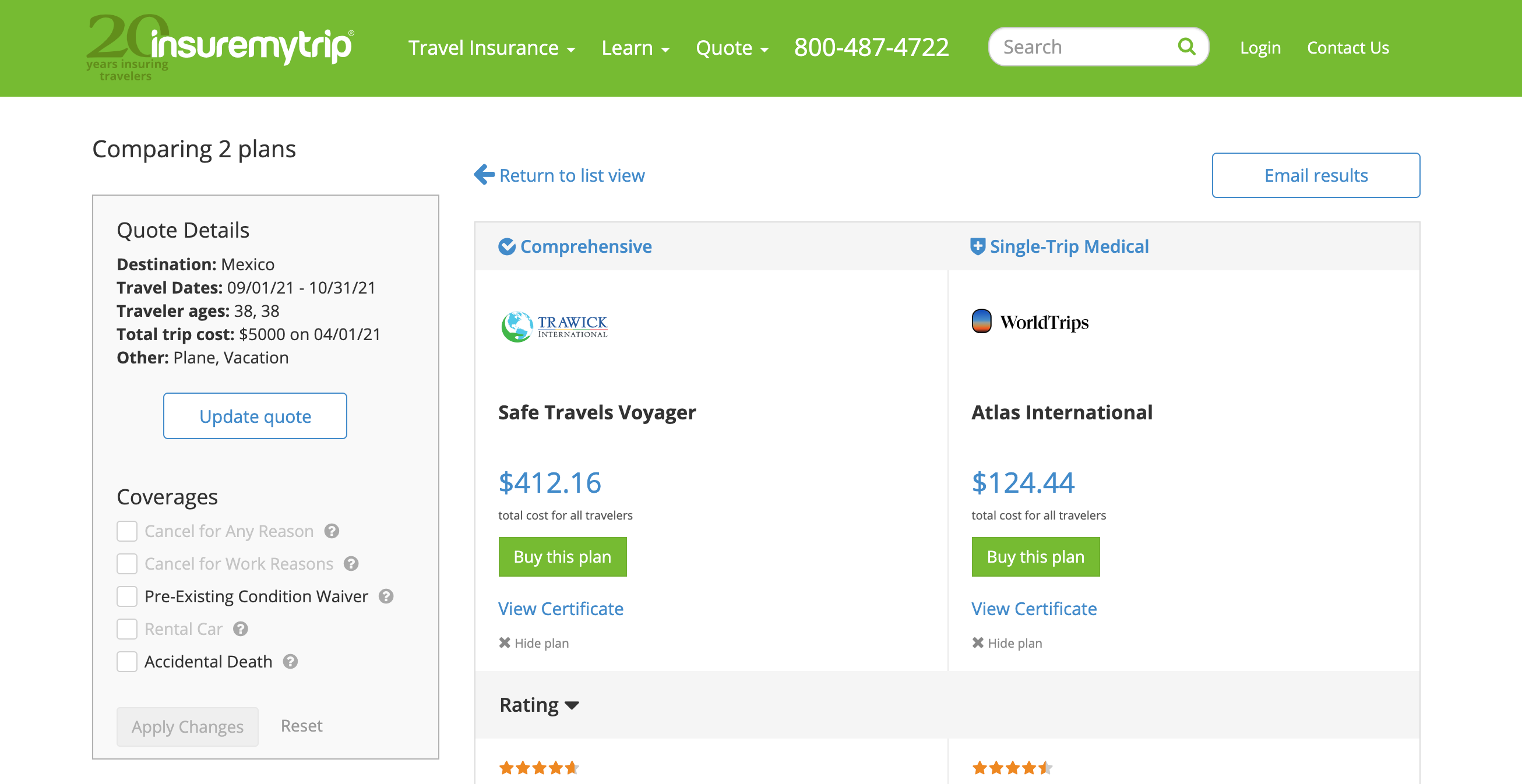

The easiest way to do a side-by-side comparison of these plan options is by checking the Compare boxes for each of them.

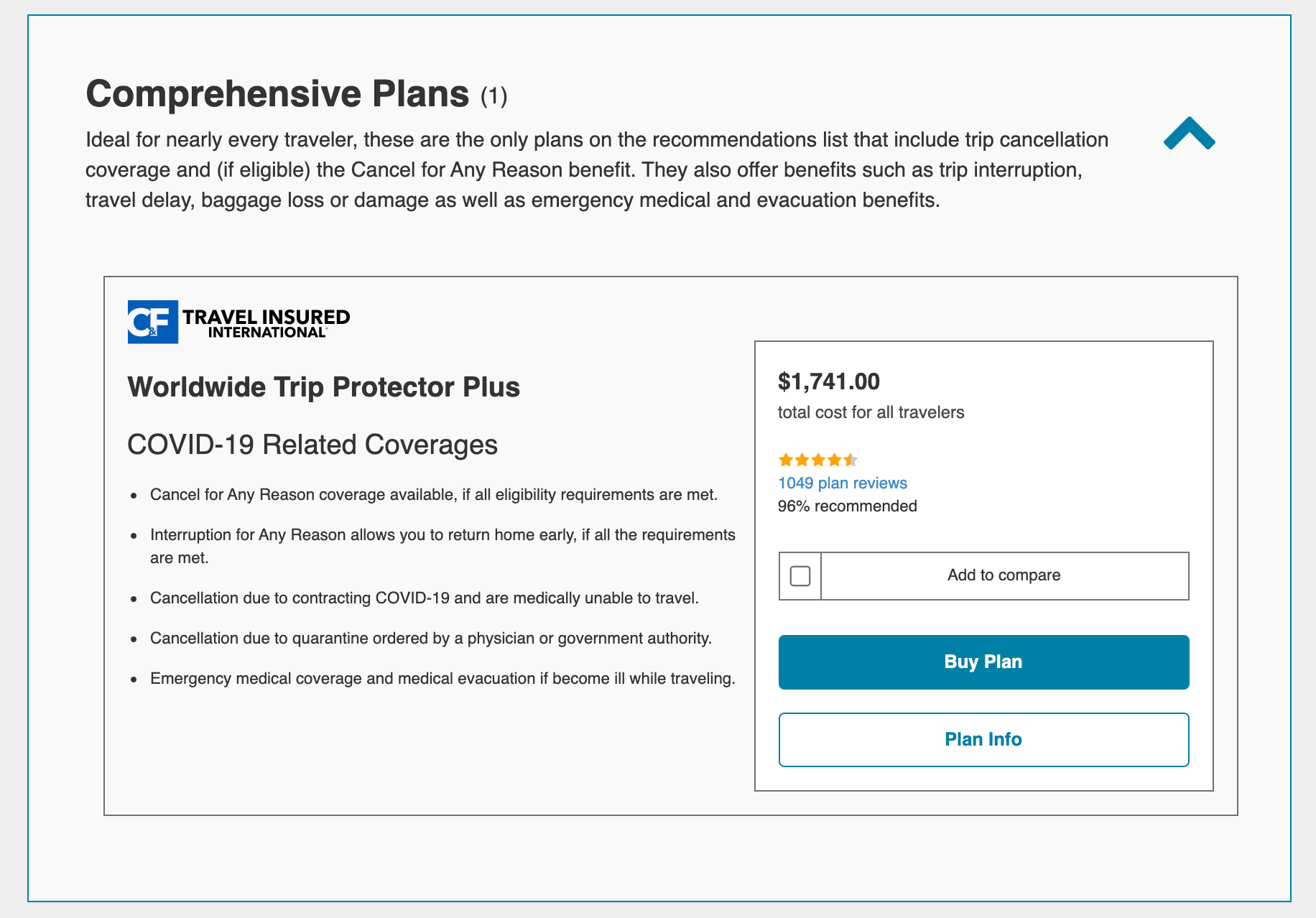

From this page, you'll see that the comprehensive plan (Safe Travels Voyager) is just that — comprehensive. For the significantly higher cost, you're receiving trip cost protection along with coverage for baggage loss or delay, travel delay, emergency medical, emergency medical evacuation and more. The Travel Medical Plan, on the other hand, only offers coverage for emergency medical services (including evacuation) and only when you leave your home country. This medical plan won't offer any assistance if you aren't traveling abroad.

So, if you're worried about losing money on a trip due to contracting COVID-19 or other related fears, what should you do?

Haven't left home yet? Purchase "cancel for any reason" or coronavirus-specific coverage before you go.

If you're planning for a trip in the near future, you may still be able to purchase coverage now.

But while you can usually purchase basic travel insurance up to 24 hours before departure, most premium add-ons such as "cancel for any reason" coverage must be purchased within a certain number of days from when you made your initial trip payment. If you've already had a trip planned for some time but haven't purchased insurance yet, do some research to see if you're still within the correct timeframe from your initial trip payment in order to qualify for "cancel for any reason" coverage — or other time-sensitive benefits.

If you're worried you may need to cancel your trip for a pandemic-related reason, a "cancel for any reason" insurance plan could be a good investment to hedge your bets. Some comprehensive plans will offer "cancel for any reason" coverage if all eligibility requirements are met, but that option will cost more — usually an additional 40-50% on top of the base premium.

With Squaremouth travel insurance , for example, you'll have to purchase "cancel for any reason" insurance within 14 to 21 days of making your initial payment on vacation expenses, and you also have to insure 100% of your trip costs in addition to canceling your trip at least 48 hours before departure time to receive a refund of up to 75% of the trip cost.

Related: Everything you need to know about "cancel for any reason" travel insurance

If you're only concerned about worst-case scenarios, consider a medical evacuation plan

As of Jan. 26, 2021, travelers entering the U.S. must provide proof of a negative COVID-19 test before boarding their international flight into the country.

But, this policy did raise questions for some travelers: What if a traveler is asymptomatic, or the test result is a false positive? Where can tests be found last minute? If a traveler can't return home, who foots the bill for unexpected expenses?

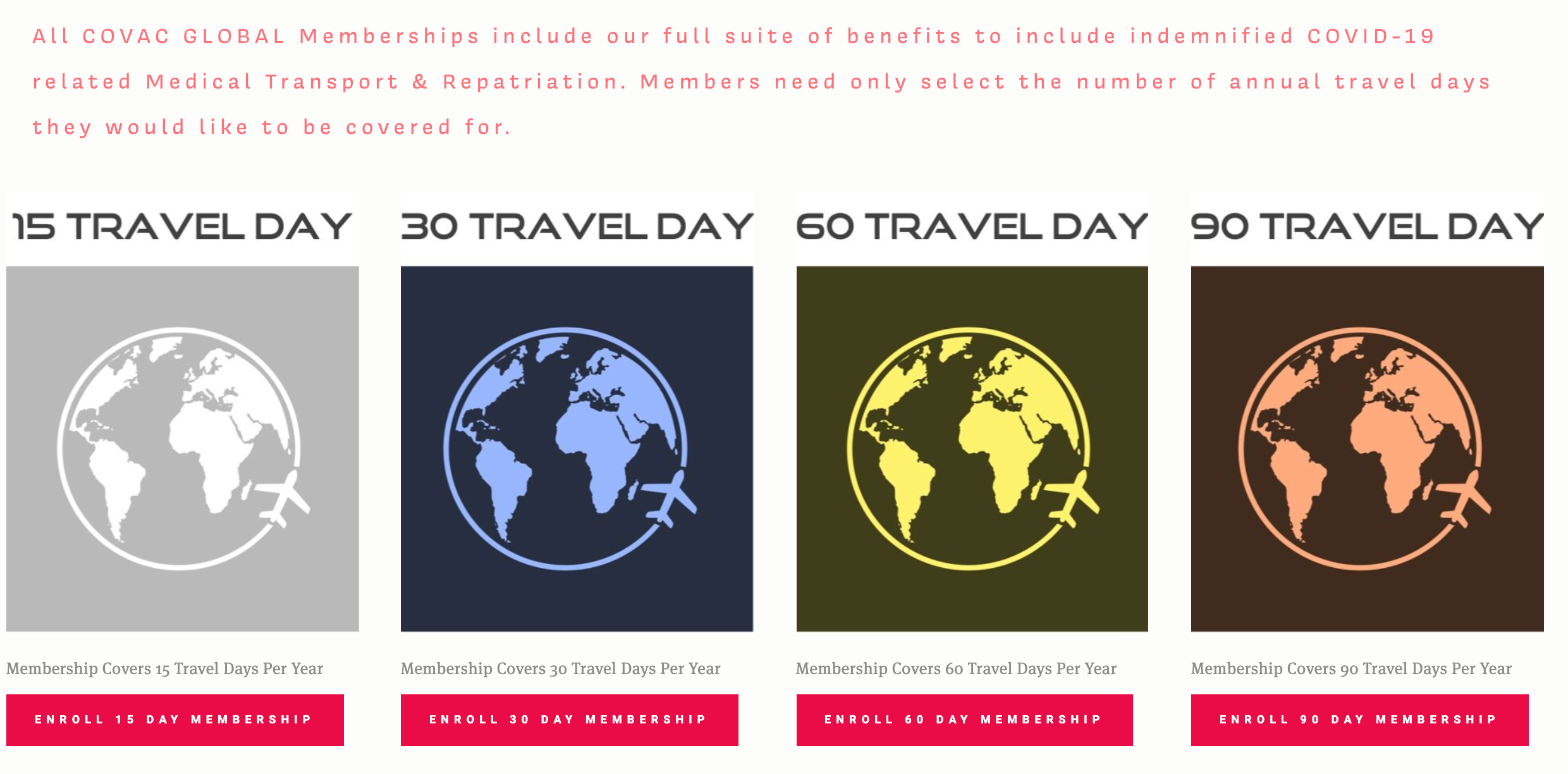

Enter companies like COVAC GLOBAL , which offer coronavirus-positive travelers a way to get home without flouting CDC requirements.

While commercial, private and charter flight passengers are all subject to the health requirements, medical transports are exempt. Thus, COVAC's insurance policy offers customers the guarantee of a private flight home on a medical transport aircraft, provided the traveler holds a positive PCR test result and shows at least one COVID-19 symptom.

COVAC's unique plan rates begin as low as $27 per person per day (on the 90-day membership), although travelers must purchase a minimum of 15 days of coverage at once. But customers can use the coverage days however they like. For example, a four-day trip this month would mean 11 days of coverage left over for future travel.

As with other forms of insurance, however, travelers can't purchase a COVAC plan when they test positive; plans require a 14-day delay between purchase and effective date.

Medjet is another popular evacuation company offering coverage that's different from typical travel insurance. Travelers who hold Medjet memberships can be transferred to their home hospital of choice, regardless of medical necessity. Even better: Your Medjet membership doesn't exclude adventure travel, has very few limitations and no preexisting condition exclusions for travelers under 75 — many of the disqualifications people face when shopping for travel insurance coverage.

What if I'm afraid to travel?

Unfortunately, risk aversion isn't a covered reason under trip cancellation or interruption protection. Even an alert from the U.S. Centers for Disease Control and Prevention for your destination won't be sufficient for most plans to offer financial relief.

Under what situations might I qualify for trip protection?

- If your doctor issues a note stating that you're too ill to fly, you may be able to file a claim under trip cancellation for reimbursement of your insured, prepaid, nonrefundable trip costs. That said, all details of the claim are reviewed once it has been filed, and every situation is different — so this is no guarantee of reimbursement. However, if you're immunocompromised and can prove you will suffer high risk from germ exposure, a travel insurance policy with the optional cancel for any reason benefit might help you recoup some of your lost travel costs.

- If you've been ordered to quarantine for safety precautions — even if you don't ultimately get sick — your insurance may cover your unexpected costs under the "trip cancellation and interruption" clause on your policy. However, this quarantine typically must be ordered by a doctor (or by a government, on some plans) to trigger coverage, and it typically requires strict isolation. In other words, a self-imposed quarantine will not be covered, so it's important to know exactly how your policy defines "quarantine" and what requirements go along with it.

Should I just stay at home?

Travel is on the rebound as we enter the latter half of 2021, but there are still hoops to jump through depending on where you plan to travel. Whether or not you should stay home is a personal decision, to be made with your doctors and with your community in mind. If you are in frequent contact with high-risk individuals, it might behoove you to postpone your trip for the time being.

But whether you stay or you go, travel insurance can be one powerful tool in protecting your trip.

Want to learn more about trip protection? Keep reading our guide to independent travel insurance below.

For more travel news and advice during COVID-19, make sure to check out our dedicated coronavirus hub page .

What is independent travel insurance, and when do I need it?

More than ever, travelers need to be prepared for times when travel plans go awry — like I experienced on a trip to Italy in the summer of 2018 (more on that below).

But the term travel insurance is often used interchangeably with trip protection and cancellation coverage, and it can be difficult to tell if your credit card benefits offer sufficient peace of mind for big or complex trips.

Related: The best credit cards with complimentary travel protection

So, what exactly is independent travel insurance, and how does it differ from credit card trip delay reimbursement, trip cancellation and interruption protection or accident and evacuation insurance?

A travel insurance plan can offer valuable protection

In a nutshell, travel insurance can help to protect your financial investment in a trip. If your domestic flight is delayed, a service like Freebird previously could help you get on another flight, sometimes even through another airline. (Unfortunately, Freebird is not an option right now , but it isn't dead: Capital One now owns the company and technology.)

But you won't be reimbursed for other consequences of your flight delay ; for instance, you usually can't get your money back for a missed hotel stay resulting from your delayed flight.

Your premium credit card benefits usually offer plenty of protection for your average domestic weekend getaway. But while card benefits vary, many only cover transportation-related cancellation or interruption costs in the event of illness, injury or death.

Furthermore, most credit card-based benefits only cover expenses and activities paid with that particular credit card. Finally, credit card terms and conditions may limit you to a certain number of claims or maximum reimbursement amount within 12 months.

Related: When to buy travel insurance vs. when to rely on your credit card protections

However, many credit cards don't provide robust protection, and even those that do provide coverage have many exclusions and exceptions — and zero options for customization. While travel insurance plans also have exclusions, you may be a great candidate for third-party coverage if you're looking for more options.

You can purchase a third-party plan for pretty much any kind of trip, which will cover many aspects of your travel from the flights and hotel stays to the prepaid, nonrefundable tours and excursions. There's a wide variety of policies available, from comprehensive coverage to plans that offer coverage for specific travel-related concerns — like emergency medical evacuation or travel medical protection.

If you're looking for broad coverage, look for a comprehensive travel insurance plan that can cover your costs in the event of canceled, delayed or interrupted transportation; medical expenses and emergency evacuations; as well as any costs associated with lost or delayed luggage.

Where should I shop for travel insurance?

Independent travel insurance plans can be purchased from providers such as Allianz and WorldNomads , and typically offer coverage that's more comprehensive than the protection included with your credit card.

You can expect your insurance plan to cost between 4–12% of your total trip expenses, depending on the plan you purchase. So if you spent $1,000 on your next vacation, for example, expect to pay between $40–$120 for a standard, comprehensive travel insurance plan.

Related: Should I buy trip insurance from my airline during checkout?

But not all plans and protection are created equal. Third-party travel insurance plans also differ from the trip protection add-on you can buy through your airline. Airline trip protection typically costs more and covers less than a travel policy purchased through a dedicated underwriter.

Additionally, airline trip protection only covers the flight-related portion of your travel and specifically targets delays or cancellations relevant to natural disasters, or dire circumstances such as a death in the family. Finally, as we saw above, not all plans include COVID-19 coverage , so you'll need to keep that in mind when shopping your options.

Related: Comparing the best travel insurance policies and providers

One option for doing so is InsureMyTrip.com , which offers an easy, straightforward way to compare plans, prices, ratings and some other factors side by side. You can thus opt for the protection that works best for your unique needs — whether that's a comprehensive plan or a policy that addresses your specific, travel-related concerns.

Usually, the basic requirement is that all coverage kicks in only if you are located a certain distance away from your primary residence (the home address listed in your plan).

Whatever you do, don't buy the "travel insurance" offered on the airline checkout page when you're purchasing your next flight without shopping around — and reading the fine print. While the plan may be offered through a reputable provider , you'll pay about the same amount for a plan that isn't offered through the airline — thus maintaining a lot more flexibility to select terms that make sense for you.

What types of coverage do these plans offer?

Trip cancellation coverage targets nonrefundable portions of your trip, from flights to excursions and hotel stays.

Most hotels and tour groups have very strict rules regarding last-minute cancellations or missed travel, so you most likely will not be able to get a refund if a canceled or delayed flight prevents you from reaching your destination. If you've planned a full, expensive vacation with many moving parts, travel insurance is the best way to protect your investment.

That said, it's critical to carefully read your policy to understand what is (and is not) covered — especially for exclusions that may prevent you from getting reimbursed when something goes wrong during a trip. If you need complete peace of mind, you can opt for plans that offer optional " cancel for any reason " or "cancel for work reasons" coverage, which will offer the most flexibility.

Trip interruption coverage is very similar to cancellation coverage, though it offers post-departure coverage rather than pre-departure protection. The wording may differ slightly, and the coverage amount can be even higher to take into account emergency flights home in the event of a covered interruption. If you're already partially through your trip and need to change your itinerary, head home early or reroute your plans for a covered reason, the plan may reimburse you for the unused portion of your trip — and may cover additional costs for last-minute travel changes.

Medical expenses can encompass anything from a saline-drip IV for heat exhaustion to serious injuries treated in the emergency room or a hospital overseas. Most health insurance plans in the U.S. don't cover international incidents or needs that arise , and a travel insurance plan can provide coverage for accidents and illnesses while abroad.

Related: I got food poisoning right before my international flight from Africa

Emergency evacuation coverage can easily save you tens of thousands in out-of-pocket expenses if you need an unexpected helicopter airlift , medically equipped flights home or ambulance transportation to a local hospital. However, this is at the discretion of the attending physician and the company. Typically, evacuation occurs if it's determined that you can't be treated properly at the hospital to which you are initially taken.

Lost or delayed luggage and delayed flights can happen at any time, and they can create a number of headaches for travelers. Third-party travel insurance may provide reimbursement here. Baggage loss coverage provides reimbursement for luggage as well as covered items that are lost or stolen while you're traveling, while baggage delay coverage allows you to purchase essential items you need for your personal comfort while you're waiting for your bags to arrive . Meanwhile, trip delay protection may offer reimbursement for additional expenses incurred due to a late-arriving flight or missed connection — including unexpected, overnight hotel stays or nonrefundable tours you missed as a result of the delay.

However, these are typically secondary coverage — so they'll supplement any reimbursements offered by a common carrier (like an airline that loses your bag or delays your flight) or your homeowner's insurance. In addition, plan limits define the amount of coverage, which varies by plan.

It's also worth noting here that many credit cards also offer protection for things like trip delays and lost luggage. Once again, be sure to carefully compare the details of these offerings to those from a third-party insurance provider to select the one that best meets your needs.

Related: These cards offer luggage delay and loss insurance

Additional coverage options

If you need or want more robust insurance for peace of mind, providers also offer add-on options for:

- Accidental death and dismemberment

- Hazardous sports

- Rental car collision damage (though not liability)

Note that death/dismemberment insurance and rental car coverage are frequently offered with many credit cards, so check your card benefits before purchasing these add-ons to avoid redundant coverage.

When travel insurance plans are a great idea

Still unsure of whether independent travel insurance is something you should consider? Here are a few scenarios in which travel insurance might make sense for you:

You're traveling in a group, especially with small children

There are a variety of things that can go wrong when traveling with your family or in a large group — more travelers means greater potential for sickness, injury or other covered reasons that could offer reimbursement under travel insurance. And standard, comprehensive travel insurance plans typically cover up to 10 travelers. A few hundred dollars spent on a good policy can save you thousands in otherwise-sunk costs in the event of an emergency.

When traveling with her niece or nephews overseas, Shannon O'Donnell of A Little Adrift purchased insurance plans that, among other protections, covered travel costs for a back-up guardian in case she became ill or injured — a scenario that doesn't typically occur to most travelers.

You need medical protection overseas

If you plan to hike Machu Picchu , backpack your way through Southeast Asia or undertake any other equally adventurous trip, it can be a good idea to look into two different types of coverage:

- Emergency medical evacuation coverage : This provides transport assistance in the event that you become seriously ill or injured while traveling. Generally, these plans provide emergency medical evacuation to the nearest appropriate care facility if the assistance company and the physician feel you'd be better suited at a different facility.

- Travel medical coverage : These plans offer specific, defined coverage needed by some while traveling abroad. These are only available to travelers who are leaving their home country and who require medical insurance that will fill the gaps in their primary health insurance coverage while traveling internationally.

Most credit card benefits don't offer robust medical expense or evacuation coverage , so if you need one or both of these coverages, you may want to purchase a comprehensive travel insurance plan.

Bear in mind that Medicare doesn't offer any international assistance, and U.S.-based private health insurance plans offer little to no coverage for international travel. Countries with universal health care may offer some basic help, but they aren't obligated to do so, especially if you aren't a citizen.

You're planning a complex trip with many moving parts

There are a few ways you can purchase insurance, even if you're planning a long-term trip.