JavaScript Required

Paper receipts aren't required, JavaScript is. Many of TravelBank's features don't work properly without it.

Oh No's! Looks like your browser is out of date.

We'd love to help you save money on business travel, but first let's save your sanity with an updated browser .

- ATM locations

- ATM locator

Estás ingresando al nuevo sitio web de U.S. Bank en español.

New travelbank feature lets travelers keep an eye on their environmental impact.

Corporate travelers booking through TravelBank can now compare flights using advanced carbon dioxide performance metrics

In 2021, U.S. Bank acquired TravelBank, an award-winning fintech focused on improving expense and travel management for businesses and employees. Together, U.S. Bank and TravelBank are delivering an all-in-one corporate card, expense and travel management solution that can help control spend and automate expense processes.

TravelBank works to continually add more value for users. Thanks to a new partnership with sustainability specialist SQUAKE, users can now easily compare flights using advanced CO 2 performance metrics, such as aircraft type, routing and more. In the near future, users will also have the option to choose hotels based on sustainability ratings and select environmentally friendly ground transportation, considering factors like fuel type, engine efficiency and car type.

“Partnering with SQUAKE is a natural fit for TravelBank as we continue to prioritize sustainability and empower our users with the tools they need to make a positive environmental impact. SQUAKE’s expertise in sustainable travel combined with TravelBank's technology platform will provide our users with the insights and options they need for reducing their carbon footprint,” said Duke Chung, co-founder and CEO of TravelBank.

Find more information on www.TravelBank.com

Media center

Press contact information, latest news and more

Company facts, history, leadership and more

Work for U.S. Bank

Explore job opportunities based on your skills and location

Investment products and services are: Not a deposit • Not FDIC insured • May lose value • Not bank guaranteed • Not insured by any federal government agency

Loans and lines of credit are offered by U.S. Bank National Association. Deposit products are offered by U.S. Bank National Association. Member FDIC.

Investment and insurance products and services including annuities are available through U.S. Bancorp Investments, the marketing name for U.S. Bancorp Investments, Inc., member FINRA and SIPC , an investment adviser and a brokerage subsidiary of U.S. Bancorp and affiliate of U.S. Bank.

Pursuant to the Securities Exchange Act of 1934, U.S. Bancorp Investments must provide clients with certain financial information. The U.S. Bancorp Investments Statement of Financial Condition is available for you to review, print and download.

The Financial Industry Regulatory Authority (FINRA) Rule 2267 provides for BrokerCheck to allow investors to learn about the professional background, business practices, and conduct of FINRA member firms or their brokers. To request such information, contact FINRA toll-free at 1- 800‐289‐9999 or via https://brokercheck.finra.org . An investor brochure describing BrokerCheck is also available through FINRA.

U.S. Bancorp Investments Order Processing Information .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

6 Things to Know About United TravelBank

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Whether you're saving up for a special occasion — like a honeymoon — or just an upcoming getaway, many travelers opt to save future travel funds in a dedicated bank account. For United Airlines loyalists, this process can be even simpler.

United MileagePlus account members can access a budgeting tool called United TravelBank. Let's dive into the things you'll want to know about the service, how to use it and if it's worth "saving" money in this account at all.

What is United TravelBank? How does it work?

United's TravelBank is pretty much what it sounds like — an online account designed for accumulating travel funds for future United flights. It aims to simplify United MileagePlus members’ budgeting for future personal and/or business flights.

Once the account is set up and has money in it, it syncs with both united.com or the United mobile app as a payment option.

» Learn more: How to use the United MileagePlus X app to earn miles

What to know about United TravelBank

1. you can purchase united travelbank credits for your account.

United gives MileagePlus members the opportunity to buy deposits for their own TravelBank account. However, you can only purchase TravelBank credits in one of six amounts:

If you want to deposit a different amount, you can do so across multiple transactions. Say you want to deposit $150. Just purchase $50 in funds and then make another purchase of $100.

The only limitation is that you can't exceed $5,000 per day per MileagePlus account, meaning that you can do at least five purchases per day.

2. United TravelBank credits are valid for five years

Does United TravelBank expire? Yes. Purchased funds are valid for five years from the date the funds are deposited into your TravelBank account. That gives you plenty of time to use the funds.

That's a much longer validity than other types of airline travel credits. For instance, when purchasing airfare on United, you generally only have 12 months from the date of purchase to use those funds for a flight. So, if you really aren't sure that you'll be able to travel in the next year, you can use the United TravelBank to stash money away for future airfare purchases.

Even with the generous expiration policy, we recommend using up your full TravelBank balance whenever possible to avoid leaving money on the table.

3. You can get United TravelBank credits by holding an IHG card

One of the unexpected ways to get United TravelBank credits is through select IHG credit cards. IHG One Rewards Premier Credit Card and IHG One Rewards Premier Business Credit Card customers can enroll to get up to $50 in TravelBank Cash each calendar year. Cardholders get one deposit of $25 in early January of each year and another $25 deposit in early July.

However, these funds work differently from purchased TravelBank funds. Instead of having five years of validity, you only have a little over six months to use these funds before they expire. The $25 deposited in early January expires on July 15 of the same calendar year, and the $25 funded in July will expire on Jan. 15 of the next year.

During the two-week crossover period, you could have up to $50 in active TravelBank funds from this IHG credit card benefit. That's probably not going to be enough to cover an entire flight, but at least it can save you some out-of-pocket cost on your next United flight.

Eligible cardholders can go to ihg.com/united to register to start receiving this new card benefit. You'll need to log into your IHG One Rewards account and then provide your United MileagePlus number and last name to complete registration. The terms and conditions note that it may take up to two weeks after registration before you receive your first $25 TravelBank deposit.

on Chase's website

4. It’s possible to use credit card travel credits to fund your United TravelBank

United TravelBank purchases often code as travel expenses on your credit card bill. That means you can earn bonus points when using credit cards with a travel bonus category. And you might even be able to use credit card travel credits — such as the Chase Sapphire Reserve® $300 annual travel credit , the Citi Prestige® Card $250 air travel credit or certain other credit card incidental fee credits.

» Learn more: The best airline credit cards right now

5. You can't use United TravelBank funds for other travel purchases

A major downside of the United TravelBank is that funds can only be used to book United-operated or United Express-operated flights, plus certain subscription products.

Travelers living near an airport with a strong United presence may not mind being limited to flying United. However, if Delta Air Lines, Alaska Airlines or American Airlines offers a much cheaper airfare, you won't be able to use your United TravelBank funds to purchase those flights.

Likewise, United TravelBank funds can't be used for hotels or car rental purchases.

» Learn more: United vs. Delta — Which is best?

6. The United TravelBank doesn't earn interest

Another downside of saving funds through the United TravelBank is that you won't earn interest on the saved funds. Over the past few years, interest rates have been so low that you wouldn't have missed out on much interest income by placing funds in the United TravelBank instead.

However, now that interest rates are increasing , you might be able to grow your travel funds faster by saving funds in an actual savings account rather than the United TravelBank.

» Learn more: Compare savings account rates in your ZIP code

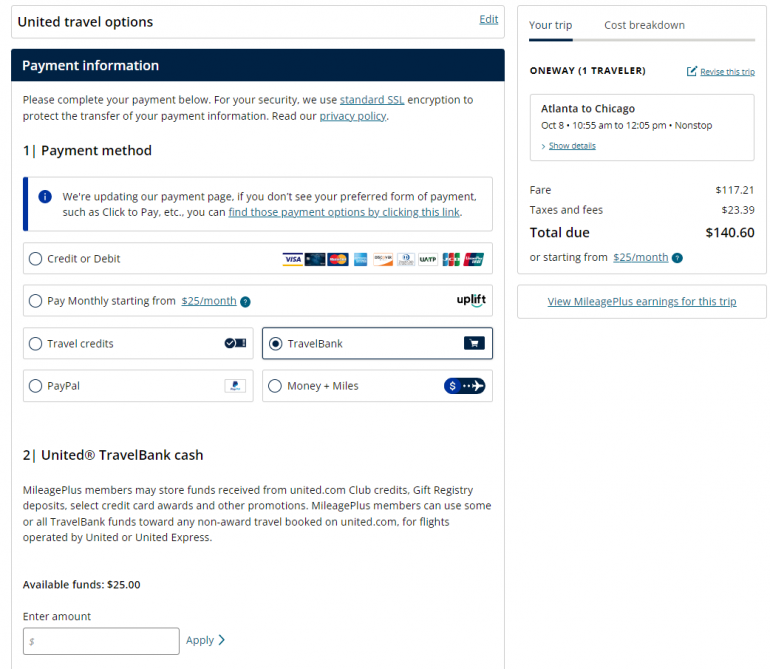

How to use United TravelBank

Once you’ve added money to the TravelBank account, you can select TravelBank cash as a payment option when logged into united.com or the United app.

When you're ready to use your travel funds, just log into your United MileagePlus account and search for a paid flight. On the checkout page, select the TravelBank payment option. Then, you can then enter precisely how much of your funds you want to apply to this booking.

Note that you can only use TravelBank funds for flights priced in U.S. dollars. And unfortunately, you can't use TravelBank funds to pay taxes and fees on a MileagePlus award ticket. For cash bookings, TravelBank monies can be used to cover the ticket price, taxes and surcharges.

Even if you have enough funds to cover the entire purchase, you may want to charge part of your flight booking to a credit card that provides travel insurance .

TravelBank cash can be used alone or in combination with other accepted forms of payment, such as Apple Pay, Visa Checkout or PayPal.

Is United TravelBank worth it?

The United TravelBank provides travelers with another way of stashing away funds for future travel. MileagePlus members can fund as little as $50 at a time, up to $5,000 per day. Your funds are valid for five years from the date of deposit, giving you plenty of time to use them.

However, funding the United TravelBank locks you into booking paid flights through United, decreasing the flexibility of your money. You can't even use TravelBank to pay for taxes and fees on award travel. So, you may only want to deposit funds in the TravelBank if you're sure that you will be paying for a United flight in the near future.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-2x Earn 2 miles per $1 spent on dining, hotel stays and United® purchases. 1 mile per $1 spent on all other purchases

50,000 Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

1x-2x Earn 2 miles per $1 spent on United® purchases, dining, at gas stations, office supply stores and on local transit and commuting. Earn 1 mile per $1 spent on all other purchases.

75000 Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

1x-3x Earn 3x miles on United® purchases, 2x miles on dining, select streaming services & all other travel, 1x on all other purchases

60,000 Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

Citi and AT&T Expand Credit Card Offerings with New AT&T Points Plus Card

No Annual Fee* Card Makes Every Day More Rewarding

New York – Today, Citi and AT&T announced the AT&T Points Plus Card from Citi, a new no annual fee* card that rewards wireless customers with statement credits and Citi ThankYou Points on purchases. Building on the long-standing relationship between the two companies, the new card delivers on a shared commitment to drive loyalty and customer engagement by providing an ideal option for AT&T wireless customers looking for rewards on everyday purchases.

Each year, cardmembers can earn up to $240 in statement credits toward their qualifying AT&T wireless bill after eligible spend,** which is in addition to existing discounts that customers may receive from AT&T directly. AT&T wireless customers can earn a $20 statement credit on their AT&T Points Plus Card statement after they spend $1,000 or more on purchases in a billing cycle or a $10 statement credit after they spend $500 - $999.99.

In addition, the new card also earns:

- 3 ThankYou Points for every $1 spent at gas stations

- 2 ThankYou Points for every $1 spent at grocery stores, including grocery delivery services

- 1 ThankYou Point for every $1 spent on all other purchases

ThankYou Points do not expire and can be redeemed for gift cards, charitable donations, travel, Shop with Points at participating merchants, and more.

"We're proud of the long-standing relationship we have with Citi in creating valuable programs," said Jeni Bell, senior vice president of wireless product marketing, AT&T. "As many of our customers are shopping for the holiday season, we're excited to bring them an opportunity to earn rewards and receive more value for each dollar they spend."

"AT&T customers have been looking for more ways to earn rewards on their everyday spending," said John LaCosta, Managing Director and Head of Co-Brand Relationships at Citi U.S. Branded Cards. "The AT&T Points Plus Card does just that. With ThankYou Points earned on every day expenses, including wireless bills, the new card is an ideal choice for AT&T loyalists."

New cardmembers can also earn a bonus $100 statement credit after spending $1,000 on purchases within the first three months of opening an AT&T Points Plus Card account.***

For more information about the new AT&T Points Plus Card, visit https://www.att.com/attpointsplus .

*Pricing & Information: A variable APR of 19.74% – 27.74% based on your creditworthiness, applies to purchases, balance transfers, and Citi Flex Plans subject to an APR. For Citi Flex Pay Plans subject to a Plan Fee, a monthly fee of up to 1.72% will apply, based on the Citi Flex Plan duration, the APR that would otherwise apply to the Transaction, and other factors. The variable APR for cash advances is 28.99%. The variable Penalty APR is up to 29.99% and may be applied if you make a late payment or make a payment that is returned. Minimum interest charge is $0.50. Annual Fee – None. Fee for foreign purchases — 3% of each purchase transaction in US dollars. Cash advance fee – either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee – either $5 or 5% of the amount of each transfer, whichever is greater. Rates as of 11/14/2022. New cardmembers only. Subject to credit approval. Additional limitations, terms and conditions apply. You will be given further information when you apply.

**To qualify for the monthly statement credit, cardmembers must enroll their AT&T consumer postpaid wireless account in Paperless billing and AutoPay at AT&T with their AT&T Points Plus Card as the payment method.

***The acquisitions bonus is not available if cardmembers have previously received a new account bonus for an AT&T Points Plus Card from Citi account in the past 48 months.

Citi Citi is a preeminent banking partner for institutions with cross-border needs, a global leader in wealth management and a valued personal bank in its home market of the United States. Citi does business in more than 160 countries and jurisdictions, providing corporations, governments, investors, institutions and individuals with a broad range of financial products and services.

Additional information may be found at www.citigroup.com | Twitter: @Citi | YouTube: www.youtube.com/citi | Blog: http://blog.citigroup.com | Facebook: www.facebook.com/citi | LinkedIn: www.linkedin.com/company/citi .

About AT&T We help more than 100 million U.S. families, friends and neighbors, plus nearly 2.5 million businesses, connect in meaningful ways every day. From the first phone call 140+ years ago to our 5G wireless and multi-gig internet offerings today, we @ATT innovate to improve lives. For more information about AT&T Inc. ( NYSE:T ), please visit us at about.att.com . Investors can learn more at investors.att.com .

Citi Elana Rueven Email: [email protected]

AT&T Jessica Swain Phone: 415-613-4267 Email: [email protected]

Sign up to receive the latest news from Citi.

Do you want to install app?

Add a shortcut to your home screen: Share button at the bottom of the browser. Scroll left (if needed) to find the Add to Home Screen button.

Travel Bank Credits

Got some JetBlue travel credits? It’s easy to view your current balance, expiration dates and transaction history—and use your credits for a new booking. Just create/log in to your travel credit or TrueBlue account to get started.

- Travel Bank 101

What can travel credits be used for?

How to access and link travel credits, how to use travel credits, using multiple travel bank accounts, helpful videos, how to use jetblue vacations credits, terms and conditions travel bank 101.

Your JetBlue Travel Bank is an online account (or bank) where you can access and manage any JetBlue travel credits you’ve received. Think of it like a payment wallet that you can choose to use on jetblue.com or the JetBlue app.

- Your Travel Bank account is created automatically the first time you’re issued a travel credit, and your login info is sent to you in two separate welcome emails.

- The link in the password creation email expires after 48 hours. If you haven’t received or can’t locate these emails, you can request your login ID and/or reset your password with our online login look-up form.

- You’ll need to use your login ID and password every time you want to view or use your Travel Bank account.

Travel credits can be used to book a reservation for anyone you’d like. The name on the account doesn't need to match the name of the traveler.

JetBlue travel credits can be applied to:

- Airfare and taxes on JetBlue-operated flights booked through jetblue.com.

- The air portion of a JetBlue Vacations package.

- Blue Basic fares booked or exchanged on or after Mar 18 2024 cannot be changed but may be cancelled.

Travel credits cannot be applied to:

- Checked bags

- Same-day switches

- Taxes for Move to Mint certificates (Mosaic 3 and Mosaic 4)

- Seat selection for Blue Basic or other seat fees

- Even More® Space

- Core (preferred) seats

- Priority security

- Unaccompanied minor fee

- Service fees (including phone and GDS bookings and changes), etc.

- Bookings on partner airlines

- Non-air portion of a JetBlue Vacations package

- Online travel sites other than jetblue.com or the JetBlue app

Access Travel Bank without a TrueBlue account

- For your security, the first email contains your login ID, and the second email contains your password.

- Create your Travel Bank password.

- Save your Travel Bank account details somewhere safe for future use.

- You now have full access to Travel Bank.

Access Travel Bank with a linked TrueBlue account

- Log in to your TrueBlue account.

- Click your initials or picture in the top right corner. Your total travel credit amount will be displayed in the dropdown menu.

- If you would like to review your Travel Bank statement, select Travel Bank Credit from the dropdown menu. You should be automatically logged into your Travel Bank account to view your Travel Bank statement.

- Any travel credits issued to you should be visible when you log in to your TrueBlue account. If you don’t see them, your TrueBlue account and your Travel Bank account might not be linked.

- Expired travel credits will not display in your TrueBlue dropdown.

Not receiving Travel Bank emails? Contact us

How to use travel credits while booking:

- If you have a TrueBlue account linked to your Travel Bank account, log in before you begin to book your trip. You also have the option to sign in during the booking process.

- If your Travel Bank is not linked to your TrueBlue account, or you are not logged in, you will have the option to log into your Travel Bank account on the payment screen while booking.

Need to use travel credits in Manage Trips?

- If you don’t have a Travel Bank account, select create a new account in Manage Trips.

- If you have an existing Travel Bank account that is not attached to a TrueBlue account, log into your Travel Bank account on the Manage Trips payment page.

- If you have an existing Travel Bank account that is attached to your TrueBlue account, log into your TrueBlue account and your Travel Bank Credits will auto-populate.

Where is my travel credit?

Credit expirations and open tickets.

Locate Travel Bank Info with TrueBlue

Find Your Travel Bank Credentials

Reset Your Travel Bank Password

How to Use Your Travel Bank Credit

If you’ve received a JetBlue Vacations credit, it’s important to know how it’s different than a JetBlue travel credit. While both can be used to book your next JetBlue adventure, here are the key differences:

- Can be applied toward any portion of a JetBlue Vacations package.

- Can't be viewed or managed in your Travel Bank account.

- Can’t be applied online—it must be redeemed by calling JetBlue Vacations at 1-844-JB-VACAY (1-844-528-2229). Provide them with your confirmation code and the last four digits of the credit card used on the original JetBlue Vacations reservation.

- Can be applied toward JetBlue-operated flights or the flight portion of a JetBlue Vacations package.

- Can be viewed or managed in your Travel Bank account.

- Can be applied online by choosing Travel Bank on the Payment screen.

Was this page helpful?

Get To Know Us

- Our Company

- Partner Airlines

- Travel Agents

- Sponsorships

- Web Accessibility

- Contract of Carriage

- Canada Accessibility Plan

- Tarmac Delay Plan

- Customer Service Plan

- Human Trafficking

- Optional Services and Fees

JetBlue In Action

- JetBlue for Good

- Sustainability

- Diversity, Equity & Inclusion

Stay Connected

- Download the JetBlue mobile app

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Don’t Lose Travel Credits: How To Use the JetBlue Travel Bank

Julian Kheel

Content Contributor

3 Published Articles

Countries Visited: 27 U.S. States Visited: 40

Editor & Content Contributor

151 Published Articles 733 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3114 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

What Is the JetBlue Travel Bank?

Credits aren’t transferable, but you can book for others, can only use with 1 other form of payment, travel bank credits expire after 12 months, what can you use the jetblue travel bank for, how to check your jetblue travel bank balance, how to use a jetblue travel bank credit, can you extend a jetblue travel bank credit, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you’ve canceled a flight with JetBlue and received a travel credit for the value of your ticket, you might be wondering how to find and use that credit. The answer is the JetBlue Travel Bank . It’s a special account issued to the airline’s customers to hold their travel credits until they can be applied to a new flight or JetBlue Vacations package.

But when it comes to using your credits, there are several tricks and pitfalls to be aware of. Here are all the details you’ll need to ensure you can use your JetBlue Travel Bank account when you need it — and with the fewest headaches.

Most JetBlue tickets can be canceled without paying a fee. The only exception is the airline’s Blue Basic fare , which can be canceled for $100 per person on routes to and from North America, Central America, and the Caribbean, and $200 per person on other routes.

That means you can get at least some value from almost any JetBlue ticket as long as you cancel your flight before it departs .

However, you don’t get the money back when you cancel a nonrefundable JetBlue ticket. Instead, you’re issued a travel credit that can be used for a future JetBlue flight. That credit is automatically deposited into the JetBlue Travel Bank and linked to you either by name or to your JetBlue TrueBlue frequent flyer account, which also contains any points you’ve earned from flying or with the JetBlue credit cards .

What Are the JetBlue Travel Bank Rules?

Like most airline travel credits, there are several rules and restrictions on JetBlue Travel Bank credits that you’ll need to know.

While you cannot transfer a JetBlue Travel Bank credit to someone else, you can use it for a friend, family member, or anyone you’d like by booking a new ticket in their name.

As long as you’re booking the flight with your Travel Bank, the passenger name on the ticket doesn’t need to match the name on the account. You don’t even need to be traveling with the person to apply your credit to their ticket.

Travel Bank credits can be used to pay any type of JetBlue fare. But if you want to use it to pay the taxes and fees on award tickets, the credit must be enough to cover the entire amount. That’s because you can only use 2 forms of payment on a single ticket . So if one of those is points, the other form of payment has to cover the entire cash amount.

This is a particularly annoying limitation when you’re trying to change an award ticket. With JetBlue, the only way to change a ticket booked with points is to cancel the original ticket, get the points back, and then book a new one.

But while the points from the original ticket will instantly go back into your JetBlue TrueBlue account, any taxes and fees you paid will go into your Travel Bank instead of back to your original form of payment. Then, if the new flight you want has higher taxes and fees, you can’t use the credits in your Travel Bank to pay for them. Instead, you’ll have to pay the cash portion again.

JetBlue Travel Bank credits have a hard expiration date — 12 months after your original ticketing date . That’s the day you booked the original ticket, not the date you were scheduled to fly or the date you canceled.

That means you’ll likely have less than 12 months to use the credit. So, it’s important to be aware of the calendar to make sure you use your credit before it expires.

You only have to book a new ticket using the credit before it expires — you don’t have to actually fly before that date. JetBlue opens its schedule nearly a year in advance, so if you’ve got a trip planned for months in the future, you can still use your Travel Bank credit for it. Just book far enough in advance to apply the credit before its expiration date.

There are only 4 things you can use JetBlue Travel Bank credits for:

- Airfare and taxes on JetBlue-operated flights booked through jetblue.com or its mobile app ( iOS , Android )

- Taxes and fees on JetBlue award flights (as long as the credit covers the entire amount)

- The air portion of a JetBlue Vacations package

- Any applicable increase in airfare when changing a booking

That means any other fees you might be charged during your travels with JetBlue, such as checked bags , in-cabin pets, seat selection, and the like, cannot be paid using credits from the Travel Bank. Essentially, you can only use it for forms of airfare for you or others and nothing else.

When you cancel a JetBlue flight, if you don’t already have a Travel Bank account, a new one is created automatically. Then, if you have a JetBlue TrueBlue frequent flyer account, the 2 accounts are linked. You can see your balance anytime by logging into your TrueBlue account on JetBlue’s website and clicking on the account menu in the upper right corner.

If you don’t have a TrueBlue account, the login info for your Travel Bank is sent to you after you cancel your ticket in 2 separate welcome emails , one of which has a temporary password that you’ll need to change within 48 hours. You can use that info to log into your Travel Bank account to see your current balance and expiration date.

Can’t find one of the emails or forgot to change your temporary password? You can use JetBlue’s Login Lookup Form to find the information.

If you’re booking a ticket with cash, using your Travel Bank credit is relatively easy. All you need to do is search for the new flight you want to book using JetBlue’s website or app.

Then, when you get to the payment page, you’ll have the opportunity to log into your TrueBlue account to apply your Travel Bank credit (if you aren’t already logged in) or to access your Travel Bank with the login info that JetBlue previously provided.

You don’t even have to use up your entire Travel Bank credit all at once . If your ticket costs less than the credit, the remaining amount will stay in your Travel Bank to be used later.

Or, if you’d simply prefer not to use your entire credit on 1 ticket, you can set the amount you want to use as partial payment. Then, if your credit doesn’t cover the entire cost of your new ticket, any remaining amount due can be paid for with any major credit card.

If you’re booking with points, you’ll have the same opportunity to use your Travel Bank credits toward the taxes and fees on your award flight. But again, in this case, the credit must be able to cover the entire amount.

Unfortunately, there’s no way to extend the expiration date on a JetBlue Travel Bank credit . While you can use the credit for a flight as far out in the future as JetBlue has available, you must book that new ticket with the credit before the 12-month clock expires, or you’ll lose it. Even having JetBlue Mosaic elite status won’t exempt you from this policy.

Also, unlike other airlines, if you book a new ticket with the credit and then cancel that new ticket, the credit will retain its original expiration date . And if the original expiration date has passed, you won’t get the credit back.

This is one of the less customer-friendly airline policies regarding travel credits. Many airlines will reset the date on your credit if you book a new ticket and then cancel it, but JetBlue doesn’t. And some airlines like Southwest don’t have expiration dates on their travel credits .

So, when booking JetBlue tickets, keep in mind that canceling the ticket later will mean less flexibility with JetBlue than it does with other airlines.

As long as you’re booking a ticket with cash, or the taxes and fees on your award ticket are fully covered by your existing credit, you should be able to access and use your JetBlue Travel Bank right during the booking process. That’s good news since you have such a limited amount of time to use it, with a 12-month expiration clock starting from the date you booked the original ticket.

Finally, remember that if you cancel a reservation with multiple passengers, each person will receive their own separate Travel Bank credits . So, it’s important to keep track of all the Travel Bank logins and TrueBlue accounts to ensure you’re not leaving any of your hard-earned money on the table.

Frequently Asked Questions

How long do you have to use the jetblue travel bank.

JetBlue Travel Bank credits expire 12 months after the date the original ticket was issued. It’s not based on the date you were planning to fly, or the day you canceled. That means you likely have less than 12 months to apply the credits, and there’s no way to extend the expiration date.

However, you don’t need to actually fly before the credits expire. You only need to book a new ticket by then. Your actual travel date can be as far in the future as JetBlue’s schedule allows.

How do I access my Travel Bank on JetBlue?

JetBlue TrueBlue frequent flyer members can access Travel Bank credits by logging into their TrueBlue account. However, if you’re not a JetBlue TrueBlue member, the airline will send you emails with the information needed to access your Travel Bank credits.

If you can’t find the emails that were sent to you, you can request the information from JetBlue via its website.

Can I use my JetBlue Travel Bank credit for someone else?

Yes, you can use your Travel Bank credit to book a JetBlue ticket for a friend or family member — literally anyone. Just make sure you’re signed into your own TrueBlue or Travel Bank account, and then book the ticket using the other person’s name. The name on the Travel Bank account doesn’t need to match the name on the ticket.

Can JetBlue Travel Bank balances be transferred?

No, JetBlue Travel Bank balances and credits cannot be transferred to other people. However, since you can book a ticket in someone else’s name while using your own Travel Bank account, this is only a burden when booking with multiple Travel Bank credits in multiple names.

Can I use the JetBlue Travel Bank for baggage fees?

JetBlue Travel Bank credits can only be used for airfare, including taxes and fees on award tickets, and for JetBlue Vacations packages. It cannot be used for baggage fees, seat fees, or any other ancillary fees on JetBlue.

Was this page helpful?

About Julian Kheel

Julian Kheel first learned the ins and outs of credit card rewards and travel loyalty programs while flying more than 200,000 miles a year as a TV producer and director for World Wrestling Entertainment. With over 15 years of professional experience studying travel loyalty programs, Julian has served as CNN’s Senior Editor covering travel and credit cards, as well as the Editorial Director of The Points Guy, and has worked as a consultant for the Big 3 U.S. airlines.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Intentionally cut AT&T wires caused massive flight delays at Sacramento International Airport, sheriff says

A n internet outage that caused massive delays, some hours long, for flights at the Sacramento International Airport (SMF) started after AT&T wires were intentionally cut, officials said.

Sgt. Amar Gandhi, a spokesperson for the Sacramento County Sheriff’s Office, said wires were deliberately cut at Bayou Way and Power Line Road, causing the outages that affected flights from Southwest and Delta Airlines. That utility pole is roughly two miles away from Terminal B.

Gandhi said the sheriff's office, which does contract security for the airport, noticed a service disruption around 1:30 a.m. Once crews arrived at the affected utility pole, they realized lines were deliberately cut.

When asked if there is a possibility that the lines may have been accidentally cut, Gandhi reaffirmed the intentional nature of the crime.

"It looks like someone who knew what they were doing," Gandhi said. "So this wasn't just a couple of teenagers ... ripping some wires out as a prank. looks very deliberate ... like they knew what they were doing."

Investigators are confident they will find the person(s) involved. Gandhi explained that any airport in the country is one of the most heavily surveilled areas possible. Those responsible could face at least felony vandalism charges, but because the FBI is also investigating, Gandhi said additional charges could arise depending on motive.

That depends on whether it was either a prank or something more criminal-driven that warrants more involvement from federal officials.

Crime scene investigators were seen photographing the area where the wires were cut. Investigators were also dusting the utility pole for prints.

SMF’s flight status webpage showed some flights were delayed by as long as 156 minutes for arrivals while most departures were delayed by anywhere from 30 minutes to an hour.

The outages caused such a backup for passengers that a line of people stretched around the entire terminal.

"Someone said down there that it's taking two hours. I'm worried that I'm not going to make my flight. Anyway, it's pretty awful," said Teresa Falkenstein who was confused about where to make a line.

Others like Byron Welch and his wife, missed their morning flight out of Sacramento. "Well, we're able to get booked into a much later flight, but now we won't get to our destination, which is Omaha, until midnight, so it's going to be a long day," said Welch, who arrived at the airport around 8 a.m.

SMF is asking fliers to contact their airlines for more information on their flight.

KCRA 3 Reporter Maricela De La Cruz, who was at the airport around 11 a.m., said additional Southwest staff were called in, and the system is being rebooted. Some kiosks are also now working. By 12:50 p.m., she reported that lines are back to normal.

A statement from AT&T reads:

"We’ve restored internet and wireless service to affected customers in the Sacramento International Airport area following a fiber cut which appears to be an act of vandalism or attempted theft. We appreciate the patience of our customers as we worked to make repairs as quickly as possible."

This is a developing story. Stay with KCRA 3 for the latest.

See more coverage of top California stories here | Download our app .

TOP STORIES FROM KCRA:

2024 Sol Blume music festival appears to be postponed

Store clerk dies after overnight shooting, Stockton police say

Man arrested in connection to downtown Sacramento hit-and-run that injured 3 pedestrians

Oakland police shoot, kill Sacramento homicide suspect

Coalition to submit 900,000 signatures to put tough-on-crime initiative on California ballot

READ THE FULL STORY: Intentionally cut AT&T wires caused massive flight delays at Sacramento International Airport, sheriff says

CHECK OUT KCRA: Stay informed. Get the latest Modesto, Stockton and Sacramento news and weather from the KCRA news team.

You are using an outdated browser. Please upgrade your browser .

Moscow International Business Center (Moscow City)

- Guide to Russia

What can you do at Moscow City?

- Dine in style: Moscow City is home to 100+ cafes and restaurants, including Europe’s highest restaurant and ice-cream shop

- See Moscow like never before: Ascend to one of Moscow City’s observation decks for an unparalleled panorama of Moscow

- Admire world-class architecture: Each of Moscow City’s skyscrapers has distinctive architecture and design

- Learn something new: Visit the Museum of High-Rise Architecture in Moscow or the Metro Museum

Moscow City is a multifunctional complex in the west of Moscow, which has come to represent the booming business of Russia’s capital. Its skyscrapers enrich Moscow’s skyline, contrasting the medieval cupolas and Stalinist high-rises. Visitors to Moscow City can enjoy entertainment high in the sky, as the complex is home not just to offices, but to restaurants, cinemas, viewing platforms, and museums.

Photo by Alex Zarubi on Unsplash

History of Moscow City

Moscow City was first conceived in 1991 by honoured Soviet architect Boris Tkhor, who proposed to construct a business center in Moscow. It would be complete with gleaming skyscrapers rivalling those of New York and London, to reflect the new life and growing ambitions of post-Soviet Russia.

The chosen site was a stone quarry and disused industrial zone in western Moscow, in between the Third Ring Road and Moskva River. Initially, the territory was divided into 20 sections arranged in a horseshoe shape around a central zone. The skyscrapers would increase in height as they spiralled around the central section, with shorter structures built on the waterfront to give the taller buildings behind a view of the river.

Architect Gennady Sirota, who contributed to iconic projects such as the Olympic Sports Complex on Prospekt Mira, was selected as the chief architect, and many other world-famous architects were attracted to Moscow to realise their visions in Moscow City.

What can you see and do at Moscow City?

Where Moscow’s cityscape was once dominated by Stalin’s Seven Sisters skyscrapers , this is no more. Moscow City is home to eight of Russia’s ten tallest buildings, six of which exceed 300 metres in height. More buildings are still under construction there today, including the One Tower (which will be Europe’s second-tallest building). Once completed, Moscow City will comprise more than 20 innovative structures.

Each of Moscow City’s skyscrapers was designed by its own architect, lending the cluster of skyscrapers a unique appearance. Aside from being a site of architectural wonder, Moscow City is a place for leisure and entertainment with over 100 cafes and restaurants, exhibition spaces, cinemas, viewing platforms, and more.

Photo by Nikita Karimov on Unsplash

Federation Tower

- East Tower: 374m, 97 floors; West Tower: 243m, 63 floors

- Completed in 2017

- Architects: Sergey Tchoban and Peter Schweger

The East Federation Tower is the tallest building in Moscow, and the second-tallest building in Europe after the Lakhta Centre in St Petersburg. Visitors can enjoy a luxurious meal of seafood, truffles or steak at restaurant ‘Sixty’ on the 62nd floor of the West Tower, or visit Europe’s highest observation deck, ‘Panorama 360’, on the 89th floor of the East Tower.

Did you know? The ice cream and chocolate shop on the 360 observation deck are the highest in the world!

- South Tower: 354m, 85 floors; North Tower: 254m, 49 floors

- Completed in 2015

- Architect: Skidmore, Owings & Merrill LLP

The South OKO Tower is the third-tallest building in Russia and Europe. Here, you can visit ‘Ruski’ to dine on hearty Russian cuisine cooked on a real Russian stove, and have a drink in the ice bar. Alternatively, visit restaurant, nightclub and performance space ‘Birds’; the restaurant is the highest in Europe, situated on the 86th floor roof terrace alongside an observation deck. The OKO Towers are also home to karaoke club ‘City Voice’.

Did you know? Underneath OKO Towers is the largest underground parking in Europe, with 16 levels and 3,400 parking spaces.

Mercury Tower

- 339m tall, 75 floors

- Architects : Mikhail Posokhin, Frank Williams, Gennady Sirota

Another multifunctional skyscraper, which was designed as the first truly ‘green’ building in Moscow. The Mercury Tower has a distinct geometric shape and copper-coloured glazing, and was the tallest building in Europe upon completion. Visit ‘More i myaso’ (Sea and meat) on the first floor of the tower to enjoy European and Mediterranean cuisine whilst surrounded by greenery. On the 2nd and 40th floors a modern art gallery, the ‘ILONA-K artspace’, has just opened.

City of Capitals

- Moscow Tower: 302m, 76 floors; St Petersburg Tower: 257m, 65 floors

- Completed in 2009

- Architect: Bureau NBBJ

The unique geometric design of the City of Capitals towers resembles stacks of rotating blocks, and is rooted in Constructivism of the early Soviet period (many Soviet Constructivist buildings can be found in Moscow). Visitors to the Moscow Tower can enjoy a range of cuisines – traditional Italian dishes on the summer terrace of ‘Tutto Bene’, Panasian cuisine in the tropical luxury of the ‘Bamboo Bar’ on the 1st floor’, and poke or smoothie bowls at ‘Soul in the Bowl’ cafe on the 80th floor.

Tower on the Embankment

- Tower A: 84m; Tower B:127m; Tower C: 268m, 61 floors

- Completed in 2007

- Architects: Vehbi Inan and Olcay Erturk

After completion, the Tower on the Embankment was the tallest building in Europe, and is now the 13th tallest. It houses the headquarters of several large Russian and international companies, including IBM and KPMG. There are two cafes located on the 1st floor of Tower C – self-service café ‘Obed Bufet’ (Lunch Buffet) and Bakery Chain ‘Khleb Nasushchny’ (Daily Bread).

Evolution Tower

- 255m tall, 54 floors

- Architects: Philip Nikandrov and RMJM Scotland Ltd

Evolution is Moscow City’s most recognisable tower, and the 11th tallest building in Russia. Its façade is a true architectural marvel, comprising continuous strips of curved glazing spiralling high into the sky. According to the architect, Philip Nikandrov, the spiral shape of the tower honours centuries of architectural design in Russia, from the onion domes of St Basil's Cathedral to Vladimir Shukhov’s Tatlin Tower, a masterpiece of Constructivist design. Outside the Evolution tower is a landscaped terrace and pedestrian zone descending to the Presnenskaya Embankment, which was also designed by Nikandrov.

Did you know? Moscow’s largest wedding palace was supposed to be built on the site of the Evolution tower, though the project was abandoned.

- 239m tall, 60 floors

- Completed in 2011

Imperia’s interesting design has a curved roof and an arched glass façade. Inside the tower are various cafes including ‘City Friends’ for all-day breakfasts and light lunches, ‘Mama in the City’ for simple meals of Russian cuisine, and ‘abc kitchen’ for European and Indian-inspired dishes. Alternatively, visit ‘High Bar’ on the 56th floor for cocktails with a view. In Imperia you’ll also find the Museum of High-Rise Construction in Moscow (suitably located on the 56th floor), and the Camera Immersive Theatre.

Did you know? Inside Vystavochnaya metro station is the Metro Museum , dedicated to the history of the beautiful Moscow Metro!

- 130m tall, 26 floors

- Completed in 2001

- Architect: Boris Tkhor

Tower 2000 was Moscow City’s first tower. It stands on the opposite bank of the Moskva River, and houses a viewing platform from which visitors can admire an unparalleled panorama of Moscow City. The Bagration Bridge reaches across the river from the tower to Moscow City, and underneath are piers from where you can take boat trips.

Photo by Alexander Popov on Unsplash

Afimall is Moscow’s largest entertainment and shopping complex, home to 450 shops, cafes and restaurants, a cinema, and a virtual-reality game park. The shopping centre is located in the central section of Moscow City, and a cinema and concert hall are currently under construction there.

What’s nearby?

Sechenov Botanical Gardens: The botanical gardens of the First Moscow State Medical University was created for students’ training and research in 1946. Today it is open for free visits, and is home to a large arboretum.

Park Krasnaya Presnya: This park belonged to the Studenets estate of the Gagarin princes. It is a monument of 18th and 19th century landscaping, with Dutch ponds, ornate bridges, and tree-lined alleys. There are also sports facilities, sports equipment rental, and cafes.

Photo by Akkit on Wikipedia

Essential information for visitors

Website: https://www.citymoscow.ru/

Email: [email protected]

Phone: +7 (495) 730-23-33

Nearest metro: Mezhdunarodnaya (closest to the skyscrapers), Delovoy Tsentr (underneath Afimall), Vystavochnaya (closest to Expocentre)

Related Tours

Moscow - St. Petersburg 3-star cruise by Vodohod

This is our most popular cruise covering Moscow and St. Petersburg and all of the significant towns between these 2 cities. Besides the Two Capitals, you will visit the ancient towns of Uglich, Yaroslavl and Goritsy, the island of Kizhi, and Mandrogui village.

Cruise Ship

Two Capitals and the Golden Ring

This tour covers the best sights of Moscow and St. Petersburg along with a trip to the Golden Ring - a group of medieval towns to the northeast of Moscow. Ancient Kremlins, onion-shaped domes and wooden architecture is just a small part of what awaits you on this amazing tour.

Accommodation

PRIVATE TOUR

Classic Moscow

This is our most popular Moscow tour that includes all the most prominent sights. You will become acquainted with ancient Russia in the Kremlin, admire Russian art in the Tretyakov Gallery, listen to street musicians as you stroll along the Old Arbat street, and learn about Soviet times on the Moscow Metro tour.

Our travel brands include

Express to Russia

Join us on Facebook

We invite you to become a fan of our company on Facebook and read Russian news and travel stories. To become a fan, click here .

Join our own Russian Travel, Culture and Literature Club on Facebook. The club was created to be a place for everyone with an interest in Russia to get to know each other and share experiences, stories, pictures and advice. To join our club, please follow this link .

We use cookies to improve your experience on our Website, and to facilitate providing you with services available through our Website. To opt out of non-essential cookies, please click here . By continuing to use our Website, you accept our use of cookies, the terms of our Privacy Policy and Terms of Service . I agree

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Credit card rates

- Balance transfer credit cards

- Business credit cards

- Cash back credit cards

- Rewards credit cards

- Travel credit cards

- Checking accounts

- Online checking accounts

- High-yield savings accounts

- Money market accounts

- Personal loans

- Student loans

- Car insurance

- Home buying

- Options pit

- Investment ideas

- Research reports

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

I don’t travel without this power bank — and now it’s at an all-time-low price

Content is created by CNN Underscored’s team of editors who work independently from the CNN newsroom. When you buy through links on our site, CNN and its syndication partners may earn a commission. Learn more

I’ve got a couple of weeks before my next trip out of town and I already have my favorite portable charger packed. Anker’s Nano Power Bank , which features a built-in USB-C cable, is a must for me when I’m on the go — and it’s currently back at its all-time low price of $32 right now at Amazon in a couple colors.

Anker Nano Power Bank With Built-In USB-C 29% off

Whether I’m getting ready for an upcoming trip or just going out for an evening, I always pack Anker’s Nano Power Bank with USB-C. The Shell White and Ice Blue colors are now marked down to $32.

$32 at Amazon

Why is this portable charger my personal favorite? After testing gadgets and electronics for nearly a decade, this power bank made me practically say “duh, finally!” when I started using it. Not only does its built-in USB-C cable make it perfect for my phone (as well as all modern Android phones and the entire iPhone 15 lineup) but the cable loops in so neatly that it’s easy to drape the cord around your fingers while still holding your phone.

It’s not just conveniently designed either. This Nano Power Bank sports a 10,000mAh battery capacity so it can refuel my iPhone 15 Pro Max more than twice, as the reputable GSMArena lists that phone as packing a 4,441mAh battery. (Apple doesn’t publicize that detail.) Plus, I could also charge someone else’s gear if I need to, as the Nano Power Bank also features a rectangular USB-A port. Lastly, you’ll always know how much of a charge it packs, as a small display shows its current status as a percentage amount when you click its little button.

I might not be the only person staying at my Airbnb with one of these powerhouses either. I’ve already recommended this charging brick to a friend who is on the verge of upgrading to an iPhone 15. This is easily one of my favorite recent tech deals — and it’s a great find ahead of summer beach days at Amazon . If you’re looking to shop this weekend, check out the best online sales happening until Monday.

Note: The prices above reflect the retailers' listed price at the time of publication.

For more CNN news and newsletters create an account at CNN.com

Recommended Stories

Pick up one of our favorite anker usb-c hubs for only $40.

One of our favorite Anker USB-C hubs is on sale for $40 via Amazon. That’s a discount of $10, or 20 percent.

Electrifying! A top-rated Anker power bank for only $17 and more steals from the brand — save up to 40%

Power-full discounts await.

The best portable speaker of 2024

A portable speaker is a great way to listen to music. You can connect them to your phone, computer, or tablet to play your favorite songs on the go.

This popular wireless iPhone power bank from Anker is 43% off for the Amazon Big Spring Sale

The Anker 622 MagGo with PopSockets Grip gives iPhone users a boost of juice while on the go and it’s 43% on Amazon.

Jay Powell just made 2024 more of a puzzle for regional banks

Higher deposit costs are eating into profits of regional banks. That pressure is not likely to abate anytime soon as the Fed dials back its expectations for rate cuts in 2024.

We found the best flouncy, flattering and fabulous Mother of the Bride dresses — and they're all on sale

No more dress anxiety! From sparkly gowns to two-piece looks, there is something special here for all mothers ahead of the big day.

I review tech for a living and these are the best AirPods Pro alternatives under $100

Before you drop $249 on Apple's earbuds, try one of these exceptional — and affordable — alternatives, each tested and reviewed.

The best polishing compound of 2024

After washing and drying your car, you need to check for other imperfections. A polishing compound can remove scratches and keep your paint looking shiny.

Fed's favorite inflation gauge and Big Tech earnings greet a slumping stock market: What to know this week

With the stock market rally at its most fragile stage in months, big tech earnings, a reading on economic growth and a fresh inflation print are set to greet investors in the week ahead.

Ryan Garcia drops Devin Haney 3 times en route to stunning upset

The 25-year-old labeled "mentally fragile" by many delivered the upset for the ages.

The mega-popular Hanes hoodie is on sale for just $11 on Amazon — that's over 50% off!

Make this your 'everywhere' hoodie this spring.

Some of our favorite Anker power banks are up to 30 percent off, plus the rest of this week's best tech deals

Engadget's weekly deals roundup includes sales on Sonos, Apple, iRobot, Google Nest and more.

Dave McCarty, player on 2004 Red Sox championship team, dies 1 week after team's reunion

The Red Sox were already mourning the loss of Tim Wakefield from that 2004 team.

Arch Manning puts on a show in Texas' spring game, throwing for 3 touchdowns

Arch Manning gave Texas football fans an enticing look at the future, throwing for 355 yards and three touchdowns in the Longhorns' Orange-White spring game.

Former Rams and Eagles QB Roman Gabriel, 1969 NFL MVP, dies at 83

Former Los Angeles Rams and Philadelphia Eagles quarterback Roman Gabriel died at the age of 83. He was the NFL MVP in 1969.

Boston Dynamics unveils a new robot, controversy over MKBHD, and layoffs at Tesla

The weather's getting hotter -- but not quite as hot as the generative AI space, which saw a slew of new models released this week, including Meta's Llama 3. In other AI news, Hyundai-owned robotics company Boston Dynamics unveiled an electric-powered humanoid follow-up to its long-running Atlas robot, which it recently retired. As Brian writes, the new robot -- also called Atlas -- has a kinder, gentler design than both the original Atlas and more contemporary robots like the Figure 01 and Tesla Optimus.

Retiring Yankees broadcaster John Sterling says feeling 'really tired' prompted decision

Retiring New York Yankees broadcaster was honored before the team's game versus the Tampa Bay Rays on Saturday. Sterling said he was tired after 64 years at the mic.

Kia EV9 review: The full-size EV SUV that America needs (but may not want)

Americans love their three-row SUVs. Korean automaker Kia is hoping they’ll love an electric version just as much.

Here's what $1 million buys in today's housing market

Surging home prices made us wonder what $1 million buys in today's housing market. Here’s a sample of listings in cities across the country.

Ditch the salon and snag this 'godsend' permanent hair-removal tool while it's over 40% off

More than 7,000 five-star fans say it has your back — and your upper lip, chin, armpits or any other place you want to banish rogue strands.

2018 Primetime Emmy & James Beard Award Winner

R&K Insider

Join our newsletter to get exclusives on where our correspondents travel, what they eat, where they stay. Free to sign up.

A History of Moscow in 13 Dishes

Featured city guides.

AT&T offers security measures to customers following massive data leak: Reports

At&t is trying to make it up their customers following the leak in march, including identity theft monitoring and a $1 million insurance policy. millions of customers were impacted by the leak..

AT&T is trying to make customers feel more at ease by offering security perks after the sensitive information of more than 70 million people was leaked on the dark web in late March.

The telecom giant said that 7.6 million current customers and 65.4 million former customers were affected by the breech, USA TODAY previously reported. The compromised data may have included personal information, like Social Security numbers from AT&T data-specific fields from 2019 or earlier, but did not contain “personal financial information or call history.”

It wasn’t immediately known whether the “data in those fields originated from AT&T or from one one of its vendors.” They were still investigating the incident.

The company contacted all 7.6 million impacted current customers after “a number of AT&T passcodes” were compromised, opting to reset the passcodes as a “safety precaution.”

They also offered complimentary identity theft and credit monitoring services, a service they continue to offer in addition other new features, like a $1 million insurance policy and help from an identity restoration team, according to reporting by KPRC-TV.

Here’s what we know.

What is AT&T offering customers following data leak?

AT&T will be offering customers a number of features, including, “one year of complimentary credit monitoring, identity theft detection, and resolution services; an insurance policy of up to $1 million in coverage in the event of identity theft; access to an identity restoration team,” according to KPRC-TV.

In addition to resetting passcodes, the company has also reached out to affected customers, saying they had “emailed and mailed letters to individuals with compromised sensitive personal information separately and offering complimentary identity theft and credit monitoring services,” according to the AT&T website.

AT&T also has encouraged customers to “remain vigilant,” monitoring account activity, reviewing credit reports, and reporting suspicious activity.

IMAGES

VIDEO

COMMENTS

1. AT&T International Day Pass® ($10/day) AT&T customers with an unlimited plan will get a great value overseas. AT&T International Day Pass lets you use your phone as you do at home for $10 per day, giving you unlimited data*, talk and text with your eligible AT&T unlimited plan. Plus, International Day Pass covers more than 210 destinations.

Use your phone while abroad. Get talk, text, and high-speed data in 210+ destinations with AT&T International Day Pass® for $10/day. *When added to your Unlimited plan. Coverage and data speed vary by destination and may be changed. See offer details. Find which AT&T international calling & data plan best fits your travel and vacation plans.

Phones Phones AT&T PREPAID AT&T PREPAID Tablets & Laptops Tablets & Laptops Smartwatches ... Portable/Travel. Works with Magsafe. Wall chargers. Brand. AT&T. Belkin. ... fill= #1d2329. 3.4 5. Power Essentials Kit with 20W TC, 20W VPC, C to C cable, C to lightning cable and 10K Power Bank. $79.99. Add to cart. Belkin. Rated4.6out of 5 stars ...

10000mAh, 23 watt max output delivers more than a simple battery boost for USB-C devices. KEY FEATURES AND BENEFITS. AT&T Fast Charge compatibility. 10000mAh, 23 watt max. 4 LED indicators show battery power level and connected devices. 3.0A / 18 watt USB C port quickly recharges battery and connected devices. 6-inch USB A to USB C Cable.

Then pack your bags and your phone because we're packing more value than ever into our AT&T International Day Pass. It comes with unlimited high-speed data*, talk and text. 1 Plus, you'll get 50% off additional lines used in the same 24 hours and only pay for 10 days of service 2 to help you save on long trips.

Pay a daily fee for each 24-hour period that you talk, text, or use data within an included country. Only one daily fee is charged even when you travel to multiple included countries in the same day. The daily fee applies to each line on your account using International Day Pass. 1. For 1 line, it's $10 a day.

Welcome to JetBlue's Travel Bank system, an online account where you can view and manage your JetBlue travel credits. If you are a TrueBlue member, you can access your Travel Bank account by logging into the TrueBlue portal. Click the down arrow next to your name and point total, then choose Travel Bank Credit from the dropdown menu.

International Travel Overview: For postpaid accounts, there are some great options available to help meet your needs on your next trip like: Cruise Ship Plans. AT&T Passport ®. AT&T International Day Pass ®. Roaming in North America - AT&T Unlimited Enhanced plan required. Wi-Fi Calling (compatible devices)

Heads up: You can no longer add AT&T Passport ® to AT&T unlimited plans, AT&T Mobile Share ®, or AT&T 4GB SM consumer rate plans. This feature retired on August 12, 2021. If you have an auto-renew AT&T Passport on your account, you'll keep it. If you are looking for a travel plan, you can add AT&T International Day Pass for international roaming. Save on international talk, text, and data ...

Shop AT&T's selection of cell phone chargers, wireless chargers & charging cables for Apple iPhone, Google Pixel & Samsung Galaxy phones. ... Portable/Travel (21) Works with Magsafe (19) Wall chargers (16) Brand. Samsung (5) AT&T (38) Aina (1) Belkin (13) Carson & Quinn (10) ... Once your bank is fully powered you can use it to charge your ...

We would like to show you a description here but the site won't allow us.

In 2021, U.S. Bank acquired TravelBank, an award-winning fintech focused on improving expense and travel management for businesses and employees. Together, U.S. Bank and TravelBank are delivering an all-in-one corporate card, expense and travel management solution that can help control spend and automate expense processes.

Say you want to deposit $150. Just purchase $50 in funds and then make another purchase of $100. The only limitation is that you can't exceed $5,000 per day per MileagePlus account, meaning that ...

If you list your plan, phone make/model, and country you are traveling in then other customers could give guidance. Otherwise you would need to call AT&T custom support for those traveling abroad. Call and Text Internationally - Wireless Customer Support (att.com)

New York - Today, Citi and AT&T announced the AT&T Points Plus Card from Citi, a new no annual fee* card that rewards wireless customers with statement credits and Citi ThankYou Points on purchases. Building on the long-standing relationship between the two companies, the new card delivers on a shared commitment to drive loyalty and customer engagement by providing an ideal option for AT& ...

United TravelBank makes it easy to manage your travel budget from your MileagePlus ® account. Simply add money to your account and then use TravelBank Cash as payment on united.com or the United mobile app. TravelBank Cash can be used alone or in combination with most other forms of payment. You can't combine TravelBank cash with travel ...

Arthur G., G2. "TravelBank can predict what employees should be spending on trips, help them file their expenses, and even give them cash rewards. User Review, Techcrunch. "Users are saying it cuts down 30 to 45 minutes of their time to book travel and submit for reimbursement. Neal, Sonacare Medical, VP of Finance.

JetBlue travel credits can be applied to: Airfare and taxes on JetBlue-operated flights booked through jetblue.com. The air portion of a JetBlue Vacations package. Change fees for Blue Basic fares booked before Mar 18 2024, and any applicable increase in airfare when changing a booking. Blue Basic fares booked or exchanged on or after Mar 18 ...

As long as you're booking the flight with your Travel Bank, the passenger name on the ticket doesn't need to match the name on the account. You don't even need to be traveling with the person to apply your credit to their ticket. Can Only Use With 1 Other Form of Payment. Travel Bank credits can be used to pay any type of JetBlue fare.

Sign on to your Citi account and enjoy a range of online banking services, such as credit cards, loans, bill payment, transfers, and more. You can also access exclusive rewards and benefits from Citi partners like Costco and American Airlines. Join Citi today and manage your money with ease.

Enroll your AT&T consumer postpaid wireless account in Paperless billing and AutoPay at AT&T with your AT&T Points Plus ® Card as the payment method. Receive a $20 statement credit on your AT&T Points Plus Card statement after you spend $ or more on purchases in a billing cycle or receive a $10 statement credit after you spend $500-$999.99.

SMF said the outages are affecting flights for Southwest and Delta airlines. While a cause for the outage was not released, an AT&T outage map shows the estimated time of restoration is 4:49 p.m ...

Walking tour around Moscow-City.Thanks for watching!MY GEAR THAT I USEMinimalist Handheld SetupiPhone 11 128GB https://amzn.to/3zfqbboMic for Street https://...

Tower 2000 was Moscow City's first tower. It stands on the opposite bank of the Moskva River, and houses a viewing platform from which visitors can admire an unparalleled panorama of Moscow City. The Bagration Bridge reaches across the river from the tower to Moscow City, and underneath are piers from where you can take boat trips.

This Nano Power Bank sports a 10,000mAh battery capacity so it can refuel my iPhone 15 Pro Max more than twice, as the reputable GSMArena lists that phone as packing a 4,441mAh battery. (Apple ...

This Nano Power Bank sports a 10,000mAh battery capacity so it can refuel my iPhone 15 Pro Max more than twice, as the reputable GSMArena lists that phone as packing a 4,441mAh battery. (Apple ...

1: Off-kilter genius at Delicatessen: Brain pâté with kefir butter and young radishes served mezze-style, and the caviar and tartare pizza. Head for Food City. You might think that calling Food City (Фуд Сити), an agriculture depot on the outskirts of Moscow, a "city" would be some kind of hyperbole. It is not.

From April 10, 2025, citizens from Australia, Canada and the US will need a visa to enter the country. On the plus side, those traveling for tourism or cruise travel can apply for an evisa online ...

AT&T is trying to make customers feel more at ease by offering security perks after the sensitive information of more than 70 million people was leaked on the dark web in late March.. The telecom ...

Partner Branch with ATM. Address Krasnaya Presnya, 34. Moscow, Moscow n/a. Phone 74957757575. Services. View Location. Get Directions. Find local Citibank branch locations in Moscow, Central Federal District with addresses, opening hours, phone numbers, directions, and more using our interactive map and up-to-date information.