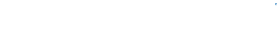

- New Zealand

- United Kingdom

- Latin America

- North America

- Sustainability & Community

- Products and Services

- Geographies

Life at Cover-More is caring, committed and packed with opportunity.

We’re there every step of a traveller’s journey..

We are here for travellers before, during and after they travel, keeping them safe, protected and cared for every step of their journey.

A global group with specialist capability in travel insurance, assistance and travel risk management.

Where we’ve come from: our australian heritage..

Global reach, personalised feel.

We are a global company where empathy and respect, diversity and inclusion are at our core.

You can now get COVID-19 travel insurance. Here's what it does and doesn't cover

Australians travelling overseas for the first time since international borders reopened are paying hundreds of dollars for travel insurance — but the fine print reveals some very big COVID-related exclusions.

Key points:

- Major companies including NIB and Qantas are starting to sell travel insurance again

- Most are offering limited protection for medical and travel expenses if people get COVID while overseas

- No policies cover people for general lockdowns or border closures outside Australia or New Zealand

Sydney couple Beth and Larry Lee are about to fly to the United States to meet a grandchild they've never seen in person.

"I'm the kind of person [who] watches people at airports and cries when the people they know come in," Ms Lee says.

"So, I'm really excited, but also a little nervous."

The Lees' nerves about their trip to the United States comes down to the unpredictability of post-COVID travel.

A recent survey by consumer group Choice found only 23 per cent of Australians were confident making travel plans.

"There are nerves because, if something happens, we might get stuck over there. We might end up in hospital," Mr Lee says.

"And we won't have money to cover that."

To try to protect themselves financially, Beth shopped around for travel insurance that could cover them for COVID-related issues.

She called several companies and got knocked back, before finding one with a supplementary policy for COVID-19.

What does their COVID travel insurance cover?

The Lees' travel insurance with the company Southern Cross cost $698 for two people for three weeks to the United States.

It was slightly more expensive than standard cover because the retired couple have some pre-existing medical conditions.

The Lees were only able to take out their policy to travel to the United States after the Smartraveller travel advice was downgraded from "do not travel" to instead "travel with caution", due to its ongoing COVID-19 outbreaks .

When it comes to what their policy covers for COVID-19, the Lees are protected for:

- Medical expenses if they are diagnosed with COVID-19 while on their journey

- Costs to change their travel arrangements if they, or a relevant person, are diagnosed with COVID-19 before they leave and their journey is cancelled or amended

- Costs to change their travel arrangements if they, or a relevant person, are diagnosed with COVID-19 after they leave and their journey is interrupted or cut short.

Importantly, if the travel advice to the United States changes to "do not travel", ABC News has confirmed that Southern Cross will not cover them for COVID-19 expenses if they decide to push forward with their plans.

"They would be able to claim under our COVID-19 cover for costs to [cut short] their journey and return to Australia, as the change happened after they left and was unexpected," Southern Cross said in a statement.

"It's really important people monitor when they're travelling around.

"You could be in New York and, while you're there, there's a huge surge in COVID-19 cases in Los Angeles. Smartraveller updates change to say "do not travel" to Los Angeles because of the surge.

"If you go to that high-risk city, regardless of government advice, and catch COVID, there won't be cover. If you go anyway, against government advice, and have an unexpected medical event, then there would be cover."

It's also important to note that Australia has reciprocal healthcare agreements with 11 nations, including the UK, New Zealand and Italy .

This covers Australians travelling there for urgent medical treatment, however, often not the entire bill. Evacuations also aren't covered by reciprocal healthcare agreements.

What about lockdowns or border closures?

The most glaring omission from the Lees' travel insurance is coverage that would see them refunded travelling costs or compensated for rearranging plans in the event of general COVID-19 lockdowns or border closures.

Southern Cross says providing this sort of generalised cover for travellers would simply be too expensive.

"Our customers also want affordable travel insurance, so our policies currently don't provide cover for lockdowns, which would expose us to much greater insured losses," the company explains.

"Were our policies to provide lockdown cover, they'd be less affordable, so fewer people would have insurance cover."

Yet, as the current situation in Europe highlights, lockdowns are still very much a consideration for travellers .

The Lees feel somewhat less nervous, knowing that their travel insurance covers them for contracting COVID-19 and associated medical and cancellation expenses.

They're both vaccinated but will still be travelling to San Francisco and then on to Los Angeles with caution.

"We're going to do rapid antigen testing twice a week while away," Beth says.

"We probably will not go into a restaurant to eat inside over there.

"We've thought about it and are taking as many precautions as we can. We want to see our family, we pray we'll get back there safely and come back safely."

They're still nervous about not being covered for rolling lockdowns or border closures.

"That's the tricky one," Larry says.

"You could certainly book into a place and be left high and dry. That could be a problem.

"We don't want to go into our superannuation. And it could take huge amounts of money."

The retired teachers have so far spent $10,000 on their short-term accommodation and flights to the United States.

Their flights aren't refundable but they may be able to get travel credits if their plans need to change.

They've intentionally booked short-term rentals where the cancellation policies say they can be given full refunds until just up to a few days before they're due to check-in.

"We love to travel, so we won't stop travelling," Beth says.

"We're aware of the fact that your travel plans can be up-ended at any time."

Is this the best COVID travel insurance on offer?

ABC News contacted a range of other major insurers that are offering overseas travel insurance, including Allianz, CoverMore and NIB.

None of them offers overseas travel insurance with COVID protections beyond what Southern Cross was selling, except CoverMore, which offers some general lockdown coverage for travel to New Zealand. (More on that later.)

Allianz is also offering customers a partial refund of the insurance that they paid for if they get caught out by general COVID-19 issues.

Pre-COVID, NIB was one of the bigger providers of travel insurance, with $200 million in premiums taken every year.

"But, of course, throughout COVID-19, things have been much tougher. And, you know, we've been losing money," NIB's chief executive Mark Fitzgibbon tells The Business.

NIB had to exit the market altogether this year after its financial backer — or underwriter — AXA ended its financial arrangement.

"Travel insurance is not the most popular category for global insurers at the moment, for obvious reasons," Mr Fitzgibbon says.

"We thought we had another underwriting arrangement in place but it fell apart at the last minute. So, frankly, we've had to scramble to establish a new underwriting partnership.

"We [now] have and, very soon, we'll be back online and selling travel insurance across Australia and New Zealand."

The NIB policy that will be on offer — underwritten by new backer Pacific International Insurance — will be very similar to the coverage offered by Southern Cross, without any protection for general COVID-19 lockdowns or border closures.

Mr Fitzgibbon says it's unlikely that NIB would ever offer this sort of coverage. He says this doesn't come down to the insurance companies who sell premiums, but the underwriters who carry the financial risk of paying out policies.

"You talk to people at some of the global underwriters, and they certainly confirm that it's not an insurable risk if the entire world shuts down and closes borders. The financial consequences are just too dire."

Unclear if premiums to rise dramatically

Mr Fitzgibbon says premiums will rise due to the extra pandemic coverage.

"There'll be a little bit of pressure on premiums as a result of that additional COVID cover, but we're talking maybe 5 to 10 per cent. Nothing particularly egregious," he predicts.

After a "collapse" in the market of 99.3 per cent at the start of COVID, insurance comparison website Compare The Market is currently experiencing a return of browsers looking for deals.

The website's travel insurance specialist, Warren Duke, says brands are also slowly re-entering the market.

"At this stage, we've not seen any travel insurers that have included cover if you need to cancel because of a border closure," he says.

"But we're all hoping that border closures and travel bans are a thing of the past.

"So, hopefully, that won't be much of an issue going forward.

"We've not seen prices change to a great degree at this stage. It's a little bit hard to tell because not all insurers have returned to the market.

"We're probably a couple of months away from understanding if the impact of introducing COVID-19 cover has had a dramatic impact on the price of policies."

What about add-on travel insurance?

Many people buy overseas travel insurance directly from companies, including Larry and Beth Lee.

However, there's also travel insurance that people sometimes buy when purchasing plane tickets or even the sort many get given for free by banks when signing up for credit cards.

The Australian airline Qantas halted sales of travel insurance during the pandemic.

ABC News has confirmed that it has just resumed selling travel insurance with a product offered through NIB, meaning people who buy travel insurance through the airline should get the general COVID-19 coverage that the insurer offers.

Online ticket sales website FlightCentre is also selling travel insurance through CoverMore which, as well covering people internationally if they catch COVID-19, offers additional protection including:

- For essential workers who have their leave revoked due to COVID-19 and can no longer travel

- If the person you were planning on staying with in Australia or New Zealand has to go into quarantine for COVID-19 and you need to find new accommodation

- If your accommodation in Australia or New Zealand is cancelled for a deep clean

- For refunds, if your holiday activities in Australia or New Zealand are cancelled due to COVID-19.

When it comes to free travel insurance offered to people when signing up for credit cards, it appears the coverage for COVID-19 is exceedingly limited.

ABC News looked at the policies for the big four banks. All exclude pandemics as a general rule.

"While there is a broad exclusion on pandemics, including COVID, this is consistent with other types of travel insurance across the industry," Commonwealth Bank said in a statement.

"We are looking at ways to offer broader cover to provide better protection for customers."

"The travel insurance offered through some CBA credit cards is complimentary. Customers can, if they choose, take up additional cover for extra cost."

- X (formerly Twitter)

Related Stories

International travel isn't far away — but will your insurance cover covid.

- Business, Economics and Finance

- Travel Health and Safety

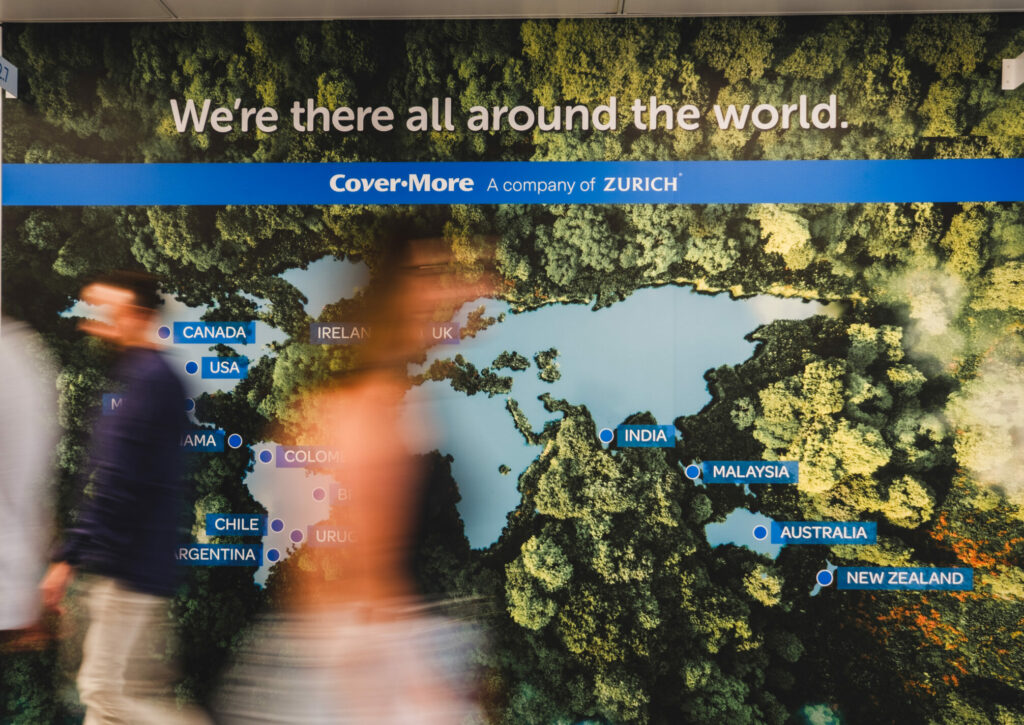

Cover-More travel insurance's cash-for-reviews competition risks breaking law

EXCLUSIVE: ONE of the biggest names in travel insurance may have broken the law by offering the lure of cash prizes for positive reviews.

Qantas to pay passengers up to $450

How collapsed airline got it so wrong

Budget airline ‘unlikely’ to recover

ONE of the biggest names in travel insurance may have broken the law by offering the lure of cash prizes for positive reviews.

Cover-More, which claims to be the choice of 1.8 million Australians annually, is at risk of breaching the Competition and Consumer Act over a two-month promotion that enticed customers to share their "positive experiences" on the leading customer feedback site productreview.com.au in return for the chance to win $1000 each month.

In some months before the promotion there was no review, positive or negative, of Cover-More. But during the late 2012 promotion nearly 350 positive reviews were published, even after Product Review rejected many for being "overly positive". Another 120 were posted in the subsequent two months.

As of yesterday, Cover-More had 544 "excellent" reviews on Product Review . Remove those generated during and immediately after the promotion and there would be half as many five-star reviews as one-star or "terrible" reviews.

Yet Cover-More talks itself up on its website as "highly rated".

"Cover-More Travel Insurance Australia is rated 4.1 stars by 846 customers on Product Review,". its homepage says.

This has angered customers who posted negative reviews.

"I think it does skew it," said Jill Kajewski of Griffith, who had great difficulty making claim on her insurance after serious illness in her family forced her and her sister to return home early from Europe.

Jeff Marriner of Melbourne said he believed Cover-More was "misleading" would-be customers. Mr Marriner struggled to have a claim approved after he and his family were forced to leave Fiji due to flood.

Both Ms Kajewski and Mr Marriner gave Cover-More 1 out of 5 ratings on Product Review. Ms Kajewski said: "I'd have given them 0 out of 5 if I could have."

An Australian Competition and Consumer Commission spokesman said: "Businesses that offer incentives to those who write positive reviews risk misleading consumers and breaching the Competition and Consumer Act."

Beyond that, the ACCC said it couldn't comment on "potential investigations".

A Cover-More spokeswoman said it had "external legal advice that our 2012 promotion was compliant with the prevailing legislation".

Product Review data manager Josh Berriman said it had stipulated future Cover-More promotions give all an equal chance of winning, regardless of whether the review was positive or negative. Cover-More denied Product Review had taken issue with the promotion.

Add your comment to this story

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout

Qantas will begin making remediation payments of $225 to $450 to customers after settling its flight cancellation lawsuit with the ACCC.

Upstart airliner Bonza launched in Australia with budgie-smugglers and purple cocktails, but 18 months later the low-cost carrier collapsed. Here’s why.

Customers had their flights abruptly cancelled after a discount regional airline fell into voluntary administration, with the government ruling out a bailout.

Cover-More, Flight Centre part ways after 33 years

06 february 2024.

Zurich’s Sydney-based travel insurer Cover-More will no longer insure Flight Centre’s retail clients in Australia and New Zealand from late this year.

The pair’s distribution arrangement had run for more than three decades.

“Due to changing directions of our companies, Cover-More Travel Insurance will cease providing travel insurance and assistance to Flight Centre leisure customers in Australia and New Zealand from November 2024,” a Cover-More spokesperson told insuranceNEWS.com.au.

“Cover-More values the strong partnership we have enjoyed with Flight Centre for the past 33 years, and the millions of customers we have looked after on their behalf. We wish everyone at Flight Centre leisure brand the very best for their ongoing success.”

Cover-More this month appointed Justin Sebire as interim Group CEO in addition to his responsibilities as Group CFO, a role he took up in March last year after three years as Catholic Church Insurance CFO. His appointment comes after former CEO Cara Morton relocated to become Zurich Global Ventures CEO in Switzerland.

Cover-More was established in 1986 in Sydney and the partnership to provide travel insurance services for Flight Centre started in 1991. Zurich bought Cover-More, which was listed on the Australian Securities Exchange, in 2017 for around $722 million.

The insurer said today it was "very proud to be the preferred travel insurance partner of many iconic and well-known brands”.

“As the appetite for travel continues to grow and evolve, we are excited about working with our ongoing distribution partners to support and care for their customers at every step of their travel journeys,” the spokesperson said.

“We will continue to push boundaries as a leading provider of travel insurance and travel medical and security assistance.”

Cover-More has 17 million customers and operations in the US, Canada, Europe, the UK and Latin America.

Travel Insurance You Can Trust

What country are you going to?

Select the Area of travel in which you will spend most time. NOTE: If you are spending more than 20% of your trip time in the Americas Area, it is compulsory to select a destination in the Americas Area for your policy.

If you are quoting a multi-trip policy please select “see region list” and select a destination in the appropriate region. For example United States for Worldwide cover or Spain for European cover.

When are you going?

Please select the departure and return dates for your trip.

For multi-trip policies the departure date will mark the start of your cover and it will automatically run for a year from that date.

Who is travelling?

Simply enter the age of each traveller including Adults and Accompanied Children*. Enter the age they are now.

Only use as many boxes as you have travellers.

*As per the Policy Wording: "Accompanied Children" means Your children or grandchildren plus one non-related child per adult policyholder who are identified on the Certificate of Insurance and travelling with You on the Journey, provided they are not in full-time employment and they are under the age of 21 years at the Relevant Time. If an Accompanied Child is in full time employment then they will need to purchase their own policy.

If you require a policy for more than 6 travellers, please contact Cover-More on (0800) 500 225 as we may still be able to offer cover to you.

Travel Alert: Important Information Regarding Coronavirus COVID-19 Benefits Now Available

Key benefits of Cover-More travel insurance

COVID-19 Cover

We provide COVID-19 Benefits on our Options Plan (both Single Trip and Annual Multi-Trip policies) to help you travel within New Zealand and overseas with greater confidence.

Luggage and Travel Documents

We offer up to $25,000^ cover for luggage and travel documents on our International Options Plan . This provides protection for items such as cameras, laptops, and mobile phones.

Emergency Assistance

Our policyholders have 24/7 access to our emergency assistance team. They’re here to help ensure you are safe, well, and can keep travelling.

Travel Delay/Cancellation

We automatically include coverage for travel delay of over six (6) hours, up to $2,000. For cancellation cover, you can customise your policy by selecting an amount that suits your needs.

Access to Virtual Care

Our Cover-More customers can access our Virtual Care service for free. If you’re feeling ill and our Emergency Assistance team believes you're eligible for support via a virtual doctor (for example, you don't require a physical exam), we can provide you with access to booking a virtual consult at a time that suits you.

Rental Vehicle Insurance Excess

If you’re hiring a vehicle on your holiday – or driving your personal vehicle on a domestic trip – our premium Options Plan can help protect you by providing cover for your excess amount if you’re involved in an accident.

Types of travel insurance cover we offer

International

A trip of a lifetime overseas can be costly and sometimes scary if you have to visit a foreign hospital. Our 24/7 emergency assistance team is there to help policyholders navigate foreign hospitals, and to organise payment for medical services. A case of gastro in the USA once cost over $100,000.

Existing Medical Conditions

Our premium Options Plan and budget-friendly Essentials Plan can provide automatic cover for over 35 conditions, and we’ll consider all other existing medical conditions. To find out if you’re eligible for cover, simply declare all your medical conditions when generating a quote.

Our travel insurance policies automatically include cover for cruise ship related claims. Any injuries or accidents onboard the ship aren’t covered by ACC, and ACC won’t cover the cost of transporting you home. That’s where travel insurance comes in.

Annual Multi-Trip Policy

Travel frequently? Annual Multi-Trip policies are ideal for travel enthusiasts who expect to take a few trips each year. You can purchase an Annual Multi-Trip policy on either our Options or Essentials Plans, saving you from organising a new policy every time you travel.

Exploring New Zealand? Our Options Plan can help protect your domestic trip from unforeseen incidents if you’re travelling more than 100km from your home or spending at least one night in paid accommodation.

For Seniors

Celebrate the golden years and travel the globe. It’s time to ticket items off that bucket list. Our plans offer existing medical assessments for travellers who require cover for medical conditions.

Adventure Sports

Love the outdoors and adventure? Our policies include a number of adventure sports including jet-skiing, parasailing, snorkelling, and more. Adventure sport accidents can be painful. Protect yourself and your finances.

Looking to save on travel insurance so you can spend more on your trip? Make sure you have a look at our Essentials Plan, providing great cover at an affordable price.

Ski & Winter Sports

If you’re hitting the slopes on your next trip, consider including our Snow Sports option in your policy. If you’re on-piste snow skiing, snowboarding and snowmobiling, or cross-country skiing, we can provide emergency medical cover and more.

Travel insurance: w hat’s the big deal?

Everyone hopes that their trip goes smoothly, sometimes that isn’t always the case. From skiing accidents in Vancouver to insect bites in Thailand, travel insurance can help protect you from the unexpected. Our 24/7 Medical Assistance team are there to help with emergencies while on your trip, and our Claims team are available to help process your claims. We encourage our customers to read the Policy Document before purchasing a policy to ensure you know what you’ve got cover for. Read more about why you should consider travel insurance .

Cover-More customer reviews

Cover-More travel insurance was reviewed on 28 February 2024 on Google and rated 4.6 stars based on 419 reviews.

Senka contracted Dengue fever in Bali, Indonesia, and spent five days in the hospital.

"When I was in hospital I spoke to Cover-More every day, and because I was in Bali on my own that was so reassuring."

Claim cost: $1,637

Diane’s father, John, fractured his hip on holiday in Australia and required surgery.

"Cover-More has been absolutely fantastic, I cannot fault them. They were in touch with me every day and they checked up on us to make sure dad was OK."

Claim cost: $10,933

Tom suffered a stroke on the first day of his holidays on the Cook Islands and had to be repatriated home.

"With all the help and care that I got, I’ve really dodged a bullet, and I couldn’t ask for anything more."

Claim cost: $114,780

Cover-More can protect your next trip with:

- 24/7 emergency assistance

- Online claims portal

- Choice of excess levels

- Options to vary your cover, including cancellation, snow sports, and luggage and personal effects

- Unlimited+* overseas emergency medical expense cover on our International Options Plan

- 21-day cooling-off period~

Travel insurance FAQs

Travel insurance is a specific type of insurance that helps cover a number of costs and disruptions associated with travelling both domestically and overseas. Levels of cover differ per policy, however, travel insurance typically protects against trip cancellation, delays, lost luggage and personal belongings, medical expenses and repatriation, and personal liability.

Most travel insurance providers offer single or multi-trip policies, which can cover multiple countries within a specific timeframe. The destination, length of trip, specific activity add-ons and pre-existing medical conditions all help determine the cost of a travel insurance policy. Policies can be purchased at the time of booking a trip up until the time a traveller leaves their home.

Travel insurance varies for individual travellers based on the options selected by them, so prices vary from person-to-person. The cost of a travel insurance policy is determined by:

- Age of traveller/s: the older the traveller, the higher the policy cost may be.

- Number of travellers included in the policy: a higher number of travellers creates more variables, therefore increasing risk.

- Length of trip/s: a single trip policy is generally around half the amount of a multi-trip policy, making the latter more cost-effective for frequent travellers, while shorter trips often pose less risk of medical incidents and travel interruptions, resulting in lower costs.

- Destination/s: costs vary greatly depending on the countries and regions covered by a policy. For example, regions such as Europe will often be cheaper than trips to the USA because of the high cost of medical treatment in America.

- Level of coverage: travellers can opt for cheaper travel insurance as well as comprehensive, more expensive plans to cater to their different needs.

- Existing medical conditions: a customer’s policy will increase if their medical history shows an increased risk of possible medical treatment requirements while travelling.

While a cheaper policy cost upfront may seem appealing, always read the Policy Wording to ensure your needs are adequately covered should an incident occur.

Travel insurance protects you when travelling domestically or internationally by providing coverage against unforeseen circumstances that may negatively impact your travel plans.

By purchasing travel insurance prior to departure, your policy can help cover the costs of trip cancellations should you no longer be able to travel, as well as the costs of medical treatment, lost passports and personal items while you’re travelling. The customer usually pays for these costs upfront, before being reimbursed by the travel insurer upon claim approval.

To approve a claim, travel insurers require documentation such as a police report or medical bill to confirm the incident occurred.

Always read the Policy Wording before purchasing a travel insurance policy to ensure it provides adequate coverage for your circumstances.

Unfortunately, travel insurance can’t cover absolutely everything. This highlights the importance for travellers to read the Policy Wording before purchasing to avoid becoming frustrated when claims are unsuccessful. It will contain details on the situations you likely won’t be covered in, including:

- Cancellation: simply changing your mind prior to your trip may not be sufficient for a successful claim.

- Pre-existing conditions: if medical conditions aren’t disclosed or covered by the policy at time of purchase, exclusions may apply to coverage related to those conditions.

- Theft or loss of belongings while left unattended: travellers must take care of their belongings as they would as home.

- Incidents occurring as a result of reckless behaviour: claims arising from excessive drinking or taking recreational drugs will likely be rejected.

- Winter and adventure sports: claims resulting from participation in high-risk sports will be void unless covered by the policy.

- Terrorism and extreme weather events: travelling to specific regions against the advice of the government or your insurer may result in unsuccessful claims because the events are no longer unforeseeable circumstances.

For full details of exclusions within a travel insurance plan, consult the Policy Wording.

Purchasing a policy soon after a trip is booked has a number of benefits and increases a traveller’s protection.

When purchased ahead of time, a traveller can cancel their travel insurance policy for a full refund within the cooling-off period. If the policy is purchased before the customer leaves their home to depart for their trip, claims for rearrangements and cancellations caused by unforeseen circumstances can also be made.

By considering travel insurance as an essential part of booking a holiday - not an afterthought when at the airport - travellers are likely to be covered should an incident arise before take-off.

See all travel insurance FAQs .

*Medical cover will not exceed 12 months from onset. Medical and dental expenses cover is limited to $1,500 for treatment provided in New Zealand. This $1,500 sub-limit does not apply to the Inbound medical section. Emergency dental expenses are limited to $1,500. ~Cooling-off period is available if you wish to cancel your policy within 21 calendar days of the date of purchase and you have not made a claim under the policy or departed on your journey.

Read our disclosure information under the Financial Markets Conduct Act 2013

Please wait, generating your policy.

- Best overall

- Best for expensive trips

- Best for exotic trips

- Best for annual plans

How we reviewed travel insurance for seniors

Best travel insurance for seniors of may 2024.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Reaching your golden years doesn't mean your adventures have to end. In fact, in this stage of life, you'll hopefully have more time and resources to travel. But as a senior citizen, you'll want to ensure you have travel insurance that covers any health-related issues arise while you travel.

Our top picks for the best senior travel insurance

- Best overall: Allianz Travel Insurance

- Best for expensive trips: John Hancock Travel Insurance

- Best for exotic trips: World Nomads Travel Insurance

Best for annual plans: Travel Guard

How we rate the best senior travel insurance companies »

Compare travel insurance for seniors

Your health gets more unpredictable as you age, which makes travel insurance more important for seniors. Unfortunately, it's also more expensive. The best travel insurance for seniors won't have too steep of a price hike compared to rates for younger travelers. It will have high coverage limits for emergency medical coverage, trip cancellations, and and emergency medical evacuation. It's also important that your travel insurance offers pre-existing condition waivers , ideally at no extra cost to the traveler.

Here are our picks for the best travel insurance coverage for seniors in 2024.

Best overall: Allianz

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz Travel Insurance is one of the most widely recognized names in travel insurance, and it stands out as one of the top travel insurance providers for seniors. It offers a wide range of policies covering medical treatments overseas and emergency medical transport.

Allianz also provides options for varying trip lengths. Its annual multi-trip policies , for example, cover any trip you make during your policy period, even if they aren't yet planned, making it an excellent option for seniors who vacation multiple times per year.

Read our Allianz Travel Insurance review here.

Best for expensive trips: John Hancock

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 3 travel insurance plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancel for any reason rider available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable travel insurance premiums

- con icon Two crossed lines that form an 'X'. Reviews of claims process are mixed

- con icon Two crossed lines that form an 'X'. Buyers may not get specialty coverage for sports equipment and other high value items

- Trip cancellation for 100% of the trip cost

- Trip interruption insurance for up to 150% of the trip cost

- Emergency medical coverage of up to $250,000 per person

- Medical evacuation coverage of up to $1,000,000

John Hancock Travel Insurance plans for seniors offer some of the best coverage available. It provides generous maximum benefit amounts while still offering affordable prices.

Each plan includes coverages like trip cancellation, emergency accident, and emergency medical, with the option to add benefits like CFAR (cancel for any reason) . Plus, getting a free online quote is a quick and straightforward process.

Read our John Hancock Travel Insurance review here.

Best for exotic trips: World Nomads

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

World Nomads Travel Insurance is a great choice for active senior citizens under 70 who want comprehensive travel insurance. The key difference between World Nomads and many other providers is that it covers 200+ adventurous activities like scuba diving, mountain biking, surfing, skiing, and even bungee jumping. In addition, World Nomads' trip cancellation and emergency medical coverage includes COVID-19-related issues. Many other insurers are excluding that type of coverage now.

For adventurous senior citizens over the age of 70 years, World Nomads suggests working with its partner, TripAssure .

Read our World Nomads Travel Insurance review here.

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip cancellation coverage of up to 100% of the cost, for all three plan levels

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR covers up to 75% of total trip costs (maximum of $112,500 on some plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Medical coverage of up to $500,000 and evacuation of up to $1,000,000 per person

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes COVID coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Above average baggage loss and delay benefits

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical evacuation coverage

- con icon Two crossed lines that form an 'X'. Premiums may run slightly higher than competitors

Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits.

- Trip cancellation coverage for up to 100% of the trip cost

- Trip interruption coverage for up to 150% of the trip cost

- Preexisting medical conditions exclusions waiver must be purchased within 15 days of initial trip payment

- Annual travel insurance plan and Pack N' Go plan (for last-minute trips) available

Travel Guard offers comprehensive insurance plans for shorter and longer trips. One of its more unique offerings is its Travel Guard Annual Plan.

This annual travel insurance comes with standard coverage benefits (trip delay, baggage loss, etc.) and substantial coverage amounts, which is important for seniors who travel multiple times per year. Travel Guard also offers a preexisting medical condition waiver, meaning those with certain medical issues can still gain coverage.

Read our AIG Travel Guard Insurance review here.

Understanding travel insurance for seniors

Before diving into the specifics, it's essential to understand what travel insurance is and why it's particularly important for senior travelers. The best travel insurance offers financial protection against unexpected events affecting your trip, such as trip cancellations, medical emergencies, or lost luggage.

Types of coverage

- Medical Coverage: Ensures your medical expenses are covered in case of illness or injury.

- Trip Cancellation/Interruption Coverage: Provides reimbursement if your trip is canceled or cut short due to unforeseen events.

- Baggage Coverage: Covers loss, damage, or theft of personal items during your trip.

Benefits of travel insurance for seniors

- Peace of Mind: Knowing you're covered in case of emergencies can make your travel stress-free.

- Financial Protection: Shields you from potentially overwhelming medical costs and trip cancellations fees.

- Assistance Services: Many plans offer 24/7 assistance services, providing help whenever and wherever you need it.

Making the most of your plan

After choosing a plan, it's crucial to understand your policy fully and know what services are available to you in case of an emergency.

Understanding your policy

- Read the fine print and understand the claims process to avoid surprises.

Emergency assistance services

- Familiarize yourself with the emergency assistance services offered by your plan and keep all necessary contact information handy.

How to pick senior travel insurance

It's wise to compare several different travel insurance policies for the best coverage and pricing, as premiums vary widely between insurers and depend on factors like your age and travel destination.

That said, some of the more essential coverages to look for if you're a senior citizen include:

- Travel medical coverage - This coverage will pay for your medical bills outside the US.

- Medical evacuation coverage - If you're injured or become sick while traveling, this coverage will transport you to the nearest hospital or even back home if your condition necessitates it.

- Preexisting conditions - Coverage for known health conditions. You'll need to purchase travel insurance within a certain time period from when you book your trip to qualify for a preexisting condition waiver .

- Cancel for any reason (CFAR) - The name says it all! It'll cost extra and you'll need to purchase insurance early, but it's the most comprehensive trip cancellation coverage you can get. Note that CFAR insurance usually only covers up to 75% of your trip fees.

- Trip cancellation insurance - This coverage provides reimbursement for your prepaid and nonrefundable costs if you cannot make your trip due to an unforeseen event.

- Baggage delay insurance - This coverage will reimburse you for essentials like toiletries and clothes if your bags are delayed.

- Lost luggage insurance - This coverage will reimburse you up to a specified amount if your bags get lost en route.

Of these, the most critical to note are whether or not your policy covers preexisting conditions and the limits for travel medical insurance and emergency medical evacuation.

Some insurance companies offer a waiver that will cover preexisting conditions. You'll have to follow the requirements for adding a waiver to your policy, like insuring the entire cost of your trip. Or purchase the policy within a specific time after making your first trip deposit payments.

You'll also want to find a policy with high maximum limits for travel medical and emergency medical evacuation coverage. These types of expenses can be substantial, so you want to have appropriate coverage.

When comparing senior travel insurance options, we looked at the following factors to evaluate each travel insurance provider:

- Coverage limits: We looked at each travel insurance company's coverage amounts for benefits like medical emergencies and trip cancellation.

- Flexibility: We looked at how customizable a policy is, so you can choose what your travel insurance policy covers .

- Coverage for preexisting conditions: Preexisting conditions are one of the more critical factors for travel insurance for senior citizens, so we looked at travel insurance companies that offer the best coverage for preexisting conditions.

- Price: We compared travel insurance providers offering reasonable basic and comprehensive coverage rates.

- Benefits geared towards seniors: We compared travel insurance companies that offer solid coverage for senior citizens, like medical evacuation, COVID-19 coverage, and trip cancellation.

You can read more about our insurance rating methodology here.

Seniors should look for travel insurance policies that offer comprehensive medical coverage, including for preexisting conditions and emergency medical evacuation. They should also consider policies with higher coverage limits to ensure adequate protection. Additionally, seniors should seek travel insurance plans that provide 24/7 assistance services, as well as coverage for trip cancellations, interruptions, and baggage protection.

The cost of senior travel insurance coverage can vary depending on your age, overall health, state of residence, travel destination, and length of your trip. However, assuming all other factors are the same, you'll pay more for travel insurance at 70 than at 30.

All travel insurance companies, except World Nomads, included in this guide offer coverage for pre-existing medical conditions as long as you buy your policy within the qualifying period from when you placed your trip deposit.

Allianz is the best travel insurance for seniors due to its wide array of medical coverages and emergency medical transport. Allianz also offers multi-trip insurance policies , which could make sense for seniors who travel frequently.

In some instances, travel insurance companies will have age eligibility restrictions, often only insuring people 80 years old and younger.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Dubai’s Extreme Weather: Travel Firms Face Higher Costs

Jesse Chase-Lubitz , Skift

May 4th, 2024 at 4:48 PM EDT

Dubai's floods seemed freakish. But the climate emergency could make weather more volatile in other places, too. Expect rising costs for insurance, disaster preparedness, and recovery.

Jesse Chase-Lubitz

Dubai, situated in one of the world’s driest regions, was hit with a second bout of heavy rains and strong winds this week — just two weeks after the desert metropolis was covered in a year’s worth of rain in the span of 12 hours.

Dubai’s extreme weather may lead to insured losses of up to $850 million across infrastructure, roads, buildings, vehicles, and public facilities, estimated the reinsurance broker Guy Carpenter.

The extreme weather event is one of many that have brought attention to climate insurance, and experts expect policy prices to rise. From airports to tours to hospitality to destination management, unforeseen climate events can have extreme impacts on the travel industry.

Downpours in the desert

Between April 14 and 17, floods brought Dubai to a standstill . The city’s airport, the second-busiest in the world, shut down, hundreds of flights were canceled, and people and cars were stranded. In Dubai and neighboring Oman, 21 people died.

Emirates diverted dozens of flights and canceled nearly 400 in the three days following.

”We know our response has been far from perfect,” said Emirates CEO Tim Clark in a statement .

Some initial reports blamed the floods on a technology the United Arab Emirates has been funding called “cloud seeding.” It involves small jets flying into rain clouds and spraying them with sodium mixtures meant to expand the droplets and encourage more rain.

The technology does work to spill buckets of sudden rain on parts of the UAE every now and then.

However, experts said cloud seeding is too small scale to create downpours like what Dubai endured. Instead, climate change was the most likely culprit . And it will almost certainly happen again.

Extreme weather worldwide

Despite the shocking nature of the event in Dubai, it isn’t actually unprecedented . In 2022, flash floods destroyed homes and infrastructure in the UAE, forcing more than 3,800 people to evacuate. The World Weather Attribution found that 85% of the UAE live in flood-prone areas .

Other impacts of global warming, such as rising temperatures, are also creating consistent financial and operational liabilities for travel companies.

In 2023, a wildfire that lasted for six days forced 25,000 tourists to evacuate from the Island of Rhodes. EasyJet and TUI operated repatriation flights and Greece launched “free” holidays for those who had to flee.

Increasingly hot summer days have already made it impossible for some operators to schedule active trips like cycling vacations in Southern Europe.

“It’s simply too hot,” said Shannon Stowell, CEO of the Adventure Travel Trade Association .

Stowell says he knows of several operators in Italy and Spain who are looking to move their active trips to northern destinations like Scandinavia.

Other countries are struggling as ski seasons are either cut short or eliminated due to higher temperatures. Wildlife migration is also changing, bringing sharks to waters that have never been seen there before.

“Tour operators are being forced to think about what shorter seasons or more logistical costs will mean to their businesses and have to look at other ways of bringing in revenue,” he said.

Rising Climate Costs

The increasing rate and intensity of extreme weather disasters has placed the question of climate insurance center stage because experts expect prices to rise.

“Underwriters are unlikely to forget about [these floods] anytime soon,” said Sami Doyle, CEO and Co-Founder of TMU Management , an insurance intermediary focused on travel.

“At this early stage, it would be hard to say how much of an increase to expect, Doyle said. “But for sure, it won’t be going down when you mention Dubai. And it could easily go up enough to make sellers think twice when pricing future sales. Certainly, we’d advise to expect a noticeable increase.”

While some companies are considering ways to mitigate their exposure to natural disasters, few seem to be actively investing in climate insurance.

“Some large companies have been hit quite severely,” said Neil Gunn, head of flood and water management research at WTW Research Network , adding that a few companies have taken actions like buying climate insurance to safeguard their business. “We expect that more will, especially with the recent incidents.”

But many companies are either not making the move to develop their resilience and purchase insurance, or they are in the very early stages of doing so.

TUI told Skift it hadn’t taken any specific actions following the recent floods.

“Developing the resilience of our services is a continuous process,” said a spokesperson at TUI, adding that it has done a company-wide risk analysis for TUI’s worldwide infrastructure. The analysis said that “the risk of airport disruption was found to be in the low physical risk analysis.”

Talk of “climate resilience”

Experience-based companies say that insurance and resilience aren’t on their radar because the industry provides built-in flexibility.

“Because the majority of tours and attractions are booked within 2-3 days of the activity taking place…our industry tends to see less impact than others with these disruptions and thus has less need for climate insurance,” said Craig Everett, CEO and Founder of Holibob , a company that provides tours & experiences technology to online travel sellers and tourism boards.

GetYourGuide said that climate insurance isn’t something it is pursuing right now.

Yet some experts say that preparedness still needs to be considered.

“The growing frequency of extreme weather and rising risks from climate change make having crisis management plans that much more important for operators,” says Douglas Quinby, co-founder and CEO of Arival , a travel events and research firm.

What may be next

Doyle said that insurance increases should be factored into future costs and pricing and that companies need to consider their safety within their destination.

“Ask yourself, am I overexposed at this – or indeed any – destination?” Doyle said.

Gunn at WTW says there are several steps companies can take to reduce their risk of flooding: develop flood emergency plans with evacuation routes and procedures for shutting off utilities to protect equipment. They can also install backup generators and ensure that their insurance policies adequately cover flood damage and business interruptions.

“Flood and climate change will inevitably become more of a consideration in the Middle East than they have up to now,” says Gunn. “While it is too early to predict the long-term impact on pricing, we do expect terms and conditions, particularly deductibles for perils like water damage and flood, to be reviewed with greater scrutiny in the coming years.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: climate change , dubai , dubai airport , ESG , insurance , storms , sustainability , Travel Experiences , weather

Photo credit: Aerial view of Dubai. Credit: Christoph Schulz Dubai Media Office / Dubai Media Office

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Pet Insurance

Embrace pet insurance review 2024

Mandy Sleight

Scott Nyerges

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Heidi Gollub

Published 6:00 a.m. UTC May 6, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Maximum annual coverage

Average monthly cost for dogs, average monthly cost for cats, why it’s the best.

Embrace is the only pet insurance company in our rating of the best pet insurance that offers a diminishing deductible. For each year you go without filing a claim, your deductible will be reduced by $50. That means if you have a $100 deductible and go without a claim for two years, you could get down to $0 deductible without it affecting your rates.

The cost of Embrace pet insurance plans is higher than the average rates of companies in our analysis. However, Embrace covers more advanced treatments than many competitors, such as prosthetics and mobility devices.

Pet insurance plans

Accident and illness plan

- Deductible: $100, $250, $500, $750 or $1,000.

- Annual coverage limit: $5,000, $8,000, $10,000, $15,000 or unlimited.

- Reimbursement percentage: 70%, 80% or 90%.

Accident only plan

- Deductible: $100.

- Annual coverage limit: $5,000.

- Reimbursement percentage: 90%.

Wellness plan

You can choose an allowance of $250 to $650 per year to reimburse you for eligible preventative care expenses, such as vaccinations, bloodwork and dental cleanings.

- 10% multi-pet discount.

- 5% military discount for active service members and veterans.

Customer reviews

Embrace pet insurance gets 4.2 out of 5 on Trustpilot (great) based on more than 3,600 reviews.

- Diminishing deductible for healthy pets.

- Coverage for vet exam fees related to a covered injury or illness.

- Coverage for medication and other therapies prescribed by a veterinarian to treat behavioral issues.

- Coverage for complementary treatments such as acupuncture, hydrotherapy and physiotherapy.

- Coverage for up to $1,000 per year in treatments for dental illnesses.

- 14-day waiting period for illnesses.

- 6-month waiting period for orthopedic conditions.

- Physical exam required for enrollment.

- Claims can take 10 to 15 days to process.

Our Partner

Paw protect.

Why trust our pet insurance experts

Our team of pet insurance experts evaluates hundreds of pet insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 4,000+ pet insurance rates reviewed.

- 500+ coverage details evaluated.

- 5 levels of fact-checking.

About Embrace pet insurance

Cleveland-based Embrace pet insurance has been in business since 2006. It partners with American Modern Insurance Company to underwrite its policies and insures more than 500,000 dogs and cats.

Embrace donates money for every policy it issues and matches employee donations at 100%, even for non-pet-related charities. It also gives back to its community by hosting a fundraising competition for local nonprofits. Consider this Embrace pet insurance review when comparing carriers to find the company that best meets your pet’s needs and your budget.

Embrace pet insurance rates

We understand budget is a deciding factor for many pet owners. We’ve gathered Embrace pet insurance quotes to give you an idea of what you might pay for coverage with Embrace. These rates are for breeds averaged across 25 ZIP codes.

Source: Petinsurer.com. Rates are based on the average monthly cost of pet insurance for dogs at ages 3 months and 3 years, with a $250 deductible and 80% reimbursement level.

What Embrace pet insurance covers

Embrace’s accident and illness pet insurance coverage options include:

- Breed-specific, congenital, genetic and chronic conditions.

- Complementary treatments.

- Dental illnesses.

- Diagnostic exam fees.

- Diagnostic testing.

- Emergency care.

- Hospitalization.

- Orthopedic conditions.

- Prescription drugs.

- Preventable conditions.

- Rehabilitation.

- Specialist care.

Pet owners can also choose Embrace’s cheaper option, accident-only coverage. This includes the above coverages, but only if they relate to a dog or cat’s accidental injuries.

Embrace wellness rewards

Pet owners can choose to add Embrace’s wellness rewards plan, which includes coverage for routine and preventive care not available in its pet insurance plans.

You can get up to $650 in rewards coverage each year, which includes:

- Acupuncture.

- Anal gland expression.

- Behavior training.

- Blood and fecal testing.

- Cremation or burial costs.

- Dental cleanings.

- Exams, X-rays, and other testing for hip dysplasia.

- Flea, heartworm, and tick prevention medication.

- Gastropexy.

- Massage therapy.

- Medicated shampoos.

- Microchip implantation.

- Nail trims.

- Nutritional supplements.

- Prescription diet food.

- Routine chiropractic care.

- Spay or neuter surgery.

- Vaccines and titers.

- Wellness visit exam fees.

- Wearable pet-activity monitors.

What Embrace pet insurance doesn’t cover

As is typical with pet insurance companies, Embrace has exclusions they don’t cover under its pet insurance plans. This includes:

- Breeding, pregnancy and whelping.

- Cosmetic procedures like ear cropping, tail docking or dew claw removal that aren’t medically necessary.

- Cruelty, fighting, racing or neglect injuries or illnesses.

- DNA testing or cloning.

- Intentional injury by anyone living in the household.

- Nuclear war.

- Pre-existing conditions.

- Routine care (unless you add a wellness rewards plan).

Embrace will cover some curable pre-existing conditions, such vomiting, diarrhea and ear infections. If your dog or cat goes a year without symptoms and treatment, the condition may be eligible for coverage.

How Embrace compares to other pet insurance companies

Via Petted’s website

Source: PetInsurer.com. Average monthly pet insurance cost assumes unlimited reimbursement (or the highest level offered by that company), a $500 deductible and a 90% reimbursement percentage for a dog insurance accident and illness plan. These average pet insurance company rates are based on dogs and cats of various ages, breeds and ZIP codes.

Methodology

To find the best pet insurance , we analyzed 15 pet insurance companies using data provided by PetInsurer.com.

Each pet insurance company was eligible for up to 100 points, based on its performance in the following key categories:

- Cost: 50 points. We calculated average rates for accident and illness pet insurance plans for dogs with the highest level of coverage available, a $500 deductible and a 90% reimbursement percentage.

- Annual coverage limits: 10 points. Pet insurance companies that offer an annual reimbursement level of $100,000, or unlimited annual coverage scored in this category.

- 24/7 vet line: 10 points. Insurance companies that offer access to a 24/7 vet line earned points. Being able to call for medical advice might save you money on vet visits.

- Routine wellness plan: 10 points. Pet insurance companies that offer an optional wellness plan add-on scored full points. Wellness plans can reimburse you for preventative care for your pet.

- Pays vet exam fees: 10 points. If a pet insurance plan includes pet exam fees, the insurer received 10 points. If this is offered as a coverage add on, the insurer received 5 points.

- Multipet discount: 5 points. Pet insurance companies that offer a discount for insuring more than one pet received full points.

- Euthanasia or end of life expenses included: 5 points. If euthanasia or other end of life expenses are covered in pet insurance plans, a pet insurance company scored in this category.

Embrace pet insurance review FAQs

Only you can decide if Embrace pet insurance wellness coverage is worth it. Embrace offers between $250 and $650 in wellness coverage each policy year. It offers a long list of eligible reimbursements, which include spay or neuter surgery, training, wearable pet activity monitors, gastropexy, nutritional supplements and medicated shampoos.

Dig into the coverage: Is pet insurance worth it?

Pet insurance premiums can increase each year, and Embrace is no exception. The carrier may increase your rates when your pet insurance policy renews because of your pet’s age, pet population trends, discount changes and statewide rate adjustments. Embrace will notify you by email two to four weeks before your renewal date if your premium changes.

Time to shop around? How to compare pet insurance quotes

While Embrace Pet Insurance Agency, LLC administers its own policies, American Modern Home Insurance Company underwrites Embrace pet insurance plans. You can download a copy of your policy at any time by logging into your Embrace account and clicking on “Claims & Documents.”

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Scott Nyerges is a veteran journalist with experience in insurance and consumer reviews. Before contributing to USA TODAY Blueprint, Scott was the senior insurance editor and content strategist for U.S. News and World Report. He's also written and edited for Consumer Reports, MSN, Cheapism and Consumer Search. He loves helping people make smart money decisions. Scott's expertise lies in car insurance, home insurance, life insurance, pet insurance and small business insurance. He has a bachelor's degree in journalism from The University of Missouri-Columbia.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

Trupanion pet insurance review 2024

Pet Insurance Mandy Sleight

MetLife pet insurance review 2024

Figo pet insurance review 2024

Healthy Paws pet insurance review 2024

Fetch pet insurance review 2024

ManyPets pet insurance review 2024

Lemonade pet insurance review 2024

Pet Insurance Katy McWhirter

Top dog-friendly vacation destinations

Survey: 81% of pet owners buy holiday and Christmas gifts for dogs, cats and other pets

Pet Insurance Kara McGinley

Survey: 91% of dog owners have experienced financial stress over the cost of pet ownership

Pet Insurance Heidi Gollub

Best cities for a happy and healthy dog in 2024

How much do dog vaccinations cost?

Pet Insurance Stephanie Nieves

Animal abuse facts and statistics 2024

Top 23 largest dog breeds

Prudent Pet insurance review 2024

Understanding What Travel Insurance Covers

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠. The details for these products have not been reviewed or provided by the issuer.

- Travel insurance is intended to cover risks and financial losses associated with traveling.

- Coverage can include trip cancellation, baggage protection, medical care, and emergency evacuation.

- When filing a claim, be specific and comprehensive in your documentation to ease the process.

Whether it's a trip across the world or a trip across the state, having travel insurance provides major relief if things go awry. Flight delays, lost baggage, illness, injuries, and other unforeseen events can disrupt even the best-laid plans. With a major disruption comes the potential for unanticipated expenses.

Travel insurance and the coverage it offers can help keep you protected and save you money in the long run.

Overview of Travel Insurance Coverage

Travel insurance policies protect travelers from financial losses should something go wrong during their trip. You can customize which coverages you want to include, and there are several to choose from.

"Common types of coverage include trip cancellation, trip interruption, baggage protection, coverage for medical care if you get sick or hurt during your trip, and emergency medical evacuation," says Angela Borden, a travel insurance expert and product strategist for travel insurance company Seven Corners.

Travel insurance plans offer nonrefundable payments and other trip-related expenses. While monetary compensation is a primary benefit, there is another valuable perk of travel insurance. It can provide peace of mind.

What does travel insurance cover?

Your specific travel insurance plan (and its terms and conditions) will determine the minutia and specifics of what is covered. As with most other forms of insurance, a general rule of thumb is the more you spend, the better your coverage.

"Travel insurance can be confusing, so it's best to research a reputable company that specializes in travel insurance and has a long history of successfully helping travelers all over the world," says Borden.

Trip cancellation and interruptions

A travel insurance policy can reimburse you for a prepaid, nonrefundable trip if it is canceled for a covered event, such as a natural disaster or a global pandemic.

Trip interruption insurance covers you if you're already on your trip and you get sick, there's a natural disaster, or something else happens. Make sure to check with your travel insurance providers to discuss any inclusions, coverage, and more.

Travel delays and missed connections

Travel delay insurance coverage provides reimbursement for any expenses you incur when you experience a delay in transit over a minimum time. Reimbursements can include hotels, airfare, food, and other related expenses.

Medical emergencies and evacuations

Typically, US healthcare plans are not accepted in other countries. So travel insurance with medical coverage can be particularly beneficial when you are abroad. Medical coverage can also help with locating doctors and healthcare facilities.

Medical transportation coverage will also pay for emergency evacuation expenses such as airlifts and medically-equipped flights back to the US. Out of pocket, these expenses can easily amount to tens of thousands of dollars. Certain plans may even transport you to a hospital of choice for care.

Travel insurance generally does not include coverage for pre-existing conditions. That said, you can obtain a pre-existing condition waiver, which we will talk about later.

Baggage and personal belongings

Most airlines will reimburse travelers for lost or destroyed baggage, but be prepared for limitations. Travel insurance plans will typically cover stolen items, such as those stolen out of a hotel room. This may not include expensive jewelry, antiques, or heirloom items. Typically, airlines have a few days to recover your bag.

In the meantime, you can make a claim to pay for items like certain toiletries and other items you need to pick up. If your bag is truly lost or you don't get it for an extended period, you can file a true lost baggage claim.

What does credit card travel insurance cover?

A major perk on several travel credit cards is embedded credit card travel insurance . Typically, you will need to use the specific card for the transaction (at least with partial payment) for travel coverage to kick in.

Each card has specific rules on what exactly is covered. But one of the industry leaders is the $550-per-year Chase Sapphire Reserve credit card. Here's a snapshot of what is covered with this specific card:

- Baggage delay: up to $100 reimbursed per day for up to five days if a passenger carrier delays your baggage by more than six hours.

- Lost and damaged baggage: up to $3,000 per passenger per trip, but only up to $500 per passenger for jewelry and watches and up to $500 per passenger for cameras and other electronic equipment.