- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

Travelers Heading to Europe Will Have to Pay a Fee Starting Next Year — Here's What It Will Cost

The €7 fee ($7.42) will apply to foreign visitors 18 to 70 years old.

:max_bytes(150000):strip_icc():format(webp)/alison-fox-author-pic-15f25761041b477aaf424ceca6618580.jpg)

American travelers heading on a European vacation will soon have to pay up thanks to a new fee to be implemented next year.

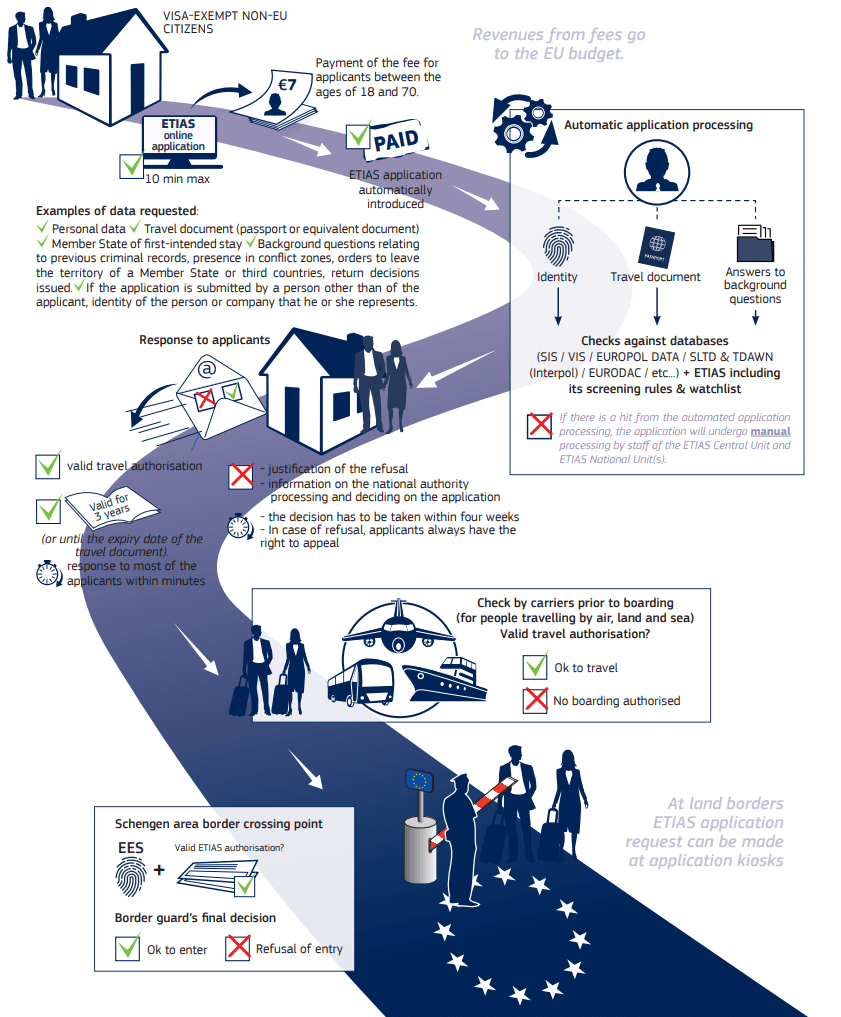

The €7 fee ($7.42), which is expected to go into effect in November 2023, will apply to foreign visitors 18 to 70 years old as part of the new European Travel Information and Authorisation System (or ETIAS), according to the European Commission . Travelers will have to apply for the authorization through an official website or app before their trip.

"ETIAS will be a largely automated IT system created to identify security, irregular migration or high epidemic risks posed by visa-exempt visitors travelling to the Schengen States, whilst at the same time facilitate crossing borders for the vast majority of travellers who do not pose such risks," the European Commission wrote on its website. "Non-EU nationals who do not need a visa to travel to the Schengen area will have to apply for a travel authorisation through the ETIAS system prior to their trip."

Most travelers who apply for the ETIAS authorization will be approved within minutes, according to the Commission. Those who are not — expected in about 5% of cases — could receive the travel authorization in up to 30 days.

The authorization, which will be required to enter all countries of the Schengen area, will be valid for three years or until the expiration date of someone's travel document.

The authorization will be checked by border guards along with other travel documents, like a passport .

The ETIAS authorization is similar to the United States' Electronic System for Travel Authorization (or ESTA), which is available to travelers from countries granted a Visa Waiver Program. Last month, the fee for ESTA increased from $14 to $21, according to the U.S. Customs and Border Protection .

Currently, travel to Europe is getting easier with several countries dropping pandemic-era entry rules, including Italy , the United Kingdom , Sweden , Iceland , Ireland , and Croatia .

Alison Fox is a contributing writer for Travel + Leisure. When she's not in New York City, she likes to spend her time at the beach or exploring new destinations and hopes to visit every country in the world. Follow her adventures on Instagram .

Related Articles

Europe to require new entry fee for visitors

After all the pandemic-era regulations and international travel rules, get ready for one new requirement coming for travelers to Europe in 2023. The European Travel Information and Authorization System will introduce a mandatory registration and a 7 euro (about $7.50) fee for visitors to most European countries as of May 2023. While some people have called this a "visitor tax," the stated reason for the program is improved security. According to then-European Commission President Jean-Claude Juncker when ETIAS was announced in 2016, "We need to know who is crossing our borders. This way we will know who is traveling to Europe before they even get here."

ETIAS states the system will be able to "Assist in detecting and decreasing crime and terrorism" and "Impede irregular migration." With the system, Americans and visitors from 62 other countries will still be able to travel visa-free in most European nations.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

What is ETIAS?

The European Travel Information and Authorization System is an electronic process to pre-screen, profile, approve and register visitors to the 26 countries of the European Schengen Zone who don't currently need a visa to enter. Similar to the U.S. Electronic System for Travel Authorization entry approval system, ETIAS will cross-check visitor information with government databases and watch lists before issuing authorization to enter. The information collected will also be used in data tracking for business and tourism purposes. ETIAS covers European countries that are part of the Schengen Zone travel agreement, in a region mostly overlapping the EU, with the addition of Iceland, Norway, Switzerland and Liechtenstein but minus Ireland. An individual's ETIAS authorization will be valid for an unlimited number of entries over three years.

Countries in the Schengen Zone to require ETIAS:

- The Czech Republic.

- Liechtenstein.

- Luxembourg.

- The Netherlands.

- Switzerland.

Who needs to apply for ETIAS?

All U.S. citizens and those from the other 62 non-EU countries that are not currently required to apply for a visa will need ETIAS authorization to enter the EU for visits of up to 90 days, including transit passengers. Only visitors who are between the ages of 18 and 70 will need to pay the application fee, but those of all ages will still need ETIAS authorization to enter. If you have applied separately for a visa to enter Europe, you will not need to complete the ETIAS application.

Related : A country-by-country guide to where you can travel without a COVID-19 test

When and where will ETIAS go into effect?

This long-planned and much-delayed system is currently targeted to be fully operational in May 2023. At that point, airlines and other transport systems will be required to check for ETIAS authorization prior to allowing passenger boarding, and visitors will be required to complete the application process prior to travel. At land borders, visitors can complete the application at an electronic kiosk.

How do you apply for ETIAS?

Before traveling, you'll need to access the ETIAS online application to input passport information, name, date and place of birth, an email address, phone number, and a credit or debit card to submit the payment fee. You'll also need to provide your destination, as well as answer a few background and profile questions. The ETIAS website indicates the form should take about 10 minutes to complete.

Approval for most applicants should take only a matter of minutes. However, if an item is flagged in the application, a manual review must take place. The applicant can then either correct the improperly entered information or appeal a denial decision.

Bottom line

No immediate action needs to be taken by U.S. citizens planning to visit Europe. However, be prepared for the May 2023 launch when you must go through one more step and pay one more fee in the traveling process as part of the ETIAS implementation. Stay tuned to The Points Guy for further developments related to this program.

- Share full article

Advertisement

Supported by

Planning to Visit Barcelona or Dubrovnik? It’s Going to Cost You.

Driven by the climate crisis, the post-pandemic surge in visitors and a growing interest in making tourism work for local communities, European cities are finding new ways to tax visitors.

By Paige McClanahan

When Hester Van Buren, a deputy mayor of Amsterdam, recently proposed a 1 percentage point increase to the city’s tourist accommodation tax — which is already among the highest in Europe — her City Council colleagues responded with a single criticism: They wanted the increase to be even bigger.

“We have a lot of costs for the city, of course — for well-being, for livability,” Ms. Van Buren said in a recent interview at Amsterdam’s City Hall. “We don’t want to increase the taxes for our inhabitants. So we said, ‘Well, let the visitors pay some more.’”

Across Europe, many of Ms. Van Buren’s counterparts are having similar thoughts. After several years of steady growth in urban tourism leading up to the pandemic, many European cities have found new ways to tax visitors, who are at once an important source of revenue and — in some cases — a cause of headaches for residents.

And while there’s little evidence that tourist taxes do much to dampen visitor demand, the measures can raise significant funds for street cleaning, roadwork and other urban improvements that benefit visitors and locals alike.

Amid growing concerns about the negative impacts of tourist crowds, the revenue generated from tourism taxes can help to ensure that this important slice of many European economies maintains its social license to operate.

“The big question that’s on the mind of many local communities is ‘How can we capture the value of tourism?’” said Peter Rømer Hansen, a founding partner and the chief strategist at Group NAO, a Copenhagen-based tourism consulting agency. “Back in the day, it used to be that tourism was tax-free. Now it’s like, ‘No it’s not — you should tax tourism to capture some of that value to add to the community.’ It’s a paradigm shift.”

The tourism ‘zeitgeist’

Tourism taxes are now widespread in Europe: Of the 30 nations surveyed in a 2020 report , of which Mr. Hansen was the lead author, 21 had taxes on tourist accommodations, usually in the range of .50 to 3 euros (about 55 cents to $3.30) per person per night. (In the United States, most states impose single-digit-percentage taxes on accommodations, but this varies widely — from zero tax on lodging in Alaska and California to a 15 percent hotel tax in Connecticut.)

Nations in southern and western Europe, where tourism tends to represent a larger share of the national economies, are more likely to have tourism taxes, Mr. Hansen said. But he expects northern European countries will soon impose similar levies, driven by factors like the climate crisis, the post-pandemic tourism surge and a growing interest in making tourism work for local communities.

“It’s part of this zeitgeist that we need to be more conscious and take better care of our local environment,” Mr. Hansen said.

In line with that trend, some European destinations that have long imposed tourism taxes have begun to increase their rates or impose additional levies.

Last year, the Barcelona City Council began imposing a “city surcharge” on visitors, over and above the accommodation tax (from €1 to €3.50 per night), which the government of Catalonia established in 2012. Barcelona’s new charge — which applies both to tourist stays and cruise visitors — is scheduled to rise to €3.25 from €2.75 on April 1 next year, said Jordi Valls, the City Council’s deputy mayor for tourism. This year’s surcharge is expected to generate €52 million, money that will be set aside for spending on public spaces and environmental protection, and to pay for the enforcement of laws regulating tourist rentals , among other activities.

It’s a similar story in the Croatian city of Dubrovnik — which, according to one index, had the highest ratio of tourists to residents of any European city in 2019. Dubrovnik has long imposed an accommodation tax, which now stands at €2.65 per person per night from April through September, dropping to €1.86 the rest of the year. But in 2019, the government announced a tax on cruise ships as well, after what the city’s mayor, Mato Frankovic, called “a very hectic situation.”

“The question from many of our inhabitants was, ‘What do we get from those cruise ships? They are not paying anything to the city of Dubrovnik,’” Mr. Frankovic said, adding that the cruise tax, which took effect in 2021, is expected to raise €750,000 this year, funds that will be spent to improve roads in the city. The mayor described the cruise tax as “a win-win.”

“The cruise companies and the cruise guests know where the money they pay is actually invested,” Mr. Frankovic said, “and the citizens of Dubrovnik clearly see the benefit of the cruise business.”

Sharing the costs of running a city

In Amsterdam, where tourist taxes are expected to generate €185 million this year, such benefits are perhaps even more evident. The city imposes two taxes: an accommodation tax, which has been in place since 1973, as well as a cruise tax, which was introduced in 2019. (The City Council recently adopted a proposal to ban cruise ships from Amsterdam’s ports. However, the measure isn’t expected to take effect until next year, at the earliest.)

The funds raised from both taxes are used to improve public spaces in parts of the city that attract few tourists, said Ms. Van Buren. In that way, she added, the tax ensures that people across Amsterdam enjoy the fruits of tourism.

Amsterdam’s accommodation tax now stands at 7 percent of the cost of accommodation for hotel stays, plus a flat fee of €3 per person per night. (Guests in short-term apartment rentals, which the city strictly regulates, pay a tax of 10 percent per night.) The City Council will meet in October to decide whether — and by how much — to increase the tax, which was most recently raised in 2018.

Ms. Van Buren believes there is support for an increase. She noted that Amsterdam residents paid €172 million just for trash collection and street cleaning last year, including in areas popular with tourists. It’s only fair, she said, to ask visitors to share the costs of keeping the city functioning.

She described the city’s tourism taxes as part of a package of measures intended to limit tourism growth in Amsterdam, which stopped marketing itself as a destination several years before the pandemic. But Ms. Van Buren acknowledged that the accommodation tax appeared to have only a slight dampening effect on visitor interest, a conclusion supported by Mr. Hansen’s 2020 report.

That doesn’t mean that taxes aren’t helping to shape tourism in the city. The extra charge of €3 per night was intended to ensure the measure would be felt by Amsterdam’s cheap hotels and the low-budget tourists who frequent them, Ms. Van Buren said, adding that such visitors, who often come for bachelor parties and the like, bring “a lot of problems.”

On that front, it seems the measure is having the desired effect. Henriette Zwart, the owner of Hotel Koffiehuis Voyagers, a lower-budget accommodation option in Amsterdam’s historic center, said the tourist tax had forced her to renovate so she could charge enough to cover her operating costs. She used to charge €100 per night for a room that could sleep three or four people, but when her hotel reopens after renovations in October, she will charge €200 for a room that can sleep only two.

“We look at the prices in this area, and everybody’s got high prices like that,” Ms. Zwart said.

“They don’t want the low-value tourist. They want the upper-class tourists, which is pretty discriminative,” she said of the city leaders. “If you have a low cost per person and a high tourist tax, then it’s almost not even motivating to run a business like that.”

More taxes coming

Other major European tourist destinations, including Edinburgh, are considering new visitor charges.

This year, Manchester became the first British city to adopt a visitor fee when local hotel owners collectively began to impose an additional charge of 1 pound (roughly $1.27) per person per night. British cities don’t have the power to create the kinds of taxes that Amsterdam and Barcelona have introduced, said Bev Craig, the leader of Manchester City Council, so businesses introduced the charge themselves, with the support of local government.

The resulting funds will be used to clean the streets, run targeted tourism campaigns and prepare bids for major events that will attract even more tourists to Manchester, said Ms. Craig, who added that tourism has become a major employer.

“We think about the role tourism has in our city — be it for football, culture or history — and actually we want to grow that,” Ms. Craig said.

It’s a different story in St. Ives, a picturesque English coastal town that has been attracting tourists for more than a century. But growing crowds of visitors have begun to strain the town’s services and the patience of its residents, said Johnnie Wells, the mayor. Mr. Wells noted that St. Ives spends nearly one-fifth of its annual budget — about £200,000 — just on cleaning the town’s eight public toilet facilities, which visitors use much more than locals.

Facing the same taxing constraints as Manchester, the local council has decided to charge visitors 40 pence to use the toilets. Local leaders are also considering a “community charge” similar to the visitor charge imposed in Manchester.

Mr. Wells stressed that tourism is a huge part of the economy of Cornwall, the southwestern English county that is home to St. Ives and dozens of other popular seaside communities. The area used to rely on mining and fishing, but as those industries have fallen away, tourism has become an increasingly important source of jobs and income.

“People always moan about the holiday industry, but it’s what we Cornish folk do,” Mr. Wells said, adding that residents’ frustration with tourists “is becoming an issue.” But he thinks a visitor charge, if they can pull it off, would be a positive step.

“If locals can feel that their town is being improved because the tourists are coming, it’s going to help bridge that gap and create a bit better feeling between the two,” he said.

Paige McClanahan, a regular contributor to the Travel section, is writing a book about the tourism industry.

Follow New York Times Travel on Instagram and sign up for our weekly Travel Dispatch newsletter to get expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places to Go in 2023 .

An earlier version of this article misstated the amount of a proposed increase to Amsterdam’s tourist accommodation tax. The proposal was for a 1 percentage point increase, not a 1 percent increase.

How we handle corrections

Open Up Your World

Considering a trip, or just some armchair traveling here are some ideas..

52 Places: Why do we travel? For food, culture, adventure, natural beauty? Our 2024 list has all those elements, and more .

Mumbai: Spend 36 hours in this fast-changing Indian city by exploring ancient caves, catching a concert in a former textile mill and feasting on mangoes.

Kyoto: The Japanese city’s dry gardens offer spots for quiet contemplation in an increasingly overtouristed destination.

Iceland: The country markets itself as a destination to see the northern lights. But they can be elusive, as one writer recently found .

Texas: Canoeing the Rio Grande near Big Bend National Park can be magical. But as the river dries, it’s getting harder to find where a boat will actually float .

Curious about the benefits available to AARP members? Watch this 2-minute video to learn more.

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

AARP MEMBERSHIP — $12 FOR YOUR FIRST YEAR WHEN YOU SIGN UP FOR AUTOMATIC RENEWAL

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

- right_container

Work & Jobs

Social Security

AARP en Español

- Membership & Benefits

- AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

Staying Fit

Your Personalized Guide to Fitness

AARP Hearing Center

Ways To Improve Your Hearing

Brain Health Resources

Tools and Explainers on Brain Health

A Retreat For Those Struggling

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

How to Protect What You Collect

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Outdoor Vacation Ideas

Camping Vacations

Plan Ahead for Summer Travel

AARP National Park Guide

Discover Canyonlands National Park

25 Ways to Save on Your Vacation

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

TV for Grownups

Best Reality TV Shows for Grownups

Robert De Niro Reflects on His Life

Looking Back

50 World Changers Turning 50

Sex & Dating

Spice Up Your Love Life

Navigate All Kinds of Connections

Life & Home

Couple Creates Their Forever Home

Home Technology

Caregiver’s Guide to Smart Home Tech

AI Technology

The Possibilities, Perils of AI

Virtual Community Center

Join Free Tech Help Events

Create a Hygge Haven

Soups to Comfort Your Soul

Your Ultimate Guide to Mulching

Driver Safety

Maintenance & Safety

Trends & Technology

AARP Smart Guide

How to Keep Your Car Running

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

Go to Series Main Page

Travelers to Europe Will Soon Face a New Fee

Visitors will also need to apply for approval before entering 26 countries.

Larry Bleiberg,

“This is an important reminder to always be checking the requirements for your destination.”

Next year, travelers to Europe will find an unexpected addition to their trip: an entrance fee.

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

Beginning in November 2023, U.S. visitors to the European Union will be required to pay a seven-euro charge (about $7.13), and must apply for approval before they arrive via a website or app.

The clearance, to be issued by the European Travel Information and Authorization System (ETIAS), can apply to multiple trips, and remains valid for three years or until the traveler’s passport expires, whichever comes first. While the fee won’t be charged to travelers over 70 years old and under 18, everyone still will need to apply for approval.

The fee was announced in 2016 and was originally supposed to roll out in 2021, but was delayed by the global pandemic . Still, few travelers are aware of it. European officials say the new system is meant to enhance security across the continent, and will allow governments to keep better track of who is visiting the 26 countries in the European Union’s Schengen zone, which have open borders for travelers. (The fee and approval aren’t required for travel to the United Kingdom, which has left the European Union.)

“We need to know who is crossing our borders,” former European Commission President Jean-Claude Juncker said in 2016, when he announced the program. “This way we will know who is traveling to Europe before they even get here.”

But for travelers from the U.S. and about 60 other countries, the new entry requirement will bring a new level of inconvenience. “It’s an extra step. It’s no longer just buying a ticket and heading to the airport anymore,” says Melanie Lieberman, global features editor for The Points Guy , a travel information website. “This is an important reminder to always be checking the requirements for your destination.”

Many details have not been finalized, but according to a memo released by the European Commission, travelers will apply for clearance online, which will take about 10 minutes. The form will ask for basic information, such as passport details, place of birth, profession, an email address and phone number. It will also inquire about any criminal records and ask if the traveler has visited conflict zones. It will require a credit or debit card for payment.

ARTICLE CONTINUES AFTER ADVERTISEMENT

The information will be checked against government databases, and in an estimated 95 percent of cases, applicants will receive approval within five minutes. Those who aren’t immediately approved should find out within 96 hours if they are authorized to travel to Europe, although a few may have to submit additional documents and wait up to 30 days for approval. There’s also an appeals process if someone is denied entrance.

“For most people, it won’t impact them,” says Peter Vlitas, executive vice president of Internova Travel Group, one of the world’s largest networks of travel advisers. But it’s unclear what would disqualify a traveler. He notes that U.S. visitors to Canada are occasionally denied entry for decades-old criminal records, including charges for driving while intoxicated.

AARP® Dental Insurance Plan administered by Delta Dental Insurance Company

Dental insurance plans for members and their families

“There’s a lot of answers that we don’t know yet," he says. "Honestly, we haven’t seen a lot of messaging from the airlines."

Ultimately, airlines, cruise ships and motor coach carriers will have to confirm their passengers have approval to enter Europe before allowing them to board. Travelers entering Europe on their own will have to apply at a border kiosk. If you’re traveling with a tour group or booking a trip through a travel adviser, the organizer or travel professional should be able to apply for you, says Vlitas.

The fee, which some have called a tax, comes partially in response to a similar $21 fee the United States charges arriving international passengers, Vlitas says. “In diplomacy, it’s always reciprocal.”

Meanwhile, experts say travelers planning to visit Europe after next April should check back with their travel adviser or carrier as their trip gets closer for the latest news about the requirement.

Virginia native Larry Bleiberg is president of the Society of American Travel Writers, a frequent contributor to BBC Travel and the creator of CivilRightsTravel.com.

Virginia native Larry Bleiberg is president of the Society of American Travel Writers, a frequent contributor to BBC Travel and the creator of CivilRightsTravel.com .

Discover AARP Members Only Access

Already a Member? Login

More on travel

Or Call: 1-800-675-4318

Enter a valid from location

Enter a valid to location

Enter a valid departing date

Enter a valid returning date

Age of children:

Child under 2 must either sit in laps or in seats:

+ Add Another Flight

Enter a valid destination location

Enter a valid checking in date

Enter a valid checking out date

Occupants of Room

Occupants of Room 1:

Occupants of Room 2:

Occupants of Room 3:

Occupants of Room 4:

Occupants of Room 5:

Occupants of Room 6:

Occupants of Room 7:

Occupants of Room 8:

Enter a valid date

You didn't specify child's age

There are children in room 1 without an adult

You didn't specify child's age for room 1

There are children in room 2 without an adult

You didn't specify child's age in room 2

There are children in room 3 without an adult

You didn't specify child's age in room 3

There are children in room 4 without an adult

You didn't specify child's age in room 4

There are children in room 5 without an adult

You didn't specify child's age in room 5

You have more than 6 people total

Please select a trip duration less than 28 days

There must be at least 1 traveler (age 12+) for each infant in a lap

Enter a valid From location

Enter a valid start date

Enter a valid drop location

Enter a valid drop off date

Select a valid to location

Select a month

Enter a valid going to location

Enter a valid from date

Enter a valid to date

AARP VALUE &

MEMBER BENEFITS

Denny's

15% off dine-in and pickup orders

AARP Travel Center Powered by Expedia: Vacation Packages

$50 gift card of your choice when booking any flight package

$20 off a Walmart+ annual membership

AARP® Staying Sharp®

Activities, recipes, challenges and more with full access to AARP Staying Sharp®

SAVE MONEY WITH THESE LIMITED-TIME OFFERS

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

U.S. Travelers to EU to Face New Fee, Paperwork in 2025

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Traveling to some countries in Europe will soon require yet another piece of paperwork — and yet another fee. For Americans, that fee is just under $8 (7 euros) per person.

Sometime in 2025, the European Commission is set to launch what’s called the European Travel Information and Authorisation System, or ETIAS.

What is ETIAS?

The new ETIAS program is expected to be a largely automated process for identifying security, irregular migration or high epidemic risks. The program is designed for certain travelers heading to the Schengen Area, which consists of 26 European countries without border controls between them.

Austria. Belgium. The Czech Republic. Denmark. Estonia. Finland. France. Germany. Greece. Hungary. Iceland. Italy. Latvia. Liechtenstein. Lithuania. Luxembourg. Malta. The Netherlands. Norway. Poland. Portugal. Slovakia. Slovenia. Spain. Sweden. Switzerland.

The European Commission says the program is designed to “facilitate border checks; avoid bureaucracy and delays for travellers when presenting themselves at the borders; ensure a coordinated and harmonised risk assessment of third-country nationals; and substantially reduce the number of refusals of entry at border crossing points.”

The new ETIAS program applies to citizens of countries who don't need visas to enter the European Union, including the U.S.

That means Americans have one more task on their to-do list (and one more fee to pay) before entering Europe’s Schengen Area.

How ETIAS will work

First, you’ll have to fill out an online application form, which the EU uses to conduct various security checks. Submitting that form also entails a fee of around $8.

In most cases, visitors will receive travel authorization within minutes. But in some cases, it could take travelers up to 30 days to receive authorization.

Once you have your authorization documents, they’ll be checked along with other travel documents such as your passport by the border guards when crossing the EU border.

What ETIAS means for travelers

An extra cost.

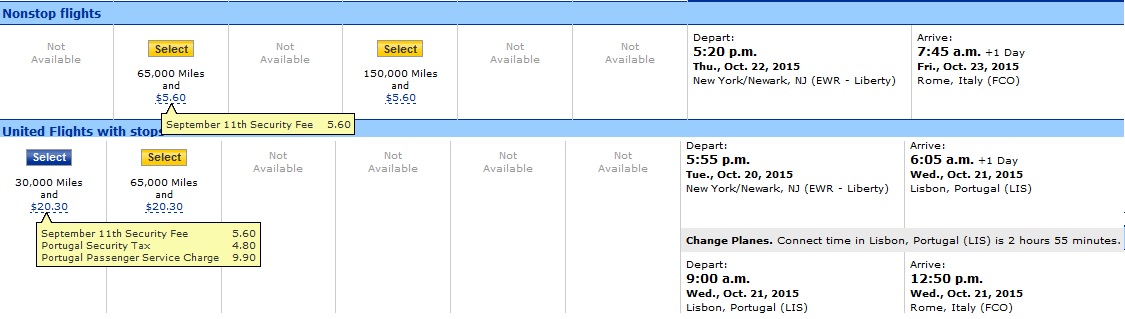

The extra fee could be a headache for travelers. Sure, about $8 is small potatoes in the grand scheme of a European trip. But it comes in an era where new fees are appearing everywhere, whether it’s hotel resort and amenity fees , or airline fees for things such as checked bags and seat selection.

Plus, the fee is per person, so if you’re bringing the family, you’ll need to pay and register everyone in your travel party.

More paperwork

ETIAS joins the list of ever-growing paperwork you need before boarding a flight. That includes needing to ensure your passport is up to date. If it’s not, that may pose its own challenges because it sometimes takes the State Department over two months to process passports.

A challenge for procrastinators (or last-minute travelers)

Given that ETIAS authorization could take up to 30 days, people booking last-minute travel may have to account for this change, as well as people who procrastinate on this particular paperwork.

Of course, the ETIAS program hasn't started, and there’s no clear initiation date.

In fact, any semblance of initiation periods have already been delayed. Back in late 2021, the European Commission stated that ETIAS would expected to be operational by the end of 2022. And from there, there was set to be a six-month transition period for the system to be implemented, meaning you would likely need to register with the ETIAS program sometime in 2023. But 2022 has come and gone.

As of October 2023, the European Union has said that it now expects ETIAS to launch in 2025.

And when it does become mandatory, add it to your growing pre-travel to-do list — and bake those $8 per person fees into your travel budget .

On a similar note...

God Save The Points

Elevating your travel

Get Ready For Europe’s $8 “Tourist Tax” Coming Next Year

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to print (Opens in new window)

Airlines have jacked up prices to recoup losses amid the massive demand, hotels have too, and restaurants not wanting to feel left out, have as well. What a time to be alive. What an even wilder time to travel the world.

2023, however, offers more questions than answers when it comes to travel. One of the few thing that’s for sure though, is that travelers will face new restrictions when heading to Europe. And for a change, they’ll have nothing to do with Covid-19.

Europe will launch its long awaited ETIAS , which is an electronic travel authorization you need to fill out and pay for before travel. It’s definitely not a “visa”, even though it is a visa, and if you tell Europe it is a visa, they’ll get mad .

One thing it definitively is though, is a new €7 (circa $8) travel tax.

Europe Will Launch ETIAS Program In May 2023

If all goes to plan the European Union and Schengen Area member states will launch the ETIAS travel program in May of 2023. For tourism and travel from this May date, an ETIAS authorization in advance of travel will be required for most visitors.

The Schengen Area of Europe consists of:

Austria, Belgium, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and Switzerland.

Basically, if you’re headed to one of these countries from May 2023 onward, you’ll probably need to submit an ETIAS before you go, and pay the accompanying €7/$8 fee. There’s no change for summer 2022.

This program mirrors the United States “ESTA” travel program by requiring all visitors to apply for a travel authorization in advance, and pay a fee accordingly.

The European ETIAS will cost €7, which is around $8 bucks. An Approved ETIAS will have a 3 year validity and will facilitate stays up to 90 days for the purpose of travel and tourism, but not business. Much like the US system, approvals should take hours rather than days for most visitors, but can take up to 30 days.

The Schengen Area of Europe also holds onto a 90 out of 180 and 180 out of 365 day rolling eligibility system, which means tourists can’t stay longer than these periods in a year.

If you are even remotely close at the time of entry, you may be denied entry even with an ETIAS authorization. Longer stays would require a more specific visa, or golden visa .

So, Is The ETIAS A Tourism Visa?

By dictionary definitions of a visa, it’s basically a visa, but since visas have a negative connotation to them, Europe is adamant that this is not a visa .

Yes, even though the real definition of a visa is “conditional authorization granted by a polity to a foreigner that allows them to enter, remain within, or to leave its territory.”

Visitors from 60+ countries including the United States and UK will be required to pay for and submit an ETIAS before being allowed to board any mode of transportation to one of Europe’s Schengen Area countries.

Breaking It Down: Reciprocal Tourism Money Grabs

The United States introduced the ESTA program , which costs $14 for a two year travel authorization in 2009 under the notion of security. In 2019, New Zealand launched a new ‘ETA’ tourism authorization for $30USD to protect sustainability.

Whether these visas contribute to either would require a formal commission set up by government and legal authorities, but they certainly bring in revenue. Tourism comes at a cost, both to infrastructure and staffing– and these — non-visa, visas — may help.

Europe is simply grabbing their “fair” share of travelers being taxed for tourism with the new ETIAS program. The move will impact over 1.4 billion global travelers, and at a rate of €7 a pop for an ETIAS application, that should pay for something.

Better immigration halls and shorter queues at airports? Don’t bet on it.

Gilbert Ott

Gilbert Ott is an ever curious traveler and one of the world's leading travel experts. His adventures take him all over the globe, often spanning over 200,000 miles a year and his travel exploits are regularly... More by Gilbert Ott

Join the Conversation

You missed one not-so-small detail: in order to enforce ETIAS, Schengen countries will begin fingerprinting and photographing all visitors at the border!

This is interesting. I hold a US passport as well as a passport of a European nation. When I enter Europe and exit Europe, I use my European passport. Our airline has our US passport information in the database so I wonder how this will effect my travel into the EU. Thanks for the article.

Don’t forget the new £5 airport (fat cat) drop off tax. Anew charge just for turning up at the door and people are worried about a European visa charge and completely forget about the highway robbery going on over here.

I agree that as in the USA, Canada, NZ and other countries, these “no visas” are just a tourist visa. Preclearance authorization works just like a visitor visa. For sure it is different from work visa but in the essence any preclearance is just like a tourist visa.

I only do not understand the hype that Americans and Canadians are making when they are asked to fill the form and pay to EU for it. The USA and Canada asks us Europeans do the same.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Leave a comment

Travel better, for less.

Stay up to date on everything travel, with our handy newsletter

What You Should Know About The Tourist Tax When Visiting Europe

Most of us who are lucky enough to travel to Europe do so on a predefined budget. Accommodations, food, and transportation are all accounted for before we set off. But, there is often a hidden cost imposed on visitors to Europe — the tourist tax. Variously dubbed the "city tax" or "occupancy tax," this is a fee imposed on visitors in many European countries, regardless of whether you're staying in a luxury suite or a humble hostel.

The tourist tax typically ranges from a few cents to several euros per night. The exact amount often depends on the city, the accommodation type, and sometimes the length of your stay. Nineteen member states of the European Union levy this tax on tourists who visit, including France, Italy, and Croatia . Conversely, you won't pay the tourist tax in most countries in the Nordic and Baltic regions (excluding Lithuania). That's a money-saving score for notoriously expensive Scandinavia.

Paying the tourist tax

Firstly, the tourist tax is not usually included in the price of the accommodation, so you need to calculate it on top of any price you see when you're booking your hotel. Usually, the tax is collected by your accommodation provider when you arrive or when you check out. Whether you've booked a boutique hotel in Florence, a seaside Airbnb in Santorini, or a hostel in Amsterdam, you're going to get hit with the tax. You can usually pay in cash or by card.

Luckily, the tax is usually not very expensive. In Bulgaria, it can be as little as €0.10 per night; over in Belgium, where you'll pay the most, it can reach €7.50. The amount depends on the city and the type of accommodation you're in, with Eastern Europe generally having lower rates than Western Europe. It may be a flat rate per day or a percentage of your accommodation bill.

The tax is usually charged per person per night. So, for example, if the city tax is €2, a couple staying three nights would pay €12 in total. Certain visitors are exempt from paying the tax, though rules vary from place to place. Children often don't need to pay, or they pay a reduced rate. Certain cities, including Amsterdam and Barcelona, impose a tax on day visitors, too.

Why you have to pay a tourist tax

So what exactly are you paying for when you hand over your Euros? In certain countries and areas, the tax is hypothecated, meaning that the funds are earmarked for the tourism sector. These places include France, Croatia, Poland, Malta, and parts of Spain. In other places, like in German resort towns, visitors who pay the tax are entitled to access some facilities not usually open to the public, like spas.

Generally across all countries, the idea of the tourist tax is to collect funds to relieve the burden visitors sometimes place on popular destinations. In Rome, for example, funds go toward maintaining tourist information points and maintaining the city's infrastructure. In Prague , funds go toward the goal of creating a sustainable tourism destination. Think of the tourist tax as your small contribution to keeping Europe's rich tapestry of cultures, landmarks, and landscapes as enchanting as ever for future tourists to enjoy.

- International edition

- Australia edition

- Europe edition

Entrance fees, visitor zones and taxes: how Europe’s biggest cities are tackling overtourism

From Seville to Venice to Amsterdam, Europe is learning to improve locals’ lives by curbing tourists’ enthusiasm

O riginally built for the grand Ibero-American Exposition of 1929, Seville’s flamboyant neo-Moorish Plaza de España has for nearly a century been one of the city’s major attractions, an ornate showcase for Spanish architecture and decorative tiling.

But the several thousand visitors from around the world who throng the plaza every day, on foot or in horse-drawn carriages, may soon have to pay for the privilege, with proceeds from a planned entry fee going towards its upkeep.

“We are planning to close the Plaza de España and charge tourists to finance its conservation and ensure its safety,” Seville’s mayor, José Luis Sanz, announced on X last week, posting a video showing missing tiles and damaged facades.

Sanz made clear local residents and visitors from Andalucía province would not have to cough up to visit the plaza, which served as a backdrop in a Star Wars film, and is used regularly for concerts, fashion shows and theatrical performances.

Many residents objected to the scheme nonetheless – but their criticism was mostly that it would be complicated to administer and not very effective. Far better, many locals said, would be a hefty tourism tax on all visitors to Seville.

“Mass tourism,” said one, “is destroying our city.”

It’s a refrain heard in historic cities across Europe , from Prague to Barcelona, Athens to Amsterdam. Mass tourism, promoted by cash-hungry councils since the 2008 crash and fuelled by cheap flights and online room rentals, has become a monster.

After plummeting during Covid, tourism numbers are soaring again and set to exceed pre-pandemic levels this summer. The number of low-cost airline seats in Europe, which rose 10% annually from 2010 and hit 500m in 2019, could pass 800m in 2024.

Before lockdown, Airbnb, the biggest but far from only platform for short lets, saw triple-digit growth in some European cities. The net result is that the most popular city break destinations now annually host 20 or more visitors for each local.

What to do about it, though, is no easy question. Delicate balances need to be struck between the much-needed revenues and jobs generated by tourism, and the quality of life of residents; between managing tourism and discouraging it.

One strategy that Seville – 3 million tourists a year for 700,000 inhabitants – may adopt is to charge for the big attractions. Since January, foreign visitors to Istanbul’s Hagia Sophia, which gets about 3.5m visits a year, have been paying €25 for the privilege.

Venice is so overrun by visitors it has introduced what amounts to an entrance fee for the entire city, ranging from €3 to €10. Paris has almost trebled its tourist tax rates, from – depending on area and accommodation type – €0.25-€5 to €0.65-€14.95.

Other cities are relying on better management – Athens, for example, last summer introduced a time-slot system for visits to the Acropolis, while summer access to Marseille’s Calanques is now regulated through a free reservation scheme.

Some places are launching information campaigns aiming to reshape tourist flows. France, where 80% of visits are concentrated in 20% of the country, will this spring roll out a €1m campaign urging domestic and foreign tourists to head more off the beaten track .

From Mont Saint-Michel and the seaside resort of Étretat in Normandy to the Atlantic beaches of the south-west and the Riviera, peak-season influxes now threaten the environment, locals’ quality of life and the visitor experience, authorities say.

They are also setting up a tourism observatory to accurately measure flows and identify possible overloads. “France is the world’s biggest tourist destination, but we have a serious lack of data to help manage the crowds,” the government said.

Some anti-tourism measures, however, turn out to be just rumours. Last summer, the walled Croatian town of Dubrovnik, said to be the most over-visited destination in Europe, with 36 visitors per resident, was widely reported to have banned wheelie suitcases.

In fact, as part of a Respect the City campaign urging visitors to dress appropriately in the historic centre and avoid climbing on monuments , the town hall had just asked them to carry their bags over cobblestones to reduce the noise level for locals.

The Netherlands

In the capital of the country that coined the term overtoerisme , tourist might be a dirty word – but Amsterdam is also increasingly desperate for visitors’ cash.

A plan last March to dissuade partying young British men with “stay away” videos warning of fines, hospital and criminal records made headlines worldwide. It’s unclear what effect it had, though, as Amsterdam’s overnight tourist numbers last year hit almost pre-pandemic levels at 9 million – 21% more than in 2022.

A soft-soap Renew your View campaign highlighting positive aspects off the beaten track (rather than sex and drugs) launched in November. Meanwhile the city is expected to expand its stay-away campaign to dissuade nuisance tourists from Germany, France, Spain and Italy after the summer.

Since last spring there has been a ban on smoking cannabis in public space in the red light district, while bar closures at 2am instead of 4am have reduced street numbers by between 30% and 60%. However, after complaints about safety, sex-worker brothel windows are open until 6am again rather than 3am.

Amsterdam is reducing the number of licensed B&B premises by 30%, has voted to close a city centre cruise terminal and is trialling tougher licensing measures to remove “rogue” tourist businesses such as candy shops suspected of being criminal fronts.

The council says it is monitoring tourist numbers to try to maintain a balance. But multimillion budget shortfalls and a bill of billions to repair crumbling canalsides mean tourism is essential for Amsterdam: this year, the tourist tax rose from 7% to 12.5%, the highest in Europe , with a day tax of €14 a head for visiting cruise ships. Senay Boztas

Spain received 85 million tourists in 2023, nearly 2% up on pre-pandemic 2019 – and in a country where tourism generates 13% of GDP, after the economic devastation of the Covid years, voices calling for curbs on numbers have been virtually silenced.

The hospitality business, however, continues to chant the mantra of quality over quantity – nowhere more so than in the Balearic Islands, where a new law is being drafted to crack down on drunk tourists.

after newsletter promotion

Last year about 15 million people visited the Balearics (population 2 million), more than half British and German, with a significant percentage coming for what the regional government calls “tourism of excess”: a week-long drinking binge.

The new law to crack down on booze tourism is expected to be in force when the season kicks off at Easter. Under a 2020 law, areas such as Magaluf in Mallorca and Sant Antoni in Ibiza were named as trouble spots.

Heavy fines were imposed for “balconing” (leaping into a pool from a balcony), shops were banned from selling alcohol after 9.30pm, and organised pub crawls, beach parties, party boats and two-for-one happy hours outlawed, Local businesses faced fines of up to €600,000.

But after areas such as Magaluf complained of being stigmatised, the new law will focus more on individuals. Among the planned measures are deportation for antisocial behaviour and a blacklist of people banned from visiting the islands.

Lawyers warn that this would infringe the EU’s principle of freedom of movement, although as the UK is no longer a member, rowdy Brits – who are among the worst offenders – could soon find themselves personae non gratae . Stephen Burgen

After years of talk, Venice is the first major tourist hotspot in Italy to introduce an entrance fee for day trippers. The measure kicks off at the start of peak season on 25 April, and in a first experimental phase will apply only on certain days until 14 July.

The €5 tickets have been bookable online since mid-January. Time will tell whether the controversial initiative works, but with visitor numbers back to pre-pandemic levels – an average of 40,000 day trippers on peak days – and the perennial threat of the fragile lagoon city losing its Unesco heritage status, authorities were forced to act. The city is also poised to limit tourist groups to 25 people from June and to ban the use of loudspeakers because they “generate confusion and disturbances”, Venice council said in late December.

Florence has long suffered from similar overtourism woes and an exodus of residents from its historic centre, prompting the council in October last year to ban new short-term lets in the historic centre from Airbnb and similar platforms.

The city’s mayor, Dario Nardella, said that while the initiative was not a “panacea”, it was a “concrete step” for tackling the issue in a city with a population of about 720,000 that records, on average, more than 16 miilion overnight visitor stays a year.

Elsewhere in Italy, drivers along the Amalfi coast will again be hit by a measure aimed at preventing a perpetual jam along the winding 35km coastal road described as “a nightmare” by locals. Cars with number plates ending in an odd number are allowed to use the road one day, and those ending in an even number the next.

In Cinque Terre, another Unesco site, local authorities are also pondering how to manage overtourism. “We don’t want fewer tourists, but we want to be able to manage [tourism] in a sustainable way,” Donatella Bianchi, president of Cinque Terre national park, said last month. Angela Giuffrida

In Greece, one of the most visited places in the world, soaring tourist numbers are not only straining infrastructure on island idylls but increasingly stretching capacity in Athens, where residents, as elsewhere, are up in arms.

Once a stopover for travellers en route to isles, the Greek metropolis is now a “must-see” destination in its own right, drawing more than 7 million tourists – an all-time record – in 2023, with Americans and Britons topping arrivals.

To cope with an influx that is only expected to grow when the Asian market rebounds, Greek authorities have announced that crowd control policies – implemented in pilot form at the Acropolis in September – will be expanded to other archaeological sites next month.

Last year, at the height of the season, more than 20,000 tourists a day climbed the hill to see the fifth-century BC site. “We got to the point of as many as 23,000 a day,” the Greek culture minister, Lina Mendoni, said. “Tourism is obviously desirable for the country, for all of us, but we have to ensure overtourism doesn’t harm the monument.”

The visitor zone scheme, in operation from 8am to 8pm, aims to ease congestion, with authorities introducing a time-slot system, electronic ticketing and fast-lane entry points for organised groups. “It will help ensure the safety of the monument and those who work there, and improve the experience of visitors,” Mendoni said.

Museums will also cap visitor numbers from April.

The spectre of the country enjoying another bumper year of tourism has been met with mounting fears among environmentalists on islands where communities have increasingly struggled with waste management, water scarcity, insufficient public services and illegal construction.

In the face of local disgruntlement the government has been forced to step in. On Santorini, where complaints of oversaturation have grown steadily over the years, a berth-allocation system for cruise ships was introduced, with the number of disembarkations in any 24-hour period being limited to 8,000 passengers.

On Mykonos – like Santorini, one of the most popular islands in the Cycladic chain – authorities have clamped down on illicit construction, bulldozing illegally built bars and eateries in prime sites. Helena Smith

- The Observer

- Croatia holidays

- Netherlands holidays

- Europe holidays

Most viewed

EU to implement Entry and Exit System and European Travel Information and Authorization System

- Link copied

In late 2022 and early 2023, the European Union (EU) will implement two new technology platforms designed to more effectively regulate non-EU nationals’ entry into, and exit from, the Schengen Area . The Entry and Exit System ( EES ) will take effect in October 2022 and the European Travel Information and Authorization System ( ETIAS ) in March 2023.

A Tax Alert prepared by EY's People Advisory Services group, and attached below, provides additional details.

Show resources

Download this tax alert.

Connect with us

Our locations

Legal and privacy

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY | Assurance | Consulting | Strategy and Transactions | Tax

EY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com.

© EYGM Limited. All Rights Reserved.

EYG/OC/FEA no.

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice.

Welcome to EY.com

In addition to cookies that are strictly necessary to operate this website, we use the following types of cookies to improve your experience and our services: Functional cookies to enhance your experience (e.g. remember settings), and Performance cookies to measure the website's performance and improve your experience . , and Marketing/Targeting cookies , which are set by third parties, allow us to execute marketing campaigns, manage our relationship with you, build a profile of your interests and provide you with content or service offerings in accordance with your preferences.

We have detected that Do Not Track/Global Privacy Control is enabled in your browser; as a result, Marketing/Targeting cookies , which are set by third parties that allow us to execute marketing campaigns, manage our relationship with you, build a profile of your interests and provide you with content or service offerings in accordance with your preferences are automatically disabled.

You may withdraw your consent to cookies at any time once you have entered the website through a link in the privacy policy, which you can find at the bottom of each page on the website.

Review our cookie policy for more information.

Customize cookies

I decline optional cookies

Tourism taxes in Europe: What travelers need to know in 2024

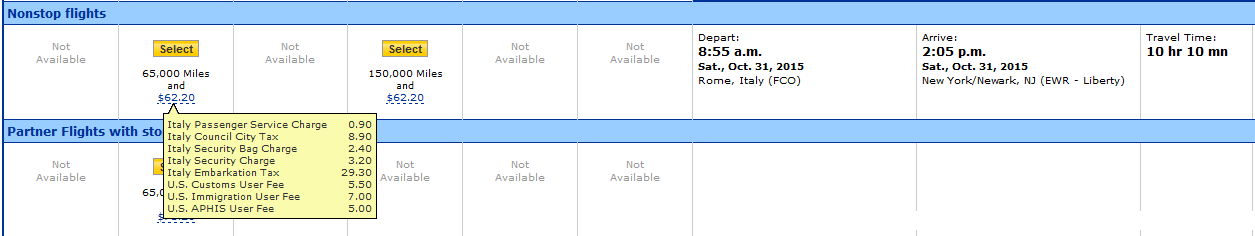

T ourist fees this year will increase in a number of European countries to generate additional funds and combat excessive tourism, according to SchengenVisaInfo.com.

Why European countries are raising tourist fees

European countries typically include tourist taxes in the cost of hotel stays. The additional charge may vary depending on the length of stay, destination popularity, season, and hotel star rating.

According to the Group NAO and GDS-Movement report, an increasing number of countries, particularly in the United States and Europe, are introducing tourism taxes. More destinations are initiating sustainable development initiatives. By implementing such fees, countries can secure more funding to achieve a range of goals, says Guy Bigwood of the Global Destination Sustainability Movement.

For instance, in Greece, an increase in the existing hotel tax will help address natural disasters caused by climate change. In Dubrovnik, Croatia, the introduction of an additional tariff for cruise ships will help improve the infrastructure of the ancient city.

Where will new tourism taxes be introduced in Europe?

European Union: Paid registration

Starting in 2025, residents of non-EU countries entering Europe without special visa requirements will need to register through the European Travel Information and Authorization System (ETIAS). The registration cost is approximately 7 euros per person. The electronic visa waiver aims to enhance the security of the EU borders.

Amsterdam, Netherlands

Amsterdam, which already has the highest tourist tax in Europe, plans to raise rates again in 2024. The city will increase the hotel room tax from 7% to 12.5%, and the cruise ship passenger tariff will rise from 8 euros to 11 euros per person per day.

According to Hester van Buren, Amsterdam's deputy mayor for finance, the increased revenue will be used to tackle the consequences of excessive tourism, maintain cleanliness, and address neighborhood issues.

Read also: Romania and Bulgaria to join Schengen soon

Photo: Tourist tax will increase in Amsterdam in 2024 (unsplash.com)

Iceland will introduce a tourist tax in 2024, but the exact amount has not been determined. Prime Minister Katrín Jakobsdóttir says the fee will be reasonable and support sustainable development programs, aligning with Iceland's goal to become carbon-neutral by 2040.

Olhão, Portugal

The largest fishing port in the Portuguese region of Algarve, Olhão, has been collecting a tourist tax since June 2023, with half of the revenue directed towards mitigating the negative impact of tourism. Visitors will now have to pay 2 euros per night in the high season and 1 euro in other periods of the year.

Barcelona and Valencia, Spain

Barcelona will increase the tourist tax in April 2024. Currently at 2.75 euros per night, it will rise to 3.25 euros. In Valencia, the tourist tax currently ranges from 50 cents to 2 euros per night.

Photo: Tourist tax in Valencia ranges from 50 cents to 2 euros per night (unsplash.com)

Venice, Italy

In 2024, tourists in Venice will have to pay 5 euros as the city has been combating mass tourism for several years. The fee applies to visitors over 14 years old and will be implemented through a digital portal with a QR code download option.

Denmark plans to introduce a passenger tax for flights in 2025. By 2030, airlines are expected to collect around 8.4 euros for flights within Europe, 32 euros for medium-distance flights, and 51 euros for long-distance flights. The revenue will be directed towards using eco-friendly fuel for domestic flights.

Photo: Denmark plans to introduce a tax on air travels (unsplash.com)

Tourist taxes in Europe

Austria: Vienna, Salzburg. Depending on location, number of days, and visiting season – 3.2 euros; Belgium : Major cities like Brussels, Bruges, and Antwerp. Tax depends on the number of nights, room prices, and hotel ratings – 7.50 euros; Bulgaria : All hotels – 1.50 euros; Croatia : All destinations, mainly depending on the season – 1.33 euros; Czechia : Prague – less than 1 euro; France : Entire country – up to 4 euros; Germany : Major cities, depending on hotel bills – 5%; Greece : All destinations – 4 euros; Hungary : Budapest – 4% of the room cost; Italy : Popular destinations – 3 to 7 euros per night; Netherlands : All cities – 7% of the room cost; Portugal : 13 municipalities – 2 euros per night in hotels; Slovenia : All destinations – 3 euros; Spain : Popular destinations depending on hotel ratings and season – 4 euros; Switzerland : Entire country.

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

Tourist tax in Europe 2021: what you will pay in Spain, Italy and other hotspots

Share the love

Tourist taxes are becoming increasingly commonplace. Find out how much you'll likely have to pay on your next European holiday.

New venice tourist tax expected next summer, austria tourist tax, belgium tourist tax, bulgaria tourist tax, croatia tourist tax, france tourist tax, germany tourist tax, greece tourist tax, hungary tourist tax, italy tourist tax, netherlands tourist tax, portugal tourist tax, romania tourist tax, slovenia tourist tax, spain tourist tax, switzerland tourist tax.

Venice is planning to charge tourists up to €10 each from next summer, according to media reports.

The tourist tax might be anywhere from €3 to €10 per day, depending on whether someone visits during the low, high or peak season and will largely be aimed at day-trippers.

This will be in addition to Italy's existing tourist tax, which is paid at the hotel and ranges between €1 and €5 per person per night.

The majority of visitors to Venice are day-trippers, many from cruises, and contribute little economically to the city, despite producing huge amounts of rubbish and disruption.

Lots of other popular European destinations have taken to charging tourists a little extra.

Often even though you’ve already paid for your holiday, you will be asked to hand over extra cash when you arrive at your hotel or when you check out.

We’ve taken a look at what tourist tax you will be hit with for a range of popular European holiday destinations.

Save a fortune on your next holiday: check deals on Travel Zoo

In Austria, tourists have to pay an overnight accommodation tax (including in caravans and campsites), which is charged according to the province you are staying in.

The tourism levy, which can go by many names, ( Tourismusgesetz and Beherbergungsbeiträge are just two), is currently up to 3.2% of the hotel cost per person per night in Vienna.

Children under 15 are exempt from the tax.

In Belgium, there are a range of tourism taxes to watch out for, which vary by city.

In Antwerp, there is a fixed rate, including VAT, of €2.97 (£2.52) per person, per night for stays in hotels.

Accommodation that falls under the Tourism for Everyone decree and children under 12 years of age are exempt from the tax.

If you are staying in Bruges, there is a tourism tax of €2.83 (£2.41) per person, per night (excluding VAT). This applies to all tourist accommodation, including hotels, guest houses and hostels.

In Brussels, there is a City Tax that is charged per room, per night according to the borough, hotel size and hotel classification.

At the Brussels Novotel, for example, you will be charged €4.25 (£3.63) per room, per night due to a City Tax.

Save hundreds on your next holiday with lastminute.com

Bulgaria levies a City Tax or a Resort Tax on visitors, which varies by area and hotel classification.

The City Tax is charged per person, per night which ranges from 0.2 Bulgarian (BGN) Lev (8p) to 3 BGN Lev (£1.31).

The Resort Tax is applied in some areas, which is charged on a per person, per stay rather than per person, per night basis.

In Croatia, holidaymakers have to pay a ‘Sojourn Tax’ which can vary depending on the category of the accommodation and season.

This tourist tax is typically more expensive during peak seasons although children under 12 are exempt from the tax.

In France, there is ‘Taxe de Sejour’ or tourist tax, which is charged per person, per night and varies according to the quality and standard of the accommodation.

The rates range from €0.20 (17p) to around €4 (£3.42) per person, per night. You can see how the prices breakdown on the service-public.fr website .

Paris charges higher rates of tourist tax ranging from €0.25 and €5 (£4.27) per person, per night, depending on accommodation. Children under 18 are exempt from the tax.

Kulturförderabgabe (Culture Tax) or Bettensteuer (Bed Tax) are some of the terms used for tourist taxes in Germany.

The taxes range from €0.50 (42p) to €5 (£4.27) per person, per night or 5% of the room bill depending on the type of accommodation, room rate and location.

In Berlin, for example, you will be charged 5% of the room rate (excluding VAT) and the tax is capped at 21 successive days although business travellers are exempt from the tax.

Munich, however, does not have a tourist tax.

In 2018, Greece introduced a tourist tax, the first time one had been levied.

You'll have to pay the tax when you check in to your accommodation and you can pay it by cash or card.

The cost is €0.50 (42p) per person per day for those in one to two-star hotels, going up to €1.50 (£1.28) in three-star hotels, €3 (£2.56) in four-star hotels and €4 (£3.42) in five-star hotels.

Visiting Budapest? You'll usually have to pay an extra 4% of the price of your room per night.

In Italy, tourists have to pay a tax called Tassa di soggiorno.

The charge varies from city to city, will depend on a hotel’s star rating and is levied on a set number of nights and there are usually exemptions for children.

In Rome, for example, you can expect to pay between €4 (£3.41) and €7 (£5.98) per person per day for up to 10 days of your stay. Children under 10 are exempt from the tax.

A table with a breakdown of the current taxes in popular cities can be found on italyvacations.com .

In the Netherlands, visitors get charged a tourist accommodation tax called Toeristenbelasting.

It's charged per person, per night by over 400 municipalities according to the ETOA but can vary according to hotel grade and accommodation type.

The rest either charge a percentage, which can also vary by hotel star rating or type of accommodation, or they can charge nothing.

For example, in popular tourist hotspot Amsterdam there is a flat fee of €3 per person, per night plus 7% City Tax based on the room price.

Visitors to the Portuguese capital of Lisbon have to pay a Municipal Tourist Tax, which is currently €2 (£1.72) per person, per night according to Airbnb.

Children under 13 are exempt from the overnight tax and it only applies to the first seven days of your stay.

In Porto, you'll pay €2 (£1.72) per person per night up to a maximum of seven nights.

A tourist tax of €1.50 per night/per person for up to seven nights was set to be introduced in Faro (Algarve) in March 2020 but this has been temporarily suspended.

The Romanian tourist accommodation tax is called taxa hoteliera locala.

It has been standardised to 1% and is charged against the total value of the accommodation for each night. However, if the accommodation is in a tourist resort, the tax is for the first night only.

Tourists under the age of 18 are exempt.

Slovenia charges a tourist tax, which varies nationwide (depending on on location and hotel grade).

Taxes in the capital Ljubljana are €3.13 (£2.67) per person per night, including a €0.63 promotion tax, while there is a 50% discount in some circumstances.

Generally, children under seven are exempt from the tax, while children aged between seven and 18 are charged at half the rate.

If you're heading to Ibiza or Majorca, you'll have to pay tourist taxes.

The Sustainable Tourist Tax, which applies to holiday accommodation on Spain’s Balearic Islands (Mallorca, Menorca, Ibiza, Formentera), applies to each holidaymaker aged 16 or over.

During high season, those staying in luxury hotels pay €4 a per person, per day (£3.42 at the time of writing), €3 (£2.56) for mid-range hotels and €2 (£1.71) for apartments and cruise ship visitors – even if you don't stay on the islands – and €1 (85p) for campers and hostels.

Prices are up to 75% lower if you're travelling from November to April and the tax drops by 50% after your eighth night on the island.

The money raised from the 'eco tax' will go towards the protection of resources on the islands.

Spain also charges people visiting the Catalonia region, a tasa turistica .

You will have to pay between €0.45 (38p) and €2.25 (£1.92) per person, per night, for the first seven nights, which depends on the hotel category and whether you are staying in Barcelona.

The table below sets out what you are likely to pay (children under 16 are exempt)

Source: Agència Tributària de Catalunya

There is also a surcharge from Barcelona City Council – you can find out more here .

The Canary Islands are considering introducing a tax but so far has yet to do so.

Anyone staying overnight in Switzerland has to pay a tourist tax.

According to the ETOA, it is charged per person, per night and varies by town and in some cases by the type of accommodation.

It is made up of two elements the Beherbergungsabgabe (BA tax) and Kurtaxe.

The BA tax goes towards paying for tourism advertising and maintaining infrastructure in regions, but the Kurtaxe is used to improve the tourism experience for visitors.

As each canton in Switzerland determines how to set the taxes, there can be further variations.

*This article contains affiliate links, which means we may receive a commission on any sales of products or services we write about. This article was written completely independently.

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature

Copyright © lovemoney.com All rights reserved.

This Travel Hack Can Help You Save Hundreds of Dollars While Shopping Abroad

Go ahead . . . buy that expensive european designer bag. you may get some cash back thanks to this handy travel tip..

- Copy Link copied

When it comes to VAT refunds, the more you spend, the more you can get back.

Photo by AboutLife/Shutterstock

If you’ve never heard of the VAT refund, get ready to see some serious financial returns the next time you go shopping abroad. If you’re looking for the best price on a high-end item, you might be able to save thousands of dollars by waiting to buy it overseas. (Discount luxury shopping: It’s not an oxymoron.) Here’s the breakdown on how to save money with VAT.

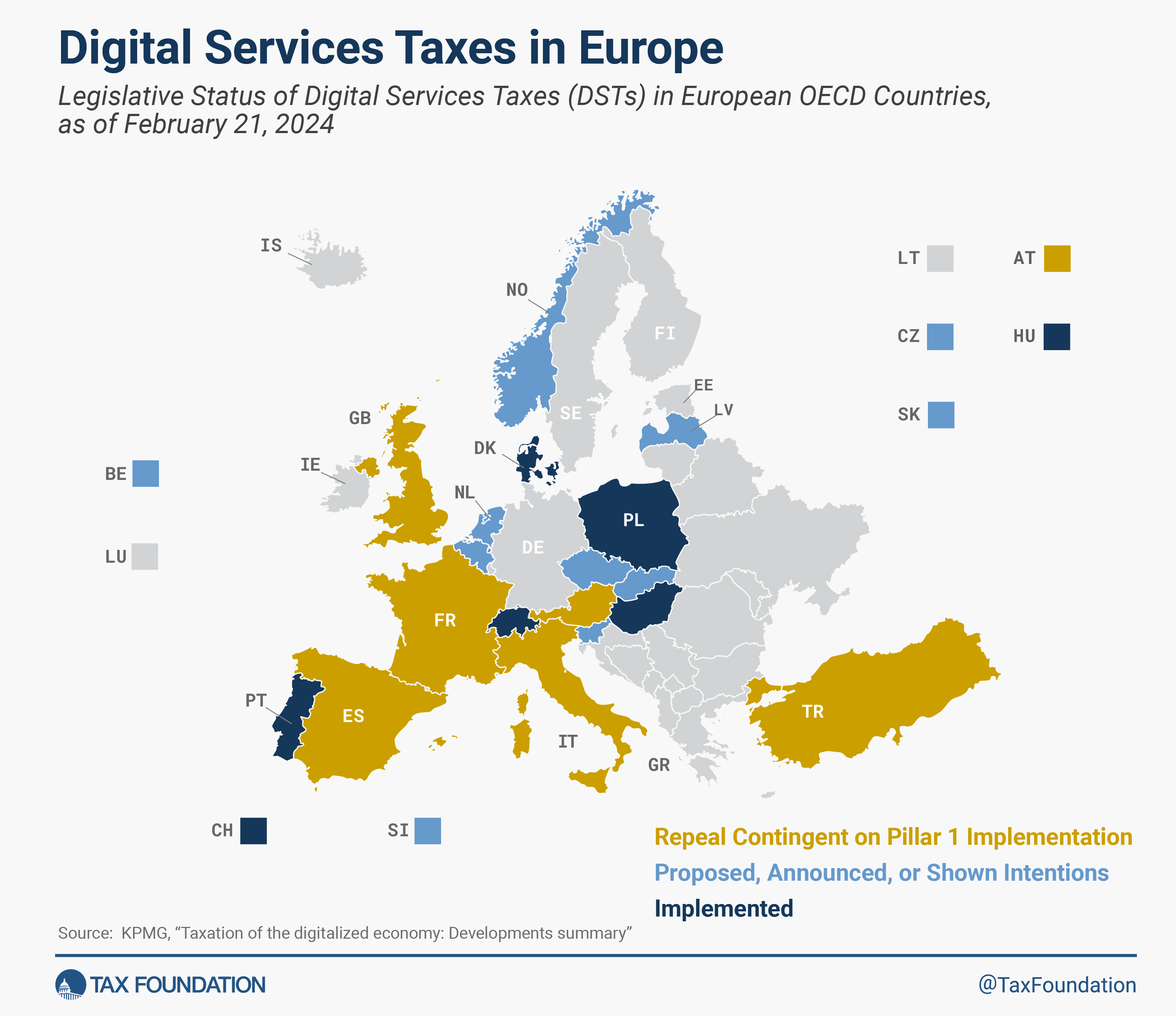

What is VAT?

VAT—sometimes redundantly called VAT tax—stands for value-added tax. This tax is associated with shopping in the European Union, though more than 160 countries around the world use value-added taxation. It’s a sales tax paid by consumers (not businesses), and it doesn’t exist in the United States. Only visitors—including U.S. tourists—are able to qualify for a VAT refund.

Keep in mind, VAT is often factored into the price of a product (so a €100 dress with a 20 percent VAT rate might have a price tag of €120). Other times, it is listed on the receipt. Ask a sales associate wherever you’re shopping if it’s unclear.

The rate of VAT in Europe varies depending on where you’re visiting and shopping, and it ranges from 7.7 percent in Switzerland (technically not an E.U. country, and it’s set to increase its VAT to 8.1 percent in 2024) to 27 percent in Hungary. The average VAT rate in the E.U. is 21.3 percent , and the minimum in the E.U. is 15 percent. Deloitte provides a very useful country-by-country breakdown .

But rates can also vary depending on what you’re buying. For example, food and pharmaceutical products are typically taxed at a lower rate than leather goods like shoes and handbags.

Can you get a VAT refund in the U.K.?

It depends: Travelers were allowed to do so throughout the U.K. up until December 31, 2020, but Brexit put an end to VAT refunds. Currently, the only country in the region that offers VAT refunds to overseas visitors is Northern Ireland.

If you’re hoping to buy luxury goods in Europe—good news. You could qualify for a VAT refund.

Courtesy of Ira Komornik/Unsplash

What qualifies for a refund?

Almost all luxury goods—including clothes, shoes, cosmetics and skincare, jewelry, handbags, leather goods, and art—will have a value-added tax. Many items qualify for a VAT refund, but it’s important to note that only new goods (not used) can be claimed. Each transaction also has to be over a certain threshold, and this threshold varies by country. For instance, you have to spend over €100 per transaction in France to qualify for a VAT refund. This means you can buy several products at one store for a total of more than €100, but if you spread those same items out over multiple stores, you would not get to claim the refund. You can also make a single large purchase over €100 at many different stores and claim for each transaction.

Your items are supposed to be unused when you declare them. That said, you can typically get away with using your new handbag or coat. But you may want to hold off on breaking in those new leather slingbacks before you present them to customs. You also will want to ensure that items you are declaring are recent purchases because you must make your claim within three months of leaving the European Union.

Items that do not qualify for a VAT refund

- Vintage items —Those vintage Chanel clip-on earrings you bought from the Marché aux Puces de Saint-Ouen? The (probably very good) price you paid is final. No refunds here.

- Goods purchased in the tax-free zones of airports —because there is nothing to refund

- Transactions that do not meet the minimum threshold

- Services —including hotel stays, restaurant meals, and tour guide fees—because these are experienced abroad and not brought home

- Anything you aren’t bringing back to the United States . The goods have to come home with you.

- Cars — unless the vehicle is being used exclusively for business purposes, in which case you can get up to 50 percent back on your VAT

- Alcohol and tobacco