How to Use the Hopper App for Cheap Flights and Hotels

Have you ever purchased airfare and wondered whether or not you got a good deal or if you overpaid?

Researching and buying airfare is stressful and can feel like you’re playing roulette. Despite countless websites touting the best deals and research like what the best day of the week is to book airfares, it’s easy to wonder if you got the best possible price.

Mix in some analysis paralysis from overthinking the abundance of information available online and it’s no wonder people looking to purchase airfares visit travel websites repeatedly before daring to hit the “purchase” button.

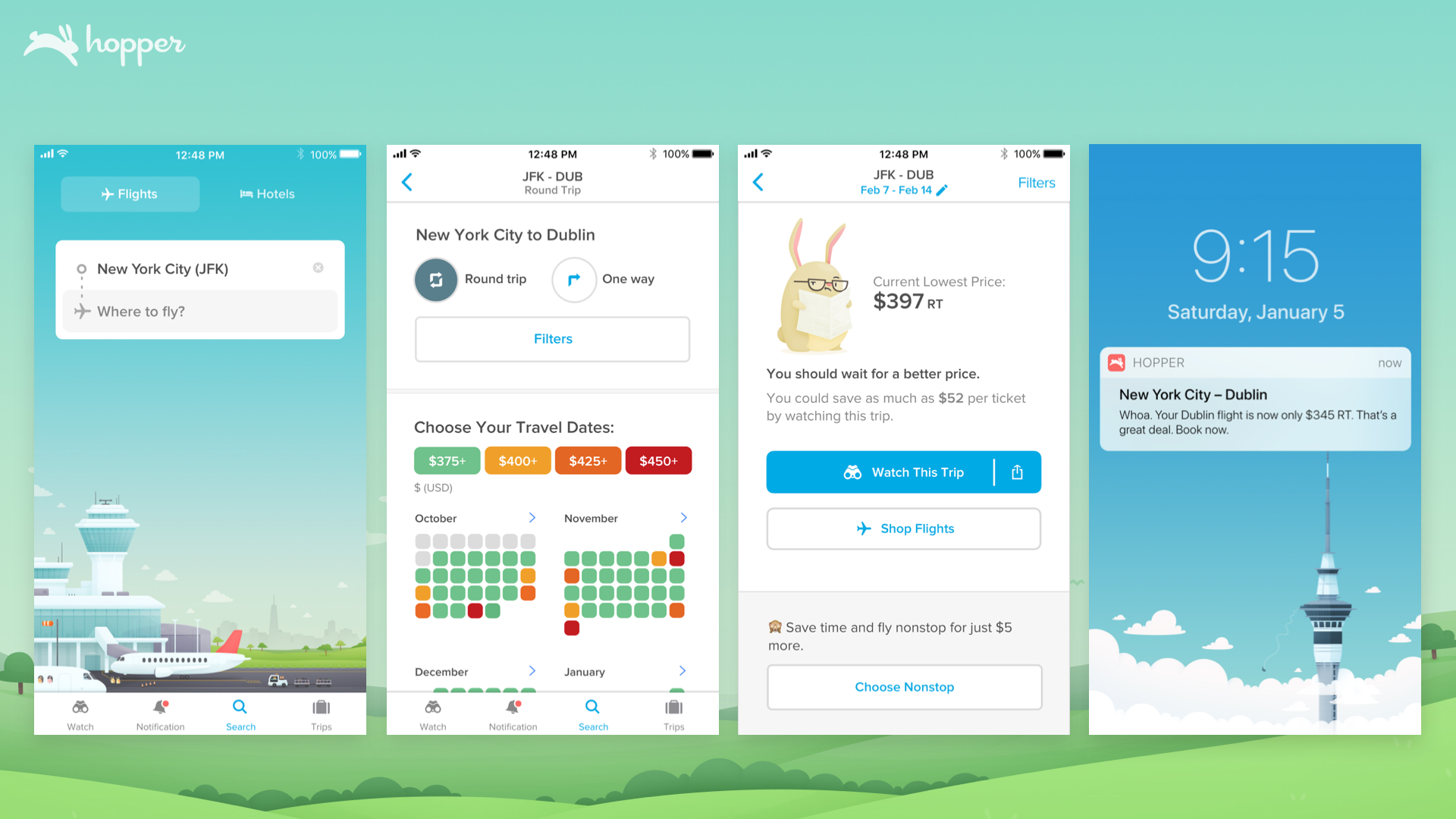

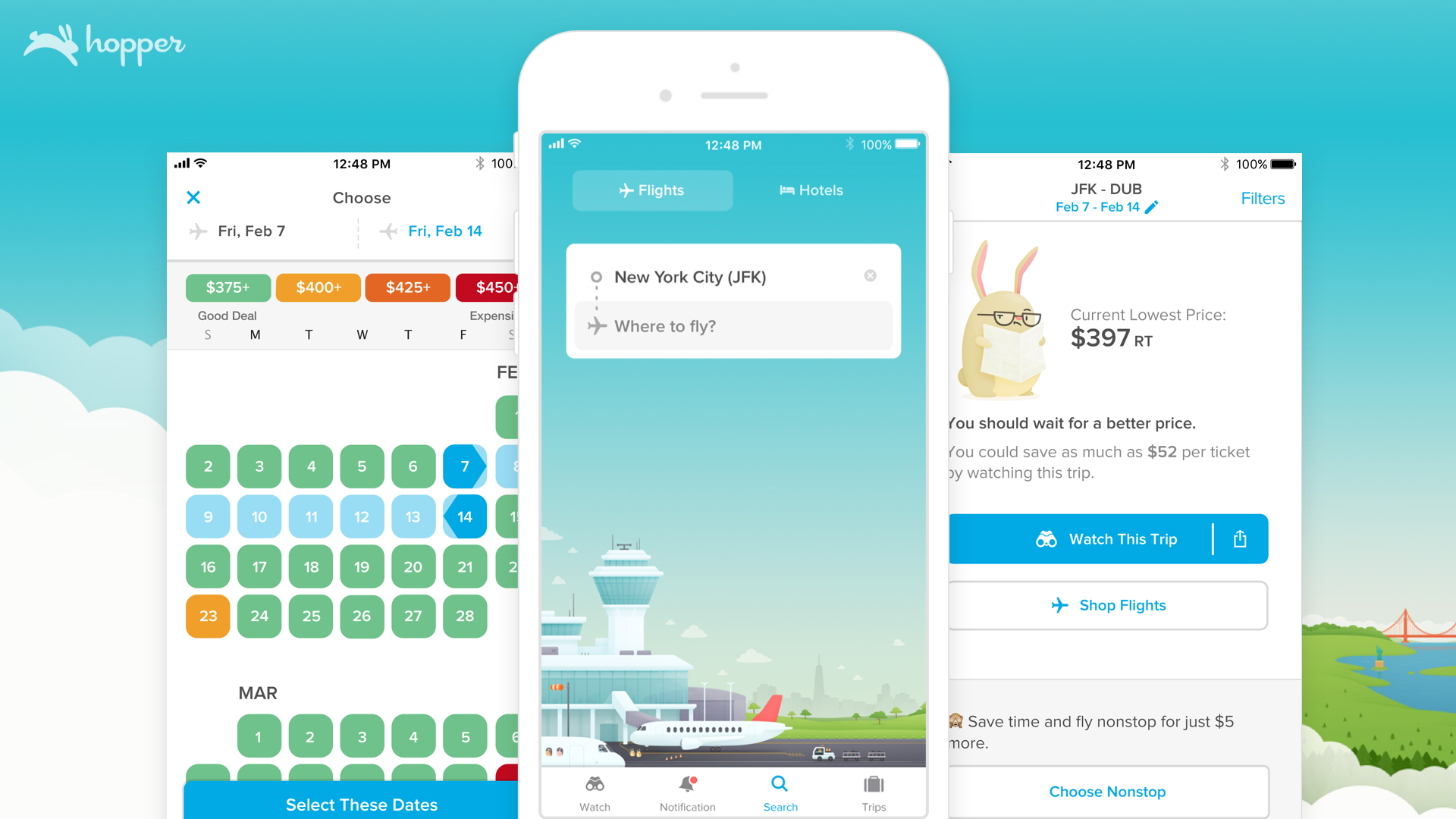

Help is here! The free Hopper app for travel smartly “predicts” when you should buy and when you should fly by analyzing the dizzying amount of airfare data on the web.

In this Hopper app review, learn how to use the Hopper app for flights and now also, hotels, so you can save money booking your travel.

What is the Hopper App?

Just in case you’ve landed on this page by accident ;), Hopper is an app for IOS and Android devices that searches for the cheapest prices on flights and hotels. But what makes Hopper stand out is its price prediction ability.

Hopper studies massive amounts of data to understand pricing trends. By doing this, Hopper can see when it’s a good time to book and when it’s not based on what they know about prices and the likelihood they’ll go down.

The Hopper app can tell you the absolute right time to book that flight with a 95% accuracy rate …for up to 1 year in advance. That certainly counts as an “A” in my classroom!

How to Use Hopper to Book Flights

Depending on the type of device you have, you’ll need to download Hopper from the App Store on your IOS smartphone or tablet or Google Play for your Android device. Hopper is a mobile-only app , so it won’t work on your desktop.

You can search for flights and hotels from a mobile phone or tablet. But, you can only make bookings while you’re signed in from the app on your mobile phone. To sign in, you’ll need to share your name, email, and phone number.

How to Search Hopper Flights

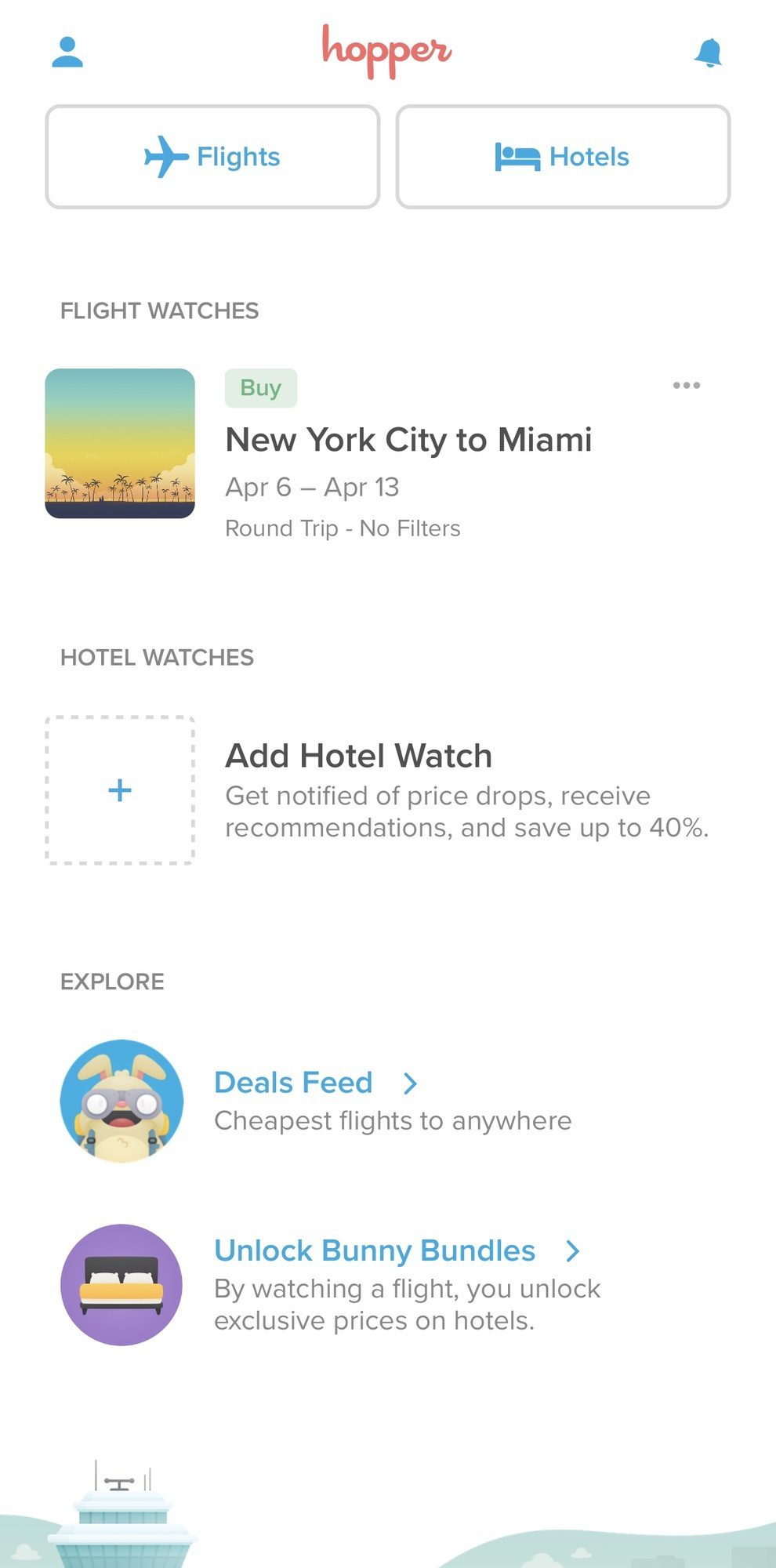

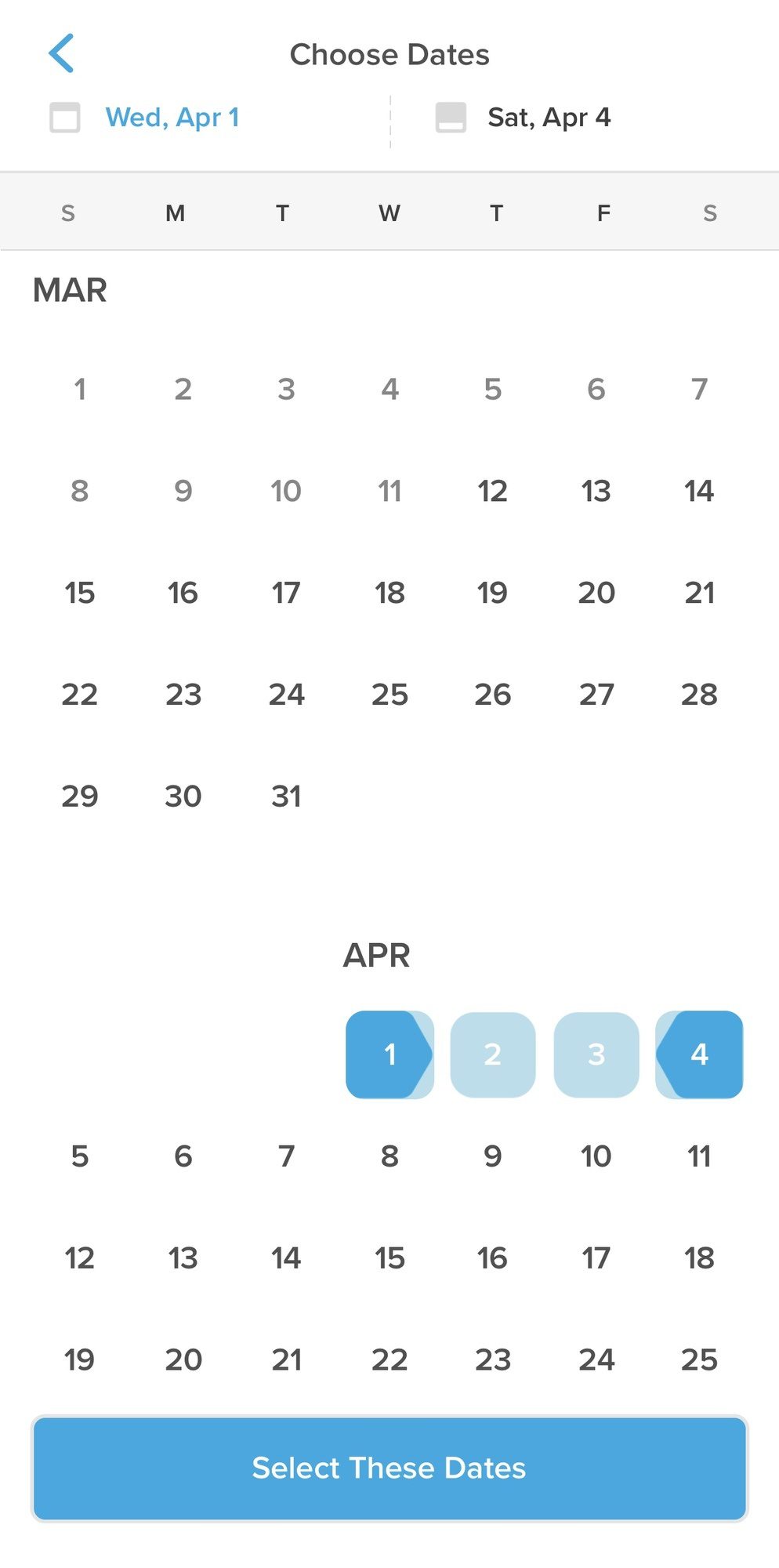

Begin by selecting “Flights” and entering where you are flying from and where you would like to go. Hopper checks airfares for your selected route over a few months.

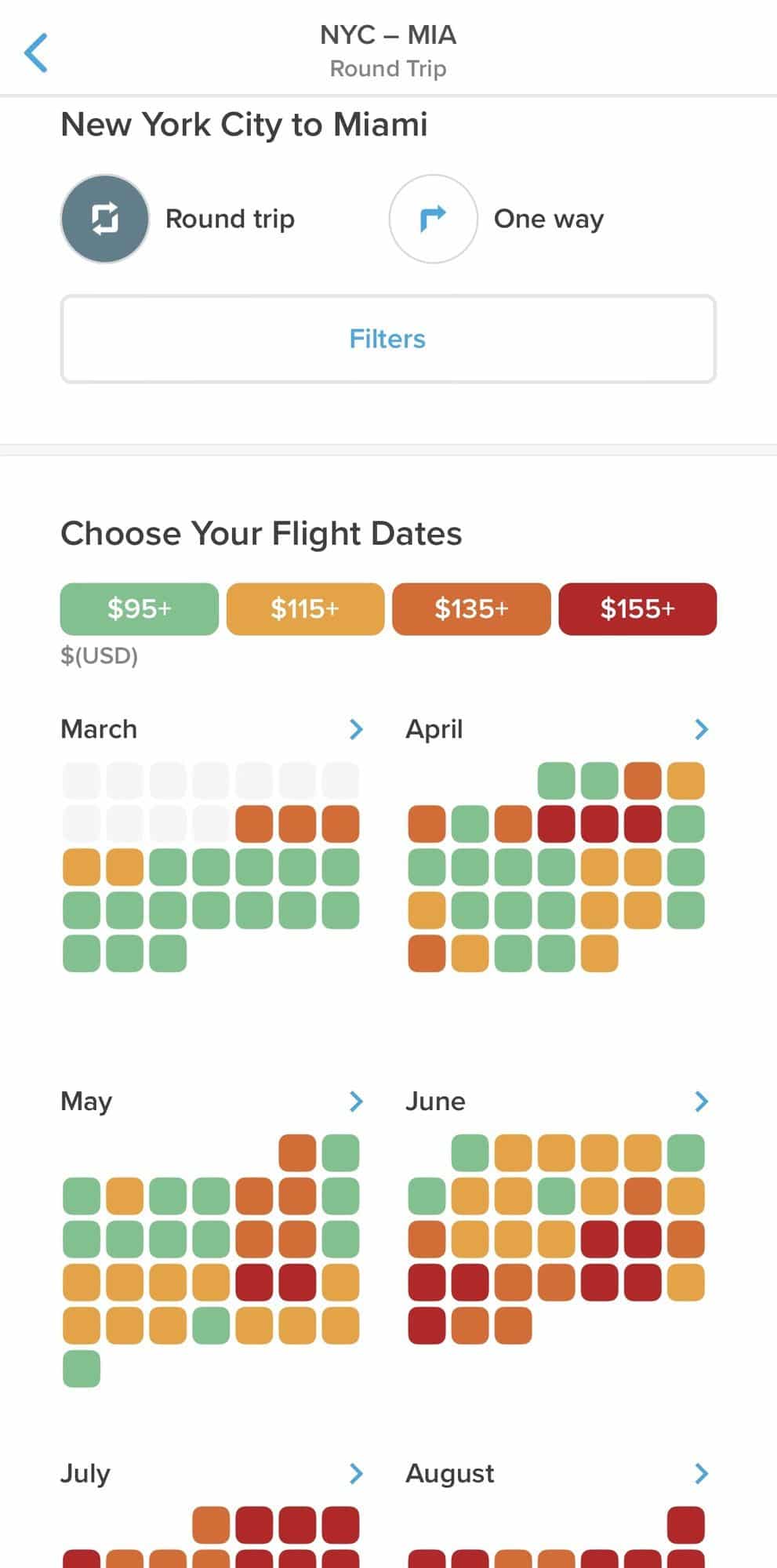

The next screen will display a color-coded calendar showing you a range of when your selected route is cheapest to when it’s most expensive. You’ll have the option to select a round trip or a one-way, as well as filter for basic fares (more restrictions but cheaper prices) and flights with or without stops.

At the top of the screen, the Hopper flight search will also display information about the typical price ranges for your selected route so you can see what’s considered low, medium, and high airfare.

Using the color-coded calendar, select your travel dates. Depending on the dates you select, Hopper will give you advice on what your next steps should be.

For example, flying from New York City to Miami, I selected dates coded in green. These are the days when the best prices for my route are available.

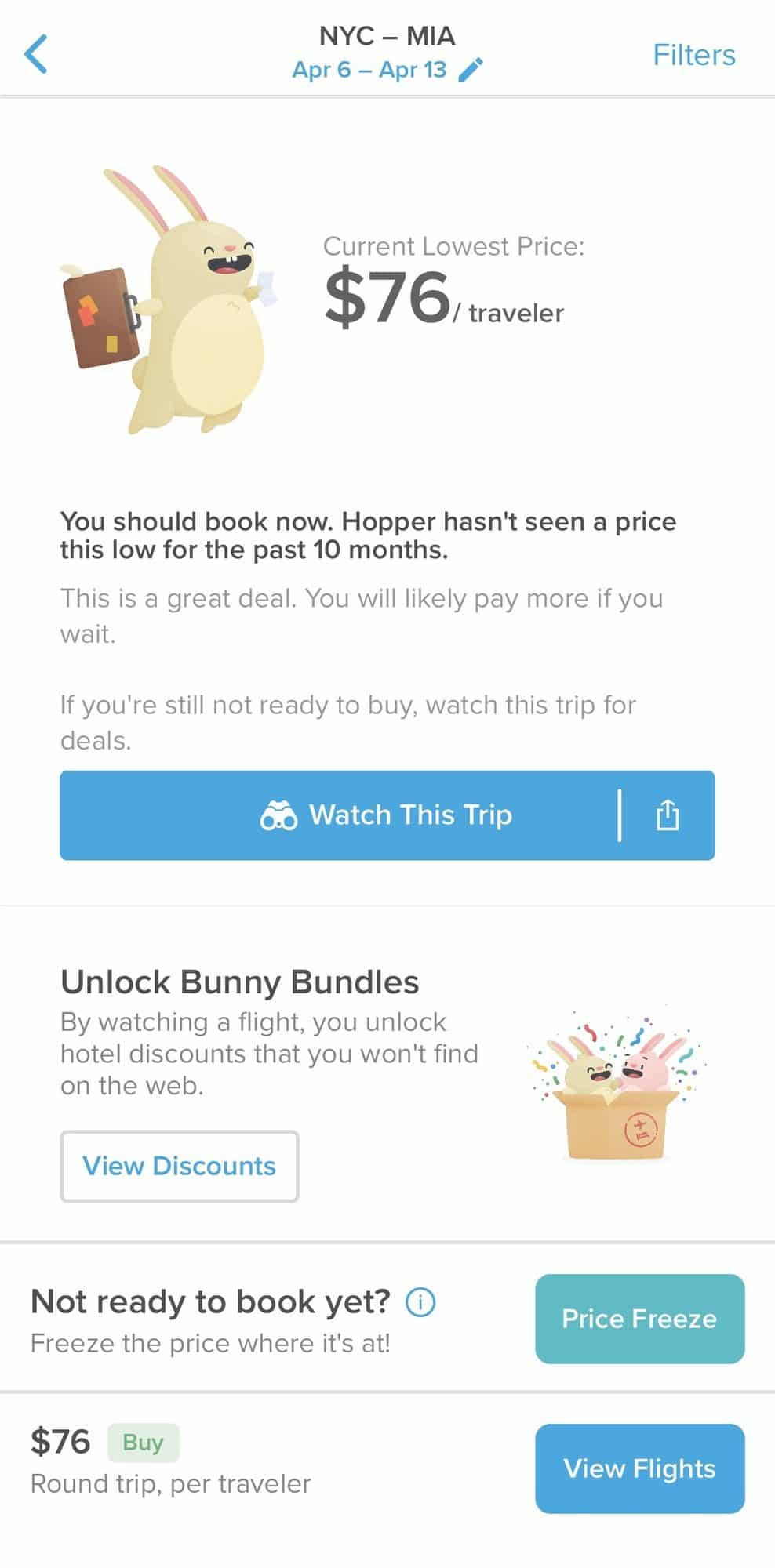

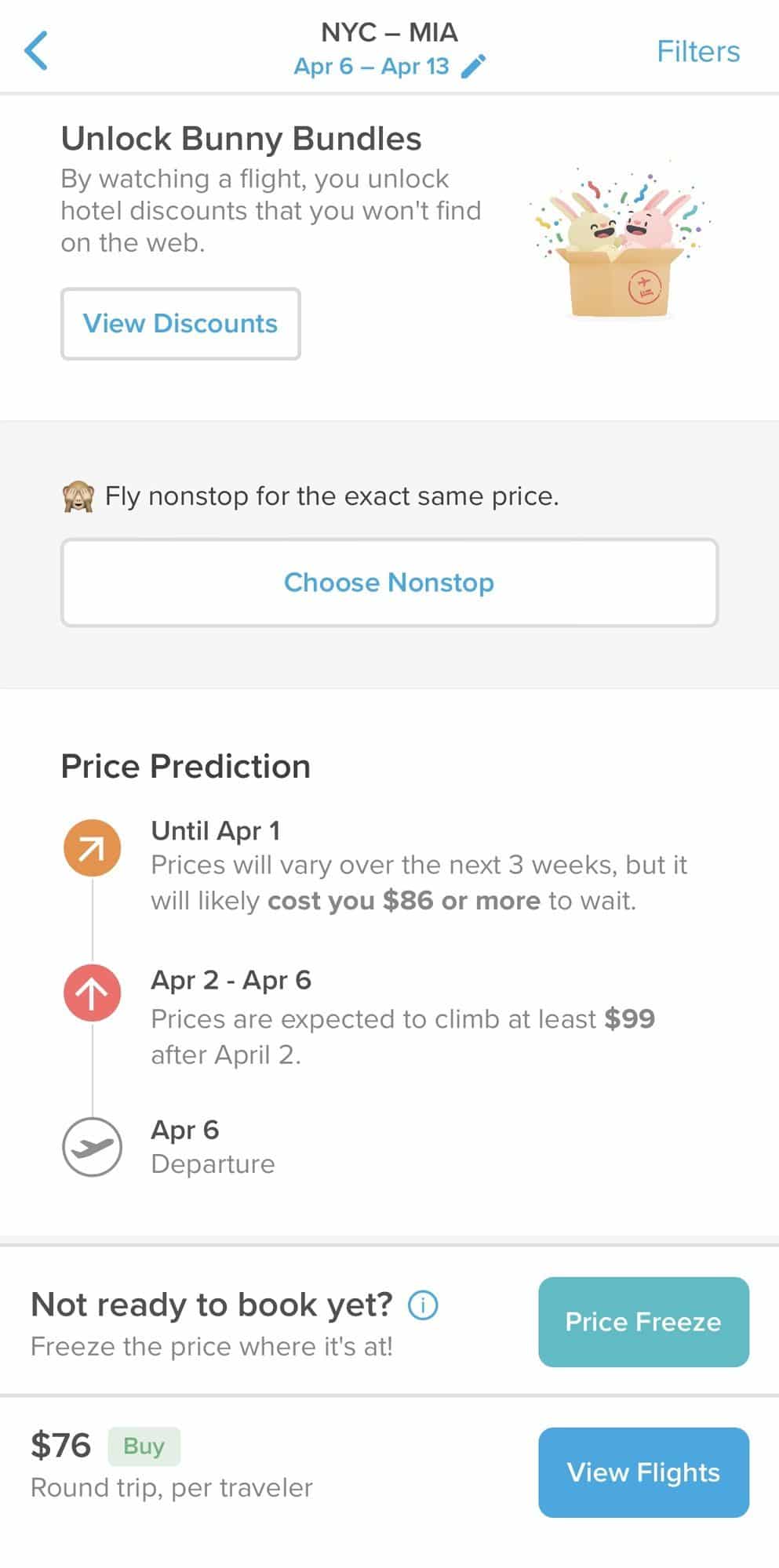

Hopper’s advice is to book now. The fare information includes the price with all taxes & fees , as well as predictions about the fare and how it will change within the coming weeks.

There will also be an option to “Watch This Trip” if you’re not ready to book. However, you must be signed into the app and have notifications turned on to enable this feature. If you choose to watch the flight, your watched Hopper flight will appear on the home screen as you open the app.

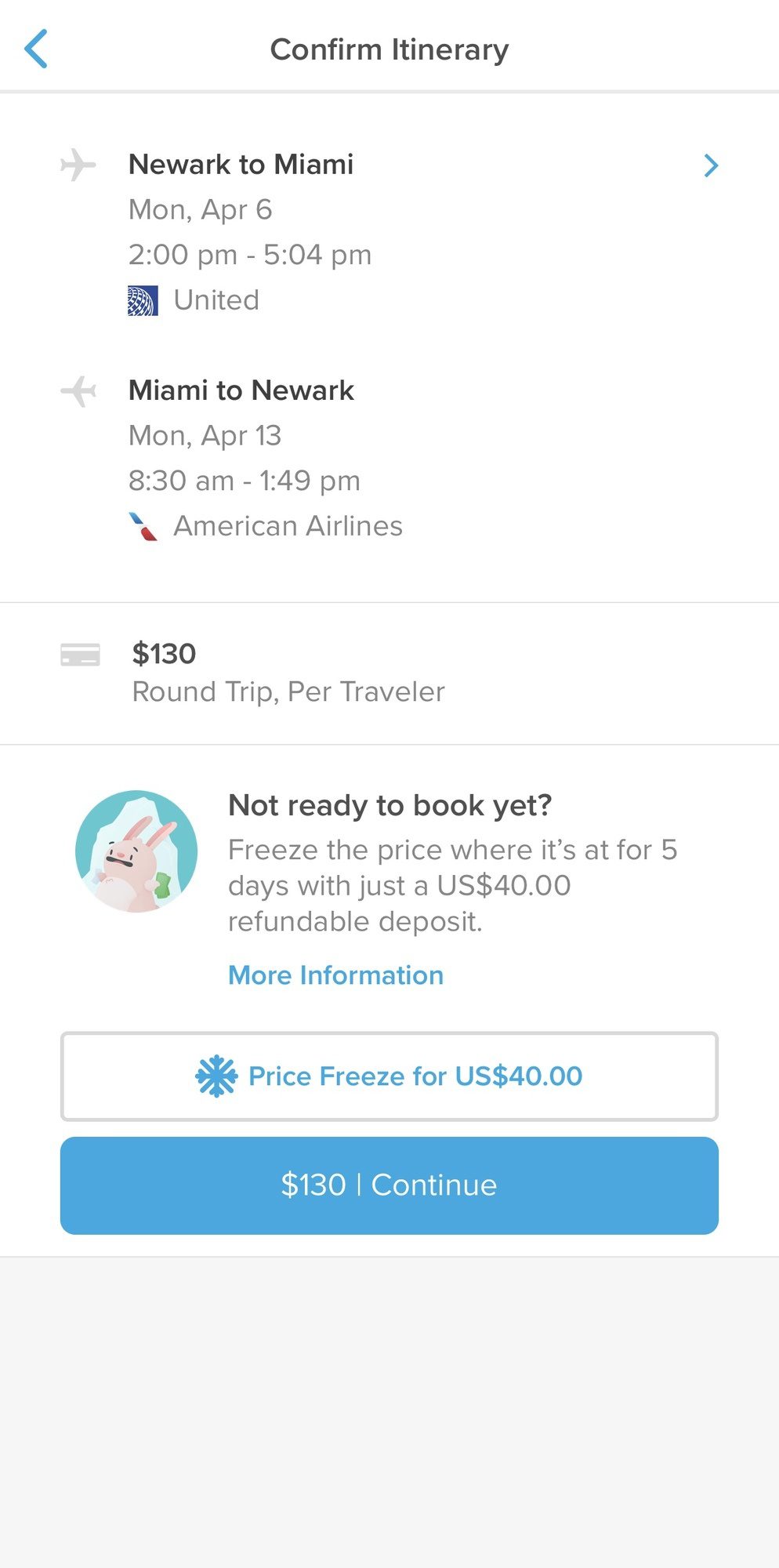

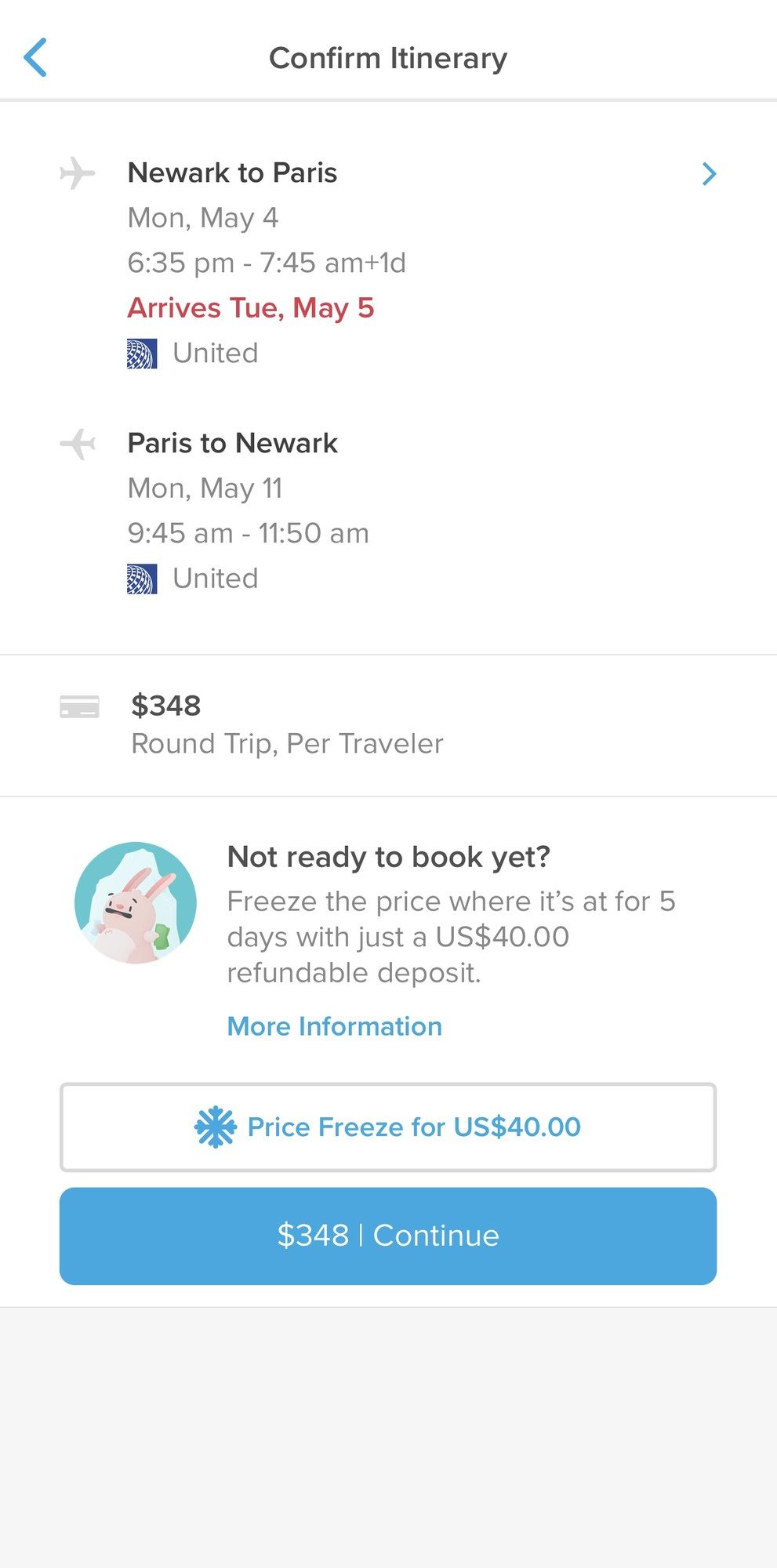

Hopper also has a “Price Freeze” feature. This lets you choose the flights you want and put a $40 deposit to freeze the airfare for 5 days. Hopper will cover the flight price increase, should it change, up to $100 per person. The $40 deposit is returned automatically when you book within that 5-day timeframe.

How to Book Hopper Flights

If you’re ready to book or you want to see flight options, click the “View Flights” button at the bottom of the screen.

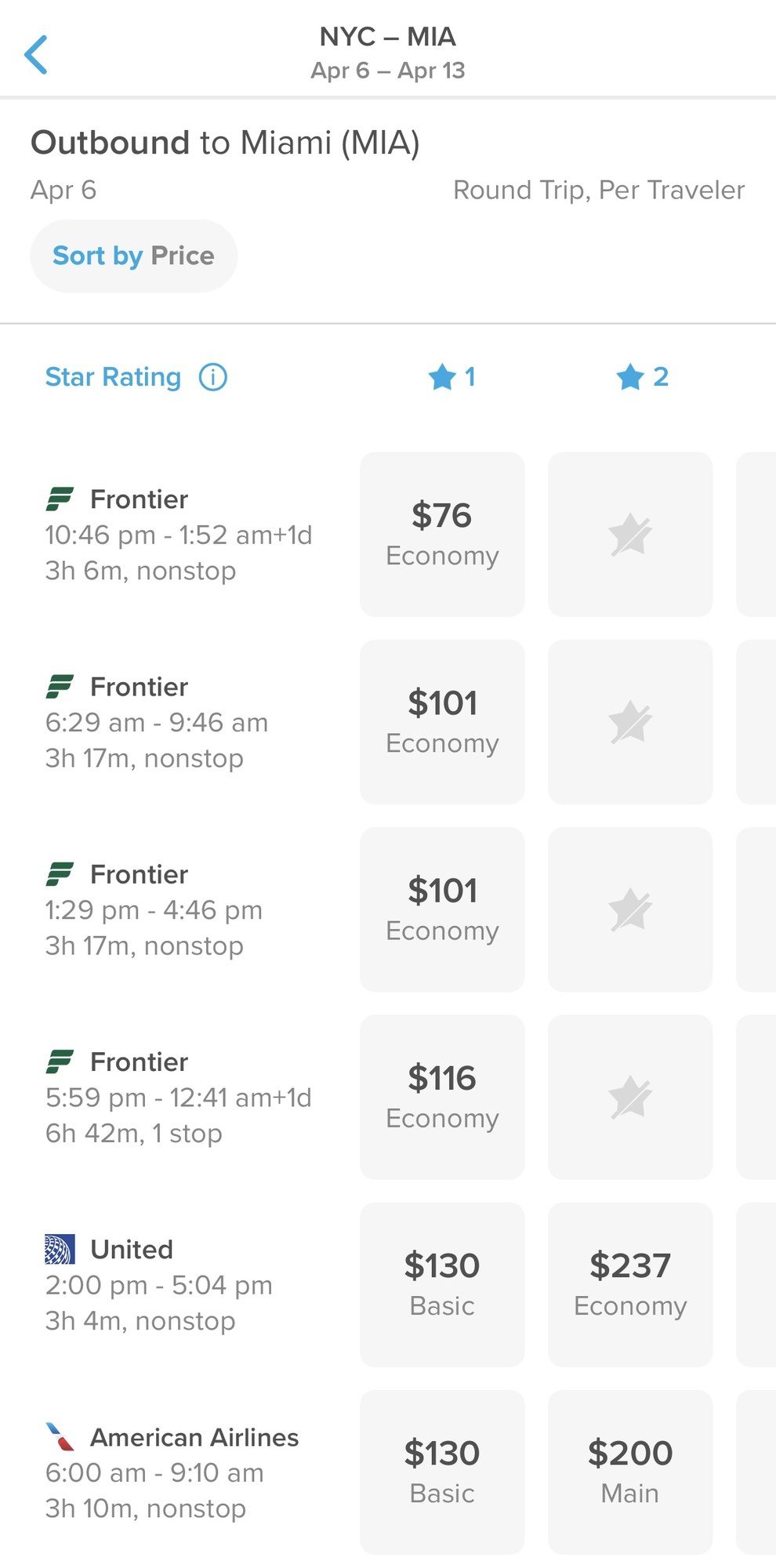

Hopper will display airlines and flight schedules, showing the outbound first.

Select your outbound and return flights to create your itinerary.

The Hopper app even lets you pick flights from different airlines . So, it’s possible to fly United on the outbound and American Airlines on the return in order to get the cheapest combination of flights.

Hopper will offer the opportunity to make the ticket refundable. Just be sure to read the terms and conditions. Refund protections don’t apply to CDC, WHO, or U.S. Department of State travel advisories.

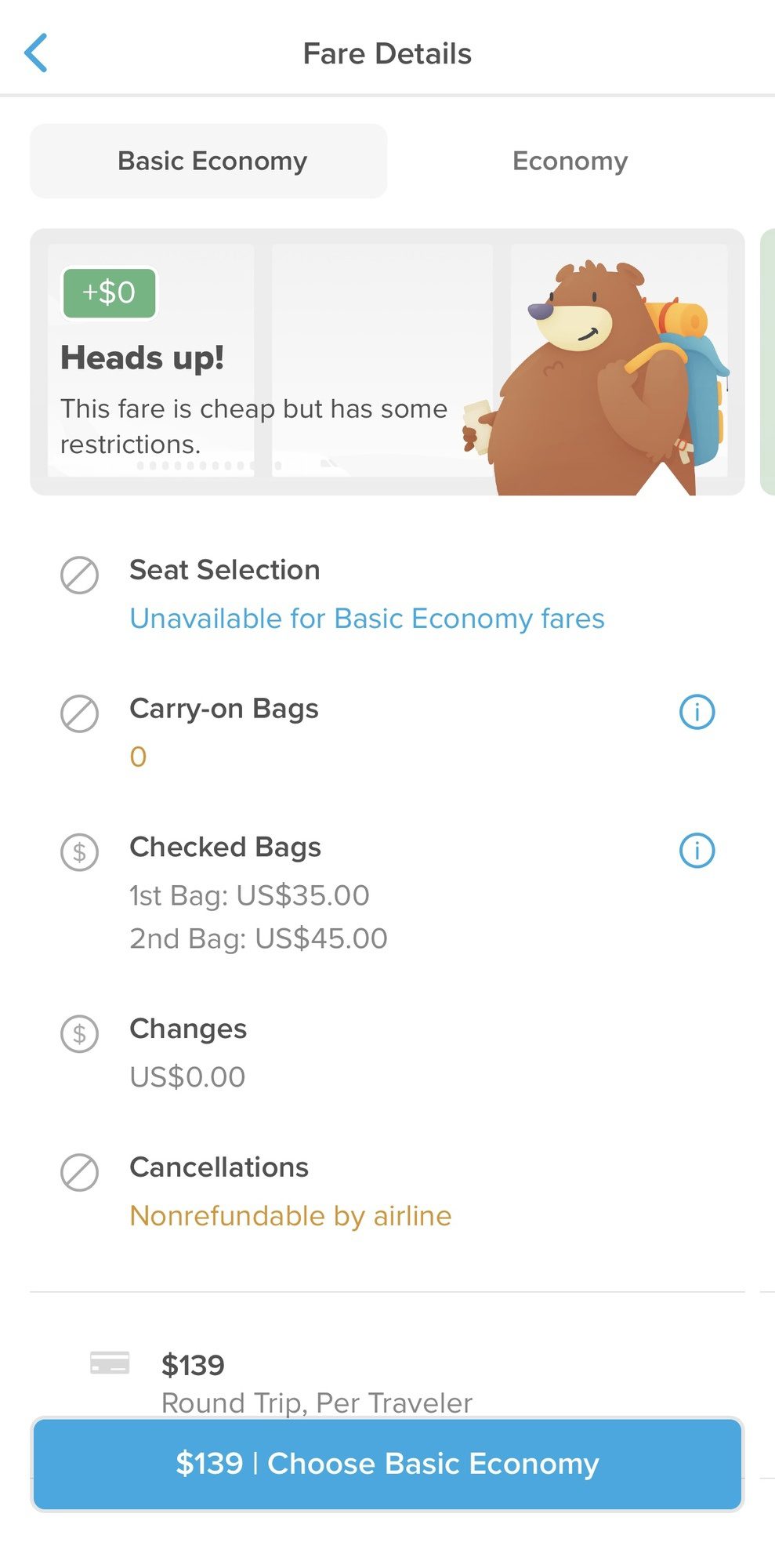

If you’ve chosen a Basic Economy fare, Hopper will alert you to the restrictions that could include seat selection and carry-on or checked bags.

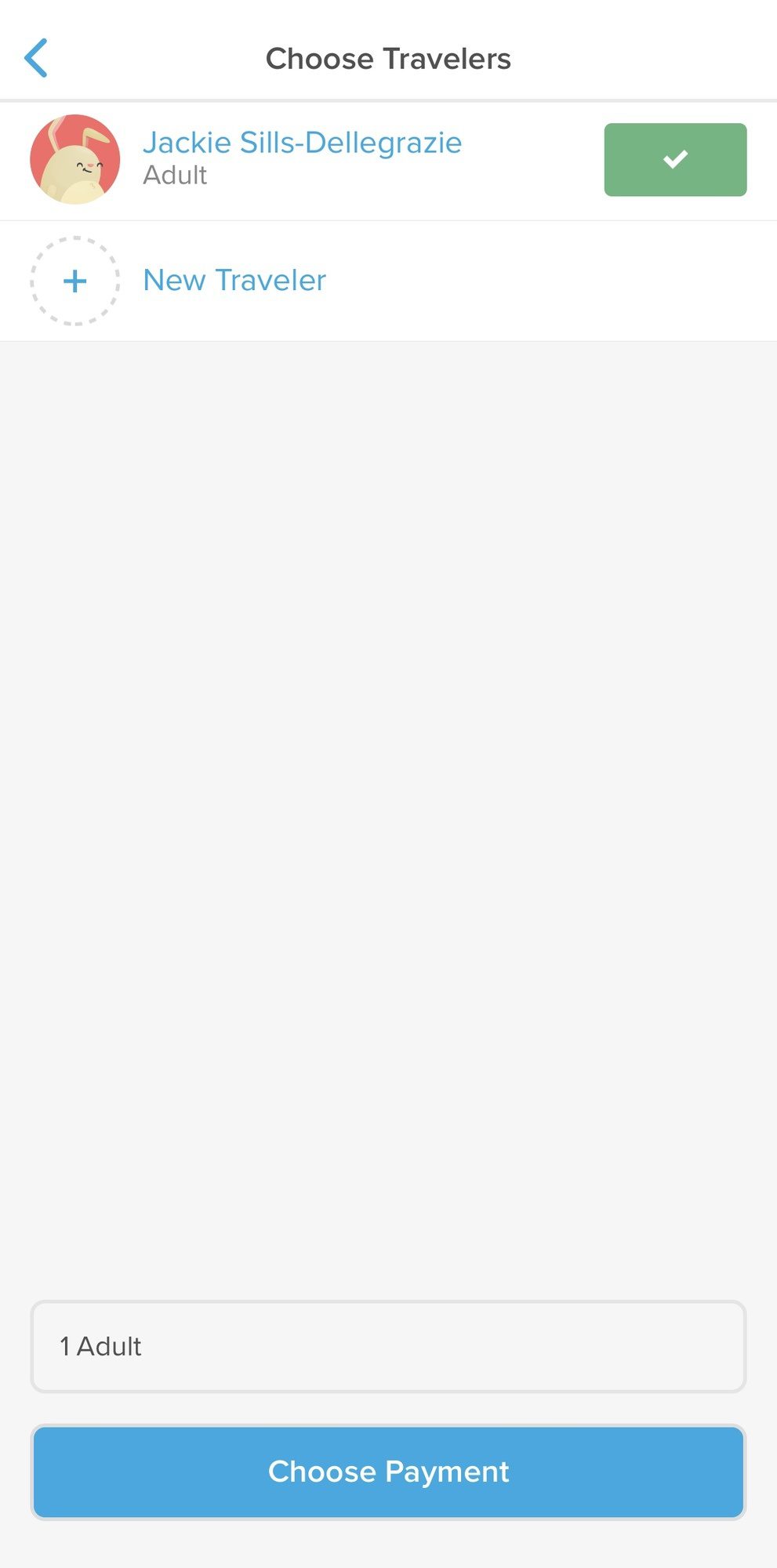

When you continue, you’ll need to choose who will be flying. If you haven’t signed in, you’ll be prompted to do this. If you need to add different or additional travelers, you can also do that now.

Once the travelers are selected or added, click on “Choose Payment” to enter your credit card information. Be sure to use a travel rewards credit card with a travel bonus category like the Chase Sapphire Preferred or Chase Sapphire Reserve so you can earn 3x the points on travel purchases.

Hopper Flight Deals

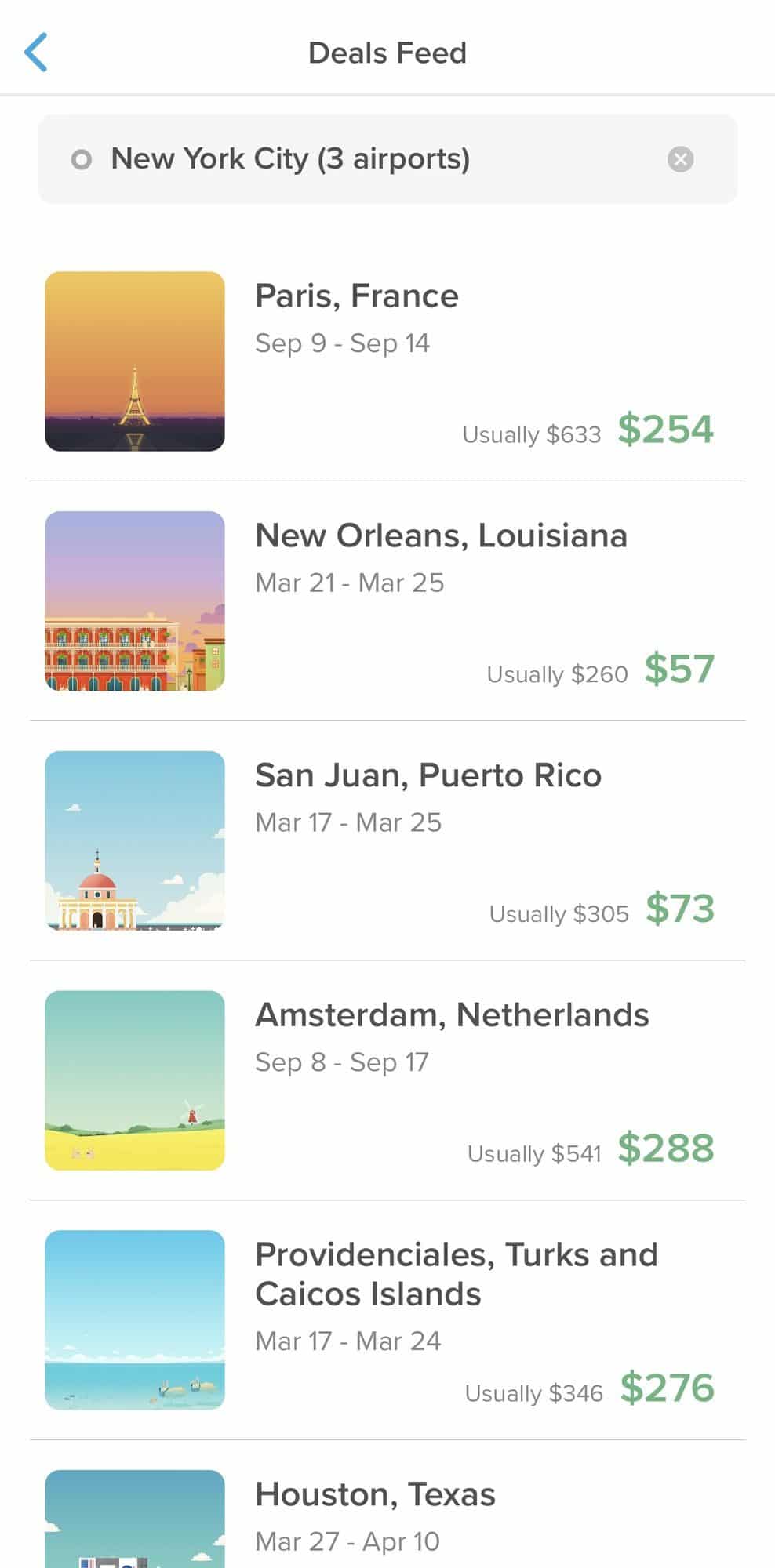

At the bottom of the home screen, the Hopper deals feed gives you the option to explore cheap flights by destination depending on your departure airport.

Simply enter your home airport and a list of destinations, prices, and dates will display. This is a great option if you’re flexible about where and when to travel and just want to find the cheapest flights.

Hopper vs Google Flights

Google Flights and even other tools like Momondo are some of my favorite websites for finding cheap flights . Naturally, I wanted to run a few tests to see if Hopper was also able to find the cheapest prices.

I first compared the flight example from above, New York to Miami. When I searched, Google Flights I found a price that was $10 cheaper than Hopper was showing. However, I suspect because I had done the New York to Miami search several times on Hopper that prices increased because of cookie tracking.

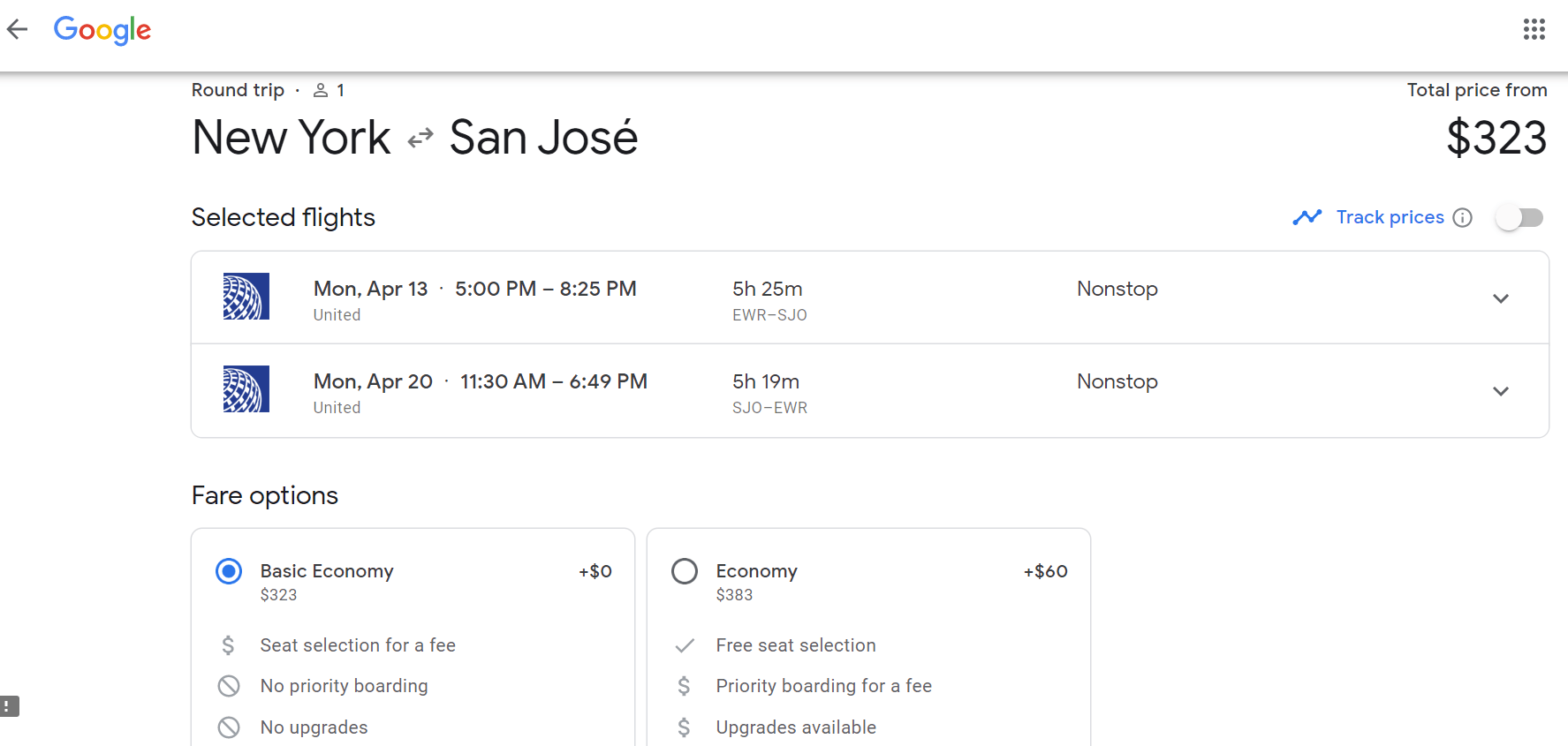

So, I chose a new destination. I searched New York City to Costa Rica , first on Google Flights and then on Hopper. I selected the same exact flights on the same dates on each platform and found an exact price match.

Then, I searched on Google Flights from New York City to Paris.

Again, I chose the exact same flights on the same dates and again the prices were the same.

This might have you asking, why not just use Google Flights? After all, there’s no need to download an app.

Hopper’s price prediction abilities, booking tips, and notifications make it a valuable tool for finding the best price…even if it ultimately makes sense to replicate the search on Google Flights or even an airline’s website to book directly with the airline in order to earn miles toward status.

Hopper’s airfare data research can help you understand when you should book and when you should wait in a much clearer way than other websites can. Think of it as another valuable tool in your travel toolbox.

ProTip: Keep in mind, Google Flights and Hopper don’t show Southwest flights. Hopper also doesn’t show Delta flights. It’s worth comparing with these airlines if they fly the route for which you’re searching.

Hopper Hotels

Hopper can also help you find the best prices on hotels. From the Hopper app home screen, click on “Hotels.” Choose where you’re going and the dates you need to stay. For this example, I chose New Orleans.

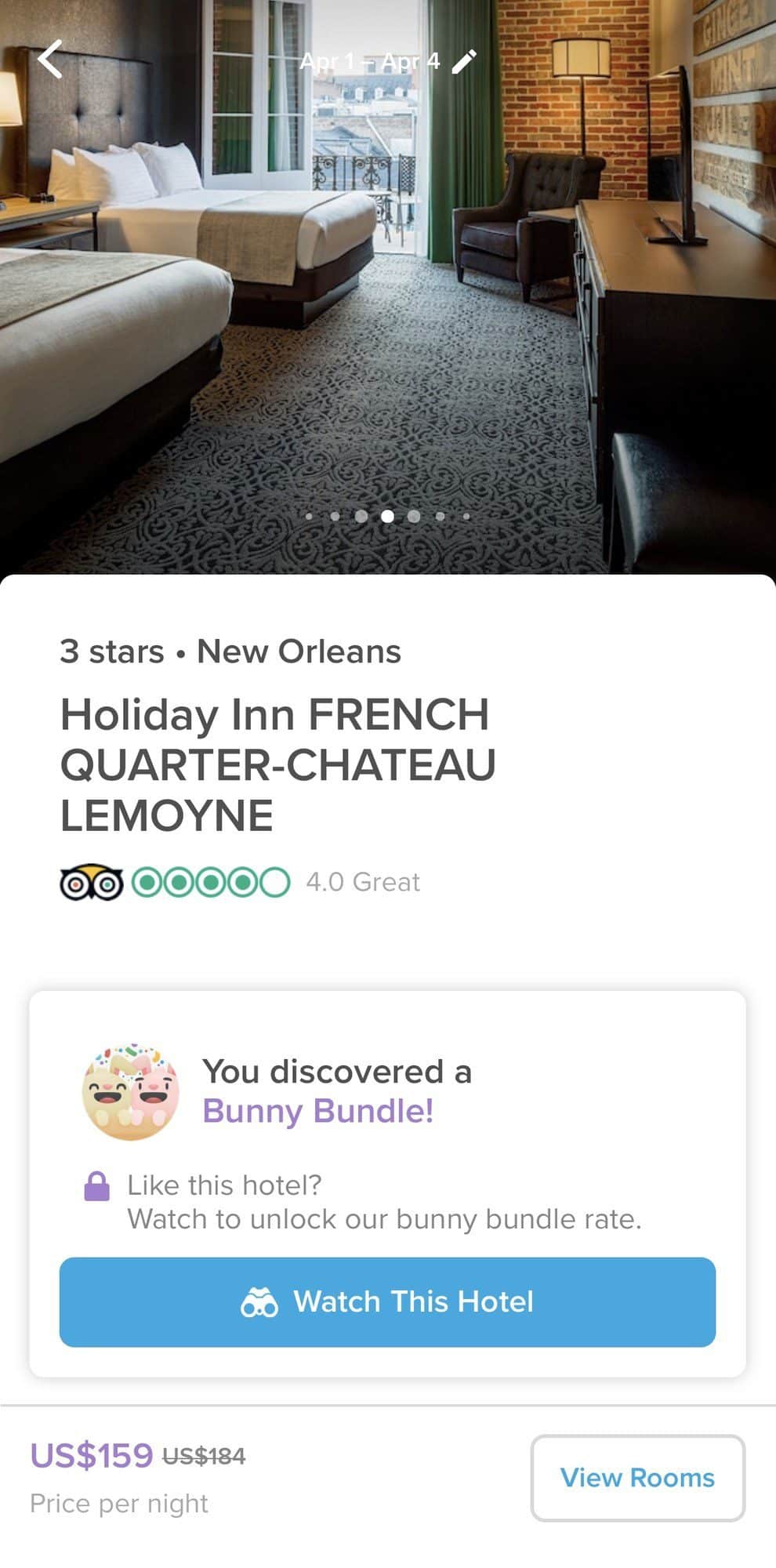

Hopper will show a list of hotels. You’ll be able to sort the list based on their star rating, user rating, and price. Hopper also has a map view so you can see where each hotel is. This is especially helpful if you want to stay near a specific attraction or in a specific neighborhood.

You’ll also be able to filter the results by star rating, user rating, amenities, price range, and location.

If you click the blue binocular icon alongside the hotel results, it’ll be added to your watch list. Remember you need to be signed in with notifications enabled to unlock this feature.

Once you add a hotel to your watch list, it’ll appear on the home screen of the app, along with any other flight or hotel watches you have set up already.

If you’d like to see more about a particular hotel, click on it from the list. Hopper will show more photos, the hotel’s rating and recent reviews from TripAdvisor, a price comparison to other booking sites, the mapped location, and amenities.

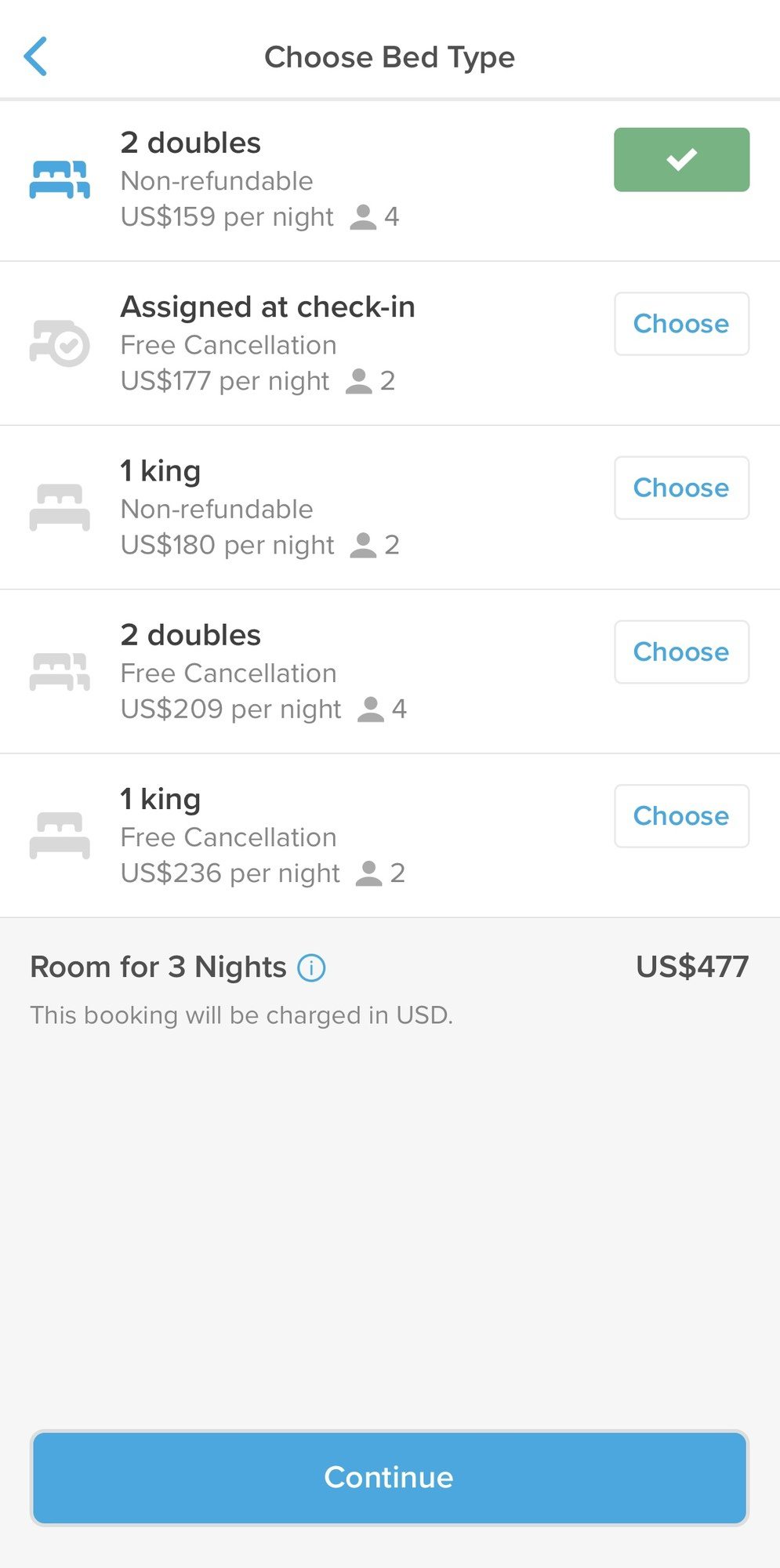

Click on “View Rooms” to select from different rooms and bed types, if available. You’ll also be able to see the complete price breakdown.

Once you continue, you’ll be prompted to choose the guests from your list or to add new guests. Once you do so, you can add a payment method to complete your booking.

Hopper Travel App Bottom Line

The Hopper App saves you time and money by searching through the masses of airfare and hotel data letting you know the best time to book your travel. Whether Hopper is your go-to tool or one of a few you use to find the best deals, you can book and travel confidently knowing you’ve used one of the best tools out there for finding the best travel deals.

Have you tried the Hopper app?

Like this post? Please share it on social media using the share buttons below!

Related Posts

Do You Know How to Avoid the Most Common Travel Mistakes?

5 Reasons Why You Need to Know Momondo for Cheap Airfare

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Privacy Overview

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

All about booking with Capital One Travel

Planning the perfect getaway? Save yourself from seemingly endless online searches and choose a better way: Capital One Travel . Capital One Travel is an online booking platform that covers every step of your trip and is designed to help you plan, book and travel with confidence.

This guide breaks down exactly how it works and what it offers.

Key takeaways

- Capital One Travel is an online booking experience where eligible cardholders can book flights, hotels and rental cars.

- Depending on your card, you can earn as much as 10X miles on hotels and rental cars and 5X miles on flights booked through Capital One Travel.

- Booking through Capital One Travel gives you access to smarter tools like price prediction, price drop protection and more.

- Venture X cardholders receive a $300 annual credit for bookings through Capital One Travel.

- Eligible cardholders also receive an experience credit and premium benefits on every hotel booking from the Premier or Lifestyle collection.

Capital One Travel

Earn extra rewards and find our best prices for flights, hotels and car rentals.

What is Capital One Travel?

Capital One Travel is an online booking experience for Capital One rewards credit cardholders in partnership with Hopper. It launched in 2021 to make trip planning and travel enjoyable and hassle free for eligible Capital One cardholders.

Capital One Travel sorts through thousands of options to help you get Capital One’s best prices for flights, hotels and car rentals and confidently book your travel online. 1 As a bonus, eligible cardholders can earn extra rewards when booking through Capital One Travel.

Capital One Travel features and benefits

Cardholders can sign in to Capital One Travel to compare prices and book flights, hotels and rental cars. But that’s just the start.

You’ll have access to unique tools and offers before and after you book, giving you a rewarding, flexible travel experience. Here’s a closer look at some of the benefits of Capital One Travel:

Cancel your flight for any reason

Need to make your travel booking more flexible? For a small fee when booking, you can add the option to cancel your flight for any reason.

This option gives you the ability to cancel your flight up to a set time within your scheduled departure. Capital One Travel will issue a refund—typically 70%-90% of the ticket price—to your original payment method.

Sometimes, you’ll also have the option to choose an airline credit worth 100% of your original ticket cost instead of the refund. Airline credit availability depends on the airline’s policies. If you choose this option, Capital One Travel will still cover any related cancellation or rebooking fees. 2

Freeze the price of a flight

Want a little extra time to decide on a flight but don’t want to stress about the price going up? For some flights offered through Capital One Travel, you can “freeze” the price for a specific period of time by paying a small fee.

When you freeze the price of the flight, Capital One Travel will hold that price for you until the expiration date of your frozen price. That expiration date will be given to you before completing your purchase.

If the price of the flight increases after you freeze it (and before your frozen price expires), Capital One Travel will cover any fare increase up to your maximum refund limit. And if the price goes down, you’ll pay the current lower price. 3

Earn bonus rewards

When you book that fabulous hotel room for the weekend or reserve a car rental for a scenic drive, you’re earning extra rewards you can put toward your next trip.

Venture X and Venture X Business cardholders get 10X miles on hotels and rental cars and 5X miles on flights booked through Capital One Travel.

And when booking through Capital One Travel with other eligible U.S.-issued Capital One cards, earn 5X miles or 5% cash back on hotels and car rentals, depending on the card:

- Travel credit cards : Venture, VentureOne

- Cash back credit cards : Quicksilver, QuicksilverOne, Quicksilver for Good Credit, Quicksilver Student, Quicksilver Secured and Capital One Walmart Rewards® Card

- Dining and entertainment credit cards : Savor, SavorOne, SavorOne Student, SavorOne for Good Credit

- Business credit cards : Spark Miles, Spark Miles Select, Spark Cash Select, Spark Classic, Spark Cash Plus

Get price prediction and price watch alerts for flights

Looking for the best time to book flights? When you search for flights on Capital One Travel, you’ll see a recommendation to either book now or wait for a better price. Capital One Travel uses artificial intelligence (AI) to analyze billions of data points and predict how flight prices will fluctuate.

To get started, you can set a price alert for the destination and dates you’re interested in flying. Capital One Travel will monitor prices 24/7 and let you know when it’s time to book. With help from our price predictions and alerts, you can save an average of 15% on flights. 4

Get free price drop protection for flights

Did you book a flight to visit loved ones based on Capital One Travel recommendations? If you booked at a recommended time, Capital One Travel will keep watching the price for 10 days. If it drops, you get up to $50 in travel credit for the difference. 5

Get Capital One Travel's best prices, guaranteed

If you find a better price on the same flight, hotel or car rental, Capital One Travel will match it. Simply submit a request within 24 hours of booking with us, and Capital One Travel will give you a travel credit for the difference. For hotels, we also proactively adjust our prices to guarantee they match or beat other travel sites. 6

Redeem rewards for travel

Have you been saving up your rewards? Apply them to any trip booked through Capital One Travel. Or use a combination of rewards and your card when booking. The choice is yours.

Stay in style

Elevate your stay with rooftop drinks, meals at signature restaurants, room service and other unique amenities when you book with the Premier Collection or Lifestyle Collection . The collections also include a $50 or $100 experience credit (depending on the collection) and other premium benefits like room upgrades, early check-in and late checkout when available—all to make it even easier to upgrade your next getaway. 7

Capital One Travel FAQ

Check out these frequently asked questions about Capital One Travel.

How can I access Capital One Travel?

If you have access through your card, you’ll see the option to start booking trips when you sign in and view your rewards . Through the site, you can pay for flights, hotels and car rentals with your Capital One card, your rewards or both. Don’t have an eligible Capital One card? You can compare options and benefits to get started.

Do I need a Capital One travel rewards credit card to use Capital One Travel?

If you have any eligible Capital One credit card, you can use Capital One Travel to plan your next getaway. Travel rewards credit cards earn miles on hotels and car rentals when booking through Capital One Travel, and other eligible cards earn cash back.

You can see if you’re pre-approved for an eligible card today—with no harm to your credit.

Can I transfer miles instead of booking through Capital One Travel?

You may be able to transfer your Capital One miles to one of Capital One’s loyalty programs .

Does Capital One offer travel insurance?

Some Capital One rewards credit cards may offer travel insurance . And some coverage may be available through your card’s network . You can check your card’s benefits and terms to determine if you qualify for travel coverage, lost luggage reimbursement or travel accident insurance.

Capital One Travel in a nutshell

Capital One Travel provides advanced booking tools, price guarantees and the ability to earn and redeem your rewards—all to help you travel smarter. All you need is a Capital One travel rewards credit card or any eligible Capital One card to use it. So if you’re jetting off to a new place soon, start planning your trip today with Capital One Travel .

Other ways to maximize your travel benefits

Who wouldn’t want to get the most out of their credit card? Here are some things to know about Capital One travel rewards credit cards:

Get a one-time 75,000-mile bonus with the Capital One Venture X card and receive an additional 10,000 bonus miles every year, starting on your first anniversary. ( View important rates and disclosures .)

Earn unlimited 2X miles per dollar on every purchase, every day and get 75,000 bonus miles upon signup with the Capital One Venture card . ( View important rates and disclosures .)

Earn unlimited 1.25X miles with no annual fee with the Venture One card from Capital One . ( View important rates and disclosures .)

Explore travel rewards card options by comparing Capital One Venture cards .

Learn how Venture X cardholders can get access to a worldwide network of airport lounges thanks to a complimentary Priority Pass membership .

Related Content

All about the capital one venture card.

video | April 23, 2024 | 1 min video

All about Capital One Lounges

video | December 12, 2023 | 1 min video

All about Venture X

article | February 20, 2024 | 9 min read

Featured Article

Hopper raises $170M and partners with Capital One on a new cardholder travel booking portal

Hopper ceo fred lalonde looks back on customer service hell, and forward to building a fintech.

Canadian travel startup Hopper has raised a $170 million Series F round, led by Capital One. The U.S. banks and credit card company is also coming on board as a strategic partner, to launch Capital One Travel, which is the first instantiation of Hopper’s new B2B platform, Hopper Cloud.

This is Hopper’s second raise in a year that has been marked by turmoil for the travel industry, owing to the disruptions caused by the global COVID-19 pandemic. Last March, Hopper raised $70 million in a round that saw Inovia Capital actually make its first investment in the startup — essentially at the very moment that things looked most bleak for the travel industry in general, and in particular for airfare-focused Hopper.

I asked Inovia partner Patrick Pichette about his decision to back Hopper at a moment when a lot of investors where essentially on pause pending the fallout of the just-declared pandemic, and about their renewed support with a contribution to this latest round.

“What we had seen in the prior six months, nine months to a year, at Hopper was a transformation of a company before COVID,” Pichette said. “And second is our thesis at Inovia — we invest in companies with the mindset of, ‘Does this company have a shot at being a global company?’ If it’s gonna be a Canadian company, it might be fine, but it’s just not for us. Also, does it really leverage tech in a way that is differentiated? And so if it has these attributes, then we’re interested.”

That pre-COVID transformation that Pichette is referring to is Hopper’s shift from being essentially a machine learning-powered lowest fare finder to what co-founder and CEO Fred Lalonde says is really much more of a fintech company. That characterization mostly comes from Hopper’s ability to offer customers financial flexibility around their travel bookings.

“The real fundamental sea change is that Hopper moved away from being a predominantly air travel company to a true fintech,” Lalonde explained in an interview. “Price freeze is a good example. We allow you to come in and hold the price of a booking for between two hours and 14 days. If the price goes up you pay what you froze, and if it goes down you pay the lower price. We have flexible date plans, cancellation plans, where you can take a non-refundable, non-changeable ticket and for a nominal fee, make it changeable. And one that’s working really surprisingly well is the disruption insurance.”

Hopper’s disruption insurance is basically a rebooking service for missed connections. Whatever the reason, if you happen to miss a connection on a multiple-leg flight and you have opted for the disruption insurance service, you’ll be presented with every flight leaving that particular airport, regardless of airline, to your destination and you can select an available option at no additional cost.

Understandably, Hopper’s overall business took a hit during the pandemic, and that had a steep cost: The company laid off around 45% of its staff last year as a result of the dip in demand. But for the bookings that were being made, Lalonde says the company was seeing very high attach rates for its products that provide more peace-of-mind around booking stability. Now, with the U.S. travel industry in particular taking its first steps toward recovery, Lalonde says behavior is not changing as much as his company had anticipated.

“What is interesting is as demand has recovered, originally we thought since we had very, very high attach rates, we thought those would never come back,” he said. “But we’ve actually outgrown our pandemic attach rate. So people are adding more of these services, and we credit that to the product innovation.”

Lalonde also credits the pandemic for proving out the validity of its fintech approach, since Hopper “had a lot of liabilities” in place prior to the global shutdowns, and so a lot of investors and observers were watching and thinking that though this was a novel and interesting approach, carrying those liabilities appeared to incur a lot of additional risk, as well. The pandemic was “the mother of all black swan events,” he notes, which means that now, it doesn’t have to talk about the theoretical resilience of its model — it can point to the actual experience.

“Three months later, [it turns out] we lost money for about 30 days,” Lalonde said. “Now we’re back on the other side of this, every color is profitable. The fact is the way that the future travel credits kicked in, and how the refunding works, we ended up with a pretty stable revenue stream.”

Hopper customers may not have felt so optimistic about the company’s performance during the pandemic, however. The startup’s app reviews, Better Business Bureau (BBB) profile and social media accounts were inundated with negative comments and reports of poor experiences . Most centered around either a lack of customer ability to secure their refund, or a failure of communication on Hopper’s part. Lalonde says that Hopper definitely failed at the communication part, and it’s still in the process of hiring hundreds of additional call center employees to improve that part of the business, but fundamentally, it opted to take a hit on that front in order to focus on building a technical solution to handle the unprecedented volume of flight credits coming from airlines.

“The part that is misunderstood is that all of a sudden, the airlines gave out these future travel credits,” he said. “These vouchers, we had to key them in all by hand. And I swear, this is a green screen — you have to go in and do commands. It takes about 20 minutes to do one, so we counted how much time with all of our staff, it would take us to do them by hand. And the answer was we’d be done in 2070, and then even if you double the number of people doing it, it was 2050.”

No existing automation for this process existed because prior to the pandemic, credits for non-refundable airline tickets just didn’t really exist, and particularly not at scale. At that point, Lalonde says Hopper “made a decision to put everybody on the automation, [and] just get murdered publicly.”

Unicorn travel startup Hopper is facing a pandemic-fueled customer service nightmare

He says that gamble has worked out, since once the automation was up and running, they’ve been able to clear out the backlog pretty much entirely. And the company has also been focused on new product developments, including shifting its roadmap to prioritize the addition of car rental and hotel/holiday home booking to better suit the needs of pandemic travel, which has largely been overland in North America. That has meant deprioritizing other areas, including international expansion, but Lalonde says that’s one focus for use of the new funds the company raised.

The other big focus is Hopper Cloud, a B2B offering that provides the benefits of Hopper’s machine-learning power price prediction, as well as its fintech travel insurance and disruption prevention products, but tied to another businesses’ unique offerings. In the case of Capital One, that means all the rewards the company offers its cardholders in terms of earning and redeeming travel credits, for instance. I asked Lalonde whether that approach was made more appealing by the fact that it somewhat intermediates the customer experience, but he pointed out that the initiative is a co-branded one, so Hopper still has its name on the product and the accountability. Plus, he added, the real advantage of these kinds of partnerships are the network effects, and Hopper’s goal remains becoming the top booking destination for customers directly.

“One of the reasons I never want to drop the marketplace — it’s growing really quickly and making money, but even if it didn’t, losing that would just put us further away from the end customer,” Lalonde said. “I like the proximity of knowing exactly what happens, and feeling the pain when we screw up and feeling the joy when we get something right.”

Why is Eugene Kaspersky funding a travel accelerator during COVID-19?

More TechCrunch

Get the industry’s biggest tech news, techcrunch daily news.

Every workday and Sunday, you can get the best of TechCrunch’s coverage.

Startups Weekly

Startups are the core of TechCrunch, so get our best coverage delivered weekly.

TechCrunch Fintech

The latest Fintech news and analysis, delivered every Sunday.

TechCrunch Mobility

TechCrunch Mobility is your destination for transportation news and insight.

AI chip startup DEEPX secures $80M Series C at a $529M valuation

The Series C funding, which brings its total raise to around $95 million, will go toward mass production of the startup’s inaugural products

Infighting among fintech players has caused TabaPay to ‘pull out’ from buying bankrupt Synapse

A dust-up between Evolve Bank & Trust, Mercury and Synapse has led TabaPay to abandon its acquisition plans of troubled banking-as-a-service startup Synapse.

Apple’s ‘Crush’ ad is disgusting

The problem is not the media, but the message.

Google built some of the first social apps for Android, including Twitter and others

The Twitter for Android client was “a demo app that Google had created and gave to us,” says Particle co-founder and ex-Twitter employee Sara Beykpour.

WhatsApp’s latest update streamlines navigation and adds a ‘darker dark mode’

WhatsApp is updating its mobile apps for a fresh and more streamlined look, while also introducing a new “darker dark mode,” the company announced on Thursday. The messaging app says…

Plinky is an app for you to collect and organize links easily

Plinky lets you solve the problem of saving and organizing links from anywhere with a focus on simplicity and customization.

Google I/O 2024: How to watch

The keynote kicks off at 10 a.m. PT on Tuesday and will offer glimpses into the latest versions of Android, Wear OS and Android TV.

Triomics raises $15M Series A to automate cancer clinical trials matching

For cancer patients, medicines administered in clinical trials can help save or extend lives. But despite thousands of trials in the United States each year, only 3% to 5% of…

Tesla drives Luminar lidar sales and Motional pauses robotaxi plans

Welcome back to TechCrunch Mobility — your central hub for news and insights on the future of transportation. Sign up here for free — just click TechCrunch Mobility! Tap, tap.…

Reddit locks down its public data in new content policy, says use now requires a contract

The newly announced “Public Content Policy” will now join Reddit’s existing privacy policy and content policy to guide how Reddit’s data is being accessed and used by commercial entities and…

Fika Ventures co-founder Eva Ho will step back from the firm after its current fund is deployed

Eva Ho plans to step away from her position as general partner at Fika Ventures, the Los Angeles-based seed firm she co-founded in 2016. Fika told LPs of Ho’s intention…

Amazon’s CTO built a meeting-summarizing app for some reason

In a post on Werner Vogels’ personal blog, he details Distill, an open-source app he built to transcribe and summarize conference calls.

Sources: Mistral AI raising at a $6B valuation, SoftBank ‘not in’ but DST is

Paris-based Mistral AI, a startup working on open source large language models — the building block for generative AI services — has been raising money at a $6 billion valuation,…

Google I/O 2024: What to expect

You can expect plenty of AI, but probably not a lot of hardware.

Bumble says it’s looking to M&A to drive growth

Dating apps and other social friend-finders are being put on notice: Dating app giant Bumble is looking to make more acquisitions.

Blackboard founder transforms Zoom add-on designed for teachers into business tool

When Class founder Michael Chasen was in college, he and a buddy came up with the idea for Blackboard, an online classroom organizational tool. His original company was acquired for…

Groww joins the first wave of Indian startups moving domiciles back home from US

Groww, an Indian investment app, has become one of the first startups from the country to shift its domicile back home.

Dell discloses data breach of customers’ physical addresses

Technology giant Dell notified customers on Thursday that it experienced a data breach involving customers’ names and physical addresses. In an email seen by TechCrunch and shared by several people…

Fairgen ‘boosts’ survey results using synthetic data and AI-generated responses

The Israeli startup has raised $5.5M for its platform that uses “statistical AI” to generate synthetic data that it says is as good as the real thing.

Rowing startup Hydrow acquires a majority stake in Speede Fitness as their CEO steps down

Hydrow, the at-home rowing machine maker, announced Thursday that it has acquired a majority stake in Speede Fitness, the company behind the AI-enabled strength training machine. The rowing startup also…

Retell AI lets companies build ‘voice agents’ to answer phone calls

Call centers are embracing automation. There’s debate as to whether that’s a good thing, but it’s happening — and quite possibly accelerating. According to research firm TechSci Research, the global…

TikTok will automatically label AI-generated content created on platforms like DALL·E 3

TikTok is starting to automatically label AI-generated content that was made on other platforms, the company announced on Thursday. With this change, if a creator posts content on TikTok that…

India likely to delay UPI market caps in win for PhonePe-Google Pay duopoly

India’s mobile payments regulator is likely to extend the deadline for imposing market share caps on the popular UPI (unified payments interface) payments rail by one to two years, sources…

Thai food delivery app Line Man Wongnai weighs IPO in Thailand, US in 2025

Line Man Wongnai, an on-demand food delivery service in Thailand, is considering an initial public offering on a Thai exchange or the U.S. in 2025.

OpenAI offers a peek behind the curtain of its AI’s secret instructions

Ever wonder why conversational AI like ChatGPT says “Sorry, I can’t do that” or some other polite refusal? OpenAI is offering a limited look at the reasoning behind its own…

US Patent and Trademark Office confirms another leak of filers’ address data

The federal government agency responsible for granting patents and trademarks is alerting thousands of filers whose private addresses were exposed following a second data spill in as many years. The…

Encrypted services Apple, Proton and Wire helped Spanish police identify activist

As part of an investigation into people involved in the pro-independence movement in Catalonia, the Spanish police obtained information from the encrypted services Wire and Proton, which helped the authorities…

Match looks to Hinge as Tinder fails

Match Group, the company that owns several dating apps, including Tinder and Hinge, released its first-quarter earnings report on Tuesday, which shows that Tinder’s paying user base has decreased for…

Gratitude Plus makes social networking positive, private and personal

Private social networking is making a comeback. Gratitude Plus, a startup that aims to shift social media in a more positive direction, is expanding its wellness-focused, personal reflections journal to…

Can AI help founders fundraise more quickly and easily?

With venture totals slipping year-over-year in key markets like the United States, and concern that venture firms themselves are struggling to raise more capital, founders might be worried. After all,…

- Vacation Rentals

- Restaurants

- Things to do

- Things to Do

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

anyone gotten intouch with Hopper regarding a travel Credit? - Air Travel Forum

- Tripadvisor Forums

- Air Travel Forums

anyone gotten intouch with Hopper regarding a travel Credit?

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Air Travel forum

Two other threads on this page about Hopper already.

When you don’t do research before giving companies your money you can lose your money.

Skim those threads for advice.

Tripadvisor staff removed this post because it did not meet Tripadvisor's forum guideline limiting each user to a single forums screen name.

Tripadvisor staff removed this post at the original author's request.

This topic has been closed to new posts due to inactivity.

- Ryanair Cabin Bag (Priority) Size 12:01 am

- First time on BA and Business class and Heathrow questions 11:19 pm

- J'burg to Sydney flight over the Southern Indian Ocean 11:18 pm

- Vacuum bags in luggage? 11:05 pm

- ASAP tickets is a scam 10:55 pm

- Connection Times-USA to Philippines 9:36 pm

- Kiwi.com safe & legit, but... 7:17 pm

- Kiwi.com Refund 6:29 pm

- Unsanitary Code 5:31 pm

- Longer flight times and flight paths 5:29 pm

- JFK Terminal 8 - Travel-size Toiletries 5:20 pm

- Fly Play - anyone used them? 5:05 pm

- JFK Terminal 8 - Travel-size Toiletries 4:22 pm

- Mobile Passport Control 3:49 pm

- ++++ ESTA (USA) and eTA (Canada) requirements for visa-exempt foreign nationals ++++

- ++++ TIPS - PLANNING YOUR FLIGHTS +++++++

- Buy now or later? What's with these screwy ticket prices?

- Around-the-world (RTW) tickets

- All you need to know about OPEN JAW tickets

- Beware of cheap business class tickets (sold by 3rd parties)

- ++++ TIPS - PREPARING TO FLY +++++++++

- TIPS - How to prepare for Long Haul Flights

- TIPS - Being Prepared for Cancellations and Long Delays

- TIPS - How to survive being stuck at an airport

- Flights delays and cancellations resources

- How do I effectively communicate with an airline?

- Airline, Airport, and Travel Abbreviations

- Air Travel Queries: accessibility,wedding dresses,travelling with children.

- Connecting Flights at London Heathrow Airport

- TUI Airways (formerly Thomson) Dreamliner - Movies and Seating Information

- ++++ COVID-19 CORONAVIRUS INFORMATION ++++

- Covid-19 Coronavirus Information for Air Travel

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

You Can Now Book JetBlue Tickets Through Hopper & Capital One Travel

Editor & Content Contributor

153 Published Articles 758 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Table of Contents

Jetblue tickets now available on 2 more major platforms, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

JetBlue Airways and the popular online travel agency (OTA) Hopper have come to an agreement that allows customers to purchase JetBlue tickets through that platform.

And, even better, Capital One Travel revamped the back end of its travel portal last year and it’s now powered by Hopper. So this news means that select Capital One cardholders can now book JetBlue tickets directly through the Capital One Travel portal , eliminating a major point of frustration for many customers.

Let’s take a look at all the details.

Online travel agencies are important players in the travel industry as they aggregate fares from carriers across the spectrum and present them to customers who can then choose their preferred option and book the ticket through the airline directly.

Until now, JetBlue tickets were missing on Hopper , which claims to be the third-largest OTA in the country. Presumably, the airline was missing out on a lot of potential business as its fares weren’t shown to people searching on the platform (Hopper is an app-only service).

And, since Hopper powers Capital One Travel ‘s new-and-improved platform, it meant that cardholders of select Capital One credit cards weren’t able to book JetBlue tickets (nor use their Capital One miles ) through the portal, a lose-lose situation for both the airline and travelers .

Now, however, that’s all changed with JetBlue and the OTA coming to an agreement to sell JetBlue tickets on Hopper and, by extension, Capital One Travel.

Hopper boasts a number of customer-friendly features, including automatic refunds in case you book a flight and the price drops after you book, a hold feature that allows you to pay a small fee to reserve a flight for 14 days before you need to make a decision on whether to book or not, a fare-monitoring feature that will notify you when the platform believes it’s the best time to book your ticket, and more.

And, with Capital One Travel now being powered by Hopper, it means that cardholders of select Capital One credit cards can use miles to book JetBlue tickets directly through the portal, which adds even more value to members’ Capital One miles.

Hot Tip: Check out our complete guide to Capital One Travel for more information about the portal.

The new ability to book JetBlue tickets through Hopper (and Capital One) is good news for both the airline and would-be travelers who will now be shown more options when searching on Hopper’s app or attempting to use their hard-earned Capital One miles for flights.

Was this page helpful?

About Nick Ellis

Nick’s passion for points began as a hobby and became a career. He worked for over 5 years at The Points Guy and has contributed to Business Insider and CNN. He has 14 credit cards and continues to leverage the perks of each.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![hopper travel on credit card New Capital One Spark Travel Elite Card [250,000-Mile Welcome Bonus!]](https://upgradedpoints.com/wp-content/uploads/2022/06/KLM-business-class-male-passenger-lie-flat-relaxing.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

How to use your credit card to save on travel as airline costs soar

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

It seems that, post-pandemic, Americans are making up for lost time and hitting the restart button on their travel plans. But it comes at a cost.

A report by the U.S. travel association showed that travel spending hit $97 billion in December—7% higher than 2021 levels. The most recent Consumer Price Index shows that airline fares are up more than 28% year-over-year.

With the cost of everyday goods on the rise , consumers will have to be savvy about how they plan and pay for travel. The good news—if you have the travel bug and plan to explore new places this summer, you likely have a money-saving trick right in your pocket: Your credit card .

What is a travel credit card?

A travel credit card is a type of rewards credit card that gives you the opportunity to earn rewards points or miles for your spending that you can later be redeemed for flights, hotels, and rental cars. Travel cards can also give you access to airport lounges , free checked bags and priority boarding, trip insurance, discounted in-flight purchases, and more.

If you’re a frequent traveler or tend to favor a particular airline or hotel , travel cards can be a great way to help you earn rewards for spending you already planned to do and save on future trips. But, fair warning, a travel card could become less of an asset and more of a liability if you aren’t traveling enough.

“Unfortunately, travel rewards cards often come with high fees and the actual value of the benefits you receive can get pretty confusing. For many people that do not travel often or have concentrated spending, a flat cash-back rewards card typically makes the most sense,” says Brian Walsh, certified financial planner and senior manager of financial planning at SoFi, a personal finance company.

Capital One Venture Rewards Credit Card

Intro bonus.

Reward Rates

- 5x Earn 5x miles on hotels and rental cars booked through Capital One Travel

- 2x Earn 2x miles on every purchase

- Flexible travel rewards

- No foreign transaction fee

- Maximizing Capital One Miles requires a learning curve

- Cash redemption value is limited

- The Venture offers travel accident insurance, rental car coverage, extended warranty protection, exclusive access to events through Capital One Dining and Capital One Entertainment

How your travel card can help you cut costs

While you’re planning your summer travel, it’s easy to become overwhelmed by flight prices, hotel rates and fees, and whether or not to purchase travel insurance. Luckily, your travel card can help you save on those expenses in a few different ways:

Airfare and hotel costs: Airline tickets can often be the most expensive part of your trip depending on where you’re flying, the type of ticket you purchase, and how soon you’ll be traveling. Several credit cards have their own travel booking platforms that offer discounts on airline tickets or hotel stays and let you redeem your rewards for ticket bookings. The Capital One Venture Rewards Credit Card , for example, lets you use your miles to get reimbursed for any travel purchase—or redeem those miles by booking a trip directly through Capital One Travel.

Rental car costs: In the top rental car markets, daily rental car rates can range from $20 to $80 per day, according to Hopper . Your travel card rewards could be redeemed for a rental car reservation. And, it doesn’t stop there. It’s not uncommon to be hit with a long list of fees at the rental car counter, but if you carry a travel card, you may already be covered. The Platinum Card® from American Express covers up to $75,000 per rental agreement for damage or theft, which applies after any claims you make with your primary insurance. (Eligibility and benefit level varies by card. Terms, conditions, and limitations apply. Please visit American Express’ benefits guide for more details. Underwritten by Amex Assurance Company.)

And all Bank of America consumer credit cards provide secondary rental car coverage.

Travel insurance: When you’re booking travel, you’re probably not accounting for everything that could possibly go wrong. Inclement weather, illnesses, family emergencies, you name it. In these cases, travel insurance can be a financial lifeboat. Although, It does come at an additional cost. According to SquareMouth, a travel insurance company, the average cost for a travel insurance policy stands at about $271. This amount can vary drastically depending on the length of your trip, number of travelers, total trip cost, and more.

Certain credit cards offer travel insurance that will cover the cost of trip cancellations, lost baggage, trip delays, emergency evacuation and more. The Chase Sapphire Reserve® covers cancellations or interruptions up to $10,000 per person and $20,000 per trip, and when your trip is delayed more than six hours, you and your family are covered up to $500 per ticket. It also offers lost baggage reimbursement of up to $3,000 per passenger per trip, even when your luggage is damaged, and baggage delay insurance for delays of more than six hours (up to $100 a day for five days).

Foreign transaction fees: Any time you make a purchase overseas or online from an international merchant, you’ll likely pay a foreign transaction fee . This fee is split between your credit card issuer and your credit card network and is charged as a small percentage of your total transaction, usually 1% to 4%. Many travel credit cards don’t charge foreign transaction fees to help frequent travelers reduce costs while they’re using their cards abroad.

How to choose a travel card

Not all travel cards are the same. It’s important to read the fine print to learn more about how each card works, the interest rate offered, if the card comes with a sign-up bonus, how to qualify for any introductory offers, and more. When choosing a travel card , you’ll want to ask yourself a few key questions to help you narrow down your options.

- Are you prepared to pay an annual fee? Travel card perks can have a lot of value, and as a result, you may be charged a steep annual fee for using those benefits. When comparing cards, determine if the perks being offered will help you save enough money to justify paying the annual fee you’ll be charged.

- Does the card’s requirements and rewards structure reward your spending habits? Some travel cards require that you spend a minimum amount to qualify for their sign-up bonus. If you’re not able to spend that amount or have to overspend just to qualify, that travel card may not be for you. You want to select a card that rewards spending you already plan to do. “You have to analyze your overall spending. At the end of the day, you may realize that you spend way more on gas and groceries or household bills than you do on travel throughout the year,” says Woroch. “With this in mind, you may be better off getting a flat-rate cash back card which will help you earn more across all spending categories and then save that money you earn to pay for your upcoming travels.”

- What kind of sign-up bonus is being offered? Many travel cards offer a lucrative sign-up bonus, and while this shouldn’t be the sole reason for choosing one card over another, it’s something to consider, especially if you have upcoming travel plans. “You can earn a sign up bonus for opening a new credit card that offers you enough miles or points to pay for some of your travel expenses such as your flights or hotel stay,” says Andrea Woroch, consumer and money-saving expert. “Even if the extra rewards you get don’t cover the entire roundtrip flight, you may get enough points to cover at least one leg of the trip which can significantly reduce your travel costs.”

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefits guide for more details. Underwritten by Amex Assurance Company.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

Guide to travel rewards credit cards

Best travel credit cards, luxury travel for less: your guide to free airport lounge passes, 10 credit card tips to help you avoid disaster when traveling abroad, how credit card travel insurance works—and what it doesn’t cover, insure your adventures: the ultimate guide to credit cards offering travel insurance, how credit card rental car insurance saves money on every rental, chase lga lounge review: luxury at laguardia, chase beefs up new york profile with a new jfk sapphire lounge—here's what you need to know, biggest-ever amex centurion lounge opens in atlanta — with outdoor terraces and bars for both whiskey and smoothies, amex centurion lounge atlanta: what to expect now that it’s open, do you have travel rewards saved up these are the best ways to use them, 5 ways your credit card can help you save on spring break travel costs, best no annual fee travel credit cards, capital one lounge: what you need to know, how i travel with my wife for less than a date night, best credit cards for cheap airport lounge access, best credit cards for airport lounge access, beginner's guide to travel rewards: how to travel with credit card points and miles, bilt rewards: everything you need to know, what’s in dia’s wallet: how i scored a hat trick using points in panama.

New hotel price freeze tool could save you $100 if rates rise

Over the past year, flexibility has become more important than ever for travelers, and we've seen the industry respond accordingly. Some airlines dropped change fees , travel credit cards added new redemption options and travel companies such as Uber and Airbnb added new features — all centered around flexibility.

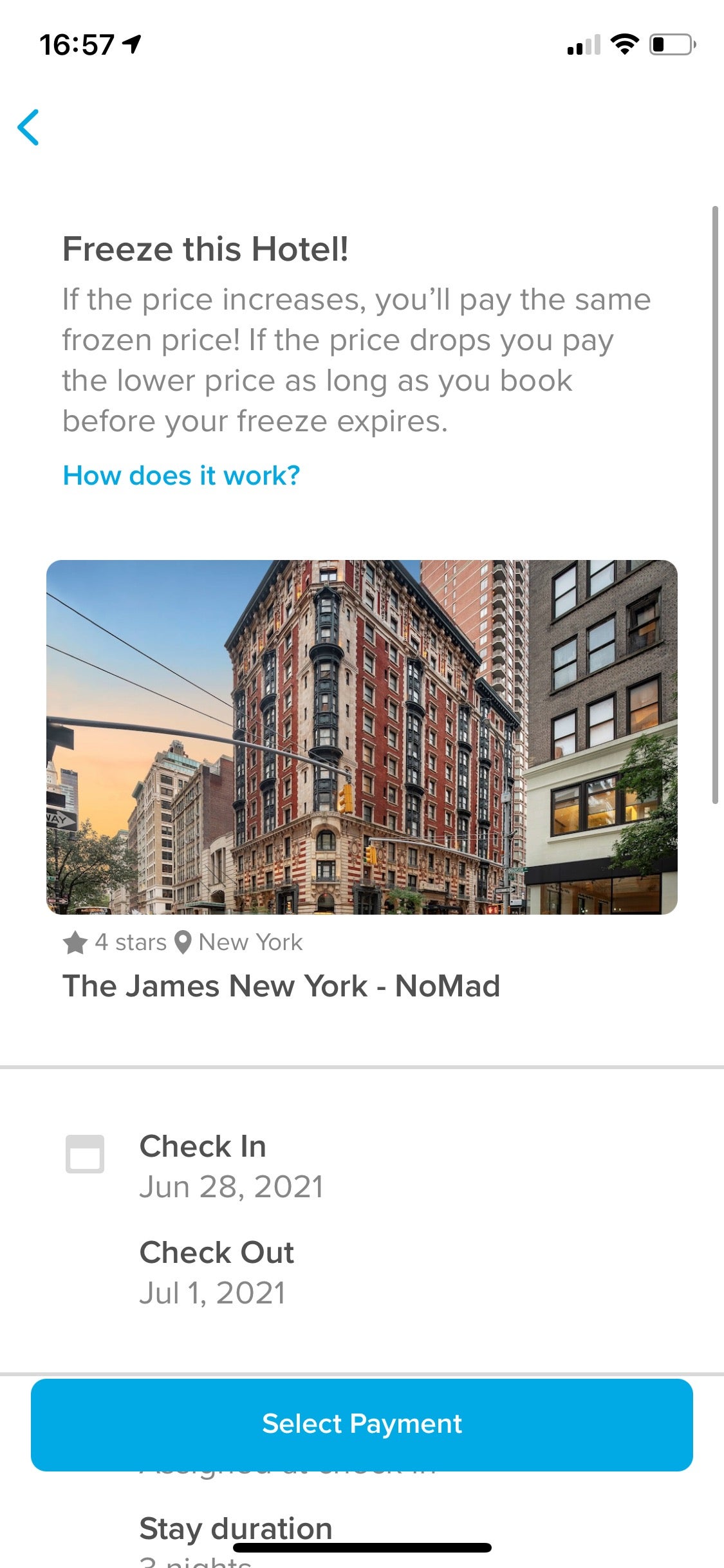

Travel planning and booking app Hopper is the most recent company to join the party as it releases a new feature for all app-users today: price freeze for hotels.

The new feature — which has been in beta but fully releases to all users on June 16 — allows travelers to search for hotels on the app and then pay a deposit to lock in that specific price for a specific window of time. If the price rises within the time between you freezing the price and booking your stay, Hopper will cover up to $100 of the difference.

"[Our customers told us] they wanted to travel, but that they didn't feel confident booking," Hopper's head of hotel fintech, Anwesha Bhattacharjee, told TPG. "We realized that our customers needed a way to feel comfortable planning a trip without necessarily making the monetary commitment until they were absolutely ready."

Want more travel news and advice delivered to your inbox daily? Sign up for the TPG newsletter.

Here's a breakdown of how it works: Let's say you are planning a trip to New York City to watch the Macy's fireworks show this year , and you find a hotel you think you want to book that is listed on Hopper for $300 per night. You aren't entirely sure you'll be able to get off work to travel yet, so you put down a deposit for the price freeze feature. Three days later, everything is in order for you to make the trip, but the price has risen $50 per night for your planned two-night stay. When you book the hotel through Hopper, you'll only be charged for the original price you locked in. Hopper will cover the $100 difference, and your deposit will act as a credit toward the cost of the stay.

If you decide you don't want to book that hotel, your deposit amount can be applied toward a future price freeze or toward another booking if you decide to go with another hotel instead.

It's important to note that when you use price freeze on a hotel on Hopper, you are not making a reservation with the hotel. The feature is more like price insurance on a particular hotel stay. Your reservation is not guaranteed with the hotel until you book and pay for your room, so you'll still want to book as soon as early use as you can — especially for busy holiday weekends like the upcoming Fourth of July. If the hotel does happen to run out of availability between you putting a price freeze on the hotel and booking, Hopper will refund the deposit you paid.

Deposits vary in price depending on a number of factors, including length of stay and price per night at that hotel. When I poked around the app, I was able to find hotels in NYC I could price freeze for $16 per night. And remember, the deposit will be applied to your booking. Generally, the price freeze tool can be used to lock in a price until seven days before the trip dates or as much as 60 days in advance of the stay.

Price freeze will benefit budget travelers booking last-minute trips the most, especially those traveling in groups where you need to coordinate accommodations for multiple people.

There are, however, a few downsides to consider.

The first is that Hopper is a third-party booking tool, which means you may not receive elite night credits or have your existing status honored when you book a hotel through the app. This won't matter as much if you're a casual traveler with no interest in elite status or if you're regularly booking stays at boutique hotels that aren't part of a major hotel brain, such as Hyatt or Hilton. But if you are an elite status holder or you're trying to make elite status a reality this year, booking direct is always the better option.

Something else to consider is that the price freeze tool will only save you a maximum of $100 on your total booking. So if the price changes $150 for the entire stay, Hopper will only cover $100 of that and you'll still be on the hook for the $50 difference. According to Hopper, customers who use the price freeze tool save on average $43 per stay (or $17 per night), so the savings aren't lucrative.

But even if this specific tool alone doesn't offer hundreds of dollars in automatic savings, it is another addition to Hopper's broader product that helps travelers — especially beginner travelers and budget travelers — plan trips. Hopper uses predictive technology to determine the best time to book with what the company claims is a 95% recommendation accuracy. You can set up alerts for price drops for flight routes and hotel stays, and there is a similar price freeze feature available for flights.

Related: The best flight booking apps

And this tool is only a hint at what is coming up next for Hopper.

"We're always innovating," said Bhattacharjee. "There are a bunch of new products that are either out or on their way."

Hopper is teaming up with Capital One to power the credit card issuer's revamped travel portal launching in the second half of 2021, and it's likely we'll see Hopper's tools — including the new price freeze tool — integrated into the experience for cardholders. Additionally, Hopper plans to roll out the ability to price freeze for specific room types soon.

For road warriors and elite status holders, this tool may not be a gamechanger for you. But budget travelers and beginners who are still experiencing a bit of booking anxiety as destinations reopen and travel returns in some regions of the world can use this tool to help plan trips and get excited about traveling once more — without having to put hundreds of dollars down on a hotel just yet. I personally might put this tool to use the next time I plan out a girls trip with friends, in case prices increase while the group chat comes to a final consensus on whether to book the hotel or not.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

14 Best Travel Credit Cards of May 2024

ALSO CONSIDER: Best credit cards of 2024 || Best rewards credit cards || Best airline credit cards || Best hotel credit cards

The best travel credit card is one that brings your next trip a little closer every time you use it. Purchases earn points or miles you can use to pay for travel. If you're loyal to a specific airline or hotel chain, consider one of that company's branded travel credit cards. Otherwise, check out our picks for general-purpose travel cards that give you flexible travel rewards without the restrictions and blackout dates of branded cards.

250+ credit cards reviewed and rated by our team of experts

80+ years of combined experience covering credit cards and personal finance

100+ categories of best credit card selections ( See our top picks )

Objective comprehensive ratings rubrics ( Methodology )

NerdWallet's credit cards content, including ratings and recommendations, is overseen by a team of writers and editors who specialize in credit cards. Their work has appeared in The Associated Press, USA Today, The New York Times, MarketWatch, MSN, NBC's "Today," ABC's "Good Morning America" and many other national, regional and local media outlets. Each writer and editor follows NerdWallet's strict guidelines for editorial integrity .

Show summary

NerdWallet's Best Travel Credit Cards of May 2024

Chase Sapphire Preferred® Card : Best for Max flexibility + big bonus

Capital One Venture Rewards Credit Card : Best for Flat-rate rewards

Capital One Venture X Rewards Credit Card : Best for Travel portal benefits

Chase Freedom Unlimited® : Best for Cash back for travel bookings

American Express® Gold Card : Best for Big rewards on everyday spending

Wells Fargo Autograph℠ Card : Best for Bonus rewards + no annual fee

The Platinum Card® from American Express : Best for Luxury travel perks

Ink Business Preferred® Credit Card : Best for Business travelers

Bank of America® Travel Rewards credit card : Best for Flat-rate rewards + no annual fee

Chase Sapphire Reserve® : Best for Bonus rewards + high-end perks

World of Hyatt Credit Card : Best for Best hotel card

Bilt World Elite Mastercard® Credit Card : Best for Travel rewards for rent payments

United℠ Explorer Card : Best for Best airline card

PenFed Pathfinder® Rewards Visa Signature® Card : Best for Credit union benefits

Best Travel Credit Cards

Find the right credit card for you..

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Max flexibility + big bonus

Flat-rate rewards, travel portal benefits, cash back for travel bookings, big rewards on everyday spending, bonus rewards + no annual fee, luxury travel perks, business travelers, flat-rate rewards + no annual fee, bonus rewards + high-end perks, best hotel card, travel rewards for rent payments, best airline card, credit union benefits, full list of editorial picks: best travel credit cards.

Before applying, confirm details on the issuer’s website.

Capital One Venture Rewards Credit Card

Our pick for: Flat-rate rewards

The Capital One Venture Rewards Credit Card is probably the best-known general-purpose travel credit card, thanks to its ubiquitous advertising. You earn 5 miles per dollar on hotels and car rentals booked through Capital One Travel and 2 miles per dollar on all other purchases. Miles can be redeemed at a value of 1 cent apiece for any travel purchase, without the blackout dates and other restrictions of branded hotel and airline cards. The card offers a great sign-up bonus and other worthwhile perks ( see rates and fees ). Read our review.

Bank of America® Travel Rewards credit card

Our pick for: Flat-rate rewards + no annual fee

One of the best no-annual-fee travel cards available, the Bank of America® Travel Rewards credit card gives you a solid rewards rate on every purchase, with points that can be redeemed for any travel purchase, without the restrictions of branded airline and hotel cards. Bank of America® has an expansive definition of "travel," too, giving you additional flexibility in how you use your rewards. Read our review.

Chase Sapphire Reserve®

Our pick for: Bonus rewards + high-end perks

The high annual fee on the Chase Sapphire Reserve® gives many potential applicants pause, but frequent travelers should be able to wring enough value out of this card to more than make up for the cost. Cardholders get bonus rewards (up to 10X) on dining and travel, a fat bonus offer, annual travel credits, airport lounge access, and a 50% boost in point value when redeeming points for travel booked through Chase. Points can also be transferred to about a dozen airline and hotel partners. Read our review.

Chase Sapphire Preferred® Card

Our pick for: Max flexibility + big bonus

For a reasonable annual fee, the Chase Sapphire Preferred® Card earns bonus rewards (up to 5X) on travel, dining, select streaming services, and select online grocery purchases. Points are worth 25% more when you redeem them for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. The sign-up bonus is stellar, too. Read our review.

Wells Fargo Autograph℠ Card

Our pick for: Bonus rewards + no annual fee

The Wells Fargo Autograph℠ Card offers so much value, it's hard to believe there's no annual fee. Start with a great bonus offer, then earn extra rewards in a host of common spending categories — restaurants, gas stations, transit, travel, streaming and more. Read our review.

U.S. Bank Altitude® Connect Visa Signature® Card

Our pick for: Road trips

The U.S. Bank Altitude® Connect Visa Signature® Card is one of the most generous cards on the market if you're taking to the skies or the road, thanks to the quadruple points it earns on travel and purchases at gas stations and EV charging stations. It's also a solid card for everyday expenses like groceries, dining and streaming, and it comes with ongoing credits that can offset its annual fee: $0 intro for the first year, then $95 . Read our review .

Capital One Venture X Rewards Credit Card

Our pick for: Travel portal benefits

Capital One's premium travel credit card can deliver terrific benefits — provided you're willing to do your travel spending through the issuer's online booking portal. That's where you'll earn the highest rewards rates plus credits that can make back the bulk of your annual fee ( see rates and fees ). Read our review.

Chase Freedom Unlimited®

Our pick for: Cash back for travel bookings

The Chase Freedom Unlimited® was already a fine card when it offered 1.5% cash back on all purchases. Now it's even better, with bonus rewards on travel booked through Chase, as well as at restaurants and drugstores. On top of all that, new cardholders get a 0% introductory APR period and the opportunity to earn a sweet bonus. Read our review.

The Platinum Card® from American Express

Our pick for: Luxury travel perks

The Platinum Card® from American Express comes with a hefty annual fee, but travelers who like to go in style (and aren't afraid to pay for comfort) can more than get their money's worth. Enjoy extensive airport lounge access, hundreds of dollars a year in travel and shopping credits, hotel benefits and more. That's not even getting into the high rewards rate on eligible travel purchases and the rich welcome offer for new cardholders. Read our review.

American Express® Gold Card

Our pick for: Big rewards on everyday spending

The American Express® Gold Card can earn you a pile of points from everyday spending, with generous rewards at U.S. supermarkets, at restaurants and on certain flights booked through amextravel.com. Other benefits include hundreds of dollars a year in available dining and travel credits and a solid welcome offer for new cardholders. There's an annual fee, though, and a pretty substantial one, so it's not for smaller spenders. Read our review.

Bilt World Elite Mastercard® Credit Card

Our pick for: Travel rewards on rent payments

The Bilt World Elite Mastercard® Credit Card stands out by offering credit card rewards on rent payments without incurring an additional transaction fee. The ability to earn rewards on what for many people is their single biggest monthly expense makes this card worth a look for any renter. You also get bonus points on dining and travel when you make at least five transactions on the card each statement period, and redemption options include point transfers to partner hotel and loyalty programs. Read our review.

PenFed Pathfinder® Rewards Visa Signature® Card

Our pick for: Credit union rewards

With premium perks for a $95 annual fee (which can be waived in some cases), jet-setters will get a lot of value from the PenFed Pathfinder® Rewards Visa Signature® Card . It also offers a generous rewards rate on travel purchases and a decent flat rate on everything else. Plus, you’ll get travel credits and a Priority Pass membership that offers airport lounge access for $32 per visit. Read our review.

United℠ Explorer Card

Our pick for: B est airline card

The United℠ Explorer Card earns bonus rewards not only on spending with United Airlines but also at restaurants and on eligible hotel stays. And the perks are outstanding for a basic airline card — a free checked bag, priority boarding, lounge passes and more. Read our review.

» Not a United frequent flyer? See our best airline cards for other options

World of Hyatt Credit Card

Our pick for: Best hotel card

Hyatt isn't as big as its competitors, but World of Hyatt Credit Card is worth a look for anyone who spends a lot of time on the road. You can earn a lot of points even on non-Hyatt spending, and those points have a high value compared with rival programs. There's a great sign-up bonus, free nights, automatic elite status and more. Read our review.

» Not a Hyatt customer? See our best hotel cards for other options.

Ink Business Preferred® Credit Card

Our pick for: Business travelers

The Ink Business Preferred® Credit Card starts you off with one of the biggest sign-up bonuses of any credit card anywhere: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠. You also get bonus rewards on travel expenses and common business spending categories, like advertising, shipping and internet, cable and phone service. Points are worth 25% more when redeemed for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. Learn more and apply .

Are you in Canada?

See NerdWallet's best travel cards for Canada.

OTHER RESOURCES

How travel rewards work.

Modern-day adventurers and once-a-year vacationers alike love the idea of earning rewards toward their next big trip. According to a NerdWallet study , 68% of American adults say they have a credit card that earns travel rewards.

With a travel rewards credit card, you earn points or miles every time you use the card, but you can often earn more points per dollar in select categories. Some top travel credit cards, such as the Chase Sapphire Reserve® , offer bonus points on any travel spending, while the Marriott Bonvoy Boundless® Credit Card grants bonus points when you use the card at Marriott hotels, grocery stores, restaurants or gas stations.

Not all points and miles earned on travel rewards credit cards are the same:

General-purpose travel credit cards — including the Chase Sapphire Preferred® Card , the American Express® Gold Card and the Capital One Venture Rewards Credit Card — give you rewards that can be used like cash to pay for travel or that can be exchanged for points in airline or hotel loyalty programs. With their flexible rewards, general-purpose options are usually the best travel credit cards for those who don't stick to a single airline or hotel chain.

Airline- and hotel-specific cards — such as the United℠ Explorer Card and the Hilton Honors American Express Card — give points and miles that can be used only with the brand on the card. (Although it's possible in some cases to transfer hotel points to airlines, we recommend against it because you get a poor value.) These so-called co-branded cards are usually the best travel credit cards for those who always fly one particular airline or stay with one hotel group.

How do we value points and miles? With the rewards earned on general travel cards, it's simple: They have a fixed value, usually between 1 and 1.5 cents per point, and you can spend them like cash. With airline miles and hotel points, finding the true value is more difficult. How much value you get depends on how you redeem them.

To better understand what miles are worth, NerdWallet researched the cash prices and reward-redemption values for hundreds of flights. Our results:

Keep in mind that the airline values are based on main cabin economy tickets and exclude premium cabin redemptions. See our valuations page for business class valuations and details about our methodology.

Our valuations are different from many others you may find. That’s because we looked at the average value of a point based on reasonable price searches that anyone can perform, not a maximized value that only travel rewards experts can expect to reach.

You should therefore use these values as a baseline for your own redemptions. If you can redeem your points for the values listed on our valuations page, you are doing well. Of course, if you are able to get higher value out of your miles, that’s even better.

HOW TO CHOOSE A TRAVEL CREDIT CARD

There are scores of travel rewards cards to choose from. The best travel credit card for you has as much to do with you as with the card. How often you travel, how much flexibility you want, how much you value airline or hotel perks — these are all things to take into account when deciding on a travel card. Our article on how to choose a travel credit card recommends that you prioritize:

Rewards you will actually use (points and miles are only as good as your ability to redeem them for travel).

A high earning rate (how much value you get in rewards for every dollar spent on the card).

A sign-up bonus (a windfall of points for meeting a spending requirement in your first few months).

Even with these goals in mind, there are all kinds of considerations that will influence your decision on a travel rewards credit card.

Travel cards are for travelers

Travel cards vs. cash-back cards.

The very first question to ask yourself when choosing a travel credit card is: Should I get a travel card at all? Travel credit cards are best for frequent travelers, who are more likely to get enough value from rewards and perks to make up for the annual fees that the best travel credit cards charge. (Some travel cards charge no annual fee, but they tend to offer lesser rewards than full-fee cards.) A NerdWallet study found that those who travel only occasionally — say, once a year — will probably get greater overall rewards from cash-back credit cards , most of which charge no annual fee, than from a travel card.

Flexibility and perks: A trade-off

Co-branded cards vs. general travel cards.

Travel credit cards fall into two basic categories: co-branded cards and general travel cards.

Co-branded cards carry the name of an airline or hotel group, such as the United℠ Explorer Card or the Marriott Bonvoy Boundless® Credit Card . The rewards you earn are redeemable only with that particular brand, which can limit your flexibility, sometimes sharply. For example, if your credit card's co-branded airline partner doesn't have any award seats available on the flight you want on the day you want, you're out of luck. On the other hand, co-branded cards commonly offer airline- or hotel-specific perks that general travel cards can't match.

General travel cards aren't tied to a specific airline or hotel, so they offer much greater flexibility. Well-known general travel cards include the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card . Rewards on general travel cards come as points (sometimes called "miles" but they're really points) that you can redeem for any travel expense. You're not locked into using a single airline or hotel, but you also won't enjoy the perks of a co-branded card.

Evaluating general travel credit cards

What you get with a general travel card.

The credit cards featured at the top of this page are general travel cards. They're issued by a bank (such as Chase or Capital One), carry only that bank's name, and aren't tied to any single airline or hotel group. With these cards, you earn points on every purchase — usually 1 to 2 points per dollar spent, sometimes with additional points in certain categories.

Issuers of general travel cards typically entice new applicants with big sign-up bonuses (also known as "welcome offers") — tens of thousands of miles that you can earn by spending a certain amount of money on the card in your first few months.

» MORE: NerdWallet's best credit card sign-up offers

What do you do with those points? Depending on the card, you may have several ways to redeem them:

Booking travel. With this option, your points pay for travel booked through the issuer's website, using a utility similar to Orbitz or Expedia. For example, if points were worth 1 cent apiece when redeemed this way, you could book a $400 flight on the issuer's portal and pay for it with 40,000 points

Statement credit. This lets you essentially erase travel purchases by using your points for credit on your statement. You make travel arrangements however you want (directly with an airline or hotel, through a travel agency, etc.) and charge it to your card. Once the charge shows up on your account, you apply the necessary points and eliminate the cost.

Transferring to partners. The card issuer may allow you to transfer your points to loyalty programs for airlines or hotel chains, turning your general card into something like a co-branded card (although you don't get the perks of a co-brand).