Philippine Consulate General

The Republic of the Philippines

PHILIPPINE CONSULATE GENERAL

New york, usa.

travel tax exemption

The travel tax is a levy imposed by the philippine government on individuals who are leaving the country irrespective of the place where the air ticket is issued and the form or place of payment, as provided for by presidential decree (pd) 1183, as amended..

The following individuals are REQUIRED by the Philippine government to pay the Travel Tax every time they leave the country irrespective of the place where the air ticket is issued and the form or place of payment, as provided for by Presidential Decree (PD) 1183, as amended:

- Filipino citizens

- Sec. 13 Quota or Preference Immigrant Visa

- Sec. 13 A Visa issued to an Alien Spouse of Philippine Citizen

- Sec. 13 B Child born outside the Philippines by a 13A Mother

- Sec. 13 C Child born in the Philippines by a 13A Mother

- Sec. 13 D Loss of Citizenship by a Filipino Woman by her Marriage to an Alien

- Sec. 13 E Returning Resident

- Sec. 13 G Former Natural-born Citizen of the Philippines who was Naturalized by a Foreign Country

- TRV Temporary Residence Visa

- RA 7919 Alien Social Integration Act of 1995

- RC /RFC Recognition as Filipino Citizen

- RA 7837 Permanent Resident

The following Filipino citizens are EXEMPTED from the payment of travel tax pursuant to Sec. 2 of PD 1183, as amended:

- Overseas Filipino workers

- Filipino permanent residents abroad whose stay in the Philippines is less than one year

- Infants (2 years and below)

- Other individuals qualified to avail of exemption. Please see complete list below, including the requirements to avail of the exemption.

Note: In all cases, the passenger will be required to bring and present his/her original passport.

The Tourism Infrastructure and Enterprise Zone Authority (TIEZA) is now accepting online application for Travel Tax Exemption Certificate (TEC). Click here to apply.

For more information, please visit TIEZA’s website here.

- The Philippines

- The President

- The Government

- The Department of Foreign Affairs

- The Secretary of Foreign Affairs

- The Consul General

- The Consulate

- History of the Consulate General

- Consulate Directory

- Non-Working Holidays

- Consulate Finder

- Announcements and Advisories

- Press and Photo Releases

- Cultural & Community Events

- Consular Outreach

- Online Appointment

- Assistance-to-Nationals

- Civil Registration

- Dual Citizenship (RA 9225)

- Notarial Services

- Overseas Voting

- Travel Document

- Passport Tracker

- Schedule of Fees

- Citizen’s Charter

- Adopt a Child from the Philippines

- Foreign Donations to the Philippines

- Foreign Medical Missions to the Philippines

- GSIS Pensioners Abroad

- Importation of Motor Vehicles to the Philippines

- Importation of Personal Effects to the Philippines

- Importation of Pets and Plants to the Philippines

- J1 Visa Waiver

- National Bureau of Investigation (NBI) Clearance

- Philippine Centenarians

- Philippine Driver’s License Renewal

- PRC Registration of New Professionals

- Renunciation of Philippine Citizenship

- Restrictions in Bringing Medicine & Other Regulated Products to the Philippines

- Shipment of Human Remains to the Philippines

- Social Security System (SSS)

- Travel Tax Exemption

- Videoconference Hearing

- Sentro Rizal

- Promoting Philippine Culture

- Doing Business & Investing in the Philippines

- Traveling to the Philippines

- Fil-Am Community Directory

- Fil-Am Community Directory Registration

- Filipino Businesses

- Filipino International Students

- Request Message of the Consul General

- Procurements

- Airport Transfer

Things to Do

Traveloka PH

14 Apr 2022 - 5 min read

Travel Tax in the Philippines: Everything a Traveler Needs to Know

Paying the travel tax is one of the steps a traveler must do before flying out for an international trip. Here's a guide on what you need to know about this tax.

What is Travel Tax?

The Philippine travel tax is an additional fee you need to pay every time you go abroad.

You can read up on it in greater detail under Presidential Decree 1183 , but all you need to know about it is that you are required to pay this fee no matter which country you are headed to.

Who is required to pay the travel tax?

If you fall under any of the following demographic, you are required to pay the travel tax:

Who is exempted from paying the travel tax?

Manila to singapore flight.

Jetstar Asia Airways

Start from ₱ 2,877.19

Manila (MNL) to Singapore (SIN)

Tue, 21 May 2024

Cebu Pacific

Start from ₱ 2,963.72

Wed, 8 May 2024

Start from ₱ 4,200.80

There are also other individuals who are exempted from paying the travel tax:

I fall under the travel tax exemption. What do I need to avail of it?

Depending on your case, you will need:

1. Original documents required by your embassy or agency , which can include but are not limited to:

2. Travel to the nearest TIEZA Travel Tax Field Office in the Philippines , either in the airports or in the provincial field offices.

Show your original documents, as well as photocopies.

3. Pay a PHP 200 processing fee.

Wait for your Travel Tax Exemption Certificate to be released, and present this to the authorities at the airport.

How much do I have to pay?

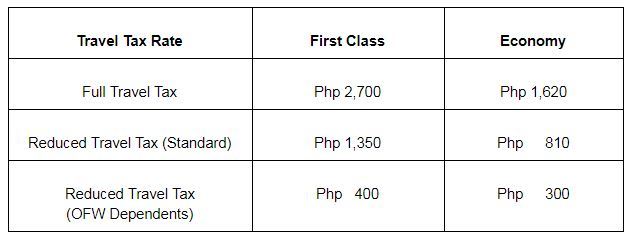

Depending on your ticket, your travel tax will vary. See the table below:

Where do I pay the Philippine travel tax?

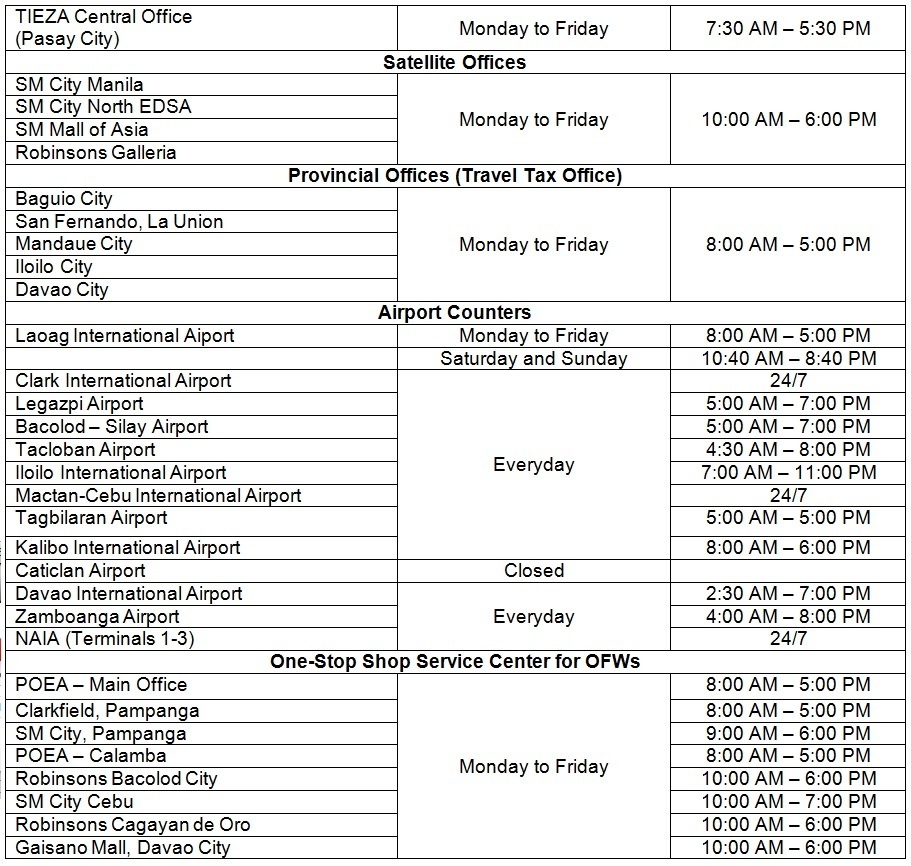

You can pay your travel tax in advance in several malls. Check out these mall counters that accept travel tax payments:

You can also pay your travel tax on the day of your flight in the airport counters. You need to show your ticket and passport.

Meanwhile, there are also provincial offices and other government offices where you can pay the travel tax:

You can also pay online. Here's how:

Where does that money go.

As per Section 73 of the Republic Act No. 9593 , the money earned from the travel tax is divided accordingly:

How do I get a refund?

You qualify for a refund if you fall under one of the following conditions:

What do you need to present to get a refund?

Depending on your case, prepare the following:

Now you know your travel tax basics. Make sure you keep them in mind when you plan and book your trips with Traveloka!

Payment Partners

About Traveloka

- How to Book

- Help Center

Follow us on

- ProductItems.cruises-search

- Traveloka Affiliate

- Privacy Notice

- Terms & Conditions

- Register Your Accommodation

- Register Your Experience Business

- Traveloka Press Room

Download Traveloka App

Travel Tax in the Philippines & Terminal Fees: Cost, Exemptions, Refunds

Traveling is not cheap. Although we Filipinos, sometimes budget our way when going out of the country, there are certain expenses that we need to pay. One of those things we can’t seem to escape during our vacation is the Travel Tax and Terminal Fees in the Philippines .

According to Presidential Decree 1183, the Travel tax is imposed on individuals leaving the Philippines . But not all have to pay; certain people are exempted from the Travel Tax or have reduced payment. The proceeds are for TIEZA (Tourism Infrastructure and Enterprise Zone Authority), CHED’s tourism-related programs (Commission on Higher Education), and NCCA (National Commission for Culture and Arts).

This article will discuss Philippine Travel tax; how much is the payment, who needs to pay, and who is exempted, how to get a refund or exemption. This will also discuss the Terminal fees of the Philippine Airports.

- How to Schedule a DFA Online Appointment to Get a Philippines Passport

- One year Visa-free Balikbayan Stay in the Philippines for the Foreign Spouse/ Children of Filipino Citizens

- OFW Guide – List of Work Abroad Websites To Help You Find Jobs Overseas

- Philippines Tourist Visa – How to Get a Tourist Visa to Visit the Philippines

- How to Teach English Abroad – Get 60% OFF Your TEFL Certification Online

Table of Contents

Travel Tax in the Philippines

How much is the travel tax in the Philippines?

Who needs to pay a travel tax?

- Filipino Citizens

- Foreign Nationals who are Permanent Residents of the Philippines

- Non-Resident Foreign Nationals who stayed for more than 1 year in the Philippines

What are the Requirements Needed for paying the Travel Tax?

- Airline Ticket

- Travel Tax Payment (maybe in Cash or Credit)

How to Pay Travel Tax?

- Included when booking an airline ticket

- At Travel Tax Centers or Counters

- Online: https://tieza.gov.ph/online-travel-tax-payment-system/

If you are in a hurry, I recommend paying ahead to avoid the long queues at the counters. However, refunds may take time but it is still possible.

Philippine Travel Tax Exemption

Who are exempted from payment of travel tax in the philippines what are the requirements needed.

Main Requirement: Passport

Overseas Filipino Workers

- If hired through POEA: Original Overseas Employment Certificate

- If directly hired: Certificate of Employment issued by the Philippine Embassy or Consulate in the country where you are working or a copy of Employment Contract authenticated by the PH Embassy or Consulate

Filipino Permanent Residents Abroad whose stay in the Philippines is less than a year

- Bio page of passport and stamp of the last arrival in the Philippines

- Permanent Residency Card or any proof that you reside permanently in a foreign country

- Certification of Residence issued by Philippine Embassy or Consulate in case the country you are staying doesn’t grant permanent residency

Balikbayan whose stay in the Philippines is less than a year

- Airline Ticket used to travel to the Philippines

Balikbayan who is a former Filipino Citizens and naturalized to another citizenship whose stay in the Philippines is less than a year (including spouse and children)

- Philippine and Foreign Passport

- For Children: certified true copy or authenticated copy of birth certificate or adoption papers

- For Spouse: certified true copy or authenticated copy of marriage certificate

Infants who are two years old and below (if two years old and one day, then standard reduced travel tax is paid)

- If no passport, PSA copy of birth certificate

Foreign Diplomatic, consular officials, and staff accredited in the Philippines. Immediate members of the family and household staff are included as long as there is an authorization from the Philippine Government.

- Certification from their respective Embassy or Consulate, from the Department of Foreign Affairs or Office of Protocol

United Nations organization and its agencies’ Officials, Consulates, Experts, and employees and those exempt under Laws, Treaties or International Agreements

- UN Passport or Certificate of Employment from UN office or agencies with international agreements with the Philippines

US military personnel and their dependents. US nationals with fares paid by the US government or on US government-owned transports. Filipinos in US military service and their dependents. Filipino employees of US government or US State department visitors traveling to the US for government business.

- Government Transport Request for airline tickets or certification from the US Embassy that the US government paid for the fare

Airline crew of international routes

- Crew’s Name

- Location of aircraft

Philippine Foreign Service personnel assigned abroad and their dependents

- Certification from the Department of Foreign Affairs

Officials and employees of Philippine Government on official business (except GOCCs)

- Certified True Copy of Travel Authority or Travel Order from Department Secretary

Grantees of foreign government-funded trip

- Proof that the foreign government funds travel

A student with an approved scholarship from a Philippine Government Agency

- Certification from the government agency

Personnel and their dependents of a multinational company with regional headquarters but not engaged in business in the Philippines

- Certificate of Board of Investments

Authorized by the President of the Philippines for national interest

- Written authorization stating that the passenger is exempt from travel tax

How to get Tax Exemption?

- Present passport and documents to the Travel Tax officer

- Get Travel Tax Exemption Certificate

Reduced Travel Tax

Certain people don’t need to pay the full amount of travel tax. There are two types; standard and privilege reduce travel tax. Here are the qualifications.

Who can avail Standard Reduced Travel Tax in the Philippines ? What are the requirements?

Minors – 2 years and one day – twelve years old (it must be exact, if twelve years old and one day, no more exemption).

- Airline Ticket, if already issued

Accredited Filipino Journalist (writers, editors, reporters, announcers) in pursuit of assignment

- Certification from an editor or station manager that passenger is an accredited journalist

- Certification from the Office of the Press Secretary

- Written authorization from Office of the Presidents stating the passenger is entitled to Reduced Travel Tax

Who can avail of Privilege Reduced Travel Tax in the Philippines ? What needs to be submitted?

If you are a dependent of an OFW traveling to the country where your spouse or parent is at, then you can avail of this.

Main Requirements: Passport and any of the following:

- Original Overseas Employment certificate

- Certified true copy of Balik-Manggagwa Form or OFW’s Travel Exit Permit

- Certification of Accreditation or Registration

- OFW’s Work Visa or Work Permit

- Valid Employment Contract or Company ID of the OFW

- Recent payslip of OFW

Legitimate spouse of an OFW

- PSA Marriage Certificate

- Certificate from the agency that the dependent is joining the seaman’s vessel

Unmarried children of an OFW who are 21 years old and below (legitimate or illegitimate)

- PSA Birth Certificate

Child of an OFW who is a Persons With Disability (any age)

- PWD ID Card issued by an office of National Council of Disability Affairs

How to get Reduced Travel Tax?

- Present passport and documents to the Travel Tax officer.

- Pay the fee.

- Get the Reduced Travel Tax Certificate (RTTC).

Philippine Travel Tax Refund

In case you have paid tax refund or are qualified for such but have paid. You can get a tax refund. You can claim if within two years from your date of payment.

Who can get a tax refund? What are the requirements?

Main Requirements: Passport and Airline Ticket with travel tax payment or If travel tax was paid at TIEZA, official receipt (passenger copy and airline copy)

Owners of an Unused ticket

- Fare refund voucher or certification from airline signatory that ticket is unused, non-rebookable and has no fare refund value

Owners of a Downgraded Ticket

- Certification from the airline that the ticket was downgraded or the airline flight manifest

Non-immigrant foreign nationals who have not stayed in the Philippines for more than a year

- If passport can’t be presented; a certification from the Bureau of Immigration indication passenger’s identity, status, and applicable date of arrival

Those Qualified for Travel Tax Exemption

- Supporting Documents (see list above)

Qualified for Reduced Travel Tax

Double payment (paid travel tax for the same ticket), undue travel tax, how to get travel tax refund.

- Fill-up TIEZA Refund application form.

- Present passport and documents to the Travel Tax officer and a SPA if the claimant is not a passenger.

- Get a check of the refund.

Travel Tax Centers and Schedules

Here are the places you can process or pay your travel tax, tax exemption, reduced tax, or travel tax refund. It’s better to process before your flight as it might take longer at the airport if there are long queues.

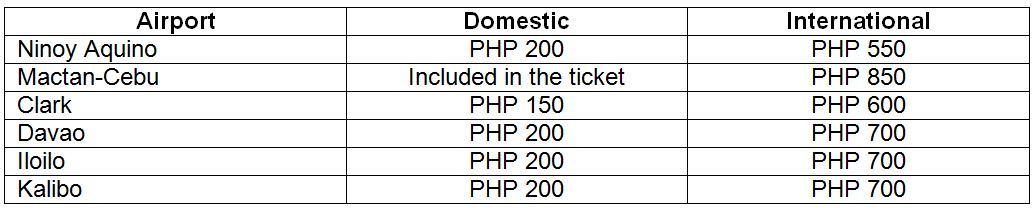

Terminal Fees

Terminal Fees are paid at the airport counters or it is included in the airline ticket. Sometimes, it is named as Passenger Service Charge. However, this is the list of terminal fees:

Who are exempted to pay terminal fees:

Note that most domestic flights cost Php 20 – 200; they are usually included in the ticket, For International flights Php 500 – 850

- Children below two years old

- Overseas Contract Workers

- Denied Passengers

- Airline Crew

- Athletes – must be endorsed from Philippine Sports Commission

- Muslim Passengers for Mecca or Hajj

- Passengers specified by law

Where to pay terminal fees?

- There are counters at the airport, you may pay there, or it is included in the airline ticket as Passenger Service Charge

I hope this guide has helped you in getting information on the Travel Tax in the Philippines or the terminal fees. So, it’s better to bring cash or pay ahead as you might get unlucky and the ATMs malfunctions. Don’t worry though; it can be refunded! Happy Travels!

Are you on Pinterest? Pin these!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

7 thoughts on “ Travel Tax in the Philippines & Terminal Fees: Cost, Exemptions, Refunds ”

How can i take my travel tax refund when im missed to passed by a counter for that?i travelled internationally and domestically.And i am an ofw.

Hello good morning. I would like to know if I am eligible to get a travel tax refund as I was denied by the BOI in Manila to board my flight to KL Malaysia last March 1 2022. I am a Filipino citizen who wanted to travel in Malaysia as a tourist. And can I get the refund if I’m eligible in Iloilo travel tax centers in my own province which is in Iloilo? Thank you.

im an ofw, where can i get my PAL and CEB terminal fee refunds?

You can have your terminal fee refunded at the terminal fee payment counters in Mactan Cebu Airport. Just make sure you have your OEC with you, and your boarding pass stamped by the airline for refund, when you approach the counter.

hello i need a government of my country to fetch me, this is lee dong rou i am a tourist licence but i have left my U.N passport because of foreign degree because i am a cabin crew different airline

Hi I’m a filipino citizen who live abroad I want to ask if I have to pay tax because my flight is only rescue flight because my son he’s a Austrian national and I have visa card from Austria thanks I hope u answer plead

If you have a permanent residency abroad then you can be exempted.

COPYRIGHT DISCLAIMER: Many of the articles on Two Monkeys Travel Group are guest posts by a number of Approved Contributors and are hosted by Two Monkeys Travel Group. Approved Contributors control their own work and post freely to our site. This includes all text and images that they use within their own work. All contributors are instructed to follow internationally recognised copyright and intellectual property guidelines. Two Monkeys Travel Group takes its own responsibilities very seriously, so if you feel that any part of this work is abusive in any way, please send us an email so that we can investigate - [email protected]

DISCLOSURE: Please note that some of the links above are affiliate links. So when you make a purchase we sometimes make a small commission, at no extra cost to you. The cost to you remains the same, sometimes even cheaper if we have negotiated a special deal for our readers.We use all of the companies we have listed here and that’s why they are in this list, but of course we need to keep Two Monkeys Travel Group running as well as it can, which is exactly what you’re helping with if you do decide to buy or book something through an affiliate link! If you have any more questions about the companies we use or any other companies you’re looking at, just email us and we’ll be happy to help. Please see our full disclaimer page for more information.

Written by Kach Umandap

Founder of Two Monkeys Travel Group. Since 2013, Kach has visited all the 7 continents (including Antarctica) and 151 countries using her Philippines Passport. In 2016, she bought a sailboat and went on sailing adventures with her two cats - Captain Ahab & Little Zissou in the Caribbean for 2 years. She now lives in Herceg Novi, Montenegro where she's enjoying her expat life and living on a gorgeous Stonehouse. She writes about her experiences traveling as a Filipina traveler with a PHL Passport. Also tips on backpacking trips, luxury hotel experiences, product reviews, sailing & adventure travel.

5 Reasons Why You Should Visit TeamLab Planets in Toyosu, Tokyo

Al hamra residence – my best stay in the uae, anavrin ras al khaimah – the perfect retreat for corporate junkies, where to stay in the gambia [best hotels and resorts in the gambia], 8 best things to do in the gambia, west africa, related posts, 10 awesome things to do in puerto galera, philippines, things to do in potipot island, zambales, philippines with diy itinerary, treat yourself to relaxation heaven at i’m onsen spa in makati, philippine gem: a complete guide to el nido, palawan, previous post, filipinos, check these tesda online courses for free, travel guide to san pablo city, laguna: explore the city of seven lakes, subscribe to our newsletter.

Receive tips on how you can live a sustainable long-term travel lifestyle!

- First Name *

- Email This field is for validation purposes and should be left unchanged.

- Disclaimer and Affiliate Disclosure

- Privacy Policy

Travel Tax Philippines: All You Need to Know to Fly Without Hassle

Published by Ms. D on January 29, 2024 January 29, 2024

Ever wondered how much the travel tax Philippines is? Traveling outside the Philippines can be an exciting adventure, but it often comes with various considerations, including the travel tax. If you’re planning a trip abroad, it’s essential to understand what this tax is about, who needs to pay it, and how much it costs.

Table of Contents

What is travel tax philippines.

The Philippine travel tax is a levy imposed on individuals departing from Philippine airports for international destinations. This tax is collected to generate revenue for the country’s tourism infrastructure and related projects.

The requirement to pay travel tax is applicable to:

1. Filipino citizens. 2. Taxable foreign passport holders. 3. Non-immigrant foreign passport holders who have resided in the Philippines for over a year.

How Much is the Philippine Travel Tax?

The amount of travel tax in the Philippines varies depending on the passenger’s class of travel and destination. As of the latest information available, the rates are as follows:

- First class passengers: PHP 2,700

- Economy class passengers: PHP 1,620

If you are qualified, you may apply for Reduced Travel Tax (RTT), which is a tax reduction program designed to lower the cost of travel for eligible individuals. There are two types of RTT, namely standard and privileged.

Standard Reduced Travel Tax

As per the Tourism Infrastructure and Enterprise Zon Authority (TIEZA) , the following individuals may apply for standard reduced travel tax.

- Minors (from 2 years and one (1) day to 12th birthday on date of travel)

- Accredited Filipino journalist whose travel is in pursuit of journalistic assignment

- Those authorized by the President of the Republic of the Philippines for reasons of national interest

The standard reduced travel tax for first-class passengers is PHP 1,350, and for economy passengers, it is PHP 810 .

Privileged Reduced Travel Tax

The privileged reduced travel tax is exclusively available to dependents of Overseas Filipino Workers (OFW), namely:

- Legitimate spouse of an Overseas Filipino Worker (OFW)

- Unmarried children of an OFW, whether legitimate or illegitimate, who are below 21 years of age

- Children of OFWs with disabilities even above 21 years of age.

The privileged reduced travel tax for first-class and economy-class passengers is PHP 400 and PHP 300 , respectively.

How to Avail of the Reduced Philippine Travel Tax

To help you get started applying for RTT, here’s a general step-by-step guide.

Step 1: Understand the criteria for eligibility for RTT and determine whether you pass for the standard or privileged reduced travel tax.

Step 2: Gather all necessary supporting documents to prove your eligibility. Depending on your eligibility, the requirements can vary. Check the complete details here – Reduced Travel Tax | Tourism Infrastructure and Enterprise Zone Authority (tieza.gov.ph)

Step 3: If you have not yet purchased your airline ticket or made any travel arrangements, you can apply for the RTT in advance online as long as you have all the requirements already. Do note that filing for RTT online is limited to those who have not yet purchased their airline ticket and have not yet paid the full travel tax rate. Online RTT applications submitted after 5 P.M. or on weekends are processed on the next working day.

If you have already purchased an airline ticket and prefer to pay your RTT at the airport, proceed to step 4.

Step 4: Arrive at the airport or designated government office where travel tax payments are processed. Look for the travel tax counter or designated personnel.

Step 5: Present your supporting documents to the personnel at the travel tax counter. This will verify your eligibility for the reduced travel tax rate.

Step 6: Pay the reduced travel tax amount applicable to your category. The personnel will inform you of the exact amount to be paid based on your eligibility.

In case you have paid for the full travel tax amount despite being eligible for RTT, TIEZA advises you to apply for a refund of the excess travel tax paid ON-SITE at any TIEZA Travel Tax Office or airport counter.

Step 7: Once the reduced travel tax is paid, you will receive a receipt or clearance indicating that the tax has been settled. Keep this document safe, as you may need it during your travel.

Step 8: With the reduced travel tax paid and clearance obtained, proceed with your travel plans as usual.

Philippine Travel Tax Discounts for Senior Citizens and PWDs

Under current laws, senior citizens and PWDs are entitled to a 20% discount on the travel tax and terminal fee.

Who Is Exempted From Travel Taxes in the Philippines?

There are certain categories of individuals who are exempt from paying travel tax in the Philippines. They are the following:

- Foreign Diplomatic and Consular Officials and Members of their Staff

- Officials, Consultants, Experts, and Employees of the United Nations (UN) Organization and its agencies

- United States (US) Military Personnel including dependents and other US nationals with fares paid for by the US government or on US Government-owned or chartered transport facilities

- Overseas Filipino Workers (OFW)

- Filipino permanent residents abroad whose stay in the Philippines is less than one (1) year

- Philippine Foreign Service Personnel officially assigned abroad and their dependents

- Officials and Employees of the Philippine Government traveling on official business (excluding Government-Owned and Controlled Corporations)

- Grantees of foreign government funded trips

- Bona-fide Students with approved scholarships by appropriate government agency

- Infants (Up to second birthday on date of travel)

- Personnel (and their dependents) of multinational companies with regional headquarters, but not engaged in business, in the Philippines

- Balikbayans whose stay in the Philippines is less than one (1) year

- Family members of former Filipinos accompanying the latter

Where to Pay Philippine Travel Tax

Passengers can settle their travel tax at designated counters in Philippine airports before departure. These counters are typically located in the international departure area of the airport.

How to Pay Philippine Travel Tax Online?

If you plan to pay the Philippine travel tax, here is a guide that provides step-by-step instructions on how you can do it.

Step 1: Go to the official website of the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) – Tourism Infrastructure and Enterprise Zone Authority (tieza.gov.ph)

Step 2: Look for the Travel Tax section on the top of the page beside the About Us tab.

Step 3: Within the Travel Tax section, select Pay Travel Tax Online .

Step 4: Click on the MYEG icon on the laptop photo. The link should direct you here – Online Travel Tax Services System (tieza.online)

Step 5: Fill out the form with the required details.

Step 6: Proceed and select your preferred payment method. This could be through e-wallets, online bank transfers, or credit/debit cards.

Step 7: Follow the prompts to complete the payment process.

Step 8: After successful payment, make sure to keep a copy of the payment confirmation for your records.

How Much is the Terminal Fee in NAIA?

The terminal fee at Ninoy Aquino International Airport (NAIA) varies depending on the terminal and the type of flight. As of 2023, the NAIA charges PHP 300 for domestic flights and PHP 750 for international flights.

How Much is the Travel Tax from the Philippines to Canada?

Filipino passengers traveling from the Philippines to Canada are subject to a travel tax. The amount varies depending on the passenger’s class of travel. First class passengers are charged PHP 2,700 while economy class passengers are charged PHP 1,620.

Is Travel Tax Included in PAL Ticket?

For Philippine Airlines (PAL) tickets, the travel tax is typically not included in the ticket price. Passengers are required to settle the travel tax separately before departure.

Can I Pay Travel Tax at the Airport?

Yes, passengers can pay their travel tax at the airport before their flight. There are designated counters in Philippine airports where travelers can settle this fee conveniently.

Want to Travel Locally in the Philippines?

If you are planning to explore the local destinations in the Philippines, make sure to check out our 15 Top Destinations in the Philippines – Our Recommendations 2024

The author of Budget and Life is a content writer based in the Philippines. Her passion for writing has led her to take up writing as a full-time profession. She has garnered a lot of experience in the field and is skilled at crafting engaging and informative content.

Leave a Reply Cancel reply

You must be logged in to post a comment.

Related Posts

10 Things to Do Before Moving to the Philippines – Insider Tips From a Local!

Preparing to move to the Philippines soon? Let me help you get ready for the new culture and environment! Born and raised in the Philippines, here are 10 recommendations I can give to every foreigner Read more…

2024 Yabu: House of Katsu Review – A First-Timer’s Impression

Have you ever heard of Yabu: House of Katsu? If you’re a fan of Japanese cuisine, you’re in for a treat. Our recent visit to Yabu was a delightful experience, and we’re excited to share Read more…

Fully Booked Bookstore Experience

For all book enthusiasts heading to the Philippines, Fully Booked is an absolute must-visit destination. This bookstore in the Philippines is a go-to destination for all your book needs! If you are curious to learn Read more…

- Ninoy Aquino International Airport

- US visa and other Visas

- CEBU PACIFIC

- PUERTO PRINCESA

- BANAUE and SAGADA

- METRO MANILA and nearby areas

- Privacy Policy

ALL YOU NEED TO KNOW ABOUT PAYING PHILIPPINE TRAVEL TAX ONLINE

June 16, 2023

I paid thru www.tieza.gov.ph. You can also go direct to www.myeg.ph.

1. You need to supply the following:

a. An email address and mobile number

b. Your passport number

c. Your plane ticket or booking refence number

d. Your destination and date of departure.

2. At present, there are only 2 payment methods, over-the-counter or via credit card/debit card.

3. I recommend you to pay via credit card or debit card to get an acknowledgement receipt immediately sent to the email address you supplied, within 5 minutes of paying online.

4. You need a printer to print 2 copies of the acknowledgement receipt from Tieza. The airline counter keeps a copy of the acknowledgement receipt.

Note: The acknowledgement receipt with the Tieza logo is the one you need to print not the payment confirmation sent to you by email by myeg.

5. There are additional charges by paying online. 50 php is charged by the portal. 1.4% is charged by the credit card company.

Why pay travel tax online? If you don't have enough time at the airport or you're travelling during high season, paying travel tax online may save you time lining up at the airport.

If you're a Cebu Pacific passenger, you can pay travel tax at their portal. They charge 100 php fee. It's cheaper at myeg coz total additional charge is only 73.38 php.

Labels: Travel Tax

0 comments:

Post a Comment

Like us on Facebook to get updates

TYPE YOUR EMAIL ADDRESS AND RECEIVE THE LATEST UPDATES IN YOUR INBOX

Delivered by FeedBurner

Department of Tourism

Blog Archive

- ► April (1)

- ► January (4)

- ► December (1)

- ► November (6)

- ► October (4)

- ► September (3)

- ► August (3)

- ► July (6)

- FABULOUS DESSERTS YOU CAN ONLY FIND IN BORACAY

- DINING AT CATICLAN AIRPORT DEPARTURE TERMINAL

- MY TIPS WHEN FLYING CEBU PACIFIC AIR INTERNATION...

- SINGAPORE: Fraser Place Robertson Walk Breakfast ...

- ALL YOU NEED TO KNOW ABOUT PAYING PHILIPPINE TRAVE...

- OVERNIGHT PARKING AT NAIA 3

- ► May (6)

- ► April (5)

- ► March (3)

- ► January (7)

- ► December (2)

- ► November (1)

- ► August (4)

- ► June (3)

- ► November (2)

- ► October (2)

- ► September (1)

- ► August (1)

- ► February (2)

- ► May (3)

- ► February (3)

- ► January (8)

- ► August (5)

- ► July (2)

- ► May (5)

- ► March (1)

- ► January (3)

- ► October (1)

- ► April (3)

- ► March (2)

- ► February (1)

- ► January (2)

- ► July (1)

- ► October (3)

- ► September (2)

- ► July (5)

- ► May (9)

- ► February (4)

- ► August (10)

- ► July (3)

- ► June (5)

- ► April (6)

- ► March (5)

- ► January (6)

- ► September (5)

- ► May (4)

- ► April (4)

- ► March (4)

- ► February (7)

- ► November (5)

- ► September (4)

- ► August (6)

- ► June (1)

- ► January (1)

- ► June (6)

- ► May (12)

- ► February (8)

- ► December (6)

- ► October (10)

- ► September (19)

- ► August (23)

- ► July (7)

- ► June (4)

FeedBurner FeedCount

Search This Blog

- Airline Meals (10)

- Airphilippines (2)

- Airport Lounge (11)

- Airport Transportation (1)

- Alona Beach Restaurants (1)

- Antipolo (6)

- Antipolo Restaurants (5)

- Australia (5)

- Australia Visa (1)

- Baguio (23)

- Baguio Accommodations (1)

- Baguio Craft Brewery (1)

- Baguio Restaurant (3)

- Balete Pass (2)

- banaue (16)

- Banaue accommodations (1)

- Banaue Itinerary (9)

- Banaue Rice Terraces (5)

- Bangkok (7)

- Bangkok Accommodation (1)

- Bangkok food (3)

- Barossa Food (1)

- Barossa Valley (3)

- Barossa Visitor Centre (1)

- Batad Rice Terraces (2)

- Batanes (24)

- Batanes Accomodations (3)

- Batanes Itinerary (4)

- Batanes Tour (1)

- Belgium (1)

- BenCab museum (1)

- Bohol Accomodations (3)

- Bohol Itinerary (2)

- Bonifacio Global City (4)

- Boracay (12)

- Boracay Activity (2)

- Boracay Food (5)

- Boracay Souvenirs (1)

- Boracay Transportation (1)

- Calendar of Events (3)

- Camp John Hay (5)

- Cathay Pacific (2)

- Caticlan Airport (3)

- Cebu Accommodations (1)

- Cebu Pacific (14)

- Changi Airport (2)

- Chatuchak (1)

- Chicago (1)

- Chicago Airport Transportation (1)

- China Sim (1)

- China Visa (3)

- Chocolates (1)

- Comelec (1)

- Corregidor (3)

- Davao Itinerary (1)

- Deal grocer (1)

- Diet plan (1)

- Divisoria (1)

- Domestic Terminal (1)

- Dried Mangoes (1)

- Driver's license (1)

- Echo Valley (1)

- El Nido (31)

- El Nido Accomodations (3)

- El Nido airport (1)

- El Nido Meals (6)

- El Nido Resorts (2)

- El Nido Tours (10)

- Fitness (1)

- Fitness First (1)

- Food Delivery (11)

- Food review (4)

- Fukuoka (3)

- Fundacion Pacita (1)

- Gardens by the Bay (1)

- German Christmas Market (1)

- Groupon (2)

- Hanging coffins (1)

- Hanoi food (2)

- Hanoi tour (3)

- Henna tattoo (1)

- Hong Kong (8)

- Hong Kong Food (7)

- Hong Kong Tours (4)

- Hospital Review (1)

- Isis Bungalows (2)

- japan food (4)

- Japan visa (3)

- Jetstar (3)

- Jose Rizal Tour Series (2)

- JR Pass (2)

- Katipunan (1)

- Korea visa (1)

- Lang Leav (1)

- Laos Food (4)

- Liqueur Review (1)

- Little India (1)

- Long weekends (3)

- Love and Misadventure (1)

- Luang Prabang (7)

- Luang Prabang Food (2)

- Lumiang cave (1)

- Magilas trail (1)

- Manila (23)

- Manila Accommodations (2)

- Manila Bay Sunset Cruise (1)

- Manila Domestic Airport Lounge (1)

- Manila Food (2)

- Manila International Airport (24)

- Manila International Airport Lounge (10)

- Manila International Airport Transport Service (3)

- Manila Walking Tours (1)

- Marikina (3)

- Marikina Restaurants (1)

- Mass Schedules (2)

- Medical City (2)

- Metro Manila Cinema (3)

- Mobile WiFi (1)

- Moderna (1)

- Motorbike Tour (2)

- Murtabak (1)

- My List of Best Travel Websites (1)

- Napa Valley (1)

- New York (13)

- New York Airport Transportation (1)

- New York Food (2)

- New York Hotel (1)

- New York Itinerary (6)

- New York Museums (2)

- New York tours (5)

- Nueva Ecija (1)

- Orlando (1)

- Orlando tour (1)

- Packing List (10)

- Pacquiao (1)

- PAL Express (1)

- Palawan Itinerary (2)

- Pampanga (5)

- Pampanga Food (3)

- Pampanga Tours (5)

- Panglao Church (1)

- Park N' Fly (1)

- Passport (5)

- Philippine Airlines (7)

- Philippine Airports (1)

- Philippine football (1)

- Philippine souvenirs (1)

- Philippine World Heritage Sites (1)

- Pranjetto (1)

- Pranjetto Hills Resort (1)

- Promo Fares (3)

- Puerto Princesa (15)

- Puerto Princesa Accomodations (2)

- Puerto Princesa Itinerary (2)

- Quezon City (1)

- Quezon City Restaurants (4)

- Quezon Tours (1)

- Resort World (1)

- Romblon (1)

- sagada (18)

- Sagada accommodations (1)

- Sagada guide (1)

- Sagada Itinerary (10)

- Sagada tourism (12)

- Shinkansen (1)

- Singapore (19)

- Singapore Accomodations (3)

- Singapore Airlines (1)

- Singapore Airport Transportation (1)

- Singapore Attractions (5)

- Singapore Food (3)

- Skypasada (1)

- Tech tips (1)

- Tekka Market (1)

- Thai food (2)

- Thai Smile (1)

- Tokyo Food (4)

- Tokyo Sightseeing (2)

- Tour Guide (4)

- Tourism Logo (1)

- Travel Cost and Expenses (4)

- Travel Insurance (1)

- Travel Tax (3)

- Travel Tips (10)

- Travel Tour Expo (1)

- UP Diliman (7)

- US Visa (4)

- Vaccination Center (1)

- Villa Escudero (3)

- Wine Festival (2)

- Wine Pairing (3)

- Wine Review (7)

- Wine Tasting Tours (1)

- Zest Air Southeast Asian Airlines (1)

Philippine Airlines Sale

Cebu Pacific Airlines Sale

Link Within

Philippine Airports – Terminal Fee, Travel Tax & Flights Guide

Are you traveling in the Philippines or abroad? There are some important things to know before you fly.

This detailed guide answers frequently asked questions about Philippine airports and flights.

Philippine terminal fee + travel tax

Here’s a lowdown on fees that you might have to pay at airports in the Philippines. Followed by helpful tips about individual airports.

What is the terminal fee? Do I need to pay at the airport?

You need not worry about the terminal fee if you are arriving at any airport in the Philippines. The terminal fee should already be included in the flight ticket price upon booking for both domestic and international flights.

The airport terminal fee or “Philippine passenger service charge” (DPSC) is an airport tax/exit fee for passengers departing from airports in the Philippines. Overseas Filipino workers (OFWs) are exempted from paying the terminal fee. The terminal fee ranges from P50 to P220 per person for domestic flights or P600 to P1,135 per person for international flights.

What is PH Travel Tax?

The Philippine travel tax is a fee for Filipinos traveling abroad. The full travel tax is P1,620 for passengers on economy class plane tickets and P2,700 when flying first class. You need not worry about the travel tax if you’re a foreigner traveling in the Philippines on a short visit or simply transiting as this fee only applies to citizens of the Philippines, permanent resident aliens, and non-immigrant aliens who have stayed in the Philippines for a period of not less than one year. You can check TIEZA’s website for the full details on PH travel tax exemptions and reduced fees.

PH Travel Tax Online Payment

Selected airlines including Cebu Pacific offer the option of paying the Philippine Travel Tax online on their website. This is highly recommended if you want to skip lining up at the airport. You can also pay the travel tax online on the TIEZA Online Travel Tax Payment System (OTTPS) website.

Manila-NAIA International Airport (MNL)

The Manila Airport is the busiest airport and the main international gateway to the Philippines. Commonly referred to as “NAIA” or Ninoy Aquino International Airport, it is located in the cities of Pasay and Parañaque, within the Metro Manila area in Luzon Island (Northern Philippines).

Manila Airport Transfers & Car Charter

Manila Airport-NAIA Shuttle Bus

Manila-NAIA Airport – Private Transfer

Manila Private Car Charter

View all discounts

Where to stay near Manila Airport — For a comfortable and convenient stay, book a room in Newport World Resorts (formerly Resorts World Manila) located right across the street from Terminal 3. The Manila Bay Entertainment City area is also a great option since it is conveniently connected to Terminal 3 via the newly opened skyway. Click below to check room rates and promos.

Check Rates See more

Manila Airport-NAIA terminal fee — The terminal fee is not collected at Manila Airport for domestic and international flights. The terminal fee should already be paid for/included in the plane ticket price, at the time of booking.

See more about Manila

Mactan–Cebu International Airport (CEB)

Cebu Airport, is around 15 kilometers away from the center of Cebu City. It is located in Lapu Lapu City, Mactan Island. Travel time may take 1 hour or more, depending on traffic jams, especially crossing Mandaue. Without traffic, the drive should take around 45 minutes.

Cebu Airport transfers

Cebu Airport Private Transfers – for Cebu City, Mactan & more

Cebu Car Charter – Cebu City/Mactan Private DIY Transport

Where to stay near Cebu Airport

Cebu Airport terminal fee — The terminal fee is not collected at Cebu Airport for domestic and international flights. The terminal fee should already be paid for/included in the plane ticket price, at the time of booking.

See more about Cebu

Boracay-Caticlan Airport (MPH)

Caticlan Airport, located in Malay, Aklan, is less than one kilometer away from Caticlan Jetty Port. You can take a shuttle, tricycle, or even walk if you are not bringing heavy luggage. Go on a short ferry ride to Cagban Jetty Port in Boracay Island. Then, ride a shuttle or multicab to your resort/destination in Boracay Island.

Boracay Airport transfers & tours

See all discounts

Caticlan Airport-Boracay Hotel Shared Transfers – Shuttle+Ferry Ticket

Caticlan Airport–Boracay Hotel Private Transfers

Hotels near Boracay Airport — There some options to stay near the airport, but most of them are not good. Head straight to Boracay if you can. If you get stuck in town, click below to check rates on places to stay nearby.

Boracay Airport terminal fee — Boracay Airport terminal fee should already be paid for / included in the plane ticket price, at the time of booking. You do not have to pay the terminal fee at the airport.

See more about Boracay

Kalibo International Airport (KLO)

Kalibo airport is located near the town center, just 4 kilometers away or under 10-minutes by car. Travel time to Boracay takes around 1 hour. If you are headed to Boracay, you can either take a 1-hour shuttle or bus to Caticlan Jetty Port, where you can find ferries that go to Boracay Island. You can find them outside the arrivals area or book the trip online easily.

Kalibo Airport transfers

Kalibo Airport-Boracay Hotel Shared Transfers – Shuttle+Ferry Ticket

Kalibo Airport–Boracay Hotel Private Transfers

Kalibo Airport terminal fee — The terminal fee is not collected at Kalibo Airport for domestic and international flights. The terminal fee should already be paid for/included in the plane ticket price, at the time of booking.

Hotels near Kalibo Airport

Check rates See more

See more about Kalibo

Puerto Princesa International Airport (PPS)

Puerto Princesa Airport, located in Palawan, is located right within city proper. Puerto Princesa has a small city center, so getting around usually takes 15-minutes or less. There are shuttle vans stationed near the arrivals area that can take you directly to El Nido and other towns on the island. Or, go on a tricycle from the arrival area or airport exit gate to get to your destination in the city.

Puerto Princesa Airport transfers

Puerto Princesa Airport to PP City Hotel Transfers

Puerto Princesa – El Nido Shuttle Transfers

Where to stay near Puerto Princesa Airport

Puerto Princesa Airport terminal fee — The Puerto Princesa Airport passenger terminal fee is P700 per person for international flights. If you are on a domestic flight, the terminal fee should already be paid for / included in the plane ticket price, at the time of booking.

See more about Palawan

Bohol-Panglao International Airport (TAG)

Bohol Airport transfers

Bohol Airport – Panglao/Tagbilaran Transfers (Private Shuttle/Car)

Bohol Private Car Charter

Where to stay near Bohol Airport

Bohol Airport terminal fee — Bohol–Panglao Airport terminal fee should already be paid for / included in the plane ticket price, at the time of booking. You do not have to pay the domestic terminal fee at the airport.

See more about Bohol

Clark International Airport (CRK)

Clark Airport is around 15 kilometers away from Angeles City proper or 95 kilometers from Manila. Travel time is approximately 2 hours.

Clark Airport transfers

Clark Airport Private Transfers – to/from Manila & more

Where to stay near Clark Airport

Clark Airport terminal fee — The terminal fee is not collected at Clark Airport for domestic and international flights. The terminal fee should already be paid for / included in the plane ticket price, at the time of booking.

See more about Clark & Pampanga

Davao International Airport (DVO)

Davao Airport is around 10 kilometers away from Davao City Center. You can ride a metered taxi, which takes around 30 to 45 minutes.

Where to stay near Davao Airport

Davao Airport terminal fee — The terminal fee is not collected at Davao Airport for domestic and international flights. The terminal fee should already be paid for / included in the plane ticket price, at the time of booking.

See more about Davao

Iloilo International Airport (ILO)

Iloilo Airport, located in Cabatuan-Santa Barbara is around 20 kilometers away from Iloilo City proper. Travel time is around 25 to 40 minutes. From the airport, you can ride a shuttle or taxi to get to Iloilo City.

Iloilo Airport transfers

Iloilo Airport-Iloilo City Hotel Shuttle – ILO Private and Shared Transfers

Where to stay near Iloilo Airport

Iloilo Airport terminal fee — The terminal fee is not collected at Iloilo Airport for domestic and international flights. The terminal fee should already be paid for / included in the plane ticket price, at the time of booking.

See more about Iloilo

Cagayan de Oro-Laguindingan Airport (CGY)

Cagayan de Oro Airport, located in the Laguindingan town, Misamis Oriental, is around 35 kilometers away from Cagayan de Oro City proper. Travel time to Cagayan de Oro or Iligan cities takes up to 1 hour.

Where to stay near Cagayan de Oro Airport

Cagayan de Oro Airport terminal fee — Cagayan de Oro Airport terminal fee should already be paid for / included in the plane ticket price, at the time of booking. You do not have to pay the domestic terminal fee at the airport.

See more about CDO & Northern Mindanao

Bacolod-Silay International Airport (BCD)

Bacolod Airport, located in Silay City, Negros Occidental, is around 18 kilometers away from Bacolod City proper. Travel time takes approximately 30 to 45 minutes.

Where to stay near Bacolod-Silay Airport

Bacolod Airport terminal fee — Bacolod Airport terminal fee should already be paid for / included in the plane ticket price, at the time of booking. You do not have to pay the domestic terminal fee at the airport.

See more about Bacolod & Negros Occidental

More Philippine Airports

Basco airport (bso), batanes.

Distance to Basco Town Proper — 750 m; 3 mins

Hotels near Basco Airport

Check rates

Busuanga-Coron Airport (USU)

Distance to Coron Town Proper — 22 km; 20 mins

Hotels near Coron Airport

Butuan Airport (BXU)

Distance to Guingona Park — 12.3 km; 17 mins

Hotels near Butuan Airport

Calbayog Airport (CYP)

Distance to Calbayog City Proper — 6 km; 11 mins

Hotels near Calbayog Airport

Camiguin Airport (CGM)

Distance to Mambajao Municipal Hall — 1.3 km; 13 mins

Hotels near Camiguin Airport

Catarman Airport (CRM)

Distance to Catarman Town Proper — 2 km; 6 mins

Hotels near Catarman Airport

Cauayan Airport (CYZ)

Distance to Cauayan City Proper — 3.5 km; 10 mins

Hotels near Cauayan Airport

Cotabato Airport (CBO)

Distance to Cotabato City Plaza — 9.1 km; 13 mins

Dumaguete Airport (DGT)

Distance to Dumaguete Boulevard — 3.5 km; 10 mins

Hotels near Dumaguete Airport

Dipolog Airport (DPL)

Distance to Dipolog Cathedral — 1.8 km; 4 mins

Hotels near Dipolog Airport

Laoag Airport (LAO)

Distance to Laoag City Proper — 7.5 km; 15 mins

Hotels near Laoag Airport

General Santos International Airport (GES)

Distance to General Santos City Hall — 14.5km; 23 mins

Hotels near General Santos Airport

Jolo Airport (JOL)

Distance to Jolo Municipal Hall — 1.5km; 4 mins

Hotels near Jolo Airport

Legazpi Airport (LGP)

Distance to Legazpi City Proper — 3.5 km; 10 mins

Hotels near Legazpi Airport

Masbate Airport (MBT)

Distance to Masbate City Center — 850 m; 2 mins

Hotels near Masbate Airport

Naga Airport (WNP)

Distance to Naga City Proper — 11 km; 24 mins

Hotels near Naga Airport

Ozamiz Airport (OSZ)

Distance to Immaculate Concepcion Cathedral — 4.8 km; 10 mins

Hotels near Ozamiz Airport

Pagadian Airport (PAG)

Distance to Pagadian City Hall — 6.5 km; 10 mins

Hotels near Pagadian Airport

Romblon-Tablas Airport (TBH)

Distance to San Agustin Pier — 34 km; 34 mins. To Odiongan Town Proper — 25 km.

Hotels near Romblon Airport

San Jose Airport (SJI)

Distance to San Jose Town Proper — 2.5 km; 5 mins

Hotels near San Jose Airport

Siargao Airport (IAO)

Distance to Dapa Ferry Terminal — 15 km; 20 mins. To Cloud 9 Boardwalk, General Luna — 32 km; 43 mins

Hotels near Siargao Airport

Surigao Airport (SUG)

Distance to Surigao City Hall — 4.5 km; 8 mins

Hotels near Surigao Airport

Tacloban Airport (TAC)

Distance to Leyte Provincial Capitol — 10.5 km; 23 mins

Hotels near Tacloban Airport

Tandag Airport (TDG)

Distance to Tandag City Proper — 4 km; 8 mins

Hotels near Tandag Airport

Tawi-Tawi Airport (SGS)

Distance to Bongao Municipal Hall — 6 km; 8 mins

Hotels near Tawi-Tawi Airport

Tuguegarao Airport (TUG)

Distance to Tuguegarao City Proper — 4 km; 10 mins

Hotels near Tuguegarao Airport

Virac Airport (VRC)

Distance to Virac Town Proper — 3 km; 6 mins

Hotels near Virac Airport

Zamboanga International Airport (ZAM)

Distance to Zamboanga City Hall — 3.5 km; 9 mins

Hotels near Zamboanga Airport

Before you go

How do I know if the terminal fee is included in the airline booking?

Check the breakdown of taxes and fees on your booking receipt or when booking the flight ticket. The terminal fee is usually labeled as PH Passenger Service Charge, Domestic Passenger Service Charge or International Passenger Service Charge. There’s usually also a corresponding Aviation Security Fee (ASF) and separate Value Added Tax for the terminal fee.

Do I still need to pay the terminal fee, even after paying the travel tax?

Yes, the terminal fee and travel tax are separate fees. If you’re not exempted, then you need to pay both.

Do I need to pay the terminal fee and travel tax when I arrive in the Philippines?

The airport terminal fee and Philippine Travel Tax does not apply to arriving passengers.

Don’t leave yet. There’s more!

Discover more blogs and travel tips in:

- Philippines

- Puerto Princesa

- General Santos

- Cagayan de Oro

- Southeast Asia

Find more posts about:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

March 10, 2016 at 10:50 am

I like the parking area in SM CITY CEBU CITY PHIL I PINES because they have red and green lights on each parking space. The red lights means occupied and the green lights means vacant.

May 4, 2016 at 9:19 pm

Do you know the current terminal fee for departure from Tagbilaran airport?

May 4, 2016 at 9:56 pm

Terminal fee at Tagbilaran Airport is P100

May 15, 2016 at 5:40 pm

Hi. I am budy from Indonesia. I would like to ask you related airport tax terminal fee and philippines travel tax. I booked the ticket from Jakarta to Manila (transit). And then Manila to Seoul. I am foreign passport holder. Should I pay airport tax terminal fee and phillipines travel tax? Thanks ☺

May 15, 2016 at 5:53 pm

If you have a single journey ticket, I’m not sure if you have to pay, but if you are changing airlines or if you’re required to check-in for your next flight then you may have to pay the international terminal fee. The Philippine travel tax is mostly for Philippine residents.

May 15, 2016 at 11:38 pm

taxinternational travel is 1,620 in pesos thats the full payment is it require to pay even after 6months you arrived in manila and you are going out again another 1,620

May 16, 2016 at 3:37 am

Hello Gloria,

If you are required to pay the PH travel tax, you may have to pay this fee for every departure regardless of the time between your flights. It is charged specifically for every plane ticket. You can read more info about it at http://tieza.gov.ph/travel-tax/ .

June 4, 2016 at 3:21 pm

was their another charges aside from travel tax, terminal fee. going to hongkong.. the so called TIEZA??

June 4, 2016 at 4:38 pm

Those are the only charges you need to pay at the airport if you are departing on an international flight from the Philippines

August 7, 2016 at 7:25 pm

I am an OFW in Dubai and i will take my vacation to Philippines this August, I already have my OEC and as part of my vacation itenerary, I am planning also to take a short visit/tour to Singapore from Philippines, Ijust want to ask , should I pay travel tax and terminal fee upon exiting Philippines going to Singapore for this tour? Awaiting your reply… Thank you so much :)

October 18, 2016 at 6:00 pm

Hello,im planning to tour in mumbai,india…how much is my travel tax? will be departuring at naia international airport…thank you

December 14, 2016 at 6:53 pm

im already travel to india last 2015 of august,do i need to pay another travel tax f i go there again this dec?

December 14, 2016 at 7:18 pm

As far as I know, Philippine citizens pay PH travel tax for every international departure, kahit same day pa yung pag uwi mo and travel international ulit.

February 1, 2017 at 4:48 pm

hi, im an OFW , me and my mom and bb will travel to HK for holiday via CEbupacific airways in the tkts it says passenger service charge and TAXES AND FEES PH Passenger Service Charge – PHP 491.07 – is this the terminal fee? Hong Kong Airport Construction Fee – PHP 577.94 Air Passenger Departure Tax – PHP 770.59 – is this the travel tax? Security Surcharge – PHP 288.97 and i want to ask also , since im OFW am i exempted with this taxes (terminal and travel tax going to HK for holiday?)

February 1, 2017 at 9:52 pm

I’ll breakdown the list so it’s easier to go through them.

PH Passenger Service Charge – PHP 491.07 – is this the terminal fee?

This I believe is the PH airport terminal fee. There should be another item called the “PH PSC Value Added Tax: 58.93,” which usually amounts to P58.93. So, the total is the P550 terminal fee.

This terminal fee should be refundable for OFWs with OEC.

Air Passenger Departure Tax – PHP 770.59 – is this the travel tax?

This is a HK$120 fee charged in Hong Kong, not in the Philippines.

February 19, 2017 at 5:12 am

Hi i am traveling to singapore next week. First time ko.. Magkanu babayaran kong travel tax, and do i need to pay terminal fees?. Mejo nervous kc aq as a first timer eh,, sana matulungan m ko.. Saka do i need to fill up embarkation card and where to get it ba… Your reply is going to be a good help.,

February 23, 2017 at 5:27 pm

P1,620 po yung travel tax per person for economy class tickets. Sa airport po yan binabayaran. Kung galing ka Manila Airport, hindi na kelangan mag bayad ng terminal fee sa airport kase nabayaran na po yan sa ticket.

Yung embarkation card before arriving in Singapore, usually dini-distribute po yan during the flight. Sakali wala sa flight mo, naka lagay lang yan sa immigration checkpoint sa Singapore.

Safe trip Lovelie!

March 5, 2017 at 5:43 am

Hi, Next week is my departure going to Saudi and I visit my hubby. How much to pay the terminal fee? Thanks

March 9, 2017 at 5:00 am

If you are departing from Manila. There is no terminal fee charged at the airport. The fee is already paid for when you bought the ticket.

March 17, 2017 at 5:15 am

Hello Marcos. My wife (Philippine citizen & Philippine passport holder) is flying out of NAIA terminal 2 for UK settlement. Does she have to pay travel tax?

March 17, 2017 at 3:31 pm

I’m not sure Jason. Better check the TIEZA website or contact them to confirm.

April 23, 2017 at 12:15 am

Hello. I am a singaporean I will be going to davao for a 1 week holiday. I just want to check do I need to pay for the airport tax for my arrival and departure when I go back to singapore

April 23, 2017 at 8:56 am

You don’t need to pay the terminal fee when you arrive in the Philippines. If you’re flying out of Davao, you need to pay the terminal fee at the airport. If you’re flying from Manila, no need to pay. The fee is already included in the ticket price. See the list of terminal fee prices above.

May 12, 2017 at 2:03 pm

I’m travelling to Vietnam with my Swedish husband flying from Manila to Hanoi.

Does he need to pay travel tax fee, P1,620? He has 9a/Tourist Visa, non-immigrant but stays here in Philippines since 2015 and only do tourist visa extension every 2 mos to stay legally here.

Riza from GenSan

May 12, 2017 at 2:09 pm

Hello Riza,

I’m not sure if he is required to pay. Best to contact TIEZA to be sure.

Enjoy your trip!

May 14, 2017 at 12:12 pm

There seems to be a bit of a confusion (mix up) here … Under “Airport terminal fee” you wrote: “You do not have to pay the terminal fee if you are on a flight from Manila, Caticlan (Boracay), or a domestic flight from Cebu.” and again under “Popular Philippine Airports” you wrote: Cebu-Mactan (CEB) Domestic – Included in flight ticket. International – P750. But … under “Mactan–Cebu International Airport (CEB)” you wrote: “The Cebu Airport passenger terminal fee is P750 per person for domestic flights. If you are on an international flight, you do not have to pay the terminal fee since it should already be paid for / included in the plane ticket price, at the time of booking.” This is the total opposite of the first two. So which is correct? Also if you go international but is required to change plane, like Cebu to Manila, then Manila to Bangkok, do you have to first pay Domestic then International terminal fees or do you pay the International terminal fee twice? Once in Cebu (750) and again (as included in ticket) in Manila?

May 14, 2017 at 5:17 pm

The first one is correct. Thanks for pointing out the error Luigi.

Just did a mock online booking for a Cebu-Manila-Bangkok flight, only the P750 PH international terminal fee shows up on the receipt. So, you might have to pay the terminal fee (for international flights) ONLY ONCE & it’s already included in the total price, upon purchase. This assumes that the whole journey is on a single plane ticket, and not two separate tickets.

If you booked a Cebu – Manila flight ticket, and another Manila – Bangkok flight ticket … You might have to pay the domestic terminal fee in Cebu, and international terminal fee in Manila. Both should already be included in the total price, upon purchase. So, you don’t need to pay at the airport. If both flights are on the same airline, on the same day, best to ask the airport/airline staff if you can get a refund for your Cebu-Manila terminal fee… If they are on different airlines & on different dates, you will need to pay both.

You only pay the international terminal fee once.

May 18, 2017 at 12:02 pm

Hello po, magandang araw pupunta po ako ng dubai by july… Aside from plane ticket, terminal fee and travel tax may babayaran pa po ba ako. Thank you po.

May 18, 2017 at 9:37 pm

Yun lang po mga babayaran sa Manila Airport.

May 30, 2017 at 5:58 pm

Kasali na ba sa na book na ticket ang travel and tax na babayaran pag sa cebu airport going singapore? Ang babayaran ko nalangba ay ang terminal fee na 750 pesos?

May 30, 2017 at 7:12 pm

Sa airport binabayad yung travel tax & terminal fee for international flights, at Cebu Airport.

May 31, 2017 at 8:46 am

Good am sir. I am a tourist here staying almost two years going bk to Singapore this month flying by Jetstar airline at naia terminal 1. Can u tell me how much is the total travel taxs I must pay? Me 1adult. And my Wife 1adult Filipino passport.1 children age 3 years plus Filipino passport and lastly 1infant 1years plus Filipino passport too. And the terminal fees do I still needs to pay in the airport terminal 1. Or no more already. Pls kindly reply n help thanks so much sir. Have a nice day.

May 31, 2017 at 11:17 am

The terminal fee is already included in the ticket if you are departing from any terminal in Manila Airport. With regards to the travel tax, you might want to review the information posted at the TIEZA website: http://www.tieza.gov.ph/index.php/travel-tax .

June 8, 2017 at 8:26 am

We want to go on holidays to Philippines from Denpasar and we would like to enter for example to Palawan and visit Boracay and Malapascua as well, please could you advice us which would be the best airport to leave Philippines or who to plan this trip? thanks a lot

June 8, 2017 at 7:10 pm

You can try this route: Bali-Denpasar – Manila – Coron — El Nido (ferry) — Puerto Princesa (land trip) — Cebu — Boracay-Caticlan — Manila. Enjoy!

July 10, 2017 at 5:09 pm

Hi im going to barhain i will visit my family nextweek do i have to pay or how much i need to pay ?

August 6, 2017 at 5:37 pm

Hi. Tumatanggap ba ng credit card ang Mactan Airport for the payment of travel tax na P1620?

August 19, 2017 at 10:26 pm

It’s paid in cash at the airport, AFAIK. You may want to check the travel tax online payment.

August 9, 2017 at 9:44 am

Hi Good morning..my husband sponsored me and my son For visa going to dubai..do i still need to pay the travel tax and terminal fee?

August 19, 2017 at 10:13 pm

Travel tax, yes. Terminal fee, no if flying from Manila.

August 17, 2017 at 6:47 am

I am going to Singapore next week and I am wondering If how much is the current terminal fee from DVO-SIN?

August 19, 2017 at 10:09 pm

Kindly see the post above for the international terminal fee at Davao Airport.

August 30, 2017 at 12:28 pm

I wish you had posted or been able to see the dates of when these posts were put up. I am so confused on this terminal fee b/s. No other country will take Philippines money so I am trying to figure out all this. A lot of your prices are wrong and not up to date.

August 30, 2017 at 5:52 pm

Hey Duane, can you share what prices you had found to be not updated?

September 4, 2017 at 6:36 pm

Hi! Filipino (ofw) with transit in the Philippines to Japan then back to bkk. Do I need to pay taxes and oec. Thank you!

September 4, 2017 at 11:23 pm

As far as I know, OFWs are exempt from PH travel tax/terminal fees.

September 6, 2017 at 1:58 pm

Hello, I’m travelling to Cebu from Australia. Are there any fees to pay for arrival?

September 6, 2017 at 4:58 pm

No fees on arrival, Jakester.

September 13, 2017 at 6:17 am

Hi how r u Pls my wife she is Filipina she is not working she is family visa at kuwait and my son have Filipino passbort wat she will pay if she go kuwait by Philippines airline Tnx Mohamed sabry

September 20, 2017 at 12:06 pm

Hello! I’m in Hong Kong for a quick vacation. Do I need to pay any travel tax in Hong Kong Intl Airport when I go back to Manila? Thank you!

September 20, 2017 at 10:24 pm

There are no travel tax or airport fees for the Hong Kong to Manila flight.

September 22, 2017 at 8:19 am

Do I need to pay all these fees when booking Philippine Airlines? Passenger service charge usd 11, airport construction fee usd 12, airport passenger security chare usd 6, Air passenger departure tax usd 16, is this what they called travel tax and do we need to pay coz we’re on European passports? Many thanks if someone can answer our queries.

September 22, 2017 at 9:00 am

The “travel tax” commonly mentioned on this page is the Philippine Travel Tax . It mostly applies to Philippine citizens traveling abroad and foreigners on long-term PH visa.

If you are visiting the PH for a short time, you shouldn’t need to worry about it. It is paid at the airport not when you book your flight online anyways.

Those fees you mentioned are probably mandatory airport/gov’t fees. So yes, you may need to pay all of them.

October 3, 2017 at 10:59 pm

Hi tanong ko Lang poh if I need to pay terminal fee or travel tax ? I’m British citizen with British passport I stayed here just for 30 days. Tnx

October 4, 2017 at 9:36 am

You only need to pay the terminal fee is it’s not already included in the ticket fare (on purchase). All airlines have started to include terminal fee in the price of the ticket recently.

October 15, 2017 at 9:29 pm

May tax and departure fee pa po bang babayaran sa Hong Kong Airport pag uwi namin sa Manila or kasama na sya ticket?

Ito po yung nakalagay sa ticket namin. Air Asia po yung airline.

Flight 2x Guests 11340.00 PHP International Passenger Service Charge – 1100.00 PHP (departure fee of ph or hk?) Airport Construction Fee – 1140.00 PHP (this is hk right?) Airport Tax – 1980.00 PHP (ito po ba yung included airport tax sa hong kong? so mag babayad pa kami ng tax & departure fee dito sa ph pag alis?)

Sorry, I’m just confused and needed answers. Thank you in advance!

October 28, 2017 at 10:51 pm

Walang Tax/Airport/Departure fee on flights from HK Airport.

July 30, 2019 at 2:52 pm

Ask ko lang about sa following fees. Bakit magkaiba sila?

Departure ( Kota Kinabalu) Fare, taxes and fees 2x International Passenger Service Charge1,100.00 PHP

Arrival (Manila) Fare, taxes and fees 2x Passenger Service Charge790.00 PHP 2x Regulatory Service Charge26.00 PHP

Thank you…

August 4, 2019 at 3:51 pm

Yung fees sa “Arrival (Manila)” na flight, fees yan ng departure airport (for example, yung exit fee/taxes for Kota Kinabalu Airport departures)

November 6, 2017 at 6:21 pm

hi pano pumunta ng clark airport galing manila? saka magkano kaya? meron bang direct?

November 17, 2017 at 10:13 pm

There is a new point-to-point/direct bus from Manila Airport – Terminal 3 to Clark Airport operated by Genesis Bus Company.

I haven’t taken it yet but news sites report that they are initially charging promo rates. Regular rates are:

Clark to North Edsa: P380 Clark to Ninoy Aquino International Airport Terminal 3: P450 Clark to Ortigas : P400

November 13, 2017 at 5:34 pm

Hi po I’m going in vacation dis November In PH for 2 months im from Italy..di ako makakakuha ng oec kasi wala na ako babalikan work dito pede ako magbayad ng travel tax para makabalik sa Italy

January 3, 2018 at 9:03 am

This is so informative and helpful! Thank you!☺

March 11, 2018 at 12:25 am

wooahhh I just know that NAIA do not need to pay terminal fees for domestic but I went to davao last november and bohol just this year January and both airports charged me for terminal fee. so doble pala binayad ko. badtrip

March 16, 2018 at 8:14 am

Hi! We’re going on a cruise to asia and we will embark the ship in manila seaport. Do we have to pay terminal fee before checking on board the ship? The cruise will end in shanghai and we already bought ticket to fly home. Same question, do we have to pay terminal fee upon arrival in manila? Thanks!

March 16, 2018 at 1:07 pm

Hello Jon M., the terminal fees discussed on this page is for airports in the Philippines. I recommend that you inquire with the cruise operator about fee included/not included in your package.

March 21, 2018 at 4:20 pm

Hi sir Marcos, have a bless day po. We’re planing for a vacation in taiwan with my children, and my husband is an Ofw . So we are entitled for travel tax exemption? As a dependents of my husband ofw? Thank you..

March 27, 2018 at 7:36 pm

i want to book ticket from Kuala Lumpur to Japan – however it will be transit at Manila Airport for 22 hours that required me to go out from the airport and check in hotel. Do I need to pay any tax in airport when arriving/departure from/to manila?Im malaysian

March 28, 2018 at 10:48 am

There are no taxes at the airport that you need to pay. Enjoy your trip!

May 5, 2018 at 8:39 pm

Would you please let me know the following fees from MIA:

– Fee for permanent resident in Philippines – Travel tax per person including permanent resident – Terminal fee per person including permanent resident

May 14, 2018 at 2:43 am

hey there…

on my airasia itinerary, the terminal fee is already included in the price. Theres also an airport tax involved in the price of the ticket which costs Php1060. Do I have to pay a separate airline tax of Php 1620? and are they different?

June 24, 2018 at 6:26 pm

I am on OFW working in Malaysia but is planning a vacation trip with my family to Taipei. As on OFW I have previleged not to pay the Terminal fee and travel tax however my family is not exempted, However as far as I know they are allowed to pay only 50% of the terminal fee, is this still applicable for them?

July 15, 2018 at 6:16 pm

Hi Eugenio. I’m not sure. You can try asking the airlines on FB.

June 29, 2018 at 6:46 am

Good day! Next week na po flight ko to migrate to new york. My ticket was booked in the US, ask ko lng po kng may bbayaran pa ako airport tax, terminal fee sa NAIA 1?thank you!

July 3, 2018 at 2:17 pm

Very expensive travel tax and terminal fee but you cannot see any progress here in Philippines. Everywhere you go, there is fee! Unlike in other countries they are not collecting any terminal fee fee from customer.

July 15, 2018 at 6:02 pm

Hi Trisha, all airports around the world charge terminal fees and taxes, you just don’t notice it because it’s already included in the airfare. As for the travel tax for international Pinoy travelers, PH Gov’t should really make an exception for ASEAN flights, which will encourage more intra-regional tourism activities/spending.

July 5, 2018 at 11:09 pm

Do I need to pay travel tax for domestic flight. Manila to Palawan?

July 15, 2018 at 5:56 pm

The P1,620 PH Travel Tax is for Pinoys traveling abroad only.

July 20, 2018 at 3:22 pm

I and my husband and my son 6 years old will travel to HK next year, may 2019. from clark airport. can i know how much is the travel tax each? I’m confused po kasi may nakita ko na blog saying that it’s only 600 pero un iba 1620 .THANKYOU!

July 29, 2018 at 1:56 am

There are two fees you will be asked to pay at the airport.

1. Clark Airport Terminal Fee = P600 per person 2. Philippine Travel Tax (for PH citizens traveling abroad = P1,620 per person

Total = P2,220

July 31, 2018 at 1:50 pm

Hi! Can i pay travel tax using credit card at the airport?

August 11, 2018 at 6:07 am

Not sure but do check out the online payment for the travel tax.

August 28, 2018 at 3:06 pm

Im not informed. Been going to Phil 2x already. Can I get the refund of my TF from those past flight I had?

September 19, 2018 at 6:48 pm

Terminal fee at Mactan International Airport is ₽850

September 21, 2018 at 12:29 am

Thanks for the update Melanie

October 3, 2018 at 3:23 am

Thanks …

November 17, 2018 at 11:34 pm

I am a filipino. My husband is indonesian.. My baby born in Brunei. We reached cebu last June 2018. And our scheduled flight Will be on november 28,2018. My baby is 9months old now. Is she need to pay for travel tax and terminal fee ? Even she is holding 1passport (Indonesia). If needed to pay, Any discount for her?

November 18, 2018 at 3:45 pm

Hi Celeste,

You can check the link to TIEZA’s website that I provided on the article. Here the link in case you missed it: http://tieza.gov.ph/travel-tax/

Details are posted there on exemptions. Here is what i found:

—– Who may be exempted from paying the Travel Tax? The following Filipino citizens are exempted from the payment of travel tax pursuant to Sec. 2 of PD 1183, as amended:

Overseas Filipino workers Filipino permanent residents abroad whose stay in the Philippines is less than one year Infants (2 years and below) —–

February 5, 2019 at 1:35 pm

Hi we are travellling to hk from davao. I have with me my wife and my kids (1 & 3). Do my children need to pay the terminal pay? Thanks

February 6, 2019 at 5:05 am

Infants (under 2 years old) are not charged the terminal fee. Children over 2 years old are applicable to pay the terminal fee.

February 27, 2019 at 8:22 am

Hi. Just want to ask if my family still needs to pay Travel Tax and Terminal Fee? They are departing from Manila International Airport. I booked their tickets at PAL and they have an Immigrant Passport . Thank you

March 1, 2019 at 2:33 pm

Hi Cecille, the terminal fee applies to all passengers & the travel tax applies to Philippine citizens. Might be worth asking the airline about the policy/exemptions, in your case.

March 26, 2019 at 12:44 pm

Hi sir good afternoon, Where’s the Kalibo international airport to pay the travel tax and terminal fee? How much? Lining up?

March 26, 2019 at 9:55 pm