HelloSafe » Travel Insurance » PC Financial

Is PC Financial travel Insurance good? Review 2024

verified information

Information verified by Alexandre Desoutter

Our articles are written by experts in their fields (finance, trading, insurance etc.) whose signatures you will see at the beginning and at the end of each article. They are also systematically reviewed and corrected before each publication, and updated regularly.

Traveling without travel insurance can have severe financial consequences. Did you know that one night's hospital stay in the U.S. can be over $14,000 CAD? In some countries, you may even be denied medical assistance if you cannot prepay for treatment.

Travel insurance is an absolute necessity when you're away from home, providing coverage for healthcare expenses and ensuring you can access medical services when needed. It also offers assistance for flight disruptions, lost baggage, and other related issues.

One popular provider worth considering is the PC Financial Travel Insurance (from President's Choice). So we've done a comprehensive review outlining the coverage, costs, and the pros and cons of their service.

Additionally, you can also use our comparator to explore the best travel insurances in Canada and get quotes in seconds.

President's Choice Financial Travel Insurance: 5 Key takeaways

- PC Financial Travel Insurance protects against unexpected medical expenses and other issues like delays and cancelations.

- It offers comprehensive coverage, including trip cancellation, interruption, emergency medical, and baggage loss/delay.

- It is important to review the policy's terms and conditions to understand coverage limitations and exclusions.

- The policy offers flexibility and customisation, allowing travellers to tailor their coverage.

- It is advisable to compare other travel insurances using our comparator, considering factors like coverage, cost, and reviews.

Our 2024 review of PC Financial travel insurance

President's Choice has joined hands with Manulife Travel Insurance to provide Canadians with exceptional plans so they can travel and enjoy their business trips or vacations stress-free.

PC primarily offers 4 travel insurance options: Complete package, Package without medical care, Global medical care, and Unequaled Protection Insurance.

Before we dive into the coverage of each option, here's a quick look at the pros and cons of this insurance overall.

Pros of PC Financial Travel Insurance

- Diverse insurance options

- Partnership with Manulife

- Insurance for seniors

- No-fee master cards with travel insurance

- Quarantine expenses covered in case of COVID

Cons of PC Financial Travel Insurance

- Pre-existing medical condition exclusions

- Limited pricing information on website

You can also compare PC Financial Travel Insurance with other providers in Canada like Allianz Travel Insurance using our comparator below and also get quick quotes based on your unique needs.

Compare the best travel insurance plans on the market!

How is the PC Financial Travel Insurance Coverage?

PC Financial travel insurance offers a wide range of coverage from trip cancellation and medical emergency to flight delays and lost baggage and more to ensure you have the most stress-free travel. However the coverages vary based on the option you choose.

What does PC Financial Travel Insurance cover?

Your PC financial travel insurance may cover medical insurance alone or a combination of travel medical and trip protection, although the specific policy details, including coverage duration and limits, vary across different plans offered.

Generally, the PC Financial Travel covers a few or all of the following based on your plans:

- Trip cancellation and interruption coverage: Reimburses non-refundable expenses if a trip needs to be canceled or cut short due to covered reasons like illness, injury, or severe weather.

- Travel medical insurance: This provides coverage for medical expenses incurred while traveling, including emergency medical treatment, hospital stays, and sometimes even medical evacuation back to your home country.

- Lost or delayed baggage coverage: In the unfortunate event of lost, stolen, or delayed baggage, this coverage will provide reimbursement for the replacement of essential items.

- Trip delay coverage: If your flight or other transportation is delayed (for a specific period of time), this coverage can reimburse you for expenses such as meals, accommodations, and transportation during the delay.

- Travel accident insurance: Offers coverage for accidental death or dismemberment that occurs during travel on planes, trains, or buses.

- Rental car insurance: Coverage for collision damage or theft of rental vehicles.

- Covid Travel Insurance : Covers Covid-related medical emergencies, repatriation and booking cancellations.

Here is a table to give you a quick overview of the coverage provided under the PC Financial Travel Insurance:

What does PC Financial Travel Insurance not cover?

PC Financial Travel Insurance, like other insurance policies in the market, has certain exclusions and limitations.

These may include coverage exclusions for pre-existing medical conditions, high-risk activities such as extreme sports, and incidents related to intoxication or drug use. Any claims arising from incidents related to being under the influence of alcohol or drugs may not be covered by the policy.

Additionally, travel to restricted or high-risk destinations may impact coverage eligibility. It's important to thoroughly review the policy's terms and conditions to fully understand the coverage limitations and exclusions that may apply.

If there are any uncertainties or specific concerns, it is advisable to contact PC Financial directly for further clarification.

How much does PC Financial travel insurance cost?

The price of PC Financial travel insurance depends on the following factors:

- Your desired coverage and respective policy

- Your deductible

- Your waiting period

- Your destination(s)

- The duration of your trip

You can compare coverages and prices of the best travel insurances in Canada using our comparator below and also get quick quotes based on your unique needs.

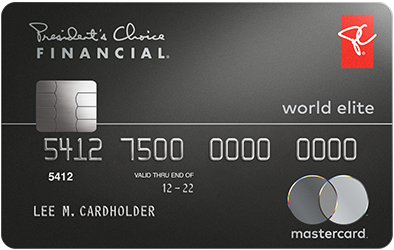

Is there a PC financial Mastercard travel insurance?

Yes, like other popular credit cards with travel insurance (to hyperlink later), President's Choice also offers this option. However, the extent of coverage and fee involved vary based on the type of credit card you choose.

PC has three primary credit cards. They are World Elite MasterCard MD , World MasterCard MD , and MasterCard MD .

PC Financial World Elite MasterCard travel insurance

PC World Elite MasterCard travel insurance provides up to $1,000,000 coverage for various emergency medical expenses during your travel including doctor charges, accidental dental care, return airfare, and more.

It also has car rental loss/damage and baggage coverage among others. It is important to read the offer documents of your card carefully.

To make insurance claims, it is highly important to ensure that your PC World Elite Mastercard account is in good standing at the time of the occurrence and the claim.

PC Financial World MasterCard travel insurance

The PC Financial World Mastercard does not offer any travel benefits, however, it does offer reward points for purchases made with respect to travel. It's best to check with your card provider to get accurate and up-to-date information.

PC Financial MasterCard travel insurance

The PC Financial MasterCard does not provide travel benefits by default. However, it might give you rewards and redeemable points that could prove beneficial for your trips and vacations. It would be best to get in touch with your provider for more information on this.

Good to know

In order to get these credit cards, you must satisfy certain eligibility criteria that also include a minimum yearly personal income or household income, apart from other credit approval criteria. Also, it's important that your travel purchases are made on your specific credit card to be eligible for claims after.

How do I contact PC travel insurance?

You can get in touch with the PC Financial travel insurance phone number: 1-844-862-8466 or 1-866-246-7262 . They are both toll-free numbers. You may have to wait a few seconds to minutes in queue when the lines are facing an unexpectedly high volume of enquiries.

The numbers are available only between 9:00 am and 5:00 pm (ET) from Monday to Friday. Weekends are closed for in-phone enquiries.

You could also fill up and submit a form on their website that is available under the contact us category and an agent will get in touch with you shortly after.

If you're an insurance holder, however, in the event of an emergency, however, you can call the toll free at 1-855-856-7569.

How do I file a claim for PC financial travel insurance?

To file a claim, you can get in touch with your provider directly on the phone and a customer service agent will guide you through the process.

You could also login on the PC Financial website to fill the claim form. It is extremely important to make sure you have all the supporting documents like invoices for purchases, bills, etc, at the time of claims process.

How do I cancel my PC financial travel insurance?

If you are looking for information and instructions to cancel PC Financial travel insurance at any time, please call 1-866-246-7262 to speak with a representative.

But canceling your travel insurance might mean putting yourself at the risk of financial stress should you be faced with unforeseen medical and other related issues during your travel. So, it's strongly recommended that you opt for a travel insurance that best suits your needs.

Now that you have a good idea about PC Financial Travel Insurance, you can compare it with the best travel insurances in Canada using our comparator below and also get quick quotes .

Save up to 25% on your travel insurance with our partner soNomad

Get a quote

1-888-550-8302

Nishadh Mohammed, an experienced news editor and writer, has been a member of the HelloSafe team since May 2023. With a robust nine-year background in journalism and content creation, he has transitioned from impactful roles at major Indian newspapers to steering the course of online content as the managing editor of The Daily Net. Possessing a proficiency in crafting content for diverse audiences, Nishadh also brings a deep understanding of data analytics tools such as SQL, Tableau, and Knime. His commitment goes beyond crafting engaging financial content for HelloSafe; he navigates the ever-changing SEO landscape, leveraging data-driven insights to make informed decisions. When he's not wrestling with SEO algorithms, Nishadh indulges in reading and passionately explores narratives on human rights, intersectionality, race, caste, and LGBTQIA+ issues.

This message is a response to . Cancel

- Book Travel

- Credit Cards

PC Financial World Elite Mastercard

Signup bonus:

Annual fee:, earning rate:.

The PC Financial World Elite Mastercard is a fine choice for people who frequently shop at Loblaw’s brands, but otherwise has limited appeal.

Bonuses & Fees

The card currently has a welcome bonus of 20,000 PC Optimum points upon making their first purchase at a store that participates in the PC Optimum program.

Occasionally, new applicants can earn a welcome bonus of 100,000 PC Optimum points upon making their first purchase at a store that participates in the PC Optimum program. If you’re interested in the card, consider waiting for this offer to make an appearance before applying.

The card has no annual fee .

Earning Rewards

The card has category bonuses for shopping at specific stores:

- All Optimum members earn an additional 15 points per dollar spent at Shoppers Drug Mart and Pharmaprix, regardless of which credit card is used to pay

- Earn at least 30 Optimum points per litre at Esso and Mobil gas stations

- Earn 30 Optimum points per dollar spent at PC Travel

- Earn 10 Optimum points per dollar spent on all other purchases

While these rates cover a wide range of categories, they only apply at these particular merchants. So while the card may appear to have strong earning rates, it only benefits cardholders who already shop at those stores, or are willing to change their shopping habits.

Redeeming Rewards

PC Optimum points have a value of 0.1 cents per point , with occasional 50% bonus redemption events. Points can be redeemed at PC Optimum’s partner grocery stores and drugstores.

Perks & Benefits

The PC Financial World Elite Mastercard has no meaningful perks or benefits to speak of.

Insurance Coverage

The card has a modest insurance package, including emergency medical insurance for trips up to 10 days, and standard extended warranty and purchase protection .

It also includes rental car collision insurance for cars up to an MSRP of $65,000.

However, it doesn’t offer the specific provisions that are important to travellers, and the coverage it does provide can also be found on many other cards.

As a World Elite product, this credit card has a minimum annual income requirement of $80,000 (individual) or $150,000 (household). Follow the below link to the PC Financial website to learn more about this card and submit an application.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- No annual fee

- Earn 45 PC Optimum Points per $1 dollar spent at Shoppers Drug Mart

- Earn 30 PC Optimum Points per $1 spent where PC Products are sold and at PC Travel

- Earn at least 30 PC Optimum Points per litre at Esso/Mobil locations

- Earn 10 PC Optimum Points per $1 spent on all other purchases

Welcome bonus and earn rate

What’s interesting about the PC Financial World Elite Mastercard is that it doesn’t typically have a welcome bonus when you apply online. However, if you’re applying in-store where there’s a PC Financial booth, they’ll usually give you 100,000 points when you sign up. That’s a value of $100.

As for the earning rate, you’ll get 45 points per $1 spent at Shoppers Drug Mart, 30 points at Loblaws-owned grocery stores (Loblaws, Superstore, No Frills, Fortinos etc.), Esso/Mobil Gas stations, PC Travel, and 10 points on all other purchases. That works out to a 4.5%, 3%, and 1% return in PC Optimum points respectively.

PC Financial World Elite Mastercard benefits

For a no fee card, the PC Financial World Elite Mastercard comes with a decent amount of benefits. Mind you, many of these benefits come with any World Elite Mastercard, but you get access to them by being a cardholder.

Travel emergency medical insurance

Those under the age of 65 get $1,000,000 in travel emergency medical insurance. This insurance applies the second you travel out of province and covers things such as ambulances, doctor charges, hospital stays, dental care, prescription drugs and more. The coverage lasts for the first 10 days of your trip. You do not need to charge your travel expenses to your PC Financial World Elite Mastercard for the insurance to apply.

Car rental collision/loss damage waiver insurance.

When you charge the full cost of your car rental to your PC Financial World Elite Mastercard, you get 31 days of car rental collision/loss damage waiver insurance. This covers you from damages if you’re in an accident, but you need to decline the rental agency’s insurance for your policy to be valid. note that this doesn’t cover you for any liability.

Airport lounge access

One little known benefit of this card is the included Airport Experiences provided by LoungeKey. This gives you access to more than 1,400 airport lounges worldwide. That said, this is just a membership you’re getting. You still need to pay for each individual visit, which is typically US $32.

Purchase assurance

Any purchases charged to your PC Financial World Elite Mastercard are automatically covered with purchase assurance. If anything happens to your goods, including loss, theft, or damage in the first 90 days, you can have them replaced/repaired at no charge.

Extended warranty

Your manufacturer’s warranty is doubled, up to one additional year, as long as you charge your purchase to your PC Financial World Elite Mastercard.

Concierge service

You can contact a Mastercard concierge 24/7 to help you with things such as booking restaurants, purchasing gifts, arranging translation services, and more. Admittedly, all of these things can be done on your own, but I suppose a concierge can be helpful if you’re in a foreign country where you don’t speak the language.

How to redeem your points

PC Optimum is one of the most popular loyalty programs in Canada. You can redeem 10,000 PC Optimum points for $10 in groceries or merchandise at Loblaws-owned grocery stores and Shoppers Drug Mart. In addition, you can use your points at Esso/Mobil gas stations for discounts on your gas purchases or for free car washes.

Occasionally, Shoppers Drug Mart has bonus redemption offers. For example, there was a promotion where you could claim 250,000 points for $400 in credit. That’s $150 more than the regular redemption, so it can be worthwhile to save your points. They’ve also had other offers, such as earning 20X the points or getting 25,000 points when you spend $75. Read my post on how to earn more PC Optimum points if you want to maximize your points.

PC Financial World Elite Mastercard eligibility

- You’re a Canadian citizen or permanent resident.

- You’re at least the age of majority in your province or territory

- You have a minimum annual personal gross income of $80,000 or a household income of $150,000.

Although PC Financial doesn’t state what credit score is required to be approved, they say a credit check will be performed at the time of application. Generally, you’ll want to have a credit score of at least 700 before applying.

How the PC Financial World Elite Mastercard compares

The PC Financial World Elite Mastercard is the best for earning PC Optimum points. That said, there are a few cards worth comparing since they offer better earning rates on groceries.

PC Financial World Elite Mastercard vs. American Express Cobalt Card

The American Express Cobalt Card has an earning rate of 5 American Express Membership Rewards points per $1 spent on eats and drinks (includes grocery stores), 3 points on streaming services, 2 points on travel and transit, and 1 point for all other purchases. The earning rate here is clearly higher than what the PC Financial World Elite offers. There’s just one problem: American Express isn’t typically accepted at Loblaws-owned grocery stores. While the Cobalt Card is one of the best cash back credit cards in Canada , it’s useless if your grocery store doesn’t accept it.

PC Financial World Elite Mastercard vs. Scotiabank Gold American Express

Another card with a high earning potential is the Scotiabank Gold American Express . With this card, you’ll get 6 Scene+ points per $1 spent at Empire-owned supermarkets (Sobeys, Foodland, IGA, FreshCo), 5 points at other grocery stores, dining, and entertainment, 3 points on gas, and transit, and 1 point on all other purchases. If you shop at an Empire-owned grocery store, this card is one of your best choices. It’s also worth mentioning that the Scotiabank Gold American Express has no foreign transaction fees.

PC Financial World Elite Mastercard vs. Rogers Mastercard

The Rogers Mastercard is a good comparison since it also has no annual fee, and it’s a Mastercard. If you have one qualifying service with Rogers, Fido or Shaw, you’ll earn 2% cash back on all your purchases. While that earning rate is lower than what the PC Financial World Elite Mastercard offers on Loblaws-owned stores, Shoppers Drug Mart, and Esso gas stations, the base earning rate could compensate for it. In addition, if you redeem your cash back earned for Rogers services, you get a 30% boost, so you’re actually getting a cash back rate of 2.6%. The other appealing aspect of the Rogers Mastercard is that it has no formal income requirement, so it’s easier to be approved for compared to the PC Financial card.

Final thoughts

My PC Financial World Elite Mastercard review is positive. This card is ideal for anyone in the following situations:

- You want to earn more PC Optimum points – No other credit card gives you a higher earning rate for PC Optimum points.

- You shop at Loblaws-owned stores – If you shop at Loblaws, No Frills, or Superstore, this is a card you want to earn points on every purchase. Otherwise, you’ll only earn points on in-store and targeted offers.

- You don’t want to pay an annual fee – This is one of the few World Elite Mastercards with no monthly or yearly fee.

PC Optimum is one of the best loyalty programs in Canada. With the PC Financial World Elite Mastercard, you’ll be able to earn PC Optimum points on every purchase. Plus, with no annual fee, getting this card and only using it where you get an enhanced earning rate could be worth it.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

92 Comments

Are you sure about the Priority Pass membership?

Yup, please see MasterCard’s website

https://www1.mastercard.com/content/mc/offer-exchange/world-elite/apmea/en/travel/airport/Airport_Lounge_Access.html

And their list of partner banks

https://www.mastercard.ca/en-ca/search-by-bank.html

Just enrolled, thanks for the tip !! Was unaware.

Another possible URL:.

Airports.mastercard.com

If I’m going out of country do I need to call PC World elite travel insurance before leaving on vacation?

You only need to call the insurance line if you’re making a claim. That said, if you plan on your PC Financial Mastercard when you’re abroad, you should call them in advance to let them know you’re travelling.

Where do you sign up for it then? I see no mention of this on the PC World Elite Mastercard page?

I believe PC Financial doesn’t mention it on their website since there’s a copyright issue with the name. However, if you go to the MasterCard site, you’ll see they’re listed as a partner.

To be honest, I don’t know how you get your actual membership with them. You may need to call MasterCard for that info.

so when I go to the PC world Elite Mastercard site, I find:

As a World Elite MasterCard cardholder, you receive

Complimentary Priority Pass membership One free lounge visit per cardholder per year

Simply present your Priority Pass membership card upon arrival at the lounge.

but when I go to the Priority pass site, it shows membership costs for Canada at $99 us.I assume that you need a priority pass card to get into the lounge?? How do you get the complementery one that is suposed to come with the credit card? What am I missing here?

With Priority Pass, you need a membership just to access the lounge. Depending on what membership you have, you’ll either get free visits or pay the one time fee of $27USD per visit.

So the One free lounge visit per cardholder per year = 1 time visit. After you’ve used that voucher or whatever it is, you pay $27USD per visit.

To be perfectly honest, it’s been difficult to get confirmation about how to get that actual one free pass. PCF is not responsible for that benefit so you need to call MasterCard. I’ve heard so many different things about the LoungeKey access with MasterCard that it’s impossible for me to give accurate information.

If I am approved… if I make a purchase at Shoppers drug mart will I need to just pay with the PC MasterCard to earn my full points or will I also need to show my PC Optimum card in addition? Is there any point in having a physical PC Optimum card if you are a PC MasterCard holder?

If you have a PCFWEMC or any Mastercard and have linked it to your PC Optimum account, then you don’t need a physical PC Optimum card. Your credit card will be fine.

I find that I do need to present twice, for points then payment, though if you have a smartphone one need not carry the loyalty nor the credit card. Personally I keep them in the Wallet app in my iPhone and use those to scan for the points & then verify the purchase (Which uses NFC to wirelessly talk to the swipe terminal.)

D. Cornelius,

Yes you do need to tap with your PC Mastercard first to get points and then again to pay. But you don’t physically need to have your PC Optimum card on you to earn points since your credit card will earn them.

Great review Barry! Merger definitely increased value with 45 total PC Optimum Points per $1 dollar spent at Shoppers Drug Mart and 30 total PC Optimum Points per $1 spent where PC Products are sold.

And, wow, a free annual standard membership ($79 US) to Priority Pass with one free visit AND no annual fee!

Yes, the PCFWEMC is a great card and offers tons of benefits with no fee which is why I love it.

Hi Barry, back to the Airport Lounge Access benefit …

I spoke with Mastercard Canada on the phone, and since I don’t have this card yet, the rep couldn’t check on the actual benefits without a CC#. She did mention that it depends on the financial institution whether the Lounge Access benefit is included, .

I checked this link and included an excerpt below: https://www.pcfinancial.ca/english/legal/pc-mastercard?list=3&scrollTo=abp-additional-exclusive

Benefits exclusive to PC Financial World Mastercard accounts Concierge Services are provided by Assurant Services Canada Inc. (ASCI). Details of what is included as part of this service is outlined in the Terms and Conditions sent with your card.

Additional benefits exclusive to PC Financial World Elite Mastercard accounts Car Rental Collision/Loss Damage Waiver Insurance is underwritten by American Bankers Insurance Company of Florida (ABIC), and Travel Emergency Medical Insurance is underwritten by American Bankers Life Assurance Company of Florida (ABLAC). Concierge Services and Identity Theft Services are provided by Assurant Services Canada Inc. (ASCI). Details of your insurance and service, including definitions, benefits, limitations, and exclusions, are outlined in the Certificate of Insurance sent with your card. Keep your Certificate of Insurance in a safe place with your other valuable documents, and take it with you when you travel. ABIC, ABLAC, ASCI and their subsidiaries and affiliates carry on business in Canada under the name Assurant®. ®Assurant is a registered trademark of Assurant, Inc.

Not sure if you have this card, or can confirm whether the Priority Pass membership + 1 free visit per year is definitely included with the PC World Elite Mastercard?

I have this card too but didn’t know that Priority Pass membership was free. I never got that info when I received my card. Did you get your membership from this card Barry?

Barry is wrong on this, period. I’ve had the card for 3 years, it does not entitle you to a priority pass membership.

Here’s the statement I received directly from PC Financial.

With the PC Financial World Elite Mastercard customers will earn 3X the regular PC Points when purchasing vacations, flights, hotels, cruises, car rentals and tours. Customers also receive exclusive travel offers at competitive rates and the Best Price Guarantee on all bookings (price matching within a 24 hr).

A new benefit introduced late last year is LoungeKey access:

If you are a PC Financial World and World Elite Cardholders you will be able to purchase lounge passes at over 800 Lounges Worldwide, including presence in all large airports in Canada and at the top Canada travel destinations at subsidized rates of $27 USD. Cardholders simply need to present their PC MasterCard World or World Elite card to the lounge staff, or register for the program by going to the “MasterCard Airport Experiences provided by LoungeKey” website. Benefits:

• Over 800 lounges, in over 400 airports worldwide (120+ countries), regardless of their airline, frequent flyer membership, or class of ticket. • Unique experiences and offers in dining, spa and retail outlets within the airport

so how do you get your one free visit if you have to pay $27 us per year?? Lots of confusion with this perk. Barry, perhaps you can investgate and clarify. – Thanks

Thank you for the info. This is was the clarification I was look for.

Paying $27 per visit is still better than paying $100 annual fee and $27 each visit with the priority pass.

Hi Barry… I’m a retiree and I have the HSBC Premier World Elite card. I shop often at shoppers and PC stores. In your opinion is it worth it for me to get the PC Elite card and split the loyalty points I’d get into two plans?

With the PCFWEMC you earn 4.5% back at Shoppers Drug Mart and 3% back where PC products are sold so you come out ahead compared to the HSBC Premier World Elite. The key is to take that money you save on groceries and to add it to your vacation fund.

Hi Barry…my wife and I love reading your financial and travel blogs. In your opinion what is the best credit card available now in Canada for maximizing returns to complement our HSBC card?

It really depends on where you shop and what categories you spend the most money on. e.g. where do you do all your grocery shopping? Do you spend a lot on gas? Do you eat out a lot?

We love to travel. When we’re home we shop usually at PC grocery stores or Walmart. We do love eating out.

So things could get complicated there.

If you shop at PC grocery stores – the PC Financial World Elite gives you 3% cash back which is quite high. At Wal Mart, you could keep using your CIBC card since it gives you 1.5%

If you eat out A LOT, then the Amex Cobalt card is good too since you get 5X the points. However, Cobalt points can’t be transferred to airlines. They can be used for fixed mileage rewards and transferred SPG at 2:1 so you still have some options.

Thanks Barry. Like your travel blogs you seem to write in a manner that is easy to read and understand.

Do you think getting an additional card for my spouse will allow my spouse to obtain free lounge access too?

If your spouse applies for the card on their own (as opposed to being a supplementary cardholder), then they would have lounge access. A reminder, that just the membership is free. You still need to pay for each visit.

Hi Barry, this is great! thank you for the post. if you use your PC WE MC for mainly gas, groceries and Shoppers, which would be a great cash back card for all the other stuff? thank you!!

Hi FernandoM,

It depends on where else you shop and what kind of benefits you like. The Tangerine money-back card since you can choose up to 3 categories that give you up 2% back.

Barry thank you for your reply! I use PC stores a lot so that would remain my main card (groceries, gas, etc.). for other stuff I can think of, monthly bills, random shopping, recreation…

I will definitely take a look into the Tangerine one. thank you!

I have the PC world elite Mc got it few weeks ago and I cannot see where are the 4.5X and 3X points. I can only see the base points which are 10X but how you know that you got the correct points? I called them several times but didn’t get a clear answer.

There’s honestly no clear place that shows you when you’re earning multipliers.

Your statement only shows you the total earned for the month.

Thank you for your answer. And yes, I know about the statement, but the statement shows only the base points.

With the comment above; do they send you a Priority Pass Membership card with it? or do we only get the LoungeKey Access membership free?

“As a World Elite MasterCard cardholder, you receive

Complimentary Priority Pass membership One free lounge visit per cardholder per year”

They don’t send you anything, but the one free visit is something offered by Mastercard as a World Elite cardholder. I honestly have no idea how to actually activate your membership and how to get that one free visit.

Thanks for the reply Barry. It’s still good to hear that you get LoungeKey Access membership for free which is nice a perk for a free NO FEE credit card.

yeah, it’s a pretty sweet perk once you figure out how to get it. No one at PCF customer service seems to know about it, but the Mastercard website lists PCF as a partner for LoungeKey access.

It’s been painful since the change was made. I am not getting 30 points/$1 with my PC World Elite Master Card instead only getting 20 points/$1 for purchases in PC stores. 0 points for purchases from non PC stores. However, no issue with purchases at Shoppers Drug Mart and I got the loyalty points showed up on my receipt, while PC stores did not show the points other than bonus points on the receipts. I had to submit the point adjustment requests for each and every receipts for PC stores and non PC stores. Sometime, I got the points adjusted for the non-PC stores, and another time I got reply telling me “In order to earn PC Optimum Points, you are required to go to PCOptimum.ca, sign-in into your account, load all offers on to your PC optimum account by viewing them, and swipe your card/device at the beginning of each transaction at participating stores. As a result of your card/device not being swiped for this transaction we are unable to make any adjustments to your account”. By the way transactions other than PC stores never showed up on my PCOptimum account. Telephone call to PC Mastercard regarding the issue was totally a waste of time and message send to PC Mastercard regarding the above issue is not getting replied nor resolution. This could be really a good card if PC Mastercard delivers their promises. I am kind of sick and tired of hearing the excuses about up to the stores including PC stores to give the loyalty points and how the heck do you tell non-PC stores to swipe your PC Mastercard before the transaction to get the loyalty points, so essentially consider sh** of luck getting any points from non-PC stores. Also, the email replies from sending the point adjustment request gave you a case# without reference to any information to the specific purchase nor the request detail. Hence it is a difficult task to match up with the receipts with the case# when I was requested to submit additional info. As always, buyer beware and don’t believe everything they tell you.

I have a MC President’s Choice Elite card. I find it impossible to decipher whether or not I am getting the appropriate amount of points on my purchases because of the way the Financial points are recorded. The detailed info for each posting should indicate which transaction it is for. ie purchase date and amount. I am concerned that I am not getting the correct amount of points. I guess I could do a points adjustment of every transactions but I do not want to have to do that. The computer system must have the info I am asking for. I use my MC for everything but I want to be assured that I am getting the correct amount of points. The points earned is why I have and use this card!

Hey Marion,

From what I understand, the bonus points only appear online via pcoptimum.ca. I agree it’s a bit sill that there’s no easier way to view your bonus points.

I do go online to pcoptimum,ca to view my earned points. I have been told by PC Financial that it takes 3-5 days for the Financial points earned to be posted. I can deal with that. But when the points are posted, I want to know which transaction the points are coming from. I have contact PC Financial with my concern but I am not satisfied with their response. Do you have an inside tract with PC Financial?

Unfortunately, I don’t know anyone who works there that would be able to assist.

Are there any caps on points earned in any of the categories? (At PC Stores, Shoppers, Anywhere else?) I ask this because on the ‘Points earned’ calculator in a recent email I received from PC, there is a cap of $2000 on spending in the ‘everywhere else’ category.

There’s should be no cap. I don’t know why they set a limit of $2,000 on the online calculator.

Thanks Barry, I didn’t think there was a cap.

Looks like PC optimum points is a scam. whenever there is an offer on Gas, I buy it. But i have to call customer care to get my points otherwise we don’t get any points. last week there was an offer 10,000 points on $40 purchase of gas. i still did not get points, i am still fighting for those. I will never ever go again to superstore and never use pc optimum. Whenever I called customer service they hangup the call. waste of time. I am planning to contact media and local news channels.

I registered for Lounge access with my PC Financial World Elite Card. I read that you can tell if your card receives a complimentary visit by going into the my account section. If you qualify for any complimentary passes the “complimentary” section will show. Mine does not…not surprised. So it looks like I have free access but will need to pay $27 US for each visit. I have a long stay in Miami for my next vacation the way the flights work out so I may use it.

Im trying to figure out what the best credit card combination for me would be. I’m retired so cash back is a great option. I was using my PC points to purchase gift cards until they removed that option last year. Now I have $400 worth in points I’m not sure how to redeem. I don’t shop at PC much. I shop at local organic grocery stores. I do shop at Shoppers sometimes, and ended up using some of it to buy sunscreen. I’d prefer to be able to get free items immediately like a gas card or even collect rewards for flights or vacations as being on a limited income makes though purchases tough. Any suggestions Barry?

Hi Michele,

With your remaining points you could shop at Loblaw’s or Superstore where they have organic produce and merchandise e.g. electronics and housewares for sale.

As for the best credit card, it depends on your spending habits and where you shop. The Amex Simply Cash preferred card and the Tangerine Money-Back card immediately come to mind as good choices

Hi, thanks for the share.

I received the Elite MasterCard this week and wondering if I have to make minimum amount of purchase with this card yearly to maintain my status.?

Please confirm, I can’t find this info anywhere, no one knows…

ONce you have the card, you keep it. There is no status with this card as it’s based on your minimum income, now how much you spend.

[…] the PC Financial Mastercards, you can increase your earn rate significantly. I personally have the PC Financial World Elite Mastercard and use it all the time. It honestly doesn’t take me long before I have enough points to make a […]

Avoid this card if you like to have online access to your account. I’ve had it for one month and still cant’ get access. Customer service has no answers. It’s an IT problem. They’re working on it. No time frame for resolution.

Can I use my pc elite mc in other countrie?

Yes, just make sure you let them know in advance of your travel dates.

Great review Barry. One thing to note which I’m a bit sore about – I am an existing PC MasterCard holder (the plain standard card) and I asked PCF if I could be upgraded to the World Elite (I am over the personal income requirment, and comfortably over the household earn requirement). They flat out said no and that I have to have spent $25000 over the past 24 months on my existing card in order to qualify. $25k is a pretty unreasonable sum for even a high spender on what is definitely not going to a primary travel card. It appears that PCF really don’t want people applying for this card (probably costs them too much from points redemptions).

I feel like that’s an uninformed rep. If you’re over the income requirement, they should be upgrading you no questions asked. It might be worth calling again to see if a different rep will upgrade you.

I currently have the PC Mastercard and was just approved for the PC World Elite card. I currently get 7 cents/liter back on my gas purchases, but I read the World Elite is only 3 cents/liter? Just curious. We have large vehicles and drive a lot, so our points add up fast just from gas purchases alone.

I believe you’re referring to the 70 PC optimum points that are earned at gas stations located at Loblaw’s owned grocery stores? That remains the same with the PC Financial World Elite card. The 3 cents earned per litre is at Esso/Mobil locations.

You may want to double check with PCF, but I’m pretty sure that’s how it works.

Excellent article! good one

Thanks for this review. But I was wondering what other credit card we could combine with the PC World Elite MasterCard to maximize our points. We shop mainly at the Loblaws and affiliate stores, so the PC WEMC is a perfect card for us.

Currently we have the Scotia Gold AMEX(restaurants, travel), Scotia VISA Momentum Infinite(grocery, gas),RBC VISA Infinite Avion, Home Trust Visa(US purchase), Capital One(Costco).

We do eat out frequently and vacation to the US at least once a year. I need to cancel all these credit cards, want to only have the PC WEMC and another card or two.

Can you suggest which other cards I should combine and will cancel the rest?

Hi Cecilia,

THe Scotia Gold Amex is actually a great complimentary card to the PCFWEMC especially if you use it to eat out a lot and travel. Come August 1st, you’ll earn 5X the points on restaurants and the card will have no forex fees.

https://www.scotiabank.com/content/dam/scotiabank/canada/en/documents/personal-banking/AW007111_CJ54869_Gold_AMEX_ENG_WEB.pdf

If you want to drop the Scotiabank Amex card, the Scotiabank Passport Visa Infinite card doesn’t give you as many points for groceries and restaurants, but you get a Priority Pass membership and 6 free annual passes.

With either of the two above cards, you could cancel the Home Trust card and the RBC Avion card.

My wife keeps pushing me for the PC World Elite MC as she is working for PCF.

I currently have TD Visa Infinite cash back card that gives me 3% on Gas, Recurring Payments and Groceries (from grocery stores – no Walmart or No Frills (Visa not accepted)).

TD Visa Infinite cash back card has a better travel insurance, rental car coverage etc than PCWEMC – Correct me if i am wrong

Does it make sense for me to go for PCWEMC just for the 3x points in No Frills shopping? BTW i have PC Optimum card that gives my 10 points on ESSO gas purchases.

Also we travel at least once a year to India or US which travel card do you recommend for lounge access + perks – Scotiabank Passport Visa Infinite or CIBC Aventura Visa Infinite?

If you always pay your bills on time, it doesn’t hurt to get the PCFWEMC since you would earn 30 points per dollar spent.

As for your other question about lounge passes and Nexus. I personally think the Scotiabank Passport Visa Infinite card is the best all-in-one travel card. Your wife would be able to use the free annual passes as long as she’s travelling with you (assuming you’re the primary cardholder). She wouldn’t be able to use the passes if she was travelling on her own.

Nexus is only $50 for 5 years, so although CIBC offers a rebate, the 2 extra lounge passes you get from Scotiabank every year are worth more. As I’m sure you know, the Scotiabank card also has no forex fees.

Hi Pradeep, Visa HomeTrust has you no exchange fees for currency. That is somewhere around 2.4% savings when out of country. Also, I get 1% cash back. So it is about 3.5% savings when travelling. Unless you get currency wihtout having to exchange it (ie cash gifts from family).

Thanks Barry. WiIl wait on PCFWEMC….

Scotia benefits are better and will go with it… Also will apply for a Supplementary card (wife) for free and add that to the Priority Pass account, not sure if they will let me register. Any thoughts?

The fine print on the Scotiabank Passport Visa Infinite card states that the Priority Pass membership is only valid for the primary cardholder so your wife would not qualify.

If she travels on her own quite a bit, it may be worth it for her to get her own card.

Thanks Barry 🙂

i only get 20 points for 1 dollar

You have the World card, not the World Elite.

i have the world elite.

The world elite card definitely earns you 30 points per $1 spent at Loblaws owned stores.

https://www.pcfinancial.ca/en/credit-cards/world-elite

thats what theY said.but i only get 20 for 1 dollar

You’d have to contact customer service again and tell them to look at your statement to varify that there’s an error and then have them fix it.

yes.i did.mastercard said it is points issue.points said its mastercard issue

my wife traveled to India last week. but unfortunately lost her luggage. she did not receive her luggage at New Delhi. Airlines are unable to track her luggage. My question is that as i paid her full ticket from PC choice world elite master card, will i be able to claim the baggage lost. please answer

Sorry to hear about your situation. Unfortunately, the PC Financial World Elite Mastercard does not come with any lost baggage insurance.

Hi, If I’m the primary card holder and I have a supplementary card issued in my Wife’s name, does the travel insurance cover her on a trip to the US. if that trip flight and hotel was charged in full on the supplemental card with her name on it if me as the primary card holder is not going on the trip with her? Thanks.

Your wife would not be insured with the card if you’re not travelling with her.

Thank Barry, I guess I’m going to Vegas as a 3rd wheel in a bachlorette party. Lol. By the way, what is the process if one needs to for example see a doctor or visit a hospital emergency room in the U.S.? Does the card member pay for all of the medical services 1st, keep the invoices, then file a claim afterwards or do you call and get pre-approval first? We are both Canadian born, I as the primary card holder and my spouse has the supplementary card. . And is it family coverage or just your spouse? And is there any deductible (i.e. card member pays first $100?). Thanks.

You’re supposed to contact your insurer before you seek medical attention or as soon as possible. Sometimes the doctor or hospital can bill the insurer directly, but sometimes you need to pay yourself and then make a claim. Generally speaking, your dependent children who are not students are also covered, again read the policy. Also note that the travel medical for this card only covers 10 days if you’re under the age of 65.

Thank Barry, can you post a link to the policy? Thanks.

https://www.pcfinancial.ca/docs/default-source/legal-stuff/pcf_worldelite_coi_en.pdf

Hi Barry, What cards currently have no forex fees? Which one offers the best cash back? Which card has best travel insurances. I do like the Amex option, but here in a more rural area, many merchants don’t accept Amex. Thanks

Check out these two pages.

https://www.moneywehave.com/canadian-credit-cards-without-foreign-transaction-fees/ https://www.moneywehave.com/best-cash-back-credit-cards-in-canada/ https://www.moneywehave.com/the-best-credit-cards-with-travel-insurance/

Hello! Thanks for the info. Does this card have any coverage for Trip Cancelation Insurance? We are currently en route to Australia from Canada with a stop over in Hawaii and Jetstar has cancelled our flight to Melbourne. Sadly, we forgot to purchase travel insurance before the trip (of course, the one time I forget…..).

Hoping this card will help over the costs at Jetstar is being absolutely useless. Cheers!

Unfortunately, this card does not have any trip cancellation.

Points are slow to add up, even if you spend a huge amount on the card. If you don’t pay off the balance on your card dinged over a 22% interest charge. In the end you do not come out ahead on the PC Mastercard!

If you’re shopping at Loblaws owned stores or Shoppers Drug Mart, the points add up fast. You’re basically earning 3% or 4.5% return on all your purchases and that doesn’t include any in-store or targeted offers. If you’re carrying a balance, the rewards are definitely not worth and you should focus on debt repayment. This is a no fee card so I would say the majority of people do come out ahead.

Sounds fantastic!! However I have the card and have been trying to get my points fixed for over 2 years. I still only get 10 points at gas stations and minimum at their stores. I called, wrote,started a points claim and even wrote to the PC ombudsman. All failed to follow up and follow through. Very disappointing.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

- Forum Listing

- Advanced Search

- Money Topics

- General Personal Finance Talk

PC Financial Mastercard world elite travel insurance

- Add to quote

Topping up travel insurance offered by credit card

Here’s a start. https://assets.ctfassets.net/xqp30uh3quox/5bjnPXwVaaD7dwD792v0TY/917c718b945ffc1051abcccbaf5598c4/pcf_worldelite_coi_en.pdf i believe the answers are: 1. Yes, automatic, subject to conditions such as pre-existing conditions 2. that’s up to you. You may consider the coverage from PC MC isn’t enough. It doesn’t need to be one or the other. What I’m not clear about is how these credit card medical coverages work if you are driving out of country. You don’t have any airline tickets to prove entry/exit dates….how would you prove when you left rhe country? I assume you would need to prove it.

But already that's not good, if they aren't even internally coordinated to answer public's basic answer.

Did you try this number: 1-866-892-8683

This thread opened is just in a nick of time. Not trying to break your estatic balloon in getting covered/iinsured even with the top up ... try getting your claim paid or deemed approved is a nightmare. Just read yesterday from G&M(?) that a gentleman broke his back from sleep-walking off his hotel's balcony (weird or what?) whilst vacationing down south (somewhere). Boy did he get his money's worth ... of hassles. He was so closed to being a paralyzed from the waist down before he got approval for the emergency surgery from his "out of country cc covered insurer" some days later ... after calling like not hanging up at all. The insurer's 1800 # wasn't being picked up ... the usual "normal than higher volulme BS" so be prepared to wait ... hours ... if not days ... if not never. Holy jesus. Only if you're interested, I'll look for the link and p ost o/w it's not all that uncommon or unheard of ... these days. You pay and you take your chances.

From past experience, what matters is the terms of the insurance contract in effect when you enter into the contract. Suggest you download and read carefully to assess you are covered for the specific risks you are concerned about. Or post a link to it here and we can chime in. What the website or an agent say are at best only useful if you keep records and go to court months after the fact. In other words, if you have a claim someone will read the Terms in the Contract and pay based on that. Or not.

Tostig said: The benefits detail from the PC Financial website says includes "airfare". So I think it that means trip interruption. Click to expand...

Attachments

- pcf_worldelite_coi_en.pdf 537.2 KB Views: 63

I just found out that TD’s US dollar Visa offers some trip interruption coverage. Up to $5,000 of coverage per insured person, to a maximum of $25,000 for all insured persons on the same trip. To be eligible for this insurance, you must pay at least 75% of the entire cost of your trip, including taxes and fees of the Common Carrier fare, and any hotel or similar accommodations with your TD Credit Card.

- you must be under age 65

- you must be permanent residents of Canada with active provincial health insurance

- pre-existing conditions are excluded

- only the first 10 consecutive days of a trip are covered

James has provided a pretty good synopsis of how these plans work (as I understand it as well). Medical vs Trip Interruption & Cancellation are two very different things. Be sure to understand the difference and the one (or both) that you require. Be sure to fully understand the limited coverage of credit card plans and recognize it cannot be all that good considering how expensive such insurance coverages actually are. On a personal basis, I have ex-country health/medical coverage as a part of my annuitant heath benefit plans via Global Allianz which is ultimately the largest provider of this type of insurance. It is the same ex-country insurance active employees of the corporation have when they are traveling on company business. The part I have to cover on my own is Trip Interruption and Cancellation if I choose to do so. I bought this coverage back in 2015 when we were going for a Peru trip and I still had a very elderly parent alive. As it turned out, she died 5 days before we were to leave.We obviously had to cancel the trip. It took a lot of work but we were compensated for our non-refundable sunk costs because of that situation. We no longer buy TI&C because now that we are in our mid-70s, we have become higher risk of not being able to travel when scheduled and premiums have increased to about 10% of the value of the trip. We now self-insure on the premise that failure to follow through on 1 of 10 trips will pay for itself (like windshield coverage). We didn't buy TI&C for our recent trip to Costa Rica and we have not done so for our upcoming trip to Maui. Somewhere along the line, we may get caught exposed but we will take our chances.

AltaRed said: We no longer buy TI&C because now that we are in our mid-70s, we have become higher risk of not being able to travel when scheduled and premiums have increased to about 10% of the value of the trip. We now self-insure on the premise that failure to follow through on 1 of 10 trips will pay for itself (like windshield coverage). We didn't buy TI&C for our recent trip to Costa Rica and we have not done so for our upcoming trip to Maui. Somewhere along the line, we may get caught exposed but we will take our chances. Click to expand...

We also look for opportunities for refundable bookings, or relatively short lock-ins. Easy to do with airfare but more difficult with bookings in resort places, and even less easily with 'vacation packages'. Our Costa Rica package was not refundable at all about 30 days out from commencement. It is a calculated risk we take.

For packages, most tour operators sell a cancellation insurance that is not age-dependent. Runs usually $50 pp for the cheap coverage (gives you future vacation credit rather than your money back) or $100 pp for the better coverage (cancel for any reason, full refund, up to 24 hours before travel).

Lots of good advice given here. I will check the other thread again and call PC Financial about the possibility of topping up the insurance for an extra two days and trip cancellation and interruption.

Well my call to PC Financial's insurance administrator at the number on post #4, didn't get any results. No top ups are available. So I called CAA and got a quote for 2 extra days and for trip cancelation and interruption. It's over $500 for a $7000 trip for two people. Then my wife comes home and gets on the phone to talk to her pension administrator. It turns out we can register and pay an annual fee of something like $250 for the both of us to have trip cancellation and interruption as well as travel medical for all our trips. And for the trip we are booking, $35 per person. So, for us, problem solved.

Thank you. I was remiss in not saying that actually. In the case of WestJet vacations (our Costa Rica trip) it only covers up to 3? 5? days before travel, so there is a short window of real exposure. Anyways, your point is well taken.

We had/have Capital One world elite Mastercard. When we called to make a cancellation claim the C1 CSR had no information other than contact their insurer at this 1 800 number. We did, and had good service/good experience. The claim paid for more than 10 years of card fees. Our experience is that the credit card CSR’s only seem to have a data sheet with very general talking points. Anything else…call their insurance carrier. No surprise.

- ?

- 689.7K posts

- 166.2K members

Top Contributors this Month

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Buying the Best Travel Medical Insurance for You [2024]

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3126 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![pc financial medical travel insurance Buying the Best Travel Medical Insurance for You [2024]](https://upgradedpoints.com/wp-content/uploads/2020/12/Travel-Medical-Insurance.jpg?auto=webp&disable=upscale&width=1200)

What Is Travel Medical Insurance?

Plan limits.

- Deductibles

Length of Trip

Does travel medical insurance cover covid-19, what doesn’t travel medical insurance cover, comprehensive travel insurance, health insurance, how does travel medical insurance work, how much does travel medical insurance cost, credit card coverage, travel medical insurance policies, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The thought of getting sick or injured while traveling can be one of the most stressful aspects of planning a trip. Often, travelers assume that their primary health insurance will cover all costs of medical expenses on their trip, but not every health insurance plan covers every country and situation.

To ensure you have coverage if you need it, you may need to consider purchasing travel medical insurance. This can fill the gap between your regular insurance and any coverage you may have with your credit cards . We’ll break down all of the important details and tell you everything you should know about travel medical insurance.

If you are traveling domestically within your own country, you will likely be covered by your primary health insurance. If you are traveling abroad, your coverage may not extend to those other countries. This is primarily where travel medical insurance comes into play.

Travel medical insurance is a type of international insurance designed to cover emergency health care costs you might face when you are traveling or vacationing abroad.

A travel medical policy can be an important addition to your trip since your primary health plan may not cover you fully if you need assistance outside of your home country. An uninsured injury or illness abroad can result in a huge financial burden that can be significantly reduced by having travel medical insurance.

Bottom Line: Travel medical insurance is recommended by the U.S. Department of State, the Centers for Disease Control and Prevention (CDC), and the World Health Organization (WHO).

According to Allianz Travel, the most common overseas medical emergencies that are claimed include:

- Fractures from falls

- Cardiovascular problems such as a heart attack or stroke

- Trauma involving motor vehicles

- Respiratory problems such as a collapsed lung

So going with that first item, let’s say you’re exploring Europe and end up twisting your ankle on the beautiful, but uneven cobblestone streets in Rome. Depending on the plan you choose, you may be covered for:

- The cost of a local ambulance to transport you to the hospital

- Your emergency room co-payment

- The bill for your hospital room and board

- Any other eligible medical expenses, up to your plan limits

But there are limitations to travel medical insurance. Before you purchase a plan, it’s important to know exactly what you are buying — including which things are and aren’t included in your coverage.

What Does Travel Medical Insurance Cover?

Travel medical plans are designed to help in the event of an unforeseen illness or injury while traveling abroad. Travel medical insurance offers emergency medical expense coverage as well as emergency evacuation coverage. This means that the plan will reimburse you for reasonable and customary costs of emergency medical and dental care (up to the plan limits — discussed below).

It is important to look closely at all plans you are interested in since many important things are hidden in the details. You might also find it helpful to brush up on your insurance lingo before doing this.

Travel medical insurance covers emergency medical costs up to the plan limit. Plan limits vary greatly by plan but typically fall between $50,000 and $2,000,000. This is obviously a HUGE range, so you will have to determine the correct amount of coverage based on a few key items:

- How much (if any) will your own health insurance plan or credit card cover when you’re traveling outside of your home country? As we discussed above, Medicare doesn’t cover you at all outside of the U.S., so this would be an instance where you might want your plan’s coverage limit to be higher.

- How long is your trip? If you’re going to be away for more than 1 to 2 months, you might want a higher plan limit to account for the greater exposure to risk.

- Do you need extra coverage due to risky activities? For example, if you expect to ski, mountain climb, or do any other risky activities where you might get injured, you might want a higher plan limit.

- What do you feel comfortable with? If you feel safer having $100,000 as opposed to $50,000, then that may be the right decision for you. This insurance plan should provide you a sense of security so you can enjoy your trip.

Most medical single trip plans have some sort of deductible that you must pay before any benefits will be paid. After this, your travel medical insurance will cover any remaining costs, up to the plan’s limit.

However, you will be offered the option to increase, decrease, or remove the deductible altogether. Based on this choice, the price you pay (aka the premium) will be affected accordingly. For example, if you choose a higher deductible, your premium will decrease. If you choose a lower (or no) deductible, your premium will increase.

You are covered by travel medical insurance based on the type of plan you purchase. These come in 3 types:

Single-Trip Coverage

This is the most common type of travel medical insurance. When you leave your home, go on a trip, and then return home, this is considered to be a single trip. While on your trip, you can still visit multiple countries and destinations all under the umbrella of this single trip. You will be covered for the duration of this trip under a single trip travel medical insurance plan.

Multi-Trip Coverage

Multi-trip coverage is for multiple trips and often purchased in 3-, 6-, and 12-month segments.

Long-Term Coverage

This is continuous medical coverage for the long-term traveler (think expats or people working abroad) and is typically paid on a monthly basis.

Many travel insurance policies offer good medical coverage, but not all plans cover expenses related to COVID-19 . If that’s important to you, make sure to verify that the plan you’re buying specifically covers you in case you contract COVID-19.

In general, cancellations due to fear of travel are not covered. However, some plans cover you if you or your covered traveling companion were to become sick as a result of COVID-19. This means that you could still receive benefits for the losses that are covered by the plan.

Many countries around the world , such as Costa Rica and the United Arab Emirates, are even requiring travelers to hold a specific level of medical coverage to account for COVID-19-related medical care and evacuation.

In addition, “ Cancel for Any Reason ” has become a hot topic. This optional coverage is not available with all plans but lets you cancel a trip for a partial refund no matter what your reason — including unexpected travel bans, lengthy quarantine periods, or cancellations due to concerns over COVID-19.

Since travel medical insurance is meant to cover emergencies, certain types of expenses are excluded from most travel medical policies. In addition, for insurance purposes, a pre-existing condition is general defined as any condition:

- For which medical advice, diagnosis, care, or treatment was recommended or received within a defined period of time prior to your coverage date (varies from plan to plan, but is typically within 60 days to 2 years)

- That would cause a “reasonably prudent person” to seek medical advice, diagnosis, care, or treatment prior to your coverage date

- That existed prior to your effective date of coverage, whether or not it was known to you (commonly includes pregnancy)

Hot Tip: You do not need a medical examination in order to purchase travel insurance. If you have a claim, the insurance company will investigate to ensure that your claim occurred during the coverage period of your policy and wasn’t a result of any pre-existing conditions.

Here are some of the most frequent exclusions:

- Pre-existing conditions as defined above

- Routine medical examinations and care (i.e. wellness exams, ongoing prescriptions, etc.)

- Routine prenatal, pregnancy, childbirth, and post-natal care

- Medical expenses for injury or illness caused by extreme sports

- Mental health disorders

- Injury caused by the effects of intoxication or illegal drugs

- Payments exceeding the plan limit

Unless you’ve purchased a comprehensive travel insurance plan, other exclusions include claims related to:

- Trip cancellation

- Lost luggage

- Rental car damage

Be sure to read the description of coverage for any plan you’re considering before you make the purchase. While reading the entire document front to back can be tedious, it’s better to know what’s excluded before you attempt to make a claim.

What Travel Medical Insurance Isn’t

Now that we’ve let you know what is and isn’t covered by travel medical insurance, we’ll also breakdown the difference between travel medical insurance and other similar options.

Comprehensive travel insurance plans offer the most benefits of all plan types and will typically include medical coverage. It can offer you additional coverage for things like trip cancellation, trip delay and cancellation, lost luggage, and more. It’s the best way to cover a host of potential common travel-related problems.

Some comprehensive plans also offer additional coverage for things like rental car damage, Cancel for Any Reason, or a pre-existing condition waiver.

Bottom Line: Comprehensive travel insurance is a full-service plan and includes travel medical coverage as well as other coverages that will protect all aspects of your trip.

You might be thinking that already have medical insurance provided by your employer or through Medicare. However, when you travel to other countries, your primary health insurance might not go with you. Before your trip, check to see whether your domestic plan provides any coverage once you’ve left your home country since many offer limited or no coverage.

In case of a medical emergency, you will want to be able to lay your hands quickly on your travel insurance plan’s contact information for the 24-hour Emergency Assistance program as well as your policy number, so make sure to keep this information somewhere that is easily accessible. Also, be sure you know how to place a call to that number from outside the country.

This is important because you’ll be required to call your travel insurance provider and notify them that you need to be seen by a medical professional as soon as possible. Obviously, you may not be medically able to call before you seek emergency medical treatment, but you should do so as soon as you are able to.

The earlier you can call, the more likely it is that you can avoid any issues for payment of claims and you can also get help and advice from the company’s emergency assistance program.

Bottom Line: Specific details on when and how to contact your insurance provider in case of a medical emergency vary by plan and provider, so thoroughly review these details in your plan information.

For example, in the event of an emergency that requires emergency medical evacuation, your insurance provider will have to approve the evacuation and even make those arrangements for you. If you don’t call ahead to have them do this, the company may not approve the expense and you may be stuck paying for the evacuation in full.

Once you are actually at a medical facility to receive care, make sure to document the experience as thoroughly as possible. This means asking for copies of all of your records before you check out. You’ll need to provide these records to the insurance company when you eventually file your claim and having proof of treatment and costs will assist you in filing a successful claim and getting your money back as soon as possible.

Travel medical insurance plans can vary widely in price, but in general, plans cost anywhere between 4-10% of your total non-refundable trip cost. The pricing of any plan takes into consideration many things, including a few that we discussed above, to determine the cost. These include:

- Age of travelers

- Plan limits

- Supplemental plans such as “Cancel For Any Reason” coverage or coverage for pre-existing conditions

- Length of trip

In addition, if you decide that a comprehensive plan is a better choice for you, this will also increase the price.

Which Company Has the Best Travel Medical Insurance?

The best travel medical insurance company for you may be determined by what type and how much coverage you’d like to have. Let’s review a few options and companies to consider.

Many premium cards have some medical coverage, so be sure to look over all of the best credit cards for travel insurance coverage and protection.

For example, cardholders of The Platinum Card ® from American Express may already have $15,000 of secondary medical coverage . For many, this may be enough, but for others, you may not feel comfortable at this level of coverage and want to purchase a travel medical insurance policy.

If you are looking to purchase a plan from a reputable company, a few options include:

1. Patriot Travel Medical Insurance from IMG Global

For the out-of-country plans, Patriot offers:

- Short-term travel medical coverage

- Coverage for individuals, groups, and their dependents

- Daily or monthly rates

- Freedom to seek treatment with the hospital or doctor of your choice

The following plans are available based on the level of coverage that you desire and you can request a quote through their website linked above.

2. GeoBlue Single Trip Traveler Medical Insurance

GeoBlue offers both the “Voyager Choice” and “Voyager Essential” single trip plans. Both plans allow you to choose your level of medical coverage (from $50,000 up to $1 million) and offer $500,000 in emergency medical transportation and repatriation coverage.

The main difference between the 2 plans is that the Choice plan does not require you to be covered by a primary health plan, but doesn’t cover pre-existing conditions. The Voyager plan will cover all pre-existing conditions, but functions as a secondary coverage after your primary health plan.

3. Allianz Travel Medical Insurance

Allianz offers an Emergency Medical plan that offers additional benefits that extend beyond simply medical coverage. This plan is a comprehensive plan that covers lost baggage and trip cancellation and delay, in addition to emergency medical coverage. See just a few of these benefits below:

In addition, many companies, such as AAA, offer travel insurance through Allianz, so you may receive a further discount if you reference your AAA policy.

Travel medical insurance can be beneficial for most travelers when traveling internationally as most primary health insurance plans won’t cover you abroad. We hope we’ve given you the tools you need to select a plan that works best for you and your travel needs.

At the end of the day, a travel medical plan is a great option if you’re traveling abroad and are not worried about covering trip costs due to a cancellation or added expenses due to a travel delay. Anyone looking for robust coverage for baggage or interruption should consider an upgrade to a more comprehensive plan.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Frequently Asked Questions

How much travel medical insurance do i need.

When considering the amount of coverage you’d like for your travel medical insurance plan, consider the following:

- How much (if any) will your own health insurance plan or credit card cover when you’re traveling outside of your home country?

- How long is your trip?

- Do you need extra coverage due to risky activities?

- What amount of coverage do you feel comfortable with?

Refer to the section titled “Plan Limits” for more detailed considerations.

How long does it take to receive travel medical insurance?

Travel medical insurance coverage starts the day of your trip, so you want to make sure you sign up for it before you leave. Most plans allow you to buy insurance up until the day before your trip.

However, the best time to buy travel medical insurance is within 15 days of making the first payment on your trip, since buying early can often qualify you for bonus coverages.

Is travel medical insurance worth it?

Depending on your primary health insurance and any secondary coverage you might be eligible for, travel medical insurance can still be a great tool to protect you from financial hits caused by injury or illness.

In addition, travel medical insurance can help organize assistance in extreme circumstances (such as medical evacuation). You can also pick the appropriate level of coverage to make you feel comfortable.

Does AAA offer travel medical insurance?

Yes, AAA offers travel medical insurance, but it is usually serviced by another company such as IMG Global or Allianz. You will normally receive a greater discount if you mention your AAA insurance policy, so don’t forget to include this when you request a quote!

Can you get travel insurance when already abroad?

Most companies do not offer travel insurance policies once your trip has already begun. There are a few reputable companies, such as World Nomads and SafetyWing , that are set up for long-term travel.

These companies allow you to purchase plans once your trip has already begun, but the rates may be higher than a plan that was purchased prior to leaving for your trip.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Key benefits of travel medical insurance

- Travel medical insurance coverage

- Who needs medical travel insurance?

Choosing the right travel medical insurance

How to use travel medical insurance, is travel medical insurance right for your next trip, travel medical insurance: essential coverage for health and safety abroad.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Travel medical insurance covers unexpected emergency medical expenses while traveling.

- Travelers off to foreign countries or remote areas should strongly consider travel medical insurance.