- Best overall

- Best for expensive trips

- Best for exotic trips

- Best for annual plans

How we reviewed travel insurance for seniors

Best travel insurance for seniors of april 2024.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Reaching your golden years doesn't mean your adventures have to end. In fact, in this stage of life, you'll hopefully have more time and resources to travel. But as a senior citizen, you'll want to ensure you have travel insurance that covers any health-related issues arise while you travel.

Best overall: Allianz

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz Travel Insurance is one of the most widely recognized names in travel insurance, and it stands out as one of the top travel insurance providers for seniors. It offers a wide range of policies covering medical treatments overseas and emergency medical transport.

Allianz also provides options for varying trip lengths. Its annual multi-trip policies , for example, cover any trip you make during your policy period, even if they aren't yet planned, making it an excellent option for seniors who vacation multiple times per year.

Read our Allianz Travel Insurance review here.

Best for expensive trips: John Hancock

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 3 travel insurance plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancel for any reason rider available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable travel insurance premiums

- con icon Two crossed lines that form an 'X'. Reviews of claims process are mixed

- con icon Two crossed lines that form an 'X'. Buyers may not get specialty coverage for sports equipment and other high value items

- Trip cancellation for 100% of the trip cost

- Trip interruption insurance for up to 150% of the trip cost

- Emergency medical coverage of up to $250,000 per person

- Medical evacuation coverage of up to $1,000,000

John Hancock Travel Insurance plans for seniors offer some of the best coverage available. It provides generous maximum benefit amounts while still offering affordable prices.

Each plan includes coverages like trip cancellation, emergency accident, and emergency medical, with the option to add benefits like CFAR (cancel for any reason). Plus, getting a free online quote is a quick and straightforward process.

Read our John Hancock Travel Insurance review here.

Best for exotic trips: World Nomads

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

World Nomads Travel Insurance is a great choice for active senior citizens under 70 who want comprehensive travel insurance. The key difference between World Nomads and many other providers is that it covers 200+ adventurous activities like scuba diving, mountain biking, surfing, skiing, and even bungee jumping. In addition, World Nomads' trip cancellation and emergency medical coverage includes COVID-19-related issues. Many other insurers are excluding that type of coverage now.

For adventurous senior citizens over the age of 70 years, World Nomads suggests working with its partner, TripAssure .

Read our World Nomads Travel Insurance review here.

Best for annual plans: Travel Guard

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip cancellation coverage of up to 100% of the cost, for all three plan levels

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR covers up to 75% of total trip costs (maximum of $112,500 on some plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Medical coverage of up to $500,000 and evacuation of up to $1,000,000 per person

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes COVID coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Above average baggage loss and delay benefits

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical evacuation coverage

- con icon Two crossed lines that form an 'X'. Premiums may run slightly higher than competitors

Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits.

- Trip cancellation coverage for up to 100% of the trip cost

- Trip interruption coverage for up to 150% of the trip cost

- Preexisting medical conditions exclusions waiver must be purchased within 15 days of initial trip payment

- Annual travel insurance plan and Pack N' Go plan (for last-minute trips) available

Travel Guard offers comprehensive insurance plans for shorter and longer trips. One of its more unique offerings is its Travel Guard Annual Plan.

This annual travel insurance comes with standard coverage benefits (trip delay, baggage loss, etc.) and substantial coverage amounts, which is important for seniors who travel multiple times per year. Travel Guard also offers a preexisting medical condition waiver, meaning those with certain medical issues can still gain coverage.

Read our AIG Travel Guard Insurance review here.

Understanding travel insurance for seniors

Before diving into the specifics, it's essential to understand what travel insurance is and why it's particularly important for senior travelers. The best travel insurance offers financial protection against unexpected events affecting your trip, such as trip cancellations, medical emergencies, or lost luggage.

Types of coverage

- Medical Coverage: Ensures your medical expenses are covered in case of illness or injury.

- Trip Cancellation/Interruption Coverage: Provides reimbursement if your trip is canceled or cut short due to unforeseen events.

- Baggage Coverage: Covers loss, damage, or theft of personal items during your trip.

Benefits of travel insurance for seniors

- Peace of Mind: Knowing you're covered in case of emergencies can make your travel stress-free.

- Financial Protection: Shields you from potentially overwhelming medical costs and trip cancellations fees.

- Assistance Services: Many plans offer 24/7 assistance services, providing help whenever and wherever you need it.

Making the most of your plan

After choosing a plan, it's crucial to understand your policy fully and know what services are available to you in case of an emergency.

Understanding your policy

- Read the fine print and understand the claims process to avoid surprises.

Emergency assistance services

- Familiarize yourself with the emergency assistance services offered by your plan and keep all necessary contact information handy.

How to pick senior travel insurance

It's wise to compare several different travel insurance policies for the best coverage and pricing, as premiums vary widely between insurers and depend on factors like your age and travel destination.

That said, some of the more essential coverages to look for if you're a senior citizen include:

- Travel medical coverage - This coverage will pay for your medical bills outside the US.

- Medical evacuation coverage - If you're injured or become sick while traveling, this coverage will transport you to the nearest hospital or even back home if your condition necessitates it.

- Preexisting conditions - Coverage for known health conditions. You'll need to purchase travel insurance within a certain time period from when you book your trip to qualify for a preexisting condition waiver .

- Cancel for any reason (CFAR) - The name says it all! It'll cost extra and you'll need to purchase insurance early, but it's the most comprehensive trip cancellation coverage you can get. Note that CFAR insurance usually only covers up to 75% of your trip fees.

- Trip cancellation insurance - This coverage provides reimbursement for your prepaid and nonrefundable costs if you cannot make your trip due to an unforeseen event.

- Baggage delay insurance - This coverage will reimburse you for essentials like toiletries and clothes if your bags are delayed.

- Lost luggage insurance - This coverage will reimburse you up to a specified amount if your bags get lost en route.

Of these, the most critical to note are whether or not your policy covers preexisting conditions and the limits for travel medical insurance and emergency medical evacuation.

Some insurance companies offer a waiver that will cover preexisting conditions. You'll have to follow the requirements for adding a waiver to your policy, like insuring the entire cost of your trip. Or purchase the policy within a specific time after making your first trip deposit payments.

You'll also want to find a policy with high maximum limits for travel medical and emergency medical evacuation coverage. These types of expenses can be substantial, so you want to have appropriate coverage.

When comparing senior travel insurance options, we looked at the following factors to evaluate each travel insurance provider:

- Coverage limits: We looked at each travel insurance company's coverage amounts for benefits like medical emergencies and trip cancellation.

- Flexibility: We looked at how customizable a policy is, so you can choose what your travel insurance policy covers .

- Coverage for preexisting conditions: Preexisting conditions are one of the more critical factors for travel insurance for senior citizens, so we looked at travel insurance companies that offer the best coverage for preexisting conditions.

- Price: We compared travel insurance providers offering reasonable basic and comprehensive coverage rates.

- Benefits geared towards seniors: We compared travel insurance companies that offer solid coverage for senior citizens, like medical evacuation, COVID-19 coverage, and trip cancellation.

You can read more about our insurance rating methodology here.

Seniors should look for travel insurance policies that offer comprehensive medical coverage, including for preexisting conditions and emergency medical evacuation. They should also consider policies with higher coverage limits to ensure adequate protection. Additionally, seniors should seek travel insurance plans that provide 24/7 assistance services, as well as coverage for trip cancellations, interruptions, and baggage protection.

The cost of senior travel insurance coverage can vary depending on your age, overall health, state of residence, travel destination, and length of your trip. However, assuming all other factors are the same, you'll pay more for travel insurance at 70 than at 30.

When it comes to saving money on senior travel insurance, you should only be covering the services that you need. For example, if your plane tickets are refundable, there's no need to insure those.

Allianz is the best travel insurance for seniors due to its wide array of medical coverages and emergency medical transport. Allianz also offers multi-trip insurance policies, which could make sense for seniors who travel frequently.

Most travel insurance policies will cover travelers up to age 80, and some even offer coverage up to age 99 or 100. The older you are, the more you should expect to pay for travel insurance.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Travel Insurance for Seniors & Retirees: 5 Top Picks

Allianz Travel Insurance »

Trawick International »

GeoBlue »

IMG Travel Insurance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Seniors and Retirees.

Table of Contents

- Rating Details

- Allianz Travel Insurance

- Trawick International

While anyone planning a trip overseas can benefit from having a travel insurance plan in place, older travelers need to prioritize this coverage more than others. The fact is, senior travelers and retirees have unique worries and risks to think about any time they travel far from home. These risks increase their need for travel health insurance and emergency medical coverage, as well as coverage for emergency medical evacuation that applies anywhere in the world.

Which travel insurance options work best for seniors? There are many travel insurance plans that were created with retirees in mind, although you'll want to compare them side by side. For example, you may want to look at coverage limits for medical expenses and coverage for preexisting conditions above all else.

U.S. News editors compared more than 20 of the top travel insurance companies to find the best plans for seniors. This list does the heavy lifting for you as you search for the best senior travel insurance of 2023, so read on to learn about the top picks.

- Allianz Travel Insurance: Best Annual Coverage

- Trawick International: Best Premium Travel Insurance for Seniors

- GeoBlue: Best Travel Medical Coverage for Expats

- IMG Travel Insurance: Best for Short-Term Travel Medical Coverage

- WorldTrips: Best for Flexibility

Best Travel Insurance for Seniors and Retirees in Detail

Available to senior travelers of all ages

Coverage for preexisting conditions is offered

Relatively low limits for emergency medical expenses

- Coverage for COVID-19

- Trip cancellation coverage up to $3,000

- Trip interruption coverage up to $3,000

- Emergency medical coverage up to $20,000

- Emergency medical evacuation coverage up to $100,000

- Baggage loss coverage up to $1,000

- Baggage delay insurance up to $200

- Travel delay coverage up to $600 ($200 daily limit)

- Rental car damage and theft coverage up to $45,000

- Travel accident coverage up to $25,000

- 24-hour hotline for assistance

- Concierge service

- Preexisting condition coverage (must be added to plan within 14 days of first trip deposit or payment)

Customize plan with optional CFAR coverage

Incredibly high limits for medical expenses and emergency evacuation

Coverage is for trips up to 30 days if you're age 80 and older

- Up to $15,000 in trip cancellation insurance

- Up to $22,500 in trip interruption coverage

- Up to $1,000 for trip delays ($200 daily limit for delays of 12-plus hours)

- Up to $1,000 for missed connections

- Up to $150,000 for emergency medical expenses

- Up to $1 million in emergency medical evacuation coverage

- $750 in emergency dental coverage

- $2,000 in coverage for baggage and personal effects

- $400 in baggage delay coverage

- 24/7 noninsurance assistance services

Get comprehensive health insurance that applies overseas

Preventive and routine care included

Age limits apply for new applicants and renewals

- Preventive and routine care

- Professional services like surgery

- Inpatient medical care

- Ambulatory and therapeutic services

- Rehabilitation and therapy

Get overseas medical coverage for single trips or multiple trips

Plans were created with seniors and retirees in mind

Lower maximum coverage limits for travelers ages 80 and older

Limited nonmedical travel insurance benefits

- Inpatient and outpatient medical coverage such as for physician visits, hospitalization and surgery

- Emergency and nonemergency medical evacuation coverage

- Coverage for emergency reunions

- Return of mortal remains

- Trip interruption coverage worth up to $5,000

- Lost luggage coverage worth up to $250 (up to $50 per item)

- Coverage for terrorism worth up to $50,000

- Accidental death and dismemberment coverage worth up to $25,000

Customize your deductible and premiums

Generous medical limits for travelers ages 65 to 79

Limited medical coverage for travelers older than 80

- Up to $1 million in emergency evacuation coverage

- Medical benefits like hospital room and board, chiropractic care, and more

- Coverage for repatriation of remains

- Up to $25,000 in personal liability coverage

- Up to $10,000 in trip interruption insurance

- Up to $1,000 in coverage for lost checked luggage

- Up to $100 per day in coverage for travel delays of 12-plus hours

- Up to $1,500 in coverage for bedside visits

- Up to $100,000 in coverage for emergency reunions

Frequently Asked Questions

You can purchase some travel insurance plans (but not all) if you're older than 80 years old. However, your premiums may be higher and you'll typically qualify for lower coverage limits overall. Make sure you compare the best travel insurance plans for seniors to find the right fit for your needs.

Since seniors and retirees are more likely to face a medical emergency during a trip, most travel insurance plans for seniors include coverage for emergency medical expenses and emergency medical evacuation. Coverages vary among plans, as do limits, so make sure to compare options before you book a trip overseas.

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel and travel insurance for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries around the world, and she has successfully filed claims during that time. Johnson lives in Indiana with her two children and her husband, Greg, a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to Senior Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

The best senior travel insurance options

Tips for selecting travel insurance for seniors, what else seniors need to know about travel insurance, travel insurance for seniors, recapped.

Travel insurance is a smart way to protect the money you have invested in a big trip in case unforeseen hurdles stop you from traveling. Seemingly now more than ever, last-minute changes can disrupt a trip, and in some cases, the money spent on nonrefundable purchases is at risk. There are numerous travel insurance options for people older than 65, but it is important to understand the nuances of senior travel insurance.

Medical issues or situations at (or en route to) your destination can stifle even the best-laid plans. Many credit cards include travel insurance as one of their benefits. These plans can assist in the event of lost or delayed baggage, flight delays and cancellations, and other adjustments to a trip paid for with that particular card.

When buying supplemental senior citizen travel insurance, don’t rely on the default option presented by your travel provider. There are many considerations to take into account, like how far from home you plan to be, the potential for injury or sickness (including your pre-existing medical conditions), and what may already be covered by other insurance plans you have.

For example, medical evacuation may not be covered, but local transportation to a hospital may be. And remember that U.S. health plans or Medicare coverage are especially limited outside of the country.

Here are some options worth reviewing from a handful of insurance providers: Allianz, Medjet, Travelers and your specific travel provider.

Here are a select few senior travel insurance options for people 65 and older.

Allianz offers excellent coverage for travelers over 65. It can help make payments for medical treatments overseas, even in the local currency and their preferred payment methods, to keep you from paying out of pocket.

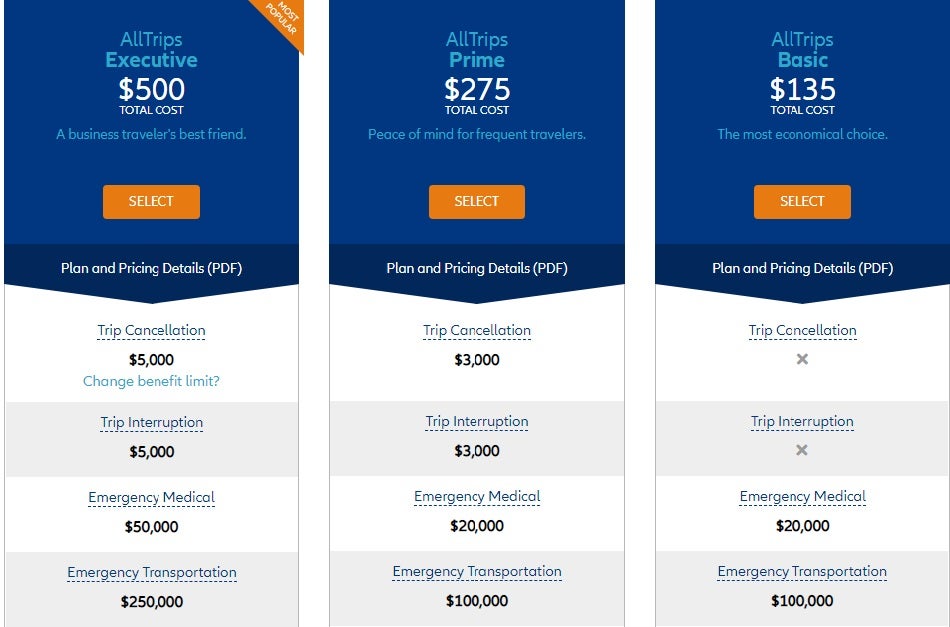

For longer trips, it offers an AllTrips Prime Plan in increments of three, six or 12 months (ideal if you plan to vacation elsewhere during the winter months, for example). This plan covers emergency medical transport. The company takes into account certain pre-existing medical conditions so be sure to read the fine print.

If you fall ill or need assistance during your travels, Medjet ’s supplemental coverage for medical transportation helps you get to your home or the hospital of your choice. It includes air medical transport. This is a membership program that covers emergencies and can be tacked onto trips or purchased annually. While not technically travel insurance, this company offers an additional medical transport option for emergencies.

This coverage can be helpful if you're planning to travel in remote or unfamiliar areas, such as on safaris, to secluded islands and other far-flung destinations.

» Learn more: Does travel insurance cover medical expenses?

Most other travel insurers might only get you to the nearest appropriate hospital facility. For travelers younger than 75, Medjet offers no pre-existing medical condition exclusions and it doesn't rule out the same number of activities that other providers might.

3. Travelers

With the option to buy an annual, multi-trip protector, Travelers insurance covers a whole year of trips with the option to upgrade several features. The add-ons include “Cancel For Any Reason” insurance and trip interruption coverage.

4. Your travel provider’s own plan

On certain types of trips, say a cruise or a Caribbean resort that is prone to hurricanes, using the travel provider’s recommended insurance can be a good bet. This coverage is usually offered as an add-on during the booking process, but it can also be added after the reservation.

Most likely, these policies are designed to cover delay or cancellation issues, but be sure to read the fine print to see if medical transportation or trip interruption is also included.

Choosing a provider of your own can make sense when planning your own travel (let’s say a honeymoon to Paris or the Maldives). If a cruise line or safari outfitter offers insurance of its own, that might be the most comprehensive when it comes to that particular provider’s operations.

» Learn more: The best cruise insurance

Deciding if you need travel insurance is the first hurdle. Next comes the task of selecting the right one without spending more than the cost of what you are actually trying to protect. These are some important tips to consider.

Compare plans

It is wise to compare the options available using aggregator websites like SquareMouth (a NerdWallet partner) and InsureMyTrip.com. These sites compare the options from dozens of different providers detailing what they do and do not cover.

Seeing the exclusions as well as considering them within the framework of your trip can help you select the best plan for your travel needs.

Consider existing coverage

Review your existing coverage, whether that is via your health insurance or any credit card protections you may have. Some of the benefits you might be paying extra for when getting supplemental travel insurance may already be covered.

Read the fine print

Don’t base your final decision on price, as sometimes the cheapest policy may be the most restrictive — and the most expensive policy may give you coverage for activities you won't even be doing.

What may seem like an inclusion may actually be disallowed due to a technicality (terrorist attack or war). If you’re not sure, pick up the phone and ask if your specific situation is covered.

Timing is key. The sooner you buy your travel insurance coverage, the more time you have to benefit from it. The price could also rise the closer you get to departure. If you wait until the departure date to buy it, you would be out of luck if the week before you get sick or the destination closes its borders. Buying insurance after an issue arises won't help you.

Travel insurance is a safe way to protect that sunken cost. Spending money on travel, even with the benefit of loyalty program miles and points to offset some of the cost, can be a significant investment. Chances are that you won’t even need it, but like other insurance policies, it can pay off in the event of unforeseen circumstances. Weigh the cost of potential expenses with the insurance plan. Canceling a rental car for a road trip may not be a big deal, but business class flights and a nonrefundable cruise might be.

Credit card coverage only protects you if you use that card to pay for your travel. The Chase Sapphire Reserve® and The Platinum Card® from American Express also offer travel insurance benefits when paying with points, too. Terms apply. Using the right card for your trip can help save money on other potential travel insurance costs.

» Learn more: Best travel insurance options for older adventurers

What may seem like an unnecessary extra cost can actually help save the day in certain circumstances.

It can pay dividends to understand what your existing coverage includes (especially via a particular credit card) so that travelers over 65 make the most advantageous insurance decision for their trips.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Best travel insurance for seniors in April 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 4:00 a.m. UTC April 1, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

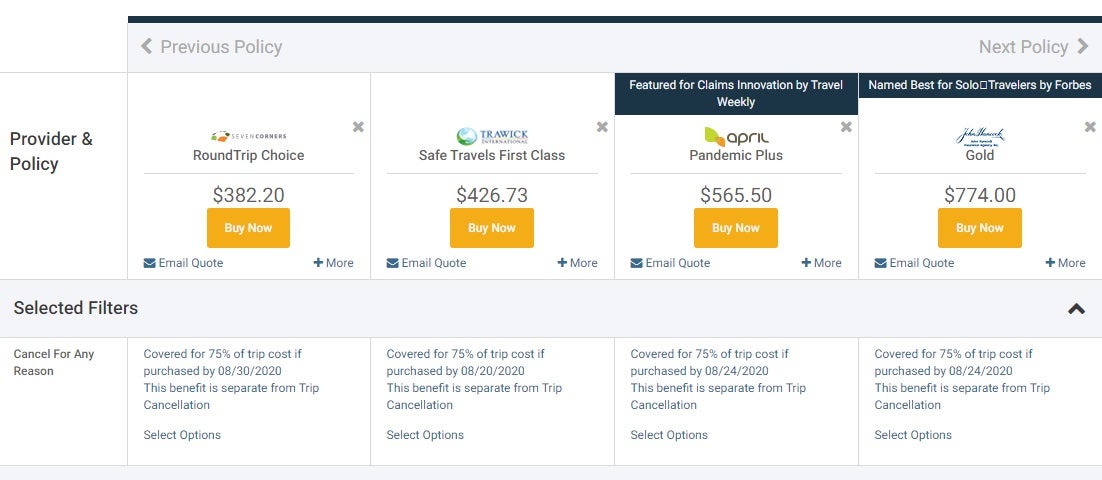

Tin Leg and Trawick International offer the best travel insurance for seniors, according to our analysis of plans’ cost and coverage limits.

Best senior travel insurance plans of 2024

- Tin Leg: Gold

- Trawick International: Safe Travels First Class

- Seven Corners: Trip Protection Choice

- Generali Global Assistance: Premium

- Nationwide: Prime

Why trust our travel insurance experts

Our team of experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 840 coverage details evaluated.

- 84 rates reviewed.

- 5 levels of fact-checking.

Top-rated travel insurance for seniors

Best plan for seniors

Average cost for seniors, covers covid, medical & evacuation limits per person, what you should know.

For the amount of coverage you get, Tin Leg’s Gold plan is competitively priced. It includes $500,000 in emergency medical benefits and another $500,000 in medical evacuation coverage.

Pros and cons

- Excellent $500,000 per person in primary emergency medical coverage.

- Very good emergency medical coverage of $500,000 per person.

- Eligible for pre-existing medical condition exclusion waiver if conditions are met.

- “Cancel for any reason” coverage of 75% available.

- No “interruption for any reason” upgrade available.

- Hurricane and weather coverage kicks in only after a 48-hour delay.

- Lowest baggage and personal item loss coverage of our top-rated senior plans.

- Lowest travel delay coverage of our top-rated senior plans.

- No rental car coverage option.

Trawick International

Trawick International’s Safe Travels First Class policy is a relatively inexpensive option that comes with $1 million in emergency medical evacuation coverage and a high per person limit for baggage and personal items loss.

- Second-cheapest of our best senior plans.

- Best-in-class medical evacuation coverage of $1 million.

- Pre-existing condition coverage available if conditions are met.

- Baggage loss coverage of $2,000 per person is the best among our top senior plans.

- No “interruption for any reason” coverage upgrade available.

- Travel delay benefit takes 12 hours to kick in.

- Lower emergency medical benefit of $150,000 is secondary coverage.

Seven Corners

Seven Corners’ Trip Protection Choice plan has high emergency medical and medical evacuation limits, as well as rare coverage for non-medical evacuation. In addition to “cancel for any reason” coverage, you can also pay extra for “interruption for any reason” coverage.

- Excellent $1 million emergency medical evacuation coverage plus $20,000 for non-medical evacuation.

- Great “interruption for any reason” coverage of 75% available.

- The most expensive of our top-rated senior travel insurance plans.

Generali Global Assistance

Generali Global Assistance’s premium plan offers trip interruption coverage of up to 175% of your trip cost. Most top-rated competitors offer a maximum of 150%.

- Top-notch $1 million per person in medical evacuation coverage.

- Solid baggage loss coverage of $2,000 per person.

- “Cancel for any reason” coverage of 75% available.

- Baggage must be delayed for 12 hours before benefits kick in.

- Missed connection coverage of $1,000 per person only applies to cruises and tours.

- Emergency medical expense benefit is secondary coverage.

Nationwide Prime travel insurance offers an exceptional 200% coverage for trip interruption.

- If you need to cut your trip short for a covered reason, you can be reimbursed up to 200% of your prepaid trip cost.

- High travel delay coverage of $2,000 per person ($250 per day limit).

- “Cancel for any reason” coverage of 75% is available.

- Low missed connection benefit of $500 per person for cruises and tours only.

- No “interruption for any reason” coverage available.

Compare the best travel insurance for seniors

Via TravelInsurance.com’s website

Methodology

Our insurance experts analyzed cost and coverage data from 21 plans to determine the best senior travel insurance. For this rating, we only scored travel insurance plans that offer the option to buy “cancel for any reason” (CFAR) coverage .

The benefits we scored out of a possible 100 points include:

Cost: 50 points. We scored the average cost for each travel insurance policy for a variety of international trips and traveler profiles.

Medical expenses: 15 points. Travel insurance plans that offer travel medical expense benefits of $500,000 per person were given the highest amount of points.

Medical evacuation: 15 points. Travel insurance plans with emergency medical evacuation benefits of $500,000 or more per person were given the highest number of points.

Pre-existing medical condition exclusion waiver: 20 points. Travel insurance plans that cover pre-existing medical conditions if the policy is purchased within a required timeline received points.

What is covered by travel insurance for seniors?

The best travel insurance bundles several types of insurance to provide financial protection before and during your trip.

A comprehensive senior travel insurance plan will include the following coverage types:

- Trip cancellation insurance .

- Trip delay insurance.

- Trip interruption insurance.

- Travel medical insurance.

- Emergency medical evacuation .

- Baggage loss and delay coverage.

What’s the most important travel insurance coverage for senior travelers?

Health is a top concern for older travelers. Travel insurance for senior citizens should have high coverage limits for trip interruption, travel medical insurance and emergency medical evacuation.

“Since Medicare doesn’t provide coverage abroad, it’s important for senior travelers to pay close attention to policies’ medical benefits, including emergency medical, medical evacuation and pre-existing conditions,” said James Clark, a spokesperson for the travel-insurance comparison site Squaremouth, the company behind Tin Leg travel insurance.

Older travelers should also pay attention to whether a travel insurance plan’s emergency medical coverage is primary or secondary.

“When traveling outside the U.S., seniors should know that it’s recommended to purchase a travel insurance plan that includes primary emergency medical coverage,” said Berkshire Hathaway Travel Protection vice president, Carol Mueller.

“Senior travelers on Medicare who purchase a travel insurance plan with secondary medical coverage will need to first try to get Medicare to cover their emergency travel medical expenses, which in many cases is limited to no coverage,” said Mueller. “Avoid the hassle and choose a travel insurance plan with primary medical coverage.”

How to choose the best senior travel insurance

Senior travelers shopping for travel insurance should look for plans with these benefits:

- Emergency medical expense coverage of at least $250,000. This pays for emergency medical expenses you incur during your trip and includes medical coverage for COVID-19 .

- Emergency medical evacuation coverage of at least $500,000. This pays to transport you to the nearest adequate medical facility for you to get the care you require when a physician says your illness or injury is severe enough to warrant it. Emergency medical evacuation coverage may also pay to fly a loved one to be with you and to fly you home for further treatment or recovery.

- Preexisting condition coverage. Some plans include a preexisting condition waiver as long as you buy travel insurance within a certain number of days of making your first trip deposit, you insure the full value of your trip and you are medically able to travel at the time of departure. Having a waiver will give you coverage for medical conditions documented in your health history in the 60 to 180 days before you buy your plan, with some exclusions.

- Trip interruption coverage of 150%. Trip interruption insurance reimburses you for unused, prepaid, nonrefundable trip expenses if your trip is unexpectedly interrupted while you’re in transit or at your destination. It can also cover travel costs associated with having to change your plans, such as needing to buy a last-minute economy ticket for a one-way flight home. Buying an extra ticket can push your claim over 100% of your original trip expenses, so it’s wise to look for a plan that reimburses up to 150%.

- “Cancel for any reason” (CFAR) upgrade available. For an additional cost, you can sometimes add “cancel for any reason” coverage to your travel insurance plan. This typically reimburses up to 75% of nonrefundable trip expenses if you decide not to travel for a reason not covered by your policy, as long as you cancel at least two days before you’re scheduled to travel.

How much does senior travel insurance cost?

The average cost of senior travel insurance is $434 per trip , based on our analysis of rates for older travelers. For senior trips with “cancel for any reason” (CFAR) coverage, the average cost of travel insurance increases to $629.

Travel insurance for seniors typically costs around 7% to 9% of your total prepaid, nonrefundable trip expenses. Adding CFAR coverage can add 45% or more to that cost.

How much you pay for travel insurance will depend on the age of you and your fellow travelers, the length of your trip and the total of your nonrefundable trip costs.

Compare senior travel insurance rates

Average senior travel insurance costs are based on rates for international trips for travelers ages 65 and 70, with CFAR coverage and without. Travel insurance plans have different levels of benefits, which can account for price differences.

Travel smart: Find cheap travel insurance that meets your needs.

How to save money on travel insurance for seniors

Travel insurance companies don’t typically offer discounts. But if you can get a senior discount on any of your travel itself, you’ll have a smaller trip cost to insure. This will lower the cost of your senior travel insurance.

Getting quotes from multiple travel insurance providers is also a great way to save money. Every policy offers more coverage in some areas and less in others. Depending on what coverage is most important to you, certain policies will give you more value than others.

Get the coverage you need: What does travel insurance cover?

Is CFAR worth it for senior travelers?

CFAR coverage adds to the cost of your plan, but older travelers may want to consider a travel insurance policy with both trip cancellation insurance and “cancel for any reason” coverage, said Clark.

CFAR benefits offer maximum flexibility to cancel your plans due to illness, injury or any other reason and will reimburse a percentage of your nonrefundable trip costs, usually 50% or 75%. The only caveat is that you’ll need to cancel at least two days before you plan to travel.

When shopping for travel insurance, look for CFAR-related fine print. You often must buy CFAR within a certain number of days of making your first trip deposit, such as 14 days. You are also usually required to insure the full value of your nonrefundable trip expenses.

More travel insurance for seniors resources

- What is travel insurance?

- What does travel insurance cover?

- Average cost of travel insurance

- Is travel insurance worth it?

- Best COVID travel insurance

- Best cruise travel insurance

Best senior travel insurance FAQs

If you rely on Medicare for health insurance and you’re traveling internationally, buying senior travel insurance with excellent emergency medical insurance and emergency medical evacuation benefits is a good idea.

“One of the most important considerations for travelers with existing health issues is to find a plan that offers a preexisting condition exclusion waiver,” said Stan Sandberg, cofounder and CEO of TravelInsurance.com.

To qualify for the waiver, you’ll usually need to purchase your trip insurance policy within seven to 14 days of making your initial trip payment. Some premium policies may extend this coverage if you buy them before or within 24 hours of making your final trip payment, he said.

Even with a waiver, medical bills related to certain excluded conditions such as dementia or depression may not be covered, so read the policy carefully to see if your preexisting conditions qualify.

More: Is travel insurance worth it?

Tin Leg’s Gold plan and Trawick International’s Safe Travel First Class plan provide the best travel insurance for seniors for the price, according to our analysis. These are the only plans to merit 5 stars in our rating.

Yes, you can get travel insurance over 80, but it will cost you more.

Yes. If you’re shopping for travel insurance over 80, for instance, you’ll pay an average of 18% of your total trip cost. That is considerably higher than the average cost of travel insurance for a 30-year-old, which is only 5%.

Travel insurance for the elderly varies by insurer when it comes to upper age limits . If you are concerned about finding the best travel medical insurance for seniors over 7 0 , start with an online comparison site like Squaremouth where you only have to enter your age and trip details once to see which policies are available to you.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Amy Fontinelle has more than 15 years of experience helping people make informed decisions about their money, whether they’re refinancing a mortgage, buying insurance or choosing a credit card. As a freelance writer trained in journalism and specializing in personal finance, Amy digs into the details to explain the products and strategies that can help (or hurt) people seeking greater financial security and wealth. Her work has been published by Forbes Advisor, Capital One, MassMutual, Investopedia and many other outlets.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

Cheapest travel insurance of April 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of April 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

- Motorcycles

- Car of the Month

- Destinations

- Men’s Fashion

- Watch Collector

- Art & Collectibles

- Vacation Homes

- Celebrity Homes

- New Construction

- Home Design

- Electronics

- Fine Dining

- Aston Martin

- L’Atelier

- Les Marquables de Martell

- Reynolds Lake Oconee

- 672 Wine Club

- Sports & Leisure

- Health & Wellness

- Best of the Best

- The Ultimate Gift Guide

65 or Older? Here Are The Best Travel Insurance Plans for Seniors

The top-rated plans all have at least $100,000 in travel medical coverage and at least $250,000 in emergency medical evacuation coverage., erica lamberg, erica lamberg's most recent stories.

- 5 Tips for Buying Travel Insurance

- Travel Insurance for Sports Equipment: Everything You Need to Know

- The Travel Insurance You Need for a Multi-Destination Vacation

- Share This Article

We may receive payment from affiliate links included within this content. Our affiliate partners do not influence our editorial opinions or analysis. To learn more, see our Advertiser Disclosure .

With more than a year of travel adventures lost, it’s time to consider how you’ll explore the world again. Whether you’re going across the country or around the world, travel insurance for seniors can provide a valuable safety net if a trip goes wrong. Here are the best senior travel insurance plans based on our ratings of two dozen travel insurance policies.

Related Stories

A bevy of luxury resorts is about to transform this quiet costa rica province, you can now drive a porsche through 5 african countries with this new off-roading experience, dubai just got 3 new luxe hotels. here’s a look inside..

All the winning travel insurance plans below include coverage for Covid in trip cancellation and travel medical benefits

Nationwide Cruise Choice Plan

Why we picked it: Nationwide Cruise Choice Plan offers superior benefits at excellent prices for senior travelers.

This plan provides $100,000 per person for emergency medical expenses and $500,000 per person for emergency medical evacuation . You will also get non-medical evacuation coverage of $25,000 per person, which covers transportation if you have to move to a safe location due to a natural disaster or civil/political unrest.

Nationwide’s Cruise Choice Plan has top-notch baggage loss coverage of $2,500 per person. Other highlights include missed connection coverage of $1,500 per person after only a three hour wait and the option to add “cancel for any reason” coverage.

If you are looking for an upgrade, it’s worth taking a look at Nationwide’s Cruise Luxury plan.

Potential drawbacks: Travel delay coverage of $750 per person is low compared to top competitors.

Trawick International Safe Travels First Class Plan

Why we picked it: Trawick’s International Safe Travels First Class plan has excellent prices for seniors and a wide range of solid benefits.

The plan comes with $150,000 per person in emergency medical expenses and $1 million per person in medical evacuation coverage. You’ll also get $2,000 per person in baggage loss coverage and $1,000 per person for missed connections (cruises and tours only).

The plan has good travel delay coverage of $1,000 per person but only after a 12-hour delay. And if you’re the type of traveler who wants the ultimate flexibility, you can add “cancel for any reason” coverage to your policy.

Potential drawbacks: Baggage delays and travel delays are only reimbursed after a 12-hour delay. That’s a long time compared to some top competitors that require only six hours (or less).

Related: Best Senior Travel Insurance Plans Of 2021

AXA Assistance USA Gold Plan

Why we picked it: Great prices for senior travelers make AXA’s Gold plan an attractive option.

The plan comes with $100,000 per person in emergency medical expenses and $500,000 per person for emergency medical evacuation. You’ll also get non-medical evacuation coverage of $50,000 per person in case you need to move to safety because of a natural disaster or civil/political unrest.

AXA’s Gold plan has good baggage loss coverage of $1,500 per person. It has generous missed connection coverage of $1,000 per person if you miss your cruise or tour. The plan also includes concierge services.

Potential drawbacks: AXA’s Gold plan does not offer optional “cancel for any reason” coverage.

Cat 70 Travel Plan

Why we picked it: Superior coverage for medical expenses at very competitive prices for seniors makes the Cat 70 plan a solid choice for senior travelers.

Cat 70’s Travel plan pairs a whopping $500,000 per person in emergency medical expenses with $500,000 per person in emergency medical evacuation coverage. Travelers seeking trip cancellation flexibility can add “cancel for any reason” coverage.

Potential drawbacks: Compared to some top competitors, reimbursement is on the lower end for travel delay ($500 per person), lost baggage ($500 per person) and baggage delay ($200 per person after 24 hours).

HTH Worldwide TripProtector Classic Plan

Why we picked it: Excellent prices for seniors make the TripProtector Classic plan worthy of consideration.

TripProtector Classic comes with $250,000 per person in emergency medical expenses and $1 million per person in emergency medical evacuation coverage. The plan includes good travel delay benefits at $1,000 per person after a six-hour delay.

Senior travelers looking for even better benefits (at a higher cost) may want to upgrade to the Worldwide TripProtector Preferred plan.

Potential drawbacks: Baggage delay benefits might be insufficient at $200 per person after a 12-hour delay and you won’t have the option of adding “cancel for any reason” coverage.

Tin Leg Gold Plan

Why we picked it: Tin Leg’s Gold plan offers ample medical benefits at competitive prices for seniors.

With $500,000 per person for emergency medical expenses and $500,000 per person for emergency medical evacuation coverage, Tin Leg’s Gold plan has some of the highest medical benefits among top competitors.

You will also have the option to add “cancel for any reason” coverage.

Potential drawbacks: Reimbursement is low compared to top competitors for travel delay ($500 per person), baggage delay ($200 per person after a 24-hour delay) and baggage loss ($500 per person).

USI Affinity Travel Insurance Services Ruby Plan

Why we picked it: USI Affinity’s Ruby plan has solid medical benefits and very competitive prices for seniors who are traveling.

The plan comes with $250,000 per person in emergency medical expenses and $500,000 per person for emergency medical evacuation. If you want the flexibility to cancel your trip, you’ll have the option to add “cancel for any reason” coverage.

Potential drawbacks: Baggage delay ($300 per person) and baggage and personal items loss ($1,000 per person) are lower than top competitors and might be insufficient for senior travelers looking for higher coverage amounts.

Tips for Seniors Buying Travel Insurance

Travel insurance can be essential for many types of trips, but seniors are particularly vulnerable to travel-related problems. Most notably, travelers age 65+ should consider a travel insurance policy with medical insurance and medical evacuation benefits.

Understand Insurance Needs When Traveling Abroad

With the vaccine rollout and countries relaxing border restrictions, you may be thinking about taking that river cruise to Portugal or a wine tour in France.

It’s important to know that when you travel outside the United States a domestic health insurance plan will not generally travel with you. This includes Medicare.

A key focus for seniors should be travel insurance with high limits of travel medical insurance, says Jeremy Murchland, president of travel insurance company Seven Corners. “Some plans on the market limit coverage to only $25,000 or $50,000,” he says. “Depending on the type of care needed, this may not be enough to cover the cost.”

“Most Medicare plans will not cover a person outside of the U.S. or U.S. territories,” explains Gail Manganite, lead customer advocate for InsureMyTrip, a travel insurance comparison provider. She notes that there are some Medigap and supplemental plans that offer health coverage outside the U.S., but deductibles and copayments will still apply.

Find out if your current health insurance includes emergency medical coverage outside the country and what restrictions apply. Then you’ll know how much travel medical insurance you need to fill the gap.

If you want top-notch coverage, look for travel insurance plans that offer $500,000 in medical coverage.

Get Medical Coverage for Pre-Existing Conditions

You don’t want a pre-existing condition to flare up during a trip, but in case it happens, have a travel insurance plan that covers it. You do this by getting a pre-existing medical condition exclusion waiver.

The availability of this important waiver is time-limited: You’ll have to add it to a travel insurance plan within a specified number of days from the date you make your first trip payment. For example, Seven Corners’ RoundTrip Choice plan covers pre-existing conditions if you buy it within 20 days of the date of your initial trip payment.

But your plan might have a window of only 14 days to get pre-existing conditions covered.

Plan for Medical Evacuation Coverage

If you require an emergency airlift back to the United States, it could easily cost $100,000 or more for private, emergency transport. Emergency medical evacuation insurance pays to move you to a medical facility with appropriate and necessary care if the facility where you are located is unable to provide the level of care needed for your medical condition, says Murchland.

You can find travel insurance plans with up to $1 million in coverage for emergency medical evacuation.

Be Aware of “Cancel for Any Reason” Coverage

“Cancel for any reason” coverage is an add-on that you can tack on to some travel insurance plans. It will add about 40% to your travel insurance cost but gives you the widest flexibility to cancel the trip for any reason and get some reimbursement (typically 50% or 75%).

Without it, you’ll receive trip cancellation reimbursement only if you cancel for a reason listed in the base policy, such as an illness or injury that forces you to abandon travel plans. “Cancel for any reason” coverage will give you the option to cancel for reasons like a sudden fear of flying or simply changing your mind.

Consider Customer Service Options

Murchland says to pick a travel insurance company that has services that match your comfort level.

“For example, Seven Corners has found that a higher percentage of seniors wish to discuss a travel insurance plan over the phone and, in some cases, want assistance selecting a plan and executing a purchase,” he says. “In today’s world of chat bots and email, this is an important consideration for seniors who would prefer to talk with a person.”

Stay on Top of Your Insurance Timeline

Buying a travel insurance plan early and taking the time to read it can pay off later. In addition, a travel insurance agent can help you understand what the policy covers and find plans that fit your travel insurance concerns. It’s wise to:

- Buy your plan early (shortly after you make your first trip deposit) so you don’t miss out on key benefits like pre-existing conditions coverage.

- Review your plan information well before your trip . Understand what reasons are covered for trip cancellation insurance claims. If you want broader coverage, consider adding “cancel for any reason” coverage, which also needs to be added shortly after your first trip payment.

- Feel comfortable asking questions to ensure you understand your plan and how it works.

- Keep in mind that travel insurance plans offer 24/7 travel assistance help . If you run into trouble during your trip, make use of the professional help available for language translation, finding a pharmacy and much more.

Methodology

Using data provided by Squaremouth, a travel insurance comparison provider, we evaluated 24 travel insurance plans that have at least $100,000 in travel medical coverage and at least $250,000 in emergency medical evacuation coverage. Scores were based on:

- Travel insurance rates (50% of score) for a range of travelers age 65 and older, for trips in a variety of lengths, destinations and costs.

- Coverage benefits (50% of score) including travel medical expenses, cancel for any reason availability, Covid coverage, medical evacuation, baggage delay, baggage loss, missed connection, non-medical evacuation, travel delay.

Erica Lamberg is a personal finance and travel writer based in suburban Philadelphia. She is a regular contributor to USA Today, and her writing credits include NBC News, U.S. News & World Report, Business Insider, Oprah Magazine and Creditcards.com .

Read More On:

- FBS Marketplace

More Travel

How Climate Change Could Disrupt the Future of Travel, According to a New Study

Culinary Masters 2024

MAY 17 - 19 Join us for extraordinary meals from the nation’s brightest culinary minds.

Give the Gift of Luxury

Latest Galleries in Travel

Kalmar Beyond Adventure’s Porsche Safari in Photos

The Dunlin, Auberge Resorts Collection in Photos

More from our brands, take a shine to the silver handbag trend with these top metallic purses that fashion insiders are carrying this spring, ncaa names nil registry partner after five-year process, meta and deloitte execs on the of genai in marketing and how it will disrupt the future of digital media, the first malta biennale draws visitors to a surreal fortress, the best yoga mats for any practice, according to instructors.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Best Travel Insurance Options for Seniors [Ages 65, 70, and Over 80]

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3126 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![seniors travel insurance The Best Travel Insurance Options for Seniors [Ages 65, 70, and Over 80]](https://upgradedpoints.com/wp-content/uploads/2021/05/Senior-couple-on-beach-at-sunset.jpeg?auto=webp&disable=upscale&width=1200)

Why Purchase Travel Insurance

The cost of travel insurance, preexisting conditions, travel insurance and medicare, covid-19 and travel insurance, world nomads — best for active seniors, allianz — best for annual multi-trip policies, best for covering covid-19 cancellations, best for preexisting conditions, best travel insurance options — age 80 and above, credit card travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Our senior years can be some of the most exciting years of our lives. If we’re fortunate, we’ll now have the time, and hopefully, the resources, to make our travel dreams come true.

As we age, however, traveling may pose some additional risks. We may be more likely to have health-related issues and therefore the need to seek medical attention during our journey. We may also have occasions where we need to cancel our plans due to health issues or the health of those around us.

Now, more than ever, we need to think seriously about purchasing travel insurance. The good news is that comprehensive travel insurance, regardless of your age, is widely available and relatively affordable. With that being said, chances are you could use a little help getting started with the process of finding and purchasing the right plan.

If you’re 65 years of age or older and thinking about purchasing travel insurance, don’t pull the trigger without reviewing the information in today’s article on travel insurance options for seniors.

Travel insurance can protect you from financial loss due to unforeseen events that can cause you to cancel your trip or disrupt your trip once it’s in progress. As we age and our health declines, we may be more likely to experience such an event.

Travel insurance can cover the following situations:

- You, a family member, or travel companion becomes seriously ill and you must cancel your trip

- You slip and fall while traveling abroad, require medical care, and are forced to stay in a foreign city until you can travel again

- You are on safari and break your ankle, requiring emergency evacuation to the nearest hospital

The types of coverage you can expect to find on travel insurance policies include the following:

- Emergency medical coverage

- Emergency evacuation

- Trip cancellation, trip interruption , and trip delay

- Baggage insurance and personal effects coverage

- Travel accident and accidental life insurance

You may also elect to add coverage such as cancel for any reason insurance (CFAR) , a waiver for preexisting conditions, or car rental insurance.

What You Need to Know About Age and Travel Insurance

It’s possible to purchase travel insurance at just about any age. If you’re healthy enough to travel, you’ll generally be able to find coverage. You’ll normally be paying more to purchase coverage as you get older, however, and most policies may have preexisting health stipulations.

As age increases, so does the cost of purchasing travel insurance . The good news, however, is that premiums tend to vary widely between companies who offer policies for older travelers, so it pays to compare.

The easiest way to compare policies is via insurance comparison sites such as SquareMouth , InsureMyTrip , or TravelInsurance.com . Travel comparison sites make it easy to compare travel insurance policy pricing and coverage options for all ages.

We’ve used these sites to find most of the comparison quotes provided in this article.

As we age, we’re more likely to have preexisting health conditions, which can be excluded from most travel insurance policies. Once again, the good news is that preexisting condition exclusions are generally limited to a specified timeframe previous to the effective date of your policy.

If you have shown symptoms or been treated within a specified time period before your trip, usually 90 to 120 days, your condition may not be covered for certain coverages such as trip interruption, cancellation, or emergency medical. Each company’s requirements may differ.

Also, on a positive note is that many insurers allow you to purchase a preexisting condition waiver when you purchase your policy.

Health insurance may or may not cover medical costs abroad. And even if there is coverage, evacuation costs may not be included. The same scenario exists with Medicare.

Medicare will not cover medical expenses incurred abroad . There are very limited situations where Medicare may grant coverage, such as if you reside in the U.S. and a foreign hospital (such as a Canadian hospital) is closer to your residence than the U.S. hospital, or you’re traveling through Canada to reach another U.S. state or territory. Also, several terms and conditions apply.

There are Medicare supplement policies you can purchase that can cover you while traveling abroad. You’ll pay a standard $250 deductible, have coverage for 80% of eligible expenses beyond that amount, and have a lifetime cap of $50,000 in coverage.

So even if you have Medicare, a Medicare supplement, or other health insurance policy, there can still be plenty of gaps in coverage when you’re traveling abroad.

For this reason, and the need for additional coverage such as trip cancellation, interruption, delay, baggage coverage, and more, it’s prudent to purchase travel insurance.

Bottom Line: Medicare will generally not cover medical expenses when you’re traveling outside of the U.S. and its territories and Medicare supplement and Advantage policies provide limited coverage. Travel insurance is a wise choice for covering medical expenses and for other travel-related events that could cause you to cancel your trip or disrupt your journey in progress.

As we advance in age, the chance we will need to cancel a trip due to health-related issues increases. Fortunately, most travel insurance policies cover trip cancellations due to illness. However, travel insurance policies do not cover voluntary cancellations such as canceling your trip due to the fear of getting sick.

Cancel for any reason insurance (CFAR), when added to a travel insurance policy, will allow you to cancel your trip for any reason you deem necessary. It will even cover you if you simply decide not to go.

While CFAR insurance allows you to cancel your trip for any reason, including COVID-19-related issues, the coverage will not reimburse 100% of your costs. The coverage can only be purchased when you purchase your travel insurance or for a short window following the purchase. CFAR insurance can also be expensive.

Our article on COVID-19-related trip cancellations goes into a lot more detail.

Best Travel Insurance Options — Ages 65 to 69

Priorities change as we change and as a result, we may have different insurance needs at age 65 than we do at age 80. Here are some examples of travel insurance plans that might be a fit for travelers age 65-69.

If you’re under age 70, you’ll find comprehensive travel insurance coverage with World Nomads . What sets World Nomads apart from other insurance providers is that they’re experts at insuring active travelers who participate in adventurous activities.

While World Nomads does not offer CFAR insurance, COVID-19 is not excluded as an illness for trip cancellation and emergency medical coverage.

World Nomads only insures those travelers under age 70 and refers older travelers to its partner TripAssure .

For a traveler 68 years of age, traveling to the Netherlands for 8 days, with a total trip cost of $3,000, here are some sample costs.

The main differences in these plans are that the Explorer Plan covers an expanded collection of over 200 covered adventurous activities, has higher limits for trip interruption/cancellation/delay and emergency evacuation, and includes rental car insurance.

Secure your own quote from World Nomads .

Allianz simplifies purchasing travel insurance with its offerings of travel insurance package policies. You can select from single trip policies with several levels of coverage options or annual multi-trip policies that cover every trip you make during the policy period, even ones you haven’t yet planned.

If you travel frequently, or even a few times each year, purchasing an annual, multi-trip plan could be a cost-effective way to protect all your trips.

To learn more about Allianz and its policy offerings , you’ll want to check out our review for details.