Outlook for China tourism 2023: Light at the end of the tunnel

China is now removing travel restrictions rapidly, both domestically and internationally. While the sudden opening may lead to uncertainty and hesitancy to travel in the short term, Chinese tourists still express a strong desire to travel. And the recent removal of quarantine requirements in January 2023 could usher in a renewed demand for trips abroad.

Domestically, there are already signs of strong travel recovery. The recent Chinese New Year holidays saw 308 million domestic trips, generating almost RMB 376 billion in tourism revenue. 1 China’s Ministry of Culture and Tourism. This upswing indicates that domestic travel volume has recovered to 90 percent of 2019 figures, and spending has bounced back to around 70 percent of pre-pandemic levels. 2 McKinsey analysis based on China’s Ministry of Culture and Tourism data.

This article paints a picture of Chinese travelers and their evolving spending behaviors and preferences—and suggests measures that tourism service providers and destinations could take to prepare for their imminent return. The analyses draw on the findings of McKinsey’s latest Survey of Chinese Tourist Attitudes, and compare the results across six waves of surveys conducted between April 2020 and November 2022, along with consumer sentiment research and recent travel data.

From pandemic to endemic

By January 8, 2023, cross-city travel restrictions, border closures, and quarantine requirements on international arrivals to China had been lifted. 3 “Graphics: China’s 20 new measures for optimizing COVID-19 response,” CGTN, November 15, 2022; “COVID-19 response further optimized with 10 new measures,” China Services Info, December 8, 2022; “China reopens borders in final farewell to zero-COVID,” Reuters, January 8, 2023. This rapid removal of domestic travel restrictions, and an increase in COVID-19 infection rates, likely knocked travel confidence for cross-city and within-city trips. Right after the first easing of measures, in-city transport saw a marked drop as people stayed home—either because they were ill, or to avoid exposure. Subway traffic in ten major cities in mainland China fell and then spiked during Chinese New Year in February. Hotel room bookings also peaked at this time.

Domestic airline seat capacity experienced a minor rebound as each set of restrictions was lifted—suggesting a rise in demand as airlines scheduled more flights. Domestic capacity fluctuated, possibly due to the accelerated COVID-19 infection rate and a temporary labor shortage. International seat capacity, however, continued to climb (Exhibit 1).

By Chinese new year, China was past its infection peak—and domestic tourism recovered strongly. For instance, Hainan drew 6.4 million visitors over Chinese New Year (up from 5.8 million in 2019) and visits to Shanghai reached 10 million (roughly double 2019 holiday figures). 4 China’s Ministry of Culture and Tourism. Overall, revenue per available room (RevPAR) during this period recovered and surpassed pre-pandemic levels, at 120 percent of 2019 figures. 5 STR data. Outbound trips are still limited, but given the pent-up demand for international travel (and the upswing in domestic tourism) the tourism industry may need to prepare to welcome back Chinese tourists.

Tourism players should be ready for this; the time to act is now.

A demand boom is around the corner—Chinese tourists are returning soon

Before the pandemic, Chinese tourists were eager travelers. Mainland China had the largest outbound travel market in the world, both in number of trips and total spend. 6 World Tourism Organization (UNWTO) Tourism dashboard, Outbound tourism ranking. In 2019, Mainland Chinese tourists took 155 million outbound trips, totaling $255 billion in travel spending. 7 China’s Ministry of Culture and Tourism. These figures indicate total outbound trips, including to Hong Kong and Macau. China is also an important source market for some major destinations. For instance, Chinese travelers made up 28 percent of inbound tourism in Thailand, 30 percent in Japan, and 16 percent of non-EU visitors to Germany. 8 United Nations World Tourism Organization (UNWTO) database.

Leisure travel was the biggest driver of China’s outbound travel, representing 65 percent of travelers in 2019. In the same year, 29 percent of travelers ventured out for business, and 6 percent journeyed to visit friends and relatives. 9 Euromonitor International database.

Our most recent Survey of Chinese Tourist Attitudes, conducted in November 2022, shows that Chinese tourists have retained their keen desire to explore international destinations. About 40 percent of respondents reported that they expect to undertake outbound travel for their next leisure trip.

Where do these travelers want to go?

The results also indicate that the top three overseas travel destinations (beyond Hong Kong and Macau) are Australia/New Zealand, Southeast Asia, and Japan. Overall, respondents show less interest in travel to Europe than in previous years, down from 7 percent to 4 percent compared to wave 5 respondents. Desire to embark on long-haul international trips to Australia/New Zealand increased from 5 percent to 7 percent, and North American trips from 3 percent to 4 percent since the last survey. The wealthier segment (monthly household income over RMB 38,000) still shows a high interest in EU destinations (13 percent).

There are stumbling blocks on the road to recovery

While travel sentiment is strong, other factors may deter travelers from taking to the skies: fear of COVID-19; the need for COVID-19 testing which can be expensive; ticket prices; risk appetite of destination countries; and getting a passport or visa.

Chinese travelers may favor domestic trips, even if all outbound travel restrictions are removed, until they feel it is safe to travel internationally. A COVID-19-safe environment in destination countries will likely boost travelers’ confidence and encourage them to book trips again. 10 “Long-haul travel barometer,” European Travel Commission, February 1, 2023.

Travel recovery is also dependent on airline capacity. Some international airlines might be slow to restore capacity as fleets were retired during COVID-19 and airlines face a shortage of crew, particularly pilots. Considering that at the time of writing, in April 2023, international airline seat capacity has only recovered to around 37 percent of pre-pandemic levels, travelers are likely to face elevated ticket prices in the coming months. For instance, ticket prices for travel in the upcoming holidays to popular overseas destinations such as Japan and Thailand are double what they were in 2019. 11 Based on Ctrip prices. Price-sensitive travelers might wait for ticket prices to level out before booking their overseas trips.

Chinese airlines, however, appear more ready to resume full service than their international counterparts —fewer pilots left the industry and aircraft are available. Chinese carriers’ widebody fleets are mostly in service or ready to be redeployed (Exhibit 2).

Moving forward, safety measures in destination countries will affect travel recovery. Most countries have dropped testing requirements on arrivals from mainland China, and Chinese outbound group travel has resumed but is still limited to selected countries.

Many Chinese travelers—maybe 20 percent—have had passports expire during the COVID-19 period, and China has not been renewing these passports. Renewals are now possible, but the backlog will slow travel’s rebound by a few months. 12 Steve Saxon, “ What to expect from China’s travel rebound ,” McKinsey, January 25, 2023. Furthermore, travel visas for destination countries can take some time to be processed and issued.

Taken together, these factors suggest that the returning wave of Chinese travelers may only gather momentum by the Summer of 2023 and that China’s travel recovery will likely lag Hong Kong’s by a few months.

Overall, China is opening up to travel, both inbound and outbound—all types of visas are being issued to foreign visitors, and locals are getting ready to travel abroad. 13 “China to resume issuing all types of visas for foreigners,” China Briefing, March 14, 2023.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

The returning chinese traveler is evolving.

Although Chinese travelers did not have opportunities to travel internationally over the past three years, they continued to travel domestically and explore new offerings. Annual domestic trips remained at around 50 percent of pre-pandemic levels, amounting to 8.7 billion domestic trips over the past three years. 14 China’s Ministry of Culture and Tourism. During this time, the domestic market matured, and travelers became more sophisticated as they tried new leisure experiences such as beach resorts, skiing trips, and “staycations” in home cities. Chinese travelers became more experienced as thanks to periods of low COVID-19 infection rates domestically they explored China’s vast geography and diverse experiences on offer.

Consequently, the post-COVID-19 Chinese traveler is even more digitally savvy, has high expectations, and seeks novel experiences. These are some of the characteristics of a typical traveler:

- Experience-oriented: Wave 6 of the survey shows that the rebound tourist is planning their trip around experiences. Outdoor and scenic trips remain the most popular travel theme. In survey waves 1 to 3, sightseeing and “foodie” experiences were high on the list of preferences while traveling. From waves 4 to 6, culture and history, beaches and resorts, and health and wellness gained more attention—solidifying the trend for experience-driven travel. Additionally, possibly due to the hype of the Winter Olympics, skiing and snowboarding have become popular activities.

- Hyper-digitized: While digitization is a global trend, Chinese consumers are some of the most digitally savvy in the world; mobile technologies and social media are at the core of daily life. COVID-19 drove people to spend more time online—now short-form videos and livestreaming have become the top online entertainment options in China. In the first half of 2022, Chinese consumers spent 30 percent of their mobile internet time engaging with short videos. 15 “In the first half of the year, the number of mobile netizens increased, and short videos accounted for nearly 30% of the total time spent online,” Chinadaily.com, 27 July 2022.

- Exploration enthusiasts: Chinese travelers are also keen to explore the world and embark on novel experiences in unfamiliar destinations. Survey respondents were looking forward to visiting new attractions, even when travel policies limited their travel radius. Instead of revisiting destinations, 45 percent of respondents picked short trips to new sites as their number one choice, followed by long trips to new sites as their second choice.

Consumers are optimistic, and travel spending remains resilient

McKinsey’s 2022 research on Chinese consumer sentiment shows that although economic optimism is seeing a global decline, 49 percent of Chinese respondents reported that they are optimistic about their country’s economic recovery. Optimism had dropped by 6 percentage points since an earlier iteration of the survey, but Chinese consumers continue to be more optimistic than other surveyed countries, apart from India (80 percent optimistic) and Indonesia (73 percent optimistic) (Exhibit 3). 16 “ Survey: Chinese consumer sentiment during the coronavirus crisis ,” McKinsey, October 13, 2022.

Chinese consumers are still keen to spend on travel, and travel spending is expected to be resilient. Wave 6 of the tourist attitude survey saw 87 percent of respondents claiming that they will spend more or maintain their level of travel spending. Moreover, when consumers were asked “which categories do you intend to splurge/treat yourself to,” travel ranked second, with 29 percent of respondents preferring travel over other categories. 17 “ Survey: Chinese consumer sentiment during the coronavirus crisis ,” McKinsey, October 13, 2022.

Against this context of consumer optimism, the wave 6 tourist attitude survey results shed light on how travelers plan to spend, and which segments are likely to spend more than others:

- The wealthier segment and older age groups (age 45-65) show the most resilience in terms of travel spend. Around 45 to 50 percent of travelers in these two groups will spend more on their next leisure trip.

- The wealthier segment has shown the most interest in beach and resort trips (48 percent). Instead of celebrating Chinese New Year at home with family, 30 percent of Chinese travelers in the senior age group (age 55-65) expect to take their next leisure trip during this holiday—10 percent more than the total average. And the top three trip preferences for senior travelers are culture, sightseeing, and health-themed trips.

- When it comes to where travelers plan to spend their money on their next trip, entertainment activities, food, and shopping are the most popular categories. These are also the most flexible and variable spending categories, and there are opportunities to up-sell—attractions, food and beverage, and retail players are well positioned to create unique and unexpected offerings to stimulate spending in this area (Exhibit 4).

Independent accommodation is gaining popularity

Overall, Chinese consumers have high expectations for products and services. McKinsey’s 2023 consumer report found that local brands are on the rise and consumers are choosing local products for their quality, not just for their cheaper prices. Chinese consumers are becoming savvier, and tap into online resources and social media to educate themselves about the specific details and features of product offerings. 18 Daniel Zipser, Daniel Hui, Jia Zhou, and Cherie Zhang, 2023 McKinsey China Consumer Report , McKinsey, December 2022.

Furthermore, 49 percent of Chinese consumers believe that domestic brands are of “better quality” than foreign brands—only 23 percent believe the converse is true. Functionality extended its lead as the most important criterion influencing Chinese consumers, indicating that consumers are focusing more on the functional aspects of products, and less on emotional factors. Branding thus has less influence on purchasing decisions. 19 Daniel Zipser, Daniel Hui, Jia Zhou, and Cherie Zhang, 2023 McKinsey China Consumer Report , McKinsey, December 2022.

These broader consumer sentiments are echoed in the travel sector. Chinese travelers pay attention to cost, but do not simply seek out the lowest prices. While 17 percent of wave 6 respondents are concerned about low prices, 33 percent are on the hunt for value-for-money offerings, and 30 percent prefer good discounts and worthwhile deals.

And consumer sentiment regarding local brands holds true for travel preferences. Independent travel accommodation continues to be the preferred choice for most respondents, increasing in share against international chain brand hotels (Exhibit 5). Almost 60 percent of respondents prefer independent accommodation such as boutique hotels, B&Bs, and Airbnb—an 8 percentage-point increase since 2020.

Local chain brand hotels remain stable, the favored accommodation for 20 percent of respondents. These hotels are seen as a more standardized option, and as most are located in urban areas, they target the budget traveler segment.

Opting for independent accommodation is not considered a trade down; Chinese travelers expect a high level of service. In particular, respondents in the wealthier segment picked independent options (57 percent) over international premium brands (27 percent).

Premium independent options for the wealthier segment are abundant, specifically in leisure travel. Setting up a premium brand hotel requires long-term construction periods and heavy capital investment. Small-scale boutique hotels or B&Bs, on the other hand, are more agile solutions that can ramp up in the short term. This may explain the abundance of premium independent offerings. For instance, in destinations such as Lijiang and Yangshuo, between seven and nine of the top-ten premium hotels listed on Ctrip are independent boutique hotels.

Premium independent accommodation’s strength lies in quality guest experience with a genuine human touch. The service level at premium independent establishments can even surpass that of chain brand accommodation thanks to the high staff-to-room ratio, which easily reaches 3:1 or even 5:1. 20 “Strategic marketing analysis of boutique hotels,” Travel Daily , June 3, 2015. For hotels in Xiamen, Lijiang, and Yangshou, Ctrip service ratings of premium independent hotels are all above 4.7, outperforming international chain brand hotels.

Travelers are becoming smarter and more realistic during hotel selection, focusing on fundamental offerings such as local features and value for money. Across all types of hotels, local features are one of the most important factors influencing hotel selection—even for chain brand hotels which have a reputation for mastering the standardized offering. On average, 34 percent of respondents report that local features and cultural elements are the key considerations affecting their choice of hotel.

Outbound Chinese tourists are evolving rapidly, becoming increasingly diverse in their travel preferences, behaviors, and spending patterns. Chinese travelers are not homogeneous, and their needs and preferences continue to evolve. Therefore, serving each group of tourists may require different product offerings, sales channels, or marketing techniques.

The path toward eco-friendly travel in China

How international travel and tourism can attract outbound chinese travelers.

China’s lifting of travel restrictions may cause some uncertainty in the short term, but a promising recovery lies ahead. Chinese tourists have maintained a strong desire to travel internationally and are willing to pay for this experience. They are also discerning and looking for high-quality accommodation, offerings, and service. As boutique hotels are becoming more popular, international hotel brands hotels could, for example, aim to stand out by leveraging their experience in service excellence.

With renewed travel demand, now may be the time for international travel and tourism businesses to invest in polishing product offerings—on an infrastructural and service level. Tourism, food and beverage, retail, and entertainment providers can start preparing for the rebound by providing unique and innovative experiences that entice the adventurous Chinese traveler.

Craft an authentically local offering that appeals to experience-driven Chinese travelers

Chinese travelers have suspended overseas trips for three years, and are now looking to enjoy high-quality experiences in destinations they have been to before. They also want to do more than shopping and sightseeing, and have expressed willingness to spend on offerings geared towards entertainment and experience. This includes activities like theme parks, snow sports, water sports, shows, and cultural activities. Authentic experiences can satisfy their desire for an immersive foreign experience, but they often want the experience to be familiar and accessible.

Designing the right product means tapping into deep customer insights to craft offerings that are accessible for Chinese travelers, within a comfortable and familiar setting, yet are still authentic and exciting.

Travel and tourism providers may also have opportunities to up-sell or cross-sell experiences and entertainment offerings.

Social media is essential

Social media is emerging as one of the most important sources of inspiration for travel. Short video now is a major influence channel across all age groups and types of consumers.

Tourist destinations have begun to leverage social media, and short video campaigns, to maximize exposure. For example, Tourism Australia recently launched a video campaign with a kangaroo character on TikTok, and overall views soon reached around 1.67 billion.

The story of Ding Zhen, a young herder from a village in Sichuan province, illustrates the power of online video in China. In 2020, a seven-second video of Ding Zhen turned him into an overnight media sensation. Soon after, he was approached to become a tourism ambassador for Litang county in Sichuan—and local tourism flourished. 21 “Tibetan herder goes viral, draws attention to his hometown in SW China,” Xinhuanet, December 11, 2020. Another Sichuan local, the director of the Culture and Tourism Bureau in Ganzi, has drawn visitors to the region through his popular cosplay videos that generated 7 million reviews. Building on the strength of these influential celebrities, visitor numbers to the region were said to reach 35 million, more than two-and-a-half times 2016 volumes. 22 “Local official promoting Sichuan tourism goes viral on internet,” China Daily, June 17, 2022; “The Director of Culture and Tourism disguises himself as a “Swordsman” knight to promote Ganzi tourism,” Travel Daily , June 17, 2022.

Online travel companies are also using social media to reach consumers. Early in the pandemic, Trip.com took advantage of the upward trend in livestreaming. The company’s co-founder and chairman of the board, James Liang, hosted weekly livestreams where he dressed up in costume or chatted to guests at various destinations. Between March and October 2020, Liang’s livestreams sold around $294 million’s worth of travel packages and hotel room reservations. 23 “Travel companies adapt to a livestreaming trend that may outlast the pandemic,” Skift, October 26, 2020.

Livestreaming is being used by tourism boards, too. For instance, the Tourism Authority of Thailand (TAT) collaborated with Trip.com to launch a new campaign to attract Chinese tourists to Thailand as cross-border travel resumed. The broadcast, joined by TAT Governor Mr Yuthasak Supasorn, recorded sales of more than 20,000 room nights amounting to a gross merchandise value of over RMB 40 million. 24 “Trip.com Group sees border reopening surge in travel bookings boosted by Lunar New Year demand,” Trip.com, January 13, 2023.

International tourism providers looking to engage Chinese travelers should keep an eye on social media channels and fully leverage key opinion leaders.

Scale with the right channel partners

Travel distribution in China has evolved into a complex, fragmented, and Chinese-dominated ecosystem, making scaling an increasingly difficult task. Travel companies need to understand the key characteristics of each channel type, including online travel agencies (OTAs), online travel portals (OTPs), and traditional travel agencies as each target different customer segments, and offer different levels of control to brands. It also takes different sets of capabilities to manage each type of distribution channel.

Travel companies can prioritize the channels they wish to use and set clear roles for each. One challenge when choosing the right channel partner is to avoid ultra-low prices that may encourage volume, but could ultimately damage a brand.

Meanwhile, given the evolution of the postCOVID-19 industry landscape and rapid shifts in consumer demand, travel companies should consider direct-to-consumer (D2C) channels. The first step would be selecting the appropriate D2C positioning and strategy, according to the company’s needs. In China, D2C is a complicated market involving both public domains (such as social media and OTA platforms) and private domains (such as official brand platforms). To make the most of D2C, travel companies need a clear value proposition for their D2C strategy, whether it be focused on branding or on commercial/sales.

Create a seamless travel experience for the digitally savvy Chinese tourist

China has one of the most digitally advanced lifestyles on the planet. Chinese travelers are mobile-driven, wallet-less, and impatient—and frequently feel “digitally homesick” while abroad. Overseas destinations and tourism service providers could “spoil” tech-savvy Chinese travelers with digitally enhanced service.

China’s internet giants can provide a shortcut to getting digital services off the ground. Rather than building digital capabilities from scratch, foreign tourism providers could engage Chinese travelers through a platform that is already being used daily. For example, Amsterdam’s Schiphol Airport provides a WeChat Mini Program with four modules: duty-free shopping, flight inquiry, information transfer, and travel planning. This contains information about all aspects of the airport, including ground transportation and tax refund procedures.

Alibaba’s Alipay, a third-party mobile and online payment platform, is also innovating in this space. The service provider has cooperated with various tax refund agencies, such as Global Blue, to enable a seamless digitized tax refund experience. Travelers scan completed tax refund forms at automated kiosks in the airport, and within a few hours, the refunded amount is transferred directly to their Alipay accounts. 25 “Alipay and Global Blue to make tax refunds easy for Chinese tourists,” Alizila, June 23, 2014.

Such digital applications are likely to be the norm going forward, not a differentiator, so travel companies that do not invest in this area may be left behind.

Chinese travelers are on the cusp of returning in full force, and tourism providers can start preparing now

With China’s quarantine requirements falling away at the start of 2023, travelers are planning trips, renewing passports and visas, and readying themselves for a comeback. Chinese tourists have not lost their appetite for travel, and a boom in travel demand can be expected soon. Though airlines are slow to restore capacity, and some destination countries are more risk averse when welcoming Chinese travelers, there are still options for Chinese tourists to explore destinations abroad.

Tourism providers can expect to welcome travelers with diverse interests who are willing to spend money on travel, who are seeking out exciting experiences, and who are choosing high-quality products and services. The returning Chinese traveler is digitally savvy and favors functionality over branding—trends suggest that providers who can craft authentic, seamless, and unique offerings could be well positioned to capture this market.

Guang Chen and Jackey Yu are partners in McKinsey’s Hong Kong office, Zi Chen is a capabilities and insights specialist in the Shanghai office, and Steve Saxon is a partner in the Shenzhen office.

The authors wish to thank Cherie Zhang, Glenn Leibowitz, Na Lei, and Monique Wu for their contributions to this article.

Explore a career with us

Related articles.

China Travel Restrictions & Travel Advisory (Updated March 7, 2024)

Updates March 7th, 2024 : Travelers from the following countries could enjoy visa-free entry to China for tourism, business, transit, or visiting friends and relatives.

- From December 1st, 2023, to November 30th, 2024: France, Germany, Italy, Netherlands, and Spain.

- From March 14th to November 30th, 2024: Austria, Belgium, Hungary, Ireland, Luxembourg, and Switzerland.

- Singapore, Brunei

- Malaysia (from December 1st, 2023 to November 30th, 2024)

If you want to arrange a private tour, even tentatively, simply contact us .

Content Preview

- What Ways to Enter China

- Do I Still Need a PCR Test to Enter China

- Hong Kong/Macau Travel Restriction

International Flights to China

What to expect when traveling in china, best times to travel to china, 8 ways to enter china: all open now.

Since China has fully permitted visa applications, there are now several ways to enter the country.

If you still hold a valid Chinese visa (any type including a tourist visa, 10-year visa, etc.), you can use it to enter China.

If you don't have a Chinese visa or your visa has expired, you can apply for a new one. All visas can now be applied for, including tourist visas, business visas, work visas, and so on. (International visitors can apply for a tourist visa to the Chinese Mainland in Hong Kong.)

For the documents required for a visa application, you can refer to the information given by a Chinese embassy/consulate . Please submit your application at least two months in advance.

To apply for a tourist visa (L visa), you will be asked to provide an invitation letter issued by a Chinese travel agency or individual or round-trip air tickets and hotel bookings.

When booking a private tour with us, we can provide you with an invitation letter, which is one more thing we do to make your travel more convenient, giving you more flexibility with your air tickets and hotel bookings.

Now it is very easy to apply for a visa . You can easily apply by yourself without an intermediary. The following is how one of our clients successfully applied for a Chinese tourist visa:

- First, fill out the form at the China Online Visa Application website ;

- Second, make an appointment on this website to submit your visa materials on Appointment for Visa Application Submission website ;

- Third, take the required documents to the embassy to submit;

- Finally, you will get a return receipt if your documents are qualified.

Usually, you will get your visa after 7 working days. The application fee is about USD185 for US citizens.

Q: What if my passport expires but my visa doesn't?

A: You can travel to China on the expired passport containing valid Chinese visa in combination with the new passport, provided that the identity information (name, date of birth, gender, nationality) on both passport identical.

If there is a change to any of the above details, you must apply for a new visa.

2. 144-Hour Visa-Free Transit Policy

If you do not apply for a Chinese visa, you may still have the opportunity to visit these areas of China visa free: the Shanghai area (including Suzhou, Hangzhou, etc.), the Beijing area (with Tianjin and Hebei), the Guangzhou area (Shenzhen, Zhuhai, etc.), and more. Take advantage of the 6-day visa-free entitlements.

Find out if you could use the 144-hour visa-free transit policy with our information on China's 144-hour Visa-Free Policy (Eligible Entry/Exit Ports, Applicable Countries, Documents to be Prepared...)

You can also obtain entry and exit control policies through the 24-hour hotline of the National Immigration Administration:

- Beijing: 0086 (+86)-10-12367

- Shanghai: 0086 (+86)-21-12367

- Guangzhou: 0086 (+86)-20-12367

Quick Test: Will My Route Qualify for China 72/144-Hour Visa-Free Transit?

1. I will depart from (only applies to direct or connected flight):

2. I will arrive in China at [city], [airport / railway station / port].

3. My arrival date is...

4. I will leave for [country/region] from China (the bounding destination on the air ticket):

5. My departure date is...

6. My nationality is...

8. I have Chinese visa refusal stamps in my passport.

You qualify to enjoy China's 72-hour visa-free policy.

You qualify to enjoy China's 144-hour visa-free policy.

You don't qualify to enjoy China's 72-hour or 144-hour visa-free policy.

Reason you don't qualify:

- You must be in transit to a third country or region.

- You must leave the city area (prefecture or municipality) after the 72/144 hours (the 72/144-hour limit is calculated starting from 00:00 on the day after arrival, i.e. 24:00 on the arrival date).

- Your passport must be valid for more than 3 months at the time of entry into China.

- Your passport nationality is not eligible for the 72/144-hour visa exemption program.

- You have Chinese visa refusal stamps in your passport.

3. Port Visas (Landing Visas)

If you don't have time to get a visa, or if you find it cumbersome to apply for a tourist visa, you could consider traveling to China through a port visa.

Port visas can be applied for a group at least including 2 people. You need to enter the country within 15 days after you get your entry permit. The port visa allows a stay period of 1 to 2 months.

Applicable ports include Beijing, Shanghai, Hangzhou, Guangzhou, Xiamen, Guilin, Xi'an, Chengdu, etc.

Note: Tourists from America are not granted a port visa in Shanghai.

Book your China trip with us and we can help you apply for a port visa.

4. Visa Exemption for ASEAN Tour Groups to Guilin

In addition, tour groups from ASEAN member countries, including Malaysia, Thailand, Indonesia, Vietnam, Cambodia, Laos, Singapore, Myanmar, Brunei, and the Philippines, can visit Guilin for 144 hours without visas as long as they meet the visa-free transit policy requirements.

5. Shanghai Visa-Free Policy for Cruise Groups

Shanghai has a 15-day visa-free policy for foreign tourist groups entering China via a cruise. You must arrive and depart on the same cruise and be received by a Chinese travel agent at the Shanghai Cruise Terminal (or Wusong Passenger Center).

6. Hainan Visa-Free Access

No visa is required for staying on Hainan Island for up to 30 days for ordinary passport holders from 59 countries. Groups and individual tourists must book a tour through an accredited travel agency.

Find out whether you qualify for the policy here .

7. Visa Exemption for the Pearl River Delta Area

International travelers from Hong Kong or Macau are able to visit the Pearl River Delta area (Guangzhou, Shenzhen, Zhuhai, etc.) visa-free as long as they go with a registered tour provider, such as us.

8. APEC Cards

If you hold a valid APEC business travel card, you can simply enter China with the card without applying for a visa.

Travelers who hold a valid APEC business travel card can stay in China for up to 60 days.

- 4-Day Beijing Private Tour - Essence of Beijing

- 11-Day Beijing–Xi'an–Guilin–Shanghai Tour - Classic Wonders

- 13-Day Beijing, Xi'an, Chengdu, Shanghai Educational Family Vacation

Do I Still Need a PCR Test or Antigen Self-Test to Enter China

No. Starting from August 30, all travelers entering China will no longer need to undergo any COVID-19 testing. You do not need to submit any test results for COVID-19 before departure.

- 8-Day Beijing–Xi'an–Shanghai Private Tour - China Golden Triangle

- 13-Day Riches of China - Beijing – Xi'an – Guilin/Yangshuo – Hangzhou - Suzhou – Shanghai

Hong Kong / Macau Travel Restriction

Hong kong entry requirements.

Travelers from any region bound for Hong Kong will no longer need to take pre-flight COVID-19 tests (no PCR test, no RAT test) from April 1.

There is also no need for any tests when traveling from Hong Kong to the Chinese Mainland. Hong Kong could be a good gateway for your China trip. See suggestions on China Itineraries from Hong Kong (from 1 Week to 3 Weeks).

Direct high-speed trains from Guangzhou and Shenzhen to Hong Kong are available now. In preparation for the Canton Fair, it is expected that direct high-speed ferries will be launched from Guangzhou Pazhou Port to Hong Kong's airport in mid-April.

- 10 Top China Tours from Hong Kong

Macau Entry Requirement

From August 30, travelers from any region bound for Macau will no longer need to take pre-flight COVID-19 tests (no PCR test, no RAT test).

There is also no need for any tests when traveling from Macau to the Chinese Mainland.

Inbound and outbound international flights in the week beginning March 6th rose by more than 350% compared with a year earlier, to nearly 2,500 flights, according to Chinese flight tracking data from APP Flight Master.

At present, there are one or two direct flights a week from New York to Shanghai, Los Angeles to Beijing, Seattle to Shanghai, London to Guangzhou, etc.

There are also many flight options with stopovers that are more frequent and affordable. Testing at transit airports is now not required!

The Coronavirus outbreak in China has subsided. China looks like it did in 2019 again. No special measures (like PCR tests or health codes) are required when traveling around China. All attractions are open as normal.

Wearing a mask is not mandatory when traveling. In hotels, masks are off for the most part. But in some crowded places, such as airports or subway stations, many people still wear masks.

Weather-wise, the best times to visit China are spring (April–May) and autumn (September–October), when most of the popular places have their most tourism-friendly weather, except for the "golden weeks" — the first week of May and of October — when most attractions are flooded with Chinese tourists.

If you are looking for smaller crowds, favorable prices, and still good weather, you should consider March and April or September.

Tourism in cultural and historical destinations like Beijing, Shanghai, and Xi'an is hardly affected by weather conditions. They are suitable to be visited all year round.

- 11-Day Family Happiness - Beijing–Xi'an–Guilin/Yangshuo-Shanghai

- 13-Day Private Tour: Beijing – Xi'an – Chengdu –Yangtze Cruise – Shanghai - China Essence and Panda Tour

- More Chengdu and Panda tours

Discover real reviews of Highlights Travel Family 's best-rated service across trusted platforms.

Tour China with Us

We've been building our team for over 20 years. Even over the past three years we have continued, serving over 10,000 expats with China tours and getting a lot of praise (see TripAdvisor ).

We are based in China and can show you the characteristics and charm of China from a unique perspective. Just contact us to create your China trip .

Our consultants will listen to and answer your inquiries carefully and prepare the best plan for you.

- 8-Day Beijing–Xi'an–Shanghai Highlights Tour — the classic Golden Triangle

- 11-Day Beijing–Xi'an–Guilin–Shanghai — our top itinerary for families

- 2-Week Beijing – Xi'an – Chengdu – Yangtze Cruise – Shanghai Tour — the best choice for panda fans

Get Inspired with Some Popular Itineraries

More travel ideas and inspiration, sign up to our newsletter.

Be the first to receive exciting updates, exclusive promotions, and valuable travel tips from our team of experts.

Why China Highlights

Where can we take you today.

- Southeast Asia

- Japan, South Korea

- India, Nepal, Bhutan, and Sri lanka

- Central Asia

- Middle East

- African Safari

- Travel Agents

- Loyalty & Referral Program

- Privacy Policy

Address: Building 6, Chuangyi Business Park, 70 Qilidian Road, Guilin, Guangxi, 541004, China

- Share full article

China Has Reopened to Tourists. The Hard Part Is Getting There.

Despite loosened visa rules, the number of flights into China is still a small fraction of what it was before the pandemic, fueled partly by geopolitical tensions.

A check-in line for a China Eastern Airlines flight to Shanghai at New York’s Kennedy International Airport last week. Credit... Hiroko Masuike/The New York Times

Supported by

By Nicole Hong and Chang Che

- April 10, 2023

When the Chinese government announced last month that it would fully reopen its borders to foreign travelers, the news came as a jolt of relief to the millions of Chinese immigrants overseas who have been separated from their relatives since 2020.

But a flood of visitors has yet to arrive. Many people are struggling to even book a plane ticket, stymied by high prices and a lack of direct flights.

Liu Wei, 62, who lives in San Diego, recently spent hours at a local travel agency filling out a pile of paperwork to obtain a long-term visa to China. After searching for weeks for a flight, she bought a ticket for later this month to reunite with her sisters in the northeastern port city of Dalian. Round-trip business-class tickets from San Diego to Dalian cost between $6,000 and $10,000, she said, double what she typically paid before the pandemic.

“I miss the choice and the freedom to go back and forth,” said Ms. Liu, who used to visit China every summer. “It’s been such a tragedy for us to not be able to go back to our own country.”

For nearly three years, China maintained some of the harshest travel restrictions in the world, largely sealing off its borders to business travelers, tourists and relatives of Chinese nationals. The ruling Communist Party enforced a “zero Covid” policy, attempting to eradicate the coronavirus with prolonged lockdowns and mass testing.

Overseas visitors who did manage to enter China were sometimes forced to quarantine for up to two months at their own expense. Some travelers even had to undergo anal swab Covid testing , triggering protests from governments outside China.

China’s isolation had broad ripple effects. Universities shut down academic exchanges with the mainland, and multinational companies shifted their supply chains to other countries. The millions of Chinese immigrants overseas — in countries like the United States, Britain, Canada and Malaysia — suffered the heaviest emotional cost, unable to return home to care for sick parents or bury relatives who died during the pandemic.

In December, China abruptly ended its “zero Covid” policy and soon began to ease border restrictions, removing quarantine requirements for international arrivals. The following month, business travelers were allowed to return on special visas.

The biggest barrier came down last month when the Chinese government resumed issuing tourist visas. China has also said it would reinstate the 10-year visas that had been suspended during the pandemic, facilitating the travel of many overseas visitors.

In a sign of pent-up demand, right after the Chinese government announced the loosened restrictions, searches on Expedia.com for travel from the United States to mainland China jumped around 40 percent from a month earlier, according to data provided by the online travel company.

Jessie Huang, who lives in Jersey City, N.J., hopes to visit China this summer but has struggled to find tickets under $2,000. Ms. Huang, 52, has not seen her 86-year-old father, who lives on an island off the coast of Shanghai, in seven years. She was supposed to visit in early 2020 after he suffered a stroke.

Ms. Huang has kept in touch with him through WeChat, the Chinese messaging app. She sometimes feels heartbroken after their conversations, sensing that each passing year becomes harder for him.

“I’m just missing my family,” she said.

Prices have stayed high partly because airlines have been slow to ramp up their flights to China. Globally, the number of flights into China in March were only about a quarter of what they were in the same month in 2019, according to Cirium, an aviation data provider.

Routes between the United States and China, the world’s two largest economies, have been capped because of geopolitical tensions. During the pandemic, the two rivals suspended each other’s flights in a political tit-for-tat, and airlines need the approval of both countries’ aviation authorities to increase routes.

American and European carriers are not as eager to resume all of their prepandemic flights to China, aviation analysts say. Since invading Ukraine more than a year ago, Russia has banned the American and European carriers from flying through its airspace, meaning flights to China now require longer routes with more fuel and flight crew.

U.S. carriers have been lobbying Washington to force Chinese airlines, which are still flying over Russia, to use the same routes as their American competitors, arguing that they have an unfair cost advantage.

A spokesman for the U.S. Department of Transportation did not provide comment on when routes to China might increase.

Direct flights between the United States and mainland China are hard to get. Last month, Delta Air Lines and American Airlines both resumed direct flights to Shanghai from hubs in Detroit, Seattle and Dallas, but only a handful of times per week. United Airlines operates a direct flight from San Francisco to Shanghai four times a week. None of the airlines has any direct flights between the United States and Beijing.

Aviation analysts say airlines are also hesitant to add flights when other hurdles are dampening the demand to fly into China.

A negative P.C.R. test within 48 hours of departure is still mandatory for citizens of many countries to enter China. And the sudden changes in China’s border policies have left consulates around the world struggling to handle paperwork for visas, which are required for all overseas travelers to and from China.

Another factor that has slowed the rebound in flights into China is the fact that most of them before the pandemic were filled with Chinese tourists returning home. About 20 percent of Chinese passports expired during the pandemic, according to data from consulting firm McKinsey, resulting in lengthy waits for renewals that have delayed the recovery in outbound travel.

But the gates are gradually opening.

Bookings for group tours have surged for a holiday break in China in early May, according to Ctrip, a Chinese online travel agency. The top destinations included Thailand, Egypt and Switzerland, Ctrip said.

For now, the visitors who can most afford to fly to China are business travelers, who have been filling up premium cabins into the mainland.

China has rolled out the red carpet for foreign business officials, part of an effort to revive its economy after years of Covid lockdowns. Dozens of chief executives, including Tim Cook of Apple, flew to Beijing to attend last month’s China Development Forum, where China’s newly elected premier, Li Qiang, pledged that “the door to China’s opening will grow wider.”

Many executives are eager to visit with employees and suppliers for the first time since 2020.

A February survey of 43 American companies showed that 50 percent of chief executives planned to visit China in the first half of this year, according to the U.S.-China Business Council, a trade group in China.

“The Chinese government has sent some signals for support about private companies, but at the same time, it’s a tense geopolitical environment,” said Jack Kamensky, a senior director at the business council.

Some business owners were more hopeful about China’s reopening.

For over a decade, Keith Collea, a film technology entrepreneur, worked in China’s budding film industry on movies like the 2014 action film “The Monkey King.” His latest project, which involved providing visual effect equipment to Chinese amusement parks, was halted when he was shut out of the country during a trip to Los Angeles in 2020.

Now, Mr. Collea is planning a long-awaited return. He was confident his projects would resume once he reunited with his former investors and partners.

“Doing business in China is not something you can do over the phone from the United States,” he said. “You have to sit with people, you have to go to dinners, you have to drink a lot. You have to invest and grow relationships there.”

Claire Fu contributed research.

Nicole Hong is a reporter covering China. She previously worked for The Wall Street Journal, where she was part of a team that won the 2019 Pulitzer Prize in National Reporting. More about Nicole Hong

Chang Che is the Asia technology correspondent for The Times. He previously worked for The China Project and as a freelance writer covering Chinese technology and society. More about Chang Che

Advertisement

China Says Visa-Free Travel Policy Has Boosted Tourism

FILE PHOTO: Travellers walk past an installation in the shape of five stars, at Beijing Daxing International Airport in Beijing, China April 24, 2023. REUTERS/Tingshu Wang/file photo

BEIJING (Reuters) - China's foreign ministry said on Tuesday its visa-free travel policy has produced a clear effect, making things easier for travellers.

"Going forward, the Ministry of Foreign Affairs will continue to adjust visa policies to create more favourable conditions and further facilitate cross-border travel," spokesperson Wang Wenbin told a press briefing when asked for an update on tourism after China announced the policy, which covers several European countries and Malaysia.

The policy came into effect Dec. 1 and the ministry, citing immigration data, said about 7,000 of nearly 18,000 travellers from France, Germany, Italy, the Netherlands, Spain and Malaysia - the countries covered by the visa waiver - entered China in the first three days of the month.

Daily average tourist numbers from those countries have risen by 39% on the first three days of December compared to on the last day of November, Wang said.

Germany's ambassador to China had expressed hope that China would extend the measures to all European Union members.

Photos You Should See - April 2024

(Reporting by Andrew Hayley; Writing by Liz Lee and Bernard Orr; Editing by Tom Hogue and Miral Fahmy)

Copyright 2023 Thomson Reuters .

Join the Conversation

Tags: France , Italy , Asia , European Union , Malaysia , Europe , Spain , Germany , Netherlands

America 2024

Health News Bulletin

Stay informed on the latest news on health and COVID-19 from the editors at U.S. News & World Report.

Sign in to manage your newsletters »

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

You May Also Like

The 10 worst presidents.

U.S. News Staff Feb. 23, 2024

Cartoons on President Donald Trump

Feb. 1, 2017, at 1:24 p.m.

Photos: Obama Behind the Scenes

April 8, 2022

Photos: Who Supports Joe Biden?

March 11, 2020

A ‘Fork in the Road’ for Democracy

Lauren Camera April 24, 2024

Johnson at Columbia: ’Stop the Nonsense’

Aneeta Mathur-Ashton April 24, 2024

What to Know: Bird Flu Virus in Milk

Cecelia Smith-Schoenwalder April 24, 2024

High Court to Again Weigh Abortion Law

Laura Mannweiler April 23, 2024

Takeaways From Pecker’s Trump Testimony

Lauren Camera April 23, 2024

Biden, Trump: Trail v. Trial

Cecelia Smith-Schoenwalder April 23, 2024

- Asia Briefing

- China Briefing

- ASEAN Briefing

- India Briefing

- Vietnam Briefing

- Silk Road Briefing

- Russia Briefing

- Middle East Briefing

China’s Tourism Sector Prospects in 2023-24

Amid the post-pandemic recovery, China’s tourism sector is rebounding with vigor in 2023. We discuss the resurgence of outbound and domestic travel, evolving traveler behavior, and tech-enabled trends in this article. From cultural exploration to wellness escapes and digital integration, the stage is set for foreign businesses and investors to seize opportunities in this transformed landscape.

After enduring the significant impacts of the COVID-19 pandemic, China’s tourism sector is gearing up for a strong resurgence in 2023. Projections indicate that the total revenue from domestic tourism is expected to exceed RMB 4 trillion (approximately US$580.96 billion), marking an impressive 96 percent growth. Several driving forces contribute to this revival in China’s tourism landscape, including:

- Easing of travel restrictions;

- Increase in disposable income among Chinese consumers; and

- Growing popularity of domestic tourism.

In particular, the government’s support in revitalizing the tourism sector is evident through subsidies and tax exemptions provided to tourism enterprises. The robust resurgence of China’s tourism industry also serves as a positive indicator for the nation’s economy, with tourism being a significant driver of economic growth and expected to contribute notably to the country’s GDP. Overall, 2023 has seen a continuous stream of new policies, products, technologies, concepts, trends, and opportunities impacting the tourism industry.

China’s evolving tourism landscape

Insights from outbound tourism in h1 of 2023.

Both outbound and inbound tourism markets in the first half of 2023 have shown impressive vitality, surpassing the levels observed in the same period of 2019. Average expenditures for outbound travelers have exhibited a notable increase, with Hong Kong and Macao leading the resurgence of outbound tourism. The total number of inbound and outbound individuals has surged by approximately 170 percent.

Data from the World Tourism Alliance’s reports, reveal that the outbound tourism sentiment index reached 28 percent in the first half of 2023, marking a 21-point increase from the same period in 2019. The outbound tourism market has displayed a gradual “U-shaped” recovery, emphasizing a steady resurgence rather than an abrupt rebound.

According to recent data from Alipay’s Overseas Spending Platform, the average expenditure per user for outbound travel in the first half of 2023 grew by 24 percent compared to 2019. Among popular destinations, the top 10 outbound travel destinations in terms of transaction volume for the first half of 2023 were:

- South Korea;

- United Kingdom; and

This data is supported by several favorable policies. Since the beginning of the year, the National Immigration Administration has continuously optimized and adjusted inbound and outbound management policies.

Starting from February 20, 2023, mainland cities within the Greater Bay Area initiated a pilot implementation of visa endorsements for cross-border talent to and from Hong Kong and Macao. On May 15, 2023, policies such as the nationwide implementation of group travel endorsements for mainland residents traveling to Hong Kong and Macao were fully restored.

The streamlined and optimized policies for travel to Hong Kong and Macao prompted provinces across the mainland to organize multiple tour groups, leading to a consistent rise in mainland visitors to these regions. According to data released by the Hong Kong Tourism Board, nearly 13 million visitors arrived in Hong Kong in the first half of 2023, of which approximately 10 million were mainland visitors, accounting for around 77 percent of the total.

Furthermore, based on recent data released by the National Immigration Administration, the first half of 2023 witnessed a total of 168 million inbound and outbound individuals passing through China’s immigration, marking a year-on-year increase of 169.6 percent.

At the same time, approximately 42.798 million entry and exit permits for travel to and from Hong Kong, Macao, and Taiwan were issued, indicating a significant 1509 percent increase compared to the same period in 2022.

These figures further underline China’s promising revival in outbound tourism. Indeed, Chinese tourists have once again become a significant force driving global tourism and offline consumption.

In terms of outbound travel numbers, the top 10 departure cities were: Shenzhen, Shanghai, Guangzhou, Beijing, Hangzhou, Foshan, Dongguan, Zhuhai, Chengdu, and Wuhan. This highlights that outbound travel is mainly concentrated in first-tier and new first-tier cities, with the “Guangzhou-Shenzhen-Foshan-Dongguan-Zhuhai” Greater Bay Area cities also playing a pivotal role in outbound tourism.

The primary reason driving Chinese tourists to travel abroad is leisure, with business and visiting friends and relatives (VFR) as the subsequent motivations. The rapid expansion of outbound tourism from China can be attributed to the rising incomes of the middle class , the growing desire among Chinese travelers to explore diverse countries and cultures, and the ease of obtaining visas and fulfilling entry criteria for various destinations.

Moreover, the retail sector captures the largest portion of Chinese tourists’ spending when traveling abroad and is anticipated to retain its dominant position in terms of outbound tourism expenditure over the projected timeframe.

The steady recovery of outbound tourism

Initial expectations for a robust rebound in outbound tourism this year have encountered a more precarious reality. Notable evidence of this transformation is seen in the changing preferences of Chinese leisure travelers. As reported by CNBC, the desire to travel abroad has surged from 28 percent to 52 percent among Chinese leisure travelers since last year, nearly doubling.

Business travel intentions have tripled, and interest in education, family visits, and medical tourism abroad is also on the rise. Other findings align, revealing that 50 percent of Chinese travelers plan to journey internationally within the next year.

A significant shift has also occurred in travel fears, particularly concerning Covid contraction. While it topped travelers’ concerns in 2022, it has diminished to the least worrisome aspect this year, as per Morning Consult’s survey. This shift reflects growing traveler confidence. Factors influencing this gradual recovery go beyond preferences. A recent report from the Mastercard Economics Institute reveals a shift in Chinese residents’ spending patterns.

Known for their shopping inclination, there’s a rising trend toward investing in experiences over possessions, particularly in a zero-Covid environment. Despite global economic uncertainties, Asia-Pacific’s, including China’s, travel recovery remains steady. As travel capacity grows, costs are anticipated to decrease, fueling a more dynamic travel landscape.

Contrary to an instant “boom,” China’s international travel revival is unfolding steadily. Though not as swift as initially projected, the evolving interests, changing attitudes, and gradual shift toward experiential spending all point to a growing and adaptive outbound tourism sector, offering a promising glimpse into the future.

The Chinese government’s recent efforts to revive outbound group travel

China’s Ministry of Culture and Tourism recently expanded outbound group tour destinations, including popular places like Japan and the US. A recent analysis provided by the EIU indicates that this move will aid global tourism recovery, benefiting countries with simplified visa procedures.

While the relaxed restrictions will moderately boost outbound tourism, obstacles and cautious spending persist. Nonetheless, domestic travel agencies are expected to see increased revenue, leading to employment and income growth in the sector.

However, challenges such as limited flights and labor shortages could hinder outbound tourism’s full recovery. A complete relaxation of restrictions is predicted in late 2023, but pre-pandemic outbound levels might not return until 2025.

Domestic tourism is thriving

In the first half of 2023, domestic tourism revenue (total tourist spending) reached RMB 2.3 trillion (approx. US$318 billion), marking a substantial increase of RMB 1.12 trillion (approx. US$155 billion) compared to the previous year. Notably, urban residents’ expenditures on travel accounted for a year-on-year surge of 108.9 percent, while rural residents’ travel spending grew by 41.5 percent.

The remarkable rebound of China’s domestic tourism sector can be attributed to a set of factors that differentiate it from the relatively slower recovery of outbound tourism. For one, the domestic tourism industry appears to be less affected by uncertainties surrounding employment and income growth compared to other service and retail sectors.

This is primarily due to the strong yearning of Chinese consumers to explore after years of mobility limitations imposed by the pandemic.

On the other hand, the prolonged revival of outbound flights has further bolstered the domestic tourism scene. Many individuals redirected their travel plans within China as international travel remained limited.

Notably, the return of international air traffic to approximately 80 percent of pre-pandemic levels is not expected until the fourth quarter of 2023, which creates a favorable environment for the vigorous resurgence of domestic tourism in the meantime.

Changing Chinese travelers’ preferences in 2023

In the wake of the COVID-19 pandemic and the subsequent travel restrictions, Chinese travelers underwent a transformation in their preferences and behaviors. Over the past three years, while international travel remained limited, domestic exploration thrived.

Around 8.7 billion domestic trips were taken, indicating an annual rate of around 50 percent of pre-pandemic levels. This period allowed the domestic market to mature, and travelers became more sophisticated in their pursuits, engaging in various new leisure experiences such as beach resorts, skiing trips, and city “staycations.”

As a result, the post-COVID-19 Chinese traveler exhibits distinct traits: heightened digital savvy, elevated expectations, and an appetite for novel experiences. These characteristics paint the profile of a typical Chinese traveler in 2023:

- Experiences matter: Survey data reveals that the rejuvenated Chinese tourist is driven by experiential travel. While outdoor and scenic trips remain popular, the preferences have evolved. Sightseeing and culinary experiences, highly valued in the initial survey series, are now joined by a growing interest in culture and history, beaches, and resorts, as well as health and wellness. This shift solidifies the trend towards experience-driven travel. Additionally, activities like skiing and snowboarding have gained popularity, possibly influenced by the 2022 Beijing Olympic Winter Games .

- Digital expert: Chinese travelers are among the world’s most digitally adept consumers, easily integrating mobile technologies and social media into their daily lives. The pandemic further propelled their online engagement. Short-form videos and livestreaming have emerged as dominant online entertainment options.

- Curious: The desire to explore novel experiences in unfamiliar destinations remains strong among Chinese travelers. Despite travel radius limitations imposed by policies, survey respondents express eagerness to visit new attractions. Instead of revisiting familiar places, 45 percent of participants prioritize short trips to new sites, while long trips to new destinations are the second most favored option.

Emerging trends and destinations

Cultural and heritage tourism.

A significant shift in China’s tourism landscape is the increasing emphasis on cultural tourism, where traditional heritage seamlessly intertwines with contemporary travel. As the nation preserves and celebrates its abundant historical and cultural treasures, a surge in cultural tourism activities like immersive experiences and interactive exchanges has taken center stage.

This trend is particularly pronounced in the realm of domestic tourism, where travelers are flocking to heritage sites and cultural landmarks to gain a deeper understanding of China’s rich heritage.

Moreover, the development of cultural and tourism industries constitutes a crucial component of China’s cultural confidence-building efforts. This sector has received significant attention from the government, evidenced by policies like the “14th Five-Year Plan for Cultural Development” and the “14th Five-Year Plan for Tourism Industry Development.” Such policies drive the integration of culture and tourism, increase the supply of cultural tourism products, and enhance the quality of such offerings.

Wellness tourism

In 2023, a remarkable shift in travel preferences among Chinese tourists has propelled wellness and health tourism to the forefront. As observed by Rung Kanjanaviroj, Director of the Tourism Authority of Thailand’s Chengdu office, Chinese travelers are displaying a distinct preference for destinations that offer a blend of sunny beaches and holistic well-being experiences.

This evolving trend has prompted destinations like Thailand to proactively adapt by refining their offerings. Through the enhancement of health tourism services and a focus on engaging student and youth travelers, Thailand has positioned itself as a prime destination for those seeking rejuvenation and self-care during their journeys.

The rise in wellness and health tourism reflects a broader shift in Chinese travelers’ priorities, as they seek destinations that not only provide scenic beauty but also nurture their physical and mental well-being.

Tech-enabled tourism in China’s innovative travel landscape

China’s tourism industry has evolved dramatically through the fusion of technology and changing consumer demands. In 2023, the landscape is marked by a growing emphasis on tech-enhanced experiences that cater to modern travelers’ evolving preferences that foreign businesses and investors in the sector can learn from.

- Smart appliances and IoT integration: China’s tech-driven tourism trend showcases the integration of smart appliances and the Internet of Things (IoT) into the travel journey. Travelers now wield the power to personalize their environment and encounters via smartphone apps. Innovations range from smart hotel rooms adjusting lighting, temperature, and ambiance to IoT-enabled transportation providing real-time updates, enhancing comfort and efficiency.

- Virtual and augmented reality immersion: Tech-savvy Chinese travelers are increasingly seeking immersive encounters. Virtual and augmented reality (VR/AR) have taken center stage, enabling tourists to explore historical sites, cultural landmarks, and natural marvels through virtual tours that breathe life into destinations. This not only enhances engagement but also serves as a potent tool for destination marketing.

- Seamless contactless services and digital payments : Contactless services and digital payments have become integral to China’s tech-enhanced tourism scene. Travelers can navigate touchpoints like check-in, security, dining, and shopping with minimal physical interaction. QR codes have revolutionized payment methods, enabling transactions through smartphones, and eliminating the need for physical currency or cards, in alignment with the country’s cashless society drive.

The city of Hangzhou offers a glimpse into the future of tech-enabled tourism. Hangzhou’s West Lake, a UNESCO World Heritage site, now features interactive kiosks that provide historical context, virtual guides, and navigation assistance to visitors. These digital enhancements blend seamlessly with the serene natural landscape, enriching the cultural experience.

Similarly, the China National Tourist Office uses VR to transport potential travelers to iconic destinations. Through immersive VR experiences, individuals can virtually explore the Great Wall, the Terracotta Army, and other renowned sites, sparking wanderlust and encouraging travel planning.

Preparing for the return of Chinese tourists to the international scene

The gradual easing of travel restrictions in China still presents a promising avenue for the recovery of the international travel and tourism sector. Amid this positive outlook, attracting Chinese tourists is becoming a priority for global businesses.

Chinese travelers, known for their enthusiasm to explore beyond their borders, are now seeking immersive experiences, quality accommodation, and exceptional service. Here are some strategies that foreign businesses can employ to entice and captivate the adventurous Chinese traveler.

Crafting authentic and familiar experiences

After a three-year hiatus from overseas travel, Chinese tourists are now yearning for high-quality experiences in familiar destinations.

They are looking beyond traditional shopping and sightseeing, expressing a keen interest in entertainment and experiential offerings. Theme parks, cultural activities, water sports, snow sports, and shows are among the sought-after activities.

The key is to offer authentic experiences that resonate with Chinese travelers’ desires for immersion, while still maintaining a touch of familiarity.

Businesses should leverage deep customer insights to design offerings that strike a balance between accessibility and authenticity, ensuring a comfortable yet exciting experience.

Harnessing the power of social media

Social media, particularly short videos, has emerged as a pivotal source of travel inspiration for all age groups. Tourist destinations have capitalized on this trend by launching engaging short video campaigns, maximizing exposure and engagement.

The burgeoning trend of city-walking , for example, where urban exploration is undertaken solely on foot, has not only captured the attention of locals but has also made significant waves across various social media platforms. Chinese netizens are embracing this form of experiential travel, and businesses can leverage social media to align with their preferences.

Platforms like Douyin, China’s counterpart to TikTok, have witnessed the rise of “city-walk content”. A recent video showcasing city-walk routes in Guangzhou amassed over 171,000 likes and found its way into the favorites of 72,000 viewers.

Furthermore, Xiaohongshu, a prominent lifestyle-sharing platform in China, reported a remarkable 30-fold increase in searches related to city walk during the first half of 2023 compared to the previous year.

Businesses can leverage social media platforms to connect with potential Chinese tourists, employing captivating content and innovative campaigns to pique their interest. Creating a strong presence on platforms like TikTok and engaging with influential figures can significantly boost visibility.

Collaboration with Internet giants

China’s tech-savvy travelers are deeply intertwined with the digital world, and internet giants like WeChat and Alipay play a pivotal role in their daily lives. Foreign businesses can tap into these existing digital ecosystems rather than starting from scratch.

For instance, Amsterdam’s Schiphol Airport offers a WeChat Mini Program providing information about the airport, including duty-free shopping and travel planning. Alibaba’s Alipay, renowned for its mobile payment capabilities, has partnered with tax refund agencies to streamline the tax refund process for Chinese travelers.

Such digital innovations enhance convenience and are fast becoming an expected norm.

Prioritize direct-to-consumer (D2C) channels

Navigating China’s intricate travel distribution landscape can be complex, as it encompasses diverse channels, such as online travel agencies (OTAs), online travel portals (OTPs), and traditional travel agencies. To make the most of this landscape, businesses can consider embracing D2C channels.

By leveraging social media platforms and official brand platforms, businesses can create a compelling value proposition that resonates with Chinese travelers. Investing in D2C channels not only enhances branding but also facilitates direct engagement with potential tourists, allowing for a personalized and enticing approach.

Key takeaways: Navigating China’s tourism resurgence

All in all, in 2023, China’s tourism is making a strong comeback, driven by key trends that reveal changing traveler preferences.

Domestically, easier travel rules and higher incomes are fueling local exploration. Internationally, outbound tourism is gradually recovering with a focus on immersive experiences, wellness, and cultural discovery.

Chinese travelers are becoming more tech-savvy, seeking out tech-enhanced experiences like virtual reality tours. This shift is boosting cultural, heritage, and wellness tourism.

Social media, especially platforms like TikTok and WeChat, are vital for engaging with Chinese travelers effectively.

In essence, China’s tourism resurgence is multifaceted, with travelers seeking enriched experiences, digital engagement, and authenticity.

Businesses that align with these preferences and capitalize on domestic and international opportunities are likely to thrive in the evolving travel landscape.

China Briefing is written and produced by Dezan Shira & Associates . The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at [email protected] .

Dezan Shira & Associates has offices in Vietnam , Indonesia , Singapore , United States , Germany , Italy , India , Dubai (UAE) , and Russia , in addition to our trade research facilities along the Belt & Road Initiative . We also have partner firms assisting foreign investors in The Philippines , Malaysia , Thailand , Bangladesh .

- Previous Article Exporting Food Products to China: A Step by Step Guide

- Next Article China Issues 24 New Measures in Clear Directive to Boost Foreign Investment

Our free webinars are packed full of useful information for doing business in China.

DEZAN SHIRA & ASSOCIATES

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

Want the Latest Sent to Your Inbox?

Subscribing grants you this, plus free access to our articles and magazines.

Get free access to our subscriptions and publications

Subscribe to receive weekly China Briefing news updates, our latest doing business publications, and access to our Asia archives.

Your trusted source for China business, regulatory and economy news, since 1999.

Subscribe now to receive our weekly China Edition newsletter. Its free with no strings attached.

Not convinced? Click here to see our last week's issue.

Search our guides, media and news archives

Type keyword to begin searching...

Advertisement

Tourism and sustainable development in China: a review

- Research Article

- Published: 08 July 2020

- Volume 27 , pages 39077–39093, ( 2020 )

Cite this article

- Chen Haibo 1 ,

- Emmanuel Caesar Ayamba ORCID: orcid.org/0000-0001-5808-6239 1 , 2 ,

- Thomas Bilaliib Udimal 3 ,

- Andrew Osei Agyemang 2 &

- Appiah Ruth 4

2199 Accesses

26 Citations

Explore all metrics

The adaption of the open-up reform policies in China some three decades ago has resulted in a rapid economic transformation of which the tourism sector has equally witnessed fast development. Therefore, the essence of this article is to review the evolution and expansion of the tourism industry in China and its obligation to observing international sustainable development policies and practices. Indications of the current policy regime, establishment, and institutions, sustainable development strategies to ensure continuity and availability of resources for future use, environmental sustainability laws and regulations, and promotional events for the development of the tourism industry are made available in this article. In effect, this article reviews how the activities of the tourism sector impacts on the environment. The findings show that China in its quest to be a world leader of tourists’ destination has impacted negatively on the environment which by extension affect the economy and society at large. On the other hand, as a leading nation in the United Nations, China has in contemporary times adapted sustainable development strategies to help safeguard the environment. However, more needs to be done in the area of advanced technology and renewable energy.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

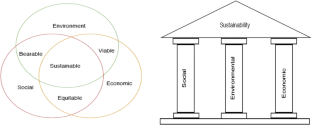

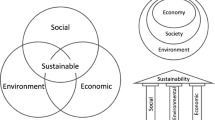

Three pillars of sustainability: in search of conceptual origins

Impact of tourism development upon environmental sustainability: a suggested framework for sustainable ecotourism

Buen vivir, degrowth and ecological swaraj: alternatives to sustainable development and the green economy.

Formerly the agency responsible for the management and operation of the tourism sector in China.

Countries that have adhered to the World Heritage Convention, including the non-member state of the Holy See

Deng Xiaoping was a Chinese leader who held the ideology that the task faced by the leadership of China was twofold: (i) promoting modernization of the Chinese economy through the theory of the productive forces, and (ii) preserving the ideological unity of the Communist Party of China (CPC) and its control of the difficult reforms required by modernization

Aimed at increasing rest times for Chinese workers accompanied with statutory paid annual entitlements to encourage the demand for domestic tourism and its related facilities, products, and activities.

Provision of eco-friendly services in the areas of transport and business to encourage easy access to tourist sites

Expansion of tourism facilities especially for those with additional needs

Encourages the usage of most advanced technological resources in the development of the tourism industry. Additionally, it seeks to diversify Chinese tourism to the development of new tourism sub-sectors such as sport tourism, medical tourism, bicycle tourism, and “red tourism” (a form of political tourism that celebrates the Chinese state and its recent revolutionary history, and aims to promote “fine traditional culture”)

Creation of new tourist information services, road signage, and websites to increase public awareness. Also, it aims at encouraging staff training at higher and vocational education levels for the tourism management

Aims at improving service and quality standards including a quality guarantee system for tourism and leisure.

Maximum population size of a given species that an area can support without reducing its ability to support the same species in the future or simply the maximum pressure or load that a system can conveniently withstand before breaking down.

Ahmad F, Draz M, Su L, Ozturk I, Rauf A (2018) Tourism and environmental pollution: evidence from the one belt one road provinces of Western China. Sustainability 10(10):3520

CAS Google Scholar