Wise Travel Debit Card Review: Fees, Exchange Rates, Limits and How to Use It

There are many things you need to keep track of as a digital nomad, such as visas , travel documents, and accommodation , to name a few.

But one of the most important things to work out is your finances. As a digital nomad, you are likely constantly moving between countries and switching currencies, so having a travel debit card is imperative .

The Wise debit card is an easy financial solution for frequent travelers, digital nomads, and expats . So, what is the fuss about this Wise travel card? How does it work? And most importantly, should you hop on the bandwagon and sign up for it?

I have been using the Wise Travel Card for quite some time now and, in this article, I will give you my honest opinion about it.

What is a Wise Travel Debit Card?

If you travel often, you have probably used or at least heard of Wise (formerly Transfer Wise) .

This UK-based tech company was founded in 2011 by Estonian businessmen Kristo Käärmann and Taavet Hinrikus on the principle of providing fast and fair exchange rates for international transfers without any sneaky fees or below-par exchange rates.

I have been personally using their Wise multi-currency account for years now, and it is still the primary way I transfer money abroad. But, I recently started using the Wise travel card , which added an entirely new dimension to my travels.

Can I Use The Wise Card For Traveling Abroad?

The Wise travel card it's not a credit card and functions pretty much like a regular debit card. You simply add funds to the account and insert, swipe, or tap to pay for items.

The main difference? With Wise, you can hold money in more than 40 different currencies and pay like a local for items in more than 160 countries worldwide without having to worry about hefty fees or markups on conversion rates.

Your Wise Travel Card is connected directly to your Wise account, so you can spend funds from your balances.

Who is the Wise Travel Card for?

Obviously, this is a “travel” card, so its primary purpose is for spending abroad while traveling . That said, you could totally use this for your day-to-day expenses. Traditional banks aren’t really designed to cater to frequent travelers or digital nomads , and the Wise Travel Card fills this gap.

For example, my wages are paid from the US, but I live abroad permanently, so I can easily transfer from my US-based bank to Wise and then simply use my Wise card for most of my daily expenses.

You should consider using the Wise Travel Card if one or more of the following applies to you:

- You frequently transfer funds from another country that uses a different currency.

- You travel internationally often and need a card with low currency conversion fees.

- You often shop online with international retailers that sell their products in a foreign currency.

- You own a business and need a card for international expenses.

- Your current bank card has high currency conversion fees and you want to get away from a traditional bank account

- Your current bank card has high fees for using international ATMs.

Wise Card Features for Traveling Abroad

If you have used a travel prepaid card like Revolut , Chime , or Monzo in the past, you can expect similar features from the Wise Travel Card. Let's see which ones are those:

- Low fees on conversions with the mid-market exchange rate

- Hold, spend, and exchange more than 40 different currencies in your Wise account

- Available to citizens and residents of more than 30 countries , including the UK, Canada, EU, USA, and Australia

- Manage, top up, freeze, and view your card balance in the Wise App

- Use at over 2 million ATMs with free monthly withdrawals up to certain limits.

- Create up to 3 digital virtual cards for free

- Auto currency convert feature to automatically convert your funds at your set rate

- Ability to make Contactless payments

- Connect to most popular eWallets like Google Pay, Apple Pay, and more

- Free spending of any currency you hold in your Wise account

- Biodegradable and eco-friendly card design

Pros and Cons of the Wise Debit Card for Travel

When I first started my digital nomad journey, I quickly came to a rude awakening when I found that my bank was charging exorbitant markups on foreign exchange and fees for ATM withdrawals .

If the same is happening to you, you’ll want to get your hands on this gem of a travel card . But before you sign up, let’s go over some of the upsides and downsides of the Wise Travel Card.

Pros and cons:

What to love about the wise debit card.

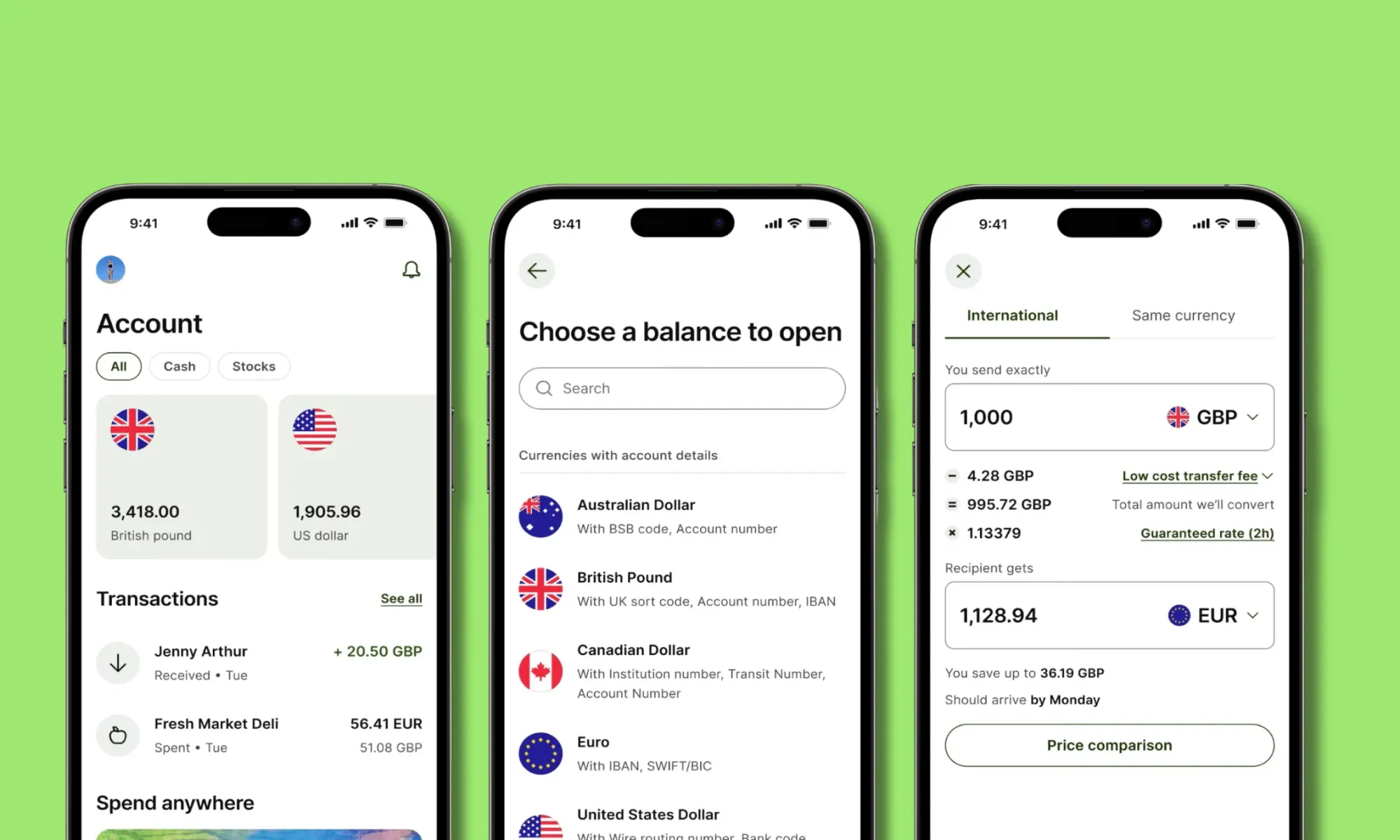

For me, the Wise card's standout features are the app's user-friendliness , the multi-currency account , and the low markup on exchange rates .

Being able to hold more than 40 currencies is a game changer. Transferring funds to different currencies in their app when I travel abroad is super easy. To give you an example, I spend quite a bit of time in Europe, the USA, and New Zealand. And with Wise , I can have separate accounts for USD, EUR, and NZD, which makes my life SO much more manageable when traveling to these countries!

On top of that, while there is a small markup fee on currency exchange, it is extremely minimal compared to other banks I have used .

What Could Be Improved About the Wise Debit Card?

The obvious downsides of the Wise Travel Card lie with ATM withdrawal limits , longer card delivery timeframes , and the lack of a premium option .

I am based in the USA, and my card took more than 2 weeks to arrive. Most digital nomads don’t spend too much time in each place, so this can make it difficult to receive your card initially if you are a frequent traveler .

Also, while card transactions are becoming the norm in many countries, cash is still king in several countries I have traveled to in the past few years. The Wise card is NOT exactly the ideal card for withdrawing cash . You’ll only get two transactions for free , and then you’ll be paying a usage fee as well as a 1.75% to 2% markup . This definitely isn’t a dealbreaker, but I hope Wise will improve this in the future.

What Currencies Can You Use With the Wise Travel Card?

One of the main reasons Wise has kept me on board as a customer all these years is their multi-currency account . This is truly the crown jewel of all of Wise’s features.

You can store 40+ currencies in various wallets in your Wise account , but this doesn’t mean you are limited to spending in those currencies. In fact, you can use the Wise debit card in more than 160+ countries ! If the currency you are spending in doesn’t have a wallet option, the Wise card will simply exchange the money into the payment currency at the time of your purchase .

For example, I was recently in Guatemala, and, unfortunately, I was not able to store Quetzal (the local currency) in my multi-currency account. But when I bought something, my funds were automatically converted from USD to Quetzal at the mid-market rate (plus 0.5%).

There are also 11 currencies for which you get account details to make bank transfers . This means you can transfer funds in the following currency balances directly from your Wise account to another bank account.

This is a feature of Wise that I use often. If I need to transfer funds from my US bank account to one in another country, I almost always use Wise as a “middleman” in order to avoid unexpected transfer fees .

While you won’t be able to make bank transfers in other currencies, you can hold them in your Wise account and spend with your travel card.

How Does the Wise Card Exactly Work?

As you can see, the Wise Travel Card is a wise decision for any traveler (see what I did there?), but how does it exactly work?

As with any new bank account or credit card, there is a bit of a learning curve when first using your Wise travel card . That said, using this card isn’t rocket science, so you’ll be saving money on exchange fees in no time!

How to Use the Wise Travel Card Abroad

The Wise travel card is specifically designed for spending money outside of your home country, so as you would expect, it is pretty easy to use abroad.

All you need to do is order your card , activate it, create a PIN, add money to your account, and you will be all set to use the card in a different country!

The Wise App

There is nothing more annoying than an app that is built for developers and not for the general public. Your banking and financial app should be easy to navigate and access.

I personally find the Wise app to be extremely user-friendly and intuitive . All features are easy to find, and when navigating through the app, I rarely got stuck or failed to find a setting.

I was easily able to change personal settings, connect bank accounts, exchange money, and send transfers from the app.

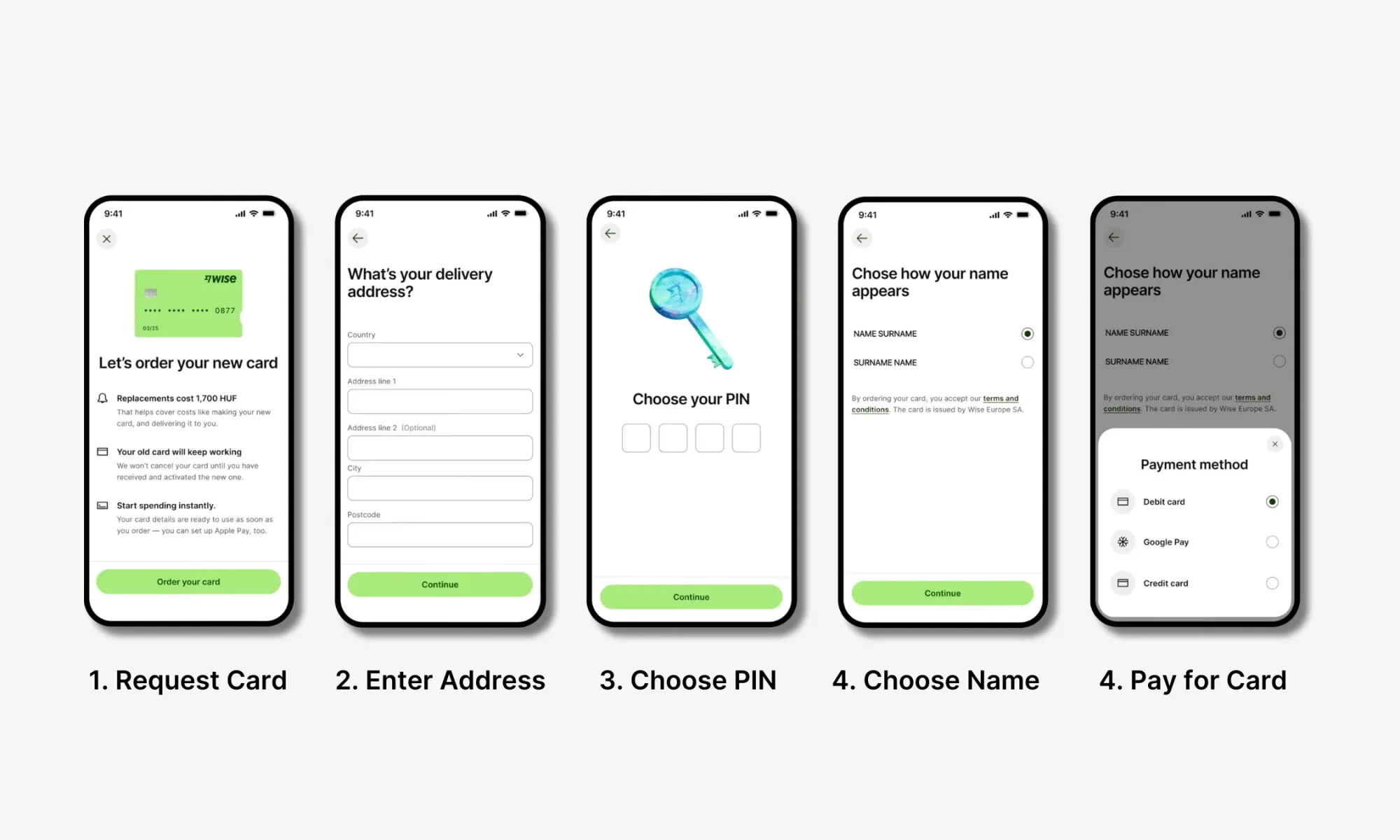

How to Order Your Wise Travel Card

Ordering your Wise Travel Card can take some time (mine took more than 2 weeks to arrive), so I recommend getting on this as soon as possible to ensure you have the card for your next trip!

These are the 3 simple steps you will need to go through:

Step 1: Create a Multi-Currency Account

If you don’t have one already, your first step will be to sign up for a Multi-Currency Account with Wise

Step 2: Start Using Your Virtual Card Immediately

After making an account and verifying your details, you will then be directed to choose a digital/virtual card or a physical card . Digital cards are free and can be added to Google/Apple Pay or used for online payments immediately!

Step 3: Order a Wise Debit Card (Recommended)

If you want instead a physical card, you can do so by clicking on the “Card” tab on the main page and then click on “ Order a Debit Card ”. Physical cards cost a one-off fee of 7 GBP/7 EUR/10 USD , and it will take 7 to 21 business days for the card to arrive, based on your location.

If you'd like to visualise the entire process, watch the instructional video below:

How to Activate Your Wise Card

Once your Wise travel card arrives, it is time to activate it and start spending ! Luckily, for most Wise account holders, you won’t need to take any steps to activate the card, simply make a chip and PIN payment, and the card is ready to go !

Activate Your Wise Card (for US and Japan Customers Only)

As I mentioned above, Wise customers in the USA or Japan must activate the card separately . This isn’t too much of a headache, just don’t forget you need to be in your home country .

Here is a step-by-step breakdown of activating your card if you are a US and Japan customer.

- Log into the Wise app and tap on “ Card ”.

- Then tap on “ Activate Card ”.

- You’ll then be prompted to enter a 6-digit code that you’ll find on your card.

- After entering the code, you’ll create your PIN .

If you'd like to visualise the steps to activate your Wise card for your region, watch the instructional video below:

How to Change the PIN for Your Wise Card

Did you forget your PIN? Don’t worry, it happens to the best of us!

Luckily, if you are a US card holder, you can easily change your PIN in the Wise app :

- Tap on “ Card ” in the Wise app

- Select “ Change PIN ”

- Enter your new PIN 2 times, and you are all set!

If you are a non-US Wise card holder , you cannot change your PIN in the app , unfortunately. Instead, you’ll need to change it using an ATM that supports PIN changes .

My best advice? Choose a PIN you’ll never forget, or keep it written down somewhere secure.

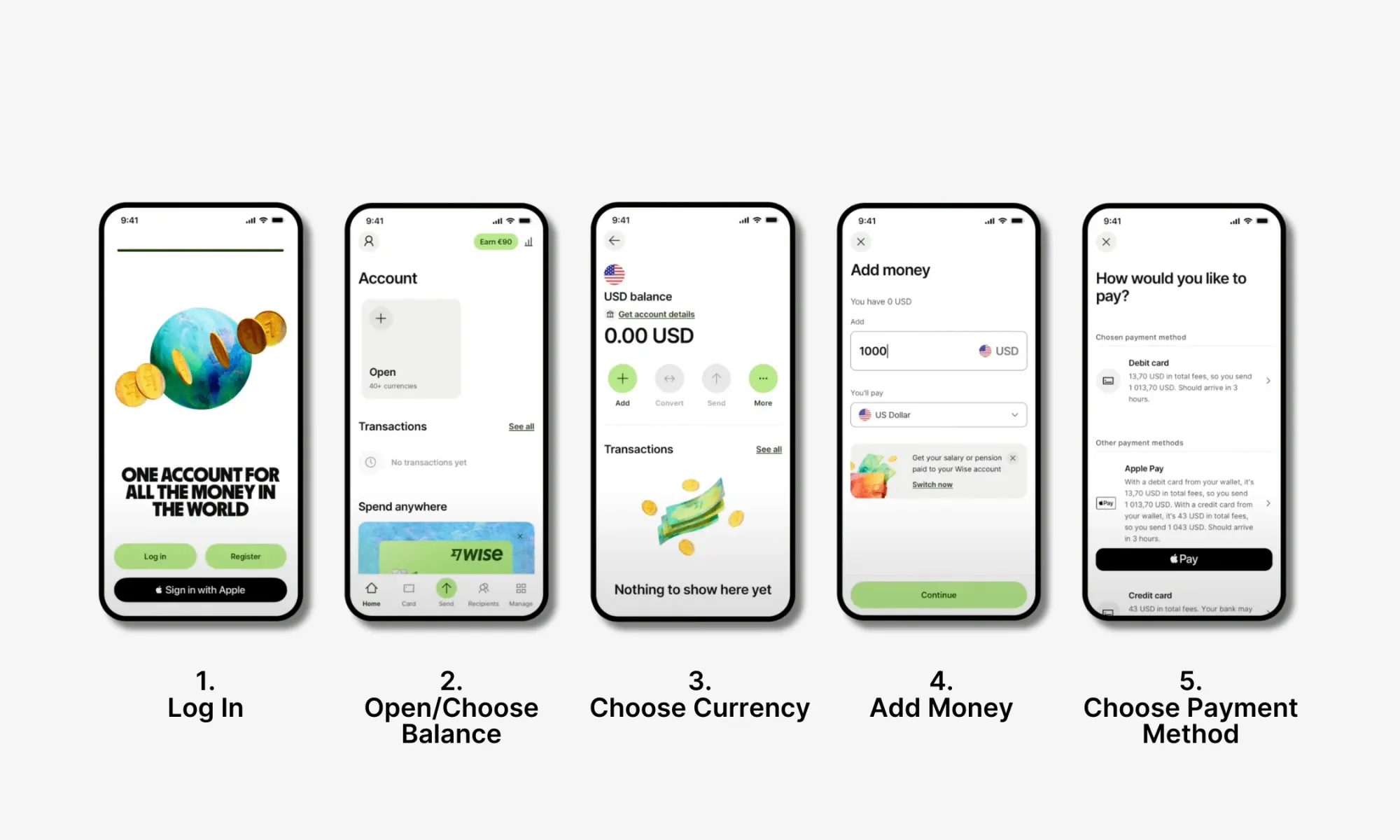

How to Add Money to Your Wise Travel Card

Your Wise travel card is linked to your Wise Multi-Currency account , so you’ll need to top up your Wise account with funds before using the card.

This is a pretty straightforward process:

- Logging into your account

- Choose which currency balance you want to add money to.

- Click “ Add ”.

- Choose which currency you want to use to top up the account.

- Type in the amount of money you want to add.

- Choose your payment method (bank transfer, debit card)

- Confirm the top-up and verify the money arrives in your balance.

Watch the instructional video below to visualise how to top up your Wise balance:

How to Freeze/Unfreeze Your Wise Card

One of the downsides of constant travel is that you put yourself at risk of fraud or losing your card. If you notice potential fraudulent transactions from your Wise card, or you believe your card is lost/stolen, you should freeze your card immediately . This way, you’ll avoid more fraud on your account.

Here are the steps to take to freeze your Wise Travel Card.

- After logging in to your Wise account, tap on “ Card .”

- Then simply click “ Freeze Card ”, or if you want to unfreeze, “ Unfreeze Card .”

- Fill out this transaction dispute form and contact customer support right away. They will be able to help you determine what to do next.

How to Replace a Lost or Stolen Wise Card

If you can confirm that your card has been lost or stolen, you’ll want to cancel the card and then order a new one.

- Log in to your Wise account and click on “ Card .”

- Tap “ Replace Card .”

- You’ll then be prompted to answer why you need a replacement card.

- Wait for the new card to arrive.

How to Use an ATM with Your Wise Travel Card

As mentioned above, ATM withdrawal is not the strongest feature with the Wise card, but you can definitely still use the card to take out cash. Spending with your Wise card is simple since the card can make contactless, chip, and swipe payments and is eligible for Google, Apple, Fitbit, and Garmin Pay. But how do you use an ATM with the Wise card?

Using an ATM with the Wise Travel Card is the same as using any other bank card. Simply insert your card into the machine, enter your PIN, determine how much cash you want to withdraw, and take your cash. Don’t forget to take your card back when you are done (I have made this mistake too many times…).

Wise Card ATM Limits

One of the biggest downsides with the Wise card is that you’ll have limited free ATM withdrawals. For all accounts, you’ll have 2 free ATM withdrawals each month, after which you will be charged an ATM usage fee and a percentage markup on the amount of cash you withdraw.

I use the Wise Travel Card for many of my day-to-day travel expenses, but I use my Charles Schwab Investor Checking account for ATMs. This card not only has a 0% ATM markup, but it also refunds any fees the ATM provider charges. This includes international withdrawals!

Wise Card Delivery Timeframe

Once you order your Wise Travel Card, you can expect it to take between 3 and 21 days to arrive, depending on your location. If you live in Singapore, you’ll get your card SUPER fast. Unfortunately for Americans like me, this isn’t the case.

Wise Travel Card Fees and Exchange Rates

One thing I really love is that using Wise itself is free, and you won’t have to pay an ongoing fee to Wise to use the card. In fact, there isn’t even a Premium account feature, so all users get 100% of the features for free. All this said, there are some charges and exchange rates you should know about before you start using the Wise Travel Card.

Comparison: How Does the Wise Card Holds Up Against Other Travel Cards?

Wise is a leader in the travel account realm, but it still has some major competitors. While all of these different companies vary, they all cater to digital nomads and frequent travelers. The table below will compare some key factors with Wise, Revolut, N26, and Chime.

You may also be interested in:

So, What Travel Card is the Best?

This is a close call and pretty dependent on where you are located. For example, N26 and Chime are awesome choices if you live in the EU or USA (respectively). But, with these options, you can’t hold different currencies like with Revolut and Wise.

For most digital nomads, Wise or Revolut will be the best option. You can hold a huge number of currencies, and they are available to many different nationalities. I have personally used both Wise and Revolut and can say they are both excellent options.

Spending Limits for the Wise Travel Card

The Wise Travel Card has set daily and monthly spending limits for all types of transactions. While these limits won’t be a deal breaker for the vast majority of users, they are still worth noting.

Keep in mind the above limits are for US Wise customers. The amounts will differ slightly for customers based in different regions.

Is It Safe to Use the Wise Travel Card?

Wise is a trusted and safe travel card provider, so you can rest assured that your funds will be protected when using the Wise Travel Card. A licensed and regulated financial institution, your funds are safeguarded in Wise. It is, however, worth noting that since Wise is not considered a bank, it is not FDIC insured. FDIC insures up to $250,000 of bank customer's money, but Wise works a bit differently. Wise safeguards users’ money and is required to ensure all customers have access to all of their funds.

So, is Wise safe to use? Yes, absolutely! We don’t recommend keeping all of your money in Wise, but in general, it is a perfectly secure financial institution.

Additionally, the company uses several security features to protect your data, including HTTPS encryption, a two-step login process, and 24/7 fraud prevention.

What to Do If Your Wise Card Is Lost, Stolen, or Compromised

If you lose your Wise card or suspect it to be stolen or compromised, you’ll need to act quickly to prevent any further fraud. Below, we will go over a step-by-step process for what to do if your card is lost, stolen, or compromised.

- Freeze your card in the Wise app.

- Contact Wise support if you suspect the card to be compromised.

- Cancel the card in the app if you confirm the card is lost or stolen or if fraud charges have been made.

- Order a new card.

- Wait for the new Wise card to arrive.

Bottom Line: Is the Wise Travel Card Worth it?

Time for the 1 million dollar question: Should you get the Wise Travel Card?

If you are a frequent traveler like me and you don’t already have a solid travel card with fair exchange rates, low ATM fees the answer is a resounding yes !

The Wise Travel Card is one of the best cards for digital nomads and expats, as it allows you to seamlessly spend money, withdraw cash, and transfer funds from anywhere around the globe without having to worry about excessive fees. The best part? After paying a one-time card order fee, your Wise account is completely free to use!

Ready To Save Money Abroad with Wise?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Sign up for our Newsletter

Receive nomad stories, tips, news, and resources every week!

100% free. No spam. Unsubscribe anytime.

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!

How to Beat Your Post-Travel Depression: Your Guide to Feeling Better

How to create a healthy work-life balance while working remotely, how to set up and manage an esim on iphone.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

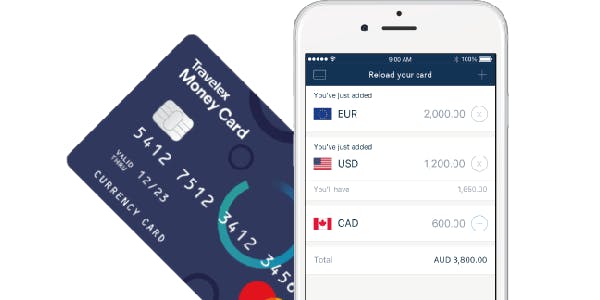

Travelex Money Card Review Australia

The Travelex Travel Money Card replaces the pre-existing Multi-currency Cash Passport with enhanced features and benefits. Learn about the Travelex travel card in this review to help you decide whether this is the card for you.

What is the Travelex Travel Money Card?

The Travelex Travel Money Card is a prepaid Mastercard%C2%AE currency card, designed specially for your overseas adventures. It replaces the Multi-Currency Cash Passport, which is no longer available.

Travelex itself is owned by Finablr, a financial company that owns many well known brands like Remit2India and UAE Exchange.

The company listed on the London stock exchange in 2019 with an implied valuation of about 1.23 billion pounds, making it one of the largest foreign exchange businesses in the world.

Pros and cons of the Travelex Travel Money Card

- Smartphone app and Free Wifi

- $0 international ATM fees

- Lock in exchange rates

- Limited number of currencies

- Expensive - high cross-currency conversion, extra initial loading, inactivity and closing fees

- ATM fees in Australia

When to use (and avoid) the Travelex Money Card for your travels

We think the Travelex Money Card is ideal for an organised traveller going to popular holiday destinations like Europe or the US. It comes with free Wifi, which fantastic for you to keep in touch with family or friends. Travelex has better online rates than your bank so you can lock in a good initial loading rate and save. Plus they don't charge you ATM fees while you're overseas.

Unfortunately, all of these conveniences comes with a high price tag. If you're looking for cheaper travel money options , you can also try the Wise (formerly TransferWise) debit card or Revolut .

Best way to use the Travelex card

The best way to use this card is to take cash from ATMs, because your limit is $3,000 and there are no additional ATM fees. The limit for in-store purchases is only $350 per day, which isn't much.

We also think it's a good idea to get a spare card, kept securely and separately from your main card. This way if your card gets lost or stolen, you won't have the hassle of ordering and waiting for a new card.

Learn more about the Travelex Money Card

Benefits of the travelex money card.

- Chip and PIN

- 24/7 Global Travel Assistance

- Emergency card/cash available if stolen/lost

Convenience

- Easy way to manage, spend and save on multiple currencies

- No bank account required

- Contactless payments

- No international ATM fee

- Lock in exchange rate by loading funds to foreign currencies and avoid fluctuations

Manage Your Money

- Reload and manage your funds easily online

- Redeem your unused funds easily on your return

How does a Travelex card work?

There are three main steps to setting up the travel money card with Travelex Australia, outlined below. You can also watch our video tutorial for a complete guide.

Step 1: Purchase Card

Order your Travelex Money Card online , over the phone or in your local Travelex store. Make an initial load amount of A$100 minimum. Get your travel card.

Step 2: Activate

Register your travel card details through the Travelex website or via the Travelex Money app and activate your card. You can manage your account online or through your app.

Step 3: Top-Up

Top up or reload money onto your travel card online, over the phone or via the Travelex Money app.

How much does the Travelex Money Card cost?

Travel money cards have multiple fees associated with them, which can make it difficult to compare.

For the Travelex Money Card, the initial load fee for Australian Dollars are the greater of 1.1% of the initial amount or A$15.00, but for loads or top-ups into all other currencies it's free. There is also a A$4.00 monthly inactivity fee.

Travelex exchange rates

Travelex provides a currency calculator on their website . However Travelex quotes the market rate, which is not necessarily the rate you will get when you load currencies on your card.

Travelex sets the exchange rate at the time you move your funds from one currency to another. If you don't have enough currency in your account and have made a purchase, Travelex will use the Mastercard%C2%AE exchange rate ("FX Rate") plus a margin of 5.95% of the transaction value to cover the cost.

All prices are in AUD * Foreign currency conversion is charged when you spend in a currency that is not loaded in the card

All prices are in AUD

Does the Travelex Money Card have an App?

Yes. When you have an account with Travelex, you can top-up your card through their website, or through their iOS and Android apps. This means Travelex is available to both Apple and Android users.

Like their website, Travelex's Money Card app is very easy to use. Having the app makes loading currencies and taking out cash on the go when you're travelling much easier.

Travelex Customer Reviews

TrustPilot TrustScore: 8.9/10

On TrustPilot , Travelex have four stars and most customers think it's an "excellent company" to use. Generally customers speak favourably about their experiences with Travelex Australia as a whole.

However customers are more negative when it comes to reviewing Travelex's travel money card. A lot of customers complained about difficulty in using the app and issues with reloading money onto the travel card.

With too many negative user experience stories in online forums, we think a comparison with alternative travel cards for your situation is a good idea.

Is the Travelex Money Card safe to use?

Yes. Travelex is regulated in Australia. They have an Australian Financial Services Licence, and are regulated by the Australian Securities and Investment Commission (ASIC). They also have strict regulatory guidelines to follow.

How to contact Travelex if you have a problem

Website: https://www.travelex.com.au/travel-money-card/contact

Phone: https://www.multicurrencycashpassport.com/contact-us/card-service-numbers/

Frequently asked questions about Travelex Money Card

How do i get a travelex card.

You can buy a Travelex Money Card from any Travelex store or online and can collect it from any Travelex store in Australia. In-store fees for the card are more expensive than buying online.

Where can I get a Travelex Money Card?

Travelex have plenty of stores all over Australia . They have 1,400 Bureau de Change outlets principally located in airports and tourist locations in over 100 airports, across 26 countries. You can pick up your Travelex Money Card instantly from any Travelex store.

Can I use my Travelex Money Card in Australia?

Yes, you can use your Travelex Money Card in Australia. However if you are withdrawing money from an Australian ATM you will be charged 2.95% of the total amount you are withdrawing.

What currencies can you load on your card?

Your Travelex Money Card can be loaded with Australian dollars, which is your default currency.

You can load up your card with 9 additional currencies, including US dollars (USD), Euro (EUR), Great British pounds (GBP), New Zealand dollars (NZD), Hong Kong dollars (HKD), Canadian dollars (CAD), Singapore dollars (SGD), Thai baht (THB) and Japanese yen (JPY).

Can I still use my Travelex Multi-Currency Cash Passport?

If you're an existing Cash Passport customer with Travelex, you can still use your card until the expiration date on the front of the card. Positively, you can also order and use a Travelex Money Card should you wish to do so. You can even transfer the balance from your existing Cash Passport to your new Travelex Money Card, in the same currencies and at no extra cost.

What happens if I lost my Travelex card?

If you lose or misplace your card you can contact 24/7 Global Assistance. Travelex quickly and securely provides you with emergency cash and a free replacement card.

Your currency knowledge centre

5 Cheaper Ways to Transfer Money Overseas

Using a bank is one of the easiest ways of transferring money overseas, but can also be the most costly. There are alternatives that can make the whole process cheaper.

- Read more ⟶

International Money Transfer Comparison and Reviews

Find the best international money transfer exchange rates to send money overseas from Australia. Compare the rates and fees from leading banks and money transfer services.

5 Safe Alternatives to Wise

Wise (formerly known as TransferWise) is a transparent and easy-to-use money transfer option. But it can still be worth looking at Wise's competitors to see which is the best option for you.

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

Best travel money cards in 2024.

Travel money cards are essential when travelling overseas.

They allow you to easily make payments whilst travelling overseas. They make paying easier for shops, restaurants, hotels and ATMs.Travel money cards work in a similar way to ATM cards. They use a pin when you purchase goods or services overseas.

In this guide, we have compared travel money cards to help you make the best selection for your next trip.

Best Travel Money Cards:

- Wise Travel Card Best Exchange Rates

- Revolut Best for Low Fees

- Travelex Money Card Best All Rounder

- Bankwest Breeze Platinum Best Travel Credit Card

- Pelikin Student Traveller Card Best Student Card

- HSBC Everyday Global Travel Card Best Travel Card by Bank

- Qantas Travel Money Card Best Reward Benefits

Wise Travel Card - Great Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

The Wise Travel Card is great for frequent travellers as it offers over 40 currencies at the inter-market exchange rate, which is the cheapest rate globally. In addition you can buy goods online from overseas with no transaction fee plus get the best exchange rate. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Our Wise Travel Card Review

Revolut - Low Fees

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best All Rounder

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

Read our Travelex Travel Card Review

Travelex Money Card

- Minimum load of $100 and maximum load of $100,000

- Can be used wherever Mastercard is accepted

- Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

- While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

- Currencies that can be loaded are AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$

- If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Card is a good all rounder.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as the Wise or Revolut Card abroad , the support network if the card is lost or stolen is very good.

Bankwest Breeze Platinum Credit Card - Lowest Interest Rate

- Lowest interest rate at 9.90%

- No international transaction fees on purchases

- 0% p.a. on purchases and balance transfers for the first 15 months

- Up to 55 days interest free on purchases

- Low annual fee

- Complimentary international travel insurance

Bankwest Breeze Platinum Credit Card

- Free annual fee first year, then $69 annual fee

- 55 interest free days

- Free international travel insurance that includes the basics but does not cover cancellation costs, pre existing conditions and travellers over 80

- $6,000 minimum credit card

- 0% p.a. on purchases and balance transfers for the first 15 months, then reverts to 9.90%

- 21.99% interest rate on purchases and cash advances

- Cash advance fee of the higher of $4 or 2% of cash advance

The Bankwest Breeze Platinum is a great no frills credit card that offers ‘no foreign transaction fees’ and the lowest interest rate on the market, at 9.90%. These two factors alone will save you hundreds of dollars when travelling overseas.

In addition it has a low annual fee and complimentary international travel insurance. Finally for its price point it is a great value credit card that will be accepted most places around the world.

HSBC Everyday Global Debit Card

- No initial card or closure fees

- No monthly or account fees

- No international ATM fees

- No cross currency conversion fees

- Lock in very competitive exchange rates before travel

- No maximum balance

- Earn 2% cashback

- 10 Currencies can be loaded are AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, CNY (currency restrictions apply to CNY)

- Awarded 5 gold stars by CANSTAR in 2021 for Outstanding Value

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with Visa pay wave, Apple Pay or Google Pay for purchases under $100. With a maximum of $50 cash back per month. In addition you need to deposit $2,000 or more into your Everyday Global Account each calendar month.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

The HSBC Everyday Global Debit Card is a good option to take travelling and to spend money in Australia with no international transaction fees, international ATM fees and monthly fees. In addition there is no maximum balance on currencies held and a 2% cash back incentive when you tap and pay under $100.

Finally it is one of the only travel cards that offers Chinese Yuan. To avoid ATM fees you need to find HSBC branches in Australia and only use ATMs overseas with a VISA or VISA Plus logo.

Best Student Card

Pelikin student traveller card.

- Use promo code SMONEY10 for a $10 discount

- Up to 15% off international flights

- A globally accepted virtual student ID card

- 2% cash back on food & drinks, transport and accommodation

- Over 150,000 discounts worldwide

- $30 for 12 months

- 20+ currencies available

- Split bills, pay and get paid instantly

Pelikin is one of the only travel cards in Australia specifically for students. While it has a small annual fee, the range of discounts and offers more than make up for it.

The app is relatively easy to use and card arrives in under a week.

Best Rewards Card

Qantas travel money card.

- No monthly fees, purchase fees and currency conversion fees

- No load fees if you pay by bank transfer or BPay

- Locked in exchange rates: 4%+ margin on exchange rates

- Earn 1.5 Qantas points for every AU$1 spent in foreign currency

- 10 currencies offered USD, GBP, EUR, THB, NZD, SGD, HKD, CAD, JPY, AED

- Free Australia ATM withdrawals

- 0.5% fee debit card reload fee

- ATM fees overseas (USD 1.95; GBP 1.25; EUR 1.50; THB 70; NZD 2.50; SGD 2.50; HKD 15.00; CAD 2.00; JPY 160; AED 6.50)

- Minload of $50 and max of $20,000

- Available to 16 year olds, has a lower age restriction than most credit cards (18 year olds)

Qantas Travel card is a great option to spend foreign currency overseas if you are already a loyal Qantas customer and use your frequent flyer points regularly on flights, accommodation or gifts. The fees are low, the exchange rate is average however the ATM fees are expensive and will easily add up.

Other popular travel money cards

Aside of the Top 5 travel money cards, there are many more options to consider. These include well known brands such as the Commonwealth Bank and Travelex and less known services like Up Bank and Revolut.

Here is a rundown of their best features, fees and available currencies:

- 13 currencies available, including Vietnamese Dong and Chinese Yuan

- No issue fee, load fees, closure and card replacement fees

- Additional card offered

- Can be accessed through Commonwealth Bank app

Commonwealth Bank Travel Money Card

- $3.50 fee at ATMs overseas

- 13 currencies offered USD, GBP, EUR, THB , NZD, SGD, HKD, CAD, JPY, AED, AUD, VND & CNY

- Minload of $1 and max of $100,000

- Available to 14 year olds, has a lower age restriction than most credit cards (18 year olds)

- When you use your card for a purchase or withdrawal in a currency that is not loaded, or when they automatically transfer funds between the currencies on your card to enable the completion of the transaction at the Visa retail exchange rate plus 4%

- To transfer money between currencies or a transaction account, it will be at the bank rate which is normally 4% above the market value

The Commonwealth Bank travel money card is great if you are already a Commonwealth bank customer who banks online and knows exactly how much money in each country you want to spend. However if you need to transfer between currencies or make a purchase in a currency you don't have funds loaded, then you can get an additional expensive charge. Watch how many withdrawals at ATMs you make as well to keep the costs down.

- Exchange rates most competitive for USD, GBP and THB

- No fee on initial card or load (not BPay)

- No fee on reloads via bank transfers

- No monthly or inactivity fees

- Card is valid for 5 years

Travel Money Oz Currency Pass

- 1.1% reloading fee via Travel Money Oz Login or with debit or credit card

- 1% reloading fee for BPay

- $10 closure fee and replacement card fee

- 2.95% on withdrawals from Australian ATMs is expensive

- Roughly $3.50 on withdrawals from overseas ATMs is expensive.

- $3.99 + 5.95% fee on cross currency transactions

- 10 Currencies can be loaded are USD, EUR, GBP, NZD, CAD, HKD, JPY, SGD, THB & AUD

- Exchange rates for SGD and CAD are the least competitive

- Minload of $20 and max of $10,000

- Only 1 card per account

- According to the website they won't take online orders if you are departing within 14 days as the card can take up to 2 weeks for delivery.

The Travel Money Oz travel money card seems to be an outdated version of the Travelex or Australia Post travel card as it does not offer Global Emergency Assistance or Boingo hotspots. However exchange rates and fees are similar to Travelex, so if you are travelling to the US, UK or Thailand, this is a great card to pay for accommodation and things in shops. We would avoid using it at any ATM, to save costs.

- No ATM fees in Australia or internationally

- No minimum monthly deposit

- No account keeping fees

- Can be used in Australia as an EFTPOS card

- Available to 14 year olds and older

Macquarie Travel Card

- $2,000 daily limit for ATM withdrawals

- Simple and easy to work out costs for account

- Exchange rates are MasterCard exchange rates, which are normally 4%+ market rate.

- 90-day theft and damage protection on eligible purchases and stolen wallet protection up to $500

- Can be used in Australia to buy goods overseas and not pay international transaction fees

- Get discounts of up to 10% on eGift cards to use at over 50 leading retailers

The Macquarie Travel Card is a very good option to take overseas for ATM withdrawals as they are all free. In addition in Australia you can buy goods online and not pay an international transaction fee. Furthermore you can use the card like a normal debit card in Australia with no hefty fees or monthly minimum deposits. However the exchange rate is the MasterCard rate which is normally 4%+ above the market rate. Finally we would recommend this card for cash withdrawals at ATMs internationally but not paying for accommodation due to the added margin on the MasterCard exchange rate.

- Cheapest way to send money overseas through a bank

- UI and UX better than traditional banks making it super easy to use

- Competitive savings interest rate

Up Bank Travel Card

- Backed by Bendigo Bank and Adelaide Bank and partnered with Wise so it has financial backing and access to the cheapest exchange rates to send money overseas

- Nifty online tools to help you track spending, budget and save. These include a detailed transaction history often including a company logo, when you paid down to the minute and the suburb where the transaction was made. In addition it has a ‘Regulars feature that detects regular billers and estimate of upcoming bills so you get a heads-up before they are due

- Good savings account interest rates of 1.85% (0.10% base rate plus 1.75% bonus). Bonus interest is easily unlocked after making five successful card or digital wallet purchases each month

The Up Bank Travel Card is aimed at younger markets who are looking to save on bank costs and receive online tools to help them budget and save for their goals. It is also able to be used overseas at any ATM without fees, no international fees and is the cheapest way to send money overseas through a bank due to their partnership with Wise (the largest money transfer company in the world). In addition the exchange rates are Mastercard rates which are normally 4% above interest rates. Finally, while this card is very useful domestically and for ATMs overseas we would not recommend it for big ticket items overseas as it is an expensive card to use.

- No foreign transaction fees

- No fee on initial card, load, unload or inactivity fees

- No cross currency transactions fees

- Lock in exchange rates before you leave

- Exchange rates most competitive for USD, GBP, EUR and CAD and JPY

- No ATM fee at 50,000 Global Alliance ATMs worldwide

- Free additional card

- Flight delay pass

Westpac Travel Money Card

- 11 Currencies can be loaded are USD, EUR, GBP, NZD, CAD, HKD, JPY, SGD, THB, AUD & ZAR

- $2,000 maximum limit on ATM withdrawals overseas within 24 hours

- $50,000 maximum limit on currencies loaded on to travel card

- $3 roughly for ATMs that are not within the Non Westpac Global Alliance

- If you run out of one currency on the card, you can pay with other currencies without the expensive cross currency transaction fee

- No foreign transaction fees, initial card, load, unload or inactivity fees

- According to the Westpac it can take upto 8 business days to receive the travel card

- Secure from fraudulent transactions with Mastercard Zero Liability protection

- 2 cards per account for free

The Westpac Travel Card is a no frills handy travel card with very low fees, no foreign transaction fees, access to some free ATMs worldwide and competitive exchange rates, especially on USD, EUR, GBP, CAD and JPY. In addition it has the South African Rand (ZAR) which is not common in prepaid travel cards. Finally it has access to a flight delay pass in case your flights are delayed and you need to access airport lounges.

- Linked to ANZ Rewards program

- 7 types of insurance for free

- 55 days interest free

- Good security on card purchases

ANZ Travel Adventure Card

- 20.24% interest on purchases and cash advances

- $120 annual fee

- No international transaction fees in person or online

- Offer 7 types of insurance for free

- ANZ Reward points can be used to buy gift cards, swap for Virgin or Singapore airline points or cash into your account.

- Earn 1.5 Reward points per $1 spent on eligible purchases up to $2,000 per statement period

- ATM fees at non ANZ ATMs

- Minimum credit of $6,000

If you utilize rewards points then the ANZ Travel Adventure Card might be suitable for you. Reward points can be used to buy a wide range of gift cards, swap for Virgin or Singapore airline points or cash into your account. In addition no international transaction fees are charged for purchases online or whilst you travel overseas. Finally this card is not recommended for cash withdrawals as the interest rate of 20.24% will eat up any savings.

- No ATM fees

- Can be used in Australia with no additional costs

- No fees for paying via bank transfer or Bpay

- Transfer limits can be set by user

ING Orange Everyday Account Debit Card

- As long as you you deposit at least $1000 and make at least 5 payments each month ING will waive international transaction fees and refund overseas ATM withdrawal fees

- Can be used in all countries

- Works with Apple Pay and Google Pay

- Visa currency conversion rates apply, which are normally 4% above market

The ING Orange Everyday Account Debit Card is a good card for most Australians travelling overseas for ATM access, with no fees. It also allows you to to buy goods online without an international transaction fee.

Furthermore you can use it in Australia for free and there are no fees to get your initial card, for account keeping or to top up your card. A word of caution however, if you travel overseas for longer than 1 month, you still need to deposit at least $1,000 and make at least 5 payments each month to get the rebates.

- Initial card and replacement cards are free

- Increased protection with Mastercard Zero Liability

- Access to cash from your account through the Global Emergency Assistance, if your card is lost or stolen

Australia Post Travel Money Card - Platinum Mastercard

- 1.1% Admin fee for instore loads, including initial load

- $5 fee for reloads via debit bank card

- $10 closure fee

- $3.50 on withdrawals from overseas ATM is expensive

- Currencies that can be loaded are USD, EUR, GBP, NZD, THB, CAD, HKD, JPY, SGD , AED and AUD

- Minload of $100 and max of $100,000

- If your card is lost or stolen you can access cash that is in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer the free wifi and you can look at their number of free hotspots per country on this map

The Australia Post travel money card is a popular option for Australian travellers due to the convenience of stores. However we would recommend the Australia Post travel money card for paying in shops or accommodation as it is costly to withdraw cash from ATMS. As the Australia Post travel money card is fee heavy we recommend not making withdrawals at ATMs or making cross currency transactions to keep additional fees down.

- Up to 11 currencies available

- Manage your account and card online

- 24/7 global assistance

- Access to emergency cash

- Free additional card when ordered at time of purchase

- Can be used at millions of locations worldwide – wherever Mastercard purchase symbol is displayed

Greater Bank Cash Passport Platinum Mastercard

- $5 fee for reloads via debit bank card, FREE reloads via BPAY

- Admin fee of up to the greater of 1.1% of the load/reload amount or $15 for in-store purchases

- Debit card load fee 0.5% of the amount loaded, per Debit Card Load transaction

- Domestic ATM fee 2.95% of value Withdrawn

- International ATM fee USD 2.50, EUR2.50, GBP 2.00,NZD 3.50, THB80.00, CAD 3.50,HKD 18.00, JPY260.00, SGD3.50, AED 10.00, AUD 3.50

- Minimum load of AUD100 and a Maximum of AUD100,000

The Cash Passport is one of the most popular travel cards in the Australian market. With Greater Bank, you can purchase it online and at one of their branches, then download the app or use the website to manage your card. While the card may be useful for international purchases, be mindful when using an ATM both locally or overseas as the fees can add up if you are withdrawing money often.

Learn more about the Cash Passport Platinum Mastercard through Greater Bank .

The best travel card in Australia depends on its use, for ATM withdrawals it is ING Orange , for best exchange rates it is Wise Travel Card, the best credit card is Bankwest Breeze Platinum , for overall best card by a bank its HSBC Global and the best rewards card is the Qantas Travel card .

A travel money card is safer than cash overseas and if you select a Wise travel card , it is the best exchange rate as well. Most places around the world accept MasterCard or Visa, so you should be able to pay for all your purchases by card.

Yes you can use all travel cards in Australia but you might choose not to due to the fees. ING , Macquarie , Up , Citibank are all good examples of travel money cards that do not charge for ATM withdrawals in Australia. However examples of travel money cards that charge $3.50 per Australian ATM withdrawal include Travelex , Australia Post and Travel Money Oz .

Both if you buy your cash from S Money and pay with a Wise card overseas, as they both use the exchange rate you see online and charge very low fees. However if you buy your foriegn currency at the airport, you are paying top prices so using a card is cheaper.

There are many travel money cards that no longer exist but appear in search engine page results. Travel money cards that no longer exist include 7-11 Just Go, NAB Travel Money Card, Travelex Cash Passport, Australia Post Cash Passport, ANZ Travel Card, Westpac Global Currency Card and the Virgin Velocity Global Wallet program.

Learn more about the best debit, credit and prepaid cards for travel

Best Prepaid Cards

Credit Card

More Travel Card Guides

Learn more about the best travel money cards for your holiday destination.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Travel Money Cards for Travelling Overseas 2024

If you’re planning on travelling overseas, getting a travel money card can help you cut the costs usually involved in spending foreign currencies.

Travel money cards can include travel debit, prepaid and credit cards, which each work slightly differently, but which all come with features optimised for reducing the costs of spending and withdrawing cash overseas. This guide covers everything there is to know about the different travel card categories, plus we’ll introduce 6 of our top travel card picks so you can see if any suit you.

Wise - our pick for travel debit card when travelling overseas

Wise accounts can hold and exchange 40+ currencies, and you can get a linked Wise card for a one time delivery fee. Top up your account in GBP and switch to the currency of your choice before you travel. All currency conversion uses the mid-market exchange rate, with low fees from 0.41%. Here are some of the pros and cons of the Wise travel money debit card, to help you decide if it’s right for you.

Hold and exchange 40+ currencies

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

7 GBP delivery fee

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

Travel money cards work much like any other credit or debit card you might have, but are designed to be easy to use when you’re overseas or spending in a foreign currency. You’ll be able to use a travel money card to spend and make ATM withdrawals while you’re travelling abroad, or when you shop online with foreign retailers. Most cards have contactless technology and can also be added to a wallet like Apple Pay for mobile spending, too.

The features you get with a travel money card can vary a lot, but you’ll often find you can hold a balance in multiple currencies, pay low or no foreign transaction fees, or earn cash back and rewards overseas.

What are different types of travel cards?

Travel cards can broadly be split into the following categories. We’ll walk through the features and benefits of each in a moment:

Travel debit cards

Travel prepaid cards

Travel credit cards

Quick summary: Best travel cards for travelling overseas

UK customers can pick from a good selection of different travel card types and providers. This guide includes an overview and in detail reviews of 2 of our favourites from each travel card category to help you choose. Here’s what we’ll be looking at:

Wise travel debit card : Hold 40+ currencies with no ongoing fees, and spend with the mid-market exchange rate with no foreign transaction fee and low conversion costs from 0.43%

Revolut travel debit card : Hold 25+ currencies in one of 4 different plan types, including some with no monthly fee, and some which come with ongoing costs but which unlock more benefits and no fee transactions

Post Office travel money card : Hold 22 currencies, with no fee to spend a currency you hold - 3% fee applies if you don’t have the currency required in your account

Monese travel money card : Hold a balance in GBP, then spend in foreign currencies with no fees, up to your plan’s limit. Different plans on offer, including Simple which has no ongoing fees to pay

Barclays Rewards Visa travel credit card: Spend with the Visa exchange rate, and earn 0.25% cash back, with no foreign transaction fee and no cash advance fee. Interest and penalties can apply

Halifax Clarity Mastercard travel credit card: No foreign transaction fee, no annual fee, and no cash advance fee if you withdraw money at an ATM. Variable interest and penalties can apply

Travel money cards for travelling overseas compared

Here’s a brief comparison of all the cards we’ve picked out - in a moment we’ll also look at each card in more detail.

The good news is that you’ve got lots of different travel cards available in the UK, from specialist providers, banks and card issuers. The right one for you will depend a lot on the way you like to manage your money - but by doing a bit of research you’ll be able to find a good match for your preferences, even travel cards with no foreign transaction fees .

Generally, travel debit cards can be cheap and flexible, but you’ll need to have your travel money saved in advance, so you can top up your account. Credit cards have the advantage that you can spend now and repay later - but are usually more expensive overall between interest and fees. This guide walks through some key points about each of these travel money card types, and proposes a couple of options you might want to check out and compare.

Travel Debit Cards for travelling overseas

Travel debit cards can be ordered online from specialist providers, and are usually linked to a digital multi-currency account. Add money to your account in GBP and then you can either convert to the currency you need in your destination if the card supports it, or just leave your money in pounds so the card’s autoconvert technology can do the conversion for you at the point of payment.

Travel debit cards are generally cheap, secure and reliable, but the exact range of supported currencies, and the way the card fee structure works, can vary a bit depending on the provider you select.

Travel debit card option 1: Wise

There’s no fee to open a personal Wise account , but you’ll pay a one time card order fee of 7 GBP. After that there’s no minimum balance and no monthly charge. Wise accounts can support 40+ currencies for holding and exchange, with low fees from 0.43% when you convert currencies, and transparent ATM fees when you exhaust the monthly free transactions available with your account. If the Wise card can’t support the currency you need to spend in your destination, you can just leave your money in pounds and the card will convert for you at the point of payment.

No fee to open a personal Wise account, no minimum balance requirement

7 GBP one time fee to get your Wise card

2 withdrawals, to 200 GBP value per month for free, then 0.5 GBP + 1.75%

Hold 40+ currencies, convert between them with the mid-market rate

Get local account details to receive GBP, NZD, EUR, USD and a selection of other major currencies conveniently

Travel debit card option 2: Revolut

Revolut has a selection of different account tiers for personal customers in the UK, from Standard plans with no monthly fee, to the top end Ultra plan which has a 45 GBP/month fee and comes with loads of perks including a fancy platinum plated card. You can hold around 25 currencies, and convert currencies with the mid-market rate to your plan’s allowance. The higher account tiers also come with extras like various different forms of complimentary insurance, discounts, cash back opportunities and travel benefits. If the currency you need can’t be held as a balance in your Revolut account you can still use your card to pay - just let the card do the conversion for you with the live rate at the time you transact, plus any applicable fair usage fee.

No monthly fee for a Standard Revolut account, or upgrade to one of 4 different account plans which have monthly fees running from 3.99 GBP/month to 45 GBP/month

All accounts have some no fee weekday currency conversion with fair usage fees after that which are 1% for Standard plan holders

Standard plan holders can withdraw 200 GBP overseas per month for free

Hold around 25 currencies

Pros and cons of using debit travel cards when travelling overseas

How much does a travel debit card cost.

Travel debit cards are usually free or cheap to order, and often offer low or no cost currency conversion.

To give an example - Wise has a one time fee to get your card, but then no monthly charges or minimum balance requirements. Currency conversion uses the mid-market exchange rate with low fees from 0.43%. Revolut has 4 different account plans, including one with no ongoing charges, or several different account options with a monthly fee in exchange for extra perks and benefits. Each account has some no-fee currency exchange, but fair usage fees of 0.5% - 1% apply if you exceed your allowance.

How to choose the best travel debit card for travelling overseas?

There’s no single best travel debit card for travelling overseas, the right one for you will depend a lot on the way you prefer to transact and manage your money.

The key things to consider include whether you’re happy to pay a monthly fee for a card or would prefer to have an option with no ongoing fees for occasional use. You’ll also want to look at the transaction costs you’ll need to pay, and what exchange rate is applied when converting currencies.

If you’re struggling to decide whether a travel debit card suits you, the Wise card and the Standard Revolut card both offer no ongoing costs, so are a fairly low risk and low commitment way to test out your options.

Is there a spending limit with a travel debit card when travelling overseas?

You’ll probably find there’s a spending limit for your travel debit card. However, this limit can vary quite significantly, depending on the provider you pick. You can also usually adjust your spending limits for security in the provider’s app which means you can set the limit you’re comfortable with.

For the providers mentioned above, Revolut UK travel debit card holders have some spending caps based on merchant and transaction type. This applies to things like sending money to others, buying travellers cheques or money orders, and betting. Wise caps monthly card spending at 30,000 GBP but you can also move your limit lower if you’d like to, for security reasons.

ATM withdrawals

ATM withdrawals with a travel debit card are also likely to be subject to limits. Revolut applies a 3,000 GBP limit based on any given 24 hour period. Wise ATM withdrawal limits are 4,000 GBP per month. Both providers allow you to make some no fee ATM withdrawals monthly, but the exact amount you can withdraw will depend on your account type.

Prepaid Travel Cards for travelling overseas

[Prepaid travel cards] ( https://exiap.co.uk/guides/best-prepaid-travel-cards ) work in a similar way to travel debit cards, but may have slightly different features and charging structures. The way prepaid travel cards work varies - for example, with the Post Office Travel Money Card, you can collect your card in person at a branch and add any of 22 currencies to it for spending and withdrawals.

The Monese Travel Money Card only lets you hold GBP, EUR and RON, but allows you to spend in foreign currencies with no fees up to a limit specified in your account plan. This range of different functionalities means you can pick the card that works best for your specific needs.

Prepaid travel card option 1: Post Office Travel Money Card

You can order a Post Office Travel Money Card online or pick one up in person at a branch as long as you have a valid ID on you. You’ll be able to top up and hold in 22 currencies, although bear in mind a fee applies if you add money in GBP. There’s no fee to add foreign currencies. The exchange rate used when you top up or convert may include a markup, but once you hold a currency balance in your account you can spend it with no further charges.

22 currencies are supported for holding and exchange

No fee to spend a currency you hold on your card

3% cross border fee if you spend in an unsupported currency

Small ATM withdrawal fee which varies by currency withdrawn, about the equivalent of 1.5 GBP per withdrawal

Manage your account and card from the Post Office travel money app

Prepaid travel card option 2: Monese Travel Money Card

Monese offers several different account plans which come with linked cards you can use while overseas. Depending on the plan you pick you’ll get some free international spending and some free ATM withdrawals. Simple account plans have no monthly fees, but are more limited in terms of no-fee transactions compared to the other account tiers.

Pick the account plan that suits your needs, including a Simple plan with no monthly costs and some plans which do have a fee to pay every month

Accounts offered in GBP, EUR and RON

Simple account plan holders can spend up to 2,000 GBP a month in foreign currencies with no fees - other account plans have unlimited overseas spending with no extra fees

All accounts have some fee free ATM withdrawals every month, with variable limits based on account plan

Virtual cards available

Pros and cons of using prepaid travel cards when travelling overseas

How much does a prepaid card cost.

A prepaid travel card could help you save money compared to using a bank debit or credit card when you travel abroad, but the chances are there will still be a few fees to pay. That could be ongoing monthly fees, currency conversion charges, or fees when you top up, particularly if you top up in cash. Weighing up a few different prepaid travel cards is the only way to decide which is the best value for your particular needs.

How to choose the best travel prepaid card for travelling overseas?

The best prepaid travel card for travelling overseas depends on your spending patterns. The Post Office Travel Money Card has the advantage that you can convert your money to the currency you need in your destination and see your budget instantly. However if you don’t do this, you might end up paying a 3% fee. Monese has different plan types, so has the flexibility to allow you to pick the one you want - but you can’t hold a foreign currency balance aside from RON and EUR.

Prepaid travel card spending limit

The Post Office travel card lets you top up to 5,000 GBP at a time, with the maximum balance at any given time set at 10,000 GBP, or 30,000 GBP annually. Monese accounts may have different limits based on the tier you pick - usually set at a maximum holding balance at any time of 40,000 GBP. You may be limited to spending up to 7,000 GBP a day, depending on your account type.

With the Post Office card, you can make up to the equivalent of 300 GBP maximum daily withdrawals and each withdrawal costs the equivalent of 1.5 GBP. Monese accounts may have a maximum ATM withdrawal of 300 GBP a day, depending on the specific account you pick, so it’s worth reading the fee schedule carefully to understand the details.

Travel Credit Cards for travelling overseas

Travel credit cards are like other credit cards in that you’ll be set a spending limit which you can not exceed on a monthly basis. At the end of the month you’ll have to pay back your bill in full to avoid interest and penalties. When you spend overseas your foreign currency transaction is converted back to GBP to add to your monthly charge - often with a foreign transaction fee added, which can be around 3%. Travel credit cards often waive this foreign transaction fee, which makes them better value for foreign currency spending compared to other credit cards. However, as with any other credit card, you might find you have fees to pay in the form of interest, particularly if you use your card in an ATM, making this a relatively expensive way of managing your money internationally.

Travel credit card option 1: Barclaycard Rewards Visa

The Barclaycard Rewards Visa credit card is a good, straightforward option for UK customers looking for a credit card which does not have foreign transaction fees, and which doesn’t have an annual fee. As with any credit card, some costs can apply including interest fees if you don’t clear your bill monthly, but you’ll be able to earn 0.25% cash back on all your card spending at home and abroad.

No annual fee, with 0.25% cash back on card spending

Currency exchange uses the network rate and no foreign transaction fee

No ATM withdrawal fee - but interest can still apply

28.9% representative APR, with penalty fees for late payments

Secure spending with extra protection on some purchases

Travel credit card option 2: Halifax Clarity Mastercard

The Halifax Clarity Mastercard has a variable interest rate which is based on your creditworthiness, but doesn’t use different rates for different transaction types as some cards do. There’s no foreign transaction fee when you spend or withdraw in foreign currencies, but bear in mind that an ATM operator might charge a fee, and interest accrues instantly for cash advance transactions.

No foreign transaction fee when spending or making a cash withdrawal overseas

Interest applies instantly when making cash withdrawals

Same interest rate applies on all purchase categories

Variable APR based on your credit score - you’ll need to check your eligibility online to see the APR you’d be offered

Spending is covered by the Consumer Credit act which means extra protections for purchases from 100 GBP to 30,000 GBP in value

Pros and cons of using credit cards when travelling overseas

How much does a travel credit card cost.

Credit cards are convenient and secure - but they’ll also often be the most expensive way to pay for things. That’s because you may end up paying an annual fee, interest costs, foreign transaction fees, cash advance charges, and penalties if you’re late to repay. The cards we’ve picked out above have the advantage that they have no annual fee, no foreign transaction fee and no cash advance fee - but if you use your card in an ATM you’ll start to accrue interest instantly, which does mean paying more in the end.

How to choose the best travel credit card for travelling overseas?

The best travel credit card for travelling overseas depends on your preferences and situation. Because there’s an eligibility screening process with credit cards, you may find you can’t get approved for some cards if you don’t have an established and strong credit history. It’s generally worth looking for a card with no annual fee, and the lowest available interest rate, just in case you can’t always repay your bill monthly.

Travel credit card spending limit

Your travel credit card spending limit will be set by the card provider, and will depend on your credit score. You’ll be shown details of your spending limit when you’re approved for a travel credit card.

The cards we’ve looked at earlier don’t charge a cash advance fee, but this is a common cost when using a credit card at an ATM, so worth looking out for when you select any credit card. It’s also worth noting that it’s very common for ATM withdrawals to start accruing interest instantly, so you’ll end up needing to repay some charges whenever you use your credit card in an ATM.

How much money do I need when travelling overseas?

Naturally, the costs of your trip can vary wildly depending on where you’re going, how long for, and what you’ll be up to during your holiday. Costs to consider when budgeting include:

Any visa fees, or travel health costs such as vaccinations, if required

Travel or medical insurance

Flights or other travel costs - don’t forget to buy baggage allowance in advance if you need it

Travel to and from the airport, or parking if you drive yourself

Local SIM or roaming data

Accommodation, plus any local tourist taxes

Food and drinks while you’re away

Activities and entry costs to tourist sites

Travel within the country - taxis or bus rides for example

Kennels or any other requirements to look after pets back home

Conclusion: Which travel money card is best for travelling overseas?

Travelling overseas is exciting but does need a bit of planning. In particular, working out how you’ll manage your money while you’re away is essential if you don’t want to get ripped off by poor exchange rates, pay high fees, or end up having a stressful time with money changers on arrival.

Travel cards can help you avoid all these potential pitfalls, manage your travel budget flexibly, and pay less for your trip in the end. Consider a Wise travel debit card for convenient, low cost spending and withdrawals with ways to pay and get paid in foreign currencies. Or as an alternative, check out a Monese travel prepaid card for free currency conversion to your specific plan limit, or a travel credit card like the Barclays Rewards Visa for cash back opportunities and ways to spread your costs over several months if you need to. No matter what type of travel card suits you best, there’s going to be an option for you - use this guide to figure out which is your perfect match, and your travel money could take you further in the end.

FAQ - Best travel cards for travelling overseas

Can you withdraw cash with a credit card when travelling overseas.

Yes. You can use your credit card to make an ATM withdrawal at any ATM where your card network is accepted when travelling overseas. However, bear in mind you’ll pay interest instantly when you use a credit card in an ATM. Choosing to withdraw with a low cost travel debit card from Wise or Revolut may bring down your overall fees.

Can I use a debit card when travelling overseas?

It’s unusual to find you can’t use a card to pay in tourist areas in more developed countries, towns and cities. However, card usage varies widely and in many places, cash is still king. Because of that, having multiple ways to pay is essential and carrying both a prepaid or travel debit card and some foreign currency in cash is a smart plan.

Are prepaid cards safe?

Yes. Prepaid cards are not linked to your normal UK bank account which means that they’re safe to use. Even if you were unlucky and someone stole your card while you're travelling overseas, they would not be able to access your main account - and you could freeze your prepaid card in the app easily if you needed to.

What is the best way to pay when travelling overseas?

Paying for things with a specialist travel debit, prepaid or credit card when travelling overseas is most convenient. However, having a few options for payment is a good plan, just in case your preferred payment method can’t be used for some reason. Consider getting a travel card from a provider like Wise or Revolut, which has some no fee ATM withdrawals so you can also conveniently get cash as a back up, and for when card payments aren’t offered.

Get a 3 month Revolut Premium trial. Click here

I’ve been traveling for almost 20 years, and until this year I hadn’t found a good spending solution.

I’m sure the stress (before I heard of Revolut) sounds familiar. For 20 years I went back and forth with:

Should I exchange money at the airport, or take money out from an ATM?

Why tf is my bank charging me so much more in exchange rate fees?

Wait, the bank charges a conversion fee AND an international transaction fee?!

I’d come to the conclusion that this was what it meant to be privledged to travel overseas – that you had to suck it up and eat the bank fees.

This past year though, I’ve traveled with Revolut in my wallet (both my phsical wallet, and my Apple wallet). And it’s saved me serious money.

Revolut is financial website and digital app used by 35+ million people, with the tools you need to easily spend, transfer, and protect your money overseas. You can set up accounts in multiple currencies, get a debit card for travel, and you can do it for no monthly fee on the Standard plan.

It’s quick to sign up for a standard account, and there is no monthly fee. If you click here you get a 3 month trial of Revolut premium (higher limits on ATM withdrawrals & currency exchange).

There are already a million Revolut reviews (spoiler – it’s trusted), so why bother writing another? Because the look of that sexy black metal card in my wallet ACTUALLY excites me.

So read on to get excited with me – Revolut is now the only way I spend my money.

Revolut Travel Card Review: Why I Only Spend Money With Revolut

I’m so happy excited using revolut.

All photos in this post are of the metal card, only available on the Metal plan

I didn’t want to write about ‘just another travel card’ until I had very thoroughly tested it and finally found a permanent solution. So since May I have used my Revolut card in the UK, Greece, Spain, Australia, and Morocco.

It’s the best travel card I’ve had, has changed the way I spend money, and I do get a mini adrenalin kick whenever I see the exchange rate they charge me, and realize that I’ve just beaten the banks.

Though I do wonder if it really counts as saving if I buy another mojito with the extra cash?!

Here are 10 quick reasons to love Revolut before jumping into the full details:

- No monthly fee on Standard plan, paid plans available

- Can top-up and hold accounts in several currencies

- Make payments in 150+ countries

- Phsyical debit card

- Withdrawals at over 55,000 ATMs worldwide (Up to plan’s limits)

- Track your spending in the Revolut app

- Quick currency conversions for 30+ currencies

- Great value with the Revolut exchange rate

- Compatible with Google Pay and Apple Pay

- Fantastic security features for travelers

Who are Revolut?

Revolut is a British financial technology company who have built an amazing reputation since starting in 2015.