- Finance >

How to Handle Your Business Travel Reimbursements Efficiently

Team Kissflow

Updated on 12 Feb 2024 • 4 min read

Travel reimbursement can sometimes be an overlooked financial process in an organization, perhaps because it used to be a particularly time-consuming task. But the truth is, if the process is done right, it can yield profitable time and resource efficiencies for both employees and the business as a whole.

Here’s how to make sure that the travel reimbursement process in your organization is offering you the best value, regarding time, ease, and money.

How does travel reimbursement work?

Travel reimbursement is the way employers pay their employees back for expenses they have incurred during business-related travel. Such expenses can range from airfare to mileage, event registration, parking, and meals. Depending on your travel policy, employees may need to pay for these first.

How to speed-up travel reimbursement process?

Digitally automating the travel reimbursement process has become an increasingly popular way for businesses to handle what was once a manual process . Regardless of how the travel expense management process is done, it is important to both employees and the company alike.

Here are some simple tips to get your travel reimbursements faster:

- Make sure the workflow fits

- Keep it simple

- Stick to cloud

1. Make sure the workflow fits

Choosing an out-of-the-box travel reimbursement solution might seem like a good idea, but there may be significant differences in how you want to process reimbursements. Rather than buying a standalone solution, you should consider building your own workflow and form on a simple automation platform.

2. Keep it simple

Many automated solutions actually make the process more complex. More than automated, employees want easy, so don’t choose a solution that complicates things more.

3. Stick to the cloud

Cloud-based travel reimbursement handling is easier for organizations of all sizes. It allows users quick and easy access to the system, coupled with sophisticated data manipulation and analysis, thus, meeting the needs of all parties in the process.

Features to look for in a travel reimbursement system

Every business has unique requirements, but there are a few features that you cannot do without. Here are some essential features that every travel reimbursement system should have:

1. Travel expense policy management

The travel management tool should let you define custom expense policies and approval hierarchies for different kinds of T&E expenses. The system should display the company’s guidelines when employees report their expenses, so they don’t submit unqualified expenses.

2. Expense reporting

Employees report their business expenses to managers or the finance team when they come back from business trips. The travel reimbursement system should let them submit expenses as and when they happen with a mobile app so no expense is left unaccounted.

3. Multi-currency expenses

When employees undertake international travel, they spend in a foreign currency. They get reimbursed in the local currency once they are back. The travel reimbursement system should accommodate multiple currencies and conversion rates.

4. Data validation

Whenever employees submit their reimbursement claims, the system should validate the expenses and throw red flags if they don’t adhere to the spending guidelines. Auto-validation deters the employees from submitting personal expenses, resulting in significant cost savings.

5. Expense approvals

If there are any expenses in the report that don’t comply with the organization’s policy, the system should notify the approver. This makes it easier for managers and the finance team to approve or reject a claim.

6. Integrated system

If the travel reimbursement software is connected with corporate credit cards, travel expenses can be automatically fetched. The system should also post journal entries to the accounting software and update the payroll software so employees can be reimbursed along with their regular paychecks.

Benefits of automating travel reimbursements

By automating the travel reimbursement process, you can experience these benefits:

- Faster, on-the-go processing

- Fewer errors or requests for more information

- Immediate insight into the state of every request

- Analytics on how long the process usually takes

- Clearer sharing of travel policies and approvals

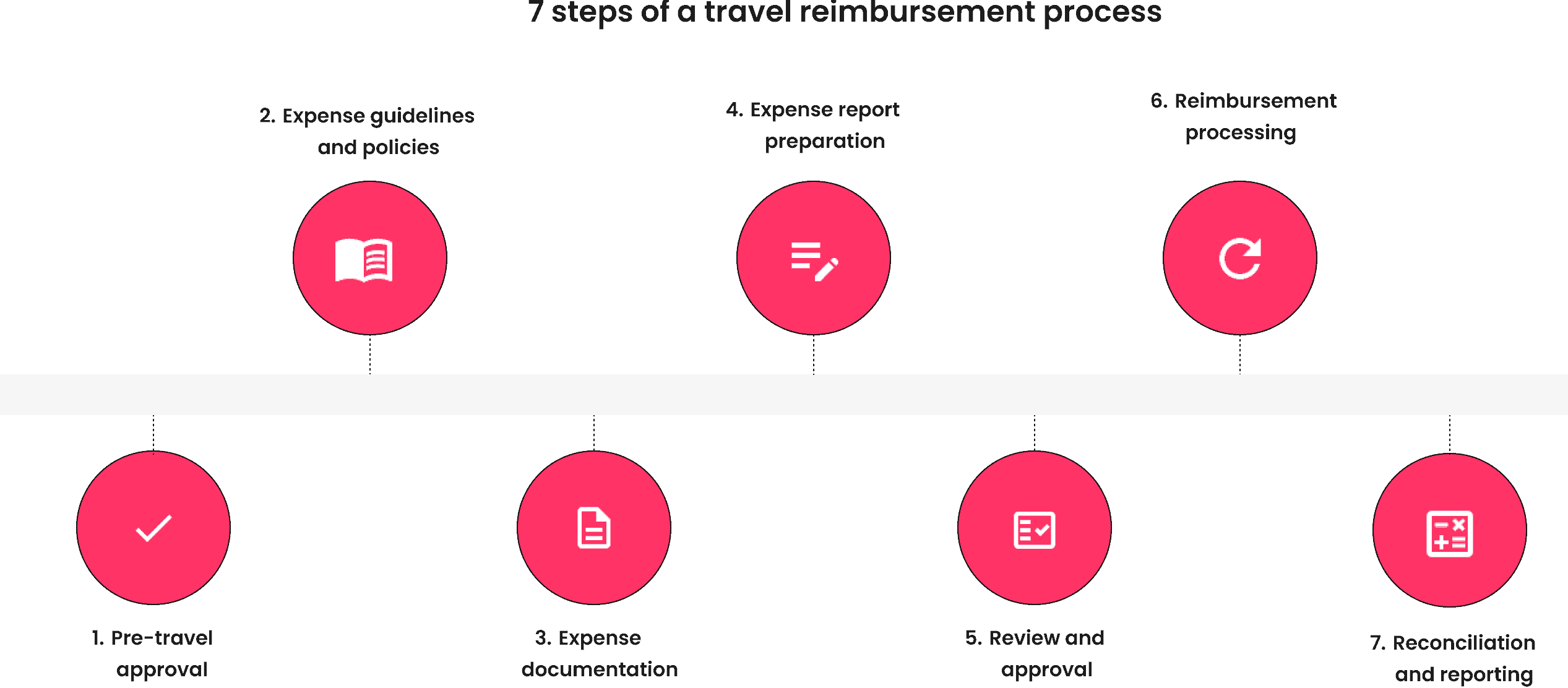

Steps involved in manual travel reimbursement process

In the past, this reimbursement process was often laborious and time consuming for all involved.

Let’s have a look at the different steps of this manual process.

Requesting Reimbursement

Approving reimbursement, requesting payment, approving payment.

The employee would likely have to fill out a paper form by hand, completing full details of the type of travel reimbursement being sought, the reasons for it, and a total cost breakdown, along with attaching all the paper receipts in an envelope or stapled to the back of the form.

This form would then be handed to their line manager, along with all those receipts, for the line manager to authorize.

The authorized form would be sent to the finance team for payment.

The payment would be approved and wired by the finance team. Finally, the employee receives the payment.

Drawbacks of manual reimbursement process

Manual process in a travel expense tracker system is prone to a number of potential issues, one of the biggest being the fact that the reimbursement crossed a number of hands before its eventual payment to the employee.

Employees relied on their manager to approve the claim quickly. Subsequently, they were bound to strict payment and processing rules, which often caused delays and inevitable frustration.

The manual travel reimbursement process often resulted in errors, or a need to further clarifications between the three key parties within the process: the employee, the manager, and the finance team.

Travel reimbursement with Kissflow Finance & Ops Cloud

Kissflow Finance & Ops Cloud offers organizations robust yet simple solutions to overcome obstacles in their travel reimbursement processes. It gives employees and managers the opportunity to make and authorize claims on the move, and its built-in system formulas mean that the number of fields that need to be manually completed is minimized, leading to quicker and more accurate processing.

The system offers substantial flexibility to add customizable features that suit the needs of the business.

For example, workflows can be adjusted to add in supervisor approvals over an absolute monetary value or auto-approvals for lower amounts. It is also straightforward to add or change permissions to the app, to ensure that the system is customized to each user, adding to the simplicity and ease of the process even further.

With Kissflow Finance & Ops Cloud , you can streamline all your key finance processes like travel reimbursement claims, travel approvals, and budget requests. Get improved control over finance approvals and see your efficiency soaring. Get your free demo today.

Related Articles

4 MINUTES READ

Budget Approval | How to Automate Budget Approval Process in 2024

5 Must-Have Features of a Budget Approval System

The Hassle-Free Solution to Fast-track Finance Business Processes

Welcome. Let's get started.

To begin, tell us a bit about yourself

By proceeding, you agree to our Terms of Service and Privacy Policy

"The beauty of Kissflow is how quick and easy it is to create the apps I need. It's so user-friendly that I made exactly what I needed in 30 minutes."

Oliver Umehara

IT Manager - SoftBank

A Trusted Choice for Companies Globally

Thank you for signing up

Someone from our team will contact you soon.

Wondering where to start? Let's talk!

Connect with our solution experts to gain insights on how Kissflow can help you transform ideas into reality and accelerate digital transformation

Book your Kissflow demo

This website uses cookies to ensure you get the best experience. Check our Privacy Policy

"Shoeboxed makes it stupid simple to scan receipts...”

What to know about travel expense reimbursement + templates.

The best way to establish an accurate reimbursement strategy for your employee and your company is to ensure that you have an expense reimbursement policy in place and that it is covered with all applicable employees during the onboarding process.

Caryl Ramsey

Published on

June 2nd, 2023

Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and reduce the hassle of doing accounting.

Employers and employees should understand the business’s guidelines for T&E or travel expense reimbursement policies so that neither runs into any issues over business-related expenses down the road.

The IRS is pretty flexible with employers when it comes to employee reimbursement for business travel expenses while away on a company trip.

Table of Contents

Does travel expense reimbursement qualify as a deductible travel expense?

What the IRS is not flexible about is whether or not the travel-related expenses incurred on the business trip qualify as a deductible travel expense.

Employers can deduct “ordinary and necessary expenses” of employees traveling away from their tax home.

According to the IRS, any reimbursement that does not qualify as a deductible travel expense is considered employee wages.

What are “accountable” and “non-accountable” plans?

There are two methods for reimbursing workers for expenses incurred when traveling for business. These are the “accountable plan” and the “non-accountable” plan.

An “accountable plan” is based on the Internal Revenue Service’s guidelines for reimbursing employees for the actual travel costs so that the reimbursable expenses incurred are not counted as income.

This means that the reimbursements are not subject to W-2 reporting or withholding taxes.

The expenses, however, must be business-related. To qualify for the “accountable plan,” expenses must be business-related, reported accurately, and excess reimbursements issued.

If the company’s reimbursement process doesn’t meet the guidelines under federal law for the “accountable plan,” then the expenses fall under the “non-accountable plan.”

If a reimbursed cost is non-accountable, then it is subject to being taxed as part of the employee’s compensation, therefore, it must be reported on the W-2 form and is subject to withholding.

What is travel expense reimbursement?

Travel expense reimbursement is when you pay employees back for business expenses incurred while traveling.

The expenses that are reimbursed are dependent upon the reimbursement policies determined by your business.

A travel reimbursement policy should be set up by your business that specifies the rules and procedures regarding reimbursement for travel-related expenses.

Many companies are using traditional expense management systems where staff can use a credit card and submit refunded trip expenses after the trip ends.

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. Expense reports don’t get easier than this! 💪🏼 30-day full money-back guarantee!

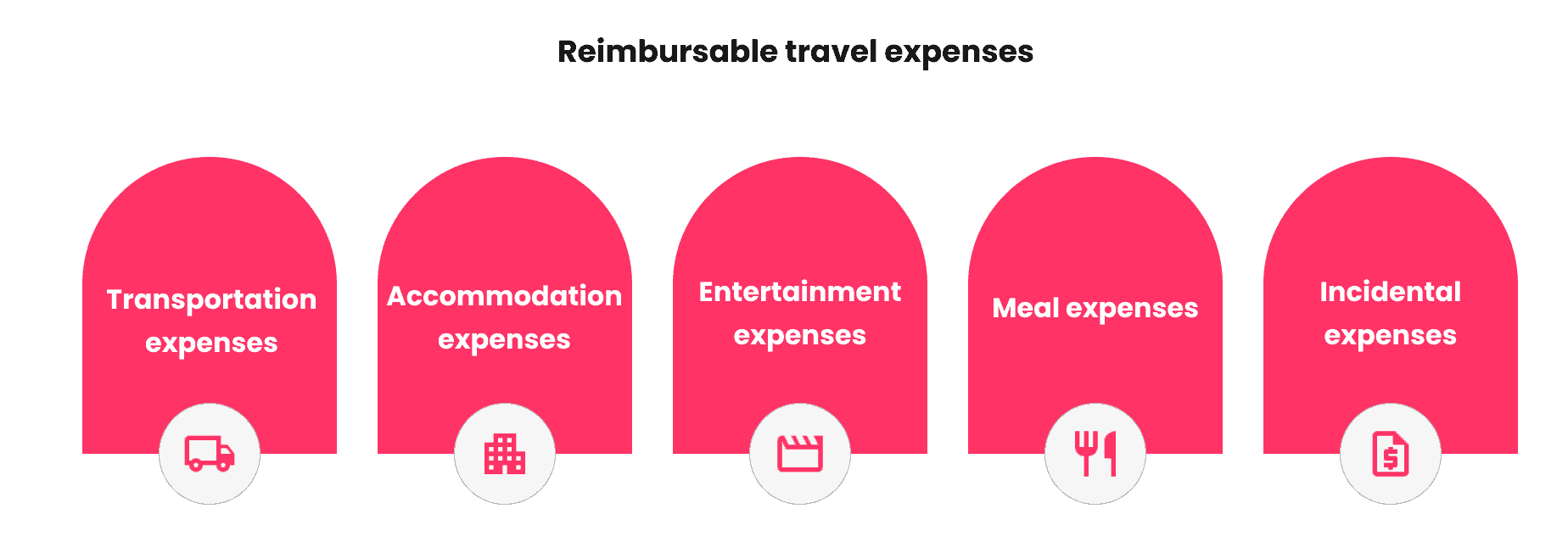

What common types of travel expenses qualify for deductible expense reimbursement?

As an optional reimbursement provider, you have a choice on whether or not to reimburse employees for travel expenses .

Regardless, a clear reimbursement policy should be established within the company.

Some of the most typical reimbursable expenses include the following:

Transportation costs between your home and the business destination

Transportation between airport/station and hotel

Transportation between the hotel and the work location

Sending company-related supplies from your regular work location to your travel work destination

Business use of a rental car or the actual expenses of operating your personal vehicle when traveling away from home on business such as mileage reimbursement

The cost of parking your rental car can vary significantly depending on factors such as location, duration, and demand. Urban areas and popular tourist destinations often have higher parking fees, while off-peak times or less crowded areas may offer more affordable options

Lodging and meal expenses

Dry cleaning and laundry

Business communication expenses

Business related tips

Parking fees and tolls

How do expense reports play a role in a business’s expense reimbursement policy?

To prevent fraud and to keep company records updated and accurate, companies should use expense reports as part of their expense reimbursement policy.

The expense report should be used by employees to report incidental expenses such as travel expenses, business meals, and small purchases of supplies or equipment for the office.

Employees fill out these expense reports, which require the information of a typical transaction.

Some of the information found on an expense report include the vendor’s name, date paid, expense description, amount paid, and totals for each expense category .

Then the expense report is submitted to the company and according to the reimbursement policy, the employee is reimbursed.

See also: Expense Report Template Google Sheets: 4 Free Templates

Receipt requirements

It’s important to always have proof or documentation of the expenses that you incurred. The best proof is to provide the original receipt from the store, merchant, or a receipt book .

Therefore, when turning in an expense report, always attach any supporting documentation such as your receipts to the expense report.

This safeguards the company against expense fraud and ensures that the company will have the documentation needed for tax deductions and any audits if requested.

Processing expense reports for travel reimbursements

Once expense reports are submitted to the company, the company is responsible for the accuracy of the expense reports.

The company has an obligation to check the expense report against its business travel and reimbursement policies.

This is meant as an assurance system for ensuring accurate compliance with corporate policies.

Deadlines for expense reimbursement

Businesses should establish monthly or quarterly deadlines for expense reports. This ensures that the business can claim the expense as a tax deduction.

It also ensures that records are kept more accurate and up-to-date, that an expense doesn’t fall through the cracks, and that the company maintains a more efficient cash flow.

Not only should there be a deadline for the employee to submit an expense report, but there also should be a deadline for when the employee will be reimbursed by the company.

See also: Travel Nurse Expenses: Put Money Back in Your Pocket

4 Free travel expense reimbursement form templates

Whether you’re a new business looking for an easy way to keep up with eligible travel reimbursements or an employee that often travels for work, these free travel expense reimbursement form templates are a great way to record travel expenses and separate them from non travel reimbursements.

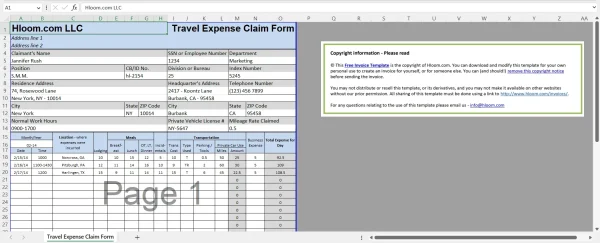

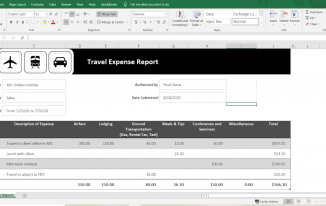

1. Hloom free travel expense reimbursement spreadsheet

Hloom free travel expense reimbursement spreadsheet for Excel.

Hloom offers a free travel expense reimbursement spreadsheet that you can use to report any travel expenses made while away on a business trip.

Employees’ travel expenses should be recorded in a concise, organized template so it’s easy to categorize eligible reimbursement claims, see if expenditures were within spending limits, and receive reimbursement all by looking at a single form.

Use this template to record:

The date, time, and location you traveled to

The meals you ate

The cost of lodging

Cost of transportation

Private vehicle license

This template is 100% free and customizable, so you can adjust the columns as needed to suit your company.

2. GeneralBlue simple free travel expense reimbursement form

This free travel expense reimbursement form by GeneralBlue is as easy as it gets. It’s an Excel template with 8 columns for recording the expenses incurred traveling for business.

With this straightforward form, you can record:

The date you traveled

A description of your trip

The cost of transportation

The cost of hotels

The cost of meals

Miscellaneous expenses

The total amount of travel expenses

There is also a line for employee and approval signatures so you have an official record of travel expenses and reimbursements.

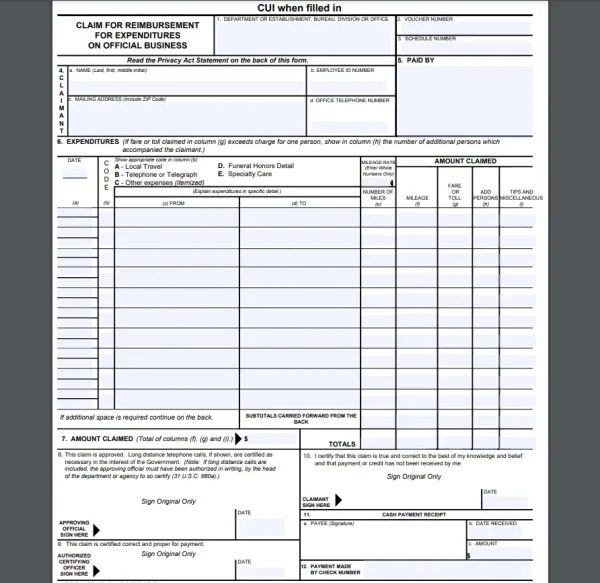

3. U.S. General Services Administration travel expense reimbursement template

Travel expense reimbursement template from the U.S. General Services Administration.

For state employees, the U.S. GSA offers a free travel expense reimbursement template that you can use to record spending while out on state business.

This template has everything an employee would need to record official business expenses, including:

Department or establishment

Official business categories

Mileage, including fare or toll

Date traveled

Additional persons

Tips and miscellaneous expenses

Spaces for authorizing signatures

The U.S. GSA travel expense template has to be printed and written as a paper copy.

4. Vertex42 travel expense reimbursement sheet

The Vertex42 travel expense reimbursement sheet is available for free and can be downloaded as an Excel file or Google Sheet .

This expense report includes:

Description of travel

Air and transportation costs

Fuel and mileage costs

Conferences and seminars

Meals and tip costs

Entertainment

Other expenses

The total cost of expenses

There’s also a place for authorized signatures, department, manager name, employee ID, and more.

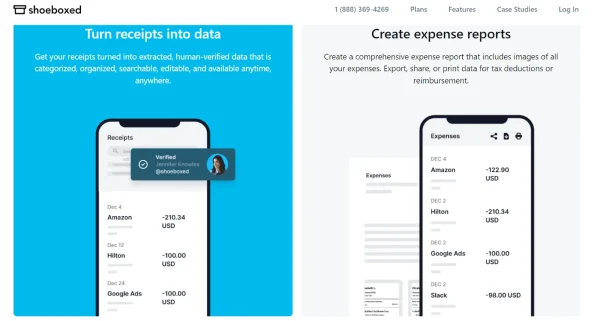

Bonus: Shoeboxed for receipt tracking and expense reports

Use Shoeboxed to capture your receipts and create detailed expense reports for reimbursement.

If you don’t want to deal with the hassle of keeping up with your receipts, manually inputting the expenses into a spreadsheet, or printing out an expense report for your boss, Shoeboxed can help!

Tracking receipts with Shoeboxed

Shoeboxed is a great travel management software that allows you to snap photos of your receipts, digitally extract the important information, and categorize the expenses so that they’re easy to find and manage in your Shoeboxed account.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Creating expense reports for business travel expenses

Once your receipt details are uploaded to your Shoeboxed account , you can select the receipts you want to put in your expense report and either export, print, or email them to the appropriate authority.

Shoeboxed will then create a detailed and organized expense report with images of your receipts attached so you can get reimbursed!

And if you didn’t think it could get any better, Shoeboxed also offers a free mileage tracker so you can effortlessly calculate business mileage and add it to your expense report.

Frequently asked questions

Can i get reimbursed for travel expenses.

The IRS offers two plans for reimbursing workers for travel expenses that are deductible: 1. Employers don’t have to pay employment tax by not including the reimbursement for travel-related expenses from the worker’s wages with the accountable plan; or 2. Employers will have to count all payments to workers as wages under a non-accountable plan.

What are travel reimbursements?

Travel compensation consists of reimbursements for out-of-pocket expenses by employees when they travel for work. The employee typically fills out an expense report and turns it in to the employer. Your employee’s costs will be affected according to your company and reimbursement policies. Travel insurance policies provide you with guidelines for reimbursement of travel expenses.

How much travel expense can I claim?

During business travel the actual cost of transport is 100% deducted—whether it is a flight ticket, train ticket, or bus ticket. Similarly, renting a motor vehicle can make your travel expenses deductible.

In conclusion

The best way to establish an accurate reimbursement strategy for your employee and your company is to ensure that you have an expense reimbursement policy in place and that it is covered by all applicable employees during the onboarding process.

Providing an expense report template makes it much easier for the employees and for those processing the expense reports.

The expense reports will also help to maximize tax deductions, make the audit process much smoother, and ensure that the employee is being reimbursed the correct amount.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt app ( iPhone , iPad and Android ) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!

Turn business receipts into data & deductibles

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.

The ABCs of Travel Expense Reimbursement: A Beginner’s Handbook

Traveling for work can be an exciting adventure, but it often comes with a myriad of expenses. Fortunately, many employers offer travel expense reimbursement to ease the financial burden on their employees. In this beginner’s handbook, we’ll explore the world of travel expense reimbursement , understanding its intricacies, and learn about Zaggle EMS which can make the process much smoother.

Understanding Travel Expense Reimbursement

Travel Expense Reimbursement is a process where an employer reimburses an employee for expenses incurred during a business trip. These expenses can include transportation, accommodation, meals, and miscellaneous costs. Employees need to understand what is eligible for reimbursement and how to track and document these expenses properly.

Common Travel Expenses

Let’s break down the common travel expenses into four categories:

A. Transportation Expenses: Transportation expenses can include airfare, train tickets, car rentals, and even parking fees. For instance, a flight from Hyderabad to Mumbai or a taxi ride to the conference venue can fall under this category.

B. Accommodation Expenses: Accommodation expenses cover the costs of staying in hotels, Airbnb rentals, or other lodging options. Whether it’s a five-star hotel in Delhi or a cozy guest house in the city, these expenses are eligible for reimbursement.

C. Meals and Dining Expenses: This category covers the cost of food and dining while on a business trip. It includes breakfast, lunch, dinner, and even snacks. Whether you’re dining at a fancy restaurant or grabbing a quick sandwich on the go, these expenses add up.

D. Miscellaneous Expenses: Miscellaneous expenses can be a bit tricky, as they encompass a wide range of costs, from conference fees and dry cleaning to business calls and internet charges. It’s essential to keep track of these smaller expenses, as they can significantly impact your reimbursement.

Expense Tracking and Documentation

One of the main challenges in the travel expense reimbursement process is proper tracking and documentation. Keeping receipts and organizing expenses can be cumbersome, and paper records are prone to loss or damage.

One of the primary difficulties lies in the proper tracking and documentation of expenses . Keeping physical receipts and records can be cumbersome, leading to potential errors, lost paperwork, or delays in reimbursement. Efficient expense tracking and reporting are key to overcoming these challenges and ensuring a smooth reimbursement process.

This is where digital tools like Zaggle EMS play a crucial role, making the process more efficient and less error-prone.

A. Submitting Expense Reports

With Zaggle EMS, employees can submit expense reports conveniently, reducing paperwork and the risk of errors. Smart Scan, a feature within Zaggle EMS, allows you to create expenses by scanning receipts using OCR (Optical Character Recognition) technology. It’s available through the Zaggle mobile application. You can even attach up to three receipts per expense, making sure you have all the necessary documentation.

B. Reimbursement Process

Zaggle EMS streamlines the reimbursement process by providing a clear and structured platform for both employees and employers. It categorizes expenses, making it easier for organizations to understand where their money is going.

C. Approval Process

The approval process is a crucial step in the travel expense reimbursement journey, ensuring that expenses are legitimate and comply with company policies

Zaggle EMS allows you to establish a hierarchical or multi-stage approval flow to ensure expenses are reviewed by the right people in the organization. In Zaggle EMS, you can configure up to 5 levels of approval in your workflow. This flexibility accommodates the unique approval structures within various organizations, from small businesses to large enterprises.

The approval process is critical to maintaining financial responsibility within an organization and adhering to established policies. By configuring hierarchical approval flows, organizations can ensure that expense reports undergo the necessary scrutiny. Moreover, the flexibility in the number of approval levels and the ability to resubmit and approve rejected reports streamline the process, making travel expense reimbursement a transparent and accountable process for both employees and employers.

Tips for a Smooth Reimbursement Process

1. Stay Organized: Keep all your receipts in one place. Using digital tools like Zaggle EMS can help you store and organize them efficiently.

2. Submit Promptly: Don’t procrastinate in submitting your expense reports. The sooner you do, the quicker you’ll get reimbursed.

3. Know Your Company’s Policy : Familiarize yourself with your company’s reimbursement policy. Some expenses may have specific limits or requirements.

4. Double-check: Before submitting an expense report, double-check all the information. Accuracy is crucial to avoid any delays.

Travel expense reimbursement doesn’t have to be a daunting process. With the right knowledge and tools, such as Zaggle EMS , you can simplify the task of tracking, documenting, and reporting your expenses. By understanding the ABCs of travel expense reimbursement , you can make your business trips financially stress-free and focus on the work at hand. Remember, the key to a smooth reimbursement process is organization and the use of efficient digital tools. Safe travels!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Zaggle Save

- Zaggle Propel

- Zaggle Edge

- Zaggle Zoyer

- Manage Cards

- Gift Cards Deals

- Partner with Us

Information

- Grievance Policy

- Refund Policy

- Privacy Policy

- Terms and Conditions

- Investor Relations

Download Zaggle App

© Zaggle 2023 | All rights reserved.

Tax Resources for Accountants and Small Businesses (U.S.)

- Expense Reimbursements / IRS / Meals and Incidental Expenses / Mileage / Payroll / Per Diem Rates / Small business

- Complete Guide to Reimbursing Employees for Travel Expenses

Published September 2, 2020 · Updated April 21, 2021

When an employee travels away from the office and incurs expenses, the company should reimburse them. Whether travelling across the world or just driving their car to a client’s location, getting the reimbursement right isn’t hard.

Keep reading to learn how to make proper employee reimbursements.

Accountable Plans

You’ll first need to decide if you will implement an accountable or nonaccountable plan. This is just as it sounds; either you’ll have employees be accountable for business expense reimbursements or not.

All businesses should have an expense reimbursement plan in writing. This includes corporations, sole proprietors, the self-employed, and non-profits. Non-profits should be extremely careful when reimbursing disqualified persons because nonaccountable plan reimbursements not properly approved or recorded can cause significant tax exposure to the charitable organization.

An accountable plan must follow the IRS guidelines for expense reimbursement. To qualify, the following rules must be met:

- Expenses must be for business purposes.

- Expenses must be adequately reported to the company in reasonable time.

- Any excess reimbursement or allowance must be returned in a reasonable amount of time.

Any expense that doesn’t meet these three criteria is considered a reimbursement under a nonaccountable plan.

This distinction between these two types of plans is important because accountable plan reimbursements are not taxable to the employee, whereas nonaccountable plans are taxable.

Business Purpose

Expenses incurred as an employee while completing work for an employer have a business purpose. Examples include things like registration fees for a conference, taxi rides to the airport for a business trip, or meals while away on a business trip.

If however, an employer reimburses an employee for dinner when the employee works late, this does not qualify as a business purpose. This reimbursement would be taxable to the employee because it was made under a nonaccountable plan.

Reporting in a Reasonable Time

While what is considered a reasonable amount of time is subjective, the general rule is that all reimbursable expenses must be submitted within 60 days of when they were incurred.

Adequate reporting involves providing a record, like an expense report, of all expenses incurred and providing evidence, like receipts, to support the expenses.

Excess Reimbursement

If an employee receives a travel advance to cover travel expenses but spends less than the advance, the difference is an excess reimbursement and must be returned to the employer to not be taxable. If the excess isn’t returned in a reasonable amount of time, it’s taxable.

A reasonable period of time in this instance is generally deemed to be within 120 days of when the expense was incurred.

With a travel advance, employees should submit an expense report and receipts to substantiate all expenses.

Mileage and Business Use of Personal Vehicle

When an employee uses their personal vehicle for company business, you’ll need to reimburse them. You have three options.

- Standard mileage rate

- Actual costs

- Monthly allowance

Standard Mileage Rate

If you use the standard mileage rate, it is 57.5 cents per mile for 2020.

You can pay more, but the IRS’ safe-harbor threshold of 57.5 cents per mile will allow you a tax deduction without having to substantiate the rate.

Note that the IRS typically updates rates in December. So, you can expect to see the 2021 rate announced in December 2020. IRS 2021 Mileage Rates are here.

IRS Standard Mileage Rates 2020

Actual Costs

Instead of using the standard rate, you can reimburse employees for actual expenses.

The employee will sum up all the costs of owning the vehicle including everything from fuel, maintenance, tolls, registration, and insurance. And based upon the percentage of business miles driven, that portion of the total actual costs is reimbursed.

Monthly Allowance

Using the monthly allowance method is relatively easy. Each month you provide a set dollar amount to the employee.

If you require the employee to provide a mileage log at the end of the month, this will determine if any part of the allowance is taxable. If no mileage log is required, the entire allowance is taxable under an unaccountable plan.

If a mileage log is provided and the employee drove less than expected, they should return the excess allowance within 30 days. If they don’t, the excess becomes taxable to them.

An employee’s commute from their home to their normal place of business is not a reimbursable expense. Any business miles driven in excess of the commute miles is reimbursable.

For example, an employee’s normal round-trip commute is 20 miles. On Fridays, the employee works on-site at a client’s office that is 30 miles away from the employee’s home. So, the employee drives 60 miles round-trip on Fridays. Since this is longer than he would drive if he commuted to the office, you’ll want to reimburse the employee for 40 miles (60 miles – 20 miles).

Mileage Logs

Employees should keep mileage logs when using a personal vehicle for business use. The log should include:

- Employee’s name

- Description of vehicle

- Date of business use

- Purpose of business use

- Starting mileage on odometer

- Ending mileage on odometer

- Approval authorization

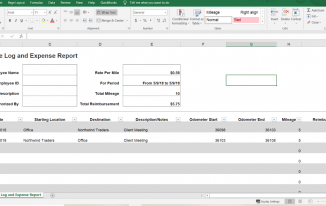

Here’s an example of a mileage log using Microsoft Excel.

Mileage log and expense report – employee reimbursement

Note that in this example, the employee drove from the office to a client and then back to the office. Therefore, there is no need to deduct commuting mileage.

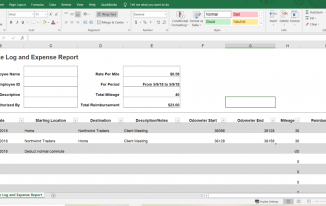

But suppose, like in our example from above, that on Fridays the employee drives from home to the client’s location and back home. His mileage log would look like this:

Mileage log and expense report example – employee reimbursement

But what if in this example, the drive to the client’s office from the employee’s home was shorter than his regular commute? In this case there is nothing to reimburse and the employee enjoys the benefit of less driving.

What would happen if this same employee didn’t normally work on Fridays or he always worked from home on Fridays? Then the entire drive to the client’s office would be reimbursable since the employee’s normal work schedule didn’t require him to commute on Fridays.

Many employees will forget to deduct their normal commute from mileage reimbursement requests. You’ll want to remind them.

Direct Expense Reimbursement of Travel Expenses

For employees who travel frequently, providing them with a company credit card is ideal. But for those times when an employee must use their own money for business expenses, you’ll want to reimburse employees quickly.

For easy recordkeeping, have employees complete expense reports when seeking reimbursements. Like the mileage log, it will detail who incurred the expense and when, what it was for, and the amount.

You can reimburse your employees with cash; however best practices would be to pay with check or some other trackable means, like ACH.

Here’s an example of an easy expense report in Excel.

Travel expense report example – employee reimbursement

For each expense, the employee should include receipts to support the amounts requested.

Receipts for purchases should contain the amount, date, place, and a brief description of the expense.

For example, hotel receipts should include:

- The name and location of the hotel.

- The dates stayed.

- Separate amounts for charges (i.e. lodging, meals, or food).

Restaurant and meal receipts should include:

- The name and location of the restaurant.

- The names of people in attendance.

- The date and amount of the meal.

You may choose to reimburse employees for meal tips. Be sure to have a clear policy of what will be reimbursed and what will not. For example, you’ll reimburse up to 20% for tips. Anything above that will not be reimbursed.

You’ll also need to consider your policy for lost receipts. You can still reimburse but have the employee fill out a missing receipt form to document the expense.

In lieu of direct expense reimbursement, consider using a per diem.

A per diem provides the employee with a specified dollar amount per day to use on meals, snacks, lodging, or other miscellaneous purchases. Larger expenses like airfare would be paid using the direct expense reimbursement method or paid for directly by the company.

Per diems should be prorated for partial days of travel. Acceptable methods include the ¾’s method or any other method you choose that is reasonable. The ¾’s method adds ¾ of a daily per diem rate on departure days and another ¾’s on return days.

The IRS sets per diem rates for cities and metropolitan areas. More expensive locales have higher daily rates than cheaper cities. For example, the daily rate for high cost cities like San Francisco, Vail, Colorado, and Nashville, Tennessee is $297. And many cities are designated high cost for only portions of the year. Miami and Park City, Utah are considered high cost only from December 1 – March 31.

And if you’re not in a high cost city, the daily rate is $200. These per diem rates are often updated each year. So you’ll always want to check for the current rates.

For example, Dave is travelling to Seattle for business. Seattle is a high cost locale. He’s leaving on Monday and returning on Thursday. Seattle’s maximum per diem rate is $297 per day. Dave will receive $222.75 ($297 x ¾) for Monday and Thursday and the full $297 for Tuesday and Wednesday.

Per diems are not taxable income to your employee if you use the IRS rates and your employee provides an expense report with receipts. However, using higher rates will create taxable income for the amount above the federal rate. And not submitting an expense report and receipts will make the entire per diem taxable because you’ll have an unaccountable plan and your company will not have the required receipts to support the tax deduction.

If your business operates in the transportation sector (i.e. shipping, trucking, or rail, etc…), it’s important to note that there are different per diem limits and rules you must follow.

Entertainment Expenses

With the 2017 Tax Cuts and Jobs Act, entertainment expenses are no longer tax deductible for companies.

As an employer, you may still reimburse your employees for entertainment expenses; however, these reimbursements will need to be segregated so that they are not included on your tax return. Examples of entertainment expenses include tickets to entertain clients at sporting events or country club fees for golf memberships.

What documentation you require for entertainment reimbursements is up to you but best practices suggest following the same requirements for travel or mileage reimbursements.

Commingling

If travel or meals involve both a business and personal aspect, only the portion of the expense that is business related is reimbursable. Expense reports and receipts should indicate whether there are any personal expenses.

For example, an employee makes a business trip to California from Georgia and elects to stay two days after business is finished for a mini-vacation. Best practices would have the employee check out of his hotel room and check back in using his personal credit card to pay the hotel bill for his extended stay. This way he has two different receipts; one for business and one for pleasure. However, if he doesn’t do that and the entire hotel stay is charged on the same receipt, you’ll need to back out the charges related to his personal stay.

None of this information should be taken as legal or financial advice, nor should it deter you from seeking the assistance of a licensed attorney, accountant, or financial services professional. But if you want to make sure your company’s policies for employee reimbursements are consistent with best practices, implementing these policies is a great place to start!

Tags: Business Use of Personal Vehicle Commingling Direct Expense Reimbursement employee Commuting reimbursement Employee Expense Reimbursement employee Monthly Allowance employees reimbursements entertainment expenses Excess Reimbursement Expense Reimbursement IRS Accountable Plans IRS Expense Reimbursement Mileage log and expense report Mileage Logs mileage on odometer Per Diem reimbursed expenses Reimbursing Employees Standard Mileage Rate travel expenses

- Next story 11 Facts about Employee Reimbursements Taxation

- Previous story Late Payment Calculator

- 2020 Mileage rates

- 2021 Mileage Rates

- Employee Reimbursements Taxation

- Gross from Net Calculator

- Reverse Sales Tax Calculator

- Taxation of Fringe Benefits

- IRS Mileage

Useful links

- Chamber of Commerce

Bistvo.com – Daily Inspiration

- 2020 Tax Calculator

- Accounting books

- Accounting education

- Accounting Jobs

- Accounting links

- Accounting software

- Accounting Software

- Accounting tutorials

- Additional Medicare Tax

- Annual Reports

- Calculators

- Chart of accounts

- Coronavirus

- Court decisions

- Depreciation

- EU Electronic Services

- European VAT on digital services

- Expense Reimbursements

- Federal income tax

- Federal Tax

- Financial statements

- FLSA – Fair Labor Standards Act

- Fringe Benefits

- Invoicing software

- Local Taxes

- Massachusetts

- Meals and Incidental Expenses

- Minimal Wage

- Minimum Wage

- Mississippi

- Net investment tax

- Nonprofits & Activism

- North Carolina

- OVDI Offshore Voluntary Disclosure Initiative

- Overtime pay

- Partnerships

- Payroll outsourcing

- Payroll software

- Penality and Interest

- Pennsylvania

- Per Diem Rates

- Principal business codes

- Professional tax software

- Retirement planning

- Self-Employed

- Small business

- Social Security and Medicare

- Sole Proprietorship

- State Licenses and Permits

- State Sales Tax

- Tax and Accounting Dictionary

- Tax calculators

- Tax court cases

- Tax Preparation Software

- Tax websites

- Title 26 – Internal Revenue Code

- U.S. Department of Labor (DOL)

- Underpayment Interest Rates

- Washinghton

- West Virginia

- West Viriginia

- Claims and Benefits

- VA Calculator

- VA Disability Rates

A Guide To Securing Travel Reimbursement: What You Need To Know

Traveling, whether for professional commitments or personal adventures, often comes with its fair share of expenses. From transportation and accommodation to meals and incidental costs, the financial aspects of travel can quickly add up. While these expenses are generally seen as a necessary part of the journey, they can sometimes strain one's budget, especially if they aren't anticipated. Fortunately, to alleviate this financial burden, numerous organizations, companies, and institutions have established travel reimbursement policies. These policies are designed to compensate individuals for certain costs they incur while on the move, ensuring that the financial aspects of their travels don't unduly burden them.

In this comprehensive guide, we will explore the underlying reasons for travel reimbursement, delve into its various categories, and provide insights on how individuals can effectively navigate the process to ensure they receive what they're entitled to.

Purpose Of Travel Reimbursement

Travel reimbursement serves as a mechanism to compensate individuals for expenses they incur while traveling for specific purposes. The primary goal is to ensure that individuals do not face financial strain due to work-related or other approved travels. Such reimbursements can cover a range of expenses, from transportation and accommodation to meals and incidental costs.

Types Of Travel Reimbursements

Travel reimbursements are payments made to employees to cover expenses incurred while on business-related travel. There are several types of travel reimbursements, including:

Business League

Business leagues, often non-profit organizations, may offer travel reimbursements to their members or representatives for attending meetings, conferences, or other league-related activities. The reimbursement typically covers transportation, accommodation, and sometimes daily allowances.

Business Trip

When employees travel for work, whether for meetings, training, or other job-related tasks, their employer often covers the associated costs. This can include flights, hotel stays, meals, and other travel-related expenses. The reimbursement process usually requires the employee to submit an expense report with receipts.

Beneficiary Travel

Beneficiary travel reimbursement is designed for veterans or specific beneficiaries who need to travel for medical or health-related reasons. For instance, the U.S. Department of Veterans Affairs offers travel pay reimbursement to eligible veterans and caregivers for travel expenses related to approved health care appointments.

Health Care Travel Reimbursement

Healthcare travel reimbursement is available in some countries to ensure that patients, especially those from remote areas, can access necessary medical services without being burdened by travel costs. For example, the NHS in the UK has a Healthcare Travel Costs Scheme (HTCS) that reimburses travel costs for eligible patients.

Employer-Provided Vehicle

When employers provide vehicles to their employees for work-related tasks, they might also offer reimbursements for associated costs. This can include fuel, maintenance, and other vehicle-related expenses. The reimbursement might be based on mileage or a fixed monthly car allowance. It's essential for employees to maintain accurate records and understand their employer's policy regarding personal use of the vehicle.

United States Regulations On Travel Reimbursement

Travel reimbursement regulations in the United States are designed to ensure that employees are fairly compensated for expenses incurred during business-related travels. These regulations are governed by the Internal Revenue Service (IRS) and other federal agencies. Here's a closer look at some of the key aspects:

Standard Mileage Rate

The IRS sets the standard mileage rate annually, which serves as the amount an employee can claim for every mile they drive for business purposes. For 2023, the standard mileage rate is 65.5 cents per mile for business travel. This rate is a reflection of the average costs of operating a vehicle, including gas, maintenance, and depreciation.

Meal Allowance

Meal allowances, often referred to as "per diem" rates, are set to cover the cost of meals and incidental expenses during business travel. The exact amount can vary based on the location of travel. For instance, traveling to major cities might have a higher per diem rate compared to smaller towns. The U.S. Department of State provides foreign per diem rates, which include meal costs and an additional amount to cover incidental travel expenses. It's essential for travelers to check the current rates and ensure they adhere to the set limits.

Accountable Plan Rules

An accountable plan is a reimbursement arrangement that meets specific IRS criteria, ensuring that reimbursements are not considered taxable income. For a reimbursement plan to be deemed "accountable," it must satisfy the following requirements:

Business Connection : The expenses must have a business purpose. This means they should be directly related to the business activities of the employer.

Substantiation : Employees must provide their employers with evidence of their expenses. This can be in the form of receipts, invoices, or other relevant documentation.

Returning Excess Amounts : If an employee receives an advance or an allowance that exceeds their actual expenses, they must return the excess amount to the employer within a reasonable time.

If a reimbursement arrangement does not meet these criteria, the IRS considers it a "non-accountable" plan, and reimbursements may be subject to taxation.

Diem Rates For Travelers

"Per diem" is a Latin term that translates to "per day." In the context of business travel, it refers to the daily allowance given to employees to cover expenses incurred while on official duty. This allowance is designed to cover lodging, meals, and incidental costs without the need for the traveler to submit detailed expense reports. Here's a closer look at the daily and mileage rates associated with per diem:

The daily rate, often referred to as the meal and incidental expenses (M&IE) rate, is set to cover the cost of meals and incidental expenses during business travel. The exact amount can vary based on the location of travel. For instance:

Traveling to major cities might have a higher per diem rate compared to smaller towns.

The U.S. Department of State provides foreign per diem rates, which include meal costs and an additional amount, equal to 10% of the combined lodging and meal costs, to cover incidental travel expenses.

For domestic travel within the United States, the General Services Administration (GSA) sets the per diem rates. For example, the M&IE per diem tiers for FY 2024 range from $59-$79, with the standard M&IE rate set at $59.

Mileage Rate

The mileage rate is designed to reimburse travelers for the costs associated with using their personal vehicles for business-related travels. This rate is set annually by the IRS and reflects the average costs of operating a vehicle, including gas, maintenance, and depreciation.

For 2023, the GSA has set the mileage reimbursement rate at 65.5 cents per mile for business travel.

This rate is applicable for travelers who opt to use their vehicles instead of other modes of transportation, such as air travel or rental cars. It's essential for travelers to maintain accurate records of their mileage to ensure proper reimbursement.

Get Travel Reimbursement

Travel reimbursement is more than just a financial relief; it's a testament to the value organizations place on their employees and members. As the world of business and healthcare continues to evolve, understanding the nuances of travel reimbursement becomes increasingly essential. Whether you're an employer setting policies or an employee navigating the reimbursement process, staying informed ensures fairness and transparency. This guide has aimed to shed light on the intricate facets of travel reimbursement, from its purpose to the regulations governing it. As you embark on your travels, remember to keep abreast of the latest guidelines and always advocate for your rights as a traveler.

Discover more opportunities for American veterans by reading our guide on how to avail GI Bill tuition reimbursement . Visit American Veteran to find comprehensive online resources dedicated to American Veterans.

- Privacy Policy

- Terms Of Use

- Cookie Policy

- Expense Management for Service Companies

- Expense Management for Construction

- Expense Management for Property Management

- Expense Management for Event Production

- Expense Management For Bookkeepers

- Expensify Alternative

- Dext Alternative

- Concur Alternative

- Airbase Alternative

- Travel Reimbursement Policy: A Comprehensive Guide

Starting a journey for a corporate excursion can be a whirlpool of commotion, but the genuine expedition frequently commences upon arrival, when confronted with a heap of receipts and the intimidating mission of maneuvering through your organization’s protocol for its travel reimbursement policy . This guide acts as your essential resource for understanding and mastering the intricacies of these policies, ensuring that you receive reimbursement for every eligible penny spent.

Understanding the Basics: What is a Travel Reimbursement Policy?

At its core, a travel reimbursement policy is a set of rules that governs how employees can claim expenses incurred on business trips. These guidelines are tailored to each company, detailing eligible expenses and the process for submitting claims. They’re the blueprint for fair compensation, covering transportation, lodging, meals, and other incidental costs.

Expense Categories

- Transportation: Flights, trains, taxis, and more.

- Accommodation: Hotels and rentals.

- Meals and Entertainment: Daily allowances based on location.

- Incidentals: Parking fees, internet charges, etc.

Spend Limits

These policies often set spending limits to prevent excessive claims, such as daily meal caps or maximum hotel rates.

Required Documentation

Receipts, invoices, and boarding passes are the keystones of a solid claim, providing the evidence needed to back up your expenses.

Approval Process

Understanding the chain of command for approvals is crucial to a smooth reimbursement experience.

Eligible Expenses: What Can You Claim?

Knowing what you can claim is half the battle. From efficient expense management solutions to transportation costs, here’s a breakdown of typical reimbursable expenses:

Transportation Costs

- Airfare, train tickets, rental cars, and taxi fares.

- Keep all travel documents as proof.

Accommodation Expenses

- Hotel stays and rentals are reimbursable.

- Save hotel bills or rental agreements.

Meals and Entertainment Allowances

- Companies usually provide a daily meal allowance.

- Document your meal expenses within the set limits.

Incidental Expenses

- Claim parking fees, internet charges, and tips.

Appropriate Documentation: How to Keep Track of Your Expenses

Organization is key when it comes to reimbursement. Here’s how to keep your expenses in check:

Save All Receipts

Collect and save every receipt related to your business expenses. Consider using a receipt management app for digital storage and easy access.

Record Details

For each expense, jot down the date, location, and purpose. This will streamline your claim process.

Use Digital Tools

Embrace digital tools and apps for expense tracking. They can automate the process, making it less of a chore.

Submission Procedures: Navigating the Reimbursement Process

With your documentation in order, it’s time to submit your claim. Here’s a step-by-step guide:

Create an Expense Report

Compile a detailed report of your expenses, complete with all supporting documents.

Submit Your Expense Report

Follow your company’s procedures, whether it’s through an online portal or via email, to submit your report.

Reimbursement Timelines: When Can You Expect to Get Paid?

Timelines for reimbursement vary, but most companies have set periods for processing claims. Stay informed about these timelines and follow up if necessary.

Tips and Strategies for Maximizing Your Reimbursement

Maximizing your reimbursement is an art. Here’s how to master it:

Review your company’s policy before your trip to understand the coverage and limits.

Keep Track of Expenses in Real-Time

Document expenses as they occur to ensure accuracy and ease the reimbursement process.

Submit Claims Promptly

Don’t delay in submitting your expense report. The quicker you submit, the faster you’ll be reimbursed.

Common Pitfalls to Avoid: Mistakes that Could Delay or Deny Your Reimbursement

Even with the best intentions, mistakes can happen. Here’s what to avoid:

Inadequate Documentation

Lack of proper receipts and invoices is a common reason for reimbursement hiccups.

Non-Compliance with Policy Guidelines

Stick to the rules set out in your company’s policy to avoid any reimbursement roadblocks.

Travel Reimbursement Policy Best Practices: Recommendations for Employers

For employers, crafting a clear and concise policy is paramount. Here are some best practices:

Clear Communication

Ensure all employees are well-versed in the policy’s details, from eligible expenses to submission guidelines.

Simplify Procedures

Streamline the process to avoid confusion and make it easier for employees to submit their claims. As we navigate the complexities of travel reimbursement, it’s clear that a solution like Clyr can transform this often cumbersome process into a seamless experience. With Clyr’s ability to integrate with major management platforms and provide real-time expense notifications, the days of manual tracking and lengthy reimbursement cycles can be a thing of the past.

Crafting a Travel Reimbursement Policy That Works for Everyone Leveraging Technology for Efficient Reimbursement

In the age of digital transformation, leveraging technology is not just a convenience—it’s a necessity for efficient expense management solutions. With the right tools, the reimbursement process can be significantly streamlined, reducing the time from submission to payment. Here’s how technology can make a difference:

- Automated Financial Reporting for Out-of-Office Teams : For teams that are constantly on the move, automated financial reporting can be a game-changer. It ensures that expenses are logged and categorized accurately, which is essential for timely reimbursement.

- Integration-Friendly Financial Tools for Property Management : Property management teams often juggle multiple tasks and expenses. Integration-friendly financial tools can synchronize financial data across platforms, making it easier to track and manage expenses.

- Real-Time Expense Tracking Software : Real-time tracking allows for immediate recording of expenses, which can prevent the loss of receipts and ensure that no expense goes unclaimed.

By adopting top financial reporting software for field teams, companies can benefit from a more cohesive and transparent expense management process. Clyr, for instance, offers seamless financial data synchronization for field services, ensuring that every dollar spent is accounted for and reimbursed accordingly.

The Role of Mobile Apps in Expense Management

Mobile apps have revolutionized the way we manage our expenses on the go. They offer the convenience of capturing receipts and tracking expenses in real-time, which is particularly beneficial for employees who are often out of the office. Here are some advantages of using mobile apps for expense management:

1. Instant Receipt Capture : Snap a photo of your receipt, and it’s securely stored and ready for your expense report.

2. On-the-Spot Expense Entry : Enter expenses as they happen, reducing the risk of forgetting or losing track of them.

3. Accessibility : Access your expense records anywhere, anytime, right from your smartphone.

For example, a receipt management app can simplify the process of collecting and organizing receipts, making it easier for employees to submit accurate expense reports. This not only saves time but also reduces the likelihood of errors that could delay reimbursement.

How to Handle International Travel Expenses

International travel adds another layer of complexity to expense management. Currency conversions, varying tax laws, and additional documentation requirements can complicate the reimbursement process. Here are some tips for handling international travel expenses:

- Understand Currency Exchange Rates : Keep track of the exchange rates at the time of each transaction to ensure accurate reimbursement.

- Know the Tax Implications : Different countries have different tax laws. Be aware of what can and cannot be claimed as a business expense.

- Use Efficient Expense Management Solutions : Choose a platform that can handle multiple currencies and automate the conversion process.

For businesses with international operations, it’s crucial to have efficient expense management solutions that can adapt to the complexities of global travel. This not only simplifies the reimbursement process but also ensures compliance with international financial regulations.

Addressing Common Questions About Travel Reimbursement

Travel reimbursement policies can be complex, and employees often have questions about what they can claim and how to go about it. Here are some common questions and their answers:

- What if I lose a receipt?- Check if your company accepts credit card statements or if they have a specific policy for lost receipts. Some companies may allow a signed statement explaining the expense.

- Can I claim expenses for leisure activities during a business trip? – Typically, only business-related expenses are reimbursable. However, some companies may allow for a reasonable amount of leisure expenses if they do not add additional cost to the trip.

- How do I claim mileage if I use my personal car?- Companies usually reimburse mileage at a standard rate. Keep a log of your business travel mileage to submit with your expense report.

- How can I address a delay in my reimbursement? – Take the initiative to follow up with your finance department. While delays can happen, it is crucial to verify that your claim is being processed.

By addressing these questions proactively, companies can alleviate concerns and make the reimbursement process smoother for everyone.

The Future of Travel Reimbursement: Trends and Predictions

The landscape of travel reimbursement is evolving with technology and changing work patterns. Here are some trends and predictions for the future:

- Increased Automation : With platforms like Clyr, we can expect more expense management automation , reducing manual entry and speeding up the reimbursement cycle.

- Mobile-First Solutions : As remote work becomes more common, mobile apps will play a larger role in expense management.

- Personalized Expense Policies : Companies may start to offer more personalized policies that cater to individual needs and work habits.

- Integration with Travel Booking : Seamless integration with travel booking systems will allow for pre-approval of expenses and automatic tracking.

These advancements will not only make the process more efficient but also more employee-friendly, leading to higher satisfaction and compliance.

Case Studies: Successful Reimbursement Stories

Let’s explore a few case studies where companies have successfully implemented efficient expense management solutions:

- A Tech Startup: By using expense report automation , a growing tech company reduced its reimbursement cycle from weeks to just a few days, improving employee satisfaction.

- A Consulting Firm: With the adoption of real-time expense tracking software, consultants could submit expenses on the go, leading to real-time budget updates and better financial planning.

- A Nonprofit Organization : By simplifying job costing with financial software, a nonprofit was able to allocate funds more accurately and report to donors more transparently.

These stories highlight the positive impact of adopting modern expense management practices.

Expert Insights: Interviews with Finance Professionals

In conversations with finance professionals, several key points are consistently highlighted:

- The Importance of Policy Clarity : Clear policies prevent confusion and ensure that employees know what’s expected of them.

- The Role of Technology: There’s a consensus that technology, especially expense reporting in QuickBooks and similar integrations, is crucial for efficiency.

- Employee Training: Educating employees on the use of expense management tools is essential for maximizing their benefits. These insights from experts underscore the need for companies to invest in both technology and employee training.

The Intersection of Travel Policies and Employee Satisfaction

Employee satisfaction is closely tied to how travel policies are structured and implemented. A fair and transparent policy can lead to:

- Boosted Morale: The sense of being valued among employees is heightened when they are assured that their expenses will be reimbursed effortlessly.

- Better Compliance: Clear guidelines and easy-to-use tools encourage employees to comply with the policy.

- Attracting Talent: Competitive reimbursement policies can be a factor in attracting and retaining top talent.

By considering employee satisfaction, companies can create policies that are beneficial for both the staff and the organization.

Crafting a Travel Reimbursement Policy That Works for Everyone

Creating a travel reimbursement policy that meets the needs of both the company and its employees involves several key steps:

- Gather Input: Include feedback from employees who travel frequently to understand their needs and challenges.

- Define Clear Guidelines: Establish what is and isn’t reimbursable, and under what circumstances.

- Leverage Technology: Implement tools like Clyr to streamline the process and reduce administrative burdens.

- Regularly Review and Update: As business needs and travel norms evolve, so should your policy.

By crafting a well-thought-out policy, companies can ensure a smooth reimbursement process that supports their financial goals and keeps employees content.

To start, please provide your work email so we can reach you. *

press Enter ↵

Thank you! Book a time for your demo below:

[cf7mls_step cf7mls_step-1 "OK" ""]

Got it. Can we have your full name? *

[cf7mls_step cf7mls_step-2 "Back" "OK" "Step 2"]

Please share your contact number? *

[cf7mls_step cf7mls_step-3 "Back" "OK" "Step 3"]

Thank you. What's the company's name?*

[cf7mls_step cf7mls_step-4 "Back" "OK" "Step 4"]

How many people are in your organization?*

1-5 6-10 10-30 30-50 50+

[cf7mls_step cf7mls_step-5 "Back" "OK" "Step 5"]

What's the biggest pain point when managing expenses today?*

[cf7mls_step cf7mls_step-6 "Back" "Step 6"]

Travel and Expense

What is a travel allowance definitions and insights.

A travel allowance can be an effective way to manage employee travel expenses and manage costs for the employee.

When employees travel for business, there are myriad expenses, from hotels to taxis or ride-sharing services. Using a travel allowance can help give travelers flexibility and control while increasing compliance with tax regulations.

What Is a Travel Allowance?

A travel allowance is compensation paid by an employer to employees to cover expenses incurred when traveling for business. In addition to lodging and transportation, travel allowances are typically used for airfare, meals, and other expenses related to business travel. It is business travel compensation, provided either before or after travel is completed.

Managing business travel compensation can be complex and hard to manage. The way businesses handle travel compensation is changing, as leaders look to implement tools that aid travelers and companies alike.

Technology is transforming how companies manage all aspects of employee travel , including the creation and coordination of travel allowances.

Types of Travel Allowance

There are many types of travel allowances, which can be given upfront or based on a reimbursement schedule. Here is a look at some of the most common.

Fixed Travel Allowance

A fixed travel allowance is a flat rate that is offered to an employee, irrespective of the level of expenses incurred. Employees are responsible for managing their travel expenses and determining how to use the money best to accommodate their needs. It is commonly used with employees for short trips or who travel infrequently.

Typically, with a fixed allowance, if the employee spends less than the allocated amount, the employee can keep the difference. If the employee spends more, they are responsible for making up the difference. Businesses using fixed travel allowance should work with their tax professional to understand the implications of this practice.

Daily Travel Allowance

Also called a per diem, a daily travel allowance is an amount used for each day of travel and can be used for lodging, transportation, meals, and other travel expenses. Typically, a traveler will reconcile the per diem by submitting an expense report and receipts. The traveler will be reimbursed for any expenses they spent in excess and will return money that was unspent.

Travel Reimbursement

This travel allowance requires the traveler to submit receipts for actual expenses incurred, which are then reimbursed. This process can be cumbersome and time-consuming for the traveler. If reimbursement is not done in a timely manner, it can be burdensome for the employee, who is essentially lending money to the company. Fortunately, there are technologies available today to simplify this work.

Mileage Allowance

This type of allowance pays the employee for miles traveled on business. It is typically used when employees use their own car for business-related travel. Technologies can tracking and reimbursing for mileage simpler and more accurate.

Methods for Calculating Travel Allowances

When using travel allowances as part of a corporate travel program, one key consideration is how the travel allowances are calculated.

The process often has to consider the distance traveled and the time spent traveling. Here is one way to calculate a travel allowance.

Location and Days of Travel

Start by determining the location of the traveler at midnight on each day of travel. A day of travel is defined as a 24-hour period an employee is conducting business while traveling.

The day of travel ends when the next day starts or they return home from a business trip to their home or office. For example, if an employee leaves for a trip at 4 p.m., the first day of travel is from 4 p.m. that day until 4 p.m. the next.

Lodging allowances are provided based on whether an employee spends the night in accommodations other than their own home. Typically, lodging allowances are based on the location and the current price rates for various hotel categories, based on company preferences for the level of hotels allowed.

Unlike with other categories, usually lodging is an either/or determination. Employees are either allowed the lodging allowance or not based on the circumstances of the trip.

Like with lodging, meal allowances are usually based on the prevailing costs of meals in each location. It assumes that a traveler will have three meals a day.

Typically, a meal allowance covers both meals and incidentals, such as snacks. Often it is prorated based on the time in any given day a traveler is on the road.

The meal allowance may also be reduced if there are meals provided as part of the work travel, such as part of a conference registration fee or transportation ticket.

Managing Travel Allowances

Managing travel allowances is a complex task. Here are some tips on how to effectively implement and manage a program:

- Develop a Clear Policy. Travelers need to understand the specifics in your travel program and how allowances are used. The policy needs to spell out, for example, what expenses are allowed and not allowed and the ways in which allowances are calculated. Transparency is essential to ensure all employees understand how travel expenses are covered

- Consider Incidentals. Business travelers face many complexities and challenges. You want a policy that makes it easy for travelers to navigate while on the road. Be sure your policy covers costs that may arise, including parking, fuel, tips, laundry services, printing, internet fees, and luggage check fees

- Analyze Data. You need a system in place that collects and reports on travel data to allow you to better understand trends, shifts and challenges. With visibility into your travel program, you can make timely, well-informed decisions

Developing Travel Allowance Policies and Guidelines

If your company wants to develop a travel allowance policy, where should you begin?

The policy should be rooted in a broader travel policy which should consider the following:

- Scope. What aspects of business travel will your policy cover?

- Coverage. Determine which elements of travel the policy will cover, such as air travel, lodging, meals, incidentals, and ground transportation

- Reimbursement Types. Will your company use travel allowances and, if so, which types?

- Participation. How will policies be determined? Be sure to include staff from human resources, finance, and departments that frequently travel, in determining the policy

- Safety. Be sure your policy provides protection for employees while they are traveling

- Expense Reporting. Develop tools or adopt that will be used for the reporting of travel expenses, with an emphasis on scalability, technology integration, and ease of use

Technological Advancements in Travel Allowance Management

Technology is changing the way companies manage business travel . There are powerful platforms available today that integrate travel policies, allow for the booking of travel and itinerary management and provide robust data collection and travel.

Employees need access to easy-to-use tools that allow for the recording of receipts and other transactions, let them reconcile expenses and generate expense reports, and simplify approvals and routing.

SAP Concur solutions can provide companies with integrated business travel, expense, and invoice solutions. With SAP Concur solutions, companies can book travel, manage expenses, integrate with business systems, manage invoices, and more.

Learn more about how SAP Concur solutions can simplify your travel management .

- Search Search Please fill out this field.

What Are Travel Expenses?

Understanding travel expenses, the bottom line.

- Deductions & Credits

- Tax Deductions

Travel Expenses Definition and Tax Deductible Categories

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

:max_bytes(150000):strip_icc():format(webp)/MichellePScott-9-30-2020.resized-ef960b87116444b7b3cdf25267a4b230.jpg)

For tax purposes, travel expenses are costs associated with traveling to conduct business-related activities. Reasonable travel expenses can generally be deducted from taxable income by a company when its employees incur costs while traveling away from home specifically for business. That business can include conferences or meetings.

Key Takeaways

- Travel expenses are tax-deductible only if they were incurred to conduct business-related activities.

- Only ordinary and necessary travel expenses are deductible; expenses that are deemed unreasonable, lavish, or extravagant are not deductible.

- The IRS considers employees to be traveling if their business obligations require them to be away from their "tax home” substantially longer than an ordinary day's work.

- Examples of deductible travel expenses include airfare, lodging, transportation services, meals and tips, and the use of communications devices.

Travel expenses incurred while on an indefinite work assignment that lasts more than one year are not deductible for tax purposes.

The Internal Revenue Service (IRS) considers employees to be traveling if their business obligations require them to be away from their "tax home" (the area where their main place of business is located) for substantially longer than an ordinary workday, and they need to get sleep or rest to meet the demands of their work while away.

Well-organized records—such as receipts, canceled checks, and other documents that support a deduction—can help you get reimbursed by your employer and can help your employer prepare tax returns. Examples of travel expenses can include:

- Airfare and lodging for the express purpose of conducting business away from home

- Transportation services such as taxis, buses, or trains to the airport or to and around the travel destination

- The cost of meals and tips, dry cleaning service for clothes, and the cost of business calls during business travel

- The cost of computer rental and other communications devices while on the business trip

Travel expenses do not include regular commuting costs.

Individual wage earners can no longer deduct unreimbursed business expenses. That deduction was one of many eliminated by the Tax Cuts and Jobs Act of 2017.