- Financial Crisis

- Wall Street Insider

- 9/11 Ground Zero

- Statue of Liberty and Ellis Island

Groups and Events

- Corporate Events

- Private Tours

- Meet Insiders

- In the Press

- Our Clients

- Financial Crisis Tour

- Wall Street Insider Tour

- Unofficial Succession Tour

- School Groups

How To Experience the New York Stock Exchange

By Gabriella Hammond

September 4, 2023

Want to experience the New York Stock Exchange? It’s not the most obvious NYC attraction, but it’s one of the most defining places for the city. This birthplace of businesses will forever stand as an anchor of Lower Manhattan’s financial community.

Compared to its early days, NYSE visits to the stock exchange have changed quite a bit. But it’s still worth visiting today. Like so many New York landmarks, the stock exchange isn’t just a building, but a critical part of the city’s history. And its influence stretches beyond the borders of New York to the rest of the country and even the world.

Excited about visiting the New York Stock Exchange yet? In this article, I’ll explain what exactly it is, what you can see when you go, and the best way to experience it.

What is the New York Stock Exchange?

The New York Stock Exchange — also known as the “Big Board” — is one of the oldest and largest stock exchanges on the planet. Located on Wall Street in Lower Manhattan, the NYSE stands as both a symbol of capitalism and as the financial center of the U.S.

Easily the most important landmark on Wall Street, the stock exchange practically created the Financial District by marking the neighborhood as an area of business. Wall Street was actually named for a real wall, built by Dutch settlers to keep out British forces. This wall served as an unofficial trading post for residents, beginning the business traditions that would continue in this same location for hundreds of years.

When the main building was built in 1903, it impressed everyone with its size and majesty. The opening solidified the prominence of the New York Stock Exchange and all but guaranteed that Lower Manhattan would be a neighborhood of commerce.

And it still is today.

A brief history of the NYSE

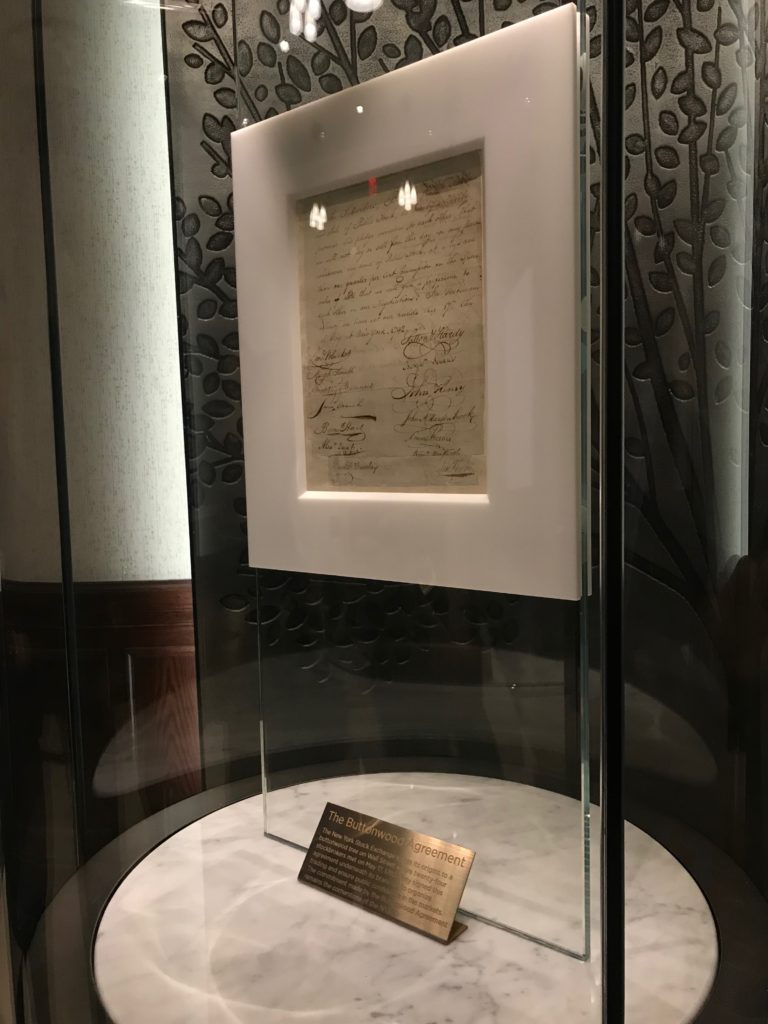

It all started on May 17, 1792, when 24 brokers and merchants met under a buttonwood tree. At the time, this tree was the tallest thing in Lower Manhattan, which, in retrospect, is a pretty appropriate setting to sign an agreement that would grow to play a very significant role in both the United States and global economies.

It was under this tree that these two dozen individuals signed the Buttonwood Agreement, establishing the grounds for trading at what was then called the New York Stock & Exchange Board.

That name was shortened in 1863 to what we know today: the New York Stock Exchange.

Guide tip: To commemorate the document that led to its creation, the stock exchange planted a new buttonwood tree out front. The tree isn’t nearly as full or towering as the original, but it’s the symbolism that counts. Snap a pic in front of the tree and tell all your friends you saw a replica of the most important tree in NYC — then watch as they’re amazed.

The NYSE trading floor: A New York legend

The NYSE has always been an exciting place with exciting things happening every minute. Up until the early 2000s, the trading floor was full of people frantically running around, shouting numbers and exchanging hand signals with each other.

The exchange even had a special trading floor clock without hour markers. There are only five-minute markers, because each trader had just five minutes to trade their stock. Talk about pressure!

You can imagine how hectic it got in there since, up until the past few decades, all the trading was done on the trading floor itself. These days, with the rapid advances in technology and the internet, most trades around the globe have transitioned to electronic systems. The NYSE is becoming one of the few remaining trading floors where humans are still actively trading in person.

Now, that doesn’t mean it’s been abandoned. In fact, in 2007, the exchange adopted a hybrid model that combines electronic and floor-based trading. It makes the trading floor all the more special because it combines the traditions of the past with the innovations of the future.

The trading floor today

Although the trading floor isn’t as lively as it once was — with the decrease of frantic people running around and volume of open outcries — it is still just as exciting today. Currently, there are approximately 500-1,000 people trading on the floor each day.

Possibly the biggest change in the demographics of the Exchange is the increase of outside guests — and we don’t mean tourists wanting to visit Wall Street. There have been more and more representatives from journalists across the world. About 33 media outlets come in and out of the building every day to broadcast from the NYSE floor.

Is the NYSE open to visitors?

Unfortunately, the exchange is no longer accessible to the public. Here’s why.

After the September 11th attacks and the increase in security that followed, many buildings once open to the public were severely limited or shut down altogether. For the stock exchange, it meant no more public tours and security stands outside the entrance. A fence was even added to the front of the building to prevent pedestrians from getting too close.

Guide Tip: While the stock exchange is not accessible, around the corner is another famous financial building — the Federal Reserve, a bank the size of a block that has a massive gold vault inside.

How to experience the NYSE even if you can’t go inside

Despite the new security measures, there are still many ways to experience the New York Stock Exchange without going inside. So there is no need to feel left out!

Here are a few suggestions if you want to visit the NYSE.

Listen for the bell

Every weekday, the opening bell of the NYSE is rung at 9:30 a.m. to mark the start of the day’s trading. The closing bell is then rung at 4 p.m. to mark the end. When the guest ringing the bell fails to ring it for the acceptable amount of time — 10 seconds for the opening bell and 15 seconds for the closing bell – it’s not uncommon for the floor to erupt into boos (they take their bell ringing very seriously). If you are lucky enough, and happen to show up on the right day and time, you just might hear it emanating from outside.

In the past, the bells used to be rung by floor managers, but they later started inviting executives, public figures, and celebrities to ring them, which became a daily event. Who knows who you may spot by the NYSE and its surrounding areas if you show up at the right bell-time?

The opening and closing bells are one of those things both New Yorkers and non-New Yorkers alike have to experience at least once in their lifetime. Just don’t show up on a weekend or a U.S. holiday when the bell definitely won’t be ringing.

Snap a selfie with a brand banner

For the past two decades, the stock exchange has started a tradition of hanging “full façade” banners to celebrate and market special events and their listed companies.

Some of the past banners include the huge logos of:

On special holidays, like Independence Day, the American flag will hang proudly across the building. There’s no way you could miss it. The NYSE loves to build their brand with companies they work with. Maybe you’ll spot the logo of a business you love hanging grandly in front of the building.

Don’t feel shy about snapping a picture (or a few — no shame) in front of it. You get the iconic New York Stock Exchange and a larger-than-life example of NYC marketing without even having to go to Times Square . That’s a double whammy.

Take a tour of Wall Street

Unlike other monuments, experiencing the New York Stock Exchange isn’t as simple as buying a ticket. Most people walk right by or snap a picture and leave. It’s the history and significance that make it special. But unlike the Statue of Liberty or the Empire State Building , this history isn’t displayed in a museum or exhibit for you to browse on your own.

The best way to learn about it is with a guide — but not just any guide, a Wall Street insider. That’s just what our guided tours of Wall Street do. You have two options when you visit Wall Street: an in-depth tour for NYC finance aficionado or an entertaining overview of Wall Street, New York City.

Here are our two Wall Street tours:

- 2 hours: Our award-winning Financial Crisis Tour is our in-depth tour. We cover the famous landmarks and dig into what happened during the 2008 financial crisis and its long-term effects on the stock market. We’ll even teach the finance lingo related to the crisis.

- 75 minutes: If you prefer something a bit shorter that delves into both the history of Manhattan and its financial hub, then the Wall Street Insider Tour is for you. You’ll still be touring with an insider, but the focus is more on the overall history of the American economy.

See how the NYSE celebrates the holidays

Credit: Omnibus / CC BY-SA 3.0

The NYSE hangs banners for their listed companies and for special occasions, but there are also certain days throughout the year reserved for special events.

One of these is during the holidays. Every year, there is a Christmas tree lighting on Broad Street, in front of the New York Stock Exchange. Lights are coiled around the exchange’s Corinthian columns and around a massive pine tree. The moment when the single switch is flipped to light up the entire NYSE is truly an amazing sight. Listed company sponsors, artists, and partners all stop by to celebrate the holiday season. It’s one of the oldest Christmas tree traditions that brings the public to the NYSE.

What are some other things to do on Wall Street?

Wall Street has plenty of other fun and historical sites to see. Before or after your visit to the stock exchange, you can check out:

- Fearless Girl, a bronze statue promoting female empowerment, directly across from the NYSE

- Federal Hall , a former treasury turned museum dedicated to George Washington’s presidential inauguration

- Trinity Church, a historic Gothic Revival church with a pretty cool Hamilton connection

- Fraunces Tavern, the city’s longest-running restaurant

Visit Wall Street NYC for the NYSE and more

It’s difficult to process all of this information about one building while simply standing outside the entrance, especially if you’re trying to do it on your own.

If you think about it, very few landmarks in the city still actively serve their original purpose. The New York Stock Exchange may be quieter than it once was, but the culture and buzz is as resounding as ever. However you feel about money or business, the stock exchange is a must-visit. Its creation gave New York power and status that still, to this day, contributes to making the city one of the greatest in America.

That’s part of why we love this corner of NYC here at The Wall Street Experience and enjoy sharing our insider perspective. On our Wall Street walking tours , you won’t learn just the history (though we’ve got plenty of that, too). We share real-world stories from people who’ve worked inside the financial trenches of Wall Street. Their insight will help you see this place in a new light — not as facts and figures or even dollar signs but through the eyes of the people who have made it what it is today.

Share article

Related articles.

Top 9 Places To Eat and Drink Near Wall Street

Everything To Know About the Fearless Girl Statue

Guide to the National Museum of the American Indian in NYC

Visiting the New York Stock Exchange

You can't go in but the Financial District is worth a look

Sebastian Bergmann/CC BY-SA 2.0/Flickr

The New York Stock Exchange is the largest stock exchange in the world, and billions of dollars worth of stocks are traded there every day. The Financial District that surrounds it is central to the importance of New York City. But because of tightened security measures after the terrorist attacks of September 11, 2001, which occurred mere blocks away from the New York Stock Exchange (NYSE), the building is no longer open to the public for tours.

The History

New York City has been home to securities markets since 1790 when Alexander Hamilton issued bonds to deal with debt from the American Revolution. The New York Stock Exchange, which was originally called The New York Stock and Exchange Board, was first organized on March 8, 1817. In 1865, the exchange opened in its current location in Manhattan's Financial District . In 2012, the New York Stock Exchange was acquired by InterContinental Exchange.

The Building

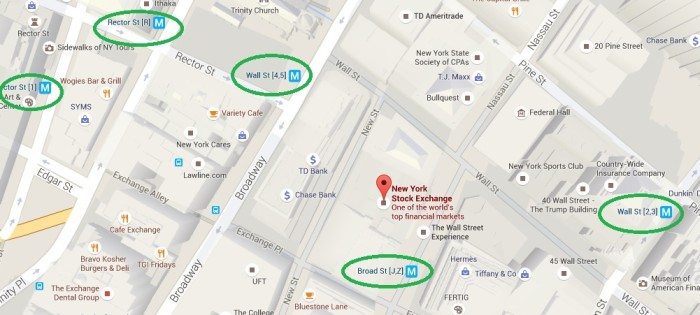

You can view the New York Stock Exchange building from the outside at Broad and Wall streets. Its famous facade of six marble Corinthian columns below a pediment sculpture called "Integrity Protecting the Works of Man" is often draped with a huge American flag. You can get there by subway trains 2, 3, 4, or 5 to Wall Street or the R or W to Rector Street.

If you want to learn more about the financial institutions in New York, you can visit the Federal Reserve Bank of New York , which offers free tours to visit the vaults and see the gold with advance booking. It is also in the Financial District and offera insight into the inner workings of Wall Street.

The Trading Floor

Although you can no longer visit the trading floor, do not get too disappointed. It is no longer the chaotic scene that's dramatized on TV shows and movies, with traders waving slips of paper, yelling stock prices, and negotiating million-dollar deals in a matter of seconds. Back in the 1980s, there were up to 5,500 people working on the trading floor. But with the advance of technology and paperless transactions, the number of traders on the floor has dwindled to about 700 people, and it is now a much calmer, quieter environment if still loaded with daily tension.

The Ringing of the Bell

The ringing of the opening and closing bell of the market at 9:30 a.m. and 4 p.m. guarantees that no trades will take place before the opening or after the close of the market. Starting in the 1870s, before microphones and loudspeakers were invented, a large Chinese gong was used. But in 1903, when the NYSE moved to its current building, the gong was replaced by a brass bell, which is now electrically operated at the start and end of each trading day.

Sights Nearby

The Financial District is the scene of a number of different sights in addition to the NYSE. They include the Charging Bull, also called the Bull of Wall Street, which is located in Bowling Green, near the intersection of Broadway and Morris streets; Federal Hall ; City Hall Park; and the Woolworth Building. It is easy and free to see the exterior of the Woolworth Building, but if you want to take a tour, you will need advance reservations. Battery Park is also within walking distance. From there, you can take a ferry to visit the Statue of Liberty and Ellis Island .

Tours Nearby

This area is rich in history and architecture, and you can learn about it on these walking tours: History of Wall Street and 9/11, Lower Manhattan: Secrets of Downtown, and the Brooklyn Bridge. And if you're into superheroes, the Super Tour of NYC Comics Heroes and More might be just the ticket.

Food Nearby

If you need a bite to eat nearby, Financier Patisserie is a great spot for light eats, sweets, and coffee and has several Financial District locations. If you want something more substantial, Delmonico's , one of NYC's oldest restaurants, is also nearby. Fraunces Tavern , which first opened as a tavern in 1762 and was later headquarters to George Washingon and home to the Department of Foreign Affairs during the Revolutionary War, is another historic restaurant where you can sit down for a meal, as well as tour its museum.

48 Hours in Lower Manhattan: The Perfect Itinerary

The 20 Best Restaurants in New York City

20 Best Things to Do in Brussels

13 Top New York City Attractions

5 Fascinating Historical Tours of New York City

5 Best Bus Tours in New York City

The 10 Tallest Buildings in New York City

Christmas in New York City: Best Events & Things to See

New York City Guide: Planning Your Trip

The Best Time to Visit New York City

The 12 Best Food Halls in New York City

Your Guide to the Federal Reserve Bank of New York

Top 15 Things to Do in Buffalo, New York

How to Travel from Washington, DC to New York City by Train, Bus, Car, and Plane

The 17 Best Rooftop Bars in New York City

Your Trip to New York State: The Complete Guide

New York Stock Exchange

- Wall St • 2 min walk

- Broad St • 2 min walk

Most Recent: Reviews ordered by most recent publish date in descending order.

Detailed Reviews: Reviews ordered by recency and descriptiveness of user-identified themes such as wait time, length of visit, general tips, and location information.

Also popular with travelers

New York Stock Exchange - All You Need to Know BEFORE You Go (2024)

- Wall Street Insider Tour with a Finance Professional (From $39.00)

- Full-Day New York "Must See" Small-Group Tour plus One World Observatory Ticket (From $129.00)

- Statue of Liberty Ticket, 9/11 Memorial and Wall Street Tour (From $59.00)

- Financial Crisis Tour with a Finance Professional (From $59.00)

- New York: The Story of Alexander Hamilton In Lower Manhattan (From $40.00)

- (0.13 mi) AKA Wall Street

- (0.18 mi) Mint House at 70 Pine

- (0.17 mi) Artezen Hotel

- (0.12 mi) Radisson Hotel New York Wall Street

- (0.15 mi) Residence Inn by Marriott New York Downtown Manhattan/World Trade Center Area

- (0.00 mi) Juice Press

- (0.01 mi) Number One Caviar Boutique Wall Street

- (0.06 mi) The Capital Grille

- (0.11 mi) Manhatta

- (0.11 mi) Trinity Place

- (0.02 mi) T.J.Maxx

- (0.02 mi) Stretch-a-leg Travel English and Mandarin Speaking

- (0.03 mi) Lower Manhattan Tours

- (0.03 mi) Conservancy For Historic Battery Park

- (0.04 mi) Castle Clinton National Monument

This website uses cookies to improve your browsing experience and analyze the use of the website. Learn More

New York Stock Exchange Tours

This post is a guide and a virtual tour of the New York Stock Exchange (NYSE) headquarters in Lower Manhattan, with tips on planning your visit.

Click here for a self-guided tour of Wall Street .

HOW TO GET TO THE NYSE

Located at the intersection of Wall Street and Broad Street, the New York Stock Exchange (NYSE) is by far the world's largest stock exchange and is the symbol of American capitalism.

The massive facade of the building is actually not on Wall Street but on Broad.

Click here for directions to the NYSE . Or why not stay in the area?

The Financial District has a number of inexpensive hotels with great reviews on TripAdvisor .

Or, let us take you here. Many of our tours of Lower Manhattan include or start at the NYSE.

Calendar of all Lower Manhattan Tours (including our pay-what-you-wish tours)

This includes our GPS-led audio tour of Lower Manhattan, which we offer in English, Spanish, and German. Here's a sample.

As you can see on the map, the NYSE is within walking distance from several New York City subway lines.

For those new to the NYC subway, read the following 2 posts.

- How to Use the NYC Subway

- Which Subway Pass to Buy

NOTE: If you are considering any of the t ourist attraction concession passes when in NYC, then keep in mind that all include one or more hop-on-hop-off bus tours for free.

HISTORY + DESIGN

When you turn the corner to see the Broad Street side of the Exchange, you will be standing in a location of great historical significance.

Prior to 1792, businessmen who engaged in the trading of goods and money met under a tree to transact business.

It was a sycamore tree but known more commonly as a buttonwood tree.

Thus in 1792, when 24 stockbrokers signed an agreement that would regulate their dealings, they named it the Buttonwood Agreement.

25 years later, the members of the Agreement drafted an official constitution and the New York Stock & Exchange Board was born.

In 1863 its name would be shortened t o the New York Stock Exchange.

The first location of the NYSE was a room rented in a small for $200 a month in 1817 located at 40 Wall Street (now the location of the Trump Building, one of the top 10 skyscrapers in New York City .

When the original NYSE HQ’s were burned down in the Great Fire of New York (1835), the Exchange moved to a temporary headquarters and then again in 1865 moved to 10-12 Broad Street.

As the Exchange grew in business, a larger, grander building was needed.

Construction of the current NYSE building began in 1901 and George B. Post was the architect (known for his neo-classical buildings around New York including the glorious Customs House at Bowling Green).

It took two years to complete the Exchange and costs ran over the estimated price. In the end, the final cost was $4 million.

R.H. Thomas, chairman of the Building Committee justified the what-was-then substantial amount of money by saying, “Where so many of our members spend the active years of their lives, they are entitled to the best that architectural ingenuity and engineering skill can produce.”

Little could he know that a century later, the price of the building was no more than a typical trader’s end of the year bonus!

Above the columns is a pediment with a sculpture designed by John Q.A. Ward (who also designed the over-life-size standing statue of George Washington on the steps of Federal Hall diagonally across from the Exchange.

Ward’s sculpture, called “Integrity Protecting the Works of Man” centers on the wing-hatted Mercury, the god of commerce.

To her left are representations of mining and agriculture and on her right, symbols of industry, s cience, and invention, all sources of American prosperity.

THE TRADING FLOOR

Although you cannot visit the trading floor for security reasons, don’t feel too disappointed.

It is no longer the chaotic scene we’ve become familiar with throw movies and TV shows, with traders waving slips of paper, yelling stock prices, and negotiating million-dollar deals in a matter of seconds.

Back in the 1980s, there were 5,500 people working on the trading floor.

But with the advance of technology and paperless transactions, the number of traders on the ground has dwindled to a mere 700 people and is now a much calmer, quieter environment.

Click the image for the interactive 360-degree view of the main trading floor.

Discovery Education offers an online virtual visit to the NYSE trading floor.

If you are missing the good old days, you can see what a typical day of trading used to be like by watching movies like “Wall Street” with Michael Douglas, “ The Pursuit of Happiness” starring Will Smith, and “ Trading Places” starring Dan Aykroyd and Eddie Murphy.

THE RINGING OF THE BELL

The ringing of the bell at 9 am and again at 4 pm is more than a gesture - it guarantees the marketplace that no trades will take place before the opening or after the close of the market.

Starting in the 1870s, before microphones and loudspeakers were invented, used a large Chinese gong to let traders know to start or stop trading for the day.

But in 1903, when the Exchange moved to its current building, the gong was replaced by a brass bell which is now electrically operated.

Each of the 4 trading areas of the NYSE has its own bell which operates synchronously from one single control panel.

You can see a detailed video history of the Exchange bell here.

STUDENT GROUP VISITS

Unfortunately, the NYSE can no longer accommodate private requests for visits by school groups.

RELATED POSTS

- Finance Tours of Wall Street

- Other Top NYC Attractions

- Other Things to Do in NYC

- Things to Do in Lower Manhattan

Choose a Destination... I want them all PLUS general travel tips. Amsterdam Berlin Boston Charleston Chicago Dubai Lisbon London Los Angeles Miami Nashville New York City New Orleans Paris Philadelphia Prague Rome San Francisco Washington DC

About The Author

Stephen Pickhardt

North america, united kingdom & ireland, middle east & india, asia & oceania.

A Rare Look Inside the New York Stock Exchange

- Arts & Culture

The New York Stock Exchange used to be a major attraction for tourists and curious locals alike. From 1939 to 2001, pretty much anyone could pop into the trading floor to glimpse the hustle and bustle of high finance. That’s how this legendary prank in 1967 could even take place. But these days, paying visits to the trading floor has become a rare commodity. The NYSE closed its doors to the public just after 9/11 and didn’t open them up again.

Until just recently. The Ultimate Wall Street Experience escorted some of the Downtown Alliance’s staff on a bright and early morning by checking in at the security booth on Wall and Broad Streets. Once inside, coats checked and fancy golden name tags donned, we got to explore the inner workings of this centuries-old institution, from the founding document that created the New York Stock Exchange, The Buttonwood Agreement, signed under a buttonwood tree back in 1792 …

… to the golden-crested original trading floor — with a Fabergé urn in the corner (the largest piece ever created by the jeweler of those iconic gem-encrusted eggs) …

… to vintage ticker-tape machines …

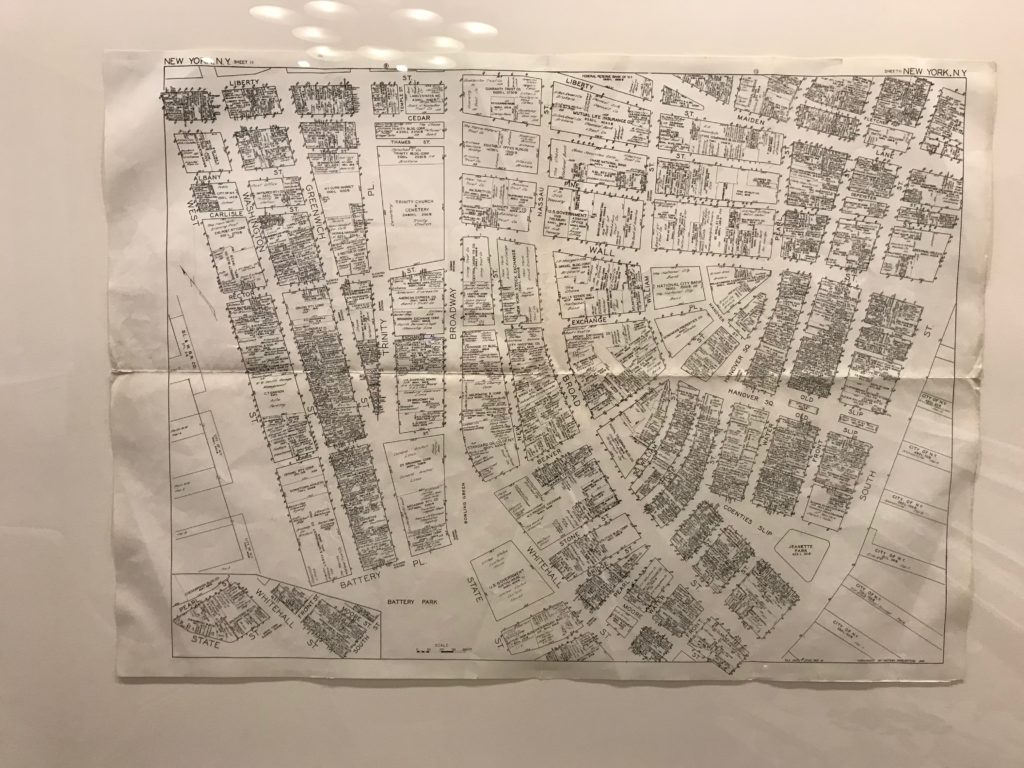

… and maps of Lower Manhattan past.

At 9:15, we were ushered into the modern-day trading floor, stationed with dozens of news crews, for the market’s opening bell, which rang out at 9:30 to wide applause. Even those among us a bit critical of capitalism enjoyed such an iconic New York City ritual.

Popped into the NYSE for the opening 🔔 pic.twitter.com/MuwWrYjlBl — Downtown Alliance (@DowntownNYC) January 22, 2020

Related articles

"Golden Thread: A Fiber Art Show" is on view through May 12.

Get your free tulip bulbs at Bowling Green Park on May 17!

Lower Manhattan is full of architectural marvels. But there’s something to be said for the structural wonders that never made it off the drawing board.

- Insider Reviews

- Tech Buying Guides

- Personal Finance

- Insider Explainers

- Sustainability

- United States

- International

- Deutschland & Österreich

- South Africa

- Home ›

- finance ›

- Wall Street »

Here's what people on the floor of the New York Stock Exchange do all day

A floor broker executes orders for their clients. they do not execute on their own accounts..

To put it simply, a floor broker is someone who represents client orders at the point of sale on the NYSE floor, our source explained.

Almost all NYSE floor brokers trade on an "agency" basis, meaning they don't trade for themselves or their firm like market-makers do.

Almost all NYSE floor brokers trade on an agency basis, meaning they don't trade for themselves or their firm like market-makers do.

A floor broker provides information for their clients. They are the 'eyes and ears' for their clients' stocks.

A floor broker's clients can include banks, broker-dealers, hedge funds, mutual funds, pension funds, day traders and even some high net-worth individuals.

"We are the 'eyes and ears' to our clients' stocks. We give them market color, let them know of market rumors and find liquidity from the other hundred or so floor brokerage shops," our source told us.

We are the 'eyes and ears' to our clients' stocks. We give them market color, let them know of market rumors and find liquidity from the other hundred or so floor brokerage shops, our source told us.

They earn a living from commission on each share traded.

A floor broker earns commission for each share traded.

This can be anywhere from half a penny per share or five cents a share, the floor broker explained.

A floor broker's workday begins a few hours before the opening bell.

The stock market opens at 9:30 a.m. and the closing bells rings at 4:00 p.m., but a NYSE floor broker begins his or her day much earlier than that.

A floor broker might get in around 7:30 a.m. or 8:00 a.m, our source said.

At this time, a floor broker will typically read newspapers, go over the news-wires, check their Bloomberg terminal and perhaps emails stories/links to their customers.

Then the orders and 'look' requests start coming in.

At about 9:00 a.m. a floor broker starts getting orders and "look" requests.

When someone asks for a "look" near the open or close of the market, it means finding out a price for the open/close and/or what the buy/sell imbalance is.

If someone asks for a "look" in the middle of the day, that means finding out some color on the stock such as who's been buying, who's been selling, any rumors or news that's out.

A floor broker would ask a specialist to find this information out.

At about 9:00 a.m. a floor broker starts getting orders and look requests.

When someone asks for a look near the open or close of the market, it means finding out a price for the open/close and/or what the buy/sell imbalance is.

If someone asks for a look in the middle of the day, that means finding out some color on the stock such as who's been buying, who's been selling, any rumors or news that's out.

Right around the opening bell it's 'complete mayhem.'

The market opens at 9:30 a.m.

From 9:15 a.m. to 9:45 a.m. it's "complete mayhem" like it has been for years.

From 9:15 a.m. to 9:45 a.m. it's complete mayhem like it has been for years.

Then things start to settle down and the computers and algos do most of the trading.

Then around 9:45 a.m. to 10:00 a.m. everything begins to settle down and algos and computer programs do most of the trading.

"We have all the algos and systems they do upstairs plus some. Also we have face-to face contact when trying to find the other side or complete a trade."

We have all the algos and systems they do upstairs plus some. Also we have face-to face contact when trying to find the other side or complete a trade.

Then it's time for lunch. The floor brokers typically eat at their booths.

"We each lunch while we work. It's too busy to leave," the floor broker said.

There's a cafeteria downstairs.

We each lunch while we work. It's too busy to leave, the floor broker said.

Around 3:30 p.m. things start to really pick up again.

Things start to get crazy around 3:30 p.m. with customers wanting to know what price the stock is going to close and how much volume, the source said.

At 4 p.m. the closing bell rings and fifteen minutes later the trading floor basically empties out.

At 4:00 p.m. the closing bell rings. The next ten or fifteen minutes are spent making sure everything closed OK and there are no problems.

At 4:15 the floor brokers head for the door. They're done for the day.

That's what they do, here are some things they don't do. First off, they don't trade mortgage-backed securities on the NYSE floor.

"Most people don't know what we do. The floor of the NYSE is the symbol of Wall Street, so yes, when they show the floor, they relate the financial crisis to the floor. I've said before, 'Hello, we don't trade mortgage backed securities here," our source said.

Most people don't know what we do. The floor of the NYSE is the symbol of Wall Street, so yes, when they show the floor, they relate the financial crisis to the floor. I've said before, 'Hello, we don't trade mortgage backed securities here, our source said.

Another big misconception is that the NYSE floor is 'out of date' and has 'old systems.'

"That could not be further from the truth," our source explained.

"It's not a matter of the floor vs. electronic trading. Almost all the trading we down here is electronic, but with a human touch."

For example, all the brokers have hand-held computers like mini iPads, which are constantly updated with news releases.

They also have access to any and every OMS, algo, or computer program. What's more is some of the algos are only for floor brokers -- ones that take into account parity and the open/close, our source said.

That could not be further from the truth, our source explained.

It's not a matter of the floor vs. electronic trading. Almost all the trading we down here is electronic, but with a human touch.

The NYSE floor isn't like the rest of Wall Street (big banks and hedge funds). There are several people on the NYSE floor who didn't even go to college.

"Unlike other places on Wall Street, the floor has a unique collection of employees," the source said.

"Not like investment bankers where almost everyone come from an Ivy League school, a lot of the guys down here never even went to college, but worked at delis, auction houses and other fast-paced environments."

There's also a good amount of former athletes and army vets on the floor, our source said.

Unlike other places on Wall Street, the floor has a unique collection of employees, the source said.

Not like investment bankers where almost everyone come from an Ivy League school, a lot of the guys down here never even went to college, but worked at delis, auction houses and other fast-paced environments.

Going to a top college isn't what matters on the floor, it's about having a good work ethic.

It's important to be able to remember orders and instructions.

It's also very important to have good work ethic.

"We don't care what college you went to, but if you're good with numbers, will be on time and not cry when someone yells at you. Those are more important things than your GPA and college," the source said.

We don't care what college you went to, but if you're good with numbers, will be on time and not cry when someone yells at you. Those are more important things than your GPA and college, the source said.

Even though there are fewer people on the floor these days, it's still a 'very fast-paced' environment.

The work environment on the floor is "very fast-paced." However, it's not like it was five or ten years ago.

These days there's more IM chatting than talking on the phone and more computers down here trading that human yelling and screaming, our source explained.

The work environment on the floor is very fast-paced. However, it's not like it was five or ten years ago.

The people on the floor talk about having a sense of camaraderie amongst each other.

"There's great camaraderie between the guys down here. People always have each others back even though they may have fought that morning. It's kind of like a brother-sister relationship."

Our source added that they do a lot of charity work and "will always help out a fellow floor broker's sick kid or parents."

There's great camaraderie between the guys down here. People always have each others back even though they may have fought that morning. It's kind of like a brother-sister relationship.

Our source added that they do a lot of charity work and will always help out a fellow floor broker's sick kid or parents.

If you want a job on the floor, you typically have to know somebody.

Getting to be a floor broker can be "tough."

"These jobs are not posted on Monster.com. You have to know somebody to get down here."

Getting to be a floor broker can be tough.

These jobs are not posted on Monster.com. You have to know somebody to get down here.

Now let's see more of the stock exchange...

We toured parts of the New York Stock Exchange you won't see on TV>

- Nothing Phone (2a) blue edition launched

- JNK India IPO allotment date

- JioCinema New Plans

- Realme Narzo 70 Launched

- Apple Let Loose event

- Elon Musk Apology

- RIL cash flows

- Charlie Munger

- Feedbank IPO allotment

- Tata IPO allotment

- Most generous retirement plans

- Broadcom lays off

- Cibil Score vs Cibil Report

- Birla and Bajaj in top Richest

- Nestle Sept 2023 report

- India Equity Market

- Best printers for Home

- Best Mixer Grinder

- Best wired Earphones

- Best 43 Inch TV in India

- Best Wi Fi Routers

- Best Vacuum Cleaner

- Best Home Theatre in India

- Smart Watch under 5000

- Best Laptops for Education

- Best Laptop for Students

- Advertising

- Write for Us

- Privacy Policy

- Policy News

- Personal Finance News

- Mobile News

- Business News

- Ecommerce News

- Startups News

- Stock Market News

- Finance News

- Entertainment News

- Economy News

- Careers News

- International News

- Politics News

- Education News

- Advertising News

- Health News

- Science News

- Retail News

- Sports News

- Personalities News

- Corporates News

- Environment News

- Nothing Phone (2a) India-exclusive edition launched

- JNK India IPO allotment

- JioCinema New Subscription Plans

- Realme 70X 5G Launched

- Apple Let Loose Launch event

- Top 10 Richest people

- Top 10 Largest Economies

- Lucky Color for 2023

- How to check pan and Aadhaar

- Deleted Whatsapp Messages

- How to restore deleted messages

- 10 types of Drinks

- Instagram Sad Face Filter

- Unlimited Wifi Plans

- Recover Whatsapp Messages

- Google Meet

- Check Balance in SBI

- How to check Vodafone Balance

- Transfer Whatsapp Message

Copyright © 2024 . Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.

Sam Rohn 360° Photography

360° VR Panoramic Photography & Virtual Tours

New York Stock Exchange :: 360° Virtual Tour

360 Degree Virtual Tour of the New York Stock Exchange

The history of the New York Stock Exchange begins with the signing of the Buttonwood Agreement by twenty-four New York City stockbrokers and merchants on May 17, 1792, outside 68 Wall Street under a Buttonwood tree.

In 1903, the Exchange moved into its present home at 18 Broad st, a building of neoclassic design by architect George B. Post , with a trading floor measuring 109 x 140 feet and marble walls rising 72 feet to meet the ornate gilt ceiling, at the time, one of the grandest spaces in the nation. Today, the NYSE building is considered one of Post’s masterpieces and is a New York City and national landmark .

[sampano file=”new-york-stock-exchange-1″ title=”New York Stock Exchange Bell Podium :: NYC”]

One of the most familiar features of the New York Stock Exchange is the loud, distinctive Trading Floor bell . the Opening Bell signals the beginning of trading each business day and the Closing Bell signals the ending of trading each business day.

Bells were introduced when continuous trading was instituted in the 1870s. Originally, a Chinese Gong was used, but brass bells have been used since 1903.

note – these images of the NYSE trading floor & bell podium may not be used for any purpose without the express written consent of the NYSE and permission from the photographer

Related 360° Virtual Tours:

- Search Search Please fill out this field.

- Stock Trading

- Stock Trading Strategy & Education

Why Are Traders on the Floor of the Exchange?

Gordon Scott has been an active investor and technical analyst or 20+ years. He is a Chartered Market Technician (CMT).

:max_bytes(150000):strip_icc():format(webp)/gordonscottphoto-5bfc26c446e0fb00265b0ed4.jpg)

The floor of the stock exchange was once the main location for market transactions. It was home to traders and brokers who did the actual buying, selling, and negotiating on the physical exchange floor. Of course, this was before the evolution of electronic trading platforms .

Those same brokers and traders are now surrounded by computers that manage the majority of the buying and selling of stocks for their various accounts. Floor trading still exists, but it is responsible for a rapidly diminishing share of market activity.

Key Takeaways

- Open outcry was developed after the first stock exchange was founded in the 17th century.

- Few exchanges now have pit trading, moving from hand signals and verbal communication to automated systems.

- Some exchanges like the NYSE and CME still use floor trading for large companies and more complicated trades.

- Floor trading allows for showmanship and to simplify large, complicated orders.

The Open Outcry System

Open outcry was a system used by traders at all stock exchanges and futures exchanges. This method of trading became the norm after the first stock exchange—the Amsterdam Stock Exchange, now called Euronext Amsterdam—was founded in the 17th century.

Traders communicate verbally and via hand signals to convey trading information, along with their intentions and acceptance of trades in the trading pit . Signals tend to vary based on the exchange. For example, a trader on one floor may flash a signal with his palms facing outward, away from his body to indicate he wants to sell a security. Just like an auction , anyone who participates and is part of the trading pit are able to compete for orders through the open outcry system.

This system of trading may appear to be chaotic and disorganized, but it is actually quite orderly. Traders use signals to quickly negotiate buys and sells on the floor. These signals may represent different types of orders, a price, or the number of shares intended to be part of the trade. Specialists maintain a book of all open orders for a stock or for a group of stocks.

The End of an Era?

Nowadays, few exchanges actually have trading that takes place physically on the floor through the open outcry system. With many exchanges adopting automated systems in the 1980s, floor trading was gradually replaced with telephone trading. A decade later, those system began to be replaced with computerized networks as exchanges began to develop and move to electronic trading platforms .

The London Stock Exchange (LSE) was among the first in the world to move to an automated system in 1986. The Milan Stock Exchange —known in Italian as the Borsa Italiana—followed suit in 1994, with the Toronto Stock Exchange making the switch three years later.

Not only did these automated systems make the trading process simpler, they also helped traders improve on the speed of their trades. Electronic trading systems also cut down on error, reduce costs, and, more importantly, help eliminate the possibility of interference and manipulation by unscrupulous brokers and dealers.

The move to automate trading electronically also made sense because it gave retail investors the opportunity to conduct trades on their own, thus cutting out the need for brokers, dealers, and other professionals to execute trades on their behalf.

Not All Is Lost

While trading on the floor of the exchange is being quickly eroded by electronic trading platforms, the open outcry method of trading doesn't appear to be completely going away any time soon. There are still traders who work on the floor of the New York Stock Exchange (NYSE) —where some large companies still trade in the pit—as well as commodity and options exchanges like the Chicago Mercantile Exchange (CME) .

Floor or pit trading through the open outcry system is still executed at the NYSE.

But with so much of the action of the trading world being executed electronically, does it really make sense to keep people in the pit? Some people believe there's a lot to lose by eliminating the open outcry method. That's because they say that electronic trading can only capture so much, while human activity on the floor reveals much more.

Proponents of the trading pit say having people on the floor can help relay the message of the pit, and can help provide an assessment of a trader's intentions behind a buy or sell move.

Trading face-to-face also helps simplify orders that are more complicated such as commodity futures or options trades. By executing these large and complex orders through the open outcry system, traders are better able to work with others to get a better price—something electronic systems can't always do.

The Bottom Line

The open outcry system has been part of the trading world since the 1600s, establishing decorum and a language that many traders had to learn in order to do their job. But that changed with the development of technology. Electronic trading may now be the norm of the industry, but it hasn't completely wiped out the open outcry system. Traders are still trading on the floor of exchanges for now. And it will probably remain that way for some time, where standing on the trading floor is still a necessary way of trading on the stock exchange

Michael Gorham and Nidhi Singh. " Electronic Exchanges: The Global Transformation from Pits to Bits ," Pages 5-7. Elsevier, 2009.

University of Amsterdam. " The World’s First Stock Exchange: How the Amsterdam Market for Dutch East India Company Shares Became a modern Securities Market, 1602-1700 ," Page 2 of PDF.

Capital Amsterdam Foundation. " From Floor to Screen ."

CME Group. " CME Group Chairman & CEO Annual Meeting Remarks on Reopening Trading Floor ."

New York Stock Exchange. "' Open Outcry' Thrives at NYSE Options ," Page 1.

FINRA. " Flashback Wall Street: Remembering the Glory Days of the NYMEX ." (Login required.)

CME Group. " An Introduction to Futures and Options Trading ," Pages 100-101.

Michael Gorham and Nidhi Singh. " Electronic Exchanges: The Global Transformation from Pits to Bits ," Page 6. Elsevier, 2009.

Michael Gorham and Nidhi Singh. " Electronic Exchanges: The Global Transformation from Pits to Bits ," Pages 10, 76-78. Elsevier, 2009.

London Stock Exchange Group. " The Market Open Ceremony ."

Michael Gorham and Nidhi Singh. " Electronic Exchanges: The Global Transformation from Pits to Bits ," Pages 67-68. Elsevier, 2009.

Michael Gorham and Nidhi Singh. " Electronic Exchanges: The Global Transformation from Pits to Bits ," Pages 13, 298. Elsevier, 2009.

Michael Gorham and Nidhi Singh. " Electronic Exchanges: The Global Transformation from Pits to Bits ," Page 36. Elsevier, 2009.

:max_bytes(150000):strip_icc():format(webp)/wall-street-sign-with-american-flags-183834979-54b7739707504eb28afab8ec18bd55e9.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Things to Do

- Travel & Explore

- Investigations

- Marketplace

- Advertise with Us

Video of the Day

How to Spend a Day at the NYSE

There are only two ways to spend the day at the New York Stock Exchange: as an employee or a student. Public tours of the NYSE were suspended after the September 11th terrorist attacks, and now visitors can only get a floor tour through an educational program on-site or an online virtual tour.

NYSE Educational Seminars

Student groups and special classes get to see how the NYSE works by touring the trading floor. According to the NYSE, 170 tours were given to 4,000 college students in 2012. If you aren't able to get to Wall Street physically, you can spend a day at the NYSE virtually. During a live online session, participants are able to take a virtual tour and ask questions about what gets done on the floor. The NYSE also offers teachers' workshops and graduate courses.

- New York Magazine: New York Stock Exchange

About the Author

Cari Oleskewicz is a writer and blogger who has contributed to online and print publications including "The Washington Post," "Italian Cooking and Living," "Sasee Magazine" and Pork and Gin. She is based in Tampa, Florida and holds a Bachelor of Arts in communications and journalism from Marist College.

Photo Credits

- r_drewek/iStock/Getty Images

- Work & Careers

- Life & Arts

New York Stock Exchange tests views on round-the-clock trading

- New York Stock Exchange tests views on round-the-clock trading on x (opens in a new window)

- New York Stock Exchange tests views on round-the-clock trading on facebook (opens in a new window)

- New York Stock Exchange tests views on round-the-clock trading on linkedin (opens in a new window)

- New York Stock Exchange tests views on round-the-clock trading on whatsapp (opens in a new window)

Jennifer Hughes in New York

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The New York Stock Exchange is polling market participants on the merits of trading stocks around the clock as regulators scrutinise an application for the first 24/7 bourse.

The survey by the NYSE , part of Intercontinental Exchange, was put out by its data analytics team rather than its management, but it highlights the growing interest in trading the likes of Nvidia or Apple overnight between 8pm and 4am Eastern time.

The issue has become a hot topic in recent years, prompted in part by the 24/7 operation of cryptocurrency trading and the rise in retail investor activity first spurred by coronavirus pandemic lockdowns.

Stock exchanges have become something of a laggard in a world where other big markets, including US Treasuries, major currencies and leading stock index futures, can be traded around the clock from Monday to Friday.

Several retail brokers, including Robinhood and Interactive Brokers, now offer 24-hour weekday access to US stocks with trades either matched with their internal holdings, or conducted via a “dark pool” trading venue such as Blue Ocean, where shares are often traded with Asian retail investors in their daytime.

An overnight exchange, however, would be a step-change in how late trading is perceived because of its heavy regulatory oversight compared with dark pools. Exchanges are directly supervised by the Securities and Exchange Commission and tested for their stability and security as well as needing approval to alter any rules.

Trades on exchanges also form part of the consolidated “tape” — the official record — of trading prices, meaning night-time activity would be more likely to set the early tone for regular hours trading.

NYSE’s survey asked respondents whether they thought round-the-clock trading should take place at weekends as well as through a five-day week, how investors should be protected from price swings, and how respondents would staff any overnight session.

It also asked whether people agreed that “time spent thinking about overnight trading would be better spent on regular market hour trading”.

The survey comes as start-up 24 Exchange, backed by Steve Cohen’s Point72 Ventures fund, is seeking SEC approval to launch the first round-the-clock exchange. The filing is the second attempt for 24X, which withdrew a proposal last year over operational and technical issues.

As of Friday, there were no letters raising issues with 24X’s latest proposal. The SEC has several months to scrutinise the plans.

“I have no idea how much volume they’re going to be doing in the middle of the night. But it’s really not up to the SEC to decide whether it’s commercially viable or not,” said James Angel, a finance professor at Georgetown University, who filed a letter supporting 24X’s plan.

“I’m in favour of letting the market decide. If it succeeds, we’re all better off and if it doesn’t, well, the exchange’s investors lost.”

The committee that oversees the consolidated tape has begun meeting, according to two sources, to examine the issues involved in shifting to 24-hour trading — including who should bear the costs. Clearing houses, which help settle trades, also operate within set hours.

Institutional interest in overnight trading has been muted because of the relatively poor liquidity on offer and concerns around settlement risk, among other issues.

Current night owl offerings only allow retail traders to put in “limit” orders where they state the price at which they would buy or sell. If that is not met, the order expires, unfilled, the next morning.

“There’s demand for 24-hour trading, but it's not necessarily from the entire marketplace,” said one institutional broker, who warned that basic staffing could prove another thorny issue.

“Things already happen outside regular hours and you need to keep on top of that to some degree — but that’s very different to something happening to, say, Apple at 2am or even 4pm on a Saturday. What do you do then?”

This article has been amended to clarify that Steve Cohen’s Point72 Ventures fund has invested in 24 Exchange

Promoted Content

Follow the topics in this article.

- US & Canadian companies Add to myFT

- US equities Add to myFT

- Financial & markets regulation Add to myFT

- New York Stock Exchange LLC Add to myFT

- Intercontinental Exchange Add to myFT

International Edition

New York Stock Exchange mulls 24-hour trading — a move Steve Cohen may welcome

- The New York Stock Exchange is considering going 24/7, the FT reported.

- The exchange polled market participants about the merits of round-the-clock trading, per the outlet.

- Meanwhile, a Steve Cohen-backed startup is seeking SEC approval for a 24-hour exchange.

In a move that may be appropriate for the city that doesn't sleep, as the song goes, the New York Stock Exchange is mulling whether trading should take place around the clock.

The Financial Times reported on Monday that the NYSE's data analytics team had polled market participants about the merits of being open 24 hours a day.

Investors can only trade equities on the exchange between 9:30 a.m. and 4 p.m. ET, while other assets including stock futures, US Treasury bonds, and cryptocurrencies can be bought and sold at any time.

Related stories

It's also possible to trade before the market opens from 4 a.m, and after it closes until 8 p.m., although liquidity is generally lower and transaction fees tend to be higher in those periods. Some brokers also allow investors to trade round-the-clock on weekdays.

In its poll, the NYSE asked market participants whether they thought the exchange should be open 24/7, or just 24 hours on weekdays, the FT reported.

It also surveyed them on how investors should be protected during periods of volatility, what its overnight staffing plan should be, and whether respondents thought that "time spent thinking about overnight trading would be better spent on regular market hour trading," per the outlet.

Meanwhile, a startup backed by billionaire Steve Cohen's VC firm Point72 Ventures is seeking SEC approval to launch the world's first 24-hour stock exchange.

Bermuda-based 24 Exchange, which netted $14 million worth of investment from Point72 Ventures and others, aims to bring the non-stop nature of crypto trading — which has captivated retail investors in recent years — to the stock market.

"The same people that trade cryptocurrencies started to trade more stocks because of the GameStop movement and the overall participation of retail that [has] increased significantly," 24 Exchange founder and CEO Dmitri Galinov said in December 2021. "If Elon Musk tweets something on Saturday, people would want to buy or sell Tesla stock."

Watch: What happens when Elon Musk moves markets with a tweet

- Main content

2024 NFL draft trades: Tracking deals for picks, players

We tracked every trade involving the 2024 NFL draft , from Round 1 all the way through Round 7 , which ended with the Jets selecting Alabama safety Jaylen Key at No. 257 overall.

Before the draft even began, there were four deals that shook up the first round, starting with the Browns' big move for quarterback Deshaun Watson in 2022. The Texans ' haul included Cleveland's 2024 first-round pick (No. 23 overall) and its fourth-rounder (No. 123). Houston ended up sending No. 23 to the Vikings , however, as part of a larger deal , and it also traded its own first-rounder to the Cardinals when it moved up the board for edge rusher Will Anderson Jr. last year.

The biggest trade, though, impacted the No. 1 overall pick, as the Panthers traded up to the top of the board with the Bears a year ago ... and then promptly had the NFL's worst record (2-15). That means Chicago owned the first pick , which it used on USC quarterback Caleb Williams . The first day of the draft saw five deals , with the Vikings moving up twice, the Bills trading back twice and the Lions moving up to the delight of the hometown fans to pick Alabama cornerback Terrion Arnold .

Friday got off to a frenetic start on the trade front, as there were six trades within the first 14 picks of the second round and seven overall, including one between the Super Bowl LVIII combatants to end Round 2. The third round had four trades, with the Eagles moving back twice. Day 3 also had its usual frenzy of deals.

Here are all of the draft-pick deals that affected the 2024 draft.

NFL draft coverage: Grading the biggest trades (ESPN+) Kiper's Round 1 recap | Round 2 (ESPN+) Experts debate the top picks (ESPN+) Scouting reports | DraftCast | More

2024 NFL draft trades

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

Philip Morris Stock (NYSE:PM): Strong Q1 Results to Fuel Gains

May 01, 2024 — 06:18 pm EDT

Written by Nikolaos Sismanis for TipRanks ->

Philip Morris ( NYSE:PM ) posted its Q1 results last Tuesday, with numbers coming in very strong across the board. The global tobacco powerhouse saw impressive growth in both its Heated Tobacco and Oral Nicotine divisions. Even its supposedly waning Combustibles division recorded growth in revenues despite a tiny decline in shipment volumes. With the company poised for continued success, management revised its guidance upwards, forecasting another year of record earnings. Thus, I’m bullish on PM stock.

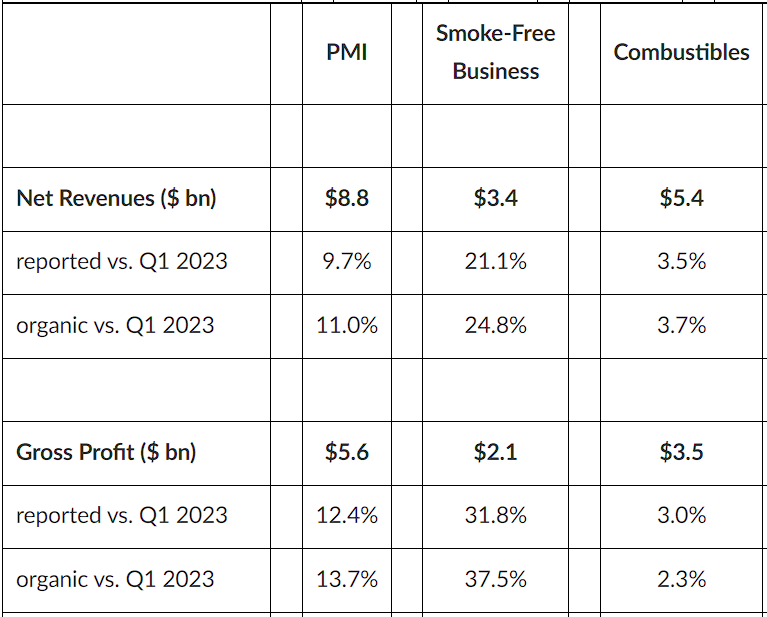

First-Quarter Results Set the Stage for a Robust FY2024

Philip Morris’ Q1 results set the stage for a robust FY2024. The company saw growth across all segments, with total revenues rising 9.7% year-over-year to $8.8 billion . In constant currency, revenues actually rose by an even more significant 11% compared to last year, as you can see below.

Let’s take a closer look at each of Philip Morris’ three major divisions.

Combustibles Perform Well Despite a Pessimistic Narrative

While the market has adopted a pessimistic narrative about the future of combustibles, the reality isn’t quite as dire as it may seem. It’s true that the demand for combustibles is on the decline, and it will likely continue to follow this trajectory. However, the pace of this declining demand is nowhere near disastrous.

In Philip Morris’s Q1 results, the company showed that cigarette volumes only declined by a tiny 0.4% compared to the previous year. In the meantime, Philip Morris leveraged the highly inelastic nature of cigarettes to increase prices much more significantly, leading to sales in the Combustibles division growing by 3.5% year-over-year or by 3.7% in constant currency.

Heated Tobacco Business Keeps Growing

While Philip Morris’ Combustibles division keeps chugging along, providing the company with high-margin cash flows, its Heated Tobacco products are experiencing a rapid increase in adoption. Shipment volumes in heated tobacco units (HTU) grew by an impressive 20.9% compared to last year, reaching 33.1 billion units. Growth was powered by strong IQOS momentum, exceptional growth in Japan, solid fundamentals in Europe, and an advancing contribution from newer markets such as Indonesia.

Moving toward Q2, management expects that growth in HTU shipment volumes will grow further toward 34 billion to 35 billion, marking a notable sequential improvement. This is to be powered by momentum in organic growth and the fact that Q1 HTU shipment volumes were negatively affected by disruption in the Red Sea. This issue held Q1 shipments back by about one billion.

Magnificent Growth in Oral Nicotine Post-Swedish Match Buyout

Besides strong growth in Heated Tobacco, Philip Morris further bolstered its smoke-free category sales due to magnificent growth in its Oral Nicotine division. The division benefited from the momentum of Zyn, the oral nicotine pouches that were added to Philip Morris’ portfolio following the acquisition of Swedish Match last year.

More specifically, nicotine pouches and Snus volumes saw significant growth, rising from 81.1 million and 55.6 million to 145.7 million and 61.4 million, marking gains of 79.3% and 10.5%, respectively. Therefore, Q1 marked the fourth consecutive quarter of market share gains in the U.S. for these categories, with an increase of 1.3 percentage points, leading to a dominant market share of 74%.

Raised Guidance Points to Record FY2024 Profits

Philip Morris’s strong Q1 results and ongoing momentum encouraged management to raise its targets, now expecting record profits for FY2024 in constant currency. Particularly, for Q1, Philip Morris achieved adjusted EPS of $1.50, up 8.7% compared to last year. Nevertheless, this result was heavily impacted by foreign exchange headwinds due to the rise of the dollar. Ex-currency adjusted EPS actually grew by a much more significant 23.2% to $1.70.

Thus, for the full year, management now expects adjusted EPS, in constant currency, to be between $6.55 and $6.67. This indicates a year-over-year increase between 9% and 11% and another year of record profits.

Is PM Stock a Buy, According to Analysts?

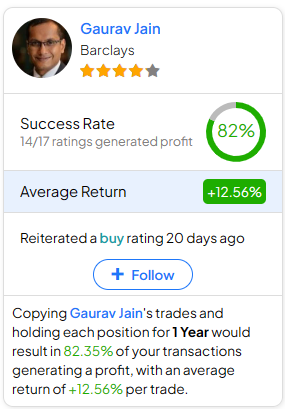

Taking a look at Wall Street’s view on the stock, Philip Morris boasts a Moderate Buy consensus rating based on eight Buys, three Holds, and one Sell recommendation assigned in the past three months. At $104.86, the average PM stock price target suggests 9.2% upside potential.

If you’re unsure which analyst you should follow if you want to buy and sell PM stock, the most profitable analyst covering the stock (on a one-year timeframe) is Gaurav Jain of Barclays ( NYSE:BCS ), with an average return of 12.56% per rating and an 82% success rate.

The Takeaway

Overall, Philip Morris stepped into Fiscal 2024 with momentum, growing sales across all three divisions. In Combustibles, the company has once again demonstrated its ability to effectively counteract the declining trend in the smoker population through its robust pricing power. Simultaneously, its smoke-free products are consistently garnering increasing consumer appeal, reflected in the remarkable surge in shipment volumes for both HTU and Oral units.

With management’s upward guidance revision promising sustained momentum throughout the rest of the year, my confidence in shares of Philip Morris has increased significantly. For this reason, I retain my bullish outlook following its Q1 results.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Stocks mentioned

More related articles.

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

IMAGES

VIDEO

COMMENTS

The NYSE trading floor: A New York legend. The NYSE has always been an exciting place with exciting things happening every minute. Up until the early 2000s, the trading floor was full of people frantically running around, shouting numbers and exchanging hand signals with each other. ... Before or after your visit to the stock exchange, you can ...

Noam Galai/Getty Images The Trading Floor . Although you can no longer visit the trading floor, do not get too disappointed. It is no longer the chaotic scene that's dramatized on TV shows and movies, with traders waving slips of paper, yelling stock prices, and negotiating million-dollar deals in a matter of seconds.

New York Stock Exchange. 601 reviews. #165 of 2,157 things to do in New York City. Points of Interest & LandmarksArchitectural Buildings. Open now. 9:30 AM - 4:00 PM. Write a review. About. The NYSE is a frantic, frenetic assemblage of traders, technology and tension.

Discovery Education offers an online virtual visit to the NYSE trading floor. If you are missing the good old days, you can see what a typical day of trading used to be like by watching movies like "Wall Street" with Michael Douglas, " The Pursuit of Happiness" starring Will Smith, and " Trading Places" starring Dan Aykroyd and ...

The New York Stock Exchange (NYSE) is a driving force of the US economy and a landmark American institution. The exchange isn't open to the public, but stopping by and walking the city's Financial District ranks as a top NYC experience. Find several iconic sights nearby, including the Charging Bull statue and Trinity Church.

I can't thank you and your team enough! ... let me thank you for an amazing Day-1 of trading for Arm. ... The 10th Floor dynamic 41,220 sq foot space opens up into a 2,000 sq ft roof terrace at ...

In this video, we're giving you an exclusive tour of the New York Stock Exchange!The New York Stock Exchange is one of the most iconic and historic buildings...

From 1939 to 2001, pretty much anyone could pop into the trading floor to glimpse the hustle and bustle of high finance. That's how this legendary prank in 1967 could even take place. But these days, paying visits to the trading floor has become a rare commodity. The NYSE closed its doors to the public just after 9/11 and didn't open them ...

The New York Stock Exchange building in the Financial District is one of the most iconic buildings in NYC. Located at 11 Wall Street, the historical site has...

It's still exciting to see the Stock Exchange in person. Our pro tip, if you ever snag an invite: don't wear jeans and wear nice shoes! Old-school rules still apply on the trading floor.

NYSE floor brokers today work the trading floor with wirelessly connected tablet computers at the ready. During major IPOs, TV viewers will see brokers crowd around trading floor posts as pricing information is yelled out and the stock prepares to open. Thanks to their handheld devices, brokers can place orders right from the middle of the scrum.

A floor broker's workday begins a few hours before the opening bell. The stock market opens at 9:30 a.m. and the closing bells rings at 4:00 p.m., but a NYSE floor broker begins his or her day ...

One of the most familiar features of the New York Stock Exchange is the loud, distinctive Trading Floor bell. the Opening Bell signals the beginning of trading each business day and the Closing Bell signals the ending of trading each business day. Bells were introduced when continuous trading was instituted in the 1870s.

Sarah Jacobs. Advertisement. Upstairs on the seventh floor, you'll find the Buttonwood Agreement, the signed document that founded the New York Stock Exchange in 1792. Named after the tree that ...

This system of trading may appear to be chaotic and disorganized, but it is actually quite orderly. Traders use signals to quickly negotiate buys and sells on the floor. These signals may ...

On Wednesday, June 7, The New York Stock Exchange welcomed Fiserv, Inc. ( NYSE: FI) to celebrate its listing, making a big orange splash on the corner of Wall & Broad! This listing marked the second largest transfer at NYSE ($71B) — the largest since 2013. 11 Wall Street is one of the most exclusive and sought-after event spaces in New York ...

The trading floor was known to be busy and loud, with hundreds of traders running back and forth between posts. Decades later, the NYSE floor is a lot calmer, with fewer traders, as systems were ...

by Cari Oleskewicz; Updated October 05, 2017. There are only two ways to spend the day at the New York Stock Exchange: as an employee or a student. Public tours of the NYSE were suspended after the September 11th terrorist attacks, and now visitors can only get a floor tour through an educational program on-site or an online virtual tour.

B-roll of the NYSE trading floor and The Opening (starting at 9:26 a.m.) and Closing Bells (starting at 3:56 p.m.) will be available via Encompass 4090 (Full HD) and The Switch. Additional requests should be made through the NYSE Broadcast Center at +1 212 656 5483. Watch the Opening and Closing Bells. View Our Bell Calendar.

The New York Stock Exchange is polling market participants on the merits of trading stocks around the clock as regulators scrutinise an application for the first 24/7 bourse.

Investors can only trade equities on the exchange between 9:30 a.m. and 4 p.m. ET, while other assets including stock futures, US Treasury bonds, and cryptocurrencies can be bought and sold at any ...

One of the most familiar images of the NYSE on the evening news is the loud ringing of a bell, signaling the opening or closing of the day's trading. Trading floor bells are more than just a colorful tradition. They are critical to the orderly functioning of the marketplace, assuring that no trades take place before the opening or after the ...

The first day of the draft saw five deals, with the Vikings moving up twice, the Bills trading back twice and the Lions moving up to the delight of the hometown fans to pick Alabama cornerback ...

NYSE Trading Floor Reopening Phase II FAQ When will Designated Market Makers (DMMs) return to the Trading Floor? A subset of DMMs will return Wednesday June 17, 2020. Why are only a subset of DMMs returning at this time? NYSE is limiting the number of people permitted on the trading floor to ensure social distancing can be observed.

Philip Morris (NYSE:PM) posted its Q1 results last Tuesday, with numbers coming in very strong across the board. The global tobacco powerhouse saw impressive growth in both its Heated Tobacco and ...