- Last Updated On

- August 20, 2023

How Much Money Should I Bring to Canada: A Practical Guide

Getting ready for an adventure and scratching your head, wondering, “How much money should I bring to Canada?

Setting the right budget for a new destination can sometimes feel like trying to solve an intricate puzzle.

This piece will help you put together those monetary pieces, from the ins and outs of local currency to smart budgeting for transport and stay.

How do we bring simplicity to travel planning?

It’s all about keeping key considerations front and center – your preferred payment method, getting a handle on taxes and duties and being up to speed on health and safety guidelines.

Tuck these insights into your planning kit to ensure a smooth and unforgettable Canadian escapade.

So, are we all set to unravel Canada?

Let’s roll.

Key Takeaways

- Understand local currency regulations and suitable payment methods for hassle-free transactions

- Budget appropriately for transportation, accommodation, and potential taxes and duties

- Ensure you have sufficient proof of funds if required for immigration or crossing the border

How Much Money Should I Bring to Canada: Understanding Currency Regulations

First things first, let’s get familiar with the basic rules.

You can bring as much money as you want into Canada, whether in cash or other monetary instruments (like traveler’s cheques, money orders, or bonds).

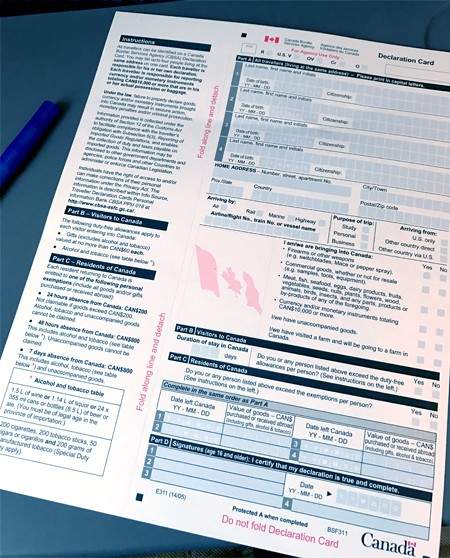

However, there’s one important detail to remember: if you have CAN$ 10,000 or more in your possession, you must declare it to the Canada Border Services Agency (CBSA) .

Filling out a declaration form is an essential step when arriving at the border with a large sum of money.

The CBSA officer will ask you to complete the necessary paperwork, where you’ll need to provide information about the amount and type of currency you’re bringing.

The purpose of this form is to prevent issues such as money laundering and financing of terrorist activities.

So, keep in mind that honesty is the best policy when it comes to declaring your money!

Now, let’s talk about spending money in Canada.

Since the cost of living varies between cities, it’s a good idea to do some research on the prices you can expect for accommodation, food, and activities.

Generally, you can use your credit or debit cards at most places, but it’s always a smart move to carry some cash for smaller purchases or emergencies.

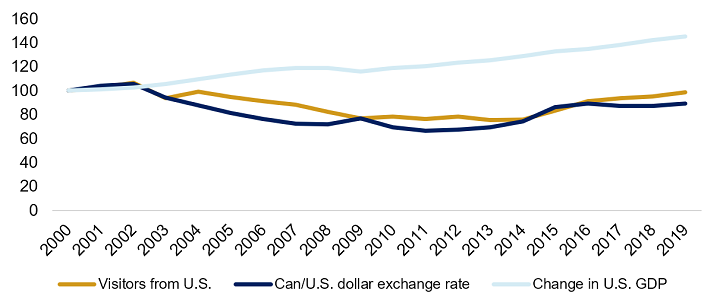

Remember to factor in the exchange rate when planning your budget, as the Canadian dollar’s value fluctuates in relation to foreign currencies.

Alright, here’s a quick rundown of the important points we covered:

- You can bring unlimited money into Canada but must declare amounts of CAN$ 10,000 or more.

- Complete the required CBSA form for currency declaration.

- Research the costs of your Canadian destination for budgeting purposes.

- Keep some cash on hand, even if using cards for most transactions.

With these tips in mind, you’re ready to enjoy your trip to Canada, fully prepared to navigate the ins and outs of currency regulations.

Methods of Payment

When visiting Canada, you might wonder about the best methods of payment to use while exploring this beautiful country.

Well, fear not! I’ve got you covered with a quick rundown of some popular and convenient payment options.

Cash is always handy to have when traveling, especially for small purchases or tipping service staff.

Ensure you have some Canadian dollars on hand for these situations.

You can exchange your currency for Canadian dollars at a local financial institution, as well as some hotels and airport kiosks.

But let’s be honest – we live in a digital world, and credit cards are our trusty companions.

In Canada, most businesses accept major credit cards like Visa, Mastercard, and American Express.

So, feel free to use your credit card for larger purchases, hotel bookings, and dining experiences.

Just remember to double-check with your bank regarding any transaction fees when using your card internationally.

Now, don’t forget about the convenience of debit cards.

Canada has a vast network of ATMs where you can withdraw Canadian dollars directly from your bank account using your debit card.

You’ll find ATMs in shopping centers, banks, and even some convenience stores.

However, it’s a wise idea to check with your financial institution about any withdrawal fees or exchange rates that may apply.

To give you a quick comparison of these payment methods, I’ve put together a handy table:

So, there you have it – a concise guide to the most common payment methods in Canada.

Just remember to budget wisely, stay vigilant of any fees, and always have a backup option.

Taxes and Duties

When you’re planning a trip to Canada, it’s essential to know what to expect in terms of taxes and duties.

The Canada Border Services Agency (CBSA) collects these fees on imported goods on behalf of the Canadian Government.

So, let’s dive into the details.

First things first – when you arrive in Canada, you must fill out a CBSA declaration card to inform them of all the goods you obtained while outside of Canada.

I know paperwork isn’t the most fun aspect of travel, but this step is a must.

Now you might be wondering, “What items am I going to pay duty and taxes on?”

Well, you’ll be happy to know that Canada offers a duty and taxes estimator for your convenience.

This tool can help you get an idea of what you might owe when bringing goods into the country.

Some common items that may be subject to duty and taxes include:

- Farm equipment

- Equipment used in contracting, construction, or manufacturing

- Vehicles intended for business use

- Items bought while traveling

- Leased or rented items

However, Canada also offers something called “personal exemptions,” which allows you to bring specific quantities of goods into the country duty-free and tax-free.

The amount of time you spend in Canada determines your personal exemptions.

For example, if you’re in Canada for 24 hours or more, you may claim up to CAN$ 200 worth of goods duty-free as your personal exemption, and all goods must be with you when you arrive.

If you’re in Canada for 48 hours or more, you may claim up to CAN$800 worth of goods duty-free.

Of course, no vacation would be complete without a visit to the duty-free shop.

While you still need to declare your duty-free purchases, they’re exempt from taxes and duties as long as you stay within your personal exemptions.

When it comes to paying duty and taxes, remember that fees may vary depending on your personal exemptions and the value of the goods you’re importing.

It’s always smart to be prepared, so set aside some cash or have a credit card handy for unexpected fees.

Budgeting for Transportation and Accommodation

When planning your trip to Canada, figuring out your transportation and accommodation budget is crucial.

Let’s dive into some tips for smart spending during your Canadian adventure.

First, consider the type of transportation you’ll need during your stay.

Are you planning to rent a car, use public transit, or perhaps even hop on a bike to explore the city?

The average cost of local transportation in Canada can be around CA$ 30 per day.

If you’re traveling as a family, weigh your options carefully to find the most affordable (and fun!) mode of transport.

Next, let’s talk about accommodation.

The best hotels in Montreal might be a bit pricey, but there are also budget-friendly options available.

For families visiting Toronto, check out the best family hotels in Toronto that offer kid-friendly amenities and space for everyone.

Canada offers a wide range of accommodation choices, from budget hotels and hostels to luxurious stays.

Your overall costs will depend on the type of lodging you choose and the city you’re visiting.

The average hotel price in Canada for a couple is CA$ 256 per night.

However, if you’re willing to be a bit flexible and creative, you can likely find more budget-friendly options.

Here are some budgeting tips for your stay in Canada:

- Look for off-season deals or promotions to get better rates on your accommodation.

- Booking your stay well in advance can also help you save money on accommodation costs.

- Consider using home-sharing platforms or staying in a vacation rental to cut down on expenses.

- Opt for accommodations that offer complimentary breakfast, as this can help save on meal costs during your stay.

By carefully planning your transportation and accommodation budget, you’ll be able to enjoy your Canadian trip without breaking the bank.

Traveling with Goods

When packing your luggage, it’s crucial to know the restrictions and rules about what you can bring across the border.

First off, be aware of the items you’ll need a permit for, such as firearms and explosives.

Canada has strict rules surrounding these, so double-check the regulations before trying to bring them in.

You can find more details on restricted and prohibited goods online.

When it comes to food, plants, animals, and related products, there are several restrictions.

Some items may require a permit or be outright prohibited.

As someone who’s traveled to Canada, I can’t stress enough how important it is to adhere to these guidelines.

My personal advice?

Do some research, plan ahead, and double-check your items before embarking on your journey.

This way, you can enjoy your family trip without any worries.

Remember, Canada is an incredibly welcoming and beautiful country teeming with incredible adventures awaiting you and your loved ones.

Crossing the Border

Now that we discussed how much money you need to declare to the Canada Border Services Agency, let’s talk about your interactions with border officers.

While you might be a bit nervous, remember that they’re just doing their job to keep everyone safe.

Make sure to have your passport ready and answer their questions truthfully.

If you’re a member of a Trusted Traveler Program, like the NEXUS program, your border crossing process will be even smoother with access to expedited lanes.

An additional tool that can help streamline your entry process is the Primary Inspection Kiosk.

These user-friendly kiosks allow you to complete your declaration electronically, saving you time and hassle.

Courier shipments and Automated Border Clearance Kiosks are also available to help speed up the process for frequent travelers and those with eligible goods.

Health and Safety Regulations

When planning a family trip to Canada, it’s essential to be aware of the health and safety regulations.

This knowledge will help you have a seamless and enjoyable experience.

If you’re packing health products or prescription drugs, make sure they’re in their original packaging and labeled correctly.

This is to avoid any mix-ups or misunderstandings at customs.

Remember, if you’re unsure whether an item is allowed, it’s better to be safe than sorry.

Check what you can bring to Canada for more information.

Did you know that certain cultural objects are also subject to regulations?

To protect Canada’s vibrant cultural heritage, it’s important to ensure that any souvenirs or artifacts you bring adhere to these rules.

Check before buying or transporting such items.

Traveling may expose you and your family to communicable diseases.

In case you feel unwell or suspect you’ve been exposed to a disease, always alert a quarantine officer upon arrival.

They are trained professionals who can provide guidance on the steps to take.

Here’s a quick rundown of tips for a healthy and safe trip:

- Pack all health products and medications in their original containers.

- Be aware of regulations concerning cultural objects.

- Stay vigilant regarding communicable diseases and contact quarantine officers when necessary.

Parting Words

Taking into account the diverse offerings of Canada, from its cosmopolitan cities to its tranquil natural beauty, it’s evident that costs can fluctuate depending on the kind of traveler you are.

The question, “How much money should I bring to Canada?” doesn’t have a one-size-fits-all answer, rather, it depends on your travel style and your plans.

Whether you’re craving poutine in the lively streets of Toronto, soaking up arts and culture in Montreal, or seeking the whispering wilderness of the Rocky Mountains, your budget will need to accommodate.

Generally, though, think in terms of C$200 per day for a moderate budget, allowing for accommodation, meals, transportation, and some attractions.

Naturally, a more luxurious trip will command a higher price, while budget-savvy adventurers could make do with less.

So pack your bags and your wallet accordingly; Canada’s charm is awaiting your discovery.

Related: Travel Cost Canada

Frequently Asked Questions

How much does a 1-week stay in canada usually cost.

A 1-week stay in Canada can vary depending on your preferences and travel style, but you can expect to spend around CAD 800-1,500. This includes accommodation, meals, transportation, and some sightseeing.

What Is The Average Price Of A Meal In Canada?

In Canada, the average price of a meal at an affordable restaurant is around CAD 15-25, while a regular fast-food meal might cost you around CAD 10-15.

What Is The Recommended Spending Money For 2 Weeks In Canada?

For two weeks in Canada, we recommend budgeting about CAD 1,600-3,000 to cover your expenses, including accommodation, food, transportation, and leisure activities. This is just a rough guideline, and individual budgets will definitely vary.

What Is The Best Way To Carry Money In Canada?

The best way to carry money in Canada is to use a combination of credit cards, debit cards, and some cash. Most establishments accept cards, and ATMs are widely available. However, it’s always a good idea to have some cash on hand for smaller purchases or businesses that don’t accept cards. Just make sure to keep your money safe and secure!

Nomadic Matt's Travel Site

Travel Better, Cheaper, Longer

Canada Travel Guide

Last Updated: November 21, 2023

Canada is often skipped over on many round-the-world trips owing to its proximity to the US, poor flight connections, and few budget cross-country travel options.

But those people miss out on so much! Canada is one of the best countries in the world for RVing and road trips and it’s brimming with outdoor activities for all levels. Backpacking Canada is an amazing experience.

I love my friendly neighbor to the north and believe Canada is a really underrated destination. There’s a reason everyone around the world loves Canadians after all.

To top it all off, it’s also easy to get a working holiday visa here so you can stay longer and make money while you explore (there are huge seasonal industries across the country).

This travel guide to Canada can help you plan your trip, save money, and make the most of your visit to this friendly natural wonderland!

Table of Contents

- Things to See and Do

- Typical Costs

- Suggested Budget

- Money-Saving Tips

- Where to Stay

- How to Get Around

- How to Stay Safe

- Best Places to Book Your Trip

- Related Blogs on Canada

Click Here for City Guides

Top 5 things to see and do in canada.

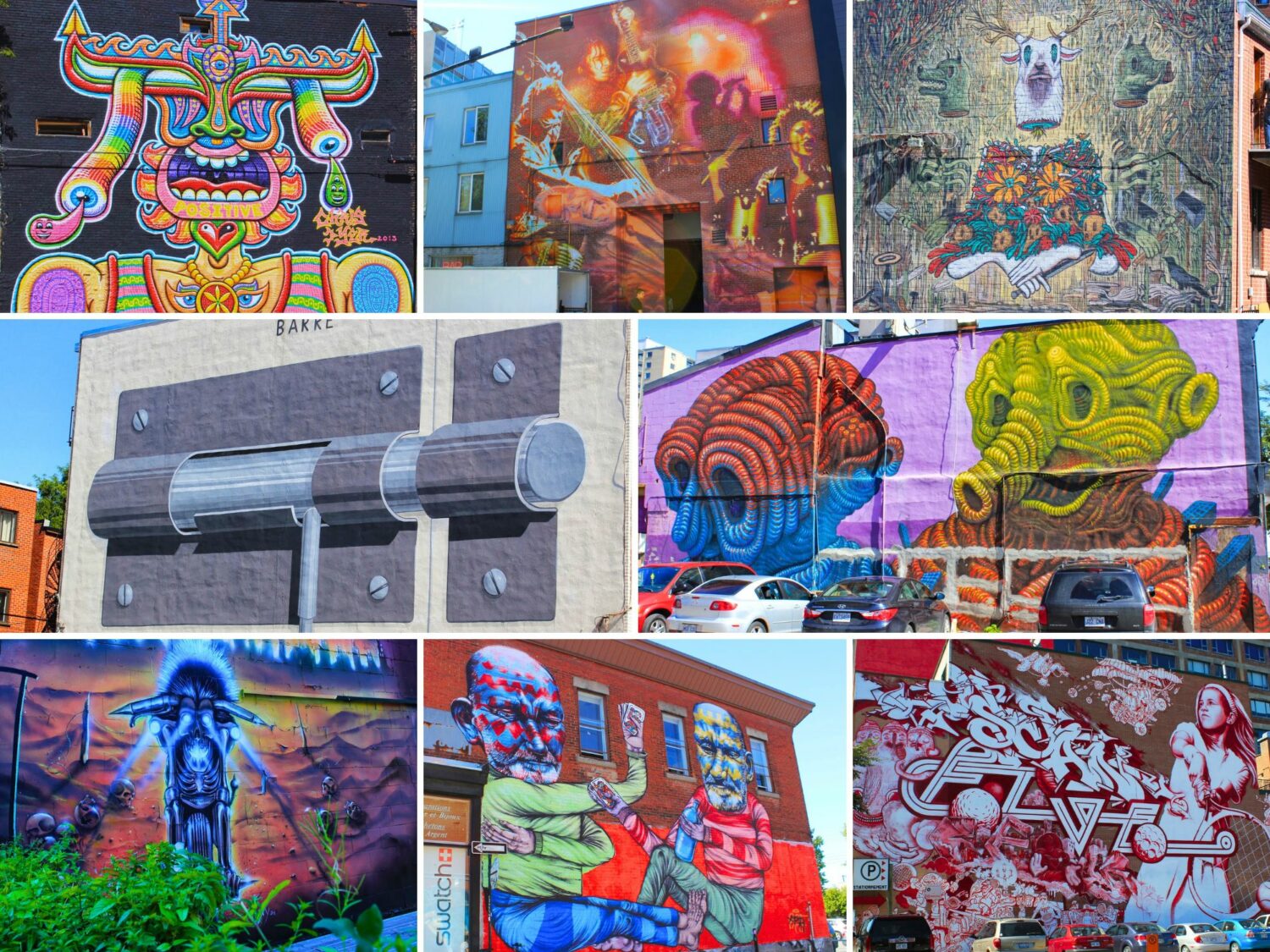

1. Tour Toronto

Toronto is often considered the most multicultural city in the world, as over half of the city’s population is foreign-born. It’s an awesome, hip, artsy city. Don’t miss Kensington Market for good eats and cool shops, and there are plenty of tasty eats to be found in the city’s massive Chinatown as well. If you want to play tourist, head up the CN Tower for the best views of the city. For a bit of swimming in the summer, check out some of Canada’s easily accessible beaches on Lake Ontario where you can go kayaking, windsurfing, stand-up paddle boarding, and more. And if you’re traveling with kids, don’t miss the nearby amusement park Wonderland.

2. Explore Jasper and the Columbia Icefield

The Icefields Parkway connects Banff and Jasper in Western Canada and is one of the most scenic drives in the country (if not the world). Stop along the way at the Columbia Icefield, an enormous icefield that feeds into eight glaciers. You can travel onto the 10,000-year-old Athabasca Glacier where you can hike around and even drink from the crystal-clear icy glacial water. If you’re not squeamish about heights, walk out to the cliff-top glass-floored Skywalk to get a spectacular panorama of the entire area. It’s easy to reach via an enormous bus or opt for a hiking tour where you can walk the glacier. There’s even a restaurant at the top that’s a bit expensive but worth at least a coffee for the view.

3. Road trip the Maritimes

Newfoundland, Prince Edward Island, Nova Scotia, and New Brunswick make up Canada’s east coast. If you want to spend your days hiking, relaxing by the ocean, and whale watching, this is the place to do it. Nova Scotia is sometimes considered the most beautiful province with rolling hills leading to lush green coastal cliffs over frothy shores. There are colorful little fishing villages like Lunenburg, a UNESCO World Heritage Site considered one of the “Prettiest Painted Places in Canada.” It boasts delicious fresh seafood and friendly locals to chat with. Be sure to set aside a few days for an incredible road trip on the 298-kilometer (185-mile) Cabot Trail around Cape Breton and spend in the Highlands National Park where you can hike, camp, or fish. The east coast is stunning and sees very few tourists compared to other areas of the country.

4. Hang out in Montreal

Montreal offers a look at the French side of the country. Old Montreal is thriving with culture and a mix of old and new architecture within its European-style cobblestone streets, the Notre Dame Cathedral, museums, and river cruises. The other side of Montreal is extremely modern with an underground city and mall, funky jazz clubs, and amazing cuisine, which make this the hippest and most romantic city in the country. It’s also cheaper than most of the other large cities in Canada. Don’t forget to try the poutine and bagels when you visit!

5. Have fun in Vancouver

Other things to see and do in canada, 1. celebrate the calgary stampede.

During July, over 1 million people descend on Calgary for this multi-day rodeo, drinking festival, and carnival where everyone gets to be a cowboy. It’s a lot of fun, and you’ll meet tons of people from around the world. It’s one of Canada’s premier events so book early — prices rise and accommodation disappears fast! Also, wear cowboy boots and a hat if you want to fit in.

2. Hit the slopes

The mountains in Canada offer great skiing and snowboarding during the winter. Banff is a popular mountain town known for its excellent trails. It’s quite busy during the winter as locals and visitors alike hit the slopes, but it’s popular for a reason. While Banff is the most popular place to go, there are tons of other great skiing destinations in the country. Sunshine Village, Whistler Blackcomb, Lake Louise, Kicking Horse, and Mont Tremblant are just a few to check out (they stretch from British Columbia to Quebec so you’ve got lots of choices).

3. Discover Vancouver Island

Take a few days off from Vancouver to explore nearby Vancouver Island . Eat delicious seafood, hike, spot some whales (lots of orcas live near here), shop, and lounge on the beach. This is a place to just sit and relax. Since it is so close to Vancouver, it’s a popular getaway with the locals during the summer. Victoria, the capital of British Columbia, is located on the island. It’s a quiet but gorgeous little city worth a couple days of exploring. From here you can also visit places like Tofino, where the bustling surf community has evolved into a fun hippie town. If you’d rather hike an incredible yet challenging trail, the West Coast Trail is famous for its rugged beach and rainforest trails, man-made ladders through the trees, and rare wildlife.

4. Hike the rainforest

Hike the Pacific Rim National Park for a wonderful look at some temperate rainforests on Vancouver Island. It’s one of the most popular parks in Canada, home to Western Red Cedars, Pacific Silver Firs, and tons of wildlife including deer, wolves, bears, and cougars. The Long Beach area is one of the most accessible places for hiking, but the sand dunes behind Wickaninnish Beach on the South Beach Trail are also worth the trek.

5. Explore Calgary

Often skipped over by travelers since it’s not on the coast, Calgary actually has a lot to offer when it comes to free and low-cost activities. Have a picnic in one of its many parks, go rollerblading, watch a hockey game, or head up to the top of the surrounding peaks. There’s great hiking, kayaking, skiing, water rafting, and camping here and you can easily rent a bike and explore the city via its many bike paths. Although it’s been long dismissed as an oil town, it’s one of the liveliest cities in Canada.

6. Visit the galleries of Toronto

Toronto has some of the best museums and galleries in the country, so take a day or two to admire the art of the city. The Royal Ontario Museum (ROM) and the Art Gallery of Ontario (AGO) are the two most famous art museums, but there are a plethora of smaller, specialty galleries too, like the Textiles Museum of Canada and the Museum of Contemporary Art. Galleries often offer discounts on certain days of the week, so check before you go to save some cash.

7. Take a road trip

This huge country is best explored by car or RV. It’s the ideal way to find yourself in tiny little towns, majestic mountains, amazing countryside, and plenty of off-the-beaten-track places. If you have a lot of time, this is your best and cheapest option to see the country. The Trans-Canada Highway stretches from coast to coast, making a road trip relatively easy to plan. Just keep in mind that the weather can be unpredictable (especially in the winter). Of course, you’ll have to keep your eyes peeled for wildlife and you’ll want to be prepared for long stretches of driving without any rest stops or gas stations. However, it’s worth it — the changing landscapes and scenic vistas are out of this world! you could easily spend weeks or months touring the country and still barely scratch the surface. For the best car rental prices, use Discover Cars .

8. Stroll the nation’s capital

Ottawa is a very easy city to explore on foot. Home to museums, art galleries, and plenty of shops, it’s a charming city worth visiting for a couple days. You can take a tour of Parliament Hill (the historic buildings where the Canadian government operates) or cross the Ottawa River and visit Quebec (the great Museum of Civilization is just across the bridge). The Canadian War Museum and the National Gallery of Canada are two must-visit museums in Ottawa. Also, don’t miss the busy Byward Market, and be sure to check out the craft breweries in Westboro. Try a beavertail (a sweet pastry with sugary toppings) when you’re here!

9. Get off the beaten path in Nova Scotia

The locals boast that Nova Scotia is home to the friendliest people in Canada. They might be right. That, combined with over 100 beaches, picturesque lighthouses, great sailing, mouth-watering seafood (this area of Canada is the main fishing region), and a marvelous coastline, makes Nova Scotia an amazing place to visit in Canada. Plus, the province doesn’t see lots of tourists so it’s far less crowded and unspoiled compared to other regions. It’s perfect for road trips and camping.

10. Admire Quebec City

Quebec City’s Old Town offers cobblestone walkways, well-preserved 17th-century architecture, and the only North American fortress, the Citadel. The historical Quartier Petit Champlain is stunning and gives you an authentic French feeling with little cheese shops, bistros, creperies, and boutiques. It’s especially magical in December as it’s fully decorated with twinkling lights, snow-covered canopies, and lined with beautiful Christmas trees. In the warm weather, you can easily lose track of time wandering the streets admiring the flowers everywhere and colorful window shutters and storefronts. Don’t forget to sample the local ice ciders, head out for drinks on Grande Allée, and explore the streets below the stunning Château Frontenac.

11. Visit Kelowna

Warm in the summer and mild in the winter, this glacial valley has some of the best weather in the entire country. It’s no wonder that this is where many Canadians spend their vacations. There’s a marina and a few golf courses, not to mention that the Okanagan Valley is home to Canada’s best vineyards and wineries (a four-hour wine tour costs around 125 CAD). In the summer, Canadians rent fancy houseboats complete with waterslides to vacation on nearby Okanagan Lake. Overall, this is just a gorgeous slice of the country that shouldn’t be missed.

12. Head north to Churchill, Manitoba

This might be a small town in the middle of nowhere, but it also happens to be the Polar Bear Capital of the World, the Beluga Whale Capital of the World, and one of the best places to view the Aurora Borealis. You can ride in a tundra buggy (a special bus raised on giant wheels to keep you out of reach from polar bears) and head out on the open plains to see polar bears in their natural habitats. Mother nature is alive and thriving here. Day tours in a tundra buggy during the summer start at around 250 CAD, including lunch.

13. See the iconic Niagara Falls

This is one of the most visited attractions on the entire continent. You can never imagine how big it is until you see it up close (you never envision so much mist either). To see it up close, on a boat tour and head out into the waterfalls (be prepared to get soaked). Walks runs a daily boat tour that has exclusive access to the best spots and includes access to behind the falls (tours are 107 CAD). The town itself is touristy and cheesy so don’t spend more than a day or two (it’s fun for kids though).

14. Get lost in the Yukon

The Yukon is the perfect place to get your nature fix. The chances of seeing a bear, elk, or deer are incredibly high (or you can tour the Yukon Wildlife Preserve, where you’re guaranteed to see them). Go hiking in Tombstone Territorial Park, soak in a mineral hot pool at the Takhini Hot Springs, or swing by the Sign Post Forest with its unique collection of over 77,000 signposts. Hardly anyone ever visits the Yukon as visitors tend to stick to the major cities in the south of the country. Because of that, you’ll find yourself surrounded by unspoiled nature.

For more information on specific cities in Canada, check out these guides:

- Calgary Travel Guide

- Montreal Travel Guide

- Nova Scotia Travel Guide

- Ottawa Travel Guide

- Quebec City Travel Guide

- Toronto Travel Guide

- Vancouver Travel Guide

- Vancouver Island Travel Guide

Canada Travel Costs

Accommodation – Rates vary a lot depending on what city you’re staying in. On average, you’ll end up paying 35-45 CAD per night for a dorm room at a hostel. Expect to pay at least 90-120 CAD for a budget hotel room. Prices rise drastically in larger cities (notably Vancouver, Toronto, and Ottawa).

Airbnb is available across the country, rivaling budget hotels for price and convenience. Expect to pay an average of 60-90 CAD per night for a private room, while entire homes/apartments start around 100 CAD. Keep in mind that many smaller towns won’t have many options. However, there are usually locally owned hotels or motels that are generally quite cheap. Also, Airbnb prices can double (or triple) when not booked in advance so book early.

If camping is your thing, you’ll have plenty of options across the country. Prices vary depending on the grounds but expect to pay between 25-35 CAD per night for a basic pitch for two people. Many of the major national and provincial campgrounds sell out early in the summer, so be sure to book in advance during the peak season (June-August).

Food – Overall, the food here is a collage of dishes from other cultures, owing to the country’s diverse history of immigration. On the coasts, seafood is king while the prairies have more of a meat and potatoes diet. Be sure to sample some of Canada’s famous staples like poutine (fries with gravy and cheese curds), beaver tails (fried dough with maple syrup), Canadian bacon, and the oddly tasty ketchup chips.

Overall, food can be inexpensive if you stick to cooking for yourself, eating street food, and dining at cheap fast-food places. Cheap sandwich shops and fast food are your best bet, usually costing less than 13 CAD per meal.

Pizzas cost 15-20 CAD while Asian food is usually 10-15 CAD for a main dish.

A meal out at a casual restaurant costs 20-35 CAD for a main dish and a drink. Casual fine dining costs double that.

Beer is around 7 CAD while a latte/cappuccino is around 4.60 CAD. Bottled water costs 2 CAD.

If you cook your own food, expect to pay 50-75 CAD per week for groceries. This gets you basic staples like rice, pasta, veggies, and some meat or fish.

Backpacking Canada Suggested Budgets

How much does it cost to visit Canada? Well, it’s complicated. How much you spend largely depends on where in Canada you’re going to visit. For example, Canada’s biggest cities like Toronto, Ottawa, and Vancouver are considerably more expensive than the smaller ones (like Halifax, St. John’s, and Quebec City). The rural areas are even cheaper but getting around costs more as you may need to rent a car or take expensive buses.

On a backpacking budget, you should plan to spend around 70 CAD per day. This assumes you’re staying in a hostel dorm, cooking all your meals, using public transportation, limiting your drinking, and sticking to free activities like hiking and enjoying nature.

On a mid-range budget of 185 CAD per day, you can stay in a private Airbnb, take buses between destinations, eat out for most meals, enjoy a few drinks, and do more paid activities like visiting museums or taking a food or wine tour.

On a “luxury” budget of 310 CAD per day or more, you can stay in a hotel, eat out for all your meals, drink more, rent a car to get around, and do whatever tours and activities you want. This is just the ground floor for luxury though, the sky is the limit!

You can use the chart below to get some idea of how much you need to budget daily, depending on your travel style. Keep in mind these are daily averages — some days you’ll spend more, some days you’ll spend less (you might spend less every day). We just want to give you a general idea of how to make your budget. Prices are in CAD.

Canada Travel Guide: Money-Saving Tips

Given the size of Canada, there are plenty of ways to save money when you travel, but it varies by region (as I’ve been repeating). The general tips below can help but for specific tips visit our city guides!

- Stay with a local – As Canada is not the most budget-friendly destination owing to its inconvenient size, you’ll be able to cut down on your costs by using Couchsurfing . While not huge in smaller towns, you won’t have a hard time finding a host in the major cities. Just be sure to plan ahead during the summer as that is prime tourist season and it’s much harder to find a host then.

- Enjoy outdoor summer festivals – Since Canadians are stuck indoors all winter, they love to make the most of hot days by packing in lots of festivals into the short summer. Many of these, like Heritage Days (Edmonton), Kits Days (Vancouver), and Caribana (Toronto), are free. Check out upcoming events online by visiting the local tourism board’s website.

- Embrace the outdoors – A vast country with a relatively minuscule population leaves lots of potential for outdoor activities. Rent a pair of cross-country skis or snowshoes in the winter and enjoy the free use of many trails (versus expensive downhill lift passes). In the summer, you can bike, hike, kayak, or canoe. The cost of most equipment rentals is around 25-100 CAD for a day, and you can explore many areas at no further cost.

- Take the bus – Megabus runs in Ontario and Quebec (with connections into the U.S., including NYC). You can find tickets for as little as 1 CAD if booked in advance. This is the most affordable way to get between Toronto and Montreal (or into the U.S.).

- Use ride-sharing services – If you are going to be traveling between cities or provinces, keep an eye out for people sharing their vehicles. Craigslist, Couchsurfing, Kangaride, and Facebook all have ride-share pages for most major cities. If you can find someone traveling in your direction you can tag along and share the cost of gas.

- Eat street food – Every major Canadian city has plenty of street vendors selling hot dogs, sausages, and veggie dogs for as little as 3 CAD. You won’t find a cheaper lunch!

- Take a free walking tour – Most major cities in Canada offer free walking tours. They are a great way to explore and get a feel for each location and its history. Most last a couple of hours and don’t need to be booked in advance. Just remember to tip your guide at the end!

- Buy gas on native reserves – If you are driving around the country, keep your eyes peeled for native reserves — they are the cheapest places to buy gas in Canada. With lower taxes, you’ll find gas prices significantly cheaper than anywhere else. They are also great places to stop and experience the vibrant cultures of Canada’s First People.

- Bring a water bottle – The tap water here is safe to drink so bring a reusable water bottle to save money. LifeStraw makes a reusable bottle with a built-in filter to ensure your water is always safe and clean.

Where to Stay in Canada

Hostels are not that plentiful across Canada, but generally, they’re high quality and clean. Here are my suggested places to stay in Canada:

- The Only Backpacker’s Inn (Toronto)

- The Parkdale Hostellerie (Toronto)

- Cambie Hostel Gastown (Vancouver)

- Samesun Vancouver (Vancouver)

- HI Calgary City Centre (Calgary)

- HI Lake Louise (Banff)

- HI Montreal Hostel (Montreal)

- Alexandrie-Montréal (Montreal)

How to Get Around Canada

Public transportation – Within city limits you’ll find great public transportation networks. Toronto and Montreal are the only two cities in Canada with subway systems (although Vancouver has SkyTrain), but even the smallest Canadian cities have extensive bus routes. It usually costs about 3.25 CAD for a one-way ticket.

Larger cities have passes designed for tourists to make the most of the metro system. For example, Toronto has a daily pass for unlimited travel for 13.50 CAD.

Bus – There’s no singular country-wide bus system here. Instead, regional operators vary per location. Megabus is the cheapest option when it comes to traveling between cities in Ontario and Quebec. Fares can be as low as 1 CAD if booked in advance. Red Arrow is primarily an Alberta coach line. On the east coast, Maritime Bus is the main coach company (except in Newfoundland where it’s DRL Group).

Toronto to Ottawa costs about 30-50 CAD with Flixbus, while Ottawa to Montreal is around 35-50 CAD. A longer ride — like the 13-hour drive from Calgary to Vancouver — costs around 125-165 CAD.

To find bus routes and prices, use BusBud .

Train – There is a train service (VIA Rail) that runs from coast to coast and is very scenic, albeit not cheap. Many train routes are currently suspended or running with limited space due to COVID-19, meaning that journeys take even longer. It takes over 24 hours to get from Halifax to Ottawa, costing about 150-170 CAD. On the other hand, shorter routes like between Montreal and Quebec City (a 3.5-hour journey) are more affordable and start at 36 CAD.

Flying – As your last alternative, you can fly, but since the country has only two major airlines (WestJet and Air Canada) prices are often high. Round-trip flights from Toronto to Vancouver usually start at around 200 CAD when booked early but they can easily cost triple that price. Round-trip from Ottawa to Calgary is around 270 CAD, but again, this is when booked in advance. Expect to pay at least double that price if you don’t book early.

Overall, flying is worthwhile only if you want to see specific cities and have limited time. For shorter routes (like Montreal to Ottawa) you’ll save a lot of money if you just take the bus or train.

Car Rental – If you’re going between provinces or staying a while in the country, consider renting a car for 35-50 CAD per day. This is one of the best, most convenient ways to get around the country — especially if you’re interested in getting out of the cities and into Canada’s wilderness (ideally if you have someone to share the cost with too).

For the best car rental prices, use Discover Cars .

Ridesharing – If you are traveling between cities or provinces, keep an eye out for people sharing their vehicle. Check these websites for rides:

- Couchsurfing

When to Go to Canada

Since Canada is such a large country, climate and temperature vary drastically from coast to coast. Canada has very defined seasons, and winter can be harsh and long in some places. For example, winters in the Northern Territories begin early and end late, and places like Newfoundland and Labrador can experience snow until late May.

On the other hand, winter in the Canadian Rockies is epic and people from all over the world flock to British Columbia and Alberta to hit the slopes around Whistler, Banff, and Revelstoke. Prepare for cold temperatures, though. In some places, like on the prairies, it can get as cold as -40°C (-40°F). In short, only visit in the winter if you’re planning to do winter sports.

Summer in Canada is beautiful, but it’s also the busiest time of year. June to the end of September is the main tourist season, with inflated prices and large crowds. On the other hand, the temperatures are lovely during this time, often in the high 20s°C (70s°F). There are music festivals galore and it’s a great time to hike, bike, and explore the Great Lakes.

Shoulder season is also a fantastic time to visit Canada, although spring (March-June) can be quite wet. Fall (September-October) is highly recommended, as temperatures are still warm enough and the autumn foliage is really something special. Quebec and the Atlantic Provinces are well worth an autumn trek.

How to Stay Safe in Canada

Canada is a safe place to backpack and travel — even if you’re traveling solo, and even as a solo female traveler. Violent attacks are rare and tend to be confined to certain areas (generally where drug and gang violence are a problem). You may encounter petty crime, like theft, around popular tourist landmarks, though that isn’t super common. Nevertheless, always keep an eye on your belongings, especially while taking public transportation, just to be safe.

Solo female travelers should feel safe here, however, the standard precautions apply (never leave your drink unattended at the bar, never walk home alone intoxicated, etc.).

If visiting in the winter, dress warmly. It gets so cold here that people literally freeze to death so take precautions and always keep an eye on the forecast.

If you’re going out hiking, always check the weather beforehand and ensure you have enough water. Bring sunscreen and a hat too. It can get humid here!

Canada’s cannabis legalization has a whole lot of rules and restrictions. The CBC has a great outline on everything you need to know if you’re thinking of consuming cannabis while in Canada.

Scams here are rare, but it never hurts to be prepared. Read about common travel scams to avoid here if you’re worried about getting ripped off.

If you experience an emergency, dial 911 for assistance.

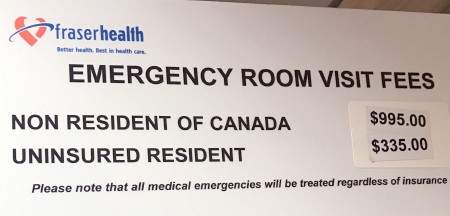

The most important piece of advice I can offer is to purchase good travel insurance. Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. You can use the widget below to find the policy right for you:

Canada Travel Guide: The Best Booking Resources

These are my favorite companies to use when I travel. They consistently have the best deals, offer world-class customer service and great value, and overall, are better than their competitors. They are the companies I use the most and are always the starting point in my search for travel deals.

- Skyscanner – Skyscanner is my favorite flight search engine. They search small websites and budget airlines that larger search sites tend to miss. They are hands down the number one place to start.

- Hostelworld – This is the best hostel accommodation site out there with the largest inventory, best search interface, and widest availability.

- Booking.com – The best all around booking site that constantly provides the cheapest and lowest rates. They have the widest selection of budget accommodation. In all my tests, they’ve always had the cheapest rates out of all the booking websites.

- Get Your Guide – Get Your Guide is a huge online marketplace for tours and excursions. They have tons of tour options available in cities all around the world, including everything from cooking classes, walking tours, street art lessons, and more!

- SafetyWing – Safety Wing offers convenient and affordable plans tailored to digital nomads and long-term travelers. They have cheap monthly plans, great customer service, and an easy-to-use claims process that makes it perfect for those on the road.

- LifeStraw – My go-to company for reusable water bottles with built-in filters so you can ensure your drinking water is always clean and safe.

- Unbound Merino – They make lightweight, durable, easy-to-clean travel clothing.

- Top Travel Credit Cards – Points are the best way to cut down travel expenses. Here’s my favorite point earning credit cards so you can get free travel!

Canada Travel Guide: Related Articles

Want more info? Check out all the articles I’ve written on Canada travel and continue planning your trip:

Where to Stay in Quebec City: The Best Neighborhoods for Your Visit

Where to Stay in Vancouver: The Best Neighborhoods for Your Visit

Where to Stay in Toronto: The Best Neighborhoods for Your Visit

Canada Road Trip: A One Month Suggested Itinerary

How to Road Trip the Yukon on a Budget

How to See Alberta: A 10-Day Suggested Driving Itinerary

Get my best stuff sent straight to you, pin it on pinterest.

- Where To Stay

- Transportation

- Booking Resources

- Related Blogs

- Skip to main content

- Skip to site information

Language selection

Help us to improve our website. Take our survey !

Travelling and money

Take steps that will help you avoid financial problems that may ruin your trip. Make sure you purchase travel insurance , and most importantly make sure you always carry a backup source of funds in case of emergency or an unexpected delay.

On this page

Cards (credit, debit and pre-paid).

- Traveller’s cheques

Travelling with $10,000 or more

Check with the embassy or consulate in Canada of the country you are planning to visit to make sure you are allowed to import or export its currency. If you are permitted to import its currency, bring enough cash to get by for a couple of days and keep it in a money belt or in several different pockets in case your wallet is lost or stolen or your financial institution accidently freezes your cards. When you arrive at your destination, you can withdraw more cash from an ATM.

Exchanging your money

The currency exchange rate tells you how much your Canadian money is worth in the local currency. When you exchange your money, you are actually using it to buy or sell foreign currency at a specific price called the exchange rate. You can find the official exchange rate of the currency in the country you will be visiting by using the Bank of Canada’s online currency converter .

It pays to know your options when dealing with foreign exchange rates. There are a number of ways to manage your finances when you are abroad that will save you a lot of money in exchange fees.

If you want cash on hand before you leave Canada, you can buy foreign currency from your financial institution over the phone or online. It can be delivered to your local branch for pick up. Exchange rates at banks are slightly better than elsewhere. You can also order currency before you leave on your trip from a number of websites that will ship it to your home within a couple of days.

Exchange desks

If you need cash in an emergency, there are foreign exchange desks at airports and hotels that will exchange Canadian money for the local currency. Fees tend to be very high. Even those advertising no commissions may have hidden fees, making these desks the most expensive places to change money.

Black market

The currency black market forms part of the underground economy in a number of countries. In a currency black market, transactions are almost always in cash, since its participants don’t want to leave any evidence.

This illegal or parallel market in foreign exchange operates outside legal banking channels. If you are tempted to take advantage of the currency black market you should be aware that you will be breaking the country’s laws and could be arrested and imprisoned . You are subject to the country’s criminal justice system. Consular officials will not arrange your release from prison.

Be aware of anyone approaching you on the street offering to exchange your money for a much better rate than a bank. Typical money exchange scams include stealing your money in the process of counting and recounting a pile of bills or mixing your money with currency from another country with a much lower exchange rate. It is safer to go through an authorized agency or a bank.

Credit cards

Use a major international credit card for your big purchases, such as your airplane tickets, hotel bills and restaurant tabs. If you reserve your hotel and rental car on your credit card, the reservation should be guaranteed even if you arrive late.

Use the credit card instead of cash wherever possible. Credit card issuers typically charge fees for international transactions and you may get the best exchange rate and fees lower than those associated with exchanging cash. However, you should not use your credit card to withdraw money from an ATM, because the fees and interest charges are usually very high.

Before you leave:

- Know the expiry dates, account balance and amount of credit available to you on all of your credit cards. Make sure you have enough money in your accounts to cover your trip expenses, plus extra in case of emergency.

- Make sure your credit card company and financial institution have your up-to-date contact details, including a cellphone number, and information on where and when you will be travelling so that your account isn’t flagged for unusual activity.

- Check with your financial institution before you leave on your trip. Not all major credit cards are accepted everywhere. Merchants in some destinations prefer to be paid in cash because they must pay a fee to the credit card company. There may be a risk that your credit card will be cloned at some destinations, particularly in restaurants.

Debit cards

Always use bank-affiliated ATMs when you are outside Canada. Check if your financial institution has international branches or partners in your destination country where you can use your debit card fee-free. Using your debit card to withdraw money from ATMs will cost you extra in fees, but you can minimize them by withdrawing larger amounts less often.

You should carry some cash to cover daily expenses. Your debit card may not work in every ATM machine or be accepted at stores or restaurants in your destination country. If you are travelling to a rural area, you may not be able to find an ATM that is part of your financial institution’s network, so withdraw enough cash to manage until you are back in a city.

Due to the potential for fraud and other criminal activity, you should use your credit cards and debit cards with caution. Use ATMs during business hours inside a bank, supermarket, or large commercial building.

Pre-paid cards

Some financial institutions offer pre-paid travel cards in foreign currencies. They may have higher fees than credit and debit cards, so check the terms and conditions and costs before you decide to travel with one. You can usually replace a pre-paid travel card as you would a lost or stolen travellers’ cheque.

Be aware that pre-paid cards may not be accepted at some hotels and car rental companies, and may be difficult to use at the ATM machines of foreign banks.

Dynamic Currency Conversion

Some shops, restaurants and ATMs give the option of using the currency of the country you are in or having the transaction converted into Canadian currency. Always choose to be charged in the currency of the country you are in. You will pay high conversion rates and transaction fees if they convert to Canadian currency.

Save your receipts

As you travel, save all ATM and transaction receipts in an envelope. Bring them home in your carry-on bag. Save your airline boarding pass to prove your return date. If you need to dispute a transaction, sending a copy of your receipt will speed up the resolution process.

After you return home, carefully examine your credit and debit card statements and continue to do so for several months. Identity theft and credit card fraud are not confined to Canada. If you notice any unusual charges on your statement, inform your financial institution immediately and request a copy of the receipt.

Travellers’ cheques

Canadian travellers’ cheques are not widely accepted worldwide, but are an option if you don’t want to use credit or debit cards or carry large amounts of cash.

When possible, order the cheques in the local currency and carry multiple cheques in small denominations. If you can’t order cheques in the currency of your destination country, order them in U.S. funds, which are widely accepted. Sign them as soon as you get them and keep the receipt in a separate location. If they are stolen they can be replaced anywhere in the world, usually within 24 hours.

Keep a record of your travellers’ cheque numbers, credit card account numbers and expiry dates and the telephone numbers for reporting lost or stolen cards in a safe place. If possible, leave a copy of the list with a family member or friend at home who can help you make telephone calls quickly if your cards are lost or stolen.

Any time you enter or leave Canada, you must declare any money or monetary instruments, such as stocks, bond or cheques, you are carrying valued at $10,000 or more.

Canadians who live or work abroad or who travel a lot may still have to pay Canadian and provincial or territorial income taxes.

If you are planning to be outside Canada for an extended period of time, you should inform the Canada Revenue Agency (CRA) before you go to ask for a determination of your residency status. Your residency status depends on whether you are leaving Canada permanently or only temporarily and the residential ties you keep with Canada and establish in another country:

You are leaving Canada permanently

You are leaving Canada temporarily

Visit International and non-resident taxes for information about income tax requirements that may affect you.

Departure tax

In some countries you must pay a departure tax or service fee at the airport or point of departure. Make sure you set aside enough money in local funds to pay it.

- Travel Advice and Advisories

- Financial assistance

- Overseas fraud: An increasing threat to the safety of Canadians

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act

The Cost of Travel in Canada: My 2024 Budget Breakdown

Oh, Canada!

So let’s get it out of the way first: I may be slightly biased, due to being Canadian, but I’ve got to tell you — Canada is one of the most beautiful countries in the world. It’s kind of got everything, from breathtaking landscapes to wonderful people, and so many only-in-Canada animal encounter opportunities (kayaking with beluga whales, anyone? Or how about hanging out with polar bears in their natural habitat?) I truly believe Canada is one of the best countries to travel across.

Unlike most of my fellow Canadians, I’ve had the pleasure and privilege of exploring my homeland in depth. It’s something I’ve prioritised doing even more since the pandemic, spending loads of time in Toronto, Montreal, Ottawa, and Vancouver, and road-tripping from east to west across the entire country. It’d be fair to say I know Canada like the back of my hand.

As a result, I have plenty of firsthand knowledge of how much it costs to travel in Canada, and most importantly, how to save money on experiences as you do so.

I can’t sugar-coat it, so I’ll hold my hands up and confess that Canada isn’t a particularly budget-friendly destination, especially if you’re coming here to enjoy it as a visitor. It’s one thing to live frugally as a student, but another to be a tourist. That being said, there are so many ways to enjoy your time here to the fullest without breaking the bank and sleeping out in your car every night.

If it’s possible, come visit us in Canada with a decent amount saved up (I’ll tell you how much to budget for each day), safe in the knowledge that spending that money will be 100% worth it. The expression spend your money on experiences not things will hit closer to home once you’ve seen what this country has to offer.

Today, I’m going to be sharing exactly how much it costs to travel in Canada, so let’s get started.

What’s Included in this Post

This budget breakdown covers how much I spend on accommodation, transportation, activities, and food as I travel around the country. I’ve not included flights into and out of Canada, since this is going to vary significantly based on where you’ll be arriving from.

The amounts in this guide are listed in U.S. dollars, simply because most of my readers are from the United States, as are the vast majority of visitors to Canada. If you’re converting U.S. dollars, euros or pounds to our weak Canadian dollar, then your time here might also feel more budget-friendly.

Okay — let’s get started!

How to Save Money on the Cost of Accommodation in Canada

As always with travel, it’s possible to cut your accommodation costs down to zero if you have the time and patience to seek out an offer.

Housesitting is a great option for free accommodation. This is where you’ll take care of somebody’s house while they’re away, and usually look after their pets, too. It’s best for long-term travellers or retirees: because you can’t pick and choose dates and destinations, you need to have a lot of flexibility as to where you go and at what time of year. If you do have that freedom, it’s a wonderful way to cut down your travel expenses, soak up some home comforts, and live like a local for a while. I have friends who have housesat in castles before! For free! Trusted Housesitters is the best site for getting started with housesitting, as they have the highest number of listings.

I’m suspecting, though, that for most of you, you’re not interested in the free accommodation and just want somewhere clean, safe, and affordable to rest your head each night. If that’s the case, there are several options available for you.

The Cost of Accommodation in Canada

If you’re feeling particularly adventurous and frugal, you could opt to drive and camp your way through Canada. This can cost you as little as $20 a night , but be sure to reserve your spots with Parks Canada ahead of time as campsites can get full very fast.

If camping doesn’t appeal, it’s time to check out hostels . In Canada, you’ll come across hostels all over the country, finding them on tiny islands, in large cities, and even in the national parks. They’re one of your best options for saving money.

Hostels in Canada are on a par with the rest of Northern America, and you can expect to spend around $25-30 a night for a dorm bed for a well-reviewed hostel in Canada, with the price increasing to about $40-50 a night for the absolute best of the best.

When it comes to private rooms in hostels, prices vary quite a bit depending on where you’re going and the time of year. Over the last few months I’ve booked really nice private rooms for as little as $65 in shoulder season, but they’ve cost anything up to double that at peak times in major cities. Either way, if you’re travelling with friends or your partner, you may find it cheaper to grab some privacy over settling for two beds in a dorm.

I use HostelWorld to find the cheapest hostels, as they tend to have the greatest number of listings at the lowest prices.

And, of course, there are always hotels, which usually come in at around $150-$200 a night for a decent, clean, mid-range property in a central location. I always use Booking , as they have the most accommodation options for the cheapest prices.

Toronto — Elegant Downtown Homestay ( $196 a night ): While you’re in Toronto, you can’t pass up staying at this lovely homestay. The location, quality, and affordability (for the area) can’t be beat. You want to be as central as possible during your time in Toronto and this stylish house is right near popular spots like Yonge-Dundas Square and the Distillery District while still being nice and quiet at night. I loved how clean and modern the rooms were, with a super-comfortable bed, smart TV, and coffee machine to get me started in the morning. What really made this place special, though, is just how nice the hosts were: it really did seem like nothing was too much bother!

Montreal — Maison Saint-Vincent ($188 a night) : Right in the heart of historic Montreal, you couldn’t ask for a better location for this great little hotel. It’s only a couple of minute’s walk from Notre Dame cathedral, with so many restaurants and cafes nearby that it was hard to choose where to go each night! The rooms were comfortable and modern, and came with an iPad loaded with useful neighbourhood information and an all-important Nespresso machine. There’s a kitchenette on each floor, with a designated area in the fridge for each room, and free croissants in the lobby each morning; that’s how I really knew I was in Montreal!

Ottawa — Auberge des Arts Bed and Breakfast ($96 a night) : I really couldn’t ask for better-priced accommodation in a better location than what I got at Auberge des Arts. Right beside the Byward Market in downtown Ottawa, it’s close to all the action while still being on a quiet street away from traffic noise. Major attractions like the National Gallery were barely a five minute walk away! Beyond the location, though, the place is just charming, and couldn’t have been further from a generic hotel stay. My room was lovely and spacious, with a very comfortable bed, and the owners couldn’t do enough for me, from waiting up for my late arrival to cooking up an incredible breakfast that still catered for my dietary restrictions!

Vancouver — Finding high-quality affordable accommodation in Vancouver isn’t always easy, but a rare exception is the excellent Times Square Suites ($209 a night) . I really liked this hotel; not only does it not break the bank, but it’s in a great location in a leafy part of the city’s West End, only a quick walk from Stanley Park, Vancouver Harbour, English Bay, and all the great eating and drinking options along Robson Street. It’s not just the location that made this place special, though: my room was much more spacious than usual for a major city, and immaculately clean. The bed was nice and comfortable, and I can’t say enough good things about the staff: their restaurant recommendations in particular couldn’t have been better!

Halifax — I absolutely adored my stay at the Prince George Hotel . Not only is it the most central property in town, but they offered so many additional amenities for the price. For $208 a night , I had access to a spacious, clean, and modern room, as well as a swimming pool, gym, and sauna – always appreciated! The breakfast was a vast buffet set-up, with everything you could possibly need to fuel your day’s exploration. Throw in a wonderfully comfortable bed and you’ve got yourself the perfect stay in Halifax!

Banff — Peaks Hotel and Suites ( $187 a night) : Considering that Banff is one of Canada’s most expensive vacation destinations, this place felt like a real bargain. My room was spotlessly clean and very spacious, with a comfortable bed and fantastic rain shower. The staff were lovely, and I really liked the little lounge area with free tea and coffee all day. I also got access to a bunch of amenities like a pool, hot tub, and gym at the sister hotel over the road: there’s a buffet breakfast available at that hotel as well, but all the restaurants and cafes in central Banff were only a short walk away, so I mostly ate there instead!

The Cost of Transportation in Canada

Car Rental — This is the main way that I’ve explored Canada and I can’t recommend it enough. Nothing else gives the same amount of flexibility, especially when it comes to getting into the national parks and many other beautiful but isolated parts of the country. If you have the time and are comfortable behind the wheel, there’s no better way to travel.

You can find great rental deal rates by using RentalCars.com in Canada, which is who I use to find cheap rentals all around the world. To give you an idea of the average cost, a two-week economy car rental from Vancouver to Toronto costs around $1736, which ends up being around $124 per day . That’s not including the cost of gas or insurance, but if you were to split this with one or two other people, it’s still pretty affordable! You’ll also pay a lot less if you return the car to the same place you rented it from.

Keep in mind that you need to be at least 25 years old to rent a car in Canada.

Bus — This is a more affordable but less flexible way to get around Canada: it wouldn’t be my first choice for long-distance travel, but can be the best way to get between cities that aren’t far apart (by Canadian standards!). If your trip is mostly confined to cities near either the east or west coasts, this can be a great way to save money.

If you’re going to take a bus, I’d recommend Megabus for travel in Ontario. I used Megabus often while I went to university in Ottawa and it was comfortable, reliable, and affordable. As an example, they’ll take you between Toronto and Montreal for only $54 ! A couple of other good options for bus travel in Canada include:

- Coach Canada : Toronto, Montreal, Kingston, Niagara Falls and Hamilton

- Rider Express: Vancouver/Calgary, Winnipeg/Regina, Calgary/Edmonton, Edmonton/Regina

Train — If the idea of traveling by long-distance train across Canada sounds appealing (and why wouldn’t it?), check out Via Rail . With close to 8000 miles of track across eight provinces, you’ve got plenty of options when it comes to riding the rails. I’ve used Via Rail frequently in Ontario, and know many people who’ve used it to travel all around the country.

If you want to see a lot of Canada in a short space of time, this is the way to do it. Get your camera out and prepare for jaw-dropping views. Here are some of the most popular routes and their one-way economy fares (taxes not included):

- The Canadian Route ($381): Toronto – Vancouver, 4 nights/4 days

- The Ocean ($113): Montreal – Halifax: 1 night/1 day

- The Best of Manitoba ($179): Winnipeg – Churchill: 2 days/2 nights

- The Pacific North Coast ($121): Jasper – Prince Rupert: 2 days/1 night

Flying — For a long time, flying across Canada cheaply was unheard of. That’s the reason why so many Canadians weren’t able to do much travelling within their own country: it was just cheaper to fly to Europe than it was domestically.

But over the past number of years, there’s been an influx of budget-friendly airlines in Canada that make flying a much more viable option if you want to quickly cover a lot of ground. Air Canada is the country’s biggest airline, but you’ll usually find cheaper prices with WestJet, Flair Airlines, and Swoop. In my opinion, you can’t really go wrong with any of these airlines for a domestic trip.

Here are some of the most common one-way routes and their average prices for an economy seat. I use Skyscanner to research all my flight options, since it consistently brings up the best fares.

- Toronto to Vancouver — $59

- Toronto to Halifax — $57

- Calgary to Vancouver — $36

- Toronto to Calgary — $62

- Montreal to Vancouver — $145

City Travel — When you’re sightseeing in a major city, the best way to get around is local transit. You can tap your credit or debit card on the reader in most major cities including Vancouver and Toronto, which is convenient if you’re only going to take public transport a few times.

If it’s something you’ll do regularly in Ontario, though, you’ll get free two-hour transfers if you use a Presto card instead. This tap-and-go card lets you pay for travel across 11 regions, including Ottawa and Toronto, and can be bought online or in-person.

If you’ll be doing a lot of travel on public transport in a single day, it’s worth picking up a day pass for whatever city you’re in instead. Fares for a few of the major cities include:

- Toronto TTC Day Pass: $10 per person

- Vancouver TransLink Day Pass: $8.35 per person

- Montreal Day Pass: $8.15 per person

- Ottawa OC Transpo Day Pass: $8.75 per person

The Cost of Food in Canada

Picture your favourite dishes from around the world, all in one place—that’s what it’s like to eat in Canada! Delicious and authentic eats can be found in nearly every corner of the country, from Vietnamese to Ethiopian to Italian and many others.

While there aren’t many “Canadian” dishes, you definitely have to get your hands on some poutine and a beavertail (don’t worry, not an actual one!). Beavertails are stretched pastries made out of fried dough to take the shape of their namesake; they can be topped with anything from sugar to peanut butter to chocolate. One of my favourite Canadian must-dos is to go skating, followed by a warm beavertail and hot chocolate; there’s truly nothing better in the winter. That combo costs around $9.

Poutine, if you haven’t heard of it before, is an absolute Canadian classic. Combining French fries with melted cheese curds and savory gravy, it’s not the healthiest of meal choices, but it is one of the most delicious. Your taste buds will thank you for this messy masterpiece, and your wallet will too: you can expect to pay $14 for more food than you know what to do with.

If you happen to find yourself in Montreal, run, don’t walk, to the nearest bagel store. Denser and chewier than traditional bagels, the ones you find in this city are slightly sweet thanks to a touch of honey in the dough. The real magic, though, lies in the iconic “Montreal-style” topping: a generous helping of sesame seeds baked right onto the crust. Pair this with a schmear of cream cheese, smoked salmon, or classic roast meat and mustard, and you’ve got an absolute taste sensation. St-Viateur makes particularly good ones, but competition is fierce so it’s hard to go too far wrong anywhere. You’ll pay around $10 for one.

And of course, no trip to Canada is complete without multiple Tim Hortons coffee runs, which by the way, are very budget friendly. You can get a coffee and bagel for as little as $3 !

The cost of food ranges depending on what you like to eat and how much you like to eat at restaurants. That being said, there’s plenty of ways to eat on a mid-range budget. Fast food costs anywhere from $7-$10 per person, while eating out at a mid-range restaurant like Cactus Club or Swiss Chalet will set you back around $20-$30 per person without drinks. Go high end, and you can easily pay $60 each or more.

While there are plenty of great restaurants to eat at in any major city or town, doing so for three meals a day does get expensive. Staying at accommodations with a kitchen, shared or otherwise, offers an easy way to save money on food. Groceries typically cost me around $80 per week, which is around $11.50 per day for fruit, vegetables, protein, and snacks.

The Cost of Activities and Entrance Fees in Canada

You’re in luck when it comes to the cost of activities and entrance fees in Canada, as most of what you see is beautiful Mother Nature herself! This is when road tripping is worth it, because driving through Canada is an experience in itself, with often jaw-dropping views just outside your window.

There are some attractions and parks, though, that are definitely worth seeing if you’re in the area. Learning from exhibitions at the Canadian Museum for Human Rights in Winnipeg, seeing whales in their natural habitat off the coast of Vancouver, and walking next to Niagara Falls are a few of my favourite travel experiences in Canada.

If you’re more of a nature or outdoorsy person, I’d recommend spending more time and money on activities and attractions in western Canada (B.C. and Alberta). If you’re more into history, the arts, and urban exploring, then central and eastern Canada (Southern Ontario, Montreal) will be more up your alley.

Here’s a breakdown of some my favourite attractions in Canada and their respective costs:

- CN Tower (Toronto): $32 per person

- Parliament Hill Tour (Ottawa): FREE

- National Gallery of Canada (Ottawa): $15 per person or FREE on Thursday evenings

- Banff Gondola (Banff): $43 per person

- Columbia Icefield Skywalk (Banff): $31 per person

- Whale watching (Vancouver): $133 per person

- Canadian Museum for Human Rights (Winnipeg): $14 per person or FREE on Sundays

- Anne of Green Gables Heritage Place: $7 per person

- Niagara Falls: FREE

Tours are really a great way to experience the country. I recommend hopping over to Get Your Guide for a range of activities and tours, like the Banff National Park Big Canoe Tour ($49), Ottawa sightseeing bike tour ($52) or a Niagara Falls Day Tour ($151).

And You Can’t Forget Travel Insurance!

If you’ve read any other posts on Never Ending Footsteps, you’ll know that I’m a great believer in travelling with travel insurance. I’ve seen far too many Go Fund Me campaigns from destitute backpackers that are unexpectedly stranded in a foreign country after a scooter accident/being attacked/breaking a leg with no way of getting home or paying for their healthcare. These costs can quickly land you with a six-figure bill to pay at the end of it.

In short, if you can’t afford travel insurance, you can’t afford to travel.

Travel insurance will cover you if your flight is cancelled and you need to book a new one, if your luggage gets lost and you need to replace your belongings, if you suddenly get struck down by appendicitis and have to be hospitalised, or discover a family member has died and you need to get home immediately. If you fall seriously ill, your insurance will cover the costs to fly you home to receive medical treatment.

I use SafetyWing as my travel insurance provider, and recommend them for trips to Canada. Firstly, they’re one of the few companies out there who will actually cover you if you contract COVID-19. On top of that, they provide worldwide coverage, don’t require you to have a return ticket, and even allow you to buy coverage after you’ve left home. If you’re on a long-term trip, you can pay monthly instead of up-front, and can cancel at any time. Finally, they’re way cheaper than the competition, and have a clear, easy-to-understand pricing structure, which is always appreciated.

With SafetyWing, you’ll pay $1.50 a day for travel insurance.

How Much Does it Cost to Travel in Canada?

It’s time to tally up all of my expenses to see my total travel costs!

- Accommodation: $181 per day for two people ($90.50 per person)

- Transportation: $124 per day for two people ($62 per person)

- Food: $27 per day

- Activities/Entrance Fees: $16 per day

Average amount spent in Canada: $195.50 a day!

Author bio: Born and raised in Toronto, Lydia has found “home” throughout her travels around the world. She’s a passionate storyteller and writer and you can usually find her dreaming about new adventures or having a deep conversation with a friend.

Related Articles on Canada 🇨🇦 22 Wonderful Things to Do in Toronto 🍁 How to Spend Three Days in Montreal 🐳 How to Spend Three Perfect Days in Vancouver

Lauren Juliff

Lauren Juliff is a published author and travel expert who founded Never Ending Footsteps in 2011. She has spent over 12 years travelling the world, sharing in-depth advice from more than 100 countries across six continents. Lauren's travel advice has been featured in publications like the BBC, Wall Street Journal, USA Today, and Cosmopolitan, and her work is read by 200,000 readers each month. Her travel memoir can be found in bookstores across the planet.

Related Posts

The Cost of Travel in Mauritius: My Detailed Budget Breakdown

The Cost of Travel in Thailand: My Detailed Budget Breakdown

2023: My Travels in Review

The Cost of Travel in South Korea: My 2024 Budget Breakdown

21 Thrilling Things to Do in Tennessee

The Cost of Travel in Peru: A 2023 Budget Breakdown

So nice to read some Canada content on your site! The one activity that’s on my Canada bucket list is seeing the polar bears in Churchill! Definitely a big ticket activity, but it looks soooo cool.

Ah, I totally agree! That’s very high on my list of things to do in Canada!

A great read, and good to hear that it doesn’t have to be too expensive. I love the idea of taking the train across Canada from east to west, and also road tripping and camping around the country. And like the other commenter mentioned, the polar bears! There’s so much to see and so little time.

Same, same, same! There’s so much to do in Canada that you could spend years exploring and barely even scratch the surface!

So useful! Especially as Canada is about to open its borders to international tourists next month. I can’t wait to visit — thanks for all the useful tips and information in this guide.

Hi Lauren, thanks so much for your recent post its very helpful. My wife and I are coming to Canada-Vancouver, early June for 19 days. We are planning to do 4-5 days on Vancouver Island a few days in Vancouver and rest travelling towards Calgary/Edmonton before internal flight back to Vancouver (not set in stone ,but just our thoughts). We want to visit Whistler and travel the 2 peaks Gondola then travel onwards over the next few days to Lake louise/Calgary . We now feel that rather than travel onto Calgary then take an internal flight back to Vancouver, that the road and activities to Jasper is very appealing. Can you advise an opinion on whether it would be best to travel back to Vancouver from Whistler, and then fly to say Edmonton and travel to Jasper – Lake Louise before a return flight to Vancouver from Calgary. Do you think the road from Jasper to Lake louise is a better drive with the possible activities than Whistler to Lake louise?. Kind Regards Mark

Hey great post, really appreciate all the info. One thing though – we’ll be in Canada for a month, have iphones.. what would be the best sim for travellers? Is there a generic easy to buy one that we can get at the airport or.. should i just get a random travel one from online? Cheers

Leave a reply Cancel reply

Your email address will not be published. Required fields are marked *

Meet Lauren Juliff

Visiting Canada and Canadian Tourism

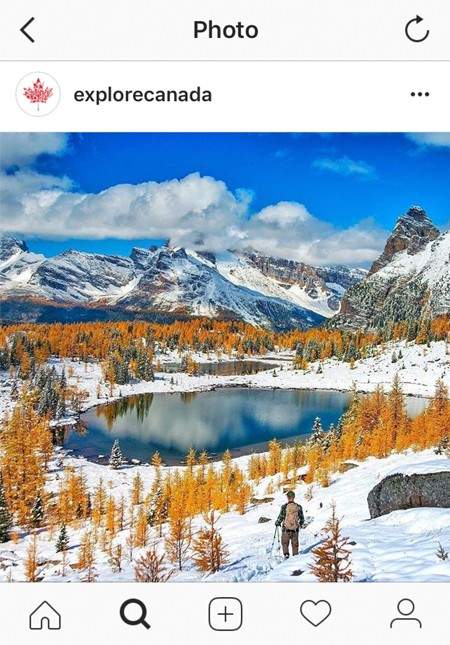

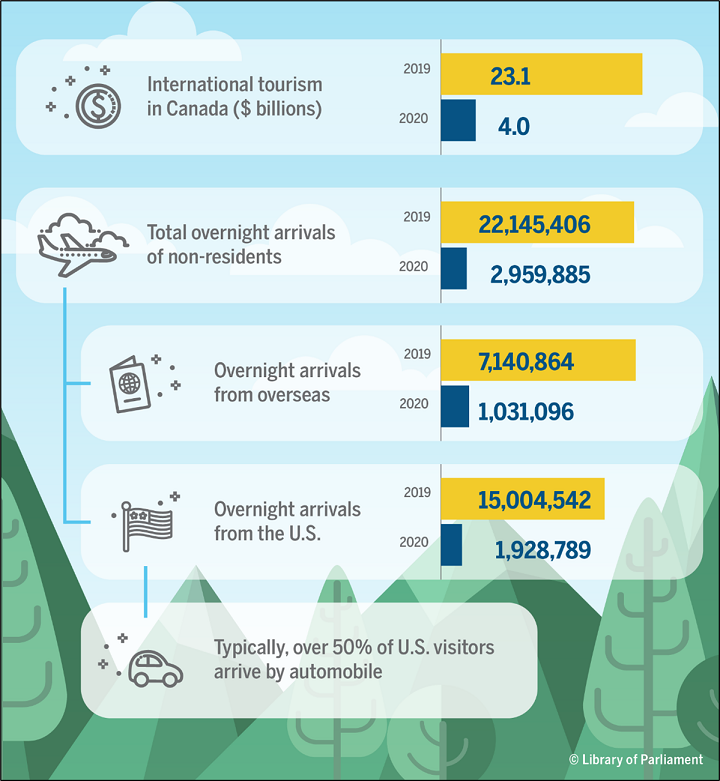

Over 18 million foreigners visit Canada every year making tourism an over $80 billion-a-year Canadian industry — bigger than lumber, fishing, and farming combined. So why not join in?

The Government of Canada spends a lot of effort promoting Canadian tourism through a variety of websites and social media accounts, including Instagram — as seen here. The current slogan is "Canada: Keep Exploring" with "explorecanada" their most widely used user name and hashtag.

Why come to Canada?

Canada is a large, diverse country with a lot going for it, but most tourists are drawn to a few of the same things:

Nature — Canada is one of the most beautiful countries in the world, full of picturesque forests, mountains, and lakes that make it a fantastic place for camping, hiking, or just wandering around and admiring.

Winter Sports — Canada’s snowy climate and mountainous geography has produced no shortage of must-visit parks and resorts for anyone interested in skiing, snowboarding, snowshoeing, or any other activity best enjoyed in the cold.

Cities — Canada is home to several large, modern cities that anyone with a taste for urban life will be able to appreciate.

Cost — The Canadian dollar is generally quite weak in comparison to other currencies, which make it a very affordable option for people without too much money in their travel budgets.

- Bank of Canada Exchange Rates

The rest of this chapter deals with general information about traveling to Canada. For more information on things to see and do in Canada’s four most popular tourist destinations, please see the specific chapters on British Columbia tourism , Alberta tourism , Ontario tourism , and Quebec tourism .

What language do they speak in Canada?