- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Seven Corners Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What plans does Seven Corners offer?

Seven corners roundtrip plans, seven corners annual plans, seven corners travel medical insurance, which seven corners travel insurance policy is best for me, can you buy seven corners travel insurance plan online, what isn't covered by seven corners insurance, is seven corners travel insurance worth it.

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Established in 1993, Seven Corners is a travel insurance provider that offers a wide assortment of plan options to U.S. and non-U.S. residents. The company provides single and annual trip plans as well as student specific options, and travel medical insurance.

When planning a vacation, you may want to consider purchasing travel insurance as it can help you in case an emergency pops up before or during your trip. Whether you’re looking for a comprehensive policy or emergency medical coverage to supplement the travel insurance with your credit cards , Seven Corners provides a number of options.

We’ll examine the travel insurance options to help you decide if they make sense for you.

Seven Corners provides an assortment of different travel insurance plans including:

Round-trip.

Annual plans.

Student options.

Travel medical insurance.

Options for non-U.S. citizens visiting the U.S.

Plans for groups of 10 or more travelers.

RoundTrip plans are created for those who are departing from their home, traveling to another destination (or destinations) and returning home.

To evaluate plan options, we used a sample itinerary for a $5,000, two-week trip to Greece by a 38-year-old Louisiana resident.

The RoundTrip Basic plan ($197) is a good comprehensive travel insurance option and offers 100% trip cancellation (for trips up to $30,000), 100% trip interruption, $100,000 for emergency medical expenses (secondary coverage), $250,000 for medical evacuation/repatriation, lost luggage, baggage delay and other benefits.

The RoundTrip Choice plan ($280) includes all the benefits of the Basic plan, but with trip cancellation coverage up to $100,000, 150% trip interruption, $500,000 for emergency medical expenses (primary coverage), $1,000,000 for medical evacuation/repatriation and other benefits.

Notably, the latter plan offers primary emergency medical coverage, allowing you to seek medical reimbursement from the policy without first contacting your main medical insurance policy.

Each plan offers several optional add-ons:

Rental car damage: Provides up to $35,000 of coverage if your rental car is stolen or damaged due to an accident, theft, natural disaster and more. The cost depends on how many days you need coverage, ranging from $7 for one day to $98 for a two-week trip.

Trip interruption for any reason: Allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund up to 75% of your unused nonrefundable deposits. The benefit must be purchased within 20 days of the initial trip payment. The added cost to the RoundTrip Basic Plan is $5.91; the added cost to the RoundTrip Choice Plan is $8.40.

Cancel for any reason : Allows you to cancel a trip for any reason and receive a reimbursement of up to 75% of your nonrefundable trip costs. Cancellation must occur two or more days before the scheduled departure date. For the RoundTrip Basic Plan, this optional add-on costs $82.74. For the RoundTrip Choice Plan, it is $117.60.

Annual travel insurance plans are designed for frequent travelers who want to take many trips throughout the coverage period (364 days). A trip begins once you leave your home country.

“Seven Corners offers one annual policy called Travel Medical Annual Multi-Trip. The policy can be customized depending on how long you plan to be away from home for any one trip. You can travel as much as you like during the 364 days, so long as any one trip doesn’t exceed the option selected — 30, 45 or 60 days.”

The plan provides coverage of up to $1,000,000 in medical expenses and $1,000,000 in medical evacuation/repatriation. In addition to the below, the plan includes additional medical-related benefits. Refer to the terms and conditions of the policy for details.

To look at policy cost and available optional add-ons, we used a sample trip starting in December 2023 for a 45-year-old who plans to travel worldwide (excluding the U.S.). The policies assume a personal deductible of $250 per occurrence and opts out of adventure activities coverage.

The plans offer customization depending on your travel needs. Whether you’re looking for adventure sports coverage or a modification to your medical deductible, Seven Corners allows you to choose the option that’s the best fit.

» Learn more: How to find the best travel insurance

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , Seven Corners offers four medical travel insurance plan choices:

Travel Medical Basic.

Travel Medical Choice.

Travel Medical Plus.

The Basic, Choice and Plus plans provide varying degrees of coverage, with the Plus plan offering the highest limits. The Plus plan includes a specific call out for COVID-19; you'll be covered for COVID-19-related treatment expenses up to the medical maximum.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Selecting the plan best for you involves understanding what type of coverage you will want while traveling.

For premium travel credit card holders: If you hold a premium travel card that already provides you with an adequate amount of trip cancellation coverage, you may only want to get a standalone emergency medical policy. For example, The Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits. If you hold this card and your trip is more expensive, you’d want to consider a standalone travel insurance plan. If you're only worried about flight cancellations, AmEx offers Trip Cancel Guard, which you can buy when you book a nonrefundable flight through the AmEx Travel Portal. Trip Cancel Guard guarantees an up to 75% refund if you cancel at least two days before departure. Terms apply.

For anyone wanting more coverage: If the coverage provided by your card isn’t sufficient, you don’t have credit card coverage or you didn’t pay for your trip with that credit card, then you might be better off with a comprehensive plan like one of the RoundTrip or Annual Trip plans from Seven Corners, depending on your travel goals.

For frequent, extensive travelers: If you’re a long-term traveler and expect to take many trips, the annual plans will be the most suitable. However, with coverage for each trip capped at 60 days, you’ll want to look at other options if you will be away from home for longer.

» Learn more: The majority of Americans plan to travel in 2022

Head over to the Seven Corners website and select the state you reside in. The next page will ask you about your travel plans.

Then, you'll choose your mode and reason for travel. On the last screen, it'll recommend a plan where you can proceed to add the trip details to receive a quote.

Trip insurance plans have a number of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions:

High-risk activities: Skydiving, bungee jumping, heli-skiing and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are commonly excluded events.

Exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

» Learn more: Does travel insurance cover award flights?

Before you purchase a travel insurance plan, check to see what coverage you may already have. If you have a travel credit card, you might have built-in complimentary travel insurance. If you hold one of these credit cards, see what the benefits and limits are because you may have sufficient coverage.

In this case, you’ll be better off purchasing a separate emergency medical plan . However, if your credit card doesn’t provide enough coverage, a comprehensive travel insurance plan might be the right choice. Seven Corners has various options to choose from.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Seven Corners Travel Insurance Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Director of Operations & Compliance

1 Published Article 1170 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Purchase Travel Insurance

Travel insurance and covid-19, why purchase travel insurance from seven corners, comprehensive travel insurance package policies, travel medical insurance plans — plans for international travelers, travel medical insurance plans — travel within or to the u.s., specialty plans, how to obtain a quote, best for comprehensive travel insurance plans, best for travel medical plans, seven corners vs. other travel insurance companies, seven corners vs. credit card insurance, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you’re planning a trip, especially in the current environment, chances are the topic of purchasing travel insurance crossed your mind. It’s good news that whether you’re looking for a comprehensive travel insurance package policy or 1 that focuses on providing medical insurance coverage during your travels, you’ll find coverage can be easily secured and it can be affordable.

The company we’re reviewing today offers both comprehensive travel insurance package plans and separate plan options that provide stand-alone travel medical coverage . Seven Corners has been offering these plans since 1993 to U.S. citizens traveling abroad, travelers who are visiting the U.S., and other international travelers.

Let’s continue as we look at why you’d want to purchase travel insurance and specifically why you’d want to consider Seven Corners. We’ll also look at the types of policies offered by Seven Corners, how the company compares to other travel insurance companies, and to the coverage that comes with your credit cards.

Join us now for a close-up look at Seven Corners and what it has to offer.

Travel insurance is designed to protect your trip investment from loss and from the additional expenses incurred due to an unexpected event, causing you to cancel your trip or resulting in disruption during your travels.

Here is a sampling of circumstances when travel insurance could provide a significant benefit:

- You break your ankle during your ski trip and need to return home early

- An immediate family member becomes seriously ill and you must cancel your trip to care for them

- You become ill or injured while staying at a remote lodge and must be evacuated to the nearest hospital

- There is a flood and your home becomes inhabitable, causing you to cancel your trip

- You suffer a dental injury on vacation and need immediate dental work

Bottom Line: Any trip that involves a significant investment in non-refundable expenses should be insured, as well as any trip that takes you where you would be without medical coverage.

Many travelers have recently found themselves in a position where they needed to cancel, postpone, or change their travel plans due to COVID-19 . While it’s reasonable to expect that travel insurance might cover these cancellations, normally, it does not.

It’s possible your travel insurance policy will cover you for canceling your trip due to getting ill from the virus, or if your trip is disrupted as a result, but many companies are excluding coverage for any COVID-19 related claims.

Additionally, voluntary cancellations due to the fear of getting ill are not a covered reason for trip cancellation on any travel insurance policy.

In order to be covered for COVID-19-related trip cancellation, you must purchase Cancel for Any Reason insurance (CFAR). Note that the coverage can be expensive, it will not cover all of your trip costs, and many companies do not offer the coverage.

If having this coverage is important, you’ll want to select a travel insurance company that offers CFAR insurance and/or offers coverage for trip cancellation, trip interruption, and medical care should you contract the COVID-19 virus.

Bottom Line: Travel insurance does not cover voluntary trip cancellations due to the fear of getting ill. In order to have coverage for voluntary cancellations, you must purchase Cancel for Any Reason insurance. Not all companies sell this CFAR insurance, it does not cover all your trip costs, and it can be expensive.

When you select a travel insurance company, you’ll first want to make sure it’s financially stable and that it has decent customer reviews. Seven Corners checks those boxes with an A+ rating of the company’s underwriters from the insurance financial rating company A.M. Best , and according to global consumer rating company Trustpilot , 81% of its customers view their experience as good or excellent.

Now that we know Seven Corners is a stable and well-respected company, we’ll next want to check out the company’s policy offerings.

We’ll compare coverages and costs shortly, but 2 critical items we’ve covered so far in this article are 1) the importance of a company offering the option to purchase CFAR insurance and 2) that a policy offers coverage for COVID-19.

If either of these items is important to you, have peace of mind knowing that Seven Corners offers both.

Let’s look closer at the types of policies Seven Corners offers.

Bottom Line: Seven Corners has highly rated underwriters, good customer service ratings, and offers both comprehensive travel insurance package plans and medical travel insurance. In addition, the company offers CFAR add-on insurance and coverage for COVID-19 related expenses.

Type of Policies Available

Seven Corners offers both comprehensive trip insurance policies and travel medical insurance plans. You can expect to find a combination of key coverages offered on each policy.

Let’s look at Seven Corners trip insurance policy options.

Whether you’re a U.S. resident or non-U.S. resident traveling internationally, Seven Corners offers a travel insurance package option that will cover you during your travels.

- Roundtrip Trip Cancellation Insurance — for U.S. residents traveling internationally; select between Roundtrip Economy, Roundtrip Choice, and Roundtrip Elite policy options

- Roundtrip International Trip Insurance — for non-U.S. residents traveling internationally

You’ll find a long list of coverage options on these single-trip comprehensive package travel insurance plans including the following:

- Trip cancellation/interruption/delay coverage

- Missed connection

- Lost, stolen, damaged, or delayed baggage

- Emergency medical, dental, and evacuation/repatriation

- Political evacuation

- Accidental death and dismemberment

- Pre-existing conditions waiver

- 24/7 worldwide assistance services

Optional coverages include car rental insurance, CFAR, cancel for work reasons, lost or damaged ski/golf equipment, and flight accident insurance.

With more focus on medical coverage while traveling and the ability to purchase 1 annual plan for multiple trips, Seven Corners’ Wander policies also provide incidental trip protections such as trip interruption/delay and luggage insurance.

- Wander Frequent Traveler — annual comprehensive medical coverage (not including COVID-19-related illness)

- Wander Frequent Traveler Plus — annual comprehensive medical coverage, including COVID-19-related illness

Hot Tip: Cancel for Any Reason insurance can be added to most Seven Corners Roundtrip package policies to cover up to 75% of non-refundable trip expenses.

Liaison travel medical insurance plans can cover up to 10 travelers, focusing on major medical coverages, and also includes incidental trip cancellation, interruption, delay, and baggage coverage.

- Liaison Travel Basic — designed for travelers traveling outside the U.S.

- Liaison Travel Plus — for those who are traveling outside the U.S., includes coverage for COVID-19

- Liaison Travel Basic U.S. — for non-U.S. visitors traveling to the U.S.

- Liaison Travel Plus U.S. — for non-U.S. visitors traveling to the U.S., includes coverage for COVID-19

Liaison Travel Plus and Travel Plus U.S. policies are recommended if you need a travel medical policy that meets Schengen visa insurance requirements.

Explore North America plans focus on providing major medical coverage while visiting the U.S. but also include a $5,000 trip interruption benefit.

- Explore North America and Explore North America Plus — policies provide coverage for non-U.S. residents who are also non-U.S. citizens who need medical coverage while visiting the U.S., Canada, Mexico, and parts of the Caribbean; the plans can cover trips up to 364 in length

The Explore North America Plus plan includes coverage for COVID-19 related expenses .

- Group Plans — Find coverage for single trips or for extended periods up to 364 days. Whether you’re an individual traveling with a group, need a plan that covers your entire group, or want to cover your entire family, there’s a group plan that will fit your situation. Select a comprehensive travel insurance plan or 1 that focuses on medical coverage.

- Liaison Student Travel Medical Insurance — Liaison Student medical plans are designed for U.S. citizen students traveling abroad, non-U.S. student citizens traveling to the U.S., and non-U.S. citizens traveling outside of the U.S. The plan can also cover faculty, scholars, and their families.

- Liaison Medical Evacuation and Repatriation — This plan is designed for students traveling in the U.S. to meet J visa insurance requirements.

- Visitor Insurance Plans — Complete medical insurance plans are available for inbound non-U.S. citizens traveling to the U.S. Coverage for family members and travel companions is also available.

Bottom Line: Seven Corners offers an expansive collection of comprehensive travel insurance plans and options for stand-alone travel medical insurance coverage. Plans include single trip coverage, annual plans, group coverage, and coverage for students. Whether you’re a U.S. citizen traveling abroad or a foreign national traveling the world, there’s a Seven Corners plan that fits your situation.

Seven Corners provides an easy-to-use website to secure a quote for any of its travel insurance products. Minimal information is needed to receive an immediate quote. The site also provides information that can help educate you on the different types of insurance available.

After submitting your information, you’ll receive an instant quote with the price and list of coverages. Review the coverages, select any desired additional coverage, and the policy is available for immediate purchase.

You’ll find the process of getting a quote and comparing coverages simple and easy to understand. Plus, you’ll be able to secure coverage for your trip immediately.

Bottom Line: Whether you need travel medical insurance or a comprehensive travel insurance policy, Seven Corners’ website makes it easy to secure a quote, review coverages, and purchase a policy with immediate coverage.

The Value of Travel Insurance Comparison Sites

Regardless of the type of insurance you wish to purchase, it’s always prudent to compare policy coverages and costs. This is especially true with travel insurance and travel medical plans as coverage is widely available and costs can vary significantly between companies.

That’s where travel insurance comparison sites can add value. You’ll find each site compares scores of highly-rated companies and dozens of policies, making it easy to compare and select the policy that best meets your needs.

Here are a few we recommend.

- TravelInsurance.com — Compare travel insurance plans that also offer travel medical insurance. No stand-alone travel medical plans are offered.

- Squaremouth — Search for single trip, annual, group, and sports/adventure plans. While travel insurance plans can include medical coverage, there is no option to search for medical-only coverage.

- InsureMyTrip — The site allows you to compare single and multi-trip travel medical policies as well as comprehensive travel insurance plans.

Bottom Line: Travel comparison websites are valuable resources for comparing travel insurance plans. However, not all sites allow you to search for stand-alone travel medical plans.

How Seven Corners Travel Insurance Compares

Purchasing travel medical insurance for a single trip is not an expensive decision, although costs can be much higher as you get older. In the above example, we searched for a quote for a 1-week $3,000 trip to Mexico for a traveler 40 years of age. All plans include COVID-19 coverage and cost $13 to $20. At 70 years of age, the same policy would cost approximately $50 to $90.

Seven Corners offers both competitive coverage and premium costs on travel medical insurance when compared to several other insurance companies. Your experience will vary based on the type of policy, the coverage selected, the age of the travelers, and the length/cost of the trip.

When we look at comprehensive travel insurance policies, Seven Corners, although competitive, had lower limits on medical coverage within the comprehensive travel insurance plans when compared to most other companies. However, higher limits are available via the Seven Corners website.

Many credit cards come with complimentary travel insurance coverages that can provide a benefit if your trip is canceled/interrupted for covered reasons, your luggage becomes damaged, lost, or delayed , or even if you have an accident with your rental car .

It’s possible this coverage could be sufficient for a simple trip that doesn’t include a significant financial outlay. However, the coverage that comes on your credit card will not take the place of a comprehensive travel insurance policy. Plus, it’s rare to find any level of travel medical insurance on a credit card.

There are just a few additional reasons for considering travel insurance over the coverage that comes with your credit card:

- Coverage that comes with your credit card is normally secondary coverage that requires you to first file a claim with any other applicable insurance

- Claims for travel insurance are not handled by the credit card issuer but by a third-party company, making it potentially more complicated to file a claim

- Credit cards do not provide comprehensive travel medical coverage

- Credit card insurance does not cover cancellations due to the fear of getting ill, including the fear of getting the COVID-19 virus

- You are normally required to use the applicable credit card to purchase the trip in order to have coverage

If your trip does not involve a significant investment, you have medical insurance that covers you while traveling outside the country, and you feel comfortable relying on the coverages offered by travel rewards credit cards, here are a few of the best cards to consider:

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Financial Snapshot

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

One of our favorite overall travel rewards cards, the Chase Sapphire Preferred card offers the following travel insurance benefits:

- Trip cancellation, trip interruption, and trip delay

- Primary car rental insurance

- Baggage insurance

- Travel and emergency assistance

- Travel accident insurance

For more information on the Chase Sapphire Preferred’s travel insurance benefits , you’ll want to read this informative article.

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Amex Platinum vs Chase Sapphire Reserve

Examples of travel insurance benefits that come with the Chase Sapphire Reserve card include:

- Trip cancellation, trip interruption, trip delay

- Emergency medical, dental, and evacuation insurance

To review all the travel insurance coverages included with the Sapphire Reserve , you can learn more in our expanded article.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 125k (or 150k) points with the Amex Platinum. The current public offer is 80,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

You can expect to find a nice collection of travel insurance benefits on the Amex Platinum . Note that terms apply and enrollment may be required through your American Express account, so don’t miss out on these benefits.

- Trip cancellation, trip interruption, and trip delay reimbursement

- Secondary car rental insurance with the option to purchase Premium Protection for 1 low fee that covers the entire rental period

- Premium Global Assist Hotline

- Emergency transport and evacuation (included in the Premium Global Assist Hotline benefit)

Bottom Line: The travel insurance coverage that comes with your credit card is not a substitute for a travel insurance package policy or medical coverage. Credit card coverage could be sufficient for a trip that does not involve a significant investment or if your health insurance covers you during your travels. For an overview of the best credit cards for travel insurance coverages , check out our article on the topic.

Here is some additional helpful information regarding purchasing a policy from Seven Corners:

- You have 10 days after you receive your policy documents to review the plan and, if not satisfied, request a full refund

- Some Seven Corners medical plans are secondary and require you to have an underlying health insurance plan that covers you in the U.S. to be eligible

- Not all policies offered by Seven Corners are available in every state

- You can initiate a claim with Seven Corners by calling 800-335-0611 or 317-575-2652 worldwide or via the Seven Corners website

- Seven Corners offers plans that meet Schengen Visa requirements

Seven Corners is a highly rated, established, and respected travel insurance company that offers a wide variety of travel and medical insurance plans for travelers. It is overall competitive and offers both COVID-19 coverage and Cancel for Any Reason insurance.

The company also excels in providing long-term medical coverage for international travelers.

One caution to note is that, as with all travel insurance companies, many of Seven Corners’ plans do not offer COVID-19 related coverage. If this coverage is important to you, be sure to select a policy that includes it and if desired, add CFAR coverage.

Because there are so many variables when it comes to purchasing travel insurance or travel medical insurance, prices and coverages can vary significantly. Be sure to check several sources to find the right coverage at the right cost.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is seven corners travel insurance good.

Yes. Seven Corners receives good reviews and its underlying underwriting companies are rated highly by insurance rating company A.M. Best.

The company, unlike many other travel insurance companies, also provides the option to purchase Cancel for Any Reason insurance and coverage for COVID-19 related events that can disrupt your travels.

How do I make a travel insurance claim with Seven Corners?

You can call 800-335-0611 or 317-575-2652 worldwide. You can also initiate and track your claim via the Seven Corners website .

Does Seven Corners' policies meet Schengen Visa requirements?

Yes. You will find several medical insurance plans offered by Seven Corners that meet Schengen Visa requirements.

Does Seven Corners cover COVID-19?

Yes. Several of Seven Corners’ policies offer the option to include coverage for COVID-19 and some include this coverage. You can also cover cancellations of any type by adding CFAR coverage, available on many of Seven Corners’ policies.

Does Seven Corners cover evacuation?

Yes. There is coverage for evacuation on Seven Corners travel medical insurance policies. The level of coverage will depend on the policy and the level of coverage chosen.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Agent Information

Seven corners travel medical insurance.

Designed for travelers abroad and offers medical insurance when traveling outside your home country.

Get Started

Do you live in the United States?

Insurance benefits may vary by state. Select your state of residence to view the benefits and services provided by the travel protection plan available for your state.

Are you traveling to the USA?

Would you like enhanced coverage to protect your trip after you leave your home country?

Why should I consider international travel medical insurance?

When you’re traveling far from home, international travel medical insurance offers medical benefits, medical evacuation coverage, and non-insurance-related travel assistance.

Travel medical insurance can help you:

Pay for eligible medical expenses.

Cover expenses for trip Interruption.

Protect your baggage.

Seven Corners Assist,* our international travel assistance service, can:

Provide 24/7 non-insurance multilingual assistance to help you find appropriate medical care near you.

Arrange and pay for emergency medical transportation and evacuation to the nearest medical facility that can provide adequate treatment.

Provide access to the Seven Corners' international network of medical providers.

*These services are not provided by Crum & Forster, SPC.

FAQs about International Travel Medical Insurance

Why should i choose seven corners travel medical insurance, does the health insurance i already have cover international travel.

Not all domestic health insurance plans will follow you outside your home country.

- Travel medical insurance provides additional coverage beyond what your domestic health insurance typically covers. The domestic health insurance you already have may be limited and apply only to an emergency.

- Some health providers overseas may require payment before treating medical emergencies. Your domestic health insurance might not provide the necessary payment prior to treatment overseas.

- Domestic health insurance does not typically include travel assistance services or medical evacuation. According to the U.S. Department of State, “although some health insurance companies pay 'customary and reasonable' hospital costs abroad, very few pay for your medical evacuation back to the United States.” Travel medical insurance can provide travel assistance and medical evacuation if the facility where you are located is unable to provide the level of care needed for your medical condition that likely is not covered by domestic insurance.

If I’m healthy, do I need travel medical insurance?

Accidents happen, regardless of whether you're healthy. Seven Corners Travel Medical Insurance can help with many different situations that occur while traveling such as:

- Car accidents

- Boat accidents

- Slip and fall injuries

- Altitude sickness

- Food poisoning

- Contagious diseases (COVID-19, malaria, yellow fever, typhoid, measles, Zika)*

Many countries have national health care. If I get sick abroad, am I covered?

Many countries with national health care have strict requirements that must be met before you can use the benefits. Check with the country’s health plan to find out if you qualify for coverage

What countries require travel medical insurance?

Some countries require proof of international medical insurance for entry or for extended visits. Check with your destination’s embassy to find out if medical insurance is required.

You also may be required to obtain travel medical insurance to be issued a visa. For example, Schengen visas require insurance with a specific plan maximum and benefits for repatriation for medical reasons. Again, check with your destination’s embassy to find out what travel and health documentation is required for international travel.

Does travel medical insurance include coverage for COVID?

Most Seven Corners Travel Medical plans includecoverage for treatment if you become sick with COVID while traveling internationally. Review your plan document or talk with one of our licensed agents to learn more about our coverage and how it works.

Product Specific FAQs

Here are real life examples of evacuation and repatriation services provided by seven corners assist to help our customers..

How We Helped Alysan Get Back Home from Ghana

Alysan was studying abroad in Ghana and contracted Malaria during her trip. Here's how we helped her get back home safely.

Felipe and Daniel were traveling South East Asia for a few months

Felipe became very ill, and Seven Corners Assist evacuated him from Myanmar to Thailand, so he could receive appropriate medical care.

Makenzie's Travel Story

What happens if you are traveling alone and become sick? Learn how Seven Corners Assist arranged for Makenzie’s mom to travel to her bedside when she became sick while traveling abroad.

Seven Corners Travel Insurance

Travel Insurance You Can Trust

Benefits on this web page are described on a general basis only. There are certain restrictions, exclusions and limitations that apply to all insurance coverages under the Plans, including an exclusion for pre-existing conditions. Full coverage terms and details, including insurance limitations and exclusions, are contained in the Plan Document. Plan benefits, limits and provisions may or may not be available in all states or may vary based on state of residence. If there is any difference between this website and your plan document, the provisions of the plan document will prevail. Benefits and plan costs are subject to change.

The travel protection plans consist of Insurance Benefits and Non-Insurance Travel Assistance Services. Individuals looking to obtain additional information regarding the features and pricing of each travel plan component, please contact Seven Corners.

RESIDENTS OF COLORADO, MARYLAND, NEW YORK, WASHINGTON, AND SOUTH DAKOTA Insurance Benefits are Underwritten by: United States Fire Insurance Company, 5 Christopher Way, 2nd Floor, Eatontown, NJ 07724 under Policy Form Series T7000 et.al., T210 et. al. and TP-401 et. al.

Non-Insurance Travel Assistance Services: These are not insurance benefits underwritten by United States Fire Insurance Company. The 24-hour non-insurance assistance services are provided by Seven Corners, Inc.

Plan Administrator: Claims are administered by Seven Corners, Inc.

Important information from the United States Fire Insurance Company

NON-U.S. RESIDENTS AND RESIDENTS OF ALL REMAINING STATES AND WASHINGTON, D.C. Insurance Benefits are underwritten by Certain Underwriters at Lloyd’s, London or Crum & Forster SPC.

Non-Insurance Travel Assistance Services: These are not insurance benefits. The 24-hour non-insurance assistance services are provided by Seven Corners, Inc.

Limitations, exclusions and disclaimers from Crum & Forster, SPC.

303 Congressional Blvd.

Carmel, Indiana 46032

Our Markets

- Consumer Insurance

- Government Solutions

- Trip Protection

- Trip Protection Annual Multi-Trip

- Trip Protection USA

- Travel Medical

- Travel Medical Annual Multi-Trip

- Travel Medical USA Visitor

- Mission & NGO

- Medical Evacuation and Repatriation

- Partnerships

- 24 Hour Urgent Travel Assistance

- Frequently Asked Questions

- Developer Portal

- System Status

Copyright © 2024 Seven Corners Inc. All rights reserved.

Privacy | Cookies | Terms of Use | Security

Seven Corners Travel Insurance Review, Explained [2024]

![liaison travel plus seven corners Seven Corners Travel Insurance Review, Explained [2024]](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0eb390368888f_Seven%20Corners%20travel%20insurance.jpg)

Travel insurance is becoming a must-have when traveling, but how do you know which one to get? You came across Seven Corners Travel Insurance, but you're unsure if they're legit. How are their services, and what do they cover? Keep reading to find out all you'll need to know about Seven Corners' travel insurance policies and whether they're worth buying.

If you're planning to travel, especially abroad, it's best practice to purchase travel insurance before you go. Travel insurances can help cover your losses in the event, such as misplaced/lost luggage, documents, or trip interruption, occurs. Additional travel insurances also cover road-trip driver and vehicle coverages, medical insurance, and more.

But how do you know which one's the best for you specifically? We've previously covered sites like InsureMyTripthat allow you to compare travel insurance. We've also covered large travel insurance providers like the World Nomads or SafetyWing .

Today, we'll review another popular travel insurance provider that you might've come across in your search for the best travel insurance: Seven Corners Travel Insurance.

What is Seven Corners?

Seven Corners Travel Insurance is a United States-based insurance provider covering trip and medical insurance for both US and non-US citizens. They have all kinds of plans for all types of travelers.

It doesn't matter if you're a student, a digital nomad, or someone who travels casually—they've got all the best and most flexible plans for you.

Who owns Seven Corners?

Seven Corners was founded by Jim Krampen and Justin Tysdal in 1993. It was initially called Specialty Risk International. It began as a traveling insurance company with a small team offering medical expense plans. Seven Corners is now a leading travel insurance company that provides thousands of members worldwide.

Seven Corners Travel Insurance Plans

Seven Corners offers a wide array of travel insurance for US travelers both on domestic and international trips. They also provide medical, student travel, annual travel, and group travel insurance. The following are the current insurance plans covered by Seven Corners:

Seven Corners' RoundTrip Basic plan

A travel insurance plan option that provides almost complete travel insurance coverage. It includes trip cancellation, interruption, emergency medical expenses, and medical evacuation insurance. It also offers coverage for lost luggage, baggage delays, and similar cases.

Seven Corners' RoundTrip Choice plan

The choice plan includes all the basic plan coverage and more. This plan adds $100,000 coverage for trip cancellation and $500,000 for emergency medical expenses. It also includes up to $1,000,000 for medical evacuation and other benefits.

Seven Corner Insurance Medical Only Plans

For travelers who don't need trip cancellation and interruption protection, Seven Corners has medical travel insurance plans for you:

- Liaison Travel Basic

- Liaison Travel Choice

- Liaison Travel Elite

- Liaison Travel Plus

All of the plans provide varying degrees of coverage, with the Elite Plan offering the highest limits. The Plus plan includes specific Covid-19 medical coverage and $500,000 for emergency medical evacuation. Seven Corners releases new insurance plans regularly, so check their website for plans that best suit you and your budget.

How much does Seven Corner Travel Insurance Plans cost?

Travel insurance cost varies depending on the insurance plan, age of travelers, and trip cost. Most of their travel insurance prices range from around $200 - $600 for trip costs that average around $5000 - $7000.

Why We Like Seven Corner Travel Insurance

Good coverage.

Seven corners have one of the best medical and travel coverage limits compared to other cheap travel insurance providers. They have insurance for traveling almost everywhere around the globe. Their plans are unique, and you won't find some on any other travel insurance provider.

Cancel for Any Reason (CFAR)

CFAR allows customers to cancel their travel insurance for any reason, no questions asked. The knowledge that Seven Corner can return a portion of their investment upon cancellation gives customers peace of mind when purchasing travel insurance.

24/7 Travel Assistance

Seven Corners travel insurance also comes with 24/7 travel assistance. They can assist you and answer questions about hotel and flight bookings, visa information, embassy contact, lost passport, etc.

What Is Not Covered?

There are some exclusions to Seven Corners insurance plans, and you should be aware of them before purchasing one of their plans.

Here are examples of common exclusions on Seven Corners plans:

- Physical examination

- Dental care

- High-risk activities (check to see if they're listed in your coverage)

- Intentional self-harm, intoxication, or criminal activity.

- Private air travel

- Special disasters, epidemics (covid-19 is covered in some plans), and war.

While some features are covered in their plans, knowing what's included and excluded from your plans is good. Make sure to double-check what your specific travel insurance package includes before you make the purchase!

What's Seven Corner's Covid-19 Policy?

The pandemic has significantly changed international travel. Seven Corner's travel insurance plans are designed to protect travelers in this new normal.

Their international medical insurance covers COVID-19, and other illnesses and injuries travelers can suffer while traveling abroad.

Seven Corners Covid travel insurance can cover as much as $100,000 worth of medical expenses for COVID-19 and other possible variations or mutations of SARS-CoV-2.

They also cover $500,000 worth of emergency medical evacuation and repatriation to transport sick travelers to a medical facility with appropriate care.

Which Seven Corners Insurance Plan Is Right For You?

Choosing the right plan can help you make the most out of your finances while traveling. Our advice is to choose based on your financial capacity and current insurance plans.

For example, suppose you're a premium travel credit card holder with existing coverage for trip cancellations. In that case, you should choose their standalone emergency medical policies.

However, if you want more coverage on top of the credit card's coverage, you're better off with their RoundTrip plan. If you're a frequent traveler, who makes a lot of trips each year, you'll want to opt for their Annual plans.

Is Seven Corner Travel Insurance Worth It?

As a travel insurance company specializing in medical coverage, Seven Corners does a good job and might be one of the best in the industry.

It's undoubtedly one of the top for delivering medical tourism protection plans to protect travelers from the high cost of medical care overseas. Another great feature of Seven Corners is that it covers all age brackets and individuals in the US — it even includes students, seniors, visitors, and recent immigrants in the US.

Our Rating: 4.3/5

- Covid insurance for travel

- Cancel for any reason upgrade

- Comprehensive pricing plan

- 24/7 customer service

- Delay for weather coverage

- No 'cancel for work reasons' available

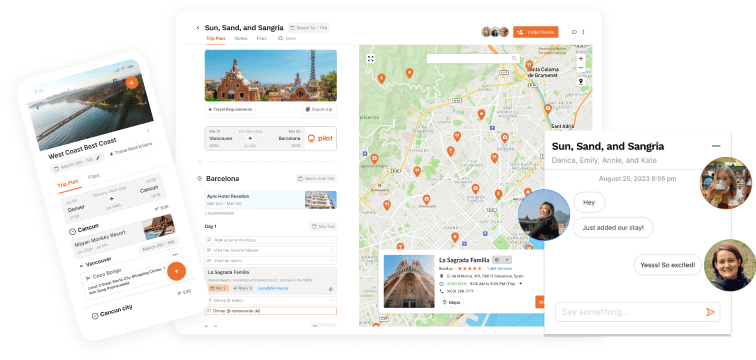

Plan Your Trip With Pilot

Creating a travel plan is a great way to stay organized and potentially avoid predictable accidents from happening during your trip. Most importantly, you can have fun planning your trip as well. Try out Pilot!

Disclosure : Pilot is supported by our community. We may earn a small commission fee with affiliate links on our website. All reviews and recommendations are independent and do not reflect the official view of Pilot.

Satisfy your wanderlust

Get Pilot. The travel planner that takes fun and convenience to a whole other level. Try it out yourself.

Trending Travel Stories

Discover new places and be inspired by stories from our traveller community.

Related Travel Guides

World Nomads Review: Should you get their travel insurance?

![liaison travel plus seven corners SafetyWing Insurance Review [2024]: Whoa. Didn't expect this...](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0eb5669688508_safetywing%20logo%202.jpg)

SafetyWing Insurance Review [2024]: Whoa. Didn't expect this...

![liaison travel plus seven corners InsureMyTrip Review [2024]: Legit travel insurance service?](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0eb63aa6887dc_insuremytrip%20logo.jpeg)

InsureMyTrip Review [2024]: Legit travel insurance service?

Make the most of every trip.

You won’t want to plan trips any other way!

The trip planner that puts everything in one place, making planning your trip easier, quicker, and more fun.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

Travel Medical Insurance Plans

- Annual Travel Insurance

- Visitors Insurance

Top 10 Travel Insurance Companies

- Evacuation Insurance Plans

- Trip Cancellation Insurance

- International Life Insurance

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Student Health Insurance

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

- Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

Travel Advice and Tips

- Best Travel Insurance for Seniors

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

Seven Corners Insurance

Travel Insurance from Seven Corners

Seven Corners is one of the most experienced travel medical insurance, trip insurance, and international specialty benefit management companies. They are a premier “managing general underwriter,” performing all facets of the global business. Since 1993, they have provided protection and professional assistance services to hundreds of thousands of international travelers.

The company has built a proprietary network of doctors and hospitals throughout the world. Seven Corners evaluates each medical provider, enabling them to direct their clients to the most appropriate care worldwide.

Seven Corners has specialized in international travel insurance for over 20 years. They offer a variety of plans perfect for short and long-term international trips that provide flexible limits and a choice of deductibles. Their specialized plans are available for travelers, visitors, students & faculty, seniors, and outdoor enthusiasts.

Seven Corners Insurance - Plan Options

Seven Corners travel insurance plans include travel medical and trip protection plans for international travelers. Their plans offer flexible limits and your choice of deductible. Plans are well-suited for families, students, seniors, missionaries, and business travelers.

Seven Corners Travel Medical Insurance

If you're planning to travel abroad and want extensive medical coverage, including for COVID-19, the Seven Corners Travel Medical Insurance plan is an excellent option.

Covers Emergency Medical Care Abroad!

Travel Delay & Trip Interruption

Acute Onset of Pre-Existing Conditions

Medical Evacuation

Telehealth Consultations

Dental Emergency

Plan details

General Restrictions:

- Non-U.S. citizens are eligible to purchase a Seven Corners Travel Medical Insurance plan excluding or including coverage in the U.S.

- U.S. citizens are eligible to purchase a Seven Corners Travel Medical Insurance plan excluding coverage in the U.S.

Age Restrictions:

- Travelers must be at least 14 days to be eligible for a plan

- Travelers 65 to 80 years and older have limited medical maximum and deductible options

Geographic Restrictions:

- U.S. State Restrictions -Seven Corners cannot accept a residence address in Maryland, Washington, New York, South Dakota, or Colorado.

- Country Restrictions -Seven Corners cannot accept a residence address in Cuba, the Democratic People's Republic of Korea (North Korea), Gambia, Ghana, the Islamic Republic of Iran, Nigeria, the Russian Federation, Sierra Leone, the Syrian Arab Republic, Ukraine, or the United States Virgin Islands.

- Destination Restrictions -Seven Corners cannot cover trips to Antarctica, Cuba, the Democratic People's Republic of Korea (North Korea), the Islamic Republic of Iran, the Russian Federation, the Syrian Arab Republic, or Ukraine.

Where can I travel with a Seven Corners Travel Medical plan?

You are covered in every country, except for your home country. US citizens are not eligible for coverage in the US or any of its territories. The Seven Corners Travel Medical plan offers two areas of coverage, worldwide including and excluding the US.

Does Seven Corners Travel Insurance cover pre-existing conditions?

Seven Corners Travel Medical Plus plans cover pre-existing conditions through a benefit called Acute Onset of Pre-existing Conditions.

What is an acute onset of a pre-existing condition?

It is a sudden and unexpected outbreak or recurrence of a pre-existing condition:

- That occurs spontaneously and without advanced warning either in the form of physician recommendations or symptoms and requires urgent care;

- That occurs while you are covered, after the 72-hour (3-day) waiting period, and

- For which treatment is obtained within 24 hours of the sudden and unexpected outbreak or recurrence.

A pre-existing condition is not an acute onset of a pre-existing condition if:

- The condition is chronic, congenital, or gradually becomes worse over time; or

- If, during the 30 days prior to the acute event, you had a change in prescription or treatment for a diagnosis related to the underlying pre-existing condition.

Coverage ends on the earlier of:

- The condition no longer being acute; or

- Your discharge from the hospital.

There is no coverage for known, scheduled, required, or expected medical care, drugs, or treatments existent or necessary prior to departure from your home country and before your coverage begins.

There is no coverage for treatment for which you have traveled or conditions for which travel was undertaken after your physician limited or restricted travel.

Related: International Insurance and pre-existing conditions

How many days does Seven Corners trip insurance cover?

A policy may be purchased at any time prior to your trip start date. You may purchase travel medical coverage for a minimum of 5 days or a maximum of 364 days.

If you initially buy less than 364 days of coverage, you may buy additional days of cover, to a total of 364 days. Your original effective date is used to calculate your deductible and coinsurance and to determine pre-existing conditions and if maximum coverage amounts have been reached.

You will be emailed you an extension (renewal) notice before your coverage expires, giving you the option to extend your plan. A $5 administrative fee is charged for each extension.

Effective Date — This is the start date of your plan, on the latest of the following:

- 12 a.m. the day after we receive your application and correct payment;

- The moment you depart your home country;

- 12 a.m. on the date you request.

Expiration Date — This is the date your coverage ends, which is the earliest of the following:

- The moment you return to your home (except for coverage through Incidental Trips to Home Country and Extension of Benefits in Home Country);

- 11:59 p.m. on the date you reach the maximum period of coverage;

- 11:59 p.m. on the date shown on your ID card;

- 11:59 p.m. on the date that is the end of the period for which you paid; or

- The moment you are no longer eligible for coverage.

All times above refer to United States Eastern Time.

Who can buy a Seven Corners Travel Insurance plan?

You must be 19 years of age to purchase a plan. You can buy coverage for your legal spouse, dependents under the age of 19, and your traveling companions.

All travelers must be at least 14 days old and under 75 years old. Coverage is available to all international travelers for a period of 5 days to as long as one year.

U.S. citizens cannot purchase a travel medical plan including the U.S.

With Seven Corners, when does my coverage expire?

Your coverage expires the moment you return home from your destination country.

Can I extend my Seven Corners travel insurance coverage?

If you purchased coverage for less than 364 days, you may buy additional coverage that amounts to a total of 364 days.

How does Seven Corners meet the Schengen Visa requirements?

Travelers with a European destination should choose a $0 deductible in order to meet minimum requirements to receive a Schengen Visa. If you are 65 years old or older, you will not meet the minimum requirements to receive a Schengen Visa with this plan.

Travel Medical Insurance Excluding the U.S.

Travel Medical Insurance Including the U.S.

Ready to Buy?

Get a free quote and apply for the Seven Corners Travel Medical Insurance plan now!

Seven Corners Trip Protection Basic & Choice

When it comes to your dream trip, there can be many unexpected disruptions. However, the Seven Corners Trip Protection Insurance plan for U.S. residents can make dealing with these disruptions much easier. Additionally, it offers an optional Cancel for Any Reason coverage to expand your protection.

Insure the Cost of Your Trip

Protection for Your Belongings

Optional Cancel For Any Reason Coverage

Medical Emergency

24/7 Travel Assistance

Show details

- Only U.S. citizens and legal U.S. residents are eligible for a Seven Corners Trip Protection Basic or Choice plan.

- Travelers up to the age of 99 years are eligible.

- U.S. State Restrictions - Seven Corners Trip Protection Basic and Choice are not available for purchase in Missouri, New York, Pennsylvania, or Washington.

- Destination Country Restrictions - Seven Corners Trip Protection Basic and Choice are not available to those traveling to Antarctica, Belarus, Cuba, the Democratic People’s Republic of Korea (North Korea), the Islamic Republic of Iran, the Russian Federation, or the Syrian Arab Republic.

How much trip protection should I purchase?

Seven Corners recommends that you purchase enough trip protection insurance to cover all of your non-refundable trip costs. Be sure to include any extra excursions you pay for separately that are not a part of your trip itinerary.

Can I change details regarding my trip?

Yes. Email Seven Corners at [email protected] and explain the details you need to change. Travelers frequently need to change trip dates, trip costs, destinations, and personal information, such as a change of home address.

How do I cancel my Seven Corners Trip Protection plan?

To cancel your Seven Corner Trip Protection plan, log in to Seven Corners at https://www.sevencorners.com/login or email them at [email protected] within the first 14 days of your plan purchase date to receive a full refund. Include your certificate number, your first and last name, and your date of birth in the email. Please allow seven days for Seven Corners to process your refund request.

What is the effective date for my Seven Corners Trip Protection plan?

The effective date is the day after you buy your plan.

For Seven Corners Trip Protection Basic and Choice plans, it begins at 12:01 a.m. on the day after Seven Corners receives your plan payment.

Who can purchase a Seven Corners Trip Protection plan?

Residents of the United States who are traveling inside the U.S. or abroad may purchase a Seven Corners Trip Protection Basic or Choice plan.

Can I insure people who are not family members?

Yes, you can insure traveling companions who are not directly related to you.

What type of medical expenses does a Seven Corners Trip Protection plan cover?

Seven Corners will cover medical expenses that occur during your trip, such as treatment for a sickness or injury, emergency dental treatment, and emergency medical evacuation or repatriation. COVID-19 medical expenses are also covered.

How do I file a claim?

When paying for your trip, save all documents that Seven Corners gives to you. You will need this information to process any claim. Please follow the steps on the Seven Corners "File a Claim" page on their website to file your claim.

Trip Protection Basic

Trip Protection Choice

Seven Corners Travel Medical Annual Multi-Trip

If you travel abroad often, you need the convenience of an annual travel insurance plan that covers multiple trips. You must ensure the plan provides comprehensive medical coverage, including COVID-19 expenses.

Protection for Multiple Trips during a Year

Trip Length Options: 30, 45, or 60 day trips

Adventure Activities

- Each traveler listed on the policy must maintain continuous medical insurance that provides coverage in their home country.

- U.S. citizens, including those with dual citizenship, and Green Card or Permanent Resident cardholders, cannot purchase this plan for travel to the U.S. and its territories.

- Travelers must be at least 14 days old and younger than 76 years to purchase this plan.

- U.S. State Restrictions - Seven Corners cannot accept an address in Maryland, New York, South Dakota, or Colorado.

- Country Restrictions - Seven Corners cannot accept an address in Cuba, the Democratic People's Republic of Korea (North Korea), Gambia, Ghana, the Islamic Republic of Iran, Nigeria, the Russian Federation, Sierra Leone, the Syrian Arab Republic, Ukraine, or the United States Virgin Islands.

- Destination Restrictions - Seven Corners cannot cover trips to Antarctica, Cuba, the Democratic People's Republic of Korea (North Korea), the Islamic Republic of Iran, the Russian Federation, Ukraine, and the Syrian Arab Republic.

How many trips can I take with this plan?

Seven Corners allows policyholders to take as many covered trips as they want. Travelers are covered when traveling outside their home country on a covered trip for the trip length option they selected.

Trip length options include 30, 45, or 60-day trips.

What is a covered trip?

A covered trip is a period of travel outside your home country with defined departure and return dates. Coverage begins on the day you leave your home country and ends when you return to your home country.

When does my Seven Corners Travel Medical Annual Multi-Trip coverage begin?

Your coverage begins on your start date, which is the later of the following times: