SCHEDULED SERVER MAINTENANCE 4/24-4/27 : GovOS is undergoing scheduled server maintenance and will be unavailable during this time.

Please enter your email address and password to log in.

New user? Register here!

Okaloosa's 'most important issue' in 30 years: Expand bed tax? Voting starts Wednesday

SHALIMAR — On Wednesday, more than 100,000 eligible voters in Okaloosa County will begin receiving mailed ballots that will ask them whether they want the county tourist development tax district to be expanded countywide.

They’ll be asked to return their ballots on the referendum question by 7 p.m. Oct. 5. With approval from a majority of voters in the proposed expansion area, the county would start charging and collecting the tourist development tax, or “ bed tax ,” in the expansion area on March 1, 2022.

More: Bed tax battle: Okaloosa County, cities seek to resolve tax district expansion concerns

More beach: A major expansion of the Shore at Crystal Beach Park in Destin is expected

The referendum is going forward after numerous meetings in recent weeks at which local officials hashed out various concerns about the possible countywide district.

Addressing worries of the city of Destin, often deemed “the goose that laid the golden egg” because it generates the most bed tax dollars, was a top priority of the meetings.

If voters approve the countywide district, that goose and many of its neighbors are expected to become better fed.

What would the tax expansion mean for Okaloosa?

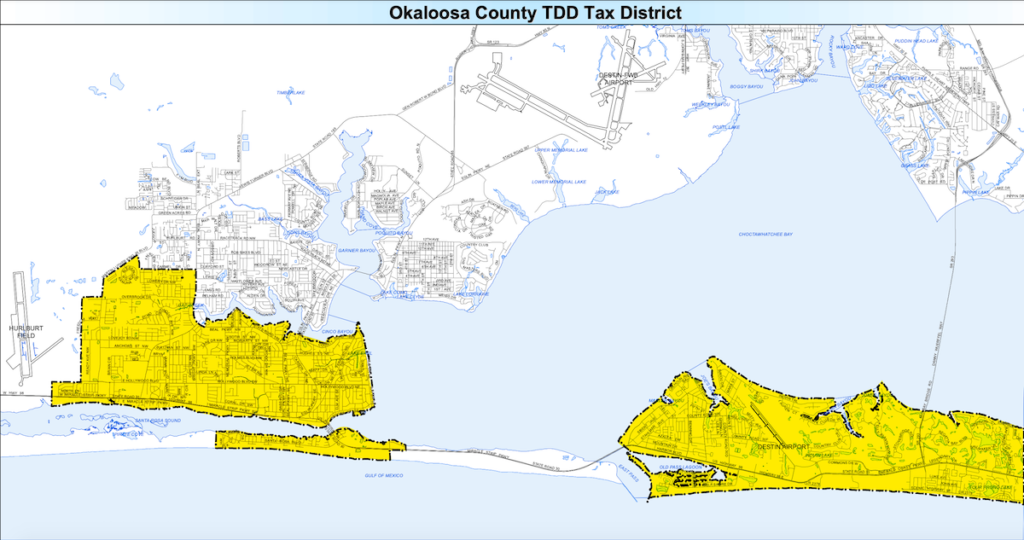

The bed tax district was approved in 1989 and encompasses Destin, Cinco Bayou and most of Fort Walton Beach and Mary Esther, as well as unincorporated areas adjacent to Destin and Fort Walton Beach, such as Okaloosa Island.

Expenses of the county Tourist Development Council are funded by the 5% bed tax paid by people staying overnight at lodging facilities in the district.

Revenue from the tax can be used only in the district. In recent years, it has generated from $18 million to more than $23 million per year, which mostly has been used to promote the area to tourists and to fund beach safety and beach improvements.

Whether to expand the bed tax district countywide is arguably “the most important issue to come before the county in the last 30 years,” Destin City Councilman Dewey Destin said in July.

With voters’ approval, Niceville, Valparaiso, Crestview, Shalimar, Laurel Hill, the rest of Fort Walton Beach and Mary Esther and more unincorporated areas all would join the district.

About 117,000 voters from those areas are eligible to vote on the district-expansion question.

If the district becomes a countywide one, a 4% bed tax would be charged in the expansion area until March 1, 2025, when an additional 1% would be added to equal the 5% that already is charged in the existing district.

The potential expansion area, which has almost 3,000 lodging units, could generate an annual total of $2 million to $3 million in additional bed tax revenue, according to updated estimates provided Thursday from Deputy County Administrator of Operations Craig Coffey.

Among other issues emphasized in recent months, Destin officials have focused on the need to ensure equitable bed tax funding allocations and tmaintain fair representation on the TDC. They also have urged the county to use a local bed tax collection method instead of partnering with the state Department of Revenue (DOR).

While the DOR currently collects bed tax revenue at no charge to the county, the state department does not track from which lodging establishments the revenue is generated. The last time county staff members tracked local collections, in 2017, they found that Destin had produced more than 60% of that year’s total bed tax revenue.

If voters approve the countywide bed tax district, the county would switch to having the county Clerk of Court collect bed tax dollars rather than continuing to use the DOR.

The Clerk of Court also would be asked to track where the revenue comes from.

“We don’t have final numbers yet” on the cost of using the in-house method, Coffey said. “It could be close to $500,000 per year.”

In addition to learning where the revenue is generated, the use of the local collection method should allow the county to receive data on where the tourists are coming from. That information will help with the Tourist Development Department’s marketing efforts, Coffey said.

How will bed tax revenue be allocated?

If the countywide bed tax district becomes a reality, the county’s nine municipalities could, per an agreement that continues to be finalized, share a 12.5% “carve-out” allocation of the total annual bed tax revenue.

That agreement could lead to Destin receiving the lion’s share, or 48.5%, of the 12.5% allocation.

For example, if the county collects $24.5 million in bed tax revenue in a certain year, $3.1 million of that would be shared among the municipalities. In that scenario, Destin would receive a little more than $1.5 million.

The next in line would be Fort Walton Beach, which could receive 18% of the carve-out, followed by smaller amounts given to Crestview, Niceville and the remaining municipalities.

The county has agreed to provide the overall 12.5% allocation for 20 years, Coffey said.

He said projects and other items that the various municipalities would like to be funded with their respective allocations would need the County Commission’s final approval but would receive “less scrutiny that we’d normally give” to bed tax-funded items.

“We would still have to follow state statutes (on the uses of bed tax revenue) but the various jurisdictions would determine what’s most important to them from a tourism prospective,” Coffey said.

At Tuesday’s commission meeting, Crestview City Manager Tim Bolduc thanked county leaders for working with the municipalities on various bed tax district expansion issues, including the 12.5% allocation.

At a special meeting Wednesday, the municipalities came to terms on the allocation, including how the funding would be shared and other issues, Destin Mayor Gary Jarvis said.

“From day one, I’ve always supported Crestview and the north part of the county being part of the district,” Jarvis said Thursday. “Our main concern was maintaining fair representation on the TDC and being treated fairly by the county. I think that everyone in the end will be treated fairly. (A countywide district) will benefit the entire county, not just certain segments of it, and that’s always a good thing.”

How Okaloosa County, FL Maximizes $30M+ in Tourist Tax Revenue with GovOS

Located in the northwestern region of Florida, Okaloosa County, plays host to millions of visitors annually, reporting a record 7.5 million visitors in 2021 alone. The area’s allure extends beyond its white sand beaches—to museums, parks, and rivers—all of which contribute to an enduring tourism industry. The increasing numbers of visitors benefit the local economy—most notably, in the form of substantial tax revenue.

Playing a central role in the management of tourist-related taxes is the Okaloosa County Clerk of the Circuit Court and Comptroller’s Office . This team is responsible for the county’s treasury and surplus funds as well as the collection, enforcement, and audit of the Tourist Development Tax (TDT).

The local Tourist Development Department relies heavily on TDT revenue for investing in programs that benefit those visiting, living, and working in the county. Beyond supporting ongoing tourism efforts, the department is responsible for multiple initiatives, including allocating funds for beach lifeguards, protecting the natural environment through marine life conservation efforts, and managing beach restoration projects.

For the county, accurate enforcement and collection of TDT, especially in the face of rising tourism, can mean the difference of millions of dollars—and consequently, the extent to which various county initiatives can be funded. Part of the team working to ensure accuracy in collections is Joshua Allen, Okaloosa County’s Board Services Director, who recognized early on the importance of having the right software in place.

Okaloosa County, FL

Joshua Allen Board Services Director

GovOS Solutions

Business Licensing, Short-Term Rental, Tax Filing

Agency Type

Project launched, 2023 customer results.

98% of transactions paid online

Okaloosa County’s 6% TDT, collected on all short-term rental (STR) income, amounts to more than $30 million annually that is collected and distributed by the County Clerk of the Circuit Court and Comptroller’s Office. Although the team already had an online STR and tax solution in place prior to 2022, the software vendor was not meeting their needs.

“The system we had was not user-friendly,” explained Allen. “We had a lot of customer complaints about the number of clicks it required to process a transaction.” The county needed a solution that could not only manage tax collections efficiently but also improve the taxpayer experience.

Another missing component was the ability to report on their data. The office was tasked with providing detailed reports, but the time required to create these reports amounted to hours. They needed a system that would enable them to easily collect, sort, and present data about TDT funds. For JD Peacock, Okaloosa County’s Clerk of Circuit Court and Comptroller, this was fundamental.

“We were looking for a software provider that would partner with us to deliver a view of the data that shows where tourist taxes were being collected, what the impacts were, where we needed to make management decisions, and how the Tourist Development Department applies those dollars towards supporting the county’s tourism infrastructure. We realized there is a lot of data, but we needed a better way of using it to make decisions, see trends, and perform analyses.”

The Solution

On an accelerated schedule to replace their previous vendor and system, the county began exploring companies that could deliver a solution to meet all their compliance, tax system, and reporting requirements. After meeting with GovOS to outline their needs, the county officially went live with the GovOS STR compliance, registration, and tax collection solutions in September 2022.

“One of the things that sets GovOS apart from other vendors is the customer service,” said Allen. “We were in a situation where we needed to implement new software quickly, and GovOS stepped up to get us the product we needed in a short amount of time. Alongside their customer service team is a product team that’s there for you, not just to implement their solution, but to find solutions that work for you.”

Following implementation, the team took to the system quickly, using it to issue notifications to their tax customers, help identify non-compliant STR properties, and leverage the system’s extensive reporting capabilities.

The Results

Revenue increases.

Currently, the county has less than half a percent of delinquent accounts remaining, and 98% of all TDT transactions are paid online. Using the GovOS system, Okaloosa County collected more than $76,500 in penalties and interest in fiscal year 2023 and reported a $1 million increase in TDT funds distributed to municipalities compared to the previous year.

What is the impact of a more than $1 million increase in funds? In 2023, the Tourist Development Department completed numerous objectives, including deploying artificial reefs for marine life, furthering waterfront park development, and finalizing an economic impact study for the Destin Fort‐Walton Beach Convention Center.

Time Savings

All in all, the county has 1,600 registered tax customers, up from 1,400, which represents a 14% increase. With the GovOS support team providing direct assistance to citizens and the business community that file taxes with the agency, the County Clerk of the Circuit Court and Comptroller’s Office has been able to dedicate more staff time to other important aspects of their work.

Falin Ivy Board Services Agent

Faster Reporting

For Okaloosa County, ensuring they had visibility into the data and the speed at which that data could be organized into usable reports was a primary focus. “Having access to our data is everything,” said Allen. “Before GovOS, I would spend, at minimum, half a day preparing the reports I needed for the industry and the county. With GovOS, I run two or three reports, and it takes me about five to ten minutes to pull what I need.”

Since implementation, the county has continued its momentum, delivering services that simplify processes for the community and for their office. For JD Peacock, the result has been positive feedback. “We get compliments from different parts of the community about how well our reports provide the data to make informed decisions, understand trends, provide transparency in how we use tax revenue, and share how the funds support our local tourism infrastructure.”

Want to learn more about what GovOS has to offer?

Success Stories

Learn how govos helps governments like yours deploy powerful digital transaction experiences..

How Rutherford County, TN is Taking Proactive Steps to Monitor Short-Term Rentals

Learn how the county is working to identify short-term rentals and communicate with property owners in response to state legislation.

How Calhoun County, MI Reduced their Marriage Application Processing Time by More Than 50%

As part of the county’s ongoing efforts to automate and streamline processes for citizens and staff, the clerk and registrar’s office recently launched the GovOS Remote Marriage application.

From Filing Cabinet to Frontline: How Franklin County, OH Created a High-Speed Document Processing System

Watch this video to learn how the largest recorder’s office in Ohio uses technology to facilitate the efficient recording of deeds, mortgages, liens, and other documents.

How the Tourist Development Council works as it relates to Okaloosa Tourism

- Jared Williams

- September 24, 2021

- No Comments

The Tourist Development Council often gets confused with the Tourist Development Department . You’ll hear people refer to the TDC when really they mean the TDD. It’s an easy mistake but the role of each acronym is vastly different.

The TDC is made up of volunteers from the tourist industry, as well as elected officials. The TDD is made up of county employees. The current makeup of the Council includes:

- 3 elected officials, including one county commissioner

- 3 lodging partners

- 3 hospitality business owners and operators

🗣 If the proposed bed-tax expansion election passes, the makeup of the TDC will slightly change.

The terms are 4 years for sitting on the TDC , and members have to be living and working in the tourism industry within the bed-tax district.

- Like any council seat , members fill out an application and go through a vetting process.

- The Board of County Commissioners then have the final say on approval.

“We want to have a good mix,” said Ken Wampler, Chairman of the TDC . “We can’t slant it one way or the other too far, because it’s all about what’s best for the community, or the bed-tax district, in this case.”

As a body , the Tourist Development Council makes recommendations to the Okaloosa Board of County Commissioners. According to Wampler, in order to make valid recommendations to the BOCC, you need to have tourism related people on the TDC, and there’s currently six.

- “The Tourist Development Tax is collected by lodging partners and obviously the lodging partners have a vested interest on how are you spending the money that we’re collecting for the county,” said Wampler. “But at the end of the day, the county has to ensure that the money is being spent the proper way.”

🚨 It’s important to note that they are a recommending board. The BOCC has the final say.

Wampler says that Florida statute dictates where you can spend money, and how you can spend money, for the funds that are generated through the bed-tax.

“Truly, I feel this, and I have for the last four years , no one is out to figure out how can I get a piece of that nickel because we’re regulated on what we can spend the money on,” explained Wampler. “And obviously the county is the last say on that.”

As for the bed-tax, Wampler says it’s collected to basically do three things…

“In my opinion, it’s to promote tourism in the area, maintain tourism related facilities, as well as add-to tourism related facilities ,” said Wampler.

The last two items are what Wampler feels the general public and the citizens of Okaloosa County benefit from the most.

- “ The local citizenry benefits from all the things that we do relative to creating a reason why someone would want to come here on vacation and ultimately hopefully move here. And that happens all the time.”

- Wampler explains that if the County decided to expand a park, as an example , it wouldn’t be just for tourists. It would be open to the public as well.

As for spending the current bed-taxing district funds throughout the county, that can’t happen at the moment. The funds can only be spent in the areas in which it was collected. This includes the promotional aspect.

- According to Wampler, back in the late 1980s , the lodging partners got together with the County Commissioners and the municipalities to collect additional funds from the tourists to help maintain and build up the attractions within the bed-tax district.

- This is the current bed-tax district that we have today. Basically everything south of the Bay.

“Clearly, areas like Crestview, Niceville, Baker, and north Fort Walton Beach have tourism,” continued Wampler. “Tourists that go to-and-from in those areas, as well has tourism-related parks and attractions.”

- The TDC cannot make recommendations for those areas because they are outside of the district.

Residents outside of the current taxing district can expect ballots to arrive in mailboxes now, and vote on the countywide expansion.

- Laurel Hill

- Parts of Fort Walton Beach

The ballot has to be returned to the Supervisor of Elections by October 5th.

- Ballots can be returned via mail, or delivered in-person.

- There are instructions on the ballot when you receive it in the mail.

For more info on the upcoming election, head to MyOkaloosa.com .

Join the conversation... Cancel reply

Continue reading 👇, join our newsletter.

Join the best local newsletter read by thousands of locals each weekday morning. Best of all, it’s free!

Community Comments

Here’s how Florida’s tourist tax, big for Rays and beaches, works

B udget season for local governments is around the corner, and with it the usual talk of property values and the tax bills local homeowners can expect to face.

But in Pinellas County, over the next few months, the pot of money that may get the most talk outside government chambers is one that most residents don’t supply: the tax dollars generated by visitors staying at hotels, motels and other short-term rentals, such as Airbnbs.

Pinellas has put those dollars toward the emergency restoration of its beaches after last year’s storms, and it could eventually use them to pay for large-scale beach renourishment to keep the tourists and locals visiting. And it’s the fund that county commissioners will consider when they vote on whether to commit more than $300 million to a new Tampa Bay Rays stadium in St. Petersburg.

Counties collect an array of taxes. Ad valorem taxes — the ones people and businesses pay based on value of property they own — cover much of Pinellas’ operating costs, paying most salaries and for many services. A lmost all counties in Florida have their own sales taxes on top of the 6% sales tax the state collects; in Pinellas, it’s a 1% tax on goods and services purchased. The so-called the Penny for Pinellas is used to build roads and bridges, maintain and improve parks, and support construction of affordable housing.

And for nearly 50 years, Pinellas has collected a local option tourist development tax, commonly called a bed tax or tourist tax. Florida began letting counties tax overnight stays in 1977, and the next year, Pinellas was among the earliest counties to take advantage of the new law.

“The hoteliers and the folks in the industry said, ‘Hey, we could impose this on ourselves, essentially, and with the collection of these funds we can then market the destination as a whole,’” said Brian Lowack, the president and CEO of Visit St. Pete/Clearwater, the county’s tourism bureau. “The better we are at doing that, the more visitation we have, the more tourist development tax is collected, and the more impact we have on our local economy.”

Today, Pinellas is one of 11 counties to impose a 6% surcharge on short-term living and sleeping accommodations, the most allowed by state law. In the 2023 fiscal year, the county collected $98 million , its most money ever from the tax . The post-pandemic years have marked a major boon for the county bed tax: Just a few years earlier, in 2017, the county pulled in $54 million in its first year with the 6% tax.

The county, in turn, has money to spend: According to this year’s budget, the county entered this fiscal year with more than $220 million in tourist tax reserves, a gain of $50 million over the previous year. About $110 million of that can be used on capital projects such as new construction.

That money can’t be used to pay cops, build new libraries or widen roads. It’s limited by state law to a narrower range of tourism-oriented uses, including marketing and capital projects that attract visitors, and further focused by a tourism plan approved by county commissioners.

In Pinellas, 60% of those taxes go to marketing and advertising, including Visit St. Pete/Clearwater, which is fully funded by the tax. The other 40% goes to building things: Tropicana Field, the Dalí Museum in St. Petersburg, the softball fields at the Eddie C. Moore Complex in Clearwater, Ruth Eckerd Hall and the Clearwater Marine Aquarium have all involved bed taxes.

Visit St. Pete/Clearwater hasn’t taken applications for capital funding since before the pandemic, Lowack said, so money for capital projects has been building in reserves. But two such projects could soon dominate future spending.

One is the renourishment of Pinellas’ beaches, which are the cornerstones of the local tourism economy but are badly eroded. For decades, the U.S. Army Corps of Engineers pumped fresh sand onto the county’s beaches every few years, and the federal government covered about two-thirds of the cost. Pinellas paid for its share using a piece of the bed tax.

Now a change in policy interpretation at the Army Corps is requiring that 100% of beachfront property owners grant permanent public access to land they own within the project area. Previously the Army Corps only required temporary access while the work was happening. Only about half the property owners in the largest project area, Sand Key , have been willing to give access. That has resulted in a years-long standoff that has put renourishment on hold.

Last year, county officials said Pinellas would likely be able to pay for renourishment on its own through bed tax dollars, at a cost of nearly a half-billion dollars over the next 40 years. If projections hold, officials said then, Pinellas still may bring in enough money to pay for other large projects, but Lowack said recently that it’s critical for the county to solve the beaches issue first.

“Until we get some closure on this issue with the Corps,” he said, “I think other things take a back seat.”

County commissioners, though, may soon have to make a call on the other big project, a new ballpark for the Rays. Though no vote has yet been set for commissioners or for the St. Petersburg City Council, there are meetings planned in May for City Council members to discuss the terms that city, county and team officials have been hammering out behind the scenes for months.

Under the broad terms unveiled last fall, the city and county would each pay for about a quarter of the $1.3 billion stadium project. While the city will face complex decisions on how to fund its portion, the county’s is relatively straightforward: if it funds the stadium, it’ll be through tourist taxes. (Pinellas would not pay its whole $312.5 million portion at once, but details about how it would finance it haven’t been publicly discussed.)

Commissioners wary of subsidizing a private sports enterprise, such as Brian Scott, have signaled that using bed tax dollars makes the idea more appealing — especially in concert with the planned redevelopment around the stadium, which would eventually turn now-unused publicly owned land into tax-generating homes and businesses. It’s also an easier sell to their constituents, who wouldn’t be footing the bill for the stadium.

When it comes to residents and tourists, Lowack said he knows there’s some friction. Many locals may not realize that visitors’ spending supports the beaches, ballparks and museums they love.

“I was in the dentist’s chair, for example, and she said, ‘What are we going to do about all these tourists?’” Lowack said. “And I said, ‘Well, we’re going to get more to come here.’”

©2024 Tampa Bay Times. Visit tampabay.com. Distributed by Tribune Content Agency, LLC.

- Business Tax Receipts

- Motor Vehicles

- Hunting and Fishing

- Drivers License & ID Cards

- Vessel Registration

- Real Estate Taxes

- Concealed Weapon License

- Public Records

- Tag Art Gallery

- All Downloads

- Help Center

- About Ben Anderson

- OCTC Budget

- Tax Collector Calendar

- Employment Opportunities

- Florida Taxpayer Bill of Rights

- Customer Survey

- Privacy Policy

- Employee Login

- Skip to primary navigation

- Skip to secondary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Official Site - Serving You

Tourist Development Qualification

- Make Online Appointments Learn More

- Concealed Weapon License Learn More

- Military Registration Learn More

- Tag Art Gallery Learn More

Tell Us More About Your Property

Is rented 6 MONTHS OR LESS Is rented for a period of OVER 6 MONTHS (must have a bone fide lease available) IS NOT RENTED

- Drivers License Check

- State Forms Online

- Okaloosa County Website

- Property Appraiser Real Estate Tax Estimator

Helpful Links

- Make Online Appointments

- Military Registration

Office Locations

Okaloosa County Tax Collector 1250 N. Eglin Parkway, Suite 101 Shalimar, FL, 32579 (850) 651-7300

- Community News

- Entertainment

- Photo Galleries

- Special Sections

TDC recommends raising tourist tax

BRADENTON – A visit to Manatee County could soon cost tourists more, as the Manatee County Tourist Development Council (TDC) voted unanimously to recommend raising the county’s tourism tax from 5% to 6% at its April 15 meeting.

The TDC makes recommendations to the Manatee County Commission, which is scheduled to vote on whether or not to approve the increase at its Tuesday, April 23 meeting.

The tourist tax is often referred to as the “bed tax” because it is paid when anyone rents a short-term vacation rental in the county, such as hotel rooms, resort rooms, condo rentals, VRBO, Airbnb and similar accommodations, for a period of six months or less.

“This is not a resident tax,” Bradenton Area Convention and Visitors Bureau Executive Director Elliott Falcione said. “This is paid for by the visitors that come in to our beautiful county. I’ve always told the media that there’s no better partnership than one that pays for an asset that appeals to a visitor and benefits the residents at no cost to the residents.”

Falcione explained that the money benefits both visitors and residents by offering maintenance, upgrades and marketing for several attractions, including:

- Coquina Beach;

- Bridge Street Pier and Anna Maria City Pier;

- Grassy Point;

- Anna Maria Bayfront Park;

- Beach renourishment (1% of the current 5%);

- Myakka History Center;

- Bradenton Area Convention Center;

- Bishop Museum;

- Manatee Performing Arts Center;

- Premier Sports Campus;

- The Sarasota-Bradenton International Airport (SRQ); and

- Gulf Islands Ferry (water taxi).

The tax also partially funds renourishment of Anna Maria Island’s beaches.

Falcione said the TDC does not plan to request more marketing dollars if county commissioners approve the 6% request, which would generate an estimated $6 million a year.

“You’re looking at a guy who doesn’t get too excited about breaking tourism records every year, because we have to be careful,” Falcione said. “I’m the weird tourism director around the state that is a less is more kind of guy. Our brand elements are low-rise, low-key detox environment; real authentic Florida. We don’t want bumper-to-bumper traffic in this beautiful community. The reality is that for 90 days a year, we’re dealing with bumper-to-bumper traffic.”

Falcione says the TDC will not spend money to promote the area during the busy spring season. He did say the TDC will invest in airline incentives so more visitors will choose SRQ and save the time involved in driving to and from airports in Tampa and St. Petersburg.

In order for the county to request the additional 1%, it had to reach a threshold of $30 million in tourism taxes collected, which was achieved in 2023 by a narrow margin of about $90,000, and the tourism industry had to generate over $600 million, which was also achieved in 2023, with the total topping $625 million. If the commission approves the recommendation, it will take effect Aug. 1. The neighboring counties of Sarasota, Hillsborough and Pinellas are all at the 6% maximum tourist tax.

Most Popular

Locals join hands to fight big government, state seeks contempt ruling in net camp case, sea turtle nesting season begins, responses filed in negligence suit.

- Manatee County Commission

- Manatee County Tourist Development Council

- tourism budget

- tourism tax

More from Author

Artists’ guild features patterson, bradenton man arrested for allegedly selling cocaine, ami chamber awards scholarships.

- Ad Products

- Anna Maria Island

- Anna Maria Island Chamber of Commerce

- Bradenton Beach

- Castles in the Sand

- Center of Anna Maria Island

- Coast Lines

- Environment

- Field hockey

- Fun in the Sun

- Guest column

- Holmes Beach

- Hurricane Guide

- Letter to the Editor

- Local Guides

- Longboat Key

- Manatee County

- Natives in Bloom

- Nesting News

- Parks and nature

- Personal Development

- Personal finance

- Photo galleries

- Political cartoon

- Postcards from The Sun

- Real estate | Development

- Red tide report

- Restaurants | Bars

- Sea turtles

- Sean Murphy

- Skateboarding

Commissioners address consolidation

Get to know suncoast aqua ventures, adult soccer league gets shaky start, prepare for hurricane season, reimagining pine avenue bid higher than expected, commission receives proposed charter amendments, city to grandfather existing cbd, hemp sales.

© Longboard Communications 2024

IMAGES

COMMENTS

Joshua Allen, Board Services Director Tourist Development Taxes Okaloosa County, Florida 101 East James Lee Blvd. Crestview, FL 32536 850-651-7200, ext 3490 Office Hours: Mon - Fri 8:30am to 4:30pm CST TouristTax@OkaloosaClerk.

The original tourism district collected a 5% Tourist Tax from overnight guests and included the cities of Destin, Fort Walton Beach, Okaloosa Island, Mary Esther and Cinco Bayou. Eligible voters approved in 2021, the County to expand to a county-wide tourism development district. The previously created "sub-district" will collect and remit 6%.

Okaloosa County Ordinance 21-22, the local ordinance created the Tourist Development Council, established the tax rate collection, and identifies the taxing district within Okaloosa County and authorizes the Clerk of the Circuit Court to locally administer the tourist development tax (effective February 1, 202 for rentals in January 2022).

Okaloosa County Tax Collector 1250 N. Eglin Parkway, Suite 101 Shalimar, FL, 32579 (850) 651-7300

Please enter your email address and password to log in. Email Address: Password:

Tax Information Publication TIP No: 21A01-12 Date Issued: November 9, 2021 Report Okaloosa County Tourist Development Tax to the Okaloosa County Clerk of Court Beginning January 1, 2022 Beginning January 1, 2022, the Okaloosa County tourist development tax collected on or after

The Okaloosa Board of County Commissioners has approved a special election for the consideration of a countywide expansion of the Tourist Development Taxing District. The mail-in ballots must be returned by October 5, 2021. Eligible voters will have the opportunity to elect whether the Tourist Development Tax, currently charged to overnight ...

Okaloosa County Clerk of Court and Comptroller % (+/-) % (+/-) 2020-2021: FY 2021: October $ 1,309,682.33 $ 1,209,246.44 $ ... Okaloosa County Tourist Development Tax Page 1 FY 2022 Expanded District 4% FY 2022. Historical TDT Collections and Percentage Current District 5%

Okaloosa County's tourist development tax or "bed tax" district will become a countywide one early next year. In the county's mail-in referendum that ended Tuesday night, more than 65% of ...

Pay the Okaloosa County Tourist Development Tax - This tax is applicable to all guests who rent for six (6) months or less. The tourist development tax is currently a tax in addition to the total rental amount received from any person who rents, leases, or lets for consideration any living quarter or sleeping or housekeeping accommodation.

According to Okaloosa County, 60 of the 67 counties in Florida implement tourism bed taxes. Of the 60 counties implementing tourism bed taxes, 56 do so countywide. ️ In the Panhandle, Okaloosa and Bay county don't collect taxes countywide.; By Florida law, the area outside of the existing Tourist Development Taxing District is the area that gets to vote on the expansion.

On Tuesday, February 28, 2023, the Okaloosa Tourist Development Council approved a request to allocate up to $1,710,000 from 6th penny tourist development taxes towards Year Two projects pursuant to the Okaloosa County 5-Year Artificial Reef Plan . According to Coastal Resource Manager Alex Fogg, these artificial reef initiatives have supported ...

The Okaloosa Board of County Commissioners has approved the expenditure plans submitted by local municipalities for their allocation of 12.5% of collected tourist development taxes for fiscal year 2024.. This funding comes from an agreement made in March 2022 that provides cities and towns across the county a share of bed tax revenue to support local tourism infrastructure projects.

County Commission Office Locations: 302 N. Wilson St. - Suite 302 Crestview, FL 32536 1250 N. Eglin Parkway, Suite 100 Shalimar, FL 32579. Call 850-689-5050 or 850-423-1542 for all departments.

0:03. 0:21. CRESTVIEW — On Tuesday, the Okaloosa County Board of County Commissioners approved local municipalities' plans to spend their shares of a portion of the county's tourist development ...

Shall the area subject to the Okaloosa County Tourist Development Tax be expanded to include all of the areas of Okaloosa County, including the municipalities, and with the funds to be collected through the tax on short term rental of lodgings or accommodations to be used as set forth in the adopted Okaloosa County Tourist Development Plan.

0:04. 0:21. SHALIMAR — On Wednesday, more than 100,000 eligible voters in Okaloosa County will begin receiving mailed ballots that will ask them whether they want the county tourist development ...

The Need. Okaloosa County's 6% TDT, collected on all short-term rental (STR) income, amounts to more than $30 million annually that is collected and distributed by the County Clerk of the Circuit Court and Comptroller's Office. Although the team already had an online STR and tax solution in place prior to 2022, the software vendor was not ...

As a body, the Tourist Development Council makes recommendations to the Okaloosa Board of County Commissioners. According to Wampler, in order to make valid recommendations to the BOCC, you need to have tourism related people on the TDC, and there's currently six. "The Tourist Development Tax is collected by lodging partners and obviously ...

Okaloosa County Tax Collector 1250 N. Eglin Parkway, Suite 101 Shalimar, FL, 32579 (850) 651-7300

The post-pandemic years have marked a major boon for the county bed tax: Just a few years earlier, in 2017, the county pulled in $54 million in its first year with the 6% tax. The county, in turn ...

property tax roll opens; consumer alert: florida homeowner assistance fund; kids tag art program delivers smiles and funds to okaloosa county schools; tax collector agents to contact delinquent businesses; okaloosa county property owners save millions

BRADENTON - A visit to Manatee County could soon cost tourists more, as the Manatee County Tourist Development Council (TDC) voted unanimously to recommend raising the county's tourism tax from 5% to 6% at its April 15 meeting. The TDC makes recommendations to the Manatee County Commission, which is scheduled to vote on whether or not to ...

In 2023, the Manatee County Tax Collector took in more than $30 million in tourism taxes. In addition, Manatee County's tourism industry generated more than $625.9 million in direct revenues.

Tourist Development Tax About the Tourist Development Tax Tourist Development Tax FAQ's Tourist Development Tax Reports ... Date: April 15, 2024. File: Okaloosa-County-Clerk-of-Courts_Leadership_April-2024-1.pdf Okaloosa County Courthouse 101 East James Lee Blvd. Crestview, FL 32536 (850) 689-5000 Office Hours: Mon - Fri 8:30am to 4:30pm ...