Destinations

Travellers' Ages

Compare domestic, worldwide travel insurance quotes in NZ

No matter where in the world you may be travelling, it goes without saying that travel insurance is a must. With so many unpredictable things that could occur during your travels, travel insurance is the best way to ensure both you and your belongings are protected if the worst were to happen.

Travel insurance in NZ provides cover for your trips both overseas and domestically, and covers things such as medical expenses, trip cancellation, lost luggage and more.

When it comes to finding cheap travel insurance in NZ, you’ve come to the right place! Here at glimp, we’re passionate about helping Kiwis find the best travel insurance plans for their travels. Whether you’re flying across the country, or to the other side of the world, we’ll help you save time and money on your travel insurance. Compare travel insurance in NZ now and you’ll be able to find the perfect policy in no time.

Travel insurance providers

When searching for the right cover for your travels, you’ll probably be wondering “who are the best travel insurance companies?’ Luckily, you don’t have to spend hours online searching through dozens of travel insurance companies trying to find the best ones; we have them all here at glimp!

We’ve gathered all of New Zealand’s leading travel insurance companies together, including Southern Cross travel insurance, AA travel insurance and AMI travel insurance, making it easy for you to find the right insurer for your travel needs.

How does our travel comparison work?

Here at glimp, we’re committed to helping you find the best travel insurance online to suit your needs! Using our travel insurance comparison tool will help you save time, energy and, most importantly, money! Cheap travel insurance NZ can be hard to come by, but with glimp it’ll be a piece of cake.

Quick and easy to use

It’s never been easier to compare travel insurance quotes in New Zealand - simply enter a few details about your upcoming trip and we’ll deliver the latest insurance policies from New Zealand’s leading travel insurance companies. We’ve already helped thousands of Kiwis have already save on their travel insurance - now it’s your turn!

Find your best deal, free of charge

When it comes to the best travel insurance, it’s all about giving you great value for your money. Our vetted travel insurance policies cover all sorts of unprecedented costs at different values so that you can find the best travel insurance policy that suits your needs. Not to mention, our tool is 100% free to use too!

Buy direct and save more

Buying travel insurance from travel agents and airlines can mean that you’re paying extra for any commission fees. When you compare travel insurance with glimp, we’ll give you the best options and take you directly to your chosen travel insurance provider. Avoid paying those extra commission fees and buy directly from your insurance provider when you compare travel insurance with glimp!

Start saving on your travel insurance premium

Travel insurance comparison in NZ has never been easier. Spare a few minutes and start comparing travel insurance policies now to start saving on your travel insurance premium for your next trip. We help people like you save on their travel insurance policy every day, now it’s your turn.

Why compare travel insurance with glimp?

We save you time & money.

Easily compare travel insurance quotes in NZ. Find the best travel insurance in minutes.

A great place to compare travel insurance

Best comparison site in NZ. Thousands of Kiwis have trusted us with their decisions.

Compare travel insurance for free

glimp is 100% free! Whether you want to compare travel insurance quotes or sign up , you pay nothing.

They talk about us

Mentioned by various news outlets, such as stuff , nzherald , Solarcity, Truenet, nbr and many more.

What does travel insurance cover?

Cancellation cover.

You never know when you might need to cancel a flight and when that happens, your chosen airline can charge you a hefty fee for doing so or will not return your deposit. Standard travel insurance policies often cover this cost so that you can cancel your flight right up to the day of the flight at no cost at all. This applies to flight delays too.

Luggage & belongings

With so many bags constantly being lugged around, there are bound to be a few bags here and there that end up in the wrong place and it’s often out of your control. If you have travel insurance in NZ, your insurer will cover the purchase of a few essentials, meaning you won’t have to bear the brunt of the loss of your GoPro, laptop, camera and whatever else you may have lost.

Medical treatment

When you compare travel insurance policies in NZ, you may notice that most policies offer medical and dental cover. This may be just something simple like drugs for a cold or allergy while you’re overseas, or it could be something a little more complicated like surgery. Some policies may even pay for someone to escort you back home if you’re feeling really unwell.

Car rental excess

If you’ve rented a car while you’re overseas and it gets stolen or damaged then your travel insurance policy may be able to help you out, by providing cover for the excess you’ll need to pay for when you make a claim.

Personal liability

In the event that you accidentally damage property or are liable for damage to a person, your travel insurance provider may provide cover to pay the costs including legal fees to defend your claim and legal costs if you’re wrongly arrested or detained. While we hope it would never come to this, it doesn’t hurt to have the assurance that you would be covered if you were liable for something. Even the cheapest travel insurance policies in NZ usually provides cover for this.

Travel Insurance FAQ

What does travel insurance usually cover.

Although it will depend on your chosen insurance provider and policy type, a typical travel insurance plan will have coverage for all of a travelers main concerns. Standard travel insurance will generally cover you for trip cancellations, travel delays, medical emergencies, lost luggage and personal liability.

Most travel insurance policies are designed to be comprehensive, to protect you from a variety of situations and events that may cause financial loss. However, there are optional extras that can be added onto your policy, such as dental, adventure activities and rental car cover.

Should I get travel insurance?

While travel and adventure is always encouraged, the reality is that even the most well planned trips can go amiss. Nobody wants to prepare for the worst, but it’s absolutely vital to do so - and that’s why you should get travel insurance. Investing in travel insurance cover allows you to safeguard your trip, providing you with peace of mind and letting you get on with your holiday.

When should you buy travel insurance?

It goes without saying, that the best time to buy travel insurance in NZ is before you embark on your travels. However, the time you get travel insurance before that matters too. Ideally, you should book travel insurance within 15 days of trip purchase so that you have enough time to cancel the insurance if need be, and you won’t have any external events affecting the premium.

How do I file a claim for travel insurance?

While this may differ between different travel insurance companies, to claim for travel insurance you generally need to fill out an online claims form which you can find on your travel insurer’s website. You’ll then need to send supporting documents to confirm that it’s you filing the claim, and your insurer will start working on it!

Is there travel insurance for seniors in New Zealand?

Travelling can be the highlight of anyone’s year no matter where you’re venturing and we believe that age is no barrier to this. That’s why we can show you affordable travel insurance in NZ for seniors from insurers such as Southern Cross Travel Insurance, 1Cover and more that will insure you on your travels even if you’re older than 85.

What our broadband customers are saying:

"Very pleased i found your service and found it such a help in finding the ideal broadband that suits my needs. Thank you very much and may you prosper on."

"Was really impressed with the level of service and assistance I received. Was quick and easy and I was provided with a recommendation for the best plan and option for me."

"Everyone should try Glimp before they switch electricity or internet providers, the comparisons are accurate and up to date. The website also has a filter so you can narrow down your choices to what you want. Highly recommended!"

"We've used Glimp recently to search for a better broadband provider and have took advantage of the credit bonus offered by signing up the service through Glimp and got an excellent deal. Just wanted to thank you for providing this to us and hope that your site will keep up the good work!"

"Moving into a new house up in Whangarei so was curious about what the best internet and power deals are available at the new location. Glimp was easy to use and got 2 great deals with service providers."

"Glimp is a very good provider of info of service providers. It really helped me make an informed decision when looking to switch my power provider. The whole process is quick and seamless."

"Very fast and clear. I could select options according to what I needed to see the best deals. I'm really happy with the deal we got. Thanks Glimp."

"Such an easy to use comparison website, gives you all the important basic information you need to get the best broadband or power plan for your particular situation. Glimp helped me make the best choice in power company. Great website."

"Didn't know it existed until it was exactly what I needed and there it was! Took all of the stress out of finding the best deal to suit our needs."

"I haven't had in home internet service since early October. As an international student I didn't really know where to go for service. Glimp made it really easy for me to find a plan that suited my needs. Without leaving the house!"

"I thought your website was great - we've been undecided about what internet options to choose for around 18 months. 5 minutes on your website and we're now sorted - finally!

"I found Glimp really user friendly with lots of fantastic deals and companies to choose from. It made it easy for me to find the best package and price to suit us. Thanks Glimp : )"

"I found glimp really useful when deciding which ISP to sign up with. Because of the clear comparison charts provided by glimp, we were able to choose the best company with the best deal and service for us. I highly recommend glimp to anyone who wants an easy way to compare internet service providers before making a decision on which to sign up with."

"I found the glimp team great, have switched to fast fibre and everything seems to be working well. Thanks again for the ease in doing that."

"Your service was very useful to me as it allowed me to compare the different options and to make an informed decision about which Broadband and phone service would be the most useful (and cost-effective) for me. I was also grateful for your personal attention and response to questions."

"I found glimp to be very helpful and look forward to the power company comparison."

"I used Glimp to compare & find the best broadband provider to meet my needs. I like to 'shop around' & get the best deal. Unlike some of the other services that offered to do this Glimp was by far the most comprehensive, accurate, up to date, & easy to use. I was able to make a decision & Glimp saved me a lot of time."

"Choosing an Internet provider is a fiddly decision that effects you long term. Glimp made that decision easier, so yeah, I love it"

"We found glimp a great way to sort out internet provider offers. It meant we could compare the offers at one site. Roll on power and gas provider analysis."

"Great to tell anyone who find it hard to choose the right ISP providers in NZ. While I was searching for a change of ISP, glimp.co.nz solves my problem. Thank you glimp for providing valuable information."

"This site was awesome. So easy to use and made the process of which provider to go with so easy. Thanks"

Compare travel insurance policies

Planning an upcoming trip compare travel insurance now.

Thank you for using:

We are now finding you the best travel insurance policies best suited to your needs!

I was a little hesitant to stay on the call when I first picked up but I’m glad I stayed until I did. Josua Legavai was the lovely lady taking care of me. She was so friendly, clear and helpful. She helped me understand everything I needed to and explained everything with great detail. I am still young and learning and have just moved into a new home with my son so I’m grateful she was able to help me today.

Highly recommend Jordan at Glimp, very professional and really good at her job! thank you for the help definitely saved me alot of time ready for our move thank you Jordan A+++++

I'm so happy I asked Glimp for help, to find a service provider that suits our family's budget, without losing quality and unlimited data on both our mobile phones and broadband. Mele Falahola is a Comparison Specialist from Glimp and she was amazing from the beginning. Mele located the right service provider for our needs that will save us money!, fulfil our usage and more! compared to what we were using. My wife and I even asked for a comparison on our electricity bill. Mele responded immediately once she saw our monthly bills and compared it to another provider that not only do not required a contract to stick too (like the mobile and broadband provider Mele recommended) but their price per kWh was so much better! Which is why we changed that also. Thank you Mele and Glimp for your help. We can now look forward to our Christmas holiday in the Cook Islands from what we can now save. :-)

You are using an outdated browser. Please upgrade your browser to improve your experience.

- Travel Insurance

Already with AMI? Take 10% off your travel insurance.*

*Use promo code AMICUST Discount applies to existing AMI customers and to premiums for the standard policies net of Government levies and GST (if applicable). Discounts do not apply to premiums for cover additional to standard policies or to any minimum premium.

Great options to suit your travel within New Zealand or overseas

Overseas cover & annual multi-trip cover

Our overseas travel covers medical, dental and hospital treatment*, lost luggage, and personal liability, and can get you and your family home in certain emergencies.

Travel a lot? Take out our annual multi-trip option and you’re covered for as many trips as you like, for 12 months.**

Find out more

Domestic Cover

If your plans while travelling in New Zealand change unexpectedly, we can cover the cost of cancelling or amending your flight, accommodation or rental car bookings and other expenses, up to $10,000.

Inbound Cover - Visiting NZ

Are you a non-resident visiting friends and family in NZ, or on a working holiday? Our Inbound plan can cover medical and dental expenses, luggage and travel documents, rental vehicle insurance excess, personal liability and more!

Travel Cover During Covid-19

Planning an adventure? Check out our scenario-based FAQs explaining how we could cover you if Covid-19 plays havoc with your trip: AMI Travel Cover and Covid-19 FAQs

Find out before you go – our Covid-19 Benefits Destination Guide explains how AMI Travel cover applies when travelling to different international destinations: Covid-19 Benefits Destination Guide

Still unsure? Ask us a question

Compare our Travel Cover Plans

Every driver’s different, so our car policies come with different features.

Policy benefits

Medical and dental expenses

Additional expenses

Amendment or cancellation costs

Luggage and travel documents

Delayed luggage allowance

Rental vehicle insurance excess

Travel delay

Resumption of journey

Missed connections

Special events

Hospital incidentals

Loss of income

Accidental death

Legal expenses

Personal liability

Get a travel quote now

This is only a summary of benefits provided. Please refer to AMI Travel Policy Wording for full details of the cover provided. Please read the entire document carefully to understand what this policy covers. Importantly, please note that conditions, exclusions, limits and sub-limits apply.

Specific terms, conditions and exclusions apply to Covid-19. See the policy wording for the most up to date information.

* Cover will not exceed 12 months from the onset of the illness or injury. Medical and dental expenses cover is limited to $1,500 for treatment provided in New Zealand. This $1,500 sub-limit does not apply to our Inbound Plan. ^ Cover chosen applies per policy. See the policy wording . • Item limits apply for any one item, set or pair of items including attached or unattached accessories. You may increase these item limits if you wish. See the policy wording . # If you or your travelling companion are diagnosed with Covid-19 by a qualified medical practitioner and are unable to travel, you can claim cancellation or amendment costs for your prepaid trip up to a benefit limit of $10,000 per policy on an international Plan or $5,000 per policy on a Domestic Plan or if applicable, up to the level of cover purchased for cancellation (whichever is lower). There is also no cover if symptoms or diagnosis occurred prior to buying your policy. ~ The maximum liability collectively 14, 15, and 16 is $15,000 International Plan, and $10,000 on a Domestic Plan

This is only a summary of the benefit provided. Please refer to the policy wording . For details of the cover provided. Please read the entire document carefully to understand what the relevant policy covers. Importantly, please note that conditions, exclusions, limits and sub-limits apply, and this summary of benefits table may change at any time.

Before you travel

Travel safety

Find out more information about events that may affect you when you travel.

Travel tips

Our team of intrepid Kiwi travellers has come up with a list of handy travel tips to help make your holiday even better.

AMI Travel insurance is underwritten by Zurich Australian Insurance Limited ("ZAIL") incorporated in Australia, ABN 13 000 296 640, trading as Zurich New Zealand. IAG New Zealand Limited (“IAG”), of which AMI is a business division, is not the insurer. IAG receives a commission for the issue of AMI-branded travel policies arranged through Cover-More (NZ) Limited (“Cover-More”). Cover-More administers the policy and acts on behalf of Zurich New Zealand. IAG does not guarantee Zurich New Zealand or Cover-More.

AMI Travel Website Disclaimer 12072022

Limits, sub-limits, conditions, and exclusions apply. Standard excess may apply.

AMI Travel insurance is administered by Cover-More NZ Ltd, underwritten and issued by Zurich Australian Insurance Limited (ZAIL) incorporated in Australia, ABN 13 000 296 640 , trading as Zurich New Zealand. For further information see Zurich New Zealand's financial strength rating .

Any advice is general advice only. Consider the AMI Travel Policy Brochure and wording therein before deciding to buy this product. IAG receives a commission for the issue of AMI branded travel policies arranged through Cover-More (NZ) Limited ("Cover-More").

IAG New Zealand Limited ("IAG"), of which AMI is a business division, is not the insurer. IAG does not guarantee Zurich New Zealand or Cover-More.

Quick and easy claims We're here for you if something disrupts your trip. Save time and submit your claim online.

Where are you going.

Worldwide including the Americas, the Caribbean and Antarctica: Antarctica (Cruising), Antigua and Barbuda, Argentina, Bahamas, Barbados, Belize, Bermuda, Bolivia, Brazil, Canada, Cayman Islands, Chile, Colombia, Costa Rica, Cuba, Dominica, Dominican Rep, Ecuador, El Salvador, Falkland Islands, French Guiana, Greenland, Grenada, Guadeloupe, Guatemala, Guyana, Haiti, Honduras, Jamaica, Martinique, Mexico, Netherlands Antilles, Nicaragua, Panama, Paraguay, Peru, Puerto Rico, St. Kitts and Nevis, St. Lucia, St. Vincent and Grenadines, Suriname, Trinidad and Tobago, United States of America, Uruguay, Venezuela, Virgin Islands.

Africa, Middle East, Indian Sub-Continent and Asia (other): Afghanistan, Algeria, Angola, Azores, Azerbaijan, Bahrain, Bangladesh, Benin, Bhutan, Botswana, Burkina Faso, Burundi, Cameroon, Canary Islands, Cape Verde, Chad, China, Central African Republic, Comoros, Congo (Dem. Rep), Djibouti, Egypt, Eritrea, Ethiopia, Equatorial Guinea, Gabon, Gambia, Ghana, Guinea, Guinea Bissau, India, Israel, Iran, Iraq, Ivory Coast, Jordan, Kazakhstan, Kenya, Korea (north), Korea (south), Kuwait, Kyrgyzstan, Lebanon, Lesotho, Liberia, Libya, Macau, Madagascar, Mauritius, Mauritania, Mozambique, Maldives, Malawi, Mali, Mongolia, Morocco, Namibia, Nepal, Nigeria, Niger, Oman, Pakistan, Qatar, Reunion, Rwanda, São Tomé and Príncipe, Saudi Arabia, Senegal, Seychelles, Sierra Leone, Somalia, South Africa, South Korea, South Sudan, Sri Lanka, Sudan, Swaziland, Syria, Taiwan, Tajikistan, Tanzania, Togo, Tunisia, Turkey, Turkmenistan, Uganda, United Arab Emirates, Uzbekistan, Yemen, Zambia, Zimbabwe.

Europe: Albania, Andorra, Armenia, Austria, Belarus, Belgium, Bosnia, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Faroe Islands, Finland, France, Georgia, Germany, Gibraltar, Greece, Herzegovina, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Maderia, Malta, Moldova, Monaco, Montenegro, Netherlands, Norway, Poland, Portugal, Romania, Russia, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Ukraine, Vatican City.

UK: Channel Islands, England, Northern Ireland, Scotland, United Kingdom, Wales.

South East Asia, Hong Kong, Japan: Brunei, Cambodia, East Timor, Federated States of Micronesia, Guam, Marshall Islands, Micronesia, Hong Kong, Indonesia, Japan, Kiribati, Laos, Malaysia, Myanmar (Burma), Nauru, Northern Marianas, Palau, Papua New Guinea, Philippines, Singapore, Thailand, Vietnam

South Pacific and Norfolk Island: Cook Islands, Fiji, French Polynesia, New Caledonia, Niue, Norfolk Island, Samoa, Solomon Islands, Tokelau, Tonga, Tuvalu, Vanuatu, Western Samoa.

New Zealand Only: New Zealand domestic travel

New Zealand Inbound Travellers : New Zealand

Dates of Travel

Departure date (travel start date).

Single Trip - The date you depart New Zealand

Cover under the Amendment or Cancellation Costs benefit begins from the time you buy your policy. Cover under all other sections begins from the Travel Start Date you select.

Annual Multi-Trip - The date your policy will commence

Cover under the Amendment or Cancellation Costs benefit begins from the time you buy your policy. For further information, we recommend you read the definition of "Relevant Time" in the Policy Wording.

Return date - (Travel end date)

Single Trip - The date you return to your home

Annual Multi-Trip

Regardless of what you enter as the Return date, you will be quoted for a 12 month Annual Multi-Trip policy.

For further information we recommend that you read the definition of "Relevant Time" in the Policy Wording.

Traveller Details

Age of each traveller at issue date

Simply enter the age of each traveller including children.

Only use as many boxes as you have travellers.

Do all travellers live in New Zealand?

New Zealand resident travellers are able to purchase Travel Insurance policies from us to any area of travel and any country/destination.

Non-New Zealand resident travellers are only able to purchase a Travel Insurance policy if travelling inbound to New Zealand.

For Non-New Zealand resident travellers wanting to purchase Travel Insurance to travel to any other part of the world other than travel to New Zealand, please contact us as we may still be able to offer cover to you.

Top Travel Insurances for New Zealand You Should Know in 2024

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

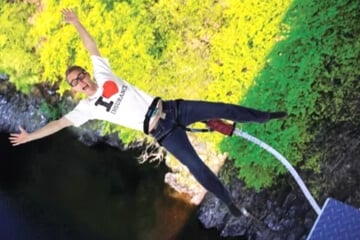

New Zealand is known for its breathtaking landscapes, including glaciers, fjords, and the Southern Alps, as well as its unique Maori history. Visitors also come to experience the adventure activities, such as hiking, skiing, and rafting, and to see the unique wildlife like the Kiwi bird. Although travelling to New Zealand can be an accessible holiday destination for many people, out-the-pocket healthcare costs in the country tend to be expensive, so it's a very good idea to arrive there with travel insurance under your belt.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to New Zealand and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

New Zealand Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for New Zealand:

Best Travel Insurances for New Zealand

- 01. Should I get travel insurance for New Zealand? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to New Zealand scroll down

Heading to New Zealand soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Do I Need Travel Insurance for New Zealand?

No, there's currently no legal requirement to take out travel insurance for travel to or through New Zealand.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to New Zealand or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for New Zealand:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to New Zealand. It lets you choose between various plans tailored to meet the specific needs of your trip to New Zealand, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for New Zealand:

- Policy names: Varies

- Medical coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip coverage: Excellent - but only available for US residents.

- Customer support: FAQ, live chat and phone support

- Pricing range: USD 25 to USD 150 /traveller /month

- Insurance underwriter: Lloyd's, Petersen, and others

- Best for: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer support: FAQ, live chat, phone support

- Pricing range: USD 80 to USD 420 /traveller /month

- Insurance underwriter: David Shield Insurance Company Ltd.

- Best for: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy names: Nomad Insurance, Remote Health

- Medical coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing range: USD 45 to USD 160 /traveller /month

- Insurance underwriter: Tokyo Marine HCC

- Best for: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to New Zealand? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to New Zealand

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for New Zealand. However, we strongly encourage you to do so anyway, because the cost of healthcare in New Zealand can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Quick Links

- Cancel Policy

- Make a claim

Relax, we're with you

Travel safe with new zealand's most trusted travel insurer ^, get a quick travel insurance quote, win your ultimate $10,000 getaway~.

Whether your ultimate getaway is soaking in the Amalfi Coast, or taking on that dream African safari, $10,000 could go a long way in escaping for your ultimate getaway! All you need to do to enter is buy an International Comprehensive or Domestic travel insurance policy between midnight 1 April and midnight 31 May 2024 and you’ll automatically go in the draw.

Find out more

Why choose Southern Cross Travel Insurance?

+ Based upon the total number of travellers trips we have insured across the markets where we operate for all our travel insurance products from January 1995 to October 2023. # Based upon the total number of claims we paid as a proportion of all claims we received across the markets where we operate for all our travel insurance products from 1 January to 31 December 2023.

Manage your policy on the go with my scti.

You can view your policy, make claims and update your details all in one secure portal.

Create a Login

With Kiwi travellers for over 40 years

SCTI is part of the Southern Cross group; one of New Zealand’s most enduring and trusted brands. We’re 100% New Zealand owned, and have worked hard to forge a reputation as our country’s leading travel insurer. During this time, we're extremely proud to be recognised both locally and internationally for our commitment to delivering quality products, value for money and dedication to customer service.

See all our awards

Award-winning service as voted by YOU for 5 years running

We’re proud to win the Reader’s Digest Quality Service Award for the 5th year in a row. Our team is dedicated to providing you with outstanding service throughout every stage of your adventure.

What is travel insurance?

Travelling is all about discovering the unknown, so it’s no surprise that there can be a few hiccups along the way! Travel insurance is designed to better protect you from these unexpected events, from the moment you book your trip to the day you return home. Whether you have an unexpected flight delay or medical emergency, we’re here to help. Let us worry about what could go wrong, so you can start dreaming about what will go right.

How to compare travel insurance

What can travel insurance cover?°

We offer cover for unexpected events, so you can travel with peace of mind. We know each traveller and trip is different - that’s why we offer different policies and add ons so you can choose the type and level of cover you need - which may, or may not, include some of the scenarios below. As with any insurance policy, terms, conditions and exclusions apply so always make sure you read the Policy Document before buying your travel insurance policy to make sure it is right for you.

If you are diagnosed with COVID-19 before you leave, or while on your journey, we offer cover in some scenarios

° Please refer to the individual Policy Documents to see what your chosen policy covers.

See what's covered

We offer travel insurance that suits how you want to travel

We know how important it is to make sure you have the right type - and level - of cover, so we have different travel insurance policies to suit different types of travel, and the ability to personalise your cover to suit you with our optional add-ons. Whether you’re heading to Fiji for some R&R, London for an OE or Queenstown to hit the slopes, we’re with you.

Have questions?

See all our FAQs

What our customers have to say about us

Need some inspiration.

When it comes to travelling, there’s always room for the unexpected to happen, that’s why we provide 24/7 emergency assistance and a simple process to make a claim on our website.

With New Zealand travellers for over 40 years

- Travel Insurance

Canstar’s Best Value Travel Insurance NZ

Posted by Bruce Pitchers November 21, 2023

Holidays promise carefree relaxation away from work pressures and domestic chores. However, plenty of unforeseen events can ruin the best-laid vacation plans, from illness and accidents to the loss or theft of possessions.

If the worst does happen, a dream holiday can turn into a financial nightmare, especially if you’re left facing bills for medical treatments overseas or for life-saving repatriation. This is why ensuring you have adequate insurance cover before you jet off or sail away on your overseas adventure is a travel essential.

But trying to find the best insurance cover can be complicated. There’s no one-size-fits-all solution, as policy details and costs vary, depending on your age and choice of destination. And comparing different levels of cover and costs can be complicated.

But that’s where Canstar can help. As part of our mission to inform Kiwi consumers about the best financial products in the market, each year we analyse a wide range of travel insurance products and award the best providers our prestigious awards and Star Ratings for Outstanding Value Travel Insurance.

What are Canstar’s Travel Insurance Awards & Star Ratings?

Canstar’s Travel Insurance ratings score travel insurance providers and their products, and awards the best our prestigious 5-Star Ratings. Each insurance product is assessed and scored for its price and array of features.

For this year’s Travel Insurance Star Ratings, our expert research panel compared 44 travel insurance products from 18 providers across a range of different age profiles, including seniors. To be eligible for our ratings, each product had to meet certain basic requirements, including cover for:

- $1 million overseas medical and hospital cover per international traveller

- Repatriation and evacuation services

- Luggage and personal effects

- Cancellation fees and loss of deposit

For ease of comparison, the different insurance products are judged across six geographical regions and two cruise types:

- Africa & Middle East

- Tras-Tasman

- Domestic Cruise

- Pacific Cruise

Canstar’s Travel Insurance Awards

On the back of our Star Ratings research, we also award the best travel insurance providers and products our prestigious awards for Outstanding Value.

To be eligible for an Outstanding Value Award, insurance providers have to meet extra policy requirements. These include:

- 24-hour emergency helpline

- Period of cover automatically extends if a medical claim requires traveller to remain overseas for treatment

- $5 million or more family overseas medical and hospital cover

- $5 million or more family cover for repatriation and evacuation services

- Included cover claims arising from cruising holidays in domestic and international waters (cruise only)

- Availability to travellers aged over 70 (senior only)

- Covers cancellation and medical claims arising from COVID-19 related events (domestic cruise only)

Canstar’s Outstanding Value Travel Insurance Award Winners 2023

This year, four providers earn Canstar’s Outstanding Value Travel Insurance Awards, across our four award categories.

Outstanding Value: International Travel Insurance

House of travel, southern cross travel insurance.

Outstanding Value: Trans-Tasman Travel Insurance

Outstanding Value: South Pacific Cruise Travel Insurance

Outstanding Value: Seniors Travel Insurance

This is the second year in a row that AMP has earned an Outstanding Value | Seniors Travel Insurance Award . Our awards panel notes that AMP has achieved its back-to-back awards due to its consistently strong performance across all overseas regions, which is due to its competitive premiums for older travellers and above-average feature scores.

House of Travel once again earns three Outstanding Value Awards, in our International , South Pacific Cruise and Trans-Tasman travel insurance profiles. The insurer’s performance continues to be driven by its competitive pricings, as well as its high levels of cover.

This year, Southern Cross wins two Outstanding Value Awards, in our International and Seniors profiles. Our research panel notes that Southern Cross Travel Insurance performs particularly well in senior profiles due to its competitive premiums for older travellers. However, premium increases across the brand’s cruise insurances did see them miss out on our South Pacific Cruise Award this year.

A newcomer to Canstar’s Travel Insurance Awards, Tower joins our Outstanding Value Awards recipients in the International , South Pacific Cruise and Trans-Tasman profiles this year due to its increased price performance and comprehensive policy offerings.

For the second consecutive year, Worldcare is the only travel insurance provider to earn an Outstanding Value Award across all award profiles.

This is due to Worldcare’s consistently competitive prices and strong range of policy features across all regions and age profiles.

In awarding Worldcare, our research panel noted the insurance brand’s exceptionally strong price performance and levels of cover in both the Trans-Tasman and South Pacific Cruise profiles.

To find out more about the best travel insurance in New Zealand, check out Canstar’s full 2023 travel insurance ratings report.

Compare Travel Insurance with Canstar

About the author of this page

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce has three decades’ experience as a journalist and has worked for major media companies in the UK and Australasia, including ACP, Bauer Media Group, Fairfax, Pacific Magazines, News Corp and TVNZ. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review , the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

Enjoy reading this article?

Sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article

Compare travel insurance.

Compare Outstanding Value Travel Insurance

Compare Travel Insurance By Destination

Outstanding Value Travel Insurance Awards

Can I Use My NZ Driver Licence in Australia?

Wise: the Best Travel Money Card in New Zealand

How to Access Air New Zealand Airport Lounges

Quick Links

- Compare Plans

- GoComprehensive

- Pre-existing Medical Conditions

- Policy Wordings

- About Worldcare Travel Insurance

- Financial Strength Rating

- Emergency Assistance

Travel Insurance

- Afghanistan

- American Samoa

- Antigua and Barbuda

- Asia (Excl Japan and South Korea)

- Asia (Incl Japan and South Korea)

- Baltic States

- Cayman Islands

- Cook Islands

- Cruise Asia

- Cruise Australia and NZ

- Cruise Europe

- Cruise Pacific Islands

- Cruise Worldwide

- Czech Republic

- Dominican Republic

- El Salvador

- Falkland Islands

- Ireland (Northern)

- Ireland (Republic)

- Marshall Islands

- Middle East (Excl. Kuwait and Lebanon)

- Netherlands

- New Caledonia

- New Zealand

- Norfolk Island

- North America

- Northern Mariana Islands

- Pacific Islands

- Papua New Guinea

- Philippines

- Puerto Rico

- Saudi Arabia

- Solomon Islands

- South Africa

- South America

- South Korea

- Switzerland

- Trinidad and Tobago

- Turkmenistan

- United Arab Emirates

- United Kingdom

- United States

- US Virgin Islands

- West Indies

Worldcare Travel Insurance Choose from our range of travel insurance plans.

Selected cover for epidemic and Pandemic diseases (Covid-19)

Cancellation and Travel Disruption Benefits

Medical Benefits

Life Benefits

Personal Liability Benefits

Baggage, Personal Effects and Money Benefits

Worldcare travel insurance benefits.

Worldcare Travel Insurance plans provide specified levels of cover from cancellation to extended benefits like travel disruption, medical, life, baggage, personal effects, money and personal liability. Whether you’re travelling locally or abroad, all Worldcare plans include 24-Hour Emergency Assistance.

Selected cover for epidemic and pandemic diseases (Covid-19)

Worldcare policies include selected cover for epidemic and pandemic diseases such as Covid-19. There is a provision to claim for cancellation and medical expenses should you contract an epidemic or pandemic disease such as Covid-19 after purchasing your policy. Cover for medical claims directly related to an epidemic or pandemic such as Covid-19 will only apply if you contract the disease after you commence your journey. There is no cover for lockdowns, changes in government alert levels, quarantine or mandatory isolation applying to a population or part of a population. As with any travel insurance, disinclination to travel due to fear or change of mind is not covered.

Cover for Pre-existing Medical Conditions

The GoComprehensive, GoFreedom and GoLocal Comprehensive plans provide automatic cover for a variety of specified Pre-existing Medical Conditions. If your Pre-existing Medical Condition is not automatically covered under these plans, you can apply for cover. If cover is confirmed and you want to proceed with your purchase, an additional premium will apply. Please note that no cover for Pre-existing Medical Conditions is available under the GoBudget and GoLocal Cancellation Only plans.

Selecting your Travel Insurance Plan

Check which Worldcare plan best suits your travel needs . Compare benefit levels, then review the Policy Wording and request a quote online. Your quote will provide excess options and a price for our GoComprehensive, GoBudget and GoLocal Comprehensive plans. Select the excess level and plan that best suits your travel plans and the level of cover that you require for your trip. An excess will apply to each separate event giving rise to a claim unless you pay a higher premium for a No Excess policy.

The GoComprehensive plan provides the highest level of cover whereas the GoBudget plan provides lower benefit levels. If you travel more frequently, the Worldcare GoFreedom plan provides the same benefit levels as our GoComprehensive plan, but has been created for customers that take multiple journeys over the course of a year. The GoComprehensive and GoBudget plans can be purchased online. The GoFreedom plan can only be purchased over the phone with one of the Customer Care team.

Travelling around New Zealand? GoLocal provides cover for domestic travel around our backyard with two plan options. GoLocal Comprehensive provides higher benefits levels and the option to add on a Cruise pack if you’re taking a cruise. Meanwhile, GoLocal Cancellation Only has been designed for those who only want cover for cancellation costs, should you be forced to cancel your trip before you go.

Whichever plan you choose, you will have access to 24-Hour Emergency Assistance while you travel.

Quote and buy online or talk to us over the phone on 0800 553 550. Our experienced team are on standby to answer your queries.

Worldcare Travel Insurance is issued and managed by AWP Services New Zealand Limited trading as Allianz Partners and underwritten by The Hollard Insurance Company Pty Ltd ABN 78 090 584 473 (Incorporated in Australia) ("Hollard"). You should consider the Policy Wording before making any decisions about your insurance policy. Terms, conditions, limits, sub-limits and exclusions apply.

The Hollard Insurance Company Pty Ltd has a financial strength rating of A (Strong) issued by Standard and Poor's. The Standard & Poor's rating scale is:

The rating may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. The rating scale above is in summary form. A full description of this rating scale can be obtained from www.standardandpoors.com . An overseas policyholder preference applies. Under Australian law, if The Hollard Insurance Company Pty Ltd is wound up, its assets in Australia must be applied to its Australian liabilities before they can be applied to overseas liabilities. To this extent, New Zealand policyholders may not be able to rely on The Hollard Insurance Company Pty Ltd’s Australian assets to satisfy New Zealand liabilities.

Allianz Partners website | Terms and Conditions | Privacy Policy .

Travel Insurance Plans

Quick links.

- Travel Alerts

Travel Insurance

Existing State customers get a 10% discount.*

Use Promo code: STATECUST

*Discount applies to existing State customers and to premiums for the standard policies net of Government levies and GST (if applicable). Discounts do not apply to premiums for cover additional to standard policies or to any minimum premium.

Important information: The Policy Wording includes specific information on how State Travel Insurance will respond to claims related to Covid-19.

A range of options for your domestic or overseas travel

Overseas cover & annual multi-trip cover

Your back up when going across the ditch or further afield.

Our cover includes medical and dental expenses* loss or theft of luggage, delayed travel and more. You can also select cover for travel related expenses if you need to change or cancel your trip.

Travel a lot? Take out our annual multi-trip option and you’re covered for as many trips as you like, for 12 months.**

See https://safetravel.govt.nz/ for the latest government advice regarding overseas travel.

Anywhere in NZ

Domestic cancellation.

Covers changes and cancellations outside of your control before you leave and extra expenses due to unforeseen circumstances while you're away. You choose the cover amount.

Domestic Plan

Comprehensive cover that also includes lost luggage, medical and dental expenses, and rental vehicle excess cover.

Inbound Cover Visiting NZ

If you are a non-resident visiting NZ our Inbound policy can cover medical and dental expenses, luggage and travel documents, rental vehicle insurance excess and personal liability.

Travel Cover During Covid-19

Travelling Overseas? Check out our handy scenario-based FAQs explaining how we could cover you if Covid-19 plays havoc with your trip: State Travel Cover and Covid-19 FAQs

Know before you go – our Covid-19 Benefits Destination Guide explains how State Travel cover applies when travelling to different international destinations: Covid-19 Benefits Destination Guide

*Medical cover will not exceed 12 months from onset. Medical and dental expenses cover is limited to $1,500 for treatment provided in New Zealand. This $1,500 sub-limit does not apply to the Inbound Plan.

**For 12 months, over 100km from home, including domestic travel, up to maximum number of days per journey as selected by you.

Get more from your travel insurance

24-hour assistance.

24/7 access to a team of experts with a global network of doctors, nurses, and logistical staff. Cover for emergency accommodation and transport expenses if a disaster like a volcano, tsunami, earthquake, or flood disrupts your journey.

Overseas medical cover

Includes hospital, medical, surgical, emergency dental and ambulance costs. Plus help to arrange treatment and medical evacuation.

Get 10% off when you buy online

*Discount applies to existing State customers and to premiums for standard policies net of Government levies (if applicable) and GST. Discounts do not apply to premiums for cover additional to standard policies or to any minimum premium.

Quick online claims

You can claim online while you are travelling. Find out more

Earn Flybuys™ on every policy you have with State. Don’t forget to register your Flybuys number with us, as we’ll also give you chances to get bonus Flybuys throughout the year too. Sweet.

The policy type you choose changes what you are covered for.

Select cover option:

International

Single Trip or Annual Multi-Trip

Limit per adult unless stated otherwise

Up to $1,500 for emergency dental expenses

Up to $1,000 per month

This is only a summary of the benefits provided. Please refer to the Policy Wordings for details of the cover provided.

Limit per adult

Up to $2,500 for personal vehicle insurance excess

Up to $250 per month

Single Trip

Limit per person

(choose the amount of cover that suits, on a per person basis)#

Not included

If you or your travelling companion are diagnosed with Covid-19 by a qualified medical practitioner and are unable to travel, you can claim cancellation or amendment costs for your prepaid trip up to a benefit limit of $10,000 per policy on an International Plan or $5,000 per policy on a Domestic Plan or if applicable, up to the level of cover purchased for cancellation (whichever is lower). There is also no cover if symptoms or diagnosis occurred prior to buying your policy. See the Policy Wording .

*Medical and dental expenses cover will not exceed 12 months from onset of the medical condition. Medical and dental expenses cover is limited to $1,500 for treatment provided in New Zealand. This $1,500 sub-limit does not apply to the Inbound plan.

^ Cover chosen applies per policy. See the Policy Wording .

• Item limits applies for anyone item, set or pair of items including attached or unattached accessories. You may increase these item limits if you wish. See the Policy Wording .

No cover for trip cancellation costs for trips commencing within 21 days of policy purchase date if you test positive to COVID-19 and cannot travel. If your COVID-19 related cancellation claim is approved, then the maximum we will pay per policy is $5,000 for international trips and $2,500 for Domestic trips. See the Policy Wording .

# You can choose $200, $400, $800, or $1,500.

~ The maximum liability collectively for Sections 14, 15, and 16 is $15,000 International Plan, and $10,000 Domestic Plan.

This is only a summary of the benefit provided. Please refer to the Policy Wording . For details of the cover provided. Please read the entire document carefully to understand what the relevant policy covers. Importantly, please note that conditions, exclusions, limits and sub-limits apply, and this summary of benefits table may change at any time.

Our State Travel Insurance contains benefits relating to the Covid-19 pandemic. While your Policy Wording may respond, your claim remains subject to the terms and conditions, limitations and exclusions set out in the Policy Wording . Please ensure you familiarise yourself with these in the Policy Wording before taking out travel cover. For Covid-19 cover to apply, you must not travel to a destination on the "Do not travel" list issued by SafeTravel.govt.nz .

Domestic Policy FAQ's

Why buy state domestic cover.

Our Domestic and Domestic Cancellation plans are for New Zealand residents travelling within New Zealand.

More than one third of domestic travellers experience an unexpected circumstance that can leave them out of pocket.

It doesn’t matter if you are travelling to Auckland or Amsterdam, if your child becomes unwell and you need to cancel your trip, it’s good to know you’re covered.

Specific terms, conditions and exclusions apply to Covid-19. See our State Travel Policy Wording for full details.

Here are some examples of real-life stories

- An airline lost a customer’s suitcase and the items were not recoverable Luggage Value: $2,500

- A customer’s rental vehicle was written off after a third-party collision Rental Vehicle Insurance Excess: $4,000.

Here are some examples of types of claims

Medical claims*

- Sprained limbs or broken arm, leg, wrist due to outdoor activities

- Asthma, seizure, stroke, heart attack

- Swimmer's ear/ear infection.

*Pre-existing medical conditions must be declared, and extra cover purchased under Domestic Plan prior to departure

Your cancellation costs prior to travel

- Prepaid deposits on motorhome rentals, scenic train, or ferry tickets

- Prepaid fares for rail trips, adventure holidays and cruises

- Costs for cancellation due to redundancy, illness, injury, and medical operations.

Cancellation prior to departure will result in the loss of deposits paid and in other instances full cancellation fees often apply.

Delayed travel

- Travel delays due to weather e.g. snowstorms and fog delaying connecting flights.

Luggage claims

- Broken cameras, smartphones and electronic items

- Lost spectacles, hearing aids and damaged dentures.

What Domestic options are available?

We offer 3 Domestic plan options to choose from and these can be purchased quickly and easily on our website.

Domestic plan (Single Trip Policy or Annual Multi-Trip Policy)

Our Domestic plan (Single Trip Policy and Annual Multi-Trip Policy) is our most comprehensive domestic plan.

The Domestic plan Annual Multi-Trip Policy is sometimes a more suitable option for those travellers who are planning to travel more than twice this year and for no longer than 30 days at a time within New Zealand.

Domestic Cancellation plan Single Trip Policy

Our Domestic Cancellation plan covers domestic travellers for cancellation cover only and you choose the cancellation cover limit to best meet your needs when you purchase your policy.

What activities are covered?

There are plenty of fun activities to do around New Zealand year-round, and we have a comprehensive list of activities which are covered under our Domestic plans (excludes Domestic Cancellation Plan).

Our plans automatically include:

- Bungy Jumping

- Horse Riding

- Jet Boating

- Paragliding

- Parasailing

- Snorkelling

- White Water Rafting

Other activities may be covered as an add-on to your Domestic plan (excludes Domestic Cancellation plan). See our State Travel Policy for full details.

What cover is available for Skiing and Snowboarding?

Because being on the snow and participating in winter sports activities often increases the risk of injuries or incidents, you'll need to ensure you amend your Domestic plan (excludes Domestic Cancellation plan) to include snow activities like skiing and snowboarding by purchasing a winter cover (snow sports) upgrade. This can help protect you against unforeseen costs should you have a mishap on the slopes and need medical assistance. Sporting and ski equipment are not covered whilst in use and if you are a New Zealand citizen, ACC may cover some costs due to injury caused by an accident.

You will only be covered if you have purchased the Domestic Plan with the winter cover (snow sports) upgrade and:

- You are skiing, snowboarding or snowmobiling on-piste, or cross-country skiing;

- You are not participating in a Professional capacity; and

- You are not racing.

Note: sporting and ski equipment are not covered whilst in use.

What if I travel frequently in NZ, do you have a multi-trip option?

Multi-trip travel insurance may save you time and money. If you are planning to travel more than twice this year and for no longer than 30 days at a time within New Zealand, consider our Domestic Plan Annual Multi-Trip Policy.

Can you explain the rental vehicle insurance excess?

This benefit applies to our Domestic Plan (excludes Domestic Cancellation Plan) and covers the rental vehicle excess if your rental vehicle is stolen, or damaged while you are driving. You will still need to take out rental vehicle insurance.

A $4,000 rental vehicle excess cover can save you money if you need to make a claim.

Note: that your rental agreement may still require you to take out rental vehicle insurance.

If you are driving your personal vehicle on your domestic holiday there is bonus cover of $2,500 for your comprehensive vehicle insurance excess.

What does the medical cover provide for?

Our Domestic Plan D *(excludes Domestic Cancellation Plan) can provide you with cover for unexpected medical and dental expenses up to $1,500. This is for treatment provided in New Zealand.

It only applies up to 12 months from when you suffered a disabling injury, sickness, or disease. Travel insurance protects you from unforeseen events. Routine medical or dental treatments, prenatal visits and continuation of treatments are not covered.

What existing medical conditions are covered?

We automatically cover a range of existing medical conditions (EMC) under the Domestic plan (excludes Domestic Cancellation Plan). Automatically covered conditions include - asthma, epilepsy, gastric reflux and more! Read the State Travel Policy Wording for a full list of the conditions we automatically cover. If your existing medical conditions are not all automatically covered, you may complete an online medical assessment to determine if cover is available. Other travel insurance benefits unrelated to your EMC still apply, even if cover cannot be provided for your specific condition/s.

*Medical cover will not exceed 12 months from onset. Medical and dental expenses cover is limited to $1,500 for treatment provided in New Zealand. This $1,500 sub-limit does not apply to International or Inbound Plans.

Before you travel

Travel safety.

Find out more information about events that may affect you when you travel.

Travel tips

Our team of intrepid Kiwi travellers have come up with a list of handy travel tips to help make your holiday even better.

Limits, sub-limits, conditions, and exclusions apply. Standard excess may apply. State Travel insurance is administered by Cover-More NZ Ltd, underwritten and issued by Zurich Australian Insurance Limited (ZAIL) incorporated in Australia, ABN 13 000 296 640, trading as Zurich New Zealand. For further information see Zurich New Zealand’s financial strength rating . Any advice is general advice only. Consider the State Travel Policy Brochure and wording therein before deciding to buy this product. IAG receives a commission for the issue of State branded travel policies arranged through Cover-More (NZ) Limited ("Cover-More"). IAG New Zealand Limited ("IAG"), of which State is a business division, is not the insurer. IAG does not guarantee Zurich New Zealand or Cover-More.

- Overseas Trip

- Domestic Trip

- Frequent Traveller

- Already Overseas

- Comprehensive

- Compare Plans

- Medical Conditions

- Ski Insurance

- Cruise Insurance

- Sports & Activities

- Manage Policy

- Policy Documents

- Make a Claim

- FAQs

- About Us

- Contact Us

- Travel Tips & Guides

- Travel Alerts

COMPARE TRAVEL INSURANCE

Compare our travel insurance plans to see the full list of benefits.

COMPARE PLANS (Benefits are per adult)

Expand to see benefits in detail

- OVERSEAS EMERGENCY MEDICAL ASSISTANCE* 24 Hour emergency medical assistance services, access to trained medical advisers, medical evacuation, hospital expense guarantees, ambulance fees, messages to family, and funeral arrangements

- MEDICAL EXPENSES INCURRED OVERSEAS * Overseas medical treatment if you are injured or become sick overseas, including hospital stays, surgery, prescription drugs, and doctor visits.

- INLUDES DENTAL EXPENSES* Cover for emergency dental treatment for the relief of sudden and acute pain to sound and natural teeth

- HOSPITAL CASH ALLOWANCE An allowance of $50 per day if you are hospitalised for more than 48 continuous hours whilst overseas

- ACCIDENTAL DEATH A benefit payable if you die because of, and within 12 months, of an accidental bodily injury sustained during your journey. (no excess applies)

- PERMANENT DISABILITY* A lump sum benefit if you suffer a total permanent disability as result of an accidental injury during your trip. (no excess applies)

- Cancellation & Trip Disruption

- CANCELLATION FEES AND LOST DEPOSITS Cover for cancellation fees and prepaid travel expenses that you cannot recover when your trip is cancelled or cut short due to unexpected events such as illness, injuries, accidents, strikes and natural disasters.

- ADDITIONAL ACCOMODATION & TRAVEL EXPENSES Covers the cost of additional travel and accommodation expenses incurred if you cannot continue on your journey because of an injury or sickness whilst overseas. (no excess applies)

- INCLUDES FAMILY EMERGENCY Cover for additional travel expenses such as your return flight to New Zealand if a relative of either you, or travelling companion requires hospitalisation or dies unexpectedly. (no excess applies)

- INCLUDES EMERGENCY COMPANION COVER Additional accommodation and travel expenses you incur to remain with your travelling companion. (no excess applies)

- TRAVEL SERVICES PROVIDER INSOLVENCY Covers costs if you have to rearrange, cancel or cut short your journey due to insolvency of certain travel service providers.

- RESUMPTION OF JOURNEY* Reimbursement for the cost of airfares for you to return to the place where your journey was interrupted in the event of a relatives death or hospitalisation, following serious injury or illness. (no excess applies)

- DISTRUPTION OF JOURNEY* Cover for reasonable meal and accommodation expenses if your journey is disrupted for more than 6 hours due to circumstances beyond your control. (no excess applies)

- ALTERNATIVE TRANSPORT EXPENSES* Reasonable travel expenses incurred to reach special events such as weddings, funerals, conferences and sporting events on time following transport delays beyond your control. (no excess applies)

- Luggage & Personal Items

- LUGGAGE AND PERSONAL EFFECTS Repair or replacement cost of any personal effects that are lost, stolen or accidentally damaged during your journey. This includes items such as cameras, laptops, tablets and mobile phones.

- TRAVEL DOCUMENTS & CREDIT CARDS* Replacement cost of lost or stolen travel documents including passports and credit cards. This includes costs incurred due to fraudulent activity on your credit card not already covered by the financial institution.

- THEFT OF CASH* Cover for cash, bank notes, currency notes, postal orders or money orders stolen from you during your journey.

- LUGGAGE & PERSONAL EFFECTS DELAY EXPENSES* Cover to purchase essential personal items following your luggage and personal effects being delayed, misdirected or misplaced by your carrier for more than 12 hours. (no excess applies)

- Personal Liability

- PERSONAL LIABILITY Cover for legal liability including legal expenses for bodily injuries or damage to property of other persons as a result of a claim made against you.

- Rental Vehicle Excess

- RENTAL VEHICLE EXCESS Cover for the excess payable on your rental car's insurance in the event of accidental damage or theft during the car rental period.

- OVERSEAS MEDICAL EXPENSES* Hospital and medical expenses incurred overseas as a result of an injury arsing from an act of terrorism.

- CANCELLATION & REARRANGEMENT* Irrecoverable costs to cancel or rearrange your travel and accommodation following terrorist threats and a subsequent upgrade in travel advice for a planned travel destination directly affected. (no excess applies)

- EVACUATION & CURTAILMENT* Evacuation to the nearest place of safety and alternative accommodation and travel expenses for you to resume your journey or return to New Zealand.

- HIJACK AND KIDNAP* If you are kidnapped, or the aircraft or vessel you are travelling on is hijacked, we will pay for each 24-hour period that you are held captive.

- Loss of Income

- LOSS OF INCOME* Weekly benefit payable if you become disabled within 30 days of an injury you sustained during your journey, and you are unable to work more than 30 days after returning to New Zealand. (no excess applies)

- $10 Million

Comprehensive

Comprehensive plus.

- OVERSEAS EMERGENCY MEDICAL ASSISTANCE^

- MEDICAL EXPENSES INCURRED OVERSEAS ^

- INLUDES DENTAL EXPENSES^

- HOSPITAL CASH ALLOWANCE

- ACCIDENTAL DEATH

- PERMANENT DISABILITY^

- CANCELLATION FEES AND LOST DEPOSITS

- ADDITIONAL ACCOMODATION & TRAVEL EXPENSES

- INCLUDES FAMILY EMERGENCY

- INCLUDES EMERGENCY COMPANION COVER

- TRAVEL SERVICES PROVIDER INSOLVENCY

- RESUMPTION OF JOURNEY^

- DISTRUPTION OF JOURNEY^

- ALTERNATIVE TRANSPORT EXPENSES^

- LUGGAGE AND PERSONAL EFFECTS

- TRAVEL DOCUMENTS & CREDIT CARDS

- THEFT OF CASH^

- LUGGAGE & PERSONAL EFFECTS DELAY EXPENSES^

- PERSONAL LIABILITY

- RENTAL VEHICLE EXCESS

- OVERSEAS MEDICAL EXPENSES

- REARRANGEMENT OR REPATRIATION

- HIJACK AND KIDNAP^

- LOSS OF INCOME^

If you claim for the same or similar services/facilities under Sections 6, 7, 7A and/or 7B, we will only pay the higher of the two amounts, not both. Sub-limits may apply, please refer to the relevant sections in the Policy Wording. * means that the benefit is not covered while travelling in New Zealand.

FREQUENT TRAVELLER TRAVEL INSURANCE

Get comprehensive cover all year round. If you’re planning several trips this year a frequent traveller policy can save you time and money.

Our annual multi-trip policy covers an unlimited number of trips over a 12 month period. We give you the same level of cover as our comprehensive plus international plan, meaning you get to cover less. You can choose your trip duration from 15 days or 30 days.

Because life’s a trip

Before You Buy

Top searches, popular destinations, customer rating.

About us | Contact us | Policy Wording | Privacy

Travel Insurance You Can Trust

What country are you going to?

Select the Area of travel in which you will spend most time. NOTE: If you are spending more than 20% of your trip time in the Americas Area, it is compulsory to select a destination in the Americas Area for your policy.

If you are quoting a multi-trip policy please select “see region list” and select a destination in the appropriate region. For example United States for Worldwide cover or Spain for European cover.

When are you going?

Please select the departure and return dates for your trip.

For multi-trip policies the departure date will mark the start of your cover and it will automatically run for a year from that date.

Who is travelling?

Simply enter the age of each traveller including Adults and Accompanied Children*. Enter the age they are now.

Only use as many boxes as you have travellers.

*As per the Policy Wording: "Accompanied Children" means Your children or grandchildren plus one non-related child per adult policyholder who are identified on the Certificate of Insurance and travelling with You on the Journey, provided they are not in full-time employment and they are under the age of 21 years at the Relevant Time. If an Accompanied Child is in full time employment then they will need to purchase their own policy.

If you require a policy for more than 6 travellers, please contact Cover-More on (0800) 500 225 as we may still be able to offer cover to you.

Travel Alert: Important Information Regarding Coronavirus COVID-19 Benefits Now Available

Key benefits of Cover-More travel insurance

COVID-19 Cover

We provide COVID-19 Benefits on our Options Plan (both Single Trip and Annual Multi-Trip policies) to help you travel within New Zealand and overseas with greater confidence.

Luggage and Travel Documents

We offer up to $25,000^ cover for luggage and travel documents on our International Options Plan . This provides protection for items such as cameras, laptops, and mobile phones.

Emergency Assistance

Our policyholders have 24/7 access to our emergency assistance team. They’re here to help ensure you are safe, well, and can keep travelling.

Travel Delay/Cancellation

We automatically include coverage for travel delay of over six (6) hours, up to $2,000. For cancellation cover, you can customise your policy by selecting an amount that suits your needs.

Access to Virtual Care

Our Cover-More customers can access our Virtual Care service for free. If you’re feeling ill and our Emergency Assistance team believes you're eligible for support via a virtual doctor (for example, you don't require a physical exam), we can provide you with access to booking a virtual consult at a time that suits you.

Rental Vehicle Insurance Excess

If you’re hiring a vehicle on your holiday – or driving your personal vehicle on a domestic trip – our premium Options Plan can help protect you by providing cover for your excess amount if you’re involved in an accident.

Types of travel insurance cover we offer

International

A trip of a lifetime overseas can be costly and sometimes scary if you have to visit a foreign hospital. Our 24/7 emergency assistance team is there to help policyholders navigate foreign hospitals, and to organise payment for medical services. A case of gastro in the USA once cost over $100,000.

Existing Medical Conditions

Our premium Options Plan and budget-friendly Essentials Plan can provide automatic cover for over 35 conditions, and we’ll consider all other existing medical conditions. To find out if you’re eligible for cover, simply declare all your medical conditions when generating a quote.

Our travel insurance policies automatically include cover for cruise ship related claims. Any injuries or accidents onboard the ship aren’t covered by ACC, and ACC won’t cover the cost of transporting you home. That’s where travel insurance comes in.

Annual Multi-Trip Policy

Travel frequently? Annual Multi-Trip policies are ideal for travel enthusiasts who expect to take a few trips each year. You can purchase an Annual Multi-Trip policy on either our Options or Essentials Plans, saving you from organising a new policy every time you travel.