- Search Search Please fill out this field.

What Are Travel Expenses?

Understanding travel expenses, the bottom line.

- Deductions & Credits

- Tax Deductions

Travel Expenses Definition and Tax Deductible Categories

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

:max_bytes(150000):strip_icc():format(webp)/MichellePScott-9-30-2020.resized-ef960b87116444b7b3cdf25267a4b230.jpg)

For tax purposes, travel expenses are costs associated with traveling to conduct business-related activities. Reasonable travel expenses can generally be deducted from taxable income by a company when its employees incur costs while traveling away from home specifically for business. That business can include conferences or meetings.

Key Takeaways

- Travel expenses are tax-deductible only if they were incurred to conduct business-related activities.

- Only ordinary and necessary travel expenses are deductible; expenses that are deemed unreasonable, lavish, or extravagant are not deductible.

- The IRS considers employees to be traveling if their business obligations require them to be away from their "tax home” substantially longer than an ordinary day's work.

- Examples of deductible travel expenses include airfare, lodging, transportation services, meals and tips, and the use of communications devices.

Travel expenses incurred while on an indefinite work assignment that lasts more than one year are not deductible for tax purposes.

The Internal Revenue Service (IRS) considers employees to be traveling if their business obligations require them to be away from their "tax home" (the area where their main place of business is located) for substantially longer than an ordinary workday, and they need to get sleep or rest to meet the demands of their work while away.

Well-organized records—such as receipts, canceled checks, and other documents that support a deduction—can help you get reimbursed by your employer and can help your employer prepare tax returns. Examples of travel expenses can include:

- Airfare and lodging for the express purpose of conducting business away from home

- Transportation services such as taxis, buses, or trains to the airport or to and around the travel destination

- The cost of meals and tips, dry cleaning service for clothes, and the cost of business calls during business travel

- The cost of computer rental and other communications devices while on the business trip

Travel expenses do not include regular commuting costs.

Individual wage earners can no longer deduct unreimbursed business expenses. That deduction was one of many eliminated by the Tax Cuts and Jobs Act of 2017.

While many travel expenses can be deducted by businesses, those that are deemed unreasonable, lavish, or extravagant, or expenditures for personal purposes, may be excluded.

Types of Travel Expenses

Types of travel expenses can include:

- Personal vehicle expenses

- Taxi or rideshare expenses

- Airfare, train fare, or ferry fees

- Laundry and dry cleaning

- Business meals

- Business calls

- Shipment costs for work-related materials

- Some equipment rentals, such as computers or trailers

The use of a personal vehicle in conjunction with a business trip, including actual mileage, tolls, and parking fees, can be included as a travel expense. The cost of using rental vehicles can also be counted as a travel expense, though only for the business-use portion of the trip. For instance, if in the course of a business trip, you visited a family member or acquaintance, the cost of driving from the hotel to visit them would not qualify for travel expense deductions .

The IRS allows other types of ordinary and necessary expenses to be treated as related to business travel for deduction purposes. Such expenses can include transport to and from a business meal, the hiring of a public stenographer, payment for computer rental fees related to the trip, and the shipment of luggage and display materials used for business presentations.

Travel expenses can also include operating and maintaining a house trailer as part of the business trip.

Can I Deduct My Business Travel Expenses?

Business travel expenses can no longer be deducted by individuals.

If you are self-employed or operate your own business, you can deduct those "ordinary and necessary" business expenses from your return.

If you work for a company and are reimbursed for the costs of your business travel , your employer will deduct those costs at tax time.

Do I Need Receipts for Travel Expenses?

Yes. Whether you're an employee claiming reimbursement from an employer or a business owner claiming a tax deduction, you need to prepare to prove your expenditures. Keep a running log of your expenses and file away the receipts as backup.

What Are Reasonable Travel Expenses?

Reasonable travel expenses, from the viewpoint of an employer or the IRS, would include transportation to and from the business destination, accommodation costs, and meal costs. Certainly, business supplies and equipment necessary to do the job away from home are reasonable. Taxis or Ubers taken during the business trip are reasonable.

Unreasonable is a judgment call. The boss or the IRS might well frown upon a bill for a hotel suite instead of a room, or a sports car rental instead of a sedan.

Individual taxpayers need no longer fret over recordkeeping for unreimbursed travel expenses. They're no longer tax deductible by individuals, at least until 2025 when the provisions in the latest tax reform package are due to expire or be extended.

If you are self-employed or own your own business, you should keep records of your business travel expenses so that you can deduct them properly.

Internal Revenue Service. " Topic No. 511, Business Travel Expenses ."

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 13.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Page 7.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Pages 6-7, 13-14.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 4.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Pages 5, 7.

:max_bytes(150000):strip_icc():format(webp)/TaxHome-3b9f1ac36f6c4e28889c34943d991fc9.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

You are using a browser that is not supported by OnTheClock . Consider changing or updating your browser. Learn More

Help us create better content by sharing your thoughts! To get started, click here .

Everything you need to know about travel expenses

Everything You Need to Know About Travel Expenses

Did you know that the average three-day domestic trip costs between $990-$1,293 ? That's a lot of money and can add up quickly if you're not careful. In this article, we're going to look at some of the most common travel expenses and how to save money on them. We'll also discuss some tax deductions that may be available to you. So let's get started!

What counts as a travel expense?

Travel expenses can add up quickly, so it's important to be aware of what does and does not count as business-related travel expenses.

So, what exactly is a business-related travel expense? The IRS defines it as "an expense incurred while away from home on business." This includes things like travel to and from meetings, conferences, and business-related events. It can also include expenses related to lodging, meals, and transportation.

Costs that occur while you're traveling away from home for business purposes, such as airfare or mileage, hotel expenses, and food, can all be considered business-related travel expenses. However, personal expenses, such as new shoes or clothing, do not count as business-related travel expenses, even if you purchase them while traveling. Keep this in mind when budgeting for your next business trip to make sure you include all relevant expenses.

Types of Travel Expenses

There are several different types of travel expenses, and it's important to understand what each one is before you start planning your trip. This way, you can include all relevant costs in your budget.

Accommodations and Lodging

One of the most common travel expenses is accommodations and lodging. This can include anything from a hotel room to an Airbnb rental. If you need to pay for overnight accommodations on a work trip, whether that's a hotel or other type of lodging, it counts as a travel expense. Of course, your lodging costs have to be within reason, so don't expect to be able to deduct a luxurious resort.

Transportation

Another common travel expense is transportation. This includes things like airfare, train tickets, taxis, and rental cars. However, it's important that depending on your mode of transportation, the things you can deduct as travel expenses may vary. For example, if you're renting a car, you can deduct the cost of gas as a travel expense, or if you're using your vehicle, you can deduct your mileage at the standard mileage rate. For 2022, that rate is 62.5 cents per mile.

Airfare Is also considered a travel expense. However, if you pay for your flight with frequent flier miles or other rewards points, or if a client provides your ticket, you cannot write off airfare as a travel expense.

Food and Meals

One of the common questions people have about travel expenses is whether or not they can deduct food and meals. And the answer is, it depends. If you're on a business trip that lasts longer than a day, you can deduct 50 percent of the cost of your meals as a travel expense. However, if your trip is less than 24 hours, you can't deduct any of your meal expenses.

Miscellaneous Travel Expenses

There are also a few other miscellaneous travel expenses that you may incur while on a business trip. These can include things like laundry, tips, business-related communication, and shipping and handling of luggage or work-related materials. As with food and meals, these expenses can only be deducted if your trip lasts longer than a day.

Travel Expenses You Can't Write Off

There are many different types of travel expenses that can be written off on your taxes, but there are also some that you cannot. It's important to be aware of both so that you can accurately calculate your tax bill. Here are examples of travel expenses you CAN NOT deduct.

Entertainment

One type of travel expense that you can not deduct is entertainment. This includes things like tickets to a show or a ball game, golf fees, and other recreational activities. Even if you're entertaining a potential client or business associate, you can not deduct the cost as a business expense.

Traveling with family and friends

If you're traveling with family or friends, the IRS doesn't allow any of their travel expenses to be deducted. However, you might be able to deduct some expenses if you can prove that the trip was for business purposes and that your family members or friends were acting as employees or contractors.

Lavish and extravagant expenses

The IRS also does not allow any extravagant expenses to be deducted as travel expenses. This includes things like first-class airfare, luxury hotels, or expensive meals. If you're not sure whether or not an expense is considered lavish or extravagant, the IRS says that it's "an expense isn't considered lavish or extravagant if it's reasonable based on facts or circumstances."

Travel that is compensated

If you're compensated for your travel, whether that's through reimbursement or a per diem, you can not deduct those expenses as business travel expenses. This includes things like airfare, lodging, and meals. The only exception to this rule is if you're an employee of a church or a qualified non-profit organization and you're traveling on behalf of the organization.

Personal vacations

Last but not least, you can not deduct any expenses for personal vacations. Even if you do some work while you're on vacation, like checking your email or attending a business meeting, you can not deduct any of those expenses.

How to manage the travel expenses for your business

Now that you know what types of travel expenses can be deducted, it's time to learn how to manage them.

Step 1: Decide the payment method

The first step is to decide how the travel expenses will be paid. You can either ask the employee to pay upfront and then be reimbursed, or you can pay the expenses directly from a company bank account or company credit card.

For many businesses, the simplest way to handle expenses is to ask employees to pay for them out of their own pockets and then submit expense claims for reimbursement. However, this can be a time-consuming process for both administrators and staff because expense reports need to be filled out and submitted, and then the claims need to be reviewed and processed.

However, with Ontheclock Employee App , the employees can submit their r eceipts electronically , and administrators approve the claims quickly. This saves everyone valuable time in managing this process!

Step 2: Set out a clear process for expense submission

The next step is to set out a straightforward process for employees to follow when submitting expenses. This will help to ensure that all the necessary information is included and will make it easier for you to process the claims.

To do this, you can create an expense policy that outlines what types of expenses are eligible for reimbursement and how employees should go about submitting their claims. For example, you might require employees to submit original receipts or to submit their claims within a specific timeframe.

Step 3: Communicate the expense policy

Travel expenses can be a minefield for companies, and many struggle to strike the right balance between keeping costs down and making sure employees are comfortable on business trips. It's well known that many companies have strict rules around expenses and that employees often try to find ways to get around them. This can leave the business in a difficult situation, as they may either have to pay the bill or leave the employee out of pocket. The best way to avoid this is to make sure that you have a clear and concise policy in place and that all employees are familiar with it. By doing so, you can minimize the risk of expenses spiraling out of control and ensure that everyone is happy with the arrangements.

Some ways to ensure that employees know and understand the expense policy are to:

- Send out the policy in a company-wide email every quarter

- Talk about it at all-hands meetings

- Post it on the company intranet

- Provide training on the policy when new employees join the company

How to calculate and track business travel expenses

When it comes to business travel, Admins and those in expense management are always looking for ways to make the process more efficient and cost-effective. Fortunately, there are a few simple steps that can make a big difference when it comes time to report on quarterly or yearly travel spending.

Keep track of all travel expenses

The first step is to make sure that all travel expenses are being tracked. This can be done using a variety of methods, such as expense reports, credit card statements, or receipts.

Classify expenses by type

Once all of the expenses have been collected, they can then be classified by type. This will make it easier to see where the majority of the spending is taking place and will help to identify any areas where costs could be reduced.

Calculate the total cost of travel

The next step is to calculate the total cost of travel. This can be done by adding up all of the expenses for each trip or by using a software program that will automatically calculate the total cost based on the information that is entered.

Track spending over time

Once the total cost of travel has been calculated, it is then possible to track spending over time. This can be done by creating a spreadsheet or using software that will allow you to track spending on a monthly or quarterly basis.

Compare spending to budget

The final step is to compare the total travel spending to the budget that was set at the beginning of the year. This will help to identify any areas where spending is exceeding the budget and will allow for corrective action to be taken.

By following these steps, Admins and those in expense management will be able to track and report on business travel expenses more effectively. This will ultimately lead to a better understanding of where the company's money is being spent and will help to identify areas where costs can be reduced.

How to reduce travel expenses for small businesses

- Use public transportation

When possible, use public transportation instead of renting a car. This can be a great way to save money, as well as avoiding the hassle of dealing with parking and traffic.

- Book in advance

Another way to save money on business travel is to book your flights and hotel rooms in advance. This will allow you to take advantage of early-bird discounts and will ensure that you get the best possible rates.

- Stay in budget hotels

There is no need to stay in a luxury hotel when traveling for business. There are many budget-friendly options that will still provide a comfortable place to stay.

- Save on entertainment expenses

When it comes to entertainment, there are many free or low-cost options available. Instead of going to a fancy restaurant or bar, consider going for a walk or exploring the local area.

By taking a few simple steps, it is possible to save money on business travel without compromising the quality of the trip. By using public transportation, booking in advance, and staying in budget hotels, small businesses can save money on travel expenses. Additionally, bringing your own food and saving on entertainment expenses can help to further reduce the cost of business travel. Finally, don't forget to recover the tax on your business travel expenses!

Related Articles

Subscribe for more articles like this!

Follow us on social media, ontheclock team.

OnTheClock is the perfect app for business that want to keep track of their employees' time without spending hours doing it. With OnTheClock, you can forget about the old way of doing things.

Do you want to know more about how OnTheClock works?

Leave your thoughts....

Travel and Expense Management 101

When it comes to managing your travel expenses, the focus should not be on cutting down, but rather on maximizing the funds available.

In this guide, we’ll cover the best ways you can optimize costs and enhance compliance in travel and expense (T&E) management, and in turn enable you to achieve greater financial control.

After all, travel should be seen as an investment. We’re here to help you get the most out of it.

What is travel expense management?

The short answer: T&E management controls costs and makes travel more convenient for employees by maintaining expenses and reporting on travel behaviors.

More accurately, its an umbrella term that encompasses various responsibilities aimed at overseeing and optimizing travel spend, such as by:

- Aligning company goals to business travel

- Creating and enforcing corporate travel policies

- Tracking and analyzing expenses

- Building approval processes for travel requests

- Ensuring the safety and satisfaction of travelers

- Measuring how much profit yields from travel-related investments

- Establishing the reimbursement process

- Employee expenses reimbursement

It also involves the crucial task of documenting and processing business travel expenses for tax deduction purposes. What is and isn’t considered a tax deductible expense varies by the country your organization is based in. Regardless of locale, it is essential to report all eligible expenses to optimize and lower tax liability.

What are the types of travel expenses?

Now that we’ve covered the importance of travel expense management, let's explore the most common travel expenses categories that businesses of all sizes should encounter. By understanding these categories, you can identify how to claim tax relief and optimize your overall spending.

Transportation

In addition to airfare, transportation expenses include fares incurred while traveling to and from business-related events (i.e., shuttles, buses, trains, taxis, and ride-sharing services). Employees who rent or use their own car during business trips can also submit expense claims for mileage deductions based on standard mileage rates, which varies by country.

Accommodations

Any costs related to overnight lodging, such as hotel stays or alternative accommodations, are considered travel expenses. Of course, lodging costs do need to be within reason, or at least justifiable in case of an audit. So unless you’re accommodating for a company-wide retreat, don’t expect to be able to claim a 5-star resort stay!

The IRS states that meals are a deductible travel expense when you’re away from home for longer than an ordinary workday and it’s necessary to stop somewhere to sleep. So multi-day trips are clearly applicable, but if you’re on a half-day trip to the next town over, it probably doesn’t count. Generally, you can deduct about 50% of the cost of a meal while traveling away from work.

Misc. Spending

While transportation, airfare, lodging, and food are the most common travel expenses, they’re far from the only ones. Be sure not to overlook these costs and more:

- Shipping and handling costs for luggage or work-related materials

- Electronics and other essential gear

- Parking fees

- Laundry and dry-cleaning

- Business related communication (international calls, faxing, etc.)

- Tips on work-related services

How do you manage travel costs?

Ready to effectively manage your corporate travel spend? Well, you’re going to need a game plan and a whole lot of tools. Here’s our top tips for managing business travel costs:

Level the spending field

When it comes to creating travel spend guidelines, it’s best to apply the same rules across your entire workforce. When your travel spend policy is consistent at every level of your business, you help maintain transparency and avoid any potential misunderstandings that could lead to unintentional, but costly, out-of-policy travel bookings.

Plus, no one likes to feel like they’re getting the short end of the stick. If you give managers and high-level administrators significantly more spending allowance and flexibility on travel and expenses than other team members – especially when booking the same trip – be prepared for some pushback.

Drive compliance with a people-first policy

It's not uncommon for employees to veer from policy from time to time. But while some companies may be quick to wield the disciplinary stick, travel policy adherence doesn't have to be a battle. Instead, a more effective approach is often to identify the reasons behind traveler noncompliance and launch initiatives to foster a culture of support.

It might also be worth considering how you can adjust the policy itself to cater to their needs while still saving money.

By finding the right balance and working with your people, you can drive traveler compliance and provide travel spend management that is both cost-effective and employee-friendly. It's all about finding creative solutions that benefit everyone involved.

Real-time data for real-time results

Data is the beacon of light guiding organizations toward smart decision making – but to make it work, you’ll need the right technology.

By supporting your corporate travel management with expense management software , you unlock the insights hidden within your spending data. With just a few clicks, you can uncover trends in spend and identify what you're getting in return. Benchmarking and forecasting functions take it a step further, allowing you to identify potential savings and efficiencies.

Plus, by consolidating data from various platforms, you'll have a live view of your travel expenses, empowering you to make smarter financial decisions at the highest levels of your company’s future spend and travel preferences.

Let automation do the heavy lifting

With automation on your side, you can say goodbye to financial headaches and wasted hours spent on a manual expense reporting process, and welcome efficiency into your daily routines. By automating expense reporting with advanced technology solutions, you can safeguard your finances, detect program leakage, and seize missed savings opportunities.

A cutting-edge custom dashboard like the FCM Platform seamlessly integrates compliance and expense information, giving you a comprehensive view of travel expenses and enabling your traveling employees toward informed decision-making. It's like having a personal assistant who always has your back, keeping your finances in check while you focus on the things that truly matter: your business.

Now put it to action

The secret’s out on efficient travel and expense management. A well-written travel policy coupled with all-in-one, proprietary technology is the key you need for a cost-effective, people-first travel management program.

But easier said than done, right?

Don’t stress just yet. FCM is here to help – and lucky for you, we’ve done this before. A lot.

Let's Talk!

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Audit and Accounting Solutions

Travelling Expenses – Meaning, Examples and Journal Entries

March 17, 2022 Runner

The name itself indicates that this travelling expense relates to expenses incurred for travel by entity employees or directors. The purpose of travel shall be connecting to the entity’s business operations. Therefore, the purpose shall not be of personal nature.

Estimated reading time: 5 minutes

Travelling expenses Examples:

Let’s see a couple of instances relating to travelling expenses

- Directors Cost of travel to other City to attend some business meeting or Client meeting

- Cab Expenses (Local Travel)

- Air Fare and insurance charges, if any relating to the business travel

- Expenses incurred for the Meals, Communication charges and WIFI Charges

- Tips or Surcharge paid for using any of the above facilities as part of travel

- Parking Fees, Toll Charges, Cab Waiting Charges and Luggage Porter Charges

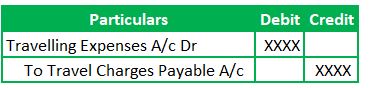

What’s the Journal Entry?

Travelling expenses is a Nominal Account that flows into the Profit and Loss A/c. As this GL is an expenditure Account, the appropriate accounting treatment is to debit this GL Account in the Journal Entry .

Let’s see what’s the corresponding Credit.

Credit is for the Liability Account. Here Liability Account is named Cab Charges Payable, Travel Charges Payable etc., based on the nature of the liability.

There might be instances where there is no requirement to recognize the liability like Meals, tips, parking fees etc. These expenditures are paid immediately, and there might not be any bills or invoices. So, the Credit, in this case, is the Cash A/c.

Journal Entry for recording the Travelling expenses:

(Being the travel charges incurred for ABC Manufacturing deal)

(Being the travel charges paid)

Frequently Asked Questions

1) are the travelling expenses of a salesman forms part of direct or indirect expenses.

The category of expenses depends on the nature of the entity’s business.

For Entities exclusively into the Marketing/Product Sales (not manufacturing), the Travel expense of a Salesman is a direct expense. That’s because those expenditures drive the business operations of the entity.

For Entities not falling into the above category, those travel expenses fall into the Marketing Expenses category, which is an indirect expense. Therefore, it depends on the business category in which the entity operates.

2) What does Accommodation expenses mean?

Accommodation Expenses are the expenses relating to hotel or motel stay. These expenses include the Food, Laundry Service, Telephone, Internet expenses, GST and Service Charges. So, these Accommodation expenses are part of travel expenses. Therefore, it qualifies for indirect business expenditure.

The thumb rule here is to check whether the accommodation expenses shall be relatable to the business operations. So, emphasis shall be given to business importance of the expenses.

3) Paid for travelling expenses journal entry:

Paid for Travelling expenses journal entry records the cash/bank payment done for the travel and related expenses incurred for the business purpose. Let’s see the nature of accounts and accounting rules applicable.

Accounts Involved – Travelling expense and Bank Account

Nature of Accounts –

Travelling Expenses is a Nominal A/c – Expenditure and Bank Account is Real A/c – Asset

Accounting Rules:

The Golden rules of accounting applicable in this scenario are below.

Nominal Account: Debit the expenses and Losses Credit the gains and incomes and

Real Account – Debit what comes in and Credit what goes out

Paid for travelling expenses journal entry is

Travelling expenses A/c Dr

To Bank A/c

4) Travelling expenses are debited to which GL account?

There are no rules for the Naming of an Account. The GL Description shall depict the nature of the Account. For example, if the GL relates to telephone expenses, it shall not fall into conveyance expenses. Therefore, the travelling expenses GL is used as a debit to record the travel expenses in general.

Conclusion:

Travelling expenses are the expenses incurred in relation to business travel . The purpose shall not be in a personal nature. The thumb rules are to check if those expenses help further business operations. This travel expenses category is wide enough to cover the accommodation charges, telephone, internet charges, ancillary charges incurred along with the hotel expenditure.

Debit the Travelling expense and Credit the Bank Account to record the Journal Entry. If the transaction happens on a credit basis, two entries are recorded. The first one is to debit the travelling expense, and the Credit is to the Liability Account. The second entry is to debit the Liability account and Credit the bank account. The net effect is knocking off the Liability Credit in the first entry and the Liability debit in the second. So, technically the journal entry is the same as the first scenario. It’s just deferment of recording the complete transaction effect.

Hope this article brings some clarity on the travelling expenses concept. If you have any questions then pls let us know through the comments below.

Recent Posts

- Is Inventory a Current Asset

- Reclass Journal Entry: Ensuring Financial Accuracy

- What is the Cost Sheet Format in Excel?

- Best Private Equity Books

- Paid Cash for Telephone Bill

Blog Whereabouts

- Privacy Policy

Search Posts

Table of Contents

Travel expenses.

Travel expenses refer to the costs incurred by an individual or business for travelling purposes. These expenses can include items such as flights, accommodation, meals, and transportation. They can be reimbursed by employers and may also be tax-deductible, depending on the purpose of the travel.

The phonetic pronunciation of “Travel Expenses” is: /ˈtrævəl ɪkˈspɛnsɪz/

Key Takeaways

- Keep receipts – It’s crucial to keep track of all the receipts during your travel. They provide proof of your travel expenses, and are particularly necessary when it comes to claiming expenses back at your work or during tax return filing.

- Understand what counts as a travel expense – Not everything during your travel can be claimed as an expense. Travel expenses typically include transportation, meals, accommodation and other expenses directly related to your travel. Understanding what can count as a travel expense can effectively control your travel costs.

- Use a travel expense app – There are numerous apps available to keep track of your travel expenses. These can simplify the process, allow you to quickly add new expenses, and even scan and save your receipts. They can save you valuable time and ensure that you are reimbursed completely and promptly.

Travel expenses are a critical business/finance term since they represent the costs incurred by employees while on business-related trips. This includes expenses for transportation, meals, lodging, and other incidentals. Travel expenses are important for several reasons. Firstly, they can significantly impact a company’s budget and financial planning, given their potential size depending on the size and globalization of the business. Secondly, reimbursing travel expenses is a way for businesses to maintain employee satisfaction and morale, as it secures employees from out-of-pocket expenses incurred during the conduct of business operations. Thirdly, accurate recording and control of travel expenses are essential for tax purposes, as certain travel expenses are tax-deductible. Thus, travel expenses strike a delicate balance between operational needs, employee satisfaction, financial management, and tax compliance.

Explanation

Travel expenses serve a crucial role in many businesses, specifically those whose operations necessitate travel. Whether the task is attending a conference, meeting prospective clients, or visiting a remote company branch, work-related travel comes with associated costs that companies should cover. From an accounting and business perspective, these expenses are considered legitimate operational costs that contribute to earning income. The application of travel expenses is often governed by company policy or tax regulation standards, and encompasses a variety of items. This could include transportation (airfare, mileage, taxi fees), lodging (hotels, motels), meals (either per diem or actual cost), and incidental expenditures that a worker incurs as a consequence of the business travel. By covering these expenses, companies not only encourage employee participation in activities beneficial to the business, but they also foster good employer-employee relations, enhance company morale, and support in attracting or retaining talented personnel. As part of a tax strategy, some companies even leverage the deductibility of these expenses to lessen their tax liability.

1. Business Trip: If an employee is sent for a business trip to another city, the company usually covers all associated costs such as flights, accommodation, food, transportation, and any other incidental costs. This is considered as a travel expense since all expenses were incurred while travelling for business purposes.2. Client Meetings: If there is a need for a face-to-face meeting with a client located in another city or country, the company would cover the expenses for the trip which could include costs of plane or train tickets, gas, meals, hotel stay, and more depending on the situation. 3. Conferences or Training: Often, companies send their employees to conferences or training sessions in different locations. The costs for these such as enrolling in these conferences or training sessions, travelling to the event (airfare or mileage), hotel stays, meals, etc. are all considered as part of travel expenses.

Frequently Asked Questions(FAQ)

Travel expenses are costs related to travels which are undertaken specifically for business purposes. These could include airfare, accommodations, meals, taxi fares, and other expenses incurred while on a business trip.

In most cases, businesses can deduct travel expenses on their taxes, as long as these expenses are business-related. However, the rules can be different depending on your country, so you should check with a tax professional for accurate information.

There are different ways to track travel expenses such as manual logging, using a spreadsheet, or using apps and software designed specifically for tracking business expenses.

Airfare, accommodation, meal costs, transportation within the destination (like taxis, car rentals, or public transit), tips, and business calls can be considered travel expenses. Some less common travel expenses could include laundry services or shipping fees.

Companies usually have a travel policy in place which includes instructions on how employees should record and submit their travel expenses for reimbursement. This can involve filling out forms and providing receipts.

If travel expenses are not reported correctly, you might not get reimbursed for those costs, or could face penalties in case of a tax audit. For businesses, incorrect reporting can lead to potential financial issues or legal consequences.

Small businesses can best manage travel expenses by creating a clear and concise travel policy, using a business credit card for expenditures, and making use of modern expense tracking tools and software.

Per diems are specific amounts of money that a company provides to an employee per day to cover travel-related expenses. They are often used instead of having the employee track each specific expense.

Typically, personal expenses cannot be included in travel expenses for business trips. However, some exceptions might be made, such as if the personal expense was reasonable and necessary for the business trip.

Related Finance Terms

- Reimbursement Policy

- Expense Report

- Business Mileage

- Receipt Validation

Sources for More Information

- Investopedia

- Internal Revenue Service (IRS)

- Accounting Tools

Due makes it easier to retire on your terms. We give you a realistic view on exactly where you’re at financially so when you retire you know how much money you’ll get each month. Get started today.

Due Fact-Checking Standards and Processes

To ensure we’re putting out the highest content standards, we sought out the help of certified financial experts and accredited individuals to verify our advice. We also rely on them for the most up to date information and data to make sure our in-depth research has the facts right, for today… Not yesterday. Our financial expert review board allows our readers to not only trust the information they are reading but to act on it as well. Most of our authors are CFP (Certified Financial Planners) or CRPC (Chartered Retirement Planning Counselor) certified and all have college degrees. Learn more about annuities, retirement advice and take the correct steps towards financial freedom and knowing exactly where you stand today. Learn everything about our top-notch financial expert reviews below… Learn More

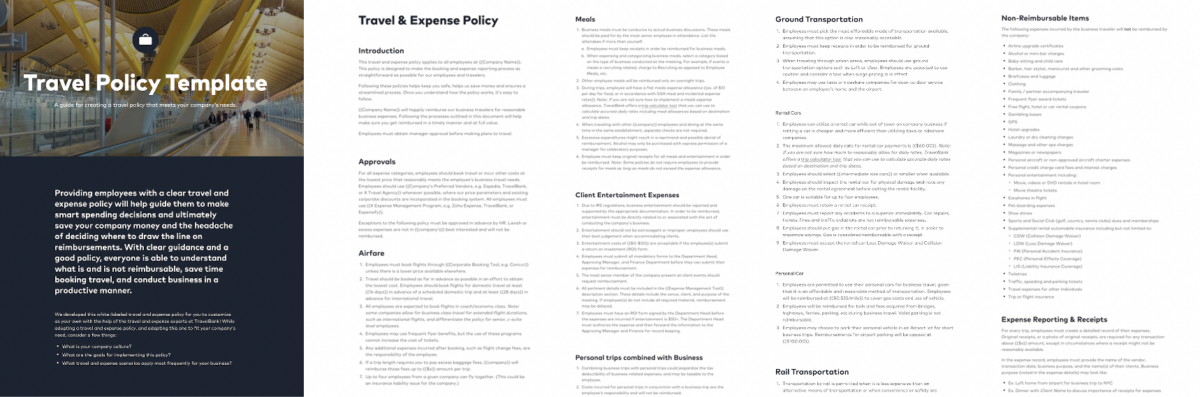

The Ultimate Business Travel Policy for Streamlining Business Travel Expenses

Why are T&E policies so tricky? It’s because:

- Policies are usually extreme: They’re draconian and cost-conscious, or unmanaged and expensive.

- The stakes are high: Travel, payments, and expenses are often a company’s second largest expense.

- They’re regularly audited: The Finance team is under enormous pressure to track costs each month, and record receipts for auditing and taxation.

This post provides a comprehensive guide to streamlining business travel expenses.

>> Related: A Step-by-Step Business Expense Template <<

Understanding Business Travel Expenses

There are generally four business expense types, all of which should be budgeted and quickly reimbursed.

Types of Expenses

- Transportation : This is the cost incurred to get from the employee’s home or office location to the destination and back. This might include flights, trains, rental cars, taxis, rideshares, mileage, or tolls.

- Accommodation : The cost of staying in a hotel or other type of lodging while traveling for business. It could also include fees associated with short-term rentals such as Airbnb. Key services like laundry or gym access may also be included.

- Meals : Meals typically make up nearly 20% of business travel expenses. They include meals at restaurants or ingredients from grocery stores. Most companies carefully restrict meals, including maximum per-person limits, tip rates, internal vs. client meals, and alcohol.

- Miscellaneous : This includes any remaining costs, including WIFI access, meeting room rentals, conference passes, currency exchange rates, insurance, etc.

With the ease and low cost of virtual meetings, and with airfares rising 5x faster than the overall inflation rate ( source ), in-person meetings are now reserved for high-value activities like rebuilding relationships, collaborative planning, and fortifying teamwork and community. There is simply no tolerance for, “this trip could have been a Zoom call.” To anticipate ROI, balance both the trip’s expected costs and outcomes. If you had pre-pandemic travel budgets, assume you’ll need at least 30% more budget for the same trip in 2023.

Reimbursement Procedures

Reimbursements are extremely important for employees, because people like to get their money back as soon as humanly possible. Some companies even offer prepaid cards or corporate cards so that spending doesn’t come out of employees’ personal accounts. Make sure your policy outlines the reimbursement process and turnaround times. Also, highlight if reimbursements will be in the form of a paper check or sent via direct deposit. If you have automated processes via expense management technology , employees will be thrilled that reimbursements can be processed and direct deposited in as little as 24-hours.

Creating a Comprehensive Business Travel Expense Policy

Business travel policies have to be comprehensive, flexible, and clearly-communicated. When creating or revamping a policy, begin with collaboration across stakeholders:

- Finance/Ops : Controlling costs, predictability, and visibility are all top of mind. Pre-trip budgets are a huge help with forecasting, along with timely and accurate data for reporting.

- Human Resources : Employee satisfaction is a major driver, and a flexible travel policy is a big draw for talent acquisition. With the ubiquity of open bookings, they need to know where travelers are to maintain a Duty of Care standard.

- Travelers : Almost 40% of frequent business travelers said convenience was the most important benefit in a travel policy, followed by cost. And since many are loyal to specific carriers and want to maintain status or earn points, a solid selection of travel partners is critical.

>> Related: The Most Common Challenges of T&E Management <<

Defining Clear Guidelines For Employees

The business travel policy should clearly state employees’ responsibilities. This may include ensuring that all required documentation is completed prior to the start of a trip (such as flight reservations and hotel arrangements), adhering to the maximum daily allowances set by the company, notifying management of any changes in plans during travel, etc. In your policy, be sure to cover if all line items require or receipt, or if only purchases over a certain dollar amount need documentation. You should also specify expense report due dates — usually within 90 days of an expense or on a monthly basis. Once you have guidelines in place, don’t assume your policy to be widely used if it’s a PDF on the shared drive! Instead, consider a modern travel management platform that supports in-app policy parameters, so employees can easily search for flights and accommodation that meet your requirements, and receive guidance as they’re booking.

Determining [Un]Acceptable Expenses

- What are the goals for implementing limits? What will improve across cost savings, reporting, and adherence?

- Don’t be vague — employees’ varied backgrounds and values can lead to drastically different interpretations.

- Provide real-world examples of allowable and non-allowable expenses. What travel and expense scenarios apply most frequently for your business?

- Keep it short — the longer and more nuanced your document, the more likely employees are to skim over it or ignore it all together.

- Consider quality of life for travelers. For example, a flight may be $30 cheaper but require two layovers or a red-eye.

- Can you responsibly encourage work/life balance, and set boundaries around [inevitable] bleisure travel?

- Beware getting too granular or rigid. A 50% tip on a $3 coffee is neither fraudulent nor wasteful.

Ready to get specific? Download: TravelBank’s sample business travel policy >

Consider Employee Engagement

Adoption is easier said than done. Can you shape your new policy to boost engagement? Here are some examples:

- Keep some savings: If employees book under budget, some employers reward this frugality by splitting the savings. An expense management solution that offers this feature makes it easier to offer this perk. ( On average, we see businesses trim 30% of their travel budget after implementing rewards .)

- Get reimbursed faster: Manually completing expense reports, sorting and attaching receipts, and submitting can be a lengthy process. If your new expense policy includes following an automated, digital system, employees can knock out expense reports in minutes and get reimbursed faster.

- Save time and hassle on expense reporting : In psychology, “negative reinforcement” means encouraging a behavior by removing something unpleasant (e.g., if a pill makes your headache go away, you’re more likely to take a pill next time, too). Making expense reporting quick and simple makes everyone’s day a little bit easier.

>> Related: The Importance of Well-Defined Travel and Expense Policies for Businesses <<

Implementing the Policy

Writing a clear policy that aligns to your corporate culture is… actually the easy part. Good data begins with your employees. It’s imperative they understand the policy and can easily adopt it.

Train and support employees

- Establish a generous schedule: Pad your timeline so you can thoroughly field questions and help employees adapt to the change curve. Some departments might need an extra grace period if they’re working through a crunch period. Once carefully considered, communicate a hard deadline to get everyone onto the new policy.

- Hold a live training meeting. The immediate feedback and questions can help you fine-tune your policy for better clarity.

- Record a short training video as a resource, especially for new employees.

- Train one department at a time, starting with departments processing highest volumes of expenses.

- Train department heads and supervisors, and listen to their advice on the best way to train their team.

- Offer support: whether it’s office hours, a dedicated Slack channel, or a hotline, be clear about who employees can field questions to.

- Make rewards clear: Usually travel expense policy goals revolve around reducing expense processing costs, improving productivity, preventing fraud, and aiding compliance. Employees may connect with these goals, but rewards and fast reimbursement will likely capture their attention.

Incorporate Technology

Asking employees to memorize every finite policy, and hand-entering data in spreadsheets, is a recipe for non-compliance. Expense tracking software makes it easier for employees to capture and submit receipts. It eases frustration, automatically routes approvals, and lessens the burden on Finance and employees alike. When evaluating expense tracking technology, look for:

- Mobile and desktop apps: Mobile apps are a must for travelers in the field, and expense reports should get the desktop treatment they need.

- Intuitive UX: A good tool inspires confidence through its usability. If travelers enjoy using it, they’re more likely to be compliant.

- Saving incentives: More carrot, less stick. Rewarding employees who beat their estimates means travelers get what they want and stay within budget.

- Support: 24/7 travel support lets business travelers focus on getting the job done instead of sweating the small stuff.

Regularly Review and Update Your policy

Review and adjust your policy every year, or when corporate or world events necessitate it. Re-engage your collaborative stakeholders, and ensure your staff is engaged, feels heard, and gets needs met.

Streamlining business travel expenses begins with a flexible policy that’s easy for employees to adopt. Rewards, in-app policy parameters, simple UX, and swift reimbursement all help drive compliance.

>> Download TravelBank’s Travel Policy template <<

- Why have a travel and expense policy? – Travel, payments, and expenses are often a company’s second largest expense. Business travel policies that are comprehensive, flexible, and clearly-communicated reduce expense processing costs, improve productivity, prevent fraud, and aid compliance.

- What expenses are included in a business trip? – [Un]acceptable expenses vary by business. Generally they cover transportation (flights, trains, rental cars, taxis, ride shares, mileage, or tolls); accommodations (hotels or short-term rentals such as Airbnb); meals (restaurants, grocery stores, client entertainment ); and other miscellaneous costs incurred while doing business (WIFI access, meeting room rentals, conference passes, currency exchange rates, etc.).

- What is reimbursement of traveling expenses? – Reimbursements refund employees for expenses made while traveling. They are either in the form of a paper check or sent via direct deposit. Companies increasingly provide prepaid cards or corporate cards so that spending doesn’t come out of employees’ personal accounts.

Your California Privacy Choices

We use technologies, such as cookies, that gather information on our website. That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites. The use of technologies, such as cookies, constitutes a ‘share’ or ‘sale’ of personal information under the California Privacy Rights Act. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on “Opt-Out” below or by broadcasting the global privacy control signal.

Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. You can find a description of the types of tracking technologies, and your options with respect to those technologies, by clicking “Learn more” below.

You have successfully opted-out.

Before you go, be sure you know:

This link takes you to an external website or app, which may have different privacy and security policies than TravelBank. We don't own or control the products, services or content found there.

Travel Expense Types

This Knowledge Base Article serves as a reference Travel Expense Types in Concur.

Essential Information

- Travel Expenses are reimbursable when they are necessary to accomplish the official business purpose of a trip.

- Please note, most Expense Types require a receipt if the Expense is over $75 (there may be cases where a receipt is always required).

- Concur should prompt an alert if any receipts are missing.

- Check the travel policy and this Blink page for more information to ensure that all Travel Requests and Travel Expense Reports are following policy requirements.

1. Air Travel Expense

Airline Fees : Baggage Fees, Change Fees, other fees imposed by Airlines.

2. Lodging Expenses

Homeshare - AirBnB / VRBO / Etc: Be sure to attach final receipt for proof of payment.

Hotel : All Hotel lodging Expenses must be itemized.

Hotel - Advanced Deposit

Hotel Group : Use this Expense Type for Group Trips, content will be developed soon on this process.

Other Accommodations : Alternate accommodations not covered in the other Expense Types, e.g., rent payments for long-term travel.

Travel Card Per Diem Offset : Used when a foreign transaction has been charged to the T&E card and there is a need to claim the transaction and Offset/Reduce the Per Diem, or Travel Allowance.

3. Ground Transportation

Car Rental Fuel

Parking : Only while on travel status - does not include monthly parking permit costs.

Taxi/Shuttle/Car Service

Tolls/Road Charges

University Vehicle Fuel

4. Personal Car Mileage

Personal Car/Business Use - Mileage : Please refer to Blink for the latest mileage rates for travel.

Personal Car/Moving Use - Mileage : Please refer to Blink for the latest mileage rates for moves.

5. Meals/Meetings/Events

Entertainment Meals - Travel Status : If someone is on Travel status and they have a meeting, they are allowed to claim the Entertainment Meal Expense on a Travel Expense Report for Meal Expenses incurred while on travel status, they can be claimed on the Travel Expense Report in accordance with Entertainment Policy (BUS-79).

Group Meals and Incidentals : Use this Expense Type for Group trips.

Meals & Incidentals

Per Diem Reduction

6. Conference/Training Registration

Seminar/Conference Registration

7. Other Expenses

Agent Booking or Service Fees : Fees from Balboa Travel can be claimed with this Expense Type.

Field Expenses

Fraudulent Charge

Internet Access

Miscellaneous (Add Comment)

Mobile/Cellular Phone

Office Supplies

Personal/Non-reimbursable

Printing/Photocopying

Team Laundry (Athletics Only)

Wire Payments Form : This is related to Travel Expense Reports that will be paid via Wire, see the KB0032371: How to Process a Travel Wire for more information.

8. Dues & Fees

Bank/Currency Fees

Medical Fees

Passports/Visa Fees - ordinary and necessary to accomplish the official business purpose of a trip; the Travel Expense entry must include an explanation of why such Expenditures are being claimed.

9. Moves/Relocation

Moving Company Invoice : Please see the KB0032130: How to Manage a Move Trip for more details on this process.

If you need any additional assistance, please submit a ticket here or call the IPPS Help Desk at (858) 534-9494.

- Accounts Payable Software

- Accounts Receivable Software

- Cash Flow Management

- Account Payable

- Account Receivable

- Travel & Expense

- Press Release

- Get Started

Mastering Expense Reimbursement: The Complete Process and Best Practices

Expense reimbursement is a significant cost for businesses, requiring efficient methods and technology to manage effectively. Without proper systems, time and money can be lost in the process.

The complexity of expense reimbursement not only consumes your and your employees’ valuable time but also leaves businesses vulnerable to fraud. To mitigate these challenges, businesses need streamlined processes and reliable technologies.

In this blog, we will explore the intricacies of expense reimbursement, highlighting the importance of efficient management and the role of technology in simplifying the process and reducing the risk of fraud.

What is Expense Reimbursement?

Expense reimbursement is a crucial process for businesses of all sizes and industries. It involves compensating employees for out-of-pocket expenses they incur while performing their job duties. Unlike regular salaries, these reimbursements are not subject to tax deductions.

Employees often need to pay for work-related expenses upfront, such as travel or client entertainment. A formal expense reimbursement plan ensures that employees are reimbursed fairly and promptly. It also helps management control spending and maximize tax benefits.

Without a well-structured reimbursement plan, requests and reports may be overlooked, leading to delays in reimbursing employees. A disorganized process can also create frustration and tension between employees and management. Therefore, it’s essential to establish a clear and efficient procedure for employee reimbursement .

Example of Expense Reimbursement

Imagine you’re a sales representative for a company, and your job involves traveling to meet clients. During one of your trips, you need to book a hotel for two nights and have meals while away. You pay for these expenses using your credit card, totaling $500.

After returning from your trip, you compile an expense report detailing your expenditures, including receipts for the hotel stay and meals. You submit this report to your manager along with the receipts as proof of your expenses.

Your manager reviews the report and approves the travel expense reimbursement . The finance department then processes the reimbursement, and you receive $500 to cover the costs you incurred during your business trip.

Types of Expenses Reimbursement

There are several types of expense reimbursements that businesses commonly use:

- Travel Expenses: This includes costs employees incur while traveling for work, such as airfare, hotel accommodations, rental cars, and meals.

- Mileage Reimbursement: When employees use their vehicles for work-related travel, they can be reimbursed based on the number of miles driven at a standard rate.

- Meal Expenses: Employees can be reimbursed for meals purchased while traveling for work or during business meetings.

- Transportation Expenses: This includes costs for public transportation, taxis, or ride-sharing services used for business purposes.

- Supplies and Materials: Reimbursement for office supplies or materials purchased by employees for work-related activities.

- Client Entertainment: Expenses related to entertaining clients, such as meals or event tickets, can be reimbursed.

- Training and Education: Reimbursement for costs associated with attending work-related training or educational events.

Businesses need to have clear policies and guidelines regarding what expenses are eligible for reimbursement and the documentation required to process reimbursement requests.

What Qualifies as a Reimbursable Expense?

When determining the validity of employee’s expense reimbursements, adherence to the organization’s travel and expense policies is paramount. Any expense incurred personally by employees must align with these policies.

If the expense fits into any of the following categories, it qualifies for reimbursement:

- Is the expense necessary for the completion of the job?

- Would any employee in the same position incur the same expense?

- Are the expenses related to travel that are essential and unavoidable for job completion?

- Did the employee use their funds to cover on-the-job expenses?

- Has the employee submitted a reimbursement claim for an expense?

- Has the employee submitted proof of payment for the expense incurred?

- Did the employee inform the higher management or accounting department within a reasonable time?

How Should Employees Report Expenses?

Employees should report expenses by filling out an expense report form, detailing costs incurred while conducting business activities. This form is essential for reimbursement and financial reporting purposes.

An expense report typically includes:

Expense Details: Date, description, amount, and currency of each expense.

Expense Categories: Grouping expenses by type (e.g., lodging, meals, travel) to help organize and analyze spending.

Supporting Documents: Receipts, invoices , or other proof of payment for reimbursement and auditing purposes.

Total Charges: Summing up all expenses for a specific period, with subtotals for different expense categories if needed.

Additional Details: Purpose of the expense, project/client associated with it, and any special notes.

Once completed, the expense report is submitted to the appropriate department or authority within the organization for review, approval, and processing. The organization’s policies and procedures will determine how expenses are evaluated, reimbursed, and recorded in financial records.

A Step-by-Step Guide to Expense Reimbursement Process

1. define a clear expense policy.

Begin by developing a comprehensive expense policy that clearly outlines which expenses are eligible for reimbursement and the procedures for submitting reimbursement claims. This policy serves as a guide for employees and helps prevent overspending or reimbursement requests for non-allowable expenses.

2. Categorize Expenses

Establish a method for organizing and categorizing expenses to streamline the reimbursement process. This could involve creating expense categories based on the nature of the expense (e.g., travel, meals, supplies) and ensuring that expenses are properly classified for accurate reporting and accounting purposes.

3. Educate Employees on Reimbursement Procedures

Ensure employees understand the rules and procedures for submitting reimbursement claims, including the importance of accurate documentation and adherence to the policy guidelines. Encourage open communication and address employees’ questions or concerns to ensure compliance with the policy.

4. Specify the Documentation Requirements

Clearly define the documentation requirements for each expense category to ensure compliance with the policy. This may include receipts, invoices, or other proof of purchase. Explain to employees the importance of maintaining and submitting accurate documentation to support their reimbursement claims.

5. Record and Manage Expenses

Implement a system for employees to capture and document their expenses. This could be a digital system where employees can upload photos of receipts or a manual process where employees keep physical copies of receipts. Ensure that the process is easy to use to encourage compliance.

6. Submit Expense Reports

Offer a platform to employees where they can submit their expense details seamlessly. The platform can be an automated travel and expense management software or a manual form or spreadsheet. Encourage employees to submit their reports on time to avoid delays in processing. Provide guidance on completing the expense report form and what information is required for each expense.

7. Review and Approve Expense Claims

Designate a review process for expense reports to ensure compliance with the policy. This may involve a review by the finance team or department managers to verify the accuracy and validity of the expenses. Any discrepancies or non-compliant expenses should be addressed and resolved before expense approval .

8. Reimbursement Expenses

Once expense reports have been reviewed and approved, ensure that reimbursements are processed promptly. Timely reimbursement helps maintain employee satisfaction and ensures that employees are not financially burdened by out-of-pocket expenses incurred while performing their job duties.

Major Roadblocks in the Manual Expense Reimbursement Process

1. Employee cash flow constraints . Traditional reimbursement processes strain employees’ finances and satisfaction; delays worsen this, especially with check-based payments.

2. Ambiguity in expense policies. Complex policies lead to confusion, non-compliance, and overspending; clear policies are crucial for adherence and a smooth reimbursement process.

3. Limited spend visibility. Lack of real-time expense data hampers effective monitoring and managing of employee spending, impacting financial processes.

4. Cumbersome paperwork. Manual receipt management is time-consuming and error-prone; automation can streamline this process, reducing manual efforts.

5. Prone to errors. Manual entry increases the likelihood of inaccuracies in financial records, emphasizing the need for digital solutions for accuracy.

6. Communication Challenges. Miscommunication delays reimbursements; clear instructions on documentation and approval procedures are essential.

7. Receipt management issues. Manual receipt handling is challenging; automation simplifies receipt verification and matching with expense reports.

8. Approval delays. Manual approval processes are inefficient and lead to delays; automation can streamline workflows for faster approvals.

9. Manual audit and compliance challenges. Manual checks are time-consuming; automated solutions are needed for efficient compliance checks and error detection.

How to Streamline Expense Reimbursement Process?

Streamlining the expense reimbursement process can significantly improve efficiency and reduce administrative burdens. Automation plays a crucial role in achieving this goal. By automating expense reimbursement, organizations can eliminate manual tasks, reduce errors, and speed up the reimbursement cycle.

Automation allows employees to submit expenses easily through digital platforms, such as expense management software or mobile apps. These tools can automatically validate expenses against company policies, ensuring compliance and reducing the need for manual review.

Furthermore, automation enables faster approval processes, as managers can review and approve expenses digitally, from anywhere. This eliminates the need for physical receipts and paper-based approval workflows, making the process more efficient and convenient for everyone involved.

How Automated Expense Reimbursement Benefit Everyone?

Automated expense reimbursement offers advantages that boost morale, tax deductions, and productivity. Let’s delve into these benefits for both employers and employees.

Benefits for Employers

- Error Reduction: Automation eliminates errors in expense reporting and reimbursement processes, reducing mistakes made by employees, managers, and finance departments.

- Paperless Processes: Automation reduces paperwork, allowing supervisors and finance teams to manage reports efficiently and quickly.

- Policy Compliance: Automation ensures greater compliance with company expense policies, flagging and preventing reimbursement for reports that violate these policies.

- Increased Visibility: Automation provides better visibility into spending, helping identify overspending or underspending categories and allowing for better control and forecasting of expenses.

Benefits for Employees

- Reduced Personal Burden: A good reimbursement process assures employees that their money spent on business expenses will be reimbursed, reducing financial stress.

- Stress-Free Travel: Structured reimbursement systems guarantee that employees’ business trips are stress-free by eliminating the possibility of payment delays.

- Simplified Expense Claims: A clear and straightforward reimbursement process helps employees adhere to procedures and expense policies, making expense claims easier and more manageable.

How Peakflo Streamlines Expense Reimbursement?

Peakflo’s Travel and Expense Management solution streamlines expense reimbursement. It provides a suite of features that simplify the entire process from policy creation to auto-disbursement . It allows companies to configure specific policies for allowable expenses, manage expense categories, and define rules for approvals based on various criteria.

With Peakflo, employees can easily submit travel requests and expenses, while managers can quickly review and approve them. Automation ensures compliance with company policies, reduces errors, and speeds up reimbursement cycles.

The system also offers 2-way matching with OCR technology , flagging any mismatches or duplicate expenses. Additionally, Peakflo centralizes communication and approvals, providing a clear audit trail for transparency and accountability.

- travel and expense

Expense Reconciliation: A How-to Guide to Reconcile Expense Reports

How to create the best expense report policy for your organization, travel expense reimbursement – all you need to know, latest post, split payment: streamlining transactions for marketplaces, future-proofing b2b payments: the payment automation handbook, what is the accounting cycle 8 steps explained, uplevelling finance operations with rpa adoption, what is delivery note and how is it different from grn.

- Accounts Payable

- Accounts Receivable

- B2B Payment Software

- Payment Automation

- Invoice Management

- Procurement Software

- Product Tour

- Saving Calculator

© 2023 by Peakflo. All rights reserved.

Accounting | How To

Determining Tax Deductions for Travel Expenses + List of Deductions

Published August 15, 2023

Published Aug 15, 2023

WRITTEN BY: Tim Yoder, Ph.D., CPA

This article is part of a larger series on Accounting Software .

- 1. Determine Your Trip Meets the Requirements of a Business Trip

- 2. Check the List of Business Expenses That Qualify for Deductions

- 3. (For Those Mixing Business & Personal Travel): Allocate Expenses

Bottom Line

The IRS considers deductible travel expenses to be any ordinary and necessary expenses you incur while traveling away from home on business. To get tax deductions for travel expenses, the trip must have a business purpose and be temporary (less than one year) and you must be away from your tax home for a length of time that exceeds your usual work day or be away overnight to get sleep to fulfill the demands of your job while away.

Key Takeaways

- A qualifying business trip must take you away from home overnight long enough to require rest.

- Most expenses incurred during a qualifying business trip are deductible, including meals on days off.

- Partnerships, limited liability companies (LLCs), and corporations can directly pay or reimburse employees for business travel expenses and deduct them from their business returns.

- Self-employed business owners will deduct their travel expenses on Schedule C, while farmers will use Schedule F.

- Purely personal expenses on business trips, such as sightseeing, are nondeductible.

Step 1: Determine Your Trip Meets the Requirements of a Business Trip

A business trip for tax purposes is one that meets the following criteria:

- There must be a business purposes for the travel

- You are required to be away from your tax home

- The trip lasts overnight or a period long enough to require rest

- The trip is temporary

Business Purpose

Your trip must be an ordinary and necessary part of conducting your business for your expenses to be deductible. Below are some reasons you may decide to travel for business:

- Meeting with clients or customers: If you travel overnight to meet with clients or customers for business purposes, such as negotiating contracts, discussing projects, or providing consultations.

- Attending business conferences or seminars: If you travel to attend conferences, seminars, or trade shows that are relevant to your business activities, including acquiring new industry knowledge or networking with other professionals.

- Training or professional developmen t : If you travel to attend training programs, workshops, or courses directly related to your business or profession.

- Conducting in-person meetings or negotiations: If you need to travel to have face-to-face meetings or negotiations with business partners, suppliers, or other stakeholders.

Your tax home is not your residence but rather your principal place of business activity including the entire city or general location of your business. So, your business trip cannot be in the general vicinity of your principal place of business for you to be away from home.

- Amount of time you spend at each location

- Degree of business activity in each area

- Relative significance of the financial return from each area

- No regular place of business: If, by the nature of the work, there is no regular or principal place of business, then your tax home will be the place where you regularly live and where you travel to different job sites to perform your service.

For example, a self-employed repair person may not have a regular place of business because they spend each workday at a different customer’s location.

Overnight Stay

Overnight stays for travel purposes do not specifically mean staying from evening to the next morning. Instead, overnight means that the trip is longer than a typical day’s work and long enough for you to require rest. Resting in your car is generally not enough, but if you have to get a hotel room, then the trip will qualify as overnight regardless of when you sleep.

Transportation vs travel expenses: Local transportation at your tax home can be deductible without an overnight stay—if there is a business reason for the transportation, such as driving from your office to visit a client. On a tangent, when you travel overnight, your transportation is deductible, and so are things like lodging, meals, and incidental expenses.

Temporary Travel

For purposes of business travel, a temporary stay is one that is expected to last for less than one year. Open-ended trips are not temporary.

However, say you initially anticipate that your trip will last less than one year, but it later becomes apparent that it will last more than one year. The trip is a deductible business trip up until the point in time it becomes apparent it will last more than one year.

The IRS will also consider a series of assignments to the same location, all for short periods, that together cover a long period to be an indefinite assignment. Any expenses you incur from this type of trip will not be deductible.

Step 2: Check the List of Business Expenses That Qualify for Deductions

Your travel expenses must be business-related—unless an exception applies—to qualify for a deduction. However, if you incur expenses that are purely for personal pleasure, they are nondeductible.

Here is a list of business travel expenses that can be deducted.

Round-trip Transportation To-and-From the Destination

Transportation for a round trip to and from your temporary work location is deductible—and it could be anything that gets you to the location, including via your personal car. If you use your personal car, your costs are calculated using either the actual expenses or the standard mileage rate .

In addition, you can deduct additional round trips to return to home when you are not working.

However, the deduction for the additional round trips is limited to the cost you would have incurred if you stayed at the temporary location. Those costs could include meals and lodging.

- The business purpose of the meals is your business trip and are thus deductible—even if you eat alone.

- Meals on days off qualify.

- Travel to and from meals is deductible—even on your days off.

- The meals do not have to have a specific business purpose, such as meeting with a client.

- For longer trips, lodging can include monthly rentals.

- If you return home on your days off but keep the lodging at your travel location, then the lodging is still deductible if it is ordinary and necessary. For instance, the monthly rent of an apartment at your travel location would be deductible even if you return home on the weekends.

Transportation at the Destination

Once you arrive at your destination, you may need additional transportation to get around town—and these costs are deductible. The only exception would be if you travel to the destination for a purely personal reason like sightseeing on your day off.

Incidentals

Incidental expenses are minor expenditures associated with business travel. You can deduct the actual cost of any one of the following expenses:

- Shipping of baggage and sample or display material between your regular and temporary work locations

- Business seminar and registration fees

- Dry cleaning and laundry

- Business calls include business communications by fax machine and other communication devices

- Tips you pay for services related to any of these expenses

- Parking, tolls, and fees

- Any other similar ordinary and necessary expenses related to your business travel

Step 3 (For Those Mixing Business & Personal Travel): Allocate Expenses

When trips are both business and personal, the allocation of expenses varies based on the primary purpose of the trip. Determining the primary purpose of your journey requires you to evaluate the time spent on business vs personal activities.

Primarily Business Domestic Trips

If your trip is primarily for business purposes, then the round-trip transportation is 100% deductible and does not need to be allocated to the personal portion of your trip. However, all other expenses, like lodging and meals, must be allocated to personal expenses for days where there was no business reason for staying.

For example, if your seminar ends on Friday and you stay until Sunday, then the lodging and meals for Saturday and Sunday are nondeductible.

Primarily Personal Domestic Trips

If the primary purpose of your trip is personal, then none of the round-trip expenses are deductible. However, you can deduct the business portion of meals, lodging, and local transportation that was incurred for a business purpose.

Let’s say you stay a couple of days after your family vacation to meet with a client. The lodging and meals for those extra days are deductible.

Business Foreign Trips