- 800-872-6358

- Routing # 291378871

- Apply for a Loan Loan application

- Open an Account Open an Account

TCCU Online

- Forgot Login

Prepaid Visa TravelMoney® Card

A prepaid Visa TravelMoney® Card is a reloadable card, providing you access to funds while traveling.

- Make purchases online and at all Visa locations when traveling the world.

- Withdraw cash at ATMs, deducting it from your card balance.

- The minimum balance to open is $100, and you can reload the Card as often as you'd like. There is a fee to open the Card each time you reload the Card.

- 833-729-2853 (toll-free number)

- www.cumoney.com

- CU Money Mobile App

Stop by any Town & Country Credit Union location to open a Visa TravelMoney® Card.

Terms & Conditions:

- TravelMoney Card Services

- TravelMoney Service Fees

- TravelMoney Electronic Funds Transfer Disclosure

*Credit Union account holders can access additional funds to Card through Mobile App. Non-members can add cash funds to the Card at any Town & Country Credit Union branch location.

A helping hand to guide you.

What we value at Swing Barrel is trust and relationships. And we know that we can always call our lender any time to get the answers we need about anything. I would highly recommend Town & Country to any business.

- Access Cards

- TravelMoney Cards

- Incentive Cards

- Marketing Materials

- Reference Materials

- Card Inventory Orders

- Access Card Transactions

- Gift Card Transactions

- TravelMoney Card Transactions

- Incentive Card Transactions

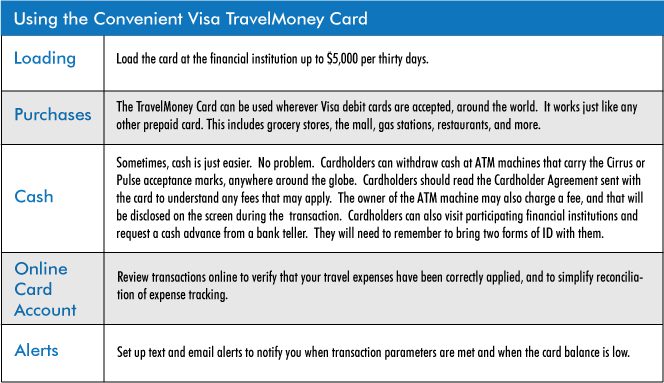

Convenient Visa TravelMoney Card

Secure your travel money.

- Combines the security of travelers' checks with the convenience of debit cards

- For business travel and vacations

- Convenient spending without the risk of exposing your credit card and bank account to fraud

- Perfect for teens that don't have credit cards or debit cards

- Fraud protection with Visa Zero Liability if card is lost or stolen

- 24-hour Travel and Emergency Assistance Services

Download our app reloadable cards only

Connect with us

Convenient Visa Prepaid Cards are issued by First Century Bank, N.A., member FDIC, pursuant to a license from Visa U.S.A. Inc. Cards issued to U.S. residents only.

© 2005-2015 Convenient Cards, Inc. All rights reserved.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Visa Travel Money Review 2024: Providers, Fees & Limits

If you’re looking for a secure and easy way to spend and make cash withdrawals when you’re away from home, a Visa travel card could be a good solution.

You can get prepaid Visa cards from banks and non-bank alternative providers, which you load with funds before you head overseas, for simple spending. Some cards – like those from Wise and Revolut – come with options to hold and convert your dollars to a selection of foreign currencies, too. Let’s dive right into our full guide to the Visa prepaid travel card options available for US customers.

Quick summary: Visa travel cards

- Visa is a large and globally accepted payment network – which means your Visa prepaid travel card will work more or less anywhere in the world

- Travel cards are secure for overseas use, and offer extra reassurance as they’re not linked to your checking account

- Some providers, like Wise and Revolut , let you hold and exchange foreign currencies for spending with your Visa travel card

- Lots of different Visa travel card options are available, through banks and non-bank digital providers

Go to Wise Go to Revolut

What is a Visa travel money card?

A Visa travel money card is a prepaid debit card which you can load with USD from your bank, with a card, or in some cases with cash. You can then securely spend and make withdrawals with the card around the world. Different Visa travel money cards have their own features and fees, so it’s handy to compare a few options to find the right one for you.

Where can I get a prepaid Visa card for international use?

There are quite a few different prepaid Visa cards on the US market, through banks and non-bank alternative providers. However, the features and fees of different cards can vary greatly. Here we’ll look at several examples, including non-bank options for international use from Wise and Revolut :

Wise – hold and exchange 40+ currencies in your account and spend globally with your linked debit card. 9 USD order fee, no foreign transaction fee and ongoing charges

Revolut – supports 25+ currencies, with account plan options including some with no ongoing fees, and other with monthly charges of up to 16.99 USD. No foreign transaction fee, and all account plans offer some weekday no fee currency conversion

Republic Bank and Trust Company – get the Everyday Select Rewards Visa Prepaid Card for home and international use, and earn up to 2% cash back. 2.5% foreign transaction fee applies to overseas use

Netspend – choose from a large range of Netspend prepaid Visa cards, issued through a selection of banks and non-bank providers. Fees do vary depending on the card you pick, and can include a foreign transaction charge of up to 2.5%

Which banks offer Visa travel money cards?

You can get a Visa prepaid card through a bank or non-bank alternative. There are lots out there so we’ve picked a few examples to kickstart your research:

*Details correct at time of writing, 8th April 2024

Wise travel card

Wise accounts can hold 40+ currencies and don’t have any foreign transaction fee, making them a great pick for international use. You can add money online or in the Wise app and then either convert to the currency you need, or just let the card convert for you when you pay.

- One time card order fee, no minimum balance, no ongoing charges

- Currency exchange uses the mid-market rate with fees from 0.43%

- Spend in 150+ countries, wherever the card network is accepted

Revolut travel card

Revolut has 3 different account plans in the US, including the Basic plan which has no monthly fees. All accounts support 25 currencies for holding and exchange, and offer some weekday no fee currency conversion before fair usage fees begin.

- Choose the account plan that suits your spending needs

- No fee for currency conversion to your plan limit – 0.5% fair usage fee after that

- Hold and exchange 25 currencies for convenient international use

Go to Revolut

Republic Bank and Trust Company travel card

Check out the Everyday Select Rewards Visa Prepaid Card which allows you to earn up to 2% cash back. Hold a balance in USD, which you can top up online or in person using cash.

- Choose a pay as you go model, or pay a monthly fee of up to 9.95 USD

- 2.5% foreign transaction fee applies to overseas use

- 3.95 USD international ATM fee

Netspend travel card

Netspend has a broad selection of different prepaid Visa travel cards, which can be issued through banks and non-bank alternative providers. Generally cards can be offered on a pay as you go basis, with higher transaction fees – or with a monthly charge which includes some transaction costs.

- Broad selection of different cards which can use used to hold USD

- Visa exchange rate with a fee of up to 3.5% for international use, depending on specific card selected

- Varying international ATM fees based on the card you choose

How does the Visa travel money card work?

Prepaid travel money cards can be helpful as they are not linked to your checking account. Instead you can top up your card conveniently – often online, and sometimes by loading cash in a physical location – before you spend or make cash withdrawals. Cards can be used to save or budget for a specific event like a vacation, and because they’re not linked to your normal checking account they’re secure to use at home and abroad.

How to top up prepaid travel money cards

Providers like Wise and Revolut allow you to top up digitally, online or in the provider’s app. Prepaid Visa cards issued through some banks and other providers may offer these top up methods as well as the option to load cash in a store, or to upload a mobile check. To add money digitally you’ll usually just need to take the following steps:

- Log into the provider’s app

- Select the Add money option

- Enter the amount and currency you want to add

- Pick the way you want to pay

- Confirm, pay, and your money will be added to your balance

How to check your balance on your card

Visa payment cards usually come with linked digital accounts which let you check your balance online or in an app. You can also insert your card into an ATM to get balance advice – but some providers do charge for this service.

International ATM cash withdrawal

Use your Visa prepaid card to make ATM withdrawals internationally, in exactly the same way as you would at home. Just look out for an ATM which displays the Visa logo, and you’re good to go.

Is Visa travel money safe to use?

Travel money cards are considered to be safe to use, particularly as they’re not linked to a checking account. However, you’ll still need to make sure that the specific card you select is issued through a reputable bank or non-bank provider, which is properly licensed and regulated.

Visa Travel money fees & limits

It’s important to check the relevant fees which apply to the specific card you select, particularly if you’re planning on using your card for overseas spending. Some providers have fairly high foreign transaction fees so picking carefully is crucial. Here’s a quick summary of key fees for the cards we’ve selected – other charges may also apply:

Visa Travel exchange rates

Different cards will use their own approach to foreign currency exchange when you spend overseas. Here’s a quick roundup:

Wise – mid-market exchange rate with low fees from 0.43%

Revolut – mid-market exchange rate to plan limit, 0.5% fair usage fee may apply after that

Republic Bank and Trust Company – Visa rate with foreign transaction fee of 2.5%

Netspend – Visa rate with foreign transaction fee of up to 3.5%, depending on specific card selected

How to get a Visa card for travel

Most Visa prepaid cards can be ordered online, for home delivery. You might need to wait a few days for your card to arrive – in the US a Wise card can take 14 to 21 days, for example. Other providers may offer ways to expedite delivery of your card, but this will come with higher costs.

To register an account with a provider and order a Visa prepaid travel card you’ll usually have to:

- Select the option to sign up, on the provider’s website or app

- Enter your personal and contact information

- Add images of your ID and address documents for verification

- Add some money to your account

- Tap to order your card – it will be delivered to your registered residential address

How to activate your travel money card

It’s common to find you have to activate your new Visa travel card before you can use it. Different providers have their own system for card activation. With Wise , as an example, you’ll need to log into your account online or in the app, and enter the 6 digit code that’s sent to you with your card. Other providers may allow you to activate a card by calling a service center or visiting a bank branch.

How to use a Visa Travel money card overseas

You could use your Visa travel money card overseas just as easily as you do at home. Look for the Visa network symbol which is displayed on ATMs, online and at the payment terminal in stores. Most Visa travel money cards are contactless, allowing you to tap and pay easily.

Supported currencies

Visa travel cards can be used more or less globally. Some, like the cards from Wise and Revolut , allow you to hold a foreign currency balance which can be a convenient option as it allows you to view your budget in advance. Once you have the currency you need you can spend with no additional fees to pay.

Other card options may convert your foreign currency spending back to USD with the Visa exchange rate and a foreign transaction fee, before deducting the final amount from your account.

Conclusion: is a Visa Travel card worth it?

Visa travel cards are globally accepted and available from many different banks and providers in the US. If you’re thinking of using a Visa card specifically for overseas use it’s useful to get a card from a provider which supports holding a foreign currency balance, as this can keep down your foreign transaction costs. It’s also a convenient way to see your travel budget in advance, and allows you to lock in a good exchange rate when you see it. Use this guide to compare a few options, like Wise and Revolut , and see which might suit your specific needs.

Visa Travel money FAQs

What is the best prepaid visa for international travel.

There’s no single best Visa prepaid card, so the one which works best for you might just come down to your spending habits and personal preferences. If you’re looking for a card to use overseas, check out the options from Wise and Revolut as they both let you hold a foreign currency balance which is a good way to keep costs down when you travel.

Is a Visa travel card a credit card or debit card?

The Visa travel cards we’ve covered in this guide are prepaid debit cards. You’ll also find some banks issue credit cards on the Visa network, so do look carefully at the terms and conditions of the card you’re signing up for so you know how to use your card most effectively.

Is Visa travel money a multi currency card?

If you get a Visa card from a provider like Wise and Revolut you can hold a foreign currency balance for overseas spending. Some other providers issue Visa prepaid cards which can only be used to hold a balance in USD – but you can still spend internationally more or less anywhere in the world.

How much does a Visa travel card cost?

Different Visa card issuers have their own fees which may include card order charges, or monthly costs. Compare a few options to make sure you’re getting the one which has the best balance of features and fees based on your specific preferences.

Please update your browser.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Update your browser

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Chase Online Account Access

Please turn on javascript in your browser.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

We have the right card for you

Cash back, savings on interest, or travel rewards — we have the right card to fit your needs.

Important Information

COVID-19 Support Sign in and find the resources you need. We’re here to help.

Servicing toolkit

- Security & fraud protection

Credit Card Education

Have questions about building your credit score, choosing the right credit card or learning about credit card rewards? Learn more about these topics and much more.

Chase cards offer exclusive perks

You’re getting so much more from your credit card. Take a look.

Contactless cards

Want a contactless Chase Visa ® credit card? Convert your existing card or find a card that fits your life and apply online.

Identify financial abuse

We can help you recognize the warning signs and give you tips on how to protect yourself and your loved ones.

Chase Offers

With Chase Offers you can activate deals on the things you love in the Chase Mobile ® app or on chase.com.

Spending Report

See your personalized spending report to track, sort and see a PDF of your Chase credit card transactions.

Refer. Reward. Repeat.

Earn rewards for each friend who gets one of your cards.

Free credit score

Chase Credit Journey ® gives you unlimited access to your credit score, email alerts that can help identify fraud and more.

Stored cards

Let us track where you stored your card so you don’t have to with this free, easy and secure tool.

Frequently asked questions

Get answers to common questions about Chase credit cards. Plus, check out our glossary for the meaning of card-related items.

Security & fraud protection

If you suspect a charge on your account may be fraudulent, please call us immediately at the number on the back of your card.

- Fraud protection

- Dispute a charge

- Security Center

Watch and learn

Explore how-to videos and see how easy it is to get things done.

Schedule a payment

Choose when you want a credit card payment made

Lock and unlock your credit card

Instantly stop purchases when your card is lost or misplaced

Chase Survey

Your feedback is important to us. Will you take a few moments to answer some quick questions?

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

- International edition

- Australia edition

- Europe edition

UK policy denying visas to children of care workers faces legal challenge

Exclusive: Action by organisation supporting migrants argues new rules are discriminatory

An organisation that supports migrant workers has launched a legal challenge against the government’s new policy to bar care workers from bringing children and partners to the UK, warning that it is “tearing families apart”.

According to Migrants at Work, care workers have to choose between family life with their children and partners or getting a job as a health or social carer in the UK – they can no longer do both.

The controversial policy , which took effect last month, has been introduced at a time when the vacancy rate in the adult social care workforce is at almost 10%.

The home secretary, James Cleverly, said the changes had been made to tighten up high levels of non-compliance as well as exploitation and abuse in the care sector.

A report from the Migration Advisory Committee estimated that 236,000 full-time care staff would be needed across the UK in the next 11 years.

A report to the Commons public accounts committee last month found there were 152,000 vacancies in the care sector – a 9.9% vacancy rate. The report said changes had been introduced at a time when “social care workforce shortages are of profound concern”.

The legal action argues that the policy is discriminatory on various grounds including sex, race and is in breach of the public sector equality duty. It claims the home secretary has failed to take into account the needs of care sector workers.

Aké Achi, the founding chief executive of Migrants at Work, said: “The Home Office’s changes to the health and social care visa will further exacerbate the staff shortages in the adult social care workforce.

“On top of this, carers who want to come to the UK are now facing an invidious choice: either they take up a job that will contribute to the delivery of social care at a time of crisis in the UK, or they continue living with their children and partners.

“The new rules will not allow them to do both. We have also seen cases where prospective care workers have been told they have to leave the UK since the new rules have come in, on the basis that their children are not permitted to stay in the UK as their dependants. The new rules are already tearing families apart and the impact on the wider care sector will be disastrous.”

Jeremy Bloom, a solicitor at Duncan Lewis, representing Migrants at Work, said the Home Office still had an opportunity to ditch the new rules and save on the expense of litigation.

He added: “We haven’t seen any evidence that the Home Office has properly considered the impact that this will have on people coming to the UK on health and social care visas, on the vulnerable individuals who need access to social care, or on the wider system of social care.”

He accused the home secretary of ignoring the impact this would have on staff shortages in the social care sector.

“The secretary of state is clear that a full impact assessment was not carried out prior to the introduction of the policy, which raises very serious concerns about whether he has complied with the public sector equality duty.”

A government spokesperson said: “Care workers make a vital contribution to society, but immigration is not the long-term answer to our social care needs. An estimated 120,000 dependants accompanied 100,000 care workers in the year ending September 2023. These numbers are unsustainable, which is why reforms are now in place restricting care workers from bringing dependants with them”.

- Immigration and asylum

- Home Office

- James Cleverly

- Employment law

- Workers' rights

- Care workers

- Social care

Most viewed

Money latest: The 'German classic' that's a healthier and cheaper alternative to crisps

Crisps are on the menu as we see where you can make healthier choices for the best value. Elsewhere, the boss of Sainsbury's has insisted customers like self-checkouts - do you agree? Leave your thoughts in the box below.

Friday 26 April 2024 18:20, UK

- New research reveals cost of having children

- Sainsbury's boss insists customers like self-checkouts

- FTSE 100 hits another record high

- Halifax hikes mortgage rates - as entire market moves upwards

Essential reads

- Do smart meters actually save you money?

- How to buy the least unhealthy crisps

- The world of dark tourism - what is it, is it ethical and where can you go?

- Money Problem : I have a mortgage offer - will it change now rates are rising?

- Savings Guide : Why locking into fixed-rate bond could be wise move

- Cheap Eats : Michelin chef's secret lasagne tip - and expensive ingredient you shouldn't use

Ask a question or make a comment

"Status symbol" pets are being given up by owners who get scared as they grow up, an animal charity has said, with the cost of living possibly paying a part in a rise in separations.

The Exotic Pet Refuge, which homes parrots, monkeys, snakes and alligators among others, says it receives referrals across the country, including from zoos and the RSPCA.

"They're a status symbol. People will say, 'OK, I'll have an alligator or a 10ft boa constrictor'," co-owner Pam Mansfield told the BBC.

"But when the animal gets big, they will get too frightened to handle them, and then the pet has to go."

She added people who want to get rid of the pets sometimes call zoos for help, which then call on her charity.

In some cases, owners don't have licences to own dangerous animals, she says, blaming a "lack of understanding" for what she says is a rise in the number of exotic animals needing to be rehomed.

She says people "just don't have the space" for some snakes, for example, with some growing to as much as 12ft and needing their own room.

The cost of living crisis has also forced owners to give their pets away, she says.

Her charity has also been affected by those increased costs, with the electricity bill rising to £10,000 a month at their highest, to fund things like heated pools for alligators.

Private car parks are accused of "confusing drivers" after introducing a new code of conduct - despite "doing all they can" to prevent an official government version.

The code of practice launched by two industry bodies - British Parking Association and the International Parking Community - includes a ten-minute grace period for motorists to leave a car park after the parking period they paid for ends.

It also features requirements for consistent signage, a single set of rules for operators on private land and an "appeals charter".

Private parking businesses have been accused of using misleading and confusing signs, aggressive debt collection and unreasonable fees.

That comes after a government-backed code of conduct was withdrawn in June 2022, after a legal challenges by parking companies.

RAC head of policy Simon Williams said: "We're flabbergasted that the BPA and the IPC have suddenly announced plans to introduce their own private parking code after doing all they can over the last five years to prevent the official government code created by an act of Parliament coming into force.

"While there are clearly some positive elements to what the private parking industry is proposing, it conveniently avoids some of the biggest issues around caps on penalty charges and debt recovery fees which badly need to be addressed to prevent drivers being taken advantage of."

BPA chief executive Andrew Pester said: "This is a crucial milestone as we work closely with government, consumer bodies and others to deliver fairer and more consistent parking standards for motorists."

IPC chief executive Will Hurley said: "The single code will benefit all compliant motorists and will present clear consequences for those who decide to break the rules."

Sky News has learnt the owner of Superdry's flagship store is weighing up a legal challenge to a rescue plan launched by the struggling fashion retailer.

M&G, the London-listed asset manager, has engaged lawyers from Hogan Lovells to scrutinise the restructuring plan.

The move by M&G, which owns the fashion retailer's 32,000 square foot Oxford Street store, will not necessarily result in a formal legal challenge - but sources say it's possible.

Read City editor Mark Kleinman 's story here...

NatWest says its mortgage lending nearly halved at the start of the year as it retreated from parts of the market when competition among lenders stepped up.

New mortgage lending totalled £5.2bn in the first three months of 2024, the banking group has revealed, down from £9.9bn the previous year.

The group, which includes Royal Bank of Scotland and Coutts, also reported an operating pre-tax profit of £1.3bn for the first quarter, down 27% from £1.8bn the previous year.

An unexplained flow of British luxury cars into states neighbouring Russia continued into February, new data shows.

About £26m worth of British cars were exported to Azerbaijan, making the former Soviet country the 17th biggest destination for UK cars - bigger than long-established export markets such as Ireland, Portugal and Qatar.

Azerbaijan's ascent has coincided almost to the month with the imposition of sanctions on the export of cars to Russia.

Read the rest of economics and data editor Ed Conway 's analysis here...

Rishi Sunak has hailed the arrival of pay day with a reminder his government's additional National Insurance tax cut kicks in this month for the first time.

At last month's budget, the chancellor announced NI will be cut by a further 2p - so some workers will pay 8% of their earnings instead of the 12% if was before autumn.

The prime minister has repeated his claim this will be worth £900 for someone on the average UK salary.

While this additional cut - on top of the previous 2p cut in January - does equate to £900 for those on average full-time earnings of £35,000, there are two key issues with Mr Sunak's claim:

- Once the effect of all income tax changes since 2021 are taken into account, the Institute for Fiscal Studies reports an average earner will benefit from a tax cut of £340 - far less than £900;

- Moreover, anyone earning less than £26,000 or between £55,000-£131,000 will ultimately be worse off.

In short, this is because NI cuts are more than offset by other tax rises.

We explain below how this is the case...

Tax thresholds

This is partly down to tax thresholds - the amount you are allowed to earn before you start paying tax (and national insurance) and before you start paying the higher rate of tax - will remain frozen.

This means people end up paying more tax than they otherwise would, when their pay rises with inflation but the thresholds don't keep up.

This phenomenon is known as "fiscal drag" and it's often called a stealth tax because it's not as noticeable immediately in your pay packet.

That low threshold of £12,570 has been in place since April 2021.

The Office for Budget Responsibility says if it had increased with inflation it would be set at £15,220 for 2024/25.

If that were the case, workers could earn an extra £2,650 tax-free each year.

Less give, more take

Sky News analysis shows someone on £16,000 a year will pay £607 more in total - equivalent to more than three months of average household spending on food.

Their income level means national insurance savings are limited but they are paying 20% in income tax on an additional £2,650 of earnings.

In its analysis , the IFS states: "In aggregate the NICs cuts just serve to give back a portion of the money that is being taken away through other income tax and NICs changes - in particular, multi-year freezes to tax thresholds at a time of high inflation."

Overall, according to the institute, for every £1 given back to workers by the National Insurance cuts, £1.30 will have been taken away due to threshold changes between 2021 and 2024.

This rises to £1.90 in 2027.

The UK could face a shortage of cava due to a drought in the sparkling wine's Spanish heartlands.

The Penedes area of Catalonia is dealing with its worst drought on record, with vineyards across the region so parched the roots of 30-year-old vines have died.

It's left shrivelled red and green grapes languishing under intense sun, fuelled by fossil-fuel driven climate change.

Cava is an increasingly popular drink in the UK, with 17.8 million bottles sold in 2023 - an increase of 5% from the previous year, when Britons stocked up on 16.8 million bottles, according to the Cava Regulatory Board.

That makes the UK the fourth-biggest buyer, behind only the US, Belgium and Germany.

Workforce slashed

The problems have been compounded after Catalonia-based cava producer Freixenet announced it will temporarily lay off 615 workers, almost 80% of its workforce.

Under Spanish law, companies facing exceptional circumstances can lay off staff or reduce working hours.

This measure is expected to take effect from May and it is not known how long it will last.

Price rises

One industry source told retail publication The Grocer that cava shortages would push up prices "certainly for next year" if there isn't enough supply.

This could last for years if the drought persists, they added.

Consumer expert Helen Dewdney told MailOnline the staff cuts at Freixenet can only mean one thing - price rises.

However, she added, supermarkets say they are not experiencing any issues right now.

Parents are being hammered by rising childcare costs, according to a new study that suggests they may spend more than £160,000 raising their child to the age of 18.

Research by Hargreaves Lansdown has found that parents with children pay £6,969 a year more than couples without.

Over 18 years and assuming an annual inflation rate of 3%, that amounts to a whopping £163,175, the investment platform said.

Its study also found that parents were less likely to have money left at the end of the month.

Single parents carry the biggest burden, with the research suggesting they have just £85 left on average compared to £365 for couples with children.

Hargreaves Lansdown also found just 23% of single parents reported having enough emergency savings to cover at least three months' worth of essential expenses, compared to 63% of couples with children.

Parents are also at a slight disadvantage when it comes to pensions, the research found, with only 43% of couples with children on track for a moderate retirement income, compared to 47% without. Only 17% of single parents have a decent projected pension fund.

Sarah Coles, head of personal finance at the firm, said "having children is one of the most expensive decisions a person can make".

She adds that as a result of having a child, "financial resilience suffers across the board", and added: "For single parents, life is even tougher, and they face far lower resilience on almost every measure.

"It means we need all the help we can get."

By Daniel Binns, business reporter

One of the top stories shaking up the markets this morning is that UK-based mining company Anglo American has rejected a major $38.8bn (£31bn) takeover bid.

Details of the attempted buyout by Australian rival BHP emerged yesterday - sending Anglo American shares soaring.

The deal would have created the world's biggest copper mining company - with the news coming as the price of the metal hit record highs this week.

However, Anglo American has now dismissed the proposal as "opportunistic" and said BHP had undervalued the company.

Anglo's shares are slightly down by 0.8% this morning - suggesting investors may not have given up hopes that a deal could eventually be agreed.

However, overall the FTSE 100 is up around 0.4% this morning, buoyed by strong reported earnings from US tech giants Microsoft and Google owner Alphabet.

It's helped the index, of the London Stock Exchange's 100 most valuable companies, hit yet another intraday (during the day) record of 8,136 points this morning.

The winning streak comes after a week of all-time highs on the index - including a record close of 8,078 points yesterday. The score is based on a calculation of the total value of the shares on the index.

Among the companies doing well this morning is NatWest - despite the bank reporting a fall in pre-tax profits of nearly 28% for the first quarter of the year.

Shares in the lender are up more than 3% after its results were better than expected by analysts.

On the currency markets, £1 buys $1.25 US or €1.16, almost on a par with yesterday.

Meanwhile, the price of a barrel of Brent crude oil has crept up slightly to $89 (£71).

Self-checkouts - they're like marmite, people seem to either love them or hate them.

But the boss of Sainsbury's has claimed that his customers do enjoy using self-checkouts, despite criticism that that machines don't always provide the convenience promised.

Simon Roberts told The Telegraph that there are more of them in Sainsbury's stores "than a number of years ago" as shoppers like the "speedy checkout".

But despite this, he said there won't be a time when they'll replace cashiers completely.

"Over the last year, where we've put more self-checkouts in, we're always making sure that the traditional kind of belted checkout is there," he said.

His comments come after northern supermarket Booths ditched self-checkouts at all but two of its sites after customer feedback.

Walmart and Costco in the US have also scaled back on the systems.

Let us know in the comments - do you love or hate self-checkouts?

We've all heard consumer advice that's repeated so often it almost becomes cliché. So, every Friday the Money team will get to the bottom of a different "fact" and decide whether it's a myth or must.

This week it is...

'Smart meters save you money'

For this one, we've enlisted the help of Dr Steve Buckley, also known as the Energy Doctor and head of data science at Loop...

So do smart meters help you save?

"The short answer is both yes and no," Steve says.

"Installing a smart meter by itself won't magically reduce your energy consumption. But, by giving you easy access to your energy usage data, smart meters pave the way for savings that you couldn't achieve otherwise."

Before smart meters, most households only found out how much energy they had used when the bill arrived.

By that stage it's too late to address wasteful usage, leading to what's known as "bill shock".

"With a smart meter, you can see your usage and costs in real-time through an in-home display or an app provided by your supplier," Steve says.

"This immediate feedback encourages you to use less energy. If you measure it, you can control it."

In 2022, the Department for Energy Security and Net Zero found that homes with smart meters used about 3.4% less electricity and 3% less gas.

"This might not seem like a lot, but it adds up to a saving of over £50 per household annually," Steve says.

If all homes in the UK made similar cuts, that would amount to savings of around £1.5bn and a potential reduction in CO2 emissions by about 2.7m tonnes each year.

"Good for individual households but also great for the planet," Steve says.

Smart meters are often installed at no extra cost to the consumer - it's effectively free data for households.

Limitations

Smart meters are more or less what you make of them - a simple, free tool that allows you to see headline figures.

However, "without detailed analysis, it's tough to identify and eliminate" where you could be wasting money, Steve says.

Apps like Utrack, Loop and Hugo Energy can help you work out where you might be losing money by offering a more detailed breakdown if connected to your smart meter.

Those tools are often free, but you may need to register your card details as proof of address.

The tools give a number of useful insights, including looking at consumption in other households of similar size or monitoring where chunks of your money are going, such as to a faulty boiler or the "phantom load" (energy wasted by devices left on unnecessarily).

Myth or must?

Although smart meters alone don't reduce energy bills, they are a vital tool to help energy efficiency and cost savings.

By Ollie Cooper, Money team

It can be hard to balance getting nutritious foods that make you feel good without spending a lot.

In this series, which ends today after digging into yoghurt, bread, pasta, fruit juice and plant-based milk, we've tried to find the healthiest options in the supermarket for the best value.

Sunna Van Kampen, founder of Tonic Health , who went viral on social media for reviewing food in the search of healthier choices, has given his input for the past six weeks.

And for the final part of the series, we're looking at the nation's favourite snack: crisps.

The series does not aim to identify the outright healthiest option, but to help you get better nutritional value for as little money as possible.

We're a people obsessed: in the UK, we get through six billion packets of crisps a year.

Sunna has three easy tips for finding the tastiest options that are kinder to your body...

1. Understand the fat facts

"Typical crisps can be oil sponges and contain over 30% fat from low-quality vegetable oils that have been fried," Sunna says.

"What we are on the lookout for those that buck the trend and stay away from the fat."

So, he says, aim for crisps that contain less than 15% total fat.

2. Fibre up your snack time

"While crisps aren't exactly salad, some can offer more nutritional value than others," Sunna says.

"Check the labels for options that have more fibre or protein."

These help you feel fuller for longer and also keep your digestive system happy.

3. Portion control

"It's easy to demolish an entire bag in one sitting - however, many brands offer multipack bags that are portion-controlled, usually around 25g a bag," Sunna says.

Sticking to these helps to manage calorie intake and stops overindulging.

The big picture

"Small changes might not immediately seem like a lot but if you eat a bag a day with your lunch, we are talking about up to a whopping two litres of oil cut from your diet over the course of the year," Sunna says,

"This is not permission to eat crisps every day (enjoy as an occasional treat) but rather an indication of how small changes add up quickly overtime."

The good news is Sunna's recommendations are all similar in price to their popular, fattier rivals - so you don't need to make a bigger investment to reap some health benefits.

We've included the prices for the brands' standard multipacks at Tesco - correct as of time of writing.

Walkers Oven Baked - £1.95 for six-pack

"Around £1.95 for a pack of six, these crisps are baked, not fried, slashing the fat content to 13%, so a great option."

Popchips - £2.25 for five-pack

"These have just 13% fat content as they're popped rather than fried so are a great way to go reducing fat without compromising on the crunch."

And for some non-crisp options...

ProperCorn Popcorn - £2 for six-pack

Often described as "the healthier, lighter option", Sunna says ProperCorn "isn't actually the best option on the market for fat content at 17.4%".

That being said, you do get "double the fibre of standard crisps at 10.9g per 100g".

At only £2 for a pack of six, it's well-priced, too.

Snack A Jacks - £2.20 for five-pack

"At only 8.3% fat per 100g, it's a great option at £2.20 for a pack of five."

Penn State Baked Pretzels - £1.50 for 175g bag

Now for Sunna's winner.

"The German classic is a great option at only 4.6% fat per 100g," he says.

One downfall is that they are not available in portioned bags, so be careful with the whole 175g bag for £1.50.

Want another option altogether?

"If you want to be even healthier, consider the switch to nuts, seeds or even dried cheese snacks," Sunna says.

"Higher in calories yes, but higher in good healthy fats too and are more satiating which will limit the chance of overeating."

The nutritionist's view - from Dr Laura Brown , senior lecturer in nutrition, food and health sciences at Teesside University...

"Baked instead of fried crisps is definitely a way forward as well as the popcorn suggestion," she says.

"We should also be aiming to look at the amount of protein and fibre found in products. For example, lentil and pea snacks are growing in popularity due to their higher protein and fibre values, so the focus should be more on looking for ingredients other than potatoes, oil and salt.

"I also feel 'crisp' based snacks made in an air fryer are becoming more popular. These can include a wholemeal wrap with a small amount of oil added, and placed in the air fryer with paprika and other seasoning added for flavour.

"Also, chickpeas in the air fryer make for a super delicious protein and fibre rich snack. They are cheaper than crisps and lower in fat since no oil has to be added."

Read more from this series...

Be the first to get Breaking News

Install the Sky News app for free

IMAGES

COMMENTS

To activate card or login, please enter the first six digits of your card number below and select Submit. First Six Digits of Your Card Number: Everyday Spend Short Form Disclosure. Everyday Spend Long Form Disclosure. Everyday Spend Reg E Initial Disclosure.

If your Visa Travel Money card is lost or stolen, the Visa Customer Service Center, available 24 hours a day, 7 days a week, 365 days a year, receives your report and takes the necessary steps to block the lost or stolen card and protect you from the unauthorized use of the account. ... Independent of your bank account. Visa Travel Money is a ...

Cuentas con el portal exclusivo de Banorte Visa TravelMoney, donde de manera gratuita tienes acceso a la consulta de tu saldo, movimientos y bloqueo de tu tarjeta. Por tu seguridad, el límite diario para utilizar tu Banorte Visa TravelMoney es: Disposición de efectivo en cajeros automáticos: 480.00 dólares americanos.

Cuentas con el portal exclusivo de Banorte Visa TravelMoney, donde de manera gratuita tienes acceso a la consulta de tu saldo, movimientos y bloqueo de tu tarjeta. Por tu seguridad, el límite diario para utilizar tu Banorte Visa TravelMoney es: Disposición de efectivo en cajeros automáticos: 480.00 dólares americanos.

Once you've purchased your card from your credit union, it's so simple to get started: Activate your card online by clicking here or via the toll-free number by calling the number on the back of your card. Follow the prompts to activate your card and create a PIN. Sign the back of card. You're now ready to use the card!

En Banorte le otorgamos la facilidad de contar con una tarjeta con saldo en euros y dólares americanos. Ofrece un bajo costo para su contratación al no requerir: Además, Banorte Visa TravelMoney permite dispersión de fondos desde la banca electrónica. Puede mantenerse un saldo máximo de 25 mil dólares ó 10 mil euros.

Assistance with Lost/Stolen Visa TravelMoney® card. Assistance with Lost/Stolen Travelers Cheques. Assistance with Lost/Stolen Visa Gift Card. Special Note: If you use a "pop-up" screen blocker, you will need to deactivate it prior to making your purchase. If you use a "pop-up" screen blocker, you will need to deactivate it prior to making your

A prepaid Visa TravelMoney® Card is a reloadable card, providing you access to funds while traveling. ... Check your balance, add funds from your Town & Country Credit Union account, and view transactions 24 hours a day, seven days a week using: 833-729-2853 (toll-free number)

Login / Activate My Card. My CUMONEY® Visa® Everyday Spend Account. My CUMONEY® Visa TravelMoney® Card Account. Key Features. How To Use Your Card. CUMONEY® Visa® Everyday Spend Card. CUMONEY® Visa TravelMoney@ Card. How To Load Your Card. CUMONEY® Visa® Everyday Spend Card.

Secure Your Travel Money. Combines the security of travelers' checks with the convenience of debit cards. For business travel and vacations. Convenient spending without the risk of exposing your credit card and bank account to fraud. Perfect for teens that don't have credit cards or debit cards. Fraud protection with Visa Zero Liability if card ...

A. Via the Internet, access www.CUMONEY.com and login with your card number and PIN. Select the menu option "Fund Card" to transfer funds from one of your existing credit union accounts. VISA TravelMoney cards can only be loaded a maximum of four times. There is a 3 to 5 day hold before funds are available.

VISA TravelMoney cards are convenient, secure, and easy to manage online, making them a perfect travel companion. VISA TravelMoney Cards can be loaded with amounts from $100 to $5,000. The cards can be used anywhere VISA is accepted, internationally and domestically. ... Locator - finds nearest Visa ReadyLink; Account - settings, help, change ...

Prepaid Mobile App Features. FREE to download in the Apple Store & Google Play. Search under: CUMONEY Mobile. Create a new account on the cumoney mobile app for your card. Use a new username and password. Or use the same username and password as your current account on the website. Reload features available. Credit or Debit Card to Card Transfer.

Revolut - mid-market exchange rate to plan limit, 0.5% fair usage fee may apply after that. Republic Bank and Trust Company - Visa rate with foreign transaction fee of 2.5%. Netspend - Visa rate with foreign transaction fee of up to 3.5%, depending on specific card selected.

The biggest disadvantage of this card are the fees that come along with it. Each time you use the card, the AAA Visa TravelMoney card charges a 3% transaction fee and a $3 international ATM fee — typical for most credit cards. The benefit of the TravelMoney card is that because it's your money, you won't pay interest on your purchases.

AAA Visa TravelMoney ® Card ... If there are fraudulent or unauthorized transactions on the card account, the cardholder should contact customer service immediately (1-866-674-9621); transactions older than 30 days are difficult to dispute. The dispute process begins once all required documentation is received and

Eligible Visa cardholders can be connected with the appropriate local emergency and assistance resources available, 24 hours a day, 365 days a year. Call 1-800-992-6029 to get your questions answered. (Outside the U.S. call 1-804-673-1675.) This benefit is provided on a best-effort basis, and may not be available due to problems of time ...

Click on Account Login and then Visa TravelMoney® in the drop-down menu. One the new page, click on Activate My Card, enter your card number and follow the prompts through the information fields to activate and register your card and select your PIN. Your card is now activated and ready for use.

We're here to help you manage your money today and tomorrow. Chase Online is everything you need to manage your Credit Card Account. Wherever you travel you'll always know what's going on with your account - quickly and easily. See when charges and payments are posted. Track your spending and view your account activity.

An organisation that supports migrant workers has launched a legal challenge against the government's new policy to bar care workers from bringing children and partners to the UK, warning that ...

Add funds. Update of personal information. To report your Card lost or stolen and you purchased your card from your credit union: Before 10/1/18, please call: 1-877-850-9650. After 10/1/18, please call: 1-833-729-2853. To purchase additional cards, please visit your credit union. Contáctenos.

By Daniel Binns, business reporter. One of the top stories shaking up the markets this morning is that UK-based mining company Anglo American has rejected a major $38.8bn (£31bn) takeover bid.

CUMONEY® Visa TravelMoney® Card. Achieve your goals with the Visa Everyday Spend Prepaid Card. Load, reload and relax with money management tools that help you stay within your budget. The Everyday Spend Prepaid card works just like a traditional debit card, but with more convenience and security. Safer than cash.