Everything you need to know about Amex Travel

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy .

You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional perks through Amex Travel.

Let's explore this booking portal to uncover all its benefits and potential disadvantages.

What is the American Express Travel portal?

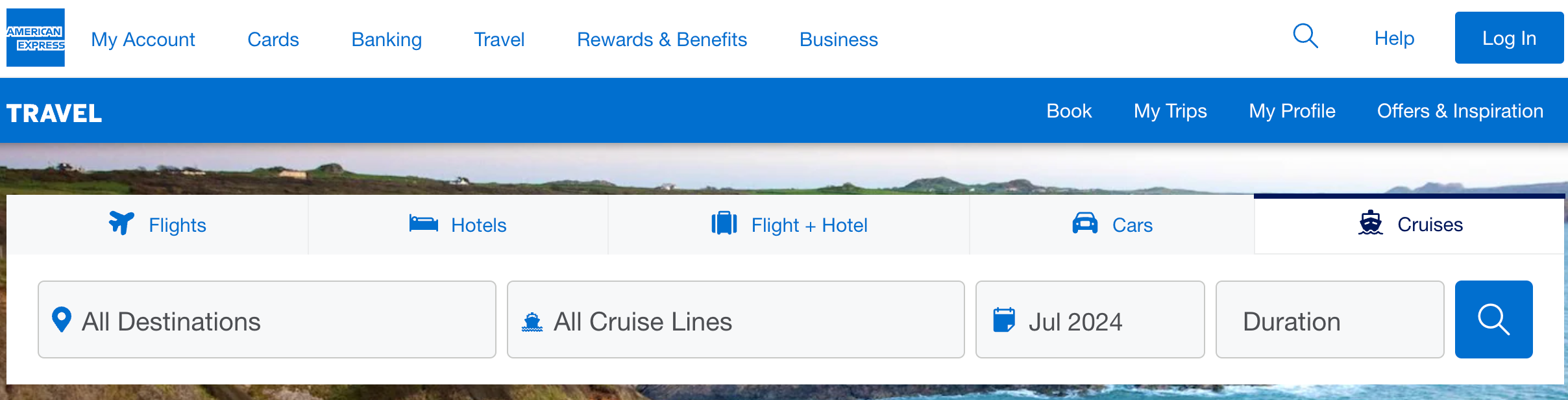

Amex Travel is the booking portal for most American Express cards . You can book flights, hotels, rental cars and cruises through the site, and you can pay with points, cash or a combination of the two.

How to book flights on the Amex Travel portal

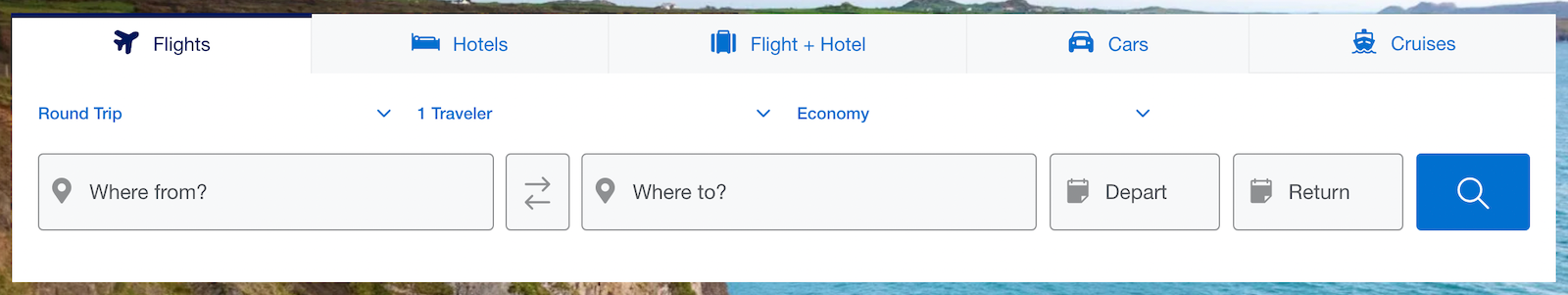

To find flights on American Express Travel, visit this webpage . The flight booking process on the Amex Travel portal is similar to other popular sites like Kayak and Orbitz. You'll find a search box where you can enter your departure and destination cities.

If you're flexible with your departure airport, you can choose an entire city, such as New York, which has multiple airports. Additionally, you can customize your booking by selecting your preferred class and the number of travelers, and choosing between one-way and round-trip flights.

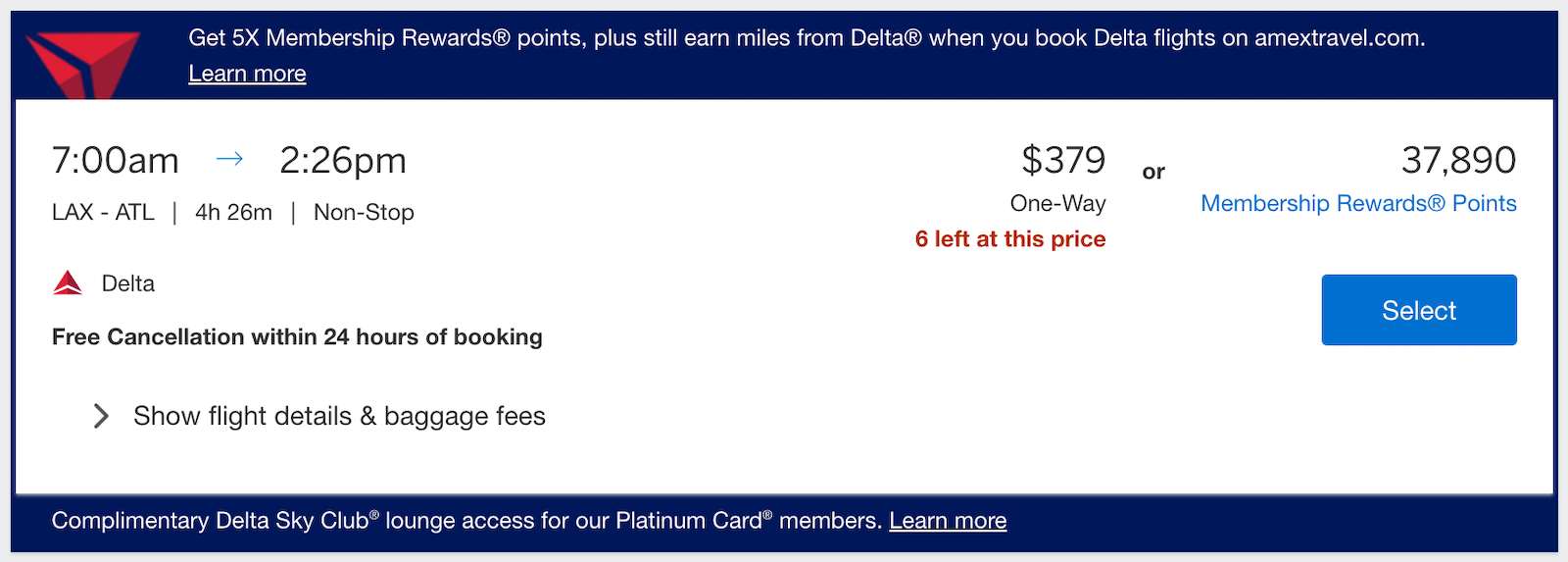

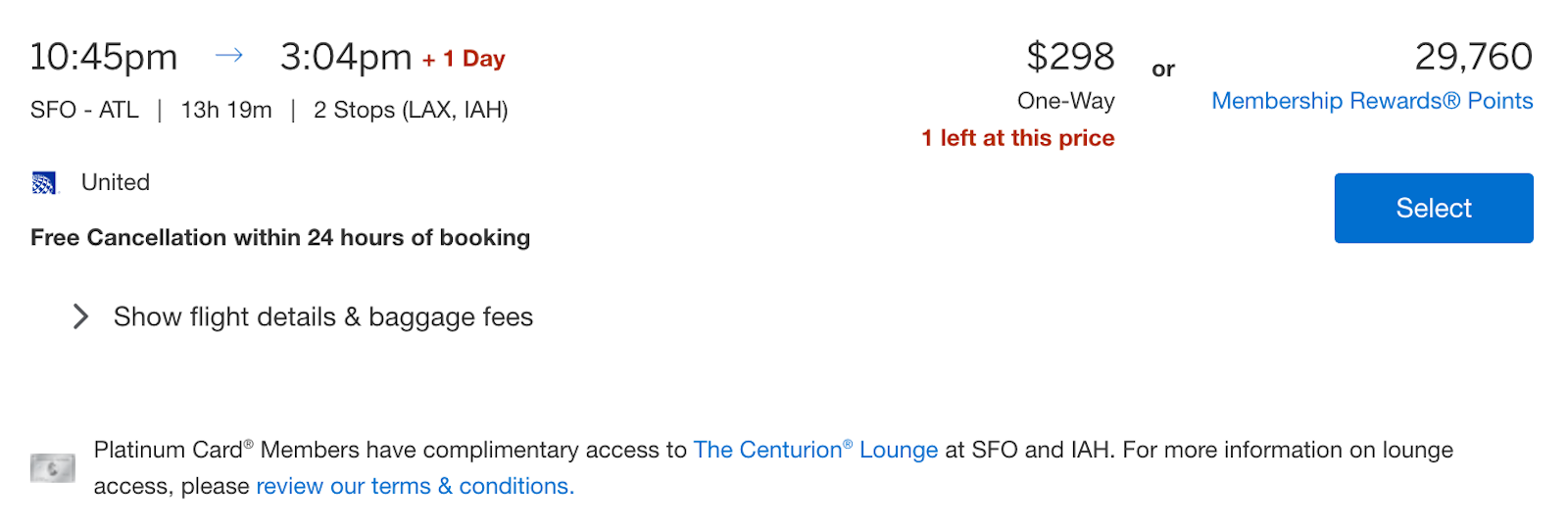

You'll see the price listed in dollars and the number of Amex Membership Rewards points during the booking process.

You can also use the options on the left-hand side to filter flights by number of stops, departure and arrival times, flight duration and airline.

Delta Air Lines is a featured airline in the Amex Travel portal. Sometimes, Delta flights appear at the top of your results, listed as "recommended," but this doesn't mean those flights are always the cheapest.

Additionally, if you have The Platinum Card® from American Express or The Business Platinum Card® from American Express and are flying from an airport with a Centurion Lounge , you'll see an indicator that a lounge is available.

Points vs. cash

When paying for your flights on Amex Travel, several American Express cards offer elevated earning rates:

You can also pay with Amex Membership Rewards points to cover the cost of your flight.

You'll see the number of points required next to the cash price of a flight. You can expect a value of 1 cent per point when using Pay with Points . However, TPG values Membership Rewards points at 2 cents apiece when you maximize Amex's transfer partners.

Related: How to redeem American Express Membership Rewards for maximum value

It's important to compare the number of points required for bookings on Amex Travel with the points you'd need to transfer to an airline program . If you can't book a flight through transfer partners and prefer to use your points, Amex Travel remains an option.

There's an additional benefit for Amex Business Platinum cardmembers: You can get 35% of your points back when paying with points on Amex Travel. This applies to first- and business-class flights on any airline plus tickets in any class on your preferred airline (the same one used for your airline incidental credits ; enrollment is required in advance). This 35% points rebate can provide a value of 1.54 cents per point, which may influence your decision to pay with cash or points.

Similarly, the Business Centurion® Card from American Express offers a 50% Pay with Points rebate on eligible flights. Note that Centurion cards are available by invitation only.

The information for the Business Centurion Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

More details about flights through Amex Travel

During the payment process, you can use points, your credit card or a combination of both. The minimum number of points you can use is 5,000, and each point is valued at 1 cent.

You can upgrade your flights using cash or points in the Amex Travel portal. This generally gives you a return of 1 cent each, and you can book using your Amex card, points or a combination of both.

During your flight search, you might come across "Insider Fares" that offer a discounted price. But to benefit from the discount, you must redeem points to cover the full fare amount.

Amex Platinum and Amex Business Platinum cardmembers have another benefit: discounted premium tickets through Amex Travel's International Airline Program . This program offers discounts on first-class, business-class and premium economy tickets from over 20 participating airlines.

To book a premium ticket using the IAP, go to the Amex Travel portal and pay with cash or points, including the Business Platinum card's 35% airline rebate. Keep in mind that not all flights are eligible and there are restrictions:

- The cardmember must travel on the itinerary.

- A maximum of eight tickets can be booked per itinerary; travel must begin and end in the U.S. or Canadian international airports.

- Tickets are nonrefundable unless stated otherwise.

- Name changes for passengers are not allowed.

Finally, note that flights booked through Amex Travel are typically treated as normal paid tickets, meaning you're eligible to earn points or miles with participating airline loyalty programs.

Related: Why I love the Amex Business Platinum's Pay with Points perk

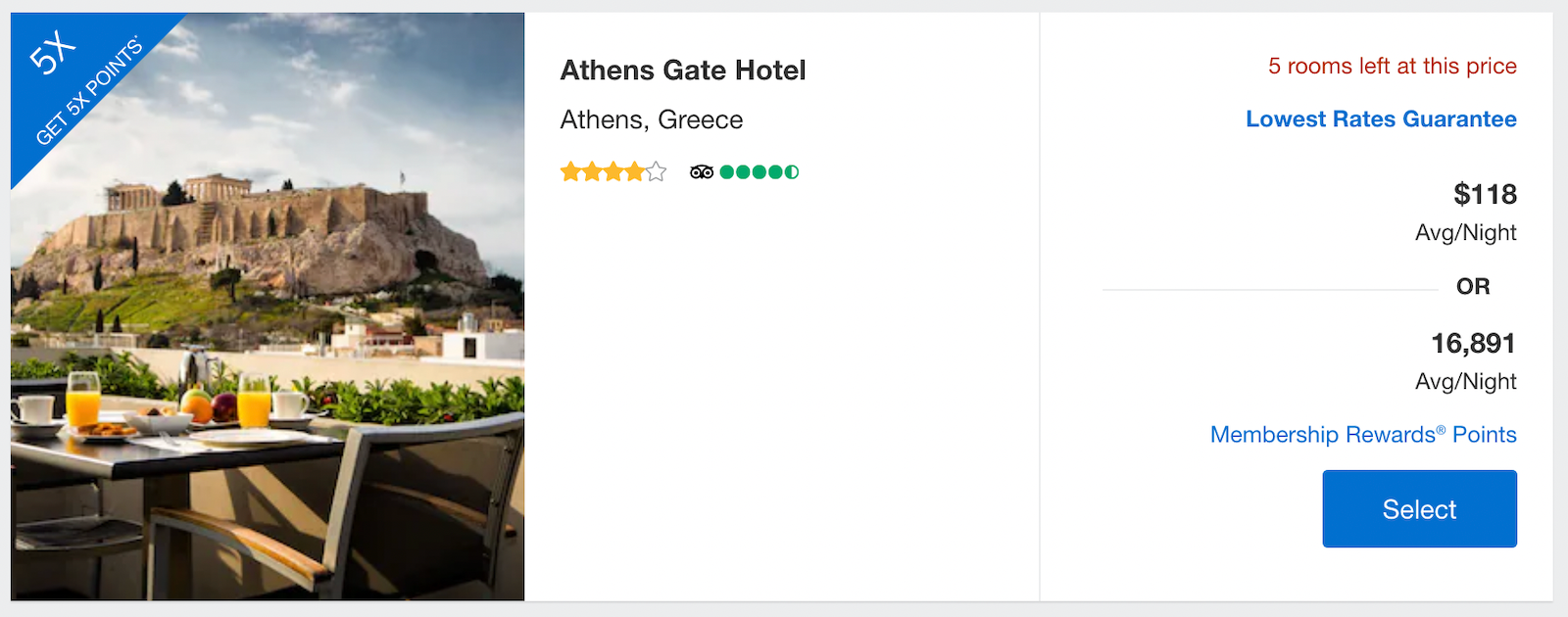

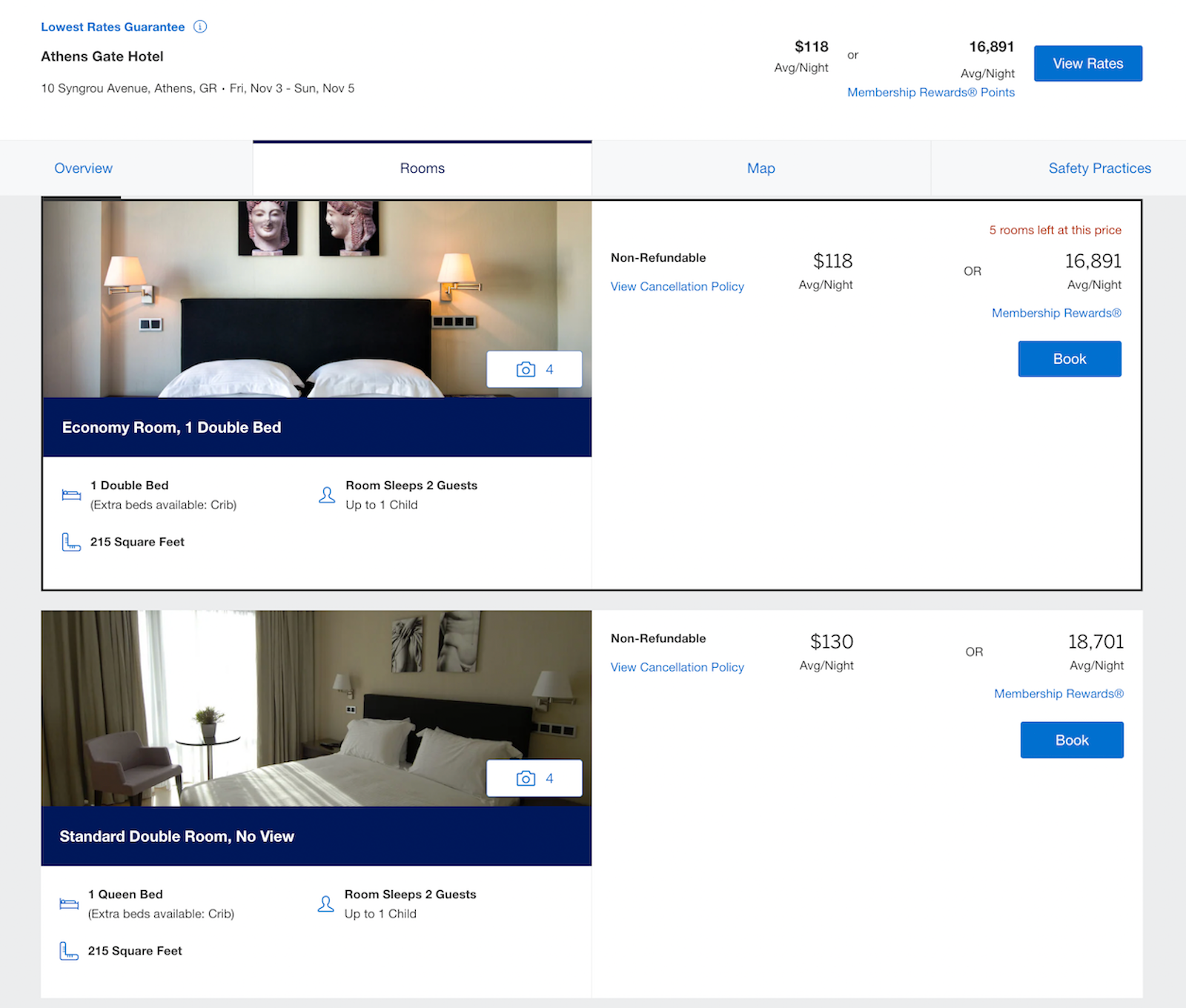

How to book hotels on the Amex Travel portal

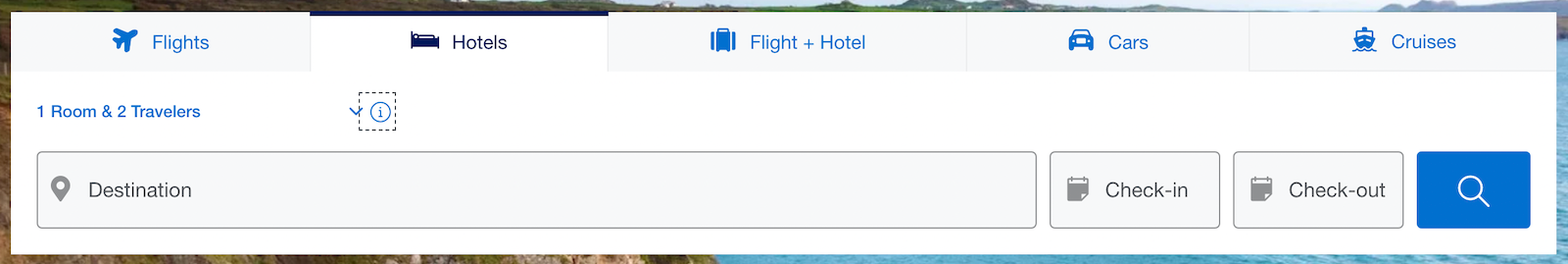

You can book hotels through American Express Travel with a Gold, Platinum or Centurion card. As with other travel portals, you can input your destination, dates, number of rooms and number of guests (with separate input fields for adults and children).

Platinum and Business Platinum cardmembers earn 5 points per dollar on prepaid hotel reservations.

After selecting your hotel, you'll choose your preferred room and pay with points or cash. If you pay with points, you'll only get a value of 0.7 cents per point (compared to 1 cent when you book flights).

Note that these are considered third-party bookings, so you likely won't earn hotel points or elite credits for your stay . While there are reports of people receiving stay credits with Marriott Bonvoy or Hilton Honors on rooms booked through Amex Travel, the hotel is not guaranteed to recognize your elite status in these programs or provide status-qualifying stay credits.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

Amex Fine Hotels + Resorts

Platinum and Centurion cardholders also have access to the Fine Hotels + Resorts program through Amex Travel. This can add some great benefits to your hotel stays — and may not cost much more than booking directly with the hotel.

Here are the perks you'll receive with every FHR booking, regardless of the length of your stay:

- Room upgrade upon arrival (when available): Some room types may be excluded, but you could receive an upgrade to preferred rooms with better views or a better location in the hotel.

- Daily breakfast for two people: The provided breakfast must be, at a minimum, a continental breakfast.

- Guaranteed 4 p.m. late checkout

- Noon check-in when available

- Complimentary Wi-Fi

- Unique property amenity: The amenity varies by hotel but should be valued at $100 or more and usually consists of a property credit, dining credit, spa credit, private airport transfer or similar amenity.

You'll need to book these stays through Amex Travel, but note that FHR is considered a separate program from Amex Travel.

In addition, if you have the personal Amex Platinum , you can also get up to $200 in statement credits every year for prepaid reservations through Fine Hotels + Resorts or The Hotel Collection — which we'll discuss next. Enrollment is required.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

The Hotel Collection

A lesser-known American Express benefit is The Hotel Collection , which allows you to book in cash or with points. Those with Amex Gold, Platinum and Centurion cards have access to this program, which offers the following benefits:

- A room upgrade at check-in (if available)

- $100 on-property credit for qualifying dining, spa and resort activities

Note that The Hotel Collection bookings require a minimum stay of two nights, though they too are eligible for the $200 hotel credit on the Amex Platinum.

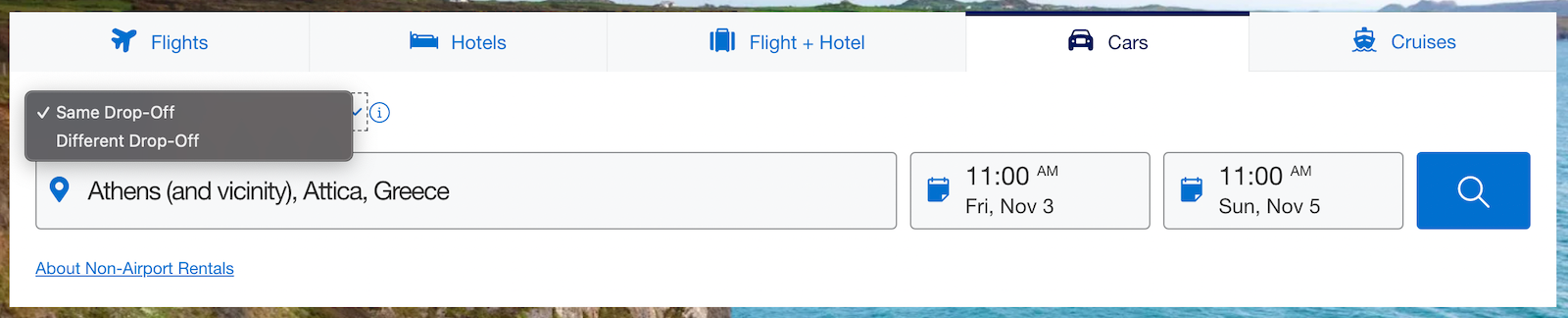

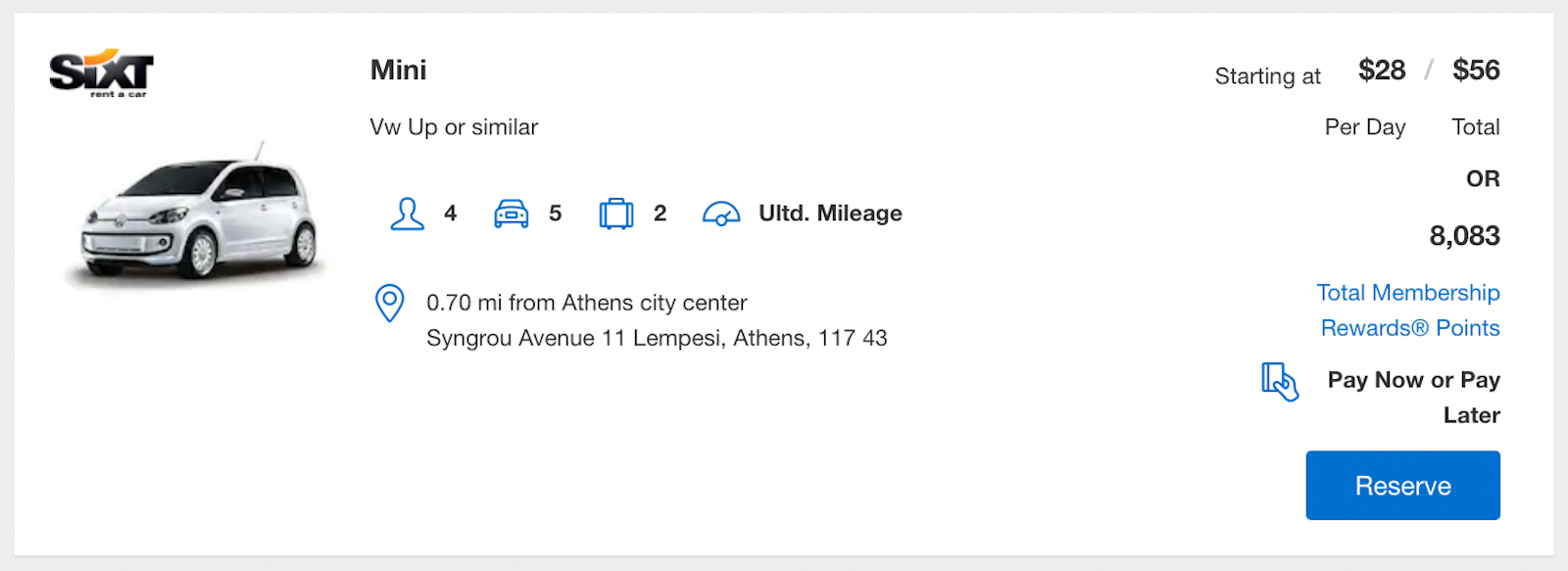

How to book rental cars and cruises on the Amex Travel portal

Reserving a car in the Amex portal is relatively simple. You'll input your pickup and drop-off times and location.

You'll see rental car prices listed in cash and points. When using Pay with Points , your points are worth 0.7 cents — just over a third of TPG's valuation of Amex Membership Rewards points.

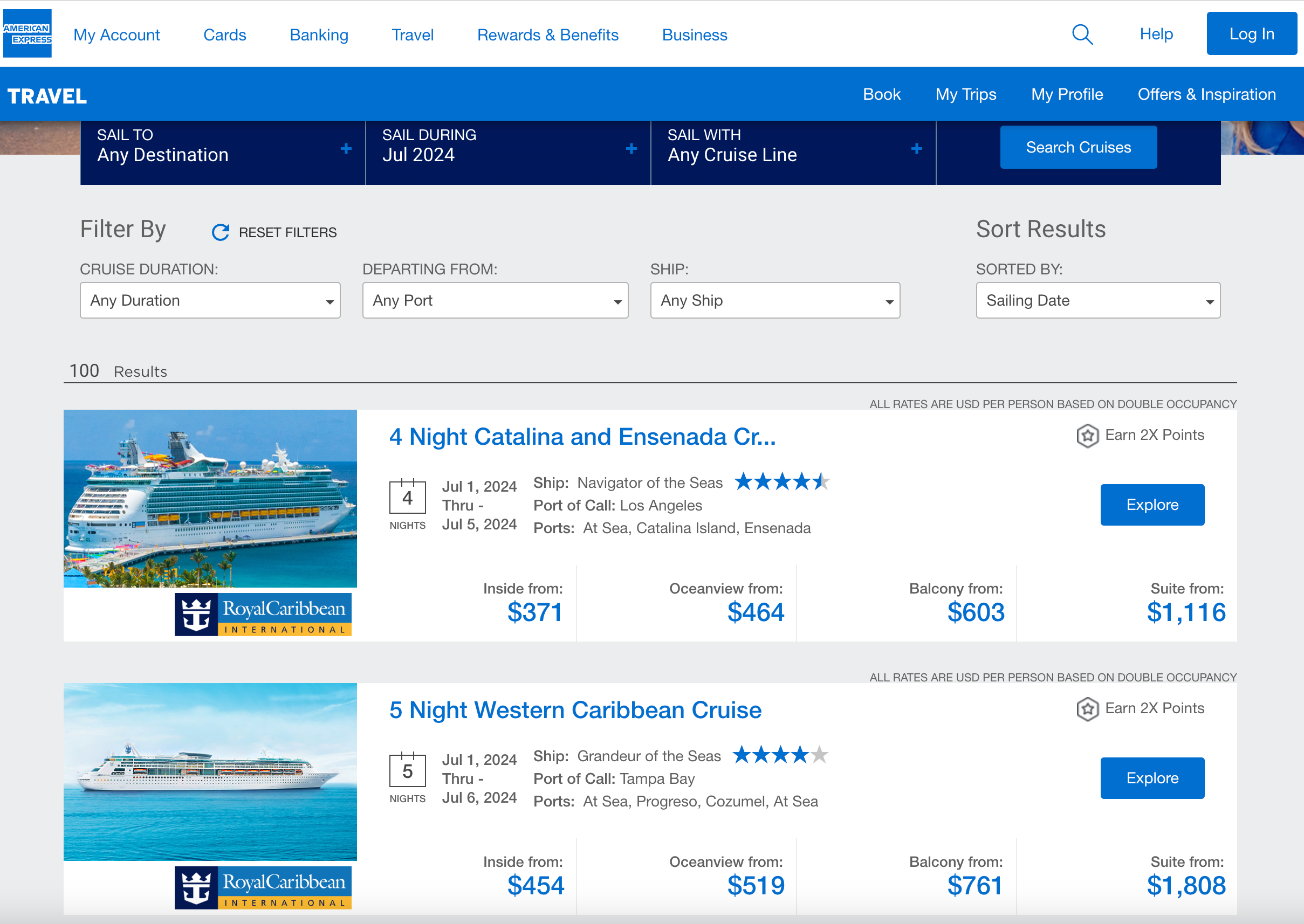

Although the format differs, you can also search for cruises on Amex Travel.

Rather than typing specific dates and numbers of passengers, you'll see four drop-down menus. These allow you to choose a destination (by region), filter by cruise lines and choose a month for travel — though not specific dates — on this first page. You can also select your desired cruise duration.

From here, you can filter by cruise duration, departure port and ship. You can sort your results by sailing date, value, price or ship rating.

On the final payment page, you can use your card or redeem points, ranging from 1 point to enough to cover the entire cost. Using points for a cruise will result in a low valuation of 0.7 cents per point, but it can be a money-saving option if you prefer not to spend cash.

There's another benefit available if you're a Platinum or Centurion cardholder (including personal and business versions of these cards): the Cruise Privileges Program .

This is available on cruises of five nights or more with select cruise lines, and it offers the following perks:

- $100-$500 in onboard ship credit (note that this cannot be used for casino or gratuity charges)

- Additional onboard amenities vary by line, such as spa vouchers, a bottle of Champagne, shore excursion credits or a private ship tour

Note that the Platinum cardmember must be one of the travelers on the cruise to enjoy these benefits.

Related: How to book a cruise using points and miles

Further things to consider about Amex Travel

When booking through the Amex Travel portal, there are a few factors to consider.

First, using Amex Membership Rewards points on Amex Travel may not provide the best value compared to transferring points to airline or hotel loyalty programs. The Pay with Points feature typically values points at 0.7 to 1 cent per point, which is far lower than our 2-cent valuation .

Additionally, the prices on Amex Travel may not always be the most competitive, so we recommend checking other platforms like Google Flights before booking your travel. Also, booking directly with hotels is advised for those seeking to utilize elite status benefits.

When you need to change your upcoming trips booked through Amex Travel, it can get complicated. You may encounter change and cancellation fees, often around $75, and making a change requires a phone call. Flight credit vouchers from cancellations can only be used for rebooking through Amex Travel via phone.

On the positive side, Amex Travel allows a 24-hour cancellation window for most reservations, and booking flights through the site generally still qualifies for earning miles and status with airline loyalty programs.

Related: Redeeming American Express Membership Rewards for maximum value

Bottom line

American Express Travel offers an array of booking options, including the ability to earn bonus Membership Rewards points on select purchases. Although you can use your points to book hotels, flights, rental cars and cruises through Amex Travel, you can get more from your points when you transfer them to Amex's airline and hotel partners .

However, there are exceptions, such as when there is no award availability for last-minute travel. In addition, Amex Travel offers perks like discounted premium flights, added benefits with Amex Fine Hotels + Resorts and a user-friendly interface. And with a simple redemption scheme that doesn't involve complicated loyalty programs and transfer partners, many Amex cardholders prefer it when planning their trips.

Additional reporting by Ryan Patterson and Kyle Olsen.

- Credit Cards

- Best Travel Credit Cards In Canada

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Best Travel Credit Cards In Canada For April 2024

Updated: Apr 18, 2024, 1:18pm

Fact Checked

Beyond cash back , travel is the most valuable redemption category on any rewards credit card. If you’re a savvy cardholder who collects reward points strategically and pays off their card every month—not hampered by a growing balance, fees and interest charges—it’s possible to travel entirely for free just by redeeming reward points alone.

We’re talking free flights, hotel stays, cruises and vacation packages that can all be redeemed with points. Plus, while you’re getting all or part of your trip paid for, many credit cards have built-in perks designed to make the trip itself as stress-free as possible. These include benefits like travel insurance, free checked bags, airport lounge access and priority designation through airport or border security. Yes, play your (credit) cards right and what once was a stressful experience can now be a breeze.

That said, with so many different travel programs to choose from, it can be difficult to know which program is the best choice to maximize your spending with.

With that in mind, Forbes Advisor Canada has researched the best cards and programs on the market and can guide you to its picks for the best credit cards for travel in Canada.

Featured Partner

Best travel credit cards in canada for april 2024, american express cobalt® card.

- CIBC Aventura Gold Visa Card

- CIBC Aventura Visa Infinite Card

- CIBC Aeroplan Visa Infinite Card

CIBC Aventura Visa Infinite Privilege

- WestJet RBC World Elite Mastercard

RBC Avion Visa Infinite

- CIBC Aeroplan Visa Card

- TD Aeroplan Visa Infinite Privilege

- TD Aeroplan Visa Platinum

- Alterna Savings Visa Infinite Card

WestJet RBC Mastercard

Here’s a summary of the best travel credit cards, methodology, best travel credit cards in canada, how travel credit cards work in canada, why get a travel credit card, travel credit card pros and cons, how to choose the right travel credit card, general travel cards vs. co-branded travel cards, travel points vs. cash back, types of travel credit cards in canada, additional rewards to look for in a travel card, using travel rewards, what are the different types of travel insurance, how to redeem travel credit card rewards, how to apply for a travel rewards credit card in canada, tips for maximizing your travel rewards credit cards, frequently asked questions (faqs), advertiser's disclosure.

- Best Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Cash Back Credit Cards

- Best Credit Cards for Bad Credit

- Best Aeroplan Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Balance Transfer Credit cards

American Express’s Secure Website

Welcome Bonus

Up to 15,000 Membership Rewards points

$155.88 ($12.99 per month)

Regular APR

On RBC’s Website

Get up to 55,000 Avion points* (a value of up to $1,100†), that’s enough to fly anywhere in North America or the Caribbean

TD® Aeroplan® Visa Infinite* Card

On TD’s Website

Up to $1200 in value†

Regular APR (Purchases) / Regular APR (Cash Advances)

20.99% / 22.99%

Best Overall Travel Credit Card

The American Express Cobalt also tops our Best Grocery Credit Cards list, but it wins when it comes to travel too. This is thanks to its impressive yearly earnings (nearly $600 worth of points) and its extensive suite of travel perks, which includes seven types of travel insurance. Plus, this card earns even more points when you spend on travel too—2 points per dollar on travel purchases—and offers flexibility, since you can transfer Membership Rewards to several frequent flier and other loyalty programs.

- Competitive welcome offer worth up to $300.

- 5 Membership Rewards points per dollar spent on groceries (up to $30,000 annually).

- 2 Membership Rewards points per dollar spent on travel and transit.

- Flexible redemption options for Membership Rewards points such as statement credits, and the ability to transfer points to leading frequent flier programs.

- An extensive suite of travel insurance coverages.

- A $100 USD hotel credit that can be used on dining, spa or other leisure activities at select hotels.

- High annual fee.

- Amex is still not accepted as widely as Visa or Mastercard.

- No interest-free grace period on cash advances.

- In your first year as a new Cobalt Cardmember, you can earn 1,250 Membership Rewards® points for each monthly billing period in which you spend $750 in net purchases on your Card. This could add up to 15,000 points in a year. That’s up to $150 towards a weekend getaway or concert tickets

- Earn 5x the points on eligible eats and drinks in Canada, including groceries and food delivery. Spend cap applies.

- Earn 3X the points on eligible streaming subscriptions in Canada

- Earn 2X the points on eligible ride shares, transit & gas in Canada

- Earn 1 additional point on eligible hotel and car rental bookings via American Express Travel Online

- Earn 1X point for every $1 in Card purchases everywhere else

- Enjoy access to hotel bookings, a room upgrade (when available), 12pm check-in and late check-out (when available), and up to $100 USD hotel credit to use on amenities when charged to the room for a stay of 2 or more consecutive nights through The Hotel Collection from American Express Travel

- Transfer points 1:1 to several frequent flyer and other loyalty programs

- Cobalt Cardmembers receive regular Perks such as bonus reward offers and access to great events

- Access Front Of The Line® Presale & Reserved Tickets to some of your favourite concerts and theatre performances and special offers and events curated for Cardmembers with American Express® Experiences

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment

Best Credit Card For Travel Points

35,000 Aventura Points

$139 (waived in the first year)

The Aventura Gold Visa card gives you an annual earnings value of over $400. Plus, it includes five types of travel insurance and flexible redemption options for your points. When redeeming points for travel, you’ll find yourself using fewer points when booking both long and short-haul flights compared to other loyalty programs.

- Flexible redemption options for Aventura Points

- $139 annual fee is waived in the first year

- Flight booking options that see you use fewer points on flights than with other frequent flier programs

- Five types of travel insurance

- Access to 1,200 airport lounges worldwide with four free visits annually

- $139 annual fee

- It costs $50 for an extra card

- Welcome bonus of up to 35,000 Aventura Points (earn 15,000 points when you make your first purchase and 20,000 points when you spend $3,000 or more in the first 4 monthly statement periods)

- 2 Aventura Points per dollar when you make travel purchases through the CIBC Travel Rewards Centre

- 1.5 Aventura Points per dollar spent at eligible gas stations, electric vehicle charging stations, grocery and drug stores

- 1 Aventura Points per dollar spent on all other purchases

- Forbes Advisor estimates you can earn $444 worth of rewards value based on average Canadian spending, factoring in the annual fee

- Four complimentary airport lounge visits per year on the Dragonpass network of over 1,200 airport lounges worldwide through the Visa Airport Companion Program

- Get a rebate on your NEXUS application every four years

- Link your CIBC Aventura Gold Visa to a Journie Rewards card for $0.10 per litre off at participating Ultramar, Pioneer, Fas Gas and Chevron gas stations

- Out-of-province emergency travel medical insurance

- Flight delay and baggage insurance

- Auto rental collision and loss damage insurance

- $500,000 common carrier accident insurance

- Hotel burglary insurance

- Mobile device insurance

- Purchase security and extended protection insurance

- Access to CIBC Pace It to pay off individual purchases in installments

- Make personalized travel booking arrangements at no additional fee with the Aventura Travel Assistant

- Optional credit card balance protection insurance

Best Credit Card For Premium Travel Perks

Cibc aventura® visa infinite* card.

Up to 60,000 Aventura Points

The CIBC Aventura Visa Infinite Card earns over $600 annually in value per year, with the annual fee factored in. It has an almost identical offering to the CIBC Aventura Gold Visa with 12 types of insurance and the Visa network benefits that come with the Infinite designation.

- 12 types of travel and consumer protection insurance, including $500,000 in common carrier accident insurance and rare mobile device insurance.

- Luxury upgrades, tickets and tours through Visa Infinite benefits.

- 4 complimentary airport lounge visits per year through the Visa Airport Companion Program.

- A NEXUS application fee rebate every 4 years.

- A $139 annual fee.

- A $60,000 personal and $100,000 household annual income requirement.

- Welcome offer of up to 60,000 Aventura Points (up to $1,200 in travel value): 15,000 Aventura Points after making your first purchase, 20,000 Aventura Points after spending $3,000 or more in net purchases in the first 4 monthly statement periods and 25,000 Aventura Points after having at least $6,000 in net purchases posted to your account in the first 4 monthly statement periods

- $139 annual fee, rebated on your first year of card membership

- 4 complimentary airport lounge passes, valued at nearly $200

- 1 NEXUS application fee rebate, a $50 value

- $60,000 minimum income requirement, $100,000 household

- Earn 2 points for every dollar spent through the CIBC rewards centre

- Earn 1.5 points for every dollar spent on gas, groceries, drug stores and EV charging stations

- Earn 1 point for every dollar spent on all other purchases.

- Points can be used for flights on any airline with points that don’t expire and cover airfare taxes and fees

- Built-in travel insurance, including emergency medical, travel accident, trip cancellation/interruption, flight delay and baggage insurance.

- Includes rental car collision/loss damage insurance, mobile device insurance and hotel/motel burglary insurance.

- Access personalized travel booking and trip planning with no booking fees through Aventura’s travel assistant

- Visa Infinite concierge service, hotel collection, and dining and wine country program

- Offer is not available to residents of Quebec

- Terms and conditions apply

Best Airline Travel Credit Card

- CIBC Aeroplan® Visa Infinite* Card

Up to 50,000 Aeroplan points

$139 (rebate in the first year)

It gives you the usual Visa Infinite benefits, but with Air Canada specific perks as well. Also, you get over $500 worth of Aeroplan points per year and the insurance coverage is still valid, even on flights paid for with Aeroplan Points.

- Healthy welcome bonus

- Annual fee rebate in the first year for the primary cardholder and up to three authorized users.

- First free checked bag whenever you fly Air Canada for you, authorized users and up to 8 traveling companions

- Reach Aeroplan Elite Status sooner.

- Get a free checked bag whenever you fly Air Canada.

- $139 annual fee.

- A $60,000 individual and $100,000 household annual income requirement to qualify for the card.

- $50 for each additional credit card.

- Welcome bonus of up to 50,000 Aeroplan points (10,000 points with first purchase, 15,000 after four months of spending $4,000 or more and 25,000 as anniversary bonus)

- 1.5 points for every dollar spent on eligible gas, electric vehicle charging, groceries and with Air Canada directly (with spending caps)

- 1 point for every dollar spent on other purchases

- Car rental discounts of up to 25% at participating Avis and Budget locations worldwide

- This offer is not available for residents of Quebec

Best Travel Credit Card For Aventura Rewards

80,000 Aventura Points

The welcome bonus on this card is huge and you can get high value rewards of nearly $700 annually, with the annual fee factored in. Plus, you get a lot of supplementary benefits, including travel insurance.

- A high and generous welcome bonus

- 3 points per dollar when you book travel through the CIBC Rewards Centre

- Exclusive business class bookings

- Includes 6 complimentary airport lounge visits per year

- A $200 annual travel credit

- High $499 annual fee

- High $150,000 individual or $200,000 household income requirement

- $99 for each additional credit card for up to nine authorized users

- Get up to 80,000 Aventura Points in the first year (25,000 points when you spend $3,000 in the first 4 months, 25,000 points when you spend $6,000 or more in the first 4 months and 30,000 points as an anniversary bonus)

- 50,000 Aventura Points when you spend $3,000 or more over your first 4 statement periods

- 30,000 Aventura Points as an additional account anniversary bonus

- 3 Aventura points per dollar on all travel purchases made through the CIBC Rewards Centre

- 2 Aventura points per dollar on all eligible dining, entertainment, grocery, gas and transportation purchases

- 1.25 Aventura Points per dollar on all other purchases

- Based on average Canadian yearly spending, can potentially earn $671.72 per year in rewards value, with the annual fee factored in

- 6 complimentary visits to over 1,200 airport lounges worldwide through the Visa Airport Companion Program

- $200 annual travel credit

- 2 NEXUS application rebates every four years (a $100 value)

- An annual fee rebate is available for the primary cardholder every year if they have CIBC Smart Plus account

- Dedicated taxi and limo services, exclusive dining and wine experiences. Plus, VIP experiences at luxury hotels and more Visa Infinite benefits

- 25% off vehicle rentals when you pay with your Aventura card at participating Avis and Budget locations

- All cardholders receive a metal card

- Get $0.10 off per litre of gas at Chevron, Ultramar, Fas Gas and Pioneer gas stations

- Includes 8 types of consumer protection and travel insurance combined, including out-of-province emergency medical, common carrier accident, mobile device insurance, trip cancellation/trip interruption, rental car collision/loss damage insurance, flight delay and baggage insurance, hotel/motel burglary insurance and purchase security and extended warranty insurance

Best Travel Credit Card For WestJet Flyers

Up to $450 in WestJet Dollarsǂ

Even if you’re not a frequent WestJet flier, this card provides enough excellent trip benefits to make it more than worth it when you do. You’ll also have access to their three partner airlines: Delta, Qantas and Air France, be able to redeem for much more than just flights and get annual earnings valued at over $300 a year.

- A generous welcome bonus worth up to $700.

- Flexible redemption options that include flights, vacation packages and with partner airlines.

- An annual companion voucher to anywhere WestJet flies starting at $119.

- Free first checked bag for you and up to 8 guests.

- Link this card with your Petro-Points card to save $0.03 per litre on gas and 20% more in bonus Petro-Points.

- Link this card with your Rexall Be Well membership and earn 50 Be Well Points per dollar at Rexall.

- High income requirement of $80,000 in personal annual income or $150,000 household income.

- Low base earn rate of 1.5% on all purchases.

- WestJet Dollars don’t cover airline taxes and fees.

- Increasing redemption minimums depending what you’re redeeming for (minimum $15 for one-way, $30 for round-trip and $50 for vacation packages).

- Get up to 450 WestJet dollars (a value of up to $450 off the base fare): – 250 WestJet dollars upon your first purchase – 200 WestJet dollars when you spend $5,000 in the first 3 months

- Plus, get a Round-Trip Companion Voucher every year – for any WestJet destination starting from $119 CAD (plus taxes, fees, charges and other ATC).

- Get free first checked bags for the primary cardholder and up to 8 guests on the same reservation

- Earn WestJet dollars 1.5% on everyday purchases and 2% on flights or packages with WestJet or WestJet Vacations

- WestJet dollars never expire. Use your WestJet dollars to book flights anytime so you can travel when and where you want.

- No blackout periods.

- Travel coverage including emergency medical insurance as well as trip interruption insurance, hotel burglary and rental car insurance. Even eligible purchases you make on the card are protected.

- Link your RBC card with a Petro-Points membership to and instantly save 3₵ per litre on fuel and always earn 20% more Petro-Points at Petro-Canada.

- Free Boingo Wifi for Mastercard holders at over 1 million hot spots

- Get $0 delivery fees for 12 months from DoorDash^ Add your eligible RBC credit card to your DoorDash account to: – Get a 12-month complimentary DashPass subscription± – a value of almost $120 – Enjoy unlimited deliveries with $0 delivery fees on orders of $15 or more when you pay with your eligible RBC credit card

- Conditions apply

Best Travel Credit Card For Avion Rewards

Up to 55,000 Avion Points

An incredibly generous welcome bonus that can fly you anywhere in North America or the Caribbean on Avion Points. Plus, a very good selection of trip benefits and an annual earnings value of nearly $500 anchor this card for only a very average purchase interest rate and annual fee.

Learn more: Read our RBC Avion Visa Infinite Review

- Avion Points can potentially be worth a lot on redemption (between $0.2 and $0.233 per point when you redeem through the RBC Air Travel Redemption Schedule).

- Flexible redemption options, including flights, merchandise, gift cards, charitable donations, RBC financial products, transfer to HBC Rewards and more.

- 4 different airlines to transfer points to, including Cathay Pacific, British Airways, WestJet and American Airlines.

- 12 different types of travel insurance and purchase protection, including the rare mobile device insurance policy.

- A huge welcome bonus that allows you to fly anywhere in anywhere in North America or the Caribbean

- High income requirements at $60,000 individual or $100,000 household annual income.

- Low redemption value for anything besides the RBC Air Travel Redemption Schedule and transferring to airline partners.

- A $120 annual fee.

- Get 35,000 Welcome Points on approval and 20,000 bonus points when you spend $5,000 in your first 6 months*. Apply by April 30, 2024.

- Earn 1 Avion point for every dollar you spend* and an extra 25% on eligible travel purchases.

- Avioners can book flights with points on any airline, on any flight, at any time, early or last minute, with no blackout periods or restrictions.

- Access to The Avion Collection of exclusive experiences, including red carpet events, rare tee times at exclusive golf courses and happenings involving dining and entertainment.

- Purchase and travel insurance options that include $1,500 of mobile device insurance, $500,000 on emergency medical travel insurance, $1,500 in trip cancellation, $5,000 in trip interruption, 90 days of purchase protection and 1 year of an extended warranty.

- Visa Infinite benefits, including front of the line event access and exclusive hotel or dining perks.

- Optional extras including RBC Road Assist, RBC BalanceProtector Max Insurance. Extra travel insurance that can be added on and identity theft and credit protection.

- †Terms and conditions apply. Refer to the RBC website for up-to-date offer terms and conditions.

Best No Annual Fee Travel Credit Card

10,000 Aeroplan Points

The CIBC Aeroplan Visa Card offers an annual earnings value of over $400,this card has a modest selection of insurance options, flexible rewards and the ability to add authorized users for free.

- Flexible rewards that can be redeemed for merchandise, gift cards and entertainment in addition to flights.

- Rewards can cover taxes and fees on flights.

- A modest selection of travel and purchase insurance.

- No annual fee.

- Add authorized users free of charge.

- A $15,000 annual household income requirement.

- A low welcome bonus only worth $200.

- Earn 10,000 Aeroplan Points when you make your first purchase (a $200 value) enough for a short-haul, economy class flight within North America.

- 1 Aeroplan Point per dollar on gas, groceries and on Air Canada purchases, including Air Canada vacations.

- 1 Point per $1.50 you spend on all other purchases.

- Based on average Canadian yearly spending, can potentially earn $444 per year in rewards value, with the annual fee factored in.

- Get $0.10 off per litre of gas with Fas Gas, Chevron, Ultramar and Pioneer when you link your Journie Rewards card.

- Earn points twice when you shop at over 150 Air Canada retail partners and over 170 online retailers through the Air Canada eStore.

- Earn Aeroplan Elite Status faster.

- Cover airfare taxes and fees with Aeroplan Points.

- Rental car collision theft. loss and damage insurance.

- $100,000 in travel accident insurance.

- Extended warranty insurance for one additional year past the manufacturer’s warranty.

- Purchase protection insurance for up to 90 days after buying an item.

Best Travel Credit Card For Aeroplan Rewards & NEXUS Rebates

Td® aeroplan® visa infinite privilege* card.

Up to 85,000 Aeroplan Points†

True to its name, the TD Aeroplan Visa Infinite Privilege Card is exclusive and expensive, but brings to bear a broad array of perks and benefits, along with a surprisingly accessible credit score threshold.

- Extensive travel perks, insurance and consumer protections

- Low credit score threshold for such a powerful card

- The most expensive annual fee on the list

- Requires minimum personal income of $150,000 a year or $200,000 in annual household income

- Earn up to $2,900 in value† including up to 85,000 Aeroplan points (enough for a round trip to Honolulu†) and additional travel benefits. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†.

- Earn an additional 40,000 Aeroplan points when you spend $10,000 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 25,000 Aeroplan points when you spend $15,000 within 12 months of Account opening†.

- Enroll for NEXUS and once every 48 months get an application fee rebate†.

- Share first free checked bags with up to 8 travel companions† and get unlimited access to Maple Leaf Lounges†, including complementary access for one guest.

- Plus, primary card holders get 6 complimentary worldwide select airport lounge visits annually through the Visa Airport Companion Program†.

- This offer is not available to residents of Quebec.

- †Terms and conditions apply.

Best Low Annual Fee Aeroplan Rewards Credit Card

Td® aeroplan® visa platinum* card.

Up to $500 in value†

$89 (first year of annual fee rebated)

The TD Aeroplan Visa Platinum Card shares many lots of the same features seen in premium cards that cost five times the annual fee. However, it does lack a bit in the insurance department.

- Decent travel and consumer protection benefits

- Allows cardholders to earn Aeroplan Points twice

- Low annual fee that’s rebated the first year

- Lower insurance coverage than other Aeroplan cards

- Earn up to $500 in value† including up to 20,000 Aeroplan points† and no annual fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†.

- Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†.

- Get an annual fee rebate for the first year†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024.

- † Terms and conditions apply.

Best Credit Union Travel Credit Card

15,000 points

20.99% (fixed)

The Alterna Savings Visa Infinite card offers a small amount of rewards and a few perks.

- A welcome bonus worth $150 that you can redeem for gift cards, travel experiences and cash rewards in the form of statement credit

- 5 combined types of travel and purchase insurance

- A fixed interest rate

- Includes some Visa Infinite Benefits

- $120 annual fee

- A low welcome bonus

- $50 for an additional credit card

- 3 points per dollar on grocery purchases.

- 2 points per dollar on dining and entertainment purchases.

- 1 point per dollar on all other purchases.

- Based on average Canadian yearly spending, can potentially earn $266.11 per year in rewards value with the annual fee factored in.

- Includes auto rental collision/loss damage insurance for up to 48 consecutive days.

- Comes with purchase protection for 90 days.

- Double the manufacturer’s warranty (up to one year) on eligible purchases.

- Includes mobile device insurance.

- Includes emergency travel healthcare coverage up to 60 days.

- Trip cancellation insurance up to $2,000.

- Includes unlimited trip interruption insurance.

- Includes lost or delayed baggage coverage.

- Visa Infinite benefits.

Best Low Annual Fee Travel Credit Card For WestJet Flyers

$150 WestJet Dollars

The WestJet RBC Mastercard is a low-annual-fee card that earns a decent amount of WestJet dollars and other perks, including an annual companion voucher.

- Low annual fee ($39).

- An annual round-trip companion voucher for $199.

- $0 delivery fees for 3 months at DoorDash.

- A low welcome bonus.

- A low earn rate.

- Additional fees for some benefits.

- $100 WestJet Dollars when you spend $1,000 in the first 3 months.

- Get 50 Be Well points per dollar spent on eligible products at Rexall.

- Save $0.03 per litre on fuel and earn 20% more Petro-Points at Petro-Canada.

- Unlimited deliveries with $0 delivery fees on orders of $15 or more on DoorDash when you pay with your RBC credit card.

- A complimentary three-month DoorPass membership.

- Earn 1% in WestJet dollars for all other eligible purchases.

- Earn 1.5% in WestJet dollars when you buy WestJet flights or WestJet Vacations packages.

- No blackout periods and no expiration on WestJet dollars.

- Extended warranty for an additional year.

- 90 days of purchase protection.

- $500,000 in travel accident insurance.

- $500 in baggage delay and lost or stolen baggage insurance.

- $2,500 in hotel/motel burglary insurance.

- Rental car collision loss/damage insurance.

When determining a rating for individual credit cards, the Forbes Advisor Canada editorial team factors in an exhaustive list of data points. With travel, the scoring model used takes into account factors such as, but not limited to, travel points value, earn rate in various purchase categories, fees, welcome bonus, and other rewards and features. Keep in mind, what may be best for some people might not be right for you. Conduct informed research before deciding which cards will best help you achieve your financial goals.

The American Express Cobalt® Card is one of the most decorated and award-winning credit cards in the Canadian market, giving massive rewards value for travel and groceries .

Rewards: Earn 5 Membership Rewards per dollar spent on groceries (up to $30,000 annually), 3 Membership Rewards points per dollar spent on eligible streaming subscriptions in Canada, 2 Membership Rewards points per dollar spent on rideshares, transit and gas in Canada 1 Membership Rewards point per dollar spent on all other eligible purchases and 1 additional Membership Rewards point for every dollar spent on eligible hotel or car rental bookings made with American Express Travel.

Welcome Offer: In your first year as a new Cobalt Cardmember, you can earn 1,250 Membership Rewards® points for each monthly billing period in which you spend $750 in net purchases on your Card. This could add up to 15,000 points in a year. That’s up to $150 towards a weekend getaway or concert tickets

Annual Fee: $155.88 ($12.99 per month)

Other Benefits and Drawbacks: Despite the annual fee and the fact that Amex is still not accepted in as many places in Canada as Visa or Mastercard , (though the Amex acceptance map is expanding) the American Express Cobalt remains arguably the most lucrative credit card in Canada. It dominates two categories (travel and groceries) with the value of its annual rewards. Plus, the ability to transfer Membership Rewards points at a one-to-one ratio to many loyalty programs makes it extremely versatile for frequent flyers.

———————————————————————————-

CIBC Aventura Gold Visa

The CIBC Aventura Visa Gold card is a good alternative to the Amex Cobalt with a slightly lower annual fee and slightly less annual rewards value, earning an estimated $444 per year with the annual fee factored in. It also has similar redemption flexibility to the Cobalt card and includes travel insurance options.

Rewards: 2 Aventura Points per dollar spent on travel purchases made through the CIBC Rewards Centre. Plus 1.5 points per dollar spent on gas, grocery and drug purchases and 1 point per dollar on all other purchases.

Welcome Offer: 35,000 Aventura Points (earn 15,000 points when you make your first purchase and 20,000 points when you spend $3,000 or more in the first four monthly statement periods).

Annual Fee: $139 (First year rebated)

Other Benefits and Drawbacks: Though the $139 annual fee and the $15,000 personal annual income requirement could be considered drawbacks, a big benefit is the fact that one Aventura point is worth an average of $0.02 per point when redeeming for travel and they could be worth between 2.3 to 2.8 cents per point depending on the route you’re redeeming for. This means that the Aventura Gold (and any Aventura credit card) stretches your dollar even further than the typical points-based credit card loyalty program that keeps its points worth an average of $0.01 per point.

Basically the same offering as the Aventura Gold Visa Card with higher annual earnings and extra Visa Infinite benefits.

Rewards: 2 Aventura Points per dollar spent on travel purchases made through the CIBC Rewards Centre. In addition, you’ll get 1.5 points per dollar spent on gas, grocery and drug purchases and 1 Aventura point per dollar for all other purchases.

Welcome Offer: Earn up to 60,000 Aventura Points (up to $1,200 in travel value): 15,000 Aventura Points after making your first purchase, 20,000 Aventura Points after spending $3,000 or more in net purchases in the first 4 monthly statement periods and 25,000 Aventura Points after having at least $6,000 in net purchases posted to your account in the first 4 monthly statement periods. Terms and conditions apply. This offer is not available to residents of Quebec.

Annual Fee: $139 (rebated in the first year)

Other Benefits and Drawbacks: You’ll get the network exclusives and benefits of the Visa Infinite banner, like special events and experiences, but you need to be making $60,000 as an individual and $100,000 as a household for the privilege.

A great card for Air Canada frequent fliers who also want Visa Infinite benefits. It also gives you annual reward earnings totaling $527.32 based on an average spend in a number of common purchase categories from Canadians.

Rewards: 1.5 Aeroplan Points for every dollar spent on gas, groceries and on Air Canada flights, including through Air Canada vacations. 1 point per dollar on all other purchases and you can earn points twice when you shop at 150 Aeroplan partners and 170 eStore online retailers.

Welcome Offer: A welcome bonus of up to 50,000 Aeroplan points (10,000 points with first purchase, 15,000 after four months of spending $4,000 or more and 25,000 as anniversary bonus). Terms apply. This offer is not available to residents of Quebec.

Annual Fee: $139 (Get an annual fee rebate)

Other Benefits and Drawbacks: Though you’ll need at least $60,000 in annual individual personal income or $100,000 in household income to qualify for this card, it will give you supplemental benefits like a free checked bag and a full suite of travel insurance options. Plus, redeem for flights, merchandise, gift cards and more.

For a hefty annual fee, cardholders get every premium credit card benefit a traveller could want.

Rewards: 3 Aventura points per dollar on all travel purchases made through the CIBC Rewards Centre. Plus, 2 points per dollar on all eligible dining, entertainment, grocery, gas and transportation purchases. Finally, you’ll get 1.25 points per dollar on all other purchases.

Welcome Offer: 80,000 Aventura Points in the first year. This means 50,000 Aventura Points when you spend $3,000 or more over your first four statement periods and 30,000 Aventura Points as an additional account anniversary bonus.

Annual Fee: $499

Other Benefits and Drawbacks: This card has a huge $499 annual fee and income requirements that will exclude most Canadians from applying for it at $150,000 individual or $200,000 household annual income. Still, if you can afford it, a world of luxury benefits is open to you like airport lounge access, dedicated taxi and limousine service, exclusive dining and wine experiences, a car rental discount, high dollar maximums on travel insurance and even a metal credit card for every successful applicant.

This card offers flexible rewards and generous trip and World Elite credit card network benefits, including insurance, for frequent WestJet fliers. However, it offers a modest annual rewards value at $311.69 according to average Canadian spending.

Rewards: 2% back in WestJet Dollars when you book WestJet flights and vacation packages. Plus, 1.5% back in WestJet Dollars on everyday purchases.

Welcome Offer: Earn up to 450 WestJet dollars (a value of up to $450 off the base fare). Get 250 WestJet dollars after the first purchase and 200 WestJet dollars after spending $5,000 in the first 3 months. Conditions applyǂ.

Annual Fee: $119

Other Benefits and Drawbacks: Though the base earn rate of 1.5% can be beaten easily by other travel credit cards, the annual companion voucher, the free-checked bag, the World Elite benefits like membership in the airport lounge club, Mastercard Airport Experiences and 10 types of insurance, make a compelling case to any potential cardholder who likes flying WestJet.

Your dollar can go further per point with the RBC Avion Visa Infinite as long as you redeem for the right rewards.

Rewards: 1 Avion Point per every dollar spent and an extra 25% savings on eligible travel purchases.

Welcome Offer: Get 35,000 Welcome Points on approval and 20,000 bonus points when you spend $5,000 in your first 6 months*. Apply by April 30, 2024. †Terms and conditions apply. Refer to the RBC website for up-to-date offer terms and conditions.

Annual Fee: $120

Other Benefits and Drawbacks: Though the RBC Airline Redemption Schedule gives you incredible value per point, other modes of redemption, though flexible, only give you 1% in value. The extra travel benefits like the Rexall Be Well points and Petro-Points are nice, but you have to decide if the extra perks and insurance are worth the high income requirements.

CIBC Aeroplan® Visa* Card

A great card if you want flexible rewards that cover taxes and fees on flights with a little bit of travel and purchase insurance for no annual fee.

Rewards: 1 Aeroplan Point per dollar on gas, groceries and Air Canada purchases, including Air Canada vacation packages. Also, get 1 point per $1.50 on all other purchases.

Welcome Offer: 10,000 Aeroplan Points when you make your first purchase ($200 in travel value).

Annual Fee: $0

Other Benefits and Drawbacks: Though the base earn rate and welcome bonus are low, it’s still nice to get flexible rewards that can be redeemed for fights, gift cards and merchandise with a modest selection of travel and purchase insurance for no annual fee.

If you’re looking for every possible travel perk, reward and consumer protection a TD card has to offer, look no further than this one.

Rewards: Earn 2 Aeroplan Points for every dollar spent on Air Canada purchases, including Air Canada Vacations. Cardholders also earn 1.5 points for every dollar spent on gas, groceries, travel and dining purchases, as well as 1.25 points on every dollar for other purchases made with your card.

Welcome Offer: Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card. Earn an additional 40,000 Aeroplan points† when you spend $10,000 within 180 days of Account opening. Plus, earn a one-time anniversary bonus of 25,000 Aeroplan points when you spend $15,000 within 12 months of Account opening.† Terms and conditions Apply. Not available for residents of Quebec. Account must be approved by June 3, 2024.

Annual Fee: $599

Other Benefits and Drawbacks: Cardholders need a minimum annual income of $150,000 individually, or $200,000 all together, so this card is beyond the means of most Canadians.

All of the features found in TD’s more expensive cards for under $100 a year.

Rewards: Earn 1 point for every dollar spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1.50 spent on all other eligible purchases made with your Card. Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore (www.aeroplan.com/estore).

Welcome Offer: Earn a welcome bonus of up to $500 in value† including up to 20,000 Aeroplan points†. Earn 10,000 Aeroplan points when you make your first purchase with your new card and an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of account opening. †Terms and conditions Apply. Account must be approved by September 3, 2024. This offer is not available to residents of Quebec.

Annual Fee: $89 (Get a first-year annual fee rebate; account must be approved by September 3, 2024)

Other Benefits and Drawbacks: This card’s insurance coverage is lower than other TD Aeroplan offerings, but it does allow cardholders to earn Aeroplan Points twice at certain participating retailers.

A cheap annual fee ($89) gets you quite the selection of travel perks, benefits and insurance.

Rewards: 3 points per dollar on grocery purchases, 2 points per dollar on dining and entertainment purchases and 1 point per dollar on all other purchases.

Welcome Offer: A welcome bonus of 15,000 Welcome Points worth $150 that you can redeem for gift cards, travel experiences and cash rewards in the form of statement credit.

Other Benefits and Drawbacks: There’s a low welcome offer and modest annual rewards but you do get a lot of travel benefits for only an average annual fee.

Welcome Offer: $100 WestJet Dollars when you spend $1,000 in the first 3 months and make your first purchase.

Rewards: Earn 1% in WestJet dollars for every qualifying purchase you make on your card and 1.5% in WestJet dollars when you buy WestJet flights or WestJet Vacations packages.

Annual Fee: $39

Other Benefits and Drawbacks: It may come with a low annual fee and a good selection of insurances, but the welcome bonus and earn rate are modest. Still, with the lower barrier for entry thanks to an average qualifying credit score, it might be the window to collecting WestJet Dollars faster for the rest of us.

Credit card data research and analysis by Debra Toews and Tia Duncombe.

Generally, travel credit cards in Canada come in two distinct varieties: those that are specific to a particular airline, like WestJet or Alaska Airlines and those that belong to a loyalty program that offers travel rewards as one of their main features, like Aeroplan, Air Miles, Aventura, Avion or Amex Membership Rewards.

They also either follow a cash back or points model when it comes to earning points, dollars or miles towards travel rewards. What that means is, you’re either collecting a point from an airline or travel loyalty program or you’re collecting a percentage of a point with every purchase.

As for redemption, largely if you’re redeeming for flights—typically, the marquee reward on any travel credit card—when you’re flying, where you’re flying, what class you’re flying in and how far you’re flying all have an impact on how many points, dollars or miles flights can cost. As a result, the value of your travel rewards are not usually static or straightforward. Instead, it’s constantly fluctuating.

What Credit Score Do I Need to Get a Travel Credit Card?

Credit scores needed to get a travel credit card can vary, but the best ones usually require credit scores described as Very Good/Excellent (740-900). A more limited selection of travel credit cards with lower earn rates and fewer travel benefits or perks are available for credit scores classified as Fair/Good (580-739) or Good/Very Good (661-780). Meanwhile, travel credit cards aren’t available for those with Poor/Fair (0-580) credit scores.

The primary reason to get a travel credit card is the chance to travel the world for free (except maybe taxes, fees and surcharges). Not only that, but with the right credit card, flying goes from stressful to swanky and it starts from the moment you get to the airport.

From airport lounges to free checked bags and more, there are several reasons to get a travel credit card. Not just where you can go for free, but the perks you’ll get at the airport and on the plane.

Plus, while you’re abroad, several insurance protections that come with your travel credit card can cover you if you run into medical issues while on your trip or if your rental car gets in an accident. Some insurance options you might find on a travel credit card include emergency travel medical, common carrier accident, delayed or lost baggage, trip cancellation or interruption and rent car collision loss/damage insurance.

Along with several benefits, there are a few drawbacks to travel credit cards that you should be aware of. They are the following:

- You can collect points or miles on everyday spending so you don’t necessarily have to travel all the time to take advantage of potentially flying for free and all the extra travel perks that may come with it.

- You’ll often receive perks at the airport that will make flying a lot easier, including priority security screening, free checked bags, priority boarding, priority check-in and a dedicated parking spot when you arrive.

- You may be able to transfer your original points or miles to other travel loyalty programs either at an equal 1:1 ratio or, if you’re lucky, more than that. This way, your points will go further faster and you’ll be able to spend less of them than you do with your original travel loyalty program to get a free flight to a further destination.

- Travel credit cards often have large sign-up bonuses, so you’ll have enough points for a free trip somewhere right away.

- Usually travel credit cardholders pay high annual fees for the privilege of having all those travel benefits, perks and rewards.

- Redeeming travel points can be anything other than straightforward with the value of a point sometimes being worth fractions of a cent and fluctuating in terms of worth depending on where you’re flying, when you’re flying, what class of travel you want and how far you’re going.

- Redeeming points or miles for any other rewards besides travel, like gift cards or merchandise typically makes them worth less than they would be if you just redeemed them for travel expenses like flights or hotels.

If you’re picking a travel credit card, it’s important to evaluate them based on the following criteria.

You’re going to want a welcome bonus that is not only large and gives you enough points or miles for a free trip right off the bat, but a welcome bonus where the criteria for those points or miles is something you both can and want to achieve. Depending on your financial situation, spending $5,000 in three months and signing up for electronic statements may not be something you can easily do, so only sign up for cards where the welcome bonus is actually achievable and makes sense for your current situation.

Related: Best Credit Card Welcome Offers

With any travel credit card, you should look for a credit card with the highest possible earn rate so you can rack up as many points and miles with your spending to get to travel rewards faster. If the earn rate is too low, you may feel like a hamster on a wheel: always turning—or in this case, earning—but never getting anywhere.

High annual fees are customary when dealing with travel credit cards, especially when it comes to the most premium among them with long lists of perks and benefits. Since you’re likely going to be paying an annual fee in every case, a good general rule of thumb is, the more benefits the card has, the higher the annual fee and the lower the number of benefits, the lower the annual fee.

Further to that, a great way to decide if an annual fee is worth it when measured against the rewards and benefits is to see if the value of those rewards and benefits are greater than the annual fee itself. If you’re getting more value from your rewards and perks than the annual fee is costing you, then the card can generally be considered worth the annual fee.

Reward Flexibility

Reward flexibility is also a great quality to use when evaluating travel credit cards. Ask yourself, “Does this card give you reward points or miles only for travel or can you redeem them for something else as well?”

Often, travel rewards cards also allow you to redeem points or miles for merchandise, gift cards, statement credits and more. However, the value of your points or miles is usually less than if you just redeemed them for travel.

Still, if multiple redemption options are important to you, then look for a travel credit card with more reward flexibility.

Perks and Benefits

Beyond reward points, every travel card comes with perks and benefits like concierge service, lounge access, travel insurance, extended warranty, free first checked bags at the airport and purchase protection, among other things, so you’ll need to ask yourself, what supplemental benefits and perks are actually important to you and choose a credit card based on that.

General Travel Cards

General travel credit cards offer the ultimate flexibility. They are agnostic in the sense that they are not tied to a specific airline or frequent flyer program like Aeroplan , Air Miles and Avion Rewards. Generally, this is good news because it means you can transfer the points associated with your credit card into a variety of frequent flyer and hotel loyalty programs, which gives you access to enough airline or hotel variety that you can truly find the best value for your points and potentially fly further and stay longer for a cheaper price. The few things you need to note about general travel cards is that the points program on your card may not have the same value when transferred into an airline, frequent flyer or hotel loyalty program of your choice, so choose a transfer partner where you can get the most value for your points. Also, you may need to redeem through your credit card issuer’s own travel portal or travel agency. Sometimes when you book travel through such an online travel portal. your points automatically become more valuable just because of how you are booking.

The Best General Travel Cards

- American Express Cobalt

- CIBC Aventura Visa Infinite Privilege Card

Co-Branded Travel Cards

Co-branded travel cards are those affiliated with frequent flyer programs or specific airlines like Air Canada, WestJet, Cathay Pacific, Air Miles, Aeroplan, Avion or Marriott Bonvoy . If you have a favourite airline, hotel or frequent flyer program you collect points from on a regular basis through their various retail partnerships, a card featuring that brand is probably best to maximize the amount of points you can collect from that brand. Your loyalty will also be rewarded because as you collect more and more points you will usually get higher status with brand, which gives you perks like free checked bags on flights with a specific airline, late check-ins with specific hotels or the privilege of needing fewer points to redeem for travel arrangements with certain loyalty programs. The one thing that co-branded travel cards take away from you is flexibility. Once you choose one, your committed to only flying that airline or only staying in that hotel or only using that frequent flyer program. If you don’t, your points will go to waste and likely eventually expire due to inactivity.

The Best Co-Branded Travel Cards

- RBC Avion Visa Infinite Card

- TD Aeroplan Visa Infinite Privilege Card

If you travel a lot and find yourself spending a lot of money on flights and hotels, then a travel card is probably for you. Most travel cards allow you to collect points towards all your essential travel expenses, such as free flights, free hotel stays and even privileges and upgrades to make your flight or hotel stay more enjoyable. It’s recommended that if your spending would lean you towards a travel card, you should select one that’s brand agnostic, with no specific allegiance to any particular hotel, airline or loyalty program. This way, you can transfer your points to any of the leading travel loyalty programs according to which one gives you the most for your spending and collected number of points and you don’t have to fly with a specific airline, stay at a certain hotel or pick from offers available from a particular travel loyalty program.

However, if your spending takes you in a more general direction, not associated exclusively with travel, or if you carry a balance pretty often, it’s best to go with a cash-back card . Cash-back cards most often give you a certain percentage of cash back on specific purchase categories. Some cards offer flat-rate cash back that gives you the same percentage of cash back for all of your purchases, regardless of category, but all cash back can be redeemed for statement credit that you can put towards your balance to bring it down. Some cash-back cards allow you to redeem your cash back for gift cards, merchandise or cash, in the form of deposits into a savings account from the bank that issues the credit card.

There are different types of travel credit cards in Canada. They generally split into the following overarching varieties based on what kind of travel rewards you can redeem.

General Travel Rewards

General travel rewards are rewards that you can redeem for any kind of travel. In addition to flights, you’ll be able to redeem for cruises, vacation packages, hotel stays and other things besides travel, like merchandise and gift cards. Most people prefer these travel credit cards because they give you the most flexibility and don’t force you to use one provider when redeeming rewards.

Airline Rewards

Airline rewards are pretty straightforward. You’re most often redeeming for flights on that particular airline. Sometimes the airline also provides vacation packages you can book with rewards or the airline has its own portal for merchandise and other rewards outside of travel, like events and experiences.

Another aspect of an airline travel rewards card is the airline may belong to a wider partnership with other airlines, such as Star Alliance. In those cases, you’ll be able to transfer your points from your airline card and exchange them for points from another airline, giving you the opportunity to cast a wider net to look for flights and redeem them with your points at a potentially greater value with the other airline’s rewards program.

Hotel Rewards

Hotel rewards cards allow you to redeem points for free nights at whatever hotel your hotel credit card is linked to. You’ll often also be entitled to a free night on your birthday or the anniversary of the day you opened the credit card account. You might also be entitled to other benefits at the particular hotel in question, such as free Wi-Fi, a discount at the hotel restaurant and more.

Usually with a hotel credit card linked to that hotel’s rewards program, you can often achieve a higher status in that hotel’s loyalty program much faster simply by having the hotel credit card. As you rise in the ranks to gold, silver and platinum for example, this will entitle you to even more perks and special treatment at that hotel.

- Travel insurance. The best travel credit cards also include travel insurance , so if anything happens with your flight, bags or on your trip, you might be covered. Particularly if you suffer a medical emergency while on your trip, something happens to your rental car, your bags are lost or delayed or your flight is delayed or canceled for a covered reason.

- Free checked bags. This benefit offers a free first checked bag for a specified number of travel companions.

- Airport lounge access. A popular perk on travel credit cards is airport lounge access , which gives you membership and either pay or free access to a semi-private lounge where you can relax, freshen up, eat, work, have a meeting or charge your devices before your flight.

- No foreign transaction fees. Useful when you’re spending money on your credit card abroad, some travel credit cards come without the customary 2.5% foreign transaction fee , so all you’re paying is the currency conversion fee.

- Free or discounted companion fare on flights. With this benefit, one of your traveling companions travels with you for free or at a discounted rate.

- NEXUS application rebate. Get an application fee rebate, in the form of statement credit, for the NEXUS program, which helps you skip the line at the Canadian border and breeze through airport security.

- Extended warranty. An extended warranty extends the manufacturer’s warranty on any purchase made with the card for typically one year.

- Purchase protection. Gives you purchase protection against damage or theft on any item purchased with your card for a certain number of days.

To use travel rewards effectively and get the most benefit from your points, it’s important to understand how to use travel rewards credit cards effectively and it starts with their earn rate.

Understanding Travel Credit Card Earn Rates

The earn rate on a travel credit card is how many points or miles you earn for every dollar you spend. The more points you earn per dollar, the faster you’ll be able to rack up the points and the quicker you’ll be able to redeem them for a trip.

You obviously want a travel credit card with a large earn rate, but you should also be aware that certain purchase categories may have a larger earn rate until you hit a maximum dollar amount and then the earn rate will revert to what the base rate is for all purchases and this is usually a lot lower. This is why, along with the earn rate, you will want to know those spending caps as well.

How to Calculate the Value of Travel Credit Card Points

The best way to calculate the value of travel credit card points is to divide the dollar value of the points by the number of points required to achieve that dollar value. For example, if 50,000 points on a welcome bonus have a $300 value, that means that each point is with $0.006 (a fraction of a cent).

Be aware however, that the value of travel points or miles change based on where you are going, what class of ticket you want, what season you are booking in and whether it is a short-haul or long-haul flight.

Points also don’t often cover taxes, fees or airport surcharges. They also usually decrease in value if you are redeeming for anything other than travel, so a gift card usually will cost more to get per point, relative to the number of points you have, than a flight would.

Do Travel Rewards Points Ever Expire?

Typically, travel points do not expire as long as your credit card account remains open and in good standing. However, some loyalty program points do expire if you do nothing with them and they sit idle for up to a year. It really depends on the program, but the vast majority of points in most travel rewards programs do not expire.

There are several different types of travel insurance policies that you may find included as part of the benefit package on a travel rewards card. Typically, the more types of insurance included, the better the card’s overall benefit package.

Out-of-province Travel Emergency Medical Insurance

This is insurance that pays out if you suffer a medical emergency while outside of your home province. Policy amounts are usually in the multiple thousands to millions of dollars. You will want to look at your credit card benefits guide to see what sort of medical circumstances are not covered by the policy and therefore not considered an “emergency travel accident.”

Common Carrier Travel Accident Insurance

This is insurance that covers you in the event that the common carrier (train, plane, bus, car, etc.) you are traveling on gets in an accident and you are injured as a result. Amounts here are typically slightly less than emergency out-of-province medical insurance and are in the neighbourhood of several hundred-thousand dollars. Like all insurance policies, check the exclusions before making a claim.

Travel Interruption/Cancellation Insurance

Travel interruption insurance reimburses the lost portion of your trip and related travel expenses, like hotel stays, if your trip is interrupted for a covered reason. Trip cancellation provides a lump sum payment meant to reimburse you for travel expenses if you had to cancel your trip in advance for an unforeseen covered reason, such as the unexpected illness or injury of you and your traveling companion that deems you unfit to travel according to a licensed medical doctor.

Flight Delay Insurance

Flight delay insurance covers your expenses related to the fact your flight was delayed past a covered amount of time, such as four hours. Covered expenses can include meals, accommodations and other reasonable or necessary expenses that occur up to a certain length of the delay, like 48 hours.

Lost/Delayed Baggage Insurance

Lost or delayed baggage insurance covers expenses, up to the maximum amount of the policy, related to lost or delayed baggage. This can include replacement clothing, replacement toiletries and any other essentials covered by the policy.

Rental Car Collision/Loss Damage Insurance

Rental car collision/loss damage insurance covers a rental car in the event that it’s damaged in a collision or stolen after you rent it. In order to qualify for this kind of coverage on your credit card, you must decline the collision damage waiver (CDW) offered by the rental car company. This type of insurance usually comes in two varieties, primary and secondary.

Primary means it will overtake your own personal car insurance policy as the primary source of insurance in case coverage is needed and secondary means the policy will cover anything your personal car insurance policy doesn’t cover.

Also, rental car collision/loss damage insurance only covers damage or theft of the car, it doesn’t cover damage on the other car involved in a collision or any other property damage. In addition, it won’t cover any expenses related to bodily injury or death.

Hotel/Motel Burglary Insurance

Hotel/Motel burglary insurance covers any covered personal items stolen from out of your hotel or motel room during your stay and reimburses you for the subsequent replacements up to a certain amount determined by the insurer.

There are various ways you can redeem the points or miles that come from travel credit cards and the style you encounter largely depends on the loyalty program you’re redeeming points or miles from.

Different Travel Redemption Models

Primarily there are three different travel redemption models you will see with a travel rewards credit card. They are the following:

Consistent Points

Consistent Points are points that are always the same value no matter what you’re redeeming for and where you are traveling. This is the most straightforward redemption model as you always know what points are worth and their value never changes.

Fluctuating Points

Fluctuating points are what you will find with most travel credit card loyalty programs, including the largest ones, Aeroplan and Air Miles. This is a model where the value of your points change according to where you’re traveling, when you are traveling, how far you are going and your class of ticket.

Typically, short-haul flights within North America are the cheapest, while long-haul flights to distant lands, such as Asia and Australia are the most expensive. Business class flights always cost more than flights in economy class and bookings during busy times always cost more than time periods that aren’t as busy.

Point Transfers

A third way to redeem rewards is through point transfers to other travel loyalty programs through other airlines. Some programs, like Amex Membership Rewards, allow you to redeem points at a ratio of 1:1 to a number of airline and travel reward loyalty programs. While sometimes point transfers decrease the original value of your points, sometimes transferring points to another travel loyalty program or airline will actually increase their value.

You can apply for a travel rewards credit card online or in-person at the issuing financial institution, the same way you can apply for any type of credit card.

Eligibility

To be eligible for a travel rewards card you likely need to be the age of majority in the province or territory where you are a resident. You must have the target credit score the issuing bank is looking for on a particular travel card. Plus, on certain cards, you will need to make a certain annual personal or household income.

Fill Out an Application

To fill out a travel credit card application, follow these steps:

- Review the terms, conditions, fees and rewards program details before applying.

- Enter your personal and income information like date of birth, place of residence, annual income, employment status, phone number, email and more.

- Provide your social insurance number (SIN).

- Enter your debts and monthly expenses.

- Verify your identity by providing photos of you and your government-issue identification.

- Review your application, make sure the information is correct and submit your application knowing a hard credit inquiry could temporarily impact your credit score by taking it down a few points.

- Don’t carry a balance. The value of your travel rewards will go down the moment you have to pay interest and pay down a balance.

- Actually get your full welcome bonus. Make sure you don’t leave points on the table and reach your spending threshold to actually receive the amount of points and rewards that come with your welcome offer .