Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

eTicket Flight Credit(s) Available

You have eTicket Flight Credit(s) available that can be applied to your booking with applicable airlines. Please see below for redemption options.

Yes, you can still redeem your travel vouchers. Here's how to do it.

The travel credit you got after the pandemic is probably about to expire. Actually, it may have already run out.

A recent American Express survey says one in three travelers plan to burn their travel credits or points to pay for all or part of a trip. Why? They have a lot of travel credits to use. After the pandemic started, airlines, cruise lines and hotels doled out points and vouchers in such generous quantities that it put the CARES Act to shame.

"The airlines are sitting on more than $10 billion in unused travel credits, most of which expire in two years or less," says Lauren LaBar, a manager at Upaway , a travel concierge app.

But you don't have to lose your travel credit. Here are a few expert tips that will help you keep your credits and travel in the future. And there are ways of ensuring this never becomes a problem again.

Read your voucher now

If you've received a voucher, flight credit or travel certificate, find it and read it now. Cruise lines are particularly strict about their vouchers, called future cruise credits.

Learn more: Best travel insurance

“You have to know the value of your credit," says Annie Scrivanich , senior vice president at Cruise Specialists . "Also, know the terms and conditions like the expiration date and book-by date."

She warns that cruise lines aren't flexible in changing the terms, so she recommends rebooking sooner rather than later.

Track your credit

Many travel companies won't tell you if your credit is about to expire. Of course not. They want to keep your money. Don't let that happen to you, says Jeremy Ellis, head of customer care operations at Priceline .

"Keep track of your credit – and its expiration date – by flagging it in your email as soon as it hits your inbox and setting a reminder on your calendar to rebook before the deadline," he advises.

The date by which you must use your ticket should be on the cancellation confirmation of the original ticket. Also, note that there's sometimes a difference between when you have to book by and when you have to travel by.

Go back to the place you booked

If you bought your tickets or hotel room through a third party, like an online travel agency, you'll want to check with them. An agency can help, but they also add a layer of complexity – and sometimes, more restrictions. You'll want to check with the place you booked to see about your options for redeeming the voucher or credit.

If you're lucky, you bought your trip through a reputable travel advisor who can help you make the most of your credit (and possibly even extend it). If not, then you might have to deal with an automated system that is programmed to tell you "no" at every turn.

Either way, you have to start here, say experts.

How to make sense of credits

It can be confusing. Consider what happened to Tom Harriman, an attorney based in Clarksville, Maryland. He had $750 in American Airlines flight credits that were about to expire. But he couldn't redeem the scrip online because of a technical glitch.

Harriman phoned American and asked for help. A representative came up with a creative solution: She used part of his flight credits to book two new tickets, and she modified the remaining balance into travel credits, which he could use for a future trip up to a year after the date of the re-issue. It turns out American has travel credits and flight credits, each with its own rules.

"This is all crazy," he added.

It is. Airline credits are particularly confusing. For example, Delta Air Lines offered eCredits, which operate a lot like American's vouchers. United has electronic travel certificates. Each one comes with a set of restrictions that you'll need to review.

Don't assume your airline will warn you before they expire. I've received lots of complaints on my nonprofit consumer advocacy site where passengers discovered only too late that time had run out on their vouchers.

Call to redeem your credits

If you want to redeem your travel vouchers, get a real person on the phone. That's the advice of veteran financial advisor Michael Foguth .

"The best thing to do is call and communicate with a live person in the company’s customer service department," he says. "A live representative can typically give you tips and ideas on how to utilize all of your available credits. If your rewards are expired or close to it, the representative can often extend the expiration dates."

Note that some companies may charge you to talk to a human, so ask before you do anything.

With dangerous COVID variants still out there, and travel plans still in flux, it's more important than ever to track your travel vouchers. The ones you have could expire soon. And if you don't act now, they probably will.

Don't let vouchers become a problem again

Travel companies love to hand out expiring vouchers. They know only a small percentage of customers will redeem them, meaning that they get to keep your hard-earned money. Here's how to ensure that doesn't become a problem for you.

If they cancel, you deserve a full refund. In virtually every sector of the travel industry that's the rule. For airlines, it's a federal rule . In other cases, state law protects you from purchases made but not delivered.

You get what you negotiate. Experts say there's still lots of room for negotiation if you have to cancel or postpone your next trip. So if a company offers you a credit, be sure to request a refund. Phone reps often have some flexibility in granting a refund as a one-time exception. Always ask for your money back first.

There ought to be a law. Ideally, travel credit – like the money used to purchase it – should never expire. Consumer advocates such as Travelers United are pushing to ensure future airline vouchers don't expire. There's talk that the airlines might be on board with the idea.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Platinum Card

The Amex Platinum Card: How To Best Use Your $200 Airline Credit [Every Year]

Andrew Kunesh

Former Content Contributor

69 Published Articles

Countries Visited: 28 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3093 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1170 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![amex travel voucher redeem The Amex Platinum Card: How To Best Use Your $200 Airline Credit [Every Year]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Platinum-Upgraded-Points-LLC-06-Large.jpg?auto=webp&disable=upscale&width=1200)

Amex Platinum Card – Snapshot

Selecting an airline for your airline incidental credit, official ways to redeem the incidental fee credit, unofficial ways to redeem the incidental fee credit, purchases that do not trigger the airline incidental credit, what if my purchase isn’t automatically reimbursed, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The Platinum Card ® from American Express is one of the top premium travel credit cards on the market, but also one of the most expensive.

The card’s annual fee is substantially higher than other cards. Still, it also comes with an extensive list of benefits like airport lounge access, Hilton Honors and Marriott Bonvoy hotel elite status, major bonus earnings on flights booked with airlines, and much more.

While the card’s fee may seem like a shocker at first, it’s not so bad when you take a look at the multiple statement credits offered, including an airline incidental credit of up to $200 (enrollment required).

Many travelers often aren’t sure how to take advantage of the airline incidental credit and what it can cover. After all, it doesn’t let you cover paid plane tickets but does let you cover other fees incurred from an airline — whether inflight or at the airport.

In this article, you’ll finally get clarity as to precisely what the Amex Platinum card’s airline incidental credit is and your best options for redeeming your card’s $200 annual credit. After all, what use is a benefit if you don’t know how to use it, right?

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

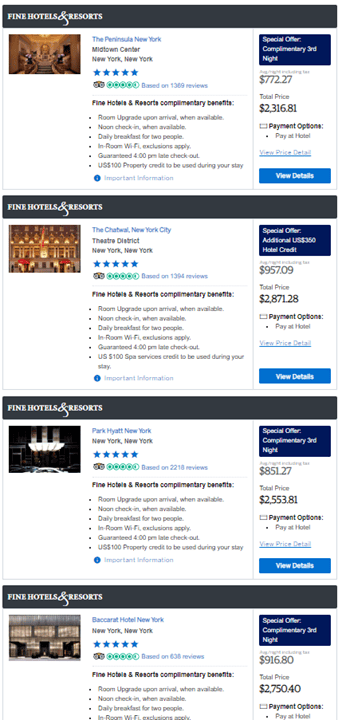

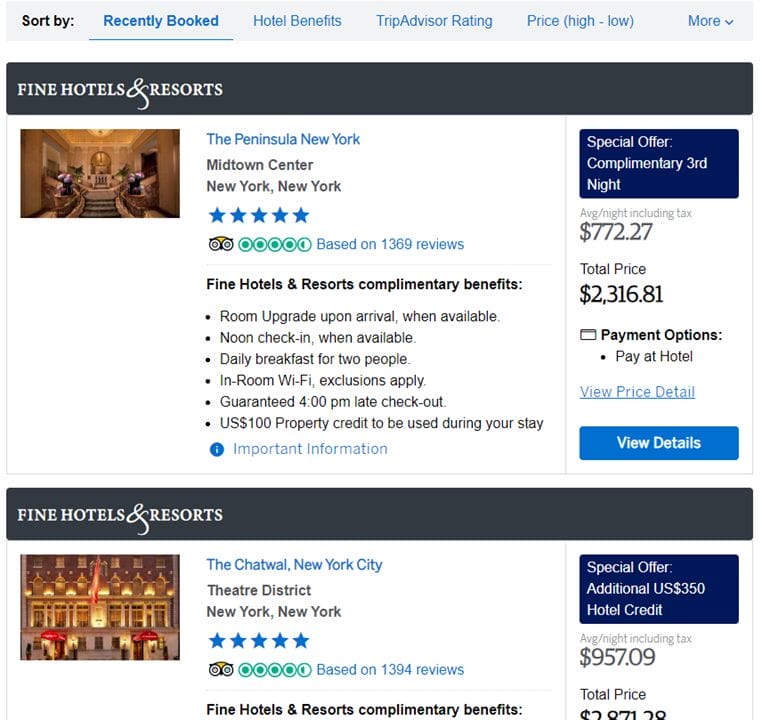

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

Credit card reviews.

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 125k (or 150k) points with the Amex Platinum. The current public offer is 80,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

What Is the Amex Platinum Card’s Airline Incidental Credit?

Both the Amex Platinum card and The Business Platinum Card ® from American Express offer a $200 airline incidental fee credit upon enrollment.

According to American Express, this credit will be used to cover inflight expenses on your selected airline. Some of the items American Express lists as eligible for reimbursement include inflight refreshments and checked bag fees. Airline tickets, gift cards, and points or miles purchases aren’t eligible for reimbursement.

Here’s what the terms and conditions have to say:

“Incidental airline fees charged prior to selection of a qualifying airline are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee.”

Once you’ve selected your airline, you can charge these expenses to your Amex Platinum card. You’ll automatically be reimbursed in the form of a statement credit within 6 to 8 weeks of the charge posting to your account.

If the statement credit has not posted after 8 weeks from the date of purchase, it is best to call the number on the back of the card.

Hot Tip: You receive the airline incidental once per calendar year. The credit is dispersed on January 1st each year and doesn’t roll over.

Unlike the Chase Sapphire Reserve ® ‘s $300 travel credit, you’re limited to using your Amex Platinum card’s incidental fee credit on a single airline. You can select your airline when you receive your card and change it once per year in January. However, we at Upgraded Points have had luck changing the airline more than once when chatting (nicely) with an American Express representative.

You can pick from the following airlines:

- Alaska Airlines

- American Airlines

- Delta Air Lines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

You must select an airline before you can use the airline incidental credit. Charges made to your account before choosing an airline are not eligible for reimbursement , so select your airline as soon as you receive your Amex Platinum card and have a trip booked.

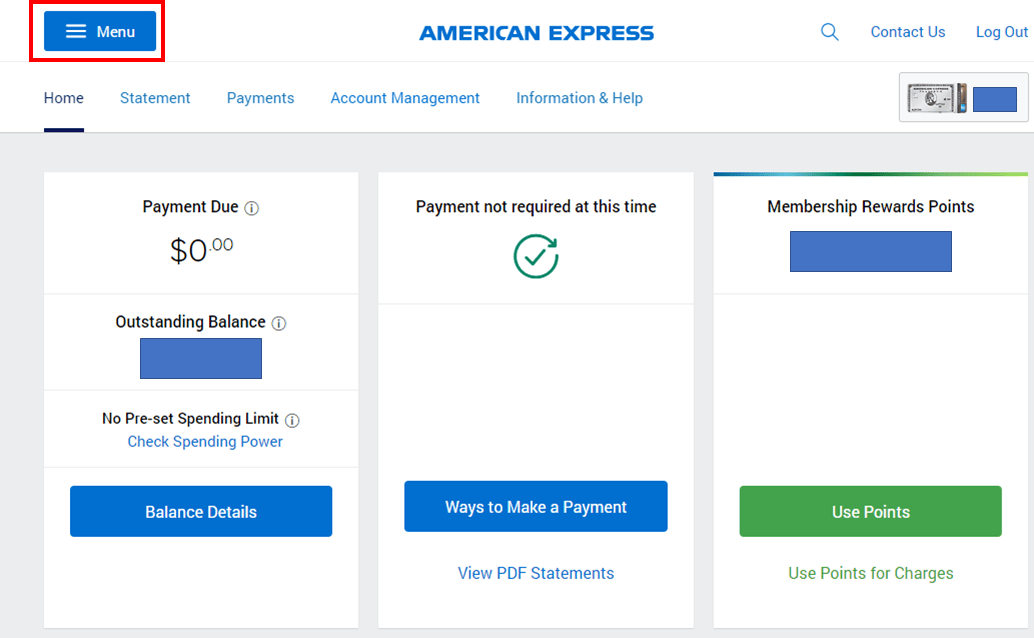

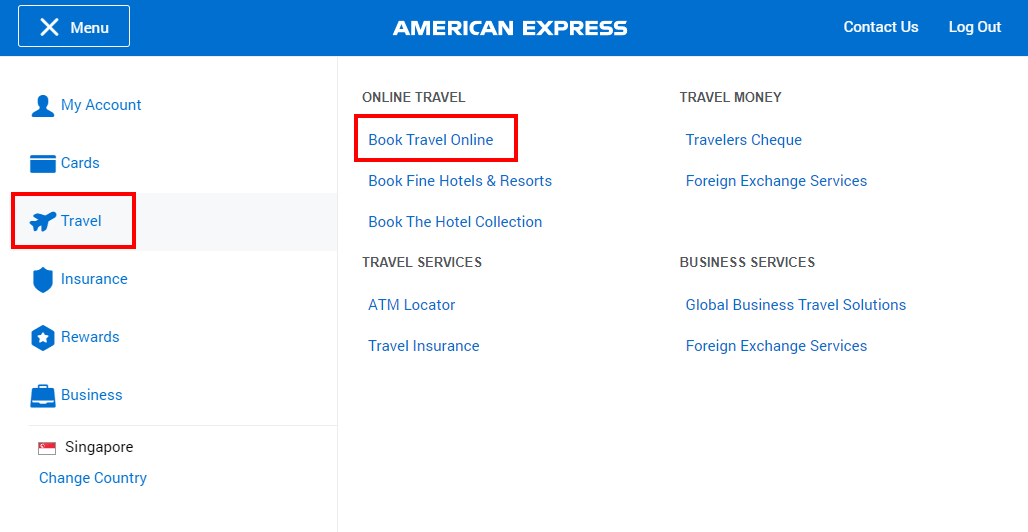

Thankfully, selecting your Amex Platinum card airline choice is easy. Just head over to the American Express website , log in, and select your Amex Platinum card (should you have more than 1 American Express card).

Click on the Rewards & Benefits tab on the bar at the top of the screen. And then click on the Benefits tab.

Here, you’ll see the balance of your Airline Fee Credit — how much you’ve used and how much you have left.

Scroll down the page for a list of benefits included with your Amex Platinum card . There will be an option labeled $200 Airline Fee Credit. Click on the Learn More button, and from there you can select your airline using the drop-down menu at the center of the screen.

The Best Ways To Use Your Airline Incidental Fee Credit

As mentioned earlier, the Amex Platinum card’s airline incidental fee credit cannot be used toward plane tickets, points purchases, or gift cards.

Frustrating, yes. But, thankfully, there are still plenty of great ways that you can spend the credit over the year.

Here are our favorite ways of utilizing the flight credit. We’ve split this section into 2 parts: official and unofficial ways to redeem the incidental fee credit.

Airport Lounge Day Passes and Annual Memberships

While the Amex Platinum card includes extensive lounge access , it doesn’t include access to all of the U.S. carrier’s lounges. You can use your Amex Platinum card’s credit to buy day passes to:

- Alaska Lounge

- American Airlines Admirals Club

- Delta Sky Club

- United Club

Just remember, you have to select the applicable airline for the lounge charge to be covered. So if you choose Delta as your preferred airline, your charges to the Admirals Club won’t be covered by your incidental fees.

United American and American Airlines both sell day passes, which could be an option if you don’t have access to a lounge on a long layover. You must be flying with the airline to have lounge access.

Hot Tip: If you purchase an annual lounge membership with your Amex Platinum card that costs more than $200, you’ll be credited the entirety of the incidental fee credit at once. So, in this case, you can think of it as a $200 discount on your lounge membership of choice.

Further, note that Amex Platinum cardmembers do not receive complimentary guest access at Delta Sky Clubs . However, guest access can be purchased for $50 for a standard day pass. If you purchase Delta Sky Club guest access and Delta is selected as your Amex Platinum card’s airline, you will be reimbursed for your entry fee.

Change Fees

Changing a trip’s date can be expensive, but your Amex Platinum card’s incidental fee credit covers the itinerary change fee. Note that the incidental fee will not likely cover the airfare difference as this is often charged like a plane ticket.

Hot Tip: Want more information on airline change fees? Learn how to avoid airline change fees in our dedicated article.

Checked Baggage Fees

So you planned on checking a bag, but it isn’t included with your ticket? Just charge it to your Amex Platinum card. This is especially helpful if you’ve selected a low-cost carrier, such as Spirit, as your airline, as these carriers generally charge more for baggage. Remember that the incidental fee credit only covers baggage fees on your selected airline.

Most airlines have a co-branded credit card that provides perks such as free checked baggage. If you carry an airline’s co-branded credit card , check if that card provides free checked baggage. This allows you to use your Amex airline incidental fee credit elsewhere.

Inflight Entertainment Fees

The incidental fee credit covers inflight entertainment fees including TV, movies, and tablet rentals charged directly by the airline. A good example of this is renting an Alaska Airlines entertainment tablet in flight. The airline charges a fee to rent these in economy class.

Unfortunately, this does not cover inflight internet, as a third party generally bills this . However, we have heard of United inflight entertainment being reimbursed, as it is usually charged by United directly. Proceed with caution, though, as there’s no guarantee it will be refunded.

Inflight Amenities

Most other inflight purchases are covered, too. Think amenities like headphones, blankets on budget carriers, food, and drink. The airline almost always charges for these directly, and you’re automatically reimbursed for them by your Amex Platinum card’s incidental fee credit.

Seat Selection Fees

Seat selection fees are another great way to redeem your airline incidental fee credit. You can use this when flying low-cost carriers or on a basic economy fare that doesn’t include free seat selection. Note that this does include things like Even More Space seating on JetBlue and Economy Plus on United Airlines.

Most airlines charge anywhere from $10 up to $50 for a seat assignment on domestic flights.

Pet Flight Fees

If you’re taking a furry companion with you , use your Amex Platinum card’s incidental credit to cover the pet fee. This can take out a nice chunk of your reimbursement, though — for example, JetBlue charges $125 per one-way flight.

Phone Booking Fees

You can usually avoid these by booking online, but there may be instances where you need to call to book an award ticket or a flight with special routing. If you can’t get the agent to waive this fee, your Amex Platinum card’s incidental fee credit should cover it.

Priority Boarding

Priority boarding purchases work on virtually all airlines. This can be especially valuable when flying Southwest Airlines, as it gives you first dibs on the best seats . Again, remember that the incidental fees only cover priority boarding fees on your selected airline.

The methods below are ways our team members have either tried or seen work for other travelers. Proceed with caution . There’s no guarantee that these will work for you, too. While we try to keep this section as up-to-date as possible, these things can change on a dime, and we can’t be held liable for a charge not being reimbursed.

Fill Your United TravelBank Account

This might be the easiest unofficial way to use your Amex incidental fee credit. United’s TravelBank allows you to fund the account with cash to use on future United flights. Any money you put in your TravelBank account does not expire for 5 years, provided there is account activity at least every 18 months.

You can fund your account in different increments up to $1,000. However, it is best to fund with how much you have available with your credit. You need to make sure United is selected as your preferred airline.

Admirals Club Food or Drink Purchases

A number of American Airlines Admirals Club locations have premium food and drink available for purchase. American Express has reimbursed these purchases, as they’re billed directly by American Airlines.

Unfortunately, we don’t have data for purchases at other lounges at this time. Again, proceed with caution.

Delta Airfare Purchased Partially With a Gift Card

There are reports of Delta tickets purchased partially with a gift card being reimbursed by American Express. This is because, when the purchase processes, it adds an “additional collection” to the transaction instead of listing an airline route, like most airfare purchases.

This means that American Express sees the transaction as if it were some sort of add-on or other inflight expense. However, this is not officially supported, and American Express may choose not to honor your incidental credit for this purchase.

Airfare of $99 or Below on Certain Airlines

We’ve seen reports of below-$99 fares on Delta, Southwest, and JetBlue being reimbursed by the incidental fee credit. But again, this is very much something you would try at your own risk, as the purchase will code as airfare.

Spirit Saver$ Club Memberships

Spirit Airlines has a members-only discount club called Spirit Saver$ Club. It provides access to discounted tickets and includes other perks but has an annual fee.

We’ve seen reports of Spirit Saver$ Club memberships being reimbursed by American Express. Definitely keep this in mind if you’re a frequent flyer on this ultra-low-cost carrier, as it can save you a nice sum of money as you travel throughout the year.

$5.60 TSA Passenger Security Fee on Award Tickets

Our team has had the $5.60 TSA passenger security fee reimbursed on multiple award tickets in the past.

Now that you have a full list of things that do (or might) trigger the airline incidental fee credit, here’s a quick look at the things that don’t trigger this credit.

Award Taxes and Fees

Aside from the $5.60 TSA security fee mentioned above, our team has not had luck having other award fees reimbursed. This is likely because these purchases code as airfare when posted to your American Express card.

Airline Gift Card Purchases

Airline gift card purchases were a longtime favorite for redeeming the airline incidental fee credit. However, as of this summer, our team has had no luck getting these reimbursed.

Class of Service Upgrades

Cabin upgrades are not eligible for reimbursement .

Inflight Wi-Fi

As mentioned, inflight Wi-Fi generally does not trigger the incidental fee credit, as a third party like Gogo or Panasonic usually bills it. However, we’ve seen reports of United Airlines Wi-Fi purchases being reimbursed because United does bill Wi-Fi purchases on its own or if you purchase the service through the airline before your flight.

While American Express states that it will reimburse eligible charges within 4 weeks, some charges don’t make it through the system. If you’re not reimbursed for an eligible charge, you can call the number on the back of your card or use the American Express live chat service to request reimbursement.

While the Amex Platinum card’s airline incidental fee credit is limited compared to travel credits offered by other premium credit cards, it still provides a ton of value. It has gotten hard to use the credits, but there are still ways to get the total value.

When you use the methods listed above, you’ll save money and have a better travel experience with extra checked bags, lounge access, and more. Better yet, the airline incidental credit can help offset the hefty annual fee of the Amex Platinum card.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here .

Frequently Asked Questions

What is the american express airline fee credit.

The American Express airline incidental fee credit allows you to receive up to $200 in statement credits per calendar year when incidental fees are charged to your account. You must select a qualifying airline before you can use the airline incidental credit.

Do authorized users get additional airline incidental fee credits?

No, the airline incidental fee credits are up to $200 per account per calendar year.

Can I use my airline incidental credit toward airfare?

Generally speaking, no. The terms and conditions prohibit this, and it has not worked in practice for a majority of Amex Platinum cardholders. However, there are reports of fares of $99 or below triggering the credit when you book on certain airlines.

Can I cash out my incidental fee credit if I don't use it?

No, you must use the entirety of the incidental fee credit before the end of a calendar year. Otherwise, the credit expires.

When does the airline incidental credit renew?

You receive $200 per year in incidental fee credit. The credit renews on January 1 of the new calendar year.

Will I earn points on purchases reimbursed by the incidental fee credit?

Yes, you will still earn points on reimbursed purchases.

Was this page helpful?

About Andrew Kunesh

Andrew was born and raised in the Chicago suburbs and now splits his time between Chicago and New York City.

He’s a lifelong traveler and took his first solo trip to San Francisco at the age of 16. Fast forward a few years, and Andrew now travels just over 100,000 miles a year, with over 25 countries, 10 business class products, and 2 airline statuses (United and Alaska) under his belt. Andrew formerly worked for The Points Guy and is now Senior Money Editor at CNN Underscored.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Top Credit Card Content

Buying guides.

- Best Credit Cards for High Limits

- Best Credit Cards for Young Adults

- Best Credit Card Combinations

- Best Credit Cards for Military

- Best Credit Card for Paying Monthly Bills

- American Express Platinum Card

- American Express Gold Card

- Chase Sapphire Preferred Card

- Chase Freedom Unlimited Card

- Capital One Venture X Card

Credit Card Comparisons

- Amex Gold vs Blue Cash Preferred

- Amex vs Chase Credit Cards

- Amex Platinum vs Capital one Venture X

- Amex Platinum vs Delta Platinum Card

- Chase Sapphire Reserve vs Amex Platinum Card

Recommended Reading

- How to Pay Your Credit Card Bill

- Credit Card Marketshare Statistics

- Debit Cards vs Credit Cards

- Hard vs Soft Credit Checks

- Credit Cards Minimum Spend Requirements

Related Posts

![amex travel voucher redeem The Amex EveryDay Credit Card — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2016/10/The-Amex-Everyday-Credit-Card-from-American-Express.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Save money! 7 ways to redeem American Express Membership Rewards points for holiday gifts

Update : Some offers mentioned below are no longer available. View the current offers here .

If money is a little tight this year, you may find your American Express Membership Rewards points balance is higher than your savings account balance. If you fall into this camp, you may wonder how you can turn some of your Membership Rewards points into holiday gifts this winter.

Typically I'd recommend redeeming your points for a trip. Travel is one of the best gifts you can give anyone — especially if you can give your time and the gift of travel together. Also, redeeming your Membership Rewards points for travel will generally provide the most value for your points.

However, not everyone can travel or wants to travel. Although redeeming your points for travel generally provides the most value on a cents-per-point basis, the best redemption is the one that helps you meet your goals. Right now, your individual goals may not involve a flight or hotel.

Whether you want to gift travel , a toy or the latest and greatest gadget, let's take a closer look at the best ways to redeem Amex Membership Rewards points for gifts this holiday season.

Transfer points to travel partners to book award travel

Some transferable rewards programs let you share rewards with others. However, Amex is one of the more restrictive programs when it comes to sharing. Specifically, Amex only allows you to transfer Membership Rewards points to your loyalty accounts or the loyalty accounts of your authorized users .

Luckily, most airline and hotel loyalty programs allow you to book awards for others when traveling together. Some loyalty programs even allow you to book travel for others when they're traveling without you. So, you may be able to give the gift of travel this holiday season by booking award travel for others.

If you're looking to book award travel this holiday season, you can transfer your points to the following Membership Rewards transfer partners :

- Airline loyalty programs : Aer Lingus AerClub, Aeromexico Rewards, Air Canada Aeroplan, Air France-KLM Flying Blue, ANA Mileage Club, Avianca LifeMiles, British Airways Executive Club, Cathay Pacific Asia Miles, Delta SkyMiles, Emirates Skywards, Etihad Guest, HawaiianMiles, Iberia Plus, JetBlue TrueBlue, Qantas Frequent Flyer, Qatar Airways Privilege Club, Singapore Airlines KrisFlyer and Virgin Atlantic Flying Club

- Hotel loyalty programs : Choice Privileges, Hilton Honors and Marriott Bonvoy

TPG's valuations peg the value of Membership Rewards points at about 2 cents each. So, you'll generally want to aim to get at least 2 cents per point when you transfer to travel partners. However, make sure award availability exists before transferring.

Although most transfers are instant, it can sometimes take up to 48 hours for points to transfer. See our post on how long American Express Membership Rewards transfers take to estimate transfer times.

Related: Which is the best American Express credit card for you?

Use Pay with Points to book travel

Amex Pay with Points allows you to redeem Membership Rewards points for 1 cent each when you book airfare through Amex Travel . So, a $1,000 flight would cost 100,000 Membership Rewards points if you use The Platinum Card® from American Express or the American Express® Gold Card .

However, cardholders of select Amex business cards get a rebate when using Pay with Points for airfare as follows:

- The Business Platinum Card® from American Express : Get 35% of your points back when you use Pay with Points for first- and business-class flights on any airline or flights in any class on your selected airline, up to 1 million points back per calendar year.

- American Express® Business Gold Card : Get 25% of your points back when you use Pay with Points for first- and business-class flights on any airline or flights in any class on your selected airline, up to 250,000 points back per calendar year.

- Centurion Business Card from American Express : Get 50% of your points back when you use Pay with Points for flights.

The information for the Centurion Business card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Best of all, you can book a flight for anyone using Pay with Points.

You can also book prepaid hotels, cruises, car rentals and vacations using Pay with Points through Amex Travel. However, you'll only get 0.7 cents per point, so $700 in prepaid hotel stays will cost 100,000 Membership Rewards points.

You'll get a slightly better redemption rate of 1 cent per point if you use Pay with Points for a prepaid stay booked through Amex's Fine Hotels + Resorts program . Keep in mind, though, that only select Amex cardmembers can access this premium hotel program.

Related: Your complete guide to maximizing holiday purchases

Redeem for gift cards

You can also redeem Membership Rewards points for a variety of gift cards. However, redemption rates depend on the type of gift card and current (targeted) offers available:

- 1 cent per Membership Reward point (for example, $1,000 in gift cards for 100,000 points) for most gift cards

- 0.85 cents per point for select gift cards, including Best Western, Bonefish Grill and Macy's

- 0.7 cents per point for select gift cards, including Best Buy, Four Seasons, Hilton, Marriott, Starbucks and Uber

- 0.5 cents per point for American Express gift cards (a $500 gift card for 100,000 points)

On my Amex Platinum Membership Rewards account, I can purchase Apple and Panera gift cards at 1.06 cents per point; they were previously 0.85 cents per point. Additionally, Delta Air Lines gift cards are currently being offered at 0.87 cents per point; they were previously valued at 0.7 cents per point.

You can get a physical or digital gift card for most redemptions. You can obtain gift cards in various values, but most start at $25 or $50.

Related: What credit cards should you use to purchase gift cards?

Use Pay with Points at checkout

Pay with Points isn't just for travel. You can use Pay with Points at checkout when you shop with various merchants, including Amazon, Best Buy, Dell, Grubhub, Seamless, PayPal, Rite Aid, Saks Fifth Avenue and Staples.

However, paying with points at these merchants usually isn't a good use of your points if you're looking for the best return. You'll only get 0.7 cents per point for the merchants listed above when you redeem Membership Rewards points. So, a $700 purchase would cost 100,000 Membership Rewards points.

The redemption rate is even worse at 0.5 cents per point if you use Membership Rewards points for event tickets through Ticketmaster.

Related: 5 ways to redeem 44 million American Express Membership Rewards points that aren't at Rite Aid

Donate points to charity

You can also donate your points to charity . Specifically, you can donate to more than 1.5 million U.S. charities through JustGiving with Amex Pay with Points.

You'll get 0.7 cents per point when you make a JustGiving redemption. So, 100,000 Membership Rewards points would provide $700 toward the charity you choose.

Related: The 6 best credit cards to maximize your charitable donation

Cover recent card charges

If you buy gifts on your card from merchants that don't participate in Pay with Points, you might consider using Membership Rewards points to cover your purchases.

Although you can redeem Membership Rewards points to cover recent charges on your card, doing so will only provide a redemption rate of 0.6 cents per point. So, you'd need 100,000 points to cover a $600 charge.

Related: Maximizing points and miles to beat inflation and save money

Shop with points

Finally, you can also use Shop with Membership Rewards. However, when you buy products from the Shop with Membership Rewards catalog, you'll only get 0.5 cents per point of value.

You'd need 100,000 Membership Rewards points for $500 of purchases through the catalog. So, even when sales offer 30% off, you may still be better off redeeming for other options discussed above.

Related: Why I love the Amex Business Platinum's Pay with Points perk

Bottom line

If cash is tight or you have a large stash of points, you may want to use your American Express Membership Rewards points for holiday gifts.

Want to give the gift of travel? You'll get the best value from your points by transferring them to travel partners and then booking luxury hotel stays or premium cabin flights for loved ones. You can also get 1 cent per point in value when using Pay with Points to book flights through Amex Travel.

Even if you don't want to give the gift of travel, you can still get 1 cent per point in value by redeeming points for select gift cards.

Understanding the redemption value before you redeem your points for holiday gifts is a good idea. One easy way to compare all the options for your Amex Membership Rewards points is to use Amex's Rewards Calculator .

- United States

- United Kingdom

Amex Travel Credits: How to get the most value

Save money on your next trip using your american express travel credits on flights, hotels, car rentals and more..

In this guide

How do American Express Travel credits work?

What is the difference between a complimentary flight and a travel credit, how to use your american express travel credit, pros and cons of the american express travel credits.

Several American Express credit cards offer yearly travel credits, which you can use to pay for flights, accommodation or car rentals. They usually offset the cost of the annual fee – as long as you use them, that is.

Depending on the card, the value of these travel credits ranges from $200 to $450. Here's how they work and how to make the most of them.

American Express Credit Card Offer

American Express Platinum Edge Credit Card

$0 annual fee for the first year.

Eligibility criteria, terms and conditions, fees and charges apply

Save with a $0 annual fee in the first year. Plus, $200 Travel Credit every year.

- $0 annual fee in the first year ($195 p.a. after that)

- $200 American Express Travel Credit each year

- Earn 3 points per $1 spent at major supermarkets and petrol stations, 2/$1 spent overseas and 1/$1 on other eligible purchases

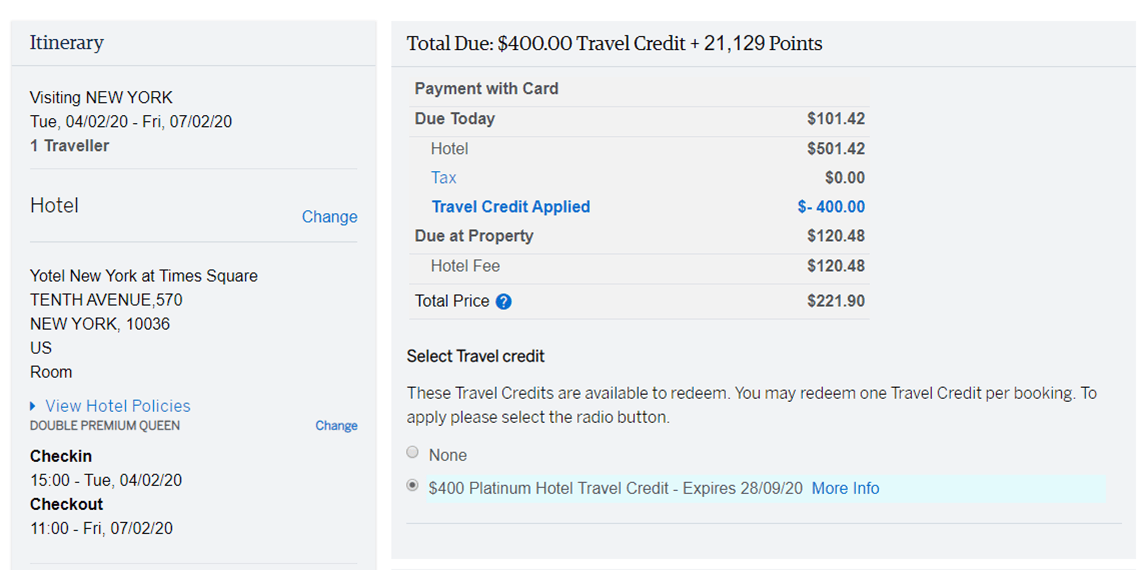

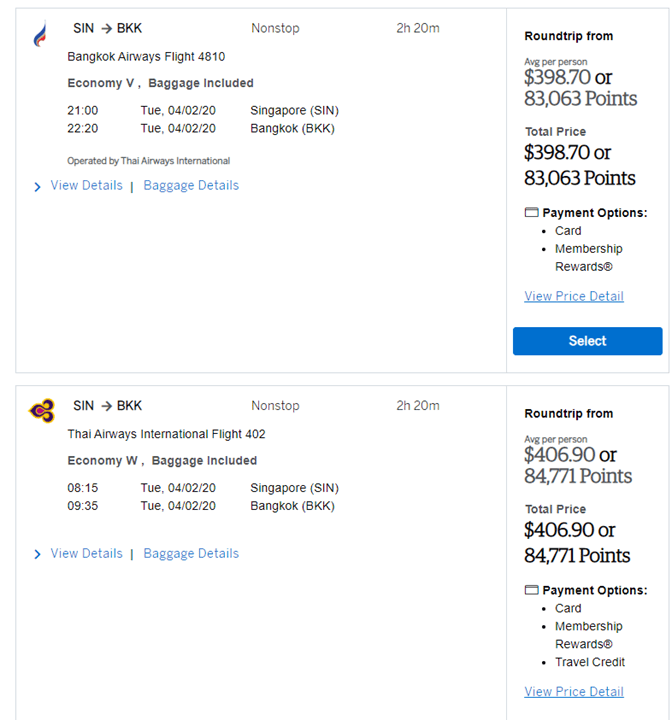

Usually, you'll need to book through American Express Travel to use your travel credit. Depending on your Amex card, you could use the credit to book flights, hotel stays, and/or car rentals.

But there's a few terms and conditions to be aware of:

- You can only use your American Express Travel credit once, in a single booking, so you can’t spread it out over multiple bookings.

- If you have more than one Amex Travel credit, you can’t pool the value of multiple credits to cover the cost.

- Your booking must be valued at more than the credit value. eg you can purchase a $432 flight with a $400 flight credit, but not a $372 flight.

- You can book cruises through American Express Travel, although you can't redeem your travel credits to cover cruise costs.

If you get an Amex card with a complimentary flight, you can book an eligible flight for free.

For example, the American Express Velocity Platinum Card offers a complimentary return domestic flight between select cities with Virgin Australia. Meanwhile, the Qantas American Express Ultimate Card offers a $450 travel credit towards either a domestic or international booking with Qantas.

In comparison, the American Express Platinum Edge offers a $200 travel credit you can use for flights, hotels, car hire and more.

Do Amex travel credits expire?

Your travel credits last for 12 months, so keep this in mind when you’re planning to use them. Once your travel credits expire, they can’t be redeemed.

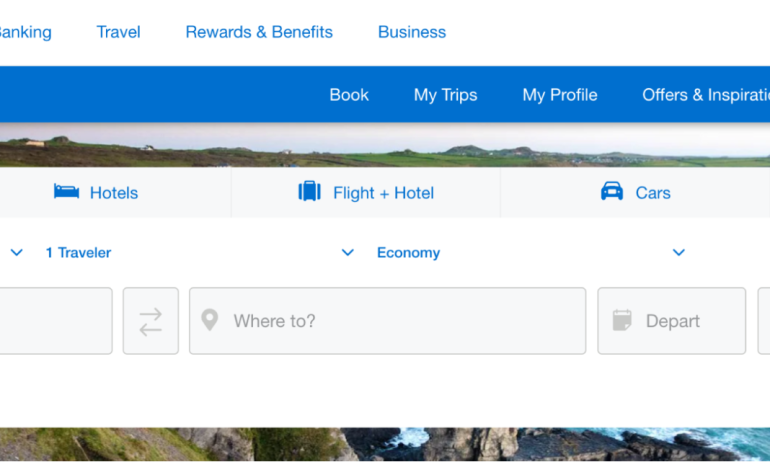

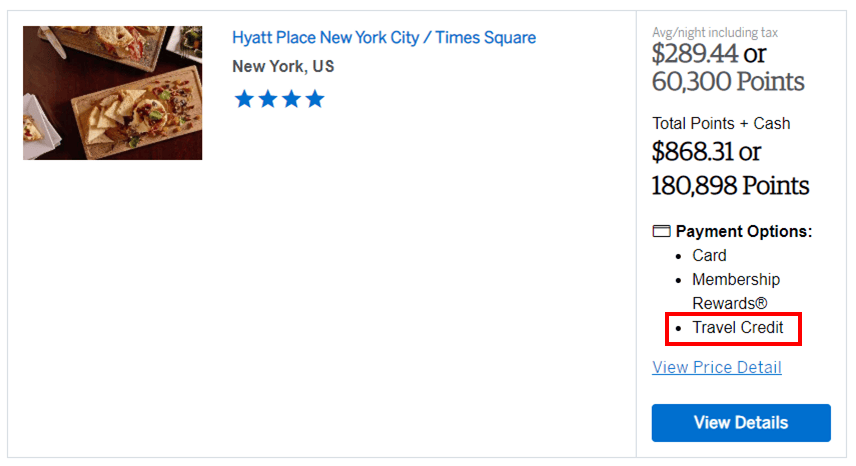

If your card offers an American Express Travel credit, you need to pay the annual fee and make the minimum payment by the due date in order you can access those credits. Then, you can redeem the credits with the following steps:

- Log in to the American Express Travel website and select the card with the travel credits you’re going to use. You’ll see the travel credits in the right-hand corner of your Amex Travel homepage once you’re logged in.

- Select what you want to book (flight, hotel or car hire) and filter your decisions by destination, travel dates, airline carrier and more.

- When you’ve picked an option that costs more than the value of your travel credits, you’ll see the total amount in dollars (which you can cover in your travel credits) or Membership Rewards points.

- Click on the “Use travel credit” button to redeem your credits. The value of the credits will be deducted from your total price and then you can pay for the remainder using your American Express card or Membership Rewards points.

- Finally, review and confirm your booking. You can’t get refunds on redeemed travel credits, so make sure you're 100% certain before you confirm your payment.

Want to redeem a flight with the Velocity American Express Platinum?

The complimentary flight offer on American Express Velocity Platinum Card is available after your first card spend each year. To redeem it go to velocityfrequentflyer.com and log in with your Velocity Frequent Flyer membership details.

- Cancels out annual fee. Some American Express credit cards offer travel credits that can offset the full cost of the annual fee, which can help justify getting the card.

- Cut travel costs. It’s an easy way to save between $200 and $400 on a trip (keeping in mind, the annual fee is still payable).

- Easy to use. The American Express Travel website is simple to use and it’s easy to access your travel credits once you’ve logged in.

- Less competitive prices. The cost of hotels, car rentals and flights booked through American Express Travel can be less competitive than if you were to book directly, as they often don't offer the same sales and deals as airlines offer direct.

- No points earned. In contrast to paying with your Amex card, you can't earn points on travel costs paid for with your travel credits.

- Expiration. You can use your travel credits within exactly 12 months from the issue date. After that they will expire and can’t be redeemed.

American Express Travel credits can be a great way to get extra value from your credit card. However, considering the restrictions and the terms and conditions, it’s good to understand how they work and whether you’re actually going to use the credits before you apply for the card.

Pictures: Shutterstock

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald.

More guides on Finder

This charge card offers expense management tools and is linked to both Qantas Business Rewards and Membership Rewards.

The American Express Qantas Business Rewards Card offers 170,000 bonus Qantas Points, no pre-set spending limit and perks including complimentary insurance.

Offers a $0 first-year annual fee, up to 2 Membership Rewards points per $1 spent and complimentary travel insurance.

The American Express Qantas Corporate card offers a combination of expense management tools and rewards for businesses with an annual turnover of $10 million or more.

A step-by-step guide on how to refer a friend through the American Express referral program to earn bonus Membership Rewards points.

The American Express Velocity Business Card earns points per $1 spent and offers complimentary travel insurance and two complimentary Virgin Australia lounge passes each year.

The American Express Velocity Platinum Card offers a range of frequent flyer benefits including a complimentary domestic return flight with Virgin Australia, airport lounge access and points per $1 spent.

From Membership Rewards Points to savings on first, business and premium economy class flights, this charge card is packed with features to help you manage business spending.

How does the huge bonus points offer, $450 annual travel credit and other platinum perks stack up against the Amex Platinum card’s annual fee?

The Qantas American Express Ultimate Card earns up to 2.25 Qantas Points per $1 spent, a yearly $450 travel credit and additional premium travel features.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to the AmEx Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use the American Express Travel portal?

Benefits of booking travel on amex travel, how to book travel in the portal, is travel insurance included when booking through amex travel, downsides of booking via amex travel, final thoughts on the amex travel portal.

The American Express Travel portal is similar to many other online booking sites in that it allows you to purchase flights, hotels and other travel reservations. The main difference is that only those who hold an American Express card can use it.

Certain cards come with additional perks for booking in the portal. For instance, some AmEx cards allow travelers to earn extra points for bookings, receive a 35% points rebate, pay for a portion of the reservation with points, get room upgrades and more. Terms apply.

Here's a look at what the AmEx Travel portal offers and how to use it to maximize your benefits.

American Express Travel flights, hotels and other reservations are available for American Express cardholders. Depending on which American Express card you have, you may earn additional points on your reservation or unlock additional features. Terms apply.

For example, The Platinum Card® from American Express cardholders earn 5x points on flights booked directly with an airline or through AmEx Travel and 5x points on prepaid hotels booked through AmEx Travel. They also have access to the Fine Hotels & Resorts collection through the travel portal. Additionally, American Express® Gold Card and The Platinum Card® from American Express cardholders can book room reservations with The Hotel Collection . Terms apply.

Here are eight reasons why booking with AmEx travel could be a good idea.

1. Earn up to 5x points

When you book flight through the AmEx Travel portal, your credit card may earn additional points for the purchase. In addition, prepaid hotel reservations through the AmEx travel portal also earn extra points. These are a few of the cards that offer a bonus when making reservations through AmEx travel:

on American Express' website

• 5 points per $1 on flights booked directly with airlines or with American Express Travel, on up to $500,000 spent per year.

• 5 points per $1 on prepaid hotels booked with American Express Travel.

• 1 point per $1 on other eligible purchases.

Terms apply.

• 4 points per $1 at restaurant plus takeout and delivery in the U.S.

• 4 points per $1 at U.S. supermarkets (on up to $25,000 in purchases per year).

• 3 points per $1 on flights booked directly with airlines or with American Express Travel.

• 3 points per $1 on eligible travel purchases.

• 3 points per $1 on restaurants worldwide.

• 1 point per $1 on other purchases.

• 2 points per $1 on the first $50,000 in purchases each calendar year.

• 1 point per $1 on purchases above $50,000 in a calendar year.

» Learn more: AmEx Membership Rewards: How to earn and use them

2. Pay for reservations using Pay with Points

With American Express Travel, flights, hotels and more can be paid for with points instead of cash. Members can even choose to pay a portion of the trip with points and the rest with cash. Once your reservations have been booked, the full amount of your trip will be charged to your American Express credit card, and then a credit will be posted for the points redeemed within 48 hours.

You must redeem at least 5,000 points in order to use Pay with Points. Points are redeemed at a value of 1 cent per point when booking flights or making Fine Hotels & Resorts reservations. Other eligible travel receives only 0.7 cents per point. NerdWallet values Membership Rewards points at 2.8 cents per point if you take advantage of transferring to and booking through travel partners, so the redemption rates in the travel portal are significantly below our ideal value.

If you need to cancel your reservation, you'll receive a statement credit on your card for the cash equivalent. Members who would rather have the unused Membership Rewards points returned to their accounts must contact American Express customer service at 800-297-3276. Terms apply.

3. Upgrade flights with points

Eligible flights booked with cash can be upgraded using your American Express Membership Rewards points. You'll receive 1 cent per point credit towards the cost when upgrading a flight with points (which is again below our AmEx point valuation ).

To upgrade your flight with points, select your airline and provide your reservation details in the AmEx travel portal. You will be notified if your flight is eligible or not. If your flight is eligible, you can submit an offer to the airline for the upgrade. The airline will accept or reject your bid between one and five days of your flight's departure and you'll receive a decision via email.

If your upgrade offer is accepted, the points will be deducted from your account. Your statement will show a charge and a credit for the corresponding points.

» Learn more: You can now use AmEx points to bid on flight upgrades

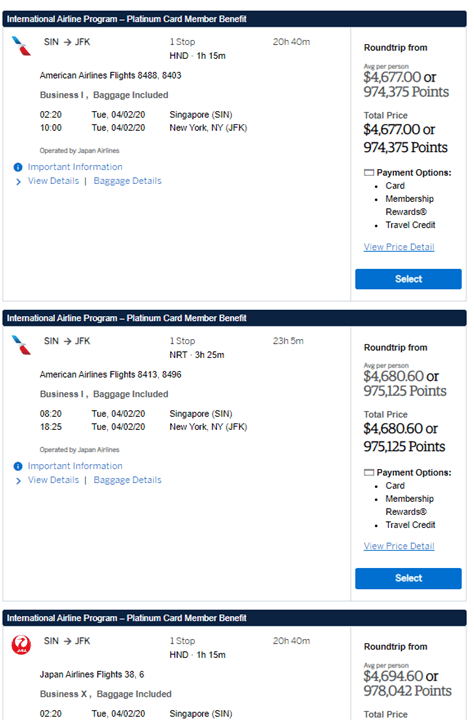

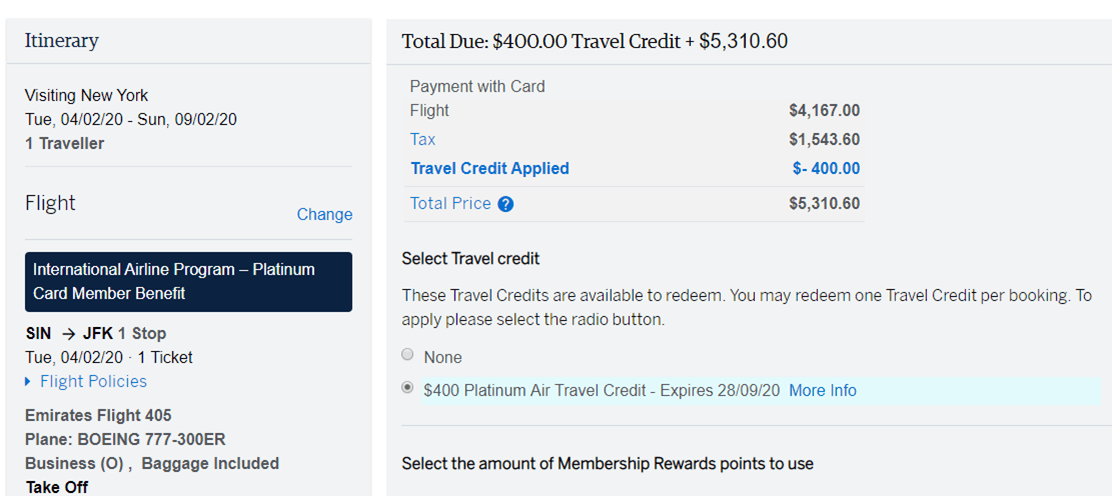

4. Discounted international flights through AmEx IAP

Platinum cardholders have access to discounted flights through International Airline Program (IAP) , which allows members to book first, business and premium economy at a discount on select airlines and routes. Plus, you'll receive 5x Membership Rewards points on the booking when using your The Platinum Card® from American Express or The Business Platinum Card® from American Express to pay for the flight. Terms apply.

There are 25 airlines that participate in this program. You can book refundable and nonrefundable tickets for up to eight passengers through the IAP. Tickets can be paid with your card, points or a combination of the two. You will have to pay a $39 nonrefundable ticketing fee, however the discount received on these tickets should outweigh the fee.

5. Cancel For Any Reason insurance

CFAR is shorthand for an insurance policy that allows you to cancel your trip for any reason whatsoever and receive a refund. In May 2022, AmEx launched its own version of CFAR coverage for airfare booked through the travel portal using an AmEx card.

This feature, called Trip Cancel Guard, will get you up to a 75% reimbursement on nonrefundable airfare costs, provided you cancel at least two calendar days out from your departure. You'll need to purchase Trip Cancel Guard coverage at the point of booking and if you cancel, whether through the airline directly or through AmEx Travel, you can request reimbursement online or over the phone.

» Learn more: The guide to Cancel For Any Reason (CFAR) travel insurance

6. 35% points rebate with The Business Platinum Card® from American Express

When The Business Platinum Card® from American Express cardholder book flights using points through the AmEx travel portal, they can receive up to 35% of their points back . The benefit is available on first or business class flights on any airline and all economy flights with their chosen airline. This benefit provides up to 500,000 points back per calendar year.

However, as with all AmEx credits , it's not as straightforward as you may hope. You will have to designate the airline for the 35% rebate and the airline must be the same as the one chosen for the $200 airline incidental credit .

» Learn more: The best travel credit cards right now

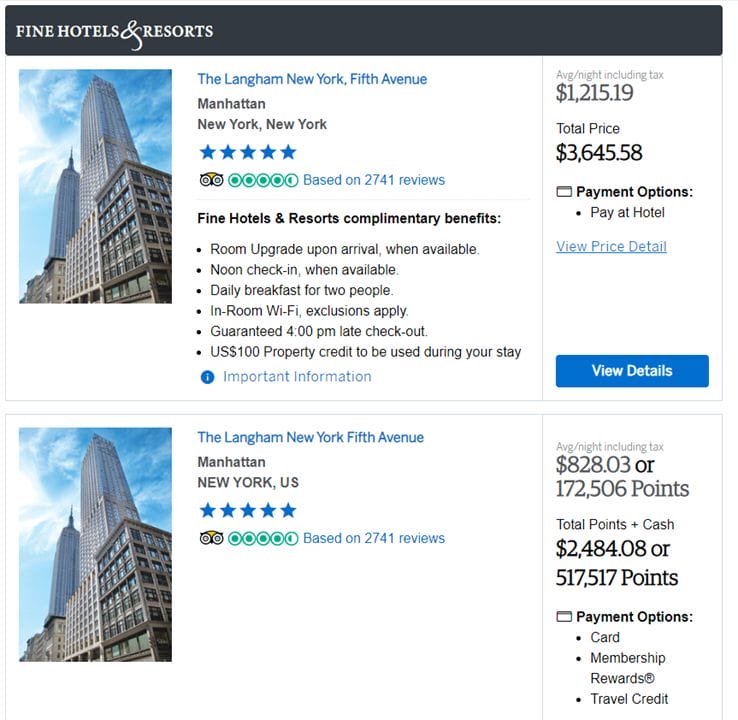

7. Fine Hotels & Resorts

The Loews Portofino Bay Hotel at Universal Orlando. (Photo by Sally French)

Fine Hotels & Resorts (FHR) is a collection of resorts and benefits available only to Platinum Card members. There are over 2,000 properties worldwide that participate in this program. When making reservations with Fine Hotels & Resorts for one night or more, you'll receive the following benefits:

$200 statement credit provided once per year.

Noon check-in (when available).

Room upgrade upon arrival (when available).

Daily breakfast for two.

Guaranteed 4 pm late checkout.

Complimentary in-room WiFi.

Unique property benefit valued at least $100.

These benefits rival those that many travelers receive when booking directly with hotels to obtain elite status perks. Some locations also offer a last-night free benefit, depending upon when you make your reservation. And some of the best hotels to book using FHR credits offer especially-unique amenities.

For example, many theme park fans consider Loews Portofino Bay Hotel as the best FHR hotel in Orlando . That's because — on top of all the above benefits — guests receive complimentary Universal Express Unlimited ride access, which allows you to skip the lines inside the Universal theme parks .

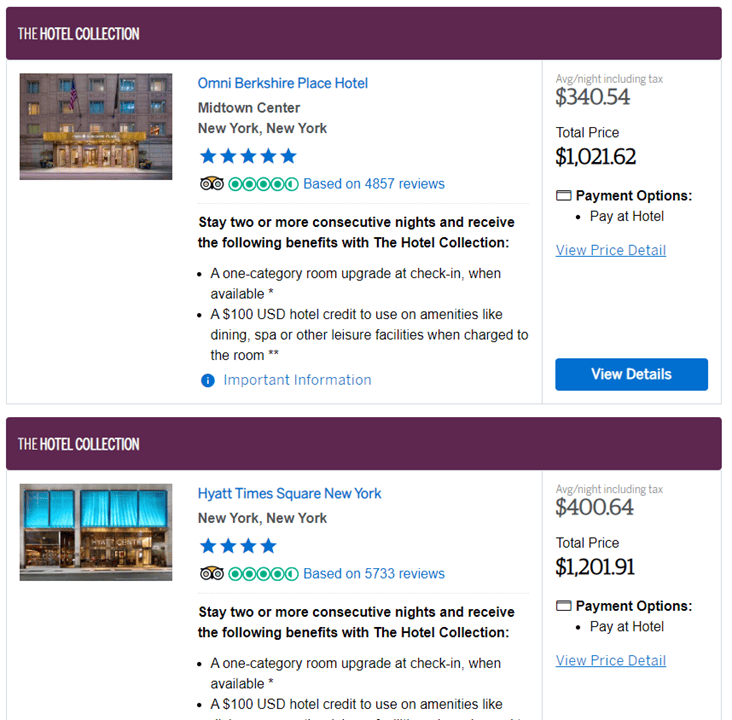

8. The Hotel Collection

The Loews Sapphire Falls at Universal Orlando falls under The Hotel Collection. (Photo by Sally French)

AmEx Gold and Platinum cardholders receive elite status-level perks at more than 600 hotels worldwide. When you stay for two nights or more, you'll receive a $100 resort credit and an upgrade upon arrival (when available). In addition, you can use your AmEx Membership Rewards credit card to book and pay for your reservation entirely or partially with your points.

While you can book travel over the phone with an agent, it is often quicker and more convenient to make your reservations through the AmEx Travel portal.

Here's how to book travel in the American Express travel portal:

Go to americanexpress.com/en-us/travel/ .

Log in with your username and password.

Select flights, hotels, flight + hotel, cars, or cruises.

Enter your travel dates, cities and other relevant information.

Choose options based on your trip.

Pay with your American Express credit card, points, or a combination.

Since you need an American Express card to make reservations through AmEx travel, you may already hold a card that offers complimentary travel insurance . If you don’t get travel insurance perks through your AmEx card, you can purchase Trip Cancel Guard through when making your booking.

Trip Cancel Guard works similarly to CFAR in that it allows you to cancel your trip for any reason whatsoever and get up to a 75% reimbursement of your travel costs as long as the cancellation is made two full days before your trip.

What is the AmEx Travel cancellation policy?

When you book travel through the American Express travel portal, you may be eligible to cancel your reservation within 24 hours and get a full refund. However, the cancellation policy is determined by the airline.

As such, AmEx instructs travelers to refer to the cancellation policy on the itinerary or reach out to customer service with any questions. Terms apply.

There are many appealing reasons why travelers want to book reservations with the AmEx travel portal. However, there are some downsides as well. These are some of the most common reasons why you shouldn't:

Low value for your points. Redeeming points through the AmEx travel portal yields a value of 1 cent per point or less. That's at least a 50% reduction compared to our value of Membership Rewards points.

Complicated customer service. Resolving flight or hotel reservation issues becomes more complicated when you book through a third party such as AmEx travel. The airline or hotel blames the booking agency and may not immediately resolve the problem in some instances. However, providers have no scapegoat when you book direct.

No hotel elite status benefits or loyalty credits. Most hotels require you to book directly to receive elite status benefits, stay credits or earn points. For travelers looking to take advantage of their elite status or earn status for the next year, booking AmEx travel hotel reservations is not a good idea.

Despite the above policy, hotels booked through Fine Hotels & Resorts allow you to earn elite night credit and earn loyalty perks associated with your elite status level on any hotel reservations — regardless if you book in the portal or not.

The AmEx travel portal offers numerous benefits for all American Express cardholders. If you have a Membership Rewards credit card, you can pay for all or part of eligible travel reservations using your points.

And any portion that you pay with your Membership Rewards card can earn up to 5x points. AmEx Travel also offers two hotel collections that provide additional perks similar to elite status benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

The Perfect card for Taj Vouchers : American Express Platinum Travel card review

Updated 15 January 2021

The American Express Platinum Travel Card fits the bill for the frequent domestic traveller and is a worthy companion for a traveller’s wallet. With bonus rewards and Taj Vouchers, you get sweetly rewarded for your normal daily spends. The annual fee pales in comparison to the super savings and makes it your worthy companion.

Note : The post has been updated with current card information.

American Express Platinum Travel Credit Card Overview

From Indigo vouchers to Spicejet vouchers and now to Domestic Travel vouchers, American Express has been changing the way it allows the card users to redeem their earned rewards. With the discontinuation of Spicejet vouchers, Amex has paved the way for its card users to redeem reward travel vouchers for domestic hotels and vouchers on their site. What I like it with Amex is that you can even pay the taxes, fees and surcharges with your reward points.

Who can benefit from Amex Platinum Travel card?

If you can achieve annual spends are in the range of ₹4 lacs per year on this card and if you can make good use of the travel vouchers redeemed from American Express various offered reward points, then this card can help you for a truly rewarding travel experience. For a modest fee, you get a premium travel experience as it lets you earn generous Milestone Bonus Reward points on reaching spending limits along with the regular Membership reward points as well. These bonus reward points are redeemable for Travel vouchers with flexibility to convert points to air miles along with other reward options. As per LBTs calculations, on spends of 4 lacs p.a., you’ll get an awesome ~6.6% return rewards in the first year and a generous ~5.3% from second year onwards.

What is the current Welcome Offer?

The American Express Platinum Travel card is presently offering 5,000 Milestone Bonus Membership Rewards Points (for the first year only) redeemable for Travel Vouchers worth ₹3,500. Check out the table below for the various reward point conversion ratios.

What are Amex Platinum Travel cards’ travel benefits?

The Amex Platinum Travel card offers following benefits, which overshadows the modest fee of ₹3,500+GST in the first year (₹5,000+GST from second year onwards) by miles :

- Domestic Travel Vouchers: You’ll get ₹5,000 Travel Vouchers (redeemed from 7,500 Spend Milestone Bonus Membership Rewards Points) on spends of ₹1.90 Lacs in a year & additional ₹8,000 Travel Vouchers (redeemed from 10,000 Spend Milestone Bonus Membership Rewards Points) on spends of ₹4 Lacs in a year.

- Taj Experiences E-Gift Card: You’ll also get Taj Experiences E-Gift Card worth ₹10,000 from Taj, SeleQtions and Vivanta Hotels on spends of ₹4 Lacs in a year. I don’t mind a free night’s stay at the Taj!

- Airport Lounge Benefits: You get 4 complimentary domestic airport lounge access per year. The benefits are extendable to 2 supplementary card members however the total lounge access cannot exceed 4 visits each year. However when it comes to International lounges, although you do get a Complimentary priority pass worth $99 but the international lounge access itself will be chargeable at $32 per visit for you and your guest as well. I guess as this card is specifically designed with the needs of the Domestic traveller in mind so International Lounge access does not fall in this cards purview.

- Zero Card Liability : If any unauthorized transactions have taken place on your card, your liability to American Express shall be Nil if you report within 3 working days. If you report the fraud after 3 days, your liability will be a maximum of ₹1,000.

- 24×7 Personal Concierge : Their customer care have been giving a great service and Emergency Card Replacement, anywhere in the world.

Related Reading: My Best Travel Credit Cards for 2020 in India

What kind of rewards can I earn?

Along with a decent welcome bonus, you’ll earn 1 Membership Rewards Point earned for every Rs. 50 spent except for spend on Fuel, Insurance, Utilities (which includes Water, Gas and Electricity bill payments), Cash Transactions and EMI conversion. This converts to 0.80% reward rate which by itself is not enough to turn heads. But coupled with various spend based milestone bonus rewards and Taj Vouchers, the overall reward rises nicely to a solid eye catching ~6.6%.

Also, with the American Express Rewards Multiplier Program , you can earn 3x Membership reward points when you shop on your favorite brands like Amazon, Flipkart among a whole lot of other brands pushing the reward rate to a kind of decent ~2.4%.

What is the rewards conversion rate?

Let’s see how the various rewards offered by this travel card and their conversions to Domestic Travel vouchers fare up with each other :

How can I redeem the reward points?

- Domestic Travel Vouchers : This gives the maximum value for the various reward points offered by this travel card. The updated conversion rate is mentioned in the table above. The Domestic Travel vouchers can be redeemed for booking domestic hotels and domestic air travel through the dedicated American Express Domestic Travel website . What works when redeeming a travel voucher is that you’ll be able to pay the applicable taxes as well.

Note: It may sometimes be more rewarding to transfer miles to your airline of choice or convert points to hotel points which brings us to the next way of redeeming points i.e. Transfer points to Travel partners:

- Transfer points to Travel Partners : You’ll be able to convert reward points to various Airline miles and Hotel points of your choice. Airline partners include British Airways Avios, Emirates Skywards, Etihad Guest, Intermiles, Qatar Airways and Singapore Airlines Kris Flyer among others with a 2 Membership Reward points = 1 Air Mile conversion rate. The newest addition to the list is Club Vistara with a conversion rate of 3 Membership Reward points = 1 Air Mile. Hotel Partners include Hilton Honors and Marriott Bonvoy.

At times I feel, transferring this is a better way to redeem points however I have not been able to make my mind as yet. There are times, when transferring miles has given better value for money. With Club Vistara joining the list of airline partners having ₹0.33 per reward point conversion rate it might just become my favorite option (after Coronavirus times of course) to redeem miles.

- Shop with points : During these times of Coronavirus, since Travel is not the first thing that comes in anyone’s mind, you may choose to redeem points for shopping from a wide array of commonly known brands such as Apple, Central, M&S, Flipkart, Big Basket, Myntra. Although for shopping, 1 Membership Rewards Points = ₹0.25 which decent but not as great as when redeemed for domestic travel vouchers.

- Convert to Shopping Vouchers : You’ll be able to convert points to instant shopping vouchers for various brands. The conversion rate varies and can range from ₹0.25 to ₹0.33 per reward point from brand to brand. Its not the best way to redeem points but if on a particular day one is not in the mood to spend out of pocket, then the option is there!

- Pay Card charges with points : If travel is off the cards (like it is in these Corona times right now), you can use your collected reward points to pay your card charges at 1 Membership reward points = ₹0.25. Again not the best use of points but in times like the one we are now, the option is there!

Is Amex Travel Platinum suitable for international spends?

With a high foreign exchange markup fee of 3.5% + Service Tax, Amex Travel Platinum is not the best card suited for international spends. When it comes to international spends, Yes First Exclusive and Yes First Preferred credit card offer a foreign exchange markup fee of 1.75% + Service Tax. However, I recently gave up my Yes First credit cards to avoid the Yes Bank mess and I am not sure I even want to go back to Yes Bank products in the future. After Yes Bank, HDFC Bank cards such as Infinia, Diners Black, Regalia, Diners Club Prestige & Premium including Club miles give a good foreign exchange markup of 1.99% + Service tax. Also, with the Global Value program, you get 1% cashback on HDFC bank cards with which you can even gain a little bit of value. But the card which stands out in this range is HDFC Diners Club Premium as it offers 10x Reward points (~13.33% reward rate) on international spends.

Which other cards compete with Amex Travel Platinum?

There is a lot of competition in this range of travel credit cards but Amex Travel Platinum with its exclusive concierge service with ease of redemption options makes it hard to miss! Although, HDFC Regalia, SBI Club Vistara and even SBI Prime Club Vistara charge lower annual fees when compared to Amex Travel Platinum, all fall slightly short of Amex Travel Platinum when it comes to return back reward rate in spite of the higher fees charged by Amex. Moreover, one would need higher annual spends to achieve those reward rates. Although HDFC Regalia has been devalued over the years, but there are many who still are happy with it as it has higher limits of complimentary domestic and international lounge access. But when compared with Amex Travel Plat, they would need annual spends to the tune of ₹8 Lacs to get close to ~5.3% reward rate. Some who regularly travel in Air Vistara and prefer a premium flying experience, are happy with SBI Prime Club Vistara although they would need annual spends to the tune of ₹8 Lacs to get close to ~6.13% reward rate. Then there are some who are happy with miles that never expire offered by CitiPremier Miles card and 32 complimentary domestic lounge visits a year doesn’t disappoint either. As such there is no annual spend requirement in CitiPremier Miles and many are happy for using it to mint accelerated miles (~4.5% reward rate) for airline and hotel bookings. With 10x reward points on international spends, HDFC Diners Premium provides huge value for those who regularly spend internationally. Ultimately, these cards each offer a very different set of perks that will appeal to different people. Those looking for higher reward rate until annual spends of ₹4 Lacs with Taj vouchers and other travel vouchers as added perks will prefer Amex Travel Platinum, while Vistara frequent flyers will do better with SBI Club Vistara card.

What’s not so good with Amex Travel Platinum credit card?