- Skip to main content

- Skip to footer

Language selection

- Search and menus

Travel and tourism statistics

- Mobile applications

Sign up to My StatCan to get updates in real-time.

Find data on

More related subjects: Travel and tourism

Frontier Counts: Interactive Dashboard

International travel: Advance Information

Crossing the border during the pandemic: 2020 in review

Measuring private short-term accommodation in Canada

Key indicators | All indicators

Changing any selection will automatically update the page content.

Selected geographical area: Canada

- Tourism share of gross domestic product - Canada (Fourth quarter 2023) 1.58%

Latest releases

View the latest Daily releases on the subject of travel and tourism .

Air passenger traffic and aircraft itinerant movements at Canadian airports

The interactive Dashboard for Air Travel is based on estimates from the Airport Activity Survey and the Aircraft Movement Statistics Survey. The Airport Activity Survey collects data on passengers enplaned and deplaned and cargo loaded and unloaded at Canadian airports. The Aircraft Movement Statistics Survey collects data on aircraft movements in Canada. Transportation Statistics: Interactive Dashboard

Canadian Tourism Activity Tracker

The Canadian Tourism Activity Tracker was an experimental product designed in 2021 to assess recovery of tourism activity in Canada. As currently designed, the Tracker has fulfilled this purpose and will no longer be updated after the December 2022 release.

About the Tourism Statistics Program

The Tourism Statistics Program produces detailed statistics on travellers travelling to, from and within Canada, as well as information on travellers' characteristics and spending. The program also provides information to the Canadian System of Macroeconomic Accounts which produces data on travel and tourism expenditures, employment and gross domestic product.

- Destination Canada

- Tourism HR Canada

Provincial and territorial tourism departments

- Government of Canada

- Newfoundland and Labrador

- Prince Edward Island

- Nova Scotia

- New Brunswick

- Saskatchewan

- British Columbia

- Northwest Territories

What do you want to see on this page? Fill out our feedback form to let us know.

- Business Events

- Visual Library

Jump to section

Tourism in canada.

Destination Canada produces regular data, market intelligence and industry analysis to help businesses market to international travellers and grow Canada’s tourism industry.

Most reports are updated monthly, quarterly or annually depending on the report type. Ad hoc reports, such as information on sectors are published as updated information is available. Stay up-to-date by subscribing to Destination Canada News .

THE CANADIAN TOURISM DATA COLLECTIVE IS COMING SOON!

A centralised, secure, and accessible platform providing relevant and timely tourism data, the Data Collective will deliver an innovative solution to tourism data challenges.

Destination Canada is proud to partner with Statistics Canada | Statistique Canada and Innovation, Science and Economic Development Canada to bring this transformative resource to life.

Featured reports

Tourism Snapshot

Quarterly Tourism Snapshot - Q4 2023, an ongoing monitor of the performance of Canada's tourism sector.

Download Quarterly Snapshot

Tourism Outlook

Read the full report to learn about travel demand, key recovery drivers and several forecast scenarios.

Download full report

Financial Times Longitude

Laws of attraction for high-value guests.

- Destination Canada partnered with FT Longitude, the respected research arm of the Financial Times, to conduct qualitative and quantitative research with travel trade professionals on the global high-end travel market.

- This research and the associated report summarizes key learnings and recommendations to help Canadian businesses and destinations better attract high value guests in this highly competitive market.

Total International Arrivals to Canada

Tourism in canada reports, overnight arrivals infographics.

Monthly and annual research infographics covering basic statistics on the state of tourism in Canada.

Tourism Spend in Canada

Quarterly foreign spend data covering 20 tourism regions and six spend categories.

National Tourism Indicators

Short summary report outlining the tourism industry's contribution to Canada's economy through jobs, GDP and tourism spending.

Tourism Fact Sheet

This document outlines key tourism facts and provides an overview of the impact of tourism on the Canadian economy.

Industry Sectors

Learn more about Canada's tourism industry sectors.

View Industry Sectors

Market Insights

Still looking for more? Get insights by market.

View Market Insights

Visit our sites

- Corporate (English)

- Entreprise (Français)

Bienvenue à | Welcome to

- Visit Parliament Visit

- Français FR

Research publications

About this publication

Executive Summary

1 introduction, 2 global travel and tourism, 3.1 general, 3.2 key details for 2019, 3.3 travel by canadians, 3.4 indigenous tourism, 3.5 canada–united states tourism, 3.6 international competitiveness, 4.1 destination canada, 4.2 federal tourism strategy, 4.3.1 2008–2013, 4.3.2 2016–2017, 4.3.3 2019, 4.3.4 2021, 4.4 other government players, 5 looking ahead.

Canada’s multi-billion-dollar tourism sector employs hundreds of thousands of Canadians and is supported by all levels of government.

In 2020, due to the COVID-19 pandemic, global tourism and travel sector revenue decreased by 49% from the previous year, to US$4.7 trillion. Global tourism employment fell by 19% to 272 million jobs. Similarly, the Canadian sector earned $49.5 billion in 2020, a decline of 40% from 2019, while domestic employment fell to 1.6 million direct and indirect jobs, a decrease of 24%. About 28% of Canadian tourism revenue is generated from inbound visits.

In 2019, Canadians made 37.8 million foreign trips consisting mainly of 27.1 million visits to the United States. Additionally, Canadians made 10.7 million trips to other countries, most frequently Mexico (1.8 million), Cuba (964,000), the United Kingdom (770,000), China (666,000) and Italy (619,000).

According to the World Economic Forum’s Travel & Tourism Competitiveness Report 2019 , which ranks the most competitive countries for travel and tourism, Canada ranked ninth out of 140 countries studied, down from eighth place in 2013. Canada ranked first in several sub-categories, such as safety and security, environmental sustainability and air transport infrastructure. Conversely, Canada was found to be deficient in several areas, including price competitiveness and international openness.

Other studies have found that tourism demand is concentrated in Canada’s largest cities, with Toronto, Vancouver and Montréal accounting for 75% of overall visitors and most of this activity taking place during the summer months. There are also challenges stemming from labour shortages, a lack of investment and promotion, and a lack of coordination of tourism policy between all levels of government.

Destination Canada (formerly the Canadian Tourism Commission) is a federal Crown corporation responsible for national tourism marketing and is governed by the Canadian Tourism Commission Act . In 2019, the federal government announced Creating Middle Class Jobs: A Federal Tourism Growth Strategy , which is based on the following three pillars: building tourism in Canada’s communities; attracting investment to the visitor economy; and renewing the focus on public-private collaboration.

Between 2008 and 2020, the federal government invested approximately $1 billion in the tourism industry. In 2021, it announced another $1 billion in funding, including the Tourism Relief Fund.

If international borders continue to reopen and the industry continues its steady overall growth of the recent years prior to the pandemic, it will again contribute to Canada’s economic well-being. And although the United States continues to be Canada’s biggest tourism trading partner, stakeholders might continue their efforts of focusing on more growth-oriented, lucrative emerging markets to better diversify tourism interests to help Canada fulfil its tourism potential.

Canada’s tourism industry is an important contributor to Canadian economic growth. This industry – which comprises hospitality and travel services to and from Canada – is a multi-billion-dollar business that employs hundreds of thousands of Canadians and is supported by all levels of government. This HillStudy provides information about Canada’s tourism industry, travel patterns of visitors to and from Canada, the importance of the United States (U.S.) to Canada’s tourism economy and the role of the federal government.

The global tourism sector suffered substantial declines in activity due to the COVID-19 pandemic. Since this HillStudy incorporates data from 2019 and 2020, special attention should be paid to both explicit tourism figures and relative comparisons to previous years due to the extraordinary effects of the pandemic.

According to the Tourism Industry Association of Canada, “travel and tourism” includes “transportation, accommodations, food and beverage, meetings and events, and attractions,” such as festivals, historical/cultural institutions, theme parks and nature settings. 1

The World Travel & Tourism Council’s latest annual research explains the COVID 19 pandemic’s impact on the global travel and tourism sector:

- The sector suffered a loss of almost US$4.5 trillion in revenues worldwide, standing at US$4.7 trillion in 2020.

- In 2019, the sector contributed 10.4% to the global gross domestic product (GDP); this decreased to 5.5% in 2020 due to ongoing mobility restrictions.

- In 2020, 62 million jobs were lost, representing a drop of 18.5% of global sectoral employment, leaving just 272 million employed compared to 334 million in 2019.

- Globally, domestic visitor spending decreased by 45% and international visitor spending declined by 69.4%. 2

3 The Canadian Tourism Industry: Facts and Figures

Only about 28% of Canadian tourism revenue (about $21.3 billion) is generated from inbound visits. The remainder represents domestic spending – i.e., what Canadians spend on domestic and foreign tourism activities. Table 1 provides further information about the industry’s recent performance.

Note: Domestic spending includes spending while on a trip in Canada, spending on airfares with Canadian carriers on outbound trips and spending on tourism-related goods, e.g., camping equipment. International spending includes spending while on a trip in Canada but excludes any pre-trip purchases. GDP refers to gross domestic product.

There are two ways to categorize jobs in tourism:

- Jobs in tourism-dependent industries – the total number of jobs in industries where a significant portion of the revenue is in tourism; this includes accommodation, passenger transportation, food and beverage, entertainment and recreation, and travel services.

- Jobs directly supported by tourism – the share of jobs in the economy servicing visitors as opposed to local clients. These are jobs that would not exist without visitors; e.g., in food and beverage, a certain portion caters to local clients, and the portion that caters to visitors is captured in this number.

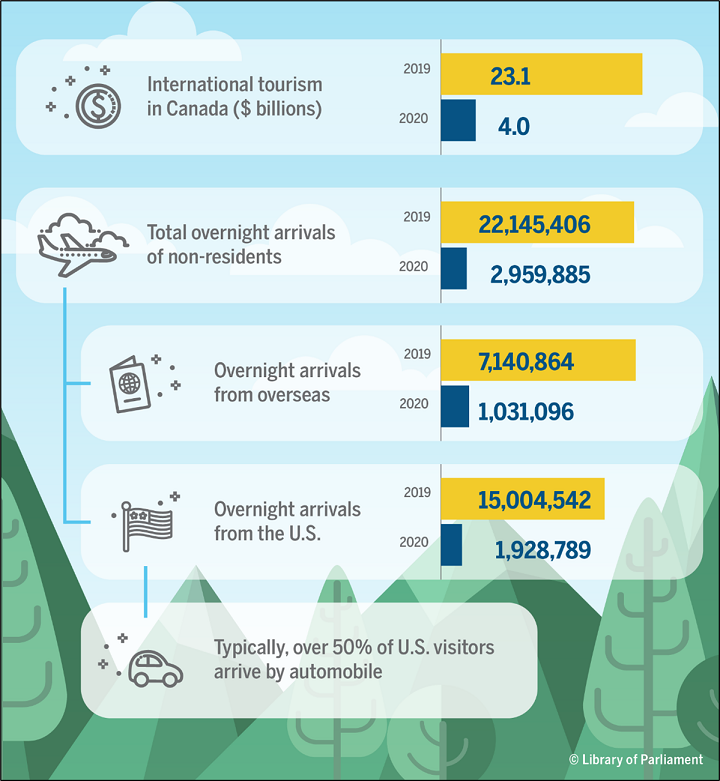

Figure 1 provides further details about international arrivals to Canada.

Figure 1 – Selected Information on International Arrivals to Canada

According to Destination Canada, prior to the pandemic, Canada benefited from the fact that the tourism sector was booming globally. Since 2000, tourism has been growing approximately three to four times faster than the global population and about 1.5 times faster than the overall global GDP . Furthermore, notwithstanding the COVID-19 pandemic, this was expected to continue into the mid-2020s. In fact, 2017’s travel and tourism sector growth of 4.6% exceeded the global GDP growth rate of 3.7%; that is, for the seventh successive year, the sector outpaced global GDP growth, which itself had the strongest growth a decade. 3

However, even with this strong performance, Canada’s tourism industry potential remains significantly underdeveloped. Specifically, even though it has outpaced global population and GDP growth, Canadian tourism growth has lagged behind global tourism growth for several years (see section 3.6 of this Hill Study). 4

Moreover, tourism represents a much smaller fraction of Canada’s exports when compared to peer countries such as the U.S., Japan, the United Kingdom and Australia. Studies suggest there is an opportunity for Canada to more than double its international arrivals and associated revenues by 2030. 5 This could be achieved, in part, by capitalizing on “substantial opportunities to increase the number of tourists to Canada from the United Kingdom, China, France, Germany and Australia.” 6

Beyond its role in helping to create revenue and both direct and indirect jobs in the Canadian tourism industry, the efficient promotion of tourism can be seen as a valuable investment in Canada’s overall economy. A 2013 Deloitte study has shown that “a rise in business or leisure travel between countries can be linked to subsequent increases in export volumes to the visitors’ countries.” 7

In 2019, the Canadian tourism sector had its best year on record, reaching 22.1 million international overnight arrivals, a 4.8% increase over the previous year. Similar to other years, the vast majority (67.7%) came from the U.S.; the top three non-U.S. sources of visitors were the U.K. (875,632), China (715,474) and France (668,490). 8

Destination Canada reported that “air and sea arrivals from the Europe region were mostly on par with 2018 levels, with the exception of France, which led the region (+7.0%).” 9 However, there were mixed results from the Asia-Pacific region as the biggest decline came from the region’s largest market, China (-9.1% in air and sea arrivals), with smaller downward trends from Japan (-1.9%) and Australia (-0.4%). More positively, air and sea arrivals from South Korea were slightly ahead of 2018 levels, while India led the region in year-over-year growth (+9.1%). 10

In North America, the U.S. provided an increase in arrivals on overnight trips entering Canada by air and auto of 6.4%. Mexico was the only one of Destination Canada’s long-haul markets to record double-digit year-over-year growth in overnight arrivals by air and sea (12.3%) in 2019. 11

Canada’s rising popularity among Chinese travellers is particularly noteworthy, as China is now Canada’s second-largest overseas tourism source after the U.K. 12 This is partly attributable to Canada’s having been granted Approved Destination Status by the Chinese government. In 2018, Canada welcomed a record 737,000 Chinese tourists, “surpassing the 700K mark for the first time and doubling the number of annual travellers since 2013, with an average annual growth rate of 16%.” 13 Travelling mainly during July and August, “Chinese tourists spend on average about $2,850 per trip to Canada, staying for around 30 nights.” 14

In 2019, Canadians made 37.8 million foreign trips consisting mainly of 27.1 million visits to the U.S. Although travel to the U.S. declined by 2.3% in 2019 compared to 2018, Canadians “spent $21.1 billion on their trips to the United States in 2019, up 4.8% from a year earlier.” 15

Additionally, Canadians made 10.7 million trips to other countries, the most common of which were Mexico (1.8 million), Cuba (964,000), the U.K. (770,000), China (666,000) and Italy (619,000). 16

Canadians also enjoy travelling within the country, making 275 million domestic trips in 2019, down 1.0% from 2018. Spending on trips within Canada declined 0.3% year over year to $45.9 billion. 17 The top locations were Ontario (116.5 million visits), Quebec (56.9 million visits), British Columbia (34.2 million) and Alberta (32.4 million); this includes both intra and inter-provincial/territorial domestic travel. 18

Canada’s Indigenous tourism sector is diverse and comprises different business models. Although its key drivers of employment and GDP come from air transportation and resort casinos, “it is the cultural workers, such as Elders and knowledge keepers, who define many of the authentic Indigenous cultural experiences available to tourists in Canada.” 19 Moreover, when compared with Indigenous tourism enterprises without a cultural focus, those involved in cultural tourism rely more on visitors from foreign markets as part of their customer base.

Prior to the pandemic, Canada’s Indigenous tourism sector had been rapidly outpacing overall Canadian tourism activity. Specifically, the Indigenous tourism sector’s GDP rose 23.2% between 2014 and 2017, reaching $1.7 billion. 20

Lastly, Indigenous tourism businesses cite access to financing as well as marketing support and training as some of the main barriers to growth. 21

Given its proximity and long shared border, the U.S. is by far the biggest source of Canada’s tourism visitors: in 2018, about two-thirds of all foreign visitors were Americans, 57% of whom arrived by automobile. 22 The U.S. is also the most visited foreign destination by Canadians.

U.S. arrivals to Canada reached 14.44 million in 2018, up 1% over 2017 and the highest level recorded since 2004. American tourists like to take advantage of their long weekends for travel, with Memorial Day (the last Monday in May), Independence Day (4 July) and Labour Day (the first Monday in September) contributing to the largest weekend spikes in road arrivals in 2018. 23

Americans spend around $700 per trip to Canada, staying an average of five nights. In 2018, they preferred mainly nature-based activities, including natural attractions, hiking or walking in nature, and viewing wildlife. 24

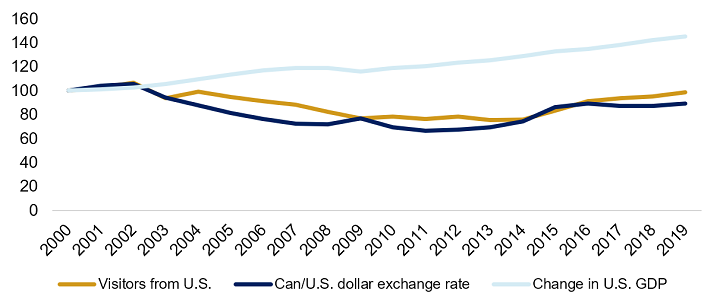

As shown in Figure 2, analysis of various factors over a 20-year period shows that the number of Americans travelling to Canada relates more to the Canadian/U.S. dollar exchange rate than to changes in the U.S. GDP .

Figure 2 – Index Comparing the Number of U.S. Visits to Canada, the Canadian/U.S. Dollar Exchange Rate and the Change in the U.S. Gross Domestic Product (GDP), 2000–2019 (2000 = 100)

Source: Figure prepared by the Library of Parliament using data obtained from Statistics Canada, “ Chart 1: Tourists to Canada from abroad, annual ,” The Daily , 20 February 2020; Federal Reserve Bank of St. Louis, “ Canadian Dollars to U.S. Dollar Spot Exchange Rate ,” FRED, Database, accessed 20 August 2021; and World Bank, “ GDP (constant 2010 US$) – United States ,” Database, accessed 20 August 2021.

According to the World Economic Forum’s Travel & Tourism Competitiveness Report 2019 , Canada ranked ninth out of 140 countries studied, down from eighth place in 2013. 25 Canada was ranked first in several sub-categories, such as safety and security, environmental sustainability and air transport infrastructure.

In contrast, Canada was found to be deficient in several areas, such as price competitiveness and international openness (e.g., visa requirements, air service agreements).

A 2018 report further indicated the following challenges facing the Canadian tourism sector:

- CONCENTRATED DEMAND – Toronto, Vancouver and Montréal (Canada’s three largest cities) account for 75% of all visitors, and most of this activity takes place during the summer months. Plus, 70% of visitors to Canada come from the U.S., making the sector very vulnerable to the vagaries of the American economy.

- ACCESS – Coming to (and travelling within) Canada can be expensive, difficult and time-consuming; this is true for travel both inter-regionally (e.g., visiting a national park from a large city) and within urban centres.

- LABOUR SHORTAGES – Similar to many sectors that service the public, the tourism industry has been facing labour shortages for some time. In fact, this sector “could face a shortage of 120,000 people by the mid-2020s, and up to 230,000 people by 2030.”

- LACK OF INVESTMENT/PROMOTION – As hotels face up to 95% occupancy during the summer months, there are insufficient room-nights for additional large-attendance events such as conventions, conferences and festivals. Also, compared to peer countries, Canada spends less on marketing and promotion per international tourist arrival (in some cases up to 20% less). One of the contributing factors is that most tourism businesses are small enterprises that face difficulties in securing capital.

- GOVERNANCE – Given that the sector is extremely diverse and made up of many destinations in different regions, successful efforts for one region or operator will not necessarily carry over to other parts of the country or service providers. Also, as tourism policies and programs are spread across numerous organizations within every level of government, making a well-coordinated and integrated Canadian approach is difficult. 26

These assessments suggest that even though Canada is doing well in certain areas, other jurisdictions may be greatly improving their ability to attract international tourism. Changing trends in consumer preferences may also play a role in determining which destinations may be more popular than others at any particular time.

4 The Role of the Federal Government

Destination Canada is a federal Crown corporation responsible for national tourism marketing and is governed by the Canadian Tourism Commission Act . It targets the following markets “where Canada’s tourism brand leads and yields the highest return on investment”: Australia, Canada, China, France, Germany, Japan, Mexico, the U.K. and the U.S. 27

In 2019, the federal government announced its new tourism strategy entitled Creating Middle Class Jobs: A Federal Tourism Growth Strategy . It is based on the following three pillars:

- BUILDING TOURISM IN CANADA’S COMMUNITIES – expand from the concentration of international visitors to Canada’s three largest cities over a few (mostly summer) months by helping communities “exploit and develop the characteristics that make them special. In so doing, they will be better able to convince tourists to get off the beaten path, explore the lesser-known parts of the country, and to visit during the off-peak seasons.”

- ATTRACTING INVESTMENT TO THE VISITOR ECONOMY – to combat the lack of investment in Canada’s tourism sector, the strategy aims to improve coordination among jurisdictions and help attract private investment by establishing “Tourism Investment Groups in every region of Canada to enable the development of impactful tourism projects, including large-scale destination projects.”

- RENEWING THE FOCUS ON PUBLIC–PRIVATE COLLABORATION – with the establishment of the Economic Strategy Table for Tourism, the federal government aims to stimulate and sustain growth in Canada’s tourism sector by working collaboratively with industry to ensure that tourism is on the front lines of economic policy making. This could include addressing “the high cost of travelling to and within Canada, labour shortages and the lack of investment. It could also look at competitiveness, sustainability, the sharing economy and digital platforms.” 28

Part of the focus on improving tourism has been improving accessibility. To that end, in 2018, the Government of Canada introduced Bill C-81, the Accessible Canada Act , which “aims to achieve a barrier-free Canada through the proactive identification, removal, and prevention of barriers to accessibility in all areas under federal jurisdiction, including transportation services such as air and rail.” 29 The bill received Royal Assent in 2019.

4.3 Federal Funding Initiatives

In 2008–2009, the federal government invested over $500 million in the tourism industry to develop facilities and events, and to promote tourism. This is in addition to investments in other areas that affect tourism, such as improvements for Parks Canada and border services. 30 In 2013, funding of $42 million was allocated to improve visa services, 31 an area where Canada has been found to be deficient.

Since 2016, the regional development agencies have allocated over $196 million to tourism businesses, and the Business Development Bank of Canada has provided more than $1.4 billion in financing. Export Development Canada assists Canadian tourism businesses that aim to expand into global markets. 32 Budget 2017 provided Destination Canada with permanent funding of $95.5 million per year for tourism-related work, up from $58 million. 33

Budget 2019 announced that starting in 2019–2020, $58.5 million over two years would go towards the creation of a Canadian Experiences Fund. The Fund supports “Canadian businesses and organizations seeking to create, improve or expand tourism-related infrastructure—such as accommodations or local attractions—or new tourism products or experiences.” These investments would focus on tourism in rural and remote communities, Indigenous tourism, winter tourism, inclusiveness (especially for the LGBTQ2 communities) and farm-to-table/culinary tourism. 34

Additionally, Budget 2019 included $5 million to Destination Canada for a “tourism marketing campaign that will help Canadians to discover lesser-known areas, hidden national gems and new experiences across the country.” 35

Budget 2019 also included the establishment of the Economic Strategy Table dedicated to tourism, which will bring together “government and industry leaders to identify economic opportunities and help guide the Government in its efforts to provide relevant and effective programs for Canada’s innovators.” 36

Announced in Budget 2021, the Tourism Relief Fund is a $500 million national program that is part of a $1 billion package to support the Canadian tourism sector. 37 Its goal is to position Canada as a destination of choice when domestic and international travel is once again deemed safe (i.e., post-pandemic) by:

- empowering tourism businesses to create new or enhance existing tourism experiences and products to attract more local and domestic visitors; and

- helping the sector reposition itself to welcome international visitors by providing the best Canadian tourism experiences to the world. 38

Initiatives under this fund will help tourism businesses and organizations adapt their operations to meet public health requirements; improve their products and services; and position themselves for post-pandemic economic recovery. 39

Part of this funding includes Destination Canada’s $2-million investment along with $950,000 of in-kind support to the Indigenous Tourism Association of Canada to “support the recovery of Indigenous tourism businesses.” 40

Several federal government institutions also play key roles in shaping the outcome of Canada’s tourism economy. For example, the federal government is responsible for the following:

- establishing ticket taxes and travel tariffs;

- providing customs and border services; and

- addressing matters related to national security.

The National Capital Commission and Parks Canada also help ensure that iconic Canadian places are protected and preserved for current and future visitors to enjoy. As well, provincial and territorial governments help develop and promote tourism in Canada.

The Canadian tourism industry was greatly affected by the global COVID-19 pandemic. However, if international borders continue to reopen and if the industry continues its steady overall growth of the recent years prior to the pandemic, tourism will again contribute to Canada’s economic well-being. And although the U.S. continues to be Canada’s biggest tourism trading partner, stakeholders might continue their efforts of focusing on more growth-oriented, lucrative emerging markets to better diversify tourism interests and help Canada fulfil its tourism potential.

- World Travel & Tourism Council, Economic Impact Reports . [ Return to text ]

- Ibid. [ Return to text ]

- Ibid., p. 7. [ Return to text ]

- Destination Canada, China . [ Return to text ]

- Statistics Canada, “ Canadians made fewer trips within Canada and around the world in 2019 ,” The Daily , 9 December 2020. [ Return to text ]

- Ibid., p. 14. [ Return to text ]

- Ibid., p. 15. [ Return to text ]

- Destination Canada, United States . [ Return to text ]

- Destination Canada, Who we are . See also the Canadian Tourism Commission Act , S.C. 2000, c. 28. [ Return to text ]

- Innovation, Science and Economic Development Canada, “ Creating Middle Class Jobs: A Federal Tourism Growth Strategy ,” Creating Middle Class Jobs: A Federal Tourism Growth Strategy . [ Return to text ]

- Ibid.; and Accessible Canada Act , S.C. 2019, C. 10. [ Return to text ]

- Government of Canada, “ Chapter 3.1: Connecting Canadians With Available Jobs –Temporary Resident Program ,” Jobs, Growth and Long-Term Prosperity: Economic Action Plan 2013 , Budget 2013. [ Return to text ]

- Government of Canada, “ Chapter 2: Building a Better Canada – Launching a Federal Strategy on Jobs and Tourism ,” Investing in the Middle Class , Budget 2019. The Government of Canada’s regional development agencies are the Atlantic Canada Opportunities Agency (ACOA); Canada Economic Development for Quebec Regions (CED); Canadian Northern Economic Development Agency (CanNor); Federal Economic Development Agency for Southern Ontario (FedDev Ontario); Federal Economic Development Agency for Northern Ontario (FedNor); Prairies Economic Development Canada (PrairiesCan); and Pacific Economic Development Canada (PacifiCan). [ Return to text ]

- Government of Canada, “ Chapter 2: Building a Better Canada – Launching a Federal Strategy on Jobs and Tourism ,” Investing in the Middle Class , Budget 2019. “LGBTQ2” refers to lesbian, gay, trans, queer and Two-Spirit. [ Return to text ]

- Government of Canada, Tourism Relief Fund . [ Return to text ]

- Destination Canada, Destination Canada providing $2 million in funding to Indigenous Tourism Association of Canada ( ITAC ) . [ Return to text ]

© Library of Parliament

- 44 th Parliament, 1 st Session

- 43 rd Parliament, 2 nd Session

- 43 rd Parliament, 1 st Session

- 42 nd Parliament, 1 st Session

- 41 st Parliament, 2 nd Session

- 41 st Parliament, 1 st Session

- 40 th Parliament, 3 rd Session

- 40 th Parliament, 2 nd Session

- 40 th Parliament, 1 st Session

- 39 th Parliament, 2 nd Session

- 39 th Parliament, 1 st Session

- 38 th Parliament, 1 st Session

- 37 th Parliament, 3 rd Session

- 37 th Parliament, 2 nd Session

- 37 th Parliament, 1 st Session

Related content

- Legislative summaries

- Trade and investment series

- See complete list of research publications

- Publications about Parliament

- Library Catalogue

- Tourism Statistics

TIAC is now providing our members with a monthly updated report on Canadian tourism statistics, including a look at monthly international arrival numbers, our place in the Canadian economy, and how we’re fairing against global competitors.

Join our mailing list

Language selection

- Français fr

WxT Search form

The canadian tourism sector.

From: Innovation, Science and Economic Development Canada

Information and resources for businesses in the tourism sector

On this page, businesses in the tourism sector can find the latest relevant news, financial resources and other useful information to assist them in welcoming Canadian and international visitors.

The new Federal Tourism Growth Strategy

Innovation, Science and Economic Development Canada launched a new Federal Tourism Growth Strategy, which sets a course for growth, investment and stability.

Learn about the new strategy

- Read the new strategy

- Learn about the public consultation process

Latest news for tourism businesses

Subscribe to updates

View all news

Supports and resources for businesses in the tourism sector

Learn more about supports and resources available to help businesses in the tourism sector improve their products and services to welcome Canadian and international visitors.

- Tourism Growth Program

- Indigenous Tourism Fund – Micro and Small Business Stream

- Canada Digital Adoption Program

- Budget 2023: Supporting the Growth of Canada's Tourism Sector

- Past programs

- Subscribe to the GC Business Insights newsletter for information on government programs to help businesses.

Don't know where to start? Canada's regional development agencies (RDA) work closely with businesses in their regions to fuel economic growth. Visit your RDA's web page to find out more about targeted advice and support available. Or fill in an online form to find the right programs and services through the Business Benefits Finder . Indigenous organizations and businesses can now also use the new Indigenous Business Navigator as a single point of contact that connects them to services and programs from different Government of Canada departments.

Canada Business app

Browse government programs and services for businesses.

Spotlight on Canadian tourism

Canadian tourism businesses showcasing all that our country has to offer

Indigenous tourism

First Nations, Métis and Inuit tourism businesses have a unique opportunity to engage with visitors and teach them about their thought-provoking histories and distinct cultures. Canadian and international travellers alike are eager to partake in Indigenous experiences . Discover how the Government of Canada is supporting Indigenous tourism businesses through the Micro and Small Business Stream of the Indigenous Tourism Fund (ITF).

Rural and remote tourism

Canadians living in rural and remote areas can unlock the economic potential of tourism to drive growth and job creation in their communities. Now, more than ever, Canada has what the world wants: wide-open spaces, rugged coastlines and unspoiled wilderness. And Canadian tourism businesses are looking to make the most of it. Learn more through the Government of Canada's Economic Development Strategy for rural Canada .

2SLGBTQI+ tourism

Canada is consistently named a top destination for 2SLGBTQI+ travellers, thanks to shared values of diversity, equity, inclusion and personal security. Canadian tourism businesses, get inspired and see how Canadian destinations are welcoming this important community .

Francophone tourism

Say bonjour and bienvenue to francophones, francophiles and anyone curious to discover Canada's francophonie from here and abroad! Find out if your tourism business is doing everything possible to attract this target market.

Destination Canada: Corporate resources

Destination Canada collaborates with provincial, territorial, municipal, and industry partners to promote Canada as a premier tourism destination and provides data, tools, and resources that help the Canadian tourism sector reach domestic and international markets.

Consult Destination Canada's Tools page to learn how to get the most out of your marketing efforts and gain valuable insights into why and how different people like to travel.

Tourism employment

Considering a career in tourism? The Canadian tourism sector is uniquely inclusive, providing opportunities for economic growth and employment in regions across Canada, including to under-represented groups, such as racialized and 2SLGBTQI+ individuals, youth, women, people with disabilities, new Canadians and Indigenous communities. There is a lot of room for growth and opportunities to shape the future of tourism in Canada.

Visit the Tourism HR Canada website to learn more.

Travel and tourism data

Visit Statistics Canada to find important data about travel and tourism in Canada and read the SME Profile: Tourism Industries in Canada, 2020 report to gain insight on small and medium-sized enterprises in the sector.

The Honourable Soraya Martinez Ferrada Minister of Tourism and Minister responsible for the Economic Development Agency for the Regions of Quebec

Did you find what you were looking for?

If not, tell us why:

You will not receive a reply. Telephone numbers and email addresses will be removed. Maximum 300 characters

Thank you for your feedback

Tourism Statistics in Canada

- Updated: March 13, 2024

- Canadian Statistics

Many industries were hit hard by the global COVID pandemic, but the hardest hit industry was the tourism industry. The ban on travel directly affected airlines, cruise lines, accommodation services, tourist attractions, and food services.

It also had an indirect impact on other industries such as retail when visiting shoppers didn’t bring in extra revenue. Some areas, such as the South Shore area in Nova Scotia, were hit harder than others because many local businesses rely on the revenue brought in by tourists.

In this article, we have collected data on how the pandemic affected the tourist industry. We have also included statistics from the first quarter of 2022 to see what has been happening with the number of tourists in Canada since travel bans were lifted.

Tourism Statistics for Canadians

Canada recorded 32 million tourists in 2019 with Toronto and Vancouver the two most popular destinations among international tourists.

- The number of jobs in tourism-dependent industries fell from 2.1 million in 2019 to 1.6 million by the end of 2020.

- Post-pandemic, the tourist industry has struggled to find staff and at the end of the first quarter of 2022, there were 170,000 unfilled jobs in tourism.

- The revenues from the aviation industry fell by 89.9% from April to December 2020.

The tourism spending in the first quarter of 2022 was 34.2% below the pre-pandemic levels of 2019.

- The GDP from tourism increased by 11.9% in the final quarter of 2021.

- Spending by Canadians was 85.8% of the total tourism spending in the first quarter of 2022.

There were 315,400 overseas tourists in Canada in May 2022.

- There were almost ten times more trips to Canada made by US residents in May 2022 compared to the year before and almost twelve times the number of overseas visitors.

- There were seven times as many trips to the United States by Canadian residents in May 2022 compared to the previous May.

- 593,200 Canadians flew to the United States in May 2022, which represents 73.6% of the trips by air recorded in May 2019. Overseas flights returned to 67.2% of the pre-pandemic levels in May 2019.

- 44% of Canadians feel confident welcoming tourists from overseas to their area, while 70% are happy to welcome tourists from other parts of Canada.

84% of Canadians believe tourism is important to the Canadian economy.

Before the Pandemic

In 2019, before COVID forced countries around the world to close their borders, Canada recorded a total of 32 million tourists, the ninth-highest number in the world. However, when looking at the number of tourists in relation to the population, Canada is 49th in the world with 0.85 tourists per resident. It ranked number one in North America.

Toronto and Vancouver were the most popular destinations in Canada among international travellers. In 2019, Toronto ranked 53rd and Vancouver 68th among the world’s most popular cities with 4.74 million and 3.4 million tourists respectively.

In 2019, there were 2.1 million jobs in the tourism-dependent industries and there were 232,000 tourism establishments.

During the Pandemic

Initially, in the first quarter of 2020, only 187,000 jobs were lost in the industry, but as the pandemic forced the borders to stay closed for much longer than initially thought, the second quarter of 2020 saw 581,000 jobs lost. By the end of 2020, there were 1.6 million jobs in the tourism-dependent industries.

The number of active tourism businesses fell by 9.9% in December 2020 compared to January 2020. This was over three times the overall contraction of the Canadian economy, which was 3.1% during the same period.

The aviation industry was one of the hardest hit, with the revenues from April to December 2020 declined by 89.9%. In the same period, accommodation revenues from hotel stays fell by 71.2%. Montreal, Toronto, and Vancouver recorded the lowest occupancies in Canada and saw the biggest revenue drop at 90.8% representing a loss of $2.3 billion across the three cities.

Post Pandemic

In the first quarter of 2022, tourism’s share of the gross domestic product in Canada was 1.3% of the total. The gross domestic product from tourism was up by 0.9% and it was the fourth consecutive quarterly increase. Tourism spending increased by 50.7% in the last four quarters, but in the first quarter of 2022, it was still 34.2% below the pre-pandemic levels of 2019.

The growth in the first quarter was largely due to an increase in tourism spending by Canadians during domestic trips. This was up 2.9% compared to the final quarter of 2021. In the first quarter of 2022, tourism spending by international tourists was down by 6.9% compared to the final quarter of 2021. However, there had been a large increase in the number of overnight visitors from the United States and overseas in the final quarter of 2021 especially during the Christmas holidays.

The tourism sector has been steadily adding back over half a million jobs and the number of jobs in the tourist industry went up by a further 0.8% in the first quarter of 2022. However, the industry has struggled to fill these jobs and there were still 170,000 jobs unfilled by the end of the quarter.

Closer look at the tourism spending increases

GDP: The GDP from tourism increased by 11.9% in the final quarter of 2021. It was followed by a more modest increase of 0.9% in the first quarter of 2022. The biggest contribution to the tourism GDP came from the transportation services at 2.9%.

Employment: The number of jobs attributed to tourism has been steadily rising since travel restrictions were relaxed. The number of jobs rose by 4.8% in the fourth quarter of 2021 and by a further 0.8% in the first quarter of 2022. Travel services were the largest contributor with a 10.2% increase followed by transportation services (2.6%).

Domestic Tourism Spending: The amount Canadians spend on travel increased by 2.9% in the first quarter of 2022. The main contributors towards the increase were passenger air transport, and pre-trip expenses such as camping equipment, recreational vehicles and crafts and activities equipment. Spending by Canadians was 85.8% of the total tourism spending in the first quarter of 2022.

International Tourism Spending: Spending by international tourists was up by 116.4% in the last quarter of 2021. However, it well by 6.9% in the first quarter of 2022. The biggest contributor to the decline in the first quarter of 2022 was passenger air transport at 11.4% followed by accommodation services at 4.8%.

Tourism Statistics for May 2022

In May 2022, the number of international tourists in Canada continued to rise but was still not at the pre-pandemic levels of 2019. There were almost twelve times as many trips to Canada from overseas countries in May 2022 compared to May 2021. It was still less than half of the trips in May 2019. There were 315,400 overseas tourists in Canada in May 2022.

There were almost ten times more trips to Canada made by residents of the United States in May 2022 compared to the year before. The number of trips represented more than half (52.1%) of the trips taken in May 2019.

The number of visits from US residents in May 2022 was over 1.1 million compared to May 2021 when there were 113,500 trips made by US residents. In May 2019, there were 2.1 million trips to Canada from the United States.

Out of the American arrivals recorded in May 2022, 692,000 were by automobile and 43.7% of the trips were day trips. In May 2021, there were 105,000 trips by automobiles and 1.4 million in May 2019.

Visitor numbers from major markets in Europe and Asia continued to grow. In May 2021, there were 7,100 European visitors to Canada compared to 164,000 in May 2022. Trips to Canada from Asia went up from 8,500 to 72,700 during the same period.

The table below shows the numbers of overnight trips before the pandemic in May 2019 and post-pandemic in May 2021 and May 2022 and the year-on-year differences. We can see from the table that the numbers travelling from France and Mexico have recovered the best while travel from China, Japan and South Korea has been the slowest to recover.

Travelling abroad by Canadians

At the same time as travel to Canada increased again, Canadians started to travel more to the United States and overseas. In May 2022, there were 2.2 million trips to the United States by Canadian residents. In May 2021 there were 311,800 trips to the United States by Canadian residents, so the number of trips a year later was around seven times higher.

The majority of the trips, 1.6 million were by automobile and 58.5% of all trips were one-day trips. The number of Canadians travelling to the United States by air in May 2022 edged closer to the pre-pandemic levels. The 593,200 flights to the United States in May 2022 represented 73.6% of the trips recorded in May 2019. In contrast, only 28,200 Canadians were flying to the United States in May 2021.

The number of Canadians who resumed overseas travel has risen sharply from May 2021 until May 2022. In the previous May, there were only 51,400 overseas trips made by Canadians compared to 652,400 this May. The flights taken in May 2022 represent 67.2% of the flights taken in May 2019 and it was the highest monthly recovery so far.

Canadian views on travel and tourism

Since the return to a more normal life, Canadians are readier to welcome both Canadian and international visitors. 70% of Canadians welcome visitors from other parts of Canada, 48% are happy to welcome visitors from the United States and 44% felt happy to receive tourists from overseas.

In a survey on the importance of tourism to the Canadian economy, 84% of Canadians believe it is important. 82% said they believe Canadians travelling domestically is important for the economy, while 79% of the people responding to the survey said overseas tourists are important to the economy.

The travel industry is expected to reach its pre-pandemic levels by 2024 or by 2025 at the latest. While more people’s confidence in the safety of travel is returning to pre-pandemic levels, the growth can be slowed down by geopolitical events such as the war in Ukraine.

Conclusions

The global pandemic hit the tourist industry the hardest, and it has been slower to recover from the pandemic than other industries. However, as the confidence to travel continues to grow, the numbers have been increasing and are slowly getting closer to pre-pandemic levels.

Foreign tourism from France and Mexico has been quickest to recover, though still lacking behind pre-pandemic levels. The number of arrivals from Asian countries such as China, Japan and South Korea has been slow to pick up again.

Most Canadians see the tourist industry as important for the Canadian economy and the number of Canadians who feel happy to welcome tourists into their towns and cities is steadily increasing.

Frequently Asked Questions

What are the most popular tourist destinations in canada, is the tourist industry in canada struggling to find new staff.

Post-pandemic, the tourist industry has struggled to find staff and at the end of the first quarter of 2022 there were 170,000 unfilled jobs in tourism.

Do Canadians feel tourism is an important part of the economy?

How many overseas tourists are in canada, is the tourism industry growing in canada after the start of the pandemic.

Statistics Canada

The World Bank

Destination Canada

Government of Canada

As Canadians, we grew tired of the tariff battles with the US and unfair practices of other partners. In July 2018, we decided to do something about it, starting to compile a list of Canadian products and services so you can rest easy knowing your dollars are having their maximum impact in the Canadian economy.

18 King Street East, Suite 1400 Toronto, Ontario, M5C 1C4 Canada

Mon – Sun: 9:30am – 5pm

+1-647-360-8033

17+ Canada Tourism Statistics to Look Forward To

Table of Contents

Pre-COVID Canada Tourism Statistics

Canada Tourism Statistics during the COVID-19 Pandemic

Top Tourist Destinations in Canada

Final Thoughts

Anyone curious to explore the Great White North should delve deep into Canada tourism statistics . And while that’s precisely what we’re going to focus on, let’s start with a little anecdote.

Check this out:

When I asked a European friend of mine what made her curious to visit Canada in the first place, she gave me a surprising three-word answer:

Pop culture references.

More to the point:

The sprawling Canadian Rockies in the BAFTA-winning film Brokeback Mountain . With a contrary appeal, there’s also Scott Pilgrim vs. the World – a shoutout to the cultural scene of Toronto.

But above all, it was the 2005 sitcom How I Met Your Mother , where the main characters frequently made fun of Robin, a Canadian. Her accent was the butt of ridicule.

But the show worked weird reverse psychology for my friend! It made her want to visit Canada all the more, to find out what the fuss is all about.

But what do tourism in Canada statistics have to say?

Let’s find out.

Engaging Tourism Statistics (Editor’s Choice)

- As of 2019 , the Canadian tourism industry generated an eye-watering $104.9 billion in tourist spending.

- 22.1 million people visited Canada in 2019.

- The tourism economy helps sustain 150,000 jobs in Canada.

- 1 in every 10 Canadian jobs is tied to tourism.

- Canada’s tourism industry is predominantly youth-led, with 30.7% of employees aged between 15 and 24 .

- Tourism businesses in Ontario witnessed a 13.7% fall between January and October 2020 .

- International visitor tourism spending dropped by 82.5% in 2020 , with the majority of the spending happening before the borders closed in mid-March .

- Government funding for the tourism industry was fixed at $95.5 million in 2017 .

1. The tourism industry in Canada has a decidedly young workforce, with 30.7% of its employees aged between 15 and 24 years.

(Source: Destination Canada)

Additionally, 20.6% of employees are between 25 and 34 years of age. Tourism also employs a higher proportion of immigrants – they make up 35.3% of the industry yet only 23.8% of the total labour force.

2. Canada tourism statistics for 2019 reveal the industry contributed an estimated $43.5 billion to GDP that year.

Destination Canada (formerly known as the Canadian Tourism Commission) celebrated 2019 as the third consecutive year with a record-breaking number of visitors to Canada – 22.1 million . Moreover, Canada’s air access was revamped in 2019 , accounting for 2.2% additional seats in international aircraft.

3. According to Toronto tourism statistics, the city attracted a whopping 28.1 million domestic and international visitors in 2019.

(Source: Cision Canada)

This represented a slight growth from the 2018 number of 27.5 million . City Hall, the Distillery Park, the Toronto International Film Festival, and the imposing CN tower are easily some of the most visited places in Canada.

Really, what’s not to like? We’ll get back to that later.

4. According to statistics on Canada tourism, the country recorded $104.9 billion worth of tourist spending in 2019.

(Sources: Ottawa tourism, CityNews)

Ottawa contributed to the revenue pool by raising $762 million from international visits. This was a substantial hike over the 2018 Ottawa tourism statistics when the capital hosted 11 million visits. However, the vast majority of these visits were domestic – 90% of them, to be precise.

5. Tourism accounts for 2.1% of the Canadian economy.

(Sources: OECD iLibrary, 150 Stat Can)

Let’s break down the 2019 Canada tourism revenue: Canadians themselves spent 78.4% out of the total tourism revenue in Q2 2019 . This sum stood at $24.3 billion in tourism spends. Accommodation, travel services, luggage, and camping equipment were the main drivers of revenue growth (2.9%).

These were stats about domestic tourists. But what about international revenue in tourism? Read on to find out.

6. Canada’s tourism revenue in 2019 from international visits rose by 3%.

(Source: 150 Stat Can)

This composite growth was driven by accommodation (3%) , air transport (2.8%) , and food and beverages (2.4%) . Finally, non-tourism products contributed 1.4% .

7. In 2017, Canada’s Ministry of Tourism dedicated $5 million to promote the exploration of national parks and indigenous experiences.

(Source: OECD iLibrary)

That’s quite a bit! And the good thing is that Canada is setting an example for governments all over the world.

Simple logic, really:

Only when a government has faith in the country’s undiscovered flora will it be able to pitch it to international markets. And the Canadian government is doing just that.

8. The Canadian Experiences Fund received a lump-sum budget of $58.5 million for 2019 and 2020.

The Canadian Experiences Fund supports investments in tourism-related infrastructures, such as accommodation or local attractions. It also promotes the development of tourism products and experiences.

9. In March 2021, arrivals from abroad were down by a massive 83.7% from March 2020, Canadian travel statistics confirm.

The tourist sector was the hardest hit due to the travel bans that COVID-19 brought on. Coupled with thousands of company closures, a large chunk of the Canadian population lost their jobs.

10. May 2020 witnessed an unemployment rate of 29.7% in the sector, Canada COVID stats reveal.

In comparison, nationwide job losses accounted for 13.8% . The tourism industry’s unprecedented trend remained at an all-time high even by the end of the year, at 14.6% . This number was significantly higher than the year-end unemployment rate of 8% in all other sectors.

11. A survey of Canada tourism statistics by province reveals that Ontario had the most international tourist trips in 2020 – over 1.3 million.

(Source: Statista)

British Columbia was second, with 841,000 tourists. Quebec ranked third among provinces, with 523,000 , followed by Alberta and Manitoba. These figures marked a massive drop from 2019 and resulted in subsequent losses.

12. Ontario tourism statistics reveal a loss of $13.7 billion in travel spending in 2020. out of the cumulative countrywide loss of $36.4 billion.

As a whole, the total figure for the country was $36.4 billion , and Ontario suffered the most by far. Other significant provincial losses in the sector include Quebec with $7.9 billion , British Columbia with $6.1 billion, and Manitoba and Saskatchewan with $1 billion each.

13. Canada inbound tourism statistics recorded 51,229 visitors in March 2021.

(Source: CEIC)

It should come as no surprise that this figure is still a long way off the July 2019 peak of 3,388,299 visitors. However, it wasn’t the lowest by far. In fact, April 2020 marked the all-time trough of incoming travellers – 23,621 .

14. Canadian outbound travel statistics listed 272,000 overseas trips by Canadians in March 2021.

(Source: 150 Stat Can, S150tat Can)

This is significantly lower than the figure for March 2020 , which counted 2.8 million tourists. And in 2019 , there were as many as 4.8 million .

But there’s light at the end of the tunnel:

15. 80% of Canadians are keen on travelling overseas as soon as restrictions are lifted.

Additionally, 84% of Canadians believe in the benefits of international and domestic travel. Hopefully, this will help support a projected 150,000 jobs.

16. The pandemic caused a drop of 32% drop in visits to national parks and historic sites.

(Source: National Parks Traveler)

However, this drop was primarily due to the loss of international visitors. In a fair change of tourism trends, Canadians flocked to near-at-hand vacation spots. Rouge National Urban Park, for instance, received more visitors than ever before. The oft-ignored Quebec Island also became a tourist favourite in 2020 .

When it comes to where to travel in Canada, the top five national parks that recorded an upsurge of visitors in 2020 were:

- Banff National Park, Alberta

- Jasper National Park, Alberta

- Saguenay-St. Lawrence Marine Park, Quebec

- Mount Revelstoke National Park, British Columbia

- Glacier National Park, British Columbia.

17. Spots within 100 kilometers of an urban center received 4% more visits in the summer of 2020.

Additionally, some locations recorded an increase in visitations throughout the entire season. In fact, tourists increasingly enjoyed urban hikes and the exploration of urban parks.

But why this change in Canadian travel trends?

Parks Canada had this to say:

“As society becomes increasingly urbanized, urban parks are emerging as essential places for conservation, exploration, recreation, learning, and wellbeing.”

No exploration of Canada tourism statistics is truly complete without a special section on the most popular tourist locations in Canada. The second-largest country in the world, Canada has tourist attractions spanning a variety of tastes. Be it the celebrated Niagara Falls or the metropolitan CN tower, Canada has something for every tourist.

Many people think of it as the Canadian equivalent of New York City. Toronto is a multicultural hub of bustling tourists, and with good reason! Tourism statistics report that in 2019 , Toronto welcomed a whopping 28 million visitors who spent $6.7 billion .

But what really attracts droves of tourists to Toronto every year?

Let’s find out:

Apart from the city’s iconic CN Tower, popular destinations include Toronto Island, Casa Loma, and the Toronto zoo. For history buffs and art enthusiasts, there are famous museums like the art gallery of Ontario and the Royal Ontario Museum. Nathan Phillips Square and the Hockey Hall of Fame are also on this list.

What’s more:

Every year, millions of cinephiles attend the world-famous Toronto International Film Festival. And, of course, Tim Hortons coffee and Timbits are for everyone.

Montreal welcomed 4 million international visitors in the summer of 2019 alone, tourism statistics reveal. Most of them flocked to Vieux-Montréal, the picturesque old town where you can come across buildings dating back to the 17th century.

Without a doubt, the most famous tourist attraction is the spectacular Notre Dame Basilica. Walking tours of the cathedral allow tourists to explore its vast insides, the twin towers, and the intricate woodcarvings.

Place Jacques-Cartier also has an old-world charm. A famous art and craft market and proximity to other historic sites like City Hall, the Old Palace of Justice, and Chateau Ramezay Museum, make it a popular choice for visitors.

But you can’t really go about just admiring the city’s beauty on an empty stomach, can you?

Let’s face it:

No visit to Montreal is complete without a poutine – the quintessential Canadian fast food. And let’s not forget the Montreal bagel. Did you know that it gets its distinctive flavour by being boiled in honey water?

Moving on to:

Thinking of tourist destinations in Canada that offer a confluence between nature and city life? Then Vancouver should be your go-to destination! And you’re not alone, as 10.3 million people visited Vancouver stood in 2017 .

Within an hour’s drive lie three mountains – Cypress Mountain, Mount Seymour, and Grouse Mountain. They’re a favorite haunt for tourists who love to go snowboarding or skiing. The 2010 Winter Olympics were held at Whistler, and Cypress Mountain was part of it.

The thing is:

Vancouver is among the most popular tourist locations in the Great White North because it’s got the best of both worlds – a vibrant urban culture and easy access to the great outdoors.

And there you have it – all the latest Canada tourism statistics . While the industry has been in the doldrums during the COVID-19 pandemic, the experts predict it will bounce back before too long.

An overwhelming majority of Canadians intend to resume travelling both domestically and overseas once the pandemic is over. And that’s terrific news for Canada’s tourism industry.

In 2019, Canada hosted a record 22.1 million international visitors.

Toronto welcomed a record 28.1 million domestic and international tourists in 2019.

Tourists from the United States rank among the top visitors to Canada, with 22,057,860 visitors in 2015. This number is followed by visitors from the UK, France, and China.

Canada tourism statistics reveal that the tourism industry made up 6.5% of total GDP in 2019.

- Destination Canada

- Cision Canada

- Ottawa Tourism

- OECD iLibrary

- 150 Stat Can

- National Parks Traveler

ABOUT AUTHOR

by Urnesha Bhattacherjee

Urnesha has worked in content writing, editorship, and translation for the last 6 years. Her dream is to be a lifelong learner and venture out of my comfort zone as she does so. She's passionate about access to quality education, animal rights, and sustainability, among other things. Currently pursuing a master's degree, I have a background in English literature. My goal is to harness my love of the language to try something new every step of the way.

Latest from this author

What we have on this page, related posts.

FHSA: What Is It and How Does It Work?

What Is the Minimum Credit Score for Mortgage Approval in Canada?

How to Purchase GIC for Students in Canada?

Couch Potato Investing Canada: The Ultimate Guide for 2024

How to Increase Your Credit Card Limit

What Percentage of Gamblers Win at Casinos?

How to Invest as a Teenager in Canada?

Conventional vs Collateral Mortgage: What’s the Difference?

Are Credit Card Rewards Taxable: Everything You Need to Know

Average House Prices in Canada – Stats, Trends and Forecasts

Leave a Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Travel, Tourism & Hospitality

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

Number of international tourist trips to Canada 2022, by province of entry

Number of international tourist trips to canada in 2022, by province of entry (in 1,000s).

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

February 2023

One or more night trips. Adapted from Statistics Canada, International Travel: Advance Information December 2022, 2022. This does not constitute an endorsement by Statistics Canada of this product.

Other statistics on the topic Prince Edward Island

Visitor exports in selected countries worldwide 2016-2017

Leading inbound travel markets in the UK 2019-2022, by number of visits

Average length of stays of inbound visitors in the UK 2003-2022

International tourism spending in the UK 2019-2022

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Other statistics that may interest you

- Number of international tourist trips to Canada from Europe 2021, by country

- Number of international tourist trips to Canada from Asia 2021, by country

- Number of international tourist trips to Canada 2013-2021

- Number of international tourist trips to Canada 2021, by region of origin

- Leading source countries for international tourists to Canada 2019-2021

- Leading source countries for international tourists to Brazil 2014

- Average length of stay of visitors in Macao 2013-2023

- Number of monthly visitor arrivals in Hong Kong 2020-2024

- Number of visitor arrivals Macao 2013-2023

- Visitor arrivals under IVS from mainland China to Macao 2023, by region

- Total number of visitors from Canada in 5-star hotels in Macao 2013-2023

- Average length of stay of visitors from Canada in 5-star hotels Macao 2013-2023

- Number of tourist arrivals from Canada to Europe 2019-2022, by destination

- Canadian visitor arrivals in Cuba 2010-2021

- Number of inbound tourists to Canada, by purpose 2014-2019

- Number of inbound tourists to Canada, by transport type 2014-2019

- Number of inbound tourists to Canada, by region 2014-2019

- International overnight visitors to Toronto 2010-2016

- Number of U.S. citizens traveling to Canada 2002-2022

- Outbound Italian tourists in America 2016 by country visited

- Countries with the highest number of inbound tourist arrivals worldwide 2019-2022

- Change in number of visitors from Mexico to the U.S. 2018-2024

- Annual revenue of China Tourism Group Duty Free 2013-2023

- Foreign exchange earnings from tourism in India 2000-2022

- Number of international tourist arrivals in India 2010-2021

- Leading countries in the MEA in the Travel & Tourism Competitiveness Index 2018

- International tourist arrivals in Europe 2006-2023

- International tourism receipts of India 2011-2022

- Number of short-haul arrivals in Macao 2023, by region

- Most popular countries of origin for inbound air travelers in Mexico 2022

- International tourism volume in Andalusia 2000-2022

- Inbound tourism volume in Norway 2010-2020

- Outbound visitor growth in the Middle East 2011-2025

- Inbound visitor growth in Africa 2021-2025

- U.S. outbound tourism volume to Latin America and the Caribbean 2011-2021

- Outbound visitor growth in the Americas 2020-2024, by region

- Visitor arrivals of the Cuban diaspora to Cuba 2012-2021

- Number of visitor arrivals from South Korea to Macao 2013-2023

- Number of visitors to the U.S. from Nigeria 2011-2022

- Number of visitors to the U.S. from Japan 2011-2022

- Number of visitors to the U.S. from China 2011-2022

- Number of visitors to the U.S. from France 2011-2022

- Number of visitors to the U.S. from Western Europe 2011-2022

- Number of visitors to the U.S. from Australia 2011-2022

- Number of visitors to the U.S. from Argentina 2011-2022

- Number of visitors to the U.S. from Costa Rica 2011-2022

- Number of visitors to the U.S. from Saudi Arabia 2011-2022

- Number of visitors to the U.S. from the Caribbean 2011-2022

Other statistics that may interest you Statistics on

About the industry

- Premium Statistic Number of international tourist trips to Canada from Europe 2021, by country

- Premium Statistic Number of international tourist trips to Canada from Asia 2021, by country

- Premium Statistic Number of international tourist trips to Canada 2013-2021

- Premium Statistic Number of international tourist trips to Canada 2021, by region of origin

- Premium Statistic Leading source countries for international tourists to Canada 2019-2021

- Premium Statistic Leading source countries for international tourists to Brazil 2014

- Premium Statistic Average length of stay of visitors in Macao 2013-2023

- Premium Statistic Number of monthly visitor arrivals in Hong Kong 2020-2024

- Premium Statistic Number of visitor arrivals Macao 2013-2023

- Premium Statistic Visitor arrivals under IVS from mainland China to Macao 2023, by region

About the region

- Premium Statistic Total number of visitors from Canada in 5-star hotels in Macao 2013-2023

- Premium Statistic Average length of stay of visitors from Canada in 5-star hotels Macao 2013-2023

- Premium Statistic Number of tourist arrivals from Canada to Europe 2019-2022, by destination

- Premium Statistic Canadian visitor arrivals in Cuba 2010-2021

- Premium Statistic Number of inbound tourists to Canada, by purpose 2014-2019

- Premium Statistic Number of inbound tourists to Canada, by transport type 2014-2019

- Premium Statistic Number of inbound tourists to Canada, by region 2014-2019

- Premium Statistic International overnight visitors to Toronto 2010-2016

- Premium Statistic Number of U.S. citizens traveling to Canada 2002-2022

- Premium Statistic Outbound Italian tourists in America 2016 by country visited

Selected statistics

- Premium Statistic Countries with the highest number of inbound tourist arrivals worldwide 2019-2022

- Premium Statistic Change in number of visitors from Mexico to the U.S. 2018-2024

- Premium Statistic Annual revenue of China Tourism Group Duty Free 2013-2023

- Basic Statistic Foreign exchange earnings from tourism in India 2000-2022

- Basic Statistic Number of international tourist arrivals in India 2010-2021

- Premium Statistic Leading countries in the MEA in the Travel & Tourism Competitiveness Index 2018

- Premium Statistic International tourist arrivals in Europe 2006-2023

- Basic Statistic International tourism receipts of India 2011-2022

Other regions

- Premium Statistic Number of short-haul arrivals in Macao 2023, by region

- Premium Statistic Most popular countries of origin for inbound air travelers in Mexico 2022

- Premium Statistic International tourism volume in Andalusia 2000-2022

- Premium Statistic Inbound tourism volume in Norway 2010-2020

- Basic Statistic Outbound visitor growth in the Middle East 2011-2025

- Basic Statistic Inbound visitor growth in Africa 2021-2025

- Premium Statistic U.S. outbound tourism volume to Latin America and the Caribbean 2011-2021

- Premium Statistic Outbound visitor growth in the Americas 2020-2024, by region

- Premium Statistic Visitor arrivals of the Cuban diaspora to Cuba 2012-2021

- Premium Statistic Number of visitor arrivals from South Korea to Macao 2013-2023

Related statistics

- Basic Statistic Number of visitors to the U.S. from Nigeria 2011-2022

- Premium Statistic Number of visitors to the U.S. from Japan 2011-2022

- Basic Statistic Number of visitors to the U.S. from China 2011-2022

- Basic Statistic Number of visitors to the U.S. from France 2011-2022

- Basic Statistic Number of visitors to the U.S. from Western Europe 2011-2022

- Basic Statistic Number of visitors to the U.S. from Australia 2011-2022

- Basic Statistic Number of visitors to the U.S. from Argentina 2011-2022

- Basic Statistic Number of visitors to the U.S. from Costa Rica 2011-2022

- Basic Statistic Number of visitors to the U.S. from Saudi Arabia 2011-2022

- Basic Statistic Number of visitors to the U.S. from the Caribbean 2011-2022

Further related statistics

- Basic Statistic Contribution of China's travel and tourism industry to GDP 2014-2023

- Premium Statistic Number of visitors to the U.S. from Russia 2011-2022

- Premium Statistic Number of international tourist arrivals APAC 2019, by country or region

- Premium Statistic Middle Eastern countries with the largest international tourism receipts 2018

- Premium Statistic Music tourist spending at concerts and festivals in the United Kingdom (UK) 2012-2016

- Premium Statistic Passenger traffic at Dubai Airports from 2010 to 2020*

- Basic Statistic Importance of BRICS countries to UK tourism businesses 2011

- Basic Statistic Growth of inbound spending in the U.S. using foreign visa credit cards

- Premium Statistic Number of Royal Caribbean Cruises passenger cruise days worldwide 2007-2023

- Premium Statistic Number of Royal Caribbean Cruises available passenger cruise days worldwide 2007-2023

Further Content: You might find this interesting as well

- Contribution of China's travel and tourism industry to GDP 2014-2023

- Number of visitors to the U.S. from Russia 2011-2022

- Number of international tourist arrivals APAC 2019, by country or region

- Middle Eastern countries with the largest international tourism receipts 2018

- Music tourist spending at concerts and festivals in the United Kingdom (UK) 2012-2016

- Passenger traffic at Dubai Airports from 2010 to 2020*

- Importance of BRICS countries to UK tourism businesses 2011

- Growth of inbound spending in the U.S. using foreign visa credit cards

- Number of Royal Caribbean Cruises passenger cruise days worldwide 2007-2023

- Number of Royal Caribbean Cruises available passenger cruise days worldwide 2007-2023

What are you looking for?

74+ canada travel & tourism statistics [fresh for 2024].

Canada is the second-largest country in the world and a paradise for road tripping .

With 32 million visitors recorded in 2019 , it’s the 9th most popular country for tourism.

Undoubtedly one of the best places to travel anywhere in the world !

But how much does tourism actually contribute to their economy?

What are the most visited cities and national parks in Canada?

Below, we’ve compiled some of the most important and recent statistics about travel and tourism in Canada.

Sources : You can see the source of each statistics. We’ve also written the full list of articles used in this round-up at the end.

Travellerspoint

How many tourists visit Canada each year?

32 million tourists visited Canada in 2019, placing them 9th in the world.

How big is the travel industry in Canada?

- The tourism expenditure in Canada in 2019 amounted to roughly $104.9 billion.

Where does Canada rank in tourism?

In 2019, Canada ranks 9th worldwide in terms of the number of tourist visits.

Canada Travel & Tourism Key Statistics

- The total international overnight arrivals alone in 2019 was a record-breaking 22.1 million travellers.

- In 2019, 11 million of those arrivals were by air travel.

- Overall, 14.99 million of the total international arrivals into Canada was by American travellers.

- Canadian millennials take the most trips per year (3.1 trips)

- In 2020, the amount that tourism contributed to Canada’s GDP was around Can$ 19.96 billion.

- As of Q4 2022, the tourism industry in Canada contributed around 657.4 thousand jobs, a rise from the 565 thousand jobs generated in Q4 2021.

- The hotel and motel market in Canada was calculated to reach around $18 billion in 2022, an improvement from the Covid figures in 2020.

- In March 2020, international arrivals in Canada dropped by 54.2% from February 2020, the biggest single monthly fall since 1972.

Canada inbound & outbound tourism statistics

1. 32 million tourists (both foreign and domestic) visited canada in 2019, placing them as the 9th most visited country in the world..

[World Data]

2. The total international overnight arrivals alone in 2019 was a record-breaking 22.1 million travellers.

[Destination Canada]

This was the country’s first time breaking the 22 million mark of international arrivals.

3. In 2019, 11 million of those arrivals were by air travel.

4. by comparing the number of tourist with the local population, there are 0.85 tourists per canadian resident, ranking them 50th worldwide and 1st in north america., 5. in 2019, direct air travel capacity increased by 2%, or 900 thousand more seats on inbound flights to canada., 6. canada is the country with the fifth highest number of backpackers in australia, making up 4.32% of all backpackers there..

[BackpackerJobBoard]

7. Canadians make up 4% of all digital nomads in the world.

[Nomad List]

4% of the world’s digital nomads are from Canada , which shows a keen interest in travelling and exploring even while maintaining a job.

Canada tourism demographics

8. overall, 14.99 million of the total international arrivals into canada was by american travellers..

The US is the largest inbound travel market for Canada, with 14.99 million total arrivals in 2019 .

9. There were 5.1 million arrivals from the US by air in 2019, compared to 4.6 million in 2018.

10. meanwhile, land crossings amounted to 8.5 million from the us to canada, compared to the 2018 figure of 8.2 million. .

11. The number of arrivals in Canada by Mexican travellers also increased to over 495 thousand arrivals in 2019, or 12.4% growth in terms of air travel.