- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the chase travel portal, you can use chase points to book flights, hotels, car rentals and more through its travel portal..

With the right amount of planning, it's possible to book your entire vacation, including flights , hotels , cruises , car rentals , tours and other activities, entirely on points through the Chase travel portal.

But are you getting the best deal by doing this instead of transferring Chase Ultimate Rewards® points to travel partners and booking directly? It turns out there's a lot more to consider — everything from travel date flexibility and brand variety to the credit card you're using — if you want to get more value for your points by booking through Chase Travel SM .

Below, CNBC Select breaks down the best ways to book flights, hotels, cruises, tours and vacation activities through the Chase travel portal with Ultimate Rewards® points.

How to use the Chase travel portal

- How to earn and redeem Chase Ultimate Rewards points

How to get started with the Chase travel portal

How to book flights through the chase travel portal, how to book rental cars, cruises, and other travel activities, bottom line, how to earn and redeem chase ultimate rewards® points.

To access Chase Travel SM , you'll need to have a credit card that earns Chase Ultimate Rewards® points, like the Chase Sapphire Preferred® Card , Chase Sapphire Reserve® , Ink Business Preferred® Credit Card , Ink Business Unlimited® Credit Card , Ink Business Cash® Credit Card , Chase Freedom Unlimited® or Chase Freedom Flex℠ .

The easiest way to earn Chase Ultimate Rewards points quickly is by taking advantage of the lucrative welcome bonuses offered by certain rewards cards:

- You'll earn 60,000 points by signing up for the Chase Sapphire Preferred and spending $4,000 within the first three months of opening your account.

- With the Ink Business Preferred Credit Card 's welcome bonus, you'll earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel SM.

- The Chase Sapphire Reserve 's welcome bonus gives you 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

The card you're using to redeem UR points will also affect your point redemption value . For instance, if you're using the Chase Sapphire Preferred to book through the Chase Travel SM portal, points are worth 25% more (1.25 cents per point). But if you're booking through Chase Travel℠ with the Chase Sapphire Reserve , points are worth 50% more (1.5 cents per point) — the other $0 annual fee Chase cards each carry a redemption rate of 1 cent per point.

That means the bonus points you'd earn from either the Chase Sapphire Preferred's welcome bonus is worth $750 towards travel and the Chase Sapphire Reserve's is worth $900 towards travel.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

Ink Business Preferred® Credit Card

Earn 3X points per $1 on the first $150,000 spent in combined purchases in select categories each account anniversary year (travel; shipping purchases; internet, cable and phone services; and advertising purchases with social media sites and search engines), 1X point per $1 on all other purchases

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

21.24% - 26.24% variable

Good/Excellent

Read our Ink Business Preferred® Credit Card review.

Chase Sapphire Reserve®

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

22.49% - 29.49% variable

5%, minimum $5

Read our Chase Sapphire Reserve® review.

To reach the Chase travel portal, log into your Chase account, then click the area near the right side of the screen where it says the amount of your Chase UR points. Depending on how many Chase credit cards you have, you may be asked to choose which one you want to proceed with.

The next screen is your credit card's main dashboard, showing how many UR points you currently have, as well as any deals or bonus opportunities. On the top of the page, you'll see several menus with redemption options.

While not the best redemption in terms of overall value, you could choose to use your Chase points for Apple and Amazon purchases, cash them in for gift cards and experiences, or reimburse yourself for certain recent charges through Chase's Pay Yourself Back tool . This is also where you can transfer points directly to one of Chase's 14 travel partners if you have a specific flight or hotel in mind. Otherwise, click "book travel" to enter the Chase travel portal.

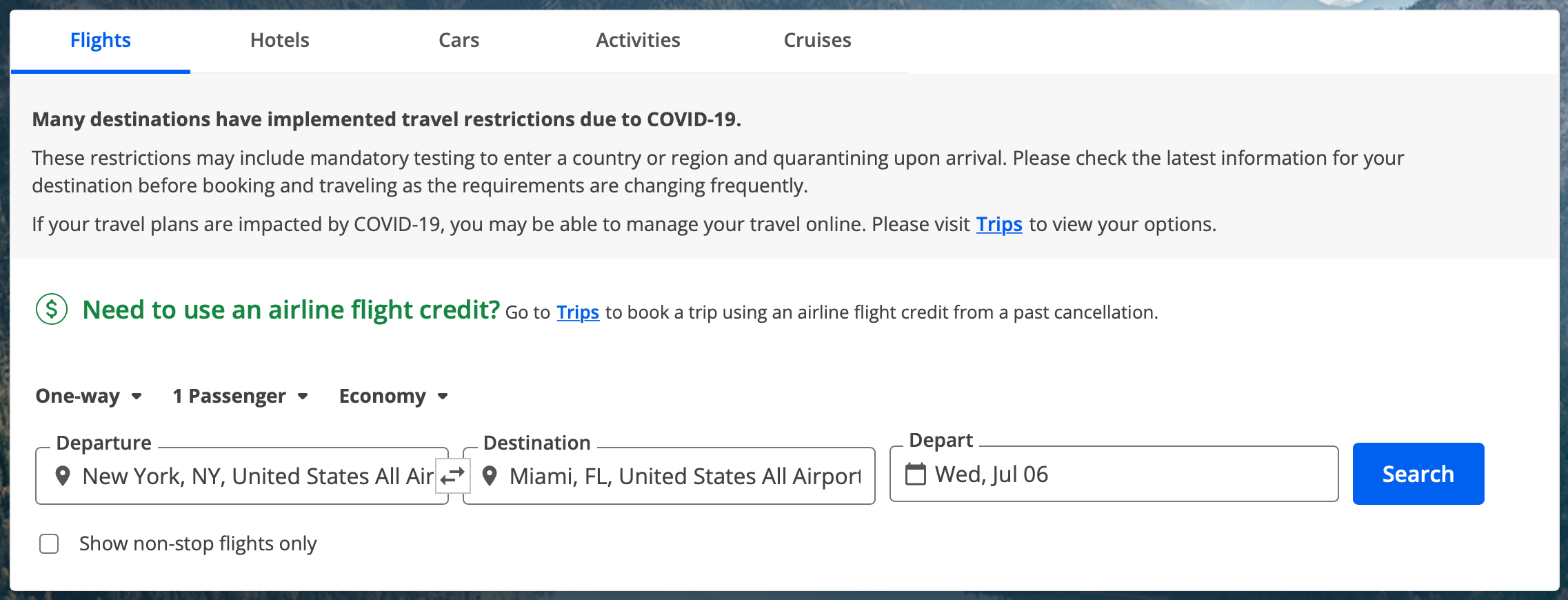

From here, you'll be able to search for flights, hotels, rental cars, activities and cruises. Simply choose your category, plug in your desired dates and details, and book with points, cash or some combination of the two.

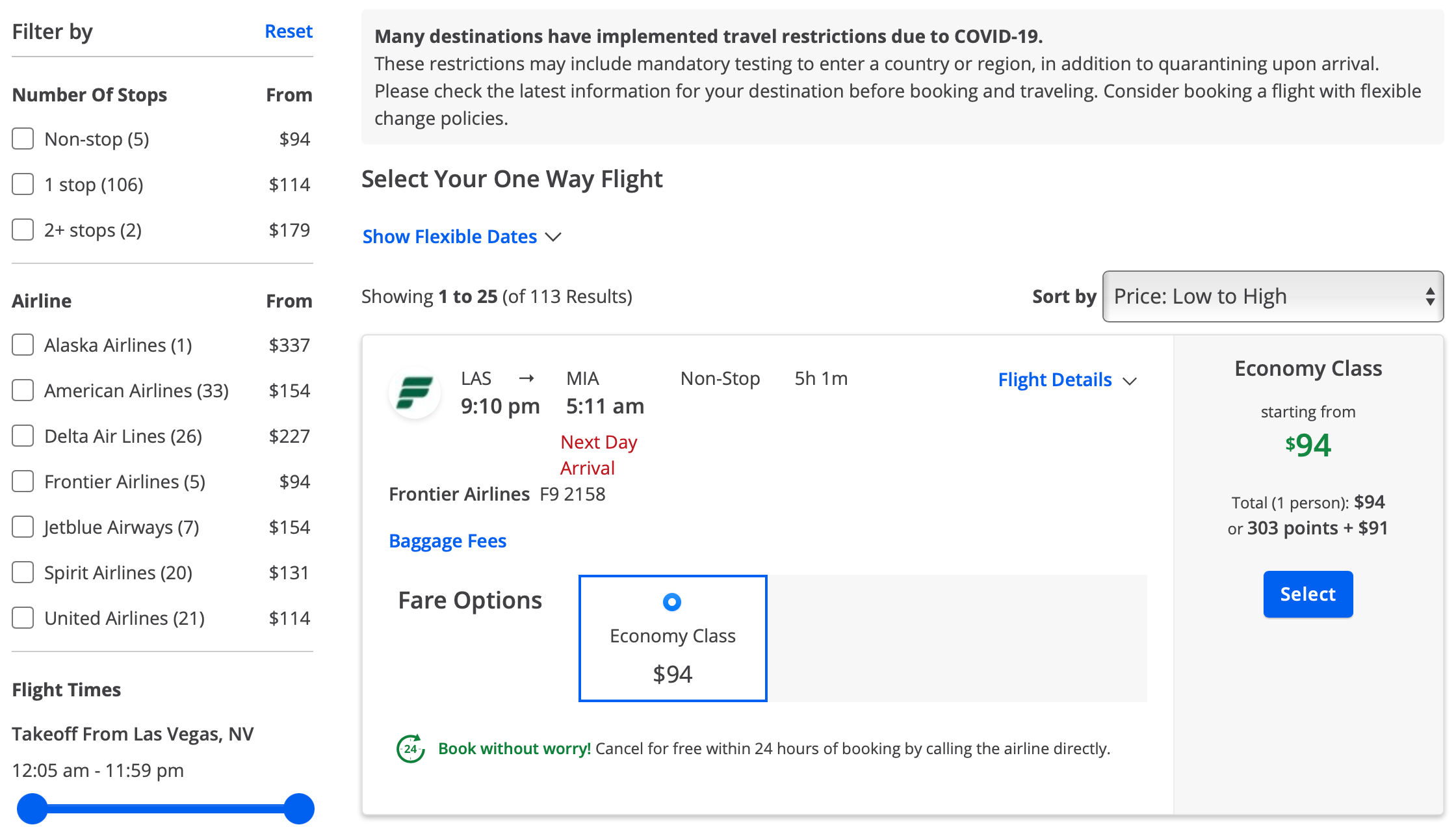

There are a few pros and cons to consider when booking flights through the Chase travel portal. You won't have to worry about blackout dates or limited award availability, which makes it great if you're not flexible with dates and flight times. Just make sure you compare the number of points needed through the Chase travel portal with how many points the airline would require if you were using its own miles, especially if you're hunting for a good deal on economy seats.

The catch with using the Chase travel portal is you won't be able to shop for tickets on low-cost carriers like Spirit Airlines, Frontier Airlines, or Allegiant Air — you can search for flights on Alaska, Southwest, Delta, JetBlue, American, and United. You'll also be able to book flights on most international carriers.

Remember that you can still earn miles and elite credits on flights, as tickets booked through the Chase travel portal are categorized as "paid" rather than as an award flight since you're "paying" for them with points instead of cash. Consider the taxes and fees you might have to pay if you were to transfer the points straight to one of Chase's travel partners versus booking directly through the portal, and to calculate and compare how many points and miles you'd earn by booking with either method.

You'll be able to search, filter, and sort by price, airline, booking class, departure time, arrival time, and departure airport. For this example, below, consider a round-trip flight from Seattle to Austin with sample dates of Feb. 1–7, 2024, booked through the travel portal with a Chase Sapphire Preferred card (redemptions are worth 1.25 cents per point):

Results included 107 results with an economy mix-and-match United and Delta fare for $370 or about 29,600 points being the most affordable option. For comparison's sake, the points price is about the same as what United and Delta are currently charging if you were to book the awards directly through the airlines, but Delta isn't a transfer partner of Chase. You also won't earn miles if you were to book these awards through the airlines, whereas you will earn miles when booking through Chase.

To finish booking your flight through the travel portal, select your route(s), review the details, choose how many points you'd like to use and complete your purchase.

How to book hotels through the Chase travel portal

While the best redemption rates are usually realized when you transfer Chase Ultimate Rewards points at a 1:1 ratio to hotel partner World of Hyatt, if you're not a huge fan of chain hotels or prefer boutiques or brands like Hilton, Choice Hotels, or Wyndham, it can be a good idea to book them through the travel portal.

As with flights, you won't have to worry about blackout dates or limited award night availability. However, keep in mind that hotels treat the Chase travel portal as a third-party booking agency, so you won't be able to earn hotel points on stays as you might by booking your stay directly with the hotel.

Hyatt hotels usually offer better deals when you book directly, and since it's one of Chase's hotel partners, you can transfer UR points instantly at a 1:1 ratio. Marriott and IHG are usually more varied, so you may score a better deal by booking via the Chase travel portal instead of transferring points over. For this reason, it's a good idea to ring up how much your hotel stay would cost in points through the portal as well as the hotel's website.

Start by searching by destination so you can see a list of all the available hotels. For this example, let's try looking for hotels in Downtown Austin from Feb. 1–7, 2024. Once the results appear, you'll be able to narrow down your search with filters based on price, star ratings, guest ratings, amenities and neighborhood.

Let's go over a couple of options within the Chase travel portal, each booked with a Chase Sapphire Preferred credit card. One option is the Four Seasons Hotel Austin, which is listed for $556 or about 44,500 points per night through Chase. If you book through Four Seasons, directly, you'll pay $561 per night. The hotel chain also doesn't have a rewards program but going through Chase provides a way to pay with points.

Another example is the Hyatt Place Austin Downtown for $288 or about 23,000 points per night through Chase. If you were to book this directly through Hyatt, you'd pay $279 per night as a member of its loyalty program or just 15,000 World of Hyatt points per night if you booked with points. Since you can transfer your Ultimate Rewards points to Hyatt at a 1:1 ratio, in this case, transferring would make more sense.

As you can see, it's worth comparing points required by the travel portal and each hotel's website, as the time of year, location, and other factors may play a part in pricing. To book your stay through the travel portal, select your room type, review the details, choose how many points you'd like to use and complete your purchase.

It's a pretty similar process if you want to book rental cars, tours and other travel activities through the Chase travel portal. Cruises can also be booked as well, but you'll need to call.

As far as car rentals, make sure you're booking through the travel portal with points that are connected to Chase Sapphire Preferred or Chase Sapphire Reserve to take advantage of extra perks like primary rental car insurance — you'll also need to decline the rental car company's auto collision damage waiver when you book to activate this. You'll want to charge at least a few dollars to the card and not use points to cover the entire booking which ensures that you're still "paying" for the car rental with your Sapphire card, which means you'll be entitled to the card's rental car insurance.

Beyond that, simply plug in your itinerary and search. Here's an example for a rental in Austin from February 1–7, 2024, booked with a Chase Sapphire Preferred credit card:

You'll be able to filter your search by capacity, car type, price per day, company, and car options (like air conditioning and automatic transmission). For a seven-day rental, it would cost around 24,800 points or $310 for the cheapest option. As with other travel portal purchases, you'll be able to enter how many Chase Ultimate Rewards points you wish to put toward the final price. It works the same way for booking tours and other travel activities, so you could potentially enjoy a free — or nearly free — vacation solely on Chase points if you were to plan it all out properly.

Booking through the Chase travel portal can be a great use of your Ultimate Rewards® points, but make sure to compare the rates against booking directly with an airline or hotel itself. Finally, consider transferring your points to one of Chase's travel partners, especially if you're looking to book a luxury hotel or flight in business class.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card guide is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Information about the Chase Freedom Flex℠ has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

- IRA vs CD — what's the difference and which one should you pick? Andreina Rodriguez

- 3 best Chase balance transfer credit cards of 2024 Jason Stauffer

- AIG Travel Guard insurance review: What you need to know Ana Staples

- What is the Chase Travel Portal?

Benefits of Using the Chase Travel Portal

Chase ultimate rewards credit cards.

- Points Value

- How to Use the Portal to Book Travel

Chase Travel: Explore Destinations and Savings with Chase Ultimate Rewards

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠, Chase Freedom® Student credit card. The details for these products have not been reviewed or provided by the issuer.

- The Chase Travel℠ portal works just like an online travel agency.

- You can use points, cash, or a combination of both to book flights, hotels, rental cars, and more.

- Several Chase cards offer better redemption values or bonus points when you book through the portal.

The Chase Travel Portal℠ is an online booking platform for flights, hotels, rental cars, cruises, activities, and vacation rentals, similar to an Online Travel Agency (OTA). If you're a Chase Ultimate Rewards® cardholder, you can use points to book travel through the portal — or pay with your card or a combination of points and cash.

Chase Ultimate Rewards is one of the most flexible and lucrative credit card rewards programs, and its benefits can be even greater depending on the Chase cards you have. With a no-annual-fee card like the Chase Freedom Flex℠ or Chase Freedom Unlimited® , your points are worth 1 cent each toward travel booked through the portal.

But if you have a Chase travel credit card like the Chase Sapphire Reserve® , Chase Sapphire Preferred® Card , or Ink Business Preferred® Credit Card , you'll get 25% to 50% more value when you redeem your points for travel, plus the ability to transfer your points to Chase airline and hotel partners .

Some Chase cards also offer bonus points for paid bookings you make through the portal. Chase added lucrative new bonus categories to the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card, including certain types of travel booked through the portal.

Here's everything you need to know about booking airfare, hotels, and more through the Chase travel portal — and how to make the most of your Chase Ultimate Rewards points.

What Is the Chase Travel Portal?

The Chase Travel portal works like any other Online Travel Agency (such as Travelocity or Priceline), and the searches you do for hotels, airfare, and more will produce similar results to what you see on that OTA.

You must be a Chase credit card customer to use Chase travel to book with cash or with points. In fact, you'll only access the Chase Travel portal when you log into your account management page with Chase.

Chase travel lets you book travel directly with Chase Ultimate Rewards points, use your credit card to pay, or combine the two. This is one of the main benefits of using Chase travel — you can spend the rewards points you earn directly on the travel you want without having to worry about dealing with specific hotel or airline loyalty programs.

There are a few other key benefits to know:

- You'll still earn airline miles and work toward elite airline status: You won't earn points or elite night credits when you book a hotel stay with Chase travel because it's considered a third-party booking. However, you can earn airline and elite-qualifying miles on flights you book as long as your frequent flyer number is attached to the reservation.

- Your points are worth more with certain Chase credit cards: Also be aware that some Chase credit cards give you more than the standard rate of 1 cent per point when you redeem your rewards for travel through Chase. We'll go into more detail on the cards that offer this perk below.

- The Chase Travel portal is easy to use: If you don't want to deal with a bunch of hotel and airline award charts, booking through Chase travel can help keep your rewards game simple. You'll always be able to use your points for any booking you want without having to worry about blackout dates or capacity controls you would normally encounter with loyalty programs.

To be eligible to use the Chase Travel portal, you'll need a Chase credit card that earns Chase Ultimate Rewards points .

No-annual-fee Chase cards open to new applicants (points are worth 1 cent each through the Chase Travel portal):

- Chase Freedom Unlimited® (read our Chase Freedom Unlimited review )

- Chase Freedom Flex℠ (read our Chase Freedom Flex review )

- Chase Freedom® Student credit card (read our Chase Freedom Student review )

- Ink Business Unlimited® Credit Card (read our Chase Ink Business Unlimited review )

- Ink Business Cash® Credit Card (read our Chase Ink Business Cash review )

Chase travel rewards cards open to new applicants (points are worth more with Chase travel, plus these cards allow you to transfer points to airline and hotel partners):

- Chase Sapphire Reserve® (read our Chase Sapphire Reserve review )

- Chase Sapphire Preferred® Card (read our Chase Sapphire Preferred review )

- Ink Business Preferred® Credit Card (read our Chase Ink Business Preferred review )

If you have more than one Chase card, you can transfer your Chase Ultimate Rewards points between accounts. It makes the most sense to pool your points in the account that gives you the best redemption value — for example, if you pair the Chase Freedom Unlimited® and Chase Sapphire Reserve®, moving all of your Chase Ultimate Rewards to your Sapphire Reserve account will increase the value of your points when you redeem through the Chase Travel portal.

To pool your points onto one card, log into your Chase online account, navigate to the "Redeem" section for your Chase Ultimate Rewards card, then select the option to combine points in the "Earn/Use" tab:

From there, you can move your Chase points between accounts in any increments you want.

Points Value in the Chase Travel Portal

Some Chase credit cards give you a bonus when you redeem points through the Chase Travel portal. Here's a summary of how much your points are worth with each Chase card:

It's important to note that Chase Ultimate Rewards points are worth, on average, 1.8 cents apiece based on Personal Finance Insider's points and miles valuations . That's because it's possible to get outsized value when you transfer points to partners for award travel.

How to Use the Chase Travel Portal

Using the Chase Travel portal is a breeze, but it all starts with logging into your online account management page. From there, you'll click on the right side of your screen where it shows your Chase Ultimate Rewards account balance.

Once you click on the account balance, you'll have the option to select the card you want to access. And remember, this step can be important because some cards give you more value from your points when you redeem them for travel.

How to book a flight through Chase travel

Once you are logged into your Chase Ultimate Rewards account, you'll see different travel options to search for at the top of the page.

To search for a flight, make sure the prompt is on "Flights" and begin searching for the flight you want. Enter your departure airport, destination, travel dates, and the number of passengers.

Once your flight options pop up on the screen, you can filter your results by the number of stops, the airlines you want to fly, and arrival times.

Note that each of your flight options will include a payment amount in points as well as a cash price.

You can also click on "Details and baggage fees" in order to find out the cost of carry-on luggage or checked baggage, as well as whether your flight charges any change fees.

When you click to "Select" a flight option, you'll get a rundown of what is and isn't included in the fare you selected. You may also get a note that you can upgrade before you check out.

Once you settle on a flight you want, you'll be taken to the "Trip Details" page that shows the final cost of your flight in points or in cash, as well as a summary of the added costs you may be charged for baggage or change fees.

After you agree to the terms, you'll be taken to a final payment page where you can decide how you want to pay. You have the option to cover your flight entirely in points if you want, but you can also choose to pay with your Chase credit card or with a combination of points and your credit card.

During the booking process, make sure to add your frequent flyer number to your reservation. That way, you can earn miles on your booking and your flight will count toward elite status requirements. You'll also want to add your Known Traveler Number or Redress number if either applies to you.

If you forget to do it during your booking, however, you can add your frequent flyer information to your flight later on using the airline's website.

How to book a hotel through Chase travel

Booking a hotel through Chase is similarly easy, and you'll find a lot of different types of lodging options available. For example, you'll find properties from major hotel brands, but you'll also find rental condo options and boutique hotels.

To search for a hotel, enter the destination, dates, and the number of people you want to have in your room. Once you're presented with your options, you can filter hotels based on the hotel name you're looking for, the area or neighborhood, price point, guest rating, property type, and more.

Once again, you'll see a price listed in points as well as a cash price per night.

These prices do not include taxes and fees, however, so your price in points or cash will be higher by the time you get to the final booking page. Also be aware that the price listed is the lowest you can get for the property, but that better or upgraded rooms and suites will cost more in points.

The major downside to booking a hotel through the Chase portal is that you won't earn hotel points or elite night credits for your stay, because it's considered a third-party booking. There's also a risk that the property won't recognize your hotel elite status or give you the perks you'd normally be entitled to, like late checkout or free breakfast . This shouldn't be an issue if you're booking an independent or boutique hotel, but if you're looking for hotel points or status, it's something to be aware of.

You'll have the option to select a hotel you want as well as a room type at the property you're considering. You can also pay with your booking with points, your Chase credit card, or a combination of the two.

How to book a rental car through Chase travel

You can also book a rental car through Chase travel using the same set of steps. Once you log into your Chase Ultimate Rewards account, click on "Cars" and then select the destination and dates.

Once you are presented with your search results, you can select the types of cars you prefer, like an economy car or an SUV. You can also filter results based on a price range, the number of passengers you have, the rental car company, and the type of transmission you prefer (manual or automatic), as well as the total area you want to search in.

Note that, once again, taxes and fees are not included on the initial search page. Instead, they are added to your total cost when you select a rental car. You can also pay for a rental car through Chase with points, your credit card, or a combination of the two.

How to book activities with the Chase Travel portal

Chase also lets you book a variety of activities through the portal, which they refer to as "Things to Do." Chase activities can include excursions like snorkeling or scuba diving, as well as tours of museums and historic sites. But you can also book more practical options through their activities tab, including airport pickups and other types of transportation.

To search for activities, enter the destination and dates for your trip. You'll be shown a price in points and in cash that does include taxes and fees. You can also filter options based on the type of activity, your interests, and more. Once again, you have the option to pay for activities with your points, your credit card, or a combination of the two.

How to book a cruise through Chase travel

If you're a cruise enthusiast, you should know you can also book cruises through Chase travel. When you select "Cruises" at the top of the Chase Ultimate Rewards search page, you'll be presented with a list of featured cruises and cruise specials.

You can also search for cruises based on the destination or the name of the cruise line. Note, however, that only cash prices are listed for each cruise on the portal, and that you'll have to call Chase to make a booking.

Either way, you can absolutely use your Chase points to pay for all or part of your cruise. Just have your credit card number handy and call their customer service line at 855-234-2542.

How to book a vacation rental through Chase

Chase also offers a selection of vacation rentals, which can include vacation condos, luxury villas, and more. To search, click on "Vacation Rentals" at the top of the main page, then enter your destination, dates, and the number of people in your party.

Once you start your search, you'll have the option to filter results based on the local neighborhood you want, star ratings, price range, guest rating, property type, and more. Like hotels through Chase, the price you are shown excludes taxes and fees, but they will be added to your total once you make a selection.

Also be aware that the price shown in your search results is for the lowest-tier option for each property, and that a larger rental or upgraded rental may cost more in points.

When you book vacation rentals through Chase, you can pay with points, your Chase card, or a combination of the two.

Use the Chase Travel portal to book Luxury Hotel & Resort Collection properties

If you have the Chase Sapphire Reserve®, you can book properties within the Luxury Hotel & Resort Collection. This list of more than 1,000 properties can be reserved ahead of time, and you'll get extra benefits with each stay such as:

- Daily breakfast for two

- A special benefit worth up to $100

- Complimentary internet access

- Room upgrades when available

- Early check-in and late checkout

One detail to note with this program is the fact that you cannot pay with points. Instead, your online booking will reserve your room, and you'll be charged for the stay when you check out from the hotel.

Should you transfer Chase points instead?

While you can book travel through the Chase Travel portal directly, many people prefer to transfer points to Chase airline and hotel partners instead. Doing so could let you get more value for each point you redeem , but you'll have to run the numbers to find out for sure.

Here's a good example of how transferring points to a Chase airline or hotel partner can be a better deal, as well as the math you'll need to do to figure this out on your own. Take this one-way flight on Air France from Chicago to Paris, for example, and assume you have the Chase Sapphire Reserve® card, so you're getting 50% more value when you redeem points through the Chase Travel portal.

If you were to book this flight through Chase Travel, you would owe 39,607 points with the Chase Sapphire Reserve®, compared with the cash price of $594.10.

However, you could book an award ticket on the exact same flight through Flying Blue (Air France's loyalty program) directly if you transferred your Chase points there first. In this case, the identical flight would set you back 22,000 miles plus $109.44. This means you would transfer 22,000 miles from Chase to your Flying Blue account, and pay the taxes and fees in cash, or by redeeming points for a statement credit to your account.

When you compare, you'll find that booking with miles directly is a better deal. After you subtract the taxes and fees from the cost of booking through Flying Blue, you wind up with a value of around 2.2 cents per mile.

With the Chase Travel portal, on the other hand, you're forking over 39,607 points for the same flight, and you're getting a value of 1.5 cents for each point if you have the Chase Sapphire Reserve®.

Accessing Chase Travel is simple. If you're a Chase credit cardholder with Chase Ultimate Rewards points, you can log in to your Chase online account. Once logged in, navigate to the 'Travel" or "Rewards" section, where you'll find the Chase Travel portal. From there, you can search and book flights, hotels, and other travel services using your earned points or card benefits. It's a convenient way to plan and manage your travel adventures.

Chase Travel refers to the travel booking and rewards platform offered by Chase Bank. It's part of the Chase Ultimate Rewards program, allowing cardholders to use their earned points to book flights, hotels, car rentals, and other travel-related expenses. Chase Travel provides a convenient way to plan and book your trips while taking advantage of the rewards and benefits associated with Chase credit cards.

To earn 5% on Chase Travel, consider using a Chase credit card that offers bonus rewards on travel purchases. Cards like the Chase Sapphire Preferred or Chase Sapphire Reserve often offer 5 points per dollar spent on travel booked through the Chase Travel portal. Additionally, taking advantage of limited-time promotions and special offers can also help you maximize your rewards when booking travel with Chase.

Bottom Line

Keep in mind that, no matter which Chase credit card you have, there are other ways you can use your rewards points. You can redeem Chase points for statement credits or cash back, or cash them in for gift cards or merchandise. And if you have a premier Chase travel credit card, you can transfer your points to Chase airline and hotel partners at a 1:1 ratio.

However, booking travel through Chase can make your life considerably easier — especially if you don't like dealing with complicated hotel and airline programs. You may not get as much value from your points as you would if you booked a premium flight with airline miles, but the Chase Travel portal does offer the flexibility to book the flight you want without any blackout dates or hoops to jump through.

The Chase Travel portal offers yet another way to maximize rewards earned with a Chase credit card. Just make sure to consider all your options and the value you're getting for your points before you pull the trigger.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Simple ways your mobile banking app can help make travel easier.

Mobile banking can help you plan trips and even lighten your stress load on the road. In fact, the Chase Mobile ® app can work with you at every stage of your trip: from seeding the idea to heading back home. You could think of it as your Chase travel buddy. Useful features include safety measures, alerts and even ways to use points for booking a trip. Let’s explore how the Chase Mobile ® app could become your best travel-planning partner.

What is a credit card travel notice?

Credit card travel notices were once synonymous with alerts you sent to your credit card company to let them know you’re traveling and that your charges may not be similar to your everyday purchases. Customers could (and still can at some banks) send this notification by phone, through email or on the bank’s mobile app. But now, many banks, including Chase, no longer require travel notices from customers.

Setting up alerts on Chase Mobile ® app?

You can choose from several available alerts. For example, Chase offers alerts for the following account events:

- Transactions of many kinds

- Balance transfer or payment postings

- Low balance (according to your chosen setting)

- Available credit limit

- Payment due dates

You can set up your alerts in a few simple steps on your mobile device:

- Sign into the Chase Mobile ® app

- Click "Profile & settings," and tap "Alerts"

- Select "Choose alerts" then pick the account you wish to include

- Customize options under "Delivery methods"

- Hit “Save” and now you're enrolled

It’s also up to you how you'd like to receive these alerts: either by email or text. Delivery of alerts may be delayed for various reasons, including service outages affecting your phone, wireless or internet provider; technology failures; and system capacity limitations.

How to book travel in the Chase Mobile ® app

The Chase Mobile ® app can also help plan and book your trip from the very start with eligible Chase credit cards with Ultimate Rewards. When you get an urge to travel, check out the Benefits tab. You’ll find it by navigating to the bottom of the app. Once there you can explore Travel and Chase Ultimate Rewards ® . Let’s run through how that can work for you.

Booking with the Chase travel portal

Tap into the Chase travel portal by clicking the travel icon at the top. There you can do the following:

- Update your travel profile and preferences.

- Find out your current reward points total.

- Book flights.

- Reserve hotel rooms.

- Set up car rentals.

- Scan destination guides.

Your Chase reward points could fit right into these travel planning steps. It’s all-in-one travel booking at your fingertips. Even when you’re not ready to commit to a single destination, the Chase travel portal offers inspiration and tips for that next trip on your horizon.

Helpful mobile app features

There are some additional Chase Mobile ® app features that may help ease your mind while on your trip. For instance, there’s no need to get lost looking for an ATM— the Chase Mobile ® app shows you ATM and branch locations near you. Here are a few more examples where the Chase Mobile ® app can come in handy:

- Digital wallet: Through the mobile app, you can add your Chase cards to your mobile wallet of choice. This feature can help you travel light and worry less about losing your physical wallet or credit cards. It allows easy access to the account and credit cards you select for contactless payments on the go.

- Chase QuickDeposit ℠ : Deposit checks right on your phone, with Chase QuickDeposit ℠ . You can choose which account to fund and all it takes is a picture of the check front and back to get your deposit started from any location.

- Pay bills: Even if you almost forget to make a payment while sipping a margarita in the sunshine, your bills don’t have to get in the way of a good time. As long as you have phone service, the Chase Mobile ® app can help you pay bills and transfer money just about anywhere with Chase Online Bill Pay .

The Chase Mobile ® app can help with every stage of your travel planning for nearly any adventure. Whether it’s a trip to the shore on the weekend or Bali on summer break, your Chase travel portal offers handy alerts and even ways to use rewards and book a trip. Check out how the Chase Mobile® app can help get you where you want to go.

- card travel tips

- credit card benefits

What to read next

Rewards and benefits frequent flyer programs: a guide.

Frequent flyer programs offer a variety of perks. Learn more about what frequent flyer programs are and what to consider when choosing one.

rewards and benefits Are frequent flyer credit cards worth it?

Frequent flyer credit cards help frequent flyers earn and redeem points or miles towards the cost of their future travel plans. Learn more about their risks and rewards.

rewards and benefits Chase Sapphire Events at Miami Art Week

Learn about the exclusive events a Chase Sapphire Reserve cardmember can experience at Miami Art Week.

rewards and benefits How to choose a credit card to earn travel points

There are many things to consider when choosing a credit card with travel points - how travel points work, how to earn them, and so on. Learn more here.

Chase is migrating cardholders to new Ultimate Rewards travel booking site

Update 12/20/2021: The article was updated with information from Expedia regarding the migration timeline. We also added a note about how new portal bookings do not usually earn hotel points.

What's old is sometimes new, and such is the case here as Chase has begun to migrate cardholders from the current Expedia-powered Chase Ultimate Rewards travel portal to one powered by cxLoyalty. Some Chase cardholders are already seeing the new booking system on the Ultimate Rewards portal.

For some background, in mid-2018, the Chase Ultimate Rewards travel portal dropped from its former Online Travel Agency partner, cxLoyalty, in favor of Expedia . Since then, Expedia has handled all travel bookings made through the portal, including flights and hotels.

In an interesting turn of events, Chase acquired cxLoyalty in late 2020 . Since then, loyalty travel enthusiasts have been waiting for Chase to switch back to the platform — a welcome change given Expedia's booking portal has long been plagued with issues, like not being able to book low-cost air carriers.

Some Chase cardholders are seeing the new portal one their Ultimate Rewards-earning cards already, while others are still on the old Expedia portal. We would expect all card members to be migrated to the new portal in the near future. Expedia confirmed to TPG that it still has a relationship with Chase, so some cards will remain on the Expedia platform for several months.

Here's what to expect as Chase transitions back to cxLoyalty.

Get the latest points, miles and travel news by signing up for TPG's free daily newsletter .

Using the new Chase Ultimate Rewards travel portal

The new cxLoyalty-powered portal is functionally similar to the old Expedia portal. You can access it the same as before through the Ultimate Rewards site – just click the Travel button from the Earn/Use toolbar at the top.

Once there, you'll notice that the user interface has slightly changed. It looks remarkably similar to the Citi ThankYou booking portal, which is also powered by cxLoyalty.

One major difference is that ultra-low-cost carriers now display in search results. As discussed, Expedia's portal didn't show airlines Frontier and Spirit in search results, and many reports said they weren't bookable over the phone. According to Expedia, it was a "business decision based on the requirements needed" to not include low-cost carriers. Under the new cxLoyalty portal, most of these airlines can be booked with cash or points online.

The only major exceptions are Allegiant and Southwest, which, according to Chase, must be booked over the phone.

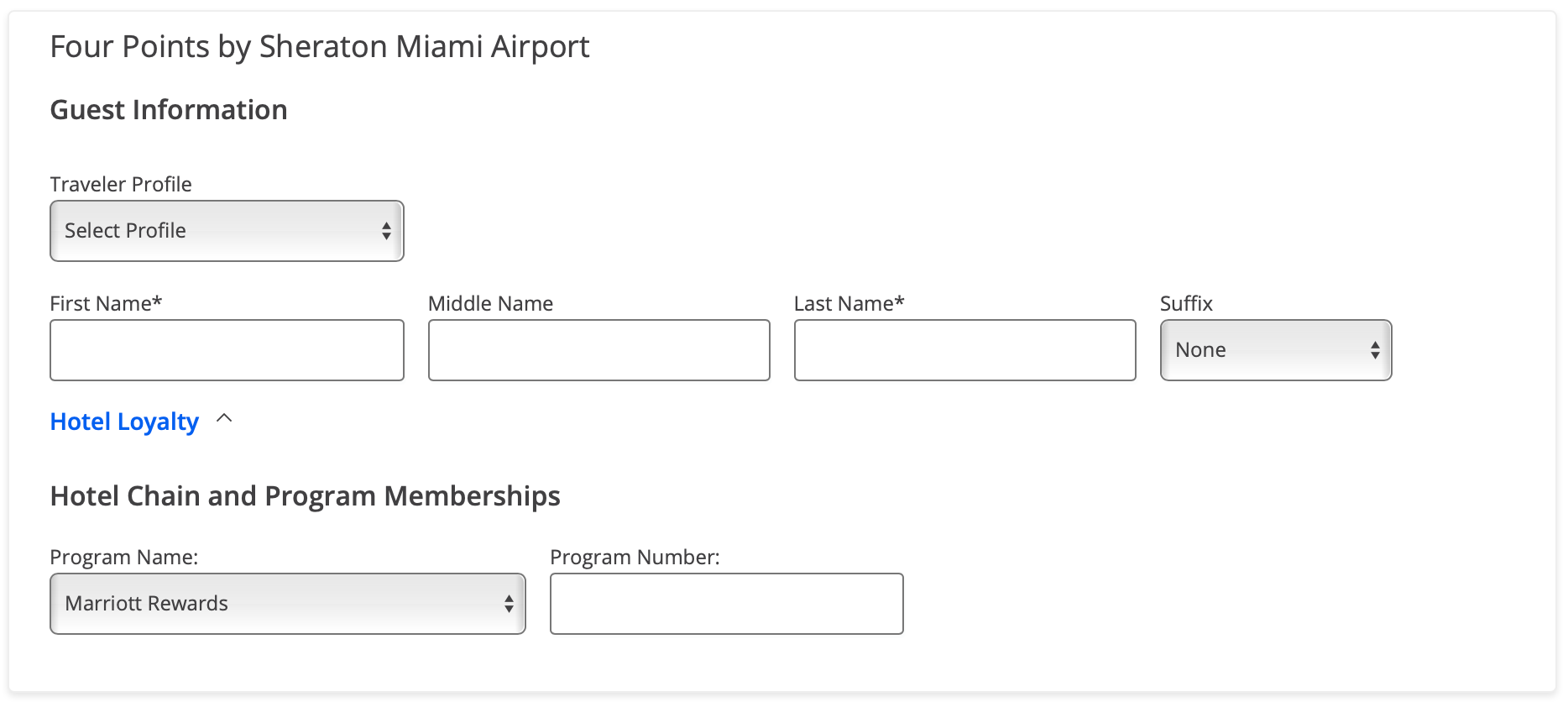

Another interesting change is that the portal now asks for a hotel loyalty number when booking hotels. That said, we tested the new platform and found that you will most likely not earn hotel points on stays booked through the portal.

Bottom line

We are encouraged as Chase starts the switch from Expedia back to cxLoyalty.

The new portal looks to have already fixed some of the major issues users had with the Expedia-powered portal, like the inability to book ultra-low-cost carriers. We'll continue diving deep into the portal and update you with further changes we find.

Feature photo by AaronP/Bauer-Griffin/GC Images

Chase Ultimate Rewards travel portal review: A messy trip, but not their fault

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- • Credit cards

- • Credit scores

- • Rewards credit cards

- • Travel credit cards

- • Rewards strategy

- • Small business marketing

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Booking travel through a credit card issuer’s portal — which is essentially their version of an online travel agency (OTA) such as Expedia or Orbitz — has its pros and cons.

The main advantage is extra rewards. That’s what convinced me to book a recent trip through the Chase Ultimate Rewards portal using my Chase Freedom Flex℠ *.

I earned 5 percent cash back on those flights, whereas I would have only earned 1 percent if I booked directly with the airline. I bought $1,137.26 worth of airfare, so there was a significant difference between 5 percent ($56.86) and 1 percent ($11.37).

Sometimes it can also make sense to use a card issuer’s travel portal if you’re redeeming rewards for the trip. That’s especially compelling if you have a card such as the Chase Sapphire Preferred® Card , which boosts the value of your rewards by 25 percent if you use them in this fashion.

The main drawback of any OTA — card issuer portals included — is that booking travel this way introduces an intermediary into the transaction. If anything goes wrong with your trip, you need to deal with the travel agency’s customer service instead of (or sometimes in addition to) the hotel or airline provider. This can make things more complicated.

Another important note is that hotel bookings made through OTAs typically do not earn loyalty points or count toward elite status. Airline reservations, on the other hand, are generally eligible for frequent flyer miles and elite status qualification.

In my case, I decided that an extra $45.49 in cash back was worth giving the Chase travel portal a shot. I also viewed it as a professional development opportunity to see how this works in the real world.

What happened with my trip

A Bankrate survey revealed that 79 percent of travelers who’ve taken an overnight trip outside their local area so far this year experienced at least one travel-related problem. These included high prices (57 percent), long waits (29 percent), poor customer service (27 percent), hard-to-find availability (26 percent) and lost money due to canceled or disrupted plans (14 percent). I experienced every single one of those things the night before my wife and daughter were scheduled to leave on the trip I booked through Chase.

Actually, I should back up. The problems started even earlier than that. Weeks before the trip, American Airlines made a schedule change that jeopardized my wife Chelsea and daughter Ashleigh’s chances of making their connecting flight. The new layover seemed impossibly short.

This was my first test of the customer service for the Chase travel portal. They passed with flying colors, efficiently rebooking Chelsea and Ashleigh at no extra cost and arranging the flights in such a way that it seemed much more likely they would be able to get from one plane to the other. It was fairly complicated because the connecting city needed to change, but the whole process was smooth. I was impressed.

Fast-forward to the night before the trip

We received an email from American Airlines that Chelsea and Ashleigh’s flight from Newark to Phoenix was canceled. There was no explanation, but we assume it had to do with either a staffing or equipment shortage since the weather was calm on both ends; the airline offered to rebook them on the same itinerary two days later. That was far from ideal, since the whole trip was only supposed to last five days (the ultimate destination was Monterey, California, where Chelsea’s parents live).

We simultaneously reached out to both Chase and American. Chelsea reported that the wait to speak with someone at the airline was listed at four hours. I got through to a Chase representative almost immediately.

I explained the situation, and the customer service agent and I started brainstorming alternatives. Was there a different way to get to Phoenix in time for the connecting flight to Monterey? We looked at Newark, JFK, LaGuardia — even as far away as Philadelphia and Hartford, but no dice. How about an entirely new routing? Could they fly from somewhere in the New York area to San Francisco, San Jose or Oakland, California? Those cities are all within a couple hours’ drive of Monterey.

After several attempts to find something that would work, we gave up. Nothing seemed to work. The Chase representative was great, and I feel like he did everything he could to try and solve our dilemma. American Airlines just didn’t have any availability.

We eventually got through to American Airlines and confirmed there were only two options: Travel two days later or cancel. We opted to cancel but — plot twist — we still found a way for Chelsea to visit her parents and for Ashleigh to see her grandparents. We rolled the dice and made an entirely new reservation with JetBlue. They had an early-morning flight from JFK to San Francisco with a few available seats.

The backup plan

The trip ended up costing $700 more due to higher-priced, last-minute plane tickets and a rental car to get them from San Francisco to Monterey, but the trip had a happy ending. It was ironic, too, because we had sworn off JetBlue after experiencing significant issues with them during family trips in the past. This time, they saved the day, and American Airlines dropped the ball.

I’ve heard that some people have taken to making backup flight reservations, especially on carriers such as Southwest, which have particularly generous cancellation policies. I’m not sure I would go that far, but there’s no doubt air travel has been a mess lately. In my view, airlines need to do a much better job of setting their schedules and sticking to them. Unfortunately, there’s little that passengers can do to protect themselves.

Travel insurance might help, and some credit cards provide travel insurance benefits at no added cost. But, at the end of the day, the airlines are the ones responsible for getting us from point A to point B.

The Chase portal wasn’t the problem; I would use it again. But given the current state of the airline industry, I’m going to be anxiously waiting to see if my next flight takes off as planned.

Have a question about credit cards? E-mail me at [email protected] and I’d be happy to help.

*The information about the Chase Freedom Flex℠ has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Related Articles

Chase Freedom Unlimited benefits guide

How to use the Chase Ultimate Rewards travel portal

Not a rewards junkie? That’s OK

Can you get a business credit card without a business?

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Chase Sapphire Preferred Review: Nearly a Must-Have for Travelers

What’s on This Page

The bottom line, pros and cons, detailed review, compare to other cards, benefits and perks, drawbacks and considerations, how to decide if it's right for you.

The big sign-up bonus and high-value points have long made this a favorite among travelers.

Rewards rate

Bonus offer

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Ongoing APR

APR: 21.49%-28.49% Variable APR

Cash Advance APR: 29.99%, Variable

Penalty APR: Up to 29.99%

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater.

Foreign transaction fee

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

New cardholder bonus offer

Bonus categories

Primary rental car coverage

Flexible rewards redemption

Transfer partners

Has annual fee

Requires good/excellent credit

Complicated rewards

For travelers, the $95 -annual-fee Chase Sapphire Preferred® Card stands out as a versatile and valuable choice.

With this card, you can earn rewards — known as Ultimate Rewards® points — in a variety of ways and redeem them strategically for travel, like transferring those points to a variety of loyalty programs, including heavy hitters such as United Airlines, Southwest Airlines, Marriott and Hyatt. And it dovetails nicely with some other Chase cards that also earn Ultimate Rewards® points.

Overall, it might not be the easiest card to use — a Swiss Army knife compared with the butter knife that simpler cards are. But it’s a go-to card for travelers who delight in finding ways to reap big value from their rewards.

Chase Sapphire Preferred® Card : Basics

Card type: Travel .

Annual fee: $95 .

Sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Ongoing rewards:

5 points per $1 spent on all travel purchased through Chase.

3 points per $1 spent on dining (including eligible delivery services and takeout).

3 points per $1 spent on select streaming services.

3 points per $1 spent on online grocery purchases (not including Target, Walmart and wholesale clubs).

2 points per $1 spent on travel not purchased through Chase.

1 point per $1 spent on other purchases.

Through March 2025: 5 points per $1 spent on eligible Peloton purchases (with a maximum earning of 25,000 points) and on Lyft.

Interest rate: The ongoing APR is 21.49%-28.49% Variable APR .

Foreign transaction fees: None.

Other benefits:

A $50 annual credit on hotel stays purchased through Chase.

Each account anniversary, cardmembers will earn bonus points equal to 10% of total purchases made the previous year.

Hotel and airline transfer partners.

Primary rental car coverage .

» MORE: Benefits of the Chase Sapphire Preferred® Card

How much is a point worth?

Chase Ultimate Rewards® points earned on this card are worth 1.25 cents each when redeemed for travel booked through Chase. Using points this way, or transferring them to travel partners, is key to getting the most value from the Chase Sapphire Preferred® Card . Otherwise, it’s not quite as lucrative to use points for less-valuable redemption options, including cash back, gift cards and merchandise.

The Chase Sapphire Preferred® Card offers versatility for travelers that's hard to find at a similar price point.

Solid sign-up bonus

The card features a generous sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Bonus rewards i n multiple categories

You earn extra points in a bunch of spending categories, which is good, but also makes it complicated:

Through March 2025: 5 points per $1 spent on Lyft.

Triple points on dining and streaming services is useful, while online grocery purchases may or may not be, depending on your lifestyle. Travel-related purchases are far more lucrative if you’re willing to book through Chase's travel portal. Even if you’re not, Chase’s definition of "travel" is fortunately broad; in addition to airfare and hotel stays, you can also earn bonus rewards on expenses like parking garage fees, bus fares and campgrounds. And these bonus rewards aren’t just available for travel and dining in the U.S., they can be earned worldwide.

Those earnings rates are, in effect, slightly higher because of the 10% anniversary bonus boost. For example, streaming services rewards effectively have a rewards rate of 3.1%. (The anniversary bonus applies to dollars spent, not points earned.)

And if you’re willing to use points to book travel through the Chase portal, your points will get a 25% boost (points are worth 1.25 cents). All told, a dollar spent at a restaurant or for a streaming service, for example, would earn a total value of 3.75 cents when used for travel through Chase.

This card’s valuable 1:1 transfer partners make it a keeper, especially if you're willing to look for good redemption opportunities. Say you spot a nice deal with one of Chase’s airline transfer partners — maybe a flight that normally costs thousands of dollars going for a mere 50,000 miles plus taxes and fees. With this card, you have the ability to transfer your Chase Ultimate Rewards® points into that airline’s loyalty program and pounce on that deal.

Here are the transfer partners:

Aer Lingus (1:1 ratio).

Air Canada (1:1 ratio).

Air France-KLM (1:1 ratio).

British Airways (1:1 ratio).

Emirates (1:1 ratio).

Iberia (1:1 ratio).

JetBlue (1:1 ratio).

Singapore (1:1 ratio).

Southwest (1:1 ratio).

United (1:1 ratio).

Virgin Atlantic (1:1 ratio).

Hyatt (1:1 ratio).

InterContinental Hotels Group (1:1 ratio).

Marriott (1:1 ratio).

» MORE: Chase Ultimate Rewards: How the Program Works

Complementary cards

The Chase Sapphire Preferred® Card is an excellent companion to other cards in the Chase Ultimate Rewards® family. That’s because you can move points to this card from your other cards that earn Chase Ultimate Rewards®, potentially opening up more redemption options.

Consider the Chase Freedom Flex℠ . It earns 5% cash back on rotating quarterly categories (on up to the first $1,500 in purchases, upon activation) in addition to rewards for other spending. You could potentially move the rewards you earn on that card to the Chase Sapphire Preferred® Card . From there, you could get more value out of your points by transferring points at a 1:1 ratio to other loyalty programs or redeeming them for 1.25 cents apiece when booking travel through Chase. (See our comparison article on Flex versus Sapphire Preferred .)

» MORE: What is the ‘Chase Trifecta’?

The Chase Sapphire Preferred® Card and its more upscale sibling, the Chase Sapphire Reserve® , have had their rewards, perks and bonuses tweaked over the years as the issuer has worked to keep them at the top of travelers' wallets. See our Chase Sapphire cards news page for a rundown.

Sapphire Preferred vs. Sapphire Reserve

If you have your eye on the Chase Sapphire Preferred® Card , you might also be checking out the pricier Chase Sapphire Reserve® . A premium travel card, the Chase Sapphire Reserve® comes with an annual fee of $550 and several rich perks and benefits, including airline lounge access and an annual $300 travel credit. If you travel enough, going for the more expensive option could be well worth the cost.

Read NerdWallet’s full comparison of these two cards to learn more about the differences.

Here’s a look at how the cards stack up on major features:

It's complicated

All those reward categories with different rates, an anniversary bonus and a 1.25 cents per point redemption for travel through Chase? Dizzying.

Additionally, the best rewards and redemptions are tightly tied to using the Chase portal to book travel or to transferring points to a different loyalty program, which is more to figure out. And to really boost your points, many people will use the card in conjunction with other Chase cards.

In the end, making the most of the Chase Sapphire Preferred® Card requires a learning curve and an ongoing juggling act that some consumers simply don’t want to deal with. If you're interested in earning travel rewards, but want something a little easier to use, the $95 -annual-fee Capital One Venture Rewards Credit Card has a much simpler rewards structure.

You'll earn 5 miles per dollar on hotels and car rentals booked through Capital One Travel. Other purchases earn 2 miles per dollar. But like the Chase Sapphire Preferred® Card , there's multiple ways to redeem rewards with this card, including transferring them to travel partners. If you want something even more straightforward, consider a cash-back credit card .

Few premium perks

The Chase Sapphire Preferred® Card is an excellent card for travelers in general. It even has a few travel perks, such as primary rental car insurance , trip cancellation/interruption insurance and lost luggage insurance.

But for those who love to travel in style, the more expensive Chase Sapphire Reserve® could be a better fit.

The Chase Sapphire Reserve® with an annual fee of $550 comes with an annual $300 travel credit and Priority Pass Select access, which gets you into several airport lounges for free and includes meal credits for certain airport eateries. And it comes with a credit for TSA PreCheck or Global Entry (or NEXUS), worth up to $100 once every four years.

To see how these cards compare to the competition, check out NerdWallet's list of best credit cards to get .

Using the Chase Sapphire Preferred® Card for simple rewards — say, earning cash back — would be akin to buying a top-of-the-line multipurpose tool just to use the nail file. The card offers outstanding value, but to fully appreciate it, a traveler needs to take advantage of its versatility. If that appeals to you, this card is an excellent choice.

With no annual fee, this card gives you 1.5 miles for every $1 you spend. It comes with a new-cardmember bonus offer, and points are redeemable for statement credit against many kinds of travel expenses.

Looking For Something Else?

Methodology.

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

Frequently asked questions

Rewards are: 5 points per $1 spent on all travel booked through Chase, 3 points per $1 spent on dining (including eligible delivery services and takeout), 3 points per $1 spent on select streaming services, 3 points per $1 spent on online grocery purchases (not including Target, Walmart and wholesale clubs), 2 points per $1 spent on travel not booked through Chase and 1 point per $1 spent on other purchases. Occasionally, the issuer may offer bonus rewards in specific categories for a limited time.

That depends on how you redeem them. If you use them to book travel through Chase — such as for airfare, hotels, rental cars or cruises — points are worth 1.25 cents each. If you redeem them for cash, they’ll be worth 1 cent apiece. You can also transfer points to about a dozen airline and hotel loyalty programs; the value you get depends on how you redeem them in those programs.

As long as your account is open, your points won’t expire. There’s no limit to the number of points you can earn.

The Chase Sapphire Reserve® has a much higher annual fee — $550 , compared with $95 for the Chase Sapphire Preferred® Card — but it offers richer rewards and more perks. Points are worth 1.5 cents apiece when redeemed for travel through Chase (versus 1.25 cents for the Chase Sapphire Preferred® Card ). Perks include an annual $300 travel credit that offsets a big slice of the annual fee. See our comparison article for more details.

If you have good to excellent credit and you’re in line with Chase’s 5/24 rule , you could be approved for the Chase Sapphire Preferred® Card . Good credit is generally defined as a FICO of 690 or higher, although issuers also take into account your income, existing debts and other information.

About the author s

Claire Tsosie

Gregory Karp

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Chase Sapphire Preferred Card

Chase Sapphire Preferred Card Travel Insurance – 10 Frequently Asked Questions [2024]

Content Contributor

66 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

84 Published Articles 482 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3134 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![chase travel trip id Chase Sapphire Preferred Card Travel Insurance – 10 Frequently Asked Questions [2024]](https://upgradedpoints.com/wp-content/uploads/2022/09/Chase-Sapphire-Preferred-Upgraded-Points-LLC-08-Large.jpg?auto=webp&disable=upscale&width=1200)

Chase Sapphire Preferred Card Overview

Recap of chase sapphire preferred card travel insurance, travel accident insurance, trip cancellation and interruption insurance, 2. does chase sapphire preferred card travel insurance cover cruises, 3. what does the chase sapphire preferred card baggage insurance cover, 4. what does the chase sapphire preferred card medical insurance cover, 5. does the chase sapphire preferred card cover hotel cancellations, 6. does the chase sapphire preferred card cover airbnb cancellations, 7. does chase sapphire preferred card travel insurance cover rental cars in other countries, 8. does the chase sapphire preferred card cover turo or zipcar rentals, 9. how do i file a chase sapphire preferred card travel insurance claim, 10. do i need travel insurance if i have the chase sapphire preferred card, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The Chase Sapphire Preferred ® Card remains one of the most popular travel rewards credit cards for numerous reasons. Alongside excellent earning rates and a fair amount of benefits that justify the $95 annual fee, the card also offers numerous shopping and travel insurance benefits.

If you’re like most people, you hear the word “insurance,” and your eyelids start feeling heavy. Let’s be honest: Insurance isn’t thrilling. The terminology can feel confusing, leaving you with many questions about what exactly the travel insurance on your Chase Sapphire Preferred card does and doesn’t cover.

You have questions, and we have answers. Here’s a simple look at your most common questions about travel insurance on the Chase Sapphire Preferred card.

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.