- Travel Money Card

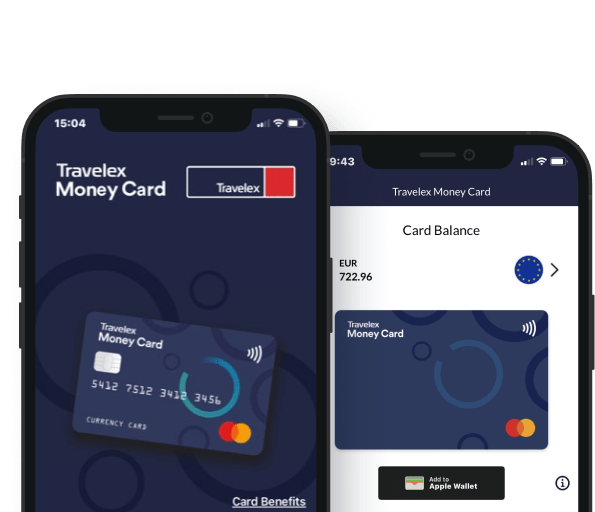

The Travelex Money Card is the quick, easy and secure way to spend abroad

- Top Up Card

- Our best rates

- No commission or hidden charges

- Free Click and Collect

- Next day home delivery

Travelex Money Card

- A safe way to carry and spend travel money abroad

- Load up to 15 currencies on your Travelex Money Card

- Manage your balance 24/7 through the Travelex Money App

- Freeze and unfreeze your card, reveal your PIN or other card details via the Travelex Money App

- Pay with confidence anywhere Mastercard Prepaid is accepted

Already have a card?

Travel money card benefits, safe & secure, find the right balance for your trip.

With our multi-currency prepaid card, you can reduce the amount of cash you need to carry on holiday and find the right balance for your trip. Plus, your card is not linked to your bank account, providing an extra layer of security against potential financial threats, and reducing the risk that comes with carrying cash.

Control at your fingertips

Manage your travel funds effortlessly with the Travelex Money App . Along with the essential features of freezing/unfreezing your card for enhanced security, the app provides seamless options to top up your card on-the-go. Always have secure access to your PIN and stay in full command of your travel money, ensuring a worry-free experience.

Peace of mind

Lock in your rates.

No more fluctuating exchange rates causing stress during your travels. With our multi-currency prepaid card, you can lock in your exchange rates 1 , shielding your budget from unexpected currency fluctuations.

Free and secure cash access

Forget about ATM fees eating into your travel budget. Our card provides free cash access with no overseas ATM charges 2 , allowing you to withdraw funds wherever you are. And in case your card is lost, stolen, or damaged, our 24/7 global assistance team is here for you. We aim to replace your card swiftly or provide emergency cash to keep your journey on track.

Easy to use

Effortless transactions.

Experience the ease of secure contactless payments – no signature or PIN required. Streamline your transactions and enjoy the convenience of a smooth payment process at millions of locations worldwide, wherever Mastercard Prepaid is accepted.

Easy money management

Enhance your travel experience with the flexibility to top up in 22 different currencies, including EUR, USD and AUD, and the convenience of transferring funds between your currency wallets in our app all through one versatile card, making international spending more seamless and efficient.

Seamless spending

You can easily add our card to your Apple Pay or Google Pay Wallet, making your payments smooth frictionless.

How does a Travelex Money Card work?

It’s fast and easy to get a Travelex Money Card.

1 | Order your Card

Order your Travelex Money Card online or in-store. Enjoy the flexibility of free delivery or convenient in-store collection.

2 | Register

Use the Travelex Money App to effortlessly register your card, granting you complete control over your account

Explore the world of hassle-free spending! Use your card at millions of locations globally, wherever Mastercard Prepaid is accepted.

Currencies and Rates

Explore the 22 currencies available to you on our prepaid travel card.

Fees and Limits

Free atm withdrawals worldwide.

Access your money without the hassle of ATM fees 2 , whether you're in the UK or exploring abroad.

Free Replacement Card

Enjoy peace of mind with our free replacement card service, available if your card is lost, stolen, or damaged while you're away or access to emergency cash.

Low Minimum Load/Top-up

Get started with a minimum load of just £50.00 GBP.

Generous Spending Limits

Spend up to £3,000.00 GBP at retailers and merchants within a 24-hour period

With our flexible fees and limits our Travelex Money Card is your perfect travel companion.

Download the Travelex Money App

- Top-up your Travelex Money Card in a flash

- Manage your money on the move

- View your latest transactions and track your spending

- Instantly freeze your card to protect your account

What our customers say

See why they trust Travelex services.

Common questions about the Travelex Money Card

What is a travel money card.

A travel money card (sometimes referred to as a prepaid currency card) is a global multi-currency card that’s not linked to a bank account. Like a debit or credit card, travel money cards can be used to make purchases in stores, online, and to withdraw cash at ATMs while travelling.

Do you get charged for using a travel money card?

Some providers may charge you for using your card abroad, but we do not charge spending fees 3 on our Travelex Money Card.

How do I get a Travel Money Card?

You can get a Travelex Money Card by purchasing currency online or in-store. Find our full list of stores here.

Where can I use my Travel Money Card?

You can use the Travelex Money Card in most countries across the world, wherever Mastercard Prepaid is accepted. Choose from 22 available currencies: British pounds, euros, US dollars, Australian dollars, Canadian dollars, New Zealand dollars, South African rand, Turkish lira, Swiss franc, UAE dirham, Mexican peso, Polish zloty, Czech koruna, Swedish krona, Japanese yen, Thai Baht, Hong Kong dollars, Singapore dollars, Danish kroner, Norwegian krone, Hungarian forint and Icelandic krona.

Can I withdraw money from my Travel Money Card?

Like most bank accounts, you can withdraw money from your travel money card at ATMs worldwide. The maximum withdrawal amount is 500.00 GBP within a 24-hour period. Please bear in mind Travelex does not charge ATM fees but some operators may do so, check before you withdraw cash. Travelex Money Card T&Cs can be found here.

Still have questions?

Explore our support categories for more help.

Basic information about the Travelex Money Card.

Getting started

Details on obtaining and eligibility for the card.

Managing your Travelex Money Card account.

Managing card

PIN, balance checks, and card management.

Using & topping up card

Card usage, currencies, and transaction limits.

Details about adding your card to an Apple Wallet.

Details about adding your card to a Google Wallet.

Fees and limits

Information on fees and limits.

Getting help

Support for lost/stolen cards and troubleshooting.

Previous cards

Information for Cash Passport customers.

- Travelex Money Card Terms & Conditions can be found here.

- 1 Lock in your exchange rates mean the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction.

- 2 Although Travelex does not charge ATM fees, some operators may charge their own fee or set their own limits. We advise to check with the ATM operator before using.

- 3 No charges when you spend abroad using an available balance of a local currency supported by the Travelex Money Card.

- Travelex Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International.

- PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated

- Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

Quick Links

- Exchange Rates

- Bureau de Change

- Max Your Foreign Currency

- Compare Your Travel Money

- Travellers Cheques

- Precious Metals

About Travelex

- Store Finder

- Download Our App

Useful Information

- Help & FAQs

- Privacy Centre

- Terms & Conditions

- Travelex Money Card Terms & Conditions

- Statement of Compliance

- Website Terms of Use

- Safety & Security

- Modern Slavery Statement

Customer Support

Travelex foreign coin services limited.

Worldwide House Thorpe Wood Peterborough PE3 6SB

Reg Number: 02884875

Your safety is our priority. Click here for our latest Customer update

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance.

Travel money card

Planning a trip overseas? Our prepaid travel money card lets you load your chosen currency and lock in a top rate before you go. Spend safely abroad with a Sainsbury’s Bank Travel Money Card.

Wherever you go, we’ve got your back

With a Sainsbury's Bank Travel Money Card, spending money abroad has never been easier – or safer. Once you’ve experienced the benefits of a travel money card, it’ll be your first choice every time. Our prepaid money travel card allows you to:

Load up to 15 currencies at any one time. No more worrying if your currency will be in stock at the bureau de change

Make secure, contactless payments. Just look for the contactless symbol when eating out or shopping abroad. Contactless payment is subject to merchant acceptance, and there may be a maximum limit when paying this way

Manage your account on the go. Use the Sainsbury’s Bank travel money card app to manage your currency card wherever you are

Put security first. Travel with confidence knowing your card is chip and PIN protected and there’s no direct link to your bank account

Live like a local. Use your travel money card to withdraw local currencies at ATMs worldwide for free. Remember to check whether the ATMs charge their own fee

Enjoy rates you can rely on. Fix the exchange rate any time you load or move money between currencies

Enter a world of convenience. Whenever you use your travel card, it automatically knows where you are and which currency to use

It’s free to get. And it won’t cost you a penny – or a cent – to load with foreign currency

Your adventure awaits. To get your travel money card next day from your local instore bureau click 'order for collection'. Or for the convenience of home delivery select 'order for delivery' (allow 5-8 days).

What is a travel money card?

Travel cards are a hassle-free alternative to taking cash on holiday. And a handy way of taking multiple currencies if you’re travelling to a few different destinations.

Use it like a debit card – without worrying about overseas bank fees when you spend in a currency loaded on the travel card. Pay contactless, pay with your PIN or withdraw at a local ATM. You can even use it to make online purchases.

Since it’s a prepaid travel money card, it’s also a great way to keep an eye on your holiday spending – just load your money before you jet off. And if you need a little extra you can even easily top up your card from the beach. Download the Sainsbury’s Bank travel money card app or find out more .

Which currencies can I load?

The world’s your oyster when you get a Sainsbury’s Bank Travel Money Card. Pick up to 15 currencies at any one time. Along with the Great British Pound, you can choose from:

- Euros

- US Dollars

- Australian Dollars

- NZ Dollars

- Canadian Dollars

- South African Rand

- Turkish Lira

- Swiss Francs

- UAE Dirham

- Mexican Peso

- Polish Zloty

- Czech Koruna

- Swedish Krona

- Japanese Yen

When you use your travel money card abroad, it will automatically pick up where you are and know which currency to use.

And as soon as you load money onto your prepaid travel money card, you’ll get a fixed exchange rate for the currency, or currencies loaded. So you know exactly how much you’ll have to spend even if rates change while you’re away.

Ready to get your travel money card?

It's easy. To get your travel money card next day from your local instore bureau click 'order for collection'.

Or for the convenience of home delivery select 'order for delivery' (allow 5-8 days). When it arrives, remember to sign the back of the card.

To start using your card, simply load it with a minimum of £50. All that's left to do is decide where you’re going.

Fees, limits and terms and conditions

Get to know our Sainsbury’s Bank travel money card fees and limits. It’ll help you understand whether it’s the right option for you.

For a full description of fees, limits and terms and conditions, please click here .

± If the currency of your transaction does not match any of the currencies on your card, or there are insufficient funds on your card in a currency to cover the whole transaction, the (remainder of the) transaction amount will be exchanged to another currency (-ies) on the card in the order of priority, at an exchange rate determined by Mastercard® on the day the transaction is processed, increased by 5.75% (the foreign exchange fee).

‡ A foreign exchange rate will apply if transferring funds to another currency. The currency exchange rate is selected from the range of rates available in wholesale currency markets (which vary each day), together with a margin.

+ If, following the debit of any monthly inactivity fee, the card fund balance is less than the fee, we will waive the difference.

^^ The amount that can be loaded/reloaded will vary depending on which channel you choose, i.e. online, in store, telephone or internet banking.

^^^ If you’ve forgotten your travel money card PIN, you can contact us for a replacement.

Already got a card?

If you’ve already got a travel money card with us, login online or use the app to top up and manage your account.

Prefer to take foreign currency?

We can help with that too. With travel money bureaux all over the UK, it’s easy to find one near you . You can also order online for home delivery. There’s 0% commission, plus, if you’re a Nectar member, you’ll get better rates. ±

Travel tools and guides

Going on holiday.

Read our holiday checklist to help you create the perfect travel plan

Keeping your valuables safe abroad

Helpful tips on how to protect your valuables while you’re on holiday

Currency converter

Use our calculator to find out how much foreign currency you could get

Frequently Asked Questions

How does a sainsbury's bank travel money card work.

Sainsbury’s Bank Travel Money Card is a chip and PIN protected prepaid Mastercard® currency card.

You can load multiple currencies onto it before you travel and then use it in millions of ATMs around the world displaying the Mastercard Acceptance Mark, to access your money quickly and safely. You can also pay for goods and services online and in-store.

Where can I use a Sainsbury's Bank Travel Money Card?

Your Sainsbury’s Bank Travel Money Card can be used to withdraw money from ATMs worldwide~ displaying the Mastercard® Acceptance Mark. All you need to do is to find your nearest ATM.

Alternatively, you can use the card to pay online and in stores around the world~.

You can use your Sainsbury’s Bank Travel Money Card in countries or areas with a different currency to those on your Card. The system will automatically convert your stored currency (-ies) to the local one. Please note that for any transactions in a currency different from the Currencies loaded on your Card, the funds available on the Card will be used in the following order of priority: GBP, EUR, USD, AUD, CAD, NZD, ZAR, TRY, CHF, AED, MXN, PLN, CZK, SEK and JPY at an exchange rate determined by Mastercard on the day the transaction is processed, increased by a percentage determined by us (see the Fees and Limits section for more details).

How do I download the Sainsbury’s Bank Travel Money Card app?

Search Sainsbury’s Bank Travel Money Card app in the Apple App Store or on Google Play.

How do I top up my Sainsbury's Bank Travel Money Card?

Even with a zero balance, your card is still valid (up to the expiry date printed on the front of the card), and you can reload it any time before your next trip##.

For information on how to reload your Sainsbury’s Bank Travel Money Card, please see the 'top up' section.

## Until card expiry and subject to reload limits (see Fees and Limits section).

What if an ATM asks for a six-digit PIN?

In some countries, you may be asked for a six-digit PIN when using an ATM.

Sainsbury’s Travel Money Card uses a standard four-digit PIN, which will still be accepted as normal if the ATM has been set up correctly in compliance with Mastercard regulations.

If you need assistance with any PIN issues, please call Card Services.

Can I get cash back with my Sainsbury's Bank Travel Money Card?

No, cash back is not available on a Sainsbury’s Bank Travel Money Card.

Terms and conditions

Sainsbury’s Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

* Nectar members receive better exchange rates on single purchase transactions of all available foreign currencies. Excludes travel money card home delivery orders and online reloads. Exchange rates may vary depending on whether you buy in store or online. You need to tell us your Nectar card number at the time of your transaction. We reserve the right to change or cancel this offer without notice.

Sainsbury's Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

- Prepaid Cards >

- Travel Prepaid Cards

Compare our best prepaid travel cards

Simplify your spending abroad with a prepaid travel card, find a prepaid travel card, what is a prepaid travel card.

A prepaid travel card , also known as a 'travel money card', is a debit card that you preload with money and take on holiday. It's a good way to stick to your holiday budget and avoid carrying a lot of cash.

Prepaid travel cards can be used at cashpoints, in shops and restaurants , or anywhere that accepts Mastercard or Visa debit or credit cards.

However, a prepaid travel card is not the same as a credit card for two key reasons:

You can only spend the amount you have put on the card; the pre-loaded limit prevents you overspending and getting into debt

You can choose which currency to preload your travel money card with depending on where you're going, which often means you can secure a better exchange rate

Pick a card with fees that suit how you plan to use it, e.g. choose one with no withdrawal fees if you'll be withdrawing cash often while travelling.”

What are the different types of prepaid travel cards?

Multi-currency prepaid cards.

These can be loaded with several different currencies , making them ideal for both frequent travellers and those taking trips to multiple destinations. For example, you holiday in Europe but often visit the US on business, you could use a prepaid travel card to cover your everyday spending wherever you are by topping it up with say £600 then exchanging £200 into euros and £200 into US dollars. The different currencies will then be stored in separate “wallets” , allowing you to switch currencies when you like.

Sterling prepaid cards

These can be used at home and abroad , making them even more flexible than the best travel cards offering multiple currencies. You don’t need to worry about setting up a wallet for the currency you want to use; the card provider simply converts your pounds to the required currency each time you make a purchase . However, this can make holiday budgeting harder and may increase your costs, depending on the charging structure.

Euro prepaid cards

As well as multi-currency cards, you can take out prepaid cards designed to hold a specific currency . This can work out excellently if you're trying to lock in a good rate now by loading your euro prepaid card, but if you then use the card to buy things in a country that isn't in the eurozone. That's because if you spend in a country that does not use the euro, it converts to the local currency each time you make a purchase, which can work out more expensive.

Prepaid US dollar cards

These keep your balance in dollars . If you spend in countries that use a different currency, the card will exchange your dollars to the local currency, and you might well be charged a fee. The currency exchange takes place as soon as you load your card . If the pound strengthens afterwards, you won’t be getting the best value for money, but it if weakens you'll do well.

How to get a prepaid travel card

Compare cards.

Use our table below to find prepaid travel card that offers the features you need with the lowest fees

Check your eligibility

Make sure you fit the eligibility criteria for your chosen travel money card and can provide the required proof of ID

Apply for the card

Click 'view deal' below and fill out the application form on the provider's website with your personal details

What are the eligibility requirements?

Anyone can get a prepaid travel card. There's no need to have a bank account, and no credit checks are required . Some providers have a minimum age of 18, but many will let you have a prepaid card from the age of 13 with parental consent.

Sometimes parents like to use travel money cards to give their children a set amount of holiday money , and to help teach them about budgeting and financial responsibility.

Pros and Cons

What exchange rate do you get.

Exchange rates vary over time depending on what is happening in the wider economy. That means the exchange rate you get on a US dollar travel card today, for example, might not be the same as you get tomorrow or next week.

What prepaid cards offer is the ability to lock in today's rate to use later on. That could see you better off if the pound weakens, but might also mean you get a poor deal if the pound strengthens.

That offers is certainty - you'll know exactly how many dollars, euros, lira or whichever currency you load onto the card you have to spend on holiday.

Today’s best exchange rates

At what point is the currency exchanged with prepaid travel cards.

Some prepaid travel cards hold the balance in pounds sterling. These convert the required amount to the local currency every time you spend on them .

The exchange rate isn’t fixed, so you’ll only know how many pounds you have on the card - not what it will buy you while overseas.

But the cards in our comparison table convert your money when you add it onto the card. This means you know the exchange rate used and your card's exact balance before you go away.

Compare the rates before you choose a prepaid card. Although rates can change several times a day, some travel cards will be more competitive than others.

Using a card with competitive exchange rates will mean you get more local currency for your pound.

You also need to watch out for fees as well as withdrawal limits when choosing a card, as these can vary between providers.

What are the alternatives to prepaid travel cards?

Travel credit card.

A travel credit card works just like a regular credit card, with which you can make purchases by borrowing money. The main difference is that travel credit cards don't charge foreign transaction fees for spending abroad.

Travel money

For many people, cash is the most comfortable form of payment when travelling. It's hassle-free and universally accepted. But it’s riskier, as you'll lose out if it’s lost or stolen and you’ll need to budget carefully to ensure your foreign currency lasts the length of your trip.

Travel debit card

These days, there are plenty of specialist banks and providers that offer bank accounts that don't charge foreign transaction fees when used abroad. This offers you a chance to take advantage of the best exchange rates. And if it's your main current account, you won't have to worry about topping up your account before you go.

What other costs or fees are there with prepaid travel cards?

As well as the exchange rate, you might have to pay several other charges on your prepaid travel card.

These could include:

A fee to buy the card

A monthly or annual fee for keeping the account open

Cash withdrawal fees

Transaction fees when you pay for anything on the card

Inactivity fees

Loading fees when you add money onto the card

Some cards also charge fees for withdrawing cash or making purchases inside the UK .

But some of the cards in this comparison do not charge fees in countries that use currencies loaded on the card - just make sure the right one is selected before spending on them.

Check carefully for fees before you pick one.

Read our full guide on how much it costs to use a travel prepaid card and how to choose one .

"With multi-currency cards, check you've selected the right currency before you arrive."

How long does it take to get a prepaid travel card?

You can apply online and get a decision immediately. However, it can take up to two weeks before your card arrives in the post.

Can I use any prepaid card abroad?

Yes, you can use prepaid Visa or Mastercard cards in most destinations worldwide. Travel prepaid cards are usually cheaper to use overseas than a standard credit or debit card.

Can I withdraw cash abroad?

Yes, you can use a travel money card in a cash machine outside the UK. Some cards charge fees for this, so always check if you want to use your prepaid travel card to make cash withdrawals.

What currencies can my card hold?

All the travel money cards in our comparison can hold a balance in popular currencies such as euros or dollars, while some support more than 50 different currencies.

Can I make international payments?

Yes, some providers let you send or receive money from abroad by logging into your online account, which works in the same way as standard internet banking.

Who sets the exchange rate?

This depends on the company that processes the transactions. Typically, it’s down to Visa or Mastercard , as well as your card provider, which may take an additional cut.

Can I use my prepaid card in the UK?

You can use prepaid cards to withdraw cash or buy things in the UK or online. However, you may pay fees or even an exchange rate if your card is loaded with a foreign currency.

Explore our prepaid card guides

About the author

Didn't find what you were looking for?

Our most popular prepaid card deals

Other products that you might need for your trip

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

- Currency Card

- Travel Money

Compare Best Prepaid Travel Money Card

Compare travel money card and travel like a pro.

- Travel Budgeting

- Security of your holiday cash abroad

- Easy reloading of cash

Who offers the best travel money card?

Compare Prepaid Euro Travel Money Cards

Compared Prepaid US Dollar Travel Money Cards

Compare Prepaid Travel Money Cards

Other popular currencies.

- Australian Dollar Card

- Canadian Dollar Card

- New Zealand Dollar Card

- South Africa Rand Card

- Swiss Franc Card

What is a travel money card?

For most people that go overseas, using your normal debit or credit card frequently on holiday comes as second nature. Perhaps you leisurely whip out the card to buy a round of drinks, buy lunch for the family or use your plastic at a favourite local restaurant. Unfortunately, you are more than likely being ripped off on a daily basis with the high costs associated with using your debit and credit card abroad!

Fortunately, your new best friend abroad maybe a specialist travel money card.

This type of plastic is a free to obtain prepaid currency card that is pre-loaded with foreign currency prior to your departure. Most offer free ATM cash withdrawals overseas and specialist travel money cards alleviate the need for any currency conversion to take place. It works in a very similar way to your standard UK Visa or Mastercard debit card. Without the hefty overseas card charges!

Effectively, the travel money card eliminates the totally unnecessary complex series of fees and charges you may encounter when taking cash out or paying for goods with your everyday debit or credit card.

In a nutshell, we have found the best prepaid currency cards as an excellent way to budget your trip, so you know exactly how much you have to spend abroad. The best card issuers listed on our travel money card comparison tables charge no overseas ATM withdrawal fees for using the card.

Budget like a pro

We all know that spending money abroad feels like play money.

One of the best benefits of a prepaid travel money cards is that they help you stick to a holiday budget. However, if you need cash fast when your abroad and running low on funds, be sure to carry some cash too. Otherwise, you will need to reload the currency card.

PrePaid cards are a secure and safe way of carrying cash abroad

One of the best advantages of prepaid currency cards versus foreign cash is that if you lose your card, you can have it replaced for a small fee. On the other hand, if you lose foreign cash in the back of a Spanish taxi, you can say 'Arivaderchi.'

How much cheaper is it to get a travel money card

Research shows the cheapest travel currency cards can save you up to 10% on buying holiday money at the airport & 5% on the cost of using UK debit and credit cards abroad.

The cheapest currency cards on the market will let you take advantage of better currency exchange rates than you would likely obtain from the high street or (heaven forbid!) airport bureaus. Airports are the world’s worst place to convert currency.

As previously mentioned, you also alleviate the complex set of fees and charges your bank will take for the convenience of using your everyday card abroad. If you use your normal credit card when taking cash out of the wall, you will have to pay interest immediately, which accentuates the costs. In most cases, when using a travel currency card there are no ATM fees for drawing money out the wall and are often the safest option when travelling.

In short, for the benefits listed below, we recommend using a pre-paid travel currency card when holidaying abroad or making a business trip.

What are the benefits of a pre paid travel money card?

Explain to me in simple terms: how travel money cards work.

- Check website for any additional in-destination fees (good housekeeping)

- Compare providers & apply for the card

- You need to make an initial first load on your new prepaid currency card

- Lock in exchange rates as soon as you load your card

- Travel money card can then be used anywhere you see a Mastercard OR Visa sign

- Use in shops or ATM’s abroad fee free to withdraw cash as you would your regular UK debit card.

- Check your balance either online, SMS or via telephone

Add more currency to your card via SMS, Online OR Telephone. Be aware of the cost of overseas calls if you top up over the phone

What prepaid travel money card is right for me?

Below, we compare travel money cards and highlight some top picks that include no spending or load fees.

It's important to remember that depending on the destination you are travelling to, you can take advantage of currency specific cards that will help you save on overseas charges.

For a more extensive comparison, check out our specialist comparison tables for: Euro Currency Cards , Dollar Currency Cards , Worldwide Currency Cards

Our Recommendation

Prepaid card comparison: best load rates or free cost of card.

You can dynamically compare rates using our prepaid travel card calculator here. We screen scrape the live exchange rates offered for all major euro and dollar currency card providers.

This is a question we are asked most often. The cheapest travel money card is not necessarily the provider who offers the currency card free of charge OR even the card that offers the best initial load rate. Consider both the purchase cost of the card together with the ‘in destination’ costs when comparing travel cards. Trying to compare prepaid currency cards on an ‘apples by apples’ basis can be difficult.

Loading your travel money card operates in a similar way to buying foreign cash online. The travel currency card exchange rates on both the Euro and Dollar specific cards will be determined on the initial load. Once you have loaded your card with foreign currency, try not to worry too much about whether the pound strengthens or weakens. Even the best traders are not able to forecast future currency fluctuations!

Who typically uses a prepaid currency card?

Holiday With Family or Friends

Whether your travelling to Spain, France or Australia you can save a fortune with superior exchange rates. Youll get more bang for your buck with a prepaid card versus using your standard UK debit or credit card abroad.

Business Travel

Business usage of currency cards is perfect to track both your and your team’s expenses abroad. You get all the benefits of your standard plastic without the unnecessary transaction costs of your standard Visa & Mastercard. This is a particular favourite of Finance Directors from small start-ups to large corporates who can manage controlled usage of spending money overseas. With most currency card programs, you don’t need to log expenses as these are detailed online in your usage reports.

Regular Travellers

The best currency cards are valid for three years so once you have applied, you can simply top up before you go abroad. This makes prepaid currency cards perfect for overseas property buyers, expats and worldwide travellers. With millions of Visa & Mastercard ATM’s worldwide, it alleviates the need to store cash every time you travel in your hotel or apartment.

Students & Backpackers

We’ve covered the budgeting benefits & boy do backpackers need to stick to a budget! This makes prepaid currency cards perfect for those 3, 6 or 12 month stints abroad. And what’s more, once your money has maxed out on the card, you can always call the bank of mum and dad to help out with a small top up to keep you going.

Pre Paid Travel Cards are issued by Visa and Mastercard

The prepaid currency card you end up choosing will either be a Visa travel money card or Mastercard issued. You can use your prepaid travel card to withdraw cash worldwide from any ATM that displays either Visa or Mastercard.

Are there more Visa or Mastercard ATM’s worldwide?

Mastercard have over one million ATM’s in over 210 countries. You can check on their website using the Mastercard Global ATM locator tool. Likewise, Visa offer a Visa Global ATM locator service for their 1.8 million ATM’s worldwide and it is recommended to use both to ensure you are never too far away from an ATM when using your prepaid visa card or prepaid mastercard abroad.

- Press centre

- Testimonials

- Privacy Policy

- Terms & Conditions

- Travel Money Widgets

- Travel Blogger University

- MyCurrencyTransfer.com

Popular Currencies

- Order Euros online

- Order US Dollars online

- Order Canadian Dollars online

- Order Australian Dollars online

- Order Thai Baht online

- Order Turkish Lira online

- Order Swiss Francs online

- Order Japanese Yen online

- Order New Zealand Dollars online

Popular Pages

- Travel Money Reviews

- Euro Currency Card

- Travel Money Survey 2012

- Buy Euros Online

- Travel Blog Awards 2012

- Travel Money Affiliates

- MyTravelMoney News

About MyTravelMoney

MyTravelMoney.co.uk is the UK’s leading travel money comparison website, with featured reviews, guides and information to bring you best deals.

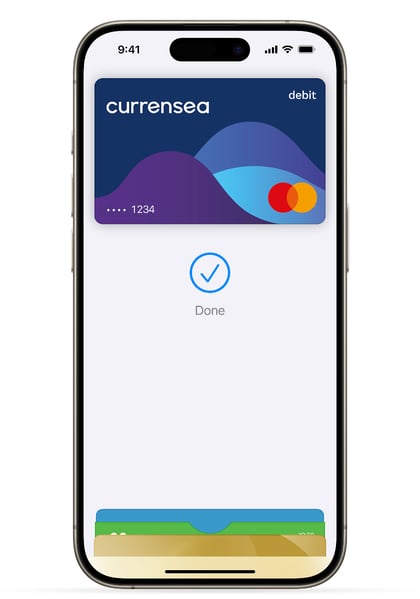

The UK's best rated travel debit card

Currensea is the layer in front of your current bank account, saving you at least 85% on every transaction, giving you extra security and making your bank work that bit harder for you.

Our connected banks

We work with all the major uk high-street banks.

What our customers think

What is currensea.

Pay safer and faster with Apple Pay

See how much you can save

Save in 180 currencies vs high street banks, prepaid travel cards and travel debit cards.

Find out more

Super-Convenient

Currensea works with your current bank account to make your holiday money go further.

No new bank account needed

Forget having to set-up and manage multiple accounts

Better than a pre-paid travel card

Currensea connects to your bank account, removing the hassle of pre-loading another card

Use your card globally

Spend abroad in 180 currencies without the normal bank fees!

Advanced Security

Currensea is the layer over your bank account, giving you increased security when you spend abroad..

All purchases are protected by Mastercard Chargeback Protection

Authorised by the Financial Conduct Authority

Secured with the latest bank security and encryption technology

All purchases protected by Mastercard Chargeback Protection

Pricing plans

Our plans are simple and transparent. we give you the best live exchange rate so you can spend in confidence, without the hidden fees. .

Essential Card - Free

0.5% FX Rate

For all transactions & ATM

Fee free ATM abroad

£500pm, 2% FX rate over

Spend in 180 currencies

Get the best live exchange rates

Market beating Money Transfer

Send £100 - £20,000 per transfer

Advanced security

Spend notifications, set spend limits & freeze/unfreeze card

Purchase protection

Mastercard 120-day chargeback protection

Spend in all 180 currencies

Get the best live interbank exchange rates

Singapore Airlines KrisFlyer air miles

Convert savings into air miles

Free card delivery

Mastercard travel debit card

Premium - £25/year

£500pm, 1% FX rate over

Premium Benefits

Hertz 5* status, Preferred Hotels discounts, and much more...

Market beating Money Transfer

Purchase protection

120-day Mastercard chargeback protection

Singapore Airlines KrisFlyer air miles Convert savings into air miles

Free card delivery

Premium offers

Access our latest offers for Premium travel debit card users

Car hire benefits

Including Hertz Gold Plus Rewards with complimentary Five Star Status and a 20% worldwide discount with Avis

Preferred Hotels & Resorts

Complimentary night's stay when booking a trip of 4 nights or more

- More about Premium

Elite - £120/year

Unbeatable 0% FX rate

£750pm, 1% FX rate over

Elite Benefits

Avis & Hertz president's club, concierge, hotel price guarantee, lounge access...

Elite offers

Access our latest offers for Elite travel debit card users

Exclusive car hire benefits

Exclusive membership to Avis President's club and Hertz's President's Circle

Complimentary night's stay when booking a trip of 4 nights or more and other exclusive benefits with 'Elite I Prefer Member Status'

World-class concierge by “Ten”

24/7 travel concierge giving you truly luxurious benefits

Worldwide airport lounge access

LoungeKey TM warmly welcomes you to access 1100+ airport lounges

Luxury hotels and resorts perks

Explore 3,000+ locations with extravagant benefits incl, complimentary breakfast, room upgrades and much more

- More about Elite

No hidden fees

Currensea has no weekend charges, no foreign currency purchase fee, no dormant card fees, and no non-sterling transaction fees.

How does Currensea make its money?

Currensea pricing plans

Our plans are simple and transparent. we give you the best live exchange rate so you can spend in confidence, without the hidden fees..

Saves 85 % on bank charges*

Across card spend & ATM withdrawals

2% FX rate over £500pm

Mastercard chargeback protection

Saves 100 % on bank charges*

1% FX rate over £500pm

£ 120 /year

1% FX rate over £750pm

Send £100 - £20,000 per transfer

Mastercard World Elite travel debit card

Enjoy 4 nights for the price of 3 and other exclusive benefits with 'Elite I Prefer Member Status'

Explore 3,000+ locations with extravagant benefits incl complimentary breakfast, room upgrades and much more

*Terms and conditions apply

So, how does Currensea make its money?

How Currensea works

Giving back

We know our cards contain plastic, and we are working on different solutions to reduce this. In the meantime, we're focussed on reducing our impact and have committed to removing 2.5 times the plastic we produce every year from the world's oceans, by supporting Plastic Bank.

You may also want to offset part of your travel, so we've provided you the option to contribute a % of your savings to removing ocean plastic, and/or planting trees every time you spend.

Find out more about our commitment

Hays Travel Money Card

The Hays Travel Mastercard® is free to use in millions of locations worldwide where Mastercard® Prepaid is accepted when you spend in a currency loaded on the card: including restaurants, bars, and shops. This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals, and also 24/7 phone support. Take your currency card with you on every holiday, simply top up and go! Just call into your local Hays Travel branch today to purchase your Hays Travel Prepaid Travel Money Card. *The Hays Travel Mastercard is only available to UK residents aged 18 or over. A valid Passport or Drivers Licence must be presented in the branch at the time of purchase.

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

- BUY IN BRANCH

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

The Hays Travel Currency Card app

The Hays Travel Currency Card App enables you to fully manage your travel card account and stay in control of your holiday finances at home and abroad. The app enables you to:

- Instantly top up multiple different currencies from anywhere in the world

- Check your real time balance

- Lock-in exchange rates when you top up and transfer money between currencies

- Keep track of your spending and view transactions

- Freeze/Unfreeze your card

- Check your card PIN

- Manage your personal details

Download our app here

Manage the card on the go via Hays Travel Currency Card App

My Account Portal

Available currencies.

- British Pounds

- Australian Dollar

- Canadian Dollar

- Czech Koruna

- Japanese Yen

- Mexican Peso

- New Zealand Dollar

- Polish Zloty

- Swedish Krona

- South African Rand

- Swiss Franc

- Turkish Lira

Useful links

- Card Services Support Numbers

- Terms and Conditions

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Travel Money Cards for the UK - 2024

If you’re visiting the UK, a specialised travel money card can make it cheaper and more convenient to access British pounds for spending and withdrawals. There are various options available, such as travel debit cards, prepaid travel cards, and travel credit cards, which cater to different types of customers. The right one for you will depend on your personal preference and how you like to manage your money.

Read on for all you need to know, including a closer look at travel money card types, some great options to consider, and the sorts of fees you need to think about when you choose.

Wise - our pick for travel debit card for the UK

Before we get into details about different travel money card options, let's begin with the Wise card as a versatile travel money debit card that can hold and spend GBP , as well as a diverse range of other currencies.

Hold and exchange over 50 currencies alongside GBP

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing costs and no interest to pay

ATM fees apply once you exceed your plan limits

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

Just like your normal bank card, a travel money card can be used for online and in-store purchases, as well as for cash withdrawals. However, with a travel money card, the features and fees are tailored for global usage. This may mean you get a better exchange rate, or fewer charges, in comparison to using your regular card abroad. Some travel cards - particularly travel credit cards- also offer opportunities to earn cashback and rewards for using your card internationally.

6 travel money cards for the UK compared

Before we get into each card option in more depth, here’s a summary of how six of the best travel money cards for the UK compare to each other.

The features of various travel money cards can differ significantly. Generally, travel debit cards can be convenient and relatively inexpensive to use, while travel credit cards may offer extra benefits such as cashback or rewards. However, they also come with the risk of incurring interest and late payment fees, if you don’t pay off your bill in full every time.

Travel debit cards usually allow you to easily add funds online or via a mobile app, which helps you stick to your budget and avoid overspending. Conversely, travel credit cards enable you to spend up to your credit limit, and you can pay off the balance over several months. Which is best for you will come down to how you like to manage your money - we’ll dive into a few more details about each card type, next.

What are different types of travel cards?

Broadly speaking, Canadian customers can pick a travel money card from either a traditional bank or a specialist provider, from a selection including travel debit cards, travel prepaid cards or travel credit cards. We’ll walk through what each travel money card type is, and pick out a couple of good card options, so you can compare and choose.

1. Travel debit cards

2. Travel prepaid cards

3. Travel credit cards

1. Travel Debit Cards

Specialist providers typically offer travel debit cards, which are accompanied by digital accounts that allow you to top up, hold, and exchange currency balances. While these cards may have different features, they usually provide a user-friendly online platform and mobile app for effortless balance top-ups. With the convenience of viewing your balance and receiving transaction notifications on your phone, it’s easier to manage your finances no matter where you are in the world.

Travel debit card Option 1: Wise

Wise is our pick for travel debit card for the UK . There’s no fee to open a Wise account, and no delivery fee for your Wise card, with no minimum balance and no monthly charge. You just pay low Wise fees from 0.41% when you convert currencies, and transparent ATM fees when you exhaust the monthly free transactions available with your account.

No fee to open a Wise account , no minimum balance requirement

No fee to get your Wise card, free to spend any currency you hold

2 withdrawals, to 350 CAD value per month for free, then 1.5 CAD + 1.75%

Hold GBP and 50+ other currencies, convert between them with the mid-market rate

Get local account details to receive CAD, GBP and 7 other currencies for free

Travel debit card Option 2: Canada Post Cash Passport

You can pick up a Canada Post Cash Passport in your local Post Office, and top up your account in CAD. You can then switch your balance to any of the 7 supported major currencies - or you can just allow the card to convert to the currency you need, although there is a foreign exchange fee of 3.25% for doing so. You can use your Canada Post Cash Passport card in ATMs and wherever the network is supported. ATM fees apply which vary by currency.

Supports 7 major currencies, including GBP

No fee to spend currencies you hold in your account

Variable ATM fee, 1.7 GBP when in the the UK for example

1.5% fee for using your card in Canada - plus any applicable fee to convert funds back to CAD if you hold a foreign currency

Pros and cons of using debit travel cards in the UK

Avoid interest costs and late payment fees

Hold and exchange currencies in advance or at the time of spending

Accounts can be topped up, viewed and managed using just your phone

Safe to use, as accounts aren’t linked to your main Canadian bank account

Travel debit cards are issued on popular global payment networks

Transaction and currency conversion fees may apply

Cash back and rewards may not be available

How to choose the best travel debit card for the UK?

Choosing the best travel debit card for the UK depends on your personal preferences and financial management style. If you travel often - and not just to the UK - it's smart to consider an account that offers mid-market currency exchange rates and a wide selection of supported currencies, including GBP, like Wise. Other providers like Canada Post also support GBP alongside a handful of other major world currencies, and the Cash Passport can be conveniently collected in your local Post Office.

Is there a spending limit with a travel debit card in the UK?

Card use limits are determined by individual providers and can vary depending on the transaction type. Limits may apply on a daily, weekly or monthly basis. For instance, there may be a cap on the number or value of ATM withdrawals allowed per day or a limit on the value of contactless payments you can make. These limits are set for security reasons and can often be adjusted using the provider's app.

2. Prepaid Travel Cards

With a prepaid travel card you’ll usually need to first order a card and then add funds in CAD from your bank account or card. Once you have a balance you can then pay merchants and make cash withdrawals at home and abroad. While prepaid travel cards are usually issued on large global networks - and can therefore be used pretty widely - you may find you pay a foreign transaction fee when overseas, depending on the specific card you select.

Prepaid travel card option 1: BMO Reloadable Mastercard

The BMO Reloadable Mastercard can be topped up in CAD and used when you travel in the UK. You’ll pay a 2.5% foreign transaction fee when overseas, but you’ll still have the advantage that - as with other prepaid and travel cards - this card is not linked to your primary bank account, so it can increase security when spending abroad. There’s a 6.95 CAD annual fee, but as this is a purchase card rather than a credit card, there’s no interest to worry about. You just top up and you can spend up to your account balance freely.

6.95 CAD annual fee, 2.5% foreign transaction fee

5 CAD ATM fee

No interest to worry about

Manage your card online or using your phone, to top up and view balance

Add funds from BMO or other Canadian banks directly

Prepaid travel card option 2: Koho Premium Mastercard

You can get up to 2% cash back with the Koho Premium Mastercard, and there’s no foreign transaction fee to worry about. Instead, you pay a monthly card fee of 9 CAD. The basic card is free to get, or you can upgrade to a Koho metal card for 159 CAD if you want a fancier way to pay when you’re at home and abroad.

9 CAD/month premium fee

No foreign transaction fee

Earn cash back on your spending

Pros and cons of using prepaid travel cards in the UK

Manage your account, add more money or convert funds online or with an app

Accounts with no monthly fees are available

Issued on globally popular networks for good coverage

ATM withdrawals supported globally

Some accounts have extras like options to earn cash back or reward points

Typically only CAD supported - watch out for foreign transaction charges

Transaction fees apply to most accounts

How to choose the best travel prepaid card for the UK?

There’s no single best travel prepaid card for the UK - it’ll come down to your personal preference. If you don’t mind paying a monthly fee you might like the Koho Premium card which waives foreign transaction fees, and other charges like ATM withdrawal fees. Otherwise, if you just want a simple prepaid card and don’t mind the foreign transaction fee when you’re in the UK, the BMO prepaid card might suit you.

Is there a spending limit with a prepaid card in the UK?

Prepaid travel cards usually have different spending and withdrawal limits that can vary depending on the currency. To find the right card for you, you’ll want to carefully review the terms and conditions of each card provider you’re considering. This way, you’ll be confident you’ve picked a provider that meets your specific needs and requirements.

3. Travel Credit Cards

Travel credit cards often come with additional benefits not found in regular credit cards. These benefits can include lower or no fees for foreign transactions and the chance to earn extra rewards when using the card abroad. While travel credit cards offer safety and convenience, it's worth noting that they may be more expensive than using a debit card.

Before choosing a travel credit card, it's essential to consider factors such as fees, rates, eligibility criteria, and interest rates. Take the time to compare different options and select the one that suits you best.

Travel credit card option 1: HSBC World Elite Mastercard

The HSBC World Elite Mastercard has been optimised for overseas use, with extra rewards on international spending and travel, plus no foreign transaction fees to pay. There are lots of ways to earn rewards, including variable new customer bonus offers - the downside is that there’s an annual fee of 149 CAD, so you’ll need to check if the benefits outweigh the costs. As with any other credit card, you’ll also need to pay off your bill in full every month to avoid interest charges.

149 CAD annual fee, 5 CAD ATM withdrawal fee

Variable interest rate

Options to earn rewards, including enhanced benefits for travel spending

Travel credit card option 2: Home Trust Preferred Visa Card

The Home Trust Preferred Visa Card is a credit card with a variable interest rate, no foreign exchange fees and 1% cash back on all eligible purchases. There’s no annual fee to pay, although the ATM withdrawal fees can run pretty high - 1% or 1.5% depending on the ATM type, and the maximum cap is 15 CAD for some withdrawals.

No annual fee, no foreign transaction fee

1% cash back on all eligible purchases

ATM fees apply, which are set as a percentage, and can run pretty high

Pros and cons of using credit cards in the UK

Enjoy peace of mind with zero liability policies offered by some cards

Spread the cost of your travel expenses over several months

Some cards have no foreign transaction fees, saving you money on international purchases

Exchange rates typically offered by card networks are usually fair

Earn cash back and rewards on your spending with select cards, making your travel even more rewarding.

Interest charged if you don’t repay in full every month

Eligibility rules apply

How to choose the best travel credit card for the UK?

Selecting the best travel credit card for the UK largely depends on individual preferences. If you aim to earn rewards and cashback on your foreign transactions, the Home Trust Preferred Visa may be a suitable option as it does not have a foreign transaction fee and provides cash back on all purchases. Whichever card you’re considering you’ll want to weigh up the potential fees you’ll need to pay against the rewards you can earn to make sure it’s worthwhile.

If you regularly travel to the UK or further afield, getting a travel money card which supports the currencies you need frequently can help you save money. Travel money cards have different features, and can be picked up via regular banks, online specialists and even the Post Office.

You could opt for a low cost travel debit card which comes with a linked account to hold a selection of currencies - like the Wise account. Or you might prefer a prepaid travel money card like the Koho Premium Mastercard which has monthly fees in exchange for features like no foreign transaction charges - handy if you use it abroad often. Finally, another option is to get a travel credit card either to earn cashback and rewards, or to avoid foreign transaction fees.

The good news is that the Canadian market is well served for all types of travel money cards - use this guide to start your research and pick the right option for your specific needs.

FAQ - Best travel cards for the UK

You can usually make cash withdrawals with a credit card in the UK at any ATM that supports your card network. You’ll often find that a fee applies, and you may start to accumulate interest on the withdrawn amount immediately. Travel money debit cards from providers like Wise and Canada Post can be a lower cost option for cash withdrawals overseas.

You can use your debit card anywhere you see the card network’s logo displayed. Visa and Mastercard networks are very well supported globally, including in the UK, making these good options to look out for when you pick your travel debit card for the UK.

Prepaid cards from reputable providers are safe to use at home and abroad. They aren’t linked to your main bank account which can offer extra peace of mind, and may also make it easier to manage your travel budget. However, you’ll need to check the card features and fees carefully to make sure you're getting the best match for your needs.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Help & Support

Help and support Travel Money Card

Manage and top up your Travel Money Card account online. Find the answers to the most frequently asked questions. Or get in touch with our travel team if you still need to.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Common Travel Money Card questions

- Before you go

- Currency questions

- While you’re away

- Lost cards and leftover funds

Do I have to pass a credit check to purchase a Travel Money Card?

No. We’ll carry out an electronic address verification check based on the information you provide. This will be stored but will not affect any credit rating.

How long will my card take to arrive?

If you order your card online it will be delivered to your home address in two to three working days. If you require a card in a shorter time please check with your local Post Office branch. Exchange rates vary between online and branch.

What do I need to do before I travel?

Before leaving the UK, make sure you have activated your Travel Money Card. Activation can be done through the free Post Office Travel app – download now from the Apple App Store or Google Play . The app allows you to top up, track spend, view balances and freeze spend.

Activation can also be done by calling our automated line on +44(0) 20 7937 0280. Full details can be found on the letter that comes attached to you your card.

How do I get my PIN / Change my PIN?

To get your PIN, download the free Post Office Travel app from the App Store or Google Play , create an account and you can check your PIN wherever you are in the world.

Alternatively, you can call our automated line on +44 (0)20 7937 0280 and select Option 1. Your change of PIN can only be done at UK ATM’s that accept Mastercard and offer the PIN change facility.

Which currencies can I load on my card?

You can load any of the following currencies on to your card. The card can hold up to 22 currencies at once, but they can only be loaded one at a time:

Euro, US dollars, Australian dollars, Canadian dollars, New Zealand dollars, Thai baht, UAE dirham, Turkish lira, South African rand, Swiss francs, Polish zloty, pounds Sterling, Chinese yuan, Czech koruna, Danish kroner, Hong Kong dollar, Hungarian forint, Japanese yen, Norwegian krone, Saudi riyal, Singapore dollar or Swedish krona.

Which currency should I load?

We recommend that you load the currency of the country that you’re travelling to. If we don’t offer that currency we recommend that you load pounds Sterling on to your card.

Should I pay in Sterling if given the choice while abroad?

We recommend that you always pay in the local currency and not Sterling. This will prevent high fees and very poor exchange rates being applied at an ATM or retailer. This is known as Dynamic Currency Conversion (DCC) . We include information about DCC in every card pack.

Using your card abroad

Where can i use my card.

Your card can be used wherever Mastercard is accepted.

Is there anywhere that my card won’t work?

We have to authorise your card immediately which means a small number of locations may not be able to take your card. This includes unmanned petrol pumps, toll booths and on board cruise ships or aeroplanes.

Anywhere I shouldn’t use my card?

We recommend that your card is not used to pay deposits on car hire or used when checking in to hotels that require a deposit. Both of these could lead to funds being held by the retailer, which would prevent you from using them.

Can I withdraw money from ATMs?

Yes you can. You can use any ATM that’s accepts Mastercard. Fees will apply for every cash withdrawal. These fees are detailed online or on your welcome letter. Please be aware that some ATMs may also charge you and this should always be displayed on the ATM screen. We always recommend that you withdraw cash in local currency and don’t choose to pay in Sterling or accept their currency conversion.

Topping up and managing currencies

How can i top up my card with more money.

The easiest way is via our mobile app, which is available to download from the App Store or on Google Play .

You can also top up via our website if you’ve created an account. And you can ask friends or family to top up on your behalf in any UK Post Office branch, too. All they need is your card number.

Can I top up with a different currency to the one I loaded in the first place?

Yes, you can. Our multi-currency card allows you to load any of the 22 currencies we offer.

Do I have to move money from one currency to another?

No, you don’t have to move money. If you have money in one currency and spend in a different currency we’ll automatically move this for you to authorise a transaction. Alternatively, you can move the funds using the "Transfer" icon on the free Post Office Travel app ( App Store , Google Play ) or "Transfer to another wallet" icon if managing your account online .

How can I track my balance?

The easiest way is to use our mobile app. This shows clearly what your remaining balance is in each currency. We do not recommend the use of ATMs to check your balance as they will provide a GBP figure using a different exchange rate. Remember, your balance is held in each currency so is not affected by exchange rates unless you change it to other currencies.

Download the Post Office Travel app from the Apple App Store or Google Play .

What do I do if my card is lost or stolen?

You need to call us immediately on +44 (0) 20 7937 0280. We’re here 24 hours a day.

We’ll cancel your card and work out the best way to replace it. A fee may be charged if we need to courier a replacement card overseas.

If you think you have misplaced your card and want peace of mind, you can freeze spend on your card using the Post Office Travel app, available on the App Store and Google Play . You can unfreeze just as easily if you find your card again.

I have money left on my card. What do I do?

You have 4 options available to you:

- Leave the money on your card for your next holiday

- Visit any Post Office branch and withdraw the balance over the counter in Sterling. There is a daily withdrawal limit of £300 per day

- Spend your money in the UK as normal. We will move the money to Sterling every time you pay for something. Anything you don’t spend stays in the currency you have on the card. No fees apply, we just use the day’s exchange rate

- Call us to ask for a refund. Please note that you will get a better exchange rate by spending on your card or withdrawing cash from a Post Office branch

- Other sections:

Manage your card with our app

Order, top up and view the balance of your Travel Money Card, and transfer leftover currency funds to a new currency of your choice.

Post Office Travel app

Download our free app for your mobile device:

Lost or stolen cards

If your card’s been lost or stolen, we’re here to help. Lines open 24 hours a day, 7 days a week

Call us 24/7

Please call our Travel Money card team immediately on: 0207 937 0280

We’ll cancel your card and work out the best way to replace it.

Contact us about using your card

Need help managing your Travel Money Card and transactions and can't find the answer you need in our FAQs above or self-service tools? Our team's here for you.

Transactions and managing your card

For enquiries about transactions or managing your card online or via the app, call: 0207 937 0280

Manage your card online

Log into your online account top up your Travel Money Card, view your transactions and more all in one place.

Top up with currencies, check recent transactions, freeze your card and more online.

Contact Post Office about in-branch services

If you have a question, feedback or a complaint about services provided in Post Office branches, including getting a Travel Money Card there, here's how to get in touch with us.

Send us a message

Please complete our enquiries form to tell us what you’d like to know or share feedback on your experience.

Make a complaint

If you’re not happy with your Post Office experience, please let us know and we’ll do our best to put things right.

Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Revolut is available in many countries. You can double-check if it's available in yours below:

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 7.9

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.1

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

These are the countries in which you can order a Wise debit card:

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

- Customer Satisfaction 8.7

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.