Book your car rental with MileagePlus ® Car Awards

Explore an extensive range of Avis and Budget vehicles using MileagePlus miles.

Perks of booking an Avis or Budget rental car with MileagePlus Car Awards

- Sign in to your MileagePlus account for the best pricing

- Pay with miles or a combination of miles & money

- To make changes/cancellations on a booking where miles were used, please visit our help center

Complimentary Avis elite status

We take care of our customers

Limited time special offer:

Earn up to 1,500 bonus miles for select rentals completed by June 30, 2024.

Book a rental car through United

- Save up to 35% off base rates* from Avis and Budget.

- Earn up to 1,250 MileagePlus base miles

- Avis: Use your MileagePlus number and Avis Worldwide Discount (AWD) number A791500 to earn MileagePlus base award miles and a discount.

- Budget: Use your MileagePlus number and Budget Customer Discount (BCD) number B204900 to earn MileagePlus base award miles and a discount.

- To use miles, or miles & money, visit cars.mileageplus.com

- Special offer: Between April 2, 2024 and June 30, 2024, complete a qualifying rental of 2-4 consecutive days to earn 500 United MileagePlus bonus miles; complete a qualifying rental of 5 or more consecutive days to earn 1,500 United MileagePlus bonus miles. Full terms here.

*The savings of up to 35% applies to the time and mileage charges only. All taxes, fees (including but not limited to Air Conditioning Excise Recovery Fee, Concession Recovery Fee, Vehicle License Recovery Fee, Energy Recovery Fee, Tire Management Fee, and Frequent Traveler Fee) and surcharges (including but not limited to Customer Facility Charge and Environmental Fee Recovery Charge) are extra.

Earn miles with Avis and Budget

Complimentary Avis elite status

We take care of our customers, explore deals at our top destinations, san francisco.

Flights, credit cards and more: How to earn miles with the United MileagePlus program

United MileagePlus miles may not be as valuable as they once were, but they have their place.

You can use them for United Airlines and Star Alliance partner awards with no fuel surcharges, saving you hundreds of dollars per ticket. Further, the airline frequently offers low-cost domestic award tickets and reasonable pricing on long-haul international business class tickets operated by United.

It's also easy to redeem United MileagePlus miles . United's website is well designed and shows nearly all available Star Alliance flights online. Because of this, it's an excellent program for points and miles newcomers who want to earn and redeem miles quickly.

In this article, I'll show you the best ways to earn United miles — many of which don't require stepping on a plane.

New to The Points Guy? Sign-up for our daily newsletter and check out our beginner's guide .

Earn United miles by flying

As you'd expect, you can earn United miles by flying with the carrier or one of its partners. However, how you earn United miles depends on several factors, including the airline operating the flight, how you booked the flight and your fare class . Let's take a closer look.

Flying on United

Over the years, United has changed how you earn miles when flying on United-operated flights. Instead of earning based on miles flown, you now earn MileagePlus miles based on your ticket's base price (minus taxes). You'll also earn additional miles if you have MileagePlus elite status — the higher your status, the more miles you earn.

Here's how many miles you'll earn per dollar spent based on your level of status:

- General member : 5 miles.

- Premier Silver : 7 miles.

- Premier Gold : 8 miles.

- Premier Platinum : 9 miles.

- Premier 1K : 11 miles.

Here's an example of how this works. If you buy a one-way United ticket from Chicago to Des Moines with a base fare of $210 and $30 in taxes, you'll earn 1,050 miles as a MileagePlus traveler without status. However, if you're a top-tier Premier 1K member, that earning jumps to 2,310 miles.

Note that these earning rates apply even if you're booked into United's basic economy fare class.

United flights also count toward earning Premier status, though the carrier changed this process significantly for the 2020 qualification year. Instead of earning status based on miles flown, you'll now earn it based on how many Premier qualifying points (PQP) you earn or a combination of how many PQPs you earn and Premier qualifying flights (PQF) you take.

PQP is determined based on how much you spend on flights and PQF is based on the number of segments flown on United or its partner airlines.

Related: What is United Airlines elite status worth?

Flying Star Alliance partners

You can earn United MileagePlus miles when flying any of United's Star Alliance or non-alliance partners — but it can be a little tricky.

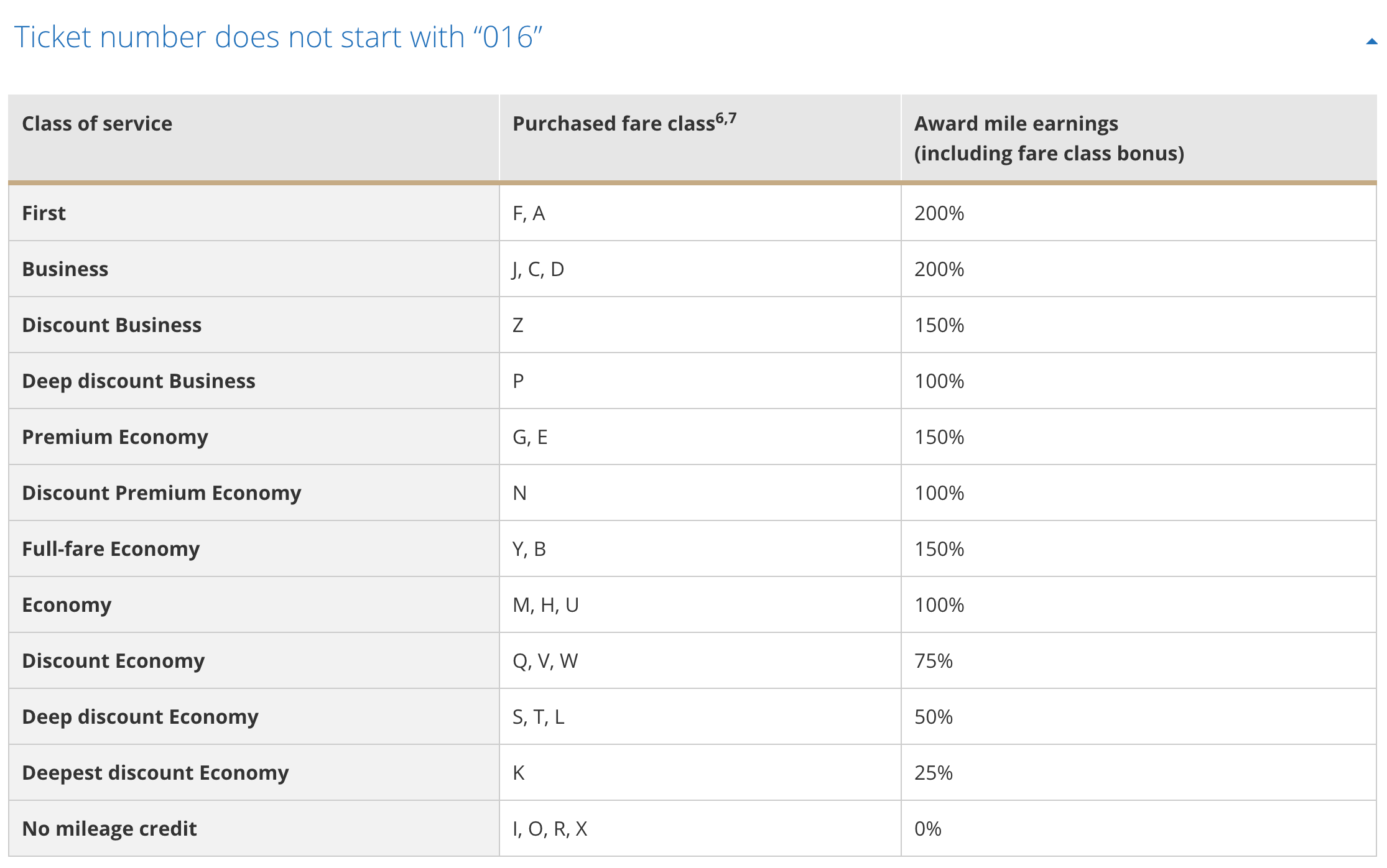

Suppose you book a partner flight through United with a United Airlines ticket number. In that case, you'll earn miles the same as if you were flying on a United-operated flight: based on the base fare of your ticket and your elite status level (as detailed above). However, if you book the ticket on a partner ticket stock, you'll earn miles based on your fare class and how long your flight is.

Fares are usually booked on a partner ticket stock when you book directly through the partner airline. For example, if you're flying on Lufthansa and booked on Lufthansa.com, you're almost definitely booked on Lufthansa ticket stock. If you book through an online travel agency (OTA) like Orbitz or a credit card portal like the Chase Ultimate Rewards Travel Portal or Amex Travel , these methods may book you on partner ticket stock.

You can verify that a ticket was booked on partner ticket stock by looking at the e-ticket issued after booking. If the ticket number starts with 016, it's on United ticket stock.

The mileage earning rates vary from airline to airline. So check your booking class by looking at your ticket or calling the airline. Then, head over to United's list of partner airlines , click on your airline and find the corresponding fare class on that list.

To figure out how many miles you'll earn, just multiply the mileage flown by the percentage in the "Award mile earnings" column. As you'd expect, fares booked in premium cabins generally earn more miles than economy tickets.

United elite status on partner flights

One of the best ways to qualify for United Premier status is by flying on long-haul, premium-cabin Star Alliance tickets. As mentioned, you generally earn around 1 PQP per dollar spent on United flights. However, on partner airlines, you can sometimes earn over 3 PQPs for each dollar you spend.

Refer to our guide on earning PQPs with partner flights to learn how flying on United's partners can help you qualify for United status. Just keep in mind that United requires at least four paid flights per year to be on United or United Express to qualify for any status level.

On tickets ticketed and operated by Air Canada , ANA , Austrian , Azul , Brussels , Lufthansa and SWISS , Premier members earn bonus miles (but no bonus PQPs):

- Premier Silver : 25% bonus.

- Premier Gold: 50% bonus.

- Premier Platinum : 75% bonus.

- Premier 1K : 100% bonus.

Let's unpack this by looking at a real example on a Lufthansa ticketed and operated flight. We'll start with United's earning chart for Lufthansa.

Let's say you're flying from New York to Munich. Your flight is booked in Z-fare business class, meaning that you'd earn 150% of the mileage flown as per the earning chart above. The flight from New York to Munich clocks in at 4,038 miles, so you'd earn 6,057 redeemable miles. The math looks like this: 4,038 * 1.50 = 6,057.

As noted above, a United Premier Gold member would earn an additional 50% of miles flown, giving them 9,086 miles for this example. Here's the math: (4,038 * 1.50) * 1.50 = 9,085.5, which would round up to 9,086.

To determine the distance between two airports, use GCmap.com and input your departure and arrival airport codes. It'll then tell you how far apart the two are in miles.

Related: Your ultimate guide to United Airlines partners

Earn miles with United credit cards

You have a few options for earning United miles with credit cards. The most obvious of these is earning miles with United credit cards . You can quickly rack up miles using these cards to pay for your everyday spending. Additionally, each card has a lucrative welcome bonus that can give you a huge amount of United miles right off the bat — so long as you meet the minimum spending requirement .

Finally, all the cards come with enhanced award availability when it's time to redeem your hard-earned miles. Here's a look at all the different credit cards you can use to earn United miles.

United Quest Card

Annual fee: $250.

Sign-up bonus: Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first three months your account is open.

Earning miles: The card earns 3 miles per dollar on United purchases, 2 miles per dollar on dining, travel and select streaming services and 1 mile per dollar elsewhere.

Card perks: The United Quest Card — the most recent addition to Chase's United portfolio — offers many perks to United frequent flyers. The card comes with a first and second checked bag for you and one travel companion when flying United. Plus, you get the following benefits:

- 25% back on United inflight purchases.

- Up to $125 in statement credits as reimbursement for United purchases charged to your card each account anniversary year.

- Get 5,000 miles back per award ticket, up to 10,000 miles per anniversary year. terms apply

- Priority boarding.

- Premier upgrades on award tickets (if you have United elite status ).

- Up to $100 in statement credits every four years to reimburse a Global Entry , TSA PreCheck or Nexus application fee.

Application link: United Quest Card.

United Explorer Card

Annual fee: $0 annual fee for the first year, then $95.

Sign-up bonus: Earn 50,000 bonus miles after you spend $3,000 on purchases in the first three months your account is open.

Earning miles: The card earns 2 miles per dollar on United purchases, dining and direct hotel purchases, and 1 mile per dollar elsewhere.

Card perks: Aside from earning miles, the United Explorer Card also offers several card perks that make it worth keeping in your wallet. The card comes with a free first checked bag for you and one travel companion. In addition, you get the following benefits:

- Two one-time United Club passes each year.

Application link: United Explorer Card

United Club Infinite Card

Annual fee : $525.

Sign-up bonus: Earn 80,000 bonus miles after you spend $5,000 on purchases in the first three months from account opening.

Earning miles: The card earns 4 miles per dollar spent on purchases with United and 2 miles per dollar spent on all other travel purchases, dining and eligible food delivery services . All other purchases earn 1 mile per dollar spent.

Card perks: The United Club Infinite Card offers premium benefits in exchange for a hefty annual fee. In addition to a Global Entry, TSA PreCheck or Nexus credit of up to $100 every four years, the card offers the first and second checked bag free for you and a travel companion. Cardholders also get a United Club membership, Premier Access, 25% back on inflight purchases and more.

Application link: United Club Infinite Card.

United Business Card

Annual fee : $0 annual fee for the first year, then $99.

Sign-up bonus: Earn 75,000 bonus miles after you spend $5,000 on purchases in the first three months your account is open.

Earning miles: Earn 2 miles per dollar on United purchases, at gas stations, on dining (including eligible delivery services), at office supply stores, on local transit and commuting (including ride-hailing services, taxicabs, train tickets, tolls and mass transit) and 1 mile elsewhere. You'll also earn 5,000 bonus miles each card anniversary when you have both the United Business Card and a personal United credit card.

Card perks: The United Business Card offers a free first checked bag benefit to cardholders and a travel companion. Other perks include priority boarding and 25% back on inflight United purchases.

Application link: United Business Card.

Transfer Ultimate Rewards points to United

Chase Ultimate Rewards is a popular transferable point currency . Although there are many ways to redeem Ultimate Rewards points, the most lucrative is to transfer points to one of Chase's airline or hotel transfer partners .

United is one of Chase's airline transfer partners. So, you can transfer Chase points to United at a 1:1 ratio, effectively turning 1,000 Ultimate Rewards points into 1,000 United miles. Ultimate Rewards has various other transfer partners, including Air France-KLM Flying Blue , British Airways Avios and World of Hyatt . This added flexibility is why we recommend earning Ultimate Rewards points over United miles.

Chase's suite of Ultimate Rewards-earning credit cards may be a better fit for your wallet. They have broader bonus categories than United's cobranded cards. So, even if you only plan on transferring your points to United, there's a good chance you'll come out ahead with an Ultimate Rewards card.

Here are some of our favorite Ultimate Rewards-earning credit cards that you may want to add to your wallet.

Chase Sapphire Preferred Card

Annual fee: $95.

Sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

Earning points: The card earns 5 points per dollar on travel purchased through Chase Ultimate Rewards, 3 points per dollar on dining (including eligible delivery services, takeout and dining out), 3 points per dollar on select streaming services, 3 points per dollar on online grocery purchases, 2 points per dollar on all other travel and 1 point per dollar on all other purchases.

Card perks: Chase Sapphire Preferred Cardholders get a complimentary DoorDash Dashpass for a minimum of one year. Cardholders also earn 5 points per dollar on Lyft rides through March 2025. Points redeemed through the Ultimate Rewards Travel portal are worth 25% more.

Application link: Chase Sapphire Preferred Card.

Chase Sapphire Reserve

Annual fee: $550.

Earning points: The Chase Sapphire Reserve earns 10 points per dollar on hotels and car rentals when you purchase travel through Chase Ultimate Rewards, 5 points per dollar on flights when you purchase travel through Chase Ultimate Rewards, 3 points per dollar on dining and travel , and 1 point per dollar on other purchases.

Card perks: Cardholders get various travel benefits, like a $300 travel credit each account anniversary year, a Priority Pass Select membership and up to $100 in statement credits every four years to reimburse a Global Entry , TSA PreCheck or Nexus application fee. Additionally, points redeemed through the Ultimate Rewards Travel portal are worth 50% more.

Application link: Chase Sapphire Reserve.

Ink Business Preferred Credit Card

Sign-up bonus: Earn 100,000 bonus points after you spend $8,000 on purchases in the first three months after account opening.

Earning points: The card earns 3 points per dollar on select business purchases (up to $150,000 in purchases per account anniversary year) and 1 point per dollar on all other purchases.

Card perks: The Ink Business Preferred card offers free employee cards and the ability to redeem points for 1.25 cents each toward travel booking through the Ultimate Rewards portal.

Application link: Ink Business Preferred card.

The only downside to getting an Ultimate Rewards credit card over a United cobranded card is the benefits; these cards don't offer free checked bags, priority boarding or other United benefits. The Sapphire Reserve does offer other travel benefits like a Priority Pass Select membership . Still, United flyers may not find it as valuable as a United Club membership on domestic flights.

Related: The power of the Chase Trifecta: Sapphire Reserve, Ink Preferred and Freedom Unlimited

Earn United miles with Marriott Bonvoy credit cards

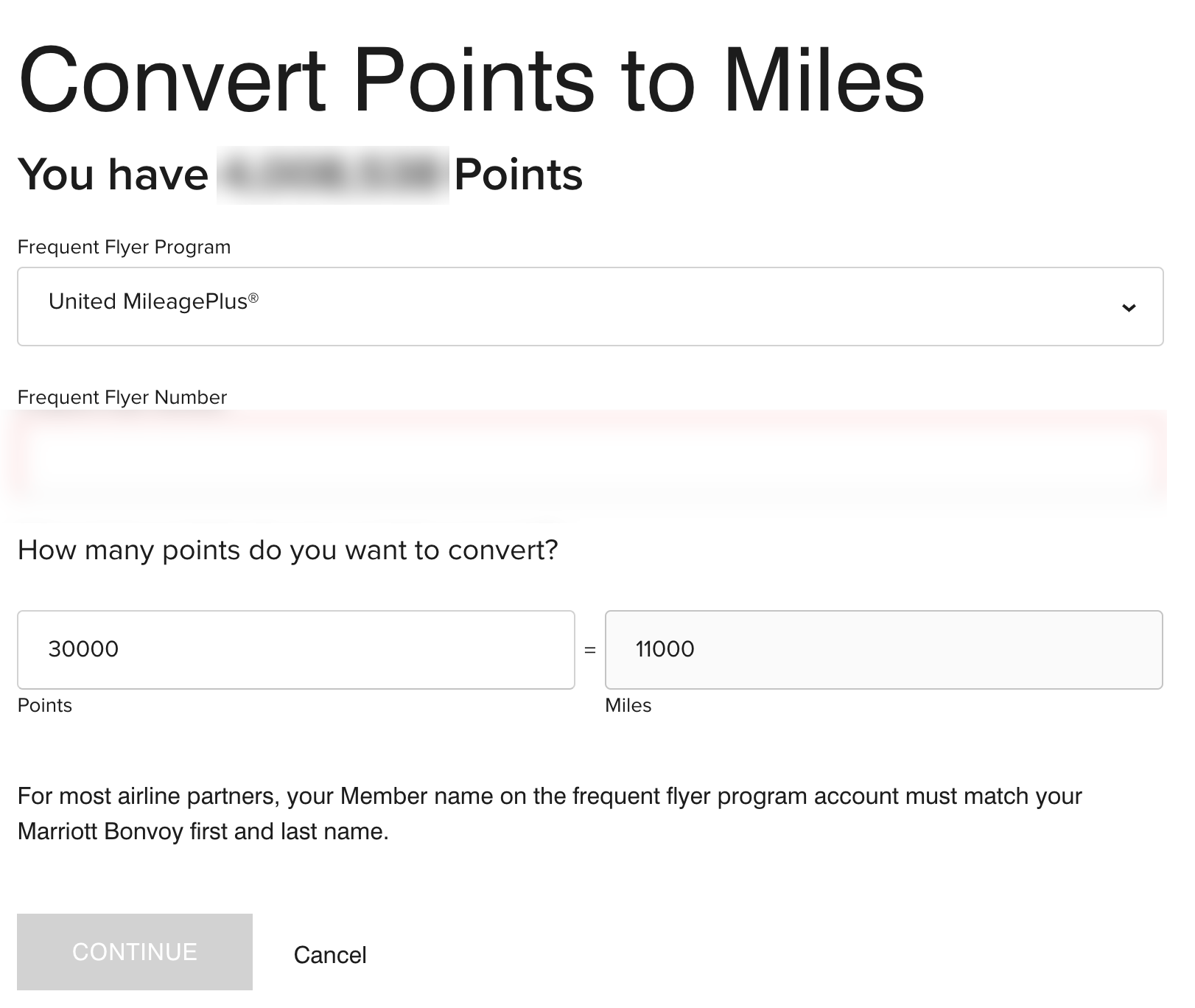

One of the Marriott Bonvoy program's best perks is that you can transfer Marriott points to the program's many airline transfer partners . You can transfer Marriott points to most airline partners at a 3:1 ratio, meaning three Marriott points equal one airline mile. Plus, you'll get a 5,000-mile bonus for every 60,000 Marriott points you transfer.

United has a preferred transfer rate due to the airline's RewardsPlus partnership with Marriott . As of the time of writing, Marriott points transfer to United MileagePlus at a 3:1.1 ratio. This is in addition to the 5,000-mile bonus we mentioned earlier, so transferring 60,000 Marriott points to United results in 27,000 United miles.

Related: When does it make sense to transfer Marriott points to airlines?

To transfer Marriott points to United, log into your Marriott Bonvoy account, head to the Transfer Points to Miles page and click the Transfer Points button at the center of the screen. Then, select United from the airline drop-down menu, enter your United MileagePlus number and enter how many points you'd like to transfer. Click the Continue button at the bottom of the window to initiate the transfer, and the miles will appear in your United account within 48 hours .

You can earn Marriott points in various ways, but the easiest way is through the program's cobranded credit cards. Here's a look at the best Marriott cobranded credit cards currently offered:

Marriott Bonvoy Boundless Credit Card

Sign-up bonus: Earn three Free Night Awards (each night valued up to 50,000 points) after spending $3,000 in the first three months of account opening. Certain hotels have resort fees.

Earning points: The card earns 6 points per dollar at Marriott Bonvoy hotels, 3 points per dollar on the first $6,000 spent in combined purchases each year on gas stations, grocery stores and dining and 2 points per dollar on all other purchases.

Card perks: Marriott Bonvoy Boundless Credit Card holders get an annual free night certificate, good for a property requiring up to 35,000 points per night, every year after their account anniversary. The card also offers 15 elite night credits per year and Marriott Bonvoy Silver Elite status each account anniversary year as a cardmember. Certain hotels have resort fees.

Application link: Marriott Bonvoy Boundless Credit Card.

Marriott Bonvoy Brilliant® American Express® Card

Annual fee: $650 (see rates and fees ).

Welcome bonus : Earn 185,000 Bonus Marriott Bonvoy Points after you spend $6,000 in purchases on the card in your first six months.

Earning points: The card earns 6 points per dollar at hotels participating in the Marriott Bonvoy program, 3 points per dollar at worldwide restaurants and on flights booked directly with airlines and 2 points per dollar on all other eligible purchases.

Card perks: The Marriott Bonvoy Brilliant® American Express® Card comes with several valuable perks, like Platinum Elite status.

Cardholders also get up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide The card also includes a free night every year after your card renewal month that's redeemable at hotels requiring 85,000 points or less per night, Priority Pass Select membership and a statement credit toward a Global Entry (up to $100 every 4 years) or TSA PreCheck (up to $85 every 4.5 years) application fee. Enrollment is required for select benefits and certain hotels have resort fees.

Application link: Marriott Bonvoy Brilliant American Express Card.

Marriott Bonvoy Business® American Express® Card

Annual fee: $125 ( rates and fees ).

Welcome bonus : Earn three free night awards after you use your new card to make $6,000 in eligible purchases within the first six months of card membership. Redemption level up to 50,000 Marriott Bonvoy points for each bonus free night award, at hotels participating in Marriott Bonvoy. Certain hotels have resort fees.

Earning points: The card earns 6 points per dollar of eligible purchases at hotels participating in the Marriott Bonvoy program, 4 points per dollar at restaurants, U.S. gas stations, U.S. wireless telephone services purchased directly and U.S. purchases for shipping and 2 points per dollar on other purchases.

Card perks: The Marriott Bonvoy Business® American Express® Card card comes with automatic Marriott Gold Elite status, 15 elite night credits each calendar year toward the next elite level and an annual free night each year after your card renewal month that's valid at hotels participating in the Marriott Bonvoy program requiring 35,000 points or less.

Application link: Marriott Bonvoy Business American Express Card.

Earn United miles with travel partners

Beyond airlines, United has a handful of other travel partners like cruise lines, hotels and rental car companies. Here's a quick look at all some of these partners and how to earn with them.

MileagePlus cruise portal

The MileagePlus cruise portal lets you earn and redeem United miles for booking a cruise.

While the earn and redemption rates vary, you can typically get around 0.6 cents per mile. This is significantly less than the 1.4 cents TPG values United miles . So you're better off using the booking portal to earn United miles on your cruise. It's not unusual to earn up to 45,000 bonus miles per booking, even on low-cost cruises.

Related: 6 reasons hardcore cruisers can't stop cruising

Booking hotels with United partners

United has a suite of hotel partners, too. You can earn miles based on your hotel stay costs using the United Hotels portal, RocketMiles and Points Hound. Each of these online travel agencies (OTAs) lets you book and pay through their website to earn miles on your hotel stays.

Unfortunately, you won't earn hotel points or get hotel elite status benefits when booking through these portals. We only recommend booking independent hotels and stays at hotels where you otherwise wouldn't earn rewards. Further, always make sure to compare the cost of the stay with booking directly.

United also has a partnership with Villas of Distinction , where you can earn 3 miles per dollar on luxury vacation villas.

You can also earn United miles when you book directly with a handful of United's travel hotel partners. Sometimes this means you'll earn based on the price of your hotel stay. Other times it means transferring points from a hotel program to United MileagePlus.

Here's a look at how many miles you can earn:

Rental car partners

United recently ended its partnership with Hertz and now has a relationship with Avis and Budget .

MileagePlus members can earn up to 1,250 award miles per qualifying rental. Also, get savings of up to 35% off with the MileagePlus Avis Worldwide Discount (AWD #) A791500 and Budget Customer Discount (BCD #) B204900.

Here's what you can expect to earn on an Avis or Budget rental with your status:

- No status : 500 miles.

- MileagePlus Chase cardmembers : 750 miles.

- Premier Silver and Gold members : 1,000 miles.

- Premier Platinum and Premier 1K members : 1,250 miles.

Related: How to never pay full price for a rental car

United packages

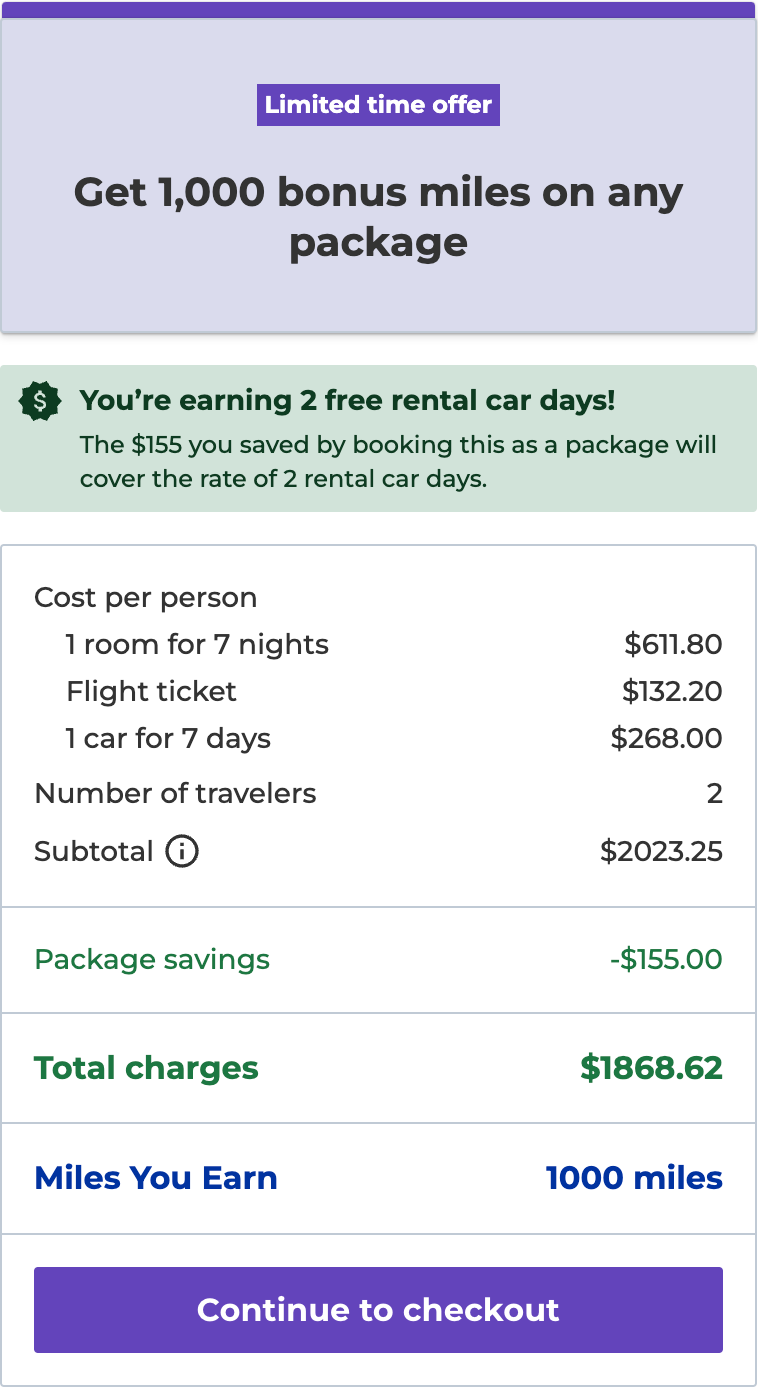

United also offers vacation packages where you can book a flight and hotel; flight and car; or a flight, hotel and car. Priceline powers this service. When I ran a seven-night flight, hotel and car package search from San Francisco to Los Angeles, it clocked in at just under $2,000 with a compact car from Budget and a standard king room at the Sheraton Gateway Los Angeles Hotel.

By booking a package, I'd get two free rental car days and 1,000 bonus miles as a limited-time offer.

Earn United miles with other partnerships

While flying and using cobranded credit cards are the primary methods to earn United miles quickly, there are also many non-travel-related MileagePlus partners. Here are some of our favorites to help you earn extra United miles.

MileagePlus Shopping

Like most airlines, United operates an online shopping portal ( MileagePlus Shopping ), where you can earn miles for making everyday purchases online. Just sign up for an account and find your merchant on the site before making a purchase.

Starting at this portal rather than the specific retailer's site will give you extra miles on your purchases in addition to the rewards you'll earn using your credit card of choice. This can be a great way to earn 1, 2 or even 5 additional miles when shopping online.

In addition, MileagePlus Shopping frequently runs holiday and seasonal promotions . Keep an eye out for these promotions and use them to earn even more on your online purchases.

However, we recommend using a shopping portal aggregator like Cash Back Monitor to see which portal offers the best return on your purchases.

Related: Which credit card should I use in shopping portals?

MileagePlus X app

Download the MileagePlus X app to earn United miles on the go. Simply put, you use the app to buy gift cards to select merchants. The gift card is available immediately and you can purchase it in any amount. When making a MileagePlus X purchase, you'll earn a select number of miles per dollar.

Participating merchants include major brands like Walmart, Staples and Panera Bread. Be sure to give it a look before you make your next purchase. One of the best things about the MileagePlus X app is that miles are awarded instantly in most cases. So if you're ever a few miles away from a redemption, buy a gift card to a store or restaurant you frequent.

Best of all, primary United Chase Cardmembers earn a 25% bonus on miles earned from MileagePlus on eGift Card purchases.

Related: Here's why it matters which card you use to pay in the United MPX app

United MileagePlus Dining

Like most other domestic carriers, United has a dining rewards program that's part of Rewards Network: MileagePlus Dining .

In short, this is a shopping portal for eating out. Just sign up for an account and link the credit cards you use for dining . You'll earn up to 5 miles per dollar when you swipe a linked card at participating restaurants. These earnings are in addition to what you earn on the credit card you use, so be sure to use one that offers a category bonus on dining purchases.

To maximize your earnings with MileagePlus Dining, you'll want to get select status and try to snag VIP status. Becoming a select member is easy: sign up for the program and enable email alerts. Doing so will get you an earning rate of 3 miles per dollar.

Once you've made 11 dining purchases in twelve months, you'll reach VIP status and start taking home 5 miles per dollar. If you don't opt in to receive emails from MileagePlus Dining , you're considered a basic member (and will only earn 1 mile per $2 spent).

Related: 10 of the most generous airline and hotel dining rewards programs

Small businesses can earn rewards with PerksPlus

United's PerksPlus program lets businesses earn rewards on employee travel. Sign up for the program and you'll be issued a PerksPlus number that you, your employees and your travel agent can add to work-sponsored travel operated by United, All Nippon Airways (ANA), Austrian Airlines, Brussels Airlines, Lufthansa and SWISS. Your business will earn PerksPlus points based on the cost of a ticket.

You can redeem these points for United elite status for employees, award travel certificates, United Club memberships and more. You can use these to reduce employee travel costs or enhance your travel experience. PerksPlus points are earned in addition to the miles an employee earns when traveling, so both parties win. Check out United's PerksPlus website to learn more and enroll.

Related: Airline loyalty programs for small businesses

Buy United miles

If you need United miles in a pinch, you can opt to buy them from the airline. Unfortunately, however, it's usually quite expensive to do this. The standard price for United miles is well over 2 cents per mile, which is rarely worth it unless you need to buy a small number of miles to top up for an award.

United frequently runs mileage sales that drop the cost of miles considerably. Even so, you should only buy miles when you have a specific redemption in mind and have already found bookable award space. Be sure to compare the cost of an award ticket against the cash fare before booking with miles.

Bottom line

As you can see, there are many ways you can earn United miles. The most robust approach is to use the above methods in tandem. If you use all of the discussed earning methods at once, you'll unlock some terrific earning rates that will quickly get you within striking distance of your next award trip .

We recommend starting with a credit card to earn United miles on everyday purchases and then moving on to the other methods discussed. This will ensure you're leaving no miles on the table when you book travel and make everyday purchases.

For rates and fees of the Marriott Bonvoy Business Card, click here . For rates and fees of the Marriott Bonvoy Brilliant Amex, click here .

Additional reporting by Kyle Olsen.

Feature photo by AaronP/Bauer-Griffin/GC Images.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to United Airlines Partners

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

United Star Alliance partners

Other united airline partners, united hotel partners, united travel partners, ways to earn united mileageplus miles, united partners can help you make the most of non-united spending.

If you have United MileagePlus miles, you can spend them on airlines other than United Airlines. And you don’t have to solely fly on United Airlines to earn United MileagePlus miles.

United Airlines has an extensive network of partners that includes other airlines, plus hotels, rental car companies and retail outlets that serve as sources to earn and redeem United miles .

» Learn more: The best airline credit cards right now

Like most of the major U.S. airlines in operation, United Airlines is a founding member of the Star Alliance , which is the largest airline alliance in the world.

There are currently about two dozen United Star Alliance partners . Fly with any of them and offer up your United MileagePlus member number during booking to earn or redeem miles for travel. Award tickets on all United partners can be booked on United.com (just as you would book any other United Award tickets), which makes for a fairly easy booking process (no having to wait for transfer delays or sitting on hold on the phone)

You’ll even be able to use your bookings to work toward Star Alliance elite status.

Aegean Airlines.

Air Canada.

Air New Zealand.

All Nippon Airways (ANA).

Asiana Airlines.

Austrian Airlines.

Brussels Airlines.

Copa Airlines.

Croatia Airlines.

Ethiopian Airlines.

Lot Polish Airlines.

Scandinavian Airlines.

Shenzhen Airlines.

Singapore Airlines.

South African Airways.

TAP Air Portugal.

Thai Airways.

Turkish Airlines.

Having so many major airlines in one alliance is convenient for frequent travelers for several reasons. First, it means you can earn miles with one airline and use them for award travel on another. For example, you can earn United MileagePlus miles on a United flight or via other partner flights, then redeem those miles for, say, a flight to Ireland on Aer Lingus or Belgium on Brussels Airlines.

It also means you could save hundreds of miles by booking with airline partners using another airline’s miles. In some cases, for example, a flight on a partner airline might require fewer MileagePlus miles than the airline’s own miles.

And since there are over 35 United Airlines flight partners to choose from (plus plenty of other travel partners), MileagePlus members have access to a wide range of travel options, including flights to nearly 200 countries. Here are the details on United Airlines partners and how to earn or redeem miles for travel with them.

Beyond Star Alliance, United also currently has more than a dozen other partner airlines that aren't in an alliance. These are airlines United partners with to increase its list of available destinations, but there may be some restrictions on earning or redeeming miles for every flight (Hawaiian Airlines, for example, offers the ability to earn United miles on interisland flights only, while miles earned on Edelweiss are restricted to specific flight numbers).

So when booking on one of these partner airlines, check the details to see when and where you can use or earn MileagePlus miles.

Aer Lingus.

Air Dolomiti.

Boutique Air.

Discover Airlines.

Eurowings Discover.

Hawaiian Airlines.

Olympic Air.

Silver Airways.

Virgin Australia.

» Learn more: Plan your next redemption with our airline points tool

United has also partnered with a number of hotel chains, allowing MileagePlus members to earn miles on qualified stays across more than 15,000 properties worldwide. Search for a stay at any of United’s hotel partners and share your MileagePlus member number during booking to earn points.

And if you are a member of a hotel loyalty program , you may be able to link your MileagePlus account to transfer hotel points into miles. United’s partnering hotel rewards programs include:

Marriott Bonvoy .

IHG One Rewards .

World of Hyatt .

Radisson Rewards and Radisson Rewards Americas .

Wyndham Rewards .

Choice Privileges Rewards .

Golden Circle.

Acorr Live Limitless.

Besides earning United miles for hotel stays, you can also redeem your miles for hotel stays. Though, you can typically get far more value out of your points by using them to book flights, so we generally don’t recommend this option.

You can also earn miles when booking through travel partner platforms, including vacation rental site Vrbo , and United’s own hotel booking platform, United Hotels. Earnings rates can vary based on promotions throughout the year, but here’s how many United miles you can typically expect to earn:

United Hotels: 2 award miles per $1 spent with United Hotels.

Vrbo: 3 miles for every $1 spent with Vrbo.

Rocketmiles: Earn 1,000 - 10,000 miles per night for every booking.

PointsHound: Earn up to 10,000 miles per night.

» Learn more: How the Marriott-United status match works

United Airlines partnerships don’t stop with airlines and hotels. You can earn up to 1,250 MileagePlus miles, plus receive additional discounts when booking a rental car with Avis or Budget . You must provide your MileagePlus number upon making your reservation or when you pick up your car rental to earn miles.

And when you book through United Cruises , you’re able to earn and use miles with offers on about two dozen cruise lines including Carnival Cruise Line, Disney Cruise Line, Princess Cruises, Royal Caribbean and Virgin Voyages.

There are plenty of other ways to earn MileagePlus miles for travel on United or its partners.

Use United credit cards

United offers a variety of co-branded credit cards that offer opportunities to earn United miles through your everyday spending. The cards also have welcome bonuses that offer a quick way to earn a boatload of miles in one go. Use those miles to book free flights on United or its partner airlines.

on Chase's website

$0 intro for the first year, then $95 .

• 2 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and hotels (when booked directly with hotel).

• 1 mile per $1 on all other purchases.

• 3 miles per $1 on United purchases.

• 2 miles per $1 at restaurants, select streaming services and all other travel.

• 4 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and all other travel purchases.

• 2 miles per $1 on United purchases, gas stations and local transit and commuting.

• First checked bag free for you and one companion on your reservation.

• 2 United Club one-time passes each year.

• Credit of up to $100 every four years for TSA PreCheck, Global Entry or NEXUS.

• Priority boarding.

• No foreign transaction fees.

• First and second checked bag free for you and one companion on your reservation.

• $125 United purchase credit per year (good on airfare).

• Two 5,000-mile award flight credits per anniversary year.

• Access to United Club airport lounges.

Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

Earn 80,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening.

Earn 20,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open.

Each of the cards have varying levels of perks, but the United Club℠ Infinite Card has the most benefits, offering a United Club membership , free first and second checked bags, priority check-in, security, boarding and baggage handling, and up to $100 Global Entry, TSA PreCheck or NEXUS fee credit.

However, if you don't need lounge access, the United Quest℠ Card and the United℠ Explorer Card , offer plenty of other perks for lower annual fees.

Other ways to earn United miles through everyday spending

To increase your miles earnings on everyday spending, you can also take advantage of United offers. That includes online shopping at hundreds of retailers via the MileagePlus Shopping portal , dining out when you link a credit card with MileagePlus Dining and in-person shopping when you purchase digital gift cards on the MileagePlusX app .

Booking on airline partners with United offers MileagePlus members an expanded network of travel options. Not only does it broaden the list of available destinations to which United frequent flyers can travel, but it also helps you earn and save valuable miles with just a bit of savvy booking. Be sure to connect your United account to its other travel partners, including hotels and rental cars, to maximize earning potential and benefits on your trips.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-2x Earn 2 miles per $1 spent on dining, hotel stays and United® purchases. 1 mile per $1 spent on all other purchases

50,000 Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

1x-2x Earn 2 miles per $1 spent on United® purchases, dining, at gas stations, office supply stores and on local transit and commuting. Earn 1 mile per $1 spent on all other purchases.

75000 Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

1x-3x Earn 3x miles on United® purchases, 2x miles on dining, select streaming services & all other travel, 1x on all other purchases

60,000 Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

Introduction to United MileagePlus

- Earning miles

- Redeeming miles

- Maximizing miles

- Elite status and benefits

- Compare MileagePlus

How to Earn, Redeem, and Maximize United MileagePlus Miles in 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: United Club℠ Business Card. The details for these products have not been reviewed or provided by the issuer.

- You can quickly earn United miles with excellent credit cards like the United℠ Explorer Card.

- If you have an eligible Chase Ultimate Rewards card, you can transfer points to your United account.

- You can use MileagePlus miles to book flights on United, and partners like Lufthansa and Air Canada.

- Read Business Insider's guide to the best airline credit cards .

United is one of the largest airlines in the world, so it should come as no surprise that its frequent flyer program, United MileagePlus, has over 100 million members. If you're one of them, there are myriad ways both to earn and redeem United miles for the best value, including some phenomenal travel rewards credit card offers.

Overview of the United MileagePlus program

Here's what you need to know to maximize your United miles, all the ways you can rack them up quickly, and how you can redeem them for the rewards you want.

Benefits of joining United MileagePlus

You'll need to join United's loyalty program before anything else. Just navigate to United's homepage and click on the "sign in" button at the top right of the page, then click on "create a new account" halfway down the right sidebar.

How to Earn MileagePlus miles

From flying United and its partner carriers, booking certain hotels, signing up for promotions, and simply carrying the right credit card, there are plenty of ways to accumulate United miles in a flash. Because United miles never expire, you can focus on earning miles now without worrying about when you'll be able to travel again.

Fly on United Airlines and alliance partners

Flying with the airline is the most obvious way to earn United miles. The number of miles you earn on each flight will depend on several factors, including your fare class and the route you fly.

You can stop up United MileagePlus miles is to fly United and its other airline partners. Regular MileagePlus members (i.e. those without elite status) earn 5x miles per dollar spent on airfare with United or United Express. Those with Premier Silver status earn 7x, Premier Golds earn 8x, Premier Platinums get 9x, and finally, Premier 1Ks earn 11x miles per dollar.

United also has over three dozen Star Alliance and non-alliance airline partners with whom MileagePlus members can accrue miles when traveling. They include major carriers like ANA, Air Canada, EVA Air, Lufthansa, SAS, and Singapore Airlines, among others.

The earning rates vary from partner to partner, but are usually based on the fare class purchased and the distance flown. For instance, tickets on Singapore Airlines earn between 0-150% of the distance flown, while those on SWISS earn 0-200%. So it pays to check the mileage rates on each individual partner page before committing to a ticket.

Travel with other United partners

In addition to just flights, you can earn United miles by booking stays with United's hotel partners , sailings through United Cruises , and entire trips through United Vacations , as well as partner car rentals .

Earn miles with United, Ultimate Rewards, and Bilt Rewards credit cards

As is the case with many frequent flyer programs these days, the quickest, cheapest, and easiest way to accrue United MileagePlus miles is to open and use a co-branded credit card. United partners with Chase as its issuer, so in addition to the airline's co-branded cards, you can transfer points from some of Chase's other products to your MileagePlus account.

Chase Ultimate Rewards points transfer to United MileagePlus instantly at a 1:1 ratio, so if you're just a few thousand miles short of an award, this is one of the best ways to top up your account.

MileagePlus Shopping and MileagePlus Dining

Many airlines offer special shopping portals and dining programs that allow you to earn additional rewards for patronizing partner businesses. United is no exception: The MileagePlus shopping portal and MileagePlus Dining program reward you with bonus miles every time you spend money with participating retailers.

MileagePlus Shopping is kind of like an online mall, with hundreds of retail partners where MileagePlus members can earn bonus points on purchases.

MileagePlus Dining earns between 3x and 5x miles on tabs at thousands of participating restaurants around the country.

United co-branded credit cards

United offers several credit cards that offer bonus miles on airfare and other common categories of spend.There are six United Airlines credit cards to consider if you want to earn United miles and enjoy some day-of-travel perks to boot.

United℠ Explorer Card

Earn 2 miles per $1 spent on dining, hotel stays, and United® purchases and 1 mile per $1 spent on all other eligible purchases.

$0 intro for the first year, then $95

21.99% - 28.99% Variable

Earn 50,000 bonus miles

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual fee is waived the first year

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earns bonus miles on several purchase categories, including dining

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes an application fee credit for Global Entry or TSA PreCheck

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Gets you a free checked bag on United when you pay with the card

- con icon Two crossed lines that form an 'X'. Not the most rewarding card for most non-United travel purchases

The United Explorer card is the best all-around credit card for United flyers, offering a generous range of benefits for a modest annual fee. Cardholders receive a free checked bag, priority boarding, and inflight discounts on United flights, plus two one-time United Club airport lounge passes each year for your anniversary.

- Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

- $0 introductory annual fee for the first year, then $95.

- Earn 2 miles per $1 spent on dining, hotel stays, and United® purchases

- Up to $100 Global Entry, TSA PreCheck® or NEXUS fee credit

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card

- Free first checked bag - a savings of up to $140 per roundtrip. Terms Apply.

- Enjoy priority boarding privileges and visit the United Club℠ with 2 one-time passes each year for your anniversary

- Member FDIC

The popular United℠ Explorer Card is currently offering a welcome bonus of 50,000 bonus miles after you spend $3,000 on purchases in the first three months your account is open. That's worth $650, per Business Insider's points and miles valuations .

You'll also get perks like two free day passes to United Club lounges each year on your anniversary, primary rental car insurance , expanded award availability for United Airlines flights, one free checked bag for you and a travel buddy on your reservation, and more.

The card charges an annual fee of $0 intro for the first year, then $95.

Review: United Explorer card review

United Club℠ Infinite Card

Earn 4 miles per $1 spent on United® purchases including tickets, Economy Plus, inflight food, beverages and Wi-Fi, and other United charges. Earn 2 miles per $1 spent on all other travel. Earn 2 miles per $1 spent on dining including eligible delivery services. Earn 1 mile per $1 spent on all other purchases.

Earn 80,000 bonus miles

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Great intro bonus offer

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. If you want United Club membership, this card gets you it for less than buying it outright

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Get two free checked bags on United

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earns 4x miles on United® purchases

- con icon Two crossed lines that form an 'X'. Steep annual fee, especially for an airline credit card

- con icon Two crossed lines that form an 'X'. The non-United bonus categories (travel and dining) only earn 2x miles

While a few of the best travel credit cards are great for United flyers, the United Club℠ Infinite Card is the most high-end of the bunch. Not only does it offer a full United Club airport lounge membership, but it can also help you rack up the miles for free trips quickly through everyday spending.

- Earn 80,000 bonus miles after qualifying purchases

- Earn 4 miles per $1 spent on United® purchases

- Earn 2 miles per $1 spent on all other travel and dining

- Earn 1 mile per $1 spent on all other purchases

- Free first and second checked bags - a savings of up to $320 per roundtrip (terms apply) - and Premier Access® travel services

- 10% United Economy Saver Award discount within the continental U.S. and Canada

- Earn up to 10,000 Premier qualifying points (25 PQP for every $500 you spend on purchases)

A premium credit card , the United Club℠ Infinite Card comes with United Club airport lounge membership . The annual fee is $525, and it offers a welcome bonus of 80,000 bonus miles after you spend $5,000 on purchases in the first three months from account opening — worth $1,040, per Business Insider's valuations.

Review: United Club Infinite card review

United Quest℠ Card

Earn 3 miles per $1 spent on United® purchases. 2 miles per $1 spent on dining, select streaming services & all other travel. 1 mile per $1 spent on all other purchases

Earn 60,000 bonus miles and 500 Premier qualifying points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Substantial intro bonus offer

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. A free first and second checked bag can save you and a companion up to $320 round-trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $125 in annual credits toward United® purchases can offset half the annual fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. 5,000-mile award flight credit can help you stretch your United miles

- con icon Two crossed lines that form an 'X'. High $250 annual fee

- con icon Two crossed lines that form an 'X'. Card doesn’t offer United Club lounge access or passes

If you fly United Airlines, even just a couple of times a year, the United Quest℠ Card should be on your radar. It comes with unique perks that can save you big time when you travel — such as two free checked bags when flying on United, up to $125 in automatic statement credits toward United purchases, and more.

- Earn 60,000 bonus miles and 500 PQP after qualifying purchases

- Earn 3 miles per $1 spent on United® purchases

- Earn 2 miles per $1 spent on all other travel, dining and select streaming services

- Free first and second checked bags - a savings of up to $320 per roundtrip (terms apply) - and priority boarding

- Up to a $125 United® purchase credit and up to 10,000 miles in award flight credits each year (terms apply)

- Earn up to 6,000 Premier qualifying points (25 PQP for every $500 you spend on purchases)

The newest United card, the United Quest℠ Card offers a welcome bonus of 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first three months your account is open, worth $780 on average, according to Business Insider's valuations. It comes with perks like a free first and second checked bag on United flights (when you use the card to pay for your ticket), and up to $125 per year in annual statement credits toward United purchases (like airfare and incidental fees). The annual fee is $250.

Review: United Quest card review

United Gateway℠ Card

Earn 2 miles per $1 spent on United® purchases, at gas stations and on local transit and commuting. Earn 1 mile per $1 spent on all other purchases.

0% intro APR on purchases for 12 months

- Earn 20,000 bonus miles

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good bonus categories (including gas stations and local transit/commuting)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Access to expanded United award availability

- con icon Two crossed lines that form an 'X'. Other United credit cards have much higher welcome bonuses

- con icon Two crossed lines that form an 'X'. No free checked bag benefit like other United cards

- con icon Two crossed lines that form an 'X'. Few United perks other than 25% back on inflight purchases

The United Gateway℠ Card isn't the best credit card for United flyers, but it can be a good option if you want an airline credit card but you never, ever want to pay an annual fee. With the card, you'll earn United miles and access expanded award availability, but you'll wind up with a relatively low welcome offer and few cardholder perks.

- No annual fee

- Earn 2 miles per $1 spent on United® purchases, at gas stations and on local transit and commuting

- Earn 2 miles per $1 spent on United® purchases

- Earn 2 miles per $1 spent at gas stations, on local transit and commuting

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Gateway Card

The $0-annual-fee United Gateway℠ Card is relatively basic, but still a strong earner. It offers a bonus of 20,000 bonus miles after you spend $1,000 on purchases in the first three months your account is open (worth $260, per Business Insider's valuations), and earns 2x miles on United purchases and at gas stations as well as on local transit and commuting, and 1x on everything else.

Review: United Gateway credit card review

United℠ Business Card

Earn 2 miles per $1 spent on United® purchases, dining (including eligible delivery services), at gas stations, office supply stores, and on local transit and commuting. Earn 1 mile per $1 spent on all other purchases.

$0 intro for the first year, then $99

Earn 75,000 bonus miles

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Solid travel benefits with United, including a free checked bag and priority boarding

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. $100 annual United travel credit is relatively easy to earn

- con icon Two crossed lines that form an 'X'. Beyond the intro bonus offer, it will take a while to earn a lot of miles through everyday spending on this card

Although it joins a crowded field of excellent United Airlines credit cards, the United℠ Business Card from Chase has several standout benefits that make it well worth considering for both frequent and occasional United flyers.

- Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

- $0 introductory annual fee for the first year, then $99.

- Receive a 5,000-mile "better together" bonus each anniversary when you have both the United℠ Business Card and a personal Chase United® credit card.

- Earn 2 miles per $1 spent on United® purchases, dining including eligible delivery services, at gas stations, office supply stores, and on local transit and commuting.

- Earn 1 mile per $1 spent on all other purchases. Plus, employee cards at no additional cost - miles earned from their purchases accrue in your account so you can earn rewards faster.

- Enjoy a free first checked bag - a savings of up to $140 per roundtrip (terms apply), 2 United Club℠ one-time passes per year, and priority boarding privileges.

- $100 United® travel credit after 7 United flight purchases of $100 or more each anniversary year.

If you already have one of the other United credit cards, you could consider this small-business credit card instead. The United℠ Business Card is currently offering 75,000 bonus miles after you spend $5,000 on purchases in the first three months your account is open — which is worth $975, per Business Insider's valuations. You'll be charged a $0 intro for the first year, then $99 annual fee.

Review: United Business card review

United Club℠ Business Card

Earn 1.5-2 miles per dollar on purchases.

20.74% – 27.74% Variable

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Full United Club membership

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earns 1.5 miles on all non-United purchases

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cardholders can get 2 free checked bags on United

- con icon Two crossed lines that form an 'X'. High annual fee

- con icon Two crossed lines that form an 'X'. No bonus miles-earning categories beyond United

The premium United Club℠ Business Card offers a welcome bonus of 75,000 bonus miles after spending $5,000 on purchases in the first three months from account opening (worth $1,300 according to Business Insider's valuations). You'll earn 2x miles on United purchases and 1.5x miles on everything else, and, like the personal version, the card comes with United Club membership. The annual fee is $0 intro for the first year, then $99.

If you prefer a credit card that earns transferable points , you can transfer Chase Ultimate Rewards® points to United MileagePlus (as well as over a dozen other Chase transfer partners ) if you carry one of the following cards. Given that versatility, you might want to apply for one of them instead.

Chase Sapphire Preferred® Card

Earn 5x on travel purchased through Chase Travel℠. Earn 3x on dining, select streaming services and online groceries. Earn 2x on all other travel purchases. Earn 1x on all other purchases.

21.49% - 28.49% Variable

Earn 60,000 bonus points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High intro bonus offer starts you off with lots of points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel coverage

- con icon Two crossed lines that form an 'X'. Doesn't offer a Global Entry/TSA PreCheck application fee credit

If you're new to travel rewards credit cards or just don't want to pay hundreds in annual fees, the Chase Sapphire Preferred® Card is a smart choice. It earns bonus points on a wide variety of travel and dining purchases and offers strong travel and purchase coverage, including primary car rental insurance.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

This customer-favorite rewards credit card offers 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. The card earns 5x points on all travel purchased through Chase Travel, 3x points on dining, select streaming services, and online grocery purchases (excluding Target, Walmart, and wholesale clubs), 2x points on other eligible travel purchases, and 1 point per dollar on everything else. The annual fee is $95.

Review: Chase Sapphire Preferred card review

Chase Sapphire Reserve®

Earn 5x points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1x point per $1 spent on all other purchases.

22.49% - 29.49% Variable

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual travel credit can effectively shave $300 off the annual fee if you use it

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel insurance

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong bonus rewards on travel and dining

- con icon Two crossed lines that form an 'X'. Very high annual fee

If you're new to rewards credit cards you may want to start elsewhere, but if you know you want to earn Chase points and you spend a lot on travel and dining, the Sapphire Reserve is one of the most rewarding options.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

With the Chase Sapphire Reserve®, you can earn a welcome bonus offer of 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. Further, you can earn 10x points on Chase Dining purchases through Ultimate Rewards, 10x points on hotel stays and car rentals purchased through Chase Travel, 5x points on air travel purchased through Chase Travel, 3x points on other travel and dining purchases, and 1 point per dollar on everything else.

There's a $550 annual fee, but it's worth it if you can use perks like up to $300 in annual travel credit , Priority Pass airport lounge access , and top-notch travel insurance .

Review: Chase Sapphire Reserve credit card review

Ink Business Preferred® Credit Card

Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases.

21.24% - 26.24% Variable

Earn 100,000 bonus points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High sign-up bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 3x bonus points on several spending categories, including travel and advertising purchases

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes comprehensive travel coverage

- con icon Two crossed lines that form an 'X'. Welcome bonus has a very high minimum spending requirement

The Ink Business Preferred® Credit Card offers a huge welcome bonus and solid earning and benefits for a moderate annual fee. If your small-business expenses line up with the card's bonus categories and you like redeeming Chase Ultimate Rewards® points for travel, this is one of the best small-business credit cards to consider.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

Don't forget about the Ink Business Preferred® Credit Card, which packs a points punch of its own. New cardholders can earn a whopping 100,000 bonus points after spending $8,000 on purchases in the first three months from account opening. They also earn 3x points on the first $150,000 spent on travel and select business categories each account anniversary year, and 1x on everything else, for a $95 annual fee.

Review: Ink Business Preferred card review

Bilt Mastercard®

Earn up to 1x points on rent payments without the transaction fee, up to 100,000 points each calendar year. Earn 2x points on travel. Earn 3x points on dining. Earn 1x points on other purchases. Earn points when you make 5 transactions that post each statement period.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only credit card to offer rent payments to any landlord

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Excellent range of airline and hotel transfer partners through the Bilt App

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. World Elite Mastercard benefits and no annual fee

- con icon Two crossed lines that form an 'X'. If you’re not a renter, other cards offer better welcome bonuses and rewards

- con icon Two crossed lines that form an 'X'. Must make 5 transactions per statement period to earn points

The Bilt Mastercard® is the first credit card to offer up to 100,000 points in a calendar year rewards for paying rent without the transaction fee — and you can redeem your points for travel, merchandise, and more. While it now offers bonus points on dining and select travel, if you're not a renter, you should consider other no-annual-fee rewards credit cards as well.

- $0 Annual Fee.

- Earn up to 1x points on rent payments without the transaction fee, up to 100,000 points each calendar year.

- 2x points on travel.

- 3x points on dining.

- 1x points on other purchases.

- Earn points when you make 5 transactions that post each statement period.

- When renting at a Bilt Alliance property, you can choose to have your rent payments automatically reported by Bilt to the three major credit bureaus each month; Experian™, TransUnion™, and Equifax™.

Bilt Rewards is a program that allows you to pay rent with no transaction fees — and earn travel rewards while you're at it. You can also open the $0-annual-fee Bilt Mastercard® to earn Bilt rewards for non-rent expenses (see rates and fees ). Here's what you'll earn:

- 3 points per dollar on dining (including food delivery services like Uber Eats and GrubHub)

- 2 points per dollar on travel booked directly with airlines, hotels, car rentals, or cruise lines

- 1 point per dollar on rent payments (with no fees) on up to $100,000 in rent payments every year

- 1 point per dollar on other purchases

Bilt cardholders must make at least five purchases per billing cycle to earn rewards on this card.

Bilt is a 1:1 transfer partner of United Airlines. This is a great way to rack up United Airlines miles on some of your biggest monthly expenses.

Plus, you'll earn 2,500 bonus points each time you successfully refer a friend (and an additional 10,000 bonus points every fifth successful referral, so 22,500 points for five referrals) up to 2,025,000 bonus points maximum.

Review: Bilt Mastercard card review

Travelers have some fantastic choices regarding credit cards they can use to accumulate United MileagePlus miles. But there are more ways to earn, too.

Redeeming MileagePlus Miles

The United MileagePlus program has lost some of its shine to devaluations in recent years, but you can still get good (and sometimes great) value by redeeming miles for flights and upgrades on United and its airline partners.

Offering some useful routing rules and freedom from fuel surcharges, United miles have an average redemption value of 1.3 cents each in Business Insider's most recent points and miles valuations . Read on to see which redemption options you should target and avoid to get the most out of your miles.

Award flights on United

One of the primary reasons to focus on United miles is to use them for award flights on the airline itself. First, the bad news: United has removed award charts with fixed rates between various regions from its website and gravitated to a dynamic pricing model for award tickets. In addition, United recently increased award prices to Europe by about 33%.

This means that the number of miles you'll need for a flight now depends more on how much paid flights cost, along with other factors. That usually makes it cheaper to fly less expensive routes. On the flip side, however, if you're looking for seats in business or first class, the mileage prices have risen recently and can be downright astronomical for Polaris business class on busy international routes.

United has one of the most robust award-search engines – both for its own flights and those of its partners – of any airline out there. To search for tickets, just go to United.com, enter your origin, destination, and flight dates, and make sure the box that says, "Book with miles" is checked. You can even check "Flexible dates" to see a month's worth of award availability and filter your search by cabin class, which makes it easier to find the flights you need.

In terms of value, you should try to get at least 1 cent per redeemed mile in value for any award flights that you book, and aim higher for tickets in business or first class.

Internationally, it's hard to pinpoint exact values for routes these days but in general, expect one-ways from the US to other regions to start at around 32,500 miles in economy and 63,000 miles in business class and to skyrocket from there.

There's also a newer redemption option called " Money + Miles, " which is similar to Delta's Pay With Miles feature. Money + Miles is currently available on select United flights, and it allows you to pay for part of your fare with cash and the rest with miles, at a fixed rate of 1 cent per mile.

Travel with Star Alliance partners and other airlines

Just as you can earn United miles on flights with partner airlines, you can also redeem them for award tickets on the carrier's Star Alliance and non-alliance partners. United stealthily raised award prices across the board by around 10% a few years ago, and then bumped them up again for close-in bookings — all of which has driven these prices higher still.

While the number of miles you need for a specific flight will also depend on the route, airline, and dates, expect to pay about 40,000 miles each way from the US to Europe in economy and 80,000 miles in business class. Flights from the US to Asia start at around 44,000 miles each way in economy and 88,000 miles in business class.

Other redemption options (hotels car rentals, merchandise)

Beyond award tickets, United lets you redeem MileagePlus miles for other travel-related purposes, such as seat upgrades and United Club memberships. The latter costs $650 or 85,000 miles, meaning you're only getting 0.76 cents per mile in value, which is definitely not worth it. You can also purchase inflight Wi-Fi passes or subscriptions using miles – but this is an even worse value.

Among the other options are redeeming miles for TSA PreCheck applications, merchandise, gift cards (many of these only net you a measly 0.3 cents per mile), various experiences like concerts and Broadway shows, charitable donations, and even hotels and cruises. Unfortunately, these redemptions are less than ideal if you're looking to maximize value.

Maximizing your MileagePlus miles

You can boost your stash of MileagePlus miles in several ways.

MileagePlus promotions and bonus offers

From time to time, United offers MilePlay promotions that allow you to earn additional miles in exchange for completing certain tasks, such as buying and flying a certain number of flights within a certain amount of time.

You may also receive targeted offers from time to time. Signing up for United's marketing emails is the best way to find these deals with they pop up.

Transfer miles and buy miles

You can gift and transfer miles between friends and family, or purchase miles to top up a balance to redeem for a flight or other purchase. You can transfer between 500 to 100,000 MileagePlus miles from your own account to that of another United member for $7.50 per 500 miles. You'll also pay a $30 processing fee per transaction.

The buy rate of United miles varies from time to time depending on promotions. You'll get the best deal buying them when they go on sale, which you can find via email or by checking the website and United app.

Premier Status and Benefits

United Airlines award flights count toward the requirements necessary to earn elite status. You'll earn Premier Qualifying Flights (PQF) just as you would have if you bought your airfare with cash — and you'll earn 1 Premier Qualifying Point (PQP) for every 100 miles you spend.

Qualification tiers and associated benefits

United has an elite status program for loyal customers, like many airlines do.

Premier Silver

This is United's base tier status. You can earn this status by flying 12 qualifying flights and earning 4,000 points-qualifying points (PQP) within a calendar year. You can also earn it by getting 5,000 PQP, or by holding Titanium status with Marriott.

Premier Silver Benefits

Premier Silver members get one free checked bag in economy class; free access to Economy Plus seats at check-in themselves and one companion; and Group 2 priority boarding. They're also eligible for free upgrades on the day of departure upgrades, and earn 7 MileagePlus miles on every flight.

Premier Gold

United Gold status gives you some solid perks. You can earn your way to this tier with 24 PQF and 8,000 PQP, or by spending 10,000 PQP.

Premier Gold Benefits

As a United Gold member, you get 2 free checked bags in economy; free access to Economy Plus seats when booking flights for you and up to one companion; and Group 1 priority boarding. You're also eligible for free upgrades 48 hours before your flight, and will earn 8 miles on every flight.

Premier Platinum elite members with United have completed 36 PQF and 12,000 PQP, or earned 15,000 PQP.

Premier Platinum Benefits

United's top-tier status what you can earn comes with steep earning requirements: 54 PQF and 18,000 PQP, or 24,000 PQP in spend.

Premier 1K Benefits