We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

- Currency Converter

- AED Exchange Rates

- EUR Exchange Rates

- GBP Exchange Rates

- INR Exchange Rates

- KWD Exchange Rates

- PHP Exchange Rates

- PKR Exchange Rates

- RUB Exchange Rates

- USD Exchange Rates

- Crypto Calculator

- DOGE to USD

- LINK to USD

- USDT to USD

- DOGE to EUR

- LINK to EUR

- USDT to EUR

- DOGE to CAD

- LINK to CAD

- USDT to CAD

- DOGE to INR

- LINK to INR

- USDT to INR

- Precious Metals

- Silver Price

- Bahasa Indonesia

- Bahasa Malaysia

- More languages

- Exchange Rates

- US Dollars to Euros

Convert USD to EUR: US Dollar To Euro Exchange Rates

1.0000 USD = 0.9341 EUR April 30, 2024 07:55 AM UTC

Live Currency Exchange Converter

Invert usd to eur conversion chart.

This chart shows data from 2023-5-1 to 2024-4-29 . The average exchange rate over this period was 0.9233 Euros per US Dollar.

What was the highest USD to EUR exchange rate in the last year?

The high point for the USD/EUR rate was 0.9554 Euros per US Dollar on October 3, 2023.

What was the lowest USD to EUR exchange rate in the last year?

The low point was 0.8894 Euros per US Dollar on July 14, 2023.

Is USD up or down compared to EUR in the last year?

The USD/EUR rate is up +2.38% . This means the US Dollar has increased in value compared to the Euro.

USD to EUR Exchange Rates

Convert usd to eur, convert eur to usd, usd to eur history rates by year.

To view rates between the US Dollar and the Euro for a particular year, click on one of the links below.

How to Convert US Dollars to Euros?

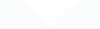

You can convert US Dollars to Euros by using the exchange-rates.org currency converter in just one easy step. Simply enter the amount of USD you want to convert to EUR in the box labeled "Amount", and you’re done! You’ll now see the value of the converted currency according to the most recent exchange rate.

USD to EUR Currency Converter - FAQs

How much is $ 1 in eur.

1 US Dollar = 0.9341 Euros as of April 30, 2024 07:55 AM UTC. You can get live exchange rates between US Dollars and Euros using exchange-rates.org, which aggregates real-time forex data from the most authoritative sources.

How much is $ 100 in EUR?

100 US Dollars = 93.408 Euros as of April 30, 2024 07:55 AM UTC.

What was the highest USD to EUR exchange rate in the last 10 years?

In the last 10 years, the highest rate from US Dollars to Euros was on September 27, 2022 when each US Dollar was worth € 1.0421.

When is the best time to convert USD to EUR?

The USD and EUR can be traded 24x5 starting from the time markets open on Monday mornings in Sydney all the way to the time markets close on Fridays at 5 pm in New York. Exchange rates can fluctuate by the minute while markets are open. However, the time between 3-4 PM GMT is often a good time to convert US Dollars to Euros because currency market liquidity and trading volume tend to be the highest during this time. Also, it’s best to convert US Dollars to Euros early in the week if you need Euros urgently. If you execute a trade late in the week, it might not settle until the following week given that forex markets are closed on weekends.

Which is stronger, USD or EUR?

The Euro is currently stronger than the US Dollar given that 1 EUR is equal to 1.0706 USD. Conversely, 1 USD is worth 0.9341 EUR.

Is the US Dollar up or down against the Euro?

The US Dollar is up +3.10% year to date against the Euro. In the last 10 years, the US Dollar is up +2.06% against the Euro. As a result, the US Dollar has gained purchasing power compared to the Euro over the last 10 years.

More USD Conversions

Why trust us.

Exchange-rates.org has been a leading provider of currency, cryptocurrency and precious metal prices for nearly 20 years. Our information is trusted by millions of users across the globe each month . We have been featured in some of the most prestigious financial publications in the world including Business Insider, Investopedia, Washington Post, and CoinDesk.

We partner with leading data providers to bring you the latest and most accurate prices for all major currencies, cryptocurrencies and precious metals. The currency, cryptocurrency and precious metals prices displayed on our site are aggregated from millions of data points and pass through proprietary algorithms in order to deliver timely and accurate prices to our users.

Popular Conversions

- Sign in

Foreign Exchange Rates for U.S. Dollars

Find out how much your foreign currency is worth in u.s. dollars.

Exchange rates are updated daily. Last update on .

Are you sure you want to remove this currency

Choose your currency, answer center.

No. Bank of America does not offer or accept foreign coins.

Any Bank of America customer can exchange foreign currency at any financial center.

Yes. Bank of America customers with a checking or savings account can order up to USD$10,000 worth of foreign currency every 30 days. Order foreign currency

See all FAQs

- Home ›

- Travel Money ›

Compare euro travel money rates

Get the best euro exchange rate by comparing travel money deals from the UK's top foreign exchange providers

Best euro exchange rate

Over 340 million people use the euro every day according to the European Central Bank, making it the second most-traded currency in the world after US dollars. Twenty out of 27 EU Member States have adopted the euro as their official currency, and euros are used officially and unofficially in many non-EU countries and territories throughout Europe such as Monaco, San Marino, and Vatican City.

If you're travelling to Europe, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best euro exchange rate by comparing a wide range of UK travel money suppliers who have euros in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Compare before you buy

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Order online

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

The best euro exchange rate right now is 1.1568 from Travel FX . This is based on a comparison of 17 currency suppliers and assumes you were buying £750 worth of euros for home delivery.

The best euro exchange rates are usually offered by online travel money companies who have lower operating costs than traditional 'bricks and mortar' stores, and can therefore offer better currency deals than their high street counterparts.

For supermarkets and companies who sell travel money online and on the high street, it's generally cheaper to place your order online and collect it from the store rather than turning up out of the blue and ordering over the counter. Many stores set their 'walk-in' exchange rates lower than their online rates because they can. By ordering online you're guaranteed to get the online rate and you can collect your order from the store as usual.

Euro rate trend

Over the past 30 days, the Euro rate is up 0.06% from 1.1568 on 31 Mar to 1.1575 today. This means one pound will buy more Euros today than it would have a month ago. Right now, £750 is worth approximately €868.13 which is €0.52 more than you'd have got on 31 Mar.

These are the average Euro rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to Euro currency chart .

Timing is key if you want to maximise your euros, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the euro rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the euro rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their euros as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your euros sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better euro rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your euros first before you collect them from the store so you benefit from the supplier's better online rate.

Euro banknotes and coins

Euros are governed and issued by the European Central Bank which is based in Frankfurt, but the actual production of euro banknotes and coins is handled by various national banks throughout the Eurozone. Spain and Greece are responsible for printing €5 and €10 banknotes, Germany prints €100 notes, and the other EU member states are responsible for printing €20 and €50 notes.

One euro (€) can be subdivided into 100 cents (c). There are seven denominations of euro banknotes in circulation: €5, €10, €20, €50 and €100 which are frequently used, plus €200 and €500 notes which are no longer printed but are still in circulation and remain legal tender. The designs printed on each banknote are intended to be symbolic of the European Union's identity and unity, as well as highlighting the diversity and richness of different European cultures. The front of each banknote features architectural styles from different periods in Europe's history, including Classical, Gothic, Renaissance and modern, while the reverse side features bridges that represent communication and cooperation between the different countries within the European Union.

Euro coins are available in eight denominations: 1c, 2c, 5c, 10c, 20c, 50c, €1 and €2. Each EU member state is responsible for minting its own coins, and can choose their own design for the 'tails' side. For example, German coins feature the 'Bundesadler' or Federal Eagle which has been the German coat of arms since 1950, while French coins depict Marianne; an important symbol of French national identity. Next time you've got a handful of euro coins, take a look at the tails side and see if you can guess which EU country they came from!

There's no evidence to suggest that you'll get a better deal if you buy your euros in Europe. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your euros in Europe:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy euros when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in Europe

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Twenty out of 27 EU member states have adoped the euro as their official currency. These are: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

The following European countries and territories who are not part of the EU also use the euro as their official currency: Andorra, Kosovo, Monaco, Montenegro, San Marino and Vatican City, French Guiana and Martinique, the Azores, Canary Islands, and Madeira.

Tips for saving money while visiting Europe

The most budget-friendly destinations in Europe are generally those located in the east such as Latvia, Lithuania and Estonia. In contrast: Luxembourg, Ireland and France usually top the list as some of the most expensive holiday destinations. Regardless of where you're planning to visit, you can save money during your trip by following some simple tips:

- Research your accommodation: Hotels can be expensive, so one way of saving money is to look for more budget-friendly accommodation such as hostels, holiday rentals, or even campsites. AirBnB can be an affordable option too, especially if you rent a room instead of an entire apartment; and you'll get to experience what it's like to live like a local. Salud!

- Use public transport: Make the most of any metro systems, buses, or trams to get around instead of relying on private taxis or rental cars. Many European countries also offer national and regional travel passes for public transport which can work out significantly cheaper than buying individual tickets.

- Eat like a local: Opt for local restaurants or street food vendors that offer authentic cuisine at lower prices. Avoid dining at expensive tourist restaurants, and try cooking your own meals if your accommodation has a kitchen. Not only is this a great way to save money, but it can also be a fun cultural experience to shop around in European supermarkets and cook with local ingredients.

- Plan your itinerary: Look out for free attractions such as museums, parks, churches and historical sites, and plan your itinerary around these. Many cities in Europe also offer free walking tours which can be a great way to get an overview of a new location while learning about its culture and history.

- Find discount vouchers: Many tourist attractions and activities offer discount vouchers and codes that can save you money on entry fees and other perks. Look for vouchers online; sign up to newsletters and follow the social media accounts of places you're planning to visit.

- Take cash: Using cash will help you to stick to a budget more easily than paying by card, and you'll also avoid foreign transaction fees. If you do take a card with you, look out for ATMs that are affiliated with your UK bank to avoid ATM fees, and if you're asked whether you want to pay in pounds or euros - always choose euros. If you pay in pounds the merchant can set their own exchange rate which won't be in your favour.

Choosing the right payment method

Sending money to a company you might not have heard of before can be unsettling. We routinely check all the companies that feature in our comparisons to make sure they meet our strict listing criteria, but it's still worth knowing how your money is protected in the unlikely event a company goes bust and you don't receive your order.

Bank transfer

Your money is not protected if you pay by bank transfer. If the company goes bust and you've paid by bank transfer, it's unlikely you'll get your money back. For this reason, we recommend you pay by debit or credit card wherever possible because they offer more financial protection.

Debit cards are the most popular payment method and they offer some financial protection. If you pay by debit card and the company goes bust, you can instruct your bank to make a chargeback request to recover your money from the company's bank. This isn't a legal right, and a refund isn't guaranteed, but if you make a chargeback request your bank is obliged to try and recover your money.

Credit card

Credit cards offer full financial protection, and your money is protected by law under Section 75 of the Consumer Credit Act. Section 75 states that your card issuer must refund you in full if you don't receive your order. Be aware that many credit cards charge a cash advance fee (typically around 3%) for buying currency, so you may have to weigh up the benefits of full financial protection with the extra cost of using a credit card.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

Exchange rates

View today’s foreign currency exchange rates below and sign up to our newsletter to stay up-to-date on the latest currency news, happy hours and offers., today’s exchange rates.

We monitor market rates every day, to bring you great value on your travel money.

Whether you’re looking to convert your pounds to dollars, euros or any other currency, simply choose the currency you need below to see our rates of the day.

Find a currency

Historical rates

See how much you get

[domesticAmount1]

[foreignAmount1]

[domesticExchangeAmount1] [domesticCurrencyCode] = [foreignExchangeAmount1] [currencyCode]

[domesticAmount2]

[foreignAmount2]

[domesticExchangeAmount2] [domesticCurrencyCode] = [foreignExchangeAmount2] [currencyCode]

[domesticAmount3]

[foreignAmount3]

[domesticExchangeAmount3] [domesticCurrencyCode] = [foreignExchangeAmount3] [currencyCode]

FREE HOME DELIVERY

How to calculate exchange rates

Exchange rates are influenced by banks and trading institutions and the volume of currency they are buying and selling at any given time. Currencies are traded (bought and sold) daily around the world.

One currency can be purchased by another currency through banking institutions or on the open market. The volumes of currencies traded are increased and decreased depending on the attractiveness of any particular currency, which depends on a multitude of factors such as political stability, economic strength, government debt and fiscal policy among others.

Government central banks also have the ability to set a currency at a constant price through a method called pegging, which essentially tethers the value of one currency to another. The value (or price) of a currency is determined by its traded volume. If a currency is competitively priced, traders will buy the currency, essentially driving up its value. If a currency is not competitively priced, traders may avoid buying, or even sell it, essentially driving down its value.

How to read exchange rates - currency jargon explained

Foreign exchange can be confusing, so to help break through the confusion, here are some common terms associated with currency:

- Buy rate – This is the rate at which we buy foreign currency back from you into your local currency. For example, if you were returning from America, we would exchange your US dollars back into British pounds at the buy rate of the day.

- Commission – This is a common fee that foreign exchange providers charge for exchanging one currency with another.

- Cross rate – This is the rate we give to customers who want to exchange currencies that do not involve the local currency. For example, if you want to exchange Australian dollars into US dollars .

- Currency Pair - This the the relationship between two country's currencies. It is often denoted like this: GBP/USD, EUR/JAP, AUD/INR

- Holiday money rate or tourist rate – This is another term for a sell rate.

- Sell rate – This is the rate at which we sell foreign currency in exchange for local currency. For example, if you were heading to Europe, you would exchange British pounds for euros at the sell rate.

- Spot rate – This is known more formally as the ‘interbank’ rate. It is the rate banks or large financial institutions charge each other when trading significant amounts of foreign currency. In the business, this is sometimes referred to as a ‘spot rate

- Spread – This is the difference between the buy and sell rates offered by a foreign exchange provider such as us.

Exchange Rates FAQ's

Why do currency exchange rates fluctuate?

Currencies constantly move up and down against each other as financial markets change. These movements can be caused by supply and demand, as well as by political and economic events.

Why are tourist money exchange rates not the same as the market spot rate?

The market (or spot) exchange rate, is the rate at which banks exchange currencies. There are a lot of processes and people involved in providing currency into your hands. There is a cost to doing this, which means that the value of the currency is affected to cover all of said cost.

At Travelex, we work to provide you with the best value on your foreign currency as possible. We are constantly striving to improve our systems and processes to make them more efficient, meaning that you get the best value for your travel money exchange rates from us.

Find out more on spot rates and tourist rates here .

Does it pay to shop around and compare rates?

There are a lot of foreign currency providers in the UK, offering you a range of products and services. With so much choice, it means that you can spend time to find the best exchange rate in the market.

Need some extra help with your currency?

Currency converter.

See how much your mojito, poncho, or dinner in Paris will cost you in British pounds by using our simple currency converter.

Travel rate tracker

Not sure if it’s the right time to buy your currency? Let us do the hard work by monitoring the rates for you! We'll email you when your chosen currency hits the rate you need.

Quick Links

- Travel Money Card

- Exchange Rates

- Bureau de Change

- Max Your Foreign Currency

- Compare Your Travel Money

- Travellers Cheques

- Precious Metals

About Travelex

- Store Finder

- Download Our App

Useful Information

- Help & FAQs

- Privacy Centre

- Terms & Conditions

- Travelex Money Card Terms & Conditions

- Statement of Compliance

- Website Terms of Use

- Safety & Security

- Modern Slavery Statement

Customer Support

Travelex foreign coin services limited.

Worldwide House Thorpe Wood Peterborough PE3 6SB

Reg Number: 02884875

Your safety is our priority. Click here for our latest Customer update

- Partnership Card

- Home Insurance

- Car Insurance

- Investments

International Payments

John lewis finance.

- Partnership Credit Card

- Points calculator

- Mobile payments & app

- Online account

- Fraud & security

- Cardholder exclusives

- Guides & articles

Customer support

- Contents Insurance

- Buildings Insurance

- High-Value Home Insurance

- Get a quote

- Show your saved quote

- Renew your policy

- Make a claim

- Policy documents

- Older drivers

- Retrieve a quote

- Things to consider

- How to register

- Pet Insurance

- Dog Insurance

- Cat Insurance

Travel Money

Bureau de Change

Click & Collect

- Travel Money Delivered

- Pre-packed Currency

Currency Buy Back

- Currency exchange rate table

- Stocks & Shares ISA

- General Investment Account

- ISA allowance 2024/25

- ISA transfers guide

- Regular transfers

- One-off payments

TRAVEL MONEY THAT TAKES YOU FURTHER

- 0% commission

- Over 50 currencies available

- Free home delivery or collection for orders over £500

- Euro ( EUR ) eu

- US Dollar ( USD ) us

- Australian Dollar ( AUD ) au

- Canadian Dollar ( CAD ) ca

- Swiss Franc ( CHF ) ch

- UAE Dirham ( AED ) ae

- Bahamian Dollar ( BSD ) bs

- Bahraini Dinar ( BHD ) bh

- Barbadian Dollar ( BBD ) bb

- Bermudian Dollar ( BMD ) bm

- Brazilian Real ( BRL ) br

- Brunei Dollar ( BND ) bn

- Bulgarian Lev ( BGN ) bg

- Cayman Island Dollar ( KYD ) ky

- Chilean Peso ( CLP ) cl

- Chinese Yuan Renminbi ( CNY ) cn

- Colombian Peso ( COP ) co

- Costa Rican Colon ( CRC ) cr

- Czech Koruna ( CZK ) cz

- Danish Krone ( DKK ) dk

- Dominican Peso ( DOP ) do

- East Caribbean Dollar ( XCD ) xc

- Fijian Dollar ( FJD ) fj

- French Polynesian Franc ( XPF ) pf

- Guatemalan Quetzal ( GTQ ) gt

- Hong Kong Dollar ( HKD ) hk

- Hungarian Forint ( HUF ) hu

- Icelandic Krona ( ISK ) is

- Indonesian Rupiah ( IDR ) id

- Israeli Sheqel ( ILS ) il

- Jamaican Dollar ( JMD ) jm

- Japanese Yen ( JPY ) jp

- Jordanian Dinar ( JOD ) jo

- Kuwaiti Dinar ( KWD ) kw

- Malaysian Ringgit ( MYR ) my

- Mauritian Rupee ( MUR ) mu

- Mexican Peso ( MXN ) mx

- New Zealand Dollar ( NZD ) nz

- Norwegian Krone ( NOK ) no

- Omani Rial ( OMR ) om

- Philippine Peso ( PHP ) ph

- Polish Zloty ( PLN ) pl

- Qatari Rial ( QAR ) qa

- Romanian Leu ( RON ) ro

- Saudi Riyal ( SAR ) sa

- Singapore Dollar ( SGD ) sg

- South African Rand ( ZAR ) za

- South Korean Won ( KRW ) kr

- Swedish Krona ( SEK ) se

- Taiwan Dollar ( TWD ) tw

- Thai Baht ( THB ) th

- Trinidad and Tobago Dollar ( TTD ) tt

- Turkish Lira ( TRY ) tr

- Vietnamese Dong ( VND ) vn

£1 = 1.2070 USD

Earn points when you pay with your Partnership Credit Card. Representative 27.9% APR (variable)*

Online orders can include multiple currencies. Minimum online order value £250. Exchange rates in our shops may vary from those offered online. Click here for our bureau rates .

*John Lewis plc is a broker. NewDay Ltd is the lender. Credit subject to status. 18 years +. UK residents. T&Cs apply .

Our currency exchange services

Home Delivery

Delivered to you next working day. Free for orders over £500

Click and Collect

Click & Collect at selected John Lewis and Waitrose stores. Free collection for orders over £500

Buy at John Lewis

Visit a Bureau de Change located in over 30 stores

Sell your currency

We’ll buy your leftover holiday money at a great rate

Exchanging currency at John Lewis

Planning a trip abroad can take up a lot of time and effort. We want to make sure buying travel money is the easiest part of your holiday preparations . Whether you’re at a John Lewis buying mini toiletry travel bottles, or at home packing your suitcases, we’ll make sure exchanging currency is at your convenience.

Trust our rates

With excellent rates , we’ll also do our best to make sure you get your money’s worth. We monitor the market daily to ensure we’re offering a competitive rate.

Delivered to you

You can order travel money online to collect it at your local Waitrose or John Lewis , or have it delivered the next working day .

No hidden costs

We promise you’ll never be charged a commission fee when buying travel money from us, so you can save your pennies for those memorable holiday moments.

Going somewhere nice?

Our guides are packed with travel money tips to help you prepare for your trip abroad.

Get a step ahead of your trip

Our currency guides, today's online rates.

Rates on Tuesday 30 April 2024, 08:00

Exchange rates in our shops may vary from those offered online. Click here for our bureau rates .

What our travel expert has to say:

“There’s a lot that goes into planning a trip abroad, which is why we’ve made a point to make sure you receive your foreign currency at your convenience. Whether it’s exchanging directly at one of our Bureau de Change or ordering online with next-day home delivery, we’ll make sure you receive your travel money in enough time. If you’re on the go, you can even pick up your currency at your local John Lewis or Waitrose.”

- Matt Richardson, Head of Foreign Currency

We buy back currency too

Whether you’re back from your holiday or visiting the UK from abroad, we’ll buy back your leftover foreign currency and exchange it into pounds. Like buying foreign currency, selling it is just as quick and easy, with no commission fees, and at a competitive rate. Sell your travel money in-store at any of our Bureau de Change.

Frequently asked questions

How do i buy currency from you.

You can exchange currency from any of our Bureaux de Change in John Lewis. You can also order online with next working day home delivery , or c lick and collect from your nearest Waitrose and John Lewis.

Exchange rates in our shops may vary from those offered online.

Does someone need to be home if I want my order delivered?

Yes, your order will be delivered by Royal Mail Special Delivery Guaranteed™ service and will need to be signed for by either you or someone else at your address.

What is click and collect?

Click and collect allows you to order online and collect your travel money from any Waitrose or John Lewis store.

Simply select the click and collect option when placing your online order. We’ll send you a collection date in your confirmation email, as well as a reminder email and text message when your order is ready to be collected. Your order will be held for seven days from the collection date.

Your travel money order can be collected from the customer information point at any time during the opening hours of the store.

What currency do I need?

It’s helpful to know what currency you’ll need when travelling abroad before you get there. This ensures you can jump right into the fun when you arrive. For guidance on what currency you might need for your destination, you can ask one of our partners at the Bureau de Change desk or check our rate table .

Are all currencies available?

We sell over 50 types of currency online and up to 30 in our Bureaux de Change. To find out if we stock the currency you need online, you can check the list on our rate table. For in-store exchanges, please visit your nearest John Lewis Bureau de Change to ask one of our Partners, or call 0330 123 3396 to ask a member of our customer service team.

Currencies in-store will be subject to availability.

Is it cheaper to withdraw cash abroad or exchange currency before you go?

Withdrawing holiday money abroad is great in an emergency, but you can’t guarantee the currency exchange rate will be the same as it was when you left home. When using a card abroad, you might be subject to ATM fees. By exchanging currency with John Lewis before you go, you can be safe in the knowledge that you’ll get a great rate and you won’t be paying any commission.

Can you use a credit card to buy travel money?

Yes, you can absolutely use a credit card to buy your travel money. It’s important to know that while we do not charge you extra to pay by credit card, some card issuers charge additional fees for foreign currency exchange payments. Make sure to check with your bank first before purchasing travel money.

How much money do I need to take on holiday?

The amount of travel money you need to take on holiday depends on what kind of trip you’re taking, but it’s always smart to have a budget so you know what to expect. No matter how big or small your budget you should take multiple ways to pay with you, to keep you safe in every scenario. This could be cash, debit/credit cards or prepaid travel cards. If you end up with leftover foreign currency at the end of your trip, we’re happy to buy it back from you at a competitive rate.

How do I find my nearest Bureau?

Finding your closest Bureau has never been easier with our Bureau de Change locator . You just need to type in your postcode and check out your options.

If you’re tight for time, you can also order online and collect your travel money from a John Lewis or Waitrose , or even have it delivered to your home by the next working day .

Move money internationally quickly, simply and safely

Enjoy fee-free transfers using our 24/7 international money transfer service. £100 minimum transfer applies.

Our partners

We have carefully selected our travel money supplier as First Rate, with their choice of over 60 currencies, to provide our Foreign Currency Exchange services.

Our International Payments service is provided by trusted global money transfer provider Xe. Xe Money Transfer Service is provided by HiFX Europe Limited and Xe Europe B.V., trading as Xe.

John Lewis Finance and John Lewis & Partners Bureau de Change are both trading names of John Lewis plc. Registered office: 171 Victoria Street, London SW1E 5NN. Registered in England (Registered Company Number 233462). John Lewis plc introduce the panel of carefully chosen providers in Bureau de Change products and services, whom each hold the appropriate licences with the Financial Conduct Authority and HMRC.

Foreign Currency online from both John Lewis Finance and John Lewis & Partners is provided by First Rate Exchange Services Limited registration number 04287490 (Money Service Business licence number MLR-64068), whose registered office is at Great West House, Great West Road, Brentford, West London, TW8 9DF England.

For UK clients: International Payments at John Lewis Finance is provided by HiFX Europe Limited. HiFX is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration 462444, for the provision of payment services. HiFX is a limited company registered in England and Wales. Registered number: 3517451. Registered office: Maxis 1, Western Road, Bracknell, Berkshire, RG12 1RT.

For EEA clients: International Payments at John Lewis Finance is provided by XE Europe B.V.. XE Europe B.V. is authorised by the Dutch Central Bank (De Nederlandsche Bank) under the Payment Services Directive II, licence number R149006 for the provision of payment services. XE Europe B.V. is a limited company registered in The Netherlands with company no. 72587873, and registered office at Rozengracht 12,1, 1016NB Amsterdam, The Netherlands.

Terms and conditions

More from John Lewis

- John Lewis for Business

- John Lewis & Partners

- Waitrose & Partners

- About John Lewis Finance

- Accessibility

- Website feedback

- Meet the experts

- Money Transfer

- Rate Alerts

1 EUR to USD - Convert Euros to US Dollars

Xe Currency Converter

1.00 Euro =

1.07 04307 US Dollars

1 USD = 0.934203 EUR

Convert Euro to US Dollar

Convert us dollar to euro, eur to usd chart.

1 EUR = 0 USD

1 Euro to US Dollar stats

Currency information.

Our currency rankings show that the most popular Euro exchange rate is the EUR to USD rate. The currency code for Euros is EUR. The currency symbol is €.

USD - US Dollar

Our currency rankings show that the most popular US Dollar exchange rate is the USD to USD rate. The currency code for US Dollars is USD. The currency symbol is $.

Popular Euro (EUR) Currency Pairings

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

US Dollar Historical Rates Table Converter

- ► Currency Calculator ►

- ► Graphs ►

- ► Rates Table ►

- ► Monthly Average averageYear 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014

- ► Historic Lookup ►

Change Historical Lookup base currency

- Argentine Peso

- Australian Dollar

- Bahraini Dinar

- Botswana Pula

- Brazilian Real

- Bruneian Dollar

- Bulgarian Lev

- Canadian Dollar

- Chilean Peso

- Chinese Yuan Renminbi

- Colombian Peso

- Croatian Kuna

- Czech Koruna

- Danish Krone

- Hong Kong Dollar

- Hungarian Forint

- Icelandic Krona

- Indian Rupee

- Indonesian Rupiah

- Iranian Rial

- Israeli Shekel

- Japanese Yen

- Kazakhstani Tenge

- South Korean Won

- Kuwaiti Dinar

- Libyan Dinar

- Malaysian Ringgit

- Mauritian Rupee

- Mexican Peso

- Nepalese Rupee

- New Zealand Dollar

- Norwegian Krone

- Pakistani Rupee

- Philippine Peso

- Polish Zloty

- Qatari Riyal

- Romanian New Leu

- Russian Ruble

- Saudi Arabian Riyal

- Singapore Dollar

- South African Rand

- Sri Lankan Rupee

- Swedish Krona

- Swiss Franc

- Taiwan New Dollar

- Trinidadian Dollar

- Turkish Lira

- Emirati Dirham

- British Pound

- Venezuelan Bolivar

Percent Change in the Last 24 Hours

- EUR/USD -0.09219%

- USD/JPY +0.79232%

- GBP/USD +0.10368%

- USD/CHF +0.11487%

- USD/CAD +0.26949%

- EUR/JPY +0.69941%

- AUD/USD -0.51620%

- CNY/USD +0.06507%

Useful Links

- Euro Information

Today's best euros - US dollar exchange rates

Compare eur to usd exchange rates and fees before your next money transfer, about the eur to usd exchange rate, conversion rates eur/usd, conversion rates usd/eur, key facts about eur and usd, about the euro, about the us dollar, what was the best euro exchange rate ever.

The best EUR to USD rate recorded in the past 10 years between March 2012 to March 2022:

1 EUR = 1.39303 USD

This highest exchange rate recorded for euros to dollars was on March 18th, 2014 when 1 euro was worth 1.39303 US dollars.

How Do I Get the Best Exchange Rate From Euro to USD?

The best way to take advantage of the current mid-market exchange rate from euro to USD is to use Monito's comparison engine, which searches for trusted international money transfer services that apply strong rates and low commission fees.

- Check the EUR to USD mid-market exchange rate ;

- Use Monito to compare services with low fees and strong rates;

- Sign up for the best service;

- Confirm your transfer to the United States.

Find the Best Euro to Dollar Exchange Rate

Euros (eur) and us dollars (usd) exchange rates with other main currencies, where is the best place to exchange foreign currency.

CurrencyFair has provided the cheapest money transfer services from the Euro to US dollar from September 2021 to March 2022 on Monito. Wise has been the second cheapest on average during this 6-month period, while Xendpay has come in at third.

High street banks can send your euros to the US, but they often apply weak exchange rates and they charge high fees. International money transfer specialists almost always offer lower transfer fees and better exchange rates when sending money to the US.

FAQ About the Best Euro to Dollar Exchange Rate

If you have euros and want US dollars in exchange, then the higher the exchange rate (or as close to the mid-market exchange rate ) the better. You want one euro to be worth as many US dollars as possible.

The highest EUR rate recorded against the US dollar in the past 10 years was at 1 EUR = 1.39303 USD. If the current market rate can reach this level, then this would be a relatively strong exchange rate. The lowest recorded rate in that time period is 1 EUR = 1.03905 USD.

The normal exchange rate is the mid-market exchange rate , also known as the interbank exchange rate. This is the standard rate at which major international banks trade currencies with each other.

As a retail customer who wants to do foreign currency exchange, it is very rare to be offered the mid-market exchange rate by a bank. Banks charge rates that are poorer, which is why Monito recommends using an international money transfer service .

The experts at Monito recommend travellers purchase euros with Wise , which applies the same market rate regardless of if you are in the United States or in Europe.

Foreign exchange services, banks, and credit unions markup their rates without a transparent schedule. You will lose money if you present your euros to either a US bank or to a European one. The best way to ensure you get the best deal for your exchange is to check the mid-market exchange rate , which is the one you see on Google or XE.com.

Then, use Monito's search engine to compare money transfer services that have the strongest rate and the lowest fees.

Top USD to EUR Exchange Rate Guides

DAX Index Today: German Inflation and ECB Rate Cut Speculation

Key points:.

- The DAX rallied 1.36% on Friday (April 26), closing the session at 18,161.

- On Monday (April 29), German inflation numbers, ECB commentary, and corporate earnings will warrant investor attention.

- Later in the session, the Dallas Fed Manufacturing Index also needs consideration as the FOMC interest rate decision and press conference looms.

In this article:

US Tech 100

US Wall St 30

S&P 500

The Overview of the DAX Performance

The DAX rallied 1.36% on Friday (April 26). Reversing a 0.95% slide from Thursday (April 25), the DAX closed the session at 18,161.

There were no stats for Germany and the Eurozone for investors to consider. However, an ECB report supported bets on a June ECB rate cut. The ECB Consumer Expectations survey revealed lower inflation and income expectations, signaling downward trends in consumer spending.

Moreover, corporate earnings results contributed to the gains as investors reacted to overnight earnings results from Alphabet ( GOOGL ) and Microsoft ( MSFT ).

US Personal Income and Expenditures Report

On Friday (April 26), the US Personal Income and Expenditures Report drew investor interest. The US Core PCE Price Index advanced by 2.8% year-on-year in March after rising by 2.8% in February. Moreover, personal income and spending increased by 0.5% and 0.8% in March. Better-than-expected numbers tempered investor expectations of a September Fed rate cut.

Nevertheless, the stats failed to impact market risk sentiment as the US equity market responded to the Alphabet and Microsoft earnings releases.

On Friday, the Dow gained 0.40%. The Nasdaq Composite Index and the S&P 500 ended the session up 2.03% and 1.02%, respectively.

The Friday Market Movers

Siemens Energy AG led the way, rallying 5.33%, with Infineon Technologies and SAP gaining 1.44% and 2.23%, respectively.

Auto stocks reversed losses from Thursday. Mercedes Benz Group advanced by 1.56%, with BMW gaining 1.29%. Volkswagen and Porsche rose by 1.09% and 0.84%, respectively.

However, it was a mixed session for the banking sector. Deutsche Bank fell by 0.77%, while Commerzbank increased by 0.36%.

German Inflation and the ECB

On Monday (April 29), preliminary inflation numbers for Germany will warrant investor attention. Economists forecast the annual inflation rate to rise from 2.2% to 2.3% in April.

Softer-than-expected figures could raise investor expectations of multiple 2024 ECB rate cuts.

Other stats include economic sentiment numbers for the Eurozone. An uptrend in economic sentiment would align with expectations of an improving macroeconomic environment.

Economists forecast the Economic Sentiment Index to increase from 96.3 to 96.9 in April.

Beyond the numbers, investors should monitor ECB commentary. ECB Vice President Luis de Guindos is on the calendar to speak. Views on the economic outlook, inflation, and the ECB rate path could move the dial.

The Dallas Fed Manufacturing Index and US Corporate Earnings

Later in the session, the Dallas Fed Manufacturing Index will draw investor interest. Higher-than-expected figures would support investor expectations of the US avoiding a recession.

Economists forecast the Index to increase from -14.4 to -11.0 in April.

However, corporate earnings could also influence market risk sentiment. MicroStrategy ( MSTR ) is among the big names to release earnings results. Upbeat earnings results could also fuel buyer demand for bitcoin ( BTC ).

Near-Term Outlook

Near-term trends for the DAX will hinge on German inflation numbers and ECB chatter. Softer-than-expected inflation could further fuel investor bets on a June ECB rate cut. Moreover, ECB commentary and corporate earnings also need consideration before Q1 GDP numbers on Tuesday (April 30).

On the Futures markets, the DAX and the Nasdaq mini were up by 56 and 60 points, respectively.

DAX Technical Indicators

Daily chart.

The DAX remained comfortably above the 50-day and 200-day EMAs , affirming the bullish price signals.

A DAX break above the Friday (April 26) high of 18,200 could support a move to the 18,350 handle.

German inflation numbers, ECB commentary, and corporate earnings need consideration.

However, a DAX drop below the 18,000 handle would give the bears a run at the 50-day EMA. A fall through the 50-day EMA could signal a drop toward the 17,615 support level.

The 14-day RSI at 50.95 indicates a DAX move to the April 2 all-time high of 18,567 before entering overbought territory.

4-Hourly Chart

The DAX sat above the 50-day and 200-day EMAs, confirming the bullish price trends.

A DAX breakout from the 18,200 handle could give the bulls a run at 18,350.

Conversely, a break below the 50-day EMA would bring the 17,800 handle into play.

The 14-period 4-hour RSI at 59.65 suggests a DAX return to the 18,350 handle before entering overbought territory.

Related Articles

DAX Index Today: Earnings, Euro Area Data, and the US Economy in Focus

Bitcoin (BTC) News Today: MicroStrategy’s BTC Acquisition vs. Weak Earnings

- XRP News Today: Legal Battle Intensifies as SEC Counters Ripple’s Motion to Strike

About the Author

With over 20 years of experience in the finance industry, Bob has been managing regional teams across Europe and Asia and focusing on analytics across both corporate and financial institutions. Currently he is covering developments relating to the financial markets, including currencies, commodities, alternative asset classes, and global equities.

Did you find this article useful?

Latest news and analysis.

German Retail Sales Rise by 1.8% in March on Food Sales

Gold (XAU) Daily Forecast: Drops to $2,329; Will Trendline Break Spur Sell-off?

Natural Gas and Oil Forecast: WTI Drops to $83, Ceasefire Eases Tensions

China Caixin Manufacturing PMI Climbs to 51.4 in April

Editors’ picks.

USD/JPY Forecast: Japan’s Economic Indicators Signal Yen’s Path

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

- FT Weekend Print delivery

- Everything in Premium Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Everything in Print

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

IMAGES

VIDEO

COMMENTS

Calculate. Get The Best Rates With xe. Via Xe's website. United States Dollar to Euro conversion - Last updated Apr 26, 2024 19:36 UTC. Result. 0.93465 Euro. 1 USD = 0.93465 EUR. 1 EUR = 1. ...

Calculate live currency and foreign exchange rates with the free Xe Currency Converter. Convert between all major global currencies, precious metals, and crypto with this currency calculator and view the live mid-market rates. ... USD - US Dollar. To. EUR - Euro. We use the mid-market rate for our Converter. This is for informational ...

To. EUR - Euro. 1.00 US Dollar =. 0.93 41686 Euros. 1 EUR = 1.07047 USD. We use the mid-market rate for our Converter. This is for informational purposes only. You won't receive this rate when sending money. Login to view send rates.

Get the latest 2,717 US Dollar to Euro rate for FREE with the original Universal Currency Converter. Set rate alerts for USD to EUR and learn more about US Dollars and Euros from XE - the Currency Authority.

0.9325 - 0.9337. 52 WEEK RANGE. 0.8869 - 0.9571. Current exchange rate US DOLLAR (USD) to EURO (EUR) including currency converter, buying & selling rate and historical conversion chart.

The high point for the USD/EUR rate was 0.9554 Euros per US Dollar on October 3, 2023. What was the lowest USD to EUR exchange rate in the last year? The low point was 0.8894 Euros per US Dollar on July 14, 2023. Is USD up or down compared to EUR in the last year? The USD/EUR rate is up +3.13%. This means the US Dollar has increased in value ...

We found that America First Credit Union was converting $1 USD into 0.85019 Euros even though the mid-market exchange rate was at $1 USD = 0.90201 Euros*. Experts at Monito have reviewed several travel money cards that convert your currency at the true mid-market exchange rate , which you can access from your phone or a debit card.

Bank of America customers with a checking or savings account can order up to USD$10,000 worth of foreign currency every 30 days.Order foreign currency. See all FAQs. Exchange rates are updated daily. ... If we assign an exchange rate to your foreign exchange transaction, that exchange rate will be determined by us in our sole discretion based ...

View the latest USD to EUR exchange rate, news, historical charts, analyst ratings and financial information from WSJ. ... Travel; Workplace; More. ... News From WSJ USD/EUR USDEUR. 04/26/24; The ...

Over the past 30 days, the Euro rate is up 0.51% from 1.1538 on 29 Mar to 1.1597 today. This means one pound will buy more Euros today than it would have a month ago. Right now, £750 is worth approximately €869.78 which is €4.43 more than you'd have got on 29 Mar. These are the average Euro rates taken from our panel of UK travel money ...

It is often denoted like this: GBP/USD, EUR/JAP, AUD/INR; Holiday money rate or tourist rate - This is another term for a sell rate. Sell rate - This is the rate at which we sell foreign currency in exchange for local currency. For example, if you were heading to Europe, you would exchange British pounds for euros at the sell rate.

Online sell rate; Euro (EUR) 1.1462: US Dollar (USD) 1.2278: Polish Zloty (PLN) 4.7657: Canadian Dollar (CAD) 1.6535: UAE Dirham (AED) 4.4368: South African Rand (ZAR) 22.5421: ... We have carefully selected our travel money supplier as First Rate, with their choice of over 60 currencies, to provide our Foreign Currency Exchange services. ...

Today's Currency Exchange Rates. We monitor market exchange rates to get you the best value for over 50 currencies. Enjoy great travel money rates and zero commission with eurochange. Check today's exchange rate for the currency you need below. We have great deals on the pound to euro exchange rate, the pound to dollar exchange rate and much more.

Compare travel money with MoneySavingExpert. Find a better exchange rate for spending overseas. Choose from a number of different currencies. Compare rates in minutes. Compare rates. Explore page: Pros and cons. Top tips.

1.00 Euro =. 1.07 05297 US Dollars. 1 USD = 0.934117 EUR. We use the mid-market rate for our Converter. This is for informational purposes only. You won't receive this rate when sending money. Login to view send rates. Euro to US Dollar conversion — Last updated Apr 28, 2024, 08:23 UTC.

Home > US Dollar Historical Rates Table US Dollar Historical Rates Table Converter Top 10. historical date. Apr 27, 2024 16:00 UTC. US Dollar 1.00 USD inv. 1.00 USD; Euro: 0.934778: 1.069773: ... EUR/USD +0.02978%; USD/JPY +0.00802%; GBP/USD +0.13518%; USD/CHF-.06775%; USD/CAD-.07705%; EUR/JPY +0.03780%; AUD/USD +0.10337%; CNY/USD-.01069%;

The best EUR to USD rate recorded in the past 10 years between March 2012 to March 2022: 1 EUR = 1.39303 USD This highest exchange rate recorded for euros to dollars was on March 18th, 2014 when 1 euro was worth 1.39303 US dollars.

The Euro has pushed higher against both the US dollar and the British Pound over the last few sessions despite the market fully expecting the European Central Bank to cut interest rates at the ...

The USD Index (DXY) traded with a gradual downside bias this week. The likelihood of a potential rate cut by the Fed in September lost some traction. US inflation gauged by the PCE rose above ...

The mighty US dollar flexed some muscle last week in a positive sign for Americans' purchasing power. The US dollar index, which measures the currency's strength against six of its peers ...

The US Dollar retraces its recent gains due to the possible shift toward risk-on sentiment. The Australian Dollar (AUD) continued its winning streak on Monday that began on April 22, trading ...

EUR/USD, GBP/USD, USD/CAD, USD/JPY Forecasts - U.S. Dollar Retreats As Treasury Yields Fall Mon, 29 Apr 2024 16:27:50 GMT US Dollar (DXY) Index News: Greenback Under Pressure Ahead of Fed Rate ...

The euro last dropped to parity with the dollar in 2022, the first time in two decades, amid the energy price shock triggered by Russia's full-scale invasion of Ukraine and during a huge bull ...

The Japanese currency had been weakened by fading expectations for near-term interest rate increases by the Bank of Japan, while the U.S. Fed remains hawkish. The USDJPY is now at 156. ( paulo ...