- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Claiming a tax deduction for business travel expenses

You can claim a tax deduction for expenses you incur travelling for your business.

Last updated 18 August 2019

As a business owner, the general rule is that you can claim deductions for expenses if you or your employee are travelling for business purposes. A travel diary is:

- compulsory for sole traders and partners in a partnership to record overnight business travel expenses

- highly recommended for everyone else.

For a summary of this content in poster format, see Travel expenses (PDF 526KB) This link will download a file .

Expenses you can claim

Your business can claim a deduction for travel expenses related to your business, whether the travel is taken within a day, overnight, or for many nights.

Expenses you can claim include:

- train, tram, bus, taxi, or ride-sourcing fares

- car hire fees and the costs you incur (such as fuel, tolls and car parking) when using a hire car for business purposes

- accommodation

- meals, if you are away overnight.

To claim expenses for overnight travel, you must have a permanent home elsewhere and your business must require you to stay away from home overnight.

If you are entitled to goods and services tax (GST) input tax credits, you must claim your deduction in your income tax return at the GST exclusive amount.

Expenses you can't claim

You can only claim the business portion of business travel expenses. You must exclude any private expenses, such as:

- a holiday or visit to family or friends that is combined with the business travel

- the expenses associated with you or your employee taking a family member on the trip

- souvenirs and gifts

- sightseeing and entertainment

- visas, passports or travel insurance

- travel expenses that arise because you are relocating or living away from home

- travel undertaken before you started running your business.

- Claiming a tax deduction for motor vehicle expenses – information about business motor vehicle expenses and travelling to and from your places of business.

Media: Business deductions - Travel expenses: Tax basics for small business https://tv.ato.gov.au/ato-tv/media?v=bd1bdiubfw7bqp External Link ( Duration: 01:23)

How to claim employee travel expenses

If your employees travel for your business, the business must actually pay for the travel expense to be able to claim it as a deduction. The business can pay for the expense by:

- paying directly for the expense from the business account

- paying a travel allowance to the employee

- reimbursing the employee for their expenses.

Fringe benefits tax (FBT) may apply if your business pays for or reimburses your employees for their travel expenses. Certain exemptions and concessions may apply to reduce your FBT liability. For example, your business may not have an FBT liability if it reimburses an employee for their travel expenses to attend a work conference, which the employee would have been able to claim as an income tax deduction if you hadn't reimbursed them.

You will be liable for FBT if your employee extended their travel for private purposes and you reimburse the employee for these private costs. If your business provides benefits to your employees, you may need to obtain some records from the employee.

If you are the director of a company and the business pays for private portions of your travel expenses, there may also be Division 7A implications.

If you pay your employees a travel allowance or a living-away-from-home allowance, there are different considerations.

- Fringe benefits tax

- Private company benefits – Division 7A dividends

- Travel allowances

Travel diaries

Sole traders and partners in a partnership.

If you are a sole trader or a partner in a partnership and you travel for six or more consecutive nights, you must keep a travel diary or similar document before your travel ends, or as soon as possible afterwards. In your travel diary, record the detail of each business activity including:

- what the activity was

- the date and approximate time the business activity began

- how long the business activity lasted

- the name of the place where the business activity occurred.

Your travel diary can be in any format as long as it contains sufficient detail to justify what you are claiming.

Example 1: Rebecca

Rebecca owns a business as a sole trader landscape gardener. She is invited to exhibit at the Chelsea flower show in England. This involves six days of work representing her business at the show. After the show is finished, Rebecca spends some time sightseeing.

Rebecca’s son James joins her on her trip. James is not involved in the business and spends the days exploring London while Rebecca is at the Chelsea flower show.

As Rebecca is travelling for more than six nights, she keeps the below travel diary.

Travel diary for May:

- Saturday 9 May – 10.00am flight Q13 to London (via Dubai)

- Sunday 10 May – Arrive London 1.00pm local time. Bus to hotel in Chelsea 3.00pm

- Monday 11 May – Rest day

- Tuesday 12 May – Chelsea flower show set-up day from 9.00am

- Wednesday 13 May – Chelsea flower show day 1

- Thursday 14 May – Chelsea flower show day 2

- Friday 15 May – Chelsea flower show day 3

- Saturday 16 May – Chelsea flower show day 4

- Sunday 17 May – Chelsea flower show day 5, ends 5.00pm

- Monday 18 May – Sightseeing in London

- Tuesday 19 May – Sightseeing day trip to Oxford

- Wednesday 20 May – Bus to airport. Flight home Q23 6.00pm from London, arrive 10.00pm local time.

This shows that Rebecca travelled for 12 days. She spent the majority of the time on business related activities and took the opportunity to do some sightseeing while in London for two extra days. Rebecca can only claim deductions for the business-related portion of her travel.

Rebecca can claim:

- the return airfare to London (which does not have to be separated out as the primary purpose of her travel is for business, the sightseeing was incidental)

- her bus fares to and from the airport

- the costs associated with working at the Chelsea flower show including the exhibitors fee and transport to and from the location from her hotel

- Rebecca’s accommodation in Chelsea up to and including 17 May

- meals and incidental costs on the days she attended the Chelsea flower show.

Rebecca cannot claim:

- accommodation, meals or transport expenses on the days noted for sightseeing

- additional private costs from the whole of her time away (such as souvenirs)

- costs of visas, passports or travel insurance

- any of James’ expenses (such as his airfares, the cost of his meals or the cost of an extra hotel room for James).

Example 2: Noah

Noah owns a business as a sole trader interior designer and decorator. He lives and works in Perth. A new customer has asked him to design and decorate her home in Broome. This will take two weeks to complete.

Noah flies to Broome on Sunday evening and returns to Perth two weeks later. On the weekend he does some sightseeing and catches up with friends. He keeps the following diary:

- Sunday: Fly to Broome (depart 4.00pm, arrive 6.30pm)

- Monday 2 September: Purchase decorating supplies 9.00am–10.30am. Working at client’s house 10.45am – 4.00pm

- Tuesday 3 – Friday 6 September: Working at client’s house 7.30am to 4.00pm

- Saturday: Day trip to Horizontal Falls. Dinner with Pam and Geoff

- Sunday: Sightseeing around Broome

- Monday 9 – Friday 13 September: Working 7.30am to 4.00pm at client’s house

- Saturday: return flight to Perth (depart 10.00am, arrive 12.30pm).

Noah can claim:

- his return airfare to Broome and taxi to his hotel and from hotel to airport

- accommodation in Broome for all nights (as the weekend in between was incidental and the primary purpose of travel was for business)

- costs of undertaking his work in Broome (such as hire of tools)

- meals and incidental costs of his work.

Noah cannot claim his private expenses, including:

- the cost of the sightseeing he does on the weekend

- the dinner he has with friends.

Companies and trusts

If your business is a company or a trust, we highly recommend you use a travel diary as it will help you work out the proportion of the travel that was for private purposes.

- PAYG withholding implications of Travel allowances

- Fringe benefits tax (FBT)

Records for business travel expenses

Keep records for five years to substantiate your business travel expenses, including:

- tax invoices

- boarding passes

- travel diaries

- details of how you worked out the private portion of expenses.

If you’re a sole trader with simple tax affairs, you can use the myDeductions tool in the ATO app to record your business-related expenses.

- Record keeping for business

- myDeductions

19th July, 2021

Work travel expenses: What you can (and can’t) claim

Knowing exactly what deductions apply to travel expenses can save a heap of hassle at tax time.

The Australian Taxation Office (ATO) has released a new ruling that clarifies what expenses employees can deduct for work-related travel.

The new ruling, Income tax: When are deductions allowed for employees’ transport expenses? was released this week, bringing together and clarifying the rules for business advisors and their clients alike.

Key takeaways:

- The ATO’s new ruling sheds light on what travel expenses employees can and cannot claim

- Travel between work locations (neither of which are your home), is typically tax deductible

- Incidental work-related travel, such as a receptionist who makes a stop to pick up office newspapers on their way to work, can’t be claimed on tax

Travel from home to a regular place of work generally isn’t deductible. The ruling states that even if you travel to work by plane, receive a travel allowance or make incidental business-related stops on the way to work, you still cannot claim your travel expenses.

But moving between two separate work locations – like driving from your office to a construction site, or from your business to a meeting at a client’s office – can be claimed.

Tax specialist and accountant, Leo Hollestelle said the ruling is well timed ahead of the busy End of Financial Year period.

“It’s timely that these views are brought together and codified into a single ruling,” said Hollestelle. “Tax advisors will be able to more easily familiarise themselves with the rules and in turn advise their clients on it.”

What are work-related expenses?

Work-related expenses are expenses that you incur in the course of gaining or producing your assessable income.

What work-related travel expenses can I claim?

Transport expenses you incur while travelling between work locations are usually deductible. The travel must occur while gaining or producing your assessable income.

While you can’t usually deduct expenses for travelling between your home and work, you might also be able to deduct the cost of travel from your home to somewhere other than your regular place of work. This might be, for example, to attend a client’s premises or one of your employer’s other offices.

To work out if travel expenses are work-related, things like these are taken into consideration:

- Does the travel fit within your duties of employment?

- Do the travel expenses arise out of your employment and not your personal circumstances?

- Is the travel relevant to the practical demands of carrying out your work duties?

- Has your employer asked you to travel?

- Has the travel occurred during normal work time?

What work-related travel expenses can’t I claim?

Transport expenses that you incur for travel between your home and a regular place of work are not deductible.

If there is a close connection between travel and your private or domestic life, this will usually not be considered deductible. For example, if you travel to your regular place of work from another location in which you undertake private activities, for example a library or a holiday house, the cost of the travel is not deductible.

If you happen to live a significant distance from your regular place of work, your travel expenses are usually considered private and not deductible.

You may also not deduct expenses that are capital, private or domestic in nature. Transport expenses that may be considered capital in nature include, for example, the cost of purchasing a car. Ask your advisor whether such expenses may be recognised under another tax provision.

How much can you claim for work-related expenses?

You can only claim the actual cost of the expenses themselves. These will need to be proven with receipts and/or other written documentation. Your advisor will be able to help you with this.

READ: How to save tax in Australia – 15 tax minimisation strategies

How to calculate work-related travel expenses

You can claim deductions for work-related travel expenses in your tax return , but how you do this depends on the expenses themselves. (See also Claiming overseas-travel expenses , below.)

If your expenses relate to a car you own, lease or hire, you may be able to use the logbook method or the kilometres method .

READ: How long does it take to get a tax return?

Working-away-from-home tax deductions

If your employment requires you to travel away from home overnight, because of your employment (and not because of private circumstances like where you choose to live, for example), the transport expenses incurred in travelling to your alternative work location will usually be considered deductible.

Claiming overseas-travel expenses

If you travel overseas for work, you might be able to deduct expenses relating to flights, accommodation, meals, transport or other minor things (like taxis or using hotel wifi). You’ll need to keep records such as receipts and you may also need to keep a travel diary.

Where’s your regular place of work?

Interestingly, there are several exceptions that – if claimed correctly – can give you an edge come tax time. This is especially true when it comes to defining what a “regular work location” actually is.

For example, imagine you currently work for a business with an office 15-minutes from your home.

But you’re asked to cover a long-service vacancy for six months at another of your business’s offices one hour away. Because this new office becomes your regular place of work for a sustained period of time, travel to and from it cannot be claimed on tax.

But, if your period of work was only for three months, then it could be argued that the second office never became a regular place of work.

Therefore, travel could potentially be claimed on tax.

This is a call to take care in making any assumptions about what you can actually claim. As the ATO ruling states, ‘the full facts and circumstances of the specific working arrangement in place must always be considered in determining the nature and deductibility of the transport expenses incurred’.

And that’s something to keep in mind when it comes to all travel-related tax claims this tax time, as it could be this ruling also indicates an increase in scrutiny for travel-related claims.

“While the ruling is very much in line with the Commissioner’s existing views on travel expenses, the timing is worth noting,” said Hollestelle.

“After a year where many employees have been working from home, it may be the ATO is concerned there will be both workers and employers seeking to make dubious claims in the tax period ahead.”

What else do I need to know?

Find more guidance on transport and travel expenses on the ATO website.

Always seek advice on your individual situation from an accredited business advisor or tax specialist to find out exactly how tax changes and updates might impact your business.

Need an advisor? Find one today with MYOB’s Find an Advisor directory .

You might also like

Car allowances and logbooks: what you can claim, 7th may, 2024 by kellie byrnes, working from home tax deductions for business owners, tradies, tax and tricky deductions at eofy, 3rd may, 2024 by myob team, subscribe to be updated on all things myob.

I am looking for…

Travel allowance or LAFHA? And how is each taxed?

Thanks to Tax & Super Australia for the article.

Being asked by the boss to travel for work purposes can be demanding on staff — financially, physically and also emotionally. Out of this has developed more than one way to compensate employees; these being a travel allowance and the living away from home allowance (LAFHA).

When both were developed, the difference between the two were often decided by an ATO-initiated rule-of-thumb in that travel of less than 21 days was deemed to be the former, while more than 21 days was considered to have a more LAFHA flavour. The 21-day “threshold” however no longer applies.

For travel allowances, typically employees are:

- paid standard travel allowance for accommodation and food

- working at the one location

- visiting home on weekends

- staying in accommodation provided by the supplier (which may be available for use by other customers when the employee is not there).

The ATO publishes guidelines each year on what it considers to be reasonable amounts for a travelling employee.

However it has also been found that some employees may be on a travel allowance for six weeks or more.

It is often asked whether these transactions should be looked at under the FBT rules (for LAFHA ) or the income tax rules (for travel allowances ). The tax treatment (and therefore the financial outcomes) of both can be different.

Deciding factors

The FBT framework would generally provide for a more concessional tax outcome where certain prescribed requirements for a LAFHA is met in comparison with the income tax effect of a travel allowance.

The reality is that you could have someone who is away from home but is still considered to be only travelling. Alternatively you could have someone that is away from home for two weeks only, but in those two weeks was actually living away from home.

When an employee is required to travel on business and overnight their food, drink and accommodation expenses become deductible expenses and are FBT free for the employer. The difference between LAFH rules and travelling on business is quite simply the employee on LAFH has to temporarily change their usual place of residence and therefore their food, drink and accommodation expenses become private and non-deductible. And that is why the employer needs the FBT concession for such employees. It is a question of fact as to whether or not the employee has temporarily changed their usual place of residence as opposed to travelling around on business.

So it is a test of substance whether someone is just travelling or is actually living away from home. It would have to be substantiated to be proven in fact as a LAFHA. Similarly, if away from home and treated as a travel allowance, the ATO will generally not challenge such treatment if substantiated as travel. Taxation ruling TR 2017/D6 deals with these factors.

Travel allowance or living away from home?

The following general principles may be of guidance:

- When a person is living away from home, there will be a change in job location and a temporary residence will be taken up near the new work location. Often, but not always, the employee’s spouse and family will accompany the employee to the new location.

- When a person is merely travelling, there will be no change in job location and there will be no establishment of a temporary residence – rather, the person will merely be accommodated while travelling. Usually the employee’s spouse and family will not accompany the employee.

- However the issue of whether the family accompanies the employee is not determinative. The critical factor seems to be where the job is located. If it is temporarily located away from the employee’s usual place of residence, the employee will usually be living away from his or her usual place of residence. Where the job location does not change, but the employee must travel to undertake duties, he or she will be regarded as travelling.

- While the length of period away from home is not determinative, the ATO will generally accept that shorter periods away will generally be deemed to be travelling. In addition, the Tax Commissioner has stated that employees attending short-term staff training courses will generally be treated as travelling in the course of their employment.

- There is no minimum or maximum period of absence to qualify as living away from home, although the application of the FBT rules may be less concessional if someone lives away from their usual place of residence for more than 12 months. The period that a person is living away from home will end when the person returns to his or her usual place of residence, or changes his or her usual place of residence to the new location.

Related resources

analyst report

Get Started

Your privacy is assured.

Related articles

- Lodging your 2022 tax return

- Tax time 2022 for businesses – your questions answered

- A few things you need to know about STP Phase 2

- Tax time 2023 for businesses – your questions answered

- Answers to your PAYG instalment questions

- Strengthen your small business with our new online learning platform

New travel expenses rulings

In February, the ATO released three new publications in relation to the income tax and FBT treatment of employee travel expenses. These are:

TR 2021/1 — When are deductions allowed for employees’ transport expenses?

What the ruling says.

An employee can only deduct a transport expense under s. 8-1 to the extent that:

- they incur the expense in gaining or producing their assessable income;

- the expense is not of a capital, private or domestic nature;

- the expense is not incurred in gaining or producing exempt income or non-assessable non-exempt income;

- a provision of the Act does not prevent it from being deducted.

Substantiation requirements must also be satisfied for the employee to claim the deduction.

Deductibility of transport expenses — general principles

While transport expenses will only be deductible if they satisfy the requirements of s. 8-1, the following factors (based on relevant case law) would support a characterisation of transport expenses as being incurred in gaining or producing assessable income:

- the travel fits within the duties of employment, that is, the obligation to incur transport expenses arises out of the employment itself and not the employee’s personal circumstances;

- the travel is relevant to the practical demands of carrying out the employee’s work duties or role, that is, the transport expenses are a necessary consequence of the employee’s income-producing activity;

- the employer asks for the travel to be undertaken;

- the travel occurs on work time;

- the travel occurs when the employee is under the direction and control of the employer.

Common circumstances

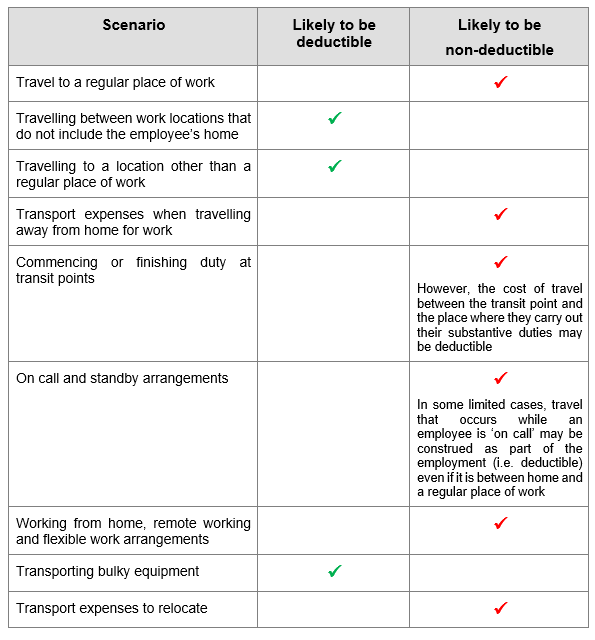

The Ruling considers the deductibility of employee transport expenses in a range of common circumstances listed below.

The following table summarises the general rule that applies to each category. However each category has conditions and exceptions and it is necessary to read the Ruling for detail.

Application

The Ruling applies both before and after its date of issue (17 February 2021). To the extent that there is any conflict between the Ruling and draft Rulings TR 2017/D6 and TR 2019/D7, the Commissioner will have regard to the earlier draft rulings in deciding whether to apply compliance resources in income years to which the earlier draft applies.

The Ruling contains 12 examples. Set out below are two examples illustrating different outcomes where an employee travels between their home and a distant work location which requires an overnight stay, and one example about an ‘on call’ employee.

Transport expenses not deductible — travel between home and a distant but regular work location

(Example 5 in TR 2021/1)

Isabelle is a specialist technician who lives in Brisbane. She works as an employee for a company based in Sydney on a part-time basis. On the days she is required to work (Wednesdays and Thursdays), she drives from her home in Brisbane to the airport, catches a flight to Sydney and then a taxi to her company’s office. She stays overnight in Sydney on Wednesday night and returns home on Thursday evening. Isabelle’s transport expenses (travel between her home and Brisbane airport, return flights from Brisbane to Sydney and taxis between Sydney airport and her office) are not deductible. Isabelle’s travel is undertaken to put her in the position to commence her duties and the expenses are not incurred in gaining or producing her assessable income. The expenses are incurred as a necessary consequence of Isabelle choosing to live in Brisbane and work in Sydney and are a prerequisite to gaining or producing her assessable income. Isabelle’s travel between her home and her regular workplace is also private in nature.

Transport expenses deductible — Travel between home and distant work location

(Example 6 in TR 2021/1)

Duy works for a company in Rockhampton, where he lives. One of the employment duties attached to Duy’s role is to attend a two-day meeting and meet clients in Brisbane once a fortnight. Duy flies from Rockhampton to Brisbane on the day of the meeting and returns home the following evening. He also catches a taxi from his home to Rockhampton airport and from Brisbane airport to the office. He does the same in reverse when he returns home. The cost of Duy’s flights and taxis between his home in Rockhampton and the office in Brisbane are deductible as the travel occurs while Duy is engaged in carrying out the employment duties attached to his role. Duy has a regular place of work in Rockhampton and in the performance of his duties travel is undertaken to an alternative destination which is not a regular place of work. Duy is required by the specific requirements of his role to carry out his duties of employment both in Rockhampton and Brisbane. The travel to Brisbane is not attributable to Duy’s choice to live in Rockhampton, or do part of his job in Brisbane. Therefore, the transport expenses are incurred in gaining or producing Duy’s assessable income and are deductible.

Transport expenses deductible — Travel between home and work location — employee on call

(Example 10 in TR 20201/1)

Christine is a highly-trained computer consultant who is involved in supervising a major conversion in computer facilities which her employer provides for its customers. This requires her to be on call 24 hours a day. In order to assist in diagnosing and correcting computer faults while she is at home after her normal work hours, Christine’s employer installs specialised equipment at her home. Typically, matters can be resolved by Christine at home with the use of this equipment but if the problem cannot be resolved at home, Christine travels to the office in order to progress the matter further.

Christine’s cost of travel between her home and the office every day is not incurred in gaining or producing her assessable income. They relate to private travel between her home and her regular work location. However, in circumstances where Christine is called to correct a fault after hours and where she commences work on that fault at home but has to travel to her employer’s premises because she cannot rectify it at home, the cost of travel between her home and the office will be deductible. Although this travel is between her home and a regular work location, the cost of these abnormal journeys is deductible because Christine commences substantive work prior to leaving home and then completes that work once she attends the office. Christine does not choose to do part of the work of her job in two separate places, but rather the two places of work are a fundamental part of Christine providing specialised support arising from the nature of her special duties. The expenses she incurs in travelling to the office in such circumstances are incurred in gaining or producing her assessable income.

TR 2021/D1 – Deductibility of accommodation and food and drink expenses

What the draft ruling says.

The draft guidance for when an employee can deduct accommodation and food and drink expenses under s. 8-1 mirrors the guidance in TR 2021/1 in relation to the deductibility of transport expenses. That is, according to the draft Ruling, an employee can on deduct accommodation and food and drink expenses to the extent that:

The applicable substantiation requirements must also be satisfied for the employee to claim the deduction.

Living expenses — not deductible

Living expenses are a prerequisite to gaining or producing an employee’s assessable income and are not incurred in performing an employee’s income-producing activities.

A person must eat and sleep somewhere, whether or not they engage in employment.

Travelling on work — expenses deductible

The occasion of the outgoing on accommodation and food and drink must be found in the employee’s income-producing activities, rather than in the personal circumstances of where the employee lives.

- Employee travelling on work and the occasion of the outgoing will generally be found in the employee’s income-producing activities — where the employee is required by their employer to stay away from their usual residence overnight for relatively short periods of time.

- The occasion of the outgoing will not be found in the employee’s income-producing activities — where the expenses are incurred because the employee’s personal circumstances are such that they live far away from where they gain or produce their assessable income.

Differentiating between travelling on work versus living expenses

If any of the following factors apply, the employee will not be travelling on work and the accommodation and food and drink expenses incurred will be living expenses:

- the expenses are incurred because the employee’s personal circumstances are such that they live far away from where they gain or produce their assessable income;

- the employee incurs the expenses because they are living at a location ;

- the employee incurs the expenses as a result of relocating from their usual residence.

[The emphasised expressions are discussed in detail in the draft Ruling.]

Incidental expenses

Incidental expenses are minor, but necessary expenses associated with travelling on work. This might include a car parking fee, a bus ticket or a charge for using the phone or internet for work-related purposes. If an employee is travelling on work and incurs incidental expenses, those expenses will be deductible under s. 8-1.

Apportionment

If accommodation and food and drink expenses are only partly incurred in gaining or producing assessable income, apportionment is required. Only that portion of the expense that relates to the employee’s income-producing activities is deductible.

In cases where there is no obvious method of apportionment, it is to be done on a ‘fair and reasonable’ basis.

Additional property expenses

Employees who travel frequently to the same location may choose to rent or buy a property rather than stay in a hotel or other commercial accommodation when travelling on work.

A deduction is allowable for expenses incurred in financing, holding and maintaining an additional property which an employee purchases or rents if it is occupied by them as accommodation in the course of travelling on work, except to the extent the expenses are capital, private or domestic in nature.

No deduction will be allowed for additional property expenses if the travel undertaken by the employee is a consequence of the employee’s personal circumstances, including their choice about where to live.

Additional property expenses must be apportioned between deductible and non-deductible where:

- the employee’s expenses are disproportionate to what they would have paid for suitable commercial accommodation; or

- the property is used for private purposes, e.g. family holidays.

Employer payments — FBT implications

There may be FBT implications for an employer where the employer:

- reimburses an employee’s accommodation or food and drink expenses; or

- incurs expenditure on accommodation or food and drink in respect of an employee.

The draft Ruling contains 12 practical examples.

Travelling on work

(Example 6 in TR 2021/D1)

Mario lives and works in Melbourne. He is employed by a large insurance company. Mario’s regular place of work is his employer’s office in the Melbourne CBD. One of Mario’s duties is to train new staff. When his employer engages some new staff in its Warrnambool office (260 kilometres away), Mario is required to travel to Warrnambool to train the new staff on site for a three-week period. Mario stays in a motel near the Warrnambool office from Sunday to Thursday night for each of the three weeks he is giving the training and returns home on Friday evenings for the weekend.

Mario is not living in Warrnambool away from his usual residence for the three-week period he is giving the training because:

- the Melbourne CBD office remains Mario’s regular place of work for the three-week period;

- the length of the overall period that Mario is away from his usual residence is reasonably short;

- Mario stays in short-term accommodation while he is working in Warrnambool.

The expenditure that Mario incurs on accommodation and food and drink during the period of the training is occasioned by Mario’s income-producing activities. Mario is travelling on work and the expenditure he incurs on accommodation and food and drink while he is working at the Warrnambool office is deductible.

Living at a location away from usual residence

(Example 5 in TR 2021/D1)

Yumi works as a senior executive for an employer based in Brisbane. Her employer is setting up a new office in Townsville and assigns her to the new office for a period of four months in order to assist in setting it up. After spending four months working at the Townsville office, Yumi will return to her usual employment in the Brisbane office.

During the period she is in Townsville, Yumi will occasionally travel to other locations around Australia (including Brisbane) for one or two days to attend work meetings or meet with clients. Yumi will live in a two-bedroom apartment close to the office in Townsville and her family will remain in the family home in Brisbane. However, the apartment in Townsville is big enough to accommodate Yumi’s family.

Yumi will be living in Townsville away from her usual residence for the four-month period due to:

- there being a change in Yumi’s regular place of work from the Brisbane office to the Townsville office;

- the extended period of time she is going to be in Townsville (an overall period of four months);

- the longer-term nature of the accommodation that she stays in while she is Townsville;

- the fact that her family could have accompanied her if they had wanted to.

The expenses that Yumi incurs on accommodation and food and drink while she is in Townsville are living expenses and will not be deductible. This would not change even if Yumi returned to Brisbane each weekend to be with her family. However, when Yumi travels from Townsville to other locations around Australia for work meetings or to meet with clients, she will be travelling on work and the amount she incurs on accommodation and food and drink will be deductible.

(Example 10 in TR 2021/D1)

Anwar is employed as an engineer. He lives with his spouse in Adelaide near his regular place of work. His employer assigns him to work on a project in Mount Gambier, almost 500 km away, for nine months.

Anwar will have to travel to Mount Gambier twice a month for three nights at a time. He decides to rent a fully furnished unit in Mount Gambier.

During the nine-month period, Anwar stays in the rented property for 65 nights. The rent was $210 per week. Anwar’s additional property expenses for the period amount to $7,560 ($210 × 36 weeks). This is less than the amount he would have spent if he had stayed in a nearby hotel.

Anwar will be entitled to claim a deduction of $7,560 for accommodation expenses and the amount he spent on food and drink for the periods he was in Mount Gambier. Anwar was travelling on work: his regular place of work remained in Adelaide, he continued living at his usual residence and he was only away overnight for short periods of time.

PCG 2021/D1 – Traveling on work vs living away from home

Who the draft guideline applies to.

An employer who provides the following to their employees (who do not work on a fly-in fly-out or drive-in drive-out basis) may rely on the Guideline once finalised:

- travelling on work, which will be a travel allowance that is assessable to an employee and will not incur FBT; or

- living at a location which may be a LAFHA benefit;

- a reimbursement of or a payment of an amount that would have been deductible to the employee had they purchased the goods or services (that is, it would be otherwise deductible).

The Commissioner’s compliance approach

The Commissioner will accept that an employee is travelling on work and will generally not apply compliance resources to determine if the above listed benefits relate to expenses for living at a location when all of the following circumstances are satisfied:

- provides an allowance to an employee or pays or reimburses accommodation and food and drink expenses for the employee;

- does not provide the reimbursement or payment as part of a salary-packaging arrangement and the employee is not given the option to elect to receive additional remuneration in lieu;

- includes the travel allowance on the employee’s payment summary or income statement and withholds tax, where appropriate;

- obtains and retains the relevant documentation to substantiate the fact that all of these circumstances are met.

- is away from their normal residence for work purposes;

- does not work on a fly-in fly-out or drive-in drive-out basis;

- no more than 21 days at a time continuously;

- an overall aggregate period of fewer than 90 days in the same work location in an FBT year;

- must return to their normal residence when their period away ends.

Will the 21-day ‘rule of thumb’ return?

The former MT 2030 had since its release in 1986 provided taxpayers with a ‘practical general rule’ that where the period that the employee spends away from their home base does not exceed 21 days the allowance will be treated as a travelling allowance rather than a LAFH allowance.

MT 2030 was withdrawn with effect from 12 July 2017, two weeks after the release of TR 2017/D6. The (now withdrawn) TR 2017/D6 did not stipulate a practical general rule of 21 days or of any other length of time. This was the result of a ‘deliberate move’ away from relying on the 21 day rule or in fact any other line in the sand, in favour of the guidance and examples in the draft ruling (see the minutes of the FBT States and Territories Industry Partnership meeting held on 28 February 2017).

The preliminary practical guidance set out in PCG 2021/D1 reintroduces a quantitative rule of thumb of 21 consecutive days for determining whether an employee should be treated as travelling rather than living away from home, but with additional requirements as set out above — including an aggregate of fewer than 90 days in the same location in the FBT year.

The draft Guideline contains three practical examples, of which example 1 is reproduced below.

Allowance is not a LAFH benefit — travelling on work

(Example 1 in PCG 2021/D1)

Kate lives in Perth and does most of her work at her employer’s head office in Perth. From time to time, Kate is required to spend a period of no more than 21 days working in various remote locations in Western Australia. Kate returns to her home in Perth for periods of more than a week before her next trip.

The employer pays Kate an allowance which she spends on accommodation and food and drink. Kate is away for a period of fewer than 90 days in total in the same location in the FBT year.

The allowance is included in Kate’s assessable income and Kate may be entitled to a deduction for her accommodation and food and drink expenses.

The employer is able to rely on the Guideline (once finalised) — i.e. the requirements are met such that the Commissioner would accept that Kate is travelling on work. The employer is paying Kate a travel allowance and not a LAFHA. The employer is not liable for FBT on the allowance paid.

Further info and training

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at locations across Australia. Click here to find a location near you.

If you’re not a current client, we can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here .

Your 2024 L&D plan

Have a team of 8 or more? Check out our in-house training option!

Stay informed with our newsletter

Join our weekly newsletter and get our blogs and podcasts sent straight to your inbox.

Tax education for smaller practices & sole practitioners

Online tax updates, online special topics, in person workshops.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.

Tax Advantaged Allowances

The following allowances receive specific tax treatment, which may reduce the tax that would otherwise be payable on income which is spent on deductions associated with earning taxable income.

ATO Reasonable Travel Allowances Reasonable allowance expense amounts for each year are set out in an annually updated Tax Determination covering:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- office holders covered by the Remuneration Tribunal

- Federal Members of Parliament

- Read more..

TR 2021/D1 – released 17 Feb 2021 Income tax and fringe benefits tax: employees: accommodation and food and drink expenses, travel allowances, and living-away-from-home allowances.

PCG 2021/D1 – released 17 Feb 2021 Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location – ATO compliance approach

Lafha The tax exempt components of a Living Away From Home Allowance are made up of reasonable food and accommodation costs less the statutory allowance amounts based on the members of your family. Read more..

Award Transport Payments Payments made under an industrial law or award that was in force on 29 October 1986. Read more..

Overtime Meal Allowances With some exceptions, an overtime meals allowance should be declared as income, and subject to conditions, may be claimable as a tax deduction. Read more..

PAYG Withholding Variation: Tax Free Allowances A regulation made under the Taxation Administration Act 1953 provides that there is no requirement to deduct tax from certain allowances associated with the tax deductible expenses of an employee. Read more..

Car Allowance

Living Away From Home Allowance Fringe Benefit

Related topic: Travel between home and work

This page was last modified 2021-05-11

- Moscow Tourism

- Moscow Hotels

- Moscow Bed and Breakfast

- Moscow Vacation Rentals

- Flights to Moscow

- Moscow Restaurants

- Things to Do in Moscow

- Moscow Travel Forum

- Moscow Photos

- All Moscow Hotels

- Moscow Hotel Deals

- Things to Do

- Restaurants

- Vacation Rentals

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

Red Arrow Train - Luggage allowance - Moscow Forum

- Europe

- Russia

- Central Russia

- Moscow

Red Arrow Train - Luggage allowance

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Central Russia forums

- Moscow forum

My partner and I will have 2 suitcases between us (20kg each) and a couple of hand luggage bags. Can this be taken with us into our compartment? Will it fit under the bed?

Sorry if this seems a simple question but I'd be grateful of any insight and advice.

Yes, you can take your suitcases with you. Please read this (use google to translate).

http://pass.rzd.ru/static/public/ru?STRUCTURE_ID=5116

The short answer is yes. You lift a bunk there is storage space underneath. There is more storage above the door but requires more athleticism

Official RZD luggage allowance is 36 kg per person. It should fit. If you travel 1st class and above you can have 50 kg per person. You seem to fit in nicely. There is another storage area in the compartment - over the corridor ceiling.

You could make your train life easier, if you pack things you need on a train in a small handbag. You can leave it on the table, and put big bags away.

Thanks for all the advice everyone. Very helpful!

This topic has been closed to new posts due to inactivity.

- travel to moscow May 04, 2024

- Planning trip to Russia Apr 28, 2024

- Train Booking Moscow to St. Peter Apr 24, 2024

- SIM card. Russian SIM cards, do they still work in the UK? Apr 09, 2024

- Union Pay debit card Mar 27, 2024

- Russian trying to book a hotel in Jerusalem Mar 14, 2024

- Dual Citizen Arrested in Russia Mar 12, 2024

- about clothes Feb 27, 2024

- NOTE - border crossing from Finland into Russia closed Feb 09, 2024

- Snow boots in Red Square Feb 04, 2024

- Travelling to Moscow & Murmansk with toddle in winter Feb 02, 2024

- Anyone traveling from London to Moscow this week ? Jan 27, 2024

- Booking accommodation Jan 11, 2024

- Traveling friends (Designers preferred) :) Jan 05, 2024

- Moscow to St Petersburg train or air?? 32 replies

- New Sapsan Express Train from Moscow to St Petersburg 18 replies

- New year's in moscow 8 replies

- Hop on Hop Off Bus Tour 5 replies

- How do you purchase Bolshoi Ballet tickets at a great price? 2 replies

- Select-a-room.com Are they legitimate? 3 replies

- Weather Moscow and St. petersburg in May 8 replies

- Night train to St Petersburg 3 replies

- ATM Access 12 replies

- Visa needed if on layover at Moscow Airport??????? 15 replies

- Where can I get initial answers to ANY question?

IMAGES

VIDEO

COMMENTS

Travel allowance is a payment made to an employee to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties. Allowances folded into your employee's salary or wages are taxed as salary and wages and tax has to be withheld, unless an exception applies. You ...

A travel allowance expense is a deductible travel expense: you incur when you're travelling away from your home overnight to perform your employment duties. that you receive an allowance to cover. for accommodation, meals (food or drink), or incidentals. You incur a travel allowance expense when you either: actually pay an amount for an expense.

Expenses you can claim. Your business can claim a deduction for travel expenses related to your business, whether the travel is taken within a day, overnight, or for many nights. Expenses you can claim include: airfares. train, tram, bus, taxi, or ride-sourcing fares. car hire fees and the costs you incur (such as fuel, tolls and car parking ...

On 17 February 2021, the Australian Taxation Office (ATO) released the following new guidance in relation to whether an employee is "travelling on work" or otherwise, and the income tax and fringe benefits tax (FBT) treatment of associated travel expenses: Draft Taxation Ruling TR 2021/D1: Income tax and fringe benefit tax: employees ...

A travel allowance is a predetermined amount of money provided by an employer to an employee to cover the expenses associated with travelling for work-related purposes. The ATO considers a travel allowance to be tax-free if it meets the following conditions: The travel is required as part of the employee's job duties.

Draft Taxation Ruling TR 2021/D1 Income tax and fringe benefits tax: employees: accommodation and food and drink expenses, travel allowances, and living-away-from-home allowances; and. Draft Practical Compliance Guideline (PCG) 2021/D1 - Determining if allowances or benefits provided to an employee relate to travelling on work or living at a ...

Knowing exactly what deductions apply to travel expenses can save a heap of hassle at tax time. The Australian Taxation Office (ATO) has released a new ruling that clarifies what expenses employees can deduct for work-related travel. ... receive a travel allowance or make incidental business-related stops on the way to work, you still cannot ...

The ATO publishes guidelines each year on what it considers to be reasonable amounts for a travelling employee. However it has also been found that some employees may be on a travel allowance for six weeks or more. It is often asked whether these transactions should be looked at under the FBT rules (for LAFHA) or the income tax rules (for ...

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25. The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019). Download the PDF or view online here.

The Australian Taxation Office has issued new rates for reasonable travel expenses for the 2021/22) financial year. Tax Determination TD2021/6 sets out the rates for employee taxpayers who travel within Australia or overseas for work-related purposes and receive travel allowances. Substantiation requirements do not apply if accommodation, food ...

In August 2021, the Australian Taxation Office (ATO) finalised Taxation Ruling TR 2021/4 and PCG 2021/3, which provide guidance on the income tax deductibility of accommodation, food and drink expenses incurred in connection with travel.To the extent that an employer provides these types of benefits to employees, these rulings will be relevant in determining the extent that these expenses may ...

ATO Community; Save. Ask a question. Related articles. Lodging your 2022 tax return. Tax time 2022 for businesses - your questions answered. A few things you need to know about STP Phase 2. Tax time 2023 for businesses - your questions answered. Answers to your PAYG instalment questions.

On 17 February 2021, the Australian Taxation Office (ATO) released the following new guidance in relation to whether an employee is "travelling on work" or otherwise, and the income tax and fringe benefits tax (FBT) treatment of associated travel expenses: • Draft Taxation Ruling TR 2021/D1: Income tax and fringe benefit tax: employees:

This Ruling sets out when an employee can deduct transport expenses under s. 8-1 of the Income Tax Assessment Act 1997. This includes the cost of travel by airline, train, taxi, car, bus, boat, or other vehicle. TR 2021/D1. Income tax and fringe benefits tax: employees: accommodation and food and drink expenses, travel allowances, and living ...

Income tax and fringe benefits tax: employees: accommodation and food and drink expenses, travel allowances, and living-away-from-home allowances. PCG 2021/D1 - released 17 Feb 2021. Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location - ATO compliance approach.

Elektrostal is linked by Elektrichka suburban electric trains to Moscow's Kursky Rail Terminal with a travel time of 1 hour and 20 minutes. Long distance buses link Elektrostal to Noginsk, Moscow and other nearby towns. Local public transport includes buses. Sports

Answer 1 of 5: Hi all, 've just managed to book my tickets for the Red Arrow train from Moscow to St Petersburg via Russian Railways. Now I'm trying to find out how much luggage I'm allowed to take and how to transport it. My partner and I will...

Rome2Rio is a door-to-door travel information and booking engine, helping you get to and from any location in the world. Find all the transport options for your trip from Lyon to Elektrostal right here. Rome2Rio displays up to date schedules, route maps, journey times and estimated fares from relevant transport operators, ensuring you can make ...

Rome2Rio is a door-to-door travel information and booking engine, helping you get to and from any location in the world. Find all the transport options for your trip from Milan to Elektrostal right here. Rome2Rio displays up to date schedules, route maps, journey times and estimated fares from relevant transport operators, ensuring you can make ...