U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best International Travel Insurance Companies for 2024

Allianz Travel Insurance »

AIG Travel Guard »

Generali Global Assistance »

World Nomads Travel Insurance »

GeoBlue »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best International Travel Insurance Companies.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

With demand for international travel still on the rise, buying travel insurance makes more sense now than ever before. Having an international travel policy in place will ensure you won't lose the money you spent if your trip is canceled or interrupted for reasons beyond your control – or if your bags are delayed or lost entirely by your airline or cruise line .

Other protective benefits come from the best international travel insurance policies as well, including travel medical coverage for unexpected medical expenses and emergency medical evacuation. You may even find that the destination you plan to visit requires travel insurance, although most countries have dropped travel insurance requirements they initially put in place due to the pandemic.

U.S. News editors compared more than 20 of the top providers to find the best travel insurance companies for trips around the world. If you're hoping to secure the best international travel policy for your needs this year, the policies outlined below provide a solid foundation for you to start your research.

Frequently Asked Questions

While many countries began mandating travel insurance for visitors during the COVID-19 pandemic, most have loosened entry requirements and dropped this condition by now. Countries that still require international visitors to have travel insurance include the following:

- Antarctica: Travel medical insurance is generally required by cruise lines and tour operators for trips to Antarctica , with a standard minimum of $100,000 in emergency medical and evacuation coverage.

- Ecuador: You do not need travel insurance to visit the country of Ecuador, but you do need insurance with medical coverage to visit the Galápagos Islands .

- Qatar: Travelers visiting Qatar for more than 30 days are required to have a travel insurance policy that is approved by the country's Ministry of Public Health.

- Saudi Arabia: Visitors to Saudi Arabia from eligible countries must pay for an eVisa, and the cost includes compulsory travel insurance coverage.

International travel insurance works the same as travel insurance for domestic trips. These plans include various coverage options and coverage limits, and a deductible may or may not apply. Travelers can choose to purchase international travel insurance for a single trip or multiple trips; long-term plans for expats and missionaries are available from some providers.

While travel insurance policies can include a broad range of coverages, the main protections you'll want for international trips include the following:

- Trip cancellation and interruption coverage: This type of protection can reimburse you for prepaid travel expenses when a trip is canceled or interrupted for a covered reason beyond your control.

- Baggage delay insurance: This coverage can pay for incidental expenses that occur when your bags are delayed for a specific period of time (usually six hours or longer).

- Lost luggage coverage: This protection can replace your luggage and your belongings or reimburse you for costs if your bags are lost by a common carrier.

- Rental car insurance: This type of insurance may provide primary coverage when you rent an eligible rental car.

- Emergency medical and dental coverage: This type of insurance will pay for emergency medical treatment or dental expenses that may arise during your trip.

- Emergency evacuation coverage: This protection can pay for emergency transportation costs when you're sick or injured during your trip.

Also note that many travelers booking an international trip choose to purchase travel insurance that offers cancel for any reason protection, so they can cancel a trip for any reason at all, even if they just decide they don't want to go. That said, adding CFAR coverage to your policy will make your travel insurance plan more expensive. Most plans also have limits on how much of your prepaid travel expenses can be refunded, which are usually capped between 60% to 80% of your trip costs.

While coverages offered through international travel insurance plans tend to be broad, keep in mind that this type of insurance won't cover every situation that could arise. Some common issues that are not covered by international travel insurance plans include:

- Acts of war

- Claims due to air or water pollution

- Claims due to natural disasters

- Epidemics not specifically included in coverage

- Extreme, high-risk sports

- Government regulations or proclamations

- Nuclear radiation and contamination

- Terrorist events

- Travel bulletins or alerts

Many travel credit cards offer international travel insurance benefits, but you should know that these coverages have some limitations. For example, travel insurance plans from credit cards never provide meaningful amounts of coverage for medical emergencies or dental emergencies. You also have to pay for each trip with your travel credit card for coverage to apply.

The best international health insurance plan depends on factors like the length of your trip, where you're traveling and how much coverage you need. While you can take the time to get quotes from several different companies, websites like TravelInsurance.com and Squaremouth make it easy to compare coverage details, limits and pricing among several providers all in one place.

The cost of international travel insurance varies and can depend on your age, the length of your trip, your total trip cost and other factors. Consider getting multiple travel insurance quotes through TravelInsurance.com to get an idea of the cost of coverage for your upcoming travel plans.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for the Cost

- Generali Global Assistance: Best for Medical

- World Nomads Travel Insurance: Best for Active Travelers

- GeoBlue: Best for Expats

Buy coverage for single trips or multiple trips at once

Annual plans available

Lower coverage amounts for emergency medical expenses than some other plans

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage up to $50,000

- Emergency medical transportation coverage up to $500,000

- Trip change protector coverage worth up to $500

- Baggage loss and damage coverage up to $1,000

- Baggage delay coverage up to $300 (12-hour delay required)

- Travel delay coverage up to $800 ($200 per day)

Add-on coverage available for lodging expenses, preexisting medical conditions and rental cars

Optional CFAR coverage available with some plans

Coverage limits for its lowest-tier Essential plan may be insufficient for some trips

Add-on coverage for preexisting conditions must be purchased within 15 days of the initial trip payment

- Trip cancellation coverage worth up to 100% of the trip cost

- Trip interruption coverage worth up to 100% of the trip cost

- Baggage coverage worth up to $750

- Up to $200 in coverage for baggage delays

- Travel medical expense coverage worth up to $15,000

- Up to $150,000 in coverage for emergency medical evacuation

Choose medical coverage limits based on your needs

Generous limits for emergency medical expenses and medical evacuation across all plans

CFAR coverage must be purchased within 24 hours of initial trip deposit and is only available with Premium plan

Rental car coverage only included in top-tier Premium plan

- Trip cancellation coverage up to 100% of the trip cost

- Trip interruption coverage up to 175% of the trip cost

- Travel delay coverage up to $1,000 per traveler ($300 daily limit)

- Up to $2,000 per person in baggage protection

- Up to $2,000 in coverage for sporting equipment

- Up to $500 per person for baggage delays

- Up to $500 per person for sporting equipment delays

- Up to $1,000 per person in protection for missed connections

- Up to $250,000 per person in coverage for emergency medical and dental procedures

- Up to $1 million in coverage for emergency assistance and transportation

- Up to $25,000 per person in rental car coverage

- Up to $100,000 per plan in accidental death and dismemberment coverage

24-hour travel assistance services included

More than 200 sports and activities covered in every plan

Coverage limits within standard plans may be insufficient

No coverage for most preexisting conditions

- Up to $10,000 in coverage for trip cancellation

- Up to $100,000 in coverage for emergency medical expenses

- Up to $500,000 in protection for emergency medical evacuation

- Up to $3,000 in protection for damage or theft to your bags or gear

Purchase international travel medical insurance for individual trips, multiple trips or long-term travel

Coverage is mostly for emergency medical expenses abroad

Some plans require a primary U.S. health insurance plan

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has covered travel and travel insurance for more than a decade. Johnson has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and she has experience navigating the claims and reimbursement process. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson also works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – in their family media business.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings.

Travel Insurance for Europe: 4 Best Options for 2024

Learn about a range of coverage options for traveling abroad.

The Best Travel Insurance for Mexico in 2024

Find coverage options for medical emergencies, travel delays, lost baggage and more.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

Search When autocomplete results are available use up and down arrows to review and enter to select.

Choose the plan that meets your needs and spend more time enjoying your international experience not worrying about your insurance coverage.

- Customer Stories

- Resume Quote / Application

What type of coverage do you need?

Vacation / holiday, visitor / immigrant, student / scholar, employer / business traveler, expat / global citizen, mission / social good, marine captain / crew.

- Flights / Airfare

- Cruises / Excursions

Travel Medical Insurance

Temporary coverage for accidents, sicknesses, & emergency evacuations when visiting or traveling outside of your home country.

Popular Plans

International health insurance.

Annually renewable international private medical insurance coverage for expats and global citizens living or working internationally.

Travel Insurance

Coverage designed to protect you from financial losses should your trip be delayed, interrupted, or cancelled.

Enterprise Services

Meet your duty of care obligations with confidence, knowing your travelers are safe, healthy, and connected wherever they may be in the world.

What type of organization do you represent?

- Corporations

- Insurance Companies

- Educational Institutions

- Mission Organizations

- Maritime Industries

- Government Agencies

- Non-Profit Organizations

Medical & Travel Assistance

Your travelers can access 24/7 global support should they need medical attention, travel assistance, or medical transport services.

Global Workers' Compensation Case Management

Rest assured knowing you have an experienced team who is committed to reducing your costs, moving your files forward, and serving as an international resource for all your work injury claims.

Security Assistance Services

Keep your travelers safe, no matter where they are, with real-time alerts and intelligence on safety, health, political, and other global risks.

Insurance Administrative Services

You’ll have experts to guide you through all things related to your health care plan needs, from enrollment to claim reimbursement.

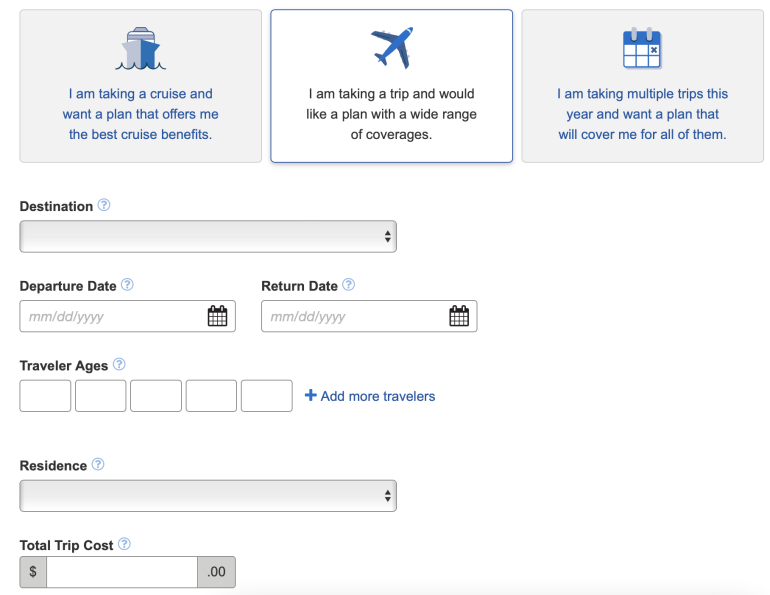

Let's Find the Right Plan for You

Answer a few questions below to see prices.

Already know what you need?

- By Popularity

- Global Medical Insurance

- Patriot Lite

- Patriot America Plus

- Patriot Platinum

- iTravelInsured Travel SE

- iTravelInsured Travel LX

- iTravelInsured Travel Lite

- Patriot Exchange Program

- Visitors Care

- Outreach Travel Medical Insurance

- Global Mission Medical Insurance

- Student Health Advantage

- GlobeHopper Senior

- Patriot Multi-Trip

- Student Health Advantage Platinum

- Global Crew Medical Insurance

International Health and Travel Insurance Offerings from IMG

IMG is an award-winning global benefits and assistance services company and one of the only companies in the market to offer travel medical, international health, and travel insurance plans. Get a quote now and choose the right plan for your next trip:

Travel Medical Insurance protects you in the event of an illness or injury while traveling outside of your home country.

Travel Insurance protects you from financial losses should your trip be delayed, interrupted, or cancelled. It also includes coverage for medical expenses while abroad.

International Health Insurance provides medical coverage for individuals and families living abroad (or away from their home country) and includes benefits such as preventive care, routine check-ups, and treatment for illnesses and injuries.

Travel Insurance Questions Answered

How to choose the best travel protection plan for you, the cost of increased flight delays & cancellations: how travel insurance can help, is travel insurance worth it, select why you are away from home., get plan recommendations and helpful resources., government services, give us a call, have any questions we’re here to help you, 866-263-0669.

You can find more information on health, travel, tourism, and insurance on our blog, Global Connect.

- "Although one hopes never to use travel insurance, IMG was a godsend throughout our ordeal. We couldn’t have done it without your continued assistance." Joan D. United States

" I took comfort in the fact that IMG had my back. "

While skiing in Chile, Mark, an IMG member, found himself on the brink of paralysis.

Global Resources. Local Care.

Languages spoken in-house, countries where members are served, insurance plans to fit your needs, employees & growing, doctors & hospitals in our global database, headquarters, send a message.

If you need to send personal information such as medical records, payment information, etc., please use our Secure Message Center .

Thank you for your message! We'll be in touch shortly.

Select your language.

Atlas Travel Insurance Review: Is it Worth it For You?

This article may contain references to some of our advertising partners. Should you click on these links, we may be compensated. For more about our advertising policies, read our full disclosure statement here.

In this Atlas Travel Insurance review, we’ll explore what plans they offer, what they cover, and whether the plans are worth it for you. Enjoy!

If you’re getting ready for a trip, you know it can involve a fair bit of planning. From finding affordable vacation ideas to choosing the ideal flights, there are a lot of decisions to make.

One decision you’d probably rather not deal with is choosing a travel insurance plan. Unlike scouting for the best flight and hotel deals, there’s nothing fun about thinking about the worst-case scenario. It’s tempting to skip it altogether – but don’t.

Anything could happen, and it’s better to be safe than sorry. The best travel insurance companies offer comprehensive coverage that protect your financial investment and your health.

Today I’ll review two types of insurance offered by Tokio Marine HCC-MIS Group, otherwise known as Atlas.

Atlas at a Glance

- Started in 1998 in Indianapolis, IN

- One of the first to make insurance products and services available on the internet

- Sells three comprehensive trip cancellation insurance plans

- Offers a multi-trip travel medical plan

- Offers two customizable single-trip travel medical plans

Atlas Travel Insurance Products

Atlas provides a suite of travel insurance options to meet the diverse needs of today’s traveler. Let’s take a look.

Trip Cancellation Insurance

Atlas trip cancellation insurance plans protect the non-refundable deposits you make when you book your trip. They’re considered comprehensive plans because they also offer emergency medical coverage. There are three tiers available:

- Atlas Excursion

- Atlas Expedition

- Atlas Enterprise

Atlas MultiTrip

The Atlas MultiTrip plan covers frequent travelers for all trips up to 30 or 45 days in a 364-day period. It’s primarily a travel medical plan, although it also includes trip interruption, trip delay, and baggage loss coverage. It does not include trip cancellation, so you’ll either have to use a travel rewards credit card that includes it, or purchase that separately for each trip.

Travel Medical Insurance

Atlas offers two customizable travel medical insurance plans that provide single-trip coverage for trips lasting 5 to 364 days. These plans also include trip interruption, travel delay, and lost baggage:

- Atlas Travel

- Atlas Premium

In this review, I’ll focus on the trip cancellation insurance and MultiTrip plans. If you want to learn more, you can compare Atlas travel medical insurance plans here .

Atlas Travel Insurance: What’s Included?

Atlas trip cancellation insurance plans protect you from financial loss if you cancel your trip or return home suddenly (for a covered reason). There are 3 plans to choose from – Excursion, Expedition, and Enterprise.

As an example, the basic Atlas Excursion plan includes:

- Trip Cancellation

- Trip Interruption

- Baggage Delay

- Emergency Medical and Dental Expense

- Emergency Medical Evacuation and Repatriation of Remains

- Common Carrier AD&D

Of course, the higher-tiered Expedition and Enterprise plans offer more coverage per category and offer extras like Cancel for Any Reason coverage and a Pre-existing Medical Conditions Waiver.

One note about these plans – they are not easy to find on their website. In fact, you have to get a quote (and therefore, already know your plans or have made reservations) to even get access to coverage amounts. We’d love to see coverage amounts front-and-center like they do for their MultiTrip and travel medical plans – without having to put in specific information first. Anyone should be able to see up-front how much insurance is provided.

Atlas’ MultiTrip plan is a travel medical plan that covers all trips lasting up to 30 or 45 days in a 364-day period. It’s an attractive solution for frequent travelers . Their MultiTrip plans include:

- Emergency Medical Evacuation: $1,000,000 lifetime maximum

- Repatriation of Remains: Up to the overall maximum limit

- Emergency Dental: $300

- Accidental Death and Dismemberment: Lifetime max up to $25,000 depending on age

- Common Carrier Accidental Death: up to $50,000 depending on age

- Personal Liability: $25,000 lifetime max

- Trip Interruption: $10,000

- Lost Luggage: $1,000

- Travel Delay (12 hours): $100/day for maximum 2 days

- Lost or Stolen Passport/Travel Visa: $100

- Deductible: $250 per covered trip

- For a full list of what’s covered, click here .

Remember that while it includes trip interruption, trip delay, and baggage loss coverage, it does not include trip cancellation insurance. If you want that, you can purchase it separately.

Great Coverage for Your Epic Trip – Protect yourself and your trip from catastrophe. Get started with comprehensive medical and trip insurance from Atlas. Get your free quote here .

Atlas Travel Insurance: How Much?

The cost of a travel insurance policy depends on several factors, including your age, the length and cost of your trip, whether you’re traveling solo or with family, and your state of residence. To weigh your options, get an online quote directly from Atlas. That said, these examples help illustrate how the plans compare in terms of price.

Let’s consider a 33-year-old solo traveler heading to Belgium for two weeks in June. He’s from the U.S. state of Georgia, and his trip costs $3,000. Here is what he would pay for each of the Atlas trip cancellation insurance plans:

- Atlas Excursion: $91

- Atlas Expedition: $107

- Atlas Enterprise: $126

Now, let’s shake things up and see what the prices would look like if it were a family vacation. Let’s add his 35-year-old wife and their two kids, ages 7 and 10. With the additional airfare, let’s say the trip costs $5,500:

- Atlas Excursion: $204

- Atlas Expedition: $240

- Atlas Enterprise: $280

In both examples, the jump from Atlas Excursion to Atlas Expedition is pretty small. Considering Atlas Expedition gets you an extra $100,000 in emergency medical coverage and the pre-existing medical conditions waiver, I think it’s worth it.

Note that adding Cancel for Any Reason coverage to the Atlas Enterprise plan would cost an extra $182. The standard trip cancellation coverage includes the most common reasons for canceling a trip, so most people probably wouldn’t add it on.

Atlas MultiTrip: How Much?

When buying the MultiTrip Plan, you can insure trips lasting up to 30 or 45 days. Let’s look at how much it would cost to insure the travelers from the previous example for all trips taken for 364 days.

Our 33-year-old solo traveler would pay:

- $188 for all trips lasting up to 30 days

- $230 for all trips lasting up to 45 days

The family of 4, ages 35, 33, 10, and 7 would pay:

- $282 for all trips lasting up to 30 days

- $345 for all trips lasting up to 45 days

Atlas Travel Insurance: What Isn’t Covered?

The nitty-gritty exclusion details vary by plan and can be found in your plan certificate. Here are a few things worth noting.

Pre-existing Medical Conditions (Certain Circumstances)

The Atlas trip insurance plans define a pre-existing medical condition as one you had in the 60 days preceding your scheduled departure. That 60 days is called the look-back period. Pre-existing conditions are handled differently based on the type of travel insurance you purchase.

The Atlas Excursion plan does not cover pre-existing medical conditions in any circumstance. For some, this is a good reason to buy the Atlas Expedition or Enterprise plans instead.

The Atlas Expedition and Enterprise plans have a pre-existing conditions waiver. That means that if you meet certain criteria, your trip cancellation, interruption, and medical benefits will cover your pre-existing medical conditions. These are the criteria:

- You purchase your travel insurance plan within 21 days of making your initial trip deposit

- You purchase insurance for the full cost of your trip

- You’re medically able to travel on the effective date of your policy

The Atlas MultiTrip plan has a look back period of two years. That means a condition is considered pre-existing if you had it in the two years prior to the beginning of your coverage.

The MultiTrip plan does not cover pre-existing medical conditions except in cases of acute onset. Acute onset means a sudden, unexpected, brief flare-up that requires urgent care (excluding chronic or congenital conditions).

Adventure Sports

There’s a whole list of adventure sports that aren’t covered. That means if you sustain an injury while taking part in one, Atlas won’t pay your claim. Here are a few notable exclusions:

- Parachuting

- Any kind of race

- Base jumping

- Independent scuba diving

- Spelunking or cave diving

- Whitewater rafting

- Big game hunting

If any of these are an important part of your travel plans, you should look elsewhere for your insurance needs. We recommend checking out World Nomads , which is known for its adventure sports coverage.

Lost or Damaged Medical Items

It’s important to note that baggage/personal effects and baggage delay coverage do not cover loss or damage to medical items you may travel with. This includes:

- Eyeglasses, sunglasses, and contacts

- Artificial teeth and dental bridges

- Hearing aids

- Prosthetic devices

- Prescribed medications

- Retainers and orthodontic devices

The best course of action is to keep these items in your carry-on luggage to reduce the chance of loss or damage.

Standard Exclusions

As is the case with most travel insurance providers, Atlas does not cover losses related to:

- Anything self-inflicted

- War, invasion, acts of foreign enemies, civil war, hostilities between nations

- Any non-emergency medical treatment

- Injury or sickness when traveling against the advice of a physician

- Participation in professional sports, piloting, or military training exercises

Again, consult your plan certificate for the full list of exclusions.

Need an all-in-one travel insurance plan? Atlas has your back with several single trip and multi-trip options. Get started today with a free quote.

Atlas Travel Insurance: Who Can be Covered?

Two of the Atlas trip cancellation plans, Atlas Expedition and Atlas Enterprise, cover travelers up to age 99. This is something to consider if you or someone you are traveling with is a senior. Atlas Excursion provides coverage to age 75. Atlas MultiTrip provides coverage to travelers aged 14 days to 75 years.

Atlas Travel Insurance Pros and Cons

Who should buy atlas travel insurance.

Frequent Travelers – If you travel several times a year, Atlas MultiTrip can save you money.

Travelers Who Need an All-In-One Insurance Product – If you need to insure your non-refundable trip deposits but you also want high levels of medical coverage, the Atlas Expedition or Enterprise plans will be a good fit for you. They come with a generous $150,000 or $200,000 in medical coverage.

Travelers Who Need Cancel For Any Reason Coverage – The Atlas Enterprise plan comes with optional Cancel for Any Reason coverage. Although it’s expensive, it will be worth it for some travelers.

Who Should Skip Atlas Travel Insurance?

Seniors Aged 75 and Over – Seniors over age 75 are not eligible for the Atlas Excursion plan or the MultiTrip plan. They can get the Atlas Expedition and Enterprise plan, but they can likely find more options elsewhere.

Adventurous Travelers – Atlas doesn’t offer adventure sports coverage, so if bungee jumping or mountain climbing are in the cards, look elsewhere. I recommend checking out World Nomads .

Frequent Travelers Who Need Trip Cancellation – The Atlas MultiTrip plan is a great option for frequent travelers, except for one thing: it doesn’t include trip cancellation insurance. If you’ll be making expensive deposits several times per year, the MultiTrip plan won’t check all your boxes.

How to Buy Atlas Travel Insurance

The simplest way to buy any of the Atlas plans is online. Start by grabbing a quote and reviewing the coverage. If you like what you see, enter your details and your payment information, and you’re good to go.

The Atlas trip cancellation insurance plans come with a 10-day review period. This means you can request a refund within 10 days of purchasing your plan if you change your mind (as long as your coverage hasn’t started).

With the Atlas MultiTrip plan, you can request a refund any time before coverage begins.

How to Make a Claim

You have 20 days for trip cancellation insurance or 60 days for MultiTrip insurance from the day coverage ends (the last day of the certificate period) to file a claim.

To start a claim, you must contact Tokio Marine HCC-MIS to give notice of your claim. You can do this online or by mail, and you can call to get help. They will advise what forms and information you need to provide.

Atlas Travel Insurance: Should You Buy It?

If you’re looking for a solid, comprehensive travel insurance plan that protects your non-refundable deposits and offers emergency medical coverage, Atlas has you covered.

Their Expedition and Enterprise plans offer robust coverage at a reasonable price. They are the trip insurance plans that will meet most travelers’ needs. In my opinion, the Excursion plan just doesn’t offer enough medical coverage for most situations.

The MultiTrip plan is a good fit for travelers looking to insure multiple trips a year but don’t need trip cancellation coverage.

Whether you chose Atlas or another provider, make sure you protect yourself and your trip by purchasing a travel insurance policy before you go. Thanks for reading and safe travels!

Get International Medical Insurance with Atlas – Are you ready to protect your trip and your health? Hop over to Atlas to get your free quote for your next trip. Grab a free quote here.

Atlas Travel Insurance Review

- Amount of Coverage

- Medical Coverage

- Travel Coverage and Protections

- Affordability

- Covered Activities & Sports

- Availability

Their Expedition and Enterprise plans offer robust coverage at a reasonable price. They are the trip insurance plans that will meet most travelers’ needs. In my opinion, the Excursion plan just doesn’t offer enough medical coverage for most situations. The MultiTrip plan is a good fit for travelers looking to insure multiple trips a year but don’t need trip cancellation coverage.

There is little adventure sports coverage and no annual plans that include trip cancellation insurance.

Sandra Parsons is a professional freelance writer and personal finance expert who writes about all things money. Her work has been featured on sites like MoneyTips, Credit Knocks, Women Who Money, and CreditCards.org. She also adores travel (preferably paid for with credit card rewards) and routinely reviews sightseeing passes and travel insurance solutions. Prior to focusing on her writing career, Sandra spent five years working in banking. She also holds master’s degrees in employment relations and psychology. Learn more about Sandra here.

Similar Posts

Trim Review: How to Automatically Lower Your Bills

In this Trim review, we’ll explore how the app can help you save money by cancelling old subscriptions for free, negotiating your cable bill, and more.

London Pass Review and Guide 2024: Is It a Good Deal?

Is the London Pass worth it? We think so. Check out our complete London Pass review and learn how you can save money on sightseeing in London.

Roma Pass Review 2024: Is It a Good Deal?

Read our Roma Pass review to learn what the Roma Pass offers, how much it costs, and how to add the OMNIA Vatican Card to save even more money in Rome!

Orlando All-Inclusive Pass Review 2024: Is It Worth It?

The Go City Orlando Pass helps you save at over 25 of the area’s top attractions. Is it right for you? We review the pass to help you decide.

Betterment Review: An “Easy Button” for Retirement Savings

Betterment makes investing easy. Through their automated process, Betterment helps you create a diversified retirement account at drastically reduced prices. In this Betterment review, we’ll explain what it is, explore how works, and help you decide whether it is a good fit for your retirement investing plans.

11 Best Mint Alternatives for 2024 | Paid & Free Replacements

Tired of dealing with Mint.com? These 14 Mint alternatives provide exceptional money management tools and a better user experience. Check them out!

Pin It on Pinterest

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Nationwide Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Nationwide travel insurance cover?

What does nationwide travel insurance cost, what isn’t covered by nationwide travel insurance, can you buy a nationwide plan online, is nationwide travel insurance worth it.

Are you considering purchasing travel insurance for your next vacation? It could be a good idea, especially in an era of overbooked flights, travel delays and lost luggage. Insurance company Nationwide can sell you travel insurance, which will cover you in the event that things stray from the plan.

Let’s take a look at Nationwide travel insurance, the policies available and the benefits that they provide.

Nationwide offers two different travel insurance plans for its customers: an Essential option and a Prime version. As the name implies, Prime provides more coverage and is more expensive.

With the essential plan, you'll have benefits like trip cancellation or interruption, coverage for medical emergencies and a fixed fee for delayed/lost luggage. The prime plan includes missed connection reimbursement, and generally, a higher reimbursement amount per benefit.

» Learn more: Common myths about travel insurance and what it covers

To do a proper Nationwide travel insurance review, we input a search for a 28-year-old from Michigan traveling to France for three weeks on a $7,000 trip.

A quick Nationwide travel insurance review shows that you’ll see quite a few more benefits associated with the Prime plan, though neither option is especially cheap. Coverage areas that are missing from the Essential plan include missed connection reimbursement, itinerary change reimbursement and 24-hour AD&D insurance, though this last one can be added on.

The Essential plan also sees significant drops in the monetary reimbursement you can expect when things go awry. Despite being only 38% cheaper than the Prime plan, coverage is significantly stripped down. You can especially see this with baggage delay ($100 versus $600), lost baggage ($600 versus $2,000) and trip delay ($600 versus $2,000). Trip cancellation is basically the only coverage area that remains the same — 100% no matter which plan you choose.

» Learn more: How to find the best travel insurance

Additional options and add-ons

No review of Nationwide travel insurance would be complete without mentioning add-ons. Your available options will differ based on the plan you choose.

As you can see, the available options and their costs can range quite a bit. If you’re looking for maximum coverage, it’s easy to more than double the cost of your original quote.

The most expensive add-on is only available to Prime policyholders. Cancel For Any Reason insurance allows the ultimate in flexibility as it’ll refund you up to 75% in trip costs in the event you want to cancel your trip.

Those opting for an Essential plan can also choose to purchase 24-hour AD&D coverage, which comes included with the Prime policy. Doing so includes flight-only coverage for Essential plans, though strangely that’s considered an add-on for Prime.

Finally, rental car insurance is available regardless of which plan you pick, though you can receive more coverage with the higher-tier Prime policy.

Many different travel credit cards provide complimentary trip insurance when you use your card to pay. Check these before purchasing travel insurance.

» Learn more: The best travel credit cards right now

As nice as it would be to purchase fully comprehensive travel insurance, the truth is that nearly all policies have exclusions of some kind. This may mean that your policy won’t cover instances of COVID-19 or the decision to jump out of a plane.

Here are some general exclusions you can expect:

Accidental injury or sickness when traveling against the advice of a physician.

Participation in canyoning or canyoneering, extreme sports or bodily contact sports.

War or any act of war whether declared or not.

Exclusions vary based on the policy and where you live, so you’ll want to read your guide to benefits carefully to see what coverages apply to your policy.

» Learn more: Is there travel insurance that covers COVID quarantine?

If this Nationwide essential travel insurance review has spurred you to make a decision, it’s simple to find a quote for yourself. You’ll need to navigate to Nationwide’s travel insurance page , where you’ll find a form asking for your personal information.

In addition to single-trip coverage, Nationwide also provides multi-trip plans and plans focused on cruises.

» Learn more: How much is travel insurance?

Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for cruises , single trips or multi-trips.

Nationwide travel insurance plans have various benefits including trip cancellation, interruption or delay, financial default, missed connection, itinerary change, Cancel For Any Reason (CFAR), medical emergencies, 24-hour accidental death and dismemberment (AD&D), pre-existing conditions exclusion and waiver, and baggage delay. Each policy is different, so you'll want to ensure you read the fine print to know your coverage.

Nationwide's essential plan does not cover Cancel For Any Reason. However, for an additional cost, you can add CFAR to Nationwide's Prime plan. With that coverage, you will be eligible for reimbursement of up to 75% of nonrefundable trip costs. Note that this must be added on within 21 days of your first trip payment.

If you need to submit a claim, you'll first call the CBP Claims Department at 888-490-7606. A representative will provide a claim form and a list of documents to submit. Claims can then be submitted via U.S. mail, fax or through email. Assuming your claim is reimbursable, you'll receive payment via direct deposit or a check.

Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for

, single trips or multi-trips.

Are you looking for strong coverage over a wide range of incidents? Nationwide could be a good travel insurance option for you, but only if you’re willing to shell out for its more expensive policy.

That being said, if you hold a travel credit card, odds are that you already have some form of complimentary travel insurance. You’ll want to check this first to see if those benefits are enough for your trip — if not, a Nationwide insurance policy could offer the coverage that you need.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

IMAGES

VIDEO

COMMENTS

It was extremely quick too (took like 2-3 days). After looking at all the horrible experiences from other insurance companies in r/Insurance, I am not so sure if I am lucky or if Chubbs is just exceptional. I recommended buying the travel insurance to all my friends. We use INF Plans and it works well.

Nerdy takeaways. Travel insurance can cover medical expenses, emergencies, trip interruptions, baggage, rental cars and more. Cost is affected by trip length, pre-existing medical conditions ...

Travel Insurance. Updated: Apr 11, 2024, 9:17am. Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations. We ...

For international trips, consider the Premium travel insurance plan from Generali. This tier of coverage includes the following: Trip cancellation coverage up to 100% of the trip cost. Trip ...

Best travel insurance category. Company winner. Best overall. Berkshire Hathaway Travel Protection. Best for emergency medical coverage. Allianz Global Assistance. Best for travelers with pre ...

International Health and Travel Insurance Offerings from IMG. IMG is an award-winning global benefits and assistance services company and one of the only companies in the market to offer travel medical, international health, and travel insurance plans. Get a quote now and choose the right plan for your next trip:

There are many companies that offer policies, with Allianz and Travel Guard among the best-known. Here is a chart showing the benefits and coverage levels available on some Allianz policies ...

Atlas' MultiTrip plan is a travel medical plan that covers all trips lasting up to 30 or 45 days in a 364-day period. It's an attractive solution for frequent travelers. Their MultiTrip plans include: Emergency Medical Evacuation: $1,000,000 lifetime maximum. Repatriation of Remains: Up to the overall maximum limit.

Allianz single-trip plan cost. Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas. The ...

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

Yes. The RoundTrip Basic plan ($197) is a good comprehensive travel insurance option and offers 100% trip cancellation (for trips up to $30,000), 100% trip interruption, $100,000 for emergency ...

Cost (25% of score): We analyzed the average cost for each travel insurance policy for trips to popular destinations: Couple, age 30 for a Mexico trip costing $3,000. Couple, age 40, for an Italy ...

60 day look back, 10 day waiver (certain conditions apply). 60 day look back, 21 day waiver (certain conditions apply). $260.48. $418.22. 3.72%. 5.97%. A quick Nationwide travel insurance review ...

456K subscribers in the medicine community. r/medicine is a virtual lounge for physicians and other medical professionals from around the world to…

Voronezh (Russian: Воро́неж; IPA: [vɐˈronʲɪʂ]) is a city and the administrative center of Voronezh Oblast, Russia, straddling the Voronezh River and located 12 kilometers (7.5 mi) from where it flows into the Don. Created Sep 25, 2016.

Wagner has real fighting experience, the Russian military they are fighting are probably more rear - echelon troops - with the best guys at the front. Wagner is well regarded apparently, whereas the Russian command isn't. There is already evidence that Russian air is refusing to attack Wagner, and some troops have sided with him.

SOURCE: https:// t . me/freevoronezh/2550 . ENGLISH: . Voronezh, VR. There were two explosions, it looks like some smart guy decided to shoot down the drone from the "Shell" right in the residential area.