You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Travel Insurance

Get a travel insurance quote and protect your next trip

For flight insurance protection:

Aircare Flight Quote

For all-in-one trip insurance protection:

ExactCare Travel Quote

Manage Your Travel And Flight Insurance

Manage your policy online

Need a travel insurance quote?

Existing policyholder?

Take the worry out of your travels with affordable flight or trip insurance.

Looking to plan the vacation of a lifetime or flying home for the holidays? Trip insurance and flight insurance can provide the peace of mind you need for your next journey. The GEICO Insurance Agency, with Berkshire Hathaway Travel Protection (BHTP), offers comprehensive travel insurance coverage, with prompt service and global assistance. Get an online travel insurance quote today and confidently protect your next adventure.

AirCare Flight Insurance

If you only need to protect your travel costs for a flight, AirCare may be what you need. With affordable coverage for both domestic and international flights, AirCare flight insurance helps you plan with peace of mind.

ExactCare Travel Insurance

If you want to cover your flight and other trip arrangement's ExtraCare can help. An ExactCare Travel Insurance policy can help with the unexpected like:

- Trip Cancellations/Interruptions/Delays

- Lost/Stolen travel documents

- Unexpected medical expenses

What's the difference between flight insurance and travel insurance?

The main difference is that a flight insurance policy only covers your airfare. On the other hand, a travel insurance policy helps protect your flight as well as other parts of your trip. While you're planning your next trip, think about where you're going and what you'll be doing. Once you have that, it'll be easier to choose which policy works best for your trip.

What does a flight insurance policy cover?

AirCare Flight Insurance has a variety of benefits including emergency travel assistance, 24/7/365. Some common flight coverages are:

- Airfare incase flights are cancelled or you miss a connection

- Personal items like lost or delayed luggage

- Flight delays in your departure (at the gate or on the tarmac)

AirCare Quote

What does a travel insurance policy cover?

ExactCare Travel Insurance provides all-in-one travel protection, with family friendly pricing and worldwide emergency travel assistance 24/7/365. Common things covered by travel insurance are:

- Trip cancellation or interruption

- Personal items like passports and luggage

- Medical costs like hospital and doctor expenses, medical evacuations, and more

ExactCare quote

What is not covered by travel insurance?

Your coverage is based on the plan you choose. However, in general some things that aren't normally covered by travel insurance are:

- Action and team sports, for example auto racing, pro sports travel, or other extreme sport activities

- Travel to get medical care

- Trip Cancellation because you changed your mind

For more information, please check your policy.

Is travel or trip insurance worth the cost?

Travel insurance can help protect your vacation or trips from unexpected things happening. You can travel without trip insurance but doing so brings greater risk if something goes wrong or you encounter unexpected delays. Flight insurance or trip insurance coverage can include things like flight cancellation, lost luggage, trip cancellation, emergency medical transportation, and more. Learn more about travel insurance and why you should get a travel insurance quote today!

How much does travel insurance cost?

Travel insurance typically costs 5 to 10 percent of your total trip cost, though that can be influenced by several things.

- The cost of the trip

- The length of your trip and destination

- The amount of coverage selected

- The number of travelers covered under the policy

Worldwide service and claims information.

It's easy to manage your travel insurance..

Berkshire Hathaway Travel Protection (BHTP) has made it easy to manage your travel insurance. You can:

- Visit Berkshire Hathaway Travel Protection's website

- Email [email protected]

Is travel insurance worth it?

Yes. Things happen that are out of your control. Whether it's your flight being cancelled or delayed to a family emergency. Life happens and that's how travel insurance can help. Plan for the unexpected with a travel insurance policy so you can rest easy knowing you're covered.

Travel Insurance: Get the answers you're looking for.

- What travel insurance plans are available? BHTB offers AirCare (flight only) and 3 main plans: ExactCare Value, ExactCare, and ExactCare Extra. ExactCare Value provides great traveling insurance coverage for budget minded travelers. You can rest easy knowing you're covered for things like trip cancellation, trip interruption, and medical expenses. The main difference is the maximum amount that will be covered. ExactCare and ExactCare Extra's insurance cover the same things as ExactCare Value and add coverage for missed connections and accidental death & dismemberment. The overall amount covered is also increased for each plan respectively.

- Can I get trip insurance for an extended overseas stay? Yes. We can help you with getting insurance for overseas. Please visit our overseas insurance page for information about all the options we have for you!

- Is there travel insurance that can cover my vehicle while traveling to Mexico? Your US auto insurance policy won't cover your vehicle when you drive into Mexico. We're here to help you find the Mexico car insurance you need to insure your car.

- Tips for saving money on your next vacation. No one wants to overpay things. We're here to help. Check out our 5 ways to save your money on your next family vacation.

- Where you're going

- Number of days you're traveling

- Cost of your overall trip

- Coverage you pick

- Number of people covered under your policy

If you choose to get a rate quote or service your policy online, you will be taken to the Berkshire Hathaway Travel Protection website which is owned by Berkshire Hathaway Specialty Insurance Company, not GEICO. Any information that you provide directly to Berkshire Hathaway Specialty Insurance Company on its website is subject to the privacy policy posted on their website, which you should read before proceeding. GEICO assumes no responsibility for their privacy practices or your use of their website.

ExactCare is provided through Berkshire Hathaway Global Insurance Services, LLC. ExactCare and AirCare are underwritten by Berkshire Hathaway Specialty Insurance Company. Both coverages are secured through the GEICO Insurance Agency, LLC.

Benefits may vary by jurisdiction. Please contact a representative to confirm availability.

Please note:

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages.

Colorado Language Preference

Are you a resident of or looking for insurance in the State of Colorado?

We are temporarily unable to provide services in Spanish for Colorado residents. You will now be directed to an English experience.

Estamos encantados de ofrecer nuestra nueva version del sitio web en Español. Apreciamos su paciencia mientras seguimos mejorando su experiencia.

Mega Travel Care International

Layanan asuransi perjalanan internasional menyeluruh yang siap menemani tiap langkah anda menjelajahi dunia. Dilengkapi dengan cakupan perlindungan untuk individu maupun anggota keluarga, melalui Mega Travel Care International, Mega Insurance siap menemani perjalanan anda. Cakupan perlindungan:

Kecelakaan Diri

- Meninggal dunia dan cacat tetap akibat kecelakaan

- Santunan tunai meninggal dan cedera akibat kecelakaan

- Biaya Pengobatan dan Perawatan Medis

- Biaya Perawatan Medis Akibat Kecelakaan dan Sakit

- Perawatan Lanjutan di dalam negeri

- Santunan tunai di rumah sakit

- Santunan tunai rawat inap ICU

- Santunan tunai rawat inap dalam negeri

- Evakuasi medis darurat dan pengembalian jenazah (repatriasi)

- Evakuasi medis darurat

- Pengembalian jenazah

- Kunjungan perjalanan

- Kunjungan perjalanan apabila rawat inap lebih 5 hari

- Kunjungan perjalanan apabila meninggal dunia

- Pengembalian anak

- Biaya perjalanan darurat

Ketidaknyamanan Selama Perjalanan

- Kehilangan bagasi dan harta benda pribadi

- Keterlambatan bagasi

- Keterlambatan penerbangan

- Biaya akomodasi akibat keterlambatan penerbangan

- Kehilangan deposit dan pembatalan perjalanan

- Pengurangan perjalanan

- Pengurangan perjalanan karena rawat inap lebih dari 5 hari

- Pembajakan pesawat udara

- Kehilangan dokumen perjalan dan uang

- Ketidaksinambungan perjalanan pesawat

- Penundaan perjalanan

- Penerbangan overbooked

Jaminan Perluasan

- Perlindungan isi rumah akibat kebakaran

- Tanggung jawab hukum pribadi terhadap pihak ketiga

- Golf equipment benefit

- Kehilangan atau kerusakan peralatan golf

- Hole in one

- Resiko sendiri asuransi atas penyewaan mobil

- Perlindungan kartu kredit

- Biaya telepon medis

- Perpanjangan polis otomatis

Hilangkan kekhawatiran selama bepergian bersama Mega Travel Care. Melalui Asuransi Mega Travel Care, Mega Insurance memberikan manfaat perlindungan menyeluruh untuk Anda dan keluarga selama melakukan perjalanan wisata ataupun perjalanan bisnis. Terdapat layanan Mega Travel Care International dan Mega Travel Care Domestik yang dapat memberikan rasa tentram dan aman selama anda bepergian.

Syarat & Ketentuan:

Batasan usia untuk peserta travel:

- Dewasa : Maksimum 70 tahun

- Anak : 45 hari sampai dengan 18 tahun dan belum menikah

- Untuk usia peserta Travel antara 71 tahun hingga 80 tahun, jaminan menjadi 75% dan dikenakan tambahan premi sebesar 25%

- Periode asuransi perjalanan maksimum 90 hari untuk satu kali perjalanan Perjalanan yang dilakukan bukan untuk perawatan medis

- Mega Insurance tidak menjamin rute satu kali perjalanan (one way)

- Berlaku untuk Warga Negara Indonesia atau warga Negara asing yang memiliki KITAS

- Tidak ada pengembalian premi untuk polis yang dibatalkan kecuali dibatalkan dan diganti dengan polis yang baru. Benefit Keluarga:

- Suami/Istri : 100% dari Limit Pertanggungan

- Pasangan: 50% dari Limit Pertanggungan

- Anak : 25% dari Limit Pertanggungan / anak (maksimum 2 anak)

Syarat & Ketentuan:

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

Tailor your annual travel insurance plan to your needs

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Introduction to TravelSafe Travel Insurance

- Coverage Options

- Purchasing and Managing a Policy

- Customer Service and Support

Compare TravelSafe Travel Insurance

- Why You Should Trust Us

TravelSafe Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

TravelSafe Insurance is a travel insurance company owned by the Chester Perfetto Agency, which provides a wide array of travel insurance options such as health, life, and auto insurance. TravelSafe can cover longer trips than many of its competitors, but charges high rates. It's also known for its golf-specific coverage.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to 120 days' coverage available for travelers ages 79 and under (30 days for 80+)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $2,500 per person for missed connections over three hours or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay coverage of up to $150 per person per day kicks in after six hours or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Policy can be purchased by U.S. citizens living abroad

- con icon Two crossed lines that form an 'X'. Medical coverage ceiling of $100,000 may be low for some travelers' needs.

- con icon Two crossed lines that form an 'X'. Claims reviews from customers say performance is not always the best

- A well-rounded insurance plan for travelers who are concerned about missing connections for cruise-related travel

- Classic and Basic travel insurance plans

- GolfSafe travel insurance plans provide coverage for you and your equipment

- Travel medical insurance through partner Trawick International

Among the companies included in our guide on the best CFAR travel insurance , TravelSafe offers thick insulation against the unpredictability of travel. The trips that TravelSafe can insure are on the higher end of the industry, covering trips lasting up to 150 days and costing up to $100,000. TravelSafe's Classic plan also offers coverage for people who are up to 100 years old.

One standout feature of TravelSafe is that all of its plans offer primary coverage, so you can file immediately with TravelSafe instead of going through your health insurance provider first, even with TravelSafe's Basic plan. Many travel insurance companies only provide primary coverage with their higher-tiered plans.

That said, TravelSafe's Basic plan costs more than many travel insurance companies' most expensive plans. This brings up the issue of cost. While its plans are technically within the bounds of the average cost of travel insurance, TravelSafe certainly stretches those limits, and it's certainly more expensive than many of the best travel insurance companies.

Ultimately, TravelSafe is best for travelers taking an expensive trip who can afford expensive insurance.

Coverage Options from TravelSafe

TravelSafe has two main policies for those seeking travel insurance: travel insurance for stateside and international travelers and travel insurance for those who are planning golf trips. For each policy type, travelers can choose between classic and basic coverage. And golfers can choose between GolfSafe Secure and GolfSafe Secure Plus.

Here's how the three TravelSafe travel insurance plans stack up in terms of what's included and coverage limits:

TravelSafe also offers specific golf insurance plans, which is something incredibly unique among travel insurance companies. If you're an avid golfer, purchasing golfing insurance will cover things like lost holes, something regular travel insurance won't. TravelSafe's golf insurance plan benefits are as follows:

Additional coverage options from TravelSafe

TravelSafe offers several optional coverages for its travelers:

Rental car damage and theft coverage: Available for both Basic and Classic plans, this add-on covers up to $35,000 per covered vehicle.

Business and sports equipment rental: Also available for both TravelSafe plans, your rental equipment is covered for up to $1,000.

CFAR coverage: Only available for Classic+, you'll receive 75% of your nonrefundable trip costs. You must purchase your policy within 21 days of your initial trip deposit.

TravelSafe Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for TravelSafe plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate TravelSafe coverage costs.

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following travel insurance quotes:

- Basic: $112

- Classic: $147

- Classic (Plus): $274

Premiums for TravelSafe plans are between 3.7% and 9.1% of the trip's cost, within and above the average cost of travel insurance.

TravelSafe provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- Basic: $153

- Classic: $202

- Classic (Plus): $377

Once again, premiums for TravelSafe plans are between 3.8% and 6.3% of the trip's cost, within the expected range of travel insurance costs.

A Texas family consisting of two 40-year-old parents with a 10-year-old and 4-year-old on a two-week trip to Australia for $20,000:

- Basic: $512

- Classic: $676

- Classic (Plus): $1,616

TravelSafe plans cost between 2.6% and 8.1% of the trip's cost, below and within the average cost of travel insurance.

A 65-year-old couple looking to escape New Jersey for Mexico for two weeks with a trip cost of $6,000 would have the following quotes:

- Basic: $472

- Classic: $582

- Classic (Plus): $952

Premiums for TravelSafe plans are between 7.8% and 15.9%, which is well the average cost for travel insurance. While older travelers should expect higher premiums, these prices are on the higher end of what you should be paying.

Purchasing and Managing a TravelSafe Policy

Purchasing a TravelSafe policy is fairly simple. You'll first need to obtain a quote through TravelSafe's website. Be prepared to provide the following details:

- State of residence

- Destination(s)

- Departure/return dates

- Date of initial deposit

- Total trip cost

- Number of travelers

- Birthday of traveler(s)

Once you obtain a quote and pick your plan, you'll enter some additional information about yourself, such as your address and contact information.

How to File a Claim with TravelSafe

If you experience a loss while insured by TravelSafe, you need to act quickly. You have 20 days after the loss to notify TravelSafe, at which point an agent will send you forms for filing proof of loss. If TravelSafe don't send a form withi 15 days, you can send your own written statement about what happened along with proof. This must be completed within 90 days of the loss.

You have several options if you need to file a claim for TravelSafe.

If you need emergency help, you can call their toll-free numbers below.

- Toll-free (US-only): 1-877-539-6729

- Direct: 1-727-475-2808

If you're international, call the following toll-free number: 1-866-509-7713.

TravelSafe Customer Service and Support

Almost all reviews for TravelSafe are concentrated on its SquareMouth page, where it has an average rating of 4.3 stars out five across over 1,500 reviews. Though an overall positive score, it's worth mentioning that most of the positive reviews come from people who didn't have to file a claim. Some of these reviews mentioned having to alter their insurance plan, which was an overall positive experience.

However, many of the reviews that mention the claims process are negative. Customers mentioned long wait times, uncommunicative claims representatives, and little guidance during the claims process. Additionally, while many travel insurance companies regularly engage with reviews, both positive and negative, TravelSafe rarely replies to customer reviews.

Learn more about how TravelSafe travel insurance compares against top insurers.

TravelSafe Travel Insurance vs Faye Travel Insurance

Faye Travel Insurance is a completely digital travel insurance company. Unlike TravelSafe, Faye Travel Insurance completely covers all cruise travel. Faye doesn't cover golf trips as TravelSafe does. They have similar amounts of coverage, but Faye Travel Insurance is about $20 cheaper for its comparable international plans.

Faye Travel Insurance covers your trip, your health, and your belongings just like TravelSafe does. But with Faye Travel Insurance, you can add different things that meet your needs, like car rental, extreme sports, and pet care.

Read our Faye travel insurance review here.

TravelSafe Travel Insurance vs World Nomads Travel Insurance

TravelSafe is an excellent option if you're traveling and participating in regular activities, like trying different foods and basic activities, like taking a train to places. But if you want to do extreme sports, it might not be the right coverage for you. Instead, consider getting a travel insurance plan like World Nomads Travel Insurance . World Nomads covers over 100 different extreme sports, and you can specifically add on different sports that you want to try. It's a better coverage insurance plan for someone who's a little bit more adventurous.

That said, if you're only planning on doing a specific activity, like golfing, TravelSafe has a plan for you. They cover golfing trips specifically with more coverage than World Nomads.

Read our World Nomads travel insurance review here.

TravelSafe vs Credit Card Travel Insurance

Some credit cards, especially travel rewards cards, come with travel benefits such as primary rental car insurance for your vehicle if you decide to rent one. However, travel insurance is generally more comprehensive than credit card coverage. For example, TravelSafe offers benefits like death and dismemberment coverage; credit cards don't typically cover this benefit.

However, you can use both your credit card benefits and your travel insurance to get the fullest coverage possible.

Read our guide on the best credit cards with travel insurance here.

TravelSafe Travel Insurance FAQ

Yes, TravelSafe is known for providing reliable coverage for international travel, including medical emergencies and trip interruptions.

TravelSafe typically allows the purchase of travel insurance up until the day before departure, making it suitable for last-minute travel plans.

TravelSafe offers policies that include coverage for trip cancellations due to COVID-19, but it's important to review the specific terms and conditions of each plan.

Claims with TravelSafe are generally handled efficiently, with a straightforward process for filing and tracking claims, and timely reimbursements according to customer feedback.

Yes, TravelSafe offers the option to add adventure sports coverage to their policies, catering to travelers who engage in higher-risk activities.

Why You Should Trust Us: How We Reviewed TravelSafe

For this review, we made sure to include the most updated information and pulled real-time quotes from TravelSafe's website. We compared two different companies that had similar coverage to TravelSafe to ensure the best review possible. We only included reputable plans. And we looked at factors like what's covered, policy limits, and coverage options.

Read more about how Business Insider rates insurance products here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Safer travel starts with travel protection

If you are a travel agent or were referred by one, enter the ACCAM number below.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

At Allianz, we continue to show our commitment to sports through our sponsorship with the International Olympic Committee and the International Paralympic Committee. Read More >>

Entry Requirements & COVID-19 Travel Resources

Confused about entry requirements for your destination? Our interactive map shows current travel rules and restrictions for each destination, including info on COVID-19 testing, necessary travel documents and quarantine periods.

Find out how our Epidemic Coverage Endorsement can protect your next trip from certain losses related to COVID-19.

Why do I need travel insurance?

Because sometimes..., you have to cancel a trip last-minute..

Travel insurance can reimburse you for your prepaid, non-refundable trip costs — including vacation rentals, car rentals, hotels and flights — if you have to cancel for a covered reason.

Travel delays leave you stranded.

Travel insurance can reimburse you for eligible meals, accommodation and transportation expenses during a covered delay.

You get sick or hurt when you're far from home.

Travel insurance can reimburse you for care following a covered medical emergency while traveling. We can even arrange and pay for a medical evacuation if needed.

Fender-benders are unavoidable.

Renting a car means taking on a big financial risk; even a tiny scrape can cost you hundreds. Low-priced rental car insurance lets you drive worry-free.

You need help in a hurry.

Whether you're planning a week-long road trip or a weekend getaway, you never know what might happen. Travel insurance gives you access to our 24-Hour Assistance hotline for expert, personalized support in a crisis.

Why go with Allianz Travel Insurance?

As a world leader in travel protection, we help more than 70 million people answer the call of adventure with confidence every year.

We're Protecting You

From protection for trip cancellation to medical bills abroad, our benefits are designed to help you explore reassured.

We're There For You

We've got your back with award-winning 24/7 assistance and a worldwide network of prescreened hospitals to help you get the right care.

We're Built For You

From our Allyz ® TravelSmart app to proactive SmartBenefits, we innovate for the way you travel today - and tomorrow.

TRAVEL RESOURCES

How Travel Insurance Works

How the Cancel Anytime Upgrade Works

What Does Rental Car Insurance Cover?

Is It Too Late to Buy Travel Insurance?

The Comprehensive Guide to Annual Travel Insurance

The Top Travel Apps That You Need This Summer

Travel Insurance with Emergency Medical Benefits

Destination Guide: Croatia

Travel Insurance & COVID-19: The Epidemic Coverage Endorsement Explained

More Travel Resources »

LATEST COVERAGE ALERTS

The events listed below are considered "known and foreseeable" for travel insurance purposes on the date listed next to the event. Please consult your policy for more information.

More Coverage Alerts »

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

COVID Information | Click here to learn more about our COVID Travel Insurance

Why should I purchase Travel Insurance?

Whether you're embarking on a weekend getaway or a month-long adventure, unexpected events can happen. An AXA protection plan can help ease your mind and help safeguard your trip, offer reimbursement for covered medical costs, and provide travelers with 24/7 access to assistance services, among other benefits.

Need to cancel your trip due to an unforeseen event?

Get coverage for your trip against illnesses, injuries, and natural disasters. Travel insurance can reimburse you for your prepaid, non-refundable trip costs.

Was your luggage lost or stolen?

Our travel plans can offer reimbursement for the value of your belongings, up to the policy limit. This includes coverage for lost or stolen passports, visas, or other important travel documents, as well as any necessary expenses related to replacing these items.

Stranded due to unexpected travel delays?

Whether it’s rebooking your flight, finding alternative transportation, or providing a place to stay, our 24/7 travel assistance team is here to help!

Is domestic and international medical coverage provided?

Our travel plans can provide up to $250,000 in medical coverage domestically and internationally for emergencies and accidents while traveling.

SILVER PLAN

Best for Domestic Travel

- 100% of Insured Trip Cost for Trip Cancellation

- $25,000 Emergency Accident & Sickness Medical

- $750 Baggage & Personal Effects

Best for Cruise

- $100,000 Emergency Accident & Sickness Medical

- $1,500 Baggage & Personal Effects

PLATINUM PLAN

Optional Cancel For Any Reason Coverage

- $250,000 Emergency Accident & Sickness Medical

- $3,000 Baggage & Personal Effects

Compare Our Silver, Gold, Platinum Plans

Axa travel insurance benefits.

Medical Travel Benefit

AXA offers coverage for certain emergency medical expenses that result from an accidental injury or illness while traveling as well as emergency medical evacuation and repatriation. Learn more

Trip Cancellation

We can reimburse you up to the maximum benefit of your selected travel plan, that is due to an unforeseen event including illness and inclement weather and other covered reasons. Learn more

Emergency Evacuation

AXA Offers coverage for medically necessary evacuations and repatriation as directed by a physician to the nearest adequate medical facility or your home. Learn more

Baggage Loss

AXA offers reimbursement coverage in the event your baggage or personal effects are lost damaged or stolen during your trip. Learn more

Cancel For Any Reason

AXA offers coverage up to 75% of your prepaid nonrefundable trip costs if your trip is cancelled for any reason. Learn more

Trip Interruption

AXA offers coverage for your non-refundable trip costs in the event you cannot continue on your trip due to a covered reason. Learn more

MY TRIP COMPANION

Not just a travel app but a comprehensive travel assistant that enhances your travel experience.

Frequently asked questions about travel insurance, what is travel insurance, what does travel insurance cover on a cruise, why choose axa, how much does travel insurance cost, what is a pre-existing medical condition, does travel insurance have covid benefits.

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Make the most out of your travels. Get AXA Travel Insurance and travel worry free!

Over 20 Years of Experience | Located in 30+ Countries | 24/7 Travel Assistance

Common concerns about travel insurance.

- It is a clever idea to purchase travel insurance If you are willing to protect your trip from variety of common travel-related incidents, including trip cancellations, flight delays or cancellations, lost or stolen baggage, and medical emergencies.

- Travel insurance provides coverage against medical expenses, reimbursement for lost or stolen luggage, compensation for expenses incurred due to travel delays and more while you are travelling.

- Travel insurance is to provide financial protection to travelers in case of unexpected events. Without adequate insurance coverage, travelers may face significant financial losses and hardships if they encounter any unforeseen circumstances while traveling in the Schengen Territory.

- A good option for travelers who are concerned about unforeseeable events or who want the freedom to cancel their trip for any reason. When you purchase CFAR coverage, you can cancel the trip without losing your entire prepaid, nonrefundable vacation expenses. Exclusive to Platinum Package holders.

Understanding What Travel Insurance Covers

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠. The details for these products have not been reviewed or provided by the issuer.

- Travel insurance is intended to cover risks and financial losses associated with traveling.

- Coverage can include trip cancellation, baggage protection, medical care, and emergency evacuation.

- When filing a claim, be specific and comprehensive in your documentation to ease the process.

Whether it's a trip across the world or a trip across the state, having travel insurance provides major relief if things go awry. Flight delays, lost baggage, illness, injuries, and other unforeseen events can disrupt even the best-laid plans. With a major disruption comes the potential for unanticipated expenses.

Travel insurance and the coverage it offers can help keep you protected and save you money in the long run.

Overview of Travel Insurance Coverage

Travel insurance policies protect travelers from financial losses should something go wrong during their trip. You can customize which coverages you want to include, and there are several to choose from.

"Common types of coverage include trip cancellation, trip interruption, baggage protection, coverage for medical care if you get sick or hurt during your trip, and emergency medical evacuation," says Angela Borden, a travel insurance expert and product strategist for travel insurance company Seven Corners.

Travel insurance plans offer nonrefundable payments and other trip-related expenses. While monetary compensation is a primary benefit, there is another valuable perk of travel insurance. It can provide peace of mind.

What does travel insurance cover?

Your specific travel insurance plan (and its terms and conditions) will determine the minutia and specifics of what is covered. As with most other forms of insurance, a general rule of thumb is the more you spend, the better your coverage.

"Travel insurance can be confusing, so it's best to research a reputable company that specializes in travel insurance and has a long history of successfully helping travelers all over the world," says Borden.

Trip cancellation and interruptions

A travel insurance policy can reimburse you for a prepaid, nonrefundable trip if it is canceled for a covered event, such as a natural disaster or a global pandemic.

Trip interruption insurance covers you if you're already on your trip and you get sick, there's a natural disaster, or something else happens. Make sure to check with your travel insurance providers to discuss any inclusions, coverage, and more.

Travel delays and missed connections

Travel delay insurance coverage provides reimbursement for any expenses you incur when you experience a delay in transit over a minimum time. Reimbursements can include hotels, airfare, food, and other related expenses.

Medical emergencies and evacuations

Typically, US healthcare plans are not accepted in other countries. So travel insurance with medical coverage can be particularly beneficial when you are abroad. Medical coverage can also help with locating doctors and healthcare facilities.

Medical transportation coverage will also pay for emergency evacuation expenses such as airlifts and medically-equipped flights back to the US. Out of pocket, these expenses can easily amount to tens of thousands of dollars. Certain plans may even transport you to a hospital of choice for care.

Travel insurance generally does not include coverage for pre-existing conditions. That said, you can obtain a pre-existing condition waiver, which we will talk about later.

Baggage and personal belongings

Most airlines will reimburse travelers for lost or destroyed baggage, but be prepared for limitations. Travel insurance plans will typically cover stolen items, such as those stolen out of a hotel room. This may not include expensive jewelry, antiques, or heirloom items. Typically, airlines have a few days to recover your bag.

In the meantime, you can make a claim to pay for items like certain toiletries and other items you need to pick up. If your bag is truly lost or you don't get it for an extended period, you can file a true lost baggage claim.

What does credit card travel insurance cover?

A major perk on several travel credit cards is embedded credit card travel insurance . Typically, you will need to use the specific card for the transaction (at least with partial payment) for travel coverage to kick in.

Each card has specific rules on what exactly is covered. But one of the industry leaders is the $550-per-year Chase Sapphire Reserve credit card. Here's a snapshot of what is covered with this specific card:

- Baggage delay: up to $100 reimbursed per day for up to five days if a passenger carrier delays your baggage by more than six hours.

- Lost and damaged baggage: up to $3,000 per passenger per trip, but only up to $500 per passenger for jewelry and watches and up to $500 per passenger for cameras and other electronic equipment.

- Trip delay reimbursement: up to $500 per ticket if you're delayed more than six hours or require an overnight stay.

- Trip cancellation and interruption protection: up to $10,000 per person and $20,000 per trip for prepaid, nonrefundable travel expenses.

- Medical evacuation benefit: up to $100,000 for necessary emergency evacuation and transportation when on a trip of five to 60 days and traveling more than 100 miles from home.

- Travel accident insurance: accidental death or dismemberment coverage of up to $100,000 (up to $1,000,000 for common carrier travel).

- Emergency medical and dental benefits: up to $2,500 for medical expenses (subject to a $50 deductible) when on a trip arranged by a travel agency and traveling more than 100 miles from home.

- Rental car coverage: primary coverage for damages caused by theft or collision up to $75,000 on rentals of 31 days or fewer

More protections are included with cards with an annual fee, but there are exceptions. The no-annual-fee Chase Freedom Flex , for instance, includes up to $1,500 per person (and up to $6,000 per trip) in trip cancellation and trip interruption coverage.

However, there are some differences between credit card travel coverage and obtaining coverage from a third party.

"Credit card coverage does not typically provide travel medical benefits," Borden says. "For protection if you get sick or hurt while traveling, you'll want a travel insurance plan with medical coverage."

Whether you get your travel insurance in a standalone policy or through a credit card, it's important to review your plan details carefully. In either case, there may be exclusions and other requirements such as deadlines when filing a claim, Borden notes.

What travel insurance coverage do you need to pay more for?

Knowing what travel insurance doesn't cover is as important as knowing what it does cover.

"Travelers should understand that travel insurance benefits come into play only if a covered reason occurs," Borden says. Most standard travel insurance plans won't reimburse you for the following:

Cancel for any reason (CFAR)

Cancel-for-any-reason travel insurance covers a trip cancellation for any reason, not just a covered event. your standard benefits won't kick in unless it's a covered event. For instance, you'll be reimbursed simply for changing your mind about taking a trip.

That said, CFAR travel insurance is not without its downsides. For one, it's more expensive than traditional insurance, and most CFAR policies will only reimburse you for a percentage of your travel expenses. Additionally, CFAR policies aren't available for annual travel insurance .

You can find our guide on the best CFAR travel insurance here.

Foreseen weather events

Sudden storms or unforeseen weather events are typically covered by standard travel insurance plans. There are exceptions to be aware of. For example, an anticipated and named hurricane will not be covered.

Medical tourism

If you're going to travel internationally for a medical procedure or doctor's visit, your travel insurance plan will not cover the procedure itself. Most medical travel plans also won't cover you if something goes wrong with your procedure.

Pre-existing conditions and pregnancy

Those with specific pre-existing conditions, such as someone with diabetes and needing more insulin, will not be covered by most plans. In addition, pregnancy-related expenses will likely not be covered under most plans.

That said, you can obtain a pre-existing condition waiver for stable conditions. In order to obtain a wavier, you will need to purchase travel insurance within a certain time frame from when you booked your trip, usually two to three weeks, depending on your policy.

Extreme sports and activities

Accidents occurring while participating in extreme sports like skydiving and paragliding will typically not be covered under most plans. However, many plans offer the ability to upgrade to a higher-priced version with extended coverage.

Navigating claims and assistance

When a trip goes awry, the first thing you should do is document everything and be as specific as possible with documentation. This will make the claims process easier, as you can substantiate and quantify your financial losses due to the delay.

For example, your flight home has been delayed long enough to be covered under your policy, you'll want to keep any receipts from purchases made while waiting. For instances where your luggage is lost, you will need to file a report with local authorities and document all the items you packed.

Cancellation protection also requires meticulous attention to detail. If you're too sick to fly, you may need to see a doctor to prove your eligibility. If an airline cancels a flight, you'll also need to document any refunds you received as travel insurance isn't going to reimburse you for money you've already gotten back.

Part of the benefit of CFAR insurance is the reduced paperwork necessary to file a claim. You'll still need to document your nonrefundable losses, but you won't have to substantiate why you're canceling a trip.

Choosing the right travel insurance

Each plan should be personalized to meet the insured party's needs. Some travelers prefer to stick to the bare minimum (flight cancellation benefits through the airline). Others want a comprehensive plan with every coverage possible. Before you buy anything, set your destination. Are there any travel restrictions or changes pending? Does your destination country require emergency or other medical coverage?

If the destination airport is known for lost or delayed luggage, travelers should keep important items in carry-ons. Lost or delayed luggage coverage protects insured parties in the event of a significant delay or total loss.

Second, check current credit card travel benefits to avoid redundancies. Savvy travelers don't need to pay for the same coverage twice.

Finally, consider your individual needs. Do you have a chronic medical condition, or do you feel safe with emergency-only medical coverage? Keep in mind, this does not include coverage for cosmetic surgery or other medical tourism. Do you have a budget limit for travel insurance? Asking and answering these important questions will help every traveler find the right product.

Most travel insurance plans are simple, and Business Insider's guide to the best travel insurance companies outlines our top picks. Remember, read your policy and its specifics closely to ensure it includes the items you need coverage for.

No one likes to dwell on how a trip might not go as planned before even leaving. However, at its core, travel insurance provides peace of mind as you go about your trip. While the upfront cost may seem significant, when you compare it to the potential expenses of a canceled flight, emergency evacuation, or a hefty medical bill, it's a small price to pay in the grand scheme of things.

Get Travel Insurance Quotes Online

Protect your trip with the best travel insurance . Compare travel insurance quotes from multiple providers with Squaremouth.

What does travel insurance cover frequently asked questions

Does travel insurance cover trip cancellations due to a pandemic like covid-19.

Coverage for pandemics vary from policy to policy. Some travel insurance companies have specific provisions for pandemic-related cancellations, while others may exclude them entirely.

Are sports injuries covered under travel insurance?

Sports injuries are often covered under travel insurance, but high-risk or adventure sports might require additional coverage or a special policy.

Can travel insurance provide coverage for travel advisories or warnings?

Travel advisories have different effects on your travel insurance depending on your policy. Traveling to a country already under travel advisory may invalidate your coverage, but if you're already traveling when a travel advisory is announced, you may be covered.

How does travel insurance handle emergency medical evacuations?

Travel insurance usually covers the cost of emergency medical evacuations to the nearest suitable medical facility, and sometimes back to your home country, if necessary.

Are lost or stolen passports covered by travel insurance?

Many travel insurance policies provide coverage for the cost of replacing lost or stolen passports during a trip.

If you enjoyed this story, be sure to follow Business Insider on Microsoft Start.

Six Travel Mistakes to Avoid

No travel medical insurance? Unnecessary luggage and hotel fees? Here are the biggest travel mistakes people make and how you can avoid them.

- Newsletter sign up Newsletter

Even the most seasoned tourists can make travel mistakes when planning a vacation. Some blunders can be minor infractions, but others can cost travelers a lot of money and heartache.

But there are steps you can take to avoid travel mistakes. Here are six slip ups that travelers may make this year, plus tips on how to avoid them.

1. Overlooking travel medical insurance

Christopher Elliott , a consumer advocate and founder of the nonprofit Elliott Advocacy , says many people don’t consider purchasing travel medical insurance . “People often think nothing bad will happen before or on their vacation, but then they get injured overseas and need to go to the hospital, and the next thing they’re looking at is a $10,000 hospital bill.” Indeed, nearly one in four Americans report they’ve experienced a medical issue while traveling abroad, according to a 2023 survey sponsored by GeoBlue, an international health insurance company.

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Unfortunately, most U.S. healthcare plans — including employer group plans, Medicare and Affordable Care Act plans — offer limited or no medical coverage outside the U.S.

How to avoid: One solution is to purchase a travel medical insurance policy, a type of insurance that provides coverage for a range of medical emergencies while traveling abroad, from minor injuries to major events like heart attacks and strokes, to medical evacuation and emergency transport in the case of severe emergencies.

The average travel medical insurance plan costs $89, according to Squaremouth , a travel insurance comparison website. Squaremouth advises international travelers to obtain a policy that provides a minimum of $50,000 in emergency medical coverage and at least $100,000 in medical evacuation coverage.

Note: Some travel insurance policies include emergency medical coverage and medical evacuation coverage up to certain limits.

2. Getting hit with unnecessary luggage fees

You may have heard that a number of airlines — including American Airlines , Delta , and JetBlue Airways — recently raised their prices for checked bags. But one thing a lot of travelers aren’t aware of, Elliott says, is that some are now charging customers more if they check a bag at the airport versus paying to check a bag in advance. For instance, JetBlue customers flying within the U.S., Latin America, the Caribbean and Canada can save up to $20 on their first two checked bags ($10 savings per bag) when they add them to their flight reservation at least 24 hours before departure.

How to avoid: Make sure to pay ahead of time for any bags that you plan to check.

3. Incurring hidden hotel fees

Wi-Fi fees, early check-in fees, gym fees—hotels today charge guests no shortage of extra fees and surcharges . It’s a widespread problem: In an April 2023 survey by Consumer Reports , nearly four out of 10 (37%) U.S. adults said they had experienced a hidden or unexpected hotel fee in the previous two years.

How to avoid: Many hotels offer to reduce or, in some cases, waive certain fees to guests who join their loyalty program, which is free in most cases. Also, sometimes simply asking an employee at check-in to waive certain fees could do the trick.

4. Not utilizing a key search feature on Airbnb

Like hotels, Airbnb rental property owners often tack on extra fees, such as cleaning fees, fees for additional guests beyond a certain number, and service fees. These additional costs can add hundreds of dollars to your bill.

How to avoid: Elliott praised Airbnb for introducing a feature in December 2022 that allows guests to view a stay’s total costs, before taxes, when searching for rental properties. But he says there’s a caveat: “If you’re in the U.S., you need to change a setting in order to see the full rate when you search for rentals.”

To enable the feature, click the slider on the upper right of the search page that says, “Display total before taxes.”

5. Paying full price for a rental car

First, the good news: “The rental vehicle shortage has improved,” Elliott says. That’s resulted in a stabilization of rates, with rental car prices recently averaging $42 a day, up only 3% from last year, according to a report from the travel search company Hopper. The bad news? Renting a car is still more expensive than it was before the pandemic, especially for travelers who pay full freight.

How to avoid: There are several ways you can avoid paying full price. Big-box stores such as Costco , BJ’s and Sam’s Club provide their members discounts on certain rental cars. AARP and AAA also offer their members discounted rates. ( AARP members save up to 30% on base rates at Avis and Budget Rent A Car; AAA members save up to 20% on Hertz rentals). In addition, a number of credit card companies offer certain cardholders rental car discounts when they book a vehicle from specific rental car companies.

You may also be able to nab a lower rate by prepaying when you book a reservation. And, some rental car companies offer limited-mileage plans at a lower cost, which could be a good option if you’re planning to take just a short trip.

Tip: See if your credit card offers rental car insurance before you pay for insurance from a rental car company.

6. Encountering sky-high hotel rates because of Taylor Swift’s European tour

When Taylor Swift performs a concert, sometimes tens of thousands of out-of-town fans descend on the city, causing hotel prices to spike. Consider: the median rate for a standard hotel room during an Eras Tour date in Europe this year is projected to jump by 44%, with average hotel room prices in Warsaw surging a staggering 154% during her tour date there, according to a recent study by Lighthouse , a travel and hospitality research company.

How to avoid: The simplest approach for Europe-bound travelers in 2024, Elliott says, is to avoid traveling to a destination during a Taylor Swift tour date in that city. “When Taylor Swift comes to town all of the hotels sell out, and it becomes very difficult to find a reasonably priced hotel,” he says.

Related Content

- 24 Best Travel Websites to Find Deals and Save You Money

- Five Ways to a Cheap Last-Minute Vacation

- Best Travel Rewards Cards May 2024

To continue reading this article please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Daniel Bortz is a freelance writer based in Arlington, Va. His work has been published by The New York Times, The Washington Post, Consumer Reports, Newsweek, and Money magazine, among others.

Five steps to take if travels go awry and you need to get money back.

By Becca van Sambeck Published 12 May 24

Is your retirement planning full of holes? Unless you fully understand a few key points, you could be setting yourself up for some surprises.

By Jenna Lolly, CFP® Published 12 May 24

Everest, Inc. author Will Cockrell discusses why high-net-worth people flock to climb Mount Everest.

By Alexandra Svokos Published 11 May 24

A new poll shows a vast majority of Americans believe now is a bad time to buy a house, in the worst low in Gallup's history.

By Alexandra Svokos Published 10 May 24

Scammers are targeting college graduates with fake job ads, according to the FTC.

Shop early and honor mothers everywhere with great deals from Walmart, Amazon, Etsy, Applebee's, Pandora and oh, so many more.

By Kathryn Pomroy Published 9 May 24

Celebrate Teacher Appreciation Week through May 10 with deals from Scholastic, Microsoft, AT&T, Verizon and more.

A new Gallup poll shows Americans are still concerned about having enough money for retirement, but there are some changes from last year.

By Alexandra Svokos Last updated 6 May 24

Jobs Report Slower jobs growth and easing wage pressures are good news for rate cuts.

By Dan Burrows Published 3 May 24

Federal Reserve The Federal Reserve struck a dovish pose even as it kept interest rates unchanged for a sixth straight meeting.

By Dan Burrows Published 1 May 24

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

A Travel Leader for Over 50 Years

. . . and counting.

Omega World Travel has over fifty years of experience as a leader in the travel management industry. Exceeding industry standards, Omega has excelled in supporting our clients’ needs by offering reliable and innovative services on an international scale. Omega continues to move forward, providing industry-leading software and services to help your employees safely navigate the globe. As one of America’s largest business travel management companies, we serve corporations, nonprofits, government agencies and contractors, and educational institutions. Our highly experienced account managers deliver the vital resources and assistance needed to transition your travel program back to full capacity. In addition to our award-winning travel services, Omega offers meetings management services through our acclaimed Omega Meetings & Events (Omega M&E) Division. Omega’s M&E Division’s highly responsive customer account teams use the newest technologies to design cost-effective, outstanding group travel experiences. Omega provides our clients the personalized attention of a small business with a wide range of resources that only a large company can deliver.

This is How to Make Your Summer Trips to Europe Worry-Free Using Travel Insurance

In planning your summer trips in advance, don’t forget to include travel insurance so you’ll be prepared for unexpected medical expenses, baggage delays, and more.

Lack of preparation can throw a real wrench into your plans. Problems are even more worrisome when they take place abroad because you’re isolated from the comforts and familiarity of home. What problems do we mean exactly? Think of sudden medical expenses, personal accidents, trip cancellations, trip terminations, flight delays, loss or damage of baggage and personal effects, and baggage delays. But fret not because these and more are all covered under Prudential Guarantee and Assurance, Inc. (PGAI) Travel Shield Insurance.

The need for travel insurance

PGAI is Schengen-accredited, which ensures European trips free of travel-related stress. You can make your dream vacation to countries like France and Italy come true and worry-free since Travel Shield Insurance offers 24-hour Worldwide Travel Assistance. This assistance gives you comprehensive protection and services from unexpected troubles that might occur during your trip. Travel Shield Insurance also offers annual plan options to frequent travelers.

It’s also worth mentioning that PGAI’s Travel Shield Insurance comes with COVID-19 coverage. This insurance package provides full medical benefits to policyholders who contract COVID-19 during a trip. It comes with the package’s coverage for medical costs incurred from a covered sickness or accident occurring during a local or foreign trip.

Specifically, Travel Shield covers costs of Emergency Medical Evacuation and Repatriation, which allows for one’s return trip to the Philippines or to a medically recommended location if the policyholder needs immediate medical treatment for an injury or sickness that happened while traveling. The Personal Accident feature, on the other hand, provides a lump sum benefit in case of disablement or death caused by an accident.

Severe weather conditions, airline equipment failure, or airline employees’ labor actions can also hamper one’s flight and cause inconveniences, so Travel Shield covers the expenses of flights delayed more than six hours for domestic and more than eight hours for international. The loss of, or damage to, baggage is also covered, while expenses on necessary clothing and toiletries are reimbursed in cases when the traveler’s baggage gets delayed.

“PGAI is consistently the number one non-life insurer in the Philippines, thanks to an innovative portfolio of products offering comprehensive coverage. Travel Shield typifies this through benefits that thoroughly address numerous contingencies,” PGAI Senior Assistant Vice President Amor Divinagracia-Laino announced.

For inquiries, call their Travel Team at (02) 8651-9556 or (02) 8651-9555 from 8:30 am to 5:30 pm, Monday to Friday. You may also e-mail [email protected] .

Photos: PRUDENTIAL GUARANTEE AND ASSURANCE, INC.

Order your print copy of this month's MEGA Magazine:

Download this month's MEGA digital copy from:

Subscribe via [email protected]

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Faye Travel Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can be a worthwhile investment, especially if you’re worried about unexpected costs during your trip. There are a ton of different travel insurance companies out there, so finding one that suits your needs can be a struggle. That’s why we’ve done the work for you.

Let’s take a look at travel insurance provider Faye to see what type of plans the company offers, the coverage levels you can expect and whether Faye travel insurance is right for you.

About Faye travel insurance

Faye is the brand name for customizable travel protection plans offered by a company called Zenner Inc. Its website notes that it specializes in quick reimbursements, which can be a big draw for travelers. Policies issued by Faye are underwritten by the United States Fire Insurance Company.

» Learn more: How to pick between travel insurance providers

Faye insurance plans

Unlike many other travel insurance companies , Faye offers only one plan.

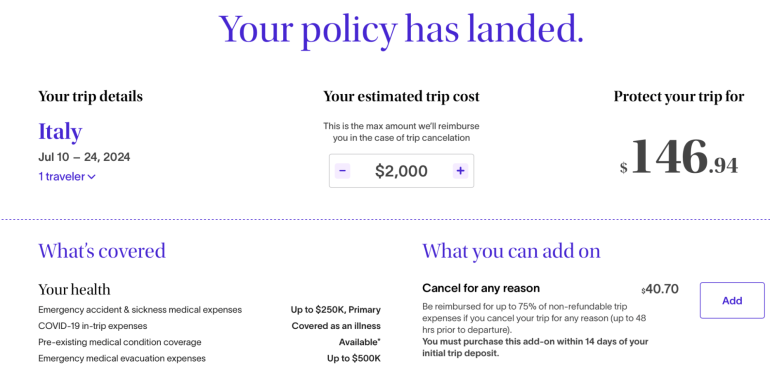

To find out what types of coverage Faye travel insurance plans include, we generated a quote for a 44-year-old woman from Arizona who was traveling to Italy for two weeks. Her total trip cost came in at $2,000.

Here’s what Faye provides:

This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis .

The plan is comprehensive and includes coverage you don’t typically see, such as reimbursement for lost credit cards and a payment for being inconvenienced.

Faye also offers a number of customizations; there are different add-ons from which to choose, all of which vary in price. More on your options in the next section.

» Learn more: How travel insurance for domestic vacations works

Plan add-ons

If you'd like to customize your Faye travel insurance plan to meet your needs more specifically, you can add on extra coverage for more money.

» Learn more: How does travel insurance work?

What isn’t covered by Faye

Even if you purchase a very comprehensive travel insurance policy, there are still situations where you’re not covered.

These include:

Bad weather, including hurricanes, if the policy was purchased after the storm was named.

Intentionally self-inflicted injuries or suicide.

Expenses incurred while under the influence of drugs or alcohol.

High-risk sports for which you are paid.

Psychological disorders, unless you’re hospitalized.

War and acts of war.

Illegal acts.

Piloting or learning to pilot or acting as crew of an aircraft.

To find the full list of exclusions for your specific policy, be sure to review your plan’s benefits schedule.

» Learn more: What to know before buying travel insurance

How to choose a Faye plan online

Purchasing a Faye travel insurance plan online is simple. You’ll first want to head to the company’s website to generate a quote.

You’ll need to input information like your age, where you live, where you’re going and how long you’re going to be away. Once you’ve got that all entered in, you’ll be taken to the results page.

Here, you’ll be able to see what plan options you have available, as well as what add-ons there are to pick.

After you’ve selected the coverage you’d like, you’ll need to go through the online checkout process.

» Learn more: Is travel insurance worth it?

Which Faye plan is best for me?

Although Faye has just one base plan available for purchase, it has plenty of different add-ons from which to choose. Faye sorts its bundles and add-ons according to the trip you’re taking, so you may see your bundled offer vary from time to time.

For tentative plans . Choosing to add on a Cancel For Any Reason (CFAR) policy can provide peace of mind if your travel plans aren’t solid. With the ability to get up to 75% of your money back, you’ll just want to make sure you’re canceling at least 48 hours in advance.

For pet owners . Not many travel insurance companies include coverage for your pets , especially not when it comes to vet bills. With a low overall cost, this add-on can make a huge difference if you end up delayed on your return.

For those wanting to customize everything . Faye’s base plan allows customers to create tons of different customizations according to their travel needs. Even though it’s costly, it makes up for it with wholly comprehensive coverage.

Faye’s travel insurance offerings may suit your needs, but before purchasing a plan, take a look in your wallet. Many different travel credit cards offer complimentary travel insurance , which can include benefits such as trip cancellation reimbursement, rental car insurance and more.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.