Do I Need To Register My Travel Trailer In Oregon

In Oregon, all trailers and towed vehicles must be registered in the state. This is to ensure that people don’t use them for any illegal purposes.

In order to register your trailer, you need to visit your local district office or DMV. If you are not sure where this is located, you can find it on the DMV website’s map.

If you do not have a license plate on your trailer and it weighs less than 10,000 pounds, then it does not need to be registered in Oregon.

What size trailer do you have to register in Oregon?

Trailers. Light trailers have a loaded weight of 8,000 pounds or less, except trailers for hire (for-rent), travel trailers, fixed loads and special use trailers. You do not have to title or register trailers with a loaded weight of 1,800 pounds or less. Heavy trailers have a loaded weight over 8,000 pounds. [1]

What do I need to register my RV in Oregon?

Completed Salvage Title Application;. The original Oregon title, out-of-state title, or other ownership document;. Original odometer disclosure, if required;. Original releases or bills of sale from all previous owners;. Original lien releases from any previous security interest holders; and. [2]

Do small trailers need license plate in Oregon?

A trailer is exempt from registration if it is equipped with pneumatic tires made of elastic material and is not operated in this state with a loaded weight of more than 1,800 pounds. A trailer for hire, travel trailer or camper is not exempt by this subsection. [3]

What are the towing laws in Oregon?

Under ORS 98.830, private property or business owners can tow a vehicle if it is illegally parked or abandoned on their property. In order to be considered abandoned, the vehicle must be left standing for 24 hours. The property owner can’t just tow a car as soon as that 24-hour period elapses, though. [4]

Can I get a title with just a bill of sale in Oregon?

What Do You Need To Transfer A Car Title? To transfer a car title, the buyer needs to bring the old title, a completed Application for Title and Registration, and money to pay the fee to an Oregon DMV office. In some cases, a completed bill of sales is also required. You can find this form on the DMV website. [5]

Is there sales tax on RV in Oregon?

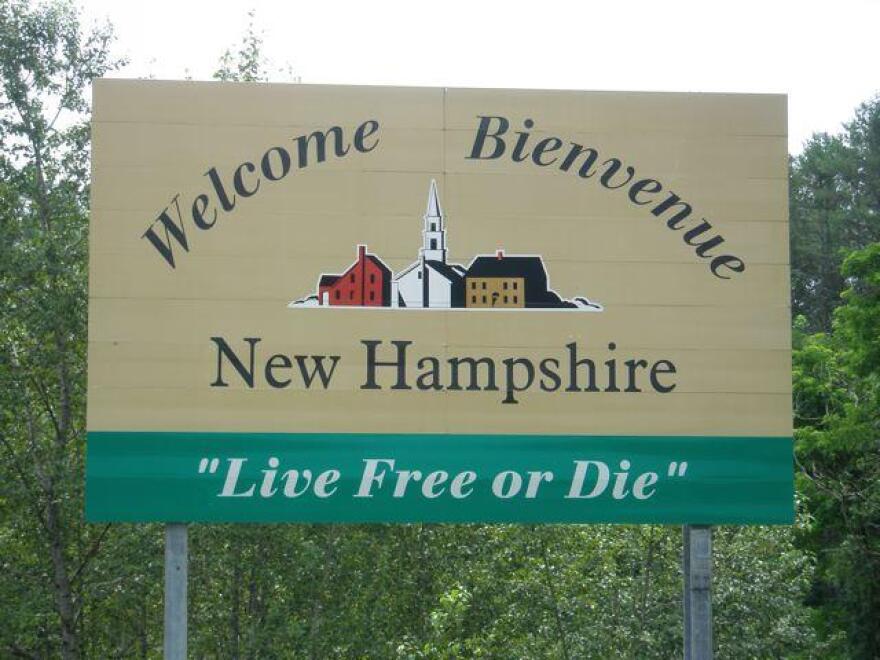

What States Have No Sales Tax on RVs. There are currently five states that have no sales tax at all. These are Alaska, Delaware, Montana, New Hampshire, and Oregon. [6]

How do I register an out-of-state vehicle in Oregon?

A completed application for a certificate of ownership. The original out-of-state vehicle title. A completed Oregon vehicle registration application. Proof of a valid OR vehicle insurance policy. Proof of identification (ex. [7]

How much is tags and registration in Oregon?

*Registration/Renewal and County fees are due if there are no plates or the Oregon plates are expired. ** If you enroll in OReGO, the brand new vehicle registration fee is $172; the used vehicle registration fee is $86. [8]

Do you need a bill of sale to transfer title in Oregon?

Buying from an individual If you purchase a vehicle from an individual, they need to sign the Oregon title and give it to you. The buyer and the seller must also complete the bill of sale. Within 30 days, submit an Application for Title and Registration to officially transfer ownership. [9]

Do all trailers need to be registered in Washington state?

License Plate Required on all trailers regardless of size. Certificate of Registration Issued to trailers registered in Washington. [10]

What size trailer does not need lights?

All trailers must have tail lights, turn signals, reflectors and stop lights. If your trailer is wider than 80 inches or longer than 30 feet, it will need additional reflectors and lights. [11]

Do utility trailers need insurance in Oregon?

While not required under state law for most cases, carrying trailer insurance is still a good idea. You may have to register and title your trailer with the OR Department of Motor Vehicles if your trailer is a business-use vehicle or its weight exceeds 1,800 pounds when fully loaded. [12]

Related posts:

- Is It Legal to Live in a Camper in Your Backyard?

- Where Do I Get a Trailer Weighed

- Does My Travel Trailer Need a License Plate

- How to Park Travel Trailer

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

- Login Search

- Who We Serve

- Membership Benefits

- Membership Categories and Dues

- Join the RV Industry Association

- Get Involved

- RV Industry Awards Program

- Association and ANSI Adopted Standards

- RV and Park Model RV Handbooks

- Recognized Listing Agencies

- Standards News Bulletins

- RV Inspection Process and Deviation Database

- Standards Education

- Standards Test Questions

- Standards Regulatory & Legislative Reports

- Outdoor Recreation Roundtable

- Take Action

- State Guide for RV Manufacturers

- Monthly Shipment Report

- View All Monthly Shipment Reports

- Monthly RV Seals Report

- RV RoadSigns Quarterly Forecast

- Historical RV Data

- 2023 Vacation Cost Comparison Study

- 2023 RV Path to Purchase Journey

- 2023 RV Aftermarket Parts and Accessories Survey

- 2023 RV Industry Association Annual Report

- 2022 RVs Move America Economic Impact Study

- 2022 Campground Industry Market Analysis

- 2022 Survey of Lenders' Experiences

- 2022 RV Industry Profile

- 2021 Go RVing RV Owner Demographic Profile

- RVs Move America Week

- Leadership Conference

- RV Aftermarket Conference

- Upcoming Webinars

- Upcoming In-Person Seminars

- News & Insights

How To Comply With New Oregon Laws

Earlier this year, the RV Industry Association secured the passage of two bills in Oregon which eliminated the Oregon state RV code program and moved all types of RVs under the purview of the Oregon Department of Transportation and the Oregon Department of Motor Vehicles (DMV). These new laws will take effect on January 1, 2020.

In addition, the new laws require all types of RVs titled in the state to be built to the NFPA 1192 standard for RVs or the ANSI A119.5 standard for Park Model RVs (PMRVs). The Oregon Building Codes Division will no longer be the titling authority in 2020, instead the Oregon DMV will title all types RVs in the new year.

For new RVs titled in Oregon to comply with the new law and the regulatory code, which was adopted by the Department of Transportation, the DMV must have certification that the RVs were built to the proper standard (NFPA 1192 or ANSI A119.5). Proof that the vehicles comply with the appropriate standard can be provided in one of two ways:

- A certification on the Manufacturer’s Certificate of Origin (MCO); or

- The manufacturer can provide a letter verifying the RV complies with the standard

The second option to provide a letter is similar to the California fifth wheel requirement, where a manufacturer can certify the vehicle is built to the proper state requirements by providing a letter which includes the unique vehicle identifier (VIN or serial number). An RV Industry Association seal will not satisfy this requirement.

As of January 1, 2020, manufacturers must include this certification for RV shipments to Oregon. Since Oregon RV dealers will also need to provide this titling information for RVs currently in their inventory, manufacturers should be prepared to provide the certification for those units, as well.

Click here for the full release from Oregon’s Department of Transportation.

For questions, please contact RV Industry Association Manager of Government Affairs Nick Rudowich at [email protected] .

Please Sign in to View

Log in to view member-only content..

If you believe you are receiving this message in error contact us at [email protected] .

US Map - State Name will appear here when state is selected

RV Industry Association uses cookies on rvia.org in accordance with our privacy policy . By using this site, you consent to the use of cookies. We use cookies for the following purposes: To enable certain functions of the service, to provide analytics, to store your preferences, and to enable advertisements delivery, including behavioral advertising.

RV Registration Rules by State

Sharing is caring!

Thanks for your support! If you make a purchase using our links in this article, we may make a commission. And, as an Amazon Associate, I earn from qualifying purchases. See the full disclosure here .

There are few things as exciting as buying a new (or new to you) RV. But before you can start your new RV adventure, there’s one thing you need to do: register your RV. Here are the RV registration rules by state.

No matter what kind of RV you have, you’ll need to register it before you can legally take it on the road. But because the process varies from state to state (and even county to county), things can get confusing. But don’t worry; we’re here to walk you through the process in all 50 states and DC. First, let’s take a look at some common registration questions.

Do RVs and Camper Trailers Need to be Registered Like a Regular Vehicle Does?

Do RVs need to be registered like your regular vehicle? The short answer is: yes. All 50 states (and DC) require you to register an RV before taking it on the road, just like a regular vehicle.

You’ll need to register your RV whether it’s self-propelled (like a motorhome) or towed by another vehicle (like a travel trailer, fifth wheel, pop-up).

In some cases, trailers are registered slightly differently than other vehicles. But in general, the process is the same for RVs as for anything else on the road.

The main difference between registering an RV and a vehicle is the cost. RVs usually (but not always) pay different fees than other passenger cars.

Do Towable RVs have VIN Numbers?

You’ll need to provide your vehicle’s Vehicle Identification Number (VIN) as a part of the registration process. But do towable RVs even have VIN numbers?

Yes, towable RVs like travel trailers and fifth wheels do have a VIN! Even small trailers like pop-up campers will have a VIN.

Their location isn’t standardized, so you might have to hunt a bit to find it. The VIN on a trailer is commonly found:

- Along the tongue of the trailer

- On the frame of the trailer

- Inside the lower corner of one of the exterior sidewalls

- Within the interior cabinets

- Inside of exterior storage areas or compartments

Because the VIN on a towable RV can be hard to find, it’s often easier to check your documentation if you can. A vehicle’s VIN can be found on its title. It is often on the bill of sale as well, but not always.

Do I Need Insurance to Register My RV or Camper?

Yes! Just like any vehicle, auto insurance is required if you want to take your RV on the road. Without insurance, you won’t be able to register your vehicle.

However, a towed RV generally doesn’t need its own insurance. Instead, the insurance of your tow vehicle will generally extend to cover the trailer.

The exact requirements will vary from state to state. You’ll need coverage for bodily injury and property damage in every state. But some states also require you to have coverage for personal injury or uninsured/underinsured motorist coverage.

One other thing to note is that if you’re planning to rent your RV for some extra cash, you’ll probably need a slightly different policy. In fact, a typical insurance policy will drop your coverage for lending out your RV to someone else!

To avoid this problem, you can use a policy like this one from Roamly . They have policies that let you rent out your RV without worrying about having your coverage dropped.

Once you buy and register your RV, give RV Trip Wizard a try for all your trip planning needs! We love it and use it almost every day! Use discount code RVBLOGGER and save 25% when you sign up!

RV Registration Rules By State

When you register your RV, you’ll generally title your RV at the same time. In the case of private sales, you’ll have to get the title transferred into your name.

In most cases, the registration process will be more or less the same, no matter what kind of RV you have. Usually, you’ll see a self-propelled RV referred to as a “motorhome” by your state’s DMV or other offices. Towable trailers are referred to by various names such as travel trailers, camper trailers, or recreational trailers.

In almost every state, you can go in person to register your RV. Some states also allow you to register by mail and a few let you register completely online. In many states, if you buy from a dealer, they can handle the title and registration on your behalf.

States usually give you a certain time period to register your vehicle after purchasing one or moving to the state. If you miss this time period, you’ll usually have to pay extra fees as a penalty.

Every state handles its registration fees differently, and fees will also often be different from county to county. In some cases, the state and/or county will provide a fee schedule or calculator. But in other cases, you’ll have to contact the relevant authority directly to find out the exact fees.

Now that we’ve covered the basics, let’s look at the different requirements to register an RV in all 50 states and DC!

You’ll have to register your RV within 20 days of purchase in Alabama . You’re responsible for registration whether you buy through a dealer or a private sale.

Just moved to the “Heart of Dixie?” New Alabama residents have 30 days to register.

In Alabama, you’ll register your RV in person at your local county registration office . It’s important to note that Alabama tags are renewed every year (so plan accordingly).

There are a couple of exceptions to registering your RV in Alabama though:

- You do not have to register travel trailers older than 20 years.

- Vehicle more than 35 years old also don’t have to be registered.

Alabama has the following coverage requirements for auto insurance:

- Bodily injury liability: $25,000 per person; $50,000 per accident

- Property damage liability : $25,000 per accident

- Uninsured/underinsured motorist coverage: $25,000 per person; $50,000 per accident

The Alabama registration fee for your RV will be based on weight. The fee starts at $23 for vehicles under 8,000 pounds and goes up to $890 for vehicles over 80,000 pounds. Travel trailers pay a flat $12 registration fee.

In Alaska, registering your RV is your responsibility whether it’s from a dealer or a private sale. If you’ve just moved to the “Last Frontier,” new Alaska residents have to register within only 10 days of arriving in the state!

RV registration is done in person at your local DMV office and Alaska tags are renewed every two years. However, vehicles over 8 years old can be permanently registered .

Alaska has the following minimum coverage requirements for auto insurance:

- Bodily injury liability: $50,000 per person; $100,000 per accident

- Property damage liability: $25,000 per accident

The base fee to register is $100 for a motorhome and $30 for a trailer. You might have to pay extra fees depending on where you live as well. For example, residents of Anchorage pay an extra $110 to register their motorhome.

You must register your RV within 15 days of purchase in Arizona. You’re responsible for handling the registration whether you buy from a dealer or a private sale. New Arizona residents must register as soon as they establish residency.

In the “Grand Canyon State”, you’ll register your RV in person at your local Motor Vehicle Division office . You can register for one, two, or five years at a time which is convenient if you’ll be on the road.

Keep in mind, you may be required to do an emissions test before registering your RV. This is required for any vehicle more than 5 years old unless it was made before 1967.

Arizona has the following coverage requirements for auto insurance :

- Property damage liability: $15,000 per accident

You’ll pay $13.50 in registration fees , plus a vehicle license tax (VLT). The VLT is based on the value of the vehicle and the amount of the VLT goes down every time you renew.

Whether you buy through a dealer or a private sale, you’ll have to handle the registration yourself within 30 days of purchase in Arkansas. New residents of the “Natural State” also have 30 days to register.

Registration is done completely online through the Arkansas My DMV website . This is a convenient method because Arkansas tags are renewed every year.

Arkansas has the following minimum coverage requirements for auto insurance:

Registration fees are based on vehicle type and weight:

- $17 for motorhomes under 3,000 pounds

- $25 for motorhomes between 3,001 and 4,500 pounds

- $30 for motorhomes over 4,500 pounds

Trailers are registered permanently for a flat $36 fee. There is also a $2.50 validation decal fee and a $10 title fee.

If you’ve completed a private RV sale in California, you’ll need to register your RV within 10 days of purchase in the “Golden State”. If you buy through a dealer, they’ll usually take care of the registration for you . Just moved? New California residents have 20 days to register their RVs.

Within California, you’ll register your RV in person at your local DMV office . California tags are renewed every year. An added step is that your RV may need to pass a smog inspection to be registered.

California has the following minimum coverage requirements for auto insurance:

- Bodily injury liability : $15,000 per person; $30,000 per accident

- Property damage liability : $5,000 per accident

California vehicle registration fees are fairly complicated. They’re based on your vehicle type, purchase price, weight, where you live, and more. There are also other fees to pay like the California Highway Patrol fee and the transportation improvement fee.

To help you figure out your fees, California has a fee calculator for both new vehicles and used vehicles .

You have 60 days to register your RV after you buy it in Colorado. New residents to the “Centennial State” have 90 days to register!

Registration can be done online at the Colorado DMV website or in person at your local DMV office . However, if you live in Crowley or Hinsdale county, you cannot register online – you’ll have to go in person. Colorado RV tags are renewed every year.

Colorado has the following minimum coverage requirements for auto insurance:

- Property damage liability: $15,000 per accident

Registration fees in Colorado are based on a number of factors like your vehicle’s type, weight, and purchase price. The exact calculation depends on what county you live in .

Connecticut

In Connecticut, registering your newly purchased RV is your responsibility in the “Constitution State”. Connecticut’s DMV doesn’t specify a timeframe for registering a newly purchased vehicle. However, new residents have 90 days to register .

You can only register in person at a DMV office and you’ll need to make an appointment . Connecticut tags are renewed every three years.

Keep in mind that you won’t be able to register your RV if you have unpaid property taxes or parking tickets. You’ll also have to meet Connecticut’s emissions testing requirements to be able to register.

Connecticut has the following minimum coverage requirements for auto insurance:

Connecticut lists the following registration fees for motorhome registration:

- $112.50 Registration Fee

- $5.00 Plate Fee

- $15.00 Clean Air Act Fee

- $10.00 Greenhouse Gas Fee

- $10.00 Administrative Fee

- $25.00 Title Fee

- $10.00 Lien Fee (if applicable)

- $15.00 Passport to Parks Fee

For a trailer, the fees are:

- $28.50 Registration Fee

- $5.00 Plate Fee

- $25.00 Title Fee (if the GVWR is more than 3000 pounds)

- $10.00 Administrative Fee

If you live in the “First State,” you must register an RV within 30 days of purchasing it in Delaware. Whether you buy from a dealer or a private sale, registration is your responsibility. New Delaware residents have 60 days to register.

Registration is done in person at your local DMV office . Delaware tags are renewed every year. Plus, your RV will have to pass a safety and emissions inspection to be able to register.

Delaware has the following minimum coverage requirements for auto insurance:

- Property damage liability: $5,000 per accident

- Personal injury protection: $15,000 per person; $30,000 per accident

Registration fees are based on weight and vehicle type. RVs under 5,000 pounds cost $40 to register. For every 1,000 pounds over 5,000, you’ll pay an extra $6.40.

Trailers are $15 under 1,000 pounds; $20 between 1,001 and 2,000 pounds; $40 from there up to 5,000 pounds. For every 1,000 pounds over 5,000, you’ll pay another $18.

A newly purchased RV in Florida should be registered within 30 days of purchase. Like in many other states, an authorized dealership can handle the registration process for you. New residents of the “Sunshine State” have just 10 days to register their vehicles.

You’ll register in person at your local tax collector’s office . Florida tags are renewed every year.

Florida has the following minimum coverage requirements for auto insurance:

- Bodily injury liability: $10,000 per person; $20,000 per accident

- Property damage liability: $10,000 per accident

- Personal injury protection: $10,000 per person

- Uninsured motorist coverage : $10,000 per person; $20,000 per accident

To register your RV in Florida, you’ll have to pay a $225 initial registration fee the first time you register, plus $28 for your license plate. You will also have to pay other fees based on your vehicle’s weight, type, and use.

Welcome to Georgia! If you purchased an RV at a dealer in the “Peach State,” you have 30 days to register a vehicle – but the dealer is able to do this for you! For a private sale, you’ll have to register your RV within seven business days . New Georgia residents have 30 days to register.

You’ll register in person at your local county tag office . Georgia tags are renewed every year.

Georgia has the following minimum coverage requirements for auto insurance:

- Property damage liability: $25,000 per person

There are a number of fees you might have to pay. Most commonly, you’ll pay $18 for the title application as well as the title ad valorem tax ( TAVT ). The TAVT is 6.6% of the fair market value of your vehicle or 3% for new Georgia residents.

Aloha and welcome to Hawaii!

Each of Hawaii’s counties has its own registration process for registering an RV. But the process doesn’t vary too much between them.

In the “Aloha State,” a dealership will usually handle the registration for you. For a private sale, you’ll have 30 days to register. New residents of Hawaii also have 30 days to register. Hawaii tags are renewed every year.

You’ll have to register in person at the appropriate office depending on your county. You can find more info on your county’s website:

- Hawaii County

- Honoulu County

- Kauai County

- Maui County

Before you can register your RV, it will have to undergo a safety inspection. These can be done at a gas station or mechanic.

Hawaii has the following minimum coverage requirements for auto insurance:

- Bodily injury liability coverage: $20,000 per person; $40,000 per accident

- Property damage liability coverage: $10,000

- Uninsured/underinsured motorist coverage: $20,000 per person; $40,000 per accident

Registration fees are based on your vehicle’s weight. The exact amount you’ll pay depends on the county and will be given to you at the DMV.

In Idaho, if you buy your RV from a dealership, they’ll usually handle the registration process for you. If not, or if you do a private sale, you’ll have 30 days to register. New “Gem State” residents have 90 days to register.

Registration is done in person at your local DMV office and Idaho tags are renewed every year.

Idaho has the following minimum coverage requirements for auto insurance:

- Property damage liability: $15,000 per person

Registration fees for RVs are based on market value.

…Fees start at $8.50 for the first $1,000 of market value, plus $5 for each additional $1,000 of market value. Idaho DMV’s registration fact sheet

A motorhome’s value will be calculated based on 25-60% of its full value. The percentage depends on the type of motorhome:

- Class C – 50%

- Class A – 60%; front engine diesel – 45%; rear engine diesel – 58%

- Van conversions or Class B – 25%

The value of a towable RV is based on 100% of the value.

On top of the value fee, there’s also an extra $4 registration fee.

In Illinois, all vehicles have to be registered within 20 days of purchase. If you buy from a dealer in the “Land of Lincoln,” (it’s a sore subject to mention that he was born and raised in Kentucky) they are required to handle this for you, but if it’s a private sale, it’s your responsibility. New residents in Illinois have 30 days to register.

You can register by mail or in person at your local Secretary of State office . Illinois tags are renewed every year.

Illinois has the following minimum coverage requirements for auto insurance:

- Property damage liability: $20,000 per person

Registration fees are based on the weight of your RV. For motorhomes, fees range from $78 to $102; for trailers, they range from $18 to $50. You will also have to pay a $150 title fee.

If you buy an RV from a dealership in Indiana, the dealer will usually handle the registration for you. For a private sale, you can register online up to 45 days after purchase; after that point, you’ll have to go in person. New “Hoosier State” residents have 60 days to register and must do so in person.

You can make an appointment at the branch nearest you through the Indiana.gov website. Indiana tags are renewed every year.

Indiana has the following minimum coverage requirements for auto insurance:

- Uninsured/underinsured motorist bodily Injury: $25,000 per person; $50,000 per accident

- Uninsured motorist property damage: $25,000 per accident

The registration fee for an RV in Indiana is $29.35. You’ll also have to pay various state, county, and possibly municipal taxes.

In Iowa, if you buy your RV through a dealer, they can handle the registration process for you. New residents to the “Hawkeye State” have 30 days to register.

Registration is done in person at your local county treasurer’s office and Iowa tags are renewed every year.

Iowa has the following minimum coverage requirements for auto insurance:

- Bodily injury liability: $20,000 per person; $40,000 per accident

Registration fees for RVs are based on class, how old the model year is, and in the case of class A RVs: the suggested retail price. The price ranges for each class are Class C: $80 to $110; Class B: $65 to $90; Class A: $85 to $400.

The fees for travel trailers are based on square footage and age. Trailers between 1 and 6 years old pay $0.30 per square foot. If the trailer is any older than that, you’ll pay 75% of this rate.

Any RV bought in Kansas should be registered within 60 days of purchase. If you buy through a dealership, they can handle this for you. New “Sunflower State” residents have 90 days to register.

Registration is done in person at your local county treasurer’s office . Kansas tags are renewed every year.

Kansas has the following minimum coverage requirements for auto insurance:

- Uninsured/underinsured motorist liability: $25,000 per person; $50,000 per accident

- Personal injury protection: $4,500 per person for medical expenses; $900 per month for one year for disability/loss of income; $25 per day for in-home services; $2,000 for funeral/burial/cremation expenses; $4,500 for rehabilitation expenses

Registration fees will depend on the county you live in. Contact your local county treasurer’s office to get an estimate of the fees you’ll owe.

Whether you just bought or are a new resident, Kentucky doesn’t give a specific timeframe to register your RV. But, you’ll still need to complete this process before you can get on the road.

Registration is done in person at your local county clerk’s office . “Bluegrass State” tags are renewed yearly.

Kentucky has the following minimum coverage requirements for auto insurance:

Kentucky will also allow you to have a single policy with a limit of $60,000 in lieu of these coverages.

Registration fees will depend on your county. You’ll need to contact your local county clerk’s office for exact fees and taxes.

In Louisiana, you have to register your RV within 40 days of purchase which can be done by a dealer if you buy through a dealership. New residents of the “Pelican State” have 30 days to register.

Registration can be done by mail or in person at your local Office of Motor Vehicles . In Louisiana, motorhome tags are renewed every two years. Trailers can be registered for 1 year, 4 years, or permanently.

Louisiana has the following minimum coverage requirements for auto insurance:

- Bodily injury liability: $15,000 per person; $30,000 per accident

Registration fees in Louisiana depend on the type and value of your vehicle. For a motorhome, some common fees include:

- $68.50 title fee

- $8.00 handling fee

- $50.00 registration fee

Additionally, you’ll pay 0.1% of your vehicle’s value per year of registration. The exact fees and taxes you pay will depend on where you live. Contact your local OMV office to get a more exact estimate.

In Maine, a dealership cannot complete your RV registration for you. It’s your responsibility to register your vehicle whether it’s from a dealership or a private sale. For new “Pine Tree State” residents, you have 30 days to register your vehicle.

The Maine Bureau of Motor Vehicles gives specific instructions for registering both camper trailers and motorhomes on their website.

Registration is done in person at your local municipal office if your municipality participates in the registration program. If they don’t, you’ll have to go to a BMV branch office . Maine tags are renewed yearly.

Maine has the following minimum coverage requirements for auto insurance:

- Uninsured/underinsured motorist coverage: $50,000 per person; $100,000 per accident

- Medical payments coverage: $2,000 per person

Maine RV registration fees are based on the type of vehicle and weight. Motorhome registration fees in Maine start at $21 and go up from there. For trailers up to 2,000 pounds, the cost is $21 to register and $40 if it’s over 2,000 pounds.

In Maine, you will also have to pay the excise tax for your vehicle. You can get more information from your local municipal office.

Home to Chesapeake Bay, blue crabs, the city of Baltimore, and RVBlogger- Welcome to Maryland! If you buy an RV from a dealership in the “Free State,” the dealer will usually complete the registration process for you. If you’re a new Maryland resident , you have 60 days to register your rig.

New residents can complete their registration by mail. In other situations, you’ll have to go make an appointment at your local Motor Vehicle Administration office. Maryland tags can be registered for one or two years at a time.

Used vehicles will need to pass a vehicle inspection to be able to register.

Maryland has the following minimum coverage requirements for auto insurance:

- Bodily injury liability: $30,000 per person; $60,000 per accident

Maryland RV registration fees are based on the vehicle type and weight. For a motorhome, you’ll pay $135 if it’s under 3,700 pounds and $187 if it’s over. For a trailer, the fees are:

- 3,000 pounds or less – $51

- 3,001 pounds to 5,000 pounds – $102

- 5,001 pounds to 10,000 pounds – $160

- 10,001 pounds to 20,000 pounds – $248

You also may have to pay a 6% excise tax on your vehicle.

Massachusetts

In Massachusetts, a dealership cannot complete your RV registration for you, so you’ll have to complete the registration yourself . New Massachusetts residents should register as soon as they establish residency.

Registration is done in person at your local Registry of Motor Vehicles office and you’ll have to make an appointment first. The “Bay State’s” tags are renewed every one or two years, depending on the type of plate.

Massachusetts has the following minimum coverage requirements for auto insurance:

- Personal injury protection: $8,000 per person, per accident

- Uninsured motorist coverage : $20,000 per person; $40,000 per accident

Massachusetts RV registration fees are based on vehicle type and, sometimes, weight. A motorhome is registered as an “auto home” and the fee is $50. For trailers, you will be charged $20 for every 1,000 pounds of weight.

If you purchase your RV in Michigan, you must register it within 15 days. If you buy from a dealership, they’re required to process this for you. New residents of the “Great Lakes State” are required to register their rigs immediately.

Registration is done in person at your local Secretary of State branch office . You can schedule an appointment, but it’s not required. Michigan tags are renewed every year.

Michigan has the following minimum coverage requirements for auto insurance:

- Personal injury protection: $250,000 per person per accident

- Property protection: $1 million

- Uninsured motorist bodily injury : $20,000 per person; $40,000 per accident

Michigan RV registration fees are based on the manufacturer’s suggested retail price for the vehicle; for trailers, it is based on the weight. There’s a fee calculator to help you estimate on the Michigan Department of State website.

If you purchase an RV from a dealership in Minnesota, the dealer can register your vehicle for you. New residents of the “North Star State” should register their RV within 60 days of making the move.

Registration can be done by mail or in person at your local Driver & Vehicle Services office .

Minnesota has the following minimum coverage requirements for auto insurance:

- Personal injury protection: $40,000 per person per accident

- Uninsured/underinsured motorist bodily injury : $25,000 per person; $50,000 per accident

Minnesota RV registration fees are $15.50 for both RVs and trailers. You’ll also have to pay a registration tax based on the age and value of your vehicle. To get more information on this tax, you can contact your local deputy registrar.

Mississippi

If you purchase an RV from a dealer in Mississippi, they’ll handle the registration for you. Private sales should be registered within seven business days. New residents of the “Magnolia State” have 30 days to register.

Vehicle registration in Mississippi is handled by the Mississippi Department of Revenue. You’ll register your RV in person at your local tax collector’s office. Mississippi tags are renewed yearly.

Mississippi has the following minimum coverage requirements for auto insurance:

To register your RV in Mississippi, you’ll pay a $12.75 registration fee, as well as various taxes. Taxes are based on the type and value of your vehicle and where you live.

In Missouri, your RV must be registered within 30 days of purchase. If it’s a sale through a dealership, the dealer cannot do this for you. New Missouri residents also have 30 days to register.

Registration is done in person at your local license office . The “Show Me State” tags are registered for one or two years at a time. Your RV may need to complete a safety inspection to be registered.

Missouri has the following minimum coverage requirements for auto insurance:

- Uninsured motorist coverage: $25,000 per person; $50,000 per accident

The registration fee for RVs in Missouri is $32.25 plus a $6 processing fee per year. So, if you register your RV for two years, you’ll pay $64.50 plus a $12 processing fee.

Trailers can be registered for one year, three years, or permanently. The costs are:

- $7.50 for one year

- $22.50 for three years

- $52.50 for a permanent registration

You may also have to pay certain taxes when you register your RV. The Missouri Department of Revenue has a tax calculator you can use to estimate this.

When you purchase an RV from a dealership in Montana, the dealer can start the registration process for you. However, you’ll still have to complete the registration yourself. If you’re a new resident to the “Big Sky Country State,” you’ll have 60 days to register.

Registration is done in person at your local county treasurer’s office . You can register your RV for one or two years at a time. If you have a motorhome that’s over 11 years old or any travel trailer, permanent registration is also available.

Montana has the following minimum coverage requirements for auto insurance:

- Property damage liability: $20,000 per accident

Montana RV registration fees for motorhomes are based on the age of the vehicle. The fee schedule is:

- Less than 2 years old – $282.50

- Between 2 and 5 years old – $224.25

- Between 5 and 8 years old – $132.50

- 8 years old or older – $97.50

- 11 years old or older (permanent registration) – $237.50

There is an additional 3% administrative fee on these amounts. You’ll also be charged $25.75 in other fees.

For travel trailers, the registration fee is based on length. You’ll pay $72 for TTs under 16 feet and $152 travel trailers over 16 feet.

Welcome to Nebraska! You’ll have to register your RV within 30 days of purchase in the “Cornhusker State,” whether it’s from a dealer or a private sale. The dealership won’t do this for you. New residents of the cornhusking state also have 30 days to register.

Registration can be done by mail or in person at your local County Treasurer’s office . Nebraska tags are renewed yearly.

Nebraska has the following minimum coverage requirements for auto insurance:

- Uninsured/Underinsured motorist coverage: $25,000 per person; $50,000 per accident

To register an RV in Nebraska, you’ll have to pay $23.80 in registration fees , plus a “motor vehicle fee” and a “motor vehicle tax”. For motorhomes and trailers, these fees are based on weight and age.

If you buy an RV from a dealership in Nevada, you can register it completely online. This should be done before your temporary placard expires. If you go through a private sale, you have 30 days to register your rig in the “Silver State.”

Registration is done in person at your local DMV office and you’ll need to make an appointment to register. Nevada tags are renewed yearly. Prior to registering your RV, your rig may be required to do an emissions test .

Nevada has the following minimum coverage requirements for auto insurance:

In Nevada, you’ll pay a $33 registration fee for a motorhome or $27 for a trailer, plus some other fees and taxes. The Nevada DMV has a fee calculator to estimate the exact amount you’ll pay.

New Hampshire

When you buy an RV through a dealer in New Hampshire, you’ll receive a 20-day temporary plate . If you go through a private sale, you can also get a temporary plate from a DMV. You’ll need to register your RV before this plate expires. New residents of the “Granite State” have 60 days to register.

Vehicle registration in New Hampshire is a two-part process. The first part is handled by the town or city clerk where you live. The second part is typically done with the state; however, your town or city clerk may be able to do this part for you.

You’ll have to register your RV in person at the clerk’s office . New Hampshire tags are renewed yearly. You will also need to have a vehicle inspection and an emissions test done as part of the RV registration process.

New Hampshire has the following minimum coverage requirements for auto insurance:

- Medical payments coverage: $1,000 per accident

In New Hampshire, you’ll have to pay registration fees to both the state and your municipality. For the state, fees are based on weight. You’ll have to contact your municipality to find out the fees they’ll charge.

When you buy an RV from a dealership in New Jersey, they’ll usually handle the registration for you. For private sales, you’ll have to register within just 10 days. New residents have 60 days to register.

You’ll have to register in person at your local Motor Vehicle Commission office. No walk-ins are accepted, so you’ll have to make an appointment . The “Garden State’s” tags are renewed yearly.

The New Jersey MVC has specific instructions on their website for how to register a motorhome , as well as a trailer . However, the process is more or less the same as for any other vehicle.

You’ll have to pass a vehicle inspection to register your RV. Inspections aren’t just a one-time thing in this state, You’ll need to do inspections every two years and every five years for new vehicles.

New Jersey has the following minimum coverage requirements for auto insurance:

RV registration fees in New Jersey are based on your vehicle’s age and weight. Fees range from $35.50 to $84.00

Whether your RV purchase is from a dealer or a private sale, you’ll have to complete the registration process yourself in New Mexico. Vehicles must be registered within 30 days of purchase. New residents have 60 days to register their RV in the “Land of Enchantment”.

You’ll have to register in person at your local Motor Vehicle Division office . You can register your RV for one or two years at a time.

New Mexico has the following minimum coverage requirements for auto insurance:

New Mexico RV registration fees are based on the weight and age of your vehicle. They range from $27 to $62 for one-year registrations and from $54 to $124 for two years.

If you buy your RV from a dealership in New York State, the dealer can handle the registration for you. You must register your vehicle within 180 days of your auto insurance’s effective date. New residents have 30 days to register their RV in the “Empire State.”

You’ll register in person at your local DMV and you can make a reservation to do so online. Vehicles in New York State can be registered for one or two years at a time. In NY, you’ll have to go through safety and emissions inspections as a part of the registration process. Plus, to maintain your RV registration, you have to do a new inspection every 12 months.

New York has the following minimum coverage requirements for auto insurance:

NY RV registration fees depend on the weight of your vehicle and where you live. You can estimate your registration fees using a calculator on the NY DMV website.

North Carolina

Whether you buy an RV from a dealer or a private sale in North Carolina, you’ll have to complete the registration process yourself. New residents of the “Tar Heel State” have 30 days to register.

In NC, you’ll register in person at your local DMV office . Appointments are available, but not required. North Carolina tags are renewed every year. Your RV will have to pass a safety inspection before you can register it. Plus, you’ll have to repeat the inspection for every renewal annually . Certain counties also require an emissions inspection.

North Carolina has the following minimum coverage requirements for auto insurance:

In North Carolina, you’ll pay various fees to title and register your vehicle. These will depend on the type of vehicle and where you live. You’ll also pay a highway use tax at 3% of your vehicle’s value, up to $250 max.

North Dakota

Welcome to North Dakota! In this state, you’ll have to complete your RV registration yourself whether you buy from a dealer or it’s sold through a private sale. However, if you buy from a dealer, you will receive a 75-day temporary registration.

The “Peace Garden State” doesn’t stress you out with a specific timeframe to register for new residents, but be sure to register it before heading out on your RV vacation.

Here you’ll register your RV in person at your local Department of Transportation office . North Dakota tags are renewed yearly.

North Dakota has the following minimum coverage requirements for auto insurance:

RV registration fees in North Dakota are based on the age and weight of the vehicle.

In Ohio, you’re required to register your RV yourself, regardless of the situation. New Ohio residents have 30 days to register.

You’ll register in person at your local deputy registrar license agency . RVs in the “Buckeye State” are eligible for multi-year registration for up to five years at a time. In Ohio, you may be required to complete an emissions test , depending on where you live and your RV’s model year.

Ohio has the following minimum coverage requirements for auto insurance:

The Ohio registration fee for a motorhome is $46; for trailers, this fee is based on weight. You’ll also have to pay a deputy registrar fee ranging from $5 to $15.

Whether you buy an RV from a dealer or a private sale in Oklahoma, you’ll need to complete the registration process yourself within 30 days of purchase. New “Sooner State” residents also have 30 days to register.

Registration is done in person at your local Oklahoma Tax Commission office or at your local tag agency. Oklahoma RV tags are renewed yearly.

Oklahoma has the following minimum coverage requirements for auto insurance:

Oklahoma charges a flat registration fee of $96, plus an $11 title fee or a $17 title transfer fee. You may also need to pay excise and/or sales tax based on the purchase price of your RV.

If you buy your RV from a dealership in Oregon, they can complete the registration process for you. Whether the dealership registers your rig or you do, the process should be done within 30 days of purchase. New Oregon residents also have 30 days to register.

You can register by mail or in person at your local DMV. You’ll need to make an appointment if you go in person. Oregon tags are renewed every two years.

The “Beaver State” has the following minimum coverage requirements for auto insurance:

- Personal injury protection: $15,000 per person

- Uninsured motorist coverage: $25,000 per person; $50,000 per accident for bodily injury

In Oregon, you’ll pay RV registration fees based on vehicle type, age, and gas mileage. If you’re a resident of Multnomah, Washington, or Clackamas County, you’ll also pay some extra fees.

Pennsylvania

In Pennsylvania, when you buy an RV through a dealership, they should complete the registration process for you. New Pennsylvania residents have 20 days to register.

You’ll register in person at a PennDOT office . Pennsylvania plates are renewed every year. You’ll have to complete a safety inspection and, in some cases, an emissions inspection to register your RV.

The “Keystone State” has the following minimum coverage requirements for auto insurance:

For motorhomes and trailers in Pennsylvania, registration fees are based on weight.

Rhode Island

If you buy your RV from a dealership in Rhode Island, they can handle the registration process for you. New Rhode Island residents have 30 days to register. You’re only required to title vehicles that are from 2001 and newer.

You’ll register in person at your local DMV office . You might need an appointment depending on what office you go to. Rhode Island tags are renewed every two years. You’ll need to go through a safety and emissions inspection to register your vehicle in the “Ocean State.” If you’re bringing an RV from out of state, you’ll also need to do a VIN check at your local police department.

Rhode Island has the following minimum coverage requirements for auto insurance:

- Uninsured/underinsured motorist coverage: $25,000 per person; $50,000 per accident; $25,000 of property damage coverage

RV registration fees in Rhode Island are based on the weight of your RV.

South Carolina

In South Carolina, you have to register your RV within 45 days of purchase. If you buy your RV from a dealer, they will generally take care of the registration process for you. New South Carolina residents also have 45 days to register.

You can register by mail or in person at your local DMV office . South Carolina tags are renewed every two years.

The “Palmetto State” has the following minimum coverage requirements for auto insurance:

- Uninsured motorist coverage: $25,000 per person; $50,000 per accident; $25,000 of property damage coverage

In South Carolina, you’ll pay a flat RV registration fee of $40 for a motorhome and $10 for a trailer.

South Dakota

There’s a reason you see so many South Dakota plated RVs roaming about the country (and Mexico)!

You have 45 days after purchase to register your RV in South Dakota. If you go through a dealership, they can handle this for you. New South Dakota residents have 90 days to register.

Registration is done in person at your local county treasurer’s office . South Dakota tags are renewed yearly.

The “Mount Rushmore State” has the following minimum coverage requirements for auto insurance:

In South Dakota, registration fees for RVs are based on age and weight.

Whether you buy your RV from a dealer or a private sale in Tennessee, you’ll have to complete the registration process yourself. Tennessee doesn’t give a specific timeframe to register for new residents or new purchases.

Registration is done in person at your local county clerk’s office . Tennessee tags are renewed every year.

The “Volunteer State” has the following minimum coverage requirements for auto insurance:

Tennessee charges a flat $26.50 RV registration fee . However, you may also have to pay additional fees depending on the county you live in.

If you buy an RV from a dealer in Texas, they’re required to handle the registration process on your behalf. For private sales, you’ll need to register your RV within 30 days of purchase. New Texas residents also have 30 days to register.

You’ll register your RV in person at your local county tax office . Texas tags are renewed every year. You’ll have to pass a safety inspection and in some cases an emissions inspection to register your vehicle in Texas.

The “Lone Star State” has the following minimum coverage requirements for auto insurance:

Texas also requires the following coverages, but you can reject them in writing:

- Personal injury protection: $2,500 per person

- Uninsured/underinsured motorist coverage: $30,000 per person; $60,000 per accident; $25,000 property damage coverage

To register an RV in Texas, you’ll pay $51.75 in registration fees, plus any other county fees.

If you buy an RV from a dealership in Utah, they can handle the registration process for you. New residents to the “Beehive State” have 60 days to register.

You’ll register in person at your local DMV office and keep in mind that some offices require an appointment. Utah tags are renewed every year.

In some cases, you might need to complete a safety and/or emissions inspection to be able to register your rig in Utah.

Utah has the following minimum coverage requirements for auto insurance:

- Bodily injury liability: $25,000 per person; $65,000 per accident

- Personal injury protection: $3,000 per accident

Utah also requires uninsured/underinsured motorist coverage, but this can be rejected in writing.

In Utah, you’ll pay RV registration fees based on your vehicle type, weight, age, as well as the county you live in. You’ll need to contact the DMV to find out the exact amounts.

If you buy your RV from a dealership in Vermont, they’re required to take care of the registration process for you. New Vermont residents have 60 days to register.

You can register by mail or in person at your local DMV office . If you go in person, you’ll need to schedule an appointment . You can register a vehicle in the “Green Mountain State” for one or two years at a time.

Vermont has the following minimum coverage requirements for auto insurance:

- Uninsured/underinsured motorist coverage: $50,000 per person; $100,000 per accident; $10,000 of property damage coverage.

In Vermont, you’ll pay RV registration fees based on your vehicle’s type and what kind of fuel it uses. Fees for trailers are based on weight.

Welcome to the state for lovers! If you buy your RV from a dealership in Virginia, the dealer can complete the registration process for you. New Virginia residents have 30 days to register.

You can register your RV by mail or in person at your local DMV office . Vehicles in the “Old Dominion State” can be registered for one, two, or (in some cases) three years at a time. For some people, you may need to pass an emissions inspection to be able to register in Virginia.

Virginia has the following minimum coverage requirements for auto insurance:

RV registration fees in Virginia are based on the type and weight of your vehicle. They’ll range from $30.75 to $35.75 for motorhomes and $18 to $40 for trailers.

When you buy an RV from a dealership in Washington state, they’ll handle the registration process for you. For a private sale , you have 15 days to register your new-to-you RV. New to Washington residents have 30 days to register.

You can register by mail or in person at your local vehicle licensing office . Washington tags are renewed every year. In some cases, you may need to pass an emissions inspection to be able to register your rig.

The “Evergreen State” has the following minimum coverage requirements for auto insurance:

In the Evergreen State, you’ll pay RV registration fees based on the type of vehicle. You’ll also pay some other fees depending on where you live and your vehicle’s value.

Washington, DC

Whether you buy your RV from a dealer or a private sale in Washington, District of Columbia (D.C.), you’ll have to handle the registration yourself. This registration process will need to be completed within 60 days of purchase. New Washington, D.C. residents also have 60 days to register.

RV registration is done in person at a DMV Service Center . D.C. tags are renewed every year. In Washington, D.C., your RV will need to pass a vehicle inspection to be able to be registered.

“The District” has the following minimum coverage requirements for auto insurance:

- Uninsured motorist coverage: $25,000 per person; $50,000 per accident; $5,000 property damage coverage

In the District of Columbia, you’ll pay RV registration fees based on the weight of your vehicle.

West Virginia

If you buy your RV from a dealer in West Virginia, they’re required to handle the registration process for you. New to West Virginia residents have 30 days to register.

In West Virginia, you’ll register your RV in person at your local DMV office . You can schedule an appointment , but it’s not required. West Virginia tags are renewed every year, but trailers are registered for three years at a time. Prior to registering, your RV will need to pass a safety inspection .

West Virginia has the following minimum coverage requirements for auto insurance:

In the “Mountain State,” you’ll pay $76.50 in registration fees for an RV. The fees for a trailer adjust according to where you fall in the three-year registration cycle.

If you buy an RV from a dealer in Wisconsin, they are required to complete the registration process for you. New Wisconsin residents should register as soon as they establish residency.

You can register online, by mail, or in-person through a licensed third party . Wisconsin does not currently handle in-person registrations at DMV service centers. Wisconsin tags are renewed every year. In some cases, you may need to complete an emissions test to be able to register.

The “Badger State” has the following minimum coverage requirements for auto insurance:

Wisconsin RV registration fees are based on the type and weight of your vehicle.

Whether you buy your RV through a dealer or a private sale in Wyoming, you’ll need to complete the registration process yourself. New Wyoming residents should register as soon as they establish residency.

You’ll register your RV in person at your local county clerk’s office . Wyoming tags are renewed every year.

The “Equality State” has the following minimum coverage requirements for auto insurance:

In Wyoming, you’ll pay RV registration fees based on the type and value of your vehicle.

Do Truck Campers Need to be Registered?

Most states don’t require truck campers to be registered or titled. The states consider them “cargo” in the pickup truck’s bed. The truck camper’s Certificate of Ownership or proper Bill of Sale has the correct information and counts as the camper’s official documentation.

If you check with your RV insurance company, your truck camper may even be covered through your truck’s insurance. We do recommend learning the details of your truck’s insurance if you go that route. If something happens, the truck camper may not have the coverage you want compared to an actual RV insurance policy.

The States below require truck campers to be registered and/or titled (Yes= +)

What is the Best State to Register a Motorhome?

If you live in your RV full-time, you might not consider any state your permanent home. But no matter how much you travel, you’ll still need to register your RV somewhere. And in most cases, you’ll need to be a legal resident (a.k.a. domicile) of a state to register your RV there.

Some of the main things to consider when deciding where to register your RV are:

- Taxes on things like your income, investments, and personal property

- Fees to title, register, and renew your registration

- How often you renew your vehicle(s) registration

- Cost of insurance

- Requirements for establishing residency

Ideally, you want a state with low taxes and fees, affordable insurance, easy renewal (and/or a long registration period), and low requirements to become a resident.

Wherever you choose, you’ll need to return to the state occasionally for renewals and other things. It’s also good to pick a state that’s easy to get to in your RV. That means Hawaii and Alaska are off the list.

With these things in mind, there are three states that are generally considered the best to register your motorhome or travel trailer. They are Florida, Texas, and South Dakota.

The Sunshine State is a popular destination for RVers in general (especially in the winter). So it’s no surprise Florida is also a popular place to register your RV as well.

Florida is a popular choice because it has no income tax and a relatively low sales tax of 6% (This doesn’t include individual county, property, and tourist additions).

You can also renew your tags online; every other driver’s license renewal can be done online as well. Because a Florida driver’s license is good for 8 years, you’d only need to go to the DMV in-person once every 16 years.

Besides these benefits, Florida residents also get discounts on passes and tickets to Disney and other theme parks (resident vs. out-of-state). And of course, there’s also Florida’s 1,350 miles of coastline for beach lovers to enjoy.

The biggest downside to Florida is that establishing residency is not especially easy.

The “Lone Star State” is one of the most popular states for RVers and for good reason.

Texas is popular because it has no income tax or personal property tax. There is also no inheritance or estate tax. Texas registration fees are also fairly low.

Plus, Texas is also the headquarters of Escapees RV Club , one of the country’s largest RV clubs. They provide tons of services to RVers such as mail forwarding and member discounts.

You can renew your vehicle tags and driver’s license online in Texas. If you do need to return to do business in person, it’s fairly central and easy to get to. Plus, establishing residency in Texas isn’t too complicated.

The biggest downside for Texas is that you’ll be required to complete an annual vehicle inspection to renew your tags. That means you’ll need to return in person at least once a year.

The absolute best state to register your RV is generally considered to be South Dakota. This is for a few reasons.

Like Florida and Texas, South Dakota has no income tax. There is also no tax on personal property, pensions, or inheritances. South Dakota also has an extremely low sales tax of only 4.5%.

South Dakota also benefits from low registration fees and insurance rates. Plus, tags can be renewed online, as well as every other driver’s license renewal.

If you do need to return in person, South Dakota is centrally located. In fact, the geographic center of the U.S. is in South Dakota!

The best part about registering in South Dakota is how easy it is to establish residency. You can become a South Dakota resident after spending only one night there!

What Paperwork Will I Need to Register My Camper or RV?

When you register your RV, you’ll need to provide various documents and fill out certain paperwork. The exact things you’ll need depend on what state you’re registering in. However, there’s usually not a huge difference.

Let’s look at what you’ll commonly need to be able to register your RV.

The title is a document establishing you as the owner of your RV. While a title is always required to register a vehicle, titling and registration are usually handled at the same time. If you buy a vehicle in a private sale, you’ll transfer the title from the seller to yourself.

You’ll also need to provide some kind of proof of ownership, such as a bill of sale. Other states might require a Manufacturer’s Certificate of Origin.

Vehicle Registration Application Form

You’ll need to fill out a vehicle registration application to register your RV. For this form, you’ll have to provide information about your vehicle and some personal info.

Most states let you download a vehicle registration application online. In some cases, however, you can only get the form in person at a DMV.

Drivers License or Another Form of ID

You’ll need to provide some form of ID, usually a driver’s license, to prove your identity to the DMV. In some cases, you’ll need an in-state driver’s license. If you’re a new resident, update your ID first.

Proof of Insurance

You’ll need to meet your state’s insurance requirements to be able to register your vehicle. Your proof of insurance will usually be in the form of a card from your insurance company.

If your insurance company only creates electronic insurance cards, printing them out, the declaration page, or other forms may work. Ask the DMV personnel or completely read through the steps so you come fully prepared.

Proof of Passed Inspections

If you’re registering your RV in a state that does safety, emissions, or VIN inspections, you’ll need to prove you passed them. You’ll usually receive some kind of document from the office or entity that does the inspection.

For weight certifications, use the CAT Scale Locator Website or App to find an authorized scale in the area. They can weigh and give you a certified document the DMV will accept.

Odometer Disclosure Statement

An odometer disclosure statement is a document recording the mileage on the odometer at the time of sale. Odometer disclosures are generally required any time a vehicle from the model year 2010 or newer. Odometer disclosures are intended to protect you from odometer fraud .

You can obtain the necessary form at the DMV or online . The document directs you to which authority can certify the document. Some states allow notaries, police officers, certain vehicle dealership personnel, or others.

Out of State Title and Registration

If you move to a different state, you’ll usually need to provide your title and registration from the previous state you lived in. Then, you can change your title and registration to the state you now live in.

Wrapping-up RV Registration Rules by State

Whether you have a Class A motorhome, a van conversion, a fifth-wheel, or any other kind of RV, you’re going to have to register it to get on the open road. With our in-depth guide to RV registration rules in every state of the U.S.A., you’ll know how to do it, no matter where you live.

Before heading out to register your new or new-to-you RV, make sure you check all the requirements to register.

Save yourself the headache and time by bringing all the required documents such as your registration application, ID, and proof of insurance. If you’re moving, you’ll need your title and registration to update them.

The final part of registration is payment. Every state charges fees differently; different counties within the state will usually have their own fees too.

Once you’ve completed all these steps, you’ll be the proud owner of a legally titled and registered RV. Once you’re legal, there’s only one thing left to do: take your RV out on the road and start your adventure.

Related Reating:

35 biggest rv beginner mistakes to avoid, how to buy a used rv from a private seller in or out of state, 115 point rv inspection checklist (new or used), rv construction methods: which is best, best rvs and campers for beginners.

About the Author

Jennifer and Kendall are avid RVers and part-time van lifers who share their years of experience both as full-time RVers and nomads through writing.

Jenn and Kendall have explored Canada, the USA, and Mexico while RVing and living full-time in all 3 countries.

They have been fortunate to work not only as part of the RVBlogger team but also with RVLife, DIY RV, Camper Report, RV Magazine, Rootless Living, Vanlifers, and more.

They have also shared their RV experience through DashboardDrifters.com and are the founders of RVSpotDrop, a web service for full-time RVers.

1 thought on “RV Registration Rules by State”

I have a weird question. We took put a loan for an RV in WA state and all of our paperwork matches eachother. But the bank has a different RV name on their paperwork. Is the loan still valid? How do I check to see if the banks VIN matches ours without raising any glags?

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Oregon DMV to title some ‘park model’ RVs

Dec. 16, 2019

SALEM – Oregon DMV will begin titling “park model” recreational vehicles that meet certain requirements under a law taking effect in January 2020.

DMV can start accepting title applications when it opens for business Jan. 2, 2020, under House Bill 2333, passed by the Oregon Legislature in 2019.

Park model RV definition and requirements

In order to qualify for titling by DMV as a park model, it must:

* Be manufactured to meet the ANSI A119.5 standard. * Be over 8.5 feet wide. * Be designed for use as temporary living quarters. * Be built on a single chassis mounted on wheels. * Have a gross trailer area of 400 square feet or less.

Along with other requirements, the title applicant must provide proof that it meets the ANSI A119.5 standard with the DMV title application form.

For a newly built park model RV, this can be part of the Manufacturer’s Certificate of Origin or by a letter from the manufacturer certifying that the park model RV meets the standard. If it is a used park model RV, the applicant can certify on the application. If it is an assembled park model RV, the applicant can certify on the Assembled, Reconstructed, or Replica Certification form.

DMV personnel will not inspect compliance labels to verify that a park model RV meets ANSI standards, and DMV cannot issue a trip permit or registration for a park model RV.

DMV will update its website in January 2020. You can start your title pre-application process online at OregonDMV.com under “DMV2U online services” if you plan to go to a DMV office within 30 days. If mailing in your application, you can complete the printable Application for Title and Registration form online on or after January 2, 2020.

Recreational vehicle definition (travel trailer, camper, motor home)

A park model RV is not the same as a recreational vehicle. Recreational vehicles are:

* Manufactured to meet the NFPA 1192 standard (or NFPA 501c or ANSI A119.2 standard if the vehicle is an older RV). * 8.5 feet wide or less. * Designed for use as temporary living quarters. * Designed to be easily transported and set up on a daily basis. * Designed to be mounted on or towed by another vehicle or travel by its own power.

If a vehicle is not built to the appropriate standard or does not meet all other requirements for an RV under Oregon law, DMV cannot title it as an RV.

Vehicle use tax

If you purchase a newly manufactured RV from an out-of-state dealer or builder, you may need to provide proof that you paid the Oregon Vehicle Use Tax. Contact the Oregon Department of Revenue for questions regarding the tax: * Phone: 503-945-8120 * Email: [email protected] * Information: https://www.oregon.gov/dor/programs/businesses/Pages/Vehicle-privilege-and-use-taxes.aspx

Any time you need to visit DMV, please first check OregonDMV.com to find business hours, locations and wait times for most offices, and to make sure you have everything you need before your visit. You also can do some DMV business from home at DMV2U.Oregon.gov .

Oregon Department of Transportation

355 Capitol Street NE, MS 11

Salem, OR , 97301-3871 USA

Takeaways from Oregon baseball's series win against Utah at PK Park

A fter dropping each of its last two conference series, the No. 21 Oregon baseball team got back into the series win column, taking two out of three against conference-leading Utah at PK Park this weekend.

The Ducks (32-15, 14-10 Pac-12) won the first two matchups against the Utes (30-15, 15-9 Pac-12) in a Saturday doubleheader after Friday’s opener was postponed due to weather before dropping the Sunday finale.

Conference sweep eludes Ducks yet again

After taking the opener Saturday, 7-5, then the second game of the day, 5-1, to clinch the series, the Ducks dropped yet another chance for a series sweep in a 9-7 decision Sunday afternoon.

Oregon has yet to record a series sweep in conference play after leading Arizona and USC 2-0 before dropping the Sunday game in each series.

“It’s extremely frustrating,” coach Mark Wasikowski said. “We’re trying to win the league. We’re disappointed in the fact that we weren’t able to sweep the team that came in here in first place. We win a series and we’re disappointed. The standard is high, obviously, when you win a series, and your guys are really disappointed.”

The Ducks fell behind 4-1 in the Saturday opener before scoring two runs in the fourth, fifth, and seventh innings to set the tone for a more dominant second game. Jacob Walsh went 3-for-4 with three RBIs in the series-opening, 7-5, victory.

In Game 2 Saturday night, Grayson Grinsell allowed just one run in six innings of work and reliever Brock Moore continued his hot streak on the mound , striking out three in three scoreless innings to give the Ducks a 5-1 win. Jeffery Heard knocked in two runs and drew two walks in the win.

On Sunday in the finale, Oregon starter Kevin Seitter got into early trouble and the Duck bats couldn’t complete a comeback late to fall 9-7. Bennett Thompson pinch hit in the eighth inning and hit a three-run homer that cut the Utes lead to just one heading into the ninth, but the Oregon bats went down quietly in the final inning.

It’s Oregon’s sixth conference series win heading into the final two weekends of the regular season.

Bryce Boettcher on a heater

In Oregon’s last five games, Eugene native and starting centerfielder Bryce Boettcher has five home runs, including two last Tuesday in a win over Oregon State .

The senior two-sport athlete went yard in Oregon’s first game against the Utes and its last, bringing his home run total to 11 for the season with a .295 average. Boettcher is one home run short of stamping his name in the Duck record books as one of just 11 players to hit 12 home runs in a single season.

“I feel good,” Boettcher said. “I’ve made a couple of adjustments, mostly just mental adjustments within myself in the box. It’s been nice coming home for these past couple of games, so I’ve been feeling good.”

Where Oregon stands heading into final stretch of regular season

With just two weekends and six games to go before the Pac-12 Tournament begins, Oregon currently sits three games back of conference-leading Arizona. The Ducks are also a game behind both Oregon State and Utah but has tiebreaker advantages over both the Wildcats and Utes.

The Ducks play Washington for a road series in Seattle next weekend and host Washington State the following weekend back in Eugene. The Huskies (18-21-1, 9-14 Pac-12) and Cougars (20-26, 8-16 Pac-12) both rank near the bottom of the Pac-12 conference standings.

Alec Dietz covers University of Oregon football, volleyball, women’s basketball and baseball for The Register-Guard. You may reach him at [email protected] and you can follow him on X @AlecDietz .

This article originally appeared on Register-Guard: Takeaways from Oregon baseball's series win against Utah at PK Park

Explaining the school-related measures on your ballot: Eugene, Junction City, Fern Ridge

Several school-related measures are on the ballot for voters in Lane County.

For those within the districts of Eugene School District 4J, Junction City School District and Fern Ridge School District, each will see a measure on the ballot which if passed would fund different projects or operations.

The primary election is on Tuesday, May 21; ballots are due that same day by 8 p.m.

To check your voter registration status or track your ballot, visit sos.oregon.gov/voting-elections/Pages/default.aspx .

Here is how the measures might impact students and educators in the region.

About the Eugene 4J Measure 20-357

Eugene School District 4J is seeking the renewal of the current local option tax of $1.50 per $1,000 of assessed property value.

4J board member Judy Newman said Eugene voters have passed the levy every time its been on the ballot since 2000. The last 4J levy was renewed in 2019, making this the first levy up for a vote since the COVID-19 pandemic.

If passed, the levy would raise $25 million per year for 4J, which makes up about 10.5% of the district's general fund budget. Newman said 89% of general fund expenditures go toward personnel, meaning the levy money goes directly into the classroom.

If not passed, Newman said there would have to be budget cuts, and those cuts would likely come down to staffing or instructional days, a decision that would weigh on Newman and the six other board members.

Newman said $25 million equals 205 licensed teachers or about 300 educational assistants. She said that amount of money translated into school days is about six weeks of classes.

"(It would be) very painful to cut budgets at a time when we know we need more resources," Newman said. "We do have some reserves ... but we already are on a path to spend those down to be able to keep our class sizes where they are."

Newman said having to make cuts would be destabilizing for 4J.

"I believe so strongly in public education," Newman said. "If you don't have healthy, well funded, strong public schools, you create bigger gaps ... It's really important to every citizen, I think, for public safety, for our economy.

"(Students), they're our future workforce. They're our future voters," she said.

If passed, this tax would be in place for five years started in fiscal year 2025-26.

Newman said passing the levy is a tangible way to show voters' support of educators.

"Morale is a struggle these days, so knowing our community really supports our work, and knowing that the community is behind us and will invest in education too, I think is huge," Newman said.

The last 4J levy passed with 71.9% in 2019.

About the Fern Ridge School District Measure 20-354

Fern Ridge School District's general obligation bond on the ballot asks voters if they want the district to be authorized to issue $16 million in bonds. If passed, the district would also receive a $6 million state grant through the Oregon School Capital Improvement Matching program.

This is an extension of previous bonds passed in the district. There would be no tax rate increase to homeowners, who are currently paying $2.20 per $1,000 of assessed property value.

Unlike levies, a school bond funds brick and mortar projects. It can also go toward in-classroom materials like technology, books, furniture, etc.

Four FRSD schools are the focus of buildings that would be the proposed bond projects. They include:

- Elmira High: updated heating, ventilation and air conditioning systems and instructional spaces; new multi-use turf field, track and athletic complex; and repaired and replaced doors, parking lot and driveways.

- Fern Ridge Middle: updated HVAC system, instructional spaces and outdoor space as well as improved traffic flow by repairing and replacing the parking lot and driveway.

- Elmira Elementary: security fencing; improved drainage; and expanded play area and new walking track.

- Veneta Elementary: upgraded gym; replaced and expanded parking; and improved drainage.

The proposal also mentions improved sports fields, updated restrooms and miscellaneous site improvements.