Guide to VAT refund for visitors to the EU

If you are a visitor to the EU and are about to leave EU territory to go home or to some other place outside the EU, you may be able to buy goods free of VAT.

"Tax-free" shopping: who is a ‘visitor’?

What is vat.

Value added tax (VAT) is a multi-stage sales tax, the final burden of which is borne by the private consumer. VAT at the appropriate rate will be included in the price you pay for the goods you purchase. As a visitor to the EU who is returning home or going on to another non-EU country, you may be eligible to buy goods free of VAT in special shops.

Who is a ‘visitor’?

A ‘visitor’ is any person who permanently or habitually lives in a country outside the EU. Your address as shown in your passport or other identity document will be taken as the place where you permanently or habitually live.

Example: Eduardo lives and works in Brazil but spends three months every summer in Portugal, where he has a time-share in a villa. Eduardo’s permanent address is in Brazil, so he is a ‘visitor’ to the EU while in Portugal.

In some countries, you may also qualify as a ‘visitor’ if you are living in an EU country for a defined period of time for a specific purpose, but your permanent home is outside the EU and you are not intending to return to the EU in the immediate future. EU citizens permanently living in non-EU countries are also eligible for the VAT refund.

Example: Paul is a Belgian citizen but lives permanently in Canada. Once a year, he returns to Belgium to visit his parents. Paul is a ‘visitor’ and can apply for a refund on a basis of his Canadian residence card.

‘Tax-free’ shopping: how is the VAT refunded?

Can’t i just pay the vat-free price in the shop.

No. You must pay the full, VAT-inclusive price for the goods in the shop; you will get the VAT refunded once you have complied with the formalities and can show proof of export.

How do I go about this?

- When you are in the shop, ask the shop assistant in advance whether they provide this service.

- Ask the shop assistant what threshold applies to the purchase in order to be eligible for a refund.

- At the check-out, the shop assistant will ask you to provide proof that you are a visitor to the EU. You will need to show your passport or other identity document proving your residence outside the EU.

- The shop assistant will ask you to fill in a form with the necessary details. You may be asked to show your ticket as proof you are leaving the EU within the required time. The shop assistant will fill in the shop’s part of the form.

- Make sure you understand exactly what you need to do and how you receive the refund. In some cases, the shop itself will refund you. In other cases, the shop will use a third party to organise the refunds on its behalf.

- Make sure you understand whether the shop takes an administrative fee for this service (which will be later deducted from the refunded amount) and if so what is the fee.

- You will receive an invoice for the goods. You must show the invoice, the refund form, the goods and any other necessary documents to the customs officers of the last EU country you leave. The customs officers must stamp the form as proof of export. Without the stamp, you will not obtain the refund.

- You must then follow the steps explained at your refund document or by the shop assistant. You can claim your VAT refund in bigger airports immediately, otherwise you will have to send the refund form to the address given in the shop.

Attention! The precise details will depend on how that particular shop organises the refund procedure.

Example: John came from the US for a vacation in Europe. He bought a designer bag in Paris; some clothes and shoes in Milan and Budapest. In each shop, he got refund forms filed. Within a month, John leaves to US from Budapest. At the airport, he shows the purchased goods to the customs officer and gets the refund documents stamped. Some of the refund documents were provided by a refund intermediary- he finds their refund counter in the airport and gets the refund immediately. An administrative cost is deducted from the refund amount. The remaining stamped refund document he has to send back to the shop where he purchased the goods.

Will I get all the VAT refunded?

This is unlikely. In the great majority of cases, there will be an administrative charge for the service. Make sure you find out how much you will be charged when still in the shop.

Can someone else go to the shop for me?

No. You must be there in person in order to make a VAT-free purchase, although you do not have to pay for the goods yourself.

Will I have to wait until I am home to receive the refund?

Not necessarily. In some larger ports and airports, you may be able to obtain a refund straight away once the customs officers have stamped your form, provided the shop in which you bought the goods uses this facility.

Where can I complain if I did not receive the refund?

You can complain to the company in which you bought the goods because this company has a principal responsibility to give the refund. If however that company used an intermediary you may first apply to the intermediary. European Commission does not intervene in particular cases of VAT refund to foreign visitors. ‘Tax-free shopping’: tax-free shops and qualifying goods

Can I buy goods VAT-free from any shop?

No. Shops do not have to offer a VAT-free facility. Those that choose to do so must make the appropriate arrangements with the tax authorities.

How shall I know whether a shop is a VAT-free shop?

The shop will usually display a prominent sign in the window, advertising that it is a ‘tax-free’ or ‘VAT-free’ shop. This may of course be in the local language.

Can all goods be bought VAT-free?

No. There are some goods that do not qualify. The facility is intended for goods that could in principle be carried in personal luggage. Goods that have to be exported as freight, for example, and cars and yachts are excluded. Some countries may also exclude other categories of goods.

Is there a threshold on each purchase?

To avoid administrative burdens over small-value items, there is a minimum value of EUR 175 (or the equivalent in national currency outside the euro zone) for the total purchase, but EU countries may set lower thresholds. The threshold applies to the total amount of goods bought in a certain shop. Normally, you cannot cumulate purchases in different shops to reach the threshold. You will receive a separate form in each shop in which you buy goods. You can enquire national tax authorities on the thresholds applicable in a particular EU country. You will be able to find the contact addresses for all national tax administrations in the document " VAT in the European Union ".

How soon do the goods have to leave the EU?

The goods you buy VAT-free must leave the EU by the end of the third month after that in which you buy them.

Example Bruce, who lives in Canada, has been on holiday in Italy for two weeks. He buys a designer suit from a VAT-free shop on 10 September. The suit must leave EU territory no later than 31 December.

Do I need to take the goods with me when I leave the EU?

Yes. The goods must accompany you when you leave the EU. You cannot buy VAT-free goods if for any reason, you cannot or do not wish to take the goods with you when leaving the EU. Moreover, you have to be ready to demonstrate those goods to the customs officer who will stamp your VAT refund form.

Do I have to leave the EU straight away from the country where I purchased goods?

No. You can buy VAT-free goods even if you are going to be visiting other EU countries before you finally return home, as long as you actually leave the EU with the goods within the time limit. You have to get your documents stamped by a customs officer at the point of exit of the EU – not necessary in the same EU country where you bought it.

Be careful if you leave the EU by train!

You may be able to get the VAT refund documents stamped at certain train stations of the departure. However, you might as well need to get off the train at the last station within the EU to get this stamp. Other methods could also apply (e.g. a customs officer might be boarding the train) .

This depends on the trains’ route and the internal arrangements in each EU country.

We therefore strongly advise you to consult in advance the national authorities or your refund company on the arrangements applicable in our concrete route.

What if I did not get a stamp?

In principle, the stamped VAT refund document is obligatory for VAT refund. Contact the entity in which you bought goods for the information whether they would accept other documents as a proof that the goods were exported in a due time and give you a refund.

Whom should I contact for questions related to my refund?

Your primary contact is the supplier / VAT refund agent mentioned in your VAT refund documents. If you have questions on VAT refund rules applicable in a particular EU country, contact national tax authorities . For questions on customs arrangements at a particular border, contact national customs authorities . The European Commission does not provide advice on particular situations.

Share this page

VAT recovery

- Recovering VAT

You can find more information about VAT refund here .

For VAT refunds you can go to the RIA exchange offices . Upon presentation of your customs stamped reclaim form, with attached invoice(s), you will receive your VAT refund, in cash or on your credit card.

You can also deposit your VAT refund form in the VAT refund mailboxes at the RIA exchange offices.

The VAT refund form must be fully completed (don't forget your bank account number). The invoice and/or tickets must also be attached to the VAT refund form*.

The VAT reclaim forms*, invoices and tickets must be stamped by the customs authorities.

If you do not have a VAT refund form, please contact the shop to obtain the VAT refund. Do not deposit tickets/invoices without the VAT refund form.

* This is a tax free form.

The VAT refund mailboxes can be found at the following locations:

Departure Hall :

- At the left side of the RIA office between Relay & PRM

- At the RIA office next to the customs desks

- At the customs office

Gates B - Gallery of Light:

- Behind the RIA office desk

Related content ico_chevron_list

- Water refill stations

- Power banks Naki

- Kidscorner Gates A

- Postal Services

Belgium Solved

Belgium Tax Refund: All You Need to Know

Navigating the waters of Belgium’s tax system can reveal pleasant surprises , like the potential for a tax refund, akin to discovering a hidden gem in the cobbled streets of Bruges.

Whether you’re an expat soaking up the diverse culture or a local delving into the intricacies of fiscal responsibilities, understanding how to secure a tax refund in Belgium is invaluable.

This guide aims to demystify the process, offering clear insights and practical tips to ensure you can reclaim any overpaid taxes , making your Belgian experience even more rewarding.

Let’s dive in!

Who Has To Pay Taxes In Belgium?

If you are above 18 years old and earn money in Belgium, you are required to pay Belgian taxes. However, the amount you pay is determined by whether you are classified as a resident for tax reasons.

Resident Taxpayer: If you are registered with the local municipality and Belgium is your center of social and economic interest (for example, your family lives there), you are deemed a resident for tax purposes in Belgium.

In addition to income taxes, you must pay municipal taxes and a 13.7% social security payment.

If you are a resident taxpayer, you must pay personal income tax in Belgium on your worldwide earnings. Every month, your company will automatically take income tax from your compensation.

Non-resident Taxpayer: You’re a non-resident taxpayer in Belgium when the center of your social and economic interests is abroad because you’re in Belgium for a limited period (of less than 183 days a year).

What Are The Common Reasons For Receiving A Tax Refund In Belgium?

A tax refund in Belgium refers to the return of excess taxes that an individual or business has paid to the Belgian government.

This typically occurs when the amount of tax withheld or paid during the tax year exceeds the amount owed based on the taxpayer’s income, deductions, and credits.

Taxpayers may be eligible for a refund if they have overpaid their taxes through payroll withholding , estimated tax payments, or other means.

Common reasons for receiving a tax refund in Belgium include:

- Overpayment of withholding taxes from employment income.

- Eligibility for tax deductions or credits that reduce the overall tax liability.

- Tax treaty benefits for individuals with income from multiple countries.

- Errors or discrepancies in tax calculations.

Tax refunds are typically claimed by filing an annual tax return with the Belgian tax authorities.

This return allows taxpayers to report their income, deductions, and credits accurately, which determines whether they are owed a refund or have additional taxes due.

Upon processing the tax return, if it is found that the taxpayer has overpaid taxes, the excess amount is refunded to them.

What Documents Are Required To Submit For A Tax Refund In Belgium?

- Tax Return Form: In Belgium, taxpayers are typically required to file an annual tax return, either online through the Tax-on-web platform or by completing a paper form. This form is where you declare your income, deductions, credits, and any other relevant financial information for the tax year.

- Salary Slips: If you’re an employee, you’ll need to provide copies of your payslips or an annual summary provided by your employer.

- Pension Statements: If you’re retired and receiving a pension, you’ll need statements showing the pension income received.

- Income from Investments: Statements from banks or investment firms showing interest, dividends, or capital gains earned.

- Rental Income: If you earn income from renting out property, you’ll need documentation showing the rental income received.

- Medical Expenses: Receipts for medical expenses not covered by insurance.

- Mortgage Interest: Documentation showing interest paid on a mortgage for your primary residence.

- Charitable Donations: Receipts for donations made to eligible charities or institutions.

- Education Expenses: Receipts for tuition fees, educational materials, and other eligible education expenses.

- Professional Expenses: If you’re self-employed or have certain types of employment, you may be able to deduct professional expenses related to your work.

- Statements from Employers: Showing taxes withheld from your salary.

- Bank Statements: Showing any tax payments made directly to the tax authorities.

- Investment Statements: Showing any taxes withheld on investment income.

- Bank Account Information: You’ll need to provide your bank account details, including the IBAN and BIC/SWIFT codes, for the tax authorities to deposit any refund directly into your account.

- Proof of Dependents: If you’re claiming tax benefits for dependents, you may need to provide their identification documents.

- Proof of Residency: If you’ve recently moved to Belgium or have dual residency, you may need to provide documentation proving your residency status.

How To File Annual Tax Return In Belgium?

Residents and non-residents of Belgium are required to file an annual tax return, even if they have no income to report.

This is significant because, even if you have no income, you can claim a tax refund by disclosing any payments made for tax-deductible things, such as childcare or mortgage payments.

If this is your first time filing a tax return in Belgium, you will receive a brown envelope with your annual tax return five weeks before the deadline.

However, nine out of ten Belgians file their tax returns online since it is a simpler method. Many fields are pre-filled because the majority of taxes are deducted at the source.

1. Tax Return Filing: Individuals in Belgium are required to file an annual tax return, which is typically due by June 30th of the year following the tax year.

The tax return can be submitted online using the Tax-on-Web platform or on paper.

2. Types of Income: Different types of income are subject to taxation in Belgium, including employment income, self-employment income, rental income, investment income, and more.

Ensure that you report all sources of income accurately in your tax return.

3. Tax Deductions and Credits: Belgium offers various tax deductions and credits that can reduce your taxable income. These may include deductions for mortgage interest, education expenses, and other eligible expenses.

Be sure to claim all applicable deductions and credits to maximize your potential refund.

4. Review and Submission: Double-check your tax return for accuracy before submission. Incorrect or incomplete information can lead to delays in processing and may affect your refund.

5. Assessment: After submitting your tax return, the Belgian tax authorities will assess the information provided. They may request additional documentation or clarification if needed.

6. Tax Assessment Notice: Once the assessment is complete, you will receive a tax assessment notice. This document outlines the calculated tax liability or refund.

If you are entitled to a refund, the notice will specify the amount and the bank account where the refund will be deposited.

7. Payment or Refund: If you owe additional taxes, you will need to make the payment by the specified deadline.

If you are eligible for a refund, the amount will be transferred to your bank account. This process usually takes several weeks after the tax assessment.

8. Appeals: If you disagree with the tax assessment, you have the right to appeal. You can submit a complaint within specific time frames and provide supporting documentation to support your case.

9. Professional Assistance: Many individuals in Belgium choose to seek professional assistance from tax advisors or accountants to ensure accurate and efficient tax filing.

To receive a tax refund, simply fulfill the following conditions:

- The buying price in Belgium must be at least 125.01 Euros (including VAT).

- The buyer must not be a European citizen and may not spend more than three months in Europe.

What Kind Of Regulations Apply To Tax Refund Products?

- Tobacco and non-EU exports are not eligible for tax refunds.

- Purchased products must be unopened and removed from the country within three months (by the final day of the third month following purchase).

- The goods have to be taken along in the tourist’s luggage (hand luggage or checked-in luggage). The reason for this is that goods that were purchased abroad and were then sent by post or intermediary agencies are eligible for a tax refund.

When Should You File Your Belgian Tax Return?

You’ll be notified to file your Belgian tax return in May. The deadline to file your tax return online is usually around July 15th . The deadline for submitting your tax return by mail is normally around June 30th for residents and November 25th for nonresidents.

If you fail to file your declaration on time, you risk receiving a fine ranging from €50 to €1,250 , as well as a penalty of 10% to 200% of the tax.

Tax Refund Belgium – What Tax Rates Apply?

The tax rate is a percentage that helps to calculate the total amount of income tax attributable to a taxpayer.

As far as Belgium is concerned, there are five tax rates, which are defined as percentages and are as follows: 25, 30, 40, 45, and 50%.

Which tax rate you are subject to depends primarily on your earnings during the tax year in question. Bear in mind, however, that income such as dividends is taxable under separate legislation.

Armed with the knowledge from this comprehensive guide , the Belgium tax refund process should now feel less like a daunting labyrinth and more like a straightforward path leading to financial benefits.

Whether you’re optimizing your tax situation as an individual or ensuring your business complies efficiently, being informed about your entitlements and the procedure for claiming a refund is crucial.

So, as you continue to navigate the scenic beauty and rich cultural tapestry of Belgium, rest assured that you’re well-equipped to make the most of its tax system. Here’s to a fruitful journey ahead.

À votre succès (To your success)!

But wait, there’s more! You might also be interested in the following:

- Belgium Tax System: How it works

- Tax Return software in Belgium: A Simple Guide

Tax Number in Belgium: An Expats Guide

Similar posts.

Stepping into Belgium, the land of divine chocolates and intricate lace, brings its own set of adventures—and yes, that includes the thrilling world of tax numbers! Fear not, dear expat, for we’re here to decode the mysteries of obtaining your very own Belgian tax number. It’s the golden ticket to navigating the financial landscapes of…

Tax Return Software In Belgium: A Simple Guide

In the heart of Europe, where chocolate meets bureaucracy, Belgium’s tax season can be as complex as a fine truffle. Looking to simplify this complexity? Fret Not! We’ve got you covered! Fortunately, modern technology offers a sweet solution: tax return software. This article serves as your digital sommelier, guiding you through the best options to…

Tax Consulting In Belgium: An Expats Guide

Navigating the intricate tapestry of Belgian tax law can feel akin to exploring the winding streets of Bruges—each turn reveals new complexities and hidden gems. Worry Not! We’ve got you covered! Whether you’re a local entrepreneur or an international expat, the right tax consulting guidance is your map to uncovering financial efficiencies and ensuring compliance….

Tax Declaration In Belgium: StepBy-Step Guide

Stepping into the realm of Belgian tax declarations can feel like navigating a labyrinth designed by Magritte—surreal, complex, and uniquely Belgian. Need assistance in filling a tax return? Don’t Worry! We’ve got you covered! This guide is your map through the intricate maze of tax codes, deductions, and deadlines. Whether you’re a freshly arrived expat…

Belgium Tax System: How It Works

Welcome to the world of Belgian waffles, chocolate, and, you guessed it, taxes! Navigating the tax system in Belgium can feel like trying to solve a Rubik’s Cube blindfolded. But don’t worry; we’re here to remove the blindfold and guide you through the intricate dance of income brackets, deductions, and tax rates. Ready to become…

Church Tax In Belgium: A Simple Guide

In the heart of Europe, Belgium’s unique church tax system intertwines the secular with the spiritual in a way that can mystify even the most astute expats. But Don’t Worry! We’ve got you covered! This guide aims to shed light on the complexities of church tax in Belgium, offering clarity to those navigating its nuances….

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Tourist Tax in Belgium: (Why) Should I pay It and how much does it cost?

Many places around the world charge an additional “tourist tax” upon the normal accommodation-cost. The tourist tax is not always included in the advertised price. This often leads to confusion and raises many questions: What exactly is this tourist tax? How do I know if it’s legit? How much does it cost?

Table of Contents

What exactly is “Tourist Tax”:

The financial budget of every city and municipality is largely depending on the amount of inhabitants. They all pay taxes for communal facilities and services. Tourism is a great way to stimulate the local economy, but it also has a large cost for extra facilities and services that are needed. In order to develop a sustainable environment where locals and tourist can share the same space, tourist can be charged for the extra costs they bring to the community.

How does Tourist Tax in Belgium work?

Charging tourist taxes at the border is too impracticable and because it’s impossible to let tourists buy an “entry ticket” at the city-gates, the government had to come up with a better solution. Therefore your accommodation will charge tourist taxes if they apply.

In Belgium every city, town and municipality is free to charge their own tourist tax for all non-inhabitants. This means even Belgians have to pay an additional tax if they are residing in a place different then their home. Isn’t that fair?

How much does the Tourist Tax in Belgium costs?

Every city, town and municipality is free to charge their own prices. This can be either a fixed price or a percentage of the price per night you pay for your accommodation.

Accommodation owners are free to either include the tourist taxes into their advertised prices or charge them separately. When booking an accommodation online, always make sure to check if the tourist tax is included, or has to be paid upon arrival separately.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

Related Articles

3 thoughts on “ Tourist Tax in Belgium: (Why) Should I pay It and how much does it cost? ”

I’ve just been charged €11 tourist tax at the Sheraton Hotel, Brussels Airport. Extortionist rate!

Is there an exemption for locals who stay in a hotel in Brussels? For example, there was a very loud party in a block of flats, and the police were seemingly unwilling to properly intervene. I booked into a hotel down the road to sleep for that night, because I had a job interview the next day.

Every Belgian municipality has it’s freedom to imply their own “Tourist Tax” with their own rules. The Brussels region counts several municipalities which can have different fees and rules. In the rare occasion that someone books an accommodation in the same municipality they live in, it could be worth mentioning that you’re a registered inhabitant and already pay city taxes. However there’s a large chance the tourist tax is applicable for everybody who books an accommodation, with no exceptions.

Leave a Reply Cancel reply

Last Updated on 15 October 2023 by BertBeckers

How to get your maximum VAT refund when traveling abroad

While a European vacation is undoubtedly an unforgettable experience, it can be expensive.

That's why savvy travelers have various strategies in place to save money on flights, hotels and rental cars (hopefully by reading some of TPG's great money-saving advice ).

One of the most overlooked ways travelers miss out on saving money is by forgetting to apply for a VAT refund.

VAT is a Value Added Tax . Let's say, for example, you just went on a shopping spree in Rome or splurged on gifts at the El Corte Ingles department store near Las Ramblas in Barcelona. You more than likely paid VAT on your purchases, but the good news is that visitors to the European Union can often get a refund on that tax. Think of it as the traveler's tax break.

Despite the obvious savings that can come with VAT refunds, the amount of money Americans leave on the table each year in unclaimed refunds is estimated to be in the billions. Don't be one of those travelers.

Getting your VAT refund is worth the time and effort it takes, especially if you're traveling within the EU .

The rules surrounding VAT refunds have somewhat changed in recent years, so it's important to read up on the latest rules (including the U.K.'s discontinuation of VAT refunds for international visitors since Brexit). Here's everything you need to know about getting your maximum VAT refund when traveling in Europe.

What is a VAT?

VATs and goods and services taxes (GSTs) are common worldwide; more than 160 countries have them.

In the EU, the VAT is similar to the sales taxes imposed in the U.S., but there are also some big differences. One of the biggest: VAT rates are much higher than those you pay in state and local sales taxes in the U.S.

The EU's minimum standard VAT rate is 15% — far more than the combined state and local sales tax rates you'll find anywhere in the U.S. However, the average standard VAT rate in the EU currently sits around 21%. All EU countries have standard VAT rates above the 15% threshold; Luxembourg has the lowest rate at 16%, and Hungary has the highest at 27%.

"The VAT is a major income revenue for the tax authorities in Europe," said Britta Eriksson, a VAT expert and CEO of Euro VAT Refund , a Los Angeles-based company that helps companies manage VAT in their overseas operations. "[VAT] represents almost as much as the income tax in terms of revenue for the government."

Many EU countries offer lower VAT rates on certain goods. Sweden, for example, has a standard VAT rate of 25%. However, for some food items, restaurant services and even hotels, a reduced VAT of 12% is offered.

France has reduced the VAT on certain agricultural products and even some cultural events to 5.5%. In other nations, items such as books, newspapers, and bike and shoe repairs receive a reduced VAT rate of only 6%.

As you can see, these "special rates" vary from country to country, so make sure you do your homework before your trip. The EU also exempts some goods and services from VAT; some exemptions include educational services, financial services and medical care.

What are the refund rules?

Prices in the EU always have the VAT included. If you're visiting an EU country, you'll generally have to pay the price of an item, VAT and all, and get your refund after the fact.

There are several requirements to follow to claim your refund. For instance, you must take your new item or items home within three months of the purchase. VAT refunds are not available for large items like cars. EU visitors also cannot get a VAT refund for services like hotel stays and meals.

Some countries require that your purchase exceeds a certain amount to be eligible for a VAT refund. Like the VAT rates, this minimum purchase amount varies from country to country.

For example, in France, the minimum amount is now 100.01 euros (about $107) for the total amount of purchases you buy on the same day in the same shop. In Belgium, the minimum is 50 euros (about $54); in Spain, there is no minimum purchase amount to claim a VAT refund.

One important thing to note is that you can only claim a VAT refund on new items. Your merchandise must be new and still in its packaging when you leave Europe. The goods can't be unpacked, consumed or worn. If you want to claim your refund, you should pack away whatever you purchase and wait until you get home to open it.

Getting your refund

Thousands of European stores do what they can to accommodate tourists seeking refunds and will usually have signs in the window reading "tax-free" or "VAT-free" shop.

As you pay for your item, inform the clerk that you're an EU visitor and intend to get a VAT refund. The store will have some paperwork for you to fill out. Have your passport ready to prove your visitor status. You may also need to show your airline ticket as proof you're leaving Europe in the allotted time in order to claim a VAT refund.

Some stores will refund your VAT, but in most cases, you'll likely have to take your refund forms and get your refund processed elsewhere.

Many stores work with third-party agencies, such as Global Blue or Planet , to process VAT refunds, and these agencies usually have facilities in major cities where you can take your completed forms and get your refund.

When purchasing your items, check to see if your merchant is partnered with these agencies.

On departure day, be sure to take your receipts, the refund forms the shops filled out, the items you bought and all your other travel documents with you to the airport so that you can present everything to customs.

If you're touring multiple EU countries during your trip, you'll complete this process at the last EU country you visit. That means if you visit France and Italy before ending your trip in Spain, you will apply for the VAT refund on your purchases in Spain.

Customs may inspect your purchases, so make sure they're available and not in your checked baggage. Also, make sure the goods are unused and unworn.

If all goes well, the customs office will stamp your refund forms. If either the store or one of the third-party refund agencies has already given you your refund, you'll have to mail this stamped form back to them to prove you left Europe within the mandated three-month period. Otherwise, you risk having your refund canceled and your credit card charged for the VAT you owe.

If you haven't done so already, you can also get your refund at the airport. The big refund agencies have facilities at all the major EU airports, sometimes at a currency exchange. Just show them your stamped customs forms and your passport to get your refund, minus a fee.

No VAT refund in the UK

Before we share some advice on getting your VAT refunds, we want to remind everyone that the U.K. no longer has VAT-free shopping for international tourists. In fact, Great Britain is now the only European country that doesn't offer the savings opportunity for international visitors.

The VAT retail export scheme was eliminated when the U.K. exited the EU in 2021. It resumed briefly before being axed, supposedly for good, in 2022.

Although there's some optimism that VAT refunds could return to Britain in the future — the U.K.'s tourism industry is lobbying for its return — it's not an option for now.

While VAT refunds are no longer available in England, Scotland and Wales, you can still claim refunds if you're visiting Northern Ireland. There are also several exceptions and rules to know; for example, it doesn't apply to services like hotel bills. You can find the list of restrictions here . You should also be aware that some merchants and refund companies in Northern Ireland charge a fee for using tax-free shopping. Still, if you're planning a visit, you could save some money on your shopping.

Tips for maximizing your savings with a VAT refund

Here are some do's and don'ts for getting your VAT refunds.

Research the country

Before your trip, look up the VAT rules for the country you're visiting and check the standard and reduced VAT rates, as well as the minimum purchase points.

As we mentioned earlier, the rates and rules of what qualifies for a VAT refund can vary depending on where you visit, so make sure you're aware before you get there.

Remember that many countries outside the EU also charge a VAT, and their refund policies can differ greatly from what you'll find in Europe.

Research the store

Stores aren't required to provide VAT refund assistance of any kind.

"If you have a store that doesn't have this program, then getting a refund is very complicated," Eriksson warned.

Keep an eye out for stores displaying "tax-free" or "VAT-free" signs. Ask the store employees which third-party agencies they partner with for refunds. Also, ask how they process refunds and what fees they charge. As we noted above, some retailers in some countries may charge a fee to visitors using tax-free shopping.

Allow extra airport time for your refunds

Don't expect to be the only traveler at the airport seeking a VAT refund before heading home. Expect to wait in line for a bit. Plan ahead and give yourself extra time at the airport, as the line can be long.

If you're strapped for time after leaving customs, some agencies will let you drop your stamped forms in one of their mailboxes, and they'll issue your refund later.

Consider shipping your purchases home to avoid VAT entirely

If you don't want to deal with any of this stuff, Eriksson suggests another option.

"You can also have the store ship [your items] to you directly," she said. "Then, they won't charge you VAT."

But there's a catch.

"You still have to pay for the freight," Erikkson added.

Shipping costs from Europe to anywhere in the U.S. can get wildly expensive. So, you have to weigh that shipping cost against the VAT and the time and effort it would take to get your refund to decide if it's worth it.

Make sure the refund is worth the trouble

"If you buy expensive clothing and china, then it's absolutely worth it," Eriksson said.

While many VAT countries have purchase minimums for refunds, in others, any purchase a visitor makes qualifies, no matter how small. So, you should ask yourself if it's worth applying for a VAT refund for that cheap tchotchke you bought as a souvenir.

Bottom line

All this talk of forms, looking for signs, standing in line and getting stamped can take the impulse out of your impulse buy. However, it could save you a lot of money in the long run.

If you pay attention and budget your time wisely, you might get back enough money through VAT refunds to help pay for your next visit across the Atlantic.

Related reading:

- When is the best time to book flights for the cheapest airfare?

- The best airline credit cards

- What exactly are airline miles, anyway?

- 6 real-life strategies you can use when your flight is canceled or delayed

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- What are points and miles worth? TPG's monthly valuations

Refundit application enables tourist visitors in Belgium to recover VAT

Two businessmen, including Uri Levine, the former President of Waze (the navigation software application), have launched their application known as “Refundit” in Belgium. It enables tourists visiting Belgium to use their mobile phone to be "easily" reimbursed VAT paid on goods purchased. Belgium has thus become the first country to offer an entirely digital solution to recover such monies.

Owing to bureaucracy and long queues, “…nearly 90% of the total VAT reimbursements due - €23 billion - are never returned to their rightful recipients,” said Ziv Tirosh, the co-founder of the system. Refundit operates with a 9% transaction commission.

Refundit “relieves both tourists and shopkeepers of queues and unproductive paperwork,” stressed the company’s communiqué.

Non-European tourist visitors in a European Union (EU) country are eligible for a VAT reimbursement (21%). The minimum reimbursement total is fixed at 50 euros.

Presently reimbursement involves tourists undertaking something of an obstacle course: long queues at a counter, acquainting themselves with complex administrative formalities and, “…ultimately, still not being sure of recovering the money due to them. The problem of VAT recovery stems from the absence of traceability in the process,” said Refundit.

In practical terms, it falls to tourists to apply for reimbursement using their mobile phone, which enables the relevant VAT administrators to approve the reimbursement entirely electronically.

“Of all EU member states, Belgium was the fastest and the most innovative in the sphere,” says Mr Tirosh. A pilot project is currently underway at Brussels Airport. The next country to offer the application will be Slovakia.

The Brussels Times

Copyright © 2024 The Brussels Times. All Rights Reserved.

Tax-free shopping in the EU: Ultimate guide to VAT refund for tourists travelling in Europe

VAT refunds can be a tricky subject, especially when you're traveling to a foreign country. In Europe, the rules and regulations regarding tax refunds vary from country to country. To help you out, we've put together a complete guide to tax refunds in Europe, so you can get your money back without any hassle.

What is a VAT refund?

Goods in European countries contain VAT (value-added tax). This tax is automatically added to your shopping and can be as much as 20-25% of the net price. However, if you're shopping abroad and take your purchases home with you to enjoy, you can get a refund on the tax that you've paid.

Please note that there's no "do-it-yourself" when it comes to VAT refunds, so you'll always have to go through a VAT operator. How much your take-home refund comes to is based on the service fee charged by your VAT-refund provider, which range can vary across a large range. Typically, once all fees are deducted, you can expect to get somewhere between 6% - 15.5% of the ticket price back.

Who and what is eligible for a VAT refund?

To be eligible for a VAT refund on your shopping in the EU, you must:

have your permanent address outside the EU;

be visiting the EU for less than six months; and

be departing the EU for a non-EU country with your purchase within 3 months following the month in which you bought your item

You can reclaim the tax on purchases made on a majority of items such as clothing, jewellery, electronics, beauty products, and much more. As a general rule, things you will use on your trips like tickets and food are excluded.

What do I need to do to get a tax refund?

To get a VAT refund on shopping in the EU, there are two main steps you need to complete:

Get a tax refund form

Validate your refund form at customs before leaving the EU

Getting a refund form

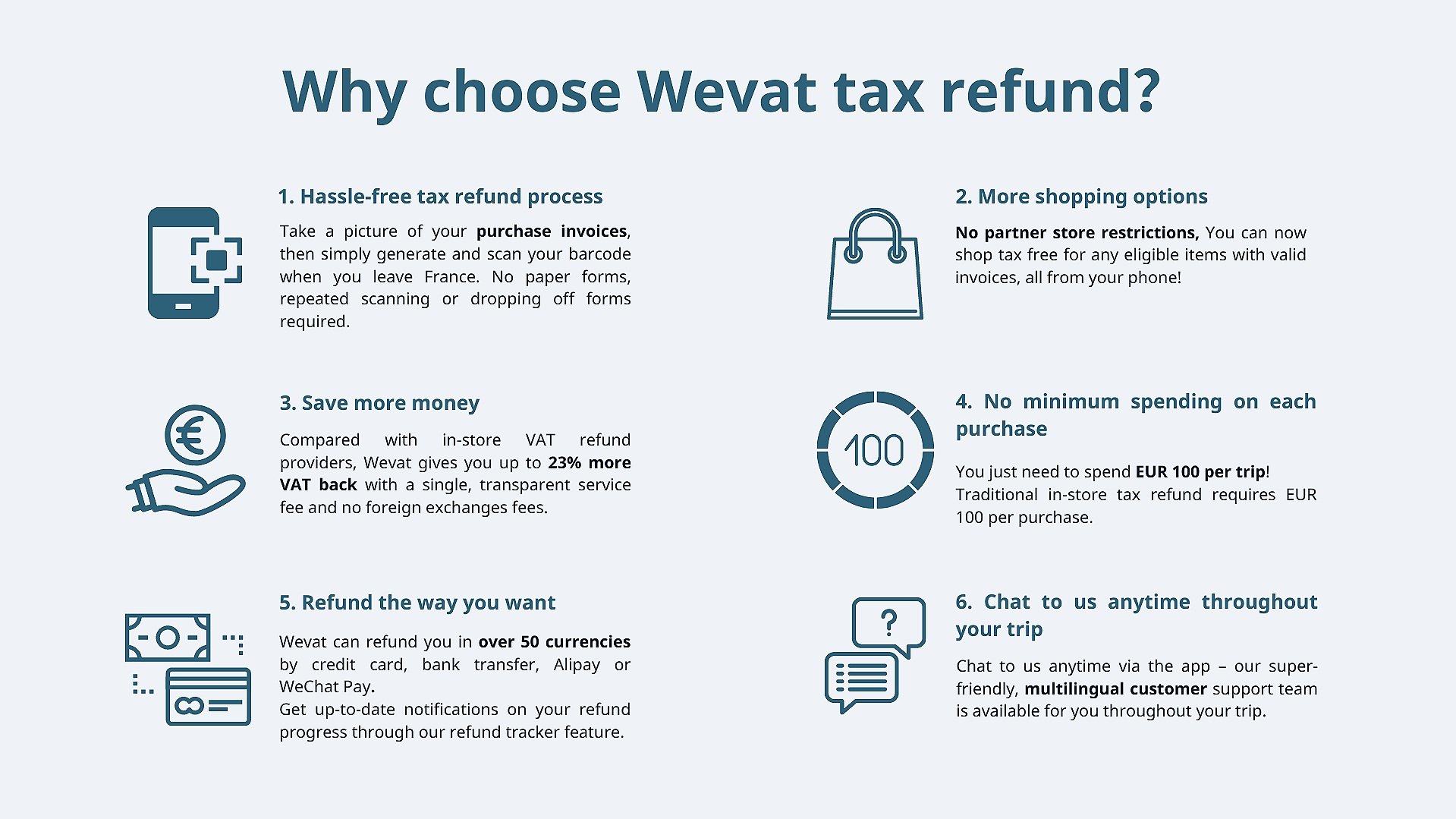

There are two main ways you can get a tax refund form – using the traditional, in-store paper method, or a digital app like Wevat.

Using the traditional method, you’ll need to show your passport to the sales assistant, ask for a refund form, and do some form filling every time you buy something.

With a digital app like Wevat, you don’t need to do any of that – the app combines invoices together into a single digital refund form , accessible at any time on your phone. You can also leave your passport safely locked at your hotel rather than drag it around to every shop – eliminating the risk of it being lost or stolen.

Another perk of using an app is that you get more money back. For paper-based tax refund methods, retailers work in partnership with the traditional tax player and these shops will take a cut from your refund every time you shop. This means the refund you take home would be less than using a digitalised refund app like Wevat.

You’ll also find that many shops, especially high-street boutiques and small shops, are not set up to offer a VAT refund to tourists. However the digital refund app works even for purchases made at shops not set up to issue a refund form . Instead of asking for a refund form, you’ll need to ask for a purchase invoice instead.

Another huge advantage of the digital method is that there might be no minimum spend per purchase . Traditionally, you’ll need to spend over the minimum spending requirements per transaction to qualify for a VAT refund form, but digitally, you’re eligible as long as your spend across all your purchases during the whole trip exceeds the minimum requirement.

Validating your refund form

Whichever method you choose, you will need to validate your refund form at your final departure point before leaving the EU.

Many countries including France, Spain, Portugal, Belgium, etc. have electronic self-service tax refund kiosks to easily scan and validate your forms in a matter of minutes. Where this is not available, you will need to find the local customs office at the departure point and have a printed, paper version of your refund form physically stamped in order for it to be validated.

With a digital app, you’ll be able to track your refund in real time after leaving the EU, never having to worry about losing your refund. For the traditional method, if you don’t hear back after one month, go to the tax refund provider’s website and send them an email.

France airport détaxe / tax refund

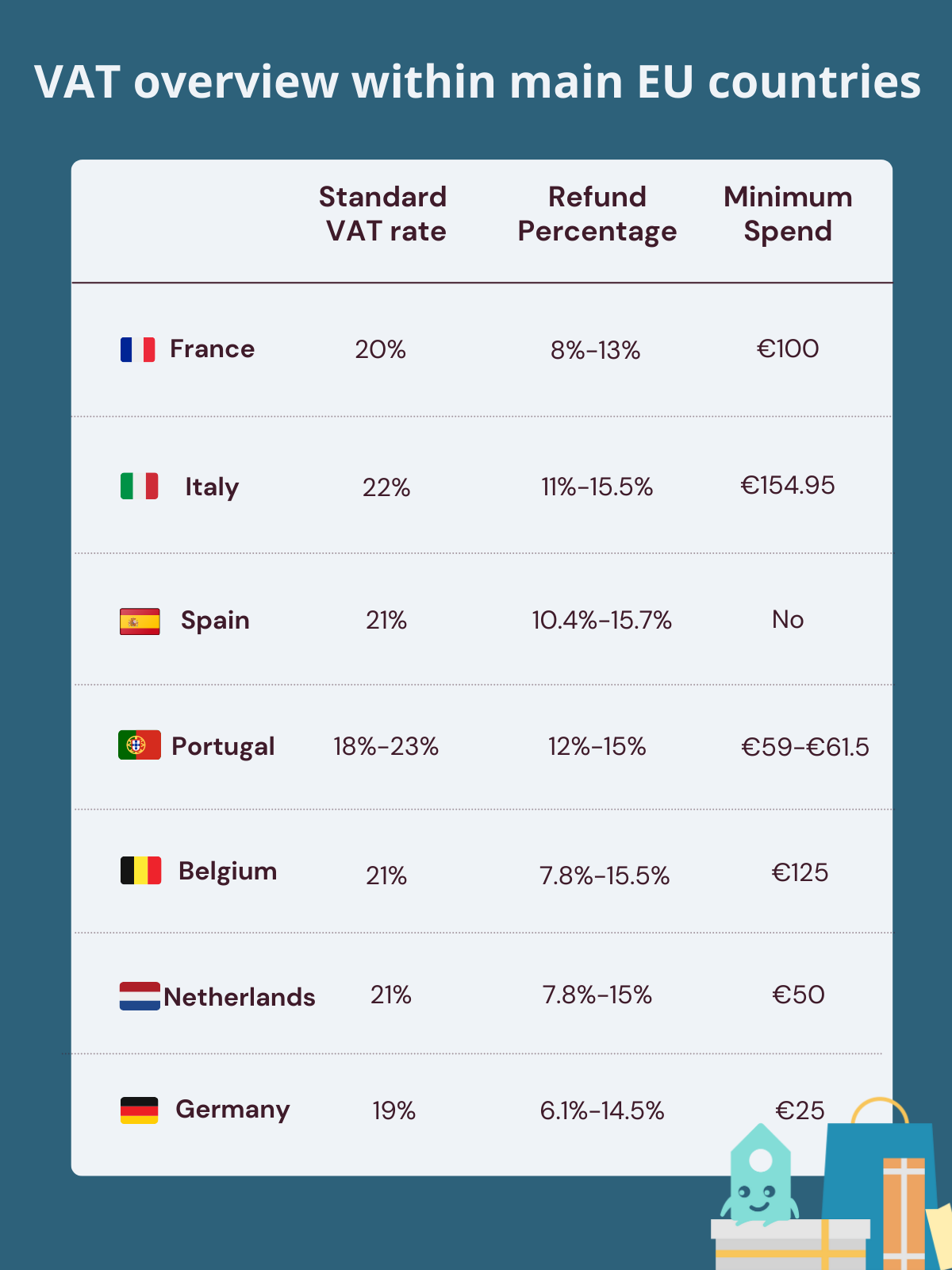

VAT overview within main EU countries

VAT refund in France

In France, the standard VAT rate is 20% . If you go down the traditional in-store tax refund method, you can only shop tax-free at shops that are partnered with traditional tax refund providers (like Global blue and Planet) such as big department stores. After these shops take a cut from your refund when issuing the paper-based tax refund form, the refund you take home would be 8%-12% . And you’ll also need to spend over the minimum requirement of €100 per purchase to be eligible for issuing a refund form.

To save money and time, you can use Wevat digital refund app for your shopping in France, refunded up to 13% of the price with €100 minimum amount per trip not per transaction, which means there’s no minimum spend per purchase and you can shop as many brands as you like. Check out our comparison of digital vs. traditional in-store tax refunds for more information.

Please remember to obtain a valid purchase invoice (or “facture” in French) when making purchases, and make sure it is addressed to Wevat. Instructions on how to do this can all be found in our app.

Take a shot of the invoice with the in-app camera, then upload it with a single tap. Wevat will generate a digital refund form with all of the purchase information, then simply scan the barcode in the app at the PABLO kiosk at the airport or station, no repeated scanning or dropping off forms required.

France tax free shopping App Wevat

VAT refund in Italy

In Italy, the standard VAT rate is 22% . After deducting the administrative fee and the fee of the tax refund company, you’ll expect to receive an 11%-15.5% refund rate of your purchase amount, depending on how much you spent. And Italy also has one of the highest minimum spending requirements ( €154.95 ).

To get a tax refund, you’ll need to present your passport or other identity document proving your residence outside the EU. And the sales assistant will ask you to fill in a form with the necessary details. You’ll bring all your tax refund documents, passport, receipts, and purchases and get your tax refund forms scanned at the airport before leaving. Whether you need to return your form to the tax refund mailbox depends on which tax refund companies you’re using and please check the instructions with your VAT-refund provider.

VAT refund in Spain

Spain’s standard VAT rate is 21% , and the refund rate can be 10.4% to 15.7% of the purchase amount. It’s worth mentioning that there is no minimum spending requirement for a tax refund in Spain since 2018 July.

To shop tax-free, you’ll need to get your DIVA tax refund form and get it validated at the departure point. Before departing, be sure to first visit the DIVA kiosk with your passport, tax refund forms, and purchased items for a possible inspection, and scan the barcode on your form to validate your refund.

VAT refund in Portugal

In Portugal, the minimum purchase amount per store and VAT rate can differ for different regions:

Mainland: €61.50 (VAT 23%)

Madeira: €61 (VAT 22%)

Azores: €59 (VAT 18%)

After deducting the service fee, you may receive 12% to 15% of the purchase amount as your refund.

The process of claiming a refund is similar to in Spain, and there’ll e-Taxfree kiosks at the airport, where you can scan the barcode on your (e)forms before you depart.

VAT refund in Belgium

The standard VAT rate in Belgium is 21% , with a minimum spend of over €125 in the same store. And you’ll expect to receive a 7.8% to 15.5% of purchase amount refund rate of your purchase amount.

The tax claim process is also similar to the countries above, remember to get your (e)refund forms validated at the self-service tax refund kiosk or the customs office at your departing airport or train station. If they’re not validated then your refund will not be approved by customs.

VAT refund in Netherlands

Netherlands’ standard VAT rate is 21% , with a refund rate ranging from 7.8% to 15% of the purchase amount and a minimum purchase amount of €50 , which has a similar refund rate as Belgium while holding a relatively lower minimum spending requirements.

Netherlands also has a similar tax refund process to go through, of which key steps involve filling out refund forms and getting them stamped before you leave. And you’ll expect your money back on your credit card in months.

VAT refund in Germany

The standard VAT rate in Germany is 19% . Germany also has one of the lowest minimum spending requirements at €25 and a relatively low refund rate from 6.1% to 14.5% of the purchase amount.

To claim a refund, you'll need to present your passport and receipts for any purchases that you want to be refunded. You can then claim your refund at the airport when you're leaving Germany for a non-EU destination.

VAT refund in the United Kingdom

Since 1 January 2021, visitors are no longer able to purchase items in stores in Great Britain under the VAT Retail Export Scheme. This means you can’t buy tax-free goods such as electronics and clothing if you are travelling to non-EU countries. You can only buy VAT-free items in-store if you have the goods sent directly to overseas addresses (you can’t bring them out yourself).

Recently, the British government is considering reintroducing a “modern, digital, VAT-free” shopping scheme to attract international visitors and drive economic growth, which will enable tourists to once again claim a VAT refund on purchases made in Great Britain. This is still under discussion, be sure to follow us for updates and news.

However, the good news is, after Brexit, residents of England, Scotland and Wales who are shopping in the EU are also eligible to shop tax-free, which means they can enjoy savings by reclaiming the VAT on purchases made on a majority of items such as fashion items, cosmetics, technology, jewellery, wine, and many more goods with the digital tax refund app Wevat when travelling in France and save up to 13%. Check out our other blogs to learn more about how to save money on purchases by shopping tax-free. We also have helpful step-by-step guides and videos on our How it works page .

We hope this guide is helpful in clarifying how tax refunds work in main European countries. There are several things for you to remember:

If you’re travelling to a few destinations on a trip, you’ll need to claim your tax refund at the customs of the last EU country you leave from

You can only get a tax refund on goods that you’re bringing outside of the EU to use for yourself, and the customs may ask to see these goods at the airport/ train station/ port. Therefore, be sure not to consume them until you’ve left the EU

If you have any more queries or questions regarding tax-free shopping or about Wevat then please contact us via the live chat in our app!

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

You might be interested in:

How to get a VAT refund at Galeries Lafayette in France?

How to save money while buying your new iPhone with tax-free shopping in France?

Please download before purchase to validate shopping.

- Belgium Tourism

- Belgium Hotels

- Belgium Bed and Breakfast

- Belgium Vacation Rentals

- Flights to Belgium

- Belgium Restaurants

- Things to Do in Belgium

- Belgium Travel Forum

- Belgium Photos

- All Belgium Hotels

- Belgium Hotel Deals

- Last Minute Hotels in Belgium

- Things to Do

- Restaurants

- Vacation Rentals

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

Vat refund for tourist - Belgium Forum

- Europe

- Belgium

Vat refund for tourist

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Europe forums

- Belgium forum

Do you know what is the minimum amount per purchase? I heard that it has changed since 2017..

I know it used to be 50 Euro ..

You heard wrong; minimum amount is still €50

https://www.brusselsairport.be/en/passngr/at-the-airport/vatrefund

This topic has been closed to new posts due to inactivity.

- 4-ish days in Brussels in December - draft itinerary 12:31 pm

- Brussels Itinerary Help 11:52 am

- Bring from USA or buy local: sim cards 11:31 am

- 1 day suggestions 10:01 am

- Robservatory open day 7:57 am

- Maternity photo session Brussels 7:21 am

- Car parking yesterday

- Train Change at Brussels Stations yesterday

- Train travel from Brussels Midi station to De Panne yesterday

- Mobility Scooter Rental yesterday

- Brussels and Bruges yesterday

- Brussels Airport Food Options yesterday

- December 1944 Museum yesterday

- Are the streets Rue de Woeringen and Maurice Lemonier safe May 13, 2024

- Getting from Charleroi airport to Paris 5 replies

- How to go From Antwerp to Gent? 6 replies

- Is Brussels worth a day or a few hours? 6 replies

- Bruges vs. Brussels 4 replies

- Amsterdam to Antwerp by train--reservation, prices, etc. 6 replies

- How to get from Amsterdam train station to ‘s-Hertogenbosch 2 replies

- Small towns to visit between Brussels and Luxembourg 4 replies

- Brussels Charleroi to Liege - public transport 10 replies

- Trappist brewery visit 5 replies

- Train from Brussels (Charleroi) airport to Eindhoven 5 replies

Belgium Hotels and Places to Stay

Business solutions

Accept payments

Tax Free solutions

Issue Tax Free forms online or in-store

Industry solutions

- Why Planet for Retail

- Why Planet for Hospitality

- Why Planet for Payments

Blogs and case studies

Guide to Tax Free shopping in Belgium

How to shop tax free in belgium.

- Step 1: Go shopping

- Look for Planet logo and ask for Planet Tax Free form when making a purchase

- Step 2: Get Customs validation

- Step 3: Return your Tax Free form and get your refund

Shopping in Belgium

Go shopping and get your Tax Free form.

- 21% Standard VAT rate

- 6% Food and books

- Shoppers who are permanent residents in a non-EU country

- 3 months + the issuing month of the Tax Free Form

- 3 years from the issuing date of the Tax Free Form

- Post-validation Cash: EUR 3000

Get your Tax Free form approved by customs

Are you leaving via a country other than belgium, refund requirements, required for refunding:.

- Fully completed Tax Free forms stamped by Customs

Required for customs approval:

- Fully completed Tax Free form

- Unused purchased goods and receipts

- Passport and travel documents

Customs advice:

- Remember to validate your Tax Free forms at Customs at the last exit point before leaving EU.

How can I get my refund?

- Visit any Planet Refund Office

- Present the validated Tax Free forms and get your refund

- Standard refund

- If you haven't received your refund at our Refund Point, provide your payment details on the Tax Free form, get Customs validation and return the Tax Free form together with shop receipts by post using Planet prepaid envelope. You can also leave your Tax Free form together with shop receipts in one of our Planet drop boxes.

What other refund options are available?

Search for refund locations in belgium.

Contact our Planet support team.

Discover all destinations

Embark on an adventure of discovery as you explore all the captivating destinations the world has to offer.

What country are you leaving from?

- Privacy Policy

- Terms and Conditions

- Cookie Policy

635th Anti-Aircraft Missile Regiment

635-й зенитно-ракетный полк

Military Unit: 86646

Activated 1953 in Stepanshchino, Moscow Oblast - initially as the 1945th Anti-Aircraft Artillery Regiment for Special Use and from 1955 as the 635th Anti-Aircraft Missile Regiment for Special Use.

1953 to 1984 equipped with 60 S-25 (SA-1) launchers:

- Launch area: 55 15 43N, 38 32 13E (US designation: Moscow SAM site E14-1)

- Support area: 55 16 50N, 38 32 28E

- Guidance area: 55 16 31N, 38 30 38E

1984 converted to the S-300PT (SA-10) with three independent battalions:

- 1st independent Anti-Aircraft Missile Battalion (Bessonovo, Moscow Oblast) - 55 09 34N, 38 22 26E

- 2nd independent Anti-Aircraft Missile Battalion and HQ (Stepanshchino, Moscow Oblast) - 55 15 31N, 38 32 23E

- 3rd independent Anti-Aircraft Missile Battalion (Shcherbovo, Moscow Oblast) - 55 22 32N, 38 43 33E

Disbanded 1.5.98.

Subordination:

- 1st Special Air Defence Corps , 1953 - 1.6.88

- 86th Air Defence Division , 1.6.88 - 1.10.94

- 86th Air Defence Brigade , 1.10.94 - 1.10.95

- 86th Air Defence Division , 1.10.95 - 1.5.98

- Yekaterinburg

- Novosibirsk

- Vladivostok

- Tours to Russia

- Practicalities

- Russia in Lists

Rusmania • Deep into Russia

Out of the Centre

Savvino-storozhevsky monastery and museum.

Zvenigorod's most famous sight is the Savvino-Storozhevsky Monastery, which was founded in 1398 by the monk Savva from the Troitse-Sergieva Lavra, at the invitation and with the support of Prince Yury Dmitrievich of Zvenigorod. Savva was later canonised as St Sabbas (Savva) of Storozhev. The monastery late flourished under the reign of Tsar Alexis, who chose the monastery as his family church and often went on pilgrimage there and made lots of donations to it. Most of the monastery’s buildings date from this time. The monastery is heavily fortified with thick walls and six towers, the most impressive of which is the Krasny Tower which also serves as the eastern entrance. The monastery was closed in 1918 and only reopened in 1995. In 1998 Patriarch Alexius II took part in a service to return the relics of St Sabbas to the monastery. Today the monastery has the status of a stauropegic monastery, which is second in status to a lavra. In addition to being a working monastery, it also holds the Zvenigorod Historical, Architectural and Art Museum.

Belfry and Neighbouring Churches

Located near the main entrance is the monastery's belfry which is perhaps the calling card of the monastery due to its uniqueness. It was built in the 1650s and the St Sergius of Radonezh’s Church was opened on the middle tier in the mid-17th century, although it was originally dedicated to the Trinity. The belfry's 35-tonne Great Bladgovestny Bell fell in 1941 and was only restored and returned in 2003. Attached to the belfry is a large refectory and the Transfiguration Church, both of which were built on the orders of Tsar Alexis in the 1650s.

To the left of the belfry is another, smaller, refectory which is attached to the Trinity Gate-Church, which was also constructed in the 1650s on the orders of Tsar Alexis who made it his own family church. The church is elaborately decorated with colourful trims and underneath the archway is a beautiful 19th century fresco.

Nativity of Virgin Mary Cathedral

The Nativity of Virgin Mary Cathedral is the oldest building in the monastery and among the oldest buildings in the Moscow Region. It was built between 1404 and 1405 during the lifetime of St Sabbas and using the funds of Prince Yury of Zvenigorod. The white-stone cathedral is a standard four-pillar design with a single golden dome. After the death of St Sabbas he was interred in the cathedral and a new altar dedicated to him was added.

Under the reign of Tsar Alexis the cathedral was decorated with frescoes by Stepan Ryazanets, some of which remain today. Tsar Alexis also presented the cathedral with a five-tier iconostasis, the top row of icons have been preserved.

Tsaritsa's Chambers

The Nativity of Virgin Mary Cathedral is located between the Tsaritsa's Chambers of the left and the Palace of Tsar Alexis on the right. The Tsaritsa's Chambers were built in the mid-17th century for the wife of Tsar Alexey - Tsaritsa Maria Ilinichna Miloskavskaya. The design of the building is influenced by the ancient Russian architectural style. Is prettier than the Tsar's chambers opposite, being red in colour with elaborately decorated window frames and entrance.

At present the Tsaritsa's Chambers houses the Zvenigorod Historical, Architectural and Art Museum. Among its displays is an accurate recreation of the interior of a noble lady's chambers including furniture, decorations and a decorated tiled oven, and an exhibition on the history of Zvenigorod and the monastery.

Palace of Tsar Alexis

The Palace of Tsar Alexis was built in the 1650s and is now one of the best surviving examples of non-religious architecture of that era. It was built especially for Tsar Alexis who often visited the monastery on religious pilgrimages. Its most striking feature is its pretty row of nine chimney spouts which resemble towers.

Plan your next trip to Russia

Ready-to-book tours.

Your holiday in Russia starts here. Choose and book your tour to Russia.

REQUEST A CUSTOMISED TRIP

Looking for something unique? Create the trip of your dreams with the help of our experts.

Follow Puck Worlds online:

- Follow Puck Worlds on Twitter

Site search

Filed under:

- Kontinental Hockey League

Gagarin Cup Preview: Atlant vs. Salavat Yulaev

Share this story.

- Share this on Facebook

- Share this on Twitter

- Share this on Reddit

- Share All sharing options

Share All sharing options for: Gagarin Cup Preview: Atlant vs. Salavat Yulaev

Gagarin cup (khl) finals: atlant moscow oblast vs. salavat yulaev ufa.

Much like the Elitserien Finals, we have a bit of an offense vs. defense match-up in this league Final. While Ufa let their star top line of Alexander Radulov, Patrick Thoresen and Igor Grigorenko loose on the KHL's Western Conference, Mytischi played a more conservative style, relying on veterans such as former NHLers Jan Bulis, Oleg Petrov, and Jaroslav Obsut. Just reaching the Finals is a testament to Atlant's disciplined style of play, as they had to knock off much more high profile teams from Yaroslavl and St. Petersburg to do so. But while they did finish 8th in the league in points, they haven't seen the likes of Ufa, who finished 2nd.

This series will be a challenge for the underdog, because unlike some of the other KHL teams, Ufa's top players are generally younger and in their prime. Only Proshkin amongst regular blueliners is over 30, with the work being shared by Kirill Koltsov (28), Andrei Kuteikin (26), Miroslav Blatak (28), Maxim Kondratiev (28) and Dmitri Kalinin (30). Oleg Tverdovsky hasn't played a lot in the playoffs to date. Up front, while led by a fairly young top line (24-27), Ufa does have a lot of veterans in support roles: Vyacheslav Kozlov , Viktor Kozlov , Vladimir Antipov, Sergei Zinovyev and Petr Schastlivy are all over 30. In fact, the names of all their forwards are familiar to international and NHL fans: Robert Nilsson , Alexander Svitov, Oleg Saprykin and Jakub Klepis round out the group, all former NHL players.

For Atlant, their veteran roster, with only one of their top six D under the age of 30 (and no top forwards under 30, either), this might be their one shot at a championship. The team has never won either a Russian Superleague title or the Gagarin Cup, and for players like former NHLer Oleg Petrov, this is probably the last shot at the KHL's top prize. The team got three extra days rest by winning their Conference Final in six games, and they probably needed to use it. Atlant does have younger regulars on their roster, but they generally only play a few shifts per game, if that.

The low event style of game for Atlant probably suits them well, but I don't know how they can manage to keep up against Ufa's speed, skill, and depth. There is no advantage to be seen in goal, with Erik Ersberg and Konstantin Barulin posting almost identical numbers, and even in terms of recent playoff experience Ufa has them beat. Luckily for Atlant, Ufa isn't that far away from the Moscow region, so travel shouldn't play a major role.

I'm predicting that Ufa, winners of the last Superleague title back in 2008, will become the second team to win the Gagarin Cup, and will prevail in five games. They have a seriously well built team that would honestly compete in the NHL. They represent the potential of the league, while Atlant represents closer to the reality, as a team full of players who played themselves out of the NHL.

- Atlant @ Ufa, Friday Apr 8 (3:00 PM CET/10:00 PM EST)

- Atlant @ Ufa, Sunday Apr 10 (1:00 PM CET/8:00 AM EST)

- Ufa @ Atlant, Tuesday Apr 12 (5:30 PM CET/12:30 PM EST)

- Ufa @ Atlant, Thursday Apr 14 (5:30 PM CET/12:30 PM EST)

Games 5-7 are as yet unscheduled, but every second day is the KHL standard, so expect Game 5 to be on Saturday, like an early start.

Loading comments...

You are using an outdated browser.

For a better experience using this site, please upgrade to a modern web browser.

- Update to Internet Explorer

- Update to Mozilla Firefox

- Update to Google Chrome

FPS Finance

fin.belgium.be myMINFIN

Attention, please make an appointment to go to any of our offices .

Foreign VAT refunds

- Center of World Population

- Closest Large Cities

- Farthest Cities

- Longest Flights

- Most Isolated Cities

- Extreme Elevations

Country: Russia

Continent: Europe

Population: 11,514,300

Country Capital: Yes

For all cities with a population greater than five hundred thousand, Moscow is closest to Tula and farthest from Auckland . The closest foreign city is Gomel and the farthest domestic city is Vladivostok . See below for the top 5 closest and farthest cities (domestically, internationally and by continent) and to see which cities, if any, Moscow is the closest and farthest to. Filter to include all cities over 100k, 500k or 1 million in population.

Cities in Africa

Cities in asia, cities in australia and oceania, cities in europe, cities in north america, cities in south america.

IMAGES

VIDEO

COMMENTS

Value added tax (VAT) is a multi-stage sales tax, the final burden of which is borne by the private consumer. VAT at the appropriate rate will be included in the price you pay for the goods you purchase. As a visitor to the EU who is returning home or going on to another non-EU country, you may be eligible to buy goods free of VAT in special shops.

Conditions for VAT refund. You made purchases that amount to more than 125 Euros per invoice or Tax-Free Form (VAT Refund form). You may combine multiple receipts from the same store on the same VAT Refund form. The sum of Belgian invoices must amount to a minimum of €125.01.

The VAT refund form must be fully completed (don't forget your bank account number). The invoice and/or tickets must also be attached to the VAT refund form*. The VAT reclaim forms*, invoices and tickets must be stamped by the customs authorities. If you do not have a VAT refund form, please contact the shop to obtain the VAT refund.

Belgium Tax Refund: All You Need to Know. By Editor February 21, 2024 February 21, 2024. Navigating the waters of Belgium's tax system can reveal pleasant surprises, like the potential for a tax refund, akin to discovering a hidden gem in the cobbled streets of Bruges.

How much does the Tourist Tax in Belgium costs? Every city, town and municipality is free to charge their own prices. This can be either a fixed price or a percentage of the price per night you pay for your accommodation. Accommodation owners are free to either include the tourist taxes into their advertised prices or charge them separately.

For example, in France, the minimum amount is now 100.01 euros (about $107) for the total amount of purchases you buy on the same day in the same shop. In Belgium, the minimum is 50 euros (about $54); in Spain, there is no minimum purchase amount to claim a VAT refund.

Reminder: a tax-free form is a document issued by either a merchant or a certified tax-refund operator (like ZappTax) and that lists all the items you want to claim a VAT refund on. It can be delivered in printed or digital formats. Each tax-free form is unique and must be validated by Customs before you leave the EU. If your form is not ...

Infocenter SPF Finances. Avenue Prince de Liège (JB) 133, boîte 126. 5100 Namur. If, for instance, your tax assessment notice mentions a refund date on August 30th 2022, you must transmit us the form before July 20th 2022 in order to receive this refund on the new account number you communicated to us.

Wednesday, 13 February 2019. Two businessmen, including Uri Levine, the former President of Waze (the navigation software application), have launched their application known as "Refundit" in Belgium. It enables tourists visiting Belgium to use their mobile phone to be "easily" reimbursed VAT paid on goods purchased.

Your total gross purchase amounts will be summed and rounded down to the nearest 1.00 Euro. From this total, the total amount of VAT refund will be calculated, based on the 21% standard VAT rate in Belgium. For example: €100 euros spent (incl. 21% VAT) = €83.00 base price + €17.00 VAT paid. In this example, you would receive an ...

First send an application for a VAT Refund ID number to [email protected]. Indeed, we first need to grant you an ID number before you can apply. If you are a representative, you may need to apply for several VAT Refund identification numbers: in your own company's name, if it is your first application.

the invoice or the Tax Free Form. the goods for which you apply for a VAT refund. Customs will stamp your invoice or Tax Free Form for export purposes. B. You fly from the airport of departure to a country outside the European Union but you have an intermediate stop in the EU (transit flight), for instance Belgium-Paris-New-York. There are two ...

The VAT refund application must be submitted before 30 September of the following year. The VAT authorities must notify their decision within 4 months (or 8 months at the latest). RSM will be pleased to assist you with the preparation and submission of refund applications, for both EU and non-EU taxpayers. Please do contact RSM Belgium VAT team ...

VAT refund in Italy. In Italy, the standard VAT rate is 22%.After deducting the administrative fee and the fee of the tax refund company, you'll expect to receive an 11%-15.5% refund rate of your purchase amount, depending on how much you spent. And Italy also has one of the highest minimum spending requirements (€154.95).To get a tax refund, you'll need to present your passport or other ...

Re: Vat refund for tourist. If you are talking about Belgium, it hasn't changed. If you have been looking at the limit in other EU Member States, they are free to set their own threshold within the EU one (maximum minimum!) of €175; so for instance in Germany it's €25 and in France, €175. 3. Re: Vat refund for tourist.

3 years from the issuing date of the Tax Free Form. Important information to validate your Tax Free Form in Belgium. Remember to validate your Tax Free Form before leaving Belgium to get your refund automatically paid using your preferred payment details or in cash at any Global Blue Refund Office or Kiosk. No Custom validation = No refund.

Go shopping and get your Tax Free form. Belgium Currency: EUR. 21% Standard VAT rate. 6% Food and books. Minimum spend: EUR 125.01. Shoppers eligible for VAT / Sales Tax Refund: Shoppers who are permanent residents in a non-EU country. Time limits:

Extra money from gifts, tax refunds, bonuses, etc. (34%) About one-third of Americans pay for travel using a windfall of extra money. At this time of year, many Americans are getting tax refunds ...

635th Anti-Aircraft Missile Regiment. 635-й зенитно-ракетный полк. Military Unit: 86646. Activated 1953 in Stepanshchino, Moscow Oblast - initially as the 1945th Anti-Aircraft Artillery Regiment for Special Use and from 1955 as the 635th Anti-Aircraft Missile Regiment for Special Use. 1953 to 1984 equipped with 60 S-25 (SA-1 ...

Yes If SPF Finances does not process a VAT refund within the legally prescribed time limits (set out above), interest is payable at a rate of 0.8% per month. For these purposes, a fraction of a month is considered a whole month. N.B. If you do not meet certain conditions, SPF Finances will not refund your VAT credit.

Zvenigorod's most famous sight is the Savvino-Storozhevsky Monastery, which was founded in 1398 by the monk Savva from the Troitse-Sergieva Lavra, at the invitation and with the support of Prince Yury Dmitrievich of Zvenigorod. Savva was later canonised as St Sabbas (Savva) of Storozhev. The monastery late flourished under the reign of Tsar ...

Luckily for Atlant, Ufa isn't that far away from the Moscow region, so travel shouldn't play a major role. I'm predicting that Ufa, winners of the last Superleague title back in 2008, will become the second team to win the Gagarin Cup, and will prevail in five games.

Foreign VAT refunds; Specific regime "events, fairs and merchandising" e-commerce. One Stop Shop OSS; Other taxes. For financial institutions and insurance companies. Tax on stock-exchange transactions; Tax on boarding an aircraft (TILEA) International. Pillar 2; Reimbursement of the withholding tax on movable property; Large-scale ...

For all cities with a population greater than five hundred thousand, Moscow is closest to Tula and farthest from Auckland.The closest foreign city is Gomel and the farthest domestic city is Vladivostok.See below for the top 5 closest and farthest cities (domestically, internationally and by continent) and to see which cities, if any, Moscow is the closest and farthest to.