- Medicines on the plane – how to transport?...

- Tourist tax in Croatia. Climate change fee

- Tourist tax in Portugal. Climate change fee

- Electrical outlets in Gran Canaria. Electricity Information

- Dominican Republic

- Canary Islands

- United Arab Emirates

- Where to go?

Benqu News & Blog WordPress Theme

Medicines on the plane – how

Tourist tax in Croatia. Climate change

Tourist tax in Portugal. Climate change

Electrical outlets in Gran Canaria. Electricity

Makuszyńskiego 99B, 42-208 Częstochowa

Tourist tax in Tenerife

- BY Simon Machniewski

Tourists traveling to the Canary Islands often hear about the need to pay a tourist tax. However, there are no such fees on Tenerife, unlike on Spain’s other island, the Balearic Islands. The tourist tax in Spain was introduced in July 2016.

It is an additional fee charged to tourists. The tax is charged for each day of stay, throughout the year, and tourists pay it along with their accommodation bill. However, it is worth remembering that the tourist tax is not included in the price of the room only increases this cost by a certain rate. For example, the tourist tax in Mallorca is 2 euros per day for a stay in a three-star hotel. Taxes make it possible to maintain tourist infrastructure and protect valuable nature.

What kind of tourist tax is paid in Tenerife?

The obligation to pay tourist tax does not apply to Tenerife, as it does to the entire Canary Islands archipelago. There have been plans to do so, but at present no additional fees are charged to tourists in Tenerife. There are also no government projects to change this, so that tourists going to Tenerife do not have to pay more for their vacation.

Hotels with a coral reef in Egypt. Best hotels for snorkeling

What to pack for a holiday to gran canaria what to take what kind of clothes.

- Simon Machniewski

About Author

Traveler and owner of a small marketing agency.

You may also like

Gran Canaria – what’s worth seeing? Best places to visit. Top attractions

Winter in Gran Canaria

A complete guide to the Tourist Tax in Spain: What it is, who must pay it and what are the consequences of non-compliance.

- Post author By Valery Saavedra

- Post date 08/08/2023

- No Comments on A complete guide to the Tourist Tax in Spain: What it is, who must pay it and what are the consequences of non-compliance.

What is the Tourist Tax in Spain?

The Tourist Tax in Spain is a tax applied in certain tourist destinations, with the main purpose of financing conservation and sustainability projects . It is characterised by the fact that it is an economic contribution that visitors make during their stay, aimed at maintaining and protecting the natural and cultural environment of the place.

The money collected through the Tourist Tax is directly invested in actions that promote environmental conservation and sustainability. This can range from the protection of natural areas, to projects to improve energy efficiency or promote the use of renewable energies.

Tourist Tax plays a crucial role in promoting responsible tourism . By paying it, travellers contribute to the care and preservation of the natural and cultural resources of the destination they visit. It raises awareness of the environmental impact of tourism and encourages visitors to adopt more environmentally friendly behaviour.

Where is the Tourist Tax paid in Spain?

The tourist tax, also known as ecotax , is applied in several regions of Spain. However, two prominent tourist destinations where this tax is levied are Catalonia and the Balearic Islands .

In Catalonia , the implementation of the tourist tax became effective from 2012. Visitors must pay a fee that varies depending on the category of accommodation and location. It ranges from 0.60 euros to 3.50 euros per night and person.

On the other hand, in the Balearic Islands , the Tourist Tax was introduced in 2016. Here, the amount to be paid depends on the season (high or low) and the type of accommodation, ranging from 0.25 euros to 2 euros per night and person in high season.

As for how this tax is paid, in both regions it is generally collected at the end of the stay, being the responsibility of the establishment to collect it and its subsequent declaration to the tax authorities.

It is important to bear in mind that each Spanish autonomous community has its own rules and rates with regard to the Tourist Tax, so it is always advisable to find out more before travelling.

Thus, although both Autonomous Communities (Catalonia and Balearic Islands) charge a tourist tax, there are significant differences in terms of how much and how it is paid . At Chekin, we are well-aware that calculating tourist taxes is a complex and tedious process. There are many parameters involved that vary between regions and countries. But don’t worry, our software calculates them automatically for you .

What VAT is levied on the tourist tax?

The Tourist Tax , also known as ecotax, is subject to a value added tax (VAT) in Spain. This tax has a tax rate of 10% . This means that 10% of the total amount of the tourist tax goes to VAT .

It is important to note that this VAT is not added to the amount of the Tourist Tax, but is included in the final amount paid by the tourist. For example, if the Tourist Tax is 2 euros per night in an accommodation, the VAT would be 0.20 euros.

This percentage of VAT on the Tourist Tax is fixed and does not vary according to factors such as the type of accommodation or the season. In fact, it is applied uniformly to all transactions related to the tourist tax.

Payment of VAT is compulsory and non-compliance may lead to penalties. As with the Tourist Tax itself, it is the responsibility of the accommodation owner to collect this VAT and remit it to the tax administration.

Which cities have a tourist tax?

In Spain , several cities and regions have implemented the tourist tax to finance sustainability and conservation projects. In Catalonia, the cities of Barcelona, Girona, Tarragona and Lleida apply this tax to visitors. Each city has its own charging system and rates vary depending on the type of accommodation and the season. You can find our legal guide for Catalonia to make sure your property meets all requirements such as Tourist Taxes.

The Balearic Islands have also adopted the ecotax . In this case, Palma de Mallorca, Ibiza and Menorca are destinations where this tax is charged to tourists. As in Catalonia, the rates may depend on the type of accommodation and the season.

It is important to note that the money collected through the tourist tax is used to finance projects that seek to preserve the environment and promote more sustainable tourism in these regions. In the following section, we will focus on who is obliged to pay this tax.

How can I automate the Tourist Tax collection process?

To facilitate the collection of the ecotax, there are tools that allow you to automate this process . One of these is Chekin , a digital platform that allows you to manage guest registration and payments, including the collection of ecotax. This tool is especially useful if you manage multiple properties or if you don’t live close to your holiday properties to be able to do it remotely.

With Chekin , you can:

- Automate the Tourist Tax calculation based on guest data and local regulations.

- Ask your guests to pay the tourist tax during online check-in.

- Manage your collections and collect the tourist tax in an automated way thanks to Chekin .

Adopting this technological solution can save you time and avoid errors in the calculation and collection of the ecotax . Remember, it is not only about complying with your tax obligations, but also about contributing to sustainable tourism.

Who has to pay the Tourist Tax in Spain?

The payment of the Tourist Tax in Spain is an obligation for all tourists over 16 years of age who stay in tourist establishments, from hotels to tourist flats, campsites and cruises. Even those who stay overnight in their private boat in the waters of the Balearic Islands are subject to this tax.

There are specific categories of individuals and entities that are obliged to pay. Owners of tourist establishments are responsible for collecting the Tourist Tax from their guests and transferring it to the government.

However, there are some exceptions as to who is exempt from paying the Tourist Tax. For example, persons with a recognised disability of 33% or more and their companions, children under the age of 16, people travelling for work purposes, or those in urgent or emergency situations are exempt from payment.

There are also specific situations where the Tourist Tax is not required. If an individual stays for a long period (more than 20 consecutive days) in the same establishment, the days from the 20th day onwards are exempt from payment.

Thus, it is important to be aware of the rules and regulations regarding the payment of the ecotax to avoid any inconvenience during your stay. Tourist Taxes by Chekin calculates the tourist rates for any place in the world, automatically meeting the official requirements of your country or region.

How much is the Tourist Tax? Amount at each site and exceptions

The ecotax, also known as tourist tax , varies depending on the location and type of accommodation. In Catalonia, for example, the amount can range from €0.60 to €3.50 per person per night, while in the Balearic Islands the amount can be as much as €2 per night.

There are certain exceptions to this general rule:

- Children under the age of 16 are exempt from this fee.

- In the Balearic Islands, during the low season (November to April), a 50% discount applies.

- Long term accommodation: if the stay exceeds 12 days, a 50% discount will be applied from the 13th day onwards.

These amounts serve as a reference to understand how much the Tourist Tax could be. However, it is crucial to consult updated local rates to get an accurate figure and to be aware of any changes in exceptions or discounts.

What happens if I do not pay the Tourist Tax?

Failure to pay the Tourist Tax can lead to severe legal consequences . It is important to understand that this tax is not optional, but a legal duty for certain tourists and accommodation establishments.

Penalties or fines vary depending on the location and the seriousness of the infraction. For example, in the Balearic Islands, the fine can be up to 400,000 euros for tour operators who do not charge the Tourist Tax. In Catalonia, fines can be equally high for those who evade this tax. Moreover, repeated non-compliance can lead to additional restrictions and possible legal action. One notable case is that of a hotel in Mallorca that was forced to close for five days for non-payment of the Tourist Tax.

It is crucial to understand the importance of compliance with the Tourist tax , also known as ecotax, not only to avoid legal sanctions, but also to contribute to the sustainable development of tourist regions.

When is Tourist Tax levied?

The specific time at which the Tourist Tax is charged may vary depending on the location. Generally, this fee is charged at check-in or upon arrival at the accommodation. However, in some cases, it may be included in the total price when booking.

In relation to tax administration, the collection and management of the Tourist Tax is carried out by the relevant local authorities. These funds are then transferred to the treasury and earmarked for conservation and sustainable projects.

The funds raised through the ecotax play a crucial role in financing sustainable and conservation projects. These projects can address a variety of issues important to the local community, such as the conservation of protected natural areas, improvements to tourism infrastructure or environmental education programmes.

How much is the tourist tax in Catalonia?

The tourist tax in Catalonia varies depending on the type of accommodation and the season. For a 5-star hotel, the rate is 3.50 euros per night during the high season. In the case of tourist flats, you pay 2.25 euros per night all year round.

It is important to note that this amount collected is used to finance projects linked to sustainable tourism in Catalonia . These can range from the preservation and improvement of natural and cultural spaces to initiatives to promote responsible tourism.

This tourism tax model seeks to balance the impact of tourism with the benefits it brings to the region. It ensures that each visitor contributes directly to maintaining and enhancing the unique and attractive features of Catalonia that have led to its choice as a destination.

How much tourist tax do you pay in the Balearics?

If you plan to visit the beautiful Balearic Islands, it is important to be aware of the tourist tax you will have to pay. The specific amount varies according to the season and type of accommodation. In high season (May to October), five-star hotels and four-star superior accommodation charge a daily rate of €4.00 per person, while holiday homes charge €2.00. During the low season, these rates are halved.

It is worth mentioning that these funds raised are used to promote sustainable tourism and protect the unique natural and cultural heritage of the Balearics. Thus, by paying this fee, you are directly contributing to the conservation of these paradisiacal Spanish destinations.

Who pays the Tourist Tax in Catalonia?

In Catalonia, the tourist tax is the responsibility of visitors over the age of 16. This obligation falls mainly on tourists staying in any type of tourist accommodation establishment, which includes hotels, tourist flats, rural houses, campsites and cruise ships.

It is important to note that there are some exceptions to consider. For example, people staying in tourist accommodation establishments located within the Ebro Delta Natural Park are not subject to this tax.

In addition, guests who prove that they are undergoing medical treatment during their stay are also not obliged to pay it. These details are crucial to understand who is exempt from paying the tourist tax in Catalonia.

Who pays the Tourist Tax in the Balearics?

In the Balearic Islands, the ecotax is a liability that falls mainly on tourists. In general, anyone staying in a registered accommodation establishment, such as hotels, tourist flats and similar places of accommodation, is obliged to pay this tax.

Visitors of all ages are subject to the tax, although there are certain exceptions. For example, Balearic residents staying in a tourist establishment on the islands are not obliged to pay the eco-tax. In addition, children under the age of 16 are also exempt from payment.

In summary, it is essential to understand who is obliged to pay the ecotax in the Balearics to avoid misunderstandings and to ensure compliance with this sustainability-oriented measure.

Privacy Overview

- Tenerife Tourism

- Tenerife Hotels

- Bed and Breakfast Tenerife

- Tenerife Holiday Rentals

- Flights to Tenerife

- Tenerife Restaurants

- Tenerife Attractions

- Tenerife Travel Forum

- Tenerife Photos

- Tenerife Map

- All Tenerife Hotels

- Tenerife Hotel Deals

- Last Minute Hotels in Tenerife

- Things to Do

- Restaurants

- Holiday Rentals

- Travel Stories

- Add a Place

- Travel Forum

- Travellers' Choice

- Help Centre

Tourist tax - Tenerife Forum

- Europe

- Spain

- Canary Islands

- Tenerife

Tourist tax

- United Kingdom Forums

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Holiday Rentals

- Canary Islands forums

- Tenerife forum

10 replies to this topic

Can you provide a link to where you read this, please?

No. But there are such taxes in other parts of Spain and Portugal and they may well be introduced in the Canaries in future. In the context of the overall cost of your trip any future tax would be a very small amount.

The British tabloids have reported demos supporting a new tax but according to official sources “There is currently no plan to introduce a Canary Islands Tourist Tax. One of the opposition parties has called for one to be introduced, specifically requesting that it be used for “environmental reasons.”

“But it isn’t being discussed seriously currently, there isn’t a working party looking into the viability of it, and it doesn’t form part of the government’s manifesto.”

There are demonstrations on 5 of the islands taking place on 20th April asking the Government to rethink the tourist model as it stands at the moment because only foreigners can afford to purchase property and homes that were long term rentals have been changed to tourist lets meaning people who live here cannot afford to have homes close to work. Also having to live so far from where they work the infrastructure needs to be improved. A suggestion is to have a tourist tax which could be used to help make improvements to the lives of locals but nothing has been decided. The only thing so far is that any new home that is built will not be approved as a tourist letting until it is 10 years old but even that is still in draft form. Needless to say UK media is getting it all wrong and making it about not wanting Brits but I suppose that gets people to read their rubbish newspapers and watch the likes of GBN

Thank you everyone for explaining it all in great derail

So Alan are you saying the photo in the press of a building with Tourists Go Home painted in it is a fake? And the protesters saying they are going on hunger strike until two tourist projects are cancelled is another fake? Here in UK most, if not all, recognise this as yet another minority group, like JSO etc, trying to impose their agenda on the great majority because they feel so entitled.

I suspect the only ones dim enough to take any notice are the ones you would prefer holidayed somewhere else!!!

By the way I agree with your view of the press (not just UK) but GBN do tend to present the news from apposing views rather than just the way they want it presented like mainstream news programmes.

John F I am not saying either is fake, what I am saying is the reason behind them as reported in the UK news is fake. The graffiti was to make the Canarian Government sit up and take action on the current situation. If you don't know many of the southern resorts are declaring themselves -stressed- areas as they cannot house the homeless even those who are working but because of costs cannot afford rent as property is going to tourists. The comment was written in English because most tourists whatever their nationality speak more than one language but the Brits exceptionalism took it to mean just them.

There are similar problems in Devon and Cornwall.

The way to sort them is build suitable affordable housing directed at the workers who are badly needed to run the hotels and bars etc.

The current hostility shown by a vocal few could grow into a deterrent for visiting tourists.

The problem in Spain and the Canaries is the huge rise in Air B&B pushing prices of property to rediculous levels. Though in my opinion the fact that Spain does not build any social housing for its people is the main problem and always will be until they do something about it

- Aircraft Noise 22:10

- Are sandals suitable for Tenerife? 20:48

- Mediterranean Palace refurb 16:09

- Breakfast/lunch etc 14:04

- Tenerife taxi today

- The Sax Rock Bar today

- Airport Transfer yesterday

- Dialysis tenerife yesterday

- Proof of £97 a day canary islands yesterday

- Pueblo Torviscas yesterday

- Are children allowed in pubs/bars yesterday

- Traditional restaurants yesterday

- Trouble yesterday

- Protests in Tenerife yesterday

- Weather in December 5 replies

- October weather 11 replies

- Best area to stay 3 replies

- Sandos San Blas Hotel 5 replies

- Weather in November 4 replies

- green garden resort aqua package with thomas cook 15 replies

- Weather in Tenerife in February 3 replies

- Thomson turn Gran Melia Palacio into Sensatori Resort. 413 replies

- Tenerife weather - September 2011 44 replies

- Who are Fly.co.uk 112 replies

Tenerife Hotels and Places to Stay

- List of Medical facilities and practitioners in Tenerife

- Where are the Hospitals and Clinics in South Tenerife ?

- Can I swim with Dolphins at Aqualand

Do you have to pay the hotel tax in Tenerife?

Do you dream of escaping to the sun-soaked paradise of Tenerife? Picture yourself lounging by the pool, sipping on a refreshing cocktail, and soaking up the breathtaking views. But amidst the excitement of planning your perfect getaway, there’s one question that lingers in the back of your mind: Do you have to pay the hotel tax in Tenerife?

This seemingly innocuous query can quickly become a stumbling block for travelers seeking an unforgettable vacation. The uncertainty surrounding this issue can leave you feeling bewildered and unsure of what to expect. But fear not, for we are here to provide you with the answers you seek.

In this article, we will delve into the intricacies of the hotel tax in Tenerife, uncovering the truth behind this often overlooked aspect of travel. We will explore the legal requirements, examine the impact on your holiday budget, and shed light on any hidden surprises that may be lurking in the shadows.

So, if you’re ready to embark on a journey of discovery, join us as we unravel the mysteries of the hotel tax in Tenerife. Prepare to be enlightened, empowered, and equipped with the knowledge you need to make the most of your dream vacation.

Exploring the Hotel Tax in Tenerife: What Travelers Need to Know

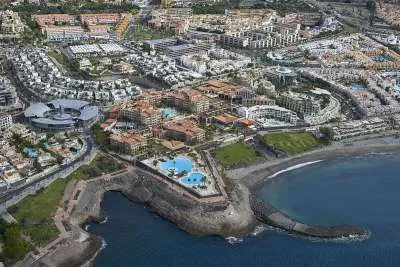

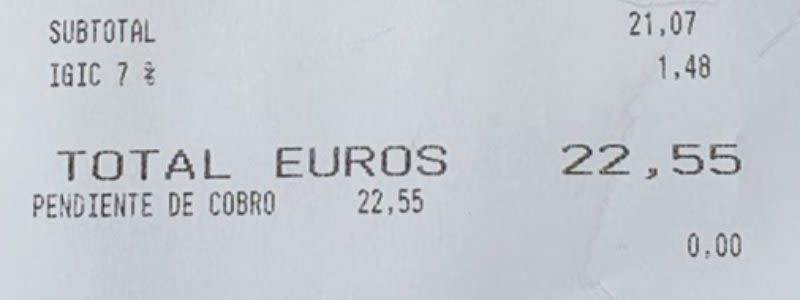

Located off the northwestern coast of Africa, Tenerife is the largest of the Canary Islands, renowned for its stunning beaches, breathtaking landscapes, and vibrant nightlife. As a popular tourist destination, it is essential for visitors to familiarize themselves with local regulations and potential expenses. Among these considerations is the hotel tax, or “I.G.I.C” (Impuesto General Indirecto Canario) in Spanish, which may be applicable to travelers during their stay on the island.

The I.G.I.C is a value-added tax that applies to goods and services in the Canary Islands, including accommodations. However, the implementation of the tax varies depending on the type of accommodation and the purpose of the stay. Tenerife offers a wide range of accommodations, from luxury resorts to boutique hotels, guesthouses, and vacation rentals, each with its own specific regulations regarding the hotel tax.

For tourists staying in hotels or resorts, the hotel tax is typically included in the overall price of the room. This means that guests are not required to make any additional payments upon check-in or check-out. The tax rate currently stands at 7%, but it is advisable to confirm this with the hotel prior to booking. It is worth noting that some hotels may charge an additional service fee, which is separate from the hotel tax, and is usually disclosed at the time of reservation.

In the case of other accommodation options, such as guesthouses or vacation rentals, the way the hotel tax is handled may differ. While some establishments may include the tax in the total price, others may require guests to pay it separately upon arrival. It is crucial to review the terms and conditions of the booking or contact the property directly to clarify the hotel tax situation in advance.

For individuals traveling to Tenerife for business purposes, it is essential to note that the I.G.I.C may be eligible for tax exemption. Business travelers should consult with their company’s finance department or tax advisor to determine if they can be exempted from paying the hotel tax. Proper documentation, such as business registration or proof of the business purpose of the trip, may be required to claim this exemption.

Additionally, there may be specific cases where the hotel tax is not applicable. These include stays in hospitals, student residences, and religious establishments, as well as those receiving social assistance or subsidized accommodations. Nevertheless, it is always recommended to verify the specifics of the reservation and seek clarification from the accommodation provider or a local tourism authority to ensure compliance with the relevant regulations.

To summarize, the hotel tax, or I.G.I.C, in Tenerife is generally included in the overall price of the room for hotels and resorts. However, for other types of accommodations, such as guesthouses or vacation rentals, the implementation of the tax may vary. It is crucial for travelers to review the terms and conditions of their booking or contact the accommodation provider directly to determine if they need to pay the hotel tax separately. Business travelers should also consult with their company or tax advisor to explore the possibility of tax exemption. By being aware of these regulations, visitors can avoid any unexpected expenses and enjoy their stay on the beautiful island of Tenerife to the fullest.

Do you have to pay the hotel tax in Tenerife: Conclusions

In this article, we have learned that the hotel tax in Tenerife is a mandatory fee that tourists must pay when staying at a hotel on the island. The tax is charged per person, per night, and the amount varies depending on the star rating of the hotel. It is important for visitors to be aware of this tax and budget for it accordingly when planning their trip to Tenerife.

The purpose of the hotel tax is to support the local tourism industry and fund various tourism-related projects and initiatives on the island. The revenue generated from the tax is used to improve infrastructure, preserve the natural environment, and promote Tenerife as a top tourist destination. By paying the hotel tax, visitors are contributing to the sustainable development of the island and ensuring that future generations can continue to enjoy its beauty and attractions.

In conclusion, it is necessary to pay the hotel tax in Tenerife when staying at a hotel. This fee helps support the local tourism industry and fund important initiatives that benefit both tourists and the local community. When planning your trip to Tenerife, make sure to factor in the cost of the hotel tax to avoid any surprises upon arrival. By paying the tax, you are not only fulfilling a legal requirement but also contributing to the preservation and development of this wonderful island.

If you found this article helpful, we invite you to read more informative articles on our blog. Don’t forget to share this post on your social media profiles to help others stay informed about the hotel tax in Tenerife.

Do you have to pay the hotel tax in Tenerife: Faqs

Is there a hotel tax in tenerife.

Yes, there is a hotel tax in Tenerife. The tax is called the “IGIC” (Impuesto General Indirecto Canario) and it is charged on the accommodation services provided by hotels, apartments, and other types of lodging establishments. The current rate of IGIC in Tenerife is 7%.

How much is the hotel tax in Tenerife?

The hotel tax in Tenerife is currently set at a rate of 7%. This tax, known as the IGIC (Impuesto General Indirecto Canario), is applied to the accommodation services provided by hotels, apartments, and other types of lodging establishments in Tenerife.

Do tourists have to pay the hotel tax in Tenerife?

Yes, tourists are required to pay the hotel tax in Tenerife. The tax, known as the IGIC (Impuesto General Indirecto Canario), is applicable to all accommodation services provided by hotels, apartments, and other lodging establishments in Tenerife. The current rate of IGIC is 7%.

Is the hotel tax included in the hotel room rate in Tenerife?

Whether the hotel tax is included in the hotel room rate in Tenerife can vary depending on the hotel and the booking terms. Some hotels may include the tax in the room rate, while others may add it as an additional charge during check-out. It is always recommended to check with the hotel or booking platform for the specific details regarding the inclusion of the hotel tax in the room rate.

Table of Contents

Tenerife City related Post:

About The Author

Tenerife no tiene iva – A tax-free paradise in the Canary Islands

- Post author By canariasacross

- Post date 12.12.2023

In the bustling world of international trade, one little-known secret has put the Spanish island of Tenerife on the map for savvy shoppers and entrepreneurs alike. Tenerife, a picturesque island in the Canary archipelago, has managed to create a unique advantage for businesses and consumers by exempting goods and services from value-added tax (VAT). This tax exemption has made Tenerife an attractive destination for bargain hunters and has also opened up a world of opportunities for businesses looking to expand and thrive in a tax-friendly environment.

The Canary Islands, including Tenerife, are a part of Spain, but have a different tax regime due to their special status as an autonomous community. While mainland Spain has a VAT rate of 21%, Tenerife is able to offer a VAT-free shopping experience. This means that visitors and residents alike can enjoy significant savings on a wide range of goods, from luxury items to everyday essentials. The island has become a shopper’s paradise, with bustling markets and malls offering a diverse range of products at attractive prices, all thanks to this tax exemption.

The tax exemption in Tenerife has not only made the island an attractive destination for shopping, but it has also created a booming economy. Businesses have flocked to the island, taking advantage of the tax-friendly environment to set up shop and expand their operations. This has led to the creation of jobs and a boost in tourism, as visitors come from far and wide to take advantage of the VAT-free shopping experience. Tenerife’s unique tax regime has propelled it onto the global stage, making it a major player in the world of international trade and commerce.

In conclusion, Tenerife’s tax exemption on goods and services has transformed this Canary Island into a VAT-free haven for shoppers and businesses alike. The ability to purchase goods without incurring VAT has made Tenerife a magnet for bargain hunters, while also attracting entrepreneurs looking to take advantage of the tax-friendly environment. With its stunning scenery and vibrant economy, Tenerife is proving that sometimes, the little-known secrets can make a big difference.

The uniqueness of Tenerife as a VAT-free destination

Tenerife, a beautiful Canary Island located off the coast of Africa, has a unique advantage as a tax-exempt destination. Unlike other regions in Spain and the European Union, Tenerife does not charge VAT (Value Added Tax) on a wide range of goods and services.

This tax exemption makes Tenerife an attractive choice for tourists and shoppers looking to enjoy a tax-free shopping experience. Visitors to the island can take advantage of the VAT-free prices on products such as electronics, luxury goods, clothing, and more.

In addition to the tax savings, Tenerife offers a wide variety of shopping opportunities. The island is home to numerous shopping centers, boutiques, and local markets where visitors can find everything from popular international brands to unique handmade crafts. Whether you’re looking for high-end fashion or traditional souvenirs, Tenerife has it all.

Furthermore, Tenerife’s VAT-free status also benefits local businesses. The tax exemption helps attract both tourists and businesses, boosting the island’s economy and creating job opportunities for the local population.

How does Tenerife maintain its tax-exempt status?

Tenerife’s VAT-free status is possible due to the Canary Islands’ special tax regime. As an autonomous community of Spain, the Canary Islands have the power to set their own taxes. The archipelago takes advantage of this autonomy to implement a reduced VAT rate, making it one of the most tax-friendly regions in Europe.

To visitors and residents alike, Tenerife’s tax exemption means significant savings on purchases and a chance to indulge in a shopping spree without the burden of VAT. So, whether you’re a tourist looking to make the most of your money or a local business owner looking to attract customers, Tenerife’s VAT-free status is a definite advantage.

The history of tax exemption in Tenerife

Tenerife, one of the beautiful Canary Islands, has a unique status when it comes to taxation. Unlike other islands in the archipelago, Tenerife enjoys a tax-exempt status for certain goods and services. This exemption from Value Added Tax (VAT), the tax imposed on the sale of goods and services, has played a significant role in the island’s economy and competitiveness.

The origins of this tax exemption can be traced back to historical and geographical factors. Tenerife, being an island paradise with a rich cultural heritage and a strategic location, has attracted business activities such as tourism and trade for centuries. Recognizing the potential economic benefits, the Spanish government implemented tax incentives to encourage investment and development in the island.

Due to its geographical location, Tenerife served as a hub for trade routes between Europe and the Americas. This trading activity led to the influx of goods and commodities, contributing to the island’s economic growth. To further enhance these trading activities, the government decided to exempt certain goods from VAT to attract more business enterprises.

Over the years, Tenerife has become a popular tourist destination, attracting millions of visitors each year. Tourism plays a crucial role in the island’s economy, and the tax exemption on goods and services is a significant factor in attracting tourists. Visitors can enjoy tax-free shopping, making Tenerife a shopping paradise for tourists from all over the world.

Tenerife’s tax exemption has also encouraged the growth of local businesses. The exemption has helped in reducing costs for businesses and making the island an attractive location for entrepreneurs. Small local businesses, especially in the tourism and retail sectors, have thrived due to the tax benefits, creating employment opportunities and contributing to the local economy.

However, it is important to note that not all goods and services are exempt from tax in Tenerife. Basic necessities such as food, medicine, and educational services are still subject to VAT. The tax exemption mainly applies to luxury goods, electronics, and other items that are commonly purchased by tourists and residents.

In conclusion, the tax exemption in Tenerife has a rich history that can be traced back to the island’s strategic location and economic potential. This exemption has played a significant role in attracting tourists and businesses, boosting the economy, and promoting local entrepreneurship. Tenerife’s status as a VAT-free island continues to contribute to its flourishing economy and its reputation as a remarkable tourist destination.

Tenerife’s tax-free status and its benefits for businesses

Tenerife, the largest island in the Canary Islands, has a unique advantage for businesses. Unlike other regions in Spain, Tenerife is exempt from paying Value Added Tax (VAT) on certain goods and services.

This tax exemption provides a significant boost to businesses located on the island. They can offer their products and services at a lower price compared to their competitors in other parts of Spain. This not only helps attract more customers but also encourages businesses to invest and expand their operations on the island.

With no VAT to worry about, businesses in Tenerife can enjoy higher profit margins and reinvest the savings into their operations. This allows them to improve their products, services, or even explore new business ideas. Additionally, the tax-free status creates a competitive advantage, attracting more entrepreneurs and investors to establish their businesses on the island.

The tax exemption also benefits consumers in Tenerife. They can enjoy lower prices on a wide range of goods, including electronics, clothing, and even luxury items. This enables them to save money and have access to a wider variety of products at a more affordable cost.

Overall, Tenerife’s tax-free status has proven to be a catalyst for the growth of businesses on the island. It not only benefits the local economy but also attracts tourists and investors, further boosting the island’s economic prospects. Whether you are a business owner or a consumer, the tax exemption in Tenerife can bring significant advantages and savings.

How Tenerife’s tax exemption attracts tourists

Tenerife, the largest of the Canary Islands, has a unique tax exemption policy that makes it an attractive destination for tourists. The island is exempt from VAT (Value Added Tax), which means that goods and services on the island are sold without any additional tax.

This tax exemption has several benefits for tourists visiting Tenerife. Firstly, it allows them to purchase goods at a lower price compared to other destinations where VAT is applicable. This is particularly beneficial for luxury goods and high-end products, as the tax exemption can result in significant savings for tourists.

Furthermore, the tax exemption in Tenerife applies to a wide range of goods and services, including electronics, fashion, jewelry, and even dining in restaurants. This means that tourists can enjoy a tax-free shopping and dining experience throughout their stay on the island.

The tax exemption policy in Tenerife is a major draw for tourists, as it allows them to make the most of their holiday budget and enjoy a luxurious experience at a more affordable cost. The island’s unique status as a VAT-free destination sets it apart from other popular tourist destinations and makes it a highly desirable place to visit.

The impact of Tenerife’s VAT-free status on the local economy

As a result of being VAT-free, Tenerife has become a popular destination for tourists and shoppers looking for tax-free goods. The absence of VAT on goods means that visitors can enjoy lower prices on a wide range of products compared to other destinations where VAT is applicable. This creates a competitive advantage for Tenerife, attracting more tourists and generating higher revenues for the local businesses.

The tax exemption has had a positive impact on various sectors of the local economy. Retail businesses, including shops, shopping centers, and duty-free stores, have flourished due to the influx of tourists seeking tax-free shopping experiences. The increased demand for goods has also led to job creation in the retail sector, benefiting the local workforce.

Tenerife’s VAT-free status has also had a ripple effect on other industries. The hospitality sector, including hotels, restaurants, and bars, has experienced a surge in business as tourists flock to the island to take advantage of the tax benefits. With more visitors, these establishments have seen increased revenues and are able to invest in expansion and improvements.

Additionally, the VAT exemption has made the real estate market in Tenerife more attractive to investors. The lower cost of goods and services, combined with the natural beauty and favorable climate of the island, has resulted in increased interest from both domestic and international buyers. This has led to a boost in the construction sector and a rise in property values, creating further economic opportunities for the local economy.

In conclusion, Tenerife’s VAT-free status has had a significant impact on the local economy. The exemption has attracted more tourists, increased consumer spending, created jobs, and stimulated growth in various sectors. By choosing to exempt goods and services from VAT, Tenerife has positioned itself as a favorable destination for both tourists and investors, contributing to the island’s economic prosperity.

Comparing Tenerife with other VAT-free destinations

Tenerife, a canary island, is exempt from VAT, making it an attractive destination for shoppers looking to save money on their purchases. While Tenerife offers tax-free shopping, it is not the only island that has this advantage.

There are several other popular holiday destinations that also have tax-exempt status, allowing visitors to enjoy duty-free shopping. Some of these destinations include:

- The Channel Islands: Located between England and France, the Channel Islands are not part of the EU and, therefore, are exempt from VAT. Visitors can shop for a wide range of goods, from luxury items to electronics, without having to pay the additional tax.

- Andorra: Nestled between Spain and France in the Pyrenees mountains, Andorra is known for its duty-free shopping. The principality has no VAT, making it a popular destination for those looking to score a bargain on designer clothing, tobacco, alcohol, and more.

- Aruba: This Caribbean island is not only a paradise for beach lovers but also a haven for tax-free shopping. Visitors can browse through a variety of shops selling jewelry, cosmetics, electronics, and more, all without having to pay the usual VAT.

If you’re planning a vacation and want to enjoy tax-free shopping, consider visiting one of these destinations. Whether you’re looking for designer clothing, electronics, or luxury items, these VAT-free locations offer a great opportunity to save money on your purchases.

Tenerife tax exemption and its implications for residents

No vat on goods.

One of the key benefits of Tenerife’s tax exemption is that there is no Value Added Tax (VAT) on goods purchased on the island. This means that residents can save money when shopping for everyday items such as clothing, electronics, and household goods. The absence of VAT allows residents to stretch their budget further and enjoy a higher quality of life.

Implications for residents

The tax exemption in Tenerife has numerous implications for residents. Firstly, it reduces the cost of living, making Tenerife an affordable place to reside. Residents can purchase goods without the added burden of VAT, allowing them to save more money or spend it on other experiences or investments.

Additionally, the tax exemption encourages local businesses and stimulates the economy. With lower prices due to the absence of VAT, businesses are able to attract more customers and generate higher revenues. This, in turn, leads to job creation and a stronger local economy.

Moreover, the tax exemption in Tenerife enhances the overall competitiveness of the island. Residents have access to a wide range of products at lower prices compared to other destinations, making Tenerife an attractive place to live and shop. This competitive advantage draws more residents and tourists to the island, further boosting the local economy.

In conclusion, the tax exemption in Tenerife has significant implications for residents. It reduces the cost of living, stimulates the local economy, and enhances the overall competitiveness of the island. Tenerife’s VAT-free status makes it an enticing destination for those seeking to enjoy a higher quality of life and save money on everyday expenses.

Tenerife’s tax policy and its relation to the European Union

Tenerife, a popular holiday destination in the Canary Islands, has a unique tax policy that sets it apart from other regions in Europe. The island is known for its tax exemption on Value Added Tax (VAT), making it an attractive destination for both tourists and businesses.

Unlike many European countries, Tenerife has chosen to exempt VAT from its economy, meaning that goods and services on the island are not subject to this tax. This has led to a flourishing tourism and retail sector, as visitors and locals alike can take advantage of lower prices and enjoy the benefits of a tax-free shopping experience.

No VAT, no problem

The decision to exempt Tenerife from VAT is driven by the island’s unique tax policy. As part of its aim to attract investment and boost economic growth, the government of Tenerife has implemented this exemption as a way to create a competitive advantage over other European regions.

By eliminating VAT, Tenerife is able to lower the prices of goods and services, making it an appealing destination for both tourists and businesses. This tax exemption has also helped to attract foreign investment to the island, as companies can take advantage of Tenerife’s tax advantages and benefit from a more favorable business environment.

Tenerife’s relationship with the European Union

Despite being a part of Spain, Tenerife, as an island within the Canary Islands, has a unique relationship with the European Union. The Canary Islands, including Tenerife, are considered an outermost region of the European Union, which means they are subject to specific regulations and policies aimed at addressing the challenges faced by these regions.

While Tenerife benefits from being a part of the European Union’s single market, the island is granted special status that allows it to implement its own tax policies, including the exemption from VAT. This demonstrates the flexibility of the European Union in allowing its member states and regions to adapt their tax systems to their specific needs and circumstances.

In conclusion, Tenerife’s tax policy, which includes an exemption from VAT, has played a significant role in the island’s economic growth and attractiveness for tourists and businesses. This unique tax policy, along with Tenerife’s relationship with the European Union, showcases the benefits of a flexible and adaptable tax system that can be tailored to the needs of specific regions.

The future of tax exemption in Tenerife

Tenerife, a popular tourist destination in the Canary Islands, has long been known for its tax-exempt status. Visitors to the island can enjoy purchasing goods without having to pay the Value Added Tax (VAT). This tax exemption has made Tenerife an attractive shopping destination for both locals and tourists alike.

However, the future of tax exemption in Tenerife is uncertain. The Spanish government has been considering changes to its tax laws, which could result in the end of this VAT exemption in the Canary Islands. While no concrete decisions have been made, the possibility of Tenerife losing its tax-exempt status is a cause for concern.

Potential impact on the island

If Tenerife were to no longer be exempt from VAT, it would undoubtedly have an impact on the island’s economy. The tax-free shopping that currently attracts so many visitors would no longer be available, potentially leading to a decrease in tourism revenue. Additionally, prices for goods and services would likely increase, making the cost of living higher for both residents and visitors.

Uncertain future

While the future of tax exemption in Tenerife is uncertain, it is important to acknowledge the potential consequences of losing this status. The island’s economy could suffer, and the overall appeal of Tenerife as a shopping destination might diminish. As discussions and negotiations regarding tax laws continue, residents and tourists alike will be watching closely to see what the future holds for tax exemption in Tenerife.

Tenerife’s tax-free shopping experiences

One of the major benefits of visiting the Canary Island of Tenerife is the exemption from value-added tax (VAT) on goods. This means that visitors to the island can enjoy tax-free shopping experiences.

Whether you’re looking to buy luxury items, souvenirs, or local products, Tenerife offers a wide range of tax-exempt goods. From designer clothing and accessories to electronics and perfumes, you’ll find a variety of products available at duty-free prices.

One popular place for tax-free shopping in Tenerife is the island’s capital, Santa Cruz de Tenerife. Here, you’ll find a number of shopping malls, department stores, and boutiques offering a range of tax-exempt goods. The city’s main shopping street, Calle Castillo, is lined with shops selling everything from fashion and jewelry to cosmetics and home goods.

Another great destination for tax-free shopping is the resort town of Playa de las Américas. The town is home to several shopping centers, such as Siam Mall and Plaza del Duque, where you can find a variety of tax-exempt goods. Whether you’re looking for high-end fashion brands or unique souvenirs, Playa de las Américas has something for everyone.

For those looking for a more local shopping experience, Tenerife’s markets are worth exploring. The Mercado Nuestra Señora de África in Santa Cruz de Tenerife is a vibrant market where you can find fresh produce, local products, and artisanal crafts. The Mercado de Nuestra Señora de África is a great place to shop for tax-exempt goods and immerse yourself in the local culture.

Overall, Tenerife offers a unique shopping experience with its tax exemption on goods. Whether you’re looking for luxury items, souvenirs, or local products, there are plenty of options available on this VAT-free island.

Tenerife’s tax-free investment opportunities

Investing in Tenerife offers a number of benefits. With the exemption from VAT, investors can save money on various expenses, including property purchases, renovations, and business-related costs. This creates an attractive investment environment, as it allows individuals and businesses to maximize their returns and allocate their resources more efficiently.

Real Estate Investment

Tenerife’s tax-free status makes it an ideal location for real estate investment. The island offers a range of properties, from luxury villas and apartments to commercial spaces and hotels. With the VAT exemption, investors can save a significant amount of money on property purchases, making it an attractive option for those looking to invest in the booming real estate market.

Tourism Industry

Tenerife is a popular tourist destination, attracting millions of visitors each year. The island’s tax-free status offers unique opportunities for investment in the tourism industry. Hoteliers, restaurateurs, and other business owners can benefit from the VAT exemption, as it allows them to offer competitive prices while maximizing profits. This, in turn, attracts more tourists and contributes to the growth of the local economy.

Overall, Tenerife’s VAT exemption provides investors with a unique advantage. Whether you are looking to invest in real estate, start a business, or expand your existing operations, this tax-free island offers a range of opportunities to maximize your returns and achieve long-term success.

Tenerife as a tax haven for businesses and individuals

Tenerife, the largest island in the Canary Islands, is known for its stunning beaches and vibrant tourism industry. However, what many people may not be aware of is that the island also offers significant tax benefits, making it an attractive destination for both businesses and individuals seeking to minimize their tax liabilities.

No VAT on goods and services

One of the key advantages that Tenerife has to offer is its exemption from Value Added Tax (VAT) on goods and services. Unlike mainland Spain, where VAT rates can range from 4% to 21%, Tenerife residents and businesses enjoy the benefit of being VAT exempt. This means that there are no additional taxes added to the cost of goods and services purchased on the island, making it an affordable place to live, work, and do business.

A haven for businesses

Tenerife’s tax advantages make it an attractive location for businesses looking to establish themselves in a tax-friendly environment. The absence of VAT allows businesses to lower their operating costs and offer competitive prices to consumers. Additionally, the island’s strategic location between Europe, Africa, and America makes it an ideal hub for international trade and commerce.

Furthermore, Tenerife offers a range of incentives and benefits for businesses, including tax breaks for foreign investors, reduced corporate tax rates, and simplified administrative procedures. This business-friendly environment, combined with the island’s excellent infrastructure, skilled workforce, and high quality of life, makes Tenerife an optimal choice for companies of all sizes and industries.

An attractive option for individuals

Tenerife’s tax advantages are not limited to businesses alone. Individuals who choose to reside on the island can also benefit from the tax breaks and exemptions available. With no VAT on goods and services, individuals can enjoy a lower cost of living and have more disposable income to spend on leisure activities and lifestyle choices.

In addition, Tenerife offers attractive residency programs for individuals who wish to establish their residence on the island. These programs provide various tax benefits, including the possibility of obtaining non-resident status and enjoying favorable tax rates.

Overall, Tenerife’s tax advantages, including its VAT exemption, make it a compelling destination for both businesses and individuals seeking to optimize their tax position while enjoying a high quality of life in a stunning island setting.

Exploring the tax regulations in Tenerife

Tenerife, a beautiful island in the Canary Islands, has its own unique tax regulations. One of the most prominent features of these regulations is the exemption from VAT. Unlike other parts of Spain, Tenerife does not impose the standard value-added tax on goods and services.

This tax exemption has made Tenerife an attractive destination for tourists and businesses alike. Travelers can enjoy shopping for various goods, such as electronics, clothing, and souvenirs, without having to pay the additional VAT. This makes Tenerife a haven for those looking to save some money while indulging in retail therapy.

For businesses operating in Tenerife, this tax exemption allows them to offer competitive prices on their products. Since there is no VAT added to the goods, businesses can pass on the savings to their customers. This helps to attract both local and international buyers, as they can purchase goods at lower prices compared to other regions.

However, it’s important to note that not all goods are exempt from tax in Tenerife. Some specific items, such as tobacco and alcohol, are subject to additional taxes. These goods are regulated separately and are not covered by the general VAT exemption.

In conclusion, Tenerife’s tax regulations set it apart from other parts of Spain. Its VAT-free status on most goods makes it an appealing destination for consumers and businesses alike. Whether you are a tourist looking to save on shopping or a business owner wanting to offer competitive prices, Tenerife’s tax regulations can benefit you.

The legal considerations of Tenerife’s tax exemption

Tenerife, as part of the Canary Islands, has a unique advantage when it comes to taxation. The island is exempt from Value Added Tax (VAT) on certain goods and services, making it an attractive location for businesses and consumers.

The tax exemption on Tenerife is allowed due to its status as an outermost region of the European Union. Under EU law, these regions are granted special tax benefits to support their economic development.

This exemption means that businesses operating on the island can sell goods and services without the burden of VAT. As a result, prices on Tenerife can be lower compared to other parts of the EU, making it an attractive destination for both tourists and locals.

However, it’s important to note that not everything on Tenerife is completely tax-free. The exemption only applies to certain goods and services, as defined by EU regulations. This includes basic necessities like food, water, and pharmaceutical products, as well as certain industries like tourism and the digital economy.

Additionally, there are strict regulations in place to prevent abuse of the tax exemption. Businesses must comply with EU guidelines and provide proper documentation to prove that they are eligible for the exemption. Failure to do so can result in hefty fines and legal consequences.

Overall, Tenerife’s tax exemption is a significant advantage for both businesses and consumers. It allows for the island’s economy to thrive and attract investment, while also providing locals and visitors with access to affordable goods and services.

Tenerife tax exemption and its impact on the real estate market

The island of Tenerife, located in the Canary Islands, has a unique tax exemption policy that has made it a popular destination for real estate investors. The main advantage of this policy is that Tenerife is exempt from the Value Added Tax (VAT), which means that buyers and sellers of real estate on the island do not have to pay this tax.

This tax exemption has had a significant impact on the real estate market in Tenerife. It has made the island more attractive to both local and international buyers, as it reduces the overall cost of purchasing property. As a result, the demand for real estate on the island has increased, leading to a rise in property prices and a boom in construction activity.

Benefits for buyers

The tax exemption in Tenerife is particularly beneficial for buyers of real estate. Since there is no VAT, buyers are able to save a significant amount of money on their property purchase. This makes Tenerife an attractive destination for those looking to invest in a second home or a holiday property.

In addition, the tax exemption also applies to other goods and services related to the real estate market, such as construction materials and furniture. This further reduces the overall cost of purchasing and furnishing a property in Tenerife.

Impact on the real estate market

The tax exemption policy in Tenerife has had a positive impact on the real estate market on the island. It has stimulated both residential and commercial development, as developers and investors are attracted by the potential for higher returns on their investments.

The increase in demand for real estate has also led to a growth in the construction sector. This has created new job opportunities and contributed to the overall economic growth of the island.

Furthermore, the tax exemption has encouraged foreign investment in Tenerife’s real estate market. International buyers see the island as an attractive destination due to its tax advantages, natural beauty, and pleasant climate. This has led to a diverse and multicultural community on the island, benefiting both the local economy and the tourism industry.

In conclusion, the tax exemption policy in Tenerife has had a significant impact on the real estate market. It has made the island more attractive to buyers and stimulated economic growth. The tax advantages, combined with the natural beauty of the island, make Tenerife a desirable destination for real estate investment.

Tenerife’s tax-free incentives for foreign investors

Tenerife, the largest island in the Canary Islands archipelago, has established itself as a prime destination for foreign investors looking to take advantage of its tax-free incentives. The island offers a unique opportunity for businesses and individuals to benefit from a no-tax environment, particularly when it comes to the value-added tax (VAT) on goods.

One of the key benefits for foreign investors in Tenerife is the exemption from VAT on goods. This means that businesses and individuals can import goods to the island without having to pay any additional taxes.

By exempting VAT on goods, Tenerife has created a favorable environment for businesses to thrive. It encourages foreign investment and trade, thereby stimulating economic growth on the island.

Tax-free environment

Tenerife’s tax-free environment goes beyond just the exemption of VAT on goods. The island offers a range of other tax incentives for foreign investors, including low corporate tax rates, tax breaks for certain industries, and exemptions for capital gains tax.

These tax incentives make Tenerife an attractive destination for foreign businesses and entrepreneurs looking to establish a presence in Europe. The island’s strategic location, excellent infrastructure, and high quality of life further add to its appeal.

Additionally, Tenerife’s government has implemented measures to streamline the investment process, making it easier and more efficient for foreign investors. These measures include simplified procedures for obtaining permits and licenses, as well as support services for market research and business development.

In conclusion, Tenerife’s tax-free incentives for foreign investors, such as the exemption of VAT on goods, coupled with its favorable business environment, make it an ideal destination for those looking to expand their businesses or invest in a tax-efficient manner.

Tenerife tax exemption and its relationship with tourism

Tenerife, a popular island in the Canary Islands, is known for its stunning landscapes and vibrant tourism industry. Apart from its natural beauty and pleasant climate, one of the main reasons why Tenerife attracts tourists is its unique tax exemption status. Unlike other regions in Spain, Tenerife is exempt from Value-Added Tax (VAT), making it an attractive destination for both tourists and businesses.

Being exempt from VAT means that the prices of goods and services on the island are generally lower compared to other places. This tax advantage has contributed significantly to the growth of Tenerife’s tourism industry. Tourists not only get to enjoy the island’s beautiful beaches and exciting activities, but they also benefit from the lower costs of accommodation, dining, and shopping.

Tax exemption and the local economy

The tax exemption in Tenerife has had a positive impact on the local economy. It has attracted numerous businesses, both large and small, to set up their operations on the island. This, in turn, has led to job creation and economic growth. The availability of VAT-free products and services has also increased the purchasing power of locals and tourists, further stimulating the economy.

The tax advantage has made Tenerife a preferred location for international companies, especially those in the tourism and hospitality sectors. Many businesses choose to establish their headquarters or branches on the island to take advantage of the tax benefits. This has not only increased employment opportunities but has also brought in foreign investment and boosted the overall development of the island.

Tourism and Tenerife’s tax exemption

Tenerife’s tax exemption plays a crucial role in attracting tourists from across the globe. The lower prices on the island make it a more affordable destination for travelers. Tourists can enjoy their vacation without feeling the burden of high costs, allowing them to indulge in the island’s diverse offerings and create unforgettable memories.

The tax exemption also benefits the local hospitality industry, including hotels, restaurants, and leisure activities. With lower costs, businesses can offer competitive prices, attracting more visitors. This, in turn, leads to higher occupancy rates and increased revenue, further fueling the growth of the tourism sector.

In conclusion, Tenerife’s tax exemption status has become a significant factor in the island’s thriving tourism industry. The absence of VAT has attracted businesses, boosted the local economy, and made the destination more attractive for tourists. Tenerife’s unique tax advantage has undoubtedly played a pivotal role in establishing its position as a top vacation spot in the Canary Islands.

Tenerife’s tax-free lifestyle: What it means for residents

The tax exemption on VAT means that residents of Tenerife can enjoy a lower cost of living compared to many other regions. They can save money on everyday expenses such as groceries, clothing, electronics, and even dining out, as these goods and services are not subject to VAT.

This tax exemption has a significant impact on the purchasing power of Tenerife’s residents. With the ability to buy goods and services without the added cost of VAT, they have more disposable income to spend on other things that enhance their quality of life.

Additionally, this tax exemption also attracts individuals who are looking to invest or start businesses in Tenerife. Entrepreneurs and investors can take advantage of the island’s tax benefits and set up their operations without the burden of VAT, allowing them to save money and potentially increase their profits.

Overall, Tenerife’s tax-free lifestyle is a major advantage for its residents. The island’s exemption from VAT means lower costs and higher purchasing power, making it an appealing place to live, work, and invest in the Canary Islands.

Tenerife tax exemption and its effect on the cost of living

The Canary Island of Tenerife, known for its stunning landscapes and beautiful beaches, not only offers a paradise for tourists but also has a unique advantage for its residents when it comes to taxes. Tenerife is a VAT-free zone, meaning that there is no value-added tax on goods and services. This tax exemption has a significant impact on the cost of living for those living on the island.

By not having to pay VAT, residents of Tenerife can enjoy lower prices on a wide range of goods. Whether it’s buying groceries, clothing, electronics, or even dining out, the absence of VAT makes these items more affordable compared to other parts of Spain or Europe where VAT rates can be as high as 20%. This lower cost of living allows residents to save money and have a higher standard of living.

Furthermore, the tax exemption also makes Tenerife an attractive destination for businesses and investors. The absence of VAT reduces the operational costs for businesses, making it more cost-effective to operate on the island. This, in turn, can lead to lower prices for consumers and a more competitive market.

However, it’s important to note that while goods and services are VAT-free, this doesn’t mean that there are no taxes on the island. Other taxes, such as income tax and local taxes, still apply. Nevertheless, the tax exemption on goods and services is a significant advantage and contributes to the overall affordability of living in Tenerife.

In conclusion, Tenerife’s tax exemption on goods and services has a positive effect on the cost of living for its residents. The absence of VAT allows for lower prices on a wide range of goods, making it more affordable to live and shop on the island. Additionally, the tax exemption makes Tenerife an attractive destination for businesses, leading to a more competitive market. Overall, the tax exemption contributes to a higher standard of living for those who call Tenerife home.

Tenerife’s tax exemption and its role in attracting international businesses

Tenerife, the largest island in the Canary Islands archipelago, has established itself as a prime destination for international businesses. One of the key factors contributing to its appeal is its tax exemption status.

On this picturesque island, goods and services are exempt from Value Added Tax (VAT), making it an attractive location for both businesses and consumers. The absence of VAT allows businesses to sell their products and services at a lower cost, thus attracting more customers and increasing their competitiveness in the global market.

Tenerife’s tax exemption policy is a strategic move by the local government to stimulate economic growth and attract foreign investment. By eliminating the burden of VAT, businesses can allocate their resources to other areas such as research and development, marketing, or hiring skilled professionals.

Furthermore, the tax exemption status of Tenerife promotes a business-friendly environment that encourages innovation, entrepreneurship, and the establishment of new companies. This, in turn, leads to job creation and stimulates the local economy.

Tenerife’s tax exemption also benefits consumers, who can enjoy a greater purchasing power and access to a wider range of goods and services. This not only enhances their quality of life but also contributes to the overall prosperity of the island.

In conclusion, the tax exemption status of Tenerife plays a crucial role in attracting international businesses to the island. The absence of VAT creates a competitive advantage for businesses, stimulates economic growth, and ultimately benefits both businesses and consumers. Tenerife’s tax exemption policy is a clear demonstration of the island’s commitment to fostering a business-friendly environment and promoting economic development.

Tenerife tax exemption and its influence on the hospitality industry

Tenerife, one of the Canary Islands, is known for its unique tax exemption policy. Unlike mainland Spain, Tenerife has no Value Added Tax (VAT) on goods and services. This tax exemption has a significant influence on the hospitality industry of the island.

Boosting the affordability of hospitality services

The absence of VAT in Tenerife means that hospitality businesses can offer their services and goods at a lower price compared to other destinations. Tourists visiting the island can enjoy a wide range of accommodations, restaurants, and recreational activities without having to pay the additional tax amount. This creates a competitive advantage for the hospitality sector in Tenerife, attracting more visitors and boosting the overall tourism economy.

Encouraging investment in the hospitality sector

The tax exemption policy in Tenerife also encourages investment in the hospitality sector. Business owners and investors see the island as an attractive destination to establish hotels, resorts, and other tourism-related ventures. The absence of VAT allows them to operate with lower costs and potentially higher profit margins, making Tenerife a favorable location for their investments. This leads to a growth in the number of hospitality establishments and job opportunities for the local population.

In conclusion, Tenerife’s tax exemption policy, which excludes VAT on goods and services, has a positive influence on the hospitality industry of the island. It enhances the affordability of hospitality services, encourages investment in the sector, and ultimately contributes to the overall growth and development of Tenerife’s tourism economy.

Tenerife’s tax-free regulations for digital nomads

Tenerife, a beautiful island in the Canary Islands, has some unique tax regulations that make it a prime destination for digital nomads and freelancers.

One of the main advantages of living in Tenerife as a digital nomad is the exemption from Value Added Tax (VAT). This means that goods and services purchased on the island are not subject to VAT, which can result in significant savings for those who work remotely.

In addition to the VAT exemption, Tenerife also offers a number of other tax benefits for digital nomads. The island has a low corporate tax rate, making it an attractive location for entrepreneurs and small business owners. Additionally, Tenerife offers a special tax regime for individuals who relocate to the island and meet certain requirements, such as working in certain industries or investing in local businesses.

Benefits of Tenerife’s tax-free regulations for digital nomads:

- VAT exemption: Digital nomads in Tenerife can enjoy the convenience and cost savings of not having to pay VAT on goods and services purchased on the island.

- Low corporate tax rate: Entrepreneurs and small business owners can take advantage of Tenerife’s low corporate tax rate, allowing for greater profitability and business growth.

- Special tax regime: Individuals who relocate to Tenerife and meet certain requirements can benefit from a special tax regime that offers additional tax advantages.

Whether you’re a digital nomad looking to save money on taxes or an entrepreneur seeking a business-friendly location, Tenerife’s tax-free regulations make it an attractive choice. With its beautiful landscapes, warm climate, and favorable tax environment, Tenerife offers the perfect balance between work and relaxation.

Tenerife tax exemption and its impact on the job market

Tenerife, a Canary Island located in Spain, offers a unique tax exemption that has a significant impact on the job market. The island is VAT-free, meaning that goods and services are exempt from the value-added tax (VAT) that is typically imposed on most products.

This tax exemption has attracted businesses and individuals alike to set up shop in Tenerife, as it provides a competitive advantage and increases the purchasing power of consumers. Without the burden of VAT, goods and services in Tenerife are often cheaper compared to other destinations, making it an attractive location for both tourists and residents.

The impact of the tax exemption on the job market is evident. With more businesses opting to establish themselves in Tenerife, job opportunities have increased significantly. The demand for workers has risen across various sectors, including retail, hospitality, tourism, and construction.

For local residents, the tax exemption has created a wealth of employment opportunities. The influx of businesses has resulted in job creation, reducing unemployment rates and improving the overall economic stability of the island.

Furthermore, the tax exemption has also encouraged entrepreneurship and innovation on the island. With lower operating costs due to the absence of VAT, individuals are more inclined to start their own businesses, contributing to the growth and diversification of the local economy.

In conclusion, the Tenerife tax exemption has had a significant impact on the job market. The absence of VAT has attracted businesses, created employment opportunities, and fostered entrepreneurship on the island. It has become a catalyst for economic growth, making Tenerife a promising destination for individuals and businesses alike.

Question-answer:

Is tenerife really vat-free.

Yes, Tenerife is VAT-free. The Canary Islands, including Tenerife, have a special tax regime that allows them to be exempt from the Value Added Tax (VAT) that is imposed in mainland Spain.

Why are the Canary Islands exempt from VAT?

The Canary Islands were granted a tax exemption from VAT in order to promote economic growth and competitiveness in the region. This exemption has been in place since 1991 and has helped to attract tourism and investment to the islands.

What is the benefit of the VAT exemption in Tenerife?

The VAT exemption in Tenerife means that goods and services are generally cheaper on the island compared to mainland Spain. This makes Tenerife an attractive destination for tourists and shoppers as they can enjoy tax-free shopping.

Are there any limitations to the VAT exemption in Tenerife?

While most goods and services are VAT-free in Tenerife, there are some exceptions. For example, certain luxury items and imported goods may still be subject to taxes. It is always best to check with the retailer or service provider to confirm if VAT applies.

Are there any other tax benefits in Tenerife?

Yes, in addition to the VAT exemption, Tenerife also offers other tax incentives for businesses and individuals. These include lower corporate tax rates, tax breaks for entrepreneurs, and tax incentives for research and development activities.

Is it true that Tenerife is VAT-free?

Yes, it is true. Tenerife, along with the other Canary Islands, enjoys a special tax status that exempts them from Value Added Tax (VAT).

Why are the Canary Islands VAT-free?

The Canary Islands, including Tenerife, are VAT-free because they are considered a remote region of the European Union. This means that they have a different tax regime compared to mainland Spain, allowing them to offer a lower cost of living and attract tourists and businesses.

Related posts:

- Discover If Tenerife is a Tax-Free Paradise for Savvy Shoppers and Investors

- Discover the Tax-Free Paradise of the Canary Islands – A Haven for Shoppers and Travelers

- Is Tenerife a Tax Free Island?

- Are Canary Islands Tax Free – A Detailed Look at Tax Benefits and Incentives on the Canary Islands

- Tenerife – The Tropical Paradise Where Taxes Don’t Exist

- How can a tax canary improve your financial security and reduce your tax burden

- Are Canary Islands a Tax-Free Destination?

- Are the Canary Islands considered a tax haven? An in-depth look at the potential tax benefits and drawbacks

Please wait while your request is being verified...

The Ultimate Guide to Tenerife

Tired of scouring the internet for incomplete, incorrect or out of date information about Tenerife? TENERIFE GURU is your ultimate guide to Tenerife, covering everything you need to know about our amazing island.

TENERIFE TAXES – Income, Inheritance, VAT, Stamp Duty, CGT, Property Tax, Plus Valia, Vehicle etc

UPDATED: 29th February 2024

SPANISH TAXES

This is perhaps the topic that creates the most confusion and misinformation among expats. In the article below, we aim to provide a basic explanation of the main taxes that resident and non-resident visitors or expats are likely to come across in Spain.

- Income Tax (Resident & Non-Resident)

- Inheritance & Gift Tax

- IGIC (VAT or Sales Tax)

- Stamp Duty / Transfer Tax

- Capital Gains Tax

- Council Tax / Rates / Property Tax

- Motor Vehicle Road Tax