An official website of the United States government.

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- American Job Centers

- Apprenticeship

- Demonstration Grants

- Farmworkers

- Federal Bonding Program

- Foreign Labor Certification

- Indians and Native Americans

- Job Seekers

- Layoffs and Rapid Response

- National Dislocated Worker Grants

- Older Workers

- Skills Training Grants

- Trade Adjustment Assistance

- Unemployment Insurance

- Workforce Innovation and Opportunity Act (WIOA)

- WIOA Adult Program

- Advisories and Directives

- Regulations

- Labor Surplus Area

- Performance

- Recovery-Ready Workplace Resource Hub

- Research and Evaluation

- ETA News Releases

- Updates for Workforce Professionals

- Regional Offices

- Freedom of Information Act

- Office of Apprenticeship

- Office of Foreign Labor Certification

- Office of Grants Management

- Office of Job Corps

- Office of Unemployment Insurance (1-877-S-2JOBS)

- Uniform Guidance for Federal Awards

- About Our Office

- Become a Grant Panelist

- Funding Opportunities

- Grants Awarded

- How to Apply

- Manage Your Awarded Grant

Uniform Guidance for Federal Awards - 2 CFR Part 200

To deliver on the promise of a 21st-Century government that is more efficient, effective and transparent, the Office of Management and Budget (OMB) is streamlining the Federal government’s guidance on Administrative Requirements, Cost Principles, and Audit Requirements for Federal awards. These modifications are a key component of a larger Federal effort to more effectively focus Federal resources on improving performance and outcomes while ensuring the financial integrity of taxpayer dollars in partnership with non-Federal stakeholders. This guidance provides a government-wide framework for grants management which will be complemented by additional efforts to strengthen program outcomes through innovative and effective use of grant-making models, performance metrics, and evaluation. This reform of OMB guidance will reduce administrative burden for non-Federal entities receiving Federal awards while reducing the risk of waste, fraud and abuse.

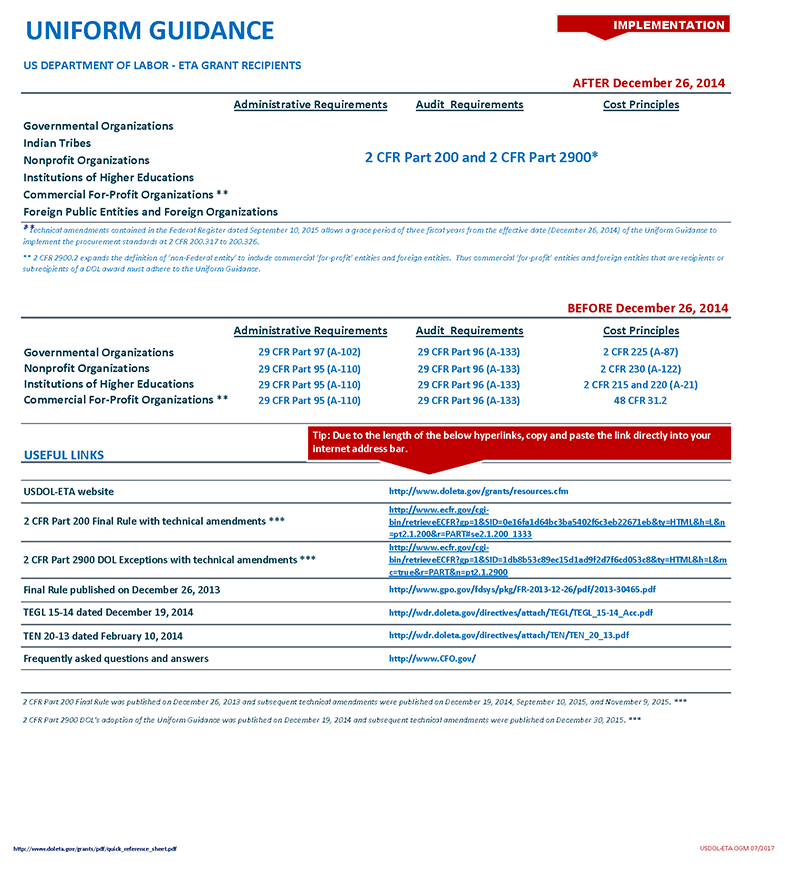

The Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance) at 2 CFR Part 200 supersedes and streamlines requirements found in eight separate OMB Circulars that are identified below:

- Administrative Requirements: OMB Circulars A-89, A-102 (29 CFR part 97), and A-110 (29 CFR Part 95)

- Cost Principles: OMB Circulars A-21 (2 CFR Parts 215 and 220), A-87 (2 CFR Part 225), and A-122 (2 CFR Part 230)

- Audit Requirements: OMB Circulars A-50 and A-133 (29 CFR Parts 96 and 99)

USDOL’s Adoption and Exceptions to the Uniform Guidance - 2 CFR Part 2900

The U.S. Department of Labor's adoption of the Uniform Guidance is found at 2 CFR 2900 which includes a limited number exceptions approved by OMB to ensure consistency with existing policy and procedures.

2020/2021 Revisions

The Office of Management and Budget (OMB) has published revisions to Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (also known as the Uniform Guidance at 2 CFR Part 200) along with other revisions to 2 CFR Parts 25, 170, 183, and 200 for grants and cooperative agreements. Two new requirements took effect on August 13, 2020 and the remaining revisions took effect on November 12, 2020.

DOL issued a technical amendment to 2 CFR Part 2900 in April 2021 to update cross-references and terminology to align with the Uniform Guidance Revisions of 2020 and 2021.

Below is the applicability chart and a crosswalk of the 2020/2021 revisions.

- Uniform Guidance Circulars DOL Applicability Chart 2021

- Crosswalk of 2020/2021 Revisions

The Office of Grants Management (OGM) provides grant management and Uniform Guidance training to its grantees, staff, and their stakeholders through a series of technical assistance modules called SMART - S trategies for sound grants management that are comprised of: M onitoring, A ccountability, R isk M itigation and T ransparency.

SMART training modules provide active DOL Federal Award recipients with helpful strategies in navigating the administration and financial management of their grants around four central themes weaved throughout the Uniform Guidance (2 CFR Part 200) and DOL's adoption and approved exceptions to the Uniform Guidance at (2 CFR Part 2900). These modules may be found on our community page called Grants Application and Management and located at WorkforceGPS.org .

For further information please see TEGL 15-14 .

Part 200 - Uniform Administrative Requirements, Cost Principles, And Audit Requirements For Federal Awards

PART 200 - UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS Authority: 31 U.S.C. 503 Source: 78 FR 78608, Dec. 26, 2013, unless otherwise noted.

- Authority: 31 U.S.C. 503

- Source: 78 FR 78608, Dec. 26, 2013, unless otherwise noted.

2 CFR Part 200 - PART 200—UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS

- Subpart A—Acronyms and Definitions (§§ 200.0 - 200.1)

- Subpart B—General Provisions (§§ 200.100 - 200.113)

- Subpart C—Pre-Federal Award Requirements and Contents of Federal Awards (§§ 200.200 - 200.216)

- Subpart D—Post Federal Award Requirements (§§ 200.300 - 200.346)

- Subpart E—Cost Principles (§§ 200.400 - 200.476)

- Subpart F—Audit Requirements (§§ 200.500 - 200.521)

- Appendix I to Part 200—Full Text of Notice of Funding Opportunity

- Appendix II to Part 200—Contract Provisions for Non-Federal Entity Contracts Under Federal Awards

- Appendix III to Part 200—Indirect (F&A) Costs Identification and Assignment, and Rate Determination for Institutions of Higher Education (IHEs)

- Appendix IV to Part 200—Indirect (F&A) Costs Identification and Assignment, and Rate Determination for Nonprofit Organizations

- Appendix V to Part 200—State/Local Governmentwide Central Service Cost Allocation Plans

- Appendix VI to Part 200—Public Assistance Cost Allocation Plans

- Appendix VII to Part 200—States and Local Government and Indian Tribe Indirect Cost Proposals

- Appendix VIII to Part 200—Nonprofit Organizations Exempted From Subpart E of Part 200

- Appendix IX to Part 200—Hospital Cost Principles

- Appendix X to Part 200—Data Collection Form (Form SF–SAC)

- Appendix XI to Part 200—Compliance Supplement

- Appendix XII to Part 200—Award Term and Condition for Recipient Integrity and Performance Matters

Travel on Non-Federal Sponsored Awards

Review the Award and sponsor regulations to determine the requirements for approval and allowable travel-related expenditures. Most sponsors require that travel be in accordance with the recipient's (UW's) travel policies. If this is the case, see the UW Travel website for more information.

Travel on Federal Sponsored Awards

Travel is a high risk expenditure on Federal awards. Some requirements differ from those of the UW, and expenses are routinely subject to Federal agency review. The information below identifies federal requirements and Best Practices for travel on a federal Award. The Federal Uniform Guidance reference for travel is section 2 CFR 200.475 "Travel costs" .

Travel Approval/Review

The Federal Uniform Guidance and most agency-specific regulations do not require sponsor approval for domestic or international travel. However, always review the Award and agency regulations to determine if there are any specific approval requirements.

While the Federal regulations may not specifically require approval, written sponsor approval minimizes the risk of travel expenses being questioned by the sponsor during or after Award implementation. Documentation of the need for travel, and careful management of travel funds, are best practices for avoiding challenges to travel expenses after the fact.

Document Need for Travel

Itemize and describe the need for travel in the proposal and proposal budget .

If the travel is not itemized in the proposal:

- Notify, in writing, the sponsor of the need for travel, even if their approval is not required.

- Document how the unbudgeted travel will benefit the award. Documentation can be part of the sponsor notification or in separate documentation retained with the travel expenditures.

- Include how the travel benefited the award in subsequent sponsor-required programmatic or progress reports .

Manage Travel Budget

- Keep travel expenditures within the Travel budget. Expenditures in excess of the budgeted amount may be questioned, even if the adjustment is within the rebudgeting authority allowed to the recipient (UW).

- If travel is unbudgeted, or actual travel expenses exceed the budget line item, be sure to document, ideally in a progress report, how the travel benefited the Award, and from which line item the funds were rebudgeted.

Timing/Personal Travel

The travel must take place between the start and end dates of the Award. Travel cannot take place after the end of the Budget Period/Award, even if the travel is directly related to the Award. The cost of any airfare purchased during the budget period for travel that will take place after the budget period is unallowable. See PAFC's Expenditure Timing page for more information.

The length of the trip must coincide with travel objectives. Any additional time added to a trip is considered personal time, and related costs cannot be allocated or charged to the Award. The UW Travel webpage has information on how to allocate personal travel time or expenses.

Commercial Air Travel (Airfare)

The Federal Uniform Guidance (2 CFR 200.475) states that Federal regulations must be followed for airfare purchases. Unlike for other travel expenditures (e.g., per diem), Federal regulations do not allow a recipient’s (UW’s) established policies to supersede the Federal regulations for airfare.

As always, individual Federal agency regulations supersede the Federal Uniform Guidance. Review the Award and individual Federal agency regulations to ensure compliance with airfare purchases. Some Federal agencies have regulations that are more restrictive than the Uniform Guidance. Information on select Federal agency regulations is provided at the end of this page.

Fly America Act

Unless exempted in writing, all airfare on Federal awards must comply with the Fly America Act (FAA). Compliance with the Fly America Act (FAA) includes allowances for itinerary-specific exemptions and for eligible flights under both airline code share agreements and the Open Skies Agreements (which is part of the FAA), both of which are updated on a routine basis. Thus, compliance for individual flights can only be determined with access to all available flight options and up to date information on Code Share and Open Skies agreements. As the PAFC team does not have this capacity, the best option is to work with a UW travel agent to ensure compliance . The UW Travel website has information on UW Travel agents.

Class of Travel

Travel must be taken using the least expensive class of travel, more commonly known as “ economy .” This is regardless of the total travel time from point of departure to final destination or duration of flight(s).

The Federal regulations do provide some exemptions for this requirement, which can be found in 2 CFR 200.475 (e) . Departments should review these exemptions and determine if their travel needs meet any of these exemptions. Keep in mind that individual Federal agency sponsors can make a determination if the use of any exemptions is reasonable and prudent.

Note that under the Federal Uniform Guidance, total travel time in excess of 14 hours is NOT listed as an exception for the least expensive class of travel. This exception is listed as part of the Federal Travel Regulations (FTR), but Federal sponsored awards are subject to the Uniform Guidance and not the FTR. There is no exception to travel in other than coach or economy class based solely on the length of the trip.

If a traveler purchases airfare other than in the least expensive class of travel, the portion of the cost of the airfare that is in excess of the least expensive class of travel is not allowable on a sponsored award.

If any of the exemptions to the Federal travel regulations are used:

- Include the anticipation of and the reasoning for any exemptions in the proposal.

- Clearly document the use of any exemptions and rationale for their use. Retain this documentation with the travel expenditures so it can be easily retrieved if questioned by the sponsor.

Type of Ticket

The least expensive unrestricted airfare is allowable. Unrestricted airfare allows for cancellation or changes with a penalty value that is less than the cost of the ticket.

Airfare purchased on a restricted fare is allowable as long as the ticket is used. If the restricted ticket is not used, then the cost of the ticket is unallowable.

Any fee paid to obtain a more desirable seat is considered to be the traveler's personal choice and therefore is not allowable on a federal award. Seat fees paid using non-federal awards must follow UW Travel policy .

Non-Commercial Air Travel

The cost of non-commercial air travel (e.g., leased or chartered aircraft) includes the cost of lease, charter, operation (including personnel costs), maintenance, depreciation, insurance, and other related costs. The use of this type of travel, in lieu of commercial air travel, must be justified as being reasonable (i.e., commercial air travel is unavailable). If commercial air travel is available, then the cost of non-commercial travel in excess of commercial travel is unallowable.

Travel Other Than by Air

Federal regulations require that travel be taken by the most direct and expeditious routing, which typically involves, when available, commercial air travel. If commercial air travel is available but the traveler wishes to travel by another means (e.g., vehicle, bus, train), any cost for this conveyance that is above the cost of commercial air travel is unallowable.

For example: The traveler is traveling from Seattle to San Francisco. The cost of the least expensive unrestricted economy airfare plus the cost of transportation to/from the airports is $500. The traveler elects to take the bus to San Francisco and the cost of the bus fare plus transportation to/from the bus station is $300. The routing via the bus would be allowable as the total cost is less than the total cost via airfare.

Best Practices

- Purchase airline tickets through UW contract travel agents to ensure FAA compliance and take advantage of any negotiated fare agreements.

- If personal time is added to a trip, ensure that the cost allocations are clearly documented and any personal-related costs are not allocated to the Award.

The Federal Uniform Guidance allows for the use of the recipient’s (UW’s) established policies and practices for Per Diem. See the UW Travel page on Per Diem for information.

- Any meals that are reimbursed directly instead of included in the per diem allowance must be within the meal allocation for the per diem rate. This includes any meals for the traveler as well as meals paid by the traveler for other people.

- Conference centers may charge lump sum amounts for lodging, meals, and conference fees. In this case, an itemized list of each expenditure must be obtained from the conference center. This is to ensure that the cost for meals and lodging does not exceed the allowable per diem amounts.

Agency-Specific Regulations

As always, an Agency’s specific policies supersede the Uniform Guidance, and any Award-specific Terms and Conditions supersede agency regulations. Below are links to Federal agency regulations on travel:

NSF Proposal & Award Policies & Procedures Guide (PAPPG): Section II.C.2.g. (iv)

NIH Grants Policy Statement (GPS): Section 7.9, see “Travel/Employees”

Post Award Fiscal Compliance email: [email protected]

For questions and issues relating to Effort Reporting, email: [email protected]

Login to ECC

An official website of the United States government Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Understanding the Uniform Guidance Requirement (2 CFR 200) for Federal Awards

Description:

This free web-based training provides an overview of the Uniform Guidance Requirements by applying relevant requirements to the Federal-aid Highway Program.

- Local Government

- Regional/Metro Planning Orgs (MPO)

- Transit Agency

- Tribal Government

- U.S. Territory

- Video/Webinar

Colorado State University

Vice president for research, office of sponsored programs, frequently asked questions about uniform guidance: general and allowability.

- January 28, 2020

A recent webinar on Uniform Guidance yielded a slew of questions. A number of those questions have been grouped into major topics of concern and addressed below. Due to the sheer number of questions asked, this first blog will address general questions and allowability. Next week’s blog will address effort reporting, F&A, participant support costs, purchasing, and subawards.

Where is the best digital version of the Uniform Guidance (UG) available?

The version found on govinfo can download as a PDF or in XML. It can also be accessed from Grants.gov which takes you to the version in the e-CFR (electronic Code of Federal Regulations). For the most up-to-date, go to the Federal Register (downloadable as a pdf).

What are the parts of UG most commonly referred to/used to in daily research administration?

The answer to this question may depend on where you sit in the lifecycle of an award (pre- or post-award) and if you are in a central unit or department. For Tricia as a trainer, I often refer to Subpart A (definitions), Subpart D (post-award requirements) and Subpart E (cost principles).

What’s the difference between uniform guidance and NIH grant policy?

Uniform Guidance is guidance to the Federal awarding agencies on administrative requirements, cost principles, and audit requirements for Federal awards. Once the Federal agencies codify these guiding principles they become agency regulations. Therefore, the NIH grant policy document is NIH’s codification of Uniform Guidance and should be followed for NIH awards.

The Department of Education regulations used to be EDGAR (Education Department General Administrative Regulations). Was EDGAR replaced by Uniform Guidance?

EDGAR (Education Department General Administrative Regulations) was amended after the Uniform Guidance was published and the U.S. Department of Education now points to Uniform Guidance for much of its guidance, though parts of EDGAR are still applicable.

Is it possible to discuss briefly Appendix IX that applies to Hospitals? Why is the difference between academic institutions?

Personnel appointments in hospitals are different than in academic settings and many of the “other hospital activities” are not allowable costs under Uniform Guidance. Additionally, there are patient care costs that you may not see at an Institution of Higher Education that is addressed in Appendix IX and credits (insurance, etc.) that must be taken into consideration in a hospital setting. Finally, the “A” portion of F&A (Facilities & Administrative) costs is not capped for hospitals like it is for institutions.

The order of Precedence that I’ve seen is the following. Is this correct?

- Applicable Laws

- Code of Federal regulations

- Standard Terms and Conditions

- Award Specific Terms and Conditions

- Other documents and Attachments

Law always trumps all else. If you cannot by law engage in an activity (such as hemp research), then it doesn’t matter what award terms or Uniform Guidance say. Typically, the most restrictive law wins, though there are exceptions. Research using alcohol is an exception. While Uniform Guidance says that alcohol is typically an unallowable charge (meaning you cannot reimburse meals that include alcoholic beverages), you may be able to purchase alcohol for a research study.

How often is the Uniform Guidance updated? Where do we find updates?

Uniform guidance is reviewed every 5 years after the initial December 26, 2013 date (2 CFR 200.109). Updates are published in the Federal Register. Always consult the on-line version for the most up-to-date information. For the most up-to-date, go to the Federal Register (downloadable as a pdf).

As a manager, what are some ways that I can increase exposure to/increase the use of Uniform Guidance for my staff? What would be best practices for ‘getting to know’ the Uniform Guidance?

You can start by sharing the free webinar and these frequently asked questions with your staff. You can also create a Uniform Guidance scavenger hunt for your staff. Also, cite any references to Uniform Guidance in communications and training as applicable.

How do the FAR and Uniform Guidance overlap?

The Federal Acquisition Regulation (FAR) establishes rules and requirements that Federal agencies must follow when procuring goods and services. The Uniform Guidance (UG) establishes requirements that must be followed by grantees when procuring goods and services needed to carry out a Federal award.

What’s new for Uniform Guidance in 2020? Could you include changes over the years?

The newest changes are in Procurement and Audit Requirements. For the most up-to-date, go to the Federal Register (downloadable as a pdf).

ALLOWABILITY

Is an Airbnb allowable on federal awards?

Allowability of an Airbnb for travel supported with federal funds is not addressed. Uniform Guidance instructs that housing/travel costs are allowable as direct costs if reasonable and necessary and approved in advance by the Federal awarding agency. See more under 2 CFR 200.474 (Travel costs). As always, follow the travel rules of the agency/program and of your institution.

Is space rental for institutional space allowable? All departments on campus charge for space not used for instruction.

Yes, space rental for institutional space is generally allowable. Double-check sponsor/program guidelines as some may consider rent or space unallowable. Also, ensure that space is not part of the indirect cost base if charging as a direct cost.

Is alcohol allowed if the sponsor says okay to it?

Yes, alcohol used in research is generally an allowable charge as long as there are no state or local laws that state otherwise.

What does Uniform Guidance say about managing unallowable purchases, especially when there is no place to put the charges?

This is something each institution must have a way of handling and is not specifically addressed in the Uniform Guidance other than to say that costs determined as unallowable may not be charged to a Federal award, and if they are, must be reimbursed. Also, institutions are directed to have a way to segregate and account for unallowable costs. For best practices, consider asking this question on RESADM-L ( https://www.healthresearch.org/office-sponsored-programs/research-administration-listserv/ ).

Please talk about the Fly America Act as it pertains to flights to/from Canada.

Fly America Act is not specifically addressed in the Uniform Guidance. However, the Fly America Act requires the use of a U.S. air carrier service for all air travel and cargo transportation funded by the U.S. government. Use a U.S. air carrier for flights to/from Canada. Find more guidance here- https://www.gsa.gov/policy-regulations/policy/travel-management-policy/fly-america-act

What does Uniform Guidance say about cost-sharing?

Federal awarding agencies are instructed to include cost-share requirements in their funding opportunities. Expenses that are cost-shared must be verifiable and allowable under the award terms and conditions. Uniform guidance states that voluntary-committed cost-sharing is not expected and cannot be used as a factor during the merit review process. See 2 CFR 200.306 for more on cost-sharing.

How does your organization deal with supplemental compensation?

Uniform guidance instructs us to follow institutional policies for supplemental compensation and instructs us to establish a consistent written definition of work covered under our definition of Institutional Base Salary (IBS). Our institutions discourage supplemental compensation during the contracted time.

Can you provide guidance compensation allowability – vacation leave payout, overload/extra pay, job announcements, and background checks?

Fringe benefits, including vacation, are allowable (2 CFR 200.431).

Overload/extra pay is addressed in 2 CRA 200.430. There are extensive guidelines for extra pay (see 2 CFR 200.430(h)(3) and (4)). Supplemental pay should not exceed Institutional Base Salary (IBS) and must follow established written institutional policy and consistently applied to both Federal and non-Federal activities.

Job announcements for grant-funded positions are allowed (unless the sponsor or guidance says differently). See 2 CFR 200.421(b)(1).

Background checks would be allowable if they are part of the non-Federal entity’s standard recruitment program. See 2 CFR 200.463(a).

We require detailed receipts for all travel meals to make sure no alcohol has been purchased and PIs are asking why we don’t use a per diem policy. Which is more prevalent?

We don’t know the ratio of institutions using per diem versus those that pay actual expenses. Based on experience, state institutions are more likely to use a state per diem rate while private institutions may reimburse for actual expenses. If reimbursing actual expenses, requiring receipts to ensure alcohol is not charged to a federal award is a best practice and it is up to the institution to decide if they want to pay for alcohol from non-federal funds.

Is there a sample allocation plan to guide the conversation for computer devices with PIs?

A sample allocation plan is not provided in Uniform Guidance. For sample plans, consider asking this question on RESADM-L ( https://www.healthresearch.org/office-sponsored-programs/research-administration-listserv/ ).

Are membership allowed as a direct charge on awards?

Memberships, subscriptions, and professional activity costs are generally allowable as direct costs. Costs of memberships to social or dining clubs are generally unallowable. See 2 CFR 200.454.

What about direct charging dean’s or director’s salaries if they are providing “technical contributions”?

Administrative services are allowable if they meet all of the following conditions:

- Services are integral to the project/activity

- Individuals can be specifically identified with the project/activity

- Costs are included in the budget or have prior written approval

- Costs are not recovered as indirect costs

Can unrecovered F&A (Facilities & Administrative) costs and/or fringe that were included in the originally accepted budget carryover to subsequent years and used for other line items in the budget?

If the agreement allows for carryforward, the amounts could be carried forward to the next project year. Depending on budgeting restrictions, the unrecovered fringe may be able to be added to other direct cost budget lines and the F&A would carry forward as well.

F&A is a percent of expenses, so it would be the same percent in the second year as it was in the first and if you are increasing the direct costs (by carrying forward unused budget), you would need to carry forward F&A from year one to two to cover that.

I heard on computers, people are splitting between a grant and unrestricted funds (unobligated funds). Ninety percent (90%) grant and ten percent (10%) unobligated funds so they have not cost-shared. Thoughts?

This isn’t necessary as computing devices can be charged as direct costs if they are essential to the project. They do not have to be solely dedicated to the performance of the Federal award. See 2 CFR 200.453.

_______________

For more Uniform Guidance FAQs, visit: https://cfo.gov/wp-content/uploads/2017/08/July2017-UniformGuidanceFrequentlyAskedQuestions.pdf

Blog post by Tricia Callahan, Senior Research Education and Information Officer, Office of Sponsored Programs and Shannon Sutton, Director of Sponsored Projects, Western Illinois University.

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

Uniform Guidance 2 CFR Part 200

The new Omni Circular impacts all Federal agencies and non-Federal entities (states, local governments, Indian tribes, institutions of higher education, and nonprofit organizations) that receive Federal awards as a recipient or subrecipient and their auditors. It combines eight previously separate sets of OMB guidance into one. It also co-locates all related OMB guidance into Title 2 of the Code of Federal Regulations (CFR). And, the CFR has the force and effect of law. Information about the new Circular can be found below.

The new Omni Circular is also the subject of the NCJA webinar Getting to Know the New Omni Circular 2 CFR Part 200 . Note: this webinar is free to NCJA members; non-members can access it for a fee.

Uniform Grant Guidance Crosswalks and Side-by-Sides

The Uniform Grant Guidance crosswalks and side-by-sides are an excellent resource to compare the new 2 CFR Part 200 to existing guidance in the OMB Circulars and Federal regulations.

History of Uniform Guidance Reform

February 2011 — Presidential Memo: Reduce Administrative Burden

February 2012 — Advanced Notice of Proposed Guidance

February 2013 — Notice of Proposed Guidance

December 2013 — Publication of Final Uniform Guidance

December 26, 2014 — On or after this date for New Awards and Supplemental Awards

Impact of Grant Reform

The new Omni Circular impacts all Federal agencies and non-Federal entities (states, local governments, Indian tribes, institutions of higher education, and nonprofit organizations) that receive Federal awards as a recipient or subrecipient and their auditors. It combines eight (8) previously separate sets of OMB guidance into one (1). It also co-locates all related OMB guidance into Title 2 of the Code of Federal Regulations (CFR). And, the CFR has the force and effect of law.

What is the COFAR?

The Council on Financial Assistance Reform (COFAR) is an interagency council of the Office of Management and Budget (OMB) and the eight (8) largest Federal grant-making agencies and one rotating small grant-making agency. On January 27, 2014, the COFAR hosted public webcast on reforms and highlighted significant changes in new Uniform Guidance 2 CFR Part 200. Webcasts are available here .

Omni Circular Effective Dates

All Federal agencies must codify or formally adopt these new requirements into regulations by December 26, 2014. OMB must approve more restrictive regulations proposed by a Federal agency. This is a short time frame; therefore, federal agencies may accept new guidance into their regulations as is. All draft regulations were due to OMB in June. OMB is currently reviewing the draft regulations for approval and or amendment.

Layout of 2 CFR Part 200

6 Subparts A through F

Subpart A, 200.XX – Acronyms & Definitions

Subpart B, 200.1XX — General

Subpart C, 200.2XX — Pre Award - Federal

Subpart D, 200.3XX — Post Award - Recipients

Subpart E, 200.4XX — Cost Principles

Subpart F, 200.5XX — Audit

11 Appendices – I through XI

OMB News and Guides

Omb evaluating agency drafts for implementing uniform guidance (aug, 2014).

The Office of Management and Budget plans to issue a document as of Dec. 26 that will contain each federal agency’s final regulations adopting the uniform grant guidance, with special attention paid to each agency’s exceptions to the guidance, according to a key OMB official. The document, once published, will be posted at the OMB website. Gil Tran of OMB’s Office of Federal Financial Management told attendees at the recent American Institute of Certified Public Accountants National Governmental Accounting and Auditing Update EAST conference that OMB currently was reviewing draft implementation regulations submitted by federal agencies this June.

GAO Tells OMB, Treasury To Address USAspending.gov (Aug, 2014)

Concerned about the widespread inconsistencies in data reported on USAspending.gov, the Government Accountability Office recommended that the Office of Management and Budget work with the Department of the Treasury, now managing the site, to clarify guidance on federal agency responsibilities in overseeing the recipient submission of award data and to implement a process to regularly assess the consistency of the information reported on the website.

Frequently Asked Questions

Answers to frequently asked questions about the new Omni Circular 2 CFR Part 200 as provided by the Council on Financial Assistance Reform (COFAR):

COFAR FAQ #1 [Published Feb 12, 2014] The COFAR released the first set of FAQs in support of 2 C.F.R 200 Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards. Over 200 thoughtful questions and comments have been received from grantors, grantees, and grant management and oversight professionals throughout country. Additional FAQ releases will parallel Federal agency submission of implementing regulations.

COFAR FAQ #2 [Published Aug 29, 2014] This second set of frequently asked questions presented by the COFAR on OMB’s Uniform Guidance at 2 CFR 200. Please note that in case of any discrepancy, the actual guidance at 2 CFR 200 governs. If there is a question pertaining to the application of the guidance to a particular Federal award, that question should be addressed to the Federal awarding agency or pass-through entity in the case of a subrecipient.

COFAR Updated FAQ #2 [Published November, 2014] COFAR has made revisions and updates to the following FAQs: 110-3 Effective Dates and Disclosure Statements (DS-2s); 110-5 Effective Dates, Applications, and DS-2s; and 431-1 Fringe Benefits and Indirect Costs. In addition, they have made an edit to the lead-in paragraph to the FAQs. The updated FAQs can be found here .

COFAR Updated FAQ #3 (Published Sept. 9, 2015) The Office of Management and Budget released the latest Frequently Asked Questions (FAQs) for the Uniform Guidance, 2 CFR Part 200, on September 9, 2015. Four (4) updates to the new regulations are included: 1) Extension of the Procurement Grace Period to Two (2) Years; 2) The Method to Send Excess Interest Earned on Federal Funds; 3) Tuition Benefits for Institutions of Higher Education (IHE’s) and others; and, 4) Items to Include in an Allocated Central Services Plan. Click here to view the updated FAQs.

- Regulations All Titles

- title 2 Grants and Agreements

- chapter II CHAPTER II—OFFICE OF MANAGEMENT AND BUDGET GUIDANCE

- part 200 PART 200—UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS

- subpart E Subpart E—Cost Principles

- subjgrp 42 General Provisions for Selected Items of Cost

- § 200.475 Travel costs.

View all text of Subjgrp 42 [§ 200.420 - § 200.476]

§ 200.475 - Travel costs.

AUTHORITY: 31 U.S.C. 503

SOURCE: 78 FR 78608, Dec. 26, 2013, unless otherwise noted.

CITE AS: 2 CFR 200.475

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

IMAGES

VIDEO

COMMENTS

Costs of travel by non-Federal entity-owned, -leased, or -chartered aircraft include the cost of lease, charter, operation (including personnel costs), maintenance, depreciation, insurance, and other related costs. The portion of such costs that exceeds the cost of airfare as provided for in paragraph (d) of this section, is unallowable.

The Electronic Code of Federal Regulations (eCFR) is a continuously updated online version of the CFR. ... its status, and the editorial process. Enhanced Content. View table of contents for this page. PART 200—UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS ... services, travel, and up to the ...

Subtitle A—Office of Management and Budget Guidance for Grants and Agreements; CHAPTER II—OFFICE OF MANAGEMENT AND BUDGET GUIDANCE; PART 200—UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS; Subpart E—Cost Principles; General Provisions for Selected Items of Cost § 200.475 Travel costs.

Chapter II—Office of Management and Budget Guidance; PART 200—UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS ... This final guidance is located in Title 2 of the Code of Federal Regulations. ... Similar outcomes are supported by reforms to 200.474 Travel Costs and 200.431 Compensation ...

Uniform Guidance for Federal Awards - 2 CFR Part 200. To deliver on the promise of a 21st-Century government that is more efficient, effective and transparent, the Office of Management and Budget (OMB) is streamlining the Federal government's guidance on Administrative Requirements, Cost Principles, and Audit Requirements for Federal awards.

7 As used here, Federal financial assistance has the same meaning as in section 200.1 of title 2 of the Code of Federal Regulations. 8 For additional details on the use of Federal funds for evaluation related activities, see the separate summary brief "Uniform Grants Guidance 2024 Revision: Evaluation."

Chapter II —Office of Management and Budget Guidance; Part 200 View Full Text; Previous; Next; Top; Details. Enhanced Content - Details ... The Electronic Code of Federal Regulations (eCFR) is a continuously updated online version of the CFR. ... § 200.475: Travel costs. § 200.476: Trustees. Subpart F: Audit Requirements: 200.500 - 200. ...

Title 2 Part 200 of the Electronic Code of Federal Regulations. Title 2, part 200 of the Electronic Code of Federal Regulations. ... Home; Title 2 PART 200. CFR › Title 2 › Volume 1 › Chapter II › Part 200. Part 200 - Uniform Administrative Requirements, Cost Principles, And Audit Requirements For Federal Awards ... 200.475 Travel costs ...

Subtitle A—Office of Management and Budget Guidance for Grants and Agreements; ... 2 CFR Part 200 - PART 200—UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS . CFR ; prev | next Subpart A—Acronyms and Definitions (§§ 200.0 - 200.1) Subpart B—General Provisions (§§ 200.100 - 200.113)

2 CFR 200 - UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS. [Government]. Office of the Federal Register, National Archives and Records Administration. ... OFFICE OF MANAGEMENT AND BUDGET GOVERNMENTWIDE GUIDANCE FOR GRANTS AND AGREEMENTS (Parts 2 - 199) PDF XML Details Share. Chapter I - OFFICE ...

The UW Travel webpage has information on how to allocate personal travel time or expenses. Commercial Air Travel (Airfare) The Federal Uniform Guidance (2 CFR 200.475) states that Federal regulations must be followed for airfare purchases. Unlike for other travel expenditures (e.g., per diem), Federal regulations do not allow a recipient's ...

2 CFR 200 - UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS. [Government]. Office of the Federal Register, National Archives and Records Administration. ... Subtitle A - Office of Management and Budget Guidance for Grants and Agreements Chapter II - OFFICE OF MANAGEMENT AND BUDGET GUIDANCE Subchap ...

This free web-based training provides an overview of the Uniform Guidance Requirements by applying relevant requirements to the Federal-aid Highway Program. Understanding the Uniform Guidance Requirement (2 CFR 200) for Federal Awards | US Department of Transportation

Law: 2 CFR Part 200. The Uniform Grant Guidance lists 55 "items of cost" that receive clarification regarding the allowability of charging to federal funds. The 55 items are not exhaustive of every expenditure out there, and leave a lot of gray area, so... The law provides guidance called "Basic Considerations" to apply to all costs ...

A recent webinar on Uniform Guidance yielded a slew of questions. A number of those questions have been grouped into major topics of concern and addressed below. Due to the sheer number of questions asked, this first blog will address general questions and allowability. ... See more under 2 CFR 200.474 (Travel costs). As always, follow the ...

If the change represents a variation from 2 CFR part 200, the change may require approval by the Federal cognizant agency for indirect costs, in accordance with § 200.102(b). Amendments of a DS-2 may be submitted at any time. Resubmission of a complete, updated DS-2 is discouraged except when there are extensive changes to disclosed practices.

2 CFR Frequently Asked Questions . Publication Date: May 03, 2021 . This document is designed to address common questions regarding the Office of Management and Budget's (OMB) implementation of the updates to Title 2 of the Code of Federal Regulations (2 CFR), also referred to as the Uniform Guidance.

The Uniform Guidance (UG), officially entitled . Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (2 CFR 200) was issued by the Office of Management and Budget (OMB) in the Executive Office of the President of the U.S. on December 26, 2014 and took effect the same day. This federal regulation

On April 22, 2024, the Office of Management and Budget (OMB) issued a Final Rule significantly revising the Uniform Guidance for grants, ... Cost Principle, and 2 CFR 200 Subpart F, Audit. Sections 200.313 and 200.314 each increase the thresholds, from $5,000 to $10,000, for the value of equipment and supplies a recipient may retain, sell, or ...

The Code of Federal Regulations (CFR) is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government. The Electronic Code of Federal Regulations (eCFR) is a continuously updated online version of the CFR. It is not an official legal edition of the CFR.

The Code of Federal Regulations (CFR) is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government. The Electronic Code of Federal Regulations (eCFR) is a continuously updated online version of the CFR. It is not an official legal edition of the CFR.

During this virtual workshop, we will provide you with federal grant regulation training relating to financial management and administration to help you with financial grant compliance. Attendees will receive a complimentary electronic copy of 2 CFR 200 Uniform Guidance. Online event registration closes 1 hour prior to the start of the training.

2 CFR 200 is a set of federal regulations published by the Office of Management and Budget. 2 CFR 200 establishes principles for determining the costs applicable to federal grants, contracts, and other sponsored agreements with educational institutions. Consistent treatment of "costs incurred for the same purpose in like

COFAR FAQ #2 [Published Aug 29, 2014] This second set of frequently asked questions presented by the COFAR on OMB's Uniform Guidance at 2 CFR 200. Please note that in case of any discrepancy, the actual guidance at 2 CFR 200 governs. If there is a question pertaining to the application of the guidance to a particular Federal award, that ...

Provides the text of the 2 CFR 200.475 - Travel costs. (CFR). U.S. Code ... All Titles. title 2 Grants and Agreements. chapter II CHAPTER II—OFFICE OF MANAGEMENT AND BUDGET GUIDANCE. part 200 PART 200—UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS.

Uniform Guidance, Code of Federal Regulations, Title 2, Section 200 (2 CFR 200) - effective December 26, 2014. Also, this policies & procedure manual is provided to assist ... Transportation costs 2 CFR § 200.473 Travel costs 2 CFR § 200.474 Trustees 2 CFR § 200.475 : Helpful Questions for Determining Whether Costs are Allowable -

OMB periodically reviews the Uniform Guidance in accordance with 2 CFR 200.109. For example, OMB made further revisions to the Uniform Guidance in 2020. 85 FR 49506 (Aug. 13, 2020). The 2020 revisions addressed topics including program development and design, as well as measuring recipient performance to assist Federal awarding agencies and non ...

Wipfli is holding a CPE Training to discuss the 2024 updates to 2 CFR 200, commonly referred to as Uniform Guidance, and explore changes to equipment, audit, the de minimis rate, reducing the ...