Check our Frequently Asked Questions

- Current Account

- Savings Account

- Ghina Savings Account

- Ghina Salary Account

- Banoon Children’s Savings Account

- Electron Account

- Short Term Investment Account

- Investment Deposit Account

- ADIB Egypt Wasel Account

- ADIB Student Account

- ADIB Salary Bonus Programme

- Smart account

- Emirates Skywards Cards

- Smiles Covered Cards

- Etihad Guest Cards

- Exceed Covered Cards

- Cashback Cards

- Booking.com Cards

- ADIB ISIC Pre-Paid Card

- ADIB Discontinued Cards

- Personal Finance

- Home Finance

- Debt Settlement

- Car Finance

- Electric Vehicle Finance

- Education Finance

- Travel Finance

- Boat Finance

- Goods Murabaha

- ADIB Yusr - Salary Advance Finance

- Motor Takaful

- Covered Card Takaful

- Personal Finance Takaful

- Takaful Protection Plan for School Fees

- Male Care Takaful Plan

- Female Care Takaful Plan

- Personal Accident Takaful Plan

- How to Invest

- Investment Solutions

- Tools & Planners

- Market Updates

- Wealth Management

- Lifestyle Benefits

- Covered Cards

- ADIB Diamond

- Dana Accounts

- ADIB Dana Master Card

- Dana Financing Solutions

- Corporate Solutions

- New to UAE Banking

- Personal Finance Solutions

- Home Finance

- ADIB Gold & Diamond Priority Banking

- Takaful Solutions

- smartdeals BACK TO Personal smartdeals

- Banking Benefits

- Wealth Management

- Transfers and Remittances BACK TO Personal Transfers and Remittances

- Business Elite

- Business Premium

- Business One

- Merchant Account

- Business Connect

- Compare Accounts’ Packages

- Business Accounts Selector Tool

- Relationship Based Finance

- Small Business Finance

- Trade Finance

- Business Savings Account

- Business Short Term Investment Account

- Business Time Deposit

- Business Wakala Deposit

- Investment Solutions

- ADIB Merchant Services

- Business Gold Covered Card

- Business Platinum Covered Card

- Business Takaful BACK TO Business Business Takaful

- Treasury Products BACK TO Business Treasury Products

- Private Banking as it should be

- Relationship management

- Investment Offering

- ADIB Securities

- Market updates

- Financing Solutions

- Your Life Style

- Business Finance Solution

- Global Transaction Services

- Priority Banking

- Personal Banking

- Private Banking

- ADIB Direct Registration Forms

- ADIB Direct Video guides & Quick Help

- ADIB Direct FAQs

- Commercial Banking

- Financial Institution

- Transaction Banking

- Government Public Sector

- Corporate Purchase Covered Card

- Corporate Travel & Hospitality (T&H) Covered Card

- Corporate Virtual Covered Card

Warning: If you pay only the card’s minimum monthly payment due, the un-waived profit at the discretion of the Bank will be more and it will take you longer to pay off your Present Balance.

ADIB Emirates Skywards Visa Infinite Card

Enjoy the best of all worlds. Sign up and experience exclusive travel and lifestyle benefits Fast track to Emirates Skywards Gold tier membership, Emirates Skywards Silver tier membership, Earn up to 50,000 bonus Skywards Miles, Emirates Home Check-in service within Dubai, Airport transfers in the UAE, Unlimited Global Lounge Access

Key Benefits

Up to 50,000 bonus Skywards Miles

Fast track to Emirates Skywards Gold tier membership

Earn Skywards Miles for every AED 3.68 equivalent spend*

Global Lounge Access

Up to 50,000 bonus Skywards Miles

Get welcome bonus of 50,000 Skywards Miles on first spend (subject to meeting the required spend threshold) *

* Sign up Skywards Miles subject to activation and spend of first retail transaction within 30 days from Card issuance date. Employees of Emirates Airlines are not eligible for Sign up Skywards Miles and Skywards Silver/Gold membership.

Complimentary Emirates Skywards Silver membership for the primary cardholder. Primary and supplementary cardholders can fast-track to Gold tier status upon achieving qualifying spend.

Earn Skywards Miles for every AED 3.68 equivalent spend:

• Emirates and Flydubai spends: 3 Miles* • Foreign currency spends 2 Miles* • Local currency spends 1.5 Miles* • Specific category spends 0.25 Miles*

Home check-in service

Enjoy Emirates Home check-in service from the comfort of your home, hotel or office anywhere in Dubai four times a year.

Dubai airport transfers in the UAE

Take away the hassle of calling a cab or organizing a ride to the Dubai airport, with your ADIB Emirates Skywards World Elite Card. Enjoy four airport transfers per year from anywhere * in the UAE ( * within city limits). Additional charges over and above the entitlement will be charged to the Cardholder's Card Account and reflected in the Cardholder's monthly statement.

For bookings, call 600543216, 3 business days prior to the scheduled trip.

Global Lounge Access

Enjoy unlimited lounge access for the cardholder and one guest companion to over 900 airport lounges across the globe.

For more information please visit https://www.loungekey.com/en/visamena

Valet Parking

Flash your Card at the Valet to avoid the stress of parking. With your card you can park for free (four times a month) through Valtrans at key locations in the UAE. Please visit Valet Parking for updated list of locations.

Golf for Cardholder and a guest.

Partners The ELS Golf Club, Dubai Arabian Ranches Golf Club, Dubai The Abu Dhabi Golf Club, Abu Dhabi

For Booking 600543216

Concierge Services*

The 24-hour concierge provides you with a personal travel assistant. The concierge will take care of all practical considerations, so you can make the most out of every moment.

Travel Inconvenience Cover*

Whether your luggage goes amiss or flight delays interrupt your plans, you are covered for:

Baggage loss or damage up to USD 3,000 Baggage delay USD 500 Trip delay / Missed departure USD 500 Trip curtailment / cancellation up to USD 7,500

Travel Medical Cover*

For the greatest peace of mind while you're traveling, your health and safety needs are met promptly and efficiently. As a ADIB Emirates Skywards Visa Signature Cardholder, you get coverage for yourself as well as your family and helper:

Card Services**

Balance Transfer

Use Balance Transfer facility on your Card by calling 600 543216

Cash on Call Transfer cash from your Card to a selected bank account by calling 600 543216

Easy Installment Plan With your ADIB Covered Card, you can now shop at selected merchants and payback in easy installment payments of 3/6/9/12 months with 100% waiver of Murabaha Monthly Profit and no processing fees by calling 600 543216.

** T&Cs apply on Balance Transfer, Cash on Call and Easy Installment Plan

ADIB Covered Card Takaful Protection

Optional Takaful cover provided to protect in the event of death, permanent total disability, critical illness and involuntary loss of employment.

Ways To Pay

For your convenience there are numerous ways to make your ADIB Covered Card Payment.

Bill Payments

The following bills can be paid via Online Banking (adib.ae) or Chat Banking +971600543216:

Etisalat and Du bills (Landline, GSM, Wasel Recharge and renewal, elife and internet) Water and Electricity bills (DEWA, SEWA, ADWEA) and Salik

Banking with ADIB

ADIB Online Banking – visit simple.adib.ae to view your Card statement and transact on your Card. 24x7 Chat Banking: Chat with us at any time on WhatsApp +971600543216 for a quick and secure way of accessing your account. E-statements: Be eco-friendly and receive your statements via email. SMS alerts: Receive Card information and transaction alerts.

ADIB Mobile Banking App

Bank anytime, anywhere with the ADIB Mobile Banking App You can manage your card on the go by downloading ADIB Mobile Banking App from iTunes App Store, Google Play Store, or the HUAWEI AppGallery.

Emirates Skywards programme rules apply.

Click here for the Cards Terms and Conditions

Key Facts Statements

Cards Comparison Document

Required Documents

- Original and copy of valid passport

- Original and copy of valid Emirates ID

- Bank account statement (last 3 months)

- Salary certificate from current employer (not more than 30 days old)

Fees and Charges

- Covered Card Annual Fee - 4500

- 5 th Supplementary Card Annual Fee (3) - 4500

- Monthly Profit Rate - 3.75%

Primary cardholders can fast-track to Gold tier status upon spending AED 5,500 with Emirates. One Supplementary cardholder can also enjoy Emirates Skywards Gold membership on an additional minimum spend of AED 5,500 on Emirates and subject to payment of Annual Fee of AED 4500.

Flight ticket/upgrade purchases made at emirates.com, Emirates Sales offices or Emirates Contact Centre will only be eligible for the fast track offer.

*Specific merchants in the following categories will receive 0.25 Skywards Miles per AED 3.68 (or equivalent) for AED and non – AED transactions: Supermarkets, Government Services (e.g. Fines, Taxes), Utilities, Education, Service/Petrol Stations, Real Estate Agents, Public Transport (e.g. Taxis, Metro, Buses), Road Tolls/Salik, Charities/Religious Organisation

For bookings call 600543216, 3 business days prior to the scheduled departure. Service is subject to availability

Additional terms and conditions apply. For more details please visit www.emirates.com

Free Valet Parking

The valet parking benefit is applicable on standard parking only and not on VIP at any Valtrans locations. Any Cardholder who valet parks his/her vehicle in VIP Valet Parking will be charged the prevailing rate as set by Valtrans. This will be charged to the Cardholder’s Card Account and reflected in the Cardholder’s monthly statement. Your Card will be charged in case of additional visits.

• Luxury travel planning and access to the best and exclusive events • Reserving the chef’s table for a special event • Scheduling personalized shopping experiences at luxury retail brands

For more details please visit www.visaconciergecemea.com Or call on Local: 800-0444-4484 International: +1-312-340-2421

Trav el Medical Cover*

- Travel accident cover up to USD 500,000

- Emergency medical evacuation and repatriation up to USD 500,000

- Medical expenses (accident or sickness) up to USD 500,00

- Daily in-hospital cash benefit USD 100 per day

Spouse – 100%; Children – 25%; Domestic Helper – 25%

Now you can choose from two exciting offers when you conduct a Balance Transfer with ADIB!

- Transfer your balance and enjoy no profit for 12 months!* (use up to 50% of your cover limit)

- Transfer your balance and enjoy no profit for 3 months!* (use up to 100% of your cover limit)

- For 12 months Balance Transfer offer Terms & Conditions, (PDF Download)

- For 3 months Balance Transfer offer Terms & Conditions, (PDF Download)

You can make payments at over 60 ADIB branches located across the seven Emirates in UAE.

ADIB CASH & CHECK DEPOSIT MACHINES (CCDM)

Visit any ADIB CCDM 24 hours a day to settle your Card Payments.

PAYMENT THROUGH e-ADIB INTERNET BANKING

Card payments can be made through e-ADIB Internet Banking Card Payment section. Use this option to view details of each Card you own, including transaction histories from and to a specified date.

PAYMENT THROUGH TELEPHONE BANKING

If you are an ADIB account holder, call 600543216 to register for telephone banking. You can then transfer funds from your account to your Card within minutes. Whatever payment method you choose, be assured that it will be processed in the easiest and safest manner.

PAYMENT AT EXCHANGE HOUSES*

Settle your Card bill at over 250 partner locations! You can settle your due amount at any Al Fardan Exchange, Al Ansari Exchange branches located across the UAE. All you have to do is bring your ADIB Covered Card with you to have the required amount settled. Please note that time until payment credited is 1-2 Working days

Click here for an updated Schedule of Charges

*Transfer of Excess Funds over the Cash Cover from Card to Account with fee of AED 100 is only applicable on exception when processed through ADIB Branch or ADIB Call Centre. Standard cash withdrawal fee is applicable on Card to Account Transfer performed through ADIB ATM/Online/Digital Channels.

(3) Entitled to four Free Supplementary Cards until further notice. Annual fees will be applied on the 5th supplementary card and onwards.

(4) Includes cash withdrawal at ATMs, Exchange Houses or similar, transfer of the original cover of the Card to any ADIB Account. This will also include all Transactions at merchants classified as "Security Brokers/Dealers" (under Visa Merchant Category Code 6211) including but not limited to National Bonds Corporation Transactions. Additionally, such Transactions will not qualify for Etihad Miles, Cashback or any other reward scheme.

(5) For damaged Cards, no fee shall be applicable if the Cardholder delivers the damaged Card to the branch.

(6) If agreed upon with the customer and stipulated in the relevant document.

(7) Added to the Non-AED transactions' wholesale foreign exchange market spot rate that is selected and applied by Visa/MasterCard on the date of conversion in addition to the fee of Visa/MasterCard.

(8) For transactions that take place outside the UAE where the Cardholder pays the merchant in AED.

(9) The Monthly Contribution includes the Monthly Takaful Contribution and the fee of the arrangement, distribution and other services related to the Takaful scheme. For Takaful products, all contribution amounts are inclusive of VAT if applicable. For all Cards including Supplementary Cards, Monthly Contribution amount shall be linked to the Principal Card.

It's easy, secure & only takes 10 minutes

Visit a Branch

Find your nearest ADIB branch

More cards for you to explore

ADIB Booking Signature Card

- Earn 2.5 Exceed Rewards per AED 100 Airline Spends (capped at 50 Exceed Rewards per transaction and 150 Exceed Rewards a month).

- Earn 0.50 Exceed Reward per AED 100 spent locally

- Earn 1 Exceed Reward (0.125 Exceed Rewards in EEA region) per AED 100 (or equivalent) spent internationally.

- Earn 0.125 Exceed Reward per AED 100 spent on Specific Merchants

- Unlimited Airport Lounge Access for cardholders only.

- Valet parking at select locations in the UAE.

- 10% discount on select hotel bookings through the Booking.com Genius Program*

*Extra 10% discount on select hotels booked through Booking.com as a Genius Member. Get free upgrade to Genius Member status as ADIB Booking.com Covered Cardholder and enjoy Genius discounts and perks. Click here to register.

Still not sure which card is for you?

Your Visa card provides you with International Medical & Travel Assistance Service provided by International SOS.

This provides you with 24/7 complimentary services including medical advice and travel advice available to you before you travel and while you are travelling.

Before you leave home make sure you save the number for International SOS in your contacts for emergency calls.

For full details on this service please download our brochure .

For your free pre-travel advice, travel or insurance assistance is required please contact International SOS. This service is available 24/7 and provides services in selection of languages.

You can contact us by:

Telephone (Please us the number below that best suits your location and language requirements)

+971 (4) 253 6024 (Arabic, French, English)

+27 11 541 1068 (Arabic, French, English)

+380 (44) 499 39 75 (English)

+44 (0) 208 762 8373 (English)

WhatsApp (Please call us by telephone should you have a medical emergency!)

- Scan QR code:

- Go to your WhatsApp, compose a new message to +27 11 541 1068

- Please note that WhatsApp channel is currently available only in English.

- Your Visa card may have a Travel Insurance benefit when you purchase travel tickets or make hotel reservations with your card. This benefit may extend to you, your spouse and dependent children

- Your Visa card may have a Purchase Protection benefit for stolen or damaged goods purchased with your card

- Your Visa card may have an Extended Warranty benefit that extends the original manufacturer’s warranty for an item purchased with your card

- Your Visa card may have other insurance benefits to protect you from unexpected losses

Please click "Login", at the top right hand of the page, to provide your card information here to verify what benefits are available to you and the terms and conditions that apply.

Visa Global Customer Assistance Services associates are on stand-by. Visa will block your card (if the card number is known) and connect you with your financial institution/Bank. Following your bank approval, you can also get an emergency card replacement within one to three business days*. Alternatively, Visa can arrange for cash to be available at a location near you usually within hours of your bank’s approval.

Call one of our global Freephone numbers.

*Some restrictions/limitations apply

Cardholder Update

Visa has suspended its operations in Russia, as was announced on March 5th, 2022.

Here’s what this means for cardholders:

- Any Visa cards issued by financial institutions outside of Russia will no longer work in Russia.

- All transactions initiated with Visa cards issued in Russia will no longer work outside the country.

- Services and Benefits on this website will no longer be available for cardholders.

- In case of any other card-related questions please contact your bank.

Emirates NBD Visa Infinite Credit Card

Top reasons to choose.

- Earn rewards on all domestic & international spends

- Complimentary airport lounge access to over 1000 lounges

- Golf club privileges

- Exclusive Concierge Desk Privileges

- Valet Parking at selected locations in Abu Dhabi

Things To Be Aware Of

- Specific spend categories earn lower rewards

Emirates NBD Visa Infinite Credit Card is for distinctive cardholders that deserve only the best and most exclusive portfolio of benefits. The Emirates NBD Visa Infinite Credit Card gives you an unprecedented and diverse range of luxurious privileges, personalised service and unmatched security to suit your lifestyle.

Reward Features

- Earn Plus Points for every spend and redeem them instantly at your favorite stores. You can also convert your Plus Points to Frequent Flyer Miles or Cash back.

- Earn up to 2 Plus Points for every AED 100 spend

- Earn 0.4% Plus Points in supermarkets and groceries spends

- Earn 0.4% Plus Points in Insurance and Car Dealership spends

- Earn 0.2% Plus Points in Fuel and Utility Payments

- Earn 0.2% Plus Points in Real Estate and Education spend

Joining Offers

Apply for an Emirates NBD Credit Card and receive a voucher worth up to AED 400 from Yougotagift

Detailed Features

- Airport transfers - up to 4 drops per calendar year in the UAE.

- Submission of visit visa at Dubai and Abu Dhabi airport 6 times a year

- Pick up and delivery of car in Dubai and Abu Dhabi for Car servicing and Car registration once a year

- Local courier services within UAE up to 12 times per calendar year

- Khalidiya Mall (Main Entrance of the Mall)

- Yas Mall (Main Entrance)

- Yas Waterworld (Main Entrance)

- Ferrari World (Main Entrance)

JA Resort Golf Course: 20% discount from the Midweek Visitor Rate Card all year round. Jebel Ali Golf Resort boasts a 9-hole Championship Course, an enormous driving range and putting green. Offer valid from February 7, 2020 00:00 GMT - February 6, 2021 23:59 GMT

Abu Dhabi City Golf Club: Redeem a 'Member's Guest / Affiliate' Rate every day of the week situated in the heart of the UAE's capital, offering a relaxed accessible environment to golfers and non-golfers alike, to play, wine and dine. www.adcitygolf.ae Offer valid from February 7, 2020 00:00 GMT - February 6, 2021 23:59 GMT

Arabian Ranches Golf Club:A 10% discount on midweek 'Visitor Rates' all year around. The links is an 18 hole, par 72 signature course designed by Ian Baker-Finch in association with Nicklaus Design. Offer valid from September 4, 2019 00:00 GMT - September 3, 2020 23:59 GMT

Trump International Golf Club: A 10% discount off the 'Best Available Rates' can be enjoyed everyday, The 7,300-yard, par 71 course is located just ten minutes from Sheikh Zayed Road, Gil Hanse, was appointed to design the spectacular 18-hole golf course. Offer valid from September 17, 2019 00:00 GMT - September 16, 2020 23:59 GMT

Jebal Sifah ( Muscat) : 15% discount on 'Best Available Rate' green fees from Sunday to Thursdays. Harradine Golf’s first ever seaside course, which can also be played as a varied 18 hole par 72 course by utilising second pin flags

Yas Links Abu Dhabi: Enjoy a 5% discount on `Best Available Rate' green fees everyday Kyle Phillips designed the multiple award Winning Championship Links Golf Course, Yas Links Abu Dhabi. Coupled with a Par 3 floodlit Academy course and practice areas, highly skilled PGA teaching professionals, and state of the art Golf Academy with covered bays and the latest in technology

Al Zorah Ajman: A 5% discount on midweek 'Best Available Rates' all year around special proposition that’s been magically created by the famed Nicklaus Design group

Address Montgomerie: 10% discount everyday off 'Visitor Rates' with a 365 day booking window. 18-hole championship golf course and 5-star accommodation are regarded one of the premier leisure destinations in the world

Sharjah Golf and Shooting Club;10% discount on Preferential rate green fees Club boasts a 9 hole, fully floodlit golf course which enables play well into the evening. Designed by internationally acclaimed architect Peter Harradine, if played twice, this wall to wall grass oasis will provide a par 72 layout that stretches in excess of the 7,300 yard mark.

Abu Dhabi Golf Club: 5% discount on "Best Available Rate" green fees rates Sunday through Thursdays.Abu Dhabi Golf Club features 27 Championship holes of golf, over 162 hectares of land co-managed by renowned worldwide golf resort management organization, Troon Golf. Offer valid from October 8, 2019 00:00 GMT - October 7, 2020 23:59 GMT

Sadiyat Beach Golf Club: 5% discount off 'Best Available Rate' green fees ,Sundays through Thursdays. Designed by Gary Player, this course is one of the world's most captivating golfing projects. The Troon managed Saadiyat harnesses the stunning natural beauty of Saadiyat Island. Offer valid from October 8, 2019 00:00 GMT - October 7, 2020 23:59 GMT

The Els Club Dubai:5% discount on 'Best Available Rate' green fees from Sunday to Thursdays. Stretching 7,538 yards with four sets of tees, allowing players a selection of differing lengths from which to play, Offer valid from September 6, 2019 00:00 GMT - September 5, 2020 00:00 GMT

Tower Links Golf Club RAK: 5% discount off Visitor green fees 7 days a week . Offer valid from October 11, 2019 00:00 GMT - October 10, 2020 23:59 GMT

Al Hamra Golf Club RAK: 15% Off Visitor green fees (Sun - Thurs) & 10% Visitor green fees (Fri - Sat). 10% discount in Pro-Shop. This 18-hole golf course, designed by Peter Harradine, meanders around four inter-connected open water lagoons merging seamless with the water of the Arabian Gulf. As many traditional links course do, the front nine measuring 3,578 yards makes its way out and away from the Clubhouse, whilst the back nine measuring 3,747 yards returns home around the lagoon to the Clubhouse.

- Restaurant advice

- Booking tables, including those that are hard-to-get

- Travel arrangements: booking flights, hotels, car rental, hotel transfers, tourist advice

- Shopping recommendations, sourcing a product

- Arranging a special gift, sending flowers

SkyShopper Whether you are shopping for electronics, paying your bills or buying tickets for entertainment venues, flights or hotel bookings, experience the convenience of shopping on Skyshopper and pay with your Plus Points rewards.

- Best available rate guarantee

- Automatic room Upgrade upon arrival

- Complimentary in-room Wi-Fi

- Complimentary continental breakfast daily

- $25 USD food or beverage credit

- VIP guest status

- 3pm check out upon request

- USD 3,000 per occurrence with USD 5,000 annual aggregate limit for Visa Infinite cardholders.

- Personal Accident Benefits up to US$ 1,000,000 (International)

- Personal Accident Benefits up to US$ 100,000 (Domestic)

- Emergency Medical Expenses up to US$ 1,000,000

- Evacuation and Repatriation Expenses up to US$ 500,000

- Hospital Daily Cash $100 per day up to US$ 3,000

- Trip Cancellation/Curtailment up to US$ 7,500

- Delayed departure up to US$ 1,000

- Baggage delay up to US$ 500

- Loss of personal belongings up to US$ 2,500

- Covers cardholder, spouse and up to 5 children; age limit of 75 for all

Please fill in the details to receive a call back with more details about this product

- Emirates NBD Diners Club Credit Card

- Emirates NBD Dnata Platinum Credit Card

- Emirates NBD Dnata World Credit Card

- Emirates NBD Etihad Guest Visa Elevate

- Emirates NBD Etihad Guest Visa Inspire Credit Card

- Emirates NBD Go4it Gold Credit Card

- Emirates NBD Go4it Platinum Credit Card

- Emirates NBD Lulu 247 Platinum Credit Card

- Emirates NBD Lulu 247 Titanium Credit Card

- Emirates NBD Manchester United Credit Card

- Emirates NBD Marriott Bonvoy World Mastercard Credit Card

- Emirates NBD MasterCard Platinum Credit Card

- Emirates NBD MasterCard Titanium Credit Card

- Emirates NBD Skywards Infinite Credit Card

- Emirates NBD Skywards Signature Credit Card

- Emirates NBD Starwood Preferred Guest World Credit Card

- Emirates NBD U By Emaar Visa Family Card

- Emirates NBD U By Emaar Visa Infinite

- Emirates NBD U By Emaar Visa Signature

- Emirates NBD Visa Flexi Credit Card

- Emirates NBD Visa Platinum Credit Card

Popular Searches

- Credit Cards

- Bank Accounts

- Personal Loan

- Best Credit Cards in Uae

- Citi Bank Credit Card

- Emirates Nbd Credit Cards

- Emirates Islamic Credit Cards

- Standard Chartered Bank Credit Card

- Hsbc Credit Cards

- Mashreq Credit Cards

- Fab Credit Cards

- Best Cashback Cards in Uae

- Emirates Skywards Credit Cards

- Rak Bank Credit Card

- Dubai Islamic Bank Credit Card

- Balance Transfer Credit Cards

- Adib Credit Card

- FAB Blue Al Futtaim Credit Cards

- Open Account Emirates Nbd

- Open Account in Citi Bank

- Standard Chartered Bank Account Opening

- Emirates Islamic Bank Account Opening

- Mashreq Neo Account Opening

- Mashreq Bank Account Opening

- Hsbc Savings Account

- Al Masraf Bank Account Opening

- Fab Bank Account

- Adcb Account Opening

- Rak Bank Account Opening

- Cbd Account Opening

- Adib Bank Account Opening

- Cbi Saver Account

- Personal Loan in Uae

- Emirates Islamic Bank Personal Loan

- Fab Personal Loan

- Emirates Nbd Personal Loan

- Adcb Personal Loan

- Citibank Loan Personal

- Cbd Personal Loan

- Rakbank Personal Loan

- Home Loan in Uae

- Fab Home Loan

- Emirates Islamic Bank Home Loan

- Emirates Nbd Home Loan

- Adib Home Finance

- Cbd Home Loan

- Standard Chartered Home Loan

- Car Loan in Uae

- Emirates Islamic Bank Car Loan

- Cbd Car Loan

- Fab Car Loan

Apply Online

FAB Cashback Credit Card

Minimum Salary AED 5,000

Annual Fee AED 315

- Free Supplementary Card

- 5% cashback on supermarket , fuel & Utilities

- Cinema Offers

- AED 300 Cashback Welcome Bonus

Are you sure you want to exit?

Currently you cannot apply for this product through us. However, we can help by showing you other options that you could apply for. Click Here

- International Travel Insurance Dubai

- Single Trip

- Schengen product

- Annual Multi-Trip

- Hajj & Umrah

- Inbound to UAE

- Sports Cover

- Policy Document

- Travel Tips

- Glossary of Terms

- Privacy Notice

- Health declaration & health exclusions

- Blogs & Newsletters

- BUY ALLIANZ TRAVEL

Inbound Travel Insurance to UAE with Allianz

Experience the wonders of the uae with confidence. our inbound travel insurance covers medical emergencies and much more for your peace of mind, why allianz travel inbound.

Choosing Allianz Travel Inbound means entrusting your journey to a globally recognized insurance provider. Our tailored solutions and unwavering support ensure that your visit to the UAE is both secure and seamless.

- Tailored Protection : Crafted specifically for visitors to the UAE, offering up to USD 150,000 for emergency medical and related expenses.

- Flexible Coverage : Whether you're here for a short visit or multiple trips on a multi-entry visa, we've got you covered for every journey.

- Global Expertise : Trusted by travellers worldwide, our insurance is recommended by leading embassies, including India and Australia.

- Hassle-Free Booking : Easy online booking system, ensuring you're protected from the moment you step into the UAE.

- 24/7 Support : Our global network is always on standby, ensuring you're never alone during your UAE adventures.

This Inbound travel insurance UAE product has been designed for all travelers visiting the United Arab Emirates. The product is dedicated to Emergency Medical coverage including medical evacuation/repatriation, return of dependents or emergency search and rescue.

Allianz Travel covers international travelers visiting the UAE for up to 3 months. Please note the insurance is linked to your trip to the UAE not to your visa. This means if you get a multi-entry visa and are planning to travel multiple times to the UAE, you will need to get a travel insurance for each of your trips.

Our Inbound travel insurance UAE product needs to be purchased before you arrive to the UAE. Any travel policy purchased while your trip in the UAE has already started will not be eligible to claim. In our booking path, you will need to enter the start date of the trip, in order to ensure you are eligible.

Our Inbound travel insurance UAE product can cover any travelers from any countries who wants to have a travel insurance while visiting the United Arab Emirates.

As some medical expenses following an accident can be high, multiple embassies recommend their nationals to be covered with a travel insurance while abroad such as India or Australia .

In a few clicks, you can get a quote and purchase this tailor-made Inbound travel insurance UAE product from AED 50.Choosing Allianz Travel Inbound means entrusting your journey to a globally recognized insurance provider. Our tailored solutions and unwavering support ensure that your visit to the UAE is both secure and seamless.

Our main Inbound Travel Insurance covers the following

- Emergency Medical Assistance : Comprehensive coverage for unforeseen medical emergencies, ensuring your well-being is prioritised.

- Emergency Medical Evacuation/Repatriation : In critical situations, we facilitate and cover the costs of medical evacuation or repatriation, ensuring you receive the best care possible.

- 24/7 Assistance Service : Day or night, our dedicated team is on standby, ready to assist with any travel-related concerns or emergencies.

- COVID-19 Quarantine Accommodation Costs : If diagnosed with COVID-19 during your trip, we provide coverage for the additional accommodation expenses related tomandatory quarantine.

- Repatriation of Remains : In the unfortunate event of a fatality, we ensure dignified and prompt repatriation of remains to the home country.

For a detailed list of benefits and detailed terms, kindly refer to our official policy document.

Travel Insurance

Travel insurance for travellers visiting uae.

Swipe to view more

Inbound Travel Insurance UAE

Provides cover if you are taken into hospital or you need to come home early or extend your journey due to illness or accident.

Frequently Asked Questions

Travel insurance to the uae, is it mandatory to have a travel insurance for dubai.

Travel insurance for Dubai is recommended by multiple sources as it will cover you for emergency medical expenses and many other benefits. In a recent news article , the Indian Embassy strongly advises that anyone travelling to the UAE take out travel insurance. It follows the case of someone who was visiting the UAE and faced high bills after an accident.

Financial burden of unforeseen circumstances is covered with a policy such as ours and prevents financial burden at such a difficult time. Money is not something someone should be worried about when someone is ill, injured or in trouble.

Allianz Travel insurance to the UAE also covers quarantine and emergency medical expenses related to COVID-19. Our online travel insurance is easy to buy in a few clicks and will give you peace of mind while exploring Dubai and the rest of the UAE.

Does Dubai visa include travel insurance?

Can i get travel insurance for covid-19 in dubai.

Yes, you can get a travel insurance with COVID-19 cover for your trip to Dubai. You just need to buy your travel insurance to the UAE before you arrive in the country. As any other international travel insurance, an Inbound travel insurance to the UAE needs to be bought before your trip starts otherwise your claims will not be eligible.

Allianz Travel has added specific benefits to its travel insurance for the UAE in order to cover quarantine and emergency medical expenses if you get tested positive to COVID-19 while you are travelling in the UAE.

You can check the Allianz travel insurance to the UAE here . Buying our online travel insurance is easy and fast. In just a few clicks, you can get a quote and buy online your travel insurance with Allianz Travel.

Is inbound travel insurance mandatory to enter the UAE?

does a uae visa include uae inbound insurance.

Travel insurance is required in the UAE to obtain a visa, especially for visitors from countries that require a visa to enter. The submission of proof of medical coverage is required as part of the visa application process. It's important to note, however, that the insurance is tied to your specific trip to the UAE, not the visa itself. As a result, if you have a multi-entry visa and plan to visit the UAE on multiple occasions, you must ensure that you have valid travel insurance for each trip.

Travellers from countries eligible for Visa on Arrival in the UAE , on the other hand, are not required to obtain travel insurance. Regardless of this exemption, it is strongly advised to have travel insurance to cover any unexpected medical expenses and other travel-related risks.

Does Emirates Airlines provide travel insurance?

does inbound travel insurance uae cover incidents related to covid-19.

Yes, our inbound travel insurance for the UAE covers COVID-19 incidents. Our policies are designed to provide Emergency Medical and Associated Expenses coverage for COVID-19. This means that if you contract the virus while travelling and require medical attention, our insurance covers the costs for your treatment.

In addition to medical expenses, our policy considers the possibility of quarantine. If you are diagnosed with COVID-19 during your trip and are required to quarantine, we will cover accommodation during this time.

What is the validity period of an inbound travel UAE insurance policy?

Are pre-existing medical conditions covered under inbound travel insurance, how can i file a claim with inbound uae travel insurance.

Using our eClaim Portal is the quickest way to open a claim, but you may also contact us by email or Whatsapp.

Customer Support/Grievances - 8 a.m. to 8 p.m. (GST) on Monday through Friday:

- Phone: +971 4 270 8702

- Email: [email protected]

- Whatsapp: +971 56 216 4563

Is there a waiting period before my inbound insurance becomes active?

With Allianz, your inbound travel insurance becomes effective immediately from the specified start date of your trip, as outlined in your policy, ensuring you are covered right from the beginning of your journey. Please note you can only purchase your Inbound travel insurance before your trip starts otherwise your claims will be declined.

To avoid any gaps in coverage, we recommend purchasing your travel insurance policy prior to the start of your trip. This ensures that you are fully protected from your departure date, with no waiting period applied.

Does inbound travel insurance UAE cover adventure sports activities?

Participating in adventure sports in the UAE requires additional protection and our current Inbound travel Insurance does not cover all activities. Please refer to the Terms and Conditions to see which activity is included. If you have a doubt, please contact our customer care :

- Email: [email protected]

What do I do if I lose my proof of travel insurance in the UAE?

Does uae inbound travel insurance offer the same cover as normal travel insurance .

UAE inbound travel insurance by Allianz is tailored for visitors to the UAE. It covers

- Medical emergencies up to AED 150,000.

- Medical evacuation and repatriation.

- COVID-19 quarantine costs up to AED 200/day for 10 days.

- Repatriation of remains up to AED 10,000.

- Emergency dental treatment up to AED 300.

- Loss of travel documents up to AED 300.

While there are similarities with regular travel insurance, the specific coverages are designed to cater to the unique needs of travellers in the UAE.

Our Travel insurance Policy wording

Apply for an Emirates NBD Credit Card to win Apple products and a guaranteed voucher!

Apply for an emirates nbd credit card and be one of 120 lucky winners of various apple products from apple watches to macbook pro laptops that’s not all, you can also get a guaranteed yougotagift happyyou card worth up to aed 400 that can be availed across 200+ brands. prize units apple watch series 8 45mm 30 apple iphone 14 pro max 256gb 30 apple airpods 3rd generation 30 apple 13-inch macbook pro 30 total 120, key benefits and highlights.

Stand out from the rest

- Up to 2 Points for every AED 100 spend

- 0.4% Points for supermarkets, groceries, insurance and car dealership spends

- 0.2% Points for fuel, utility bill payments, real estate and education spends

- Complimentary airport lounge access to over 1000 lounges worldwide via LoungeKey

- Concierge services to take care of your time-consuming errands

- Valet Parking at selected locations in Abu Dhabi

- Interest rate of 3.25% per month; minimum payment: 5% of the outstanding or AED 100, whichever is higher

- Complimentary Concierge

- Airport pick up and drop off

- Complementary golf

- Luxury shopping and travel with miles & points

- Free Valet parking

- Premium loyalty memberships

- Movie Offers

Nine Great Mastercard Benefits in UAE and Middle East

Unknown to many, Mastercard plastics come with a host of benefits. While some are specific to UAE, others are applicable to the entire Middle East.

In this post, I will be discussing the benefits in detail. However, before we do that, it is important to understand the different variants of Mastercard credit cards.

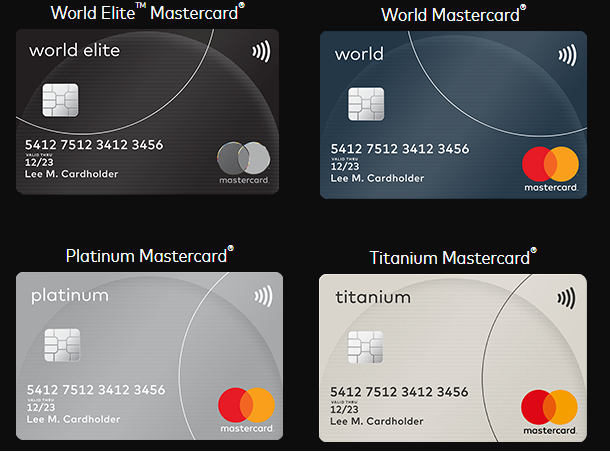

Mastercard Variants

There are four variants of Mastercard – Titanium, Platinum, World and World Elite. This is in increasing order of ‘premium-ness’, World Elite being the most premium card.

It should be easy to know which variant of card you are holding. Usually, the type is mentioned in the name itself e.g. Standard Chartered Platinum Credit Card . However, in some cases, the variant is mentioned on the card e.g. Citi Prestige is a World Elite card.

Let us look at the benefits now.

1. Free Travel Insurance

Both World and World Elite credit cards offer free travel insurance and travel insurance letter. As you may know, travel insurance letter is a mandatory requirement for a few countries (e.g. Schengen visa) while applying for a visa.

Platinum credit card does not offer travel insurance. However, Platinum prepaid card does.

While I have not claimed insurance benefit yet, I have used the travel insurance letter a few times. Both on my ADCB World Credit Card and Citi Prestige World Elite Credit Card. The process is very simple. You need to visit this website and select your card variant .

Upon selecting the variant, you can click on ‘Travel Insurance Letter’ and fill in the details. The letter would be sent to your email and can be used for visa purposes.

World cards also offer Purchase protection and insurance against ATM robbery. World Elite card goes one step further and additionally offers complimentary rental collision and loss damage waiver.

2. Free Airport Lounge Access

Mastercard offers unlimited airport lounge access through LoungeKey for all its World cardholders including supplementary cardholders. For World Elite members, it is even better ( one of the reasons why Citi Prestige is my favorite card ). Both primary and secondary cardholders can bring one guest each.

The list of lounges is available on LoungeKey website .

Platinum and Titanium cards also provide limited airport lounge access – the list would be different for each bank.

3. Free Nights at Marriott Properties in Middle East

World and World Elite members get complimentary nights at over 200 participating Marriott Bonvoy hotels across Middle East and Africa. You can get one of the following depending upon the property

- One complimentary night when booking two nights

- One complimentary night when booking three nights

- Two complimentary nights when booking six nights

To avail this benefit, you need to visit www.marriott.com/mastercardmea .

While this looks like a great benefit, I have noticed the rates offered on this portal are higher than those offered at Marriott website. Therefore, it is best to check before making bookings.

4. Discounted Rides on Careem

You can get 20% discount on up to 3 rides every month by adding your Mastercard credit card to your Careem account and using the promotional code ‘MASTERCARD’. Usually, this is promoted as a benefit of World and World Elite cards. However, I had used it on my Titanium card as well and it worked fine.

5. Discount on Flights Booked Via Cleartrip

If you are a Platinum Mastercard holder, you can get discounts on international round-trip flights and hotel bookings. You need to use the coupon code ‘MASTERCARD’.

For flight bookings, the discount is structured as:

For hotel bookings, the following discount is offered:

For Mastercard World and World Elite members, the discount and coupon code is different. You need to use the code ‘MCWORLD’ and you receive 10% discount on international flight bookings. This discount is not capped but is applicable only on base fare.

6. Free but Limited Version of The Entertainer (Buy 1 Get 1 Free Offers)

Mastercard has partnered with The Entertainer to come up with a stripped-down version of its popular app. Upon entering your Mastercard credentials, you can get Buy-1-Get-1 offers across a variety of merchants including dining, leisure, home services etc.

You can download the Android version and iPhone version using the links.

Remember, this is not the full version of Entertainer. That does not come free.

7. Complimentary Discovery Black Membership

I had discussed the GHA Discovery hotel loyalty program previously . With over 550 hotels in 75+ countries the complimentary upgrade to Discovery Black membership could be very useful. Usually, this is offered to members who have stayed 30+ nights.

These are the benefits provided for Black members

- Local amenity upon check-in

- One local experience per calendar year

- One local experience when staying at a new DISCOVERY brand for the first time

- Guaranteed room availability at least 24 hours prior to arrival

- Double room upgrade at check-in (subject to availability)

- Late check-out privileges until 6pm (subject to availability)

- Early check-in privileges starting at 9am (subject to availability)

There are some great local experiences, especially in Middle East. It ranges from airport transfers to dinner in a palace.

Further, the double room upgrade for Discovery Black members can be very lucrative. Difference between basic rooms and suits in some of these properties is huge. However, I have never tried it so I am not sure how easy it would be to receive an upgrade.

8. Complimentary Qatar Gold Membership

As a World Elite Mastercard holder, you receive complimentary upgrade to Gold membership in Qatar Privilege Club. This is the third tier of Qatar Privilege membership. The benefits are

- 75% bonus miles on Qatar Airways flights

Priority check-in at Hamad International Airport, Doha

- 15 kg excess baggage allowance

Some of these benefits may not be useful to UAE residents. However, it is important to remember that Qatar Airways is part of Oneworld alliance. Gold membership at Qatar Airways matches you to the Oneworld Sapphire membership. This provides you some great benefits which you can use at any airport

- Access to Business class lounge across airports

- Priority check-in

- Prirority baggage

- Extra baggage allowance

To avail these benefits, you can fly on any Oneworld airline regardless of class of travel. To reiterate, these lounges cannot be ordinarily accessed by PriorityPass or LoungeKey. For example, at Dubai airport (DXB), you can access the British Airways Lounge (Terminal 1) with your Oneworld Sapphire status.

9. Complimentary Hertz Gold Plus Rewards® Five Star Membership

With a complimentary Gold Plus membership, you get benefits such as

- Up to 15% discount worldwide, including Hertz Collections vehicles

- Faster and easier car rental with Gold Plus Rewards

- Free One Car Class Upgrade for Five Star members

- Free additional driver for spouse or partner

Visit www.hertz.com/mcworld to get the benefit.

Final Thoughts

As I mentioned before, not many people are aware of these benefits. I keep running into people who own the Emirates NBD Marriott Card but are not aware ‘easy to score’ benefits like free travel insurance and discounted Careem rides.

Along with Emirates NBD, Citi Prestige and ADCB Travellers are some of the popular cards in the World and World Elite category. At present, Citi is offering AED 1,500 of statement credit if you sign up for Citi Prestige or Emirates-Citibank Ultima credit card. You can apply through this link if you wish ( link ).

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

10 Comments

Is that only for UAE residents with those cards or are those global benefits? Thanks.

It depends. I have tested the Careem discount with an international card and the discount works.

There is only one benefit where Visa is better – free airport rides with Careem. I get 4 rides (Visa Infinite) annually per card (valid on supplementary card as well). This itself pays for my cards annual fees. 🙂

That’s true. Although VISA does have many similar benefits. Wait for a post on it soon

I have the Citi Premier Card (World Elite) and I have been having a lot of trouble getting the Qatar Gold status. Qatar’s website says to contact the World Elite Concierge, and after many redirects I ended up at Citi’s Thank You department. But then the person I talked to said they don’t do that. Who did you have to contact to get the Qatar Gold? Thanks!

Hi Kyle, See the email below I had received. “Since you already have a Membership number with Qatar Airways (533926677), all you need to do is to call MasterCard Concierge Phone Number to get upgraded to Gold status. MC Concierge phone numbers are : 800-0444-0844. 1-312-843-5359.”

I had called the number and it was done pretty quick. AK

This helped. Thank you. Albeit, may I add that one has to accumulate a few QPOINTS (forgot the exact number but it was 340 from what I recall) in Year 1 via QATAR airways to maintain Gold status in the following year.

@Samuel. Do you actually need to fly with Qatar to get those Qpoints? And do you know if this works with the supplementary card-holders as well?

That is correct. Although, many such incentives are available only for the first year. Another option is to discontinue one card and get a World Elite MasterCard from another bank. There are a few of them in UAE.

This Daniel hayslip see I can get a loan I get SSI every month right payment long ain’t hole lot I can afford it need all help I can get thanks

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

IMAGES

VIDEO

COMMENTS

Visa Infinite ® card benefits. Enjoy excellent spending power with a high credit limit, the convenience of Visa Infinite Concierge, personalized privileges, rewards and service. Complimentary access to over 1000 airport lounges globally for you and a guest. Travel Insurance.

TRAVEL INSURANCE FOR VISA INFINITE CARDHOLDERS - UAE Maximum Benefit Amount / Limit of Liability A. Personal Accident Benefits (Common Carrier) Personal Accident Adult: International Trips: USD 500,000 Domestic Trips: USD 100,000 Children: USD 5,000 Accidental Death 100% of the Benefit Amount

Apply for a Multi Trip Travel Insurance. If you have an Emirates Islamic Credit or Debit Visa Infinite/Signature Card and purchase your air ticket using your card, you are eligible for multi-trip travel insurance. To apply for multi trip insurance and print your insurance certificate, please visit cardholderbenefitsonline.com.

Useful Contacts. Access to International Medical and Travel Assistance and pre-travel advice is available to our cardholders 24/7 from International SOS. They can be contacted on the following numbers: +971 (4) 253 6024 (Arabic, French, English) For any other claim please contact [email protected]. 1.

For customers within the UAE. For customers outside of the UAE. 600 52 5500. +971 2 681 1511. Travel the world with the FAB Infinite Travel Card! Enjoy exceptional travel benefits including exclusive travel discounts & miles transfer to partners. Book your adventure today!

The CBD Visa Infinite Credit Card offers you complimentary airport lounge access worldwide - perfect for starting a trip in style. And for blissful peace of mind, you will get multi-trip Travel Insurance for you and your family. Plus a number of travel discounts just for you. Time to start browsing destinations.

American Home Assurance Company (Dubai Br.) Claims Department The H Hotel - Complex, Trade Centre First, 27th Floor, P.O. Box 40569, Dubai, UAE Tel: +971 - 4 - 5096111 Fax: +971 - 4 - 6014018 Office Timings: 8:00am to 5:00pm, from Sunday to Thursday Languages Supported: English / Arabic [email protected] Definitions:

Travel Insurance: Multi-trip travel insurance with coverage of up to USD 1,000,000. Access 500+ dining and lifestyle offers through CBD Mobile app. To view other lifestyle, dining and travel benefits. Please visit https://ae.visamiddleeast.com.

Hotel/Motel/Burglary Insurance Certificate. Travel Medical Insurance Certificate. Trip Cancellation/Trip Interruption Insurance Certificate. Common Carrier Travel Accident Insurance Certificate. Delayed and Lost Baggage Insurance Certificate. Flight/Trip Delay Insurance Certificate. Auto Rental Collision/Loss Damage Insurance Certificate

ADIB Online Banking - visit simple.adib.ae to view your Card statement and transact on your Card. 24x7 Chat Banking: Chat with us at any time on WhatsApp +971600543216 for a quick and secure way of accessing your account. E-statements: Be eco-friendly and receive your statements via email.

Visa Infinite cardholders can get up to 35% discount on Avis car rental standard rates. And up to 30% off of international leisure rates. ... (in the UAE) or +1 303 967 1096 (internationally). Eligible cards: ... Multi-trip Travel Insurance. Enjoy your travel experience with Multi-trip Travel Insurance.

For your free pre-travel advice, travel or insurance assistance is required please contact International SOS. This service is available 24/7 and provides services in selection of languages. ... Your Visa card may have a Travel Insurance benefit when you purchase travel tickets or make hotel reservations with your card. This benefit may extend ...

Enjoy travel benefits and discounts with Visa's partners including DragonPass Airport dining offers, YQ Meet & Assist, Avis Car Rental, Booking.com and many more*. ... If you used your FAB Rewards Infinite Credit Card to pay for your travel, you are eligible for free Medical and Travel Assistance Insurance for you and your family when ...

Find the best travel insurance credit cards in UAE only at soulwallet.com. Choose from top travel insurance credit cards with exclusive offers, feature, deals & more. Apply online! ... FAB VISA Infinite Credit Cardholders can enjoy 6 Meet & Greet services per annum from AED 40 (individual booking) or AED 100 (family booking). Note: The service ...

With multi-trip travel insurance, you as the cardholder and your family are covered on all trips up to 90 days in duration including COVID-19 starting from December 2020. ... Proof of full payment with your Visa Infinite card is required. Please refer to the terms and conditions for full policy details, including cover, conditions, limits and ...

Baggage delay up to US$ 500. Loss of personal belongings up to US$ 2,500. Covers cardholder, spouse and up to 5 children; age limit of 75 for all. Apply for Emirates NBD Visa Infinite Credit Card online in Dubai & entire UAE that offer a wide range of benefits, joining offers and privileges. Apply Online Now!

UAE CAREEM DISCOUNT. As a VISA Infinite Elite cardholder, get 20% off three Careem rides by VISA. EARN FAB MILES WITH EACH USD 1. - Get 1.5 FAB Miles for each USD 1 spent on retail purchases anywhere. - Get 2 FAB Miles for each USD 1 spent on any travel purchase. FAST, CONVENIENT AND EASY WITH THE FAB TRAVEL PORTAL.

UAE inbound travel insurance by Allianz is tailored for visitors to the UAE. It covers. Medical emergencies up to AED 150,000. Medical evacuation and repatriation. COVID-19 quarantine costs up to AED 200/day for 10 days. Repatriation of remains up to AED 10,000. Emergency dental treatment up to AED 300.

Total. 120. The ultimate in spending power, convenience, personal privileges and unparalleled service - our cardholders deserve only the best. Plus Points. Up to 2 points for every AED 100 spent. Airport Lounge Access. Unlimited access to over 1,000 premium lounges in over 300 cities. Concierge desk.

1. Free Travel Insurance. Both World and World Elite credit cards offer free travel insurance and travel insurance letter. As you may know, travel insurance letter is a mandatory requirement for a few countries (e.g. Schengen visa) while applying for a visa. Platinum credit card does not offer travel insurance. However, Platinum prepaid card does.