- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AAA Travel Insurance Review 2024: Is it Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does AAA travel insurance cover?

Aaa single-trip plans, aaa annual plans, which aaa travel insurance plan is best for me, can you buy aaa travel insurance online, what isn’t covered by aaa travel insurance, aaa travel insurance, recapped.

- You don't need to be an AAA member.

- Annual or single-trip policies are available.

- Can add on a Rental Car Damage protector plan.

- Cheapest option doesn't include medical coverage.

- CFAR upgrade is only available for higher-cost plans.

Before going on a trip, it's important to give travel insurance some serious thought as it can protect you if anything goes wrong on your vacation. One provider to consider is AAA Travel Insurance.

The company’s policies are administered by Allianz Global Assistance, an insurer that serves 40 million customers in the U.S. and operates in 35 countries. You do not have to be a AAA member to purchase AAA travel insurance.

AAA offers annual or single-trip policies for domestic and international travel. The policies vary by state and travel destination, so the plans available in your home area may differ from the examples shown below. Use AAA's Get A Quote tool to see your specific pricing.

» Learn more: The majority of Americans plan to travel in 2022

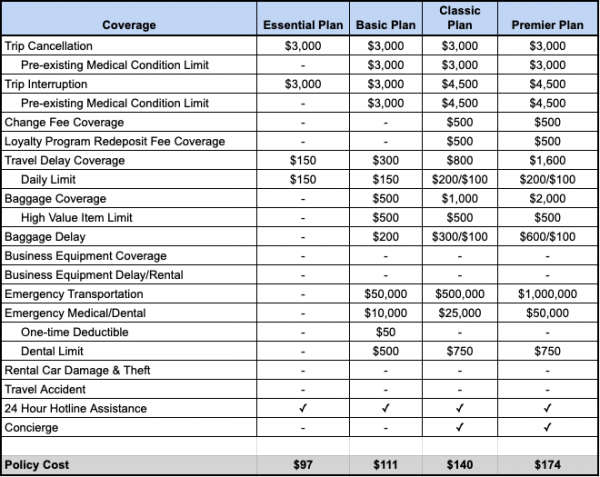

AAA’s single-trip plans are designed for travelers who are leaving their homes, visiting another destination, domestic or international, and returning. To get an idea of which plans are available, we input a sample itinerary of a $3,000, two-week trip to Spain by a 45-year-old from Indiana. For this itinerary, AAA offered four single-trip plans.

* Higher limit requires receipts to be submitted.

AAA single-trip plans cost

The Essential Plan ($97) is ideal for those who just want the basics of trip cancellation and trip interruption insurance and don't need the other protections. This is a good fit for domestic travelers who already have health coverage in the U.S. and don't plan on bringing business equipment.

The Basic Plan ($111) includes all the features of the Essential Plan, along with medical coverage and some increased protections for baggage and travel delays.

The Classic ($140) and Premier Plans ($174) are nearly identical, but the latter provides double emergency medical coverage, emergency transportation, trip delay and baggage delay limits.

The Classic Plan offers a "cancel for any reason" optional upgrade for $71, which would bring the total to $211.

There is also a Rental Car Damage protector plan for $135, which provides $1,000 of trip interruption and baggage loss coverage and $40,000 of rental car damage and theft benefits. This plan will cover your costs if the rental car is stolen or damaged. In addition, you’ll be reimbursed for the unused portion of your trip and if your bags are lost or damaged. This plan offers an alternative to purchasing coverage at the rental counter.

» Learn More: Cancel For Any Reason (CFAR) travel insurance explained

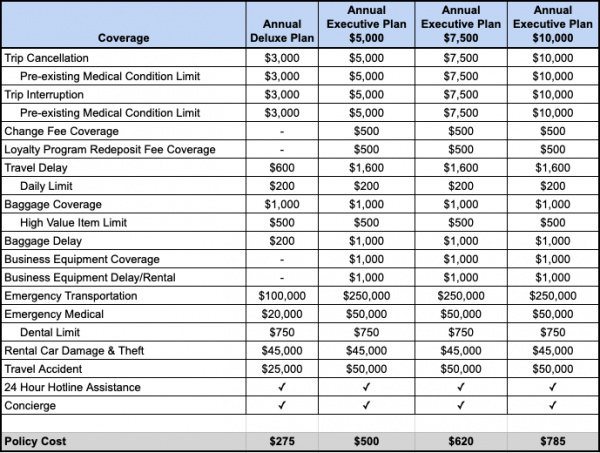

The annual policies provide 365 days of domestic and international coverage and are best suited for those who travel often. To see which plans are available, we input a $15,000 annual travel budget for coverage starting in July 2020 for a 30-year-old from New Hampshire. For this itinerary, AAA is offering four policies, with the three higher-end plans geared toward business travelers.

AAA annual plans cost

The Annual Deluxe Plan ($275) is designed for those who aren’t too concerned with pre-trip cancellation benefits or business equipment protections and are more interested in medical coverage while abroad. If you already have some travel insurance through a credit card, this plan may be sufficient.

The next three Annual Executive Plans ($500-$785) are tiered based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500 or $10,000). All the other protections under the Executive Plans are identical. All three plans include business equipment coverage as well as business equipment rental and delay protections. If you’re traveling for work, these plans may be your best bet.

Although all four of these are annual plans, no individual trip can exceed 45 days. For trips longer than 45 days, Allianz offers an AllTrips Premier plan , which provides coverage for up to 90 days per trip.

» Learn more: What to know before buying travel insurance

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re traveling.

If you have a premium travel card that already provides you with a sufficient level of trip cancellation coverage, you may only need to get a standalone emergency medical policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits. Terms apply. Only the Annual Executive Plan ($10,000) has a comparable level of trip cancellation coverage.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card, then you might be better off with a comprehensive plan like one of the single or annual trip plans, depending on your travel goals.

If you’re a long-term traveler and expect to take many trips, the annual plans will be the most suitable. However, with coverage for each trip capped at 45 days, you’ll want to look at other options if you will be away from home for longer.

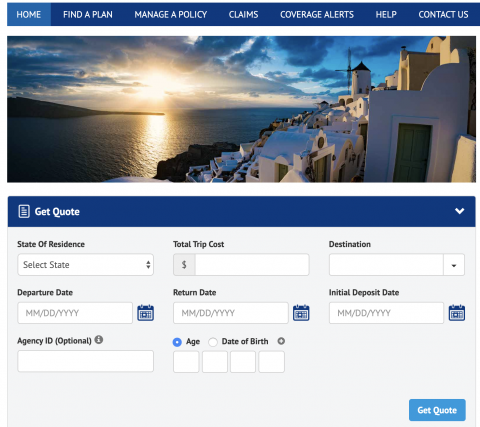

Yes, you can buy AAA Travel Insurance onlince. Head over to Agentmaxonline.com , input your trip details and choose “Get Quote” to see a list of available plans.

Trip insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

» Learn more: Will travel insurance cover winter weather woes?

Yes. However, plan choices depend on your state of residence and trip duration. We performed various searches for sample trips and found policies for single trips and annual trips. Single-trip plans are great for travelers who are traveling from their home to a different destination (domestic or international) and then returning. Coverage ends when the traveler returns home. Annual trip plans are designed for those who want to take several trips during a specific period of time, regardless of how many times they return home during the covered period.

The cost of a travel insurance policy depends on many factors , including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit AAA’s travel insurance site and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if travel insurance is worth it .

The cost of a travel insurance policy

depends on many factors

, including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit

AAA’s travel insurance site

and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if

travel insurance is worth it

AAA was found to be one of the best travel insurance companies according to NerdWallet's most recent analysis.

Before shopping for a policy, check to see what coverage you may already have. Some premium credit cards provide travel insurance. If you hold one of these credit cards and the coverage limits are adequate, you may only need a standalone emergency medical insurance policy . However, if your credit card doesn’t cover you sufficiently, a comprehensive travel insurance plan might be the right choice. AAA offers a few plans to pick from, but the choices boil down to annual or single-trip insurance plans.

No matter what type of traveler you are, AAA offers various trip insurance options to choose from. Rates and options vary by state, so be sure to input your information into the online tool.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

9 Reasons to Purchase TripProtect Travel Insurance through AAA

Updated : March 27, 2024

AAA Travel Editors

Table of contents.

- Life is unpredictable.

- Don’t let sickness stop you.

- Your health insurance has its limits.

- Forgot your medication?

- Lost luggage can leave you in a lurch.

- The plan crumbles.

- Unexpected travel hiccups...

- Your credit card may not cover you.

- Tap into smart travel tools.

- Plan Your Next Trip With AAA

Nobody likes to spend more money, but the truth is that anything can happen when traveling. It’s a good idea to be protected just in case.

Below are some of the most common ways vacations can get sidetracked and how travel insurance can help. Trip delays, interruptions or even cancellations can cause unexpected headaches and expenses, but travel insurance can help make sure you are protected from any adjustments you need to make to overcome these situations. Some plans include cancellation benefits and if you have a covered reason, you can be reimbursed for prepaid nonrefundable expenses — like a covered medical emergency or loss of employment. Allianz Partners, a world leader in travel insurance and assistance services and AAA partner of over 30 years, offers many reasons to protect yourself and your family with travel insurance — helping travelers every year through unanticipated travel delays, bad weather, lost luggage and medical emergencies in foreign countries.

Here are nine reasons why experienced travelers choose Allianz Travel Insurance through AAA:*

1. Life is unpredictable.

Some trips need to be cancelled. With travel insurance, you don’t necessarily have to pay for a trip you are unable to take. Instead, enjoy more confidence knowing you’re a step ahead of unpredictable situations before and during your trip.

2. Don’t let sickness stop you.

From falls to food poisoning, illnesses and injuries can happen anywhere. It’s less scary to be sick or hurt with travel insurance to help you through these troubles with financial benefits and expert assistance services.

3. Your health insurance has its limits.

When you travel outside the U.S., you may be leaving your health insurance at home. Many U.S. plans (including Medicare and Medicaid) don’t cover international travel. Why risk it when a medical evacuation can cost $50,000+?

4. Forgot your medication?

Lost or forgotten medication can set off an alarm when you’re far from home. Let travel assistance help you locate a pharmacy to purchase a replacement. It’s always nerve-wracking when something goes wrong. But when you’re in a foreign country, you don’t want to face any kind of crisis alone.

5. Lost luggage can leave you in a lurch.

Allianz Travel Insurance provides benefits that can help you replace needed items if your bags are delayed, damaged or stolen while you’re traveling. With reimbursement for your trip essentials, you can still suit up for wherever your journey takes you next.

6. The plan crumbles.

If a travel supplier ceases operations, you may not get a refund for the money you fronted for a cruise, flight or tour. Allianz Travel Insurance offers protection in case of covered travel supplier default, so you’re less likely to pay for an experience that’s no longer possible.

7. Unexpected travel hiccups...

Flight delays can add up. Beyond being annoying, prolonged delays can cause you to accrue expenses while you wait—or worse, miss a connection. With travel insurance, a covered travel delay can mean reimbursement for rebooking fees, meals and accommodations.

8. Your credit card may not cover you.

Some travelers opt out of travel insurance, thinking credit card coverage would suffice in a crunch. Truth is, even if you have this free coverage benefit, it won’t likely be as extensive as a separate travel insurance plan.

9. Tap into smart travel tools.

Allianz Partners’ TravelSmart mobile app has recently been updated and rebranded as the Allyz® TravelSmart Mobile App . The Allyz® TravelSmart app has the same great functionality with a new look and FAQ section.

Note, there is no change to the Allianz in-app assistance services embedded in AAA Mobile.

Plan Your Next Trip With AAA

Join the over a million people who are AAA members and start planning your dream vacation today. Dream up the perfect trip with our Trip Canvas research tool and use your membership to get the best discounts on hotels , rental cars and entertainment tickets.

_____________________________________________________________

*Terms, Conditions, and exclusions apply to all plans. Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance (AGA) or its affiliates. AGA compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company.Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected].

More Articles

Travel like an expert with aaa and trip canvas, get ideas from the pros.

As one of the largest travel agencies in North America, we have a wealth of recommendations to share! Browse our articles and videos for inspiration, or dive right in with preplanned AAA Road Trips, cruises and vacation tours.

Build and Research Your Options

Save and organize every aspect of your trip including cruises, hotels, activities, transportation and more. Book hotels confidently using our AAA Diamond Designations and verified reviews.

Book Everything in One Place

From cruises to day tours, buy all parts of your vacation in one transaction, or work with our nationwide network of AAA Travel Agents to secure the trip of your dreams!

Join AAA today Membership gives you access to Roadside Assistance, Deals, Discounts, and more.

- Add Members

- Gift Membership

- Member Benefits Guide

- The Extra Mile

- Renew Expires in 28 days

AAA Visa Signature® Credit Cards

Earn a $100 Statement Credit

After spending $1,000 on your card within 90 days of account opening.

- Advice back All Advice Travel Auto Money Home Life

- Destinations back All Destinations Northeast States Southeast States Central States Western States Mid-Atlantic States National Parks Road Trips International Travel Inspiration

- Connect back All Connect Community Stories Authors & Ambassadors

- Guides back All Guides Doing Your Taxes Protecting Your Valuables Winter Driving Buying and Selling a Car Buying and Selling a Home Getting Organized Home Improvement Improve Your Finances Maintaining Your Car Saving Money Staying Healthy Traveling

- Series back All Series AAA World Member News AAA's Take KeeKee's Corner AAA Traveler Worldwise Foodie Finds Good Question Minute Escapes Car Reviews

HOW A SIMPLE TRAVEL INSURANCE POLICY MADE A HUGE IMPACT ON HER LIFE

By tony adubato | june 14, 2021 | 5 min read.

Kim Wiesmann is an avid business traveler. Throughout her career, she’s visited a number countries and is accustomed to traveling internationally. But on her last business trip to Hungary, she experienced a fall that would change her life.

“I fell down a flight of stairs. I felt like I had broken my leg or my hip,” says Wiesmann.

She was immediately taken to a local hospital for X-rays.

“It was immediately determined that I had a cancerous tumor in my hip which caused it to break,” says Wiesmann.

Medical professionals knew she needed to get home to the US as soon as possible. Out of pocket, medical transportation would have cost upwards of $50,000. But thanks to Wiesmann’s travel insurance policy, it cost only a fraction.

“It covered trip cancellation, trip interruption, medical and dental, and emergency evacuation, which was covered up to one million dollars, as well as baggage loss and baggage delay,” says Wiesmann.

Wiesmann faced challenges trying to leave Hungary to return to Ohio to seek medical care. As is the case in most foreign countries, hospital bills need to be paid before a patient is allowed to be discharged. For American travelers in this situation, it can create a big, expensive problem – especially if they’re traveling alone.

“Since my husband wasn’t with me, [the travel insurance agency] worked with him back here in the United States to get all the paperwork in and to make sure the hospital was paid,” says Wiesmann.

The agency also coordinated Wiesmann’s medical flight from Budapest, Hungary, to Cincinnati, Ohio, and arranged an emergency nurse to accompany her.

“You just never know what’s going to happen,” says AAA Travel agent Courtney Parsons. “My job as a travel agent is to protect my client’s investment and their best interest because virtually so much of travel is non-refundable and non-changeable.”

But who needs travel insurance? Many travelers gamble and assume a travel insurance policy is something they'll never have to cash in on. Parsons begs to differ.

“I would say that travel insurance is absolutely recommended for both international and domestic travel. Especially international, where you’re further away from home,” says Parsons. "You may need to have that emergency evacuation or any of that kind of assisted health insurance while traveling abroad. God forbid something should happen, and you need to get home."

According to Parsons, there several different types of travel insurance, with many offered by airlines or tour operators. Policies from travel agencies like AAA can offer a broader range of protection, including 'cancel for any reason' options.

"For example, I had a client once that was in Jamaica, and a hurricane was coming through," says Parsons. "It wasn't supposed to hit Jamaica but was going to hit Florida, which is where their flight was connecting through. So they ended up having to stay in Jamaica three extra days, and the trip interruption [coverage] covered the cost of those nights.”

Parsons adds that the relatively inexpensive cost of travel insurance is worth it to protect a travel investment.

“Costs are based on the total trip cost and your age at the time of travel,” says Parsons. “What gives you the best peace of mind when traveling so you can just go and have fun and enjoy and not have anything to worry about?”

As for Wiesmann, travel insurance is something she also recommends to every traveler.

“Insurance provides peace of mind,” says Wiesmann. “Why ruin your vacation over not having travel insurance? You’re worth it.”

- facebook share

- link share Copy tooltiptextCopy1

- link share Copy tooltiptextCopy2

AAA Traveler Worldwise

4 US National Parks Accessible to Those with Disabilities

Exploring Portugal’s Douro Valley on a Uniworld Boutique River Cruise

Discover The Great Lakes In Luxury WIth Viking River Cruises

Related articles.

The Perks Of Guided Vacations

What To Expect At America’s National Parks This Year

Serve up some cool magic at home.

Limited Time Offer!

Please wait....

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Cheapest travel insurance of April 2024

Mandy Sleight

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:52 a.m. UTC April 11, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best cheap travel insurance company of 2024 based on our in-depth analysis of the cheapest travel insurance plans. Its Atlas Journey Preferred and Atlas Journey Premier plans offer affordable travel insurance with high limits for emergency medical and evacuation benefits bundled with good coverage for trip delays, travel inconvenience and missed connections.

Cheapest travel insurance of 2024

Why trust our travel insurance experts

Our team of travel insurance experts analyzes hundreds of insurance products and thousands of data points to help you find the best travel insurance for your next trip. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Best cheap travel insurance

Top-scoring plans

Average cost, medical limit per person, medical evacuation limit per person, why it’s the best.

WorldTrips tops our rating of the cheapest travel insurance with two plans:

- Atlas Journey Preferred is the cheaper travel insurance plan of the two, with $100,000 per person in emergency medical benefits as secondary coverage and an optional upgrade to primary coverage. It’s also our pick for the best travel insurance for cruises .

- Atlas Journey Premier costs a little more but gives you $150,000 in travel medical insurance with primary coverage . This is a good option if health insurance for international travel is a priority.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier offers $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan offers travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Cheap travel insurance for cruises

Travel insured.

Top-scoring plan

Travel Insured offers cheap travel insurance for cruises and its Worldwide Trip Protector plan gets 4 stars in our rating of the best cruise travel insurance .

- Worldwide Trip Protector offers $1 million in emergency evacuation coverage per person and a rare $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits, which means you won’t have to file medical claims with your health insurance first.

- Cheap trip insurance for cruises.

- Offers a rare $150,000 for non-medical evacuation.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person only available for cruises and tours.

Best cheap travel insurance for families

Travelex has the best cheap travel insurance for families because kids age 17 are covered by your policy for free when they’re traveling with you.

- Free coverage for children 17 and under on the same policy.

- $2,000 travel delay coverage per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Only $50,000 per person emergency medical coverage.

- Baggage delay coverage is only $200 and requires a 12-hour delay.

Best cheap travel insurance for seniors

Evacuation limit per person

Nationwide has the best cheap travel insurance for seniors — its Prime plan gets 4 stars in our best senior travel insurance rating. However, Nationwide’s Cruise Choice plan ranks higher in our best cheap travel insurance rating.

- Cruise Choice has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion. It also has a missed connections benefit of $1,500 per person after only a 3-hour delay, for cruises or tours. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Coverage for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” (CFAR) upgrade available.

- Missed connection coverage of $1,500 per person is only for tours and cruises, after a 3-hour delay.

Best cheap travel insurance for add-on options

AIG offers the best cheap travel insurance for add-on options because the Travel Guard Preferred plan allows you to customize your policy with a host of optional upgrades.

- Travel Guard Preferred upgrades include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings. There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million.

- Bundle upgrades allow you to customize your affordable travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best cheap travel insurance for missed connections

TravelSafe has the best cheap travel insurance for missed connections because coverage is not limited to cruises and tours, as it is with many policies.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of the best cheap travel insurance plans.

- No “interruption for any reason” coverage available.

- Weak baggage delay coverage of $250 per person after 12 hours.

Cheapest travel insurance comparison

How much does the cheapest travel insurance cost?

The cheapest travel insurance in our rating is $334. This is for a WorldTrips Atlas Journey Preferred travel insurance plan, based on the average of seven quotes for travelers of various ages to international destinations with a range of trip values.

Factors that determine travel insurance cost

There are several factors that determine the cost of travel insurance, including:

- Age and number of travelers being insured.

- Trip length.

- Total trip cost.

- The travel insurance plan you choose.

- The travel insurance company.

- Any add-ons, features or upgraded benefits you include in the travel insurance plan.

Expert tip: “In general, travelers can expect to pay anywhere from 4% to 10% of their total prepaid, non-refundable trip costs,” said Suzanne Morrow, CEO of InsureMyTrip.

Is buying the cheapest travel insurance a good idea?

Choosing cheaper travel insurance without paying attention to what a plan covers and excludes could leave you underinsured for your trip. Comparing travel insurance plans side-by-side can help ensure you get enough coverage to protect yourself financially in an emergency for the best price.

For example, compare these two Travelex travel insurance plans:

- Travel Basic is cheaper but it only provides up to $15,000 for emergency medical expense coverage. You’ll also have to pay extra for coverage for children.

- Travel Select will cost you a bit more but it covers up to $50,000 in medical expenses and includes coverage for kids aged 17 and younger traveling with you. It also offers upgrades such additional medical coverage, “cancel for any reason” (CFAR) coverage and an adventure sports rider that may be a good fit for your trip.

Reasons to consider paying more for travel insurance

Make sure you understand what you’re giving up if you buy the cheapest travel insurance. Here are a few reasons you may consider paying a little extra for better coverage.

- Emergency medical. The best travel medical insurance offers primary coverage for emergency medical benefits. Travel insurance with primary coverage can cost more than secondary coverage but will save you from having to file a claim with your health insurance company before filing a travel insurance claim.

- Emergency evacuation. If you’re traveling to a remote location or planning a boat excursion on your trip, look at travel insurance with a high medical evacuation insurance limit. If you are injured while traveling, transportation to the nearest adequate medical facility could cost in the tens to hundreds of thousands. It may make sense to pay more for travel insurance with robust emergency evacuation coverage.

- Flexibility. To maximize your trip flexibility, you might consider upgrading your travel insurance to “ cancel for any reason” (CFAR) coverage . This will increase the cost of your travel insurance but allow you to cancel your trip for any reason — not just those listed in your policy. The catch is that you’ll need to cancel at least 48 hours before your trip and will only be reimbursed 50% or 75% of your trip expenses, depending on the plan.

- Upgrades. Many travel insurance plans have optional extras like car rental collision and adventure sports (which may otherwise be excluded from coverage). These will cost you extra but may give you the coverage you need.

How to find the cheapest travel insurance

The best way to find the cheapest travel insurance is to determine what you’re looking for in a travel insurance policy and compare plans that meet your needs.

“Travel insurance isn’t one-size-fits-all. Every trip is different, and every traveler has different needs, wants and concerns. This is why comparison is key,” said Morrow.

Consider the following factors when comparing cheap travel insurance plans.

- How often you’re traveling. A single-trip policy may be the most cost-effective if you’re only going on a single trip this year. But a multi-trip travel insurance plan may be cheaper if you’re going on multiple international trips throughout the year. Annual travel insurance policies cover you for a whole year as long as each trip doesn’t exceed a certain number of days, usually 30 to 90 days.

- Credit card has travel insurance benefits. The best credit cards offer perks and benefits, and many offer travel insurance-specific benefits. The coverage types and benefit limits can vary, and you must put the entire trip cost on the credit card to use the coverage. If your trip costs more than the coverage limit on your card, you can supplement the rest with a cheaper travel insurance plan.

- The coverage you need. When looking for the best travel insurance option at the most affordable price, only buy extras and upgrades you really need. A basic plan may only provide up to $500 in baggage insurance, but if you only plan to take $300 worth of clothes and accessories, you don’t need to pay more for higher coverage limits.

Is cheap travel insurance worth it?

Cheap travel insurance can be worth it, as long as you understand the plan limitations and exclusions. Taking the time to read your policy, especially the fine print, well before your trip can ensure there won’t be any surprises about what’s covered once your journey begins.

“If a traveler is looking for coverage for travel delays, cancellations, interruptions, medical and baggage — a comprehensive travel insurance policy will provide the most bang for their buck,” said Morrow. But if you’re on a tight budget and are only worried about emergency medical care and evacuation coverage while traveling abroad, stand-alone options are cheaper.

Before buying travel insurance, you should also consider what your health insurance will cover.

“Most domestic health insurance plans, including Medicare, will not cover medical bills abroad,” said Morrow. Even if you’re staying stateside, you may find value in an affordable travel insurance plan with medical coverage if you have a high-deductible health plan (HDHP).

A cheap travel insurance plan is better than none at all if you end up in a situation that would have covered some or all of your prepaid, nonrefundable trip expenses.

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance . From those top-scoring travel insurance plans, we chose the most affordable for our rating of the cheapest travel insurance.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Cheapest travel insurance FAQs

When buying travel insurance, cheapest is not always the best. The most affordable travel insurance plans typically offer fewer coverages with lower policy limits and few or no optional upgrades. Add up your total nonrefundable trip costs and compare travel insurance plans and available features that cover your travel expenses. This strategy can help you find the cheapest travel insurance policy that best protects you from financial loss if an unforeseen circumstance arises.

Get the coverage you need: Best travel insurance of 2024

According to our analysis, WorldTrips , Travel Insured International and Travelex offer the best cheap travel insurance. Policy coverage types and limits can vary by each travel insurance provider, so the best way to get the cheapest travel insurance plan is to compare several policies and companies to find the right fit for your budget.

A good rate for travel insurance depends on your budget and coverage needs. The most comprehensive travel insurance plan is usually not the cheapest. But cheap trip insurance may not have enough coverage or the types of coverage you want. Comparing different levels of coverage and how much they cost can help you find the best cheap insurance for travel.

The average cost of travel insurance is between 5% to 6% of your total travel expenses for one trip, according to our analysis of rates. However, you may find cheaper travel insurance if you opt for a plan with fewer benefits or lower coverage limits. How much you pay for travel insurance will also depend on the number of travelers covered, their ages, the length of the trip and any upgrades you add to your plan.

Travel insurance covers nonrefundable, prepaid trip costs — up to the policy coverage limits — when your trip is interrupted or canceled for a covered reason outlined in your plan documents. Even the cheapest travel insurance policies usually provide coverage for:

- Medical emergencies.

- Trip delays.

- Trip interruption.

- Trip cancellation.

- Lost, stolen or damaged luggage.

However, if you’re looking to save on travel insurance, you can shop for a policy that only has travel medical insurance and does not include benefits for trip cancellation .

Even when you buy cheap travel insurance, you can often use upgrade options to customize your policy to meet your specific needs.

Some common travel insurance add-ons you may want to consider include:

- Rental car damage coverage.

- Medical bundle.

- Security bundle.

- Accidental death and dismemberment coverage.

- Adventure sports bundle.

- Pet bundle.

- Wedding bundle.

- “Cancel for work reasons” coverage.

- “Interruption for any reason” (IFAR) coverage.

- “Cancel for any reason” (CFAR) coverage .

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

Travel Insurance Jennifer Simonson

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travel Insurance Mandy Sleight

Travelex travel insurance review 2024

Best travel insurance companies of April 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

Survey: Nearly 85% of Americans avoid family over the holidays

Travel Insurance Kara McGinley

I'm a financial planner, and I'd recommend annual travel insurance to anyone who loves to travel abroad

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Frequent and spontaneous travelers will likely benefit from annual travel insurance policies.

- Your credit card may come with some travel protections, but it may not be enough.

- When choosing a policy, look at what it covers, not just what's cheapest.

Summer is just a few months away — and if you're planning a vacation this year, the last thing you want is an unexpected event to derail your plans (and cost you hundreds).

Flights get delayed or canceled constantly. Luggage disappears into the ether. Medical emergencies occur in remote destinations. Yet many jetsetters simply cross their fingers and hope for the best rather than prepare for the worst.

That's why, as a financial planner, I believe it's crucial to consider protecting your trips with the right insurance coverage. One option often overlooked, particularly by frequent travelers, is annual travel insurance .

Annual travel insurance covers all your trips within 365 days. Unlike stand-alone travel insurance, which only covers you for a specific trip, an annual policy covers any trips you take within the year.

That's why I tell clients who travel frequently that an annual policy is a good choice for their needs. By opting for an annual plan, you don't have to go through the hassle of booking multiple policies and potentially save money compared to purchasing individual trip coverage. Here's how it works.

What to look for in a policy

While specifics may vary depending on the insurer and plan tier, most include the following key benefits:

- Trip cancellations or interruptions: You may be able to get reimbursed for expenses (even nonrefundable ones!) related to an illness, injury, or natural disaster that forced you to cancel or cut your trip short.

- Emergency medical and dental care: If you fall ill or get injured while traveling, your insurance can help cover the cost of medical treatment.

- Emergency evacuation: In a serious medical emergency or security situation, your policy will arrange and pay for transportation to a hospital or back to your home country.

- Lost, delayed, or damaged baggage: If your luggage is lost, delayed, or damaged during your trip, you can get financial coverage for essential items while you wait for your stuff to be recovered or replaced.

- Trip delays and missed connections: When your travel plans are disrupted due to issues like mechanical problems or severe weather, you may get reimbursement for additional expenses incurred, like meals, lodging, and transportation.

It's important to note that annual travel insurance plans have limitations. Certain high-risk activities, pre-existing medical conditions, and travel to specific regions may be restricted or require additional coverage.

Some travelers may assume that their credit card's built-in travel protections are enough. While many travel rewards credit cards offer perks like rental car insurance, trip cancellation, and baggage reimbursement, the coverage limits are often much lower than a dedicated annual travel insurance plan.

Credit card coverage for emergency medical care is also particularly limited — capped at a few thousand dollars — which may not be enough in the face of a major international medical emergency.

How much travel justifies an annual plan?

For the occasional traveler who takes one or two trips a year, single-trip policies will probably work for you. But if you fall into any of these buckets, you may want to consider an annual policy:

- Regular international travelers (three or more trips abroad yearly)

- Road warriors frequently away for work

- Adventurers engaging in high-risk activities like heli-skiing, scuba diving, or mountain climbing

- Cruisers and tour group travelers

- Students or retirees taking extended trips throughout the year

- Those visiting developing countries with limited medical care

Annual plans cover all of your trips within a 365-day period after purchasing. They're basically a bundle of multiple policies into one package deal. This means you only have to buy one policy to manage, locking in your coverage for the year.

How to decide if an annual policy makes sense for you

Start by reviewing your travel plans this year — and your risk tolerance. Calculate how much buying individual travel insurance policies would cost you over the next year and compare it to the price of an annual plan.

Don't just focus on the premium — carefully evaluate coverage limits, exclusions, and deductibles to ensure you have enough protection for your needs.

An annual policy gives you the flexibility to take spontaneous trips without the hassle of obtaining last-minute insurance. More importantly, it provides peace of mind, knowing that you're covered for a wide range of travel disruptions and emergencies.

As the busy summer travel season ramps up, definitely explore protecting your trips with insurance, especially if you're jetting off internationally. Spending hours on the phone trying to rebook canceled flights or worrying about affording an overseas medical emergency is no way to vacation.

- Main content

Saratov History, Russia

Saratov is one of the oldest cities of Russia. It was established in the second half of the 16th century (precisely in 1590) along with other cities in Volga Region like Kazan and Volgograd, as part of Tsar Feodor Ivanovich’s policy of creating a centralized Russian state. But then, a long pre-history precedes Saratov history – a prehistoric connection woven through legends and corroborated by scientific evidences. Researchers have indicated that Saratov happens to be a part of the region (the Eurasian Steppes) where people took the initial steps of domesticating horses. Again Saratov, according to one legend, was the site of the legendary city of the pre-Christian era, Gelonus. Of course, there is no need to look that far – the 13th century Golden/Great Horde city of Ukek or Uvek was Saratov’s immediate-predecessor.

Saratov History: Establishment of the City to the end of 18th Century

Saratov was founded as a Russian military post. A lot of pre-planning went into setting up the whole town – buildings, mostly wooden-structures that would later be part of the town, were assembled a year in advance in a different location. When all the structures were ready, they were disassembled and transported to the actual-site to be re-assembled. This speeded up the whole process and the town was ready in a few weeks’ time. The construction of Saratov Fortress began in July 1590 and it was completed the same year. The fortress was destroyed twice in the course of the next century (first in 1616 and again in 1674) and the whole town had to be shifted.

Saratov ceased to be a military post in 1718 and this marked a new beginning in Saratov history . The town saw influx of people in huge numbers, resulting in population-growth and expansion of the boundaries. Salt production had become the chief occupation of the people and when the town became an important Salt Administration center in 1747, its importance as a trading center increased.

The last decade of the 18th century saw Saratov making remarkable progress as the provincial capital of the Saratov Province – the city not only prospered agriculturally, it also gained reputation as an industrial and trading center.

Saratov History: 19th Century Onwards

The 19th century ushered Saratov into an era of growth and development – the city became an important shipping port, it got its first railroad link and also a number of key industries. With the growing importance of Saratov, it essentially became a cosmopolitan city that boasted a rich culture.

The 20th century was far more eventful. Saratov got its first university in 1909 and by 1916 the city had at least 5 institutes where people could pursue higher studies. Year 1917 marked the beginning of the Soviet-era (that lasted till 1991). Saratov prospered immensely in this period. One of the biggest achievements of Soviet-era Saratov was the completion of the 2.8 km road-bridge spanning the Volga in 1965. Saratov’s present-significance as a cultural and scientific center owes much to the Soviet-period.

Things about Saratov you may be interested in

Read our members' reviews about saratov, read our members' travel tips about saratov, saratov city ratings.

- Rating 67% City Rank 249

- History & Culture: rated for 100%

- Night Life & Entertainment: rated for 40%

- Family & Fun: rated for 60%

- Outdoors Activities: rated for 60%

- Food: rated for 80%

- Sightseeing: rated for 80%

- Shopping: rated for 30%

- Public Transportation: rated for 100%

- Must visit this place: rated for 60%

Popular destinations

popular flights | destination reviews | about us | advertising | partners | affiliates | FAQ | privacy | terms of service | travel insurance | frequent flyer

- travelgrove.com

- travelgrove.it

- travelgrove.co.uk

- travelgrove.es

- travelgrove.de

- travelgrove.fr

Travelgrove news what's happening on travelgrove Questions about how to use Travelgrove read our F.A.Q. for help Tell us your opinion help travelgrove improve

Saratov State Medical University

About University

Saratov State Medical University is an established and prestigious government-funded institution that has been providing medical education to international students at an affordable cost for over a century Saratov city in Russia houses the University, which boasts a long and storied past tracing back to its establishment in 1909 by Professor Vassily Razumovsky. It is recognized globally and enlists in the World Directory of Medical Schools, making its degree holders eligible to practice medicine anywhere in the world upon passing the Foreign Medical Graduates Examination (FMGE) of the country they wish to practice in.

The University follows the classical system of teaching medicine, which involves comprehensive theoretical lectures and practical training in various clinical departments. The MBBS course duration is six years. Since its inception, the University has enrolled over 500 international students each year, with more than 1,500 currently studying medicine at Saratov State Medical University from all parts of the world.

Check Your Eligibility

The University’s first batch of 93 male students started in 1909, and the first international batch was enrolled in 1991, with many Indian medical aspirants. Saratov State Medical University has made a name for itself by providing high-quality medical education, and its graduates are respected in the medical industry worldwide. The University has been recognized by various medical council bodies, including the Medical Council of India (MCI), as one of the top institutions for medical education.

Saratov State Medical University’s facilities are modern and equipped with the latest technology. The University has become a center of education, science, and culture in the region. Students can take advantage of various student organizations and participate in extracurricular activities to enhance their skills and gain practical experience.

Affiliation and Recognition of Saratov State Medical University

Medical council of india (mci).

The responsibility of setting and upholding elevated levels of medical education in India falls under the jurisdiction of the Medical Council of India, which is a legally mandated organization.Saratov State Medical University is recognized by the MCI, which means that Indian students who study at the university are eligible to appear for the Foreign Medical Graduates Examination (FMGE) and practice medicine in India after passing the examination.

World Health Organization (WHO)

The responsibility for international public health falls under the jurisdiction of the World Health Organization, which is a specialized agency of the United Nations.Saratov State Medical University has been recognized by the WHO, which means that the university’s medical programs are recognized globally and meet the international standards of medical education.

International Directory of Medical Education (IMED)

The International Directory of Medical Education is a comprehensive database of worldwide medical schools that have been recognized by the Educational Commission for Foreign Medical Graduates (ECFMG). Saratov State Medical University is listed in the IMED, which means that its medical programs meet the international standards of medical education and are recognized by the ECFMG.

United States Department of Education

The United States Department of Education is a federal department that is responsible for promoting educational excellence and ensuring equal access to education. Saratov State Medical University is recognized by the department, which means that its medical programs meet the US standards of medical education and are recognized by US medical schools.

General Medical Council of Great Britain

The General Medical Council of Great Britain is a regulatory body responsible for ensuring high standards of medical education and practice in the UK. Saratov State Medical University is recognized by the council, which means that its medical programs meet the UK standards of medical education and its graduates are eligible to practice medicine in the UK after passing the relevant examination.

Why Study MBBS in Saratov State Medical University for Indian Students?

- Accreditation SSMU is recognized by both the Medical Council of India (MCI) and the World Health Organization (WHO). This means that Indian students who graduate from SSMU can return to India and practice medicine after passing the MCI screening test. The WHO recognition also means that SSMU graduates are eligible to practice medicine in many countries around the world.

- Duration of MBBS course The MBBS course at SSMU lasts for six years, which is the standard duration for MBBS courses in Russia. This is in contrast to some other countries where the MBBS course may take longer to complete. The six-year duration ensures that students receive a comprehensive education in all aspects of medicine.

- English language instruction The language of instruction for all foreign students at SSMU is English. This is beneficial for Indian students who may not be fluent in Russian. English language instruction ensures that students can fully understand and engage with the course material.

- Internship The internship at SSMU lasts for one year. During this time, students have the opportunity to gain practical experience in a clinical setting. The internship is an important part of the MBBS course as it allows students to apply their theoretical knowledge to real-life situations.

- Affordability The cost of studying MBBS at SSMU is relatively affordable compared to other countries. The tuition fees and living expenses are lower in Russia than in countries such as the United States or the United Kingdom. This makes studying MBBS at SSMU a cost-effective option for Indian students.

- Quality of education SSMU has a reputation for providing high-quality medical education. The university has modern facilities and experienced faculty members who are experts in their respective fields.

- International student community SSMU has a large international student community, with students from around the world studying at the university. This provides Indian students with the opportunity to interact with students from different cultures and backgrounds. It also allows for the exchange of ideas and perspectives, which can enhance the learning experience.

- Cultural experience Studying MBBS at SSMU provides Indian students with the opportunity to experience Russian culture. Russia has a rich history and culture, and studying in the country can be a rewarding cultural experience. Students can also learn the Russian language, which can be useful in their future careers.

- Career opportunities Graduating from SSMU can open up a range of career opportunities for Indian students. They can return to India and practice medicine after passing the MCI screening test. They can also work in other countries that recognize SSMU qualifications. Furthermore, studying medicine in a foreign country can provide students with a unique perspective on healthcare, which can be valuable in their future careers.

Saratov State Medical University Overview

Saratov State Medical University (SSMU) is a premier medical institution located in the city of Saratov, Russia. Established in 1909, it has a rich history of over a century and is one of the oldest and most prestigious medical universities in Russia. The university is recognized by the World Health Organization (WHO), the Medical Council of India (MCI), and the European Union.

The university offers a wide range of undergraduate and postgraduate programs in medicine, dentistry, nursing, and pharmacy. The medium of instruction is Russian, and the university also provides preparatory courses for international students to help them learn the language and adapt to the Russian educational system.

The faculty at SSMU consists of highly qualified and experienced professors, who are experts in their respective fields. The university has a strong emphasis on research, and students are encouraged to participate in various research projects and conferences. The university has collaborations with several international institutions and has exchange programs with universities in Germany, Italy, Spain, France, and other countries.

SSMU has state-of-the-art infrastructure, which includes modern classrooms, well-equipped laboratories, and a well-stocked library. The university also has a medical center, which provides healthcare services to the local community and serves as a training ground for medical students.

The university has a vibrant campus life, with several student organizations and clubs catering to diverse interests. The university has a sports complex, which includes facilities for basketball, volleyball, tennis, and other sports. The university also organizes cultural events and festivals throughout the year, providing students with a rich cultural experience.

SSMU has a strong commitment to social responsibility and actively participates in several community service projects. The university runs a program to provide medical aid to orphanages and nursing homes, and students are encouraged to participate in these initiatives.

The university provides several scholarships and financial aid programs to deserving students, both domestic and international. The tuition fees at SSMU are affordable, and the cost of living in Saratov is lower compared to other major cities in Russia.

The city of Saratov is located on the banks of the Volga River and has a rich cultural and historical heritage. It is known for its architecture, museums, and art galleries. The city is well-connected with other major cities in Russia, and the international airport offers direct flights to several destinations in Europe and Asia.

Advantages of Studying MBBS in Saratov State Medical University for Indian Students

- Conducive Environment : Saratov State Medical University provides a lively and vibrant environment that is conducive to learning. The university aims to promote the overall development of every student and organizes various cultural, sports, and personality development programs, such as student exchange programs, conferences, debates, and other events.

- Student Center : The university has a student center where local and international students can come together to foster new friendships. This helps create a sense of community and belonging among students, especially for those who are studying abroad and may feel homesick.

- Festivals and Celebrations : The University celebrates all major Indian national festivals inside the hostel and university premises to help students feel at home. This ensures that students do not miss out on the feeling of home while studying abroad.

- Comfortable Accommodation : Saratov State Medical University provides cozy and comfortable accommodations to all international students. The rooms are allocated on a twin-sharing basis, with students of the same gender sharing a room. The hostel provides essential amenities in all of its rooms to ensure comfortable living, as well as laundry facilities and a central heating and cooling system.

- Self-Cooking Option : There is a kitchen available on every floor, giving students the option to self-cook. This is especially beneficial for students who prefer home-cooked meals or have dietary restrictions.

- Security : Parents do not have to worry about the security of their children as the hostel premises are under CCTV surveillance. Moreover, the girls’ hostel is under the supervision of female wardens, ensuring the safety and security of all female students.

- High-Quality Education : Saratov State Medical University is one of the top medical universities in Russia, providing high-quality education to its students. The university has state-of-the-art facilities, experienced faculty, and a comprehensive curriculum that prepares students for a successful career in medicine.

- Affordable Fees : Studying MBBS in Saratov State Medical University is affordable for Indian students, making it an excellent choice for those who are looking for high-quality education at an affordable cost.

- Recognition and Accreditation : The University is recognized by the Medical Council of India (MCI) and is also listed in the World Directory of Medical Schools (WDOMS). This ensures that Indian students who graduate from Saratov State Medical University are eligible to practice medicine in India and other countries.

- Opportunities for Clinical Experience : Saratov State Medical University provides ample opportunities for clinical experience to its students. The university has tie-ups with leading hospitals and clinics in Russia, providing students with hands-on experience in real-life medical scenarios.

Duration of MBBS in Saratov State Medical University

The university offers a six-year MBBS program, which is divided into two parts: pre-clinical and clinical. During the first two years, students learn fundamental concepts in medical sciences such as anatomy, biochemistry, physiology, and microbiology. The remaining four years focus on clinical training, where students are trained to diagnose and treat patients.

The university has a well-structured curriculum that emphasizes practical training, including hospital visits, clinical rotations, and internships. The program is designed to provide students with a comprehensive understanding of medical science and prepare them for successful careers as medical professionals.

Fee Structure for MBBS in Saratov State Medical University for Indian Students

As shown in the table, the tuition fee for each year of MBBS in Saratov State Medical University for Indian students is 275,000 Ruble. It is important to note that this fee structure may be subject to change and does not include other expenses such as accommodation, food, and travel. Students are advised to check with the University for the most up-to-date fee structure and to budget accordingly for all associated costs.

Global Ranking of Saratov State Medical University

Saratov State Medical University is ranked 130th in its country and 3873rd in the world. The university is located in Saratov, Russia and offers a variety of medical programs including general medicine, pediatrics, dentistry, and pharmacy. The university is known for its modern facilities and high-quality education.

The country ranking for Saratov State Medical University indicates that it is one of the top 130 medical universities in Russia. The world ranking, on the other hand, shows that it is among the top 4,000 universities worldwide.

Eligibility Criteria for MBBS in Saratov State Medical University for Indian Students

- NEET Exam Clearance Indian students must have cleared the National Eligibility cum Entrance Test (NEET) to be eligible for admission into Saratov State Medical University. NEET is a mandatory qualifying exam for students seeking to pursue medical studies in India or abroad.

- Age Requirement The student must be at least 17 years of age on 31st December of the year in which they are seeking admission to Saratov State Medical University. This is a common requirement for many medical universities in Russia and other countries.

- Minimum Academic Qualification Indian students must have completed their class 12th with a minimum of 50% marks from a regular board. This academic qualification is essential for admission to any undergraduate course, including MBBS.

- Subject Requirements Indian students must have studied Physics, Chemistry, and Biology in their 12th standard. These three subjects are mandatory for students seeking to pursue MBBS studies at Saratov State Medical University.

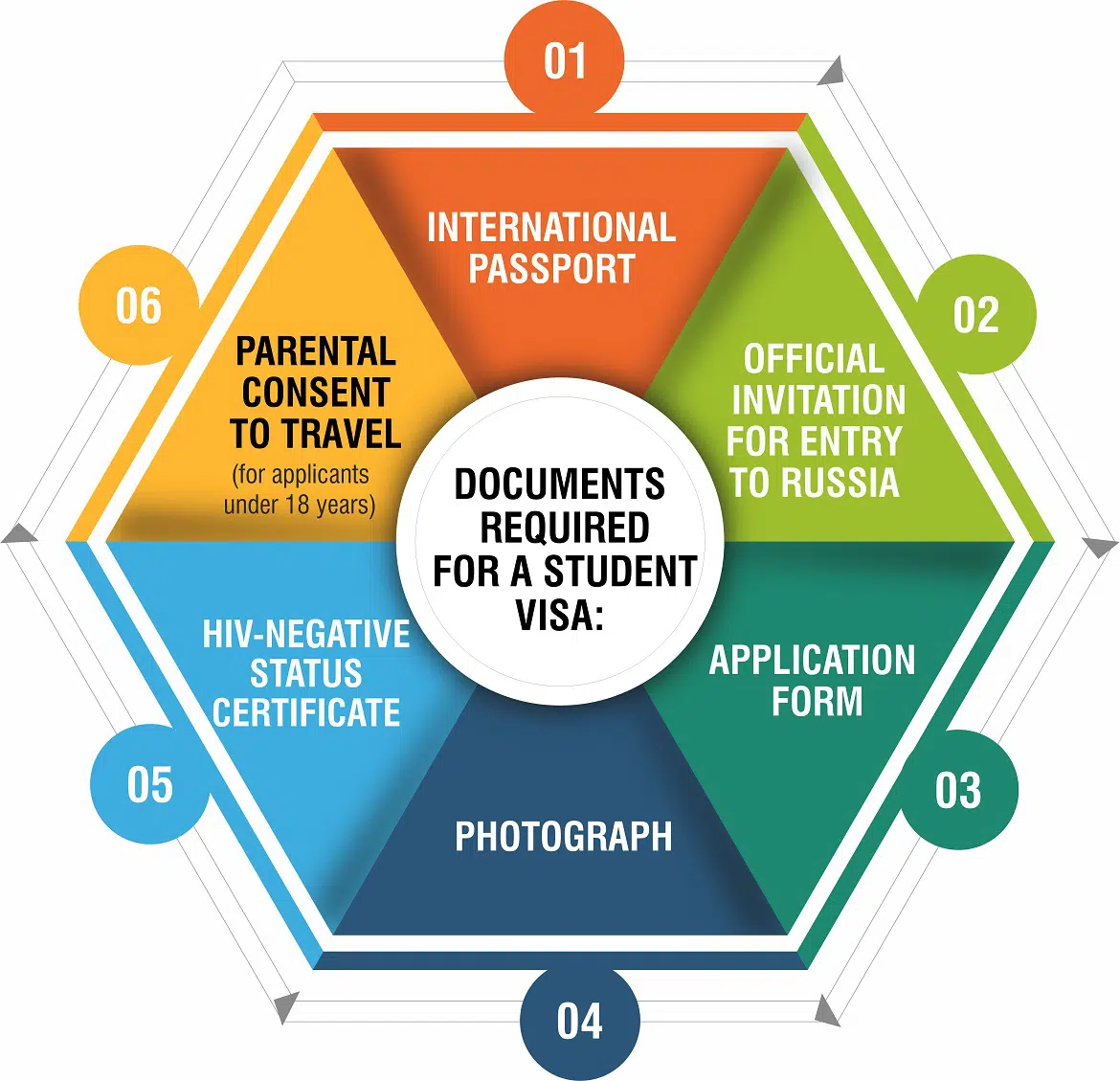

Admission Procedure for MBBS in Saratov State Medical University for Indian Students

- Application Form: Applicants can fill the application form online and submit the necessary documents via email.

- Required Documents: Along with the application form, students need to submit a school leaving certificate, birth certificate, copy of passport, transcripts of records and other necessary documents.

- Admission Letter: Once students submit the required documents, they will receive an admission letter from the university.

- Registration Fees: Students need to pay the registration fees to the university’s account or through net banking.

- Invitation Letter: The Department of Federal Migration Service of the Russian Federation will issue an official invitation letter for study upon confirmation of admission by the respective universities.

- Student Visa: After receiving the admission letter from the Russian Federation, students need to visit the embassy or consulate of the Russian Federation in their country for a student visa.

Syllabus of MBBS in Saratov State University for Indian Students

Here are some key points to help understand the syllabus:

- The first year of MBBS at Saratov State University focuses on Anatomy and Histology. Students will learn about the structure of the human body and the microscopic structure of tissues and organs.

- In the second year, students will be introduced to a variety of subjects such as Biochemistry, Microbiology, Physiology, and Pathology. They will also learn about Pathophysiology and Pharmacology in the sixth semester.

- In the final three years of MBBS, students will study a range of specializations including General Surgery, Neurology, Primary Care Medicine, Obstetrics and Gynecology, Oncology, Internal Medicine, Pediatrics, Neurology and Psychiatry, Psychology, ENT, Emergency Medicine, and Cardiology.