You need a web browser that supports JavaScript to use our site. Without it, some pages won't work as designed. To make sure JavaScript is turned on, please adjust your browser settings.

Browser Help and Tips

Log In to Online Banking

We can't process your request.

How does "Save this User ID" work?

Saving your User ID means you don't have to enter it every time you log in.

Don't save on a public computer

Only save your User ID on your personal computer or mobile device.

How to clear a saved User ID

To clear a saved User ID, log in and select Saved User IDs from Profile and Settings.

We sent a notification to your registered device. Verify your identity in the app now to log in to Online Banking.

If you're enrolled in this security feature, we sent a notification to your registered device. Verify your identity in the app now to log in to Online Banking.

We can't identify you at this time. Please use your User ID/Password to log in.

Stay connected with our app

Download directly to your mobile device.

{noticeText}

We'll text you a link to download the app.

We'll email you a link to download the app..

By providing your mobile number you are consenting to receive a text message. Text message fees may apply from your carrier. Text messages may be transmitted automatically.

Visit bankofamerica.com in your mobile web browser for a link to download the app.

Our mobile app is not available for all devices

Select your device

Please select your device to continue:

- Forgot ID/Password?

- Problem logging in?

Not using Online Banking?

- Enroll now for online Banking

- Learn more about Online Banking

- Service Agreement

Bank of America, N.A. Member FDIC. Equal Housing Lender © 2024 Bank of America Corporation.

- Sign In Secure Sign In. Sign in to your Bank of America account.

- bankofamerica.com

- En Español

Get the card that makes your travel more rewarding. Apply now »

For complete program details, view the Program Rules Bank of America ® Travel Rewards ® Program Rules (PDF) .

© 2024 Bank of America Corporation. All rights reserved.

You have selected to redeem your points for travel.

If you want to redeem your points, select Continue . If you wish to purchase travel, select Purchase Travel and you will be directed to the Bank of America Travel Center where you can purchase travel without using your points.

En este momento, estamos actualizando nuestros sistemas para incorporar caracterÃÂsticas mejoradas a la experiencia de recompensas en lÃÂnea. Como resultado, este sitio web se encuentra temporalmente fuera de servicio. El canje de recompensas no estará disponible hasta las últimas horas de la tarde el 20 de mayo. Gracias por su paciencia.

We are currently updating our systems to bring enhanced features to the online rewards experience. As a result, this website is temporarily unavailable. Rewards redemption will not be accessible until late afternoon on May 20. Thank you for your patience.

Va a entrar a una página que pordrÃa estar en inglés

Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios especÃÂficos en esa página estén disponibles solo en inglés. Antes de escoger un producto o servicio, asegúrese de haber leÃÂdo y entendido todos los términos y condiciones provistos.

En este momento, estamos actualizando nuestros sistemas para incorporar características mejoradas a la experiencia de recompensas en línea. Como resultado, este sitio web se encuentra temporalmente fuera de servicio. El canje de recompensas no estará disponible hasta las últimas horas de la tarde el 20 de mayo. Gracias por su paciencia.

Important Notice

We are in the process of converting your BankAmericard Privileges ® with Travel Rewards credit card to a BankAmericard Travel Rewards ® credit card. As a result, you will not be able to access the rewards site at this time. Thank you for your patience.

Your BankAmericard Privileges ® with Travel Rewards credit card has recently been converted to a BankAmericard Travel Rewards ® credit card. Please visit bankofamerica.com to access your new rewards site and find out what your new credit card program has to offer.

How to use Bank of America travel rewards points

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Building credit

- • Credit card debt

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- The Bank of America travel rewards program can be lucrative and flexible, but the specifics of how you'll earn points in this program depend on which credit card you sign up for.

- Bank of America travel rewards points can generally be redeemed for eligible travel purchases, cash back and gift cards.

- Bank of America Preferred Rewards members can earn an additional 25 percent to 75 percent more in rewards for each dollar spent.

Many credit card issuers boast a lineup of rewards credit cards that let you earn cash back, points or miles on travel, and Bank of America is no exception. Although not as popular as travel credit cards from Chase or American Express, Bank of America travel cards can be rather lucrative and flexible — but the specifics will depend on which credit card you sign up for.

If you’re ready to give the Bank of America travel rewards program a chance, you should find out which Bank of America credit cards let you earn rewards for travel, which travel rewards benefits are offered and how to use Bank of America travel rewards points to your advantage.

Which Bank of America cards earn travel rewards?

The main two Bank of America travel rewards cards are the Bank of America® Travel Rewards credit card and the Bank of America® Premium Rewards® credit card . However, Bank of America also offers the Bank of America® Premium Rewards® Elite Credit Card * and the Bank of America® Travel Rewards credit card for Students .

Bank of America Travel Rewards credit card: Best for no annual fee

Card details.

- Welcome bonus : 25,000 online bonus points (a $250 statement credit value toward travel purchases) if you make $1,000 in purchases within 90 days of opening the account

- Rewards rate : Unlimited 1.5X points per dollar on all purchases

- Annual fee : $0

- Notable perks : No foreign transaction fees, flexible travel rewards

Bank of America Premium Rewards credit card: Best for occasional travelers

- Welcome bonus : 60,000 online bonus points (a value of $600) after spending $4,000 on purchases in the first 90 days

- Rewards rate : Unlimited 2X points per dollar on travel and dining; 1.5X points per dollar on all other purchases

- Annual fee : $95

- Notable perks : Up to $100 in statement credits per year for incidental airline expenses to cover eligible costs; up to a $100 statement credit toward Global Entry or TSA PreCheck application fees every four years; no foreign transaction fees

Bank of America Premium Rewards Elite Credit Card: Best for frequent travelers

- Welcome bonus : 75,000 online bonus points (a $750 value) after you make at least $5,000 in purchases in the first 90 days of account opening

- Rewards rate :Unlimited 2X points on dining and travel purchases; unlimited 1.5X points on all other purchases

- Annual fee : $550

- Notable perks : Up to $300 annually in airline incidental statement credits for qualifying purchases (like seat upgrades and baggage fees); up to $150 annually for eligible lifestyle conveniences (including video streaming services, food delivery, fitness subscriptions and rideshare services); up to a $100 statement credit toward Global Entry or TSA PreCheck application fees every four years; complimentary Priority Pass membership; 20 percent off on domestic or international airfare for any class when paid with points

Bank of America Travel Rewards Credit Card for Students: Best for students

- Welcome bonus : 25,000 online bonus points after spending $1,000 in purchases within the first 90 days of account opening

- Rewards rate : 1.5X points on all purchases

- Notable perks : No foreign transactions fees, flexible travel rewards

Which Bank of America travel cards do not earn travel rewards points?

Bank of America also offers a surprising number of co-branded travel credit cards that are geared to loyalists with specific brands. However, these cards do not earn Bank of America travel rewards points. These include:

- Alaska Airlines Visa® credit card

- Free Spirit® Travel More World Elite Mastercard®*

- Allways Rewards Visa® Credit Card*

- Royal Caribbean Visa Signature® card*

- Norwegian Cruise Line® World Mastercard®*

- Celebrity Cruises Visa Signature® card*

- Virgin Atlantic World Elite Mastercard® *

- Air France KLM World Elite Mastercard®*

When it comes to redeeming your Bank of America travel rewards, your options may vary depending on the card you have.

Bank of America Travel Rewards credit card and Bank of America Travel Rewards Credit Card for Students

With the Bank of America Travel Rewards credit card and the Bank of America Travel Rewards Credit Card for Students, you can use your points for:

- Cash back in the form of a check or direct deposit to an eligible Bank of America or Merrill account

- A statement credit to cover eligible travel-related purchases

Unlike with other travel rewards programs, you can use your eligible card to book travel with any eligible providers, and Bank of America’s list of qualifying travel purchases is extensive. In addition to airlines, hotels, car rentals and eligible transit, travel-related purchases also include purchases made with eligible cruise lines, parking garages, travel agencies, tourist attractions, art galleries, amusement parks and more.

From there, you can redeem your points for a travel credit statement through your Bank of America account. However, note that you’ll need at least $25 worth of points to redeem for a travel credit.

Bank of America Premium Rewards credit card

The Bank of America Premium Rewards credit card lets you cash in your rewards for:

- Travel bookings through the Bank of America Travel Center

- Cash back in the form of a statement credit or a direct deposit to an eligible Bank of America or Merrill account

Bank of America Premium Rewards Elite Credit Card

With the Bank of America Premium Rewards Elite Credit Card, you can redeem your points for:

- Travel, experiences, event tickets and more through Bank of America’s Concierge service

How to maximize Bank of America travel rewards points

To get the most of your travel rewards points with Bank of America, you should try to be as strategic as you can. When you go to redeem points, consider the ways you may be able to earn more points on your spending and any ways you can maximize your rewards .

Join the Bank of America Preferred Rewards program

One major way to earn more Bank of America travel rewards involves signing up for the Bank of America Preferred Rewards® program. Doing so can net you an additional 25 percent to 75 percent more in rewards for each dollar you spend. However, you do need to meet certain qualifications to enroll in this program, such as having:

- An active, eligible Bank of America checking account

- A three-month average combined balance of $20,000 or more in eligible Bank of America accounts and/or Merrill investment accounts

Also, keep in mind that the Bank of America Preferred Rewards program offers additional perks like savings boosters and loan discounts for members with cash on deposit. The following chart shows how much more you could earn in rewards as a member, as well as how much you need to keep in eligible accounts to qualify for each tier.

While the minimum balance requirements are high, the Bank of America Preferred Rewards program can help you earn considerably more points on your spending if you qualify. For example, Bank of America Premium Rewards credit card members in the Platinum Honors tier have the potential to earn up to 3.5X points for every dollar spent on travel and dining purchases and up to 2.62X points on other purchases.

Compare pricing in the travel portal

The Bank of America Travel Center lets you make travel bookings with over 200,000 hotels and resorts and more than 200 airlines, among other options. Since some Bank of America travel rewards credit cards let you redeem your points for either travel-related statement credits or travel booked through the Bank of America Travel Center, you should compare the prices offered in the travel portal with other travel sites. By comparing prices, you can make sure you get the best deal.

Decide whether a card with an annual fee is right for you

Finally, make sure to think about your goals before you sign up for a travel credit card from this issuer. It’s often tempting to just choose a card with no annual fee — and that might be the right move for you. However, a card with an annual fee typically comes with more benefits and perks. For example, when you pay the $95 annual fee for the Bank of America Premium Rewards card, you’ll get higher rewards rates on travel and dining spending, up to a $100 annual credit for incidental airline expenses to cover eligible costs and up to a $100 application fee credit toward Global Entry or TSA PreCheck membership every four years. All of this could easily make the annual fee worthwhile for some people.

The bottom line

Bank of America travel rewards can work differently depending on the card you sign up for, so make sure to compare the best rewards cards available before you decide on a card. In the meantime, spend some time comparing cards from this issuer to top travel rewards credit cards from other major issuers. You may find that Bank of America has what you’re looking for in a travel rewards card, but you’ll never know for sure unless you check.

*Information about the Free Spirit® Travel More World Elite Mastercard®, Allways Rewards Visa® Credit Card, Royal Caribbean Visa Signature® card, Norwegian Cruise Line® World Mastercard®, Celebrity Cruises Visa Signature® card, Virgin Atlantic World Elite Mastercard® and Air France KLM World Elite Mastercard® has been collected independently by Bankrate. Card details have not been reviewed or approved by the card issuer.

Information regarding Bank of America credit cards was last updated on January 5, 2024.

Related Articles

Bank of America travel rewards guide

Bank of America Premium Rewards card benefits guide

Is the Bank of America Premium Rewards card the travel card you should get?

Why I love the Bank of America Travel Rewards card

Bank of America Travel Rewards Credit Card Review 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Bank of America® Travel Rewards Credit Card for Students. The details for these products have not been reviewed or provided by the issuer.

The Bank of America® Travel Rewards credit card is a good travel credit card for beginners or those who prefer simplicity in earning and redeeming rewards. It's got a solid bonus for a no-annual-fee card, and you can use your points toward a wide variety of travel purchases.

Earn 1.5 points per dollar on all purchases

0% intro APR for the first 15 billing cycles for purchases and for any balance transfers made within the first 60 days of account opening

18.24% - 28.24% Variable

Earn 25,000 online bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earns 1.5 points per dollar on every purchase

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee or foreign transaction fee

- con icon Two crossed lines that form an 'X'. Some cards earn more rewards, though usually only in bonus categories

- con icon Two crossed lines that form an 'X'. You can't transfer points to travel partners (though you can use points to cancel out travel purchases on your statement)

The Bank of America® Travel Rewards credit card is a good travel credit card for beginners or those who prefer simplicity in earning and redeeming rewards.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that's currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Bottom Line

If you're in search of a no-annual-fee travel credit card that offers a straightforward points program, the Bank of America® Travel Rewards credit card is worth considering. This card offers a flat earning rate of 1.5 points per dollar on all purchases, and you can redeem your rewards toward travel expenses you charge to your card.

However, if you're a Bank of America Preferred Rewards member, the card can be much more lucrative. Depending on your rewards tier, you can earn 25% to 75% more points with this card.

The Bank of America® Travel Rewards credit card is a good choice if you don't like dealing with complicated frequent flyer or hotel rewards programs that limit award availability and make their points hard to use. And on the earning side, there are no bonus categories or spending caps to track, either. If you're new to travel rewards, this could be a great way to start earning and redeeming points.

Detailed Overview

Welcome bonus.

With the Bank of America® Travel Rewards credit card, you can earn a welcome bonus of 25,000 online bonus points after making at least $1,000 in purchases in the first 90 days of account opening of account opening. Each point is worth 1 cent, so the welcome bonus offer is worth $250 in travel.

0% Intro APR

New cardholders also receive a 0% intro APR for the first 15 billing cycles for purchases and for any balance transfers made within the first 60 days of account opening, after which a 18.24% - 28.24% Variable APR applies. This can save you money if you plan to make a large purchase but want to spread the payments out over several months — as long as you have a plan to pay off the debt before the introductory period runs out.

How to Earn Points From the Bank of America Travel Rewards Credit Card

Bank of America® Travel Rewards credit card cardholders earn 1.5 points per dollar on all purchases, with no categories or limits to keep track of.

Things get more interesting if you're a Bank of America Preferred Rewards customer. The amount of money you have on deposit (like savings or investments) with Bank of America and Merrill (Bank of America's wealth management division) determines your rewards tier. Depending on your tier, you could earn 25% to 75% more rewards.

One other way to boost your returns from the Bank of America® Travel Rewards credit card is by purchasing travel through the Bank of America travel center. In that case, you'll earn 3 points per dollar (instead of 1.5 points per dollar) for your purchase.

With the Bank of America® Travel Rewards credit card, you'll earn points that are easy to redeem for a wide variety of travel expenses. Once you charge a travel purchase to your card, you can apply points at a rate of 1 cent each toward a statement credit to cover the purchase. The minimum redemption amount is 2,500 points ($25), and you'll have 12 months from the transaction date to apply your points.

Bank of America has a broad definition of travel, including some purchases most would classify as entertainment. Categories that qualify for a Bank of America® Travel Rewards credit card travel statement credit include:

- Trailer parks

- Recreational vehicle rentals

- Campgrounds

- Car rental agencies

- Truck and trailer rental

- Cruise lines

- Travel agencies

- Tour operators and real estate agents

- Operators of passenger trains

- Boat rentals

- Parking lots and garages

- Tolls and bridge fees

- Tourist attractions

- Exhibits like art galleries

- Amusement parks, carnivals, circuses, aquariums, and zoos

If you're not traveling, the Bank of America® Travel Rewards credit card allows you to use points for non-travel redemptions, but the rates aren't as attractive. For example, you can use points for gift cards starting at 3,125 points ($31.25), and the value per point varies.

If you prefer cash back, you can redeem points for a check or electronic deposit into a Bank of America checking or savings account, or for credit to an eligible Cash Management Account with Merrill. In that case, your points are only worth 0.6 cents apiece, which is not a great value.

Benefits and Features

The Bank of America® Travel Rewards credit card doesn't have a ton of valuable cardholder perks, which is common among credit cards with no annual fee .

Introductory 0% APR on purchases

The Bank of America® Travel Rewards credit card comes with a 0% intro APR for the first 15 billing cycles for purchases and for any balance transfers made within the first 60 days of account opening. After that, there's a 18.24% - 28.24% Variable APR.

Using a 0% APR credit card offer can be a good way to spread out payments for a big purchase over time without incurring huge interest charges, but you'll want to be sure you have the means and a plan to pay it off. Otherwise, you'll end up with high-interest debt after the introductory period expires.

Keep in mind there are longer intro periods on the best 0% APR credit cards available right now, and some also include balance transfers in their offers.

No foreign transaction fees

Good travel credit cards don't charge foreign transaction fees , and the Bank of America® Travel Rewards credit card is no exception. Because it doesn't tack on these fees, you can use the card for international purchases and not get stung with extra charges.

Free FICO score

Primary cardholders with the Bank of America® Travel Rewards credit card can check their FICO score for free through Bank of America's online banking, mobile website, or mobile banking app for iPhone and Android. This is a useful tool for keeping tabs on your credit, especially if you don't have another credit card that offers free credit scores ,

Overdraft Protection

The Bank of America® Travel Rewards credit card comes with an optional Balance Connect overdraft protection feature that lets you link your eligible Bank of America deposit account to your card. If you choose to use the service, Bank of America automatically transfers funds from your credit card account to cover overdrafts on your deposit account, as long as you have credit available on your credit card.

You won't be charged overdraft fees for this service, but you'll pay interest on the cash advance.

Mobile Wallet

When you add your Bank of America® Travel Rewards credit card to digital wallets like Apple Pay, Google Pay, or Samsung Pay, you can use it for in-person, online, or in-app transactions. Because your actual card number isn't stored on your device or shared with most merchants, you'll have more security when you make purchases.

$0 Liability Guarantee

Losing a credit card or having it stolen stinks, but you won't have to worry about fraudulent or unauthorized transactions on your Bank of America® Travel Rewards credit card as long as you report the issue promptly.

Along with not having an annual fee and offering an intro APR, the Bank of America® Travel Rewards credit card doesn't add foreign transaction fees, which makes it a good pick to have in your wallet when you travel abroad.

As with most other cards, you'll pay fees for balance transfers, cash advances, and late or returned payments.

Card Comparison

Before you decide on the Bank of America® Travel Rewards credit card, you'll want to consider similar no-annual-fee cards, because some have better earning rates and more flexible options for redeeming rewards. For example, the Wells Fargo Active Cash® Card earns 2% cash rewards on purchases, and you can use your rewards for whatever you like — not just travel.

Similarly, the Discover it® Miles earns 1.5 miles per dollar on all purchases, and at the end of the first 12 billing cycles, Discover will match all the rewards you earn. This means you'll effectively earn 3 miles per dollar in the first year, and while it's framed as a travel card, you can also redeem your miles for cash back at the same rate of 1 cent per mile.

If you're more interested in cash back, Bank of America also has cash-back cards available; you can read our Bank of America® Customized Cash Rewards Credit Card review . Or, if you're looking for a higher-tier travel rewards card and are open to an annual fee, you can read our Bank of America® Premium Rewards® credit card review .

Frequently Asked Questions

Most people who are approved for the Bank of America® Travel Rewards credit card have at least a good credit score. That means a FICO score of at least 670 or a VantageScore of 700 or more.

You still have options if your credit score is below that range. Our guides to the best credit cards for fair or average credit and for bad credit include some cards that earn solid rewards. Keep in mind there's also a student version of this card — the Bank of America® Travel Rewards Credit Card for Students — that offers most of the same benefits and can be easier to qualify for if you're a college student.

The Bank of America® Travel Rewards credit card is worth it if you're looking for a simple way to earn and use credit card rewards for travel without paying an annual fee. It's best suited for beginners or those who don't want to mess with complicated award programs, but to that end, it doesn't come with a lot of benefits.

Yes, the Bank of America® Travel Rewards credit card offers trip cancellation and interruption coverage, trip delay coverage, as well as lost luggage coverage like many other top travel rewards cards. This is a great benefit for those who want an additional layer of protection.

The Bank of America® Travel Rewards credit card is a Visa Signature card.

Why You Should Trust Us

Business Insider's experts evaluated the Bank of America® Travel Rewards credit card relative to other no-annual-fee credit cards that earn points. It's a strong option for beginners getting into travel rewards, especially if you're a Bank of America Preferred Rewards member.

That said, its points aren't as flexible as those from comparable cards, like the Wells Fargo Active Cash® Card and the Discover it® Miles.

For a closer look at our methodology, see how we rate credit cards at Business Insider.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Step-by-step: How to redeem points using the Bank of America Premium Rewards card

If you hold the Bank of America® Premium Rewards® credit card , you have a few choices when it comes time to redeem your points: You can use them to book travel, get cash back or buy gift cards. But how exactly do you go about redeeming them? Here's a step-by-step guide for using your Bank of America Premium Rewards credit card points.

Want to make sure you're maximizing every purchase like a points expert? Download the free TPG App to start spending like a pro.

Getting started

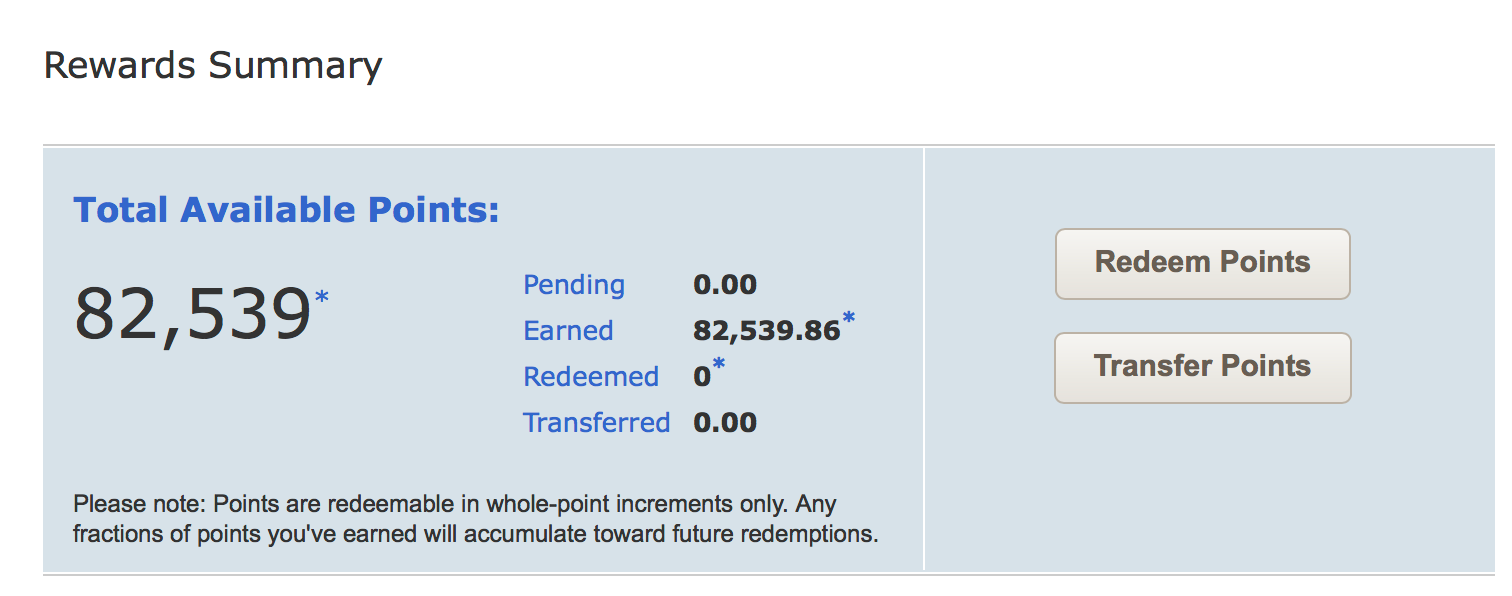

First, you'll need to sign in to your Bank of America account, select your Premium Rewards credit card from the list of accounts and click on the "Rewards" tab. That tab will show your total available points and provide an option to redeem them.

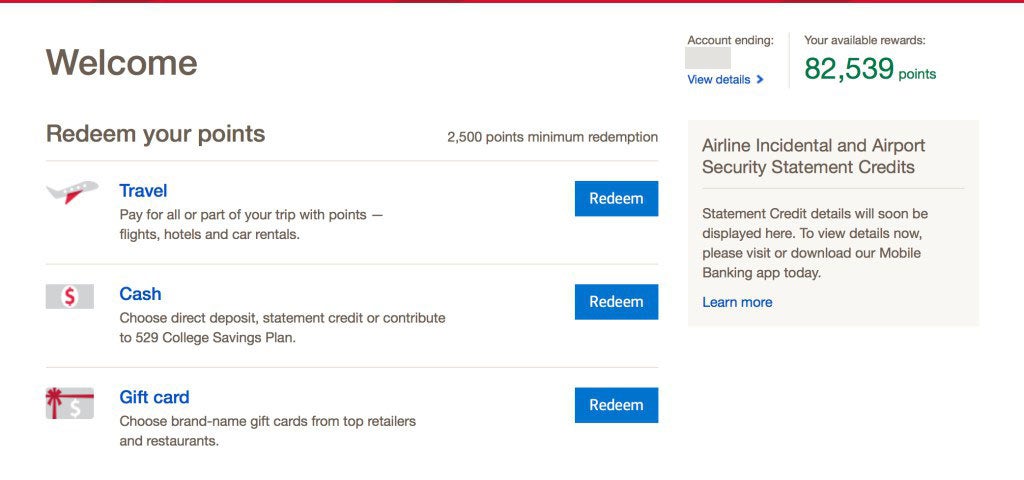

Clicking on "Redeem Points" brings you to a screen with three redemption options — you can use your points for travel, cash or gift cards. There's a 2,500-point minimum on all redemptions.

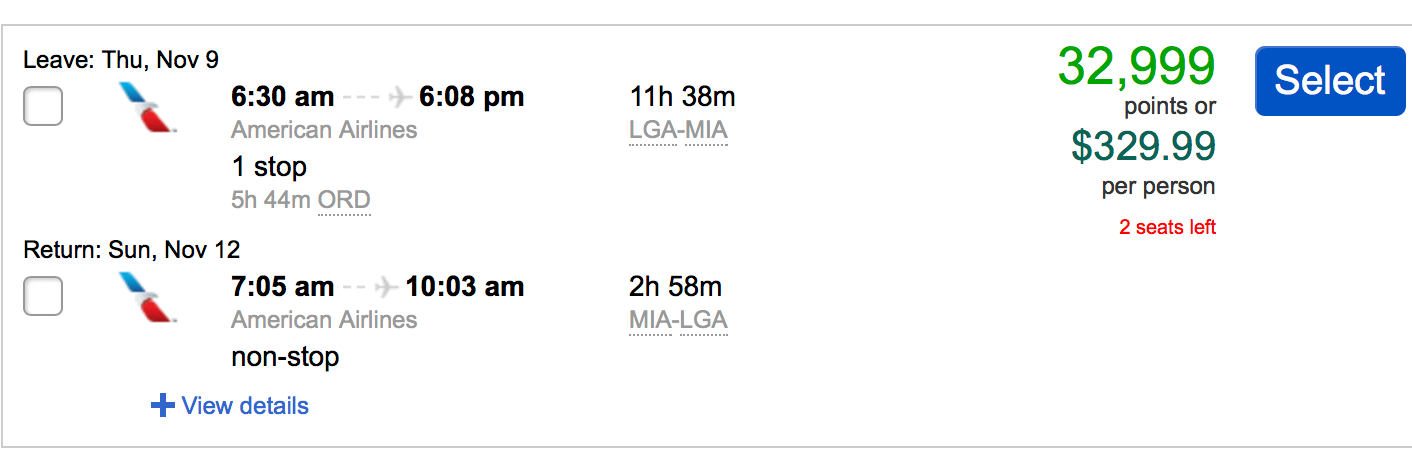

Bank of America doesn't have any airline or hotel transfer partners , but the first redemption option — "Travel" — will allow you to use your points to directly book a flight, hotel or car rental. The redemption rate is one cent per point, just as it is with the other two choices.

Shopping portals and gift card redemptions

However, you'll probably be better off booking your travel another way. For instance, if you use an online travel agency (OTA) such as Orbitz or Expedia, you can earn additional rewards from the OTA itself . Also, many OTAs appear on cash-back shopping portals , so you can double-dip on a booking and get even more cash back. Then if you still want to use your Premium Rewards points for the travel booking, just redeem them for a statement credit for the same amount and you'll get the identical one-cent redemption rate.

The same advice applies to gift card redemptions — you'll get one cent per point. You're not losing any value by going this route, but there are generally better ways to buy gift cards with a discount or cash back , or you can just pay for purchases with a credit card and earn additional rewards that way.

Cash redemptions

That brings us to the most valuable option — cash. We love points and miles, but nothing is more flexible than cash and the Premium Rewards card is one of the most powerful cash-earning cards out there, especially when you combine it with the Bank of America Preferred Rewards® program . With this program, you can earn up to a 75% bonus on your credit card rewards, but to reach this tier you'll need to have $100,000 in assets with Bank of America or its Merrill Lynch sibling.

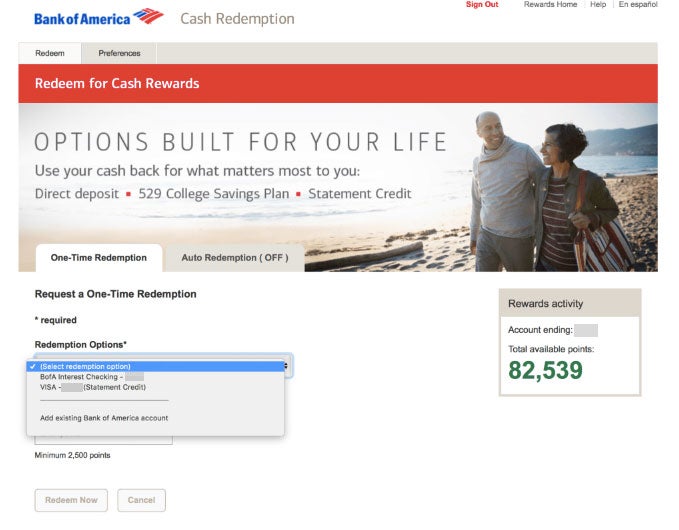

So when you click on the "Cash" option, you'll come to a screen that allows you to use points for a direct deposit into a Bank of America or Merrill account, a 529 College Savings Plan or a statement credit to your Premium Rewards card. Click the "Redemption Options" pull-down menu and you'll find your various Bank of America accounts listed, including the Premium Rewards card itself.

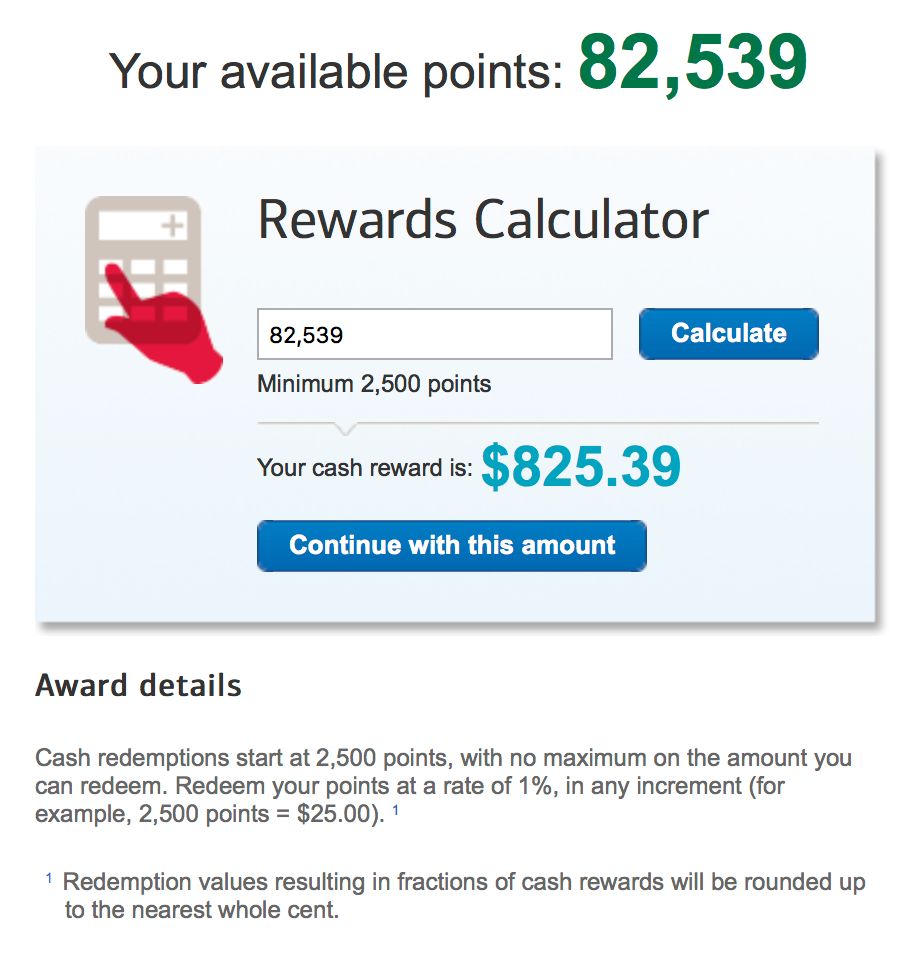

Once you've selected an account, you can enter the number of points you want to redeem. Bank of America will show the cash amount you'll receive for those points and ask you to confirm your entry.

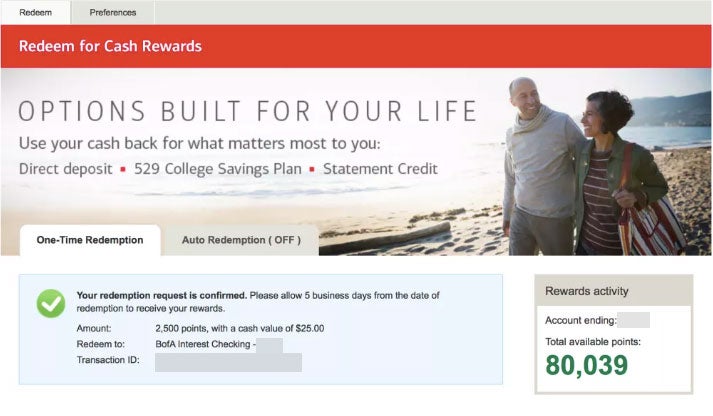

The final screen will show a confirmation that your redemption request has been submitted, along with all the details and a transaction ID number (which you should note in case there are any issues). It can take up to five business days for the redemption to appear, so don't panic if you don't see it immediately.

Automatic redemptions

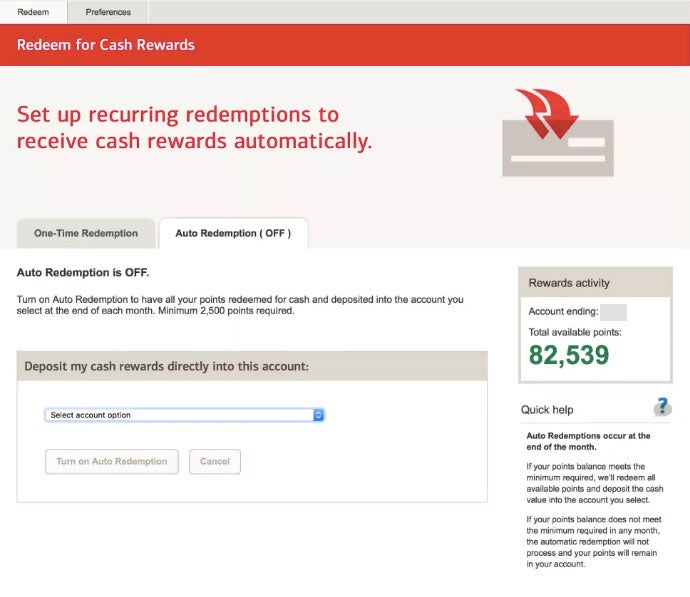

You might have noticed that, along with the above process of making a single redemption (which Bank of America refers to as a "One-Time Redemption"), there's a tab to the right that offers the opportunity to set up an Auto Redemption.

Turning on Auto Redemption will cause all the points you earn to be automatically redeemed as a statement credit or deposited into the account you've set at the end of each month, as long as you have at least 2,500 points to redeem. If you'd like to set your redemptions on autopilot, you'll never have to think about it. Just watch the cash build up each month .

As you can see, redemptions with this card are pretty straightforward and the Premium Rewards card has a reasonable annual fee .

Alternative cards

The Premium Rewards card is an excellent cash-back credit card , but if you're interested mainly in travel rewards, the Chase Sapphire Preferred® Card has the same $95 annual fee and equal bonus — you'll earn 60,000 Chase Ultimate Rewards points after spending $4,000 in the first three months of having the card. The Premium Rewards card has a bonus of 60,000 points after spending $4,000 in the first 90 days of account opening.

The Chase points you earn with the Sapphire Preferred are worth one cent each as cash back or 1.25 cents each toward travel booked through Chase Travel℠ . It earns a higher 3 points per dollar on dining and 5 points on travel booked through Chase Travel (or the same 2 points per dollar on travel booked elsewhere).

For spending that falls outside of these bonus categories, the Premium Rewards card's 1.5 points per dollar beats out the Sapphire Preferred's 1 point per dollar. But with the Sapphire Preferred you have the ability to transfer Chase points to the issuer's airline and hotel partners.

This option makes the best travel credit cards a much better option for booking business- and first-class flights than even the best cash-back cards . For some examples of what you can do with transferrable Chase points, check out our article on the best ways to use Chase Ultimate Rewards points .

Or, if you prefer the simplicity of earning cash back and don't qualify for Bank of America's Preferred Rewards program, the Citi Double Cash® Card (see rates and fees ) is an excellent choice. It has no annual fee and earns 2% cash back on purchases: 1% when you make the purchase and an additional 1% as you pay your balance off.

Bottom line

Redeeming points with the Bank of America Premium Rewards card is quick and easy. This card is one of the top cash-back cards to use for your everyday spending, especially if you qualify for the highest status with the Bank of America Preferred Rewards program.

If you do, you'll get a 75% bonus on your credit card rewards, making every purchase with the Premium Rewards card worth at least 2.62% cash back — a very good rate of return.

Apply here: Bank of America Premium Rewards card .

Additional reporting by Ryan Wilcox and J ason Stauffer.

Updated 12/06/2023.

How to use Bank of America travel rewards points

Key takeaways.

- T he Bank of America travel rewards program can be lucrative and flexible, but the specifics of how you’ll earn points in this program depend on which credit card you sign up for.

- Bank of America travel rewards points can generally be redeemed for eligible travel purchases, cash back and gift cards.

- Bank of America Preferred Rewards members can earn an additional 25 percent to 75 percent more in rewards for each dollar spent.

Many credit card issuers boast a lineup of rewards credit cards that let you earn cash back, points or miles on travel, and Bank of America is no exception. Although not as popular as travel credit cards from Chase or American Express, Bank of America travel cards can be rather lucrative and flexible — but the specifics will depend on which credit card you sign up for.

If you’re ready to give the Bank of America travel rewards program a chance, you should find out which Bank of America credit cards let you earn rewards for travel, which travel rewards benefits are offered and how to use Bank of America travel rewards points to your advantage.

Which Bank of America cards earn travel rewards?

The main two Bank of America travel rewards cards are the Bank of America® Travel Rewards credit card and the Bank of America® Premium Rewards® credit card . However, Bank of America also offers the Bank of America® Premium Rewards® Elite Credit Card * and the Bank of America® Travel Rewards Credit Card for Students .

Bank of America Travel Rewards credit card: Best for no annual fee

- Welcome bonus: 25,000 online bonus points ($250 statement credit value toward travel purchases) if you make $1,000 in purchases within 90 days of opening the account

- Rewards rate: Unlimited 1.5X points per dollar on all purchases; 3X points on Bank of America Travel Center purchases

- Annual fee: $0

- Notable perks: No foreign transaction fees, flexible travel rewards

Bank of America Premium Rewards credit card: Best for occasional travelers

- Welcome bonus: 60,000 online bonus points after spending $4,000 on purchases in the first 90 days

- Rewards rate: Unlimited 2X points per dollar on travel and dining; 1.5X points per dollar on all other purchases

- Annual fee: $95

- Notable perks: Up to $100 in statement credits per year for incidental airline expenses to cover eligible costs; up to a $100 statement credit toward Global Entry or TSA PreCheck application fees every four years; no foreign transaction fees

Bank of America Premium Rewards Elite Credit Card: Best for frequent travelers

- Welcome bonus: 75,000 online bonus points (a $750 value) after you make at least $5,000 in purchases in the first 90 days of account opening

- Rewards rate: Unlimited 2X points on dining and travel purchases; unlimited 1.5X points on all other purchases

- Annual fee: $550

- Notable perks: Up to $300 annually in airline incidental statement credits for qualifying purchases (like seat upgrades and baggage fees); up to $150 annually for eligible lifestyle conveniences (including video streaming services, food delivery, fitness subscriptions and rideshare services); up to a $100 statement credit toward Global Entry or TSA PreCheck application fees every four years; complimentary Priority Pass membership; 20 percent off on domestic or international airfare for any class when paid with points

Bank of America Travel Rewards Credit Card for Students: Best for students

- Welcome bonus: 25,000 online bonus points after spending $1,000 in purchases within the first 90 days of account opening

- Rewards rate: 1.5X points on all purchases

- Annual fee: $0

- Notable perks: No foreign transactions fees, flexible travel rewards

Which Bank of America travel cards do not earn travel rewards points?

Bank of America also offers a surprising number of co-branded travel credit cards that are geared to loyalists with specific brands. However, these cards do not earn Bank of America travel rewards points. These include:

- Alaska Airlines Visa® credit card

- Free Spirit® Travel More World Elite Mastercard®*

- Allegiant World Mastercard®*

- Royal Caribbean Visa Signature® card*

- Norwegian Cruise Line® World Mastercard®*

- Celebrity Cruises Visa Signature® card*

- Virgin Atlantic World Elite Mastercard® *

- Air France KLM World Elite Mastercard®*

When it comes to redeeming your Bank of America travel rewards, your options may vary depending on the card you have.

Bank of America Travel Rewards credit card and Bank of America Travel Rewards Credit Card for Students

With the Bank of America Travel Rewards credit card and the Bank of America Travel Rewards Credit Card for Students, you can use your points for:

- Cash back in the form of a check or direct deposit to an eligible Bank of America or Merrill account

- A statement credit to cover eligible travel-related purchases

Unlike with other travel rewards programs, you can use your eligible card to book travel with any eligible providers, and Bank of America’s list of qualifying travel purchases is extensive. In addition to airlines, hotels, car rentals and eligible transit, travel-related purchases also include purchases made with eligible cruise lines, parking garages, travel agencies, tourist attractions, art galleries, amusement parks and more.

From there, you can redeem your points for a travel credit statement through your Bank of America account. However, note that you’ll need at least $25 worth of points to redeem for a travel credit.

Bank of America Premium Rewards credit card

The Bank of America Premium Rewards credit card lets you cash in your rewards for:

- Travel bookings through the Bank of America Travel Center

- Cash back in the form of a statement credit or a direct deposit to an eligible Bank of America or Merrill account

Bank of America Premium Rewards Elite Credit Card

With the Bank of America Premium Rewards Elite Credit Card, you can redeem your points for:

- Travel, experiences, event tickets and more through our Bank of America’s Concierge service

How to maximize Bank of America travel rewards points

To get the most of your travel rewards points with Bank of America, you should try to be as strategic as you can. When you go to redeem points, consider the ways you may be able to earn more points on your spending and any ways you can maximize your rewards .

Join the Bank of America Preferred Rewards program

One major way to earn more Bank of America travel rewards involves signing up for the Bank of America Preferred Rewards program . Doing so can net you an additional 25 percent to 75 percent more in rewards for each dollar you spend. However, note that you do need to meet certain qualifications to enroll in this program, including:

- An active, eligible Bank of America checking account

- A three-month average combined balance of $20,000 or more in eligible Bank of America accounts and/or Merrill investment accounts

Also, keep in mind that the Bank of America Preferred Rewards program offers additional perks like savings boosters and loan discounts for members with cash on deposit. The following chart shows how much more you could earn in rewards as a member, as well as how much you need to keep in eligible accounts to qualify for each tier.

While the minimum balance requirements are high, the Bank of America Preferred Rewards program can help you earn considerably more points on your spending if you qualify. For example, Bank of America Premium Rewards credit card members in the Platinum Honors tier have the potential to earn up to 3.5X points for every dollar spent on travel and dining purchases and up to 2.62X points on other purchases.

Also, it’s worth noting that there is one more Bank of America Preferred Rewards program tier, Diamond Honors.

Compare pricing in the travel portal

Keep in mind that the Bank of America Travel Center lets you make travel bookings with over 200,000 hotels and resorts and more than 200 airlines, among other options. Since some Bank of America travel rewards credit cards let you redeem your points for either travel-related statement credits or travel booked through the Bank of America Travel Center, you should compare the prices offered in the travel portal with other travel sites. By comparing prices, you can make sure you get the best deal.

Pick a card with an annual fee

Finally, make sure to think about your goals before you sign up for a travel credit card from this issuer. After all, a card with an annual fee comes with more benefits and perks. For example, when you pay the $95 annual fee for the Bank of America Premium Rewards card, you’ll get higher rewards rates on travel and dining spending, up to a $100 annual credit for incidental airline expenses to cover eligible costs and up to a $100 application fee credit toward Global Entry or TSA PreCheck membership every four years. All of this could easily leave you “ahead” in a financial sense.

The bottom line

Bank of America travel rewards can work differently depending on the card you sign up for, so make sure to compare all the rewards card options available before you decide on a card. In the meantime, spend some time comparing cards from this issuer to travel rewards credit cards from other major issuers. You may find that Bank of America has what you’re looking for in a travel rewards card, but you’ll never know for sure unless you check.

The Bank of America content in this post was last updated on June 23, 2023.

The information about the Alaska Airlines Visa® credit card was updated on June 23, 2023.

*The information about the Bank of America® Premium Rewards® Elite Credit Card, Free Spirit® Travel More World Elite Mastercard®, Allegiant World Mastercard®, Royal Caribbean Visa Signature® card, Norwegian Cruise Line® World Mastercard®, Celebrity Cruises Visa Signature® card, Virgin Atlantic World Elite Mastercard® and Air France KLM World Elite Mastercard® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Bank of America Travel Rewards Card for Students: Good Credit Required

It's an OK pick if you can meet the credit requirements. But if that's the case, you can likely already qualify for a better card. And if not, other student credit cards are easier to get.

- No annual fee.

- New cardholder bonus offer.

- Intro APR period.

- Requires good/excellent credit.

- Best rewards limited to certain customers.

18.24%-28.24% Variable APR

0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%

Rewards rate

Bonus offer

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

Ongoing APR

APR: 18.24%-28.24% Variable APR

Cash Advance APR: See Terms

Penalty APR: 29.99%, Variable

Balance transfer fee

3% for 60 days from account opening, then 4%

Foreign transaction fee

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Compare to Other Cards

Detailed review: Bank of America® Travel Rewards credit card for Students

In theory, the Bank of America® Travel Rewards credit card for Students offers a lot of value for cards in its class. Students looking for their first credit card might be wowed by the $ 0 annual fee, the lucrative sign-up bonus, the long 0% introductory annual percentage rate period and the decent rewards for everyday spending.

The problem is, this card requires at least good credit to qualify ( FICO scores of 690 or higher), meaning it'll be inaccessible for many students with limited credit history.

If you can already clear that FICO hurdle, you might qualify for any number of better (nonstudent) cards. Alternately, even if you have thin or less-than-ideal credit, plenty of other student credit card options are available, many of which will be easier to qualify for.

» MORE: What's the easiest credit card to get?

The Bank of America® Travel Rewards credit card for Students is nearly identical to the nonstudent version of the card, the Bank of America® Travel Rewards credit card . Both cards require good credit or above. Check out our guide to all four of Bank of America®'s student credit cards.

Bank of America® Travel Rewards credit card for Students : The basics

Card type: Student .

Annual fee: $0

Sign-up bonus: 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

1.5 points per $1 spent on purchases.

3 points per $1 spent on eligible travel booked through the Bank of America® Travel Center.

(Cardholders can qualify for the Bank of America Preferred Rewards ® program, which adds a multiplier to the everyday 1.5 points per $1 you’d earn. But to qualify, you need at least $20,000 in a qualifying Bank of America® account. For most students, that required account balance will make this benefit unattainable.)

Redemption: Points are worth 1 cent apiece when redeemed for a statement credit against travel or restaurant purchases, or 0.6 cents apiece for cash. There is a minimum redemption of 2,500 points for travel or cash. Points can also be redeemed for gift cards at varying values depending on the retailer.

Interest rate: 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4% .

Foreign transaction fee: None .

Benefits and perks

Simple ongoing rewards.

Simplicity is a key feature of the Bank of America® Travel Rewards credit card for Students . You'll earn 1.5 points per $1 spent on nearly all purchases with no cap. That makes this card perfect for students with other things to worry about than bonus categories.

But if you’re an optimizer, you might do better with the Discover it® Student Cash Back , which earns 5% cash back on up to $1,500 in spending per quarter in categories that rotate every three months. (Activation is required; all other purchases earn 1% back.)

» MORE: See Discover's current 5% bonus categories

Sign-up bonus

The Bank of America® Travel Rewards credit card for Students comes with a big sign-up bonus, especially for a student card, and that can help defray any number of costs you might incur while on campus. But remember, many students won’t qualify because of the credit score requirements.

If you’re a student looking to earn a sign-up bonus on a card that will be easier to obtain and help build your credit report, consider the Capital One Quicksilver Student Cash Rewards Credit Card . It offers the same ongoing earnings rate, along with the following sign-up bonus: Earn $50 when you spend $100 in the first three months.

» MORE: Best credit card bonuses for new cardholders

0% intro APR offer

The introductory APR offer on the Bank of America® Travel Rewards credit card for Students is a stellar promotional period for a travel card, let alone a student card. This might provide some peace of mind to students looking to finance a purchase like textbooks or a new laptop. Just remember, you’ll still have to pay the minimum balance due every month. And if you pay your balance in full each month, you’ll never have to worry about interest charges anyway.

» LEARN: How to avoid credit card interest

No proof of student status required

Though the Bank of America® Travel Rewards credit card for Students is marketed toward students, it's one of the few student cards that don't require proof of enrollment at a college or university. Other student cards will require more documentation.

» LEARN: Do you have to be a student to get a student credit card?

Drawbacks and considerations

Good credit score required.

Despite being geared toward students, the Bank of America® Travel Rewards credit card for Students requires good to excellent credit to qualify. That won’t be possible for many students who are shopping for their first credit card. But don’t worry; other student credit cards have less-stringent credit score requirements. In fact, some such cards — like the Discover it® Student Chrome or Chase Freedom® Student credit card — may not require an established credit history at all.

» LEARN: What to do when you’re denied a student credit card

Other cards have better earning potential

For qualifying students who want a no-hassle entry into earning credit card rewards, the Bank of America® Travel Rewards credit card for Students will work fine. But for optimizers who are OK with managing their card, there may be better options. For example, the Capital One SavorOne Student Cash Rewards Credit Card offers an uncapped 3% cash back on dining, entertainment, streaming services and grocery purchases, along with the following sign-up bonus: Earn $50 when you spend $100 in the first three months. And this card will be easier to qualify for than the Bank of America® Travel Rewards credit card for Students .

This $0 -annual-fee card requires at least fair credit (FICO scores starting at 630), so it may be easier to qualify for. It earns 3% cash back on dining, entertainment and eligible streaming services and at grocery stores. Other purchases earn 1% back.

How to decide if it's right for you

The Bank of America® Travel Rewards credit card for Students would be competitive with other student cards if the requirements for approval were similar. But because of the card's credit score criteria, students without an established credit history will want to look elsewhere. And if you do have the credit history to qualify for this card, you can likely find one with a better sign-up bonus and ongoing rewards.

- The best credit cards of 2024

- Best travel credit cards

- Best rewards credit cards

- Best cash back credit cards

Methodology

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Craig Joseph

Bank of America® Travel Rewards credit card

Good to Excellent

Credit Recommended (670-850)

Flat-rate travel rewards with no foreign transaction fee . The 25,000 sign-up points after only a $1,000 spend within the first 90 days is generous for a no annual fee card. The 1.5X points on all purchases is also quite nice.

The Bank of America Travel rewards credit card is among our picks for the best credit cards .

Staff Review

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Know your odds before you apply

- Enter your information

- We’ll run a soft credit pull, which won’t impact your credit score

- You’ll see your estimated approval odds near cards to help you narrow down your options

Your personal information and data are protected with 256-bit encryption.

Tell us your name to get started

We’ll use this information to to verify your credit profile.

What’s your mailing address?

What's your employment status?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considered as a basis for repaying a loan. Increase non-taxable income or benefits included by 25%.

Put $0 if you currently don't have a rent or mortgage payment.

Last four digits of your Social Security number

We’ll use the last four digits of your Social Security number to get your approval odds. This won’t impact your credit score.

What’s your email address?

Your email address unlocks your approval odds. Don’t worry, we won’t spam your inbox.

By clicking "See my odds" you agree to our Terms of Use (including our Prequalification Terms ) and Privacy Policy . These terms allow CreditCards.com to use your consumer report information, including credit score, for internal business purposes, such as improving the website experience and to market other products and services to you. I understand that this is not an application for credit and that, if I wish to apply for a credit card with any participating credit card issuer, I will need to click through to complete and submit an application directly with that issuer.

Calculating your approval odds

Oops something went wrong..

We’re sorry, but something went wrong and we couldn’t find your approval odds. Instead, you'll see recommended credit ranges from the issuers listed next to cards on our site.

- Sign in

Norwegian Cruise Line® World Mastercard®

We're sorry, this page is temporarily unavailable. We apologize for the inconvenience.

Unavailable

One or more of the cards you chose to compare are not serviced in English.

Continue in English Go back to Spanish

Online Offer: 20,000 bonus points

That’s enough for a $200 onboard credit or $200 off your next Norwegian cruise

Card Details

Earn triple points.

Earn 3 WorldPoints ® points for every $1 spent on Norwegian purchases, 2 WorldPoints ® points per $1 spent on eligible air and hotel purchases and 1 WorldPoints ® point per $1 spent on all other purchases

No annual fee † and no foreign transaction fees †

Enjoy no annual fee and no foreign transaction fees while earning points to redeem for upgrades, travel, on-board credits and more

You choose the rewards that matter most to you

Redeem points for stateroom upgrades, travel discounts, exclusive redemption opportunities for last minute cruises, onboard credits, car rentals, hotel stays, cash and gift cards.

Get 20,000 bonus points after you make $1,000 or more in purchases in the first 90 days of account opening – which can be redeemed for a $200 off your next Norwegian cruise

Earn even more rewards

Bank of America Preferred Rewards ® members earn 25% - 75% more points on every purchase, applied to the base earn of 1 point per $1. Learn more about Preferred Rewards Norwegian Cruise Lines

Interest Rates & Fees Summary †

Introductory apr, standard apr.

18.24% - 28.24%

Balance Transfer Fee

of each transaction †

† Please see Terms and Conditions for rate, fee and other cost information, as well as an explanation of payment allocation. All terms may be subject to change.

Note: minimum payments are applied to lower-interest balances first. Additional payments are applied to higher-interest balances first.

Earn 3 WorldPoints ® points for every $1 spent on Norwegian purchases

Earn 2 WorldPoints ® points per $1 spent on eligible air and hotel purchases

Earn 1 WorldPoints ® point per $1 spent on all other purchases

Redeem points for stateroom upgrades, travel discounts, onboard credits, last-minute cruises, car rentals, hotel stays, cash, gift cards, and more.

Start redeeming your points at 2,500 points

Security & Features

Stay protected, contactless chip technology, balance connect ® for overdraft protection, paperless statement option, digital wallet technology, online & mobile banking, account alerts, fico ® score.

Now, when you opt-in you can access your FICO ® Score updated monthly for free, within your Mobile Banking app or in Online Banking. FICO ® Score Program . The FICO ® Score Program is for educational purposes and for your non-commercial, personal use. This benefit is available only for primary cardholders with an open and active consumer credit card account who have a FICO ® Score available. The feature is accessible through Online Banking, the Mobile website, and the Mobile Banking app for iPhone and Android devices. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Data connection required. Wireless carrier fees may apply." data-footnote="ADDITIONAL_BENEFITS_FOOTNOTE_07" aria-label="Footnote 5"> Footnote [5] Learn More about Free FICO Credit Score opens in a new window

Priority code: QAF2CT

Schedule an appointment to apply in person

Connect one on one with a credit card specialist

IMAGES

VIDEO

COMMENTS

The Bank of America® Travel Rewards credit card offers unlimited 1.5 points per $1 spent on all purchases everywhere, every time and no expiration on points. Apply online. ... If you link your Bank of America deposit account to your credit card for Overdraft Protection, we will automatically transfer funds from your credit card account to ...

Sign in to your Bank of America online banking account with your User ID and enjoy the convenience and security of managing your finances anytime, anywhere.

Your BankAmericard Privileges®with Travel Rewards credit card has recently been converted to a BankAmericard Travel Rewards®credit card. Please visit bankofamerica.comto access your new rewards site and find out what your new credit card program has to offer. MaintenanceOutageConversion.

3.8. NerdWallet rating. This solid no-fee travel credit card is especially rewarding for Bank of America® banking customers. Jump to: Detailed Review. Apply Now. on Bank of America's website, or ...

The Bank of America Travel Rewards credit card is currently offering 25,000 bonus points after you make at least $1,000 in purchases in the first 90 days of account opening. These points are redeemable at a flat rate of 1 cent per point toward travel or dining purchases, so this bonus is worth $250 — a solid offer but significantly less ...

Apply now for Bank of America® Travel Rewards credit card at Bank of America's secure site 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases. Earn unlimited 1.5 points per $1 ...

Right away, the Bank of America® Travel Rewards credit card 's annual fee of $0 sets it apart from other travel credit cards and makes it an excellent pick for budget-minded travelers. Even if ...

The Bank of America® Travel Rewards credit card comes with a 0% introductory APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days, followed by a 18.24% ...

The Bank of America Travel Rewards credit card offers a solid welcome bonus that's easily attainable for most cardholders. You can earn 25,000 points when you make $1,000 in purchases within 90 ...

Bank of America Travel Rewards points are stuck at a maximum value of 1.0 cents cents per point. According to Bankrate's point valuations, several issuers' points or miles can be worth around ...

The Bank of America® Travel Rewards credit card currently has a nice welcome offer: 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening ...

Get the loyalty bonus. With the Bank of America® Travel Rewards credit card, everyone gets 1.5 points for every $1 spent. Enroll in the Bank of America Preferred Rewards® program, and the ...

Welcome bonus: 60,000 online bonus points (a value of $600) after spending $4,000 on purchases in the first 90 days. Rewards rate: Unlimited 2X points per dollar on travel and dining; 1.5X points ...

Welcome Bonus. With the Bank of America® Travel Rewards credit card, you can earn a welcome bonus of 25,000 online bonus points after making at least $1,000 in purchases in the first 90 days of ...

The Premium Rewards card is an excellent cash-back credit card, but if you're interested mainly in travel rewards, the Chase Sapphire Preferred® Card has the same $95 annual fee and equal bonus — you'll earn 60,000 Chase Ultimate Rewards points after spending $4,000 in the first three months of having the card. The Premium Rewards card has a ...

Welcome bonus: 75,000 online bonus points (a $750 value) after you make at least $5,000 in purchases in the first 90 days of account opening Rewards rate: Unlimited 2X points on dining and travel ...

Annual fee. $0. Rewards rate. 1.5x. Bonus offer. 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement ...

1.5X Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open. Balance Transfers Intro APR. 0% Intro APR for 15 billing cycles for any BTs made in the first 60 days. A fee of 3% for 60 days from account opening, then 4% will apply.

The Bank of America® Business Advantage Travel Rewards World Mastercard® credit card offers a 0% introductory APR on purchases for the first 9 billing cycles, then a 18.49% - 28.49% variable APR ...

Bank of America® Travel Rewards credit card The Bank of America Travel Rewards card is a straightforward card with no annual or foreign transaction fees. You'll earn a flat 1.5X points on every ...

FICO ® Score Program.The FICO ® Score Program is for educational purposes and for your non-commercial, personal use. This benefit is available only for primary cardholders with an open and active consumer credit card account who have a FICO ® Score available. The feature is accessible through Online Banking, the Mobile website, and the Mobile Banking app for iPhone and Android devices.