Suggested companies

Post office.

Post Office Travel Money Card Reviews

Visit this website

Company activity See all

Write a review

Reviews 3.8.

Most relevant

Post office travel money card was…

Post office travel money card was excellent when I use abroad I can top up freeze unfreeze East to top up online text I manage to withdraw cash from ATM too V good service

Date of experience : April 11, 2024

Reply from Post Office Travel Money Card

Thank you for your great review and feedback!

Didn't get delivered on time. Can't move balances. No online alternatives.

Still haven't received my card after 6 days. Called the help line and was told to order another card in branch to get it instantly but there is no way to transfer a balance from an online order onto a new card. Long and short of it is, if I want the use of this service before my holiday I need to spend more of my money and order fresh again. I also don't live in a town with a branch that can do this so I'd need to travel to even do this. Bad delivery service, no means to swap balances, no online card alternatives (it's 2024 - this could be an online digital app like many other cards), and no "help" from the help line worth the effort of calling. Won't be using the card in future and will continue to just buy cash for travelling from other brokers.

Date of experience : May 02, 2024

Would not recommend

Would not recommend. Loaded with US dollars, as in Barbados that is widely accepted. However, when I used card I was charged a commission fee. My children then said , should have got a Monzo card as they give you the rate on the day with no commission. Another scam from the great institution of the Post Office!!

Date of experience : April 26, 2024

Thank you for your review, we’re sorry to read that the Travel Money Card hasn’t met with your expectations on this occasion, we would like to understand more so we can help resolve this. Could you call us at 0207 937 0280 or email us at [email protected] , Thanks -Aaron

Perfect for saving foreign currency…

Perfect for saving foreign currency through out the year for my holidays.

Date of experience : May 03, 2024

I got a travel card from post office to…

I got a travel card from post office to be delivered i put £50 on there but was charged £50.70 ...post office said it was not them , monzo state it was not them ..so whose took the 0.70..gonna cost a bomb with further instalments on the card ..may have to look elsewhere or just use good old fashioned cash

So easy !!!

Fantastic card ease of use can't see me going back to cash / currency for future holidays

Date of experience : April 28, 2024

Postoffice travel money card is a great…

Postoffice travel money card is a great little card to take away I have used this all over in Europe and worldwide highly reccommend 🎉

Date of experience : April 25, 2024

Easy system to use

Easy system to use, and saves a huge amount of time standing in the PO queue

Thank you for your great review and feedback, it really helps us 🙂

Great card which is very easy to use

Great card which is very easy to use. App keeps you updated on transactions and balance among other things. Used it in USA, UAE and Europe. Topping up is simple via the app

I loaded my new card, which I received today, with £4,000 at a rate of 1.143 euros per £1.00. I changed my pin number, this was accepted. I requested a printed balance which shows only £3,836.00. I have not made ANY withdrawals on this card, what is the Post Office up to now?

Date of experience : April 29, 2024

Hi there, you will have not lost any funds and this is due to exchange rates. To allow us to explain further please contact us on 0344 335 0109 or email us at [email protected].

Post Office Travel Card

Ordered a Post Office travel card and unfortunately loaded a reasonable sum in USD on 08 April 2024, on the expectation that it would arrive in 2-3 days as advertised on the Post Office portal. After 6 days, no card so this is followed by a telephone call. 43 minutes later, following scripted dialogue from the operator, I move on. We're now 12 days on and still no travel card. 14 e-mails, 2 complaints and another 40+ minute phone call and still no travel card or refund or compensation. The Post Office are also unable to evidence actually posting the travel card... Post Office - you should be ashamed of yourselves - your customer service is absolutely appalling at best.

Date of experience : April 08, 2024

I am sorry to hear that we have been unable to assist you when you contacted Customer Services. Please contact us via email on [email protected] and we will be able to take a further look into your account and give assistance.

Just found out that the Post office…

Just found out that the Post office travel card does prize draws. Really good rates when im in thailand/pound to baht. Spend money on the card often when abroad

Date of experience : April 24, 2024

The App is very easy to use

The App is very easy to use, I can check my balance, transactions and top up my card. The card is accepted everywhere. I have used the card in USA (Florida) and in Europe.

Date of experience : April 22, 2024

No fees and easy to use

The Travel Money Card was so easy to use and having the physical card as well as the app meant my husband and I could pay for things from the same account when needed. There are no transaction fees as there are with most bank cards used overseas so would definitely recommend and use next time we go abroad.

Date of experience : March 02, 2024

It is very useful to have a Travel card with you as you know how much money you have to spend !!

It is very useful to have a Travel money card when on holiday. The staff at the Post Office are very helpful to get it loaded and set up. Also the staff at head office are there for you if you need help

Date of experience : April 18, 2024

so far, so good

I am an older person and view apps and phone banking as necessary evils and with great distrust. However it is almost impossible to live without them and some products do help make life easier. This is the premise behind the PO Travel card which allows you to carry foreign currency in the equivalent of a use-abroad deposit account card. While it wasn't entirely pain-free to set up it was bearable with minimal faff, and it worked 100% the small handful of times I tried it in shops abroad. Assuming the remainder of the currency I put in that card does not vanish before I next go abroad I will continue to use it. I'm unsure of the exact advantage it gives over my UK bank account card and using that abroad, perhaps not getting fleeced by fluctuating exchange rates. I was told it is more efficient than just buying a wad of Euros at the Post Office.

Date of experience : April 01, 2024

Useless. Card worked ok until it didn't. Stopped working while on holiday. Tried to check balance at local Spanish ATMs but they would not recognise the card. The app wouldn't open and when I tried opening the account via the browser it would not let me in. Eventually I was locked out. Luckily I also had a TUI money card which was easier to set up and works perfectly. Would advise you get card from a travel agent or bank. Do not rely on the Post Office.

Date of experience : April 20, 2024

Hi there, I am sorry to hear that this. Please contact us via email on [email protected] or telephone 0344 335 0109 and we will be able to take a further look into your account and give assistance.

Best card to travel with

It is a great card. Easy to use almost everywhere with no extra cost. Great rates when topped up. Top it up on the move.

Date of experience : April 05, 2024

Good price compare to other stores

Good price compare to other stores. Easy to buy and sell them back with good rate👍 Sparkhill Post office

Very simple user friendly easy process…

Very simple user friendly easy process to open up new Post Office Money Travel Card account

Date of experience : April 16, 2024

Using the Post Office Travel Money Card: Pros and Cons

Table of Contents

What is the post office travel money card, pros of the post office travel money card, cons of the post office travel money card, user experiences and reviews, how to get and use the card, best practices for cardholders, alternatives to the post office travel money card.

T he Post Office Travel Money Card is a convenient and secure way for UK residents to manage their finances while traveling abroad. This prepaid card allows travelers to load funds in multiple currencies, offering a practical alternative to carrying cash or using credit cards overseas. It’s particularly popular among those who seek a controlled and budget-friendly travel spending method.

The Post Office Travel Money Card is a prepaid, multi-currency card that can be loaded with up to 23 different currencies. It functions similarly to a debit card but is specifically designed for international travel. The card can be used to make purchases at millions of locations worldwide where MasterCard is accepted and to withdraw money from ATMs.

- Convenience and Ease of Use : The card is straightforward to obtain and use. Travelers can easily load funds onto the card online or at a Post Office branch.

- Security Features : The card is not linked to a bank account, reducing the risk of fraud. Additionally, if lost or stolen, it can be easily replaced.

- Wide Acceptance : Being a MasterCard product, it’s accepted at a vast number of outlets and ATMs worldwide.

- Currency Exchange Rates : Users benefit from competitive exchange rates compared to traditional currency exchange services.

- Budget Control : The prepaid nature allows travelers to manage their spending effectively, avoiding the risk of debt.

- Fees and Charges : Although the card offers free purchases, there are fees for certain transactions, such as ATM withdrawals and inactivity.

- Limitations in Usage : Some countries and establishments may not accept the card, limiting its utility in certain situations.

- Reloading Issues : Adding more funds to the card can be less straightforward, especially in remote areas or during non-business hours.

- Customer Service Concerns : Some users have reported issues with customer service, particularly in resolving card-related problems quickly.

- Comparison with Other Travel Money Options : While the card has many benefits, it may not always be the best option compared to other travel money products, like credit cards with no foreign transaction fees.

Feedback from users generally highlights the convenience and security of the card. However, some have noted the fees and reloading issues as drawbacks. It’s essential to consider both the positive and negative aspects to make an informed decision.

Obtaining the card is a simple process, either online or at a Post Office branch. Users need to load the card with the desired amount and can start using it immediately. For reloading, options include online transfers or visiting a Post Office.

To maximize the benefits of the card:

- Keep track of spending and remaining balance.

- Be aware of the fees for different transactions.

- Have an alternative payment method as a backup.

Other options include other brands of travel money cards, credit cards with no foreign transaction fees, and traditional cash exchange. Each has its pros and cons, depending on individual travel needs and spending habits.

The Post Office Travel Money Card is a valuable tool for travelers seeking a secure and convenient way to manage their funds abroad. While it has several advantages, potential users should also be aware of its limitations and fees.

Q: How does the Post Office Travel Money Card work? A: It’s a prepaid card that you load with currency before traveling. You can use it for purchases and ATM withdrawals anywhere MasterCard is accepted.

Q: Are there any fees associated with the card? A: Yes, there are fees for certain transactions like ATM withdrawals, and there may be inactivity fees if the card is not used for a prolonged period.

Q: How do I load money onto the card? A: You can load money online or at any Post Office branch. The process is simple and can be done in multiple currencies.

Q: What should I do if my card is lost or stolen? A: Contact the Post Office immediately to report the lost or stolen card. They will arrange for a replacement and transfer the balance from the old card.

Q: Can I use the card in any country? A: The card is accepted in most countries worldwide. However, it’s always best to check the specific country’s acceptance before traveling.

Q: How does the card compare to using a regular debit or credit card abroad? A: Unlike regular cards, the Travel Money Card is prepaid, which helps in budget management. However, some regular cards might offer better exchange rates or lower fees, so it’s worth comparing options.

Q: Is the Post Office Travel Money Card a good option for all travelers? A: It depends on individual needs. The card is excellent for those who want a secure, budget-friendly way to carry money abroad. However, for those who travel frequently or to less common destinations, other options might be more suitable.

Related Posts

Expert Tips for Managing Hays Travel Money Effectively

Navigating TUI Travel Money for Better Holiday Finance

John Lewis Travel Money: Convenience and Value Combined

Marks & Spencer Travel Money : Maximizing Value with M&S Travel Money on Your Trips

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

create unique & memorable travel experiences with VOLodge

About volodge.

1325 Derry Rd E Suite 3, 2nd Floor, Mississauga, ON L5S 0A2, Canada

Sign up for the exclusive offers and best deals from us

© 2023 | VOLodge.com | All Rights Reserved

Post Office Travel Card Review

Travelling is one of the most exciting and liberating experiences out there. Whether you’re jetting off to a far-off destination or just exploring your own country, having the right travel card can make the whole experience easier and more enjoyable.

Are you planning a trip? If so, you may be wondering if the Post Office Travel Money Card is a good option for you. In this article, we’ll take a close look at the Post Office Travel Money Card, how it works, and what you need to know before using it.

By the end of this guide, you’ll have all the information you need to make an informed decision about whether or not the Post Office Travel Money Card is right for your next trip.

Table of Contents

Benefits of Having a Travel Card

First and foremost, travel cards are an excellent way to earn miles and points. This can be incredibly valuable if you are a frequent traveller or want to visit somewhere far off where you’ll have to pay high airfare. Plus, you can use these miles and points to book travel, hotels, flights, vacation packages, and more.

Another major advantage of travel cards is their versatility. As you travel, you’ll have the ability to withdraw cash from ATMs using your card, pay for purchases using your card, and even get roadside assistance on select cards. You’ll also have access to excellent trip cancellation and travel insurance.

Plus, travel cards are typically easier to qualify for than other types of credit cards. This is because many companies view travel cards as a “safe” type of credit. However, having a travel card can also help to improve your credit score.

Post Office Travel Cards: What Are They?

The Post Office Travel card is a Mastercard prepaid card, which can be loaded with a choice of 23 currencies. ATMs are available in more than 200 countries where you can spend and withdraw money.

You can load your account with any currency before travelling and then use it abroad without having to convert your currency.

Post Office Travel offers a contactless card that can be accessed through its app.

Post Office Travel Cards Benefits and Features

Here’s a quick look at the Post Office Travel card’s main features and benefits:

- Payments for low-value items can be made quickly and conveniently using contactless technology

- Compatible with Apple Pay and Google Pay

- With the Travel app, you can manage your card, top it up, transfer currencies, as well as freeze it.

- You can choose from 23 different currencies and top it up whenever you need it

- Accepted everywhere Mastercard is accepted

- Call centre assistance is available 24/7

- Whenever there is currency left over, it can be transferred into another currency by using the wallet-to-wallet feature

- If you use a local currency supported by your card to spend abroad, there are no fees

Post Office Travel Card Costs

Travel money cards from the Post Office cost nothing to order and no fees apply when you pay for purchases using the currency you hold. Provided your available balance is in a currency accepted by the card, you can shop, dine, and drink without any charges.

When using your card in a country that doesn’t support the currency of your card, you will have to pay a 3% foreign transaction fee. Using your card in Brazil, for example, will result in a 3% foreign transaction fee since the Brazilian Real isn’t a supported currency.

Despite the card’s currency support, you’ll still have to pay ATM withdrawal fees. Each currency has a different ATM fee.

An example would be:

- Euro – 2 Euros

- Canadian Dollar – 3 Canadian Dollars

- US Dollar – 2.5 United States Dollars

- Swiss Franc – 2.5 Switzerland Francs

- Australian Dollar – 3 Australian Dollars

- Pound Sterling – 1.5 Pounds Sterling plus 1.5% commission

Regarding fees, one final note. There is a three-year validity period on all Post Office Travel cards. After your card expires, you will be charged a maintenance fee of £2 per month.

Exchange Rates

Exchange rates fluctuate based on the demand for currencies at the Post Office. Thus, you’ll receive a particular amount of travel money depending on the current exchange rate.

For travel money cards, you can get exchange rates at Post Office branches and on the website. Be sure to remember that rates may differ whether you are purchasing online, by phone, or in person.

In addition to the margin, the exchange rate at the Post Office will probably include a markup. When you search for the rate on Google or currency websites, you’ll most likely get an accurate one. Consequently, a margin will reduce the amount you receive when exchanging EUR, USD, or another currency.

A Post Office Travel Money company profits by offering its customers a better rate than the base rate. U.K. pounds are converted into U.S. dollars at a rate of 1.23 dollars per pound, for example.

If you exchange £400 through Post Office Travel Money, you can get 1.18 USD per pound. In this case, there is a difference of £16 or 4%. Exchange rates are better when you exchange large sums of money .

Exchange Rates for In-Branch Travel Money

According to the Post Office, in-branch exchange rates are determined by many factors, including branch location, competitor pricing, convenience, etc. The company will always strive to offer the best possible rate within these parameters. Online orders/distribution is the cheapest method for many retailers, as they can use centralised packing costs. Because of this, online exchange rates are always better than branch rates.

Comparing Post Office Travel Money Rates to Other Providers

There are several new services that it’s worth comparing directly to Post Office Travel Money.

Online-Only Banks

There have been several purely mobile banks launched in recent years both in the UK and across Europe. With services like Monzo, N26, Revolut, Monese, or Bunq, consumers can access a wide range of banking options.

Each of these modern financial institutions provides services such as money transfer agencies and international travel cards, and it makes sense to compare them with Post Office Travel Money.

For example, Monzo facilitates international money transfers through the popular exchange company Wise. For example, when sending a thousand pounds to a Swedish account using Monzo/Wise, the recipient receives 12,103 Swedish crowns versus 11,546 with Western Union, a difference of around 5%.

Other Currency Providers

It may also be possible to transfer money at a better rate in some countries. Using Xendpay, you could send 500 pounds to Saudi Arabia, and the beneficiary would receive 2,289 Saudi Riyals instead of 2,158 Saudi Riyals with Post Office Travel Money.

Supported Currencies

Prepaid travel cards from Post Office can be loaded with any of the following 23 currencies:

- CAD – Canadian dollar

- JPY – Japanese yen

- USD – US dollar

- AUD – Australian dollar

- CHF – Swiss franc

- AED – UAE dirham

- CNY – Chinese yuan

- DKK – Danish kroner

- PLN – Polish zloty

- CZK – Czech koruna

- ZAR – South African rand

- GBP – Pound sterling

- TRY – Turkish lira

- HKD – Hong Kong dollar

- THB – Thai baht

- HRK – Croatian kuna

- SGD – Singapore dollar

- HUF – Hungarian forint

- SEK – Swedish kronor

- SAR – Saudi riyal

- NOK – Norwegian krone

- NZD – New Zealand dollar

Sending Money With the UK Post Office

Many Post Office branches and their website offer Post Office Travel Money. They offer convenient and quick foreign exchange services. They are useful for local currency exchanges because they are so widely available. Post Office services like international money transfers and travel cards offer additional options for sending and spending overseas.

How to Get and Use a Post Office Travel Card?

Post Office travel cards are only available to UK residents over 18 years old.

Ordering Your Card

To order a Post Office Travel card, you can do one of three things:

- You can order through the Post Office Travel app

- Visit the Post Office website to apply online

- Get your card at your local Post Office. It will be necessary to bring photo identification, like a passport or driver’s licence

Your card should be available immediately if you apply at a branch. Your card will be delivered within two to three days after you apply online or via the app.

Card Activation

It’s necessary to activate your travel card before you can use it. You’ll find detailed instructions in your welcome letter.

Using Your Card

ATMs and online sites that accept MasterCard accept Post Office travel cards, too. If you are buying something in person, you’ll need your PIN to verify your purchase and possibly your signature if the Chip and PIN system is not widely available in the country.

In some countries, contactless payments are also allowed for small amounts, although the rules and limitations vary.

According to its terms and conditions, you should not use your Post Office card in certain situations.

Some of them include:

- Tolls on the road

- Petrol pumps with self-service

- Deposits for car rentals or hotels

- Airline or cruise ship transactions

Adding Money to Your Card

With the Post Office Travel app, you can add money to your card easily. Additionally, you can add money at a local branch or on the Post Office website.

Buying Back Currencies

Having unused currency on your card gives you a few options. You may be able to withdraw cash at your local Post Office branch or ATM, but there may be a fee.

Wallet-to-wallet transfers are also available in the app. You can transfer unused balances from one currency to another. In preparation for your next trip to Europe, you can convert unused USD into EUR.

Each currency listed above can be topped up for between fifty pounds and five thousand pounds on your card. Your card can hold up to ten thousand pounds, as well as carry out transactions of up to thirty thousand pounds annually.

Different currencies have different limitations on cash withdrawals. For example, in a single transaction, you may withdraw up to 450 euros or 500 dollars.

App Overview

On Google Play and the App Store, you can download the Post Office Travel app for free. With the app, you can activate and order your card, check your balance, add money to it, and more.

In addition to transferring leftover currency between wallets, it’s possible to convert it to another currency you prefer by using the new wallet-to-wallet feature.

Furthermore, you can book airport parking, purchase travel insurance through the app, and use other features.

Contacting the Post Office

If you need assistance, you may reach the contact centre by dialling 0344 335 0109 in the United Kingdom or 0044 20 7937 0280 from abroad. Customer service is available each day of the week at any time of the day.

In addition, you can reach Customer Services at the Post Office in the following ways:

- Postal mail at PO Box 3232, Cumbernauld, G67 1YU, Post Office Travel Card

- Send an email to [email protected]

Post Office Travel Card: FAQs

Here are some common travel card problems you might encounter.

When I lose or damage a card, what do I do?

Post Office currency cards are easy to replace if lost or damaged. Your card will be blocked, and another one will be sent to you. App users can also freeze their cards.

How should I deal with a declined or blocked card?

The first thing you need to do is ensure that you have enough money in your account via the app. If you don’t have enough money in your account to purchase your item, call the customer care centre.

If I forget my PIN, what should I do?

Call the customer service centre if you cannot remember your travel money card PIN. If you need a new one, they can issue it for you.

My card is about to expire. What should I do?

A new card should automatically be sent to you. You can call the contact centre if it hasn’t arrived after the expiration date, and they’ll issue you another.

Post Office Prepaid Travel Card Summary

Travel cards from the Post Office are handy if you want to keep your money safe while you’re away from home. The convenience of not carrying cash around with you and not having to change money during your trip will make your trip much more enjoyable.

Because it’s a contactless card, you can pay in local currencies quickly and easily. This helps you budget because you can only spend what’s on it.

If you travel frequently or take multi-destination holidays, the card is convenient since you can store 23 currencies on it. A card that supports a variety of currencies might be more useful if you love exploring far-flung areas.

The exchange rate is a drawback to take into account. Post Office rates may be competitive (compared to airport exchange rates, for example), but they will likely include a margin or markup. ATMs also charge fees when you use your card.

Comparing other travel money cards could help you find a better deal, so make sure to shop around.

by Matt Woodley

- About Antique Wolrd

- Antique News

- Cards & Envelopes

The Post Office Travel Money Card Review: Key Features, Rates and Fees

If you’re heading overseas, a travel card could be a handy solution for covering your spending. They tend to be cheaper to use than your ordinary bank debit card, and can even offer better exchange rates compared to buying currency.

- 70 Best Valentine’s Day Wishes to Write in All of Your Cards

- 21 Companies That Will Pay You to Write Greeting Cards (Hallmark Isn’t the Only Company!)

- How to Track Delivery of Your Notice or Secure Identity Document (or Card)

- 17 Best Cardinal Gifts for That Special Someone

- Are Trading Cards Considered Media Mail?

There are lots of travel cards out there, but here we’re going to focus on the Post Office Travel card. We’ll run through what it is and how it works, along with fees, exchange rates, supported currencies and how to apply for one.

You are watching: The Post Office Travel Money Card Review: Key Features, Rates and Fees

And while you’re comparing spending options ahead of your trip, make sure to check out the Wise card. This international card can be used in 175 countries worldwide, automatically converting your pounds to the local currency at the mid-market rate. There’s only a small fee to pay for the conversion¹, or it’s free if you already have the currency in your Wise account.

But for now, let’s focus on the Post Office travel card.

¹ Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

What is the Post Office travel card?

The Post Office Travel card is a prepaid Mastercard that you can load up with up to 23 currencies. You can use it for spending and ATM withdrawals in over 200 countries, in 36 million locations².

Simply top up with your chosen currency before you travel, then spend overseas without needing to convert currency.

The card is contactless and can be managed using the Post Office Travel app.

Key features and benefits

Here’s your quick at-a-glance guide to the main features and benefits of the Post Office Travel card ²:

- Contactless for making fast and convenient low-value transactions

- Available with Google Pay and Apple Pay

- Manage, top up, transfer between currencies and freeze your card using the Travel app

- Reload whenever you need to, with up to 23 currencies available

- Can be used wherever Mastercard is accepted

- 24/7 call centre help is available if you need it

- Wallet-to-wallet feature – where you can transfer any leftover currency to a new currency of your choice

- No charges when you spend abroad using an available balance of a local currency supported by the card (although there are some fees to know about – we’ll look at those next).

Post Office travel card fees and charges

Post Office travel cards are free to order and there are no charges for paying retailers in the currencies held on your travel money card. So, you can spend in shops, bars and restaurants without any charge – as long as you’re paying with an available balance of a currency supported by the card².

If you do use your card in a country with a local currency that isn’t supported by the card, you’ll be charged a cross-border fee of 3%². For example, if you go to Brazil and use your card at a local restaurant, you’ll be charged the cross-border fee of 3% as Brazilian real isn’t supported by the card.

You’ll also be charged for withdrawing cash from any ATM, even in currencies supported by the card. These ATM fees vary depending on the currency used. For example ²:

- Euro – 2 EUR

- US Dollar – 2.5 USD

- Australian Dollar – 3 AUD

- Pound Sterling – 1.5 GBP + commission of 1.5%

- Swiss Franc – 2.5 CHF

- Canadian Dollar – 3 CAD.

One last thing to note on the subject of fees. All Post Office Travel cards are valid for up to 3 years. Exactly 12 months after your card expires, you’ll start to be charged a monthly maintenance fee of £2².

Here is also a list of the European countries that charge the highest ATM fees.

Exchange rates

The Post Office offers exchange rates that move up and down according to the demand for currencies. So, the exact amount of travel money you’ll receive on your travel card will depend on the rate at the time of your purchase.

You can check the Post Office exchange rates on its website, travel money card app and branches. Keep in mind though that rates may vary whether you’re buying online, via phone or in-store.

The Post Office exchange rate is also likely to include a margin or mark-up on the mid-market rate. This is the rate you’ll find on Google or currency sites like XE.com, and is generally considered to be a fair rate. A margin added on top of this makes the rate worse for you, so you’ll get less EUR, USD or whatever other currency you’re exchanging.

Read more : Explosion Cards: How To Make A Pop Up Box

Wise only ever uses the mid-market exchange rate, with no mark-ups or margins. This means that your pounds go further, wherever you’re travelling to.

Currencies supported

You can load your Post Office prepaid travel card with funds in any of these 23 currencies²:

- EUR – Euro

- USD – US dollar

- AUD – Australian dollar

- AED – UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish kroner

- GBP – Pound sterling

- HKD – Hong Kong dollar

- HRK – Croatian kuna

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish kronor

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

You can top up your card with between £50 and £5,000 in any of the currencies listed above. The maximum you can hold is £10,000, plus you can load and spend up to £30,000 on your card each year².

Cash withdrawal limits vary from currency to currency. For example, you can withdraw a maximum of €450 euros or $500 US dollars² in a single transaction.

App overview

The Post Office Travel app is free to download from the Google Play and Apple App stores. You can use it to order and activate your card, monitor your balance and top up with currencies. Using the new wallet-to-wallet feature, you can also transfer leftover currency to other currencies of your choice in just a few taps.

You can also buy Post Office travel insurance, book airport parking and access other features through the app.

How good is the Post Office prepaid travel card?

The Post Office travel card is handy to have if you’re travelling and want to keep your money safe. You won’t need to carry cash around with you, or have to take time out of your trip to change currency.

Paying in local currencies is quick and easy, especially as it’s a contactless card. Plus, you can only spend what’s on it, so this can help you to budget.

As you can store 23 currencies on it, the card is convenient if you travel regularly or are taking multi-destination holidays. If you love visiting far-flung places, however, you might need a card that supports more currencies.

One drawback to consider is the exchange rate. While rates may be competitive (compared to changing money at the airport, for example), the Post Office is likely to include a margin or mark-up on the mid-market rate. There are also charges for using your card at an ATM.

So, it’s important to shop around and compare other travel money cards, as some could offer you a better deal.

Take the Wise card, for example. With this contactless international card, you can spend in 175 countries and manage over 50 currencies in your Wise account. There are no ATM fees¹ for withdrawing up to £200 a month (2 or less withdrawals) and you’ll get the mid-market exchange rate on every transaction. Note, that Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks.

The Wise card will automatically convert your money to the local currency at the mid-market rate when you spend, for just a small conversion fee¹.

How to get and use a Post Office travel card

You can only get a travel card from the Post Office if you’re aged over 18 and a resident of the UK.

Ordering your card

There are three ways to order a Post Office Travel card:

- Download the Post Office Travel app and place an order there.

- Apply online at the Post Office website.

- Pop into a local Post Office branch to apply for a card. You’ll need to take a form of photo ID with you, such as a passport or UK driving licence.

If you’re applying in a branch, you should be able to pick up your card there and then. For applications made online or in the app, you’ll need to wait 2-3 days for your card to be delivered.

Card activation

You’ll need to activate your travel card before you can use it.

Read more : Hallmark Pack of 20 Thank You for Your Sympathy Cards, Cherry Blossom (Funeral Thank You Cards)

You’ll be given instructions on how to do this in the welcome letter delivered along with your new card.

Using your card

You can use your Post Office travel card anywhere that accepts MasterCard, online and at ATMs³.

If you’re buying something in person, you’ll need to enter your PIN. If you’re in a country where Chip & PIN isn’t as widely available (such as the USA), you may be asked to sign to verify your purchase instead.

You can also make contactless payments for small amounts, although different countries have different rules and limits for this.

The Post Office’s terms and conditions list a handful of situations in which you shouldn’t use your card. These include the following³:

- Self-service petrol pumps

- Car hire or hotel check-in deposits

- Transactions on planes or cruise ships.

How to top up your card

The easiest way to top up your Post Office Travel card is using the app. If you prefer, you can also top up at the Post Office website or in a local branch³.

Buying back currencies

If you have unused currency on your card, there are a couple of options available. You may be able to withdraw it at a local Post Office branch or ATM, although fees may apply³.

Alternatively, you can use the new wallet-to-wallet feature in the app³. This lets you transfer unused balance in one currency over to another. For example, you can transfer unused USD to EUR, ready for your next trip to Europe.

How to contact the Post Office about your card

You can call the contact centre on 0344 335 0109 when you’re in the UK or +44 (0) 20 7937 0280 when you’re overseas³. Lines are open 24 hours a day, seven days a week.

You can also contact the Post Office Travel Card Customer Services department via the following methods³:

- By post at Post Office Travel card, PO Box 3232, Cumbernauld, G67 1YU

- By email at [email protected].

Post Office Travel Card: troubleshooting tips

Here’s how to deal with some common problems you might have with your travel card.

How do I report a lost or damaged card?

If you lose your Post Office currency card or discover that it’s damaged, just phone the contact centre. They’ll block it and send you another. You can also freeze your card using the app.

What should I do if my card is declined or blocked?

Firstly, check your account via the app to make sure you have enough money in it. If you have enough to pay for your item or have less than you should have in your account, call the contact centre.

What if I’ve forgotten my PIN?

If you can’t remember your travel money card PIN, phone the contact centre. They can issue you with a new one.

What happens when my card expires?

You should receive a new card automatically³. If it hasn’t arrived after the expiry date, call the contact centre and they’ll issue you with one.

And that’s pretty much it – everything you need to know about the Post Office Travel card. It’s handy if you don’t want to carry cash around or exchange currency while on holiday. And you can use it in multiple countries, as it supports 23 currencies. The app is another great feature, letting you top up and manage your money on the move.

But just remember to compare exchange rates and fees (especially for those all-important ATM withdrawals) before choosing a travel card for your trip – as you could be getting a better deal elsewhere.

Sources used:

- Wise – terms and conditions & pricing

- Post Office – Travel Money Card

- Post Office Travel card – Terms and Conditions

Source: https://antiquewolrd.com Categories: Cards & Envelopes

Join Lenon Blur

I am a JOIN LENON BLUR - world-leading expert, and I am the admin of Antiqueworld with many years of experience researching antiques and postal publications. I hope to provide the audience with the most accurate and informative information.

Best prepaid travel money cards 2024

In this article

Which prepaid travel card do you need?

Best multi-currency prepaid cards, best sterling prepaid cards, what exchange rate do you pay.

- Fees and charges to watch out for

Is it worth getting a prepaid card?

Are prepaid cards secure, alternatives to prepaid travel cards.

Your holiday could be ruined by fees on overseas spending if you pack the wrong card to spend with.

Prepaid travel cards, also known as 'currency cards', allow you to load money in pounds and spend in another currency fee-free and usually allow you to lock in competitive exchange rates, saving you money compared with using your everyday debit or credit card.

However, these types of deals can come with their own special variety of hidden fees. In this guide, we take the hard work out of comparing these deals and explain the pros and cons of using a prepaid card for your trip.

Be more money savvy

free newsletter

Get a firmer grip on your finances with the expert tips in our Money newsletter – it's free weekly.

This newsletter delivers free money-related content, along with other information about Which? Group products and services. Unsubscribe whenever you want. Your data will be processed in accordance with our Privacy policy

There are two main ypes of prepaid travel cards to consider packing for your next trip:

- Multi-currency prepaid cards allow you to load several currencies onto one card, ideal for visiting multiple destinations. For example, you could have £100, $200 and €300 stored on one card in different 'wallets'. You can lock in rates by converting when you load the cash, or store some money in pounds to convert later.

- Sterling prepaid cards offer the most flexibility, as you can load your card with pounds and spend in dozens of different currencies. Each time you spend or withdraw cash, the pounds are converted to the required currency at the exchange rate on the day. This may make it harder to forecast how much money you'll have available in any given destination.

Multi-currency prepaid cards allow you to load a variety of major currencies in one place.

We've analysed the main providers of multi-currency prepaid cards including the type of currency offered, load fees (loading money onto the card), fees for withdrawing cash, and inactivity fees that could catch you out.

Please note the table is ordered alphabetically, not ranked in order of features.

The Post Office Travel Money Card and Travelex card can load the most currencies, however, charges apply for some cash withdrawals at an ATM wth the Post Office deal.

Asda Money, Caxton, EasyFX, Sainsbury's and Travelex had similar offers with free ATM withdrawals. While most have £500 withdrawal limits Easy FX allows £1,000 (limited to £500 in a single transaction) and Nectar cardholders can get better exchange rates at Sainsbury's.

All the cards allow you to load money that is immediately converted to a foreign currency free of charge. However, more than half of the providers charge a fee of up to 2% for topping up your wallet with pounds to convert at a later date. So if you plan on doing this often you may be better off with one that doesn't charge.

Sterling prepaid cards offer the most flexible option for travellers and our analysis shows they can be as competitive as multi-currency deals.

We looked at the exchange rates offered, as well as the fees you'll pay and maximum balances.

*Rate could be higher depending on currency

These cards are convenient as they allow you to load as much currency as you want into your account, however, you'll need to download an app to use them.

The Revolut card uses the interbank rate and you will incur no fees on top of the rate if you convert money Monday to Friday - therefore it's worth loading up and exchanging before the weekend. You'll be charged a 2% fee if you withdraw more than £200 a month.

The Wise card also uses the interbank exchange rate but charges a 0.43% fee on top every day of the week. It offers two fee-free cash withdrawals of up to £200 each month in the UK or Europe.

HSBC-backed app Zing could also be a good option. It has a lower fee when converting currencies, and it uses a third party conversion rate which is typically lower than the interbank rate.

Which? Money Magazine

Find the best deals, avoid scams and grow your savings and investments with our expert advice. £4.99 a month, cancel anytime

Prepaid card providers offer different exchange rates.

Some use the 'interbank rate' (the rate banks charge one another) and others may use Mastercard or Visa's exchange rates.

In some cases, a provider may pick one of these rates, then apply a percentage on top, usually between 1% and 2.5%.

When picking a prepaid travel card you should compare the exchange rates offered as well as the card's fees.

Fees and charges to watch out for

Prepaid cards designed for spending abroad are usually cheaper than spending on your everyday debit or credit card.

However, almost all prepaid cards currently on the market come with a variety of fees and charges. Common charges to watch out for include:

- Application fees - some providers apply a one-off charge to open the account ranging from £5 to £10, though most will offset this if you load a certain amount.

- Monthly fees - the worst prepaid cards will charge an ongoing fee just for holding the card. It can range from £2 to £5 a month, which can be hugely expensive over a year.

- Top-up fees - if you're using a credit card to top up your prepaid card you could be charged a fee by your prepaid card provider. Plus as it counts as a 'cash transaction' your credit card provider could charge you a fee and interest. So it's usually best to use a debit card to top-up your account.

- UK and foreign ATM withdrawal fees - some prepaid cards charge for using ATMs abroad, usually £1.50 to £2 per withdrawal. Some providers will waive the fee if you withdraw a certain amount. You can minimise the risk of being hit with fees by planning how much you want to spend before you travel and taking out cash in one lump sum.

- Cross border fees - if you use your prepaid card for a transaction that's not in your card's currency, you could be charged a fee of around 2.75%.

- Inactivity fees - if you don't use your card you could also face a penalty. Some providers will charge around £2 a month if you haven't spent on the card within 12 months.

- Replacement fees - prepaid cards, like credit and debit cards, come with an expiry date, which can range between one and five years after opening. You'll normally have to pay a renewal fee of around £5 if you want to continue to use the account.

- Redemption fees - some providers charge a fee to get any money you haven't used back. This can be up to £10 so it's wise to only load what you plan to spend and nothing more.

Prepaid cards also often come with limits on loading and transactions, which could leave you in a tricky situation if you aren't aware of them.

If you're considering getting a prepaid travel card, here are the pros and cons to weigh up.

Each card provider will have its own terms and conditions, so read them carefully before you sign up.

What are the pros of getting a prepaid card?

- Widely accepted around the world.

- Comes with chargeback protection.

- Can help you budget and avoid overspending.

- Could be cheaper for overseas spending and withdrawals.

What are the disadvantages of getting a prepaid card?

- Not accepted for pre-authorised transactions such as hiring a car.

- No Section 75 protection on purchases over £100.

- Low withdrawal limits and no way to borrow money in an emergency.

- Come with a variety of fees including charges for lack of use.

Prepaid cards offer a secure way to carry cash when abroad.

They come with the same security features as credit and debit cards, so you need a Pin to withdraw cash or use them in person. However, many are now contactless so you may not need a Pin for smaller purchases.

It's also worth bearing in mind that prepaid cards offer no protection for losses under Section 75 of the Consumer Credit Act . However, redress may be possible under the MasterCard or Visa chargeback scheme.

What if the prepaid card provider goes bust?

The Financial Services Compensation Scheme does not cover deposits onto prepaid cards.

Most prepaid providers will deposit customers' cash in a ring-fenced account held in a bank or building society. So, if the prepaid company goes bust, your money should be protected by the bank holding your cash.

However, if the bank or building society fails, your cash won't be protected. So you should never store lots of money on a prepaid card, just what you need to spend in the near future.

Prepaid cards are a safe way to carry cash overseas. But you won't be able to spend from your main current accounts or borrow money in an emergency.

A credit card with low fees on overseas spending can work out as the best option for purchases made abroad, as long as the bill is paid off in full each month. For a credit card with low overseas spending fees, check out the best travel credit cards .

Alternatively, many banks offer debit cards with fee-free overseas spending. We round up your options in our guide to the best debit cards to use abroad .

That said, applying for a credit card or current account for a debit card requires a credit check, whereas applying for a prepaid card doesn't. So if you have a poor or no credit history it will be easier for you to get a prepaid card.

Currensea has launched what it calls the 'first UK direct debit travel card'. This card is linked to your bank account which means you do not need to top up the card, as long as you have money in your account.

It provides a layer over your existing bank account that will allow you to spend in all 180 currencies without charges. It uses the interbank exchange rate for 16 major currencies and Mastercard rates for all other available currencies.

Currensea doesn't charge any non-sterling transaction fees or dormancy fees. For personal accounts, there is a 0.5% markup on the exchange rate. ATM withdrawals are free under a limit of £500 a month. After this, a 2% fee will be applied.

Your prepaid card questions answered

Grace, our prepaid card expert, answers the top questions people have about these types of deals.

Where can I use a prepaid travel card?

Prepaid cards are usually issued by major card networks like Visa or Mastercard, meaning they can be used in millions of places around the world, as well as online, just like a debit or credit card.

You should be able to use your card at most ATMs abroad, and at most retailers that accept card payments.

However, there are some notable exceptions to this, including car hire firms, hotels and petrol stations that require pre-authorisation.

Should I pay in pounds or in the local currency?

When abroad you will sometimes be asked if you want to pay or withdraw cash in sterling or the local currency. This is called dynamic currency conversion and is usually best avoided.

With a specialist prepaid card you'll get a better rate paying in the foreign currency rather than in sterling. In fact, you might be charged a fee for paying in sterling if you don't have a multi-currency card.

What happens if my prepaid card is lost or stolen?

Like travellers cheques , your money is safe and will be replaced if the prepaid card is lost or stolen.

However, you might be charged for calling the customer helpline and for emergency card replacement by courier.

As long as you contact the provider of your prepaid card and get it blocked, you shouldn't lose out on any money, though you may have to pay up to £10 for a replacement card.

Bear in mind that if your prepaid card is contactless it could be used for a series of small, fraudulent transactions, so always alert your card provider as soon as possible. It's also worth alerting local police or security services if there's been a theft - you may need an incident number to claim losses back on your travel insurance.

Why can't I use it for car hire or a hotel room?

Most prepaid cards don't allow you to make pre-authorised transactions. These are often required when you have to pay for something where the final cost hasn't been decided, or where you use the service before paying.

As such, you may not be able to use your prepaid car to pay for petrol at the pump, hire a car, or pay for a hotel room.

What if I have an emergency or run out of money overseas?

You'll be able to load more money onto your prepaid card after you've activated it, usually through the provider website or app.

Most cards have daily withdrawal limits, so make sure you can withdraw enough cash to cover your spending for the full day.

Keep in mind that prepaid cards don't have a borrowing facility, so you won't be able to rely on it for emergency funds. For this reason, it can be wise to bring a travel credit card overseas with you, in case you need to buy flights home or pay for out-of-pocket medical expenses.

- Best travel credit cards 2024

- Best debit cards to use abroad 2024

- Buying travel money online

- Free newsletters for everyone

Related articles

- Credit card repayment calculator

- Best personal loan rates 2024

- Credit reports: all you need to know

- How to pay off your debts

- Share on Facebook

- Share by email

Latest News In Which? Money

Which? Money podcast: how would a base rate fall impact your savings?

03 May 2024

Which? Money podcast: how to make the most of your pension in 2024-25

19 Apr 2024

Which? Money podcast: can banking hubs save our access to cash in the UK?

05 Apr 2024

Which? Money podcast: can you cut your council tax?

29 Mar 2024

Which? Money podcast: explaining the best way to use your ISA allowance

22 Mar 2024

Which? Money podcast: should you have a Power of Attorney?

15 Mar 2024

Which? Money podcast: unpacking the Spring Budget 2024

06 Mar 2024

Help for those in debt announced in Spring Budget

New British Isa and British Savings Bonds announced in Spring Budget

Which? Money podcast: what your financial data reveals about you

01 Mar 2024

Which? Shorts podcast: the reality of owning a listed property

21 Feb 2024

Which? Money podcast: could mis-sold car finance be the next PPI scandal?

16 Feb 2024

Which? Money podcast: credit cards you should consider

26 Jan 2024

Ski travel insurance: 4 dos and 4 don'ts

22 Jan 2024

Which? Money podcast: why you should act now to get the best savings rates

19 Jan 2024

Which? Money podcast: the tax mistakes you must avoid

12 Jan 2024

Which? Money podcast: ways to make and save more money in 2024

05 Jan 2024

10 realistic New Year's resolutions to strengthen your finances in 2024

31 Dec 2023

The strangest scams of 2023

20 Dec 2023

Which? Money podcast: state pension explained

15 Dec 2023

Siri Stafford/Getty Images

Advertiser Disclosure

What to know about prepaid travel credit cards

Prepaid travel cards are one more way to access cash while traveling the globe

Published: December 15, 2022

Author: Allie Johnson

Author: Dan Rafter

Editor: Brady Porche

Reviewer: Kaitlyn Tang

How we Choose

Prepaid travel cards can make it easy to access cash while you’re traveling abroad, but remember that convenience comes with limitations.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

Finally ready to take your next international trip? Whether it’s a business meeting in Brussels or a foodie’s tour of Florence, you might consider packing a prepaid travel card for your trip.

Prepaid travel cards let you access cash in your destination’s local currency without the risk of using your debit card. They also let you avoid the high fees of credit card cash advances or the hassles of scrounging up traveler’s checks before you depart.

But, be careful — despite the convenience of prepaid travel cards, they come with their own set of fees and limitations (most notably ATM withdrawal and purchase amount caps that could put a damper on your vacation).

“A prepaid travel card is one tool in a diverse travel wallet,” said Julie Hall, internal communications manager for Hilton Grand Vacations and former public relations manager for AAA, in a previous interview. “It’s one of the most convenient ways to get money while traveling.”

Let’s take a look at everything you need to know about prepaid travel cards — from how they work to the pros and cons of using them for your travels.

- How do prepaid travel cards work?

Prepaid travel cards work much like general-purpose prepaid cards, except that they typically offer special features and perks designed for travel — which can vary based on the issuing bank.

In general, to use a prepaid travel card, you purchase the card and simultaneously load it with the funds you want to spend on your trip, up to the maximum amount allowed on the card. (For example, the PayPal Prepaid Mastercard® , a general prepaid card, allows a maximum balance of $15,000.)

Once you’ve arrived at your destination, you can use your prepaid card to make purchases directly (much like you would with a debit card). You can also use it at an ATM to get cash in that destination’s currency.

Depending on the card issuer, you’ll be able to log in to a mobile app or your online account to check the balance, review your purchases and see any any account charges.

- What are the benefits of a prepaid travel card?

Why not just take cash, your credit cards and your debit card the next time you travel to an international destination? Why would you also take a prepaid credit card?

If you lose your card, thieves only have access to the loaded cash

If a thief gains access to your prepaid card abroad, they’ll only have access to whatever funds are loaded onto the card (unlike debit cards, which can provide thieves access to your bank account, or credit cards, which a thief can charge up to a certain limit).

Further, the network through which a prepaid card is offered may provide a zero liability policy , though, overall, prepaid cards don’t offer the same breadth of protections as debit and credit cards (think chargebacks and fraud alerts).

More convenient than traveler’s checks

Prepaid travel cards also provide more convenience than, say, traveler’s checks (which, yes, still exist). Getting traveler’s checks before you go can be a hassle, and you might also be surprised at how many retailers across the globe no longer accept them. As a result, prepaid cards are often a better option than these paper checks.

- What are the drawbacks of a prepaid travel card?

Like most financial products, prepaid travel cards come with pros and cons. Here are some of the drawbacks of using one:

Foreign transaction fees, among others

Travelers should be wary of the fees connected to prepaid cards, as they can add up to a lot of money during an international trip. Many prepaid cards carry foreign transaction fees. Today, it’s far easier to find credit cards with no foreign transaction fees than to find prepaid cards without them.

Further, prepaid travel cards may also charge a card purchase fee, ATM withdrawal fee, higher foreign ATM withdrawal fee, inactivity fee and a fee to get any remaining balance back by check.

No help for your credit score

If you charge restaurant meals, souvenirs and tickets to a traditional credit card and pay your bill on time, your three-digit credit score will receive a boost. This doesn’t happen with purchases you make with prepaid travel cards, because your prepaid card activity isn’t reported to the national credit bureaus .

If you don’t keep track, you could run out of funds

If you’re used to swiping a credit card without much thought, there’s a chance a prepaid card could leave you high and dry when you go to make a purchase. Just be sure to keep tabs on the amount of money you’ve loaded — and spent — on your card.

Prepaid travel card tips

Prepaid travel cards do come with some potential hurdles. Here are some tips for avoiding the most common downsides of these cards:

- Check the fees associated with your card (or potential card): Prepaid cards can charge fees that existing debit and credit card holders aren’t used to, so it’s important to read the fine print before swiping. For example, the Netspend® Visa® Prepaid Card charges a $5.95 inactivity fee per month after the card has been idle for 90 days.

- Verify the card will work at your destination: Double-check with your issuer that your prepaid card will be accepted where you’re traveling. Even a card that’s designed for international travel might not work in specific locations due to restrictions from U.S. trade sanctions.

- Know the limits: Prepaid travel cards typically have limits that could throw a wrench into your trip if you don’t understand them ahead of time. For example, some cards can have a daily reload limit as low as $500 (or as high as $7,500, in the case of the Netspend Visa card). Again: Be sure to read through your card’s fine print before embarking.

- Avoid holds at all costs: In a sense, prepaid travel cards work like debit cards. Be sure to avoid using a prepaid travel card to reserve a hotel room or a rental car, which can trigger a hold that could tie up hundreds of dollars of your cash for a week or longer. Instead, use a credit card to reserve these items, then use your prepaid card to pay the final charges.

Should you use a travel credit card instead?

If the drawbacks of a prepaid travel card outweigh the benefits, you might be better off signing up for a travel credit card or using one you already have as your primary payment method while traveling.

Travel credit cards almost always have zero fraud liability, which can set your mind at ease in the event your card is lost or stolen . They also let you earn rewards for your spending, and many offer purchase and trip protection and have no foreign transaction fees. Some even offer perks such as access to airport lounges where you can get complimentary food and drink. And, depending on your credit limit, you may have more spending power with a credit card than a prepaid card.

That said, they can also have pitfalls. Not all travel credit cards are accepted in all countries. For example, Visa and Mastercard are widely accepted, while American Express and Discover have a smaller international presence. And, depending on your location, some merchants may require chip-and-pin cards or may not accept payment cards at all.

It’s advisable to carry a few different payment methods with you (credit, debit and prepaid) when traveling, along with some local cash. Also, notify your credit card company about your travel plans, lest they flag your card as stolen and cancel it.

Bottom line

A prepaid travel card doesn’t come without downsides, but if you want an easy way to access cash in your destination’s currency — and want a quick way to pay merchants once you arrive at your international destination — the ease of using them might make your trip a less stressful one.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Allie Johnson is an award-winning freelance writer covering personal finance, business and lifestyle. She loves tracking down tips, tricks and cautionary tales about credit cards and money.

Dan Rafter has covered personal finance for more than 15 years for publications ranging from The Washington Post and Chicago Tribune to Wise Bread, HSH.com and MoneyRates.com. His work has also appeared online at the Motley Fool, Fox Business, Huffington Post, Christian Science Monitor and Time.

On this page

- Prepaid travel card perks

- Stick with travel credit card?

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Education

Best credit cards for international travel

The best credit cards for international travel can make traversing the globe a more comfortable and rewarding experience. Compare our top picks to see how they work for your travel style and goals.

Best no-annual-fee travel credit cards of 2023

Looking for the best travel rewards with no annual fee doesn’t have to be hard. There are plenty of great credit cards you can explore to help you earn and redeem rewards for travel.

Best credit cards for trip cancellation

10 credit and money tips for travel abroad

TSA PreCheck vs. Global Entry vs. Clear: Which is best for you?

How do travel rewards credit cards work?

Explore more categories

- Card advice

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

- TRAVEL MONEY

- TRAVEL ADVICE

Currensea vs Post Office review - What’s the best travel money card

Who is the post office .

The Post Office is a well-known high-street brand, trusted by millions for postage, government, and financial services through its wide network of branches. However they are not the ones to deliver your mail, that is the Royal Mail, and is a different business to the Post Office.

What are they offering?

The Post Office offers a prepaid multi-currency travel card allowing you to hold 23 different currencies. Being a prepaid travel card means you need to load money directly onto it and then reload or top up when you need more money on it. This can be done by their travel app at any time, and it allows you to then spend in any of their available currencies.

The aim is to provide an easy solution to managing your travel money abroad. The Post Office is well known for promoting a 0% commission service when taking physical cash abroad, so has been favoured by travellers for a long time.

*Rates and charges shown are correct as of 30th September 2021

Currensea travel debit card

What travel money card options and plans do the Post Office have?

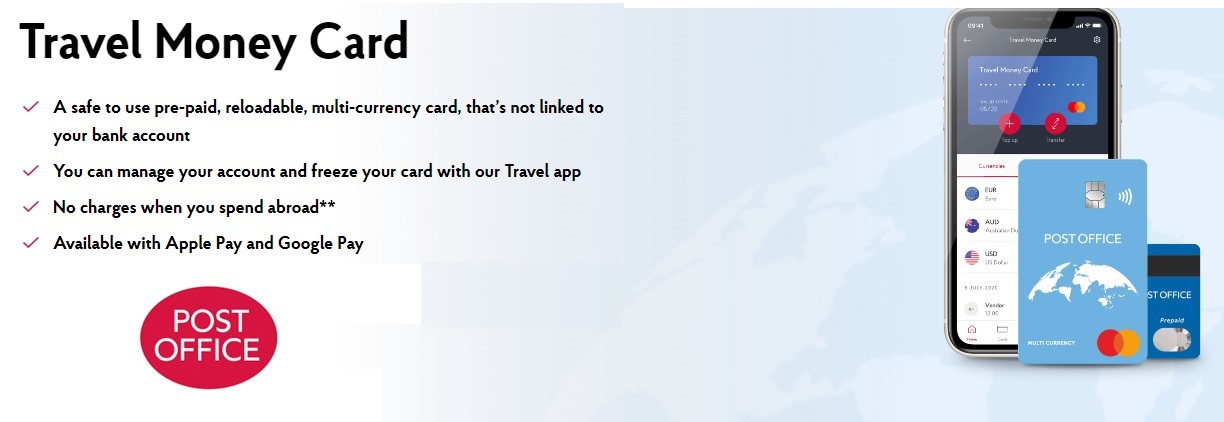

The Post Office has one simple plan, their basic Post Office Travel Money Card. While the travel money card is free to get, there is a minimum load amount of £50 of whichever of the 23 currencies you choose.

What are Post Office fees when spending abroad?

Terms such as fee-free, no commission, and zero charges are used a lot by travel money providers, and the Post Office is no different when it comes to marketing their card, which offers 0% commission. But as with most others, there is often a hidden fee under the bonnet. After all, how else would a provider make any money?

So what fees does the Post Office charge?

All of the above fees can be found in the Post Office terms and conditions , pages 12-15

We took a look at the EUR exchange rate they offered when loading the card before purchase, when we compare this to the interbank (real) rate we can also see a hidden charge in the FX rate of 3.8%!

We checked a few currency conversions and there is a maximum hidden FX fee of 3.78% across all when loading up to £499.

A great indicator as to whether there are hidden fees or not, is if a better rate is offered when loading more money as you can see here:

Even with the better rate there is still a hidden fee of 2.4% when compared to the live interbank rate at the time.

It’s also worth noting that if you use your Post Office card to withdraw cash abroad, you will be charged at the point of loading your desired currency (the FX mark-up rate ), you will then be charged a minimum of £1.50 per ATM withdrawal on top of this. So withdrawing £100 worth of currency could cost around £5.20.

Why would you use a Post Office Travel Money Card?

More often than not the Post Office works out more expensive than if you were to use your high-street bank account. However, you may like the functionality of separating your holiday money from your main bank account by preloading the card.

The Post Office travel card could also be a good solution if you have younger family members travelling abroad and want to help them fund their trip, but don’t want to give access to large amounts of money or for them to use their bank card while abroad. The Post Office travel money card would allow you to top up from afar and smaller amounts (although other card providers do allow limits to be set up on the card or account, which could solve this particular issue).

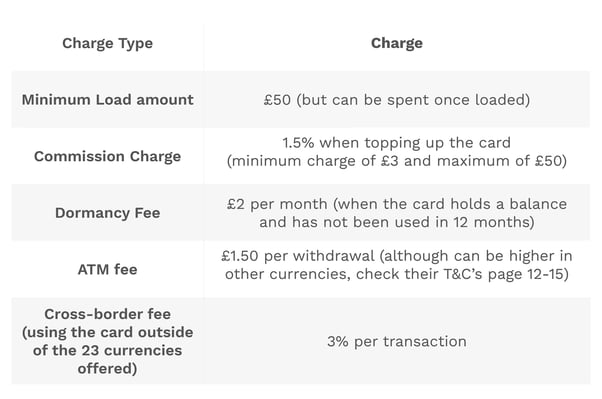

Who is Currensea?

Currensea was founded by James Lynn and Craig Goulding in 2018, then launched in 2019 aimed at reducing hidden FX fees for travellers when spending abroad and the hassle of topping up or prepaying.

Currensea is the UK’s best rated travel debit card. The layer in front of your current bank account, saving you money, giving you extra security and making your bank work that bit harder for you.

Currensea's travel debit card partners with your current bank account to save you at least 85% on the high-street banks fees and charges on all overseas transactions. Unlike other travel cards, there is no need to prepay, no need to top-up and no need for a new bank account. Spend as seamlessly abroad as you do at home, with the money only debited from your existing bank account after you’ve spent.

What are the different charges applied by a Currensea travel debit card?

Currensea offers 15 currencies at the real (interbank) exchange rate and 165 currencies at the Mastercard exchange rate (which is the rate also used by Monzo, Starling and many other FinTechs). When signing up for the free plan, users will be charged at a flat FX mark-up rate of 0.5% over these two base rates - with no extra charges over a certain amount or at weekends, it's that simple.

What card options and plans does Currensea offer?

Currensea's travel debit card currently offers three pricing plans. The Essential plan is free to use, the Premium plan is £25 per year and the Elite plan is £120 per year. The Essential Plan charges 0.5% FX per transaction, whereas the Premium and Elite plan incur no fees. The Elite plan also includes a host of exclusive benefits and memberships, as well as the exclusive Currensea black card.

Currensea has no additional weekend charges, or fair usage limits on any plan.

So how does Currensea compare to Post Office TMC?

In real terms what is cheaper (and when)?

When comparing Post Office and Currensea, Currensea will always be the cheaper option when spending abroad. This is due to the hidden FX charge when pre-loading and exchanging to your desired currency on a Post Office travel money card.

More often than not, The Post Office travel money card also works out more expensive than your high-street bank, so it’s definitely important to check the exchange rate before ordering your card.

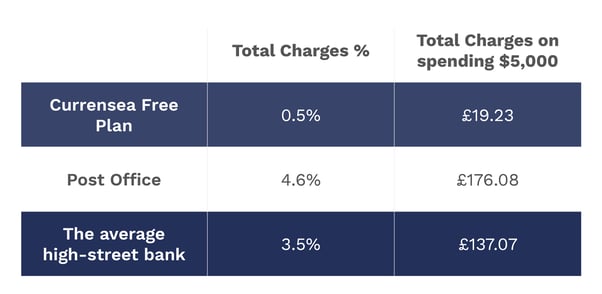

Here are the total charges when you spend $5,000 dollars ($500 of that in cash).

View our comparison table to find out more including how we calculated the above charges.

You may also like

Currensea vs curve r..., currensea vs starlin..., currensea vs caxton ....

- Exchange rates

- Giving back

Terms and policies

- Terms of use

- Privacy policy

- Terms and conditions

- Get in touch

Currensea Limited is registered in England and Wales (No. 11413946), authorised by the Financial Conduct Authority (Reference No. 843507) and is a Principal Member of Mastercard. We are registered with the Information Commissioner's Office (Registration No. ZA524676). © Currensea Limited 2022

Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder