The future of tourism: Bridging the labor gap, enhancing customer experience

As travel resumes and builds momentum, it’s becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. —a number made more significant because it was reached without travelers from China, which had the world’s largest outbound travel market before the pandemic. 2 “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Recovery and growth are likely to continue. According to estimates from the World Tourism Organization (UNWTO) for 2023, international tourist arrivals could reach 80 to 95 percent of prepandemic levels depending on the extent of the economic slowdown, travel recovery in Asia–Pacific, and geopolitical tensions, among other factors. 3 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. Similarly, the World Travel & Tourism Council (WTTC) forecasts that by the end of 2023, nearly half of the 185 countries in which the organization conducts research will have either recovered to prepandemic levels or be within 95 percent of full recovery. 4 “Global travel and tourism catapults into 2023 says WTTC,” World Travel & Tourism Council (WTTC), April 26, 2023.

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022 , WTTC, August 2022.

So, is it all systems go for travel and tourism? Not really. The industry continues to face a prolonged and widespread labor shortage. After losing 62 million travel and tourism jobs in 2020, labor supply and demand remain out of balance. 6 “WTTC research reveals Travel & Tourism’s slow recovery is hitting jobs and growth worldwide,” World Travel & Tourism Council, October 6, 2021. Today, in the European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022.

There has been an exodus of tourism staff, particularly from customer-facing roles, to other sectors, and there is no sign that the industry will be able to bring all these people back. 8 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022. Hotels, restaurants, cruises, airports, and airlines face staff shortages that can translate into operational, reputational, and financial difficulties. If unaddressed, these shortages may constrain the industry’s growth trajectory.

The current labor shortage may have its roots in factors related to the nature of work in the industry. Chronic workplace challenges, coupled with the effects of COVID-19, have culminated in an industry struggling to rebuild its workforce. Generally, tourism-related jobs are largely informal, partly due to high seasonality and weak regulation. And conditions such as excessively long working hours, low wages, a high turnover rate, and a lack of social protection tend to be most pronounced in an informal economy. Additionally, shift work, night work, and temporary or part-time employment are common in tourism.

The industry may need to revisit some fundamentals to build a far more sustainable future: either make the industry more attractive to talent (and put conditions in place to retain staff for longer periods) or improve products, services, and processes so that they complement existing staffing needs or solve existing pain points.

One solution could be to build a workforce with the mix of digital and interpersonal skills needed to keep up with travelers’ fast-changing requirements. The industry could make the most of available technology to provide customers with a digitally enhanced experience, resolve staff shortages, and improve working conditions.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

Complementing concierges with chatbots.

The pace of technological change has redefined customer expectations. Technology-driven services are often at customers’ fingertips, with no queues or waiting times. By contrast, the airport and airline disruption widely reported in the press over the summer of 2022 points to customers not receiving this same level of digital innovation when traveling.

Imagine the following travel experience: it’s 2035 and you start your long-awaited honeymoon to a tropical island. A virtual tour operator and a destination travel specialist booked your trip for you; you connected via videoconference to make your plans. Your itinerary was chosen with the support of generative AI , which analyzed your preferences, recommended personalized travel packages, and made real-time adjustments based on your feedback.

Before leaving home, you check in online and QR code your luggage. You travel to the airport by self-driving cab. After dropping off your luggage at the self-service counter, you pass through security and the biometric check. You access the premier lounge with the QR code on the airline’s loyalty card and help yourself to a glass of wine and a sandwich. After your flight, a prebooked, self-driving cab takes you to the resort. No need to check in—that was completed online ahead of time (including picking your room and making sure that the hotel’s virtual concierge arranged for red roses and a bottle of champagne to be delivered).

While your luggage is brought to the room by a baggage robot, your personal digital concierge presents the honeymoon itinerary with all the requested bookings. For the romantic dinner on the first night, you order your food via the restaurant app on the table and settle the bill likewise. So far, you’ve had very little human interaction. But at dinner, the sommelier chats with you in person about the wine. The next day, your sightseeing is made easier by the hotel app and digital guide—and you don’t get lost! With the aid of holographic technology, the virtual tour guide brings historical figures to life and takes your sightseeing experience to a whole new level. Then, as arranged, a local citizen meets you and takes you to their home to enjoy a local family dinner. The trip is seamless, there are no holdups or snags.

This scenario features less human interaction than a traditional trip—but it flows smoothly due to the underlying technology. The human interactions that do take place are authentic, meaningful, and add a special touch to the experience. This may be a far-fetched example, but the essence of the scenario is clear: use technology to ease typical travel pain points such as queues, misunderstandings, or misinformation, and elevate the quality of human interaction.

Travel with less human interaction may be considered a disruptive idea, as many travelers rely on and enjoy the human connection, the “service with a smile.” This will always be the case, but perhaps the time is right to think about bringing a digital experience into the mix. The industry may not need to depend exclusively on human beings to serve its customers. Perhaps the future of travel is physical, but digitally enhanced (and with a smile!).

Digital solutions are on the rise and can help bridge the labor gap

Digital innovation is improving customer experience across multiple industries. Car-sharing apps have overcome service-counter waiting times and endless paperwork that travelers traditionally had to cope with when renting a car. The same applies to time-consuming hotel check-in, check-out, and payment processes that can annoy weary customers. These pain points can be removed. For instance, in China, the Huazhu Hotels Group installed self-check-in kiosks that enable guests to check in or out in under 30 seconds. 9 “Huazhu Group targets lifestyle market opportunities,” ChinaTravelNews, May 27, 2021.

Technology meets hospitality

In 2019, Alibaba opened its FlyZoo Hotel in Huangzhou, described as a “290-room ultra-modern boutique, where technology meets hospitality.” 1 “Chinese e-commerce giant Alibaba has a hotel run almost entirely by robots that can serve food and fetch toiletries—take a look inside,” Business Insider, October 21, 2019; “FlyZoo Hotel: The hotel of the future or just more technology hype?,” Hotel Technology News, March 2019. The hotel was the first of its kind that instead of relying on traditional check-in and key card processes, allowed guests to manage reservations and make payments entirely from a mobile app, to check-in using self-service kiosks, and enter their rooms using facial-recognition technology.

The hotel is run almost entirely by robots that serve food and fetch toiletries and other sundries as needed. Each guest room has a voice-activated smart assistant to help guests with a variety of tasks, from adjusting the temperature, lights, curtains, and the TV to playing music and answering simple questions about the hotel and surroundings.

The hotel was developed by the company’s online travel platform, Fliggy, in tandem with Alibaba’s AI Labs and Alibaba Cloud technology with the goal of “leveraging cutting-edge tech to help transform the hospitality industry, one that keeps the sector current with the digital era we’re living in,” according to the company.

Adoption of some digitally enhanced services was accelerated during the pandemic in the quest for safer, contactless solutions. During the Winter Olympics in Beijing, a restaurant designed to keep physical contact to a minimum used a track system on the ceiling to deliver meals directly from the kitchen to the table. 10 “This Beijing Winter Games restaurant uses ceiling-based tracks,” Trendhunter, January 26, 2022. Customers around the world have become familiar with restaurants using apps to display menus, take orders, and accept payment, as well as hotels using robots to deliver luggage and room service (see sidebar “Technology meets hospitality”). Similarly, theme parks, cinemas, stadiums, and concert halls are deploying digital solutions such as facial recognition to optimize entrance control. Shanghai Disneyland, for example, offers annual pass holders the option to choose facial recognition to facilitate park entry. 11 “Facial recognition park entry,” Shanghai Disney Resort website.

Automation and digitization can also free up staff from attending to repetitive functions that could be handled more efficiently via an app and instead reserve the human touch for roles where staff can add the most value. For instance, technology can help customer-facing staff to provide a more personalized service. By accessing data analytics, frontline staff can have guests’ details and preferences at their fingertips. A trainee can become an experienced concierge in a short time, with the help of technology.

Apps and in-room tech: Unused market potential

According to Skift Research calculations, total revenue generated by guest apps and in-room technology in 2019 was approximately $293 million, including proprietary apps by hotel brands as well as third-party vendors. 1 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. The relatively low market penetration rate of this kind of tech points to around $2.4 billion in untapped revenue potential (exhibit).

Even though guest-facing technology is available—the kind that can facilitate contactless interactions and offer travelers convenience and personalized service—the industry is only beginning to explore its potential. A report by Skift Research shows that the hotel industry, in particular, has not tapped into tech’s potential. Only 11 percent of hotels and 25 percent of hotel rooms worldwide are supported by a hotel app or use in-room technology, and only 3 percent of hotels offer keyless entry. 12 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. Of the five types of technology examined (guest apps and in-room tech; virtual concierge; guest messaging and chatbots; digital check-in and kiosks; and keyless entry), all have relatively low market-penetration rates (see sidebar “Apps and in-room tech: Unused market potential”).

While apps, digitization, and new technology may be the answer to offering better customer experience, there is also the possibility that tourism may face competition from technological advances, particularly virtual experiences. Museums, attractions, and historical sites can be made interactive and, in some cases, more lifelike, through AR/VR technology that can enhance the physical travel experience by reconstructing historical places or events.

Up until now, tourism, arguably, was one of a few sectors that could not easily be replaced by tech. It was not possible to replicate the physical experience of traveling to another place. With the emerging metaverse , this might change. Travelers could potentially enjoy an event or experience from their sofa without any logistical snags, and without the commitment to traveling to another country for any length of time. For example, Google offers virtual tours of the Pyramids of Meroë in Sudan via an immersive online experience available in a range of languages. 13 Mariam Khaled Dabboussi, “Step into the Meroë pyramids with Google,” Google, May 17, 2022. And a crypto banking group, The BCB Group, has created a metaverse city that includes representations of some of the most visited destinations in the world, such as the Great Wall of China and the Statue of Liberty. According to BCB, the total cost of flights, transfers, and entry for all these landmarks would come to $7,600—while a virtual trip would cost just over $2. 14 “What impact can the Metaverse have on the travel industry?,” Middle East Economy, July 29, 2022.

The metaverse holds potential for business travel, too—the meeting, incentives, conferences, and exhibitions (MICE) sector in particular. Participants could take part in activities in the same immersive space while connecting from anywhere, dramatically reducing travel, venue, catering, and other costs. 15 “ Tourism in the metaverse: Can travel go virtual? ,” McKinsey, May 4, 2023.

The allure and convenience of such digital experiences make offering seamless, customer-centric travel and tourism in the real world all the more pressing.

Three innovations to solve hotel staffing shortages

Is the future contactless.

Given the advances in technology, and the many digital innovations and applications that already exist, there is potential for businesses across the travel and tourism spectrum to cope with labor shortages while improving customer experience. Process automation and digitization can also add to process efficiency. Taken together, a combination of outsourcing, remote work, and digital solutions can help to retain existing staff and reduce dependency on roles that employers are struggling to fill (exhibit).

Depending on the customer service approach and direct contact need, we estimate that the travel and tourism industry would be able to cope with a structural labor shortage of around 10 to 15 percent in the long run by operating more flexibly and increasing digital and automated efficiency—while offering the remaining staff an improved total work package.

Outsourcing and remote work could also help resolve the labor shortage

While COVID-19 pushed organizations in a wide variety of sectors to embrace remote work, there are many hospitality roles that rely on direct physical services that cannot be performed remotely, such as laundry, cleaning, maintenance, and facility management. If faced with staff shortages, these roles could be outsourced to third-party professional service providers, and existing staff could be reskilled to take up new positions.

In McKinsey’s experience, the total service cost of this type of work in a typical hotel can make up 10 percent of total operating costs. Most often, these roles are not guest facing. A professional and digital-based solution might become an integrated part of a third-party service for hotels looking to outsource this type of work.

One of the lessons learned in the aftermath of COVID-19 is that many tourism employees moved to similar positions in other sectors because they were disillusioned by working conditions in the industry . Specialist multisector companies have been able to shuffle their staff away from tourism to other sectors that offer steady employment or more regular working hours compared with the long hours and seasonal nature of work in tourism.

The remaining travel and tourism staff may be looking for more flexibility or the option to work from home. This can be an effective solution for retaining employees. For example, a travel agent with specific destination expertise could work from home or be consulted on an needs basis.

In instances where remote work or outsourcing is not viable, there are other solutions that the hospitality industry can explore to improve operational effectiveness as well as employee satisfaction. A more agile staffing model can better match available labor with peaks and troughs in daily, or even hourly, demand. This could involve combining similar roles or cross-training staff so that they can switch roles. Redesigned roles could potentially improve employee satisfaction by empowering staff to explore new career paths within the hotel’s operations. Combined roles build skills across disciplines—for example, supporting a housekeeper to train and become proficient in other maintenance areas, or a front-desk associate to build managerial skills.

Where management or ownership is shared across properties, roles could be staffed to cover a network of sites, rather than individual hotels. By applying a combination of these approaches, hotels could reduce the number of staff hours needed to keep operations running at the same standard. 16 “ Three innovations to solve hotel staffing shortages ,” McKinsey, April 3, 2023.

Taken together, operational adjustments combined with greater use of technology could provide the tourism industry with a way of overcoming staffing challenges and giving customers the seamless digitally enhanced experiences they expect in other aspects of daily life.

In an industry facing a labor shortage, there are opportunities for tech innovations that can help travel and tourism businesses do more with less, while ensuring that remaining staff are engaged and motivated to stay in the industry. For travelers, this could mean fewer friendly faces, but more meaningful experiences and interactions.

Urs Binggeli is a senior expert in McKinsey’s Zurich office, Zi Chen is a capabilities and insights specialist in the Shanghai office, Steffen Köpke is a capabilities and insights expert in the Düsseldorf office, and Jackey Yu is a partner in the Hong Kong office.

Explore a career with us

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Tourism on Track for Full Recovery as New Data Shows Strong Start to 2023

- All Regions

International tourism is well on its way to returning to pre-pandemic levels, with twice as many people travelling during the first quarter of 2023 than in the same period of 2022.

New Data from UNWTO: What We've Learned

The second UNWTO World Tourism Barometer of the year shows that the sector's swift recovery has continued into 2023. It shows that:

- Overall, international arrivals reached 80% of pre-pandemic levels in the first quarter of 2023

- An estimated 235 million tourists travelled internationally in the first three months, more than double the same period of 2022.

- Tourism has continued to show its resilience. Revised data for 2022 shows over 960 million tourists travelling internationally last year, meaning two-thirds (66%) of pre-pandemic numbers were recovered.

Recovery by Region in Q1 2023:

- The Middle East saw the strongest performance as the only region exceeding 2019 arrivals (+15%) and the first to recover pre-pandemic numbers in a full quarter.

- Europe reached 90% of pre-pandemic levels, driven by strong intra-regional demand.

- Africa reached 88% and the Americas about 85% of 2019 levels

- Asia and the Pacific accelerated its recovery with 54% of pre-pandemic levels, but this upward trend is set to accelerate now that most destinations, particularly China , have re-opened.

In many places, we are close to or even above pre-pandemic levels of arrivals

The UNWTO data also analyses recovery by sub-region and by destination: Southern Mediterranean Europe and North Africa have also recovered pre-pandemic levels in Q1 2023, while Western Europe, Northern Europe, Central America and the Caribbean all came close to reaching those levels.

What it Means:

UNWTO Secretary-General Zurab Pololikashvili says: "The start of the year has shown again tourism's unique ability to bounce back. In many places, we are close to or even above pre-pandemic levels of arrivals. However, we must remain alert to challenges ranging from geopolitical insecurity, staffing shortages, and the potential impact of the cost-of-living crisis on tourism, and we must ensure tourism's return delivers on its responsibilities as a solution to the climate emergency and as a driver of inclusive development."

International tourism receipts grew back to hit the USD1 trillion mark in 2022, growing 50% in real terms compared to 2021, driven by the important rebound in international travel. International visitor spending reached 64% of pre-pandemic levels (-36% compared to 2019, measured in real terms). By regions, Europe enjoyed the best results in 2022 with nearly USD 550 billion in tourism receipts (EUR 520 billion), or 87% of pre-pandemic levels. Africa recovered 75% of its pre-pandemic receipts, the Middle East 70% and the Americas 68%. Due to prolonged border shutdowns, Asian destinations earned about 28%.

International tourism receipts: Percentage of 2019 levels recovered in 2022(%) *

International tourist arrivals: percentage of 2019 levels recovered in q1 2023 (%)*, looking ahead: what's in store.

The Q1 2023 results are in line with UNWTO's forward-looking scenarios for the year which project international arrivals to recover 80% to 95% of pre-pandemic levels. UNWTO's Panel of Experts expressed their confidence in a strong peak season (May-August) in the Northern Hemisphere, reflected in the latest UNWTO Confidence Index which indicates performance for the period is on track to be even better than 2022.

However, tourism's recovery also faces some challenges . According to the UNWTO Panel of Experts, the economic situation remains the main factor weighing on the effective recovery of international tourism in 2023, with high inflation and rising oil prices translating into higher transport and accommodations costs. As a result, tourists are expected to increasingly seek value for money and travel closer to home. Uncertainty derived from the Russian aggression against Ukraine and other mounting geopolitical tensions, also continue to represent downside risks.

International Tourist Arrivals, World and Regions

Related links.

- Download the News Release in PDF

- UNWTO World Tourism Barometer - EXCERPT Volume 21 • Issue 2 • May 2023

- World Tourism Barometer (PPT version)

- The UNWTO Tourism Data Dashboard

- UNWTO World Tourism Barometer

Category tags

Related content, international tourism to reach pre-pandemic levels in 2024, international tourism to end 2023 close to 90% of pre-p..., tourism’s importance for growth highlighted in world ec..., international tourism swiftly overcoming pandemic downturn.

- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

Skift Research Global Travel Outlook 2024

Seth Borko, Varsha Arora, Pranavi Agarwal, Ashab Rizvi, Saniya Zanpure + Skift Team

Report Overview

The watchword for 2024 is normalization. We expect that overall travel industry revenue growth will decelerate from eye-watering double digits. But this slow-down is not a sign of weakness. Rather it is a sign of the continued strength of the travel industry as business finally gets back to normal.

Economic conditions appear poised to support further consumer spending. And even though there are some clouds on the horizon, shifts in consumer behavior that prioritize travel over other spending, should help deliver growth for our industry. Expect Asia to experience strong growth, as it finally stretches its legs after prolonged lockdowns. Capacity constraints are from over, but ironically can help support travel’s pricing power. We see room for growth from hotels to airlines.

This year our flagship piece includes more data than ever before. The core estimates you will find in this piece are for international trips out to 2028 and 2024 revenue forecasts for the hotel, airline, online travel, short-term rental, and cruise industry.

On top of that we have included sector-specific analysis and insights into how economics, demographics, and consumer trends will shape travel into 2024 and beyond.

We hope you enjoy!

What You'll Learn From This Report

- International Travel Forecast, 2023-2028

- Online Travel Revenue and Gross Bookings Forecast, 2023-2025

- Hotel Revenue Forecast, 2023-2025

- Short-Term Rental Revenue Forecast, 2023-2025

- Airline Passenger Revenue Forecast, 2023-2024

- Economic and Demographic Factors Driving Travel in 2024

- Key Consumer and Business Trends that Will Impact Travel

Related Reports

- Tying the Knot Abroad: Market Sizing Indian Wedding Tourism April 2024

- Navigating Q4 2023: Analysing the Value of Travel Credit Cards in the U.S. February 2024

- Exploring Gen Z and Millennial Travel Habits January 2024

- U.S. Travel Tracker: Q3 2023 Highlights October 2023

Want to read this report?

Get access to this report when you subscribe.

- 3+ new reports per month

- Access to 200+ reports

- Analyst Q&As through email

- 25% off tickets to Skift Forum events

- Quarterly analyst report review calls

- High resolution PDFs of new reports as they're released

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

- Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Tourism Market

Tourism Market: Global Industry Analysis and Opportunity Assessment 2022 - 2032

Market Insights on Tourism covering sales outlook, demand forecast and up-to-date key trends

- Report Preview

- Request ToC

- Request Methodology

Tourism Market Overview

Valued at US$ 10.5 Trillion in 2022, the global tourism market is expected to develop at a CAGR of 5% over the next ten years. By the end of this forecast year in 2032, analysts anticipate the tourism market size would be worth US$ 17.1 Trillion.

Countries such as the United States, France, and other European countries are traditionally famous tourist destinations across the world with an established tourism market. However, in recent years, several lesser-known Asian and African countries have come to the fore as destinations of appeal to foreign tourists. As a result, global tourism service providers are realigning their offerings to capitalize on the potential economic benefits of this shift.

The emergence of new trends such as adventure tourism, art tourism, and so on is projected to boost the global tourism market growth. Rock climbing, mountaineering, excavating, kayaking, and other pursuits are examples of adventure tourism significantly contributing to the tourism market share in recent years. Secondly, the adoption of tourism websites plays a significant role in the management and monetization of all types of tourism. The expanding tendency of social networking sites is also projected to give a promising possibility for tourism market advancement.

In accordance with a travel market analysis report, cultural and pilgrimage tourism are the sectors with the highest exponential growth in Asia, Africa, and South America, while adventure and ecological tourism are the fastest-growing sectors in North America and Europe. Unfortunately, outbreaks of diseases such as Ebola, SARS, and COVID in certain countries, along with geopolitical tensions, are having a significant impact on global tourism market opportunities.

During the years of the Covid-19 pandemic, the global tourism market dealt a near-fatal blow, and the market players' income declined due to severe lockdown circumstances and the suspension of transportation options. However, after the lifting of the lockdown, the tourism business recommenced in 2022 and is expected to return to its previous growth rate in the next one to two years.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Govt. Initiatives to Bode Well for the Market

Health tourism produces significant cash in emerging nations, allowing them to expand their healthcare operations. As a response, public bodies have increased their engagement through travel and tourism websites in support of healthcare services. For instance, in February 2018, the administration of Thailand announced the requirements for granting smart visas for professionals or entrepreneurs willing to engage in launching new enterprises, which could assist global health tourism service providers in expanding their operations in Thailand.

As per the previous tourism market report, Thailand was ranked as the most popular medical tourist attraction in 2019. Thailand's prominence as one of Asia's most popular dental tourism destinations has contributed to its overall market development.

Increasing per capita income is driving the growth of global tourism market leading to continuous growth in international tourism. Over the last five years, tourism market in emerging economies, especially countries in South America and Asia have driven the global tourism market. Compared to a decade ago, global tourism market has undergone a lot of changes. Emerging economies now account for more market share as compared to developed economies. As per International Travel Association (ITA), the number of international tourists arrivals in the U.S.is expected to grow from 69.8 million in 2013 to 83.8 million by 2018.

Government bodies and organizations such as World Tourism Organization UNWTO are promoting tourism in order to attract diverse tourists across the globe. These initiatives are leading to the growth of global tourism market. Adventure tourism is new concept in tourism market driving the overall tourism market. Further, medical tourism is also a new trend observed in global tourism market. Significant price difference of medical procedures between different countries is driving the trend of medical tourism across the world. Global sports and game events is another driving factor for the global tourism market. People travel to enjoy sports events such as FIFA World Cup 2014, London Olympics 2012 and ICC World Cup 2011. However, disease outbreaks such as Ebola in specific countries affect the global tourism up to large extent. Ebola outbreak in West Africa affected the tourism market in African region.

The global tourism market is segmented on the basis of type, industry products, activities involved and geography. On the basis of type, international tourism and domestic/local tourism are the two major types of tourism market. Along with it, on the basis of purpose of travel or tourism the market for global tourism is segmented into adventure tourism, leisure business travel, conference or seminar travel, business tourism, visiting relatives and friends. The companies providing tourism services offer various products and services to their customer. Thus, the industry products included in the global tourism industry are traveler accommodations, travel arrangement and reservations, air transportation, other local transport such as car rental , food and beverage establishments, recreation and entertainment, gasoline and other retail activities. Further, the industry activities considered within the global tourism market include traveler accommodation services, providing hospitality services to international tourists, airline operation, automotive rental, travel agent and tour arrangement services. Countries such as U.S., Germany and France are popular destinations for global tourism; but in recent years other less well known countries from Asia and Africa have emerged as destinations of interest for international travelers. Thus, tourism service providers are realigning their services in order to reap the economic benefits from this trend

The global tourism market has a low level of concentration as there are large numbers of international and local players in tourism market. The market for global tourism is highly fragmented in nature. Aban Offshore Ltd., Accor Group, Crown Ltd., Balkan Holidays Ltd., Fred Harvey Company and G Adventures are some of the players in global tourism market.

This research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data and statistically-supported and industry-validated market data and projections with a suitable set of assumptions and methodology. It provides analysis and information by categories such as market segments, regions, product type and distribution channels.

The report covers exhaustive analysis on

- Market Segments

- Market Dynamics

- Market Size

- Supply & Demand

- Current Trends/Issues/Challenges

- Competition & Companies involved

- Value Chain

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Regional analysis includes

- North America

- Latin America

- Western Europe

- Eastern Europe

- Middle East and Africa

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Recommendations

Travel and Tourism

Wildlife Tourism Market

Published : March 2024

Medical Tourism Market

Published : November 2023

Turkey Medical Tourism Market

Published : July 2023

Tourism Security Market

Published : February 2023

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Report Description

Table of content, competitive landscape, methodology.

- Consumer Goods

- Travel & Luxury Travel

- Tourism Market Size, Share, Growth & Industry Trends [2032]

Tourism Market

Segments - by Travel Days (Within 7 Days, More Than 15 Days, and 7-15 Days), Travel Type (Business Spending and Leisure Spending), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Global Industry Analysis, Growth, Share, Size, Trends, and Forecast 2024–2032

Debadatta Patel

Fact-checked by:

Partha Paul

Tourism Market Outlook 2032

The global tourism market size was USD 12.4 Trillion in 2023 and is projected to reach USD 23.1 Trillion by 2032 , expanding at a CAGR of 5.4% during 2024–2032 . The market growth is attributed to the increasing standard of living and mobility. Increasing global mobility and disposable income are expected to boost the market. Tourism offers immense opportunities for economic growth and job creation as one of the world's largest economic sectors. It generates revenue, fosters cultural exchange, promotes peace, and helps preserve natural and cultural heritage.

Rising popularity of experiential tourism is projected to signify a shift in consumer preferences from traditional sightseeing to immersive experiences. Today's tourists seek authentic, personalized experiences that allow them to connect with local cultures, learn new skills, and gain a deeper understanding of their destinations. This trend is driving innovation in the tourism industry, with businesses developing unique offerings to cater to these evolving demands.

Impact of Artificial Intelligence (AI) in Tourism Market

Artificial Intelligence (AI) has a significant impact on tourism market. AI's role in enhancing customer service is particularly noteworthy, with chatbots and virtual assistants providing round-the-clock assistance, thereby improving response times and customer satisfaction. AI's ability to analyze vast amounts of data allows for the creation of highly personalized travel recommendations, enhancing customer engagement and fostering loyalty. AI-powered predictive analytics enable businesses to forecast demand accurately, optimize pricing strategies, and manage resources effectively on the operational side. Additionally, AI's role in automating routine tasks reduces operational costs and allows staff to focus on complex, value-adding activities.

Tourism Market Dynamics

Major drivers.

Surging globalization is expected to drive the market. Travel becomes easier and accessible as the world becomes interconnected. This trend is projected to boost the market, as it facilitates international travel and promotes cultural exchange. Rising government initiatives promoting tourism is projected to propel the market. Governments worldwide are estimated to invest in tourism infrastructure and marketing to attract international visitors. These initiatives are expected to boost the tourism market, as they enhance the accessibility and attractiveness of travel destinations.

Existing Restraints

Increasing environmental concerns are expected to pose a significant challenge to the market. The industry's impact on natural resources, pollution, and climate change is leading to growing scrutiny. This trend is projected to intensify, leading to stricter regulations and a decrease in tourist activities in certain regions. Growing security concerns are projected to act as a restraint on the market. Instances of terrorism, political instability, and natural disasters significantly deter tourists. This factor is likely to continue to influence the decisions of travelers, limiting the market.

Emerging Opportunities

Increasing adoption of digital technology is projected to present a significant opportunity for the market. An increasing number of travelers are expected to use digital platforms for booking and planning their trips as technology advances. This trend is projected to open new avenues for market players, as they offer innovative and convenient digital solutions for travelers. High demand for wellness and medical tourism is expected to present potential for the market. Consumers are projected to seek travel experiences that promote wellness as health and wellness become important to them. This demand is likely to create opportunities for market players, as they develop and offer wellness-focused travel products and services.

Scope of the Tourism Market Report

The market report includes an assessment of the market trends, segments, and regional markets. Overview and dynamics are included in the report.

Regional Outlook

In terms of region , the global tourism market is classified as Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. Europe, specifically France held a major market share in 2023 due to its rich cultural heritage, world-renowned landmarks such as the Eiffel Tower and the Louvre, and its reputation as a global culinary capital. Additionally, France's well-developed infrastructure and strategic location in Europe, which allows for easy travel from neighboring countries, further bolstered its market share. The market in Asia Pacific, particularly China is projected to grow at a significant pace in the years to come owing to China's rich cultural history, diverse landscapes, and rapid urban development making it an increasingly attractive destination for international travelers. China's growing middle class is driving domestic tourism , contributing to its overall market share. The government of China’s initiatives to boost tourism, such as improving infrastructure and easing visa restrictions, are expected to enhance its appeal as a travel destination, thereby driving its market.

Tourism Market Segment Insights

Travel days segment analysis.

Based on travel days , the tourism market is divided into within 7 days, more than 15 days, and 7-15 days. The 7-15 days segment held the major share of the market in 2023 due to this duration offering an optimal balance between exploration and relaxation, enabling travelers to immerse themselves in the destination without feeling rushed. The rise of this segment is attributed to the increasing preference for comprehensive travel experiences that allow for a deeper understanding of the local culture and environment. The 7 days segment is expected to expand at a significant growth rate in the coming years owing to the growing demand for short, frequent getaways that provide a quick respite from daily routines. The convenience and affordability of these shorter trips and the increasing availability of weekend packages and city breaks, is expected to fuel the segment.

Travel Type Segment Analysis

On the basis of travel type , the global market is segregated into business spending and leisure spending. The business spending segment held largest market share in 2023 due to the necessity of face-to-face meetings and networking events in many industries. Despite the rise of digital communication tools, in-person interactions remain crucial in the business world, leading to a steady demand for business travel. The leisure spending segment is anticipated to grow at a substantial CAGR during the forecast period owing to the growing emphasis on work-life balance and the recognition of travel as a means of relaxation and rejuvenation. The increasing disposable income and the rising trend of experiential travel is projected to drive the segment in the coming years.

The tourism market has been segmented on the basis of

Travel Days

- Within 7 Days

- More Than 15 Days

Travel Type

- Business Spending

- Leisure Spending

- Asia Pacific

- North America

- Latin America

- Middle East & Africa

Key Players

- Austin Adventures, Inc.

- Butterfield & Robinson Inc.

- Cox & Kings Ltd.

- Discovery Nomads

- G Adventures

- Geographic Expeditions Inc.

- Intrepid Group, ltd.

- Mountain Travel Sobek

- Row Adventures

Key players competing in the global tourism market are Austin Adventures, Inc.; Butterfield & Robinson Inc.; Cox & Kings Ltd.; Discovery Nomads; G Adventures; Geographic Expeditions Inc.; Intrepid Group, ltd.; Mountain Travel Sobek; Row Adventures; and Tui Group. These companies use development strategies including mergers, acquisitions, partnerships, collaboration, and product launches to expand their consumer base worldwide.

In January 2021 , Geographic Expeditions Inc. , a key market player, initiated a three-country expedition across the Horn of Africa, encompassing less explored destinations such as Eritrea, Djibouti, and the self-proclaimed nation of Somaliland.

Purchase Premium Report

- Single User $4200

- Multi User $5500

- Corporate User $6600

- Online License $2999

- Excel Data Pack $2599

Customize This Report

- Ask for Research To Be Focused On Specific Regions or Segments

- Receive Data As Per Your Format and Definition

- Companies Profiled based on Your Requirements

- Breaking Down Competitive Landscape as per Your Requirements

- Any Level of Customization

Our Clients

We needed a highly accurate and precise report, which delivered promptly. The company compiled information from a wide array of reliable agencies and sourcess.It is extremely satisfactory to be working with you. Strategy Head of Major Tech Company

We were very pleased to contact as they tailored reports precisely as per our requirements. As we are dealing with the aerospace and defense industry, we need reports of high accuracy and substantial quality. Major Player in Defense Industry

Extremely delighted to have a well-crafted report on “Global Packaging Solutions Market Research Report” from your team. Thank you for providing me with all our requirements and for incorporating our suggestions. CMO of Leading Packaging Company from USA

I had a good experience working with as they were very open to all constructive changes in the report. I found that the report had its charm embedded with ample of data. Founder and Managing Partner of Major Korean Company

Our company has been working with for some years now and we are very happy with the quality of the reports provided by the company.I, on behalf of my organization, would like to thank you for offering professional reports. Global Consulting Firm

Quick Contact

+1 909 414 1393

Certified By

Related Reports

Some other reports from this category!

Camping Sleeping Bags Market Report | Global Forecast From 2023 To 2032

Cruise Liners Market Report | Global Forecast From 2023 To 2032

Duty-Free and Travel Retail Market Report | Global Forecast From 2023 To 2032

Duty Free & Travel Retail Market Report | Global Forecast From 2023 To 2032

Business Travel Market Report | Global Forecast From 2023 To 2032

Travel Luggage & Bags Market Report | Global Forecast From 2023 To 2032

Adventure Tourism Market Report | Global Forecast From 2023 To 2032

Cooler Bags Market Report | Global Forecast From 2023 To 2032

Luggage & Bags Market Report | Global Forecast From 2023 To 2032

Leather Luggage Market Research Report 2032

- Free Sample

- Stand Up for Free Enterprise

The State of the Travel Industry in 2023: Current Trends and Future Outlook

Kentucky chamber ceo: we must protect the free enterprise system, how franchising can help fuel the american dream, microsoft president: responsible ai development can drive innovation, suzanne clark's 2024 state of american business remarks, rhythms of success: the free enterprise tune of a small business.

January 12, 2023

Featured Guest

Tony Capuano CEO, Marriott International, Inc.

Chip Rogers President & CEO, American Hotel & Lodging Association (AHLA)

As COVID-19 restrictions have continued to ease, the travel and hospitality industries have seen a resurgence in customers. Companies like Marriott have seen percentage increases in revenue and rate, even topping pre-pandemic levels.

During the U.S. Chamber of Commerce’s 2023 State of American Business event, Chip Rogers, President and CEO of the American Hotel and Lodging Association , and Tony Capuano, CEO of Marriott International, Inc. , sat down for a fireside chat. Read on for their insights on the post-COVID state of the travel industry, a shifting customer base, and the outlook for 2023 and beyond.

2022 Demonstrated the Power and Resilience of Travel

After declines amid the pandemic, 2022 brought about a positive recovery for the travel industry.

“[2022] reminded us of the power and resilience of travel,” said Capuano. “If you look at the forward bookings through the holiday season, [you’ll see] really strong and compelling numbers … so we’re really encouraged.”

“The only caveat I would give you about that optimism is, as you know, the booking windows are much shorter than we’ve seen them in a pre-pandemic world,” he added. “So those trends can change more quickly than we’re accustomed to."

The ‘Regular’ Customer Segments Are Shifting

At the start of pandemic recovery, industry leaders believed leisure travel would lead travel recovery, with business travel closely behind and group travel at a distant third, according to Capuano. While some of those predictions have held, others have shifted.

“Leisure [travel] continues to be exceedingly strong, and group [travel] has surprised to the upside,” he explained. “Business travel is perhaps the tortoise in this ‘Tortoise and the Hare,’ slow-and-steady recovery.”

However, Capuano noted customer segments are becoming less and less strictly defined.

“[There’s] this trend we've seen emerge over the pandemic of blended trip purpose … [where] more and more folks are combining leisure and business travel,” he said. “If this has staying power, I think it’s absolutely a game changer, as we get back to normal business travel and hopefully maintain that leisure travel.”

To accommodate this shifting demand, Marriott has focused on expanding offerings to accommodate both the business and leisure sides of travelers’ trips.

“[We’ve had] a very big focus on [expanding bandwidth], so that if [we’ve] got 300 rooms full of guests on Zoom calls simultaneously, we’ve got the bandwidth to cover it,” Capuano added. “[We’re also] being more thoughtful about fitness, leisure, and food and beverage offerings — and having the flexibility to pivot those offerings as somebody sheds their business suit on Thursday and changes into shorts and flip flops for the weekend.”

2023 Offers Hope for Continued Growth in the Travel and Hospitality Sectors

As the travel and hospitality sectors continue to grow and shift in the post-pandemic era, Capuano shared reasons for optimism in 2023.

“Number one, it's our people,” he emphasized. “When you see their passion, their enthusiasm, their resilience, their creativity, and just how joyful they are to have their hotels full again … it's hard not to be filled with optimism.”

“If you look at how far the industry has come over the last few years,” Capuano continued, “any lingering doubts folks may have had about the resilience of travel — and about the passion that the general public has to explore cities and countries — it's hard not to be excited about the future of our industry.”

- Post-Pandemic Work

From the Series

State of American Business

View this online

Global Tourism - Market Size, Industry Analysis, Trends and Forecasts (2024-2029)

Instant access to hundreds of data points and trends.

- Market estimates from

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

100% money back guarantee

Industry statistics and trends.

Access all data and statistics with purchase. View purchase options.

Global Tourism

Industry Revenue

Total value and annual change from . Includes 5-year outlook.

Access the 5-year outlook with purchase. View purchase options

Trends and Insights

Market size is projected to over the next five years.

Market share concentration for the Global Tourism industry is , which means the top four companies generate of industry revenue.

The average concentration in the sector in Global is .

Products & Services Segmentation

Industry revenue broken down by key product and services lines.

Ready to keep reading?

Unlock the full report for instant access to 30+ charts and tables paired with detailed analysis..

Or contact us for multi-user and corporate license options

Table of Contents

About this industry, industry definition, what's included in this industry, industry code, related industries, domestic industries, competitors, complementors, international industries, performance, key takeaways, revenue highlights, employment highlights, business highlights, profit highlights, current performance.

What's driving current industry performance in the Global Tourism industry?

What's driving the Global Tourism industry outlook?

What influences volatility in the Global Tourism industry?

- Industry Volatility vs. Revenue Growth Matrix

What determines the industry life cycle stage in the Global Tourism industry?

- Industry Life Cycle Matrix

Products and Markets

Products and services.

- Products and Services Segmentation

How are the Global Tourism industry's products and services performing?

What are innovations in the Global Tourism industry's products and services?

Major Markets

- Major Market Segmentation

What influences demand in the Global Tourism industry?

International Trade

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

- Industry Trade Balance by Country

What are the import trends in the Global Tourism industry?

What are the export trends in the Global Tourism industry?

Geographic Breakdown

Business locations.

- Share of Total Industry Establishments by Region ( )

Data Tables

- Number of Establishments by Region ( )

- Share of Establishments vs. Population of Each Region

What regions are businesses in the Global Tourism industry located?

Competitive Forces

Concentration.

- Combined Market Share of the Four Largest Companies in This Industry ( )

- Share of Total Enterprises by Employment Size

What impacts market share in the Global Tourism industry?

Barriers to Entry

What challenges do potential entrants in the Global Tourism industry?

Substitutes

What are substitutes in the Global Tourism industry?

Buyer and Supplier Power

- Upstream Buyers and Downstream Suppliers in the Global Tourism industry

What power do buyers and suppliers have over the Global Tourism industry?

Market Share

Top companies by market share:

- Market share

- Profit Margin

Company Snapshots

Company details, summary, charts and analysis available for

Company Details

- Total revenue

- Total operating income

- Total employees

- Industry market share

Company Summary

- Description

- Brands and trading names

- Other industries

What's influencing the company's performance?

External Environment

External drivers.

What demographic and macroeconomic factors impact the Global Tourism industry?

Regulation and Policy

What regulations impact the Global Tourism industry?

What assistance is available to the Global Tourism industry?

Financial Benchmarks

Cost structure.

- Share of Economy vs. Investment Matrix

- Depreciation

What trends impact cost in the Global Tourism industry?

Financial Ratios

- 3-4 Industry Multiples (2018-2023)

- 15-20 Income Statement Line Items (2018-2023)

- 20-30 Balance Sheet Line Items (2018-2023)

- 7-10 Liquidity Ratios (2018-2023)

- 1-5 Coverage Ratios (2018-2023)

- 3-4 Leverage Ratios (2018-2023)

- 3-5 Operating Ratios (2018-2023)

- 5 Cash Flow and Debt Service Ratios (2018-2023)

- 1 Tax Structure Ratio (2018-2023)

Data tables

- IVA/Revenue ( )

- Imports/Demand ( )

- Exports/Revenue ( )

- Revenue per Employee ( )

- Wages/Revenue ( )

- Employees per Establishment ( )

- Average Wage ( )

Key Statistics

Industry data.

Including values and annual change:

- Revenue ( )

- Establishments ( )

- Enterprises ( )

- Employment ( )

- Exports ( )

- Imports ( )

Frequently Asked Questions

What is the market size of the global tourism industry.

The market size of the Global Tourism industry is measured at in .

How fast is the Global Tourism market projected to grow in the future?

Over the next five years, the Global Tourism market is expected to . See purchase options to view the full report and get access to IBISWorld's forecast for the Global Tourism from up to .

What factors are influencing the Global Tourism industry market trends?

Key drivers of the Global Tourism market include .

What are the main product lines for the Global Tourism market?

The Global Tourism market offers products and services including .

Which companies are the largest players in the Global Tourism industry?

Top companies in the Global Tourism industry, based on the revenue generated within the industry, includes .

How many people are employed in the Global Tourism industry?

The Global Tourism industry has employees in Global in .

How concentrated is the Global Tourism market in Global?

Market share concentration is for the Global Tourism industry, with the top four companies generating of market revenue in Global in . The level of competition is overall, but is highest among smaller industry players.

Methodology

Where does ibisworld source its data.

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

Deeper industry insights drive better business outcomes. See for yourself with your report or membership purchase.

Discover how 30+ pages of industry data and analysis can give you the edge you need..

2024 travel trends: what the experts predict

A look at the travel trends and destinations set to drive the tourism industry

- Newsletter sign up Newsletter

The year of 'surprise travel'?

- Lonely Planet's Best in Travel

Set-jetting continues to take off

Music tourism 'accelerates', palate-led holidays and uk getaways, cultural exploration and quaint cities, journeys with 'a sense of purpose'.

- Michelin Guide 'keys'

Fodor's 2024 'No List'

Sign up to The Week's Travel newsletter for destination guides and the latest trends.

'More and more surprise trip companies have popped up'

"Surprise travel" may become the big trend of 2024, said David Farley on the BBC . A survey of 27,000 travellers in 33 countries by Booking.com found that 52% are "keen" to book a surprise trip where "everything down to the destination is unknown until arrival". In the last decade, "more and more surprise trip companies have popped up", Farley added, and the "element of mystery" is "tempting travellers to seek a new way to see the world".

Mongolia and Nairobi included in Lonely Planet's Best in Travel

Mongolia is tipped as one of the top countries to visit

In its "Best in Travel" report for 2024, Lonely Planet has predicted the world's top 50 countries, regions, cities, best value and most sustainable destinations. Looking at the top places to "unwind, connect, eat, learn and journey", there's "plenty to pack in" over the next year. Destinations highlighted in the report include Mongolia (country), Western Balkans' Trans Dinarica Cycling Route (region), Nairobi in Kenya (city), Spain (sustainable) and The Midwest, USA (best value).

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The new season of 'Emily in Paris' will inspire travel to the French capital

Travellers turning to their TV sets and movie screens for inspiration "shows no signs of stopping in 2024", said Expedia Group . In its "Unpack '24: The Trends in Travel" survey, more than half of travellers have researched or booked a trip to a destination "after seeing it on a TV show or movie", and one in four admit that TV shows and films "are even more influential on their travel plans than they were before". In fact, travellers say TV shows influence their travel decisions more than Instagram, TikTok and podcasts.

In its "set-jetting forecast", the group predicts the "entertainment-inspired destinations" tourists will be heading to in 2024. The top picks include Thailand, inspired by "The White Lotus" season three; Romania, inspired by "Wednesday" season two; Malta, inspired by the new "Gladiator 2" film; and Paris, inspired by "Emily in Paris" season four.

Taylor Swift performs at Lumen Field, Seattle, on the Eras Tour

Travel technology company Amadeus has released its fourth travel trends report. Using the latest data and industry-leading insight, travel in 2024 will be dominated by five trends: music tourism, business class fares unbundled, influencers becoming agents, artificial intelligence matures, and electric vertical take-off and landing (eVTOL) aircraft prepare for take-off.

Music tourism is a trend that's expected to "accelerate" in 2024, Amadeus said. After the social isolation of the pandemic, when bands and musical artists were "grounded for months", a "boom" in concerts and festivals in 2023 tapped into "a desire for connection". When Taylor Swift announced her Asia Pacific tour dates for 2024, Amadeus research suggested that Swift's concert dates in Australia, Singapore and Japan had a "significant impact on travel searches and booking volumes to the countries".

Lucknam Park Hotel & Spa in Wiltshire is part of the PoB Hotels collection

PoB Hotels ' "Cultivating Luxury" market trends report found that palate-led holidays and increased domestic getaways in the UK were among the key findings for 2024. Food and drink "undeniably take centre stage" in "capturing the attention" of domestic travellers, commanding an impressive 82% of their interests. A significant 54% of affluent high net worth individuals (HNWIs) plan to enjoy "three or more" leisure holidays within the UK in the upcoming year, reflecting a "notable increase on the previous 12 months". And a considerable 27% of affluent/HNW travellers anticipate taking UK trips "lasting three or more nights" in the coming year.

Bydgoszcz in Poland is one of the 'quaint cities' attracting interest

"Cultural exploration" will "more than ever" be a priority for travellers, Skyscanner said in its 2024 travel trends report. Expect "gig trippers" to jet off to see their favourite artists and "budget bougie foodies" to seek out the very best food experiences. When it comes to the destinations that are whetting would-be tourists' appetites, the metasearch engine and travel agency has seen an increase in searches for "quaint cities" such as Vigo in Spain (+1,235%) and Bydgoszcz in Poland (+313%). Meanwhile, the cost-of-living crisis remains "top of mind" with Skyscanner's "Everywhere" search tool being the "top search destination for travellers globally".

'Off-grid' Peru is on Black Tomato's 2024 destination hotlist

The founders of luxury travel company Black Tomato predict that travellers will be looking to journey with "a sense of purpose" in 2024. With ever increasing demands on time, and the desire to make travel truly count, travellers want to create "positive and lasting change" – not only in the destinations they visit, but in their own lives.

"What we've uncovered," said Black Tomato, is that the feeling a trip ultimately evokes "greatly informs the destination booked". For groups "craving togetherness", journeys which "strengthen bonds and connection" are "prioritised". Black Tomato has picked out "off-grid" Peru, Morocco's Tangiers, the Mitre Peninsula in remotest Argentine Patagonia, and New Zealand's waterways on its 2024 destination hotlist.

The new Michelin Guide 'keys'

Which hotels will get a Michelin key?

The Michelin Guide will award hotels with "keys" as part of a "new rating system" launching in 2024, said the Visit California PR Pulse Report. The system will be aimed at recognising hotels based on factors including "location, design, service, uniqueness and value". As it does for restaurants, the guide said it intends to independently recommend hotels that "constitute true destinations" and will propose a new selection of more than "5,000 remarkable hotels in 120 countries".

Venice is one of the destinations that has been impacted by overtourism

Most travel experts recommend places to go in their annual reports, but Fodor's has a "No List" of nine regions to "reconsider" in 2024. The travel guide company said it's not a "round-up of spots we revile", it's a "declaration of places we revere". However, the "frenzied admiration", and "incessant need to experience them", are "not sustainable".

The 2024 No List focuses on three main areas of tourist impact: overtourism, rubbish production, and water quality and sufficiency. For overtourism, Venice in Italy, Athens in Greece, and Mount Fuji in Japan are highlighted. Rubbish production no-gos include San Gabriel Mountains National Monument in California, Ha Long Bay in Vietnam, and the Atacama Desert in Chile. While water quality and sufficiency has impacted Lake Superior in North America, the Ganges River in India, and Koh Samui in Thailand.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published 26 April 24

Speed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published 26 April 24

Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published 26 April 24

The Week Recommends These institutions provide insight into American leaders

By Catherine Garcia, The Week US Published 25 April 24

The Week Recommends Have a rip-roaring time on the water

By Catherine Garcia, The Week US Published 18 April 24

The Week Recommends This 'genre-bending' new Amazon series is set in a post-apocalyptic wilderness where survivors shelter below ground

By Adrienne Wyper, The Week UK Published 17 April 24

The Week Recommends Peru's most famous trail leads to Machu Picchu

By Catherine Garcia, The Week US Published 17 April 24

The Week Recommends The southwestern region pretty much has it all, from beachfront, to port metropolis, to verdant mountainside

By Scott Hocker, The Week US Published 15 April 24

The Week Recommends Stay at a zoo in Sydney, or meet vortex hunters in Sedona

By Catherine Garcia, The Week US Published 8 April 24

Under the Radar Some in Italy are trying to stop what they consider 'debasing' use of the sculpture

By Justin Klawans, The Week US Published 5 April 24

Under the Radar Quite a few people believe that George Lucas ripped off Frank Herbert's sci-fi universe. So does Herbert himself.

By Anya Jaremko-Greenwold, The Week US Published 2 April 24

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise With Us

The Week is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

Industry Verticals »

- Chemicals And Materials

- Consumer Goods

- Electronics and Semiconductors

- Energy and Natural Resources

- Factory Automation

- Food and Beverages

- Heavy Engineering Equipment

- IT and Telecom

- Pharmaceutical

- Latest Reports

- Forthcoming Reports

- Top Industry Reports

Press Releases »

About tmr ».

Travel and Tourism Market

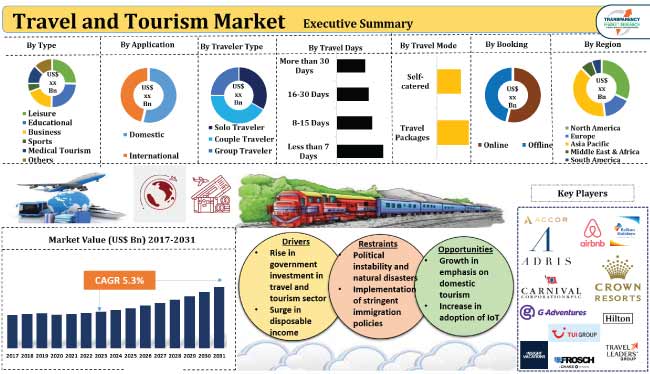

Travel and Tourism Market (Type: Leisure, Educational, Business, Sports, Medical Tourism, and Others; and Application: Domestic and International) - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2023-2031

- Report Preview

- Table of Content

- Request Brochure

Global Travel and Tourism Market Outlook 2031

- The global industry was valued at US$ 615.2 Bn in 2022

- It is estimated to grow at a CAGR of 5.3% from 2023 to 2031 and reach US$ 972.5 Bn by the end of 2031

Analysts’ Viewpoint on Market Scenario Growth in disposable income, affordable commutes, easy accessibility of remote locations, and emerging travel trends are major factors boosting the travel and tourism market growth during the forecast period. Rise in government investment in the tourism sector is also projected to drive demand for travel and tourism in the next few years. Surge in adoption of IoT is likely to offer lucrative opportunities to players in the global travel and tourism industry. However, political instability, natural disasters, and implementation of stringent immigration policies are estimated to limit the travel and tourism market progress in the near future.

Market Introduction

Travel and tourism refers to the movement of people from one place to another due to various reasons such as leisure, education, business, and sports. It can be domestic, overseas, short distance, or long distance. The tourism sector is witnessing immense growth opportunities around the globe owing to rise in discretionary income, governmental support, infrastructural development, and technical integration to facilitate easy commutes.

Online booking platforms, mobile apps , and travel websites are gaining traction among travelers. Rapid globalization has led to a more interconnected world through trade, social media networks, business, and culture. Thus, people are traveling within and out of their borders with ease. These scenarios and travel trends are expected to augment the travel and tourism market value in the next few years.

Social media platforms and online websites are being used widely to promote various tourist destinations and hospitality and leisure facilities. They are attracting travelers through influencer marketing , travel blogs, articles, and user-generated content. This, in turn, is projected to spur growth of the travel and tourism industry. Moreover, increase in investment in infrastructural development and emergence of new travel trends among millennials are boosting the travel and tourism market size.

Tourism is becoming one of the major sectors driving a country’s revenue. Thus, governments across the globe are promoting and investing heavily in the sector, which is leading to improvements in public transportation, tourist destinations, and accommodation facilities. According to the latest travel and tourism market trends, travel and tourism is gaining traction among the middle-class population due to surge in disposable income.

In 2019, an average household in the U.S. spent around US$ 2,100 on travel. Security and health concerns play a major role in the tourism sector. This average dropped to US$ 926 post the emergence of the COVID-19 pandemic in 2020. Thus, travelers prefer safe and secure destinations.

Rise in Government Investment in Travel and Tourism Sector

The tourism sector across the globe is growing at a rapid pace, especially after COVID-19 lockdowns were lifted. Major governments are focusing on promoting and enhancing tourist traffic. In India, the Ministry of Tourism, under the CSSS Scheme of ‘Incentive to Tour Operators for Enhancing Tourist Arrivals to India’ is extending financial incentives to foreign tour operators, approved by the government. These promotional activities are contributing to the market size of travel and tourism.

Accessibility to remote yet beautiful tourist places and increase in popularity of travel destinations through online platforms has resulted in the tourist industry emerging as one of the key sectors in many countries. According to the U.S. Department of Commerce, International arrivals to the U.S. grew from 19.2 million in 2020 to 22.1 million in 2021. Moreover, the U.S. government is focusing on attracting around 90 million international visitors who are expected to spend approximately US$ 279 Bn annually by 2027. Hence, rise in number of international visitors is estimated to fuel the travel and tourism market.

Surge in Disposable Income

Rise in digital transformation and growth in penetration of the internet are offering emerging opportunities in the travel and tourism market. Online resources provide convenience in booking flight tickets and hotels and searching for places to plan trips.

Increase in disposable income provides a sense of economic stability, in which people tend to spend on leisure activities such as travel. Families are more likely to plan vacations, leading to surge in demand for trips and tourism. The gross national disposable income in India reached US$ 3,182.4 Bn in the financial year 2021-2022, recording a growth of 17.4% compared to the previous year. In the U.S., personal income increased US$ 45.0 billion (0.2% at a monthly rate) in July 2023, according to the Bureau of Economic Analysis. Hence, rise in disposable income is projected to boost the travel and tourism market revenue during the forecast period.

Regional Outlook

According to the latest travel and tourism market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. Rise in disposable income and growth in government investment are fueling the market dynamics of the region. Geographical advantages, increase in number of international travelers, and presence of a well-established tourism sector are driving the travel and tourism market statistics in North America.

Analysis of Key Players

Most travel and tourism service providers are offering lucrative tour packages to attract more travelers. They are also investing heavily in promotional activities to increase their travel and tourism market share.

Accor, Adris Grupa d.d., Airbnb, Inc., Balkan Holidays Ltd., Carnival Corporation & plc, Crown Resorts Ltd., G Adventures, Hilton Worldwide Holdings Inc., TUI Group, Travel Leaders Group, LLC, Insight Vacations, and Frosch International Travel, Inc. are key players in the travel and tourism market.

Key Developments

- In August 2023 , G Adventures added two new National Geographic Family Journeys in Italy and Tanzania. The eight-day Tanzania Family Journey is expected to take families on game drives in the Serengeti throughout the tour and include a visit to a community tourism project.

- In July 2023 , TUI Group released a ChatGPT-powered chatbot on its U.K. app, the first of what is expected to be a wave of rollouts that incorporates generative AI into the company’s tech, to help consumers search through its own portfolio of products

- In February 2023 , Adris announced plans to invest US$ 511 Mn in its tourism arm Maistra until 2025 with an aim to boost its luxury segment

Travel and Tourism Market Snapshot

Frequently asked questions, how big was the travel and tourism market in 2022.

It was valued at US$ 615.2 Bn in 2022

What would be the CAGR of the travel and tourism industry during the forecast period?

It is estimated to be 5.3% from 2023 to 2031

How big will the travel and tourism business be in 2031?

It is projected to reach US$ 972.5 Bn by the end of 2031

What are the prominent factors driving demand for travel and tourism?

Rise in government investment in travel and tourism sector and surge in disposable income

Which region is likely to record the highest demand for travel and tourism?

Asia Pacific is anticipated to record the highest demand from 2023 to 2031

Who are the prominent travel and tourism service providers?

Accor, Adris Grupa d.d., Airbnb, Inc., Balkan Holidays Ltd., Carnival Corporation & plc, Crown Resorts Ltd., G Adventures, Hilton Worldwide Holdings Inc., TUI Group, Travel Leaders Group, LLC, Insight Vacations, and Frosch International Travel, Inc.

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology